Business Loan Accounts

Business Loan Accounts is a loan product that helps users avail funds for business purposes. The Business Loans section allows users to view key benefits of a product, choose plan, and learn more, about the product.

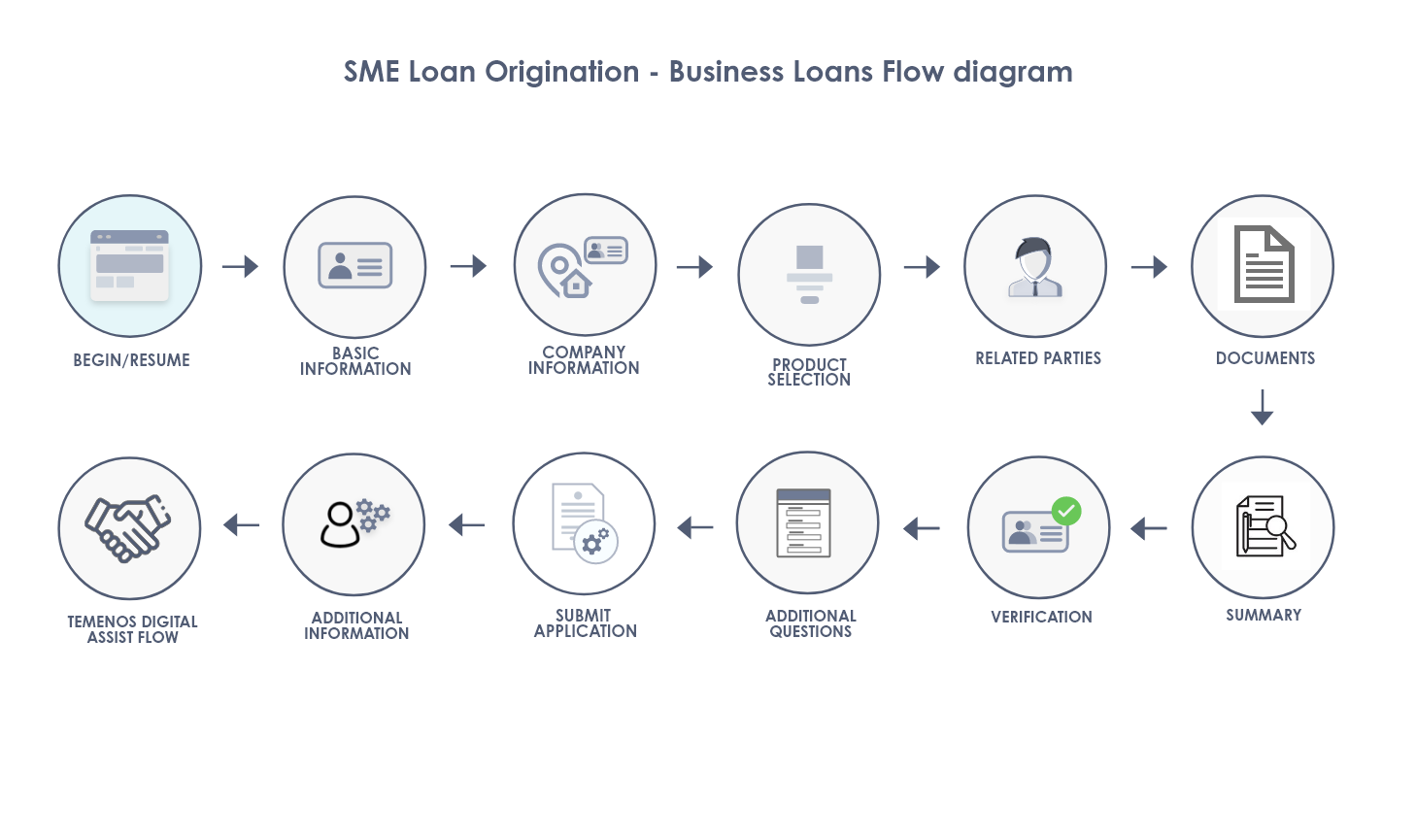

Business Loan Accounts Workflow

Business Loan Accounts workflow illustrates the sequence of steps from start of an application till submission of an application in the Origination App.

To know more about the Business Loan Accounts flow in Temenos Digital Assist App (post-submission), click here.

Process Flow

When an existing customer or prospect customer selects Business Loan Accounts in the Product Group Dashboard, the road map in the Origination App for Business Loan Accounts journey is as follows:

- Basic Information

- Company Information

- Product Selection

- Related Parties

- Documents

- Summary

- Additional Questions

- Submit

UX Overview

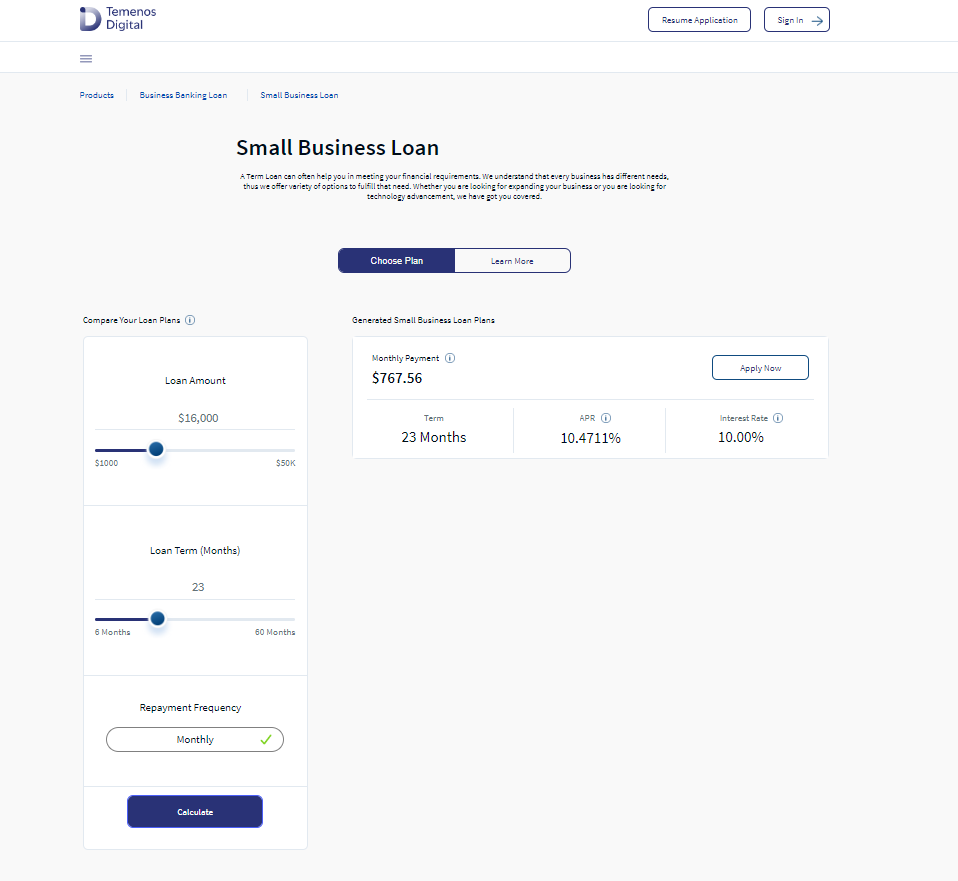

This section provides an overview of the Business Loan Accounts Dashboard. It contains Choose Plan (Simulation) section and Business Loan details Dashboard. For example, the Business Loan Accounts product group contains the Business Growth Loan product.

Upon selecting Loan Accounts product from the Landing dashboard, the Choose Plan section is displayed.

Choose Plan

Enables you to choose a plan for the desired loan product by using loan simulation. On click of this option, the Choose Plan section in the respective Product details dashboard appears.

This section contains the following sub-sections:

- Compare Your Loan Plans: Provide desired Loan Amount and Loan Term from the ranges displayed. The default minimum and maximum values can be configured from Spotlight. For more information on the Spotlight configurations, click here.

The Repayment frequency such as Monthly, Fortnightly, or weekly is auto-selected based on the configurations set for the specific product in the MCMS. This field is non-editable.

Click on Calculate to see the generated business loan plans based on your requirements.

- Generated Business Growth Loan Plans: Displays the applicable loan plan based on the predefined loan amount and loan term. Each loan plan contains details such as payment amount, Term, APR, and Interest rate. Click Apply Now to proceed with the loan plan.

Important Disclosures at the end of the section contains vital information that the users must consider while applying for a loan.

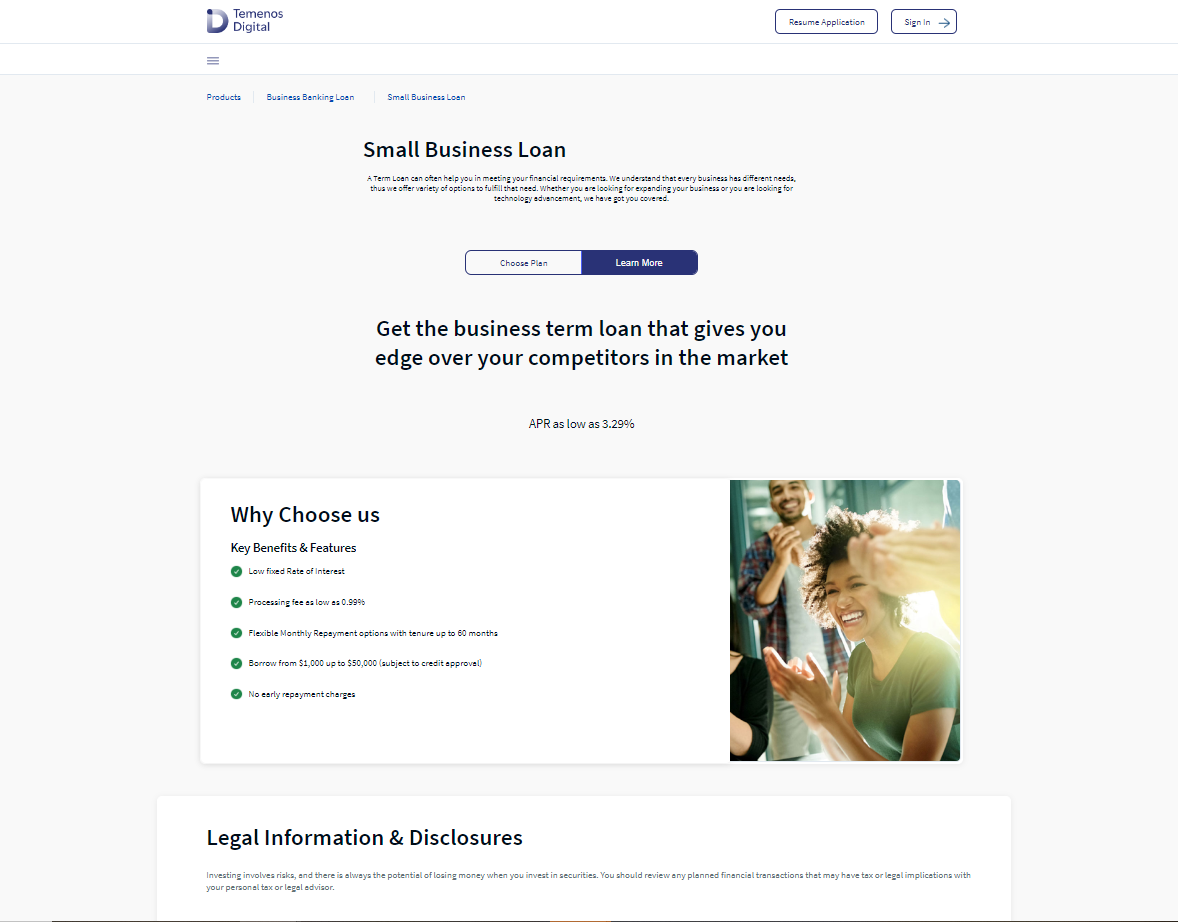

Learn More

Provides more information about the specific card. On click of this option, the Learn More section in the respective Product details dashboard appears.

Reference Table

| Journey | Product | Road Map in the Origination App for Prospect Customer & Existing Customer |

|---|---|---|

| SME Loan Origination | Business Loan Accounts | Basic Information > Company Information > Product Selection > Related Parties > Documents > Summary > Additional Questions > Submit Application |

Components

The Business Loan Accounts dashboard contains the following list of components:

| Component Name | Instance Name |

|---|---|

| com.olb.common.BrowserCheckPopup | BrowserCheckPopup |

| com.nuo.loadingV3 | loadingV3 |

| com.dbx.Explore | Explore |

| com.dbx.bannerError | bannerError |

| com.dbx.breadcrumbs | breadcrumbs |

| com.dbx.customfooter | customfooterNUO |

| olb.dbx.customheaderNUOV2V2 | customheaderNUOV2V2 |

| com.dbx.dataNotLoaded | dataNotLoadedAd |

| com.dbx.dataNotLoaded | dataNotLoadedContentImage |

| com.dbx.dataNotLoaded | dataNotLoadedExplore |

| com.dbx.dataNotLoaded | dataNotLoadedProdLists |

| com.dbx.SliderAndTextbox | SliderAndTextbox |

| com.dbx.nativeSlider | nativeSlider |

Experince APIs

| API | Description |

|---|---|

| getLoanSimulationDetails | This API retrieves the Ioan simulation section. |

| createApplication | This API creates an application in the Origination Data Microservice from the Origination application. |

| getProductSelection | This API retrieves all the selected products from the Origination Data Microservice (ODMS). |

| updateProductSelection | This API updates the selected products in the Origination Data Microservice (ODMS); and the Product IDs in Infinity. |

In this topic