Permissions Based Access to Features

This section explains the permissions (entitlements) based visibility to features and services for business users in the banking application. The permissions are assigned at the following levels: Company, User role, and User.

Users have permissions (entitlements) based access to the features and associated actions in the application. The permissions are assigned to each user role such as administrator, authorizer, creator, and viewer. The roles are configured at the financial institution (FI) level and are assigned to every user, which controls the features and actions that the user can perform.

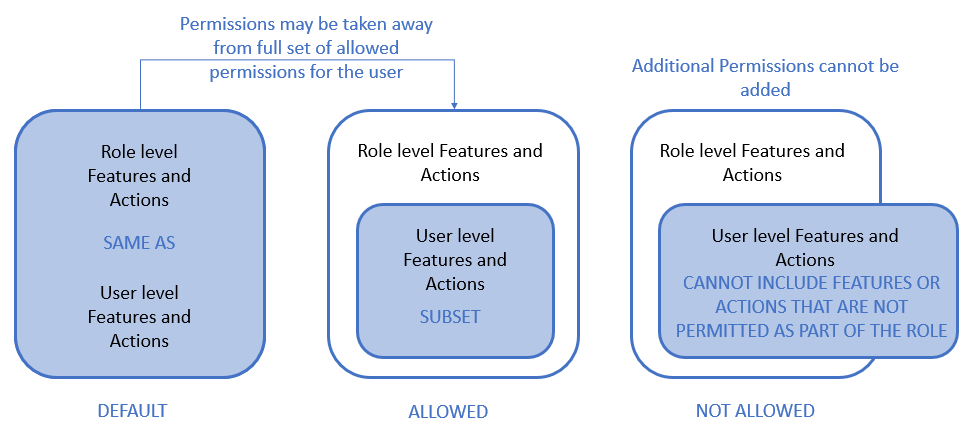

A role defines the highest level of permission that is given to a business user and can even contain permissions to a partial set of actions for a feature, and the permissions can be restricted at the user level as well. A user’s permissions are governed by two things - permissions it inherits from the role and the permissions given to the Company / Business. However, a business owner or an authorized person can take away some of the permissions that the user inherits from a role. Therefore, it is possible to have a custom set of permissions for every user. For example, Bill Pay can be turned on or off for a specific company customer of the bank, a role within that company, or for a specific user within the company. The following graphic explains the permissions concept.

Only when a feature is turned on for company/business or a user, that feature and its expressions (dashboard links, widgets etc.) are visible in the customer-facing banking application and can be interacted with all channels (mobile, responsive web etc.).

This section covers the following topics:

- Role mapping to features

- Visibility of features and services in Responsive Web

- Visibility of features and services in Mobile Native

- User and account level permission to features for business users

Role Mapping to Features

The following table is a sample used for reference purpose showing the feature and associated actions mapped to the user roles. The FIs can configure their own roles.

This is only a sample table and used for reference purposes only.

The following table is a sample used for reference purpose only showing the feature and associated actions mapped to the user roles. The FIs can configure their own roles.

|

Feature |

Action |

Admin |

Authorizer |

Creator |

Viewer |

|---|---|---|---|---|---|

|

Check Management |

Check management |

Yes |

No |

No |

No |

|

|

Add or stop check request |

Yes |

Yes |

Yes |

No |

|

|

View disputed checks |

Yes |

Yes |

Yes |

No |

|

Domestic Wire Transfer |

Approve domestic wire transfers |

Yes |

Yes |

No |

No |

|

|

Wire transfers within the country |

Yes |

Yes |

Yes |

No |

|

|

View history of domestic wire transfers |

Yes |

Yes |

Yes |

Yes |

|

|

Create recipient |

Yes |

No |

No |

No |

|

|

Delete recipient |

Yes |

No |

No |

No |

|

|

Approve self-initiated domestic wire transfer |

Yes |

No |

No |

No |

|

|

View recipient |

Yes |

No |

No |

Yes |

|

ACH Payment |

Approve ACH payments |

Yes |

Yes |

No |

No |

|

|

ACH service |

Yes |

Yes |

Yes |

No |

|

|

ACH payment create template |

Yes |

Yes |

Yes |

No |

|

|

ACH payment delete template |

Yes |

Yes |

Yes |

No |

|

|

Approve self-initiated ACH payments |

Yes |

No |

No |

No |

|

|

View history of ACH payments |

Yes |

Yes |

Yes |

Yes |

|

|

ACH payment view template |

Yes |

Yes |

Yes |

Yes |

|

Recipient Management |

View recipient |

Yes |

Yes |

Yes |

Yes |

|

User Management |

User management |

Yes |

No |

No |

No |

|

|

User management activate |

Yes |

Yes |

Yes |

No |

|

|

User management create |

Yes |

Yes |

Yes |

No |

|

|

User management delete |

Yes |

Yes |

Yes |

No |

|

|

User management suspend |

Yes |

Yes |

Yes |

No |

|

|

User management view |

Yes |

Yes |

Yes |

Yes |

|

Bill Payment Service |

Bill pay activate |

Yes |

Yes |

Yes |

No |

|

|

Bill pay activate e-bill |

Yes |

Yes |

Yes |

No |

|

|

Activate or deactivate bill pay |

Yes |

No |

Yes |

Yes |

|

|

Approve bill payments |

Yes |

Yes |

No |

No |

|

|

Bulk bill pay |

Yes |

Yes |

Yes |

No |

|

|

Bill payment service |

Yes |

Yes |

Yes |

No |

|

|

Bill pay create payees |

Yes |

Yes |

Yes |

No |

|

|

Bill pay deactivate |

Yes |

Yes |

Yes |

No |

|

|

Bill pay deactivate ebill |

Yes |

Yes |

Yes |

No |

|

|

Bill pay delete payees |

Yes |

Yes |

Yes |

No |

|

|

Approve self-initiated bill payments |

Yes |

No |

No |

No |

|

|

View bill payments |

Yes |

Yes |

Yes |

Yes |

|

|

Bill pay view payees |

Yes |

Yes |

Yes |

Yes |

|

|

Bill pay view payments |

Yes |

Yes |

Yes |

Yes |

|

Profile Settings |

Update profile settings |

Yes |

Yes |

Yes |

Yes |

|

|

View profile settings |

Yes |

Yes |

Yes |

Yes |

|

Alert Management |

Alert management |

Yes |

No |

No |

No |

|

Manage E-statements |

Manage E-statements |

Yes |

No |

No |

No |

|

Customer requests and messages |

Create message |

Yes |

Yes |

Yes |

Yes |

|

|

Delete message |

Yes |

Yes |

Yes |

Yes |

|

|

Reply message |

Yes |

Yes |

Yes |

Yes |

|

|

View message |

Yes |

Yes |

Yes |

Yes |

|

Account Settings |

Manage account settings |

Yes |

No |

No |

No |

|

|

View account settings |

Yes |

No |

No |

Yes |

|

ACH Collection |

Approve ACH collections |

Yes |

Yes |

No |

No |

|

|

ACH collection service |

Yes |

Yes |

Yes |

No |

|

|

ACH collection create template |

Yes |

Yes |

Yes |

No |

|

|

ACH collection delete template |

Yes |

Yes |

Yes |

No |

|

|

Approve self-initiated ACH collections |

Yes |

No |

No |

No |

|

|

View history of ACH collections |

Yes |

Yes |

Yes |

Yes |

|

|

ACH collection view template |

Yes |

Yes |

Yes |

No |

|

Approval Matrix |

Manage approval matrix |

Yes |

Yes |

No |

No |

|

|

View approval matrix |

Yes |

Yes |

No |

Yes |

|

Transaction Management |

Delete transaction |

Yes |

Yes |

Yes |

Yes |

|

Applicant |

Create applicant |

Yes |

Yes |

Yes |

Yes |

|

Intra Bank Fund Transfer |

Intra bank fund transfer - approve |

Yes |

Yes |

No |

No |

|

|

Intra bank fund transfer - create |

Yes |

Yes |

Yes |

No |

|

|

Intra bank fund transfer - create recipient |

Yes |

Yes |

Yes |

No |

|

|

Intra bank fund transfer - delete recipient |

Yes |

Yes |

Yes |

No |

|

|

Intra bank fund transfer - self approval |

Yes |

No |

No |

No |

|

|

Intra bank fund transfer - view transactions |

Yes |

Yes |

Yes |

Yes |

|

|

Intra bank fund transfer - view recipient |

Yes |

Yes |

Yes |

Yes |

|

International Account to Account Fund Transfer |

Approve fund transfers to accounts in international banks and credit unions |

Yes |

Yes |

No |

No |

|

|

Fund transfer to accounts in international banks and credit unions |

Yes |

Yes |

Yes |

No |

|

|

International account fund transfer create recipient |

Yes |

No |

No |

No |

|

|

International account fund transfer delete recipient |

Yes |

Yes |

Yes |

No |

|

|

Approve self-initiated fund transfers to accounts in international banks and credit unions |

Yes |

No |

No |

No |

|

|

View history of fund transfers to accounts in international banks and credit unions |

Yes |

Yes |

Yes |

Yes |

|

|

International account fund transfer view recipient |

Yes |

Yes |

Yes |

Yes |

|

Payee Management |

Create payee |

Yes |

Yes |

Yes |

Yes |

|

|

Delete payee |

Yes |

Yes |

Yes |

Yes |

|

|

Edit payee |

Yes |

Yes |

Yes |

Yes |

|

|

View payee |

Yes |

Yes |

Yes |

Yes |

|

Manage Debit and Credit Cards |

Card management |

Yes |

No |

No |

No |

|

|

Change PIN |

Yes |

Yes |

Yes |

Yes |

|

|

Create card request |

Yes |

Yes |

Yes |

Yes |

|

|

Lock card |

Yes |

Yes |

Yes |

Yes |

|

|

Card management - partial update |

Yes |

Yes |

Yes |

Yes |

|

|

Replace card |

Yes |

Yes |

Yes |

Yes |

|

|

Unlock card |

Yes |

Yes |

Yes |

Yes |

|

Dispute Transactions |

Dispute transactions |

Yes |

No |

No |

No |

|

|

Manage dispute transaction |

Yes |

No |

No |

No |

|

|

View dispute transaction |

Yes |

No |

No |

Yes |

|

Notification |

Update notification |

Yes |

Yes |

Yes |

Yes |

|

|

View notification |

Yes |

Yes |

Yes |

Yes |

|

Transfer Between Customer's Accounts |

Approve transactions |

Yes |

Yes |

No |

No |

|

|

Create transaction |

Yes |

Yes |

Yes |

No |

|

|

Self-approval of transfer between customer's accounts |

Yes |

No |

No |

No |

|

|

View transactions |

Yes |

Yes |

Yes |

Yes |

|

International Wire Transfer |

Approve international wire transfers |

Yes |

Yes |

No |

No |

|

|

International wire transfers |

Yes |

Yes |

Yes |

No |

|

|

International wire transfer create recipient |

Yes |

Yes |

Yes |

No |

|

|

International wire transfer delete recipient |

Yes |

Yes |

Yes |

No |

|

|

Approve self-initiated international wire transfers |

Yes |

No |

No |

No |

|

|

View history of international wire transfers |

Yes |

Yes |

Yes |

Yes |

|

|

International wire transfer view recipient |

Yes |

Yes |

Yes |

Yes |

|

Feedback |

Submit feedback |

Yes |

Yes |

Yes |

Yes |

|

Interbank Account to Account Fund Transfer |

Approve fund transfers to accounts in other domestic banks and credit unions |

Yes |

Yes |

No |

No |

|

|

Fund transfer to accounts in other domestic banks and credit unions |

Yes |

Yes |

Yes |

No |

|

|

Inter bank fund transfer create recipient |

Yes |

No |

No |

No |

|

|

Inter bank fund transfer delete recipient |

Yes |

No |

No |

No |

|

|

Approve self-initiated fund transfer to accounts in other domestic banks and credit unions |

Yes |

No |

No |

No |

|

|

View history of fund transfers to accounts in other domestic banks and credit unions |

Yes |

Yes |

Yes |

Yes |

|

|

Inter bank fund transfer view recipient |

Yes |

No |

No |

Yes |

The role to feature mapping is defined and managed in the Spolight (Customer 360) application and any changes in the mapping reflects in the business banking application. However, the business banking application allows business owners and other authorized manager of business users to control access to various features at user level at the time of user creation or editing the user permissions after the user has been created.

Visibility of Features and Services - Responsive Web

Permissions based visibility is available to the following features and services of the Responsive Web (OLB) application for business users.

Accounts List (Dashboard)

The accounts dashboard shows only those accounts to which the user has been explicitly given access and the visibility of each of the quick actions for every account type is controlled by the following permissions:

UI impacted: Accounts List or Dashboard

|

Account type |

Actions |

Conditions for Visibility |

|---|---|---|

|

Savings |

Transfer (new flow) / Make transfer from (old flow) |

New flow If the user has "Create Transaction" permission for any of the following:

Old flow If the user has "Create Transaction" permission for any of the following:

|

|

|

Stop Check Payment |

If the user has "Check Management - Add New Stop check" permission |

|

|

View Statements |

|

|

Checking |

Transfer |

New flow If the user has "Create Transaction" permission for any of the following:

Old flow If the user has "Create Transaction" permission for any of the following:

|

|

|

Pay Bill |

If the user has "Create Transaction" permission for Bill Payments |

|

|

Stop Check Payment |

If the user has "Check Management - Add New Stop Check Payment Request" permission |

|

|

View Statements |

|

|

Credit Card |

Pay Bill |

If the user has "Create Transaction" permission for Bill Payments |

|

|

View Statements |

|

|

Loan/Mortgage |

Pay due amount |

If the user has "Create Transaction" permission for any of the following

|

|

|

Update Account Settings |

|

|

|

View Statements |

|

|

Deposits, IRA, Certificate Share/Deposits |

Update Account Settings |

|

|

|

View Statements |

|

Account Details

Account Details - Actions

A business user while viewing the account details can see only those actions that the user has the permission to perform. The control to switch between account details shows only those accounts to which the user has been explicitly given access. The visibility of each of the actions on the account details page for every account type is controlled by the following permissions.

UI impacted: Account Details page

|

Account type |

Type of Link |

Actions |

Conditions for Visibility |

|---|---|---|---|

|

Savings |

Quick Link |

Make transfer from |

If the user has "Create Transaction" permission for any of the following:

|

|

|

Quick Link |

Scheduled Transactions |

|

|

|

Other Actions |

Stop Check Payment |

If the user has "Check Management - Add new stop check payment request" permission |

|

|

Other Actions |

View Statements |

|

|

|

Other Actions |

Update Account Settings |

|

|

Checking |

Quick Link |

Make transfer from |

If the user has "Create Transaction" permission for any of the following:

|

|

|

Quick Link |

Scheduled Transactions |

|

|

|

Quick Link |

Pay a bill from |

If the user has "Create Transaction" permission for Bill Payments |

|

|

Other Action |

Stop Check Payment |

If the user has "Check Management- Add new stop check payment request" permission |

|

|

Other Action |

View Statements |

|

|

|

Other Action |

Update Account settings |

|

|

Credit Card |

Other Action |

Pay a bill from |

If the user has "Create Transaction" permission for Bill Payments |

|

|

Quick Link |

Scheduled Transactions |

|

|

|

Quick Link |

View Statements |

|

|

|

Other Action |

Update Account Settings |

|

|

Loan |

Quick Link |

Pay due amount |

If the user has "Create Transaction" permission for any of the following:

|

|

|

Quick Link |

Update Account Settings |

|

|

|

Quick Link / Other Action |

View Statements |

|

|

|

Other Action |

Payoff Loan |

If the user has "Create Transaction" permission for any of the following

|

|

Deposits, IRA, Certificate Share/Deposits |

Other Action |

Update Account Settings |

|

|

|

Quick Link |

View Statements |

|

Transactions - All / Transfers / Deposits / Withdrawals

- Repeat Transaction: A business user can view and execute a Repeat Transaction action only on those transactions that the user has the Create Transaction permission to the service through which the transaction has been created (Wire Transfer / Internal Fund Transfer / Third-party Fund Transfer).

- Dispute Transaction: A business user can dispute transactions only those transactions that the user has the Dispute Transaction - Manage permission.

- View Request: A business user can view disputed transactions only those transactions that the user has the Dispute Transaction - View permission.

UI impacted: Account Details page

Account Details - Scheduled Transactions

Modify/Cancel: A business user can modify or cancel a scheduled transaction if the user has the permission. Modify/Cancel is visible only if the user has "Create Transaction" permission to the service through which the transaction has been created (Wire Transfer / Internal Fund Transfer / Third-party Fund Transfer).

Menus - Top and Hamburger

The visibility of each of the menu items under the top menu and hamburger menu is controlled through the following permissions. Where no conditions are mentioned, it is implied that there is no permissions based visibility control for these menu options.

UI impacted: Top menu and Hamburger menu

|

Feature |

Actions |

Conditions for Visibility |

|---|---|---|

|

Top Menu |

Transfer & Pay |

If the user has "View" permission for any of the following:

|

|

|

Transfer money |

If the user has "View" / "Create Transaction" / "Manage Payee" permission for any of the following:

|

|

|

Pay Bills |

If the user has "View" permission for Bill Payments |

|

|

Wire Money |

If the user has "View" permission for any of the following:

|

|

Hamburger Menu |

Accounts |

(Visible if any of the options under Accounts is visible) |

|

|

My Accounts |

|

|

|

Card Management |

If the user has "Card Management" permission |

|

|

Stop Payment Requests |

If the user has "Dispute Transactions - View" / "Check Management - View" permission |

|

|

Personal Finance Management |

If the user has "Personal Finance Management" permission. Applicable only for retail user. |

|

|

Transfers |

(Visible if any of the options under Transfers is visible) |

|

|

Transfer Money |

If the user has "Create Transaction" permission for any of the following:

|

|

|

Transfer History |

|

|

|

External Accounts |

If the user has "Manage Payee" permission for any of the following:

|

|

|

Add Temenos Digital Bank Accounts |

If the user has "Manage Payee" permission for any of the following:

|

|

|

Add External Accounts |

If the user has "Manage Payee" permission for any of the following:

|

|

|

Bill Pay |

(Visible if any of the options under Bill Pay is visible) |

|

|

Pay A Bill |

If the user has "Create Transaction" permission for Bill Payments |

|

|

Bill Pay History |

|

|

|

My Payee List |

|

|

|

Add Payee |

If the user has "Manage Payee" permission for Bill Payments |

|

|

Make One Time Payment |

If the user has "Create Transaction" permission for Bill Payments |

|

|

Alerts & Messages |

(Visible if any of the options under Alerts & Messages is visible) |

|

|

Alerts |

|

|

|

My Messages |

|

|

|

New Message |

|

|

|

Settings |

(Visible if any of the options under Settings is visible) |

|

|

Profile Settings |

|

|

|

Alert Settings |

If the user has "Alerts management" permission |

|

|

Account Settings |

|

|

|

Wire Transfer |

(Visible if any of the options under Wire Transfers is visible) |

|

|

Make Transfer |

If the user has "Create Transaction" permission for any of the following:

|

|

|

History |

|

|

|

My Recipients |

|

|

|

Add Recipients |

If the user has "Manage Payee" permission for any of the following:

|

|

|

Make One Time Payment |

If the user has "Create Transaction" permission for any of the following:

|

|

|

About Us |

|

|

|

Terms & Conditions |

|

|

|

Privacy Policy |

|

|

|

User Management |

(Visible if any of the options under User Management is visible) |

|

|

All Users |

If the user has "User Management" permission |

|

|

Create a User |

If the user has "User Management" permission |

Transfers

Transfers - Transfer Money

- Transfers: A business user can see only those Transfers option to which, the user has the permission to perform.

- Transfers Dashboard - Transfer Money: The visibility of each of the actions on the following is controlled by the permissions given in the table.

- On the dashboard

- Change Transfer Type while creating a transaction.

- Choose a Transfer Type while creating a transaction.

|

Transfer Option |

Conditions for Visibility |

|---|---|

|

To My Temenos Digital Bank accounts

|

If the user has "Create Transaction" permission for any of the following:

|

|

To external members

|

If the user has "Create Transaction" permission for any of the following:

|

|

To other Bank accounts

|

If the user has "Create Transaction" permission for any of the following:

|

|

International accounts

|

If the user has "Create Transaction" permission for any of the following:

|

|

Wire Transfer |

If the user has "Create Transaction" permission for any of the following:

|

- Create Transaction: While creating a transfer, a business user can see only those accounts in the "From Account" list to which the user has access and can change the "transfer by" to only a Transfer Type that the user has the permission to perform.

- Add Recipients Quick Links: The visibility of the quick links is driven by the following permissions.

|

Transfer Option |

Conditions for Visibility |

|

Add Temenos Digital Bank Recipient

|

If the user has "Manage Payee" permission for any of the following:

|

|

Add External Recipient

|

If the user has "Create Transaction" permission for any of the following:

|

|

Add International Recipient

|

If the user has "Create Transaction" permission for any of the following:

|

A user can have access to multiple contracts and a contract can have single or multiple Customer IDs within it. Also, a contract can be a combination of single or multiple retail and business customer IDs. The beneficiaries are stored/associated at a customer ID level and all the actions of view, edit, and delete a beneficiary is controlled by the permissions the user has at the customer ID level. A user can share the beneficiary with other customer IDs (to which the user has permission) or associate with one or multiple customer IDs. In the "Manage Beneficiary" feature, the beneficiaries are listed based on the customer IDs to which the user has access. The beneficiaries are stored in the DBX DB.

A contract can have the following use cases and a user associated with the contract can be classified as:

- Single Retail Customer ID (Retail)

- Multiple Retail Customer IDs (Retail)

- Single Business Customer ID (Business)

- Multiple Business Customer IDs (Business)

- Multiple Retail & Business Customer IDs (Combined)

Key points:

- The beneficiaries are linked at a customer ID level.

- A logged-in user can create/edit a beneficiary only if the user has permission for Create Beneficiary feature action under any of the following: Transfer/Bill Payment/Bulk payment/Domestic and International Wire/P2P.

- User will have an option to share the beneficiary with other Customer IDs (to which the user has permission) or can associate it with one or multiple Customer IDs.

- If the user has Edit permission, the user can edit the beneficiary also as stated above.

- In case of Delete, if the user deletes a specific beneficiary, it will be deleted against all the customer IDs linked to it.

- While making a payment, when a user selects a particular account based on the customer ID of the that account in the "To" field, all the beneficiaries are listed.

- In the "Manage Beneficiary" feature, the beneficiaries are listed based on the customer IDs the user has access. Also, if the same beneficiary is available across multiple Customer IDs, the beneficiary appears once on the screen.

- In addition to the customer ID level access, the beneficiary listing is based on the Feature level permission of the logged-in user.

UI impacted: Transfer module screens

Transfers - Recent and Scheduled

- Recent tab: A business user can see the "Repeat" transaction action for those transactions to which, the user has the "Create Transaction" Permission to the service through which, the transaction has been created (Wire Transfer / Internal Fund Transfer / Third-party Fund Transfer).

- Scheduled tab: A business user can see the 'Edit / Cancel' actions for scheduled transactions to which, the user has the "Create Transaction" Permission to the service through which, the transaction has been created (Wire Transfer / Internal Fund Transfer / Third-party Fund Transfer).

- For "Choose a Transfer Type" options, see Permissions for Transfer Money table under Transfer Money.

- For "Add Recipients" options, see Permissions for Add Recipient Quick Links table under Transfer Money.

Transfers - Recipients

Recipients tab: A business user can see the "Edit / Delete" actions on the recipients for Fund Transfers only if the user has the "Manage Payee" permission to any of the following services: created (Wire Transfer / Internal Fund Transfer / Third-party Fund Transfer).

UI impacted: Transfer module

- For "Choose a Transfer Type" options, see Permissions for Transfer Money table under Transfer Money.

- For "Add Recipients" options, see Permissions for Add Recipient Quick Links table under Transfer Money.

Transfers (New Money Movement Flow) - Top Menu - Transfers and My Bill

- A financial institution (FI) can set the Transfer option be visible to only those users who have the permission to perform transfers using the application.

- An FI can set the Transfer Activities be visible to only those users who have the permission to perform transfers using the application.

- An FI can set the Manage Recipients option be visible to only those users who have the permission to view and manage recipients.

Transfer Menu (Top Level) - Transfer

- The Transfer option is shown if the user has the "CREATE" permission for Transfers/P2P/both.

- The Transfer option checks the "CREATE" transaction permission for the following services:

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

- If the permission exists for at least one of the above services, the application shows the "Transfer" option. Otherwise, it is not shown.

Transfer Menu (Top Level) - Transfer Activities

- The Transfer Activities option is shown if the user has the permission to do Transfers/P2P/both.

- The Transfer Activities option checks the transaction permissions for the following services. If the user has access to "View" permission to any of the features below "Transfer Activities" option.

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

Transfer Menu (Top Level) - Manage Recipients

- The Manage Recipients option is shown if the user has the "Manage Recipients" permission to do Transfers.

- Check the permissions for the following services. If the "View Recipients" permission exists for at least one of the following services, then the user can see the "Manage Recipients" option.

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

Transfer Menu (Top Level) - Add Recipient

- The Add Recipient option is shown if the user has the "Add/Edit/Edit Recipients" permission to do Transfers/P2P/ both.

- Check the permissions for the following services. If the "Add/Edit Recipients" permission exists for the following services, then the user can see the "Add Recipients" option.

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

The top level "Transfers" option on both the top menu and on the hamburger menu, is hidden if the user does not have the permissions required to show even a single sub-option under the menus.

Transfers (New Money Movement Flow) - Hamburger Menu

Transfer Menu (Top Level) - Transfer

- The Transfer option is shown if the user has the "CREATE" permission for Transfers/P2P/both.

- The Transfer option checks the "CREATE" transaction permission for the following services:

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

- If the permission exists for at least one of the above services, the application shows the "Transfer" option. Otherwise, it is not shown.

Transfer Menu (Top Level) - Transfer Activities

- The Transfer Activities option is shown if the user has the permission to do Transfers.

- The Transfer Activities option checks the transaction permissions for the following services. If the user has access to "View" permission to any of the features below "Transfer Activities" option.

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

Transfer Menu (Top Level) - Manage Recipients

- The View Recipients option is shown if the user has the "Manage Recipients" permission to do Transfers.

- Check the permissions for the following services. If the "View Recipients" permission exists for at least one of the following services, then the user should be able to see the "Manage Recipients" option.

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

- If the business user has only permission for "Transfer between customer own accounts", the Manage Recipients option will not be available on the Hamburger Menu.

Transfer Menu (Top Level) - Add Recipient

- The Add Recipient option is shown if the user has the "Add/Edit/Edit Recipients" permission to do Transfers/P2P/ both.

- Check the permissions for the following services. If the "Add/Edit Recipients" permission exists for the following services, then the user can see the "Add Recipients" option.

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

The top level "Transfers" option on both the top menu and on the hamburger menu, is hidden if the user does not have the permissions required to show even a single sub-option under the menus.

My Bills (Top Level)

Applies same permissions of Bill Pay in the old transfers flow.

Transfers (New Money Movement Flow) - Accounts Dashboard - Quick Links

Transfer

- The Transfer option is shown if the user has the "CREATE" permission for Transfers.

- The Transfer option checks the "CREATE" transaction permission for the following services:

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

- If the permission exists for at least one of the above services, the application shows the "Transfer" option. Otherwise, it is not shown.

Transfers (New Money Movement Flow) - Account Details Page - Quick Links

Transfer

- The Transfer option is shown if the user has the "CREATE" permission for Transfers.

- The Transfer option checks the "CREATE" transaction permission for the following services:

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

- If the permission exists for at least one of the above services, the application shows the "Transfer" option. Otherwise, it is not shown.

Transfers (New Money Movement Flow) - Quick Links in the Transfers Flow

Transfer

- The Transfer option is shown if the user has the "CREATE" permission for Transfers.

- The Transfer option checks the "CREATE" transaction permission for the following services:

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

- If the permission exists for at least one of the above services, the application shows the "Transfer" option. Otherwise, it is not shown.

Transfers (New Money Movement Flow)

A user can initiate a money movement by selecting the accounts to make the transfer. The user can view all the accounts (eligible to make a transfer from) - for which, the user has access, grouped by the account type.

A business user has access to the particular account for it to appear in the From list and has "CREATE" permission for one or more of the following services:

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

When there are no such accounts which meet the above criteria:

- If there are no eligible accounts to transfer money from, the same is indicated to the user through an appropriate message.

- The Open New Account link is shown only if the user has the "New Account Opening" permission. Applicable only for retail user.

- If the permission exists:

- Takes the user to the new account opening screen.

- On conclusion of the new account opening flow, the user initiates the transfer again.

- If the permission does not exist, the option is not shown to the user at all.

- If the permission exists:

User’s own accounts grouped by account type

- Business users can only see this section if they have been given the "Create" permission on Transfer between customer's accounts. In this case, the business user can see all of the Company's own accounts and be able to transfer funds between them.

- If there are no such accounts or the user does not have the associated permission, then these grouped sections are not shown to the user at all.

When there are no "To Accounts" to transfer

- If there are no recipients to transfer money, the same is indicated to the user through an appropriate message.

- A "Transfer to New Recipient" link is shown if the user has Add/Edit Recipient permission on any of the following features. This takes the user to the flow for adding a new recipient.

- Intra Bank Fund Transfer

- Transfer between customer's accounts

- Interbank Account to Account Fund Transfer

- International Account to Account Fund Transfer

- After adding a new recipient, the user must initiate the transfer again.

Transfers - Add New Recipients

A financial institution can make the option to add a particular type of Account/Recipients visible to only those users who have the permission to view and manage recipients.

- Temenos Digital Account: This option is shown if the user has the "ADD / EDIT RECIPIENTS" permission to do "Intra Bank Fund Transfer".

- External Account: This option is shown if the user has the "ADD / EDIT RECIPIENTS" permission to do "Interbank Account to Account Fund Transfer".

- International Account: This option is shown if the user has the "ADD / EDIT RECIPIENTS" permission to do "International Account to Account Fund Transfer".

Options that are not available to the user are hidden and the positions on the components on the page are adjusted accordingly.

Link to activate the P2P services is shown only to those users who have the "Activate P2P service" permission to activate the service on behalf of the company.

Transfers - Transfer Activities - Scheduled Transfers

A user with "CREATE" permission on the associated service can do the following:

- Edit the scheduled transfers.

- Cancel a transfer.

- Cancel a single instance / occurrence of a repeating transfer.

- Cancel the complete series for a repeating transfer.

Transfers - Transfer Activities - Past Transfers

A business user can view all the past transfers that have been completed over the banking application in the following conditions:

- If the user has been given access to the From account on which the transaction has been initiated.

- The transfer is created by any business user on the account through the online channel.

Transfers - Repeat Transfer

A user can repeat a transfer only if the user has "CREATE" permission on the associated service and access to the From account.

Transfers - Manage Recipients tab

- The Manage Recipients tab is shown only if the business user has any one of the following feature action permissions in Inter Bank Fund Transfer, Intra bank Fund Transfer, and International Fund Transfer. The Manage Recipients tab is common across Interbank, Intra Bank, and International Fund Transfer. If the business user does not have permission for all the following feature actions under all three features, the Manage Recipients tab will not be displayed. But if the user has the feature action permission under any one of the Fund Transfer type, the Manage Recipients section will be displayed.

- View Recipient

- Create Recipient

- Delete Recipient

- Based on the above permissions, on expanding a specific recipient, the action buttons, Edit and Delete are available.

- The business user can view list of recipients if "View Recipient" feature action permission under Inter-Bank Account to Account Transfer, Intra Bank Fund Transfer, and International Fund Transfer is enabled.

- The business user can Create or Edit a specific recipient if "Create Recipient" feature action permission under Inter-Bank Account to Account Transfer, Intra Bank Fund Transfer, and International Fund Transfer is enabled.

- The business user can delete an existing recipient if "Delete Recipient" feature action permission under Inter-Bank Account to Account Transfer, Intra Bank Fund Transfer, and International Fund Transfer is enabled.

- When the business user has, say permission for Interbank Fund Transfer in the Manage Recipients list, then the other recipients such as international recipients and same bank (Temenos Digital Bank) recipients are not displayed.

- The recipients list displays details based on the permissions (type of transfer) the logged-in business user has been given.

Bill Payment

A business user can do the following if the user has the required permissions:

- Manage Payees (add/delete/edit) for Bill Payments

- Create bill payments only from those accounts to which the user has been given access.

- Edit/Cancel scheduled payments only if the user has been given access.

UI impacted: Bill Payments

Note:

- The existing actions Activate/Deactivate Bill Pay, Bill Pay Activate, and Bill Pay Deactivate are merged as single feature action, "Activate /Deactivate Bill Pay".

- The existing actions, Bill Pay Activate E Bill and Bill Pay Deactivate E Bill are merged as single feature action, Bill Pay Activate /Deactivate E-Bill.

- The existing actions, Bill Pay View Payments and View Bill payments are merged as single feature action, "View Bill Payments".

Quick Actions

- Add Payee: This action is displayed only if the user has "Manage Payees" access to Bill Payments.

- Make One Time Payment: These options are visible only if the user has the "Create Transaction" permission for Bill payments.

Tabs

- All Payees: Shown only if the user has "Create Transaction" permission for Bill payments.

- Payment Due: Shown only if the user has "Create Transaction" permission for Bill payments.

- Scheduled: Shown only if the user has "Create Transaction" permission for Bill payments.

- History: Shown only if the user has "View", "Create Transaction", or "Manage Payees" permission for Bill payments.

- Manage Payees: Shown only if the user has "Manage Payees" permission for Bill payments

Bill Pay - Scheduled Tab

Edit / Cancel: These options are visible only if the user has the "Create Transaction" permission for Bill payments.

Bill Pay - History Tab

Repeat: This option is visible only if the user has the "Create Transaction" permission for Bill payments.

Bill Pay - Manage Payees tab

- Pay a Bill: This option is visible only if the business user has "Create Transaction" permission for Bill payments.

- Add/Edit/Delete payees

- The Manage Payees tab is shown only if the business user has any one of the following feature actions:

- Create Payee

- View Payee

- Delete Payee

- Based on the above permissions, on expanding a specific payee, the action buttons, Edit and Delete are available.

- The business user can view the list of payees if "View Payee" feature action permission under Bill Payment Service is enabled.

- The business user can create a payee or edit a biller if "Create Payee" feature action permission under Bill Payment Service is enabled.

- The business user can delete an existing biller if "Delete Payee" feature action permission under Bill Payment is enabled.

- The Manage Payees tab is shown only if the business user has any one of the following feature actions:

A user can have access to multiple contracts and a contract can have single or multiple Customer IDs within it. Also, a contract can be a combination of single or multiple retail and business customer IDs. The beneficiaries are stored/associated at a customer ID level and all the actions of view, edit, and delete a beneficiary is controlled by the permissions the user has at the customer ID level. A user can share the beneficiary with other customer IDs (to which the user has permission) or associate with one or multiple customer IDs. In the "Manage Beneficiary" feature, the beneficiaries are listed based on the customer IDs to which the user has access. The beneficiaries are stored in the DBX DB.

A contract can have the following use cases and a user associated with the contract can be classified as:

- Single Retail Customer ID (Retail)

- Multiple Retail Customer IDs (Retail)

- Single Business Customer ID (Business)

- Multiple Business Customer IDs (Business)

- Multiple Retail & Business Customer IDs (Combined)

Key points:

- The beneficiaries are linked at a customer ID level.

- A logged-in user can create/edit a beneficiary only if the user has permission for Create Beneficiary feature action under any of the following: Transfer/Bill Payment/Bulk payment/Domestic and International Wire/P2P.

- User will have an option to share the beneficiary with other Customer IDs (to which the user has permission) or can associate it with one or multiple Customer IDs.

- If the user has Edit permission, the user can edit the beneficiary also as stated above.

- In case of Delete, if the user deletes a specific beneficiary, it will be deleted against all the customer IDs linked to it.

- While making a payment, when a user selects a particular account based on the customer ID of the that account in the "To" field, all the beneficiaries are listed.

- In the "Manage Beneficiary" feature, the beneficiaries are listed based on the customer IDs the user has access. Also, if the same beneficiary is available across multiple Customer IDs, the beneficiary appears once on the screen.

- In addition to the customer ID level access, the beneficiary listing is based on the Feature level permission of the logged-in user.

Creating a Bill Payment Transaction

In addition to the current set of conditions applied, the application ensures that the accounts shown in the "Pay From" account list are the accounts to which the signed in user has access. This applies to all the tabs and pages from which Bill Payments can be created.

Bill Pay - Bulk

Acknowledgment screen shows different icons based on the status of payment - Success, Failed, Under Approval

Bill Payment - Add payee

A business user can pay bills to Registered Payees from the Add Payees page if the user has the "Create Transaction" permission for Bill payments.

UI impacted: Bill Payments - My Registered Payees section

Initiate a bill payment

Initiate a bill payment if "Bill Payment Services" feature action permission under Bill Pay Service is enabled.

Activate and deactivate e-billers

Activate and deactivate e-billers if "Bill pay Activate /Deactivate E-Bill" feature action permission under Bill Pay Service is enabled.

View history of bill paid

View history of bill paid if "View Bill payments" feature action permission under Bill Pay Service is enabled.

Initiate multiple bill payments

Initiate multiple bill payments to several billers in a single payment if "Bulk Bill Pay" feature action permission under Bill Pay Service is enabled.

Wire Transfer

A business user can do the following if the user has the required permissions:

- Manage payees (add / delete / edit) for wire transfers.

- Initiate wire transfers only from those accounts to which the user has been given access.

UI impacted: Wire Transfer pages

Quick Actions

- Add Domestic accounts: Shown only if the user has "Manage Payees" access to Domestic Wire Transfers.

- Add international accounts: Shown only if the user has "Manage Payees" access to International Wire Transfers.

- Transfer Money Once: Show only if the user has "Create Transaction" permission to Domestic/International Wire Transfers.

- View Account Information: Shown only if the user has "View/"Create Transaction" permission to Domestic/ International Wire Transfers.

Tabs

- Transfer Money: Shown only if the user has "Create Transaction" permission to Domestic / International Wire Transfers.

- Recent: Shown only if the user has "View"/ "Create Transaction" permission to Domestic / International Wire Transfers.

- Manage Recipients: Shown only if the user has any one of the following feature action permissions in Domestic Wire Transfer / International Wire Transfers.

- View Recipient

- Create Recipient

- Delete Recipient

Recent tab

- Repeat

If Account Type = Domestic, shown only if the user has "Create Transaction" permission to Domestic Wire Transfers.

If Account Type = International, shown only if the user has "Create Transaction" permission to International Wire Transfers

Manage Recipients tab

- Transfer Money

- If Account Type = Domestic, shown only if the user has "Create Transaction" permission to Domestic Wire Transfers.

- If Account Type = International, shown only if the user has "Create Transaction" permission to International Wire Transfers.

- Add/Edit/Delete Recipients

- The Manage Recipients tab is shown only if the user has any one of the following feature action permissions in Domestic Wire Transfer / International Wire Transfers. The Manage Recipient tab is common across domestic and international wire transfers. If the user does not have permission for all the following feature actions under both the features, the Manage Recipients tab will not be displayed. But if the user has the feature action permissions either under Domestic or International, the Manage Recipients section will be displayed.

- View Recipient

- Create Recipient

- Delete Recipient

- Based on the above permissions, on expanding a particle recipient, the action buttons, Edit and Delete are available.

- The business user can view the list of recipients if "View Recipient" feature action permission under Domestic Wire Transfer or International Wire Transfer is enabled.

- The business user can Create/Edit a specific recipient if "Create Recipient" feature action permission under Domestic Wire Transfer or International Wire Transfer is enabled.

- The business user can delete an existing recipient if "Delete Recipient" feature action permission under Domestic Wire Transfer or International Wire Transfer is enabled.

- In case the user has only Domestic Wire Transfer permissions, recipients of International Wire Transfer are not displayed in Manage Recipients screen.

- The Manage Recipients tab is shown only if the user has any one of the following feature action permissions in Domestic Wire Transfer / International Wire Transfers. The Manage Recipient tab is common across domestic and international wire transfers. If the user does not have permission for all the following feature actions under both the features, the Manage Recipients tab will not be displayed. But if the user has the feature action permissions either under Domestic or International, the Manage Recipients section will be displayed.

A user can have access to multiple contracts and a contract can have single or multiple Customer IDs within it. Also, a contract can be a combination of single or multiple retail and business customer IDs. The beneficiaries are stored/associated at a customer ID level and all the actions of view, edit, and delete a beneficiary is controlled by the permissions the user has at the customer ID level. A user can share the beneficiary with other customer IDs (to which the user has permission) or associate with one or multiple customer IDs. In the "Manage Beneficiary" feature, the beneficiaries are listed based on the customer IDs to which the user has access. The beneficiaries are stored in the DBX DB.

A contract can have the following use cases and a user associated with the contract can be classified as:

- Single Retail Customer ID (Retail)

- Multiple Retail Customer IDs (Retail)

- Single Business Customer ID (Business)

- Multiple Business Customer IDs (Business)

- Multiple Retail & Business Customer IDs (Combined)

Key points:

- The beneficiaries are linked at a customer ID level.

- A logged-in user can create/edit a beneficiary only if the user has permission for Create Beneficiary feature action under any of the following: Transfer/Bill Payment/Bulk payment/Domestic and International Wire/P2P.

- User will have an option to share the beneficiary with other Customer IDs (to which the user has permission) or can associate it with one or multiple Customer IDs.

- If the user has Edit permission, the user can edit the beneficiary also as stated above.

- In case of Delete, if the user deletes a specific beneficiary, it will be deleted against all the customer IDs linked to it.

- While making a payment, when a user selects a particular account based on the customer ID of the that account in the "To" field, all the beneficiaries are listed.

- In the "Manage Beneficiary" feature, the beneficiaries are listed based on the customer IDs the user has access. Also, if the same beneficiary is available across multiple Customer IDs, the beneficiary appears once on the screen.

- In addition to the customer ID level access, the beneficiary listing is based on the Feature level permission of the logged-in user.

Creating Transaction - Wire Transfer

In addition to the current set of conditions applied, the application ensures that the accounts showed in the "Pay From" account list are the accounts to which the signed in user has access. This applies to all the tabs and pages from which wire transfer can be initiated.

Wire Transfer - Add recipient

A business user can add the type of recipient (Domestic/International) based on the permission that the user has been given.

UI impacted: Wire Transfer pages

Tabs:

- Domestic Account tab: Shown only if the user has "Manage Payee" permission to Domestic Wire Transfers.

- International Account tab: Shown only if the user has "Manage Payee" permission to International Wire Transfers.

Quick Actions:

Transfer Money Once: Shown only if the user has "Create Transaction" access to Domestic Wire Transfers.

Wire Transfer - One-time Transfers

For a business user, selection of account type "Domestic" / "International" for a one-time wire transfer is based on the permissions given to the user.

UI impacted: Wire Transfer pages

Selection of Account type:

For a business user, selection of account type "Domestic" / "International" for a one-time wire transfer is based on the permissions given to the user. Selection of Account type is auto-selected and not changeable if the user has "Create Transaction" permission for only one of the following:

- Domestic Wire Transfer

- International Wire Transfer

Quick Actions:

- Add Domestic accounts: Shown only if the user has "Manage Payees" access to Domestic Wire Transfers.

- Add international accounts: Shown only if the user has "Manage Payees" access to International Wire Transfers.

Wire Transfer - View Account Info

A business user can select from only those accounts that the user has been given the permission to access in the view account information for wire transfers page. Besides other conditions that are already applied to the 'Account info drop down', the drop-down list shows only those accounts that the signed in user has been given access.

Wire Transfer - Combined Retail + Business

- A combined user with access to both business and retails accounts, while initiating a wire transfer or managing payees can know the recipients that were added for personal use and the ones that were added for business use, and whether the accounts to which a wire transfer is to be initiated are personal accounts or business accounts.

- Transfer Money: Shows a list of wire recipients. The application differentiates between personal and business recipients with specific icons.

- Manage Recipients: Shows a list of personal and business recipients.

- Create Wire Transfer: Selection of from account shows a differentiation between the personal and business accounts, and which recipients were added for personal and business use.

UI impacted: Wire Transfer pages

Account Settings

Account Settings - Account Preferences

A business user can control the setting for enabling or disabling e-statements and also setting or managing the e-mail address for the e-statements for the user's business. Other business users cannot change these settings unless they have been given the permission change.

The following sections in the account preferences are hidden for each account unless the user has "E-statement Management" permission:

- Enable e-statements

- Terms agreement

- Changing the email address

Account Settings - Alert Preferences

A business user can control the alert preferences for all other users within the business and also delegate the management of alert preferences to other users within the business.

- Alert preferences are set, managed, and applied commonly for users of a business.

- Alert Preferences section in Account Settings is visible to those users who have the "Alert Management" permission.

- Changes applied by any authorized person applies to all users of a business.

My Requests - Checks and Disputes

A user with necessary permissions can do the following:

- View Stop Check Payments requests and Cancel the requests.

- Raise new Stop Check Payments requests.

- View Disputed Transactions and Cancel the dispute requests.

The My Requests page is accessible to users who have either of the following permissions:

- Check Management - View

- Dispute Transactions - View

Disputed Transactions

- The tab is accessible only to users with "Dispute Transactions - View" permission.

- Cancel: Dispute Transaction - Manage permission

- Send a Message: Message - Create permission

Disputed Checks

- The tab is accessible only to users with "Check Management" permission.

- Cancel: Check Management - Add stop check payment

- Send a Message: Message - Create permission

Add New Stop Check Payments Requests

This action is accessible to users with "Check Management - Add new stop check request" permission.

Users can view the list of only those disputed checks which are raised on the accounts for which they have “View Disputed Checks” permission.

When selecting from accounts, a clear distinction is available between the personal accounts and the business accounts - in the case where the user has combined access to both business and retail accounts.

Cards Management

A combined user with access to both business and retails accounts can view all cards of the signed in user including those that are for business use and for personal use based on the permissions that are assigned to the user.

Retail customer

- Cards are associated with a user.

- The card control actions are driven by the retail permissions only for the retail cards.

Business customer

- Cards are associated with the company/business entity.

- It is possible that all/few of these cards are assigned to business users belonging to the company.

- Card control permissions (user level) applies to all the cards that the user has access.

Combined Retail + Business user

- Retail Permissions applies on the cards that are meant for personal use.

- Business Permissions applies for the cards that are meant for business use.

- The card management module shows clear distinction been retail and business cards.

User Management

The User Management menu is available on the Hamburger menu only if a business user has any one of the following permissions:

- Create Users

- View Users

- Manager users

- Activate/Suspend User

The logged-in user can distinguish between self-user and other users in the user list. The logged-in user record is marked with (Me) after the name, for example - John (Me). In online banking application, maximum 15 characters of name is displayed and includes (Me) in case of the logged-in user. If the first name (which is displayed in online banking) is very long, the (Me) suffix part will be truncated. The user can only view the permissions and cannot edit own permissions even if "Manage Users" permission is enabled in User Management feature.

The following are the revised feature actions:

| Feature Action | Description |

|---|---|

| View Users | This action is associated with permission for viewing all the users and their list of permissions. |

| Activate/Suspend Users | Single action is associated with permission for activating and deactivating a user. |

| Create Users | Associated with permission for creating a new user. |

| Manage Users | Associated with permission for editing an existing user. A business user can view the list of users and their account access and all the associated permissions. |

Custom View

A business user can create custom views for the accounts to which the user has access to organize and categorize accounts for a preferred viewing purpose. The user can also create, manage, and delete the custom views if the user has the necessary permissions.

- The Custom View option will be available to the user in the account dashboard and filters if "Custom View" permission is enabled.

- The logged-in business user can create, edit, and delete a custom view if "Create/Manage Custom View" action feature under Custom View is enabled.

The feature actions, Create/ Manage Custom view will be available under Other Feature Permission and not under Account level permissions for any user.

Visibility of Features and Services - Mobile Native

Permissions based visibility is available to the following features and services of Mobile Native application for business users:

|

Module |

Description |

UI Impact |

|---|---|---|

|

Account List on the Landing Page |

The account dashboard shows only those accounts to which the user has been explicitly given access. In the account filters, only those accounts to which user has permission is shown. |

Dashboard |

|

Account Dashboard |

|

Dashboard |

|

Account Details Page |

The visibility of each of the actions on the account details page for every account type is controlled by the permissions as shown in the table. |

Account Detail Page |

|

Account Details – Transactions |

A business user can do the following:

|

Account Page |

|

Transfer - New Flow |

A business user can do the following:

|

Transfer Page |

|

Transfer Activities |

|

Transfer Page |

|

Manage Recipients |

A business user can do the following:

|

Recipient Page |

|

Bill Payment |

A business user can do the following:

Bill Pay landing page shows all the Posted Payments if the user has View Payment permission for Bill Payment if user has "Create Transaction" permission for Bill payments. |

Bill Pay Page |

|

ACH |

A business user can,

A business user must have any one of the following permissions in any of the accounts to which the user has access to view ACH option in the menu:

|

ACH Page |

|

Approval and Request |

A business user can see the Approval and Request option on dashboard and in Hamburger menu based on the permissions.

|

Hamburger Menu and Landing page |

|

Manage User |

A business user can do the following if the user has the required permission:

|

Manage User Page |

|

Card Management |

A business user can see the Card Management option on the Hamburger Menu only if the user has permission to the feature.

|

Card Management Page |

|

Cheque Management |

A business user can see the Cheque Management option on the Hamburger Menu only if the user has permission to the feature.

|

Cheque Management Page |

|

Check Deposit |

The permissions are tied at the account level. A business user can see the Check Deposits option on the Hamburger Menu only if the user has permission to the feature and the user can upload the check images from a mobile device.

|

Check Deposit |

|

Settings |

A business user can see the Settings option on the Hamburger Menu always and can edit the account and Profile Setting based on the user's permissions.

|

Account Setting & Profile Settings |

|

Feedback |

A business user can see the Feedback option on the Hamburger Menu only if the user has permission to the feature and can send a feedback from the mobile application.

|

Feedback in Hamburger menu |

| Withdraw Cash | A business user can initiate and manage a card less cash withdrawal transaction from the mobile application if the user only has the permission. The permissions are tied up at the account level.

|

Cardless Cash Withdrawal |

| Personal Finance Management (PFM) |

|

Business Widgets on Dashboard |

Account Details Visibility Conditions

| Account Type | Actions | Conditions for Visibility |

|---|---|---|

|

Savings

|

Withdraw Cash | If the user has Withdraw Cash permission. |

| View Statements | -- | |

| Make Transfer |

New flow If the user has "Create Transaction" permission for any of the following:

|

|

| Request Cheque Book | If the user has "Cheque Management - Create a Cheque Book Request" permission. | |

| New Stop Cheque Request | If the user has "Cheque Management - New Stop cheque request" permission. | |

| Call Bank | If the user has Withdraw Cash permission. The permission is tied up at user level. | |

| Message Bank | If the Use has permission for "Message Bank". | |

| Checking Account | Withdraw Cash | If the user has Call Bank permission. The permission is tied up at user level. |

| View Statement | -- | |

| Make Transfer |

New flow If the user has "Create Transaction" permission for any of the following:

|

|

| Request Cheque Book | If the user has "Cheque Management - Create a Cheque Book Request" permission. | |

| New Stop Cheque Request | If the user has "Cheque Management - New Stop cheque request" permission. | |

| Call Bank | If the user has Withdraw Cash permission. The permission is tied up at user level. | |

| Message Bank | If the user has permission for "Message Bank". | |

| Credit Card | Make a Payment | If the user has "Create Transaction" permission for -Transfer between Customer's Accounts. |

| View Statement | -- | |

| Call Bank | If the user has Call Bank permission. | |

| Message Bank | If the user has permission for "Message Bank". | |

| Loan/ Mortgage | Pay Due Amount | If the user has "Create Transaction" permission for -Transfer between Customer's Accounts. |

| View Statement | -- | |

| Call Bank | If the user has Call Bank permission. | |

| Message Bank | If the user has permission for "Message Bank". | |

| Deposit | New Deposit | -- |

| View Statement | -- | |

| Call Bank | If the user has Withdraw Cash permission. The permission is tied up at user level. | |

| Message Bank | If the user has permission for "Message Bank". |

Add Recipients Visibility Condition

| Transfer Option | Conditions for Visibility |

|---|---|

| Add Within Bank Recipient | If the user has "Create Transaction" permission for Internal Fund Transfers. |

| Add Other Bank Recipient | If the user has "Create Transaction" permission for 3rd Party Fund Transfers. |

| Add International Recipient | If the user has "Create Transaction" permission for 3rd Party Fund Transfers. |

User and Account Level Permission to Features for Business Users

A financial institution (FI) can allow all the FI level controls on permissions and transaction limits to be set for internet banking user with combined access to both business and retails accounts.

| Item | Description | Details |

|---|---|---|

| User Permissions | A financial institution (FI) can allow all the FI level controls on permissions to be set for internet banking user with combined access to business and retails accounts. |

Retail Users Retail users inherit permissions from two sources:

All these permissions are available for every personal account of the user. Business Users Business users inherit permissions from two sources and the user permissions are derived using the most restrictive rule:

Additionally, permission restrictions added on top of the above derived set. Combined Users

|

| Transaction Limits | An FI can allow all the FI level controls on transaction limits to be set for internet banking user with combined access to business and retails accounts. |

Retail Accounts Retail users inherit transaction limits from two sources:

Business Accounts Business users inherit transaction limits from two sources:

|

The following table is a sample used for reference purpose showing the list of all user level and account level permissions to the set of actions per feature applied for business users. An authorized user can configure the permissions to features and corresponding actions at the user level.

This is only a sample table and used for reference purposes only.

|

Feature |

Action |

Account Level |

Mandatory Action |

OLB Feature |

Mobile Feature |

Feature Type |

Mandatory / Optional Feature for Companies |

|---|---|---|---|---|---|---|---|

|

Transfer to own Account within the FI |

View Transfers |

Yes |

Mandatory |

Yes |

Yes |

Retail Customer Business User

|

Optional |

|

Create / Edit Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

Approve Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

Self Approval |

Yes |

Optional |

Yes |

Yes |

|||

|

Transfer to other accounts in the same FI |

View Transfers |

Yes |

Mandatory |

Yes |

Yes |

Retail Customer Business User

|

Optional |

|

Create / Edit Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

Approve Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

View Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Add / Edit Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Delete Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Self Approval |

Yes |

Optional |

Yes |

Yes |

|||

|

Transfer to accounts in other FIs |

View Transfers |

Yes |

Mandatory |

Yes |

Yes |

Retail Customer Business User

|

Optional |

|

Create / Edit Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

Approve Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

View Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Add / Edit Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Delete Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Self Approval |

Yes |

Optional |

Yes |

Yes |

|||

|

International Transfers

|

View Transfers |

Yes |

Mandatory |

Yes |

Yes |

Retail Customer Business User

|

Optional |

|

Create / Edit Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

Create / Edit One Time Transfer |

Yes |

Optional |

Yes |

Yes |

|||

|

Approve Transfers |

Yes |

Optional |

Yes |

Yes |

|||

|

View Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Add / Edit Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Delete Recipients |

Yes |

Optional |

Yes |

Yes |

|||

|

Self Approval |

Yes |

Optional |

Yes |

Yes |

|||

|

Domestic Wire Transfers

|

View Transfers |

Yes |

Mandatory |

Yes |

No |

Retail Customer Business User

|

Optional |

|

Create / Edit Transfers |

Yes |

Optional |

Yes |

No |

|||

|

Approve Transfers |

Yes |

Optional |

Yes |

No |

|||

|

View Recipients |

No |

Optional |

Yes |

No |

|||

|

Add / Edit Recipients |

No |

Optional |

Yes |

No |

|||

|

Delete Recipients |

No |

Optional |

Yes |

No |

|||

|

Self Approval |

Yes |

Optional |

Yes |

No |

|||

|

View Bulk Files |

Yes |

Optional |

Yes |

No |

|||

|

Upload Bulk Files |

No |

Optional |

Yes |

No |

|||

|

View Bulk Templates |

No |

Optional |

Yes |

No |

|||

|

Create / Edit Templates |

No |

Optional |

Yes |

No |

|||

|

Delete Templates |

No |

Optional |

Yes |

No |

|||

|

International Wire Transfers |

View Transfers |

Yes |

Mandatory |

Yes |

No |

Retail Customer Business User

|

Optional |

|

Create / Edit Transfers |

Yes |

Optional |

Yes |

No |

|||

|

Approve Transfers |

Yes |

Optional |

Yes |

No |

|||

|

View Recipients |

No |

Optional |

Yes |

No |

|||

|

Add / Edit Recipients |

No |

Optional |

Yes |

No |

|||

|

Delete Recipients |

No |

Optional |

Yes |

No |

|||

|

Self Approval |

Yes |

Optional |

Yes |

No |

|||

|

Bulk Wire |

Yes |

Optional |

Yes |

No |