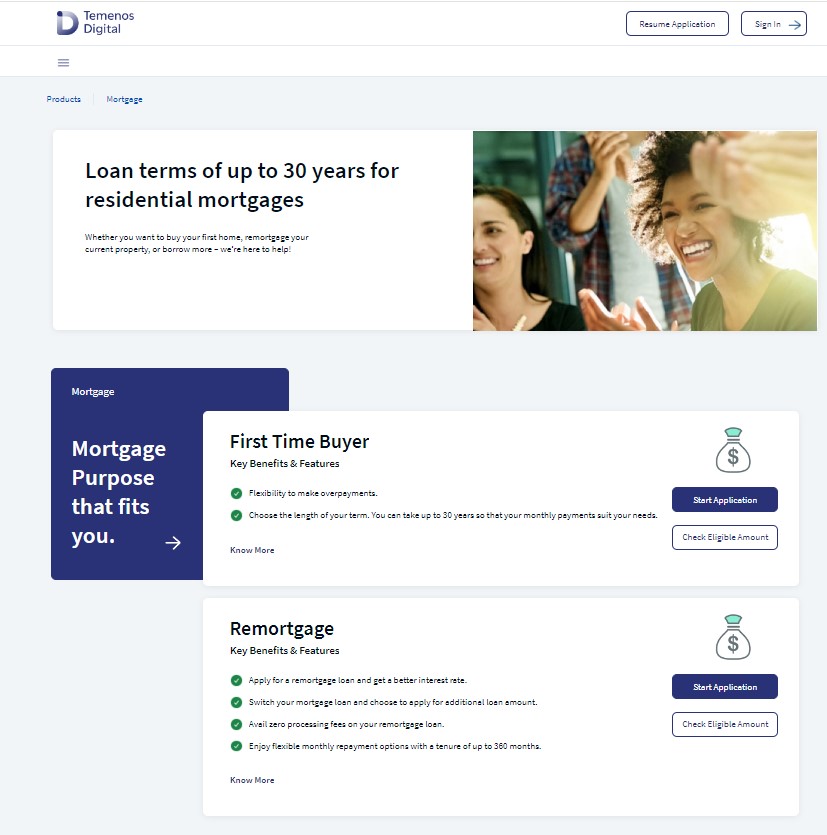

Mortgage

Mortgage loan is used to finance a property such as a home, land, or any other immovable asset. This section contains mortgage products with mortgage purpose, key benefits of a product, know more, and apply for a product.

Mortgage Workflow

Mortgage workflow illustrates the sequence of steps from start of an application till submission of an application in the Origination App.

To know more about the Mortgage flow in Temenos Digital Assist App (post-submission), click here.

Process Flow

When an existing customer or prospect customer selects Mortgage in the Product Group Dashboard, the road map in the Origination App for Mortgage journey is as follows:

- Login Page

- Personal Information

- Financial Information

- Co-Applicant

- Property Details

- Funding Position

- Mortgage Composition

- Documents

- Summary

- Additional Questions

- Submit Application

UX Overview

This section provides an overview of the Mortgage Purpose (First-time buyer) dashboard. It consists of Key benefits of a product, check eligible amount and start new application. Mortgage details are fetched from Marketing Catalog Micro Service (MCMS) and other purpose related details are stored in Spotlight.

- When the applicant clicks Start Application, the control navigates to the Consent screen. Also, the applicant can click Check Eligible Amount and can initiate the application from there as well.

- While initiating the application in Temenos Digital Assist, if the RM has chosen First Time Buyer (FTB), post login with the applicant's credentials, only First Time Buyer displays on the product dashboard.

When applicant selects Mortgage from the Retail product group in the Landing dashboard, the applicant navigates to the Mortgage dashboard with purpose as First Time Buyer screen. It has the following tabs:

Start New Application: Click Start New Application button to login either as a prospect or as an existing customer using the OLB credentials to log in to the Origination App and initiate the Mortgage loan process.

Check Eligible Amount: Click Check Eligible button, to evaluate the maximum loan amount at the initial stage.

Know More: This section provides more information about the specific purpose you have chosen.

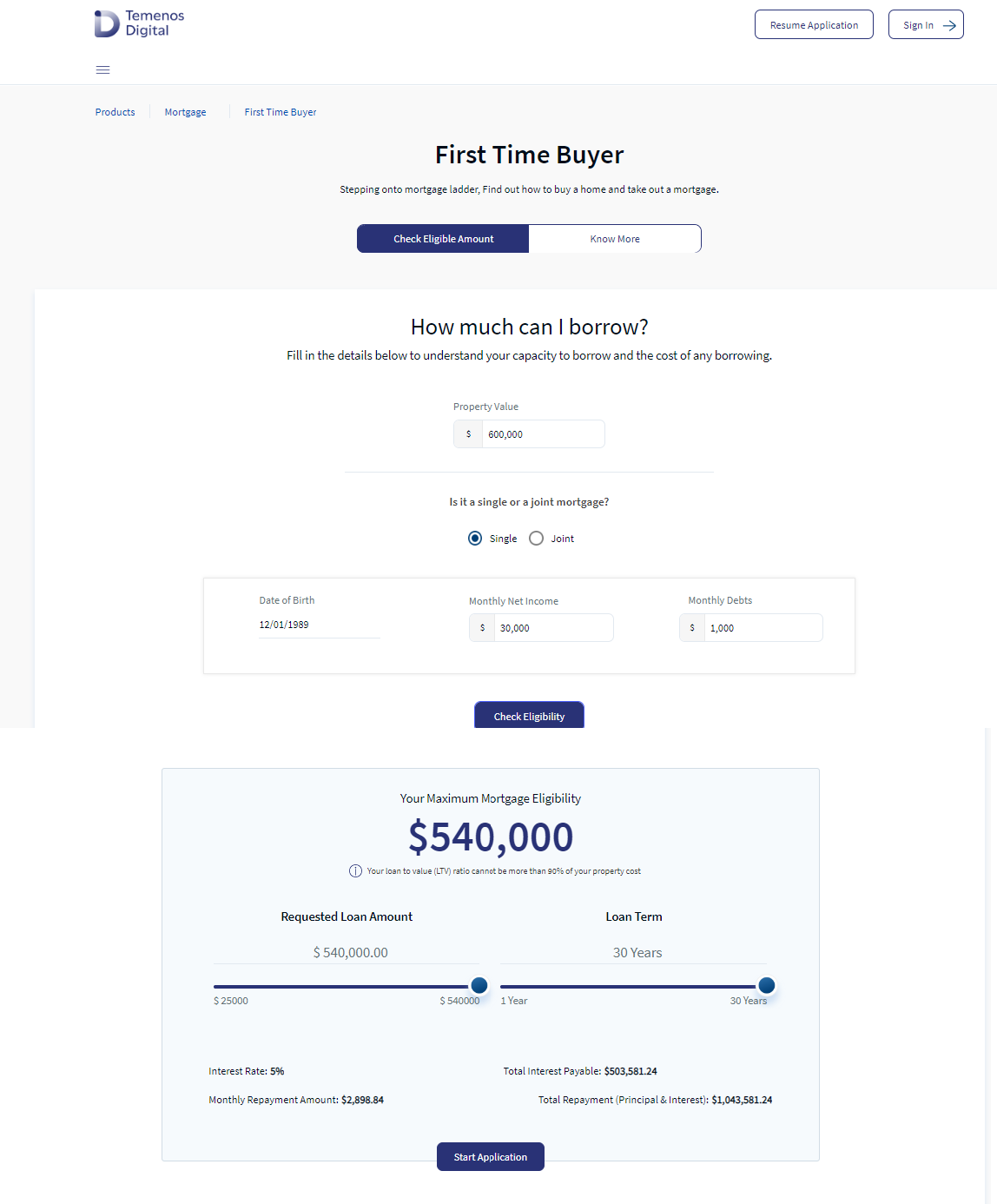

Check Maximum Eligible Loan Calculator

Mortgage loan eligibility calculator allows the applicant to compute the maximum loan amount the applicant can avail. Check Eligible Amount button is available in the product tab in the mortgage dashboard.

Click Check Eligible Amount button, and enter the information in the following fields to evaluate the maximum loan amount.

- Property Value: Property Value is a mandatory field. The applicant has to input the value for Property Value.

- Single/Joint: Select if it is a single mortgage or a joint mortgage. When the applicant selects Single mortgage, enter the following information.

- Enter the applicant's Date of Birth.

- Enter the applicant's Net Monthly Income.

- Enter the applicant's Monthly debts.

Joint: When the applicant selectsJoint mortgage, enter the applicant details along with the partner's details which includes the following information.

- Enter applicant's Date of Birth and partners Date of Birth.

- Enter applicant's Net monthly income and partners Net monthly income.

- Enter applicant's Monthly debt and partners Monthly debt.

Check Eligibility button enables after the applicant has filled in all the required information. Click Check Eligibility button, and your Maximum Mortgage Eligibility amount displays on the screen. A Help icon indicates as Your loan to value (LTV) ratio cannot be more than 90% of your property.

Requested Loan Amount: Requested Loan Amount displays on the screen. You can edit this field with default value as maximum mortgage value. You can slide between minimum value as 25000 and maximum value, which is the same as the Maximum mortgage eligible amount calculated.

Mortgage Repayment Term: Applicant can edit this field with default value as the maximum mortgage value. Choose the repayment term between 1 year to 30 years as indicated on the field label. Choose the repayment term on the slider with minimum value of five years and a maximum value dependent on Maximum repayment term allowed.

Mortgage Repayment Amount EMI (Estimated): Monthly repayment amount value changes when the applicant changes the loan requested and Repayment term.

Interest Rate: Interest rates for the default product are fetched from Marketing Catalog Microservice (MCMS). It is a non-editable field.

Total Interest Payable : This field calculates and displays the Total Interest Amount Payable for the Requested Loan Amount and Total Loan Term.

Total Repayment : This field calculates and displays the Total Repayable Amount (Monthly Loan Repayment * Loan Tern(In months)) for the Requested Loan Amount and Total Loan term.

Limitation of two applicants is applicable for joint applications.

- Field validations: This section has the following field validations.

- Date field: Enter your age which must not be less than 18 years and must not exceed 60 years.

- Net monthly Income & Monthly Debts: Provide your monthly income and monthly debts.

- Check Eligibility: This button enables only after you enter all the required information in Single/Joint application.

Repayment Term & Monthly Interest Calculation

This section allows the bank user to fix allowed mortgage repayment term limits and interest rate, so that the applicant can check the maximum loan eligible under the following constraints.

- Capture Applicant(s) Date of Birth.

- Define the following configurable parameters.

- Bank allows maximum repayment term, defaulted value to 30 years.

3. Maximum allowed repayment term is calculated using the below formula:

(n) - Minimum (Bank allowed maximum repayment term, (Maximum allowed Repayment age - Current age)).

In the case of Joint applicants, the applicant who is older along with their age is considered for the calculation.

4. Product Interest rates are fetched from MCMS (Marketing Catalogue Micro Service) and (Default Product is MORTGAGE.OFFER). Bank user converts annual interest rates to Monthly interest rates by using the formula: Monthly Interest rate (r) = Annual Rate(R)/12.

Maximum Loan Eligibility based on DTI

This section allows the bank user to calculate the eligibility amount based on your income and expenses to minimize the risk of defaults in the future.

- Bank user captures your Net Monthly Income & Monthly Debts.

- Bank user has to maintain DTI a percentage parameter, which is configurable and not displayed on the screen. Default Value of the DTI value is 36%.

- Bank user calculates the loan principal amount using the below formula:

- To calculate the Maximum eligible mortgage based on DTI, Maximum EMI allowed is calculated using the below formula: Max eligible EMI = [DTI * Net Monthly Income] – (total monthly debt expenses).

- Maximum Eligible Loan Amount= (EMI/r)*(((1+r)^n -1)/(1+r)^n) /** r- monthly interest rate and n- maximum allowed repayment term.

Maximum Loan Eligibility based on LTV

This section allows Bank user to calculate the eligibility amount based on the Property value so that the loan does not extend beyond necessity.

- Bank user captures the Property cost.

- Bank user maintains a configurable percentage parameter - Down payment, Default value should be 10%.

- Bank user calculates loan principal amount using the below calculation:

- Maximum Eligible Loan Amount = (1- Down Payment%)* Property cost.

Mortgage Loan Selection and Display

This section allows the Bank user has to show the applicant the final loan eligible amount along with EMI, Term and Interest rate so that applicant can view and take a decision on the loan application.

- Applicant can view the final loan value which is minimum of values calculated based on LTV & DTI.

- The Maximum Mortgage Eligible displays on the screen.

Mortgage Loan EMI Predictor

This section allows the applicant to get an estimation of monthly repayments, so that the applicant can select the desired installments as required.

- Applicant can edit the Loan amount requested field.

- Applicant can edit the Loan repayment term field.

- Applicant can view non-editable Estimated Monthly installment for a particular requested loan amount and Repayment period.

- Applicant can change either Loan requested amount or Loan repayment term and Estimated EMI is calculated accordingly.

- The applicant's EMI is calculated using the below formula:

- EMI = PL*r*(1+r)^n/ (1+r)^n -1.

- PL= Loan amount requested.

- n= Repayment period in months.

- r= Monthly interest rate.

The following information pre-populates in the respective screen, so that the applicant need not enter the details again.

- Date of Birth: Date of Birth information of Applicant/Co-applicant.

- Net Monthly Income: Net Monthly Income in Financial Information Screen of Applicant/Co-applicant.

- Monthly Debts: Total monthly debts/ Expenses Field in Financial Information Screen of Applicant/Co-applicant.

- Property Price: Cost of Property pre-populates in the Property Details screen.

- Loan Amount Requested: Requested Loan amount pre-populates in Funding Position Screen.

- Term: Loan Term in Mortgage Composition screen of the Applicant.

Help Information

When the applicant clicks the Help Information icon, the following help information displays:

- Loan Term: Indicates the maximum allowed repayment period allowed for the Mortgage selected. This is calculated based on your age and Maximum Loan Term allowed by Bank.

- Interest Rate: This is a default product interest rate considered for estimating the monthly installments. It is subject to change depending on the prevailing rates and Interest type selected.

- Monthly Repayment Amount: Indicates the Monthly repayment for the Loan Term.

Start New Application

When applicant clicks Start Application, Product group dashboard leads you to the login page, where you can login either as a prospect or as an existing customer using the OLB credentials and click Sign in.

Select all the consents that display on the login screen. Applicant cannot proceed to the next screen without providing your consent. All the consent received on the login page are stored in ODMS/OPMS against the respective application. The following consents display on the login screen.

- I hereby accept the terms of the eSign Agreement, I accept to receive all the communication electronically.

- I hereby give my consent to GDPR Terms.

- I hereby give my consent to T&Cs on Data Usage Policy.

To know more about the Consent disclaimer Terms & Conditions, click here.

Click Continue button, the control navigates to the Personal Information screen.

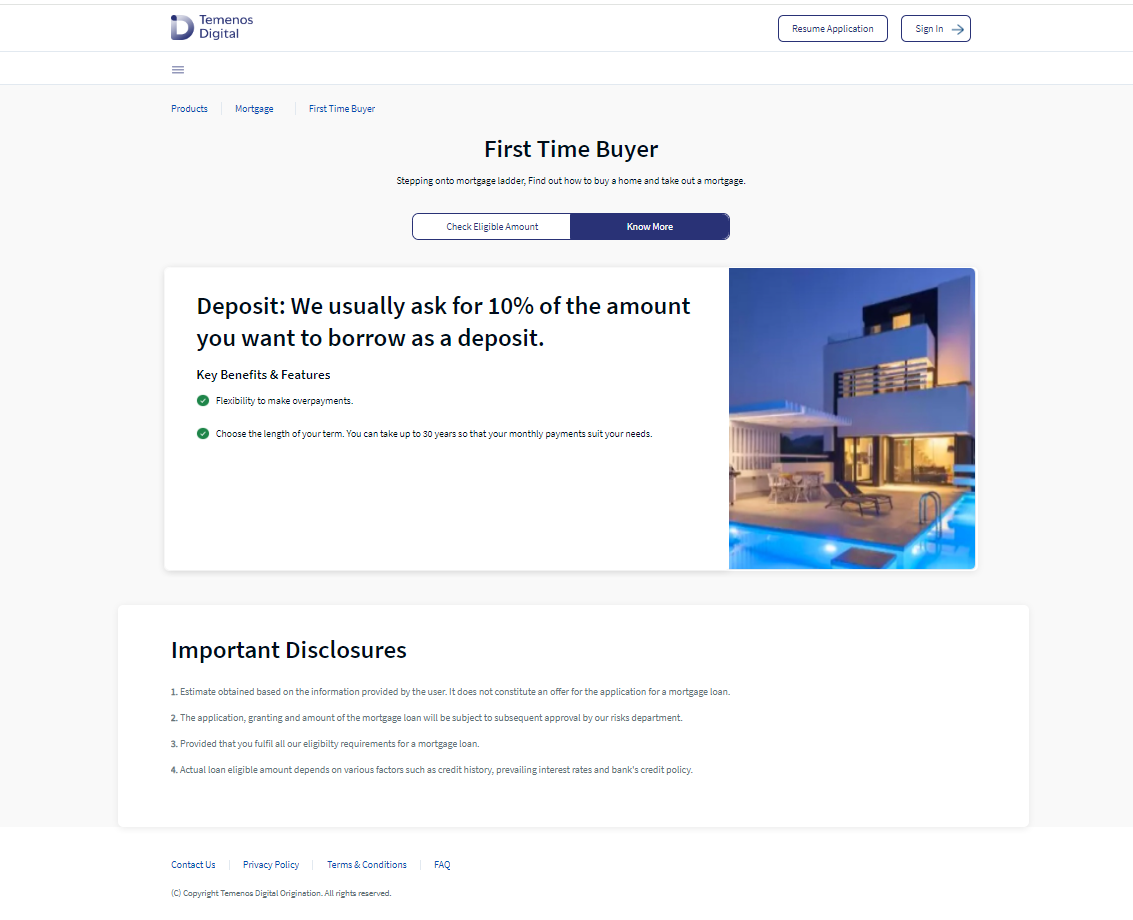

Know More

Know more section provides more information about the specific product, the applicant has chosen. When you click here, Know More section in the respective Product details dashboard appears with the features of the purpose First time buyer.

Important Disclosures section is located at the end of the screen, which contains vital information that you must consider while applying for a loan.

Reference Table

| Journey | Product | Road Map in the Origination App for Prospect Customer & Existing Customer |

|---|---|---|

| Retail Loan Origination | Mortgage | Login Page > Personal Information > Financial Information > Co-applicant > Property Details > Funding Position > Mortgage Composition > Documents > Summary > Additional Questions > Submit Application |

Configurations

The system administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Funding Position section, click here.

Components

Mortgage dashboard contains the following list of components:

| Component Name | Instance Name |

|---|---|

| com.olb.common.BrowserCheckPopup | BrowserCheckPopup |

| com.nuo.loadingV3 | loadingV3 |

| com.dbx.Explore | Explore |

| com.dbx.bannerError | bannerError |

| com.dbx.breadcrumbs | breadcrumbs |

| com.dbx.customfooter | customfooterNUO |

| olb.dbx.customheaderNUOV2V2 | customheaderNUOV2V2 |

| com.dbx.dataNotLoaded | dataNotLoadedAd |

| com.dbx.dataNotLoaded | dataNotLoadedContentImage |

| com.dbx.dataNotLoaded | dataNotLoadedExplore |

| com.dbx.dataNotLoaded | dataNotLoadedProdLists |

| com.dbx.SliderAndTextbox | SliderAndTextbox |

| com.dbx.nativeSlider | nativeSlider |

Experience APIs

| API | Description |

|---|---|

| getEligibleAmount | This API allows to retrieve the calculated eligible Amount |

In this topic