Documents

The Documents section consists of a list of documents which an existing customer or prospect must upload as evidence in the Origination App. The document list varies depending on Journey type, the selected product. For details on the complete list of documents supported in the retail user journey, refer to Document Categories and Documents.

UX Overview

This section provides an overview of the Documents screen for Retail Account

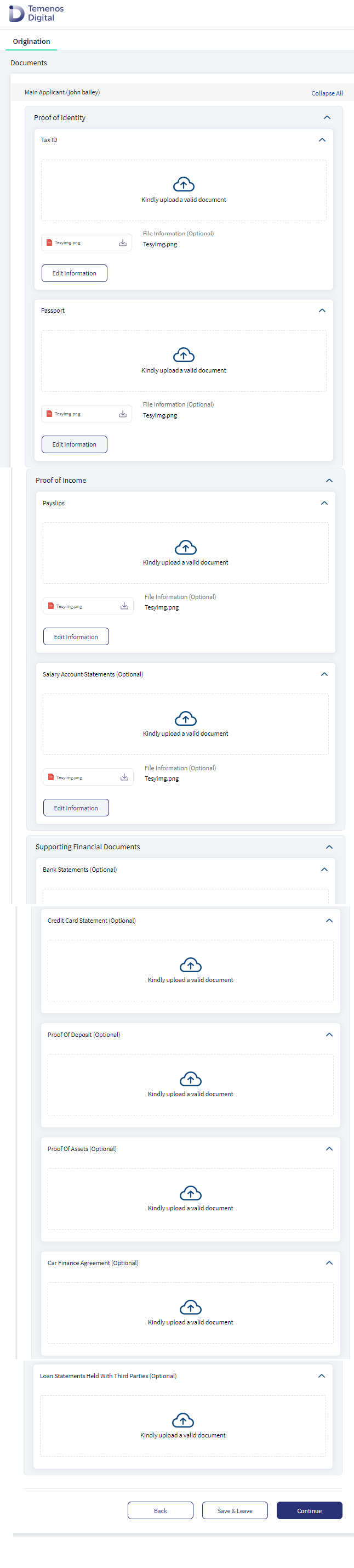

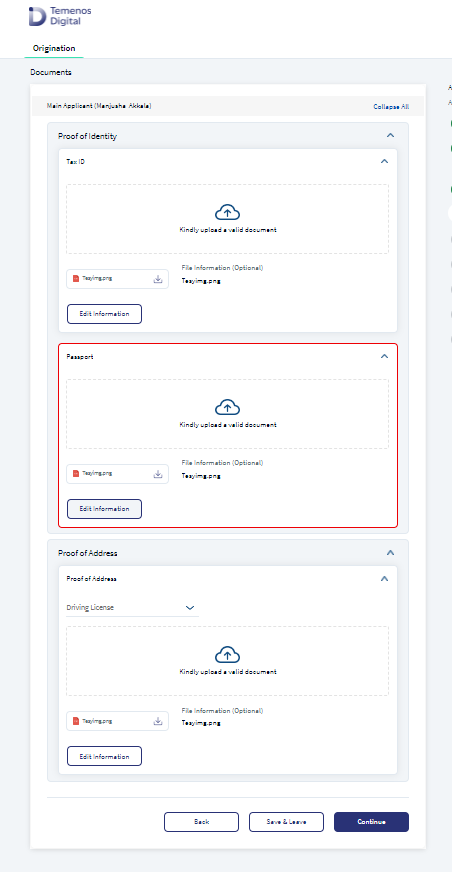

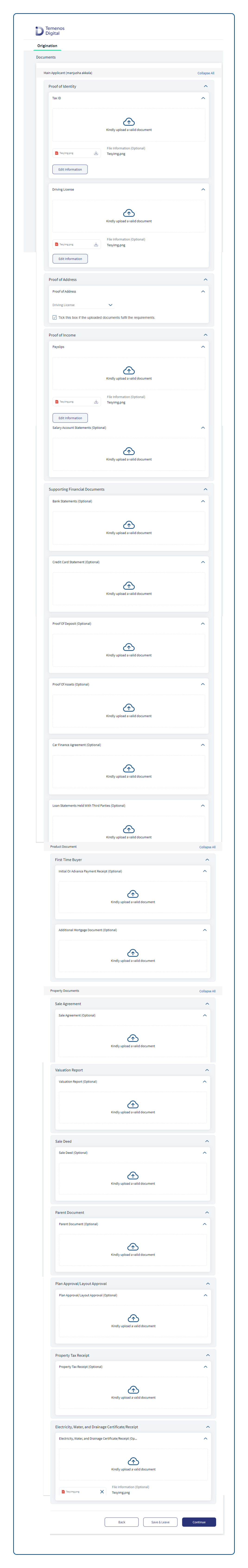

For the Retail journey, the Documents section contains the following sub-sections:

- Main Applicant

- Co-Applicant

- Product Document (First Time Buyer)

- Property Document

Main Applicant and Co-Applicant

The Main Applicant and Co-Applicant sections contain the following drop-downs:

- Proof of Identity: Proof of Identity contains the following questions:

- Tax ID: A document as proof of unique tax identification number. Click on the upload icon. Select the document you want to upload and click Upload button.

- Document-based on the input provided in the Identity section: The document type such as Passport and Driving License is pre-selected depending on the identity type previously chosen in the Address & Identification Details section.

- Doc checklist when Document Type has defined value: Based on the DMN rule for a particular document category if there is only one Document Type, the type of document label displays as a static text with the Upload X icon. Click Add document icon to upload the document.

- Doc checklist when Document Type has no defined value: Based on the DMN rule, if you must upload multiple document types for a particular document category, select the document from the drop down. The values in the drop-down depend on the DMN rules.

- Proof of Address: Proof of Address contains a drop-down list of various documents supported as proof of Address.

If the selected document is already uploaded as a part of Proof of Identity, primary applicant can select the check box below the Document Type field indicating the document uploaded under the previous category (Proof of ID) will suffice for this category (Proof of Address) as well.

- Proof of Income: The documents under this section vary based on the employment type.

- Full-time, Part-time, Contract, and Casual Employment: Payslips (mandatory), Salary account statements (optional).

- Others: Tax Return Statements (mandatory), Account Statements.

- For salaried Prospect (applicant/co-applicant), based on the below DMN rule. To refer to the Proof of Income applicable for Main and Co-applicants click here.

Evidence Consumption

Evidence MS Consumption is designed to resolve the rule-based requirements for evidence submission, evidence fulfilment and evidence reuse capability by the Origination and Temenos Digital Assist app.

Evidence Requirement: Bank Staff Administrator will have the capability to define

- Evidence types: Evidence types such as documents or 3rd party API responses for the various financial product offerings and services offered by the bank.

- Evidence type attributes: Bank user has the capability to define the attributes that must be captured for each evidence type. For example: validity period and version. These attributes are captured at the time of evidence verification, either through manual or automated means.

Bank Staff Administrator has the capability to define the evidence requirements for each of the following categories:

- Proof of Identity: Passport or National ID

- Proof of Address: Passport or National ID or 3 months of Utility Bills

- Proof of Income: Payslips or latest Tax Return and Bank Account Statement for the last 6 months

- Proof of Business: Registration document (e.g. Sale Deed for home ownership)

The Evidence Management system permits the following:

- Allows multiple documents to be defined for a single category with an OR condition. For e.g., Proof of Identity: Passport or National ID

- Allows multiple documents to be defined for a single category with an AND condition. For e.g., Proof of Income: Latest Tax Return and Bank Account Statement for the last 6 months.

- Allows the same document to be used for multiple categories. For e.g., Passport may be used as documentary evidence for Proof of Identity as well as for Proof of Address.

Evidence submission by prospect customer:

When a prospect customer submits an application for a single product or multiple products, the Evidence Management system accepts all the evidences which are provided by the applicant as part of the application process.

Evidence Fulfilment- Evidence submission by an existing customer:

When an existing customer submits evidence and if the evidence submitted is valid, the Evidence Management system returns the evidence submitted in the past only if it is still valid, based on the expiry date and reusability for that piece of evidence. The applicant can download the valid document returned by the Evidence Management system.

If the evidence submitted earlier is still valid and can be reused, Origination App displays a message as Document provided earlier is still valid for use with the document being available for download.

- If the applicant chooses to re-use the same evidence for the current application, then there is no need to upload a new document.

- If the applicant does not choose to re-use the same evidence for the current application, the applicant must submit new evidence towards the same requirements (e.g., provide a National ID towards Proof of Identity even if the Passport is still valid).

The Evidence Management system / Origination App performs the above steps for each category of evidence required for that specific product (journey).

Whenever the applicant is in the Document Upload screen, System triggers the Fulfilment API to fetch the list of documents that are valid and reusable. This implies that if the customer navigates away from the Document Upload screen and comes back to the screen, the documents uploaded or retrieved earlier will not be present and System triggers the Fulfilment API to fetch the list of documents that are valid and reusable.

Evidence Submission - existing customer with valid evidence and additional evidence requirements:

If there are any additional evidence requirements for the product being applied by an existing customer with valid evidence, then Evidence Management system allows the applicant to upload the evidence to meet additional evidence requirements.

Evidence Submission - existing bank customer with invalid evidence:

When an existing customer submits evidence which is valid, the Evidence Management system returns the evidence submitted in the past only if it is still valid based on the expiry date and reusability for that piece of evidence. If the evidence submitted earlier is invalid, the applicant must upload a fresh piece of evidence towards the evidence requirements that will need to be verified again by the bank staff on submission of the application. If there are any additional evidence requirements for the products applied by the existing customer, the Evidence Management system permits the applicant to upload evidence to meet the additional evidence requirements in addition to the evidence being uploaded in lieu of the invalid evidence.

To know about Evidence Management Workflow, click here

CRUD Operations of Documents:

- Upload documents: Click upload icon to upload single or multiple documents based on the requirement. Click upload button to upload the document and the selected document is uploaded. Click the cross (X) icon to delete the document.

After uploading a document, the cross icon changes to the Download icon, applicant can click on the download icon to download the document if required. To edit the uploaded files or the file information click the Edit Information button.

Applicant will not be able to upload documents in the Summary screen document section.

- View uploaded documents: Post uploading the documents, you can view the uploaded documents in the Document Section. Click the download icon to view the uploaded documents. All the uploaded documents are available in the Summary screen under the Document section.

- Edit document: After uploading a document, the upload icon changes to the Edit information icon, using which the applicant can edit the document. While editing a file, the document is deleted in the back end, and the new document is uploaded.

- Download document: After uploading a document, the cross icon changes to Download icon. Click the download icon to download the document. If the applicant wants to edit the uploaded files or the file information, click Edit Information.

- Replace document type: To replace the already uploaded documents under the document category only (if multiple document types are applicable under a document category)

- Click Edit Information button, and replace the document type within a document category.

- When the applicant wants to change/replace the document type, a notification displays If you change the Document Type, existing files under the previously selected category will be deleted. If you click Yes, you can select the new document type and upload the documents to proceed further.

- If the applicant clicks No, the existing screen with already uploaded documents will display.

- Delete document: To delete the uploaded document on the document section.

- Click Edit Information, delete option displays against the uploaded document. Click the delete button to delete the document.

- When the applicant clicks Delete, a notification displays If you click Yes, document will be deleted. If you click No, you will return to the previous page.

- If the applicant has deleted a Mandatory document, Continue button remains disabled until you upload another document in the document page.

When an existing customer submits evidence and if the evidence submitted is valid, the Evidence Management system returns the evidence submitted in the past only if it is still valid, based on the expiry date and reusability for that piece of evidence. The applicant can download the valid document returned by the Evidence Management system.

- If the evidence submitted earlier is still valid and can be reused, Origination App displays a message as Document provided earlier is still valid for use with the document being available for download.

- If the applicant chooses to re-use the same evidence for the current application, then there is no need to upload a new document.

- If the applicant does not choose to re-use the same evidence for the current application, the applicant must submit new evidence towards the same requirements (e.g., provide a National ID towards Proof of Identity even if the Passport is still valid).

- When the applicant is in the Document Upload screen, System triggers the Fulfilment API to fetch the list of documents that are valid and reusable. If the customer navigates away from the Document upload screen and comes back to the screen, the documents uploaded or retrieved earlier will not be present and System triggers the Fulfilment API to fetch the list of documents that are valid and reusable.

- Origination App performs the above steps for each category of evidence required for that specific product (journey).

If an existing customersubmits valid evidence and has to provide any additional evidence for the product applied, Evidence Management system allows the customer to upload the evidence to meet the additional evidence requirements.

If an existing customer submits evidence which is valid, the Evidence Management system returns the evidence submitted in the past only if it is still valid based on the expiry date and reusability for that piece of evidence. If the evidence submitted earlier is invalid, the applicant must upload a fresh piece of evidence towards the evidence requirements that will need to be verified again by the bank staff on submission of the application. If there are any additional evidence requirements for the products applied by the existing customer, the Evidence Management system permits the applicant to upload evidence to meet the additional evidence requirements in addition to the evidence being uploaded in lieu of the invalid evidence.

Document checklist attributes for Retail journey is listed below.

Retail Flow: For Primary Applicant and Co-Applicant

| Sl.No | Change in Data Fields | Entity type | Applicable Document Category | Applicable Document Type |

|---|---|---|---|---|

| 1 | First name | Individual | Proof of Identity | |

| 2 | Last Name | Individual | Proof of Identity | |

| 3 | Date of Birth | Individual | Proof of Identity | |

| 4 | ID Type | Individual | Proof of Identity | |

| 5 | ID Number | Individual | Proof of Identity | |

| 6 | Issue date | Individual | Proof of Identity | |

| 7 | Expiry date | Individual | Proof of Identity | |

| 8 | Issue Country | Individual | Proof of Identity | |

| 9 | Issue State | Individual | Proof of Identity | |

| 10 | Address Line 1 | Individual | Proof of Address- Individual | |

| 11 | Address Line 2 | Individual | Proof of Address- Individual | |

| 12 | Country | Individual | Proof of Address- Individual | |

| 13 | State | Individual | Proof of Address- Individual | |

| 14 | City | Individual | Proof of Address- Individual | |

| 15 | Zip code | Individual | Proof of Address- Individual | |

| 16 | Employment Type | Individual | Proof of Income | To refer to the DMN rules click here. |

The Product Document section is optional. It displays only for specific types of lending journeys such as vehicle loan. The Product document section may include Proforma Invoice and Insurance Quotation.

Document Categories and Documents

The following table lists the document categories and documents defined for in the retail user journey as part of the Out of the Box (OOTB) configuration.

| Document Category | Documents |

|---|---|

| Proof of Identity |

|

| Proof of Address |

|

| Proof of Income |

|

| Loan Specific (First Time Buyer) |

|

| Collateral Document |

|

| Agreement Documents |

|

Mortgage Loan Document Checklist

The system administrator has the capability to define the specific parameters for the Mortgage Origination application. Based on the attributes that the applicant selects, the document checklist rules are triggered and the appropriate categories are displayed on the Document screen.

- When there is a change in the attributes, the document checklist triggers a Mortgage loan. It can be initiated by an existing customer or prospect.

- The attributes must be available in the Origination App in the form of data entry fields.

- These attributes are defined in PAM, and the document checklist is defined in Document MS.

- Bank user has the capability to define these attributes and the corresponding checklist values.

- Attributes must support multi-select. (Ex: Retail journey, product Mortgage Loan, and status Employment Status-salaried that displays in the document checklist.

DMN Rule 1: First Time Buyer in Origination

The below DMN Rule 1 is defined for First Time Buyer Mortgage. To refer to the Mortgage Document Checklist 1, click here.

DMN Rule 2: First Time Buyer in Origination

The below DMN Rule 2 is defined for First Time Buyer Mortgage. To refer to the Mortgage Document Checklist 2, click here.

DMN Rules in Origination

The Document Checklist is available in the Document MS and is controlled by the DMN rule for mandatory and non-mandatory classification.

The mandatory and non-mandatory classification is not configured in the MS, as one document which is mandatory for one journey can be optional for another journey.

In DMN rules, we can define the checklist and Mandatory/Non-mandatory classification specific to the Document Category for a particular product in combination with other attributes such as collateral type, property type, residential type.

Bank user can configure the mandatory and non-mandatory checklist classification as per the bank requirement for each document using the DMN rule.

When the primary applicant is on the Document screen, a list of documents displays (mandatory or optional) which the primary applicant must upload as per the Document Checklist. To refer to the document checklist, based on the DMN rules defined for Mortgage Loan (First Time Buyer Mortgage) click here.

Generic Document Checklist for First Time Buyer Mortgage

| Document Checklist for Mortgage Loan |

|---|

| 1. Proof of Identity |

| a. Tax ID ( mandatory) |

| b. The ID which is entered under ID section to be pre populated (Any one document from below is Mandatory) |

| i. Driving License |

| ii. Passport |

| iii. Employee ID |

| iv. Photo ID card issued by Local Government |

| 2. Proof of Address : (Any one document from below is Mandatory) |

| a. Driving License |

| b. Passport |

| c. Utility Bills |

| d. Employer/HR letter |

| e. House Rent Contract |

| 3. Proof of Income : |

| a. For Status (Employment Status) - Salaried (Full Time Employee, Part Time Employee, Contract Employee, Casual Employee) |

| i. Pay-slips(mandatory) |

| ii. Salary Account statement ( optional) |

| b. For Status (Employment Status) - Non-Salaried (Self-Employed, Retired, Unemployed, Trainee) |

| i. Tax Return Statements(mandatory) |

| ii. Account Statements ( optional) |

| 4. Product Document: First Time Buyer : (Add below documents if available) |

| a. Initial/Advance Payment Receipt |

| b. Sale Agreement |

| c. Additional Mortgage Document |

| 5. Property Document : (Add below documents if available) |

| a. Sale Deed |

| b. Parent Document |

| c. Plan Approval/Layout Approval |

| d. Property Tax Receipt |

| e. Electricity, Water and Drainage Certificate/Receipt |

| Note : Proof of ID, Proof of Address and Proof of Income mentioned above is required for all applicant (Main applicant and co-applicants) |

Mortgage Loan: DMN Rules and Document Checklist

| DMN Rules | Document Checklist |

|---|---|

|

Mortgage Loan DMN Rule 1 Journey Type: Retail Entity Type: Individual Mortgage Purpose: First Time Buyer Property Sub-Type: Re-sale |

Document Checklist 1 Product Document: First Time Buyer (All the below fields are optional)

Property (Collateral) Document

|

|

Mortgage Loan DMN Rule 2 Journey Type: Retail Entity Type: Individual Mortgage Purpose: First Time Buyer Property Sub-Type: New |

Document Checklist 2 Product Document: First Time Buyer (All the below fields are optional)

|

After the main applicant uploads all the mandatory documents in the checklist, click Continue button and control navigates to the Summary screen.

If you want to quit the application temporarily and resume later, click Save & Leave. Then, click Yes on the Save & Leave confirmation pop up. If you are a prospect user, you will receive the following email with an application resume link, user name, and application number. A temporary password is sent to the registered phone number.

If you are existing user, you will receive the following email with an application resume link and application number. You can login to the application by using your login credentials.

MicroApps

Documents Micro App (Document MA) contains forms related to Scan documents, upload and download documents which an existing customer or prospect must upload in the document section in the Origination App.

Components

The Documents section contains the following list of components:

| Component Name | Instance Name |

|---|---|

| com.dbx.uploadFiles3 | uploadFiles3 |

| com.nuo.Roadmap | Roadmap |

| com.dbx.bannerError | bannerError |

| com.dbx.customheaderNUOV2 | customheaderNUOV2 |

| com.dbx.customfooter | customfooter |

| com.nuo.loadingV3 | loadingV3 |

| com.dbx.popup | popup |

Configurations

The system administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Documents section, click here.

Extensibility

By using the Extensibility feature, you can customize the modules based on your requirements. For more information, refer to Extensibility.

In this topic