Introduction to Canada Deposit Insurance Corporation (CDIC)

In the event that a (FI) Member Institution (MI) should fail, the Canada Deposit Insurance Corporation (CDIC) is obliged to make payments to depositors in accordance with its insurance rules, in a timely manner. In order to determine the amounts owing to depositors, the deposit liability information would be extracted from Temenos Transact and loaded into the CDIC's payout application. The pay-out application then organizes the deposit information such that the payments of insured deposits can be made to depositors. CDIC will either make its deposit insurance payment directly to depositors or establish a bridge institution through which the deposit insurance payment is made available.

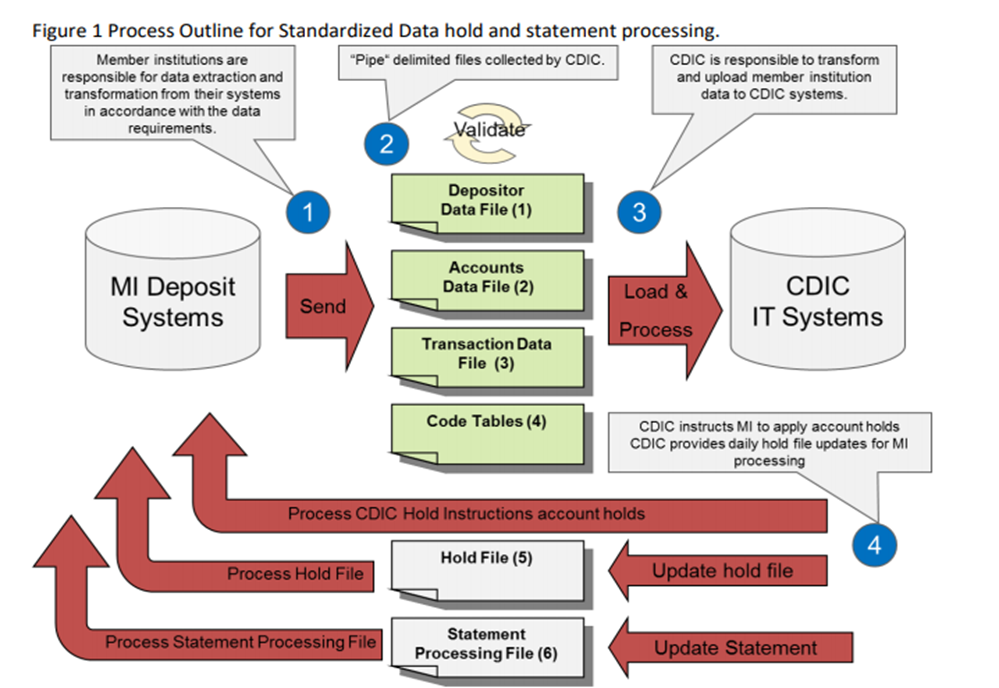

The registered members are termed as Member Institutions of CDIC and they have to adhere to the pre-defined process of CDIC. CDIC requires the bank to send the details of the deposits or investments placed by their customers in a standard format. To achieve that, a tool named GIT has been used to map the details from Temenos Transact to the specified CDIC format.

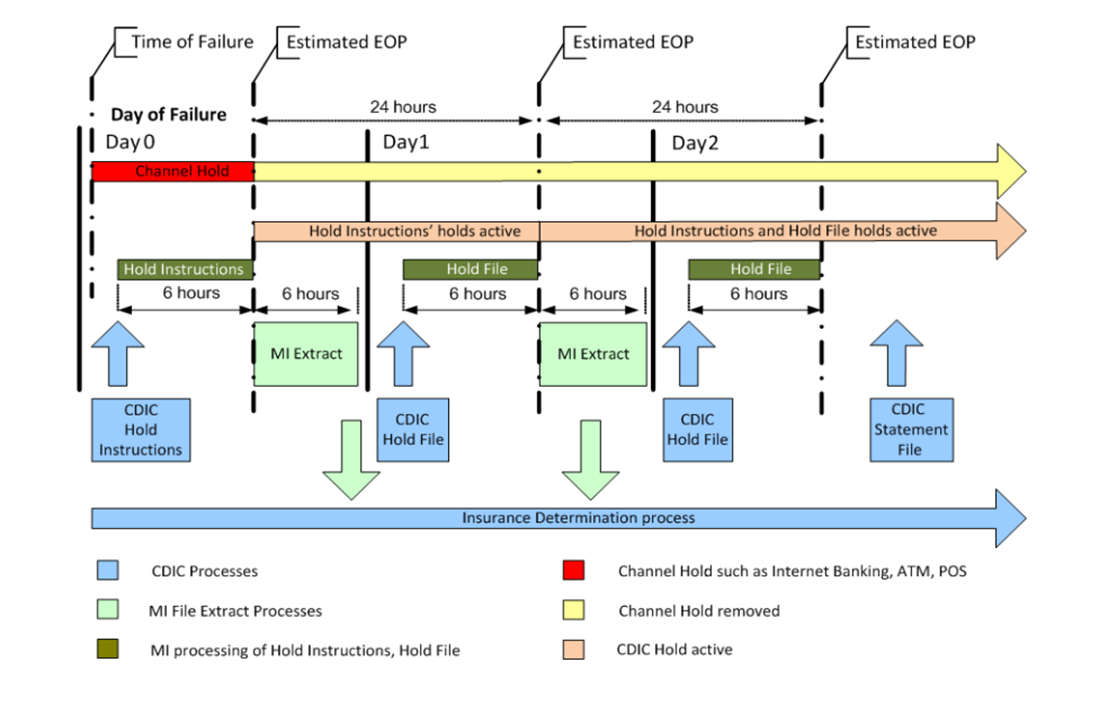

Based on the information of the depositors, CDIC needs to return the payments to the depositors of the banks or financial institutions on the event of their failure. For the same, banks or financial institutions will be instructed to place a hold on the deposits and the hold will not be reversed until CDIC instructs.-

The workflow for the interaction between CDIC and MIs is provided below:

The processing timelines are provided below:

In this topic