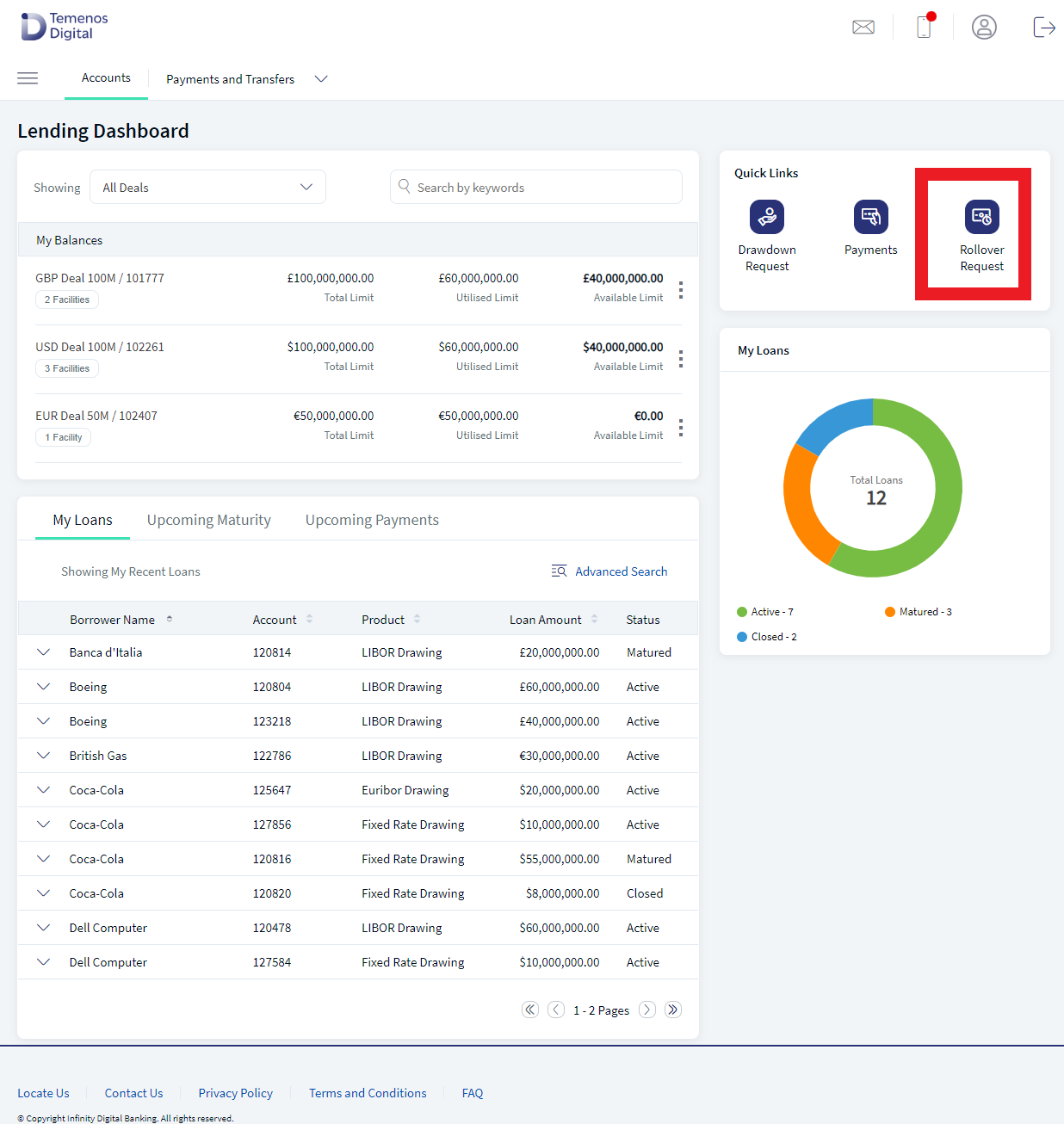

Lending Dashboard

The Lending Dashboard is a menu designed in the Digital Self Servicing (Web Channel) channel for corporate/ business customers to view all their Lending/ Loans held with the bank. The Lending Dashboard displays Deal/ Facility/ Loan level balances and widgets to view all Loans and the status of each loan. Corporate Customers can also initiate requests for rollover of existing loans, make payment towards existing or upcoming bills due for payment, and initiate requests for drawdown against a facility. Additionally, the dashboard displays tabs such as My Loans to view information about existing loans, Upcoming Maturity to track loans nearing maturity and if eligible for rollover, and Upcoming Payments to monitor upcoming repayment obligations.

The Lending Dashboard is a collection of widgets. These widgets provide insights into all lending by the user. The following are the widgets:

- My Balances

- My Loans

- Upcoming Maturity

- Upcoming Payments

- Quick Links

- Donut Chart - My Loans

Navigation Path: Web Channel > Menu > Lending Dashboard

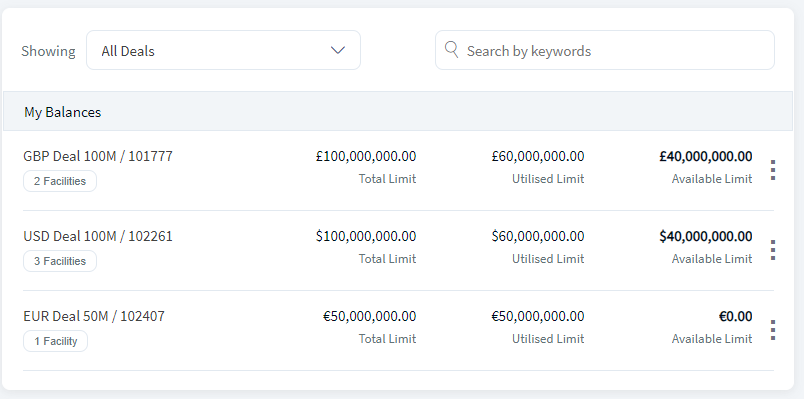

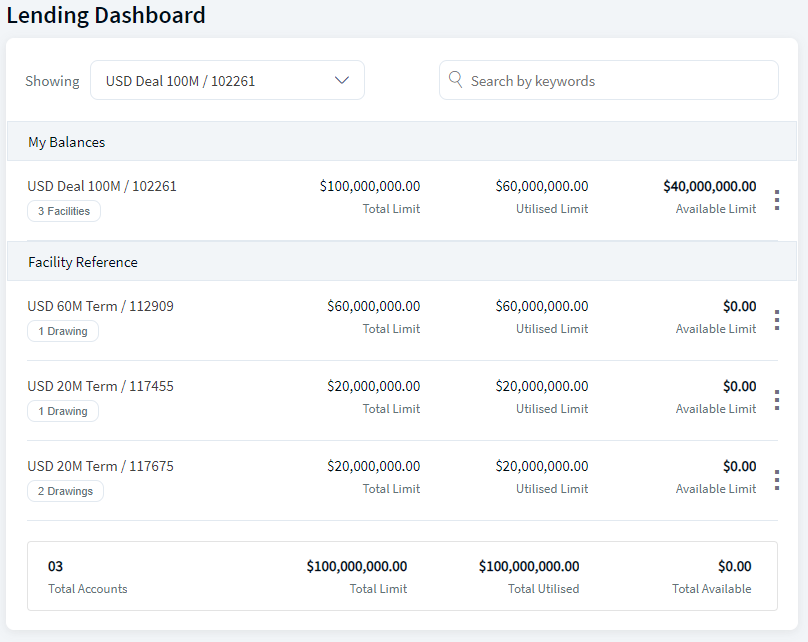

My Balances

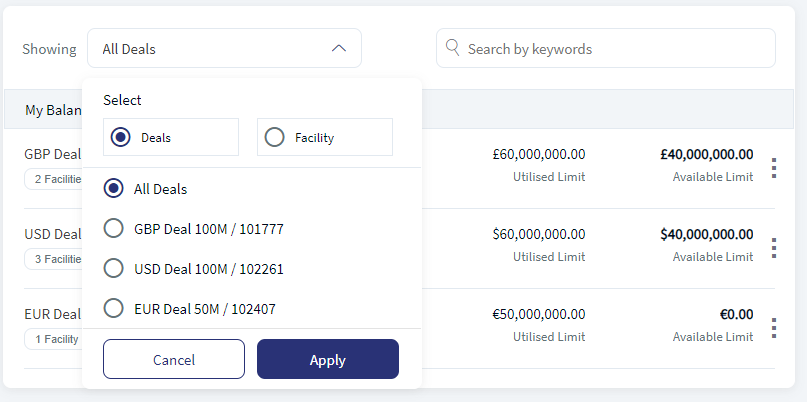

The Top section of the Lending dashboard is My Balances widget. This provides comprehensive insights into their balances. This widget offers a default view showcasing all associated deals, displaying the Total Limit, Available Limit, Utilized Limit, and the Total Count of mapped facilities for each Deal. Additionally, a summary at the bottom of the widget presents the total number of deals linked to the customer's ID, along with cumulative values for the Total Limit, Available Limit, and Utilized Limit across all deals. Customers can filter their view by selecting specific Deals or All Deals and choosing individual Facilities or viewing All Facilities. By default, the widget displays All Deals.

Selecting All Facility from the dropdown lets customers view comprehensive details for all facilities, including Total Limit, Available Limit, and Utilized Limit. Customers can further drill down by selecting a particular facility from the filter to view detailed information, including drawing/ loan counts and respective drawing/ loan balances.

The system displays No Records Found if the user has no deals, facilities, loans, or drawing contracts.

By default, the application displays All Deals.

The user can also search for a particular record. A search functionality labeled Search by keywords enables customers to search for specific Deals/ facilities/ loans by entering their respective name or ID to narrow down the results.

The total count and balances at the bottom of the balance widget reflect Deal Count and its balances or Facility Count and its balances based on the selection made. The application will not display the total summary if currency varies across deals or facilities.

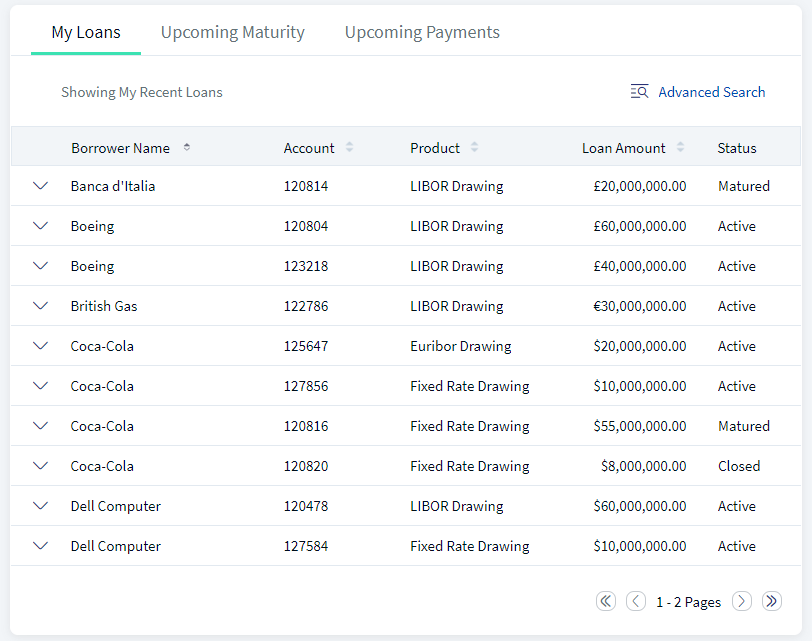

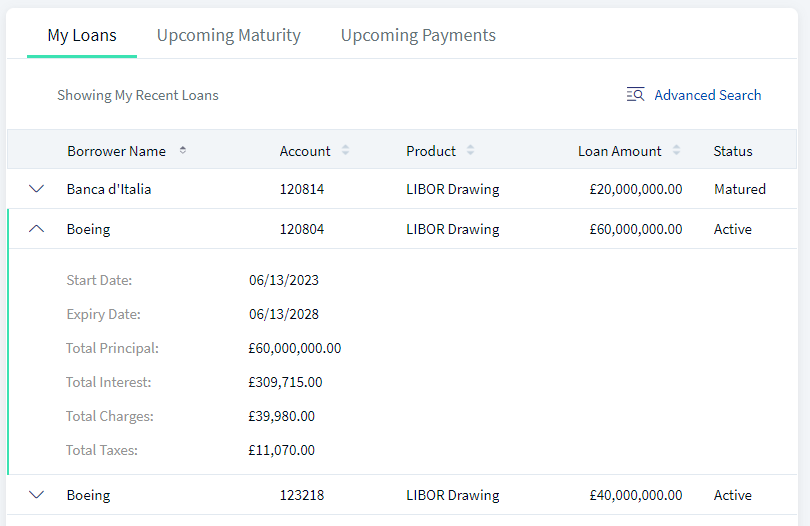

My Loans

My Loan widget displays all the user loans. The user with the required access can only view My Loans tab. Customers can effectively track all their loan and view their current status. Whether they need to monitor the maturity of the loan, review interest charges, or assess tax implications, this information empowers them to make informed financial decisions. The application displays only the loans that are matured, closed and active.

At a time, the application displays ten records per page. Use pagination to view more records. Use the Advanced Search to narrow down the results.

- Borrower Name. Displays the name of the borrower associated with the loan.

- Account. Specifies the loan account number.

- Product. Indicates the type of loan product.

- Loan Amount. Shows the loan amount along with the currency.

- Status. Indicates the current status of the record. There are three types of status available Active, Matured, and Closed.

Use the drop down arrow to see additional details:

- Start Date. Specifies the date when the loan was initiated.

- Expiry Date. Specifies the Expiry date of the loan.

- Total Principal. Specifies the total principal amount of the loan.

- Total Interest. Specifies the total interest accrued on the loan.

- Total Charges. Specifies any additional charges associated with the loan.

- Total Taxes. Specifies the total tax amount applicable to the loan.

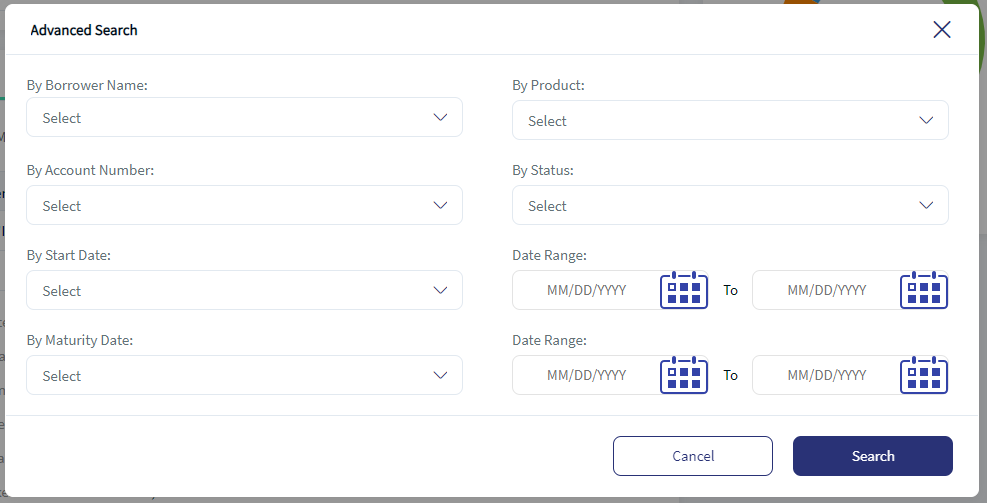

The following are the advanced search fields available:

- By Borrower Name. The drop down displays the available borrower name as per the sign in user.

- By Product. The drop down displays the available Products as per the sign in user.

- By Account Number. The drop down displays the available account numbers as per the sign in user.

- By Status. The drop down displays all available status.

- By Start Date. Use Date Range for custom dates.

- By Maturity Date. Use Date Range for custom dates.

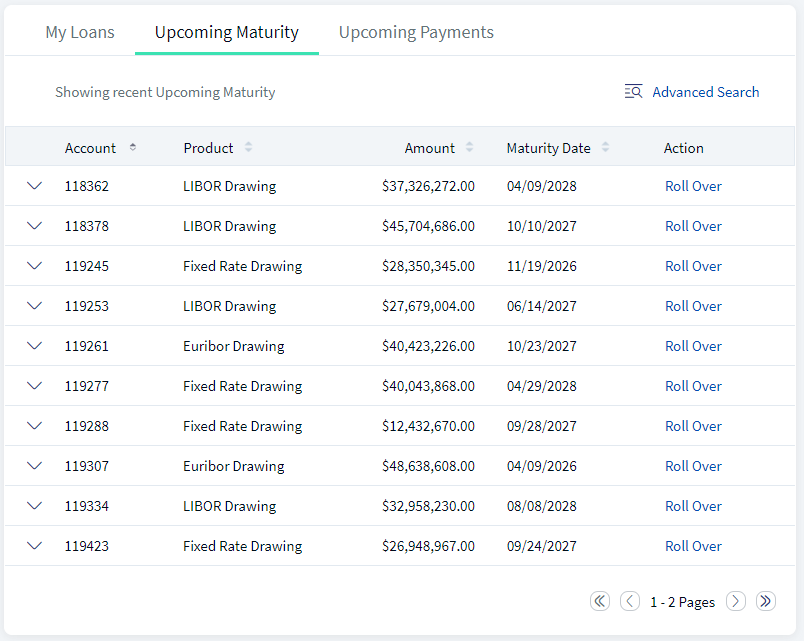

Upcoming Maturity

The Upcoming Maturity tab displays information regarding loans that are approaching maturity. This will enable the customer to stay informed about upcoming loan getting matured, so that customer can choose to rollover the loans if required provided the facility is not expired. At a time, the application displays ten records per page. Use pagination to view more records. Use the Advanced Search to narrow down the results.

The application does not displays Rollover when the facility is already expired, instead View option is available to see details of the loan.

- Amount. Specifies the loan account number.

- Product. Specifies the type of loan product.

- Amount. Specifies the loan amount along

- Maturity Date. Specifies the date when the loan is scheduled to mature.

- Action - This is based on the facility maturity date.

- If the loan is eligible for rollover, the action displays Rollover. On click of Rollover, the application navigates to Rollover Request page to initiate rollover.

- If the loan is not eligible for rollover, then the action displays View. On click of View, the application displays the Loan details.

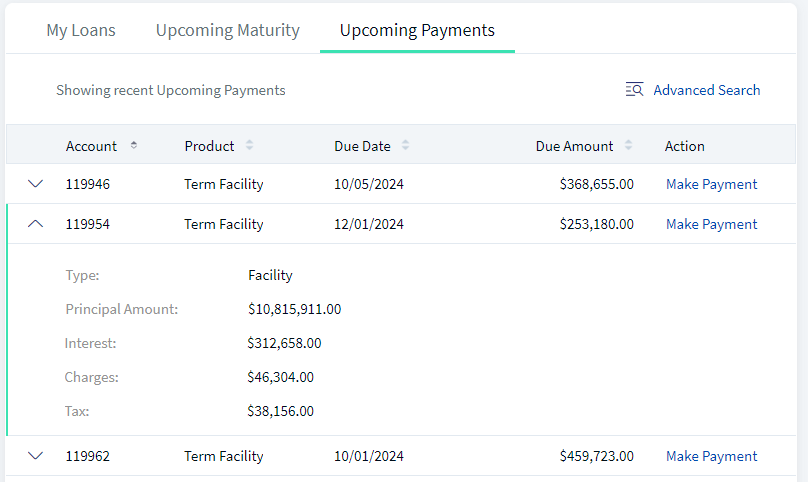

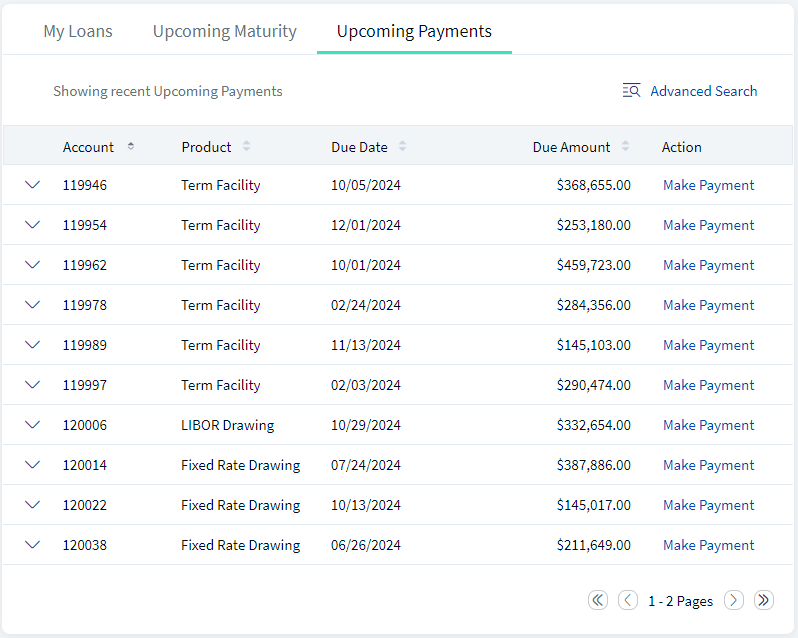

Upcoming Payments

The Upcoming Payments tab feature provides essential information regarding upcoming payments that are getting due to be paid by customer, so that customer can view and make the payments on time. The users can see detailed information of upcoming payments due either at loan or facility level. Based on the facility or loan level payments it displays complete details of the payment like:

- facility level like as charges, interest, tax.

- Loan level such as due amount and principal amount.

At a time, the application displays ten records per page. Use pagination to view more records. Use the Advanced Search to narrow down the results.

- Account. Specifies the account number associated with the payment.

- Product. Specifies the type of product, whether it is a facility or a loan.

- Due Date. Specifies the payment due date.

- Due Amount. Specifies the amount due along with the currency.

- Action. The application provides an option to make the payment directly from the dashboard.

Upcoming Payments - Record Expanded

The user can see different fields based on facility level payments and loan level payments.

On expanding each row for facility payment, following details are visible:

- Type. Specifies the payment is for a facility or loan. In this case it is facility.

- Charges. Specifies any additional charges associated with the facility payment.

- Fees. Specifies the fees amount due for the facility payment.

- Tax. Specifies the tax amount applicable to the facility payment.

On expanding each row for loan payment, following details are visible:

- Type. Specifies the payment is for a facility or loan. In this case it is loan.

- Principal Amount. Specifies the principal amount due for the loan payment.

- Interest. Specifies the interest amount due for the loan payment.

- Charges. Specifies any additional charges associated with the loan payment.

- Tax. Specifies the tax amount applicable to the loan payment.

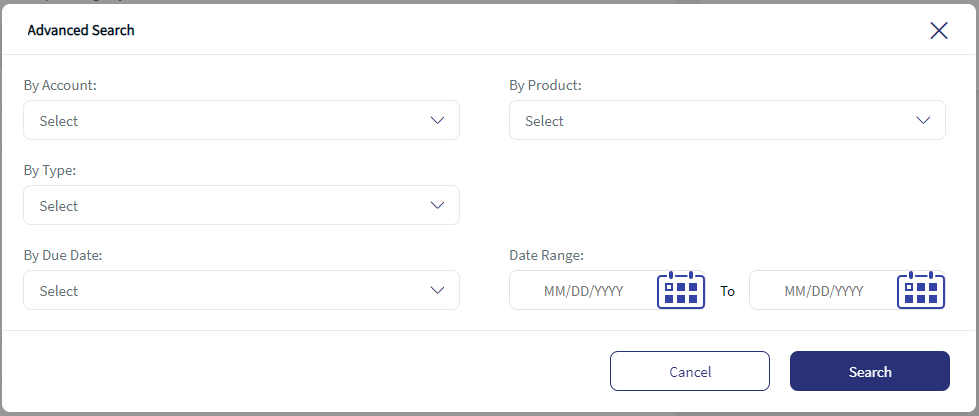

Advanced Search

- By Account. The drop down displays the available borrower name as per the sign in user.

- By Product. The drop down displays the available products as per the sign in user.

- By Type. The drop down displays the available product types.

- By Due Date. Use Date Range for custom dates.

Quick Links

The quick links section is the collection of three frequently used actions by the user. Following are the quick links available:

- Drawdown Request. Use this for requesting a loan under a facility.

- Payments. Use this to repay the loan or facility due amount.

- Rollover Request. Use this to create rollover request for a specific period.

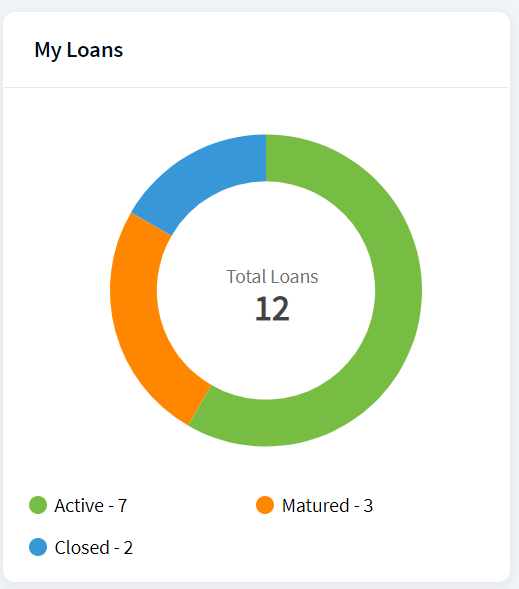

My Loans - Donut Chart

The user can see the summary of all the Loans. The donut chart displays the data as per status. The donut chart helps provide insights into the total number of loans and the bifurcation of each loan according to its status. The data for this chart is derived from the My Loans tab.

- Active. The active loans of the user.

- Matured. The matured loans of the user.

- Closed: The closed loans of the user.

In this topic