Property Details

This section contains information about the Property Details screen. Property Details Information can be configured for the specific journey type using Spotlight Configurations.

Property details screen is applicable for Mortgage loan (First Time Buyer) and Remortgage loan.

Property details for Mortgage Loan - First Time Buyer

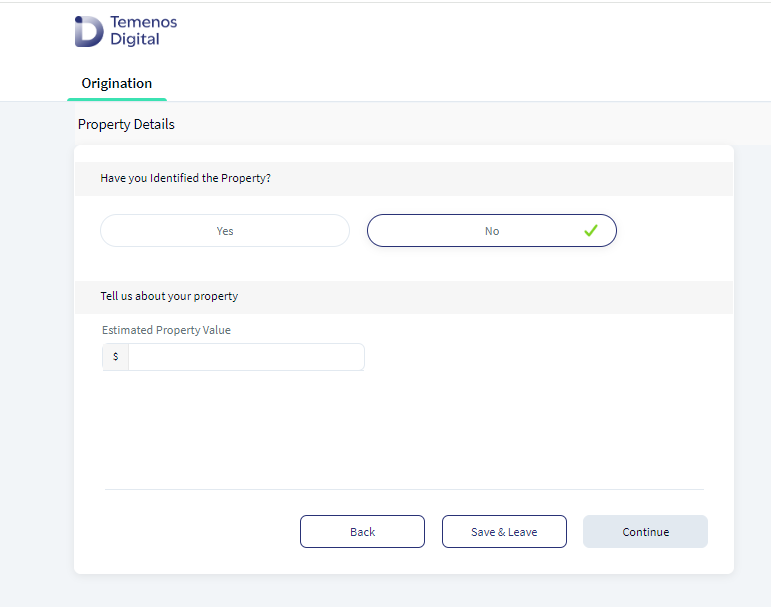

- If the applicant selects Have you identified the Property as No, then Estimated Property Value field displays in the Property details screen. Estimated Property value pre-populates from Mortgage (First Time Buyer) calculator screen.

- Estimated Property Value: Estimated property value is a mandatory field. Enter the value of the estimated property value and the amount of the property value is mapped to the Property Value in the Funding Position screen for Mortgage (First Time Buyer).

- The amount which the applicant enters in Estimated Property Value is pre-populated in the Property Value field in Mortgage Calculator screen. This is a mandatory field.

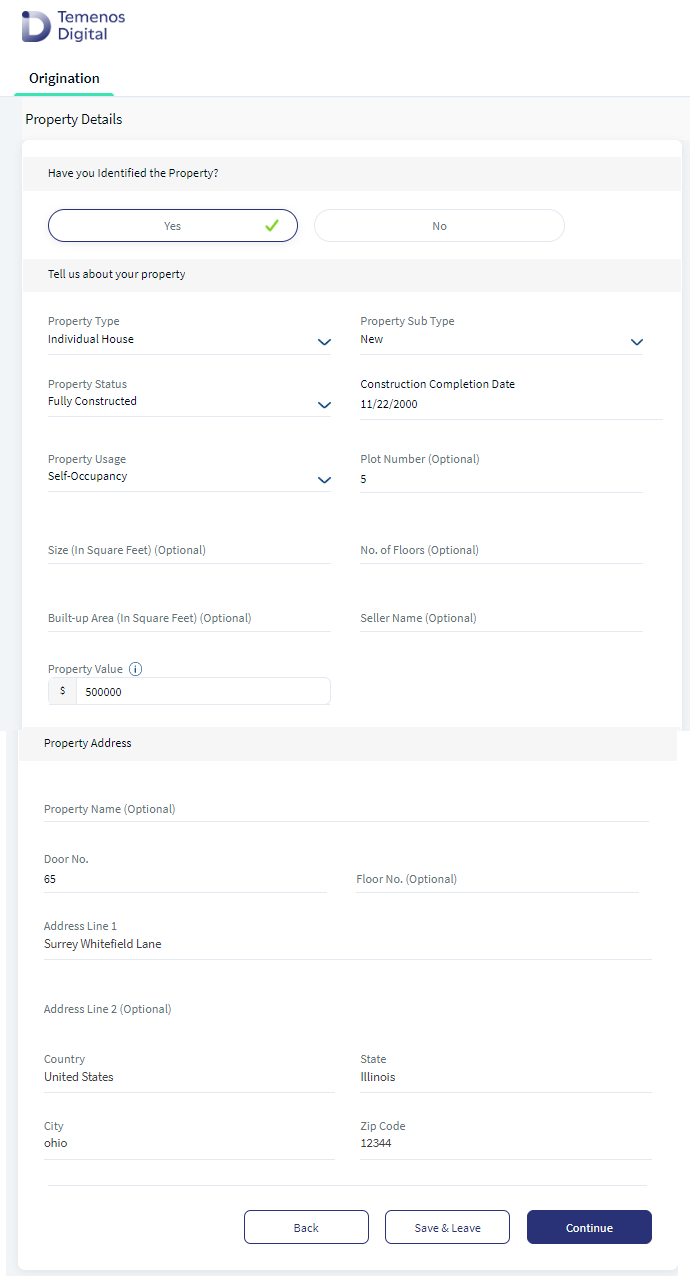

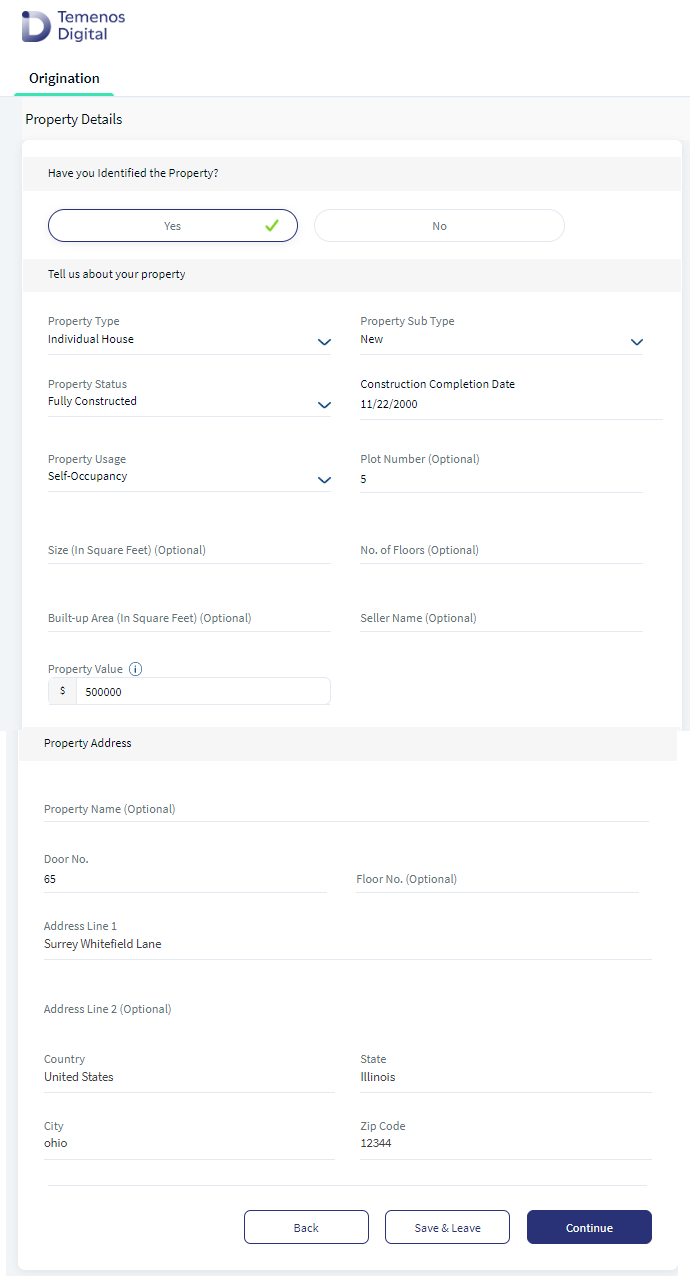

If applicant selects Have you Identified the Property as Yes, then rest of the Property Details and Property Address fields display.

Property Details:

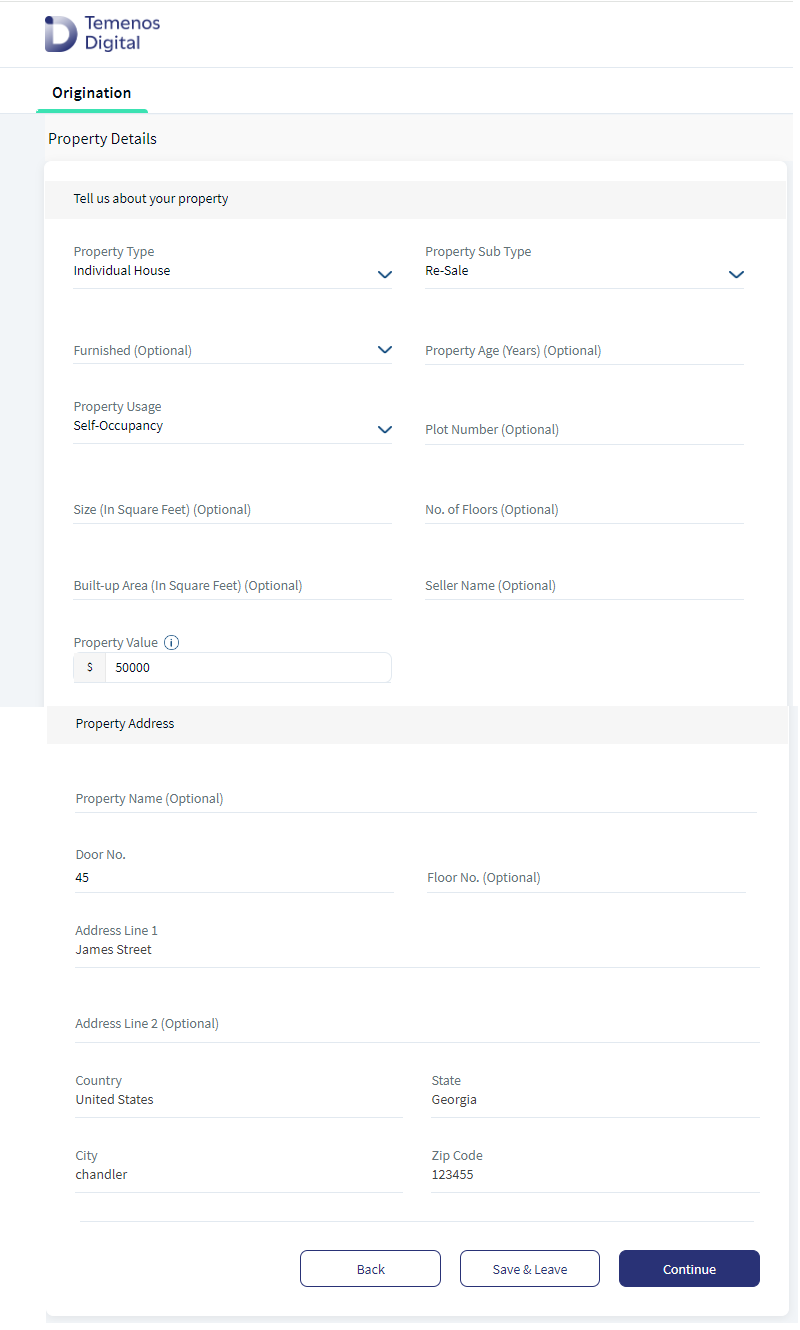

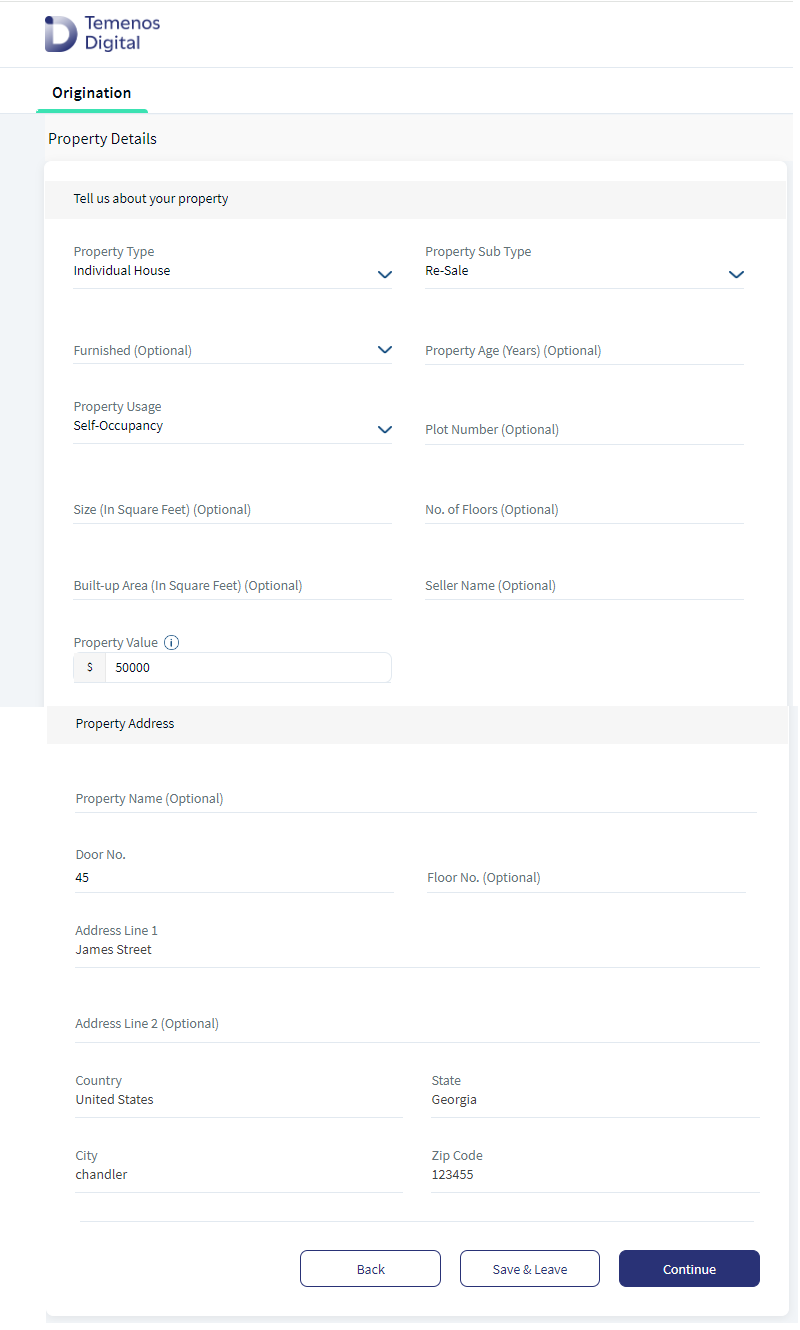

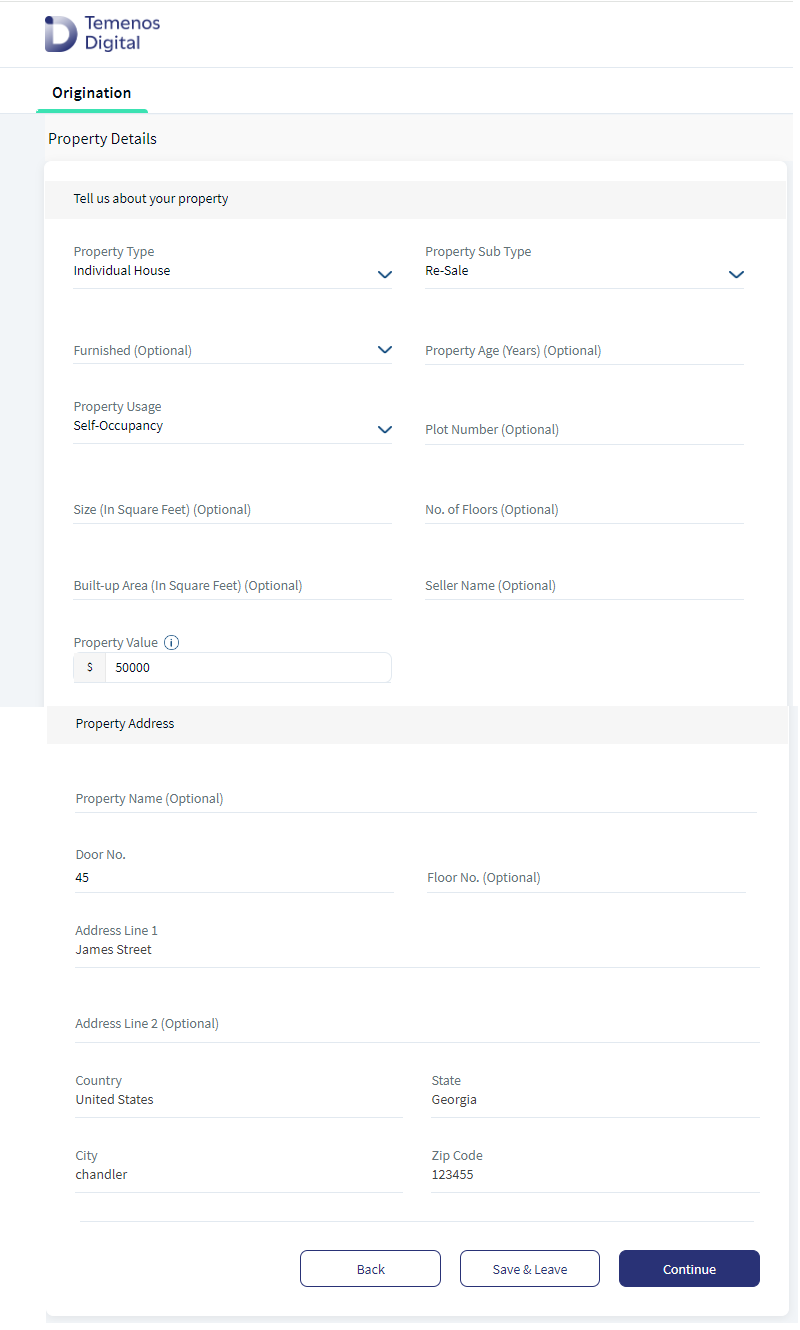

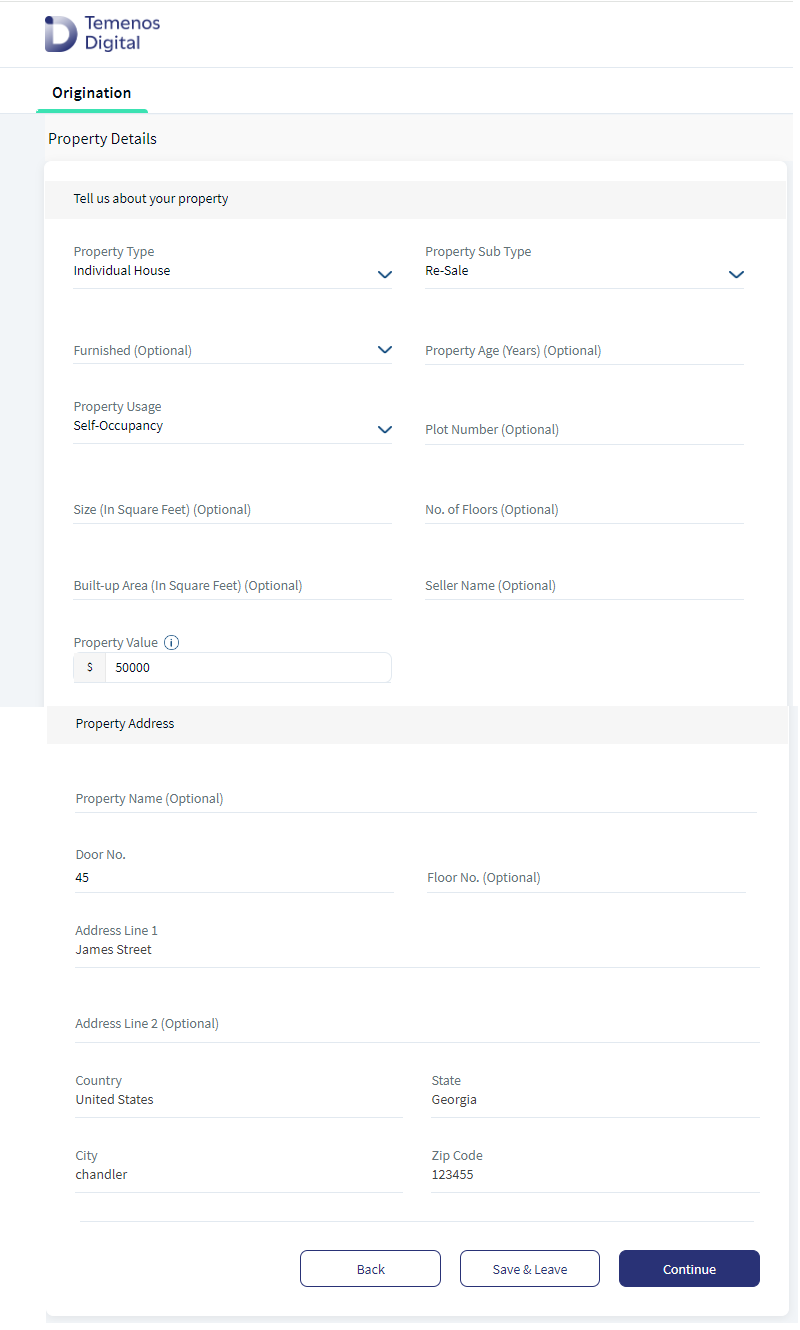

UX Overview for Mortgage Loan- First Time Buyer

This section provides an overview of the Property Details for Mortgage (First Time Buyer).

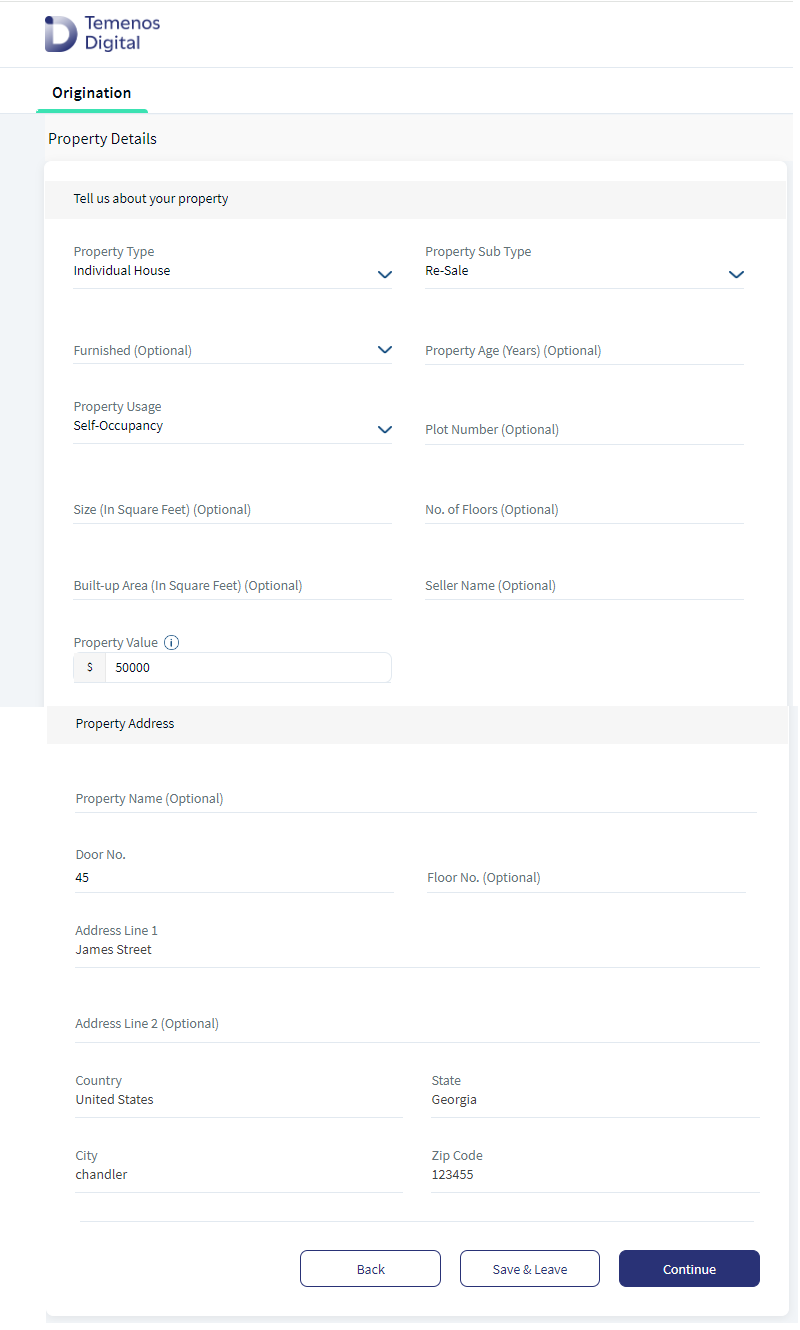

Property Details screen has the following fields and drop-downs.

- When Property Sub-type is selected as (Resale), select the values from the drop-down for the mandatory fields.

| Property Type | Property Sub-type | Furnished | Property Age(Years) | Property Usage | Plot Number | Size in (Square feet) | No of Floors | Built-up Area (Square feet) | Seller Name | Property Value |

|---|---|---|---|---|---|---|---|---|---|---|

| Individual house | Resale | Fully Furnished, Not Furnished. This field is Optional | Number of years. This field is Optional | Self Occupied, Investment | Alphanumeric field. This field is Optional | Size in Square.feet. This field is Optional | Numeric field. This field is Optional | Numeric field. This field is Optional | Text field. This field is Optional | Pre-populates from Mortgage Calculator screen. |

| Flat/Apartment | ||||||||||

| Row House | ||||||||||

| Bungalow | ||||||||||

| Penthouse |

- When Property Sub-type is selected as (New), select the values from the drop-down for the mandatory fields:

| Property Type | Property Sub-type | Property Status | Construction Completed Date | Property Usage | Plot Number | Size in (Square feet) | No of Floors | Built-up Area (Square feet) | Seller Name | Property Value |

|---|---|---|---|---|---|---|---|---|---|---|

| Individual House | New | Fully Constructed | Select Construction Completion Date from the date picker. | Self Occupied, Investment | This field is Optional | This field is Optional | This field is Optional | This field is Optional | This field is Optional | Pre-populates from Mortgage Calculator screen. |

| Flat/Apartment | Partially Constructed | Select Expected Construction Completion Date from the date picker. | ||||||||

| Row House | Not Started | Construction Completed Date or Expected Construction Completion Date is not required. | ||||||||

| Bungalow | ||||||||||

| Penthouse |

Property Address:

Property Address has the following fields:

| Property Name (Optional) | Door No | Floor No (Optional) | Address Line 1 | Address Line 2 (Optional) | Country | State | City | Zip Code |

|---|---|---|---|---|---|---|---|---|

| Text field | Numeric field | Numeric field | Text field | Text field | Select the country from the drop-down | Select the State from the drop-down for the selected country. | Select the City from the drop-down for the selected State. | Numeric field |

- All the drop-down values in the Property details screen are fetched from Configuration MS.

- All the Property related details updated in the Origination app is stored in Origination Data Microservice (ODMS).

Click Continue button, the control navigates to Funding Position screen.

Property Details for Remortgage

UX Overview for Remortgage Loan

This section provides an overview of the Remortgage Property Details.

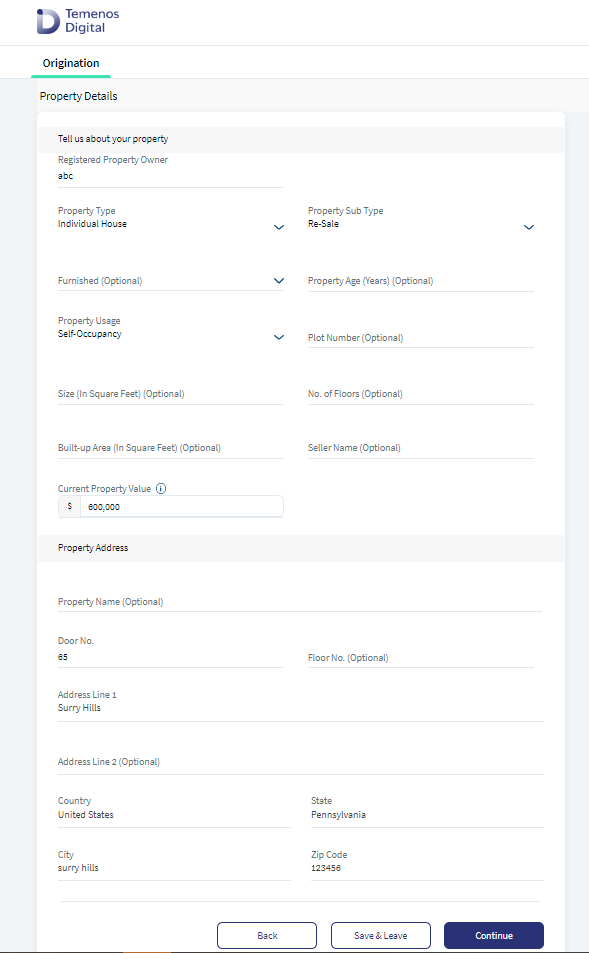

Property Details:

Property Details screen has the following fields and drop-downs.

Registered Property Owner: Registered Property Owner field is a mandatory field for Remortgage Loan. The value entered in Registered Property Owner field is stored in Origination Data Microservice (ODMS) and copied to OPMS.

When Property Sub-type is selected as (Resale), select the values from the drop-down for the mandatory fields:

| Registered Property Owner | Property Type | Property Sub-type | Furnished | Property Age(Years) | Property Usage | Plot Number | Size in (Square feet) | No of Floors | Built-up Area (Square feet) | Seller Name | Current Property Value |

|---|---|---|---|---|---|---|---|---|---|---|---|

| This field is applicable only for Remortgage | Individual House, Flat/Apartment Row House, Bungalow, Penthouse | Resale | Fully Furnished, Not Furnished. This field is Optional | Number of years. This field is Optional | Self Occupied, Investment | Alphanumeric field. This field is Optional | Size in Square.feet. This field is Optional | Numeric field. This field is Optional | Numeric field. This field is Optional | Text field. This field is Optional | Numeric field |

When Property Sub-type is selected as (New), select the values from the drop-down for the mandatory fields:

| Registered Property Owner | Property Type | Property Sub-type | Property Status | Construction Completed Date | Property Usage | Plot Number | Size in (Square feet) | No of Floors | Built-up Area (Square feet) | Seller Name | Current Property Value |

|---|---|---|---|---|---|---|---|---|---|---|---|

| This field is applicable only for Remortgage | Individual House, Flat/Apartment, Row House , Bungalow, Penthouse | New | Fully Constructed | Select Construction Completion Date from the date picker. | Self Occupied, Investment | This field is Optional | This field is Optional | Provide input value as a Numeric field. This field is Optional | This field is Optional | This field is Optional | Provide input value as Numeric field. |

| Partially Constructed | Select Expected Construction Completion Date from the date picker. | ||||||||||

| Not Started | Construction Completed Date or Expected Construction Completion Date is not required. |

Property Address:

Property Address has the following fields:

| Property Name (Optional) | Door No | Floor No (Optional) | Address Line 1 | Address Line 2 (Optional) | Country | State | City | Zip Code |

|---|---|---|---|---|---|---|---|---|

| Text field | Numeric field | Numeric field | Text field | Text field | Select the country from the drop-down | Select the State from the drop-down for the selected country. | Select the City from the drop-down for the selected State. | Numeric field |

Click Continue button, the control navigates to the Remortgage details screen.

Property Details for Bridge Loan

UX Overview of Bridge Loan

This section provides an overview of the Bridge Loan Property Details. Property details supports the following scenarios for applicants who are either existing customers or prospect customers and applying for Bridge Loan with mortgage loan with the same bank or with other banks.

Property Details

Property Details screen has the following fields and drop-downs.

- Bridge Loan for Existing Customer with Mortgage Loan in the same bank (YES_WITHIN_BANK) : An existing customer who already has Mortgage Loan against the property in the same bank which the applicant wants to use to secure the Bridge Loan.

The following fields display based on the applicants selection of Yes or No to the below question in the Bridge Loan Detail Screen. Do you have any mortgage loan on the property you wish to use as the collateral for the Bridge Loan?. If the applicant selects Yes, mortgage is held with this bank, then the following details are captured as shown below.

Collateral ID: Select the Collateral ID from the drop-down which displays the list of all the Collaterals fetched from Get API from OPMS. Collateral ID is enabled for an existing customer who is applying for Bridge Loan with mortgage loan in the same bank. On selecting the Collateral Id from the drop-down, the Property details of the corresponding collateral ID display on the screen as non-editable fields. The applicant can only edit the Property Value field.

Outstanding Loan amount in existing Mortgage Loan: This value is auto-populated from Bridge Loan Details screen.

Property Details

When Property Sub-type is selected as (New), select the values from the drop-down for the mandatory fields:

| Property Type | Property Sub-type | Property Status | Construction Completed Date | Property Usage | Plot Number | Size in (Square feet) | No of Floors | Built-up Area (Square feet) | Seller Name | Current Property Value | Outstanding Loan Amount |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Individual House, Flat/Apartment, Row House , Bungalow, Penthouse | New | Fully Constructed | Select Construction Completion Date from the date picker. | Self Occupied, Investment | This field is Optional | This field is Optional | Provide input value as a Numeric field. This field is Optional | This field is Optional | This field is Optional | Provide input value as Numeric field. | This value auto-populates from the Bridge Loan details screen. |

| Partially Constructed | Select Expected Construction Completion Date from the date picker. | ||||||||||

| Not Started | Construction Completed Date or Expected Construction Completion Date is not required. |

When Property Sub-type is selected as (Resale), select the values from the drop-down for the mandatory fields:

| Property Type | Property Sub-type | Furnished | Property Age(Years) | Property Usage | Plot Number | Size in (Square feet) | No of Floors | Built-up Area (Square feet) | Seller Name | Current Property Value | Outstanding Loan Amount |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Individual House, Flat/Apartment Row House, Bungalow, Penthouse | Resale | Fully Furnished, Not Furnished. This field is Optional | Number of years. This field is Optional | Self Occupied, Investment | Alphanumeric field. This field is Optional | Size in Square.feet. This field is Optional | Numeric field. This field is Optional | Numeric field. This field is Optional | Text field. This field is Optional | Numeric field | This value auto-populates from the Bridge Loan details screen. |

| Not Furnished. This field is Optional |

|

Property Address:

Property Address has the following fields:

| Property Name (Optional) | Door No | Floor No (Optional) | Address Line 1 | Address Line 2 (Optional) | Country | State | City | Zip Code |

|---|---|---|---|---|---|---|---|---|

| Text field | Numeric field | Numeric field | Text field | Text field | Select the country from the drop-down | Select the State from the drop-down for the selected country. | Select the City from the drop-down for the selected State. | Numeric field |

- Bridge Loan for Existing Customer with Mortgage loan with the External Bank (YES_EXTERNAL_BANK): An existing customer who does not have any Mortgage Loan (in the same Bank) against the property which the customer wants to use to secure Bridge Loan, but has Loan in External Bank against the property which the customer wants to use to secure Bridge Loan.

The following fields display based on the applicants selection of Yes or No to the below question in the Bridge Loan Detail Screen. Do you have any mortgage loan on the property you wish to use as the collateral for the Bridge Loan?. If the applicant selects Yes, mortgage is held with the external bank.

Outstanding Loan amount : This value is auto-populated from Bridge Loan Details screen.

Property Details : To check the Property Details table, click here.

Property Address: To check the Property Address table, click here.

- Bridge Loan- For Existing Customer without Mortgage Loan (NO): An existing customer who does not have any Mortgage Loan (in the same bank or external bank) against the property which the customer wants to use to secure Bridge Loan.

The following fields display based on the applicants selection of Yes or No to the below question in the Bridge Loan Detail Screen. Do you have any mortgage loan on the property you wish to use as the collateral for the Bridge Loan?. If the applicant selects No, mortgage is held with external bank, then:

Outstanding Loan amount : This field does not display on the screen.

Property Details : To check the Property Details table, click here.

Property Address : To check the Property Address table, click here.

- Bridge Loan for Prospect Customer with Mortgage Loan with External Bank (YES_EXTERNAL_BANK): Prospect customer who does not have any Mortgage Loan (in the same Bank) against the property which the customer wants to use to secure Bridge Loan, but has Loan in External Bank against the property which the customer wants to use to secure Bridge Loan.

The following fields display based on the applicants selection of Yes or No to the below question in the Bridge Loan Detail Screen. Do you have any mortgage loan on the property you wish to use as the collateral for the Bridge Loan?. If the applicant selects Yes, mortgage is held with external bank, then enter the Outstanding Loan Amount.

Outstanding Loan amount: This value auto-populates from Bridge Loan details screen.

Property Details : To check the Property Details table, click here.

Property Address: To check the Property Address table, click here.

- Bridge Loan for Prospect Customer without Mortgage Loan (NO): Prospect Customer who does not have any Mortgage Loan (in the same Bank or in external Bank) against the property which the customer wants to use to secure Bridge Loan. This should be based on the answer given to below question:

The following fields display based on the applicants selection of Yes or No to the below question in the Bridge Loan Detail Screen. Do you have any mortgage loan on the property you wish to use as the collateral for the Bridge Loan?. If the applicant selects No, then:

Outstanding Loan amount : This field does not display on the screen.

Property Details : To check the Property Details table, click here.

Property Address: To check the Property Address table, click here.

Click Continue button, the control navigates to the Document Checklist screen.

Experience APIs

The following APIs are shipped as part of this feature:

| API | Description |

|---|---|

| getDetails | This API allows to retrieve Property details from ODMS. |

| updateDetails | This API allows to create/update Property details in ODMS. |

| getOPMSDetails | This API is used to fetch the collaterals associated to the PartyId. |

Configurations

The data displayed in the Property Information screen is based on the information in the Marketing Catalog Microservice (MCMS). MCMS can be configured to enhance or modify the data in the Product Selection module. For more information on Marketing Catalog Configurations (MCMS), click here.

Extensibility

By using the Extensibility feature, you can customize the modules based on your specific requirements. For more information, refer to Extensibility.

In this topic