Bridge Loan

Bridge loan also known as Interim Financing is a short-term loan which an individual or a company can utilize to bridge the gap in funding a new mortgage loan or use the funds for home renovation or home improvement purpose. A customer can digitally apply for Bridge Loan without visiting the Bank premises.

System Administrator has the capability to enable Bridge Loan product under Mortgage Product group from Transact. Bridge Loan Product is flagged with purpose as Onboarding in Marketing Catalog Microservice (MCMS) and the details are fetched from MCMS and the product displays in the Retail dashboard group. On click of the product from the hamburger menu, the control navigates the user to the respective Product Dashboard.

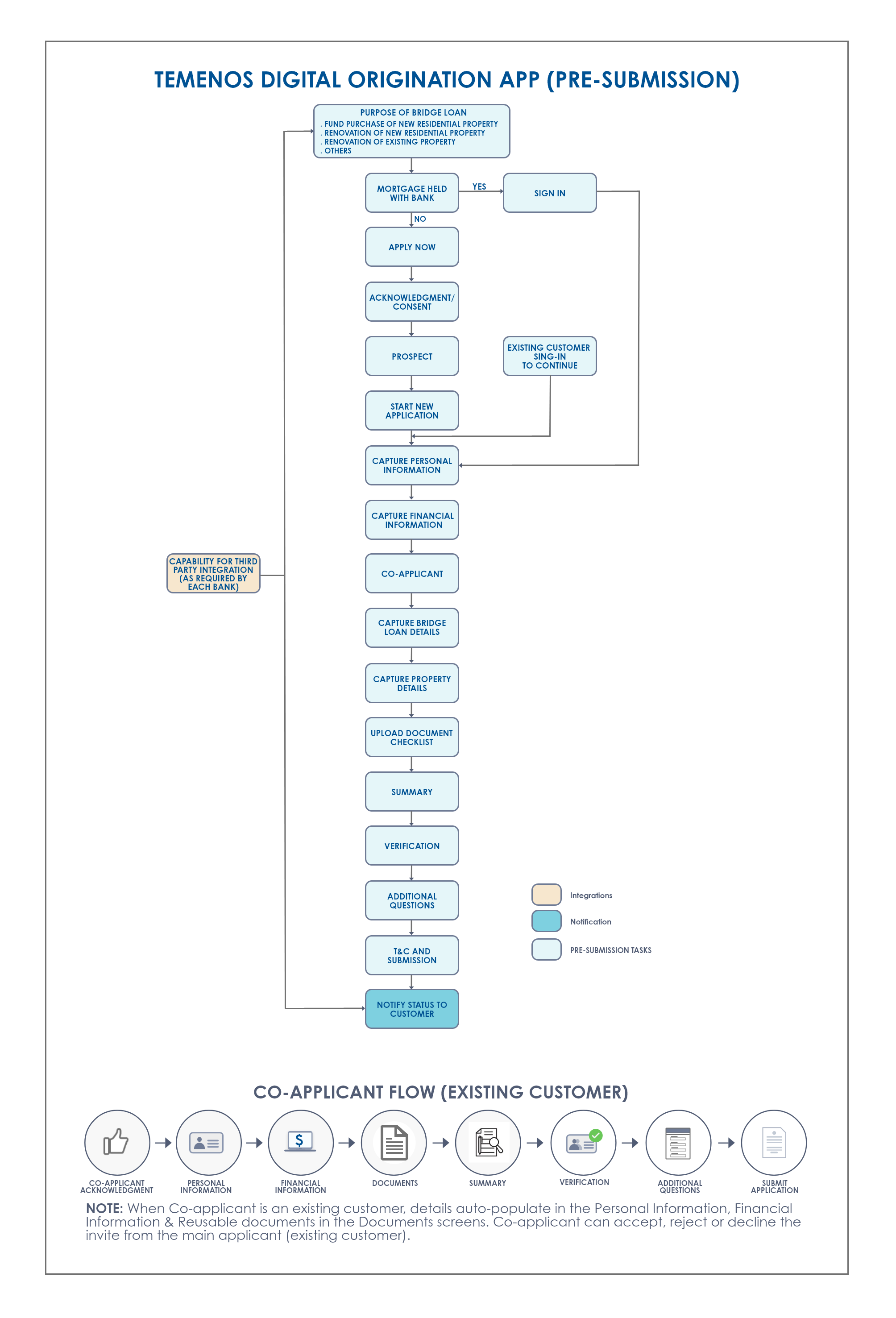

Bridge Loan Workflow

Bridge loan work-flow illustrates the sequence of steps from start of an application till submission of an application in the Origination App.

To know more about the Bridge Loan flow in Temenos Digital Assist App (post-submission), click here.

Process Flow

When an existing customer or prospect customer selects Bridge Loan in the Product Group Dashboard, the road map in the Origination App for Bridge Loan journey is as follows:

- Login Page

- Personal Information

- Financial Information

- Co-Applicant

- Bridge Loan Details

- Property Details

- Documents

- Summary

- Additional Questions

- Submit Application

UX Overview

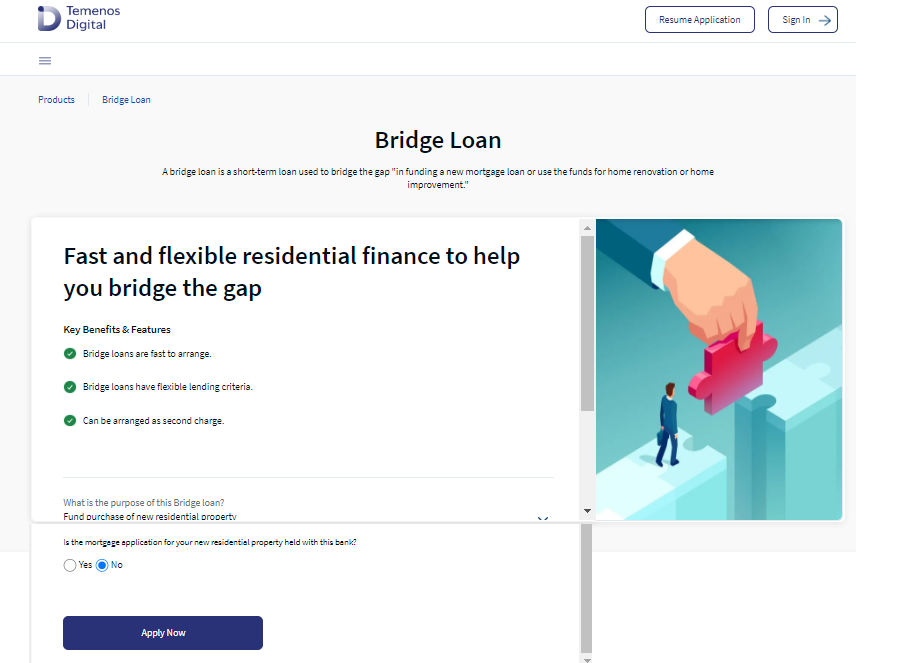

This section provides an overview of the Bridge Loan dashboard. Bridge Loan product details screen consists of Bridge Loan description, Key benefits and features of Bridge Loan, purpose of Bridge Loan and Apply Now button to initiate the Bridge Loan application. Important Disclosures section displays at the bottom of the screen.

- While initiating the application in (Undefined variable: Product_Names.Infintiy)Assist, if the RM has chosen Bridge Loan, post login with the applicant's credentials, only Bridge Loan displays on the product dashboard.

Key Benefits and Features: The benefits and features of Bridge Loan display as configured in Spotlight.

- Bridge loans are fast to arrange

- Bridge loans have flexible lending criteria

- Can be arranged as second charge

The below questions display in the Product details page:

Purpose of Bridge Loan: Select the purpose to apply for Bridge Loan from the drop-down. The available options are:

Fund purchase of new residential property : When applicant selects Fund purchase of new residential property, a question displays on the screen as Is the mortgage application for your new residential property held with this bank? with Radio button option Yes or No. Select Yes to login with the existing OLB credentials to connect Bridge Loan with the existing loan. Select No, and click Apply Now button to navigate to the Consent page screen to initiate the Bridge Loan either as a prospect or an Existing Customer.

Renovation of new residential property: When applicant selects Renovation of new residential property a question displays on the screen as Is the mortgage application for your new residential property held with this bank? with Radio button option Yes or No. Select Yes to login with the existing OLB credentials to connect Bridge Loan with the existing loan. Select No, and click Apply Now button to navigate to the Consent page screen to initiate the Bridge Loan either as a prospect or an Existing Customer.

Renovation of existing property: When applicant selects Renovation of existing property, no question displays on the screen. Click Apply Now button to navigate to the Consent page screen to initiate the Bridge Loan either as a prospect or an Existing Customer.

Others: When applicant selects Others, a text box displays to enter the reason for applying for Bridge Loan. The reasons for Bridge Loan are Business Finance, Personal Expenses, Medical Expenses, etc. The purpose to apply for Bridge Loan displays in the Bridge Loan details screen in the road map of the Origination App.

Is the mortgage application for your new residential property held with this bank?: If the applicant selects Yes, below Note displays on the screen.

Please login with the Existing credentials to connect Bridge Loan with the Existing Loan.

For the same question, if the applicant selects No, the Note does not display on the screen. Apply Now button is enabled. Based on the applicant's answer to the above questions, on click of Apply Now button, the control navigates to the next screen.

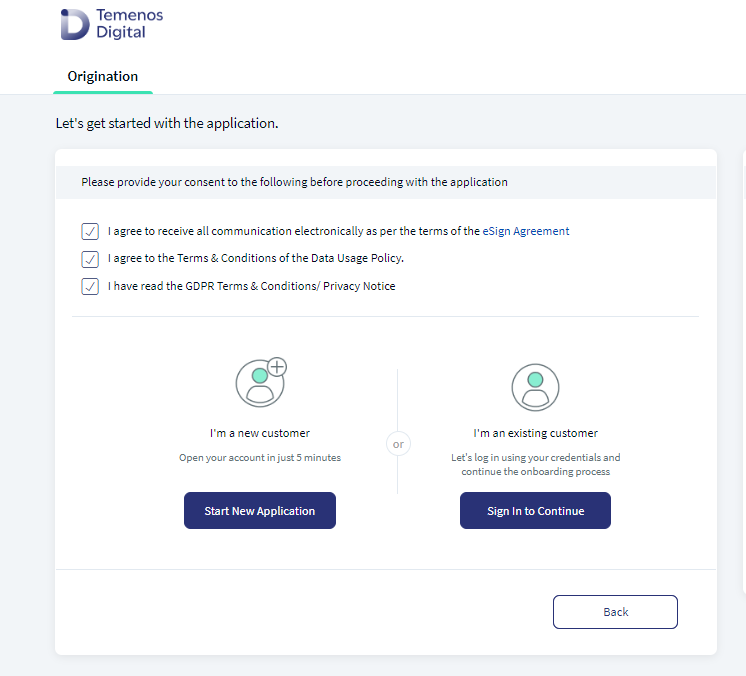

Acknowledgment Screen

Prospect Customer :The Acknowledgment screen displays based on the condition that if a prospect customer selects purpose of Bridge Loan as Fund purchase of new residential property or Renovation of new residential propertyin the product details screen. Selects Yes for Is the mortgage application for your new residential property held with this bank? The customer must login with their existing credentials to connect bridge loan with the existing loan and then the prospect customer can login.

When the customer selects purpose of Bridge Loan as Fund purchase of new residential property or Renovation of new residential property, Apply Now button will not be enabled if the customer selects option Yes for the question Is the mortgage application for your new residential property held with this bank? Then the customer needs to login with their existing credentials to connect bridge loan with the existing loan and then the prospect customer can login.

A prospect customer can login with the user Id and temporary password while applying to the previous mortgage application and after successful login, the customer lands on the acknowledgment screen.

When the prospect customer selects Bridge Loan in the product dashboard and select purpose as Fund purchase of new residential property or Renovation of new residential property from the drop down and selects No in the radio button or if the prospect customer selects Renovation of existing property or Others from the drop down, the control navigates to the Consent page. Provide your consent and login as a prospect customer and the Personal Information screen displays. The prospect has to fill in the details in Personal Information screen and navigates ahead to provide other details to submit the application successfully.

Existing Customer : The Acknowledgment screen displays based on the condition that if an existing customer selects purpose of Bridge Loan as Fund purchase of new residential property or Renovation of new residential propertyin the product details screen. Selects Yes for Is the mortgage application for your new residential property held with this bank? Then the applicant must login with their existing credentials to connect Bridge Loan with the existing loan and then the prospect customer can login. If the existing customer has NOT logged in already, the control navigates to the Login screen. Enter the user Id and OLB password to login successfully. If the existing customer has already logged in using OLB credentials, the control navigates to the Acknowledgment screen.

When existing customer selects Bridge Loan in the product dashboard and select purpose as Fund purchase of new residential property or Renovation of new residential property from the drop down and selects No in the radio button or if the prospect customer selects Renovation of existing property or Others from the drop down, the control navigates to the Consent page. Provide your consent and login as an existing customer and the details in the Personal Information screen is auto-filled from Party MS. Existing customer must be able to Review/change the Personal Information, Address and Identification details, Financial Information details in the Origination App for Bridge Loan and submit the Bridge Loan application successfully.

Existing Customer applying for Bridge Loan via OLB : When an existing customer applies for Bridge Loan through the Online Banking App, navigate to the OLB dashboard>Accounts> Open New Account. From the OLB, if the customer wants to apply for a Bridge Loan, the customer navigates from OLB Dashboard, Accounts > Open New Account and in the product dashboard group, selects Bridge Loan.

After selecting Bridge Loan, the control navigates to the Product Dashboard, the applicant must select the purpose for bridge loan from the drop down and select Yes or No for Is the mortgage application for your new residential property held with this bank? and click Apply Now button. The control navigates to the Acknowledgment screen. Select all the consents that display on the screen and click Login. The data auto-populates in Personal Information, Address and Identification, Financial Information details for Bridge Loan, the applicant can review the data and submit the application.

Consent in the Acknowledgment screen

Select all the consents that display on the Acknowledgment screen. Applicant cannot proceed to the next screen without selecting all the consents. All the consent received on the Acknowledgment screen are stored in ODMS/OPMS against the respective application. The following consents display on the Acknowledgment screen.

- I accept to receive all communication electronically as per the term of e-sign agreement.

- I agree to the terms and conditions of the data usage policy.

- I have read GDPR terms and conditions/Privacy notice.

Please choose mortgage application of your new residential property that you intend to buy or renovate. Under the text above, an option displays to select the Application Number from the drop-down. Based on the logged in customer (Party ID), the System fetches all the Mortgage and Remortgage applications from ODMS and displays them in the drop-down. When the applicant selects a particular application number from the drop-down, the corresponding Property Address fields (Address 1, Address 2, Door Number, Floor Number, Country, City, State and Zip code) display as non-editable fields.

After providing the consents and selecting an application number from the drop-down, click the Continue button. On click of the Continue button, the information displayed in the further screens such as (Personal Information, Address & Identification Financial Information and Property Details screen) the data copied and the data is prefilled from the selected application number.

Post login, if the System cannot fetch the Mortgage/Remortgage application for the logged in prospect or existing customer an error message displays as We couldn’t find any applications applied recently. Please click on Start Again Button to restart the application. Click Start Again button and the applicant is logged out and navigated to the Landing page to initiate the application again.

Prospect Customer applying for Bridge Loan:

When prospect customer selects Bridge Loan in the product dashboard and select purpose as Fund purchase of new residential property or Renovation of new residential property from the drop down and selects Yes in the radio button and clicks Apply Now button, the control navigates to the Acknowledgment screen.

When prospect customer selects Bridge Loan in the product dashboard and select purpose as Fund purchase of new residential property or Renovation of new residential property from the drop down and selects No in the radio button or if the prospect customer selects Renovation of existing property or Others from the drop down, the control navigates to the Consent page. Provide your consent and login as a prospect customer and the Personal Information screen displays. The prospect has to fill in the details in Personal Information.

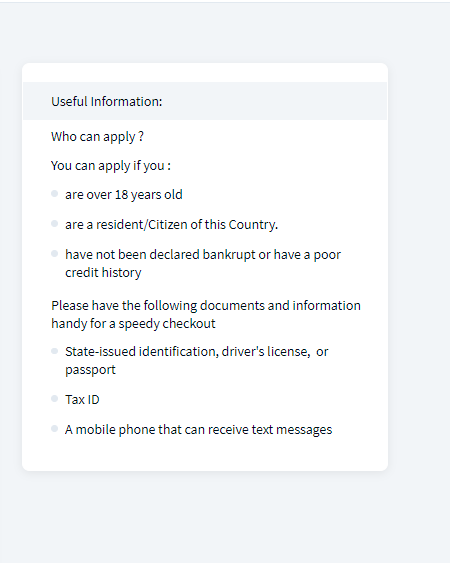

Useful Information

Useful Information displays on the right pane of the screen. It consists of information on who can apply and documents and information to carry. Check Documents to Carry hyperlink displays at the bottom of the screen. On click of the hyperlink, the document checklist for Bridge Loan displays.

Important Disclosures

Important Disclosures section is located at the end of the screen in the Product Dashboard page. It contains vital information that you must consider while applying for a loan. When the applicant submits the Bridge Loan application, disclosure are copied from ODMS to OPMS and the same must display in the Temenos Digital Assist Consent Section.

After the Bridge Loan Request is successfully completed and arrangement ID is created in Transact, Important disclosures are stored from OPMS to Consent MS against the verified Party ID, Request ID (Application ID) and Arrangement ID. Bank user can retrieve the consents stored from Consent MS for a particular Party ID or Application Id or Arrangement ID and displays it to the user.

Reference Table

| Journey | Product | Road Map in the Origination App for Prospect Customer & Existing Customer |

|---|---|---|

| Retail Loan Origination | Bridge Loan | Login Page > Personal Information > Financial Information > Co-applicant > Bridge Loan Details > Property Details > Documents > Summary > Additional Questions > Submit Application |

Configurations

The system administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Bridge Loan section, click here.

In this topic