Mortgage Servicing

This section explains the mortgage servicing module that enables users to view and manage the mortgage facilities issued by the bank on the online banking application.

Introduction

Mortgage loan is used to finance a property such as a home, land, or any other immovable asset. In Mortgage, the customer avails the loan in single/multiple parts. These are part of the main mortgage loan product which the customer applied. The multi-parts are also called as Drawings.

The mortgage servicing feature enables users to view and manage the list of bank-approved mortgages they have taken against their properties (collateral). Users can view details such as total outstanding amount, borrower names, and the list of loans or drawings taken under a selected mortgage. For each loan, the user can see information such as interest rate, principal amount, and outstanding amount. Users can also change the repayment day and account.

This feature is applicable for users and implemented in Responsive Web channel. The mortgage servicing module is integrated with Transact and Service Request Microservice.

Glossary

See Glossary for the terms related to mortgage servicing.

UX Overview

The application displays the list of approved mortgage facilities (represented as a row) to which the signed-in user has been given access, along with the outstanding amount. Click any facility to view the mortgage facility overview and the corresponding loans taken under the selected facility.

Using the feature, users can do the following:

- View mortgage facilities on the accounts dashboard

- View the mortgage facility overview

- View mortgage loans created under facilities

- View all transactions and loan schedule

- Search, sort, download, or print transactions

- View mortgage documents

- Change repayment day

- Change repayment account

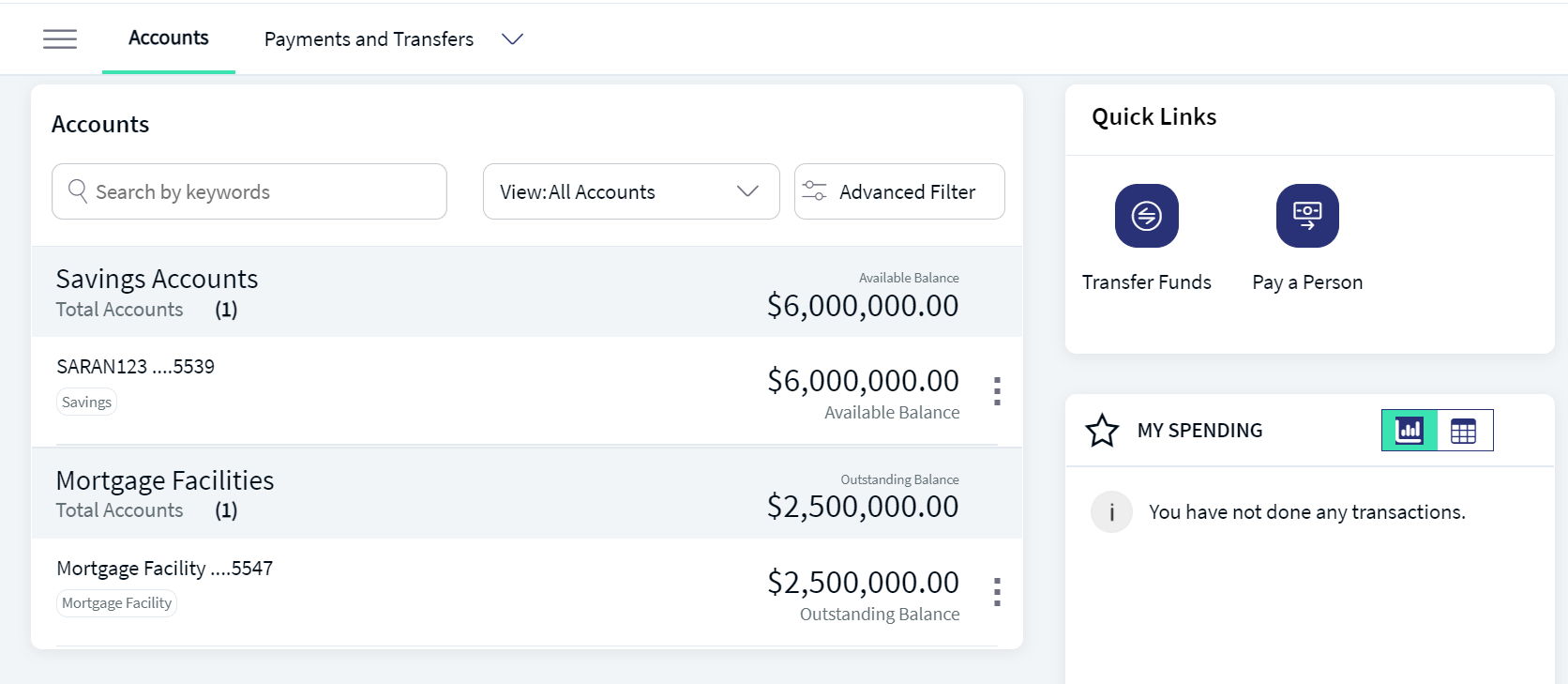

View Mortgage Facilities on the Accounts Dashboard

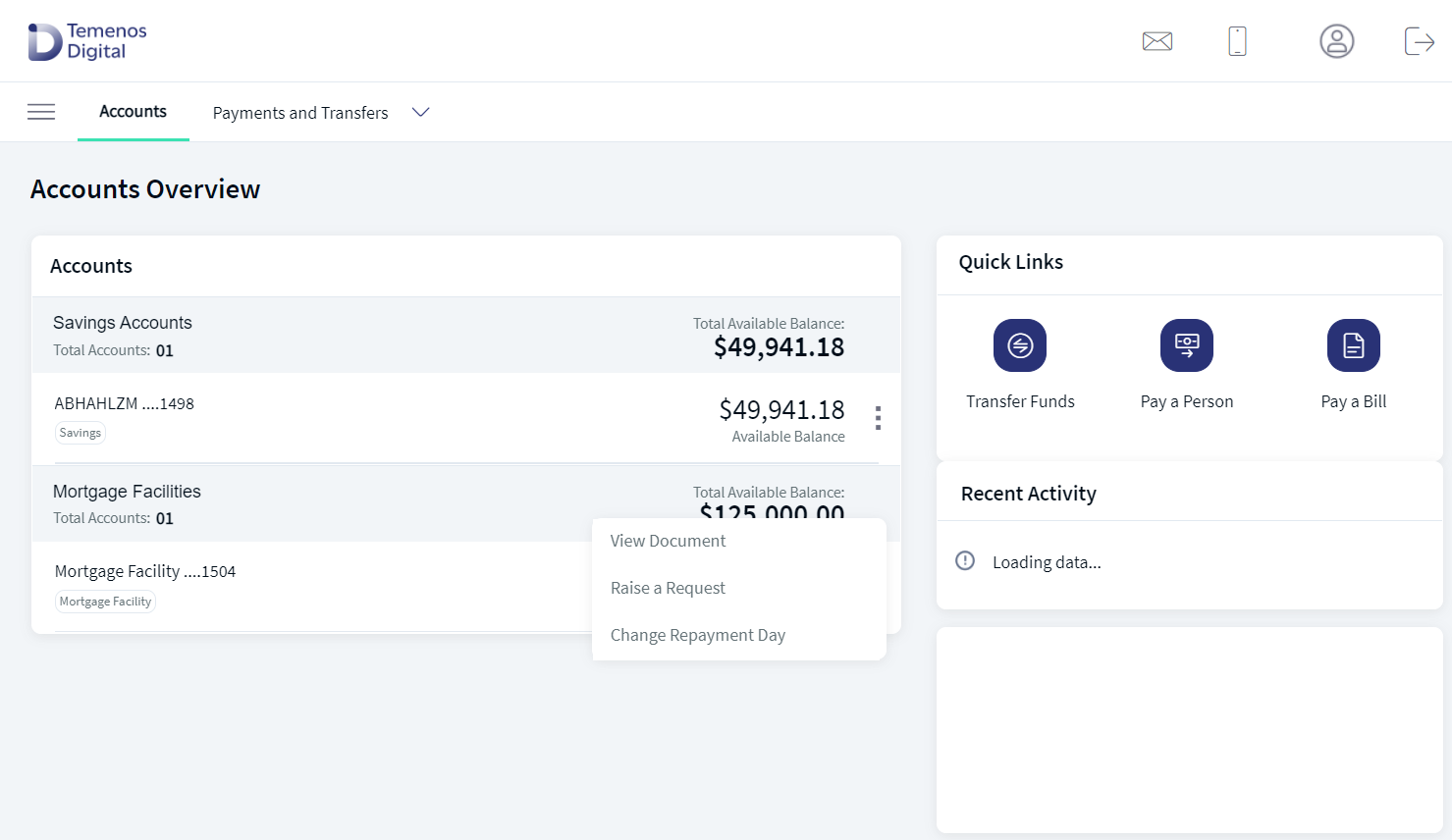

After successfully signing into the banking application, the application displays the accounts dashboard screen and the list of active mortgage facilities taken by the user under the Mortgage Facilities group.

Expectation and Business Rules

Expectation and Business Rules

- The user has originated for a mortgage, and the bank has approved the mortgage.

- The user has activated the digital banking profile.

- The user has to be a part of Mortgage Facilities contract to view the mortgage facility accounts on the accounts dashboard.

- The user has the permissions to view the quick actions on the contextual menu and quick links.

- ArrangementsMA Visualizer Micro App is required.

The application displays the list of approved mortgage facilities (represented as a row) to which the signed-in user has been given access. The accounts list is integrated with Transact to pull the list of accounts to which the user has access. The application displays the following:

- Concatenated facility name and masked account number (x1234).

- Outstanding Balance amount with currency code.

- Favorite facility: Preferred facility is represented by a blue star. Use the contextual menu to set or remove as favorite.

- Quick actions on the

contextual menu. The application displays quick actions depending on the permission assigned to the user. It does not display the contextual menu if the user does not have permission for any of the quick actions.

contextual menu. The application displays quick actions depending on the permission assigned to the user. It does not display the contextual menu if the user does not have permission for any of the quick actions.- View Documents

- ArrangementsMA Visualizer Micro App is required.

- A user can view the mortgage documents for the respective account depending on the user permission - Customer ID/User Level Permission. The permission is enabled in the Spotlight application from Master Data Management.

- Raise a Request

- This feature enables the user to connect with the bank directly through secure messages.

- MESSAGES_CREATE_OR_REPLY permission is required.

- SecureMessageMA Visualizer Micro App is required.

- Set as Favorite: The application displays this action if no facility is marked as a favorite account. Click to set the account as a favorite.

- Remove as Favorite: The application displays this action when the facility is marked as a favorite account. Click to remove the account as a favorite.

- Change Repayment Day

- ArrangementsMA Visualizer Micro App is required.

- Create Change Repayment Day permission is required to raise a Change Repayment Day service request on the channel app and View Change Repayment Day permission is required to view the raised Change Repayment Day service requests on the channel app.

- Users can request a change in the repayment date for their mortgage loans, and allowing them to suggest a new preferable repayment date for their loans that falls on any day of the month.

- View Documents

Click any facility to view the mortgage facility overview and the corresponding loans taken under the selected facility.

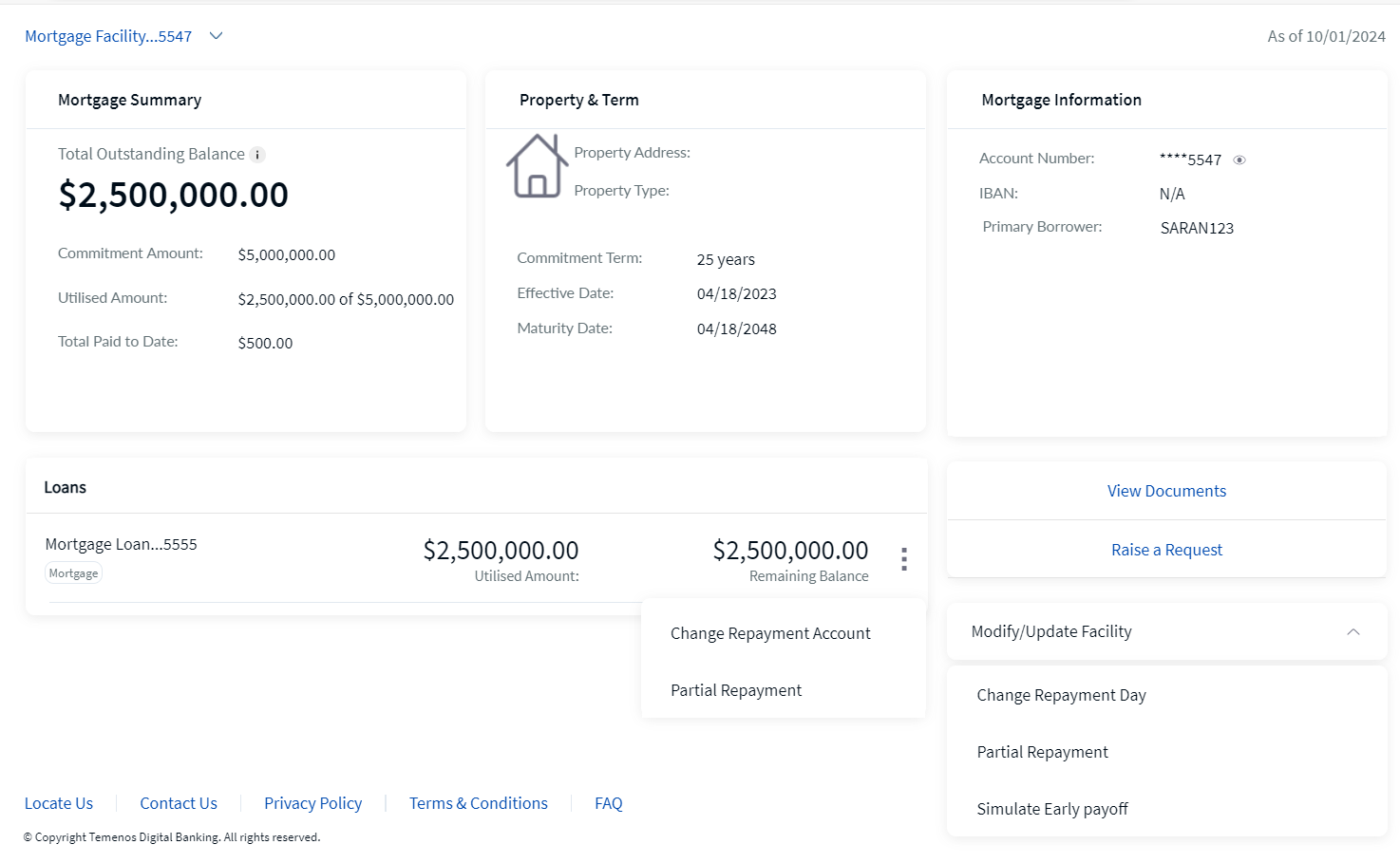

Mortgage Facility Overview

Use the feature to view the details of a selected mortgage facility provided by the bank.

Expectation and Business Rules

Expectation and Business Rules

- The user has originated for a mortgage, and the bank has approved the mortgage.

- The user has activated the digital banking profile.

- The user has to be a part of Mortagage Facilities contract to view the mortgage facility accounts on the accounts dashboard.

- The user has the permissions to view the quick actions on the contextual menu and quick links.

- The user has the permission to view the documents related to mortgage servicing.

- ArrangementsMA Visualizer Micro App is required.

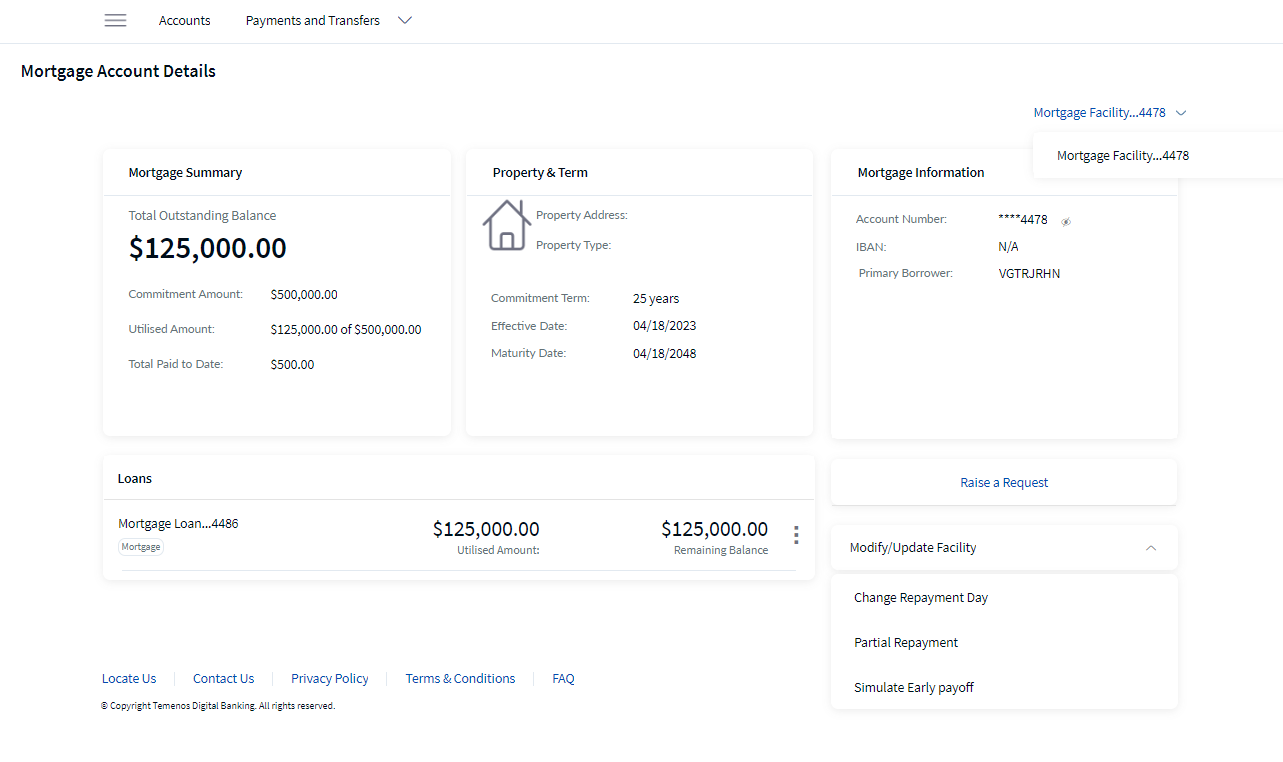

Click any mortgage facility on the accounts dashboard screen from the list of active mortgage facilities under the Mortgage Facilities group.

The application displays the selected mortgage facility with the following details:

- Mortgage facility list displays the active facilities. Select the required facility from the list.

- Mortgage Facility card with the following tabs:

- Mortgage Summary

- Total Outstanding Balance

- Commitment Amount

- Utilized Amount

- Total Paid to Date

- Property & Term

- Property Address

- Property Type

- Commitment Term (in Months and Years)

- Effective Date

- Maturity Date

- Mortgage Information

- Account Number (masked account number with eye icon for masking. Click to view the number)

- IBAN (masked number with eye icon for masking. Click to view the number)

- Primary Borrower

- Co-Borrowers

- Mortgage Summary

- Mortgage Loans list: List of loans taken (represented as a row) for the mortgage facility that is issued by the bank with the following details.

- Concatenated loan name and account number.

- Utilized Amount with currency code.

- Remaining Balance with currency code.

- Click any loan to view the mortgage loan overview of the selected loan under the selected mortgage facility.

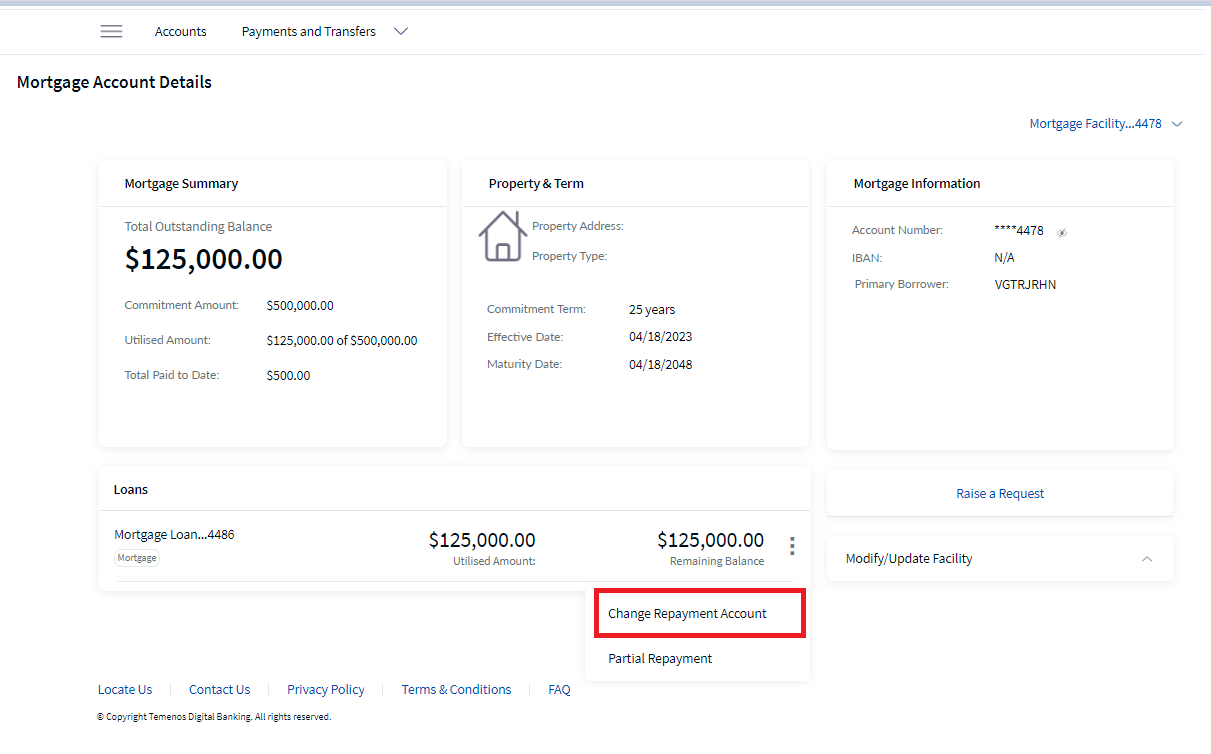

- On the quick actions of the

contextual menu, click Change Repayment Account to change the repayment account for a mortgage loan taken under a specific mortgage facility.

contextual menu, click Change Repayment Account to change the repayment account for a mortgage loan taken under a specific mortgage facility.

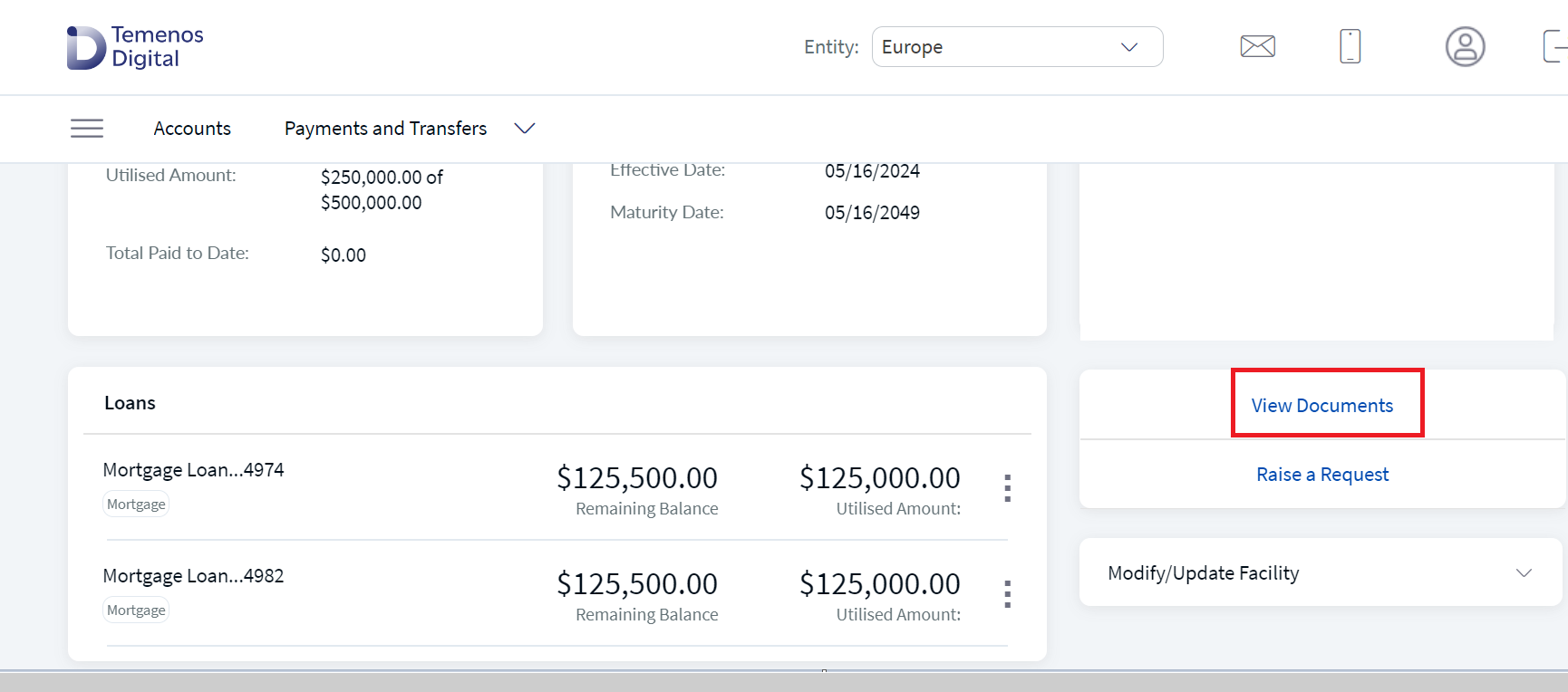

- Quick Links: The application displays quick links depending on the permission assigned to the user. It does not display the links if the user does not have the permission for any of the quick links.

- View Documents

- ArrangementsMA Visualizer Micro App is required.

- A user can view the mortgage documents for the respective account depending on the user permission. The permission is enabled in the Spotlight application from Master Data Management.

- Raise a Request

- This feature enables the user to connect with the bank directly through secure messages.

- MESSAGES_CREATE_OR_REPLY permission is required.

- SecureMessageMA Visualizer Micro App is required.

- Change Repayment Day

- ArrangementsMA Visualizer Micro App is required.

- Users can request a change in the repayment date for their mortgage loans, and allowing them to suggest a new preferable repayment date for their loans that falls on any day of the month.

- Create Change Repayment Day permission is required to raise a Change Repayment Day service request on the channel app and View Change Repayment Day permission is required to view the raised Change Repayment Day service requests on the channel app.

- Change Repayment Account:

- ArrangementsMA Visualizer Micro App is required.

- Users can request a change in the repayment account for repaying the Installments of respective mortgage loans under a mortgage facility.

- Create Change Repayment Account permission is required to raise a Change Repayment Account service request for the respective mortgage loan on the channel app and View Change Repayment Account permission is required to view the raised Change Repayment Account service requests on the channel app.

- View Documents

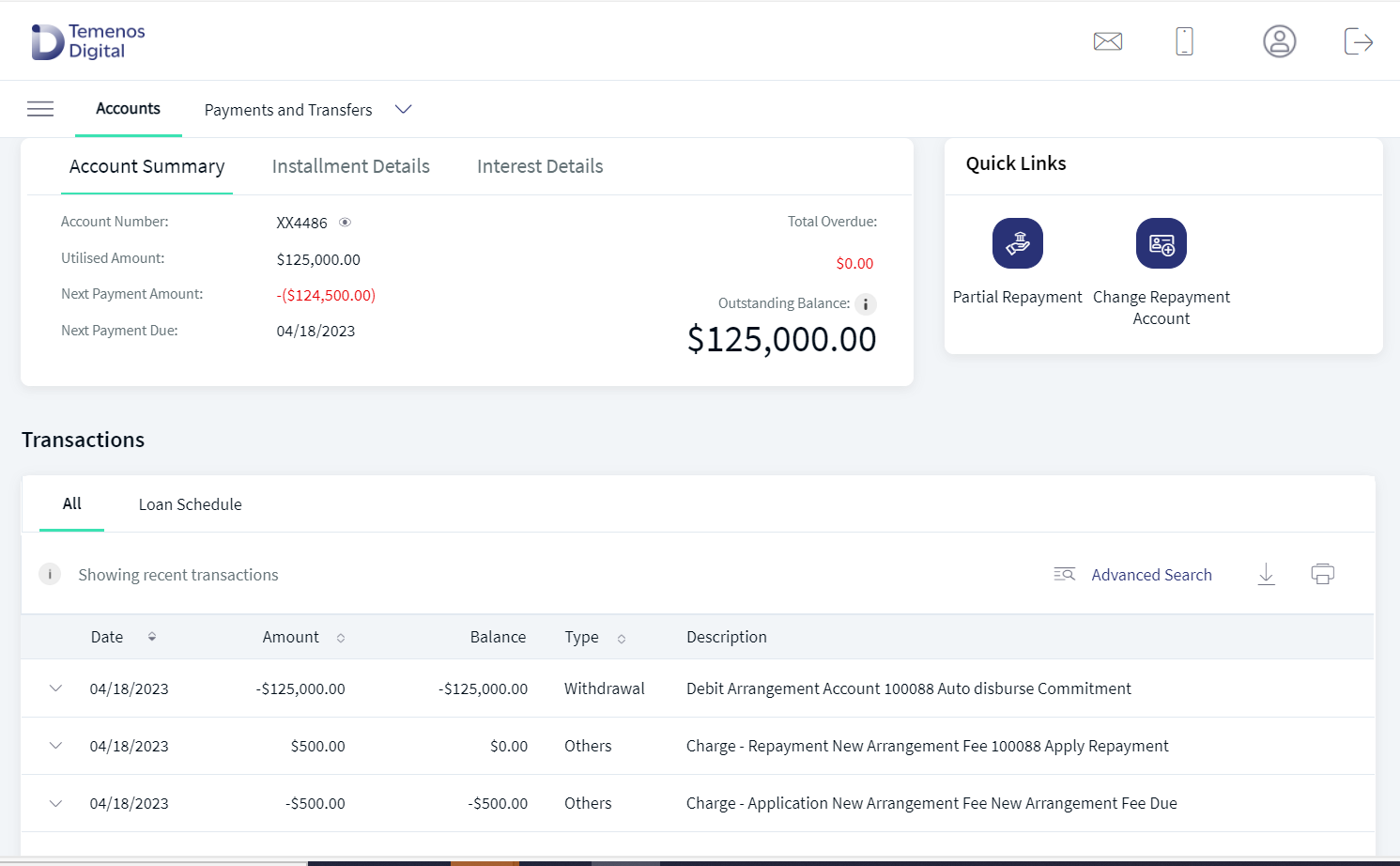

Mortgage Loan Overview

Use the feature to view the loan/drawing details from the respective mortgage facility.

Expectation and Business Rules

Expectation and Business Rules

- The user has originated for a mortgage, and the bank has approved the mortgage.

- The user has activated the digital banking profile.

- The user has to be a part of Mortagage Facilities contract to view the mortgage facility accounts on the accounts dashboard.

- The user has the permissions to view the quick actions on the contextual menu and quick links.

- The user has the permission to view the loan schedule.

- The user has the permission to view the documents related to mortgage servicing.

- ArrangementsMA Visualizer Micro App is required.

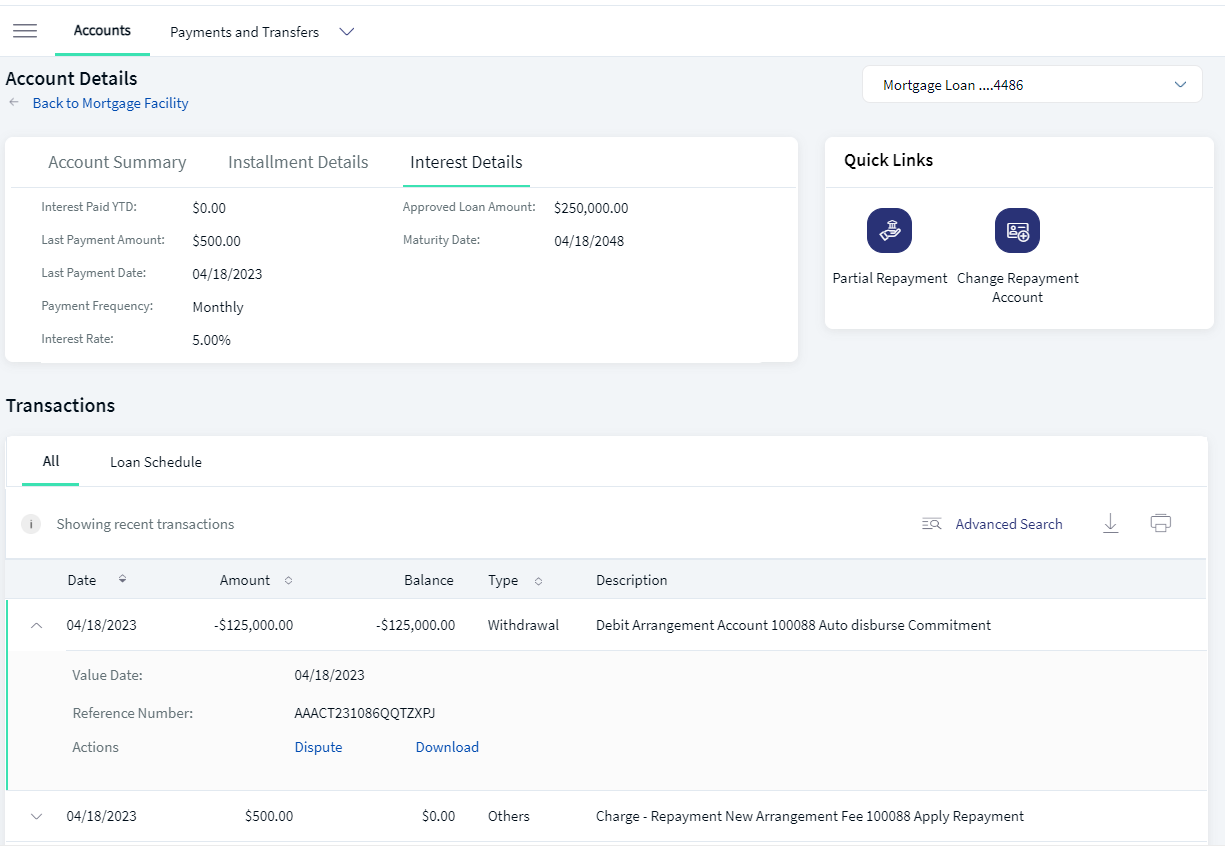

From the list of loans for a selected mortgage facility, click any of the loan to view the loan overview. The application displays the following details:

- Loan balance card with the following tabs:

- Account Summary

- Account Number (last four digits unmasked). Click the information icon to view the field description.

- IBAN (last four digits unmasked). Click the information icon to view the field description.

- Utilized Amount

- Next Payment Amount

- Next Payment due

- Total Overdue

- Outstanding Balance. Click the information icon to view the field description.

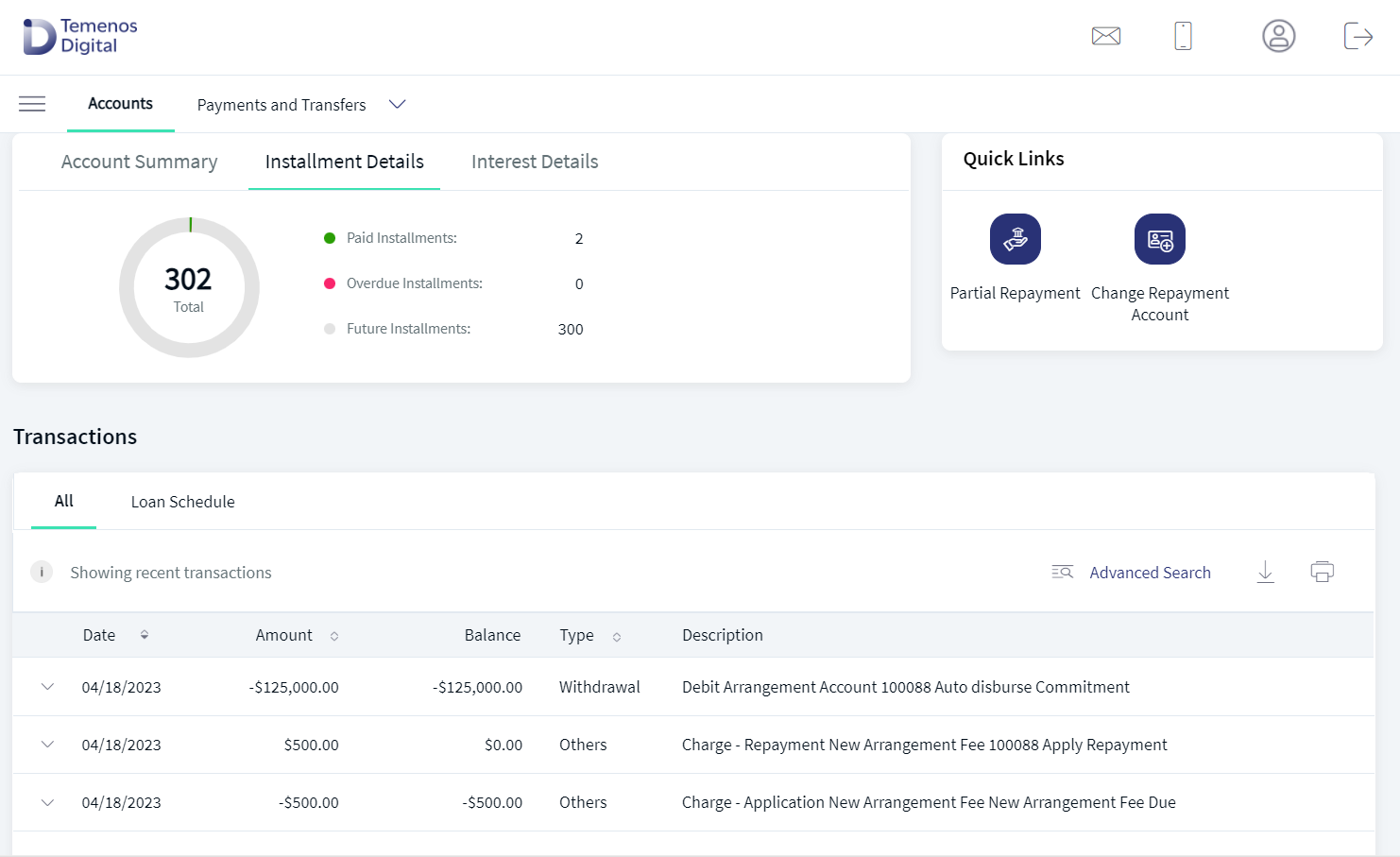

- Installment Details

- Pie chart for Paid, Overdue and Future installments with the total count.

- Paid Installments with count.

- Overdue Installments with count.

- Future Installments with count.

- Interest Details

- Interest Paid YTD

- Last Payment Amount

- Last Payment Date

- Payment Frequency

- Interest Rate

- Maturity Date

- Approved Loan Amount

- Account Summary

- Transactions section displays the transactions list of the respective loan under the mortgage facility.

- Quick Links: The application displays quick links depending on the permission assigned to the user. It does not display the menu if the user does not have the permission for any of the quick links.

- FAQ

- No permission required.

- AboutUsMA Visualizer Micro App is required.

- View Documents

- ArrangementsMA Visualizer Micro App is required.

- A user can view the mortgage documents for the respective account depending on the user permission. The permission is enabled in the Spotlight application from Master Data Management.

- Raise a Request

- This feature enables the user to connect with the bank directly through secure messages.

- MESSAGES_CREATE_OR_REPLY permission is required.

- SecureMessageMA Visualizer Micro App is required.

- Change Repayment Account

- ArrangementsMA Visualizer Micro App is required.

- Users can request a change in the repayment account for repaying the Installments of respective mortgage loans under a mortgage facility.

- Create Change Repayment Account permission is required to raise a Change Repayment Account service request for the respective mortgage loan on the channel app and View Change Repayment Account permission is required to view the raised Change Repayment Account service requests on the channel app.

- FAQ

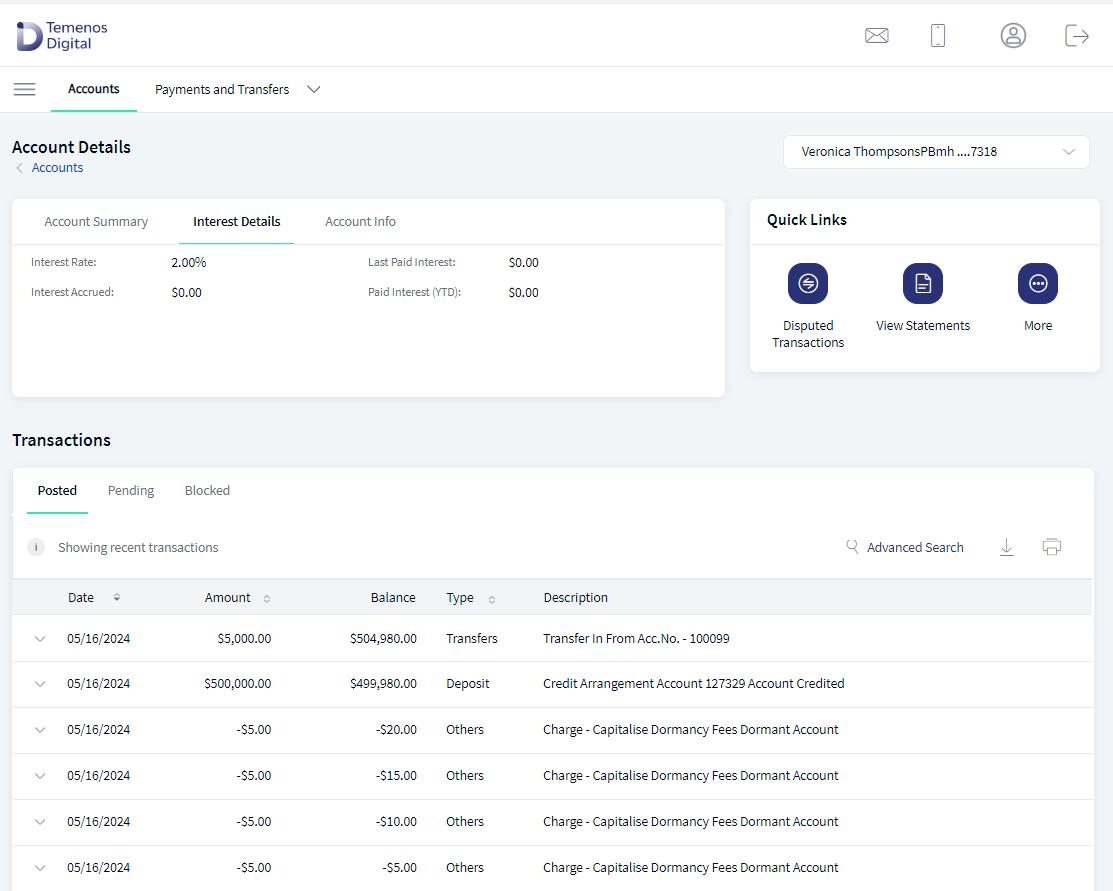

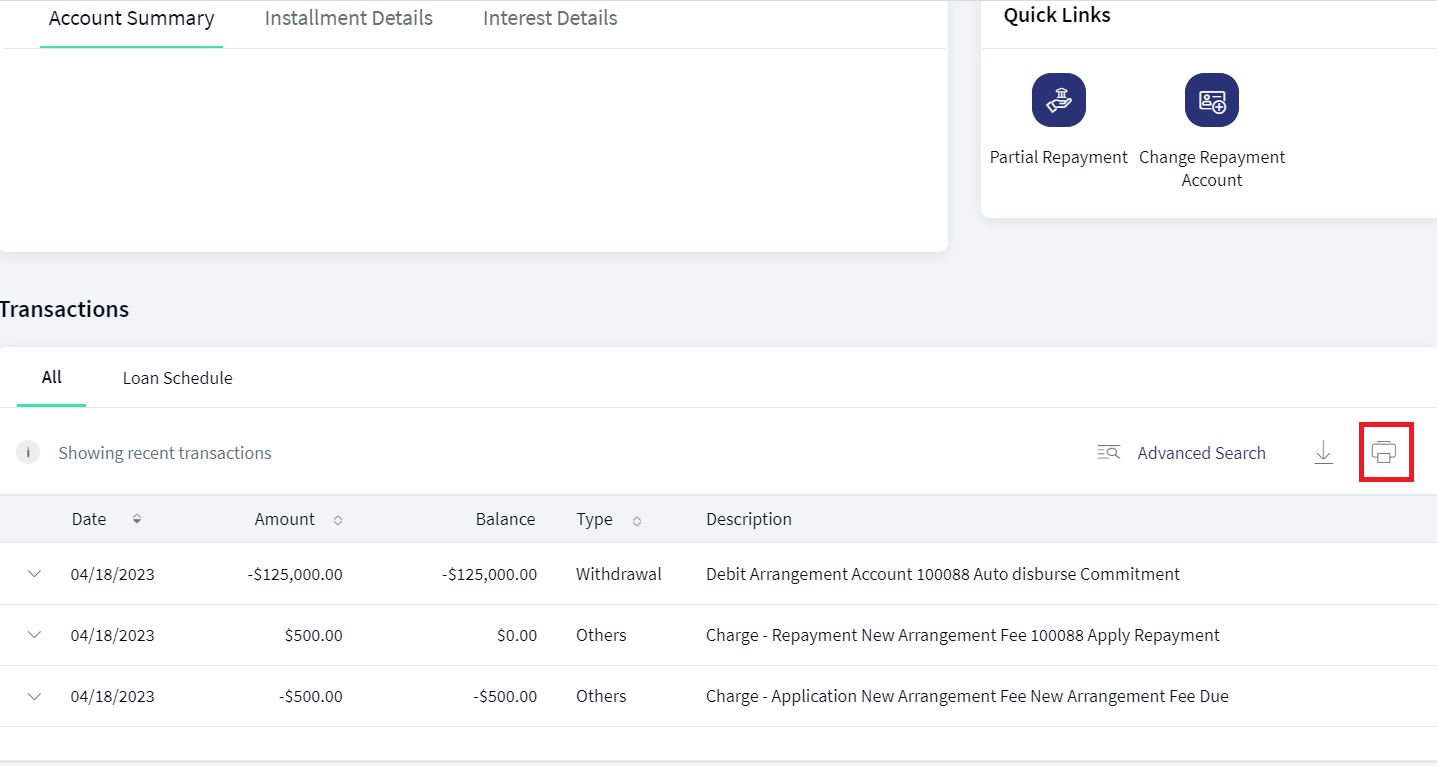

View All Transactions and Loan Schedule

Use the feature to view the transactions list of the respective loan/drawing under the selected mortgage facility.

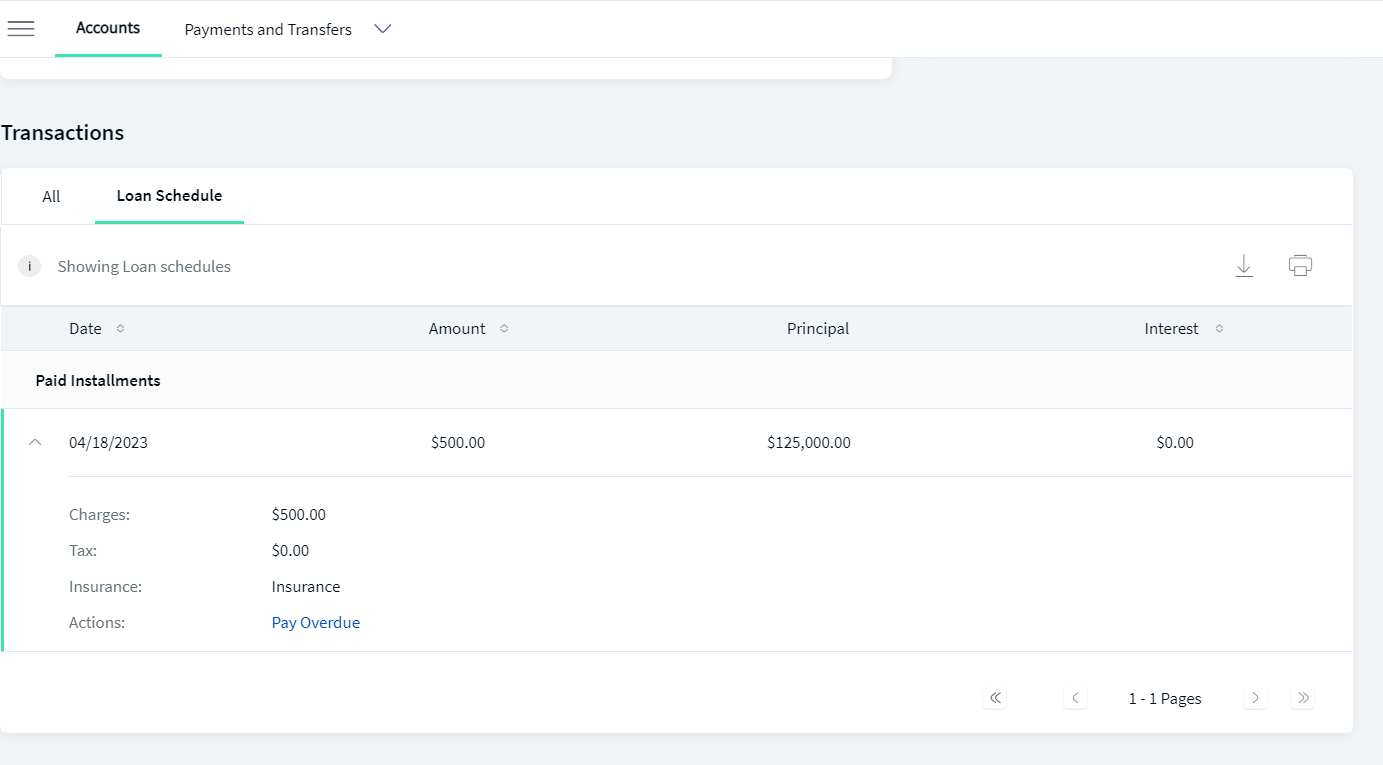

The application displays the transactions list (All and Loan Schedule tabs) of the selected loan. By default, the All transactions tab is selected.

Do any of the following:

- All tab: Click to view the list of all transactions of the respective loan/drawing.

- Loan Schedule tab: Click to view the list of installments with respective to the mortgage loan account.

All Transactions List

View the list of all transactions of the respective loan/drawing under the selected mortgage facility on the All transactions tab.

The application displays the list of all transactions (represented as rows) with the following details.

- Date

- Description

- Type

- Amount

- Balance

Each transaction can be expanded/collapsed using the down and up arrows, respectively, and contains the following:

- Transaction Date

- Reference Number

Loan Schedule

View the list of installments to the respective mortgage loan account on the Loan Schedule tab.

The application displays the list of installments (Paid and Overdue) with the following details.

- Date

- Amount

- Principal

- Interest

- Outstanding Balance

Each transaction can be expanded/collapsed using the down and up arrows, respectively, and contains the following:

- Charges

- Taxes

- Insurance

Advanced Search

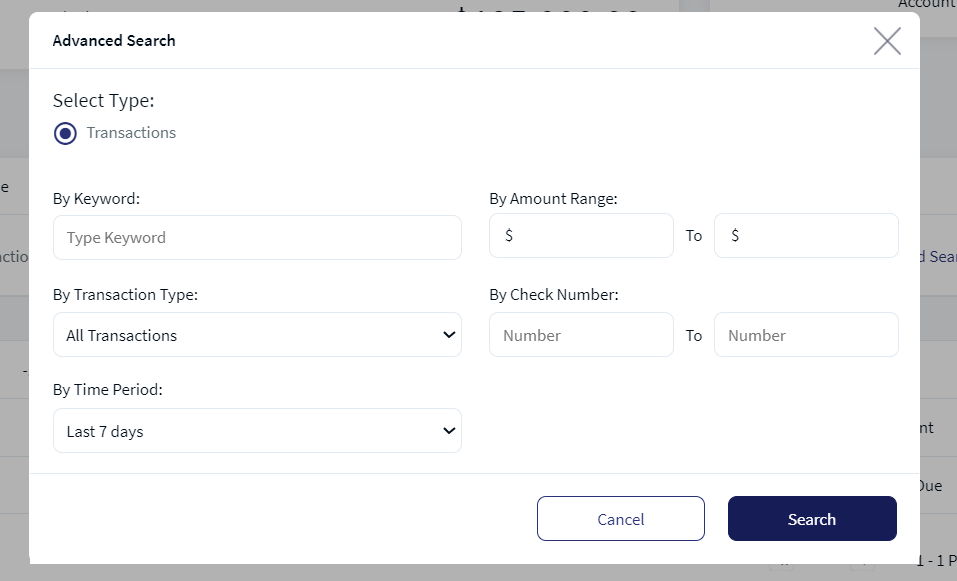

Use the feature to do an advanced search using filters on the transactions list to identify the required transaction. The advanced search can only be performed when transactions are listed under the All and Loan Schedule tabs.

To do an advanced search, follow these steps:

- From the list of transactions on the mortgage loan overview screen, click the Search icon.

- The application displays the following filters to narrow down the search:

- By Keyword: When performing a keyword search, the user must provide a description of the transaction.

- By Transaction Type: Select the required transaction type from the list. The options are: All Transactions, Deposits, Withdrawals, Checks, Transfers, My Bills, Person-To-Person Debits, and Person-To-Person Credits.

- By Time Period: Select a time range from the list. The options are: Last 7 days, Last 14 Days, Last 1 month, Last 2 months, Last 3 months, Last 6 months, Last 12 months, and Custom Date Range. If Custom Date Range is selected, select the time period from the calendar to give the start date and end date.

- By Amount Range: Enter the From and To amount to define the range.

- By Check Number: Using the transactions Cheque Number range, the user can search for Cheque related Transactions.

- Click Search. The application displays the list of transactions that fits the applied filters.

Sort

Use the feature to sort the transactions list by using the  Sort icon. The application allows to perform the sort action on the following:

Sort icon. The application allows to perform the sort action on the following:

- Date (either oldest to newest or newest to oldest)

- Amount (either smallest to largest or largest to smallest)

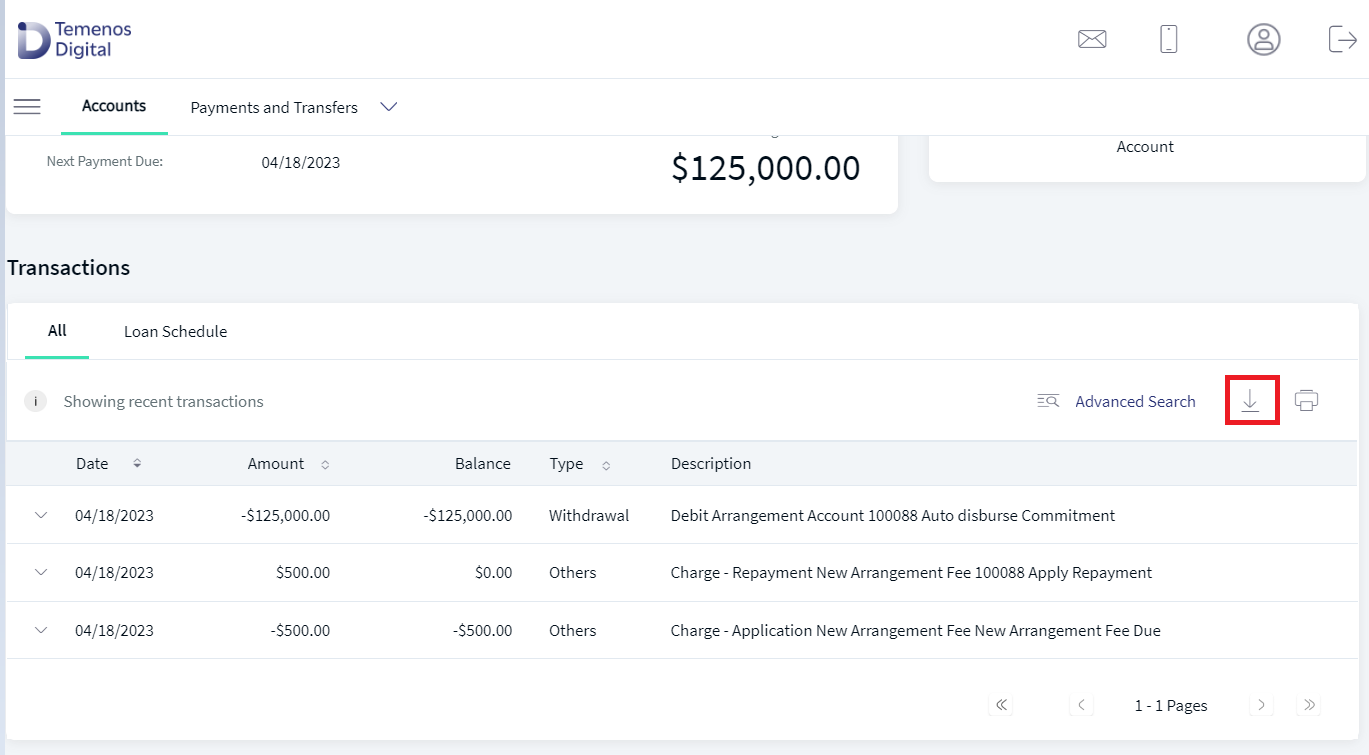

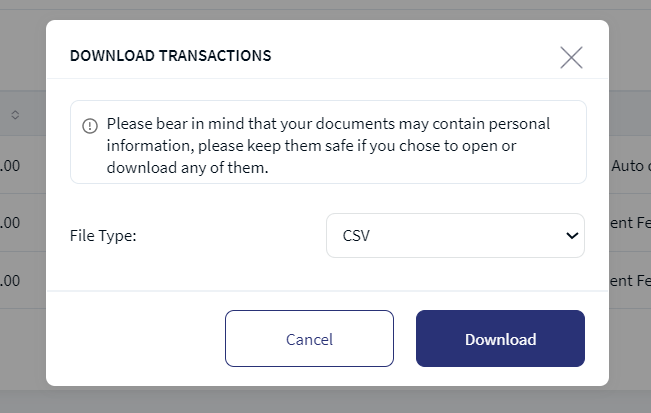

Download

Use the feature to download the transaction summary using the Download icon.

To download transaction, follow these steps:

- From the list of transactions on the mortgage loan overview screen, click the Download icon. The application displays the Download Transactions screen.

- Specify the following details:

- Pick Date Range: Click the Calendar icon to select the From and To date range or enter the date in mm/dd/yyyy format.

- Select Format: Click the list and select the format to download the transaction in the selected format. The available download formats are:

- CSV

- Excel

- QFX

- QBO

- Click Download to download the transactions within the selected criteria.

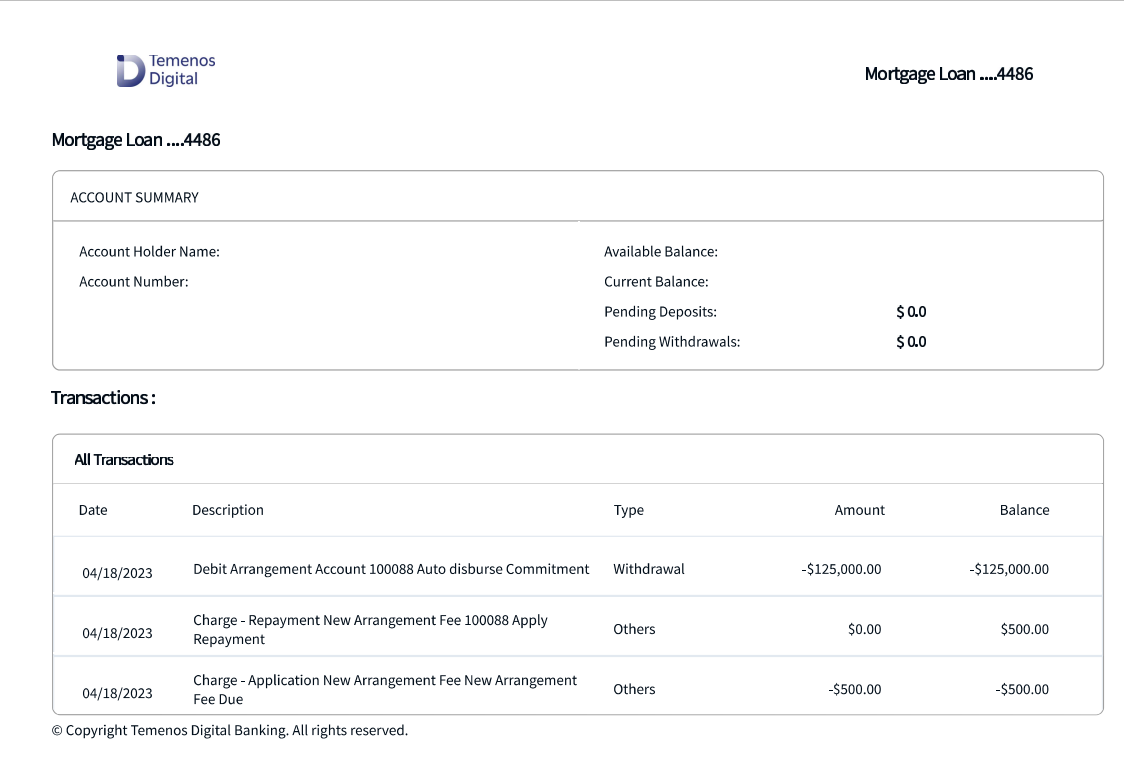

Use the feature to print the transactions list using the Print icon. The application displays the Print icon above the transactions list and provides a preview of the screen before printing.

The application provides a preview of the screen before printing with the following details:

- Account Summary

- Account Holder Name

- Account Number

- Outstanding Balance

- Principal Amount

- Current Due Amount

- Transactions list (Posted and Pending) with the following details:

- Date

- Description

- Type

- Amount

- Balance

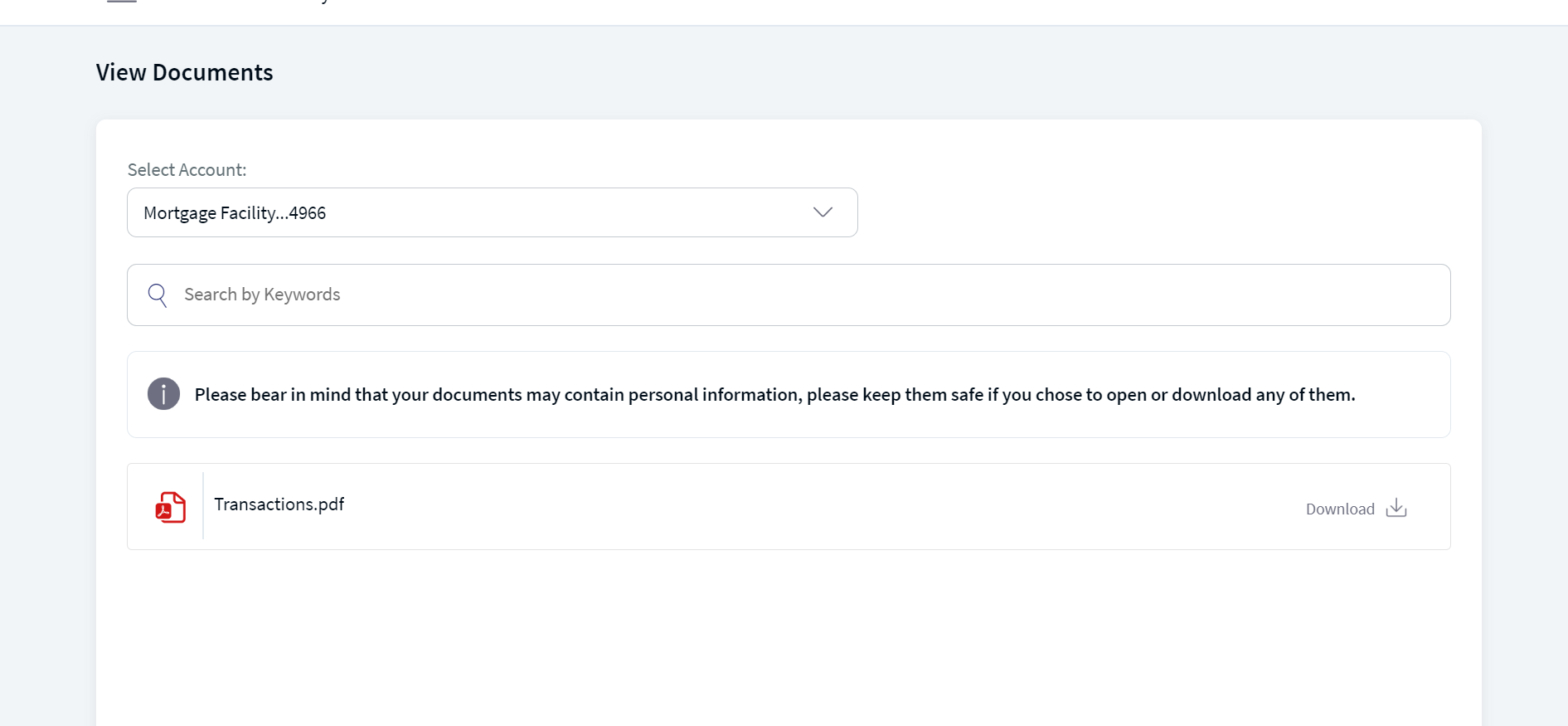

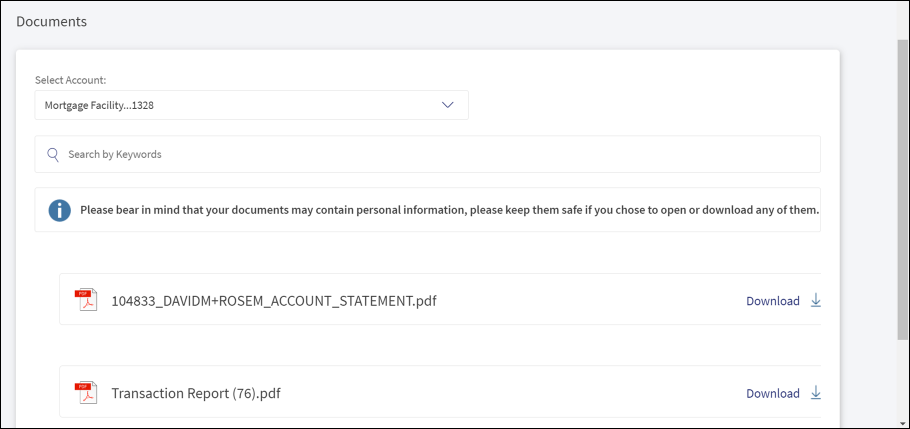

View Mortgage Documents

Users can facilitate this feature to view all the documents the bank provides when the customer originates with the Mortgage Facility.

Expectation

- User has originated for a mortgage and the bank has approved the mortgage.

- User has activated the digital banking profile.

- User has the permission to view the documents related to mortgage servicing.

Business rules

- ArrangementsMA Visualizer Micro App is required.

- A user can view the mortgage documents for the respective account depending on the user permission - Customer ID/User Level Permission. The permission is enabled in the Spotlight application from Master Data Management.

To view and download the document for the selected mortgage facility, follow these steps:

- Click View Documents from any of the following:

- Quick actions of the

contextual menu of the Mortgage Facilities section on the accounts dashboard.

contextual menu of the Mortgage Facilities section on the accounts dashboard. - Quick links on the mortgage facility overview screen.

- Quick actions of the

- The application displays the Documents screen

- The application displays the following details. Do as required:

- Select Account: Mortgage facility account number is auto-populated in the Select Account field. Select the required account from the list to view the corresponding documents.

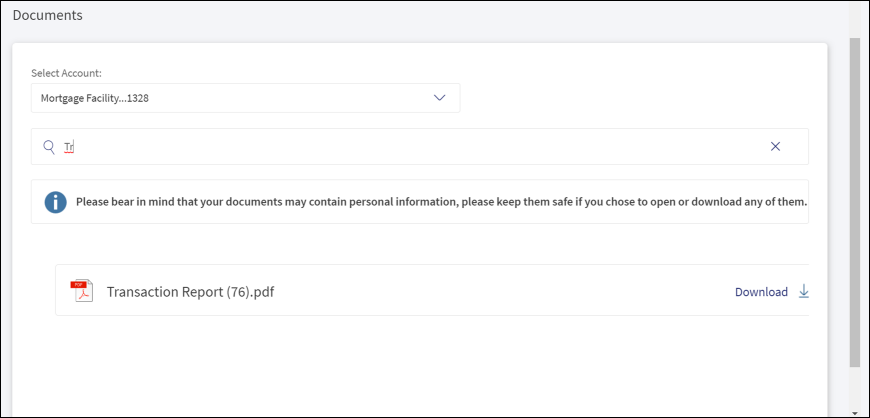

- Search by Keywords: Use the search bar for searching the documents by document name. Click X to cancel the search.

- Documents list: List of all documents that is presented by the bank with document name and option to download the documents.

- Download: Option to download the document as PDF. Click Download to download and view the document in PDF format.

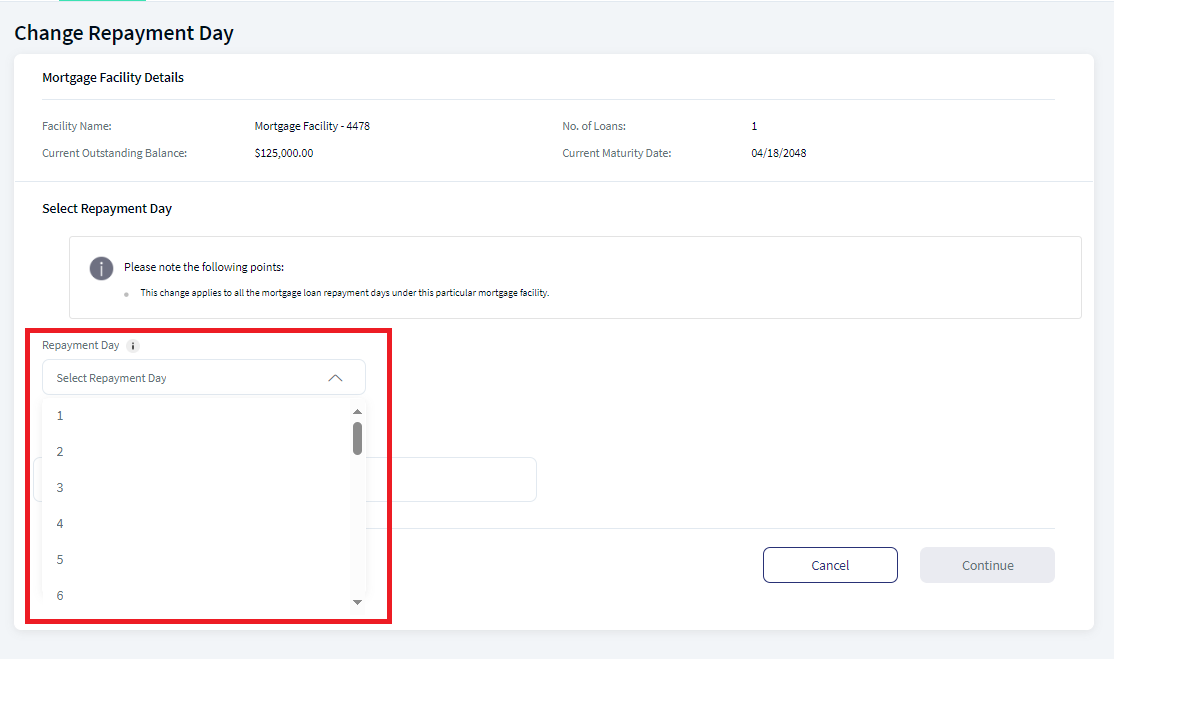

Change Repayment Day

Use the feature to request a change in the repayment day for repaying the Installments for mortgage loans, and suggest a new preferable repayment date for the loans that fall on any day of the month.

A user with appropriate permission can raise a request to change repayment day of all the loan installments under a specific facility from the accounts dashboard or the mortgage facility overview screen. The change applies to all the mortgage loan repayments under the selected mortgage facility. The submitted request is displayed on the Service Requests dashboard. See Glossary for the terms related to mortgage servicing.

- The user has taken Mortgage Facilities and have drawings under the Facilities.

- The user must have permission to raise the Repayment Day service request. The feature action must be present in Spotlight for raising the request for repayment day request.

- The Change Repayment Day feature must be present for the user to entitle repayment day service request.

- For the Change Repayment Day feature, the following actions must be active:

- Create repayment day action to raise the service request from the channel app.

- View repayment day action for the users to view the request created by the user.

- If the feature actions are inactive, the user cannot raise the service request.

To raise a request to change repayment day for the loan installments under a specific mortgage facility, follow these steps:

- Click Change Repayment Day from any of the following:

- Quick actions of the

contextual menu of the Mortgage Facilities section on the accounts dashboard.

contextual menu of the Mortgage Facilities section on the accounts dashboard. - Modify/Update Facility list on the mortgage facility overview screen.

- Create Change Repayment Day permission is required to raise a Change Repayment Day service request on the channel app and View Change Repayment Day permission is required to view the raised Change Repayment Day service requests on the channel app.

- If the user does not have permission for raising the request for change repayment day for the Mortgage Facilities taken, then the user will not view the option for raising the request for changing the repayment day.

- Quick actions of the

- The Change Repayment Day screen is displayed with the following details: Facility Name, Number of Loans, Current Outstanding Balance, and Current Maturity Date.

- Under the Select Repayment Day section, select a day from the list for changing the repayment day for the installments. The change applies to all the mortgage loan repayments under the selected mortgage facility. It is mandatory to select a day from the list to continue.

- Under the Supporting Documents section, click Attach Documents and add supporting documents as required.

- Validations

- Adding documents is optional.

- A maximum of five attachments are allowed. If the user uploads more than 5 documents, the application displays an appropriate message - Exceeded Maximum No. of Files.

- Only PDF and JPEG formats are supported. If the user uploads the document with file type other than PDF and JPEG, the application displays an appropriate message - Invalid File Type.

- The individual file size cannot exceed 2 MB. If the user uploads the document with file size more than 2 MB, the application displays an appropriate message - File Exceeds Maximum Size.

- The application stores the submitted documents in the Document Microservice against the respective customer.

- If the Service Request for Change Repayment Day is not effected in Service Request MS due to technical error, the application displays an appropriate message - Failed to Capture the Service Request, Try again later.

- Validations

- Click Continue. The button is enabled only after the repayment day is selected.

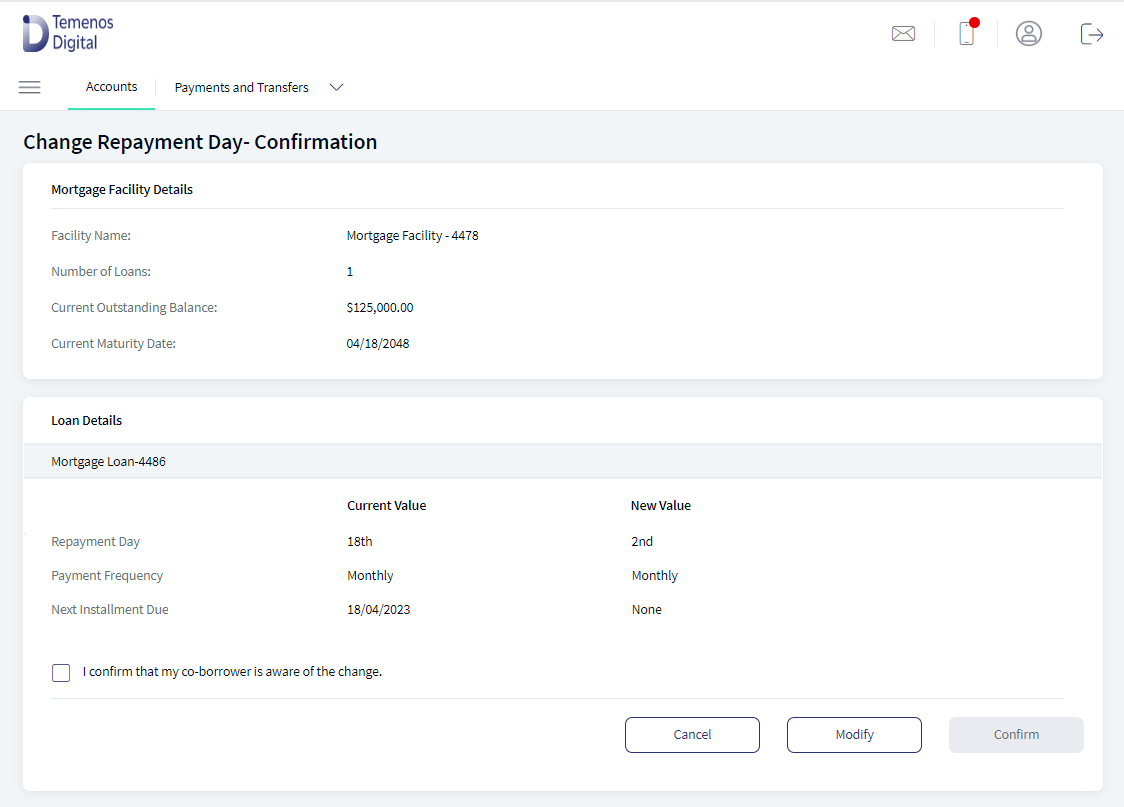

- The application displays the Confirm Repayment Day screen with the following information:

- Mortgage Facility Details: Facility Name, Number of Loans, Current Outstanding Balance, and Current Maturity Date.

- Loan Details: Repayment Day, Payment Frequency, and the Next Installment Due under the Current Value and New Value heads.

- Supporting Documents: The list of attached documents, if any.

- Do these as required:

- Modify: Click to make changes to New Repay Day (Mandatory) and Supporting Documents (Optional).

- Cancel: Click to cancel the repayment day request if not satisfied with the new repayment plan or before submitting the request.

- Select the check box to confirm that the co-borrower is aware of the repayment day change. It is mandatory.

- Click Submit. The button is enabled only after the confirmation check box is selected.

- The application displays the acknowledgment screen that the change repayment day request is submitted with the following details:

- Acknowledgment: Success message with Reference ID generated from the Service Request MS.

- Mortgage Facility Details: Facility Name, Number of Loans, Outstanding Balance, and Maturity Date.

- Loan Details: The list of loans (loan name with the account number), New Payment Day and Payment Frequency.

- Do any of the following on the Acknowledgment screen:

- Click the Download icon on the top-right of the screen to download the onscreen data.

- Click the Print icon on the top-right of the screen to print the onscreen data.

- Click Back to Facility Overview to navigate to the mortgage facility overview.

- Post submitting the request, the application displays the repayment day change request with the current plan, the new requested plan details, request reference number, and the appropriate request status on the Service Requests dashboard.

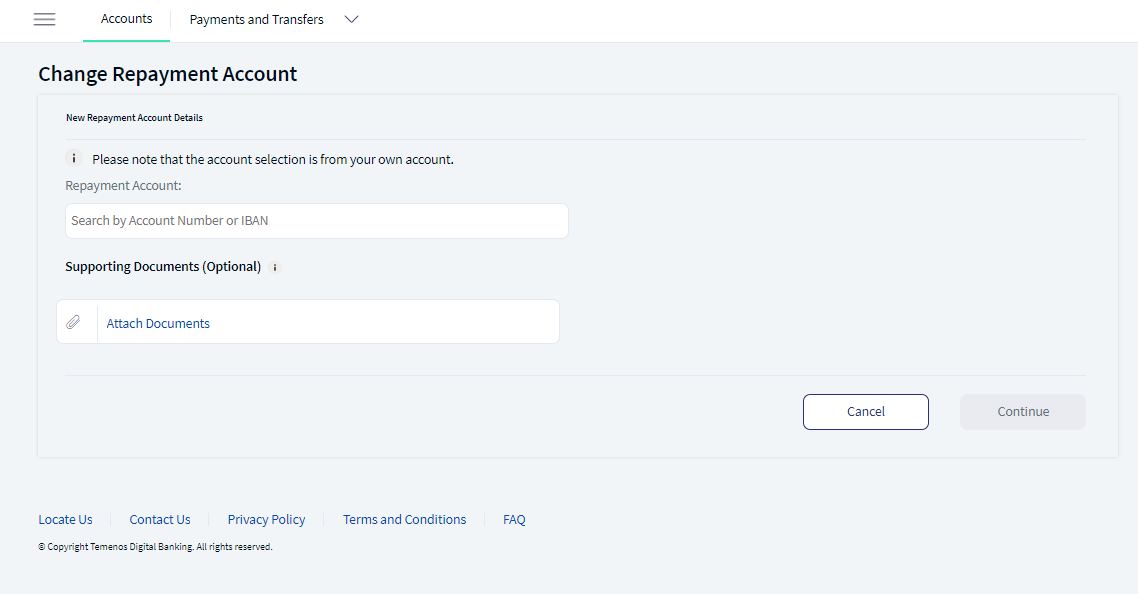

Change Repayment Account

Use the feature to request a change in the repayment account for repaying the Installments of respective mortgage loans under a mortgage facility.

A user with appropriate permission can raise a request to change repayment account of a mortgage loan under a specific facility on the mortgage facility overview and mortgage loan overview screens. The submitted request is displayed on the Service Requests dashboard. See Glossary for the terms related to mortgage servicing.

- The user has taken Mortgage Facilities and have drawings under the Facilities.

- The user must have permission to raise the Repayment Account service request. The feature action must be present in Spotlight for raising the request for repayment account request.

- The Change Repayment Account feature must be present for the user to entitle repayment account service request.

- For the Change Repayment Account feature, the following actions must be active:

- Create repayment account action to raise the service request from the channel app.

- View repayment account action for the users to view the request created by the user.

- If the feature actions are inactive, the user cannot raise the service request.

To raise a request to change repayment account for a mortgage loan under a specific mortgage facility, follow these steps:

- Click Change Repayment Account from any of the following:

- Quick actions of the

contextual menu of the Loans section and the Quick Links section on the mortgage facility overview screen.

contextual menu of the Loans section and the Quick Links section on the mortgage facility overview screen. - Quick Links section on the mortgage loan overview screen.

- Create Change Repayment Account permission is required to raise a Change Repayment Account service request for the respective mortgage loan on the channel app and View Change Repayment Account permission is required to view the raised Change Repayment Account service requests on the channel app.

- If the user does not have permission for raising the request for change repayment account for the mortgage loans, then the user will not view the option for raising the request for changing the repayment account at the loan level.

- Quick actions of the

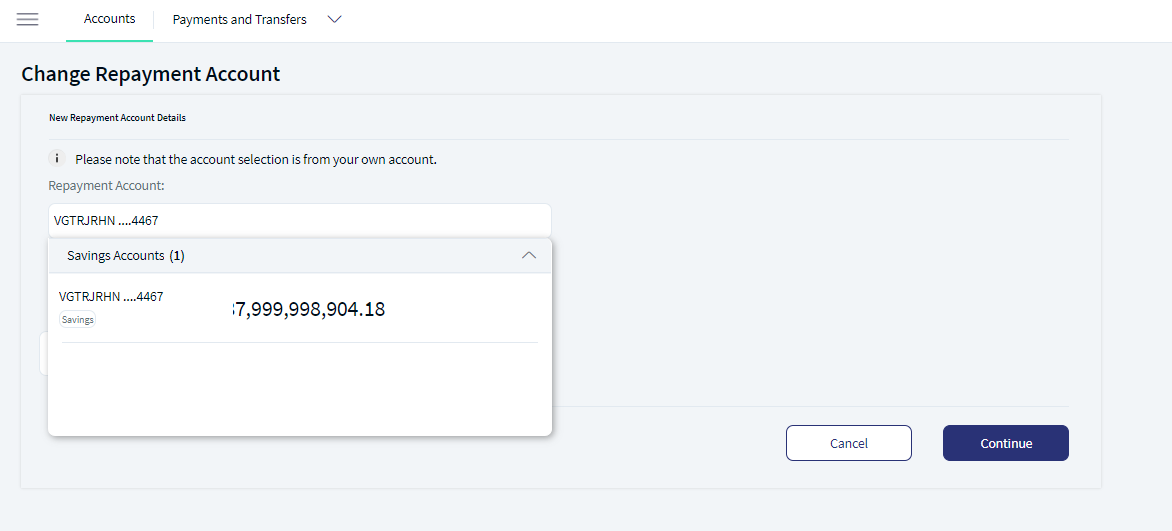

- The Change Repayment Account screen is displayed with the provision to change the account number and add supporting documents.

- Under the New Repayment Account Details section, search by account number or IBAN to select the Repayment Account for repaying the installments. It is mandatory to specify an account number to continue.

- Under the Supporting Documents section, click Attach Documents and add supporting documents as required.

- Validations

- Adding documents is optional.

- A maximum of five attachments are allowed. If the user uploads more than 5 documents, the application displays an appropriate message - Exceeded Maximum No. of Files.

- Only PDF and JPEG formats are supported. If the user uploads the document with file type other than PDF and JPEG, the application displays an appropriate message - Invalid File Type.

- The individual file size cannot exceed 2 MB. If the user uploads the document with file size more than 2 MB, the application displays an appropriate message - File Exceeds Maximum Size.

- The application stores the submitted documents in the Document Microservice against the respective customer.

- If the Service Request for Change Repayment Account is not effected in Service Request MS due to technical error, the application displays an appropriate message - Failed to Capture the Service Request, Try again later.

- Validations

- Click Continue. The button is enabled only after the repayment account is entered.

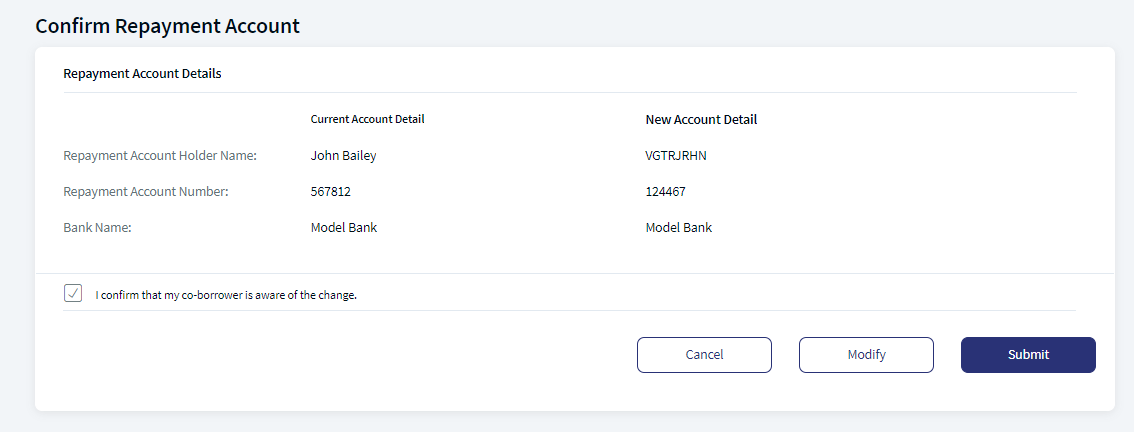

- The application displays the Confirm Repayment Account screen with the following information:

- Account Details: Account Holder Name, Account Number, and Bank Name under the Current Account Detail and New Account Detail heads.

- Supporting Documents: The list of attached documents, if any.

- Do these as required:

- Modify: Click to make changes to New Repay Account (Mandatory) and Supporting Documents (Optional).

- Cancel: Click to cancel the repayment Account request if not satisfied with the new repayment plan or before submitting the request.

- Select the check box to confirm that the co-borrower is aware of the repayment day change. It is mandatory.

- Click Submit. The button is enabled only after the confirmation check box is selected.

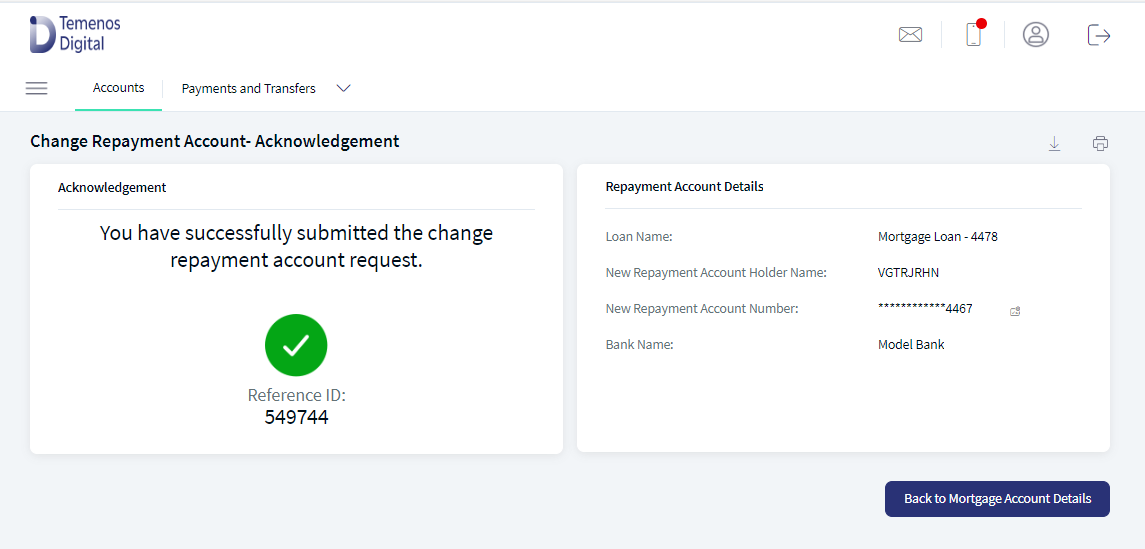

- The application displays the acknowledgment screen that the change repayment account request is submitted with the following details:

- Acknowledgment: Success message with Reference ID generated from the Service Request MS.

- Repayment Account Details: Loan Name, New Repayment Account Holder Name, New Repayment Account Number, and Bank Name.

- Do any of the following on the Acknowledgment screen:

- Click the Download icon on the top-right of the screen to download the onscreen data.

- Click the Print icon on the top-right of the screen to print the onscreen data.

- Click Back to Facility Overview to navigate to the mortgage facility overview.

- Post submitting the request, the application displays the repayment account change request with the current plan, the new requested plan details, request reference number, and the appropriate request status on the Service Requests dashboard.

Configuration

Change Repayment Day Request in Service Request Microservice (SRMS)

The Service Request definition must be preconfigured in SRMS for the Change Repayment Day service request to be captured and persist the request. Out-of-the-box, the system supports Type and Sub Type.

Request Type Details

- Product: Mortgage Facility Account

- Type: Manage Facility

- Sub Type: Change Repayment Date

Change Repayment Account Request in Service Request Microservice (SRMS)

The Service Request definition must be preconfigured in SRMS for the Change Repayment Account service request to be captured and persist the request. Out-of-the-box, the system supports Type and Sub Type.

Request Type Details

- Product: Mortgage Facility Account

- Type: Manage Facility

- Sub Type: Change Repayment Account

Current Mortgage Servicing functionality is via SRMS, as per the requirement, configuration name and configuration values should be as following:

| Module | Configuration name | Config Possible values |

|---|---|---|

| Mortgage Servicing | MORTGAGESERVICING_BACKEND | STUB/SRMS |

API

For the complete list of APIs shipped as part of this feature, see Experience APIs documentation.

In this topic