Transfers

Use the feature to transfer funds between user's and other accounts, schedule and manage transfers including recurring transfers, and manage recipients.

The accounts are segregated by customer ID at all relevant places in the application during transfers and other flows and icons against each account indicates the type of account. A business user with access to both retail and business accounts can transfer funds to any of the recipients - both personal and business, based on the permissions that are assigned to the user.

The application supports the following:

- Transfers to user's own accounts in the same bank

- Transfers to other members of the same bank

- Transfers to other banks

- International transfers

- Wire transfers

Users can schedule a transfer to be executed at a later date. It is also possible to set up recurring transfers. Recurrence can be defined to end on a specific date, after a certain number of recurrences or when the user cancels the transaction.

For scheduling recurring transfers, the application provides a common data model and the capability to integrate with the third-party systems. The actual storage of running any back-end recurring jobs, communicating with the core banking or other system is determined by the third-party provider.

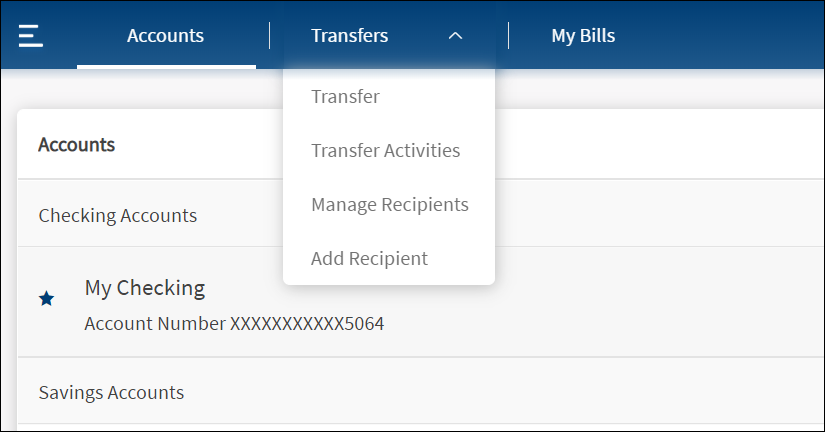

Menu path: On the top menu > Transfers

The application displays the following sub-menus:

- Transfer: Initiate a new fund transfer to the user's own accounts within the same bank, to other accounts within the same bank, to external bank accounts, to international accounts, and person to person transfers through email or phone number.

- Transfer Activities: View the list of recent transfers and scheduled transfers. Click any transaction to view its in-depth details and perform applicable actions.

- Manage Recipients: Manage recipients and transfer money.

- Add Recipients: Add members as recipients to transfer funds in the same bank, other banks, and international banks. You can add the following recipients:

- Add Same Bank Account. You can add a recipient who has an account within the bank by providing the details such as account number, account type (Checking/Savings), account beneficiary's name, and nickname.

- Add External Account. You can add a recipient who has an account in another bank (domestic) by providing the details such as bank name, account number, account type (Checking/Savings), routing number, account beneficiary's name, and nickname.

- Add International Account. You can add a recipient who has an account in an international bank by providing the details such as SWIFT code, bank name, account number, account type (Checking/Savings), routing number, account beneficiary's name, and nickname.

- Add Person to Person Account. You can add a recipient by providing the person's email address or mobile number.

A user can have access to multiple contracts and a contract can have single or multiple Customer IDs within it. Also, a contract can be a combination of single or multiple retail and business customer IDs. The beneficiaries are stored/associated at a customer ID level and all the actions of view, edit, and delete a beneficiary is controlled by the permissions the user has at the customer ID level. A user can share the beneficiary with other customer IDs (to which the user has permission) or associate with one or multiple customer IDs. In the "Manage Beneficiary" screen, the beneficiaries are listed based on the customer IDs to which the user has access. The beneficiaries are stored in the DBX DB.

A contract can have the following use cases and a user associated with the contract can be classified as:

- Single Retail Customer ID (Retail)

- Multiple Retail Customer IDs (Retail)

- Single Business Customer ID (Business)

- Multiple Business Customer IDs (Business)

- Multiple Retail & Business Customer IDs (Combined)

Key points:

- The beneficiaries created are associated with Customer ID.

- A logged-in user can create/edit a beneficiary only if the user has permission for Create Beneficiary feature action under any of the following: Transfer/Bill Payment/Bulk payment/Domestic and International Wire/P2P.

- If the logged in user has access to more than one Customer ID, the user will have an option to share the beneficiary with one or multiple Customer IDs (to which the user has permission).

- If the user has Edit permission, the user can edit the beneficiary also as stated above.

- In case of Delete, if the user deletes a specific beneficiary, it will be deleted against all the customer IDs linked to it.

- While making a payment, when a user selects a specific account based on the customer ID of the that account in the "To" field, all the beneficiaries are listed.

- The same logic is applied when making payment through "Send Money" option from the Manage Beneficiary screen. This is applicable only for transfers.

- In the "Manage Beneficiary" section, the beneficiaries are listed based on the customer IDs the user has access. Also, if the same beneficiary is available across multiple Customer IDs, the beneficiary appears once on the screen. On clicking the Beneficiary, the number of customer IDs with which it is associated are displayed.

- In addition to the customer ID level access, the beneficiary listing is based on the Feature level permission of the logged-in user.

- If a user tries to add a same beneficiary record which is already associated with that customer ID, the system will do a duplicate check and throw error.

- Only those users with permission to create transactions for a particular service can create respective transactions.

- Only the users with permission to manage recipients for a particular service can add recipients.

- Users can create debit transactions only on those accounts to which they have access.

- Straight-through Processing - Alerts for Transfers and Approval Flows: If the initiator is also the approver of the same transaction, the authorization on transaction is implicitly counted. In such cases, the initiator will not receive an Approver type alert. This applies to Euro payment flows as well. The following are the two scenarios for straight-through processing:

- There are other approvals required on that specific transaction: In such cases, all the other approvers receive the notification of the request and the initiator who is also an approver, receives only the Initiator type alert.

- There are no other approvals required on that specific transaction: In such cases, the transaction is directly submitted and neither the approver or the initiator (who are the same) receives any Approver type alerts. An alert that the request has been submitted only is triggered.

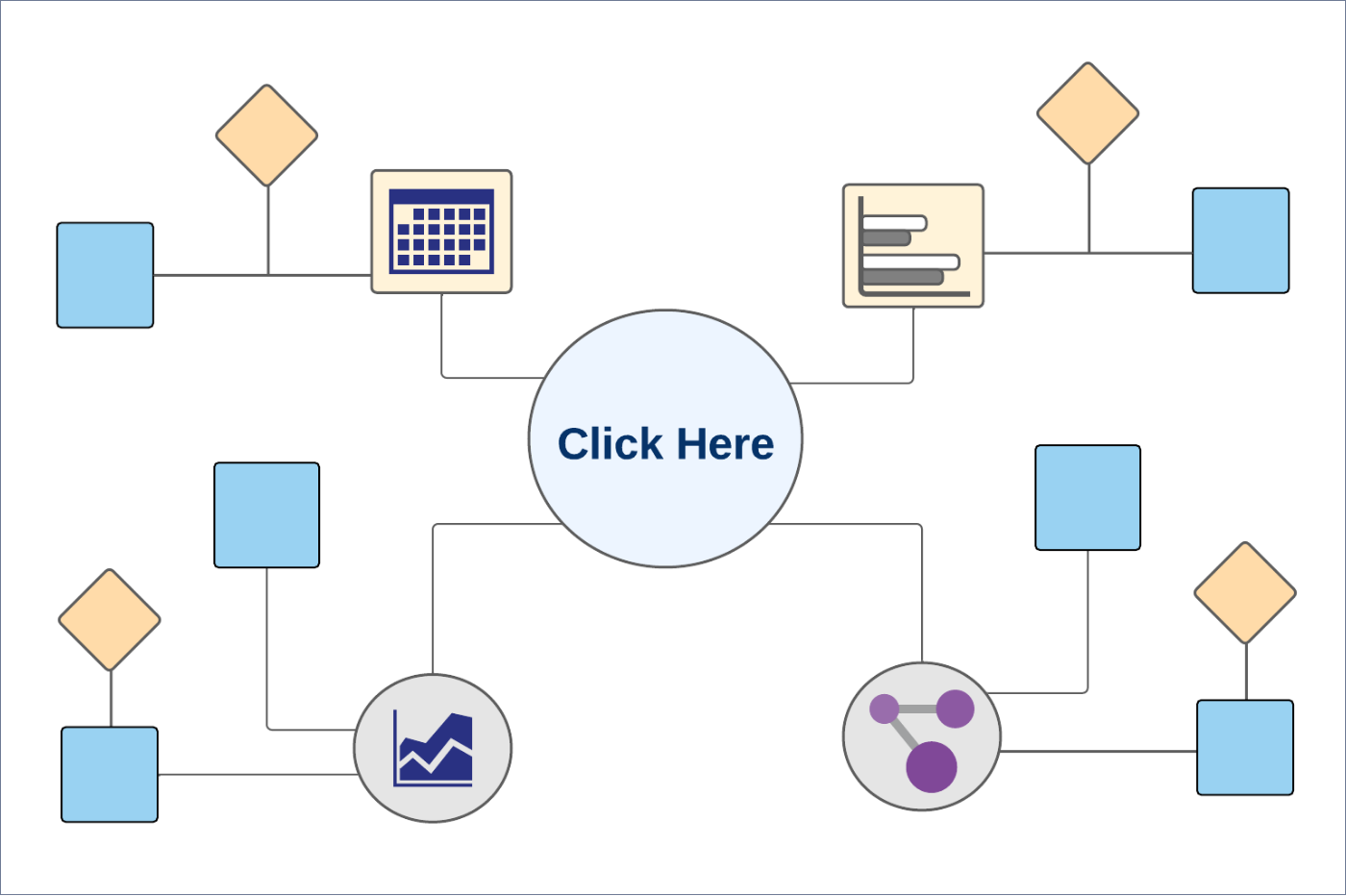

Business Process Diagram - Transfer

Configuration

- The visibility of each feature is controlled through the permissions defined for the user.

- The capability to revoke or restore the features is available in the Spotlight application.

- The Feature/Role/Company level transaction limits for recurring, nonrecurring, non-scheduled, and scheduled transactions are managed in the Spotlight application. User level limits can be managed in Spotlight and the customer-facing application.

- The display of the accounts in the drop-down list depends on the permission given to the user.

- The

retail/personal or

retail/personal or  business icons against the accounts to indicate whether the accounts belong to a Retail or a Business CIF are shown at all relevant places in the application based on the contracts the logged-in user has been given access.

business icons against the accounts to indicate whether the accounts belong to a Retail or a Business CIF are shown at all relevant places in the application based on the contracts the logged-in user has been given access.- When the user has access to only one Customer ID, no personal or business indication is shown at any place in the application.

- When the user has access to only one type of Customer ID (Business/Retail) - this may be through access to a single contract or a mix of contracts, then no personal or business indication is shown at any place in the application.

- A user having access to multiple CIFs either through a single contract or multiple contracts sees the icons representing retail/personal or business accounts against the accounts across the application.

- Person icon: Accounts belong to a CIF where the user is the account holder in core banking. This CIF is marked as the primary CIF in the contract.

- Person icon: Accounts belong to a CIF of type Retail. The user is not an account holder in the core Banking but has been given access through the contract.

- Business icon: Accounts belong to a CIF of type Business.

Approval Alert Notification for transaction

Applies to transfer, bill payment, wire transfer, ACH collection/payment request, or an ACH file.

- The initiator is notified whenever a transaction is submitted for approval through a Global type of alert. Bank agents can configure the Alerts from Spotlight for this specific event.

- The initiator receives a Global type of alert whenever an approval is received on a transaction that the initiator has initiated and submitted for approvals. The use case is providing an alert notification to the initiator when a user approves a transaction, but transaction is not submitted for execution. Bank agents can configure the Alerts from Spotlight for this specific event.

- The initiator receives a Global type of alert whenever a transaction that the initiator has initiated has received the requisite number of approvals and it is submitted for execution. All the approvers receive an alert notification indicating that the transaction that was in their bucket for approval has now been authorized and is submitted for execution. Bank agents can configure the Alerts from Spotlight for this specific event.

- The initiator receives a Global type of alert whenever a transaction that the initiator has initiated has been rejected by any one of the approvers. Bank agents can configure the Alerts from Spotlight for this specific event.

- A Global type of alert notification is sent to all the approvers of a specific transaction when the transaction has been rejected by any one of the approvers. The approver who has rejected a transaction, receives an alert indicated that the specific transaction has been rejected.

APIs

For the complete list of APIs, see Experience APIs documentation.

In this topic