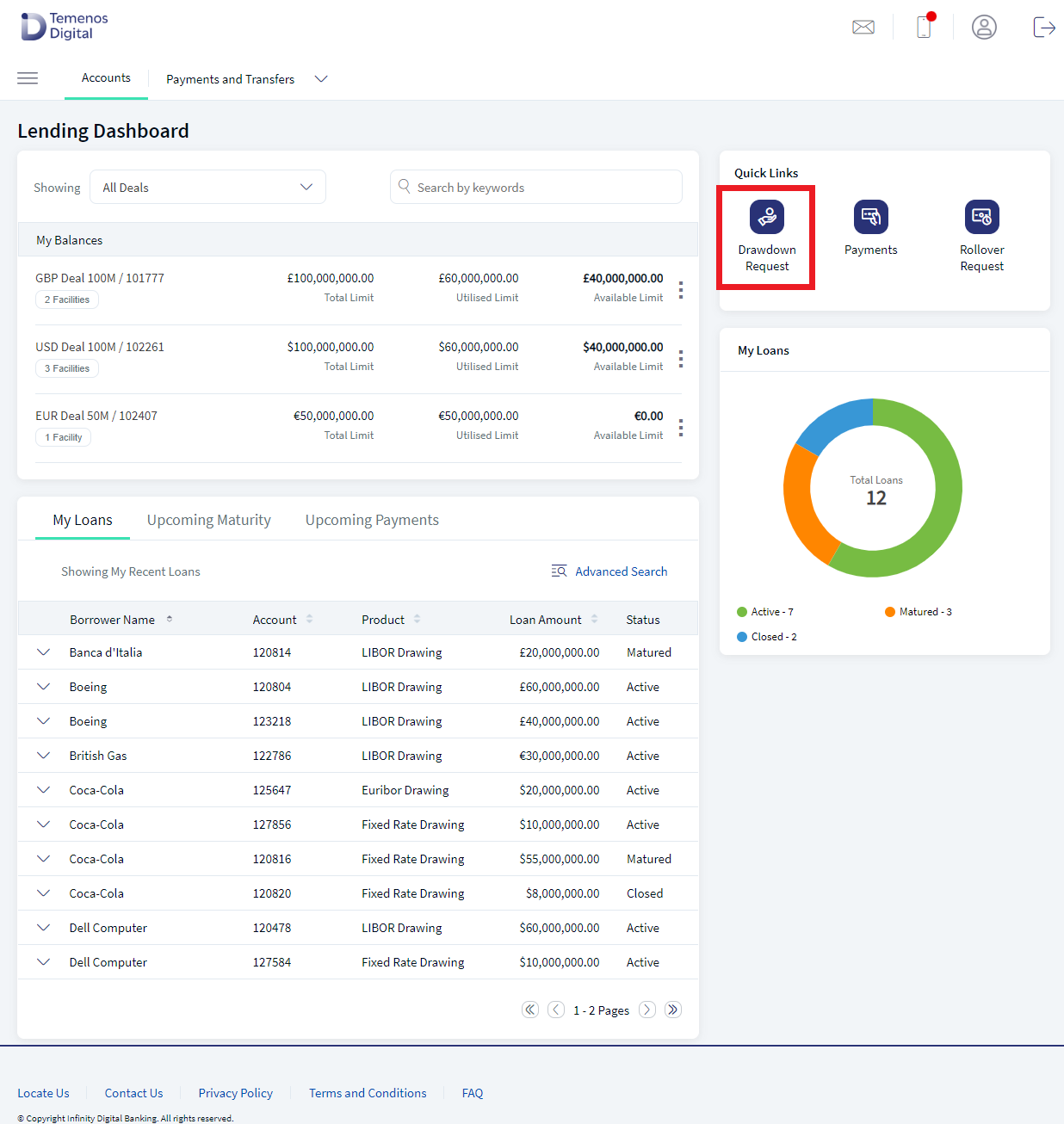

Drawdown Request

The customer who activated Web Channel access and is successfully enabled for Business or Corporate banking service (ex: Corporate Online Banking) which has the feature Lending Dashboard and action View Quick Links - Drawdown Request enabled, then Lending Dashboard and a quick link Drawdown is available to initiate a drawdown request. When the customer initiates a Drawdown request, it is a request to the bank to take the loan. Once the customer submits the request through the Web Channel, the bank user will validate and approve the request raised by the customer. Once the loan is approved, the same is shown in My Loans tab of the customer's Lending Dashboard.

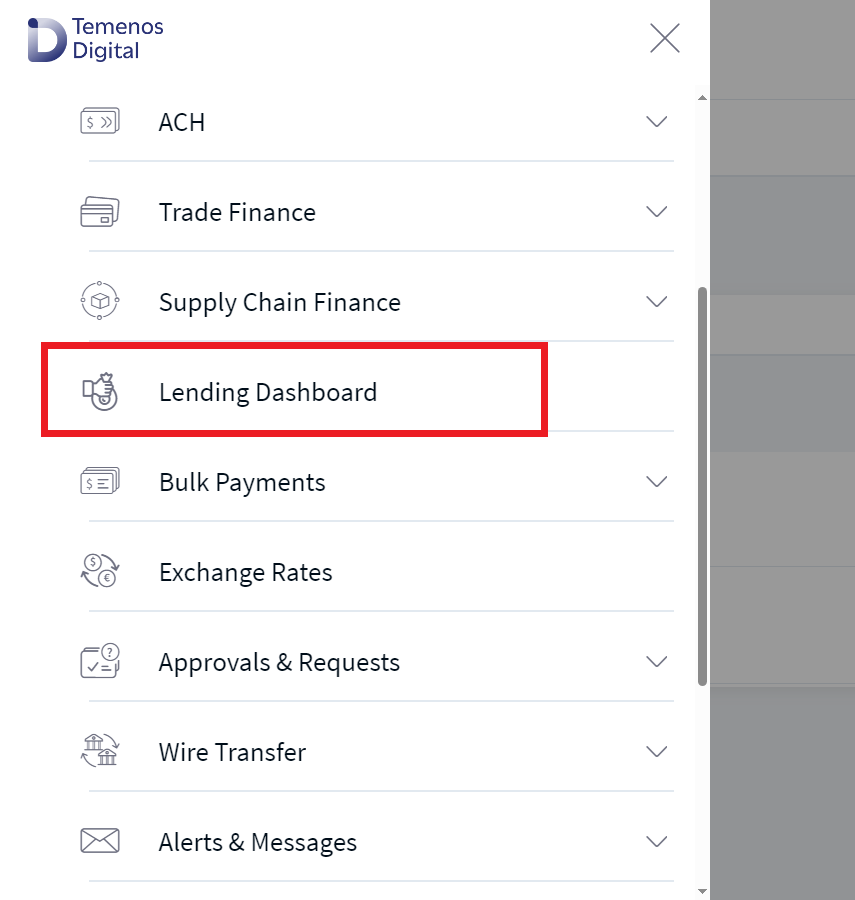

Navigation Path: Web Channel > Menu > Lending Dashboard > Quick Links > Drawdown Request

UX Overview

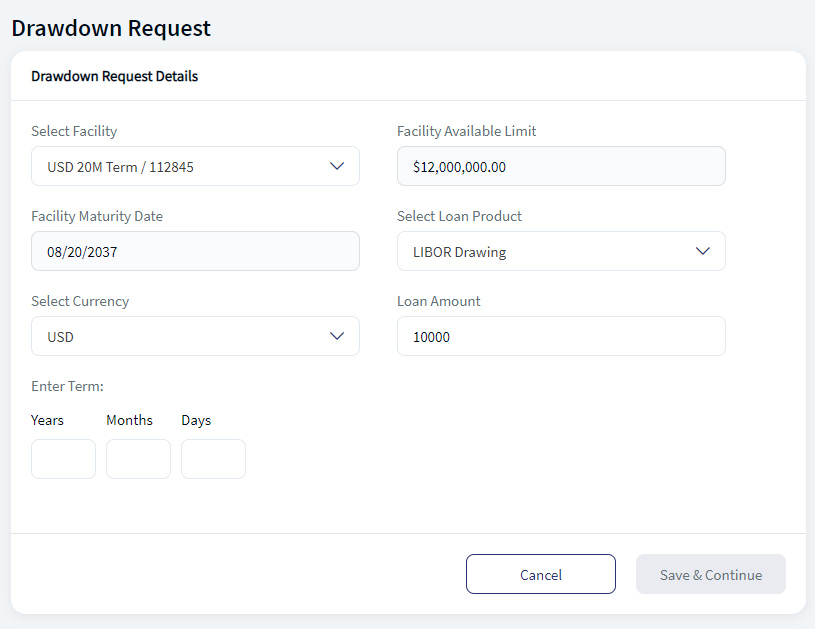

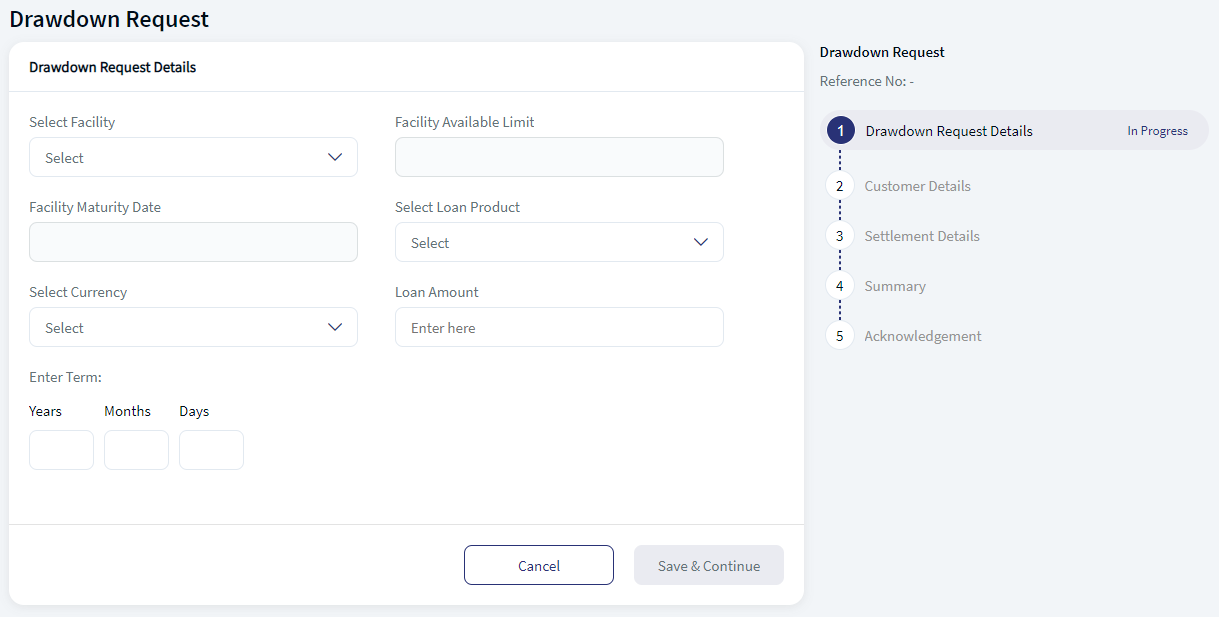

The following is the screen users can see when creating a Drawdown request.

Drawdown Request Details

- Select Facility. This is a drop down list. The application displays the facilities that are linked to the customer.

- Facility Availability Limit. The limit available with respect to the facility. This is an auto populated field.

- Facility Maturity Date. The maturity date of the facility. This is an auto populated field.

- Select Loan Product. This is a drop down list. This displays the list of loan products as allowed for the Selected Facility. The user can choose to select any one of the loan product for which a loan drawdown request is to be created.

- Select Currency. This is a drop down list. The application displays the available currencies for the selected product.

- Loan Amount. Enter the amount required as loan.

- Enter Term. Select the Years, Months, and Days. Enter the numeric value in the text box.

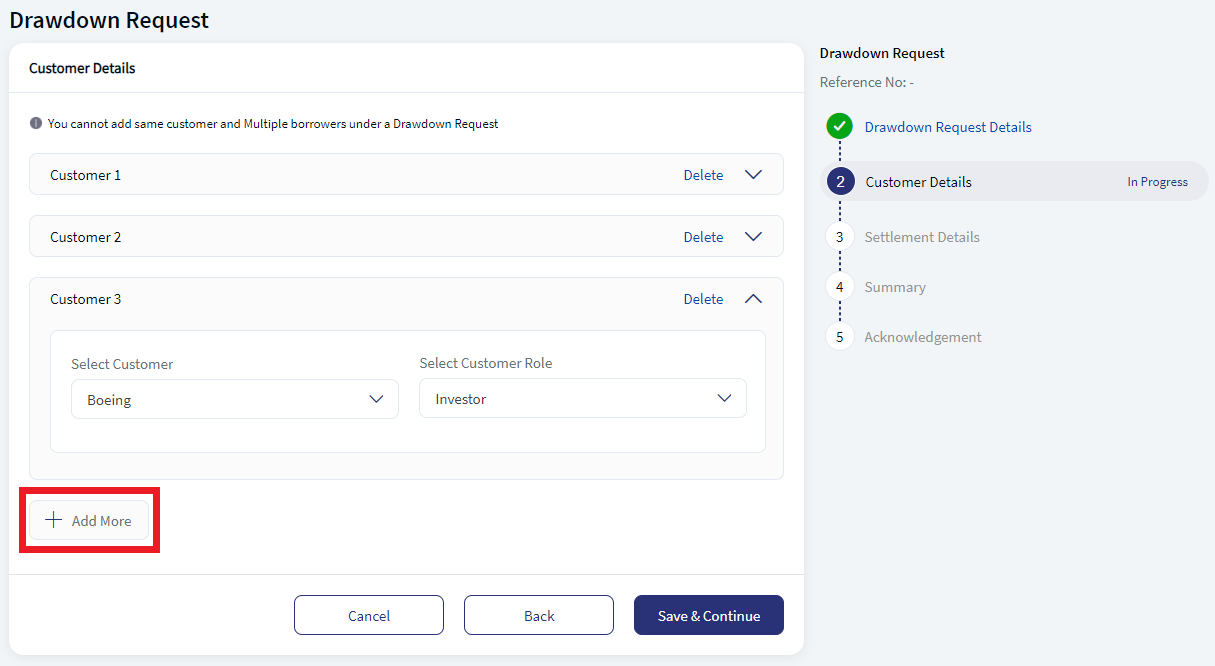

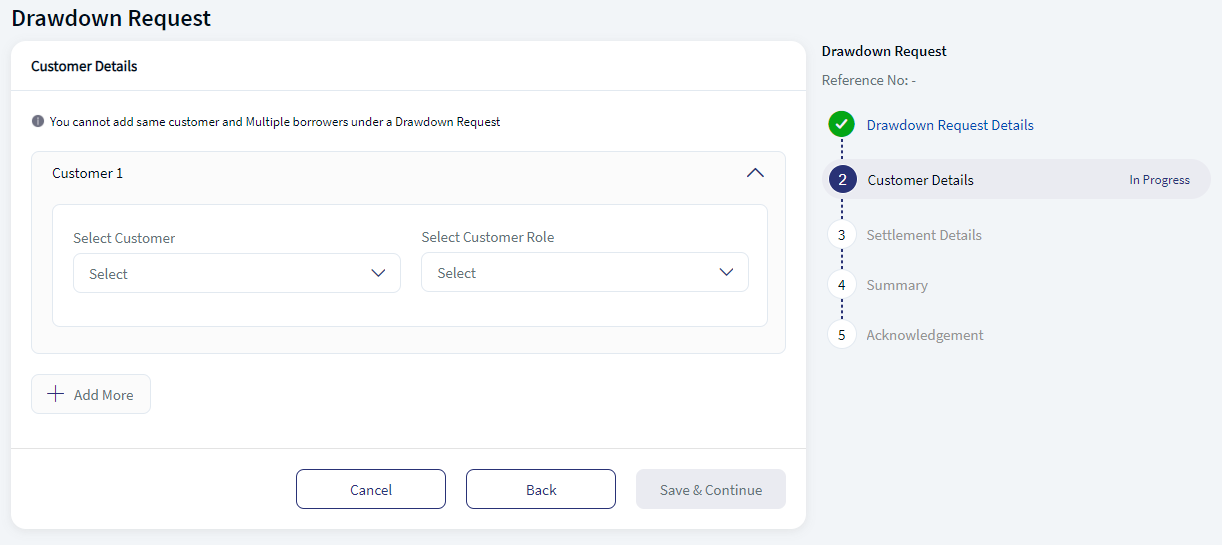

Customer Details

- Select Customer. This is a drop down list. The application displays the available customers for the selected Facility.

- Select Customer Role. This is a drop down list. The application displays the available customers roles.

The user can add more customer by clicking the Add More. The same customer cannot be added multiple times.

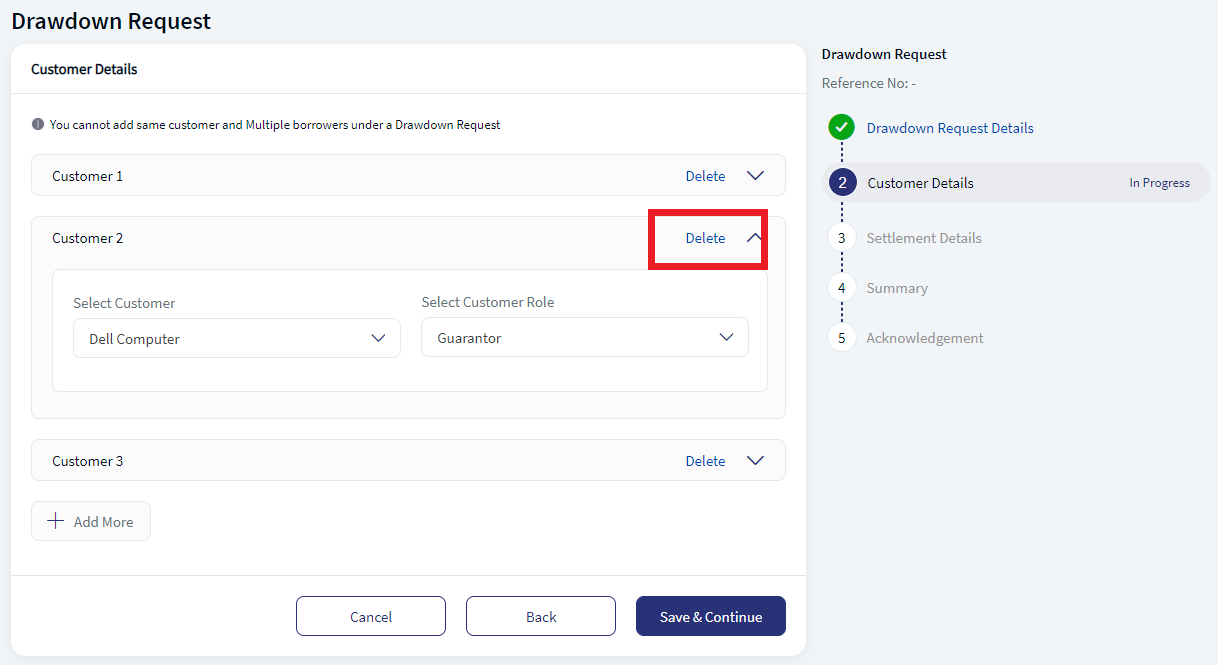

Click Delete, if the user wants to delete any customer details.

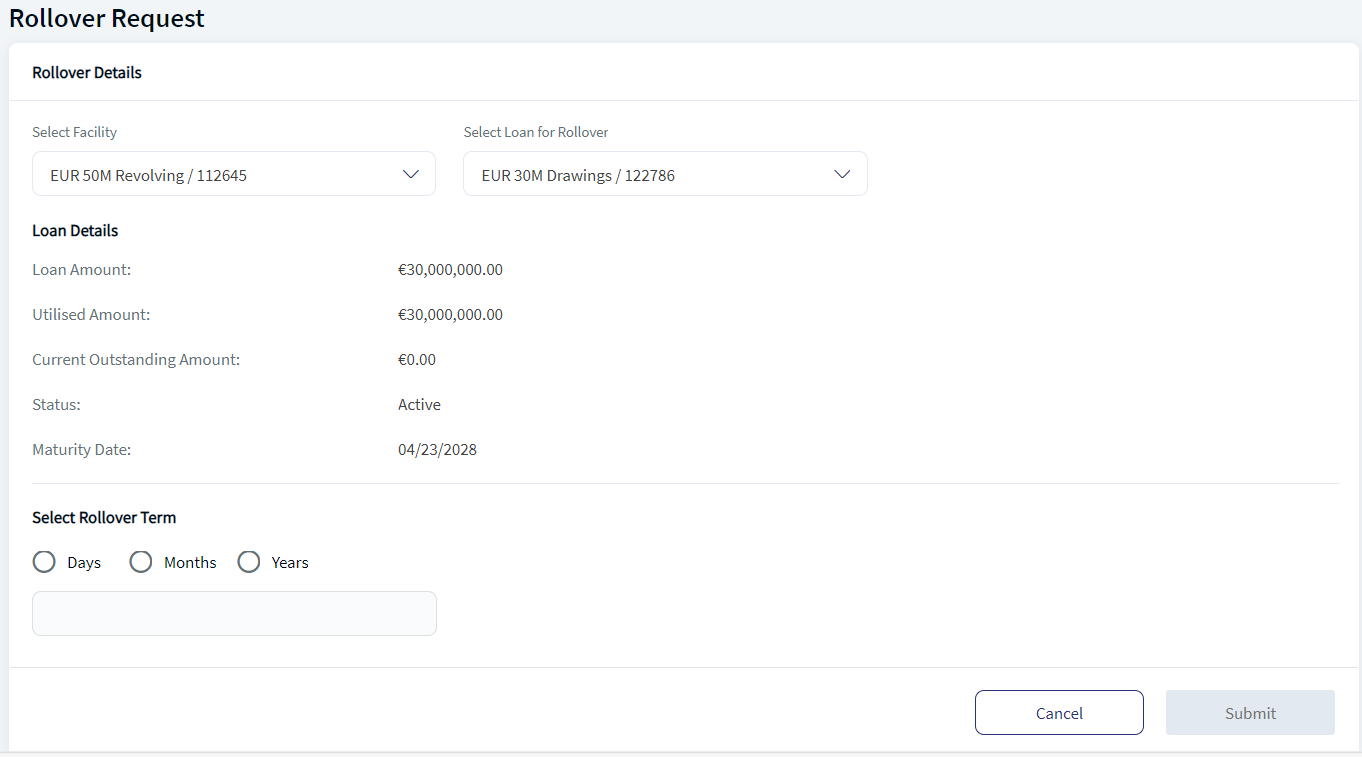

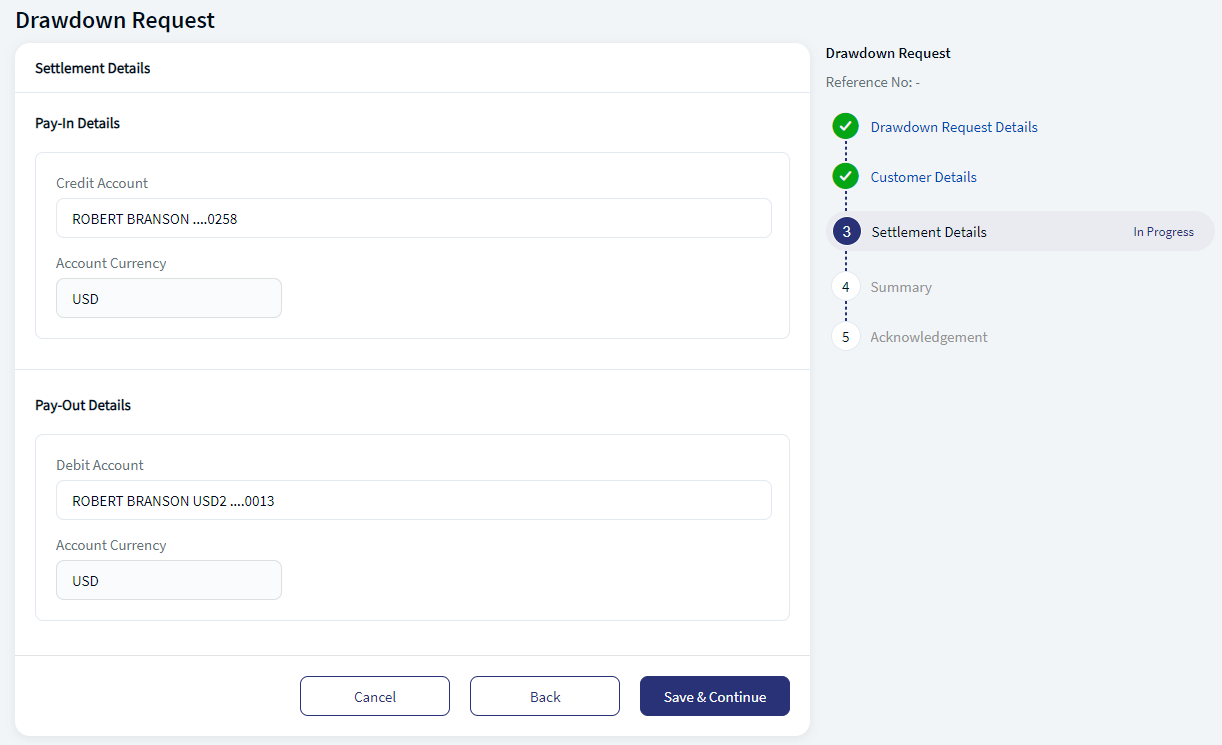

Settlement Details

The Settlement Details page have two sections Pay-In Details and Pay-Out Details.

Pay-In Details

- Credit Account. Select or search for the account you want the loan to be credited.

- Account Currency. This field is auto populated based on the credit account.

Pay-Out Details

- Debit Account. Select or search for the account you want the loan to be debited from.

- Account Currency. This field is auto populated based on the debit account.

Create Drawdown Request

The following is the procedure to create a Drawdown request.

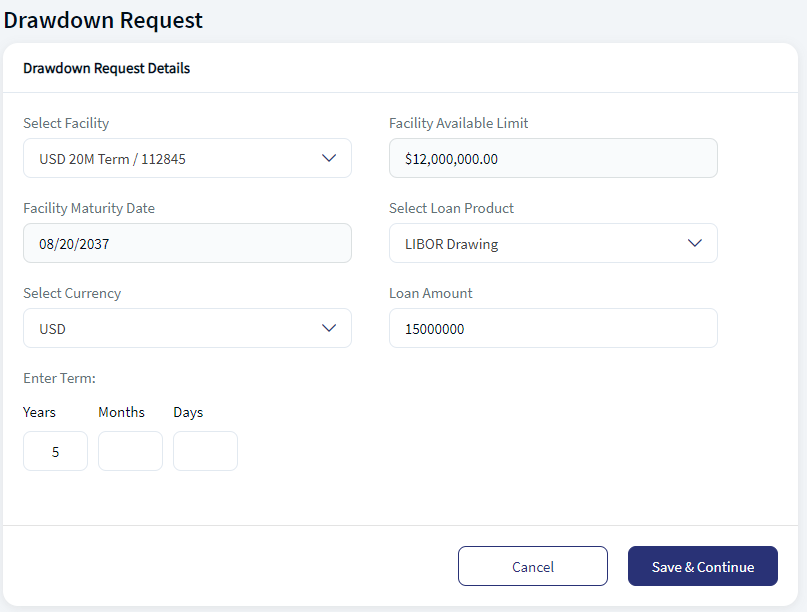

- Click Drawdown Request in the Quick Links section. This displays the Drawdown Request Details page.

- Select the Facility, Loan product, and Currency from the drop down list. This fetches the details of the facility and loan.

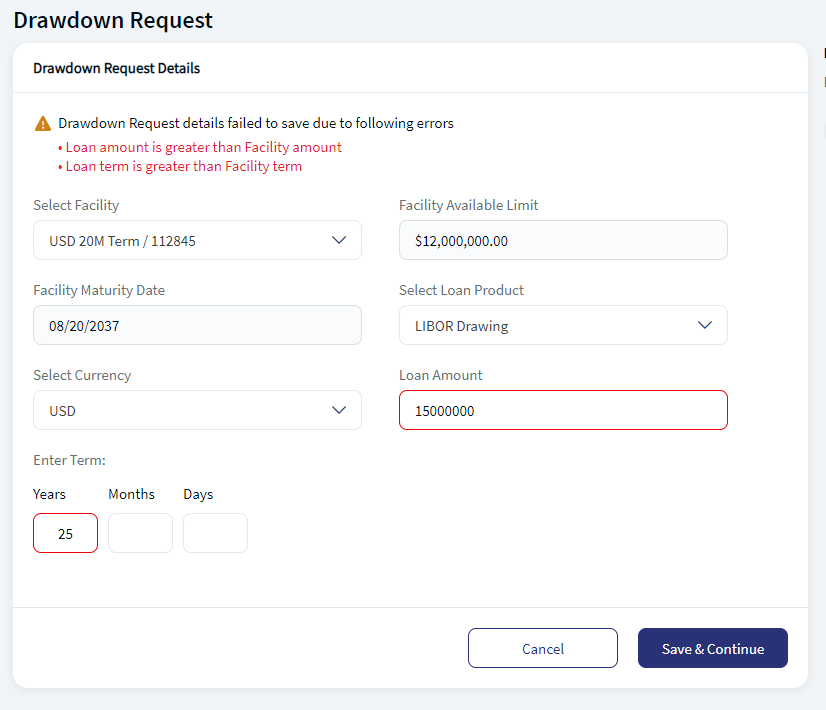

- Enter the Loan Amount. Ensure the entered number is not greater than the Facility Availability Limit, else the application displays a error message. This validation restricts the user from requesting loan amount greater than the available limit for the selected facility.

- Enter the Term details and click Save & Continue. Ensure the term is not greater than the maturity date, else the application displays error message. This validation restricts the user from requesting loan term greater than the maturity date for the selected facility.

- In the Customer Details page, Select the Customer and Customer role. Click Add More to add more customer details. Click Delete to delete any existing customer details.

- Click Save & Continue. The application will navigate to the Settlement Details.

- Enter the Pay-in Details and Pay-Out Details. Click Save & Continue.

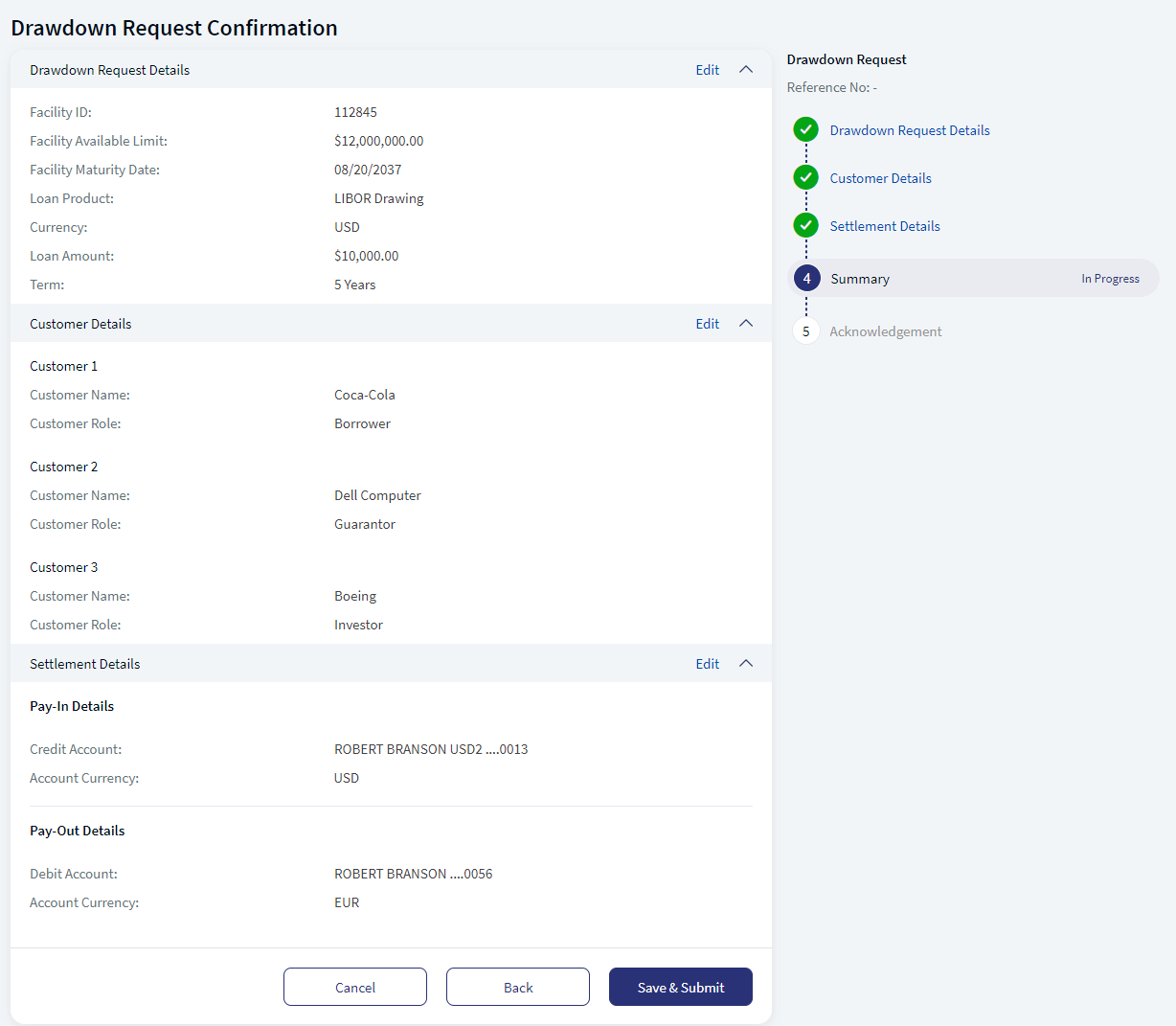

- In the Summary page, verify all the details. Click Edit to update any details.

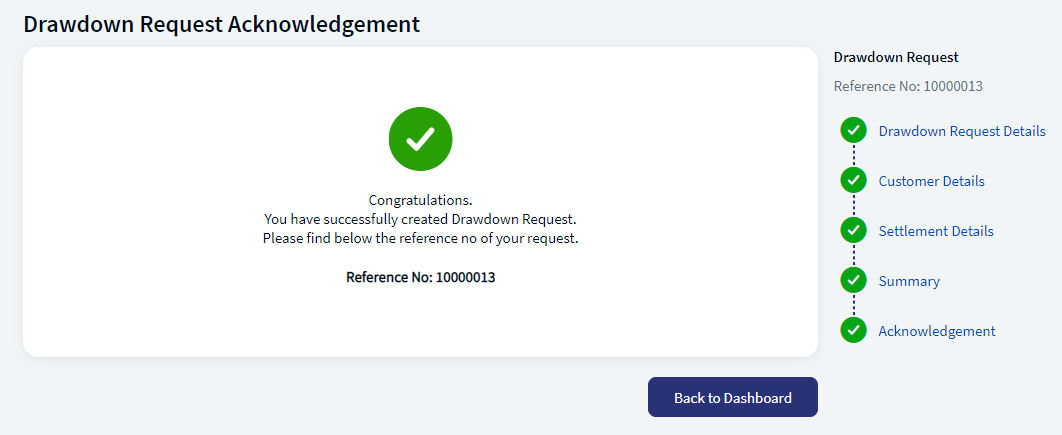

- Click Save & Submit. An acknowledgement page is displayed.

Experience API

The following are the experience API for Drawdown Request:

| Name | Description | Introduced In |

|---|---|---|

| submit | This API submits the Drawdown Request. | 2024.04 |

In this topic