Mortgage - First Time Buyer Lending Tasks

Click here for details regarding Mortgage Flow in Origination (Pre-Submission).

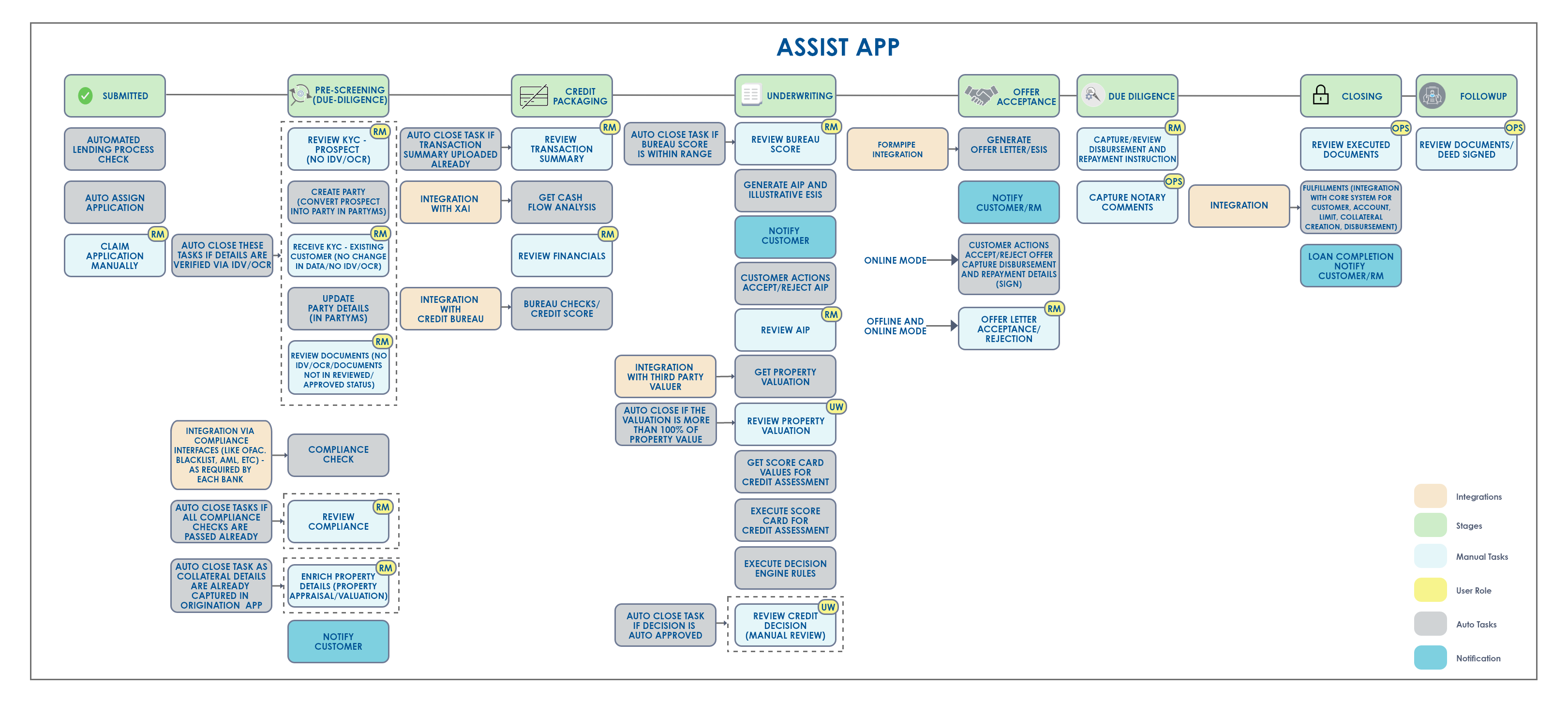

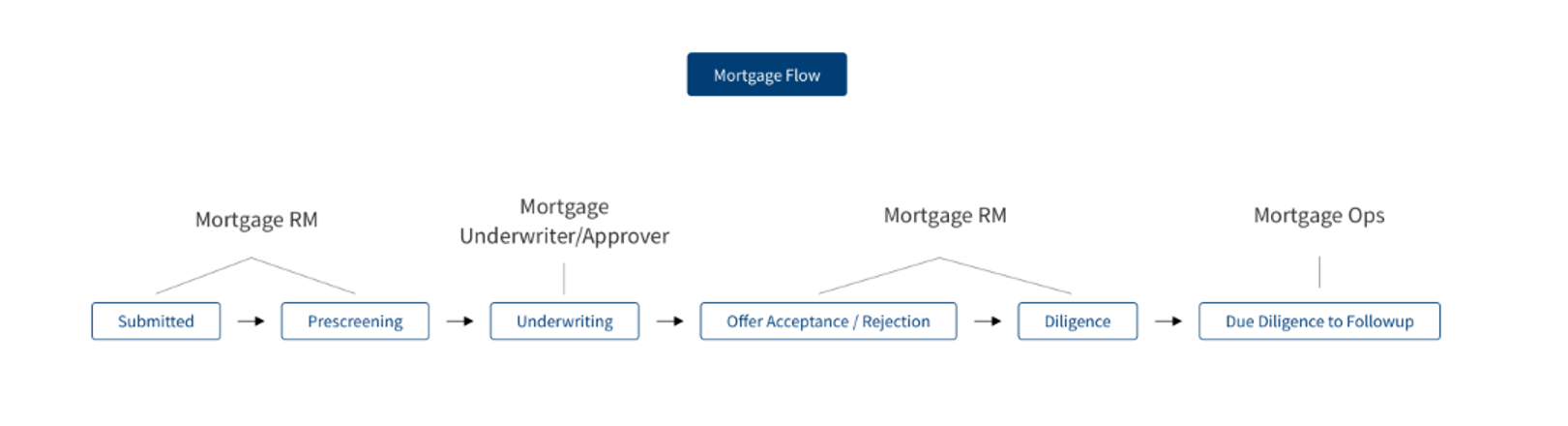

Below is the vertical flow of Mortgage - First Time Buyer Lending Tasks.

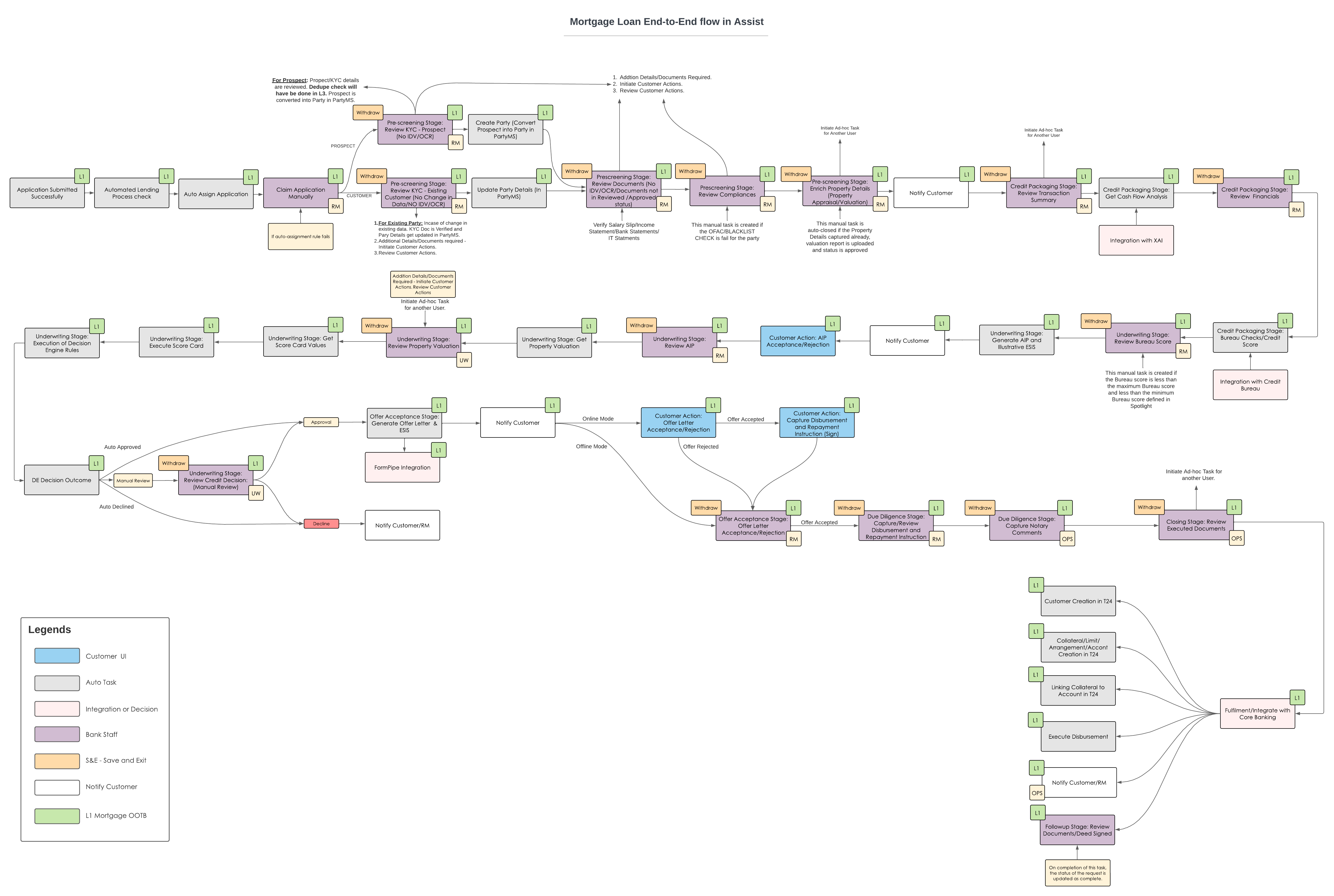

Mortgage end-to-end flow in Assist (Sequential Flow)

Post Submission stages

- Submitted

- Prescreening

- Credit Packaging

- Underwriting

- Offer Acceptance

- Due-Diligence

- Closing

- Follow-up

- Default User: Relationship Manager (RM) is the default user.

- Name of Party: All Entity related tasks will have the Entity Name and Product related tasks will have the Product Name.

Tasks created in each of the stages and the effect on the workflow - Retail Mortgage First Time Buyer Lending

Click here for more information on Mortage automated lending process - Redhat PAM.

Submitted

Automated Lending Process Check (Check STP Rules):This is an Auto Task.

Once the Application is submitted in the Origination app, the application enters the Temenos Digital Assist App, where the STP rules is first evaluated by the system. The Assist app runs the following rules:

- Check if the application has any existing customer.

- If it is an existing customer and if there is no change in the customer data.

- If an existing customer changes any values in the above fields it is considered as change in existing customer’s data.

- A Flag displays if there is any change in KYC data.This is applicable for both main applicant and all co-applicants.

- The system checks if all the documents (Proof of Address, Proof of Income, Supporting Financial documents) are in approved status.

- The system checks if the applicant has updated Property details by checking the field 'Have you Identified the Property'.

- The system checks if the applicant has not uploaded any new document for Proof of Address, Proof of Identity, Proof of Income.

- Once the above mentioned checks get completed the system automatically closes this task.

The STP rules are executed and a pass or fail determines the flow of the application through STP or Manual process.

If the result is Yes for both the rules, the application is auto-claimed and routed to the next stage, Pre-screening.

Check STP Rules - Fields to be checked: For a system to execute the existing customer rule, the following fields are checked for aan existing customer record to find out if any changes are made to these fields.

KYC Information:

- First Name

- Last Name

- Date of Birth

- Email Address

- Country Code

- Phone Number

- Tax ID No

- Identity Type

- Identity Number

- Issued Country

- Issued State

- Issued Date

- Expiry Date

- Address Line 1

- Address Line 2

- City

- State

- Zip Code

Financial and Employment

Occupation Details:

- Status

- Occupation

Income Information:

- Income Period

- Total Gross Income Per Month (Optional)

- Total Net Income Per Month

- Other Income (Optional)

Expense Details:

- Total Monthly Loan Repayment

- Total Monthly Household Expenses

Assets:

- Total Asset

Liabilities:

- Total Liabilities

Employment Details:(should have multiple records if there are more than one employment detail)

- Organization Name

- Employment Start Date

- Employment End Date (NA, if I currently work here option is checked)

- I currently work here

- Address Line 1

- Address Line 2

- Country

- State

- City

- Zip Code

- Country Code

- Phone Number

Business Details: (should have multiple records if there are more than one business detail)

- Organization Name

- Business Start Date

- Business End Date (NA, if I currently work here option is checked)

- I currently work here

- Address Line 1

- Address Line 2

- Country

- State

- City

- Zip Code

- Country Code

Automated Lending Process Check (Check STP Rules)

After an application is submitted in the Assist App, System checks if the below criteria is met. If the applicant is an Existing customer, then there is no change in customer data(Address, Identity, Personal, Financial Information).

If existing customer changes values in the above fields, then System compares the customer data in ODMS with the customer data in Party MS to confirm if there is any change in Customer data. If there is any change in data, a flag is set if there is change in KYC data. After these checks are performed, System closes the task automatically.

Below fields in each section have to be compared.

KYC Information

- First Name

- Last Name

- Date of Birth

- Email Address

- Country Code

- Phone Number

- Tax ID No

- Identity Type

- Identity Number

- Issued Country

- Issued State

- Issued Date

- Expiry Date

- Address Line 1

- Address Line 2

- City

- State

- Zip Code

Financial Information

- Status

- Occupation

- Income Period

- Total Gross Income Per Month (Optional)

- Total Net Income Per Month

- Other Income (Optional)

- Total Monthly Loan Repayment

- Total Monthly Household Expenses

- Total Asset

- Total Liabilities

Employment Details :

- Organization Name

- Employment Start Date

- Employment End Date (NA if "I currently work here" is checked)

- I Currently work here

- Address Line 1

- Address Line 2

- Country

- State

- City

- Zip Code

- Country Code

- Phone Number

Business Details

- Organization Name

- Business Start Date

- Business End Date (NA if "I currently work here" is checked)

- I currently work here Address Line 1

- Address Line 2

- Country

- State

- City

- Zip

- Code

- Country

Documents in the below category should be in approved status.

- Proof of Address

- Proof of Identity

- Proof of Income Supporting Financial documents

After the checks are done, System automatically closes the task. If Have you Identified the Property is Yes, then System checks the above mentioned checks and automatically closes the task.

The Documentswhich are under the below category display in approved status. The Document check is implemented across all the Retail lending journeys.

- Proof of Address

- Proof of Identity

- Proof of Income

- Supporting Financial documents

Have you Identified the Property = yes

Once the above mentioned checks get completed the system automatically closes this task.

Assign to Supervisor User Role: The system, checks if the application follows the above STP rules and automatically assigns the application to the RM Supervisor as per the configuration. This is an auto task executed by the system.

Automatic Assignment of Application/Tasks to User: Based on Automatic assignment rule Application/Tasks is auto assigned to the available user (who has less tasks to action in the queue). Automatic assignment reduces the step of claiming Task/Application manually.

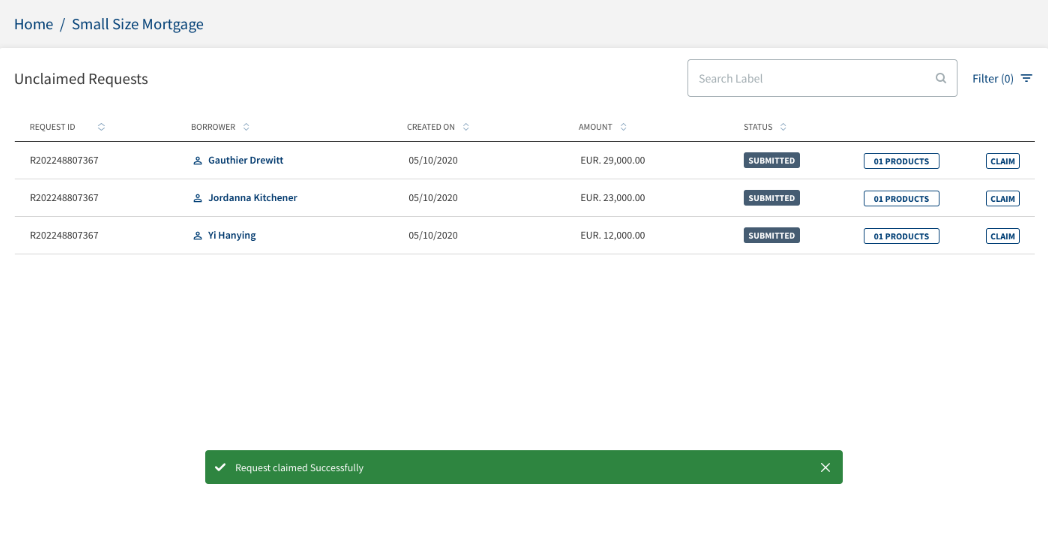

Move Application to Queue: The System checks if the result (STP Rules is not met i.e, if the application has a Prospect customer or if there is any changes in the existing customer data pre-filled and shown in the Origination app) for either of the rules and routes the application to the queue of the respective Bank user to claim & process it. This is an auto task executed by the system. Please refer to the link for more details regarding the auto task.

The system moves the application to the respective queues depending on the condition satisfied in the Automated Lending Process task and closes this task automatically.If the Conditions in the Automated Lending Process check task are satisfied the application follows the automated process and is assigned to the Supervisor RM and directly process the next task.

Depending on the loan amount the application is moved to the respective queues as given below:

- Small Size Mortgage

- Medium Size Mortgage

- Large Size Mortgage

Rule: System evaluates the STP rules and if the result is N, the application is moved to the queues.

The STP rules executed result is fail.

When the customer submits the application and when the application meets the criteria defined in the Automated Lending Process check, the application follows automated process and the application is assigned to the Supervisor RM and proceeds to the next task.

Queue Definition - Application Level: The Bank Administrator user can configure the below mentioned application level queues in the system. The application is automatically mapped to the respective queues depending on the loan amount. These queues are applicable only for Mortgage loans:

The mapping is as follows:

Small Size Mortgage:

- This queue is for small ticket mortgage loans

- Loan Amount range >0 and <=50000

Medium Size Mortgage:

- This queue is for medium ticket mortgage loans

- Loan Amount range >50000 and <=100000

Large Size Mortgage:

- This queue is for large ticket mortgage loans

- Loan Amount range >100000

The loan amount threshold is parameterized and the range is editable as per the Bank's policy in the future.

Rule: Check the loan amount and assign to the respective queue.

The stages available in the process flow and the applications are automatically mapped to the respective queues.

Claim Application: The RM user claims the applications/task when automatic assignment rules fails or disabled that are pushed to the queue for manual processing of capturing and reviewing the customer details. This is a manual task to be processed by the respective user (The application is claimed only if the application is moved to queue to be claimed manually).

Once a RM user claims the application/task when automatic assignment rules fails or disabled, it moves into the respective user's My Task.

Rule: User clicks on the claim application and the application is assigned to the respective user.

This functionality of the claim application is applicable to all the manual queues whenever the user clicks on the claim application.

Prescreening

Review KYC-Prospect:This Task is created when the application has a Prospect applicant and Prospect data/document is to be reviewed by the Bank user. The RM user Reviews, Validates KYC and other information along with the documents submitted by the Prospect. This is a manual task which is processed by the respective user.

If the application is submitted by the customer and the applicant is an existing customer then the Review KYC Prospect task gets closed automatically.

The task runs all the prospect parties in the application. The task is in the Mortgage Pre-screening Tasks queue under My Queue (Refer the attachment Mortgage Stages and tasks with queue for the Task Description). The RM user views the task under My Task after claiming the task. When user clicks the task it navigates to the Entity Overview section. Once the user completes the task, the status is marked as Complete and the next task in the workflow gets created. The same set of fields that are given as part of this task Check STP Rules - Fields to be checked is reviewed / checked by the RM.

Rule: This task is created if there is a new party (prospect) in Review KYC - Existing Customer details.

Review KYC - Existing Customer Task:The system checks if the applicants are existing customers and the status of proof of identity,proof of income documents are approved. If the applicants are existing customers and the status of proof of identity ,proof of income and supporting financial documents are approved, the task gets closed automatically. This is applicable for all the lending journeys.

Review KYC - Prospect

When prospect customer submits an application, then System moves the application to the respective Queue’s if the criteria condition is satisfied in the Automated Lending Process, the task closes automatically.

If the Conditions in Automated Lending Process check task are satisfied then the application will follow automated process and should be assigned to Supervisor RM and directly process the next task.

Review KYC - Existing Customer

When existing customer submits an application, and if there is a change in the KYC Information or if the status of Proof of Identity, Proof of Income and Supporting Financial documents are not approved, then Review KYC task is raised and assigned to the RM to review the customer data. RM can raise a customer action if any data or document is required from the customer. After the Customer Action is complete, RM reviews the Customer Action and manually closes the task.

Update Party in Party MS:The System checks the following scenarios to update the party details. This is an auto task executed by the system.

Scenario 1: STP Application - This task is not applicable and is not created.

Scenario 2: Non STP Application (Manual Application Process) - Update Party in Party MS for existing customers.

The existing customer data needs to be updated in the Party MS as the existing customer data is changed during the application filling time and the updated data reflects in the Party.

Name, Primary Contact, Phone, Name, Country, Address 1, City, State, Postal Code, all other customer information.

Rule: When existing customer data is modified and updated.

The changed or updated customer details display against the existing customer id. Post data updation in PartyMS, the party data shown in Assist, is fetched from the PartyMS and any changes post this task to the party data is updated in the PartyMS.

Once the task is completed, the application moves to the next task Review Documents.

Create Party in Party MS: The System checks the following scenarios to update the party details.This is an auto task executed by the system.

Scenario 1: STP Application - This task is not applicable and is not created.

Scenario 2: Non STP Application (Manual Application Process) - Create a Party in Party MS for prospects

A new Party is created in Party MS for the prospect with status Active. Customer (Customer ID) is created in the Transact. Once the KYC details are reviewed for all prospect Parties, the Party ID is created for all the parties (Borrower and co-borrower).

Rule: When a prospect customer record is created.

The new customer details display. Post party is created in Party MS, party data shown in Assist, is fetched from Party MS. Any changes done to the party data post this task, is updated in the Party MS. Once the task gets completed, the application moves to the next task Review Document.

Review Documents: This task is created to review the income documents uploaded by the customer. All the Income documents (Financial information related documents) submitted in the Origination app is shown in the Entity Overview with status as Pending/Approved.

The User can view all the income documents.

The RM reviews the loan application documents if the task is created. If there are any changes to the financial information or the status of the document category-Income Documents is Pending the task is created.

This is a manual task processed by the respective user who can view the application under My Task when the task is claimed. When the task is clicked it navigates to the Document section under Entity Overview. The application is in the Mortgage Pre-screening Tasks queue .

If the document status is Pending / Approved for the document category Income Documents, this is auto closed. This rule is added as Income documents are validated as part of the KYC Review task itself, to reduce the number of Manual tasks in the OOTB, we are auto closing this task. However if the Bank wants this task, to be auto-closed only when the uploaded document status is Approved, then this rule can be accordingly modified.

When customer submits the application and when there is change in Financial information data and status of Proof of Income documents are NOT Approved, then Review task is created and assigned to the RM. RM can raise Customer Action if any data or document is required from the customer. After the Customer Action is complete, RM reviews the Customer Action and manually closes the task.

Financial Information

- Status

- Occupation

- Income Period

- Total Gross Income Per Month (Optional)

- Total Net Income Per Month

- Other Income (Optional)

- Total Monthly Loan Repayment

- Total Monthly Household Expenses

- Total Asset

- Total Liabilities

Employment Details :

- Organization Name

- Employment Start Date

- Employment End Date (NA if "I currently work here" is checked)

- I Currently work here

- Address Line 1

- Address Line 2

- Country

- State

- City

- Zip Code

- Country Code

- Phone Number

Business Details

- Organization Name

- Business Start Date

- Business End Date (NA if "I currently work here" is checked)

- I currently work here Address Line 1

- Address Line 2

- Country

- State

- City

- Zip

- Code

- Country

Documents: In the category below should have a different status than approved.

- Proof of Income

Rule:

a. Check if the financial Information data is changed.

If there are NO changes to the financial information, the task gets auto closed.

If there are changes in the financial Information fields, the task gets created.

The system checks if there are any changes to the financial information and the status of proof of income documents.If there is no change the documents are approved and automatically the review documents task gets closed.

b. Once the user completes the activities, the task is marked as completed, the application moves to the next task OFAC Check & Blacklist Check.

OFAC Check: The System auto closes the OFAC check task and marks it as Pass. The rule for the same is configured when the integration is done. This is an auto executed task, since there is no integration with OFAC, by default OFAC check status is updated as Passed for each Party in the application and the Status is configurable.

Rule: To check if the parties in the application are part of the OFAC database.

The system first checks if there is any existing OFAC report for the applicant in the Party MS, if yes, the report should not be older than 5 days.

- Incase the report is older than 5 days, a new report is fetched from an external system.

- If the report is not older than 5 days,the existing data is updated.

These 5 days are configured by the bank.The reports which are extracted from the external system is stored in the Party MS.Once the results are received this task gets automatically updated with the results and gets closed.

The OFAC check status is updated as Pass, if there are no matches and the task is marked as completed. The application moves to the next task Review Compliance if any match found in the OFAC and/or Blacklist data base else to the task Enrich Property Details.

When OFAC task fails to fetch the results from third party due to some technical error, System raises an error task and this task must be assigned to the Admin user. System has an option to manually trigger OFAC task in Create Adhoc tasks. Customer can edit the checklist field with the following available drop-down options.

- Adhoc tasks

- Re-trigger task

RM can re-run the OFAC and Blacklist task in all the post-submission stages. Once the Re-run is completed, RM receives an email that re-run has completed.

The user can re-trigger the cash predictions task to fetch the updated results from the XAI by using the create new task option (adhoc task).The system does not allow to select any other option apart from XAI - Cashflow for request Id.A notification is sent to the RM.

Black List Check: The System auto closes the Blacklist check task and marks it as Pass. The rule for the same can be configured as and when the integration is done. This is an auto executed task, since there is no integration with Blacklist, by default the Blacklist check status is updated as passed for each Party in the application and the Status is configurable.

Rule: To check if the parties in the application are part of the Black list database.

When Blacklist task fails to fetch the results from third party due to some technical error, System raises an error task and this task must be assigned to the Admin user. System has an option to manually trigger Blacklist task in Create Adhoc tasks.

Review Compliance task

When the results of OFAC check or Black list check fail or partially Failed, a Review Compliance task is created and assigned to the RM. RM can rerun and review the failed tasks individually and after the review is complete, RM can manually close the task.

Review Compliances: The RM user reviews the compliance details when an exception gets triggered. This is a manual task processed by the respective user. The RM claims and reviews the application.

The Black list check has an individual task. The system first checks if there is any existing Black list report for the applicant in the Party MS, incase there is an existing report it should not be older than 5 days.

- Incase the report is older than 5 days, a new report is fetched from an external system.

- If the report is not older than 5 days,the existing data is updated.

These 5 days are configured by the bank.The reports which are extracted from the external system is stored in the Party MS.Once the results are received this task gets automatically updated with the results and gets closed.

The Review Compliance task gets created only when the OFAC check fail or the black list check fail or if both fail.

If the OFAC and Black List tasks get completed with status Pass then the Review Compliance task gets closed automatically.

The RM user reviews the compliance details when an exception gets triggered. This is a manual task processed by the respective user. The RM claims and reviews the application.

On completion of all the OFAC and Blacklist, check tasks for an application. If the compliance status Fails for one or more compliances of the party/prospect, only then a Review Compliances task is created.

Clicking the Review Compliances task navigates to the Compliance Section under Request overview (Request Overview >Monitoring >Compliances). The RM can add/view/update/delete Compliances.

The application is in the Mortgage Pre-screening Tasks queue. Clicking the task navigates to Monitoring --> Compliances section of the RO.

Rule: Match found (status-fail) in the OFAC and/or Blacklist data base.

Once the user completes the activities, the task is marked as completed. The application moves to the next task Enrich Property Details.

Enrich Property Details: As part of this task, the Property details can be captured/enriched. Once the compliance details are checked, the RM updates the property details if not captured. This is a manual task to be processed by the respective user.

This task gets auto closed if the flag Have you identified the Property = Yes.

This task gets auto closed if the flag “Have you identified the Property” = Yes or if all the Compliance results is Fail. Since the user has to mandatorily enter property details while submitting the application, by default this task gets auto-closed. However in future release, if the user chooses to skip entering the Property details while submitting the application, Then this task will be created and the user can capture the property details as part of this task.

If it is No, the task is initiated and the user (RM) captures the property information. The task is in the Mortgage Pre-screening Tasks queue. Clicking the task navigates to the Collateral Section of the Entity Overview.

Rule: Check if the property details are captured.

Once the user completes the activities, the task is marked as completed. The application moves to the next task Notification to Customer.

If Have you identified the Property field is No and if all the compliance results are Pass or Partially Pass, then Enrich Property details task is created.

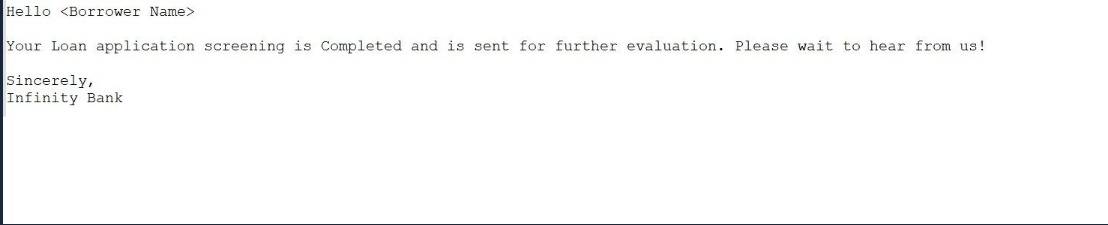

Notification to customer: The System triggers a notification to the customer based on the configured event. This is an auto task executed by the system.

Rule: Once the enrich property details task is closed, the system triggers a notification to the customer indicating the status of the application.

If the Customer details are updated, OFAC/Blacklist check is pass, then the property details are updated and the task is closed and the Notification gets triggered. Once the task gets completed, the application moves to the next Stage and triggers to check next task Business Bureau Check.

Notification Template:

Dear <Entity Name> (Display Entity name of Primary Applicant/Co-Applicant as per the entity to whom the mail is sent)

We are evaluating your application now, and will get back to you within 5-7 business days with an update on next steps.

Regards,

Temenos Digital Bank.

Credit Packaging

Review Financials :The Bank user reviews the financial details of the applicants in this task.This is a mandatory manual task for First Time Buyer, Re-mortgage and Bridge Loan Journey.

Business Bureau Check: Once the pre-screening activities are done, As part of this stage System triggers the bureau check. Service call to specified business bureau to fetch results for a named Party(s). This is an auto task executed by the system which gets auto closed and it defaults a value in the credit score field (since there is no integration with Credit Bureau, by default Bureau check scores is updated as configurable in spotlight. Bureau scores are configuration in spotlight, based on the value setup the next task gets triggered).

Trigger the bureau check and the status is updated as success. Once the task gets completed, the application moves to the next Stage and triggers next task Review Bureau Score. Since there is no integration with Credit Bureau, by default the Bureau check score is updated as configurable in spotlight. The Bureau scores are configuration in spotlight, based on the value setup the next task gets triggered. In case the score is < the prescribed level, else, the application will move to the task to Generate AIP and Illustrative ESIS.

System checks the status of the Compliance results for all the applicants. The available options for Compliance results are Pass, Fail, Some pass and Some fail. If the Compliance results are all Fail, then System does not fetch the Bureau Score and the task is closed automatically. When the Credit Bureau task fails to fetch report with some technical error. System raises an error task and this task is assigned to the Admin user.

Credit Bureau Score : The system initiates the Bureau Check task once the Loan Documents review and Compliance review tasks get completed.The system first checks the compliance results. The results can be either of the below,

- All Compliance results for all applicants are “Pass”.

- All Compliance results for all applicants are “Fail”.

- All Compliance results for some applicants are Pass and some are Fail.

If all the results are “Pass” or if the result is partially pass the system continues fetching the Bureau Score.

The system checks if there is any existing Bureau report for the Applicant in CDD, if yes, then it should not be older than 30 days.

- If the report is older than the expected days,a new report is fetched from an external system.

- If the report is not older than the expected days,the existing data gets updated.

These 30 days are configured by the bank.The reports which are extracted from the external system is stored in the CDD.The Bank may get the credit scores from various providers,the Credit score from different providers for the same customer is stored in the CDD.

Similarly Bank is also allowed to configure (Temenos Digital Assist) which provider's credit score the bank wants to fetch from the CDD.The System also can fetch the credit score from the CDD based on the provider.

The system displays the history of credit scores for a customer in the Entity Overview, whereas the Request overview displays the current score.

when the OFAC and blacklist is pass or partially pass,for an individual account holder the excel sheet account summary is uploaded in request overview and the XAI is implemented as per the details in the account summary excel sheet.If it is a joint account holder the transaction summary excel sheet is implemented to the XAI.

The credit score is obtained once the account summary proceeds to the XAI.

Review transaction summary:When the excel sheet is available and uploaded in CSV format,the task gets auto closed since the transaction summary is already available.If the excel sheet is unavailable or missing or not in the CSV format a manual task is created and assigned to the RM to upload the excel sheet in CSV format only.

Cash flow prediction task:Once the cash flow is executed by the transaction summary, the XAI returns the cash flow analysis with its prediction in the financials menu under the credit section in the Request Overview.

Review cash flow:A manual task is created and assigned to the RM to review the acquired XAI cash flow predictions.

Underwriting

For more details regarding Mortgage Approval In-Principle please refer to the link.

Mortgage Loan Approval In Principle:

This defines that the Bank has agreed to provide funds for the Mortgage Loan based on the valuation of the Property by evaluating the credit worthiness.

The below mentioned is applicable only for Mortgage Loan in Underwriting Stage.

Review Bureau Score: On receipt of the Bureau check results, the system triggers a Review Bureau Score task (part of underwriting stage), when the value of the bureau score is less than X whose value can be configured in Spotlight.

- The system triggers the task only when the value of the bureau score is less than X value (Bureau Score < “X“ Value)

- The system does not trigger the task when the bureau score is greater or equal to X value (Bureau Score >= “X“ Value) however it proceeds to the next task i.e. Generate Approval In- Principle and Illustrative ESIS task.

- The RM can claim the task from the Mortgage Processing Tasks queue.

- The system navigates to the Product overview when the RM clicks the Product ID in the task.

- Case 1: If the RM decides to proceed with the application after reviewing the bureau score of the customer and adding an appropriate narrative by completing this task, the system navigates to Generate Approval In-Principle and Illustrative ESIS task.

- Case 2: If the RM decides not to proceed with the application after reviewing the bureau score of the customer, the RM can withdraw the application.

OOTB “X” value is 700.

- The system triggers the task only if it is <700.

- If the value is >700 it gets auto approved

- If its between <400 it gets auto rejected and this value of X is configurable.

Review Credit Bureau Score :The system auto closes the Review Credit Bureau Score task when the Credit Bureau score is > “700”, where “700” is configurable. If all the compliance results fail , the task gets auto closed.

Generate Approval In Principle and Illustrative ESIS: The System creates a Generate Approval In-Principle and Illustrative ESIS task (Underwriting stage) to create In-Principle approval letter and Illustrative ESIS documents on successful completion of Bureau Check task (Bureau score >= X value) or for completion of the Review Bureau Score task by RM (Bureau score < X value).

- As this is an auto task, the system automatically generates an In-Principle Approval Letter and Illustrative ESIS Document.

- The Validity period of the In-Principle Approval Letter and ESIS documents is configurable in the spotlight.

- The Validity period is calculated from the document creation date.

- Once the In-Principle Approval Letter and Illustrative ESIS are successfully generated, the system automatically closes the task.

When the Bank user is in the Underwriting stage, and if the Credit Bureau score is < 400, or if all the compliance results are failed, then System generates approval in-principal (AIP) and illustrative ESIS document through FormPipe, which is automatically rejected and the task is automatically closed.

When the Bank user is in the Underwriting stage, and if the Credit Bureau score is between 700 and 400, and/or when the compliance results are all Fail, then System creates Review Credit Bureau task.

The system generates approval in-principal and illustrative ESIS document through FormPipe, when the Credit Bureau score is > “400”. where the AIP is considered as approved.Once the AIP and Illustrative ESIS is generated this task gets auto closed.

Notification to RM: The System sends notification to the RM once the In-Principle Approval Letter and Illustrative ESIS documents are generated as part of Notify RM/Customer task (part of the underwriting stage) after the successful completion of the Approval In-Principle and Illustrative ESIS task.

- As this is an auto-task, the system sends a notification to the RM once the In-Principle Approval Letter and ESIS documents are generated.

- The System automatically closes the Notify RM/Customer task after sending the notification.

Notification To Customer:The System sends an email notification to the customer once the In-Principle Approval Letter and Illustrative ESIS documents are generated as part of the same Notify RM/Customer task (mentioned above) after the successful completion of the Approval In-Principle and Illustrative ESIS task.

- As this is an Auto task, the system sends an email notification to the customer after the In-Principle Approval Letter and ESIS documents are generated.

- Email Notification sent to the customer (both Applicant and Co-applicant if any) contains the details such as

Email Notification template for customer

Dear <Entity Name> (Display Entity name of Primary Applicant/Co-Applicant as per the entity to whom the mail is sent).

we are pleased to inform you that we have provided an approval in-principle for your mortgage loan of <Approved Loan Amount> which is valid for only <Validity Period> from the receipt of this mail.

Regards,

Temenos Digital Bank

- The System automatically closes the Notify RM/Customer task after sending an email notification.

Automatic customer action for Approval in Principle: The system initiates an Automatic customer action after successfully sending the notification to RM/Customer. It is a mandatory Customer Action.The system initiate the automatic customer action when the Principal amount is approved. The customer action is used to capture the customer consent. As soon as the customer action is raised an email is sent to the customer stating a customer action has been raised.

Once when the customer answers the customer action then system should send mail to RM indicating that the customer has addressed the customer action.

The customer action raised is used to capture the customer consent. As soon as the customer action is raised an email is sent to the customer stating that a customer action has been raised.

Customer action in Temenos Digital Assist - When the customer action is raised automatically, it is available in the Customer action summary screen which is under Customer actions Menu in the Request and Product Overview updated with status as Pending with Customer.

By clicking the customer action in the summary page, the RM can view a link to Product Overview page where the Consent provided by the customer displays.

- If the Automatic customer action is raised by the workflow for Approval in principal.

- An Email notification is sent to the customer indicating the customer action is raised.

Email Notification Template:

Dear <Entity Name> (Display Entity name of Primary Applicant)

We need some additional information to process your application. Please provide requested information in the below link to proceed further.

Click here to Login.

Regards,

Temenos Digital Bank.

- The RM can view the customer action in Customer Actions menu >> Customer action summary page.

- When the customer action is raised the status of the customer action will be Pending with customer.

- The Customer Action response has a link to the Product overview where the answers provided by the customer is stored.

View Customer Action - Approval in principle: A customer expects the system to display the In-principle approval letter and Illustrative ESIS documents, an option to capture the customer consent.

The customer action is displayed in the additional information under income and employment details.

- The customer action contains:

- In-principle approval letter and Illustrative ESIS documents.

- An option to either Accept or Reject AIP.

- The system allows the user to download the In-principle approval letter and Illustrative ESIS documents.

- The system allows the customer to either Accept or Reject AIP.

- The system does not allow the customer to submit the customer action, if the customer does not provide their consent.

- The system displays the customer action in the additional information under income and employment details.

Customer Action - Accept/ Reject AIP: The system provides the capability to the customers to review the In-Principle Approval Letter and Illustrative ESIS documents and to either accept or reject the indicative offer. It gets created after generating the automatic customer action for Approval in Principle and successfully sending notification to both the customer and the RM.

- When the customer answers the customer action, the system sends a mail to the RM indicating the customer has addressed the customer action.

- When the customer answers the customer action, the status is changed to completed.

- The system sends an email notification to the RM when the customer answers the customer action.

Email Notification Template:

Dear <RM Name>

Customer action request <Customer Action ID> initiated by you for the Entity/Product <Entity Name/Product ID> is now actioned by customer.

Please review the details provided by the customer.

Regards,

Temenos Digital Bank.

- Case 1: If the Customer Accepts the In-Principle Approval Letter and ESIS documents within the validity period i.e. on or before the expiry date.

- Case 2: If the Customer rejects the In-Principle Approval Letter and ESIS document within the validity period i.e. on or before the expiry date.

- Case 3: If the Validity period of the In-Principle Approval Letter and ESIS document gets expired.

Case 1: If the Customer Accepts the In-Principle Approval Letter and ESIS documents within the validity period.

The system generates the Perform Property Valuation/Title search task (Underwriting) when the customer accepts the In-Principle Approval Letter and ESIS documents through the customer action.

- The system generates the Perform Property Valuation/ Title search task (as a part of Underwriting) when the customer accepts the In-Principle Approval Letter and ESIS documents through the customer action.

- Acceptance status of the Product is updated as AIP Accepted.

- The status of the customer action in the summary is Completed.

- The system sends an email notification to RM.

- The system automatically closes the customer Action once the customer accepts the In-Principle Approval Letter and ESIS documents through the customer action.

Case 2: If the Customer rejects the In-Principle Approval Letter and ESIS document within the validity period.

The system creates a Review AIP task for the RM when the customer rejects the In-Principle Approval Letter and ESIS document within the validity period i.e. on or before the expiry date through the customer action.

- The system generates the Review AIP task.

- The RM claims Review AIP task from the Mortgage Processing Tasks queue.

- The Acceptance status of the Product is updated as AIP Rejected.

- The status of the customer action in the summary is Completed.

- The system sends an email notification to the RM.

- The system automatically closes the customer Action when the customer rejects the In-Principle Approval Letter and ESIS document within the validity period i.e. on or before the expiry date through the customer action.

Customer rejects the Approval In-Principal (AIP) Letter and Illustrative ESIS document within the validity date asking for higher loan amount, lower interest rate or reduction of fees / charges:

In this case the system,

- Creates a Review AIP task and the RM can

- Revise the loan amount and/or interest rate in the Assist.

- Reduce the fees/charges in the Transact through offer amendment.

- Re-trigger the simulation with the revised loan attributes.

- Resend the AIP Letter and Illustrative ESIS documents to the primary applicant and co-applicants (if any).

- Retrigger an automatic mandatory customer action with the latest AIP Letter and Illustrative ESIS documents.

Revise Loan Amount: In the “Review AIP” task, the RM can increase or decrease the loan amount requested by the customer. The Maximum Mortgage Eligible Loan Amount field ensures the RM does not increase the requested loan amount greater than an acceptable threshold value.

Maximum Mortgage Eligible Loan Amount (Assist): The value for the Maximum Mortgage Eligible Loan Amount is updated from the Maximum Mortgage Eligible calculated in the Funding Position screen in the Origination client app as part of the copytoOPMS service. This field is non-editable in the Assist.

However, when any of the parameters in the calculation of the Maximum Mortgage Eligible are changed, the Maximum Mortgage Eligible Loan Amount in Assist also changes in line with the formula Maximum Mortgage Eligible Loan Amount = Minimum (DTI-based Eligible amount, LTV-based Eligible amount).

Revise Interest Rate: The RM can reduce the interest rate that was initially communicated to the customer in the AIP Letter & Illustrative ESIS.The updates/changes can be done in the Interest Pricing section only until the customer accepts the Offer (i.e., Offer Letter status is updated as Signed).The RM cannot reduce the interest rate lower than an acceptable threshold value, the Minimum Interest Rate and Maximum Interest Rate fields in the Interest Pricing section helps in determining.

Minimum Mortgage Interest Rate (Assist) : The Minimum Mortgage Interest Rate is calculated as the Interest Rate + Minimum Spread configured for the product in Transact.The Spread details (MARGIN.RATE Maximum & MARGIN.RATE Minimum values) are configured at the product level in the Transact and exposed in MCMS.

Retrigger Simulation :The retrigger simulation button remains disabled until the Requested Loan Amount or the Interest Rate at the drawing level are modified as part of the Review AIP task or the validity period of the AIP Letter & ESIS documents gets expired. The button displays beside the latest version of the AIP document and gets hidden once the customer accepts the AIP Letter.

Clicking the Retrigger Simulation button:

- The IRIS API fetches the latest Mortgage Loan Repayment schedule from the Transact.

- After receiving the required data from the Transact,the API provided by Formpipe with the xml generates the required artefacts (AIP Letter & Illustrative ESIS).

- Resend the AIP Letter & Illustrative ESIS to the primary applicant and co-applicants (if any).

- Retrigger an automatic mandatory customer action with the latest AIP Letter and Illustrative ESIS documents for the primary applicant to accept / reject the latest AIP Letter & Illustrative ESIS.

Send a notification to the RM on completion of the entire process.

Email Notification Template

Dear <RM Name>,

Retrigger Simulation initiated by you for the Entity/Product <Entity Name/Product ID> is now complete.

Regards,

Temenos Digital Bank.

Since the mortgage/remortgage related artefacts such as AIP Letter / Illustrative ESIS & Offer Letter/Final ESIS can be generated multiple times, the bank user can view the history of all system generated documents. Clicking the link, displays all versions of each system generated document along with the date of generation. The individual documents can be downloaded by clicking the document.

Customer neither accepts nor rejects the AIP Letter and ESIS documents and validity period expires: In this case the system,

- Sends a notification to the RM stating the validity period of the AIP Letter and ESIS documents has expired.

- Creates a Review AIP task for the RM to confirm with the customer regarding the decision and do the following:

- If the customer requests for more time period to decide,the RM retriggers simulation.

- The system closes the open customer action (with the expired AIP Letter & Illustrative ESIS) as Expired before retriggering a new automatic mandatory customer action with the latest AIP Letter and Illustrative ESIS documents for the primary applicant to accept/reject the bank’s offer.

Case 3: The Validity period of the In-Principle Approval Letter and ESIS document gets expired.

The system sends a notification to the RM indicating that the validity of the AIP is expired, the RM waives the generated customer action. When the RM waives the customer action, the system generates the Review AIP Task.

- The system sends a notification to the RM when the validity of the AIP gets expired.

- The Acceptance status of the Product is updated as AIP Expired.

- The system generates the Review AIP task.

- The RM claims the Review AIP task from the Mortgage Processing Tasks queue.

- The status of the customer action in the summary will be Pending With the Customer after the Validity gets expired.

Review AIP: The system triggers the Review AIP task when the customer rejects the AIP or when the RM waives the customer Action i.e. the validity of the AIP gets expired.

The system auto closes the Review AIP task when the customer accepts the AIP .

The system provides the capability for the RM to add the Narrative and change the acceptance status of the In-Principle approval letter and Illustrative ESIS document, when the customer rejects the AIP or when the RM waives the customer Action i.e. the validity of the AIP gets expired.

- The RM claims the Review AIP task from the Mortgage Processing Tasks queue.

- The system navigates to the Product overview when the RM clicks on the Product ID on the task.

- The system allows the RM to change the acceptance status only to AIP Accepted or AIP Rejected.

- The RM changes the acceptance status to AIP Accepted if the customer is satisfied with the bank’s indicative offer.

- The RM changes the acceptance status to AIP Rejected if the customer is not satisfied with the bank’s indicative offer.

- The RM can add narrative and change the acceptance status.

- Case 1: If the RM gets the customer’s approval to proceed with the application , a narrative can be added and change the acceptance status to AIP Accepted in the Product Overview screen. The system generates the next task i.e. Perform Property valuation/Title search task.

- Case 2: If the customer is not satisfied with the bank’s indicative offer even after the RM reaches out, the RM can change the acceptance status to AIP Rejected in the Product Overview screen. The system then completes the Application.

When the Bank user is in the Underwriting stage and customer rejects the AIP or when the RM waives off the customer Action i.e. validity of the AIP gets expired, Review AIP task is raised. The RM can contact the customer and update the AIP status manually in the Product Overview.

When Bank user has to close the Review AIP task, if the Acceptance Status is AIP rejected then workflow does not process further and RM has to withdraw the application.

Reason for Rejection - visibility in Assist app: If the customer rejects an AIP / Offer Letter through the Customer Action in the Origination, the reason for rejection is captured and displayed in the Product Overview section of the Assist app in the AIP Rejection Reason (if AIP was rejected) and Offer Rejection Reason (if Offer was rejected) fields. Both the fields are non-editable in the Assist app but can be edited only if the customer chooses the offline mode for offer acceptance / rejection.

Reason for Rejection - editability in Assist app: If the customer chooses the offline mode for offer acceptance / rejection, the RM enters the reason for rejecting the bank’s offer on behalf of the customer.The Offer Rejection Reason field displays the below dropdowns.

- Higher Loan Amount

- Lower Interest Rate

- Reduced Fees/Charges

The Offer Rejection Reason field is editable only in the Offer Acceptance stage of the Mortgage/Remortgage application and is non-editable at all other times.

Perform Property Evaluation/Title search

When the customer accepts the AIP, then Perform Property Evaluation/Title search task is created and assigned to the queue. The task will be automatically closed when the collateral document is not in Approved / Reviewed status.

Get Property Valuation:The actual property valuation is initiated after the Review Remortgage details task. A valuation for the property is done to know the exact property cost.Integration with 3rd party valuators provides the actual property valuation report and this is taken from the spotlight.This value is updated in General- edit collateral documents in the valuation tab under value.

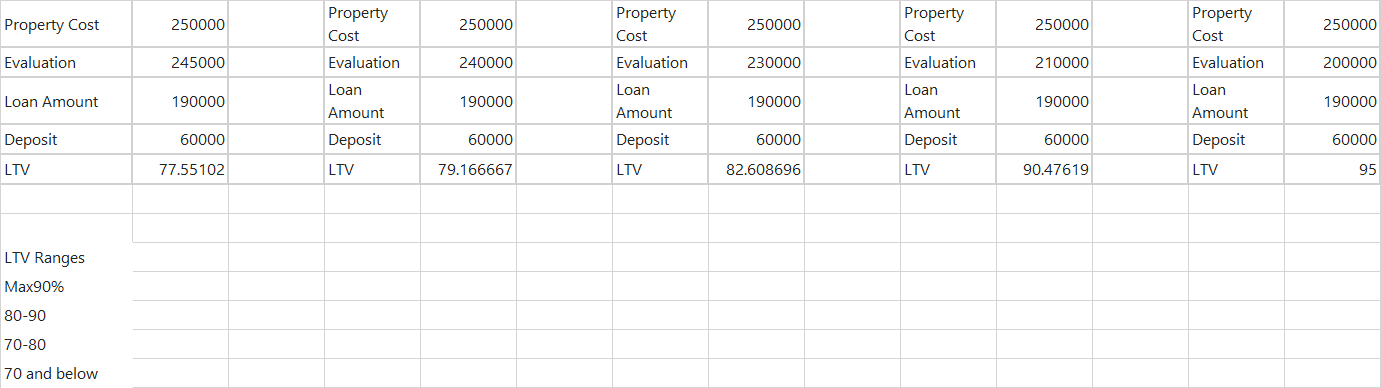

Receive valuation and valuation amount is higher than the Property cost (LTV not breached):When the actual property valuation is acquired from the third party valuators and if the value is higher than the property cost,the LTV is not breached and the system continues with the next task “get score card values for credit assessment”.

Receive valuation and valuation amount is lesser than the Property cost(Re-calculate LTV):When the actual property valuation is acquired from the third party valuators and if the valuation is less than the property cost the system recalculates the LTV.

Re-calculation of LTV: Whenever there is a change in the loan amount or the adjusted collateral value,the LTV is re-calculated each time.

Manual Task Creation:When the property valuation report acquired from the third party valuators is less than the property cost and the re-calculated LTV percentage is higher, a manual task (Underwriter) is created under to manually review and update the higher LTV percentage to the customer.

Re-calculated LTV is higher (move to higher range or decrease the loan amount):When the re-calculated LTV percentage is higher and the customer is informed the same, the customer can opt for the increased LTV range or the decrease in loan amount to hold on the previous LTV range.

- If the customer opts for the increased LTV range (refer below excel image) the ROI also increases.

- If the customer opts for decrease in the loan amount, the older LTV range is applicable.

Updating the Loan amount during Review Valuation:When the property valuation report acquired from the third party valuators is less than the property cost and the re-calculated LTV percentage is high,a task for the Underwriter is created under the review task as review property valuation to manually review and if the customer needs any change, an Adhoc RM task is created to handle the change in Loan amount.

The user confirms if the system has checked the latest formulas for the LTV and updated when the "Review Property Valuation" task is created for the in-progress applications.This is part of the task creation process where the user reviews the latest details.

This enables dynamic calculation based on the fields captured and ensures accurate display of recalculated values within the respective credit components.

Loan Completion Notify Customer/RM

After the fulfilment task is successfully completed, and the loan account is created, the application is marked as complete and the task is automatically closed.

Spotlight Configurations

- Configure Bureau Score

| Key | Value |

|---|---|

| RETAIL_BANK_BUREAU_SCORE | 400 |

This configuration enables you to modify the retail bank bureau score. The default value is set to 400. You can modify the value based on the requirement.

- Configure Validity Period

| Key | Value |

|---|---|

| RETAIL_ AIP_ESIS_DOCUMENT_VALIDITY_PERIOD | 30 |

Email Template:

Dear <Entity Name>

We are pleased to offer you that we have provided an approval in-principle for your Mortgage loan of <Approved Loan Amount> which is valid for only <Validity Period> from the receipt of this mail

Regards,

Temenos Digital Bank.

Perform Property Valuation/Title Search : If a customer Accepts the in-principal approval of the bank, the application is routed to the Mortgage Underwriting Tasks queue for the Underwriter to capture and initiate the valuation / technical / legal formalities. This is a manual task to be processed by the assigned user.

This task gets closed automatically when the Valuation document gets Approved / Reviewed.

An underwriter claims the application/ task when automatic assignment rules fails or disabled and performs the activity. Clicking the task navigates the user to the Collateral section of the Entity Overview.

If the status of the valuation report under the document category collateral document is Approved / Reviewed in the Product Overview --> Document Section, this task gets auto closed.

Get Score Card Values for Credit Assessment: Once the Perform Property Evaluation/Title search task gets completed,Get Score Card Values task gets triggered.The system determines the values for all the attributes mentioned in the score card for the credit assessment. This is an auto task executed by the system.

Rule: Bureau Check is completed and the Score values are stored in the database.

Once the task gets completed, the application moves to the next task Execute Score Card for Credit Assessment.

When the System is in Get Score Card Values task, the task is automatically executed and closed.

Execute Score Card for Credit Assessment: Once the Get score card values task gets completed, Execute Score Card task gets triggered.The system carries out the following function - once the values are determined for all the attributes mentioned in the score card, overall score card is executed and based on the score card rules the final score is determined. This is an auto task executed by the system.

When the System is in Execute Score Card task, the task is automatically executed and closed.

Rule: Score values are retrieved as part of the get score card task and the score values are stored against the application.

Final Score value is arrived at and stored against the Request. Once the task gets completed, the application moves to the next task Execute Decision Engine Rules.

Execute Decision Engine Rules: All the Underwriting related business rules and policies configured in the system are executed by the system and results in the final approval of the application. This task is performed by the system automatically based on the rules configured, the application gets auto approved, auto declined or sent for Manual review/Under review.

- Auto approved Cases move to the next stage Offer.

- The application gets closed for auto rejected cases.

- Deviation cases move for manual review (Review Credit Decision).

Rule: Evaluate the business policies, rules and score card values to arrive at the final decision.

Once the task gets completed, the auto approved application moves to Integration to Transact task and the deviation cases moves to the Review Decision Engine Credit Decision task - Depending on the loan amount the respective user group can view / action on the application. The rejected applications are marked completed and move out of the workflow.

Decision engine task triggers automatically when the Credit Scoring task is complete. . Decision engine’s outcome can be either Auto Approved, Auto Denied or Manual Review. When the Decision is auto-declined, the Decision status in Product Overview is marked as Rejected. Product stage moves to completed and is highlighted in Red. Based on the Decision outcome received the Decision engine task is automatically closed.

The rejected applications are marked completed and move out of the workflow.

Review Decision Engine Credit Decision: The Review Credit Decision task is created only when a manual decision is required. If the conclusion of Decision Engine is either Auto Approved or Auto Denied, the Review Credit Decision task gets closed automatically.

(By Underwriter user): If the Loan amount is < 1 million USD, then this task gets created for Mortgage Underwriter user to approver/reject. The underwriter user reviews the task which are sent for manual review and provides the decision accordingly. Underwriter claims the application/task when automatic assignment rules fails or disabled and processes the case. Clicking the task navigates the user to the Credit section under Request Overview.

Any case not processed straight through the credit rule engine, is routed to this stage for the underwriter to review the application for its merit and take decision to approve or decline accordingly.

- The decision makers at this stage have the appropriate rights.

- Approved Cases move to the next stage Offer acceptance.

- The application is marked as Completed for Rejected cases.

Task is routed to Mortgage underwriting Tasks queue, which is accessed by the Underwriter if the Loan Amount <= 1 million.

Rule: The task is created if the Product does not meet the rules for auto approval or auto decline.

Underwriter updates the final decision after the review. Once the user completes the activities, the task is marked as completed, the application moves to the next task Integration to Transact.

Review Decision Engine Credit Decision(by Mortgage Credit Approver user) : The Mortgage credit approver user reviews the application having exceptions and provide the decision accordingly. The Mortgage credit approver user claims the application/task when automatic assignment rules fails or disabled and processes the case. Clicking the task navigates the user to the Credit section under the Request Overview.

Any case not processed straight through the credit rule engine, is routed to this stage for the underwriter to review the application for its merit and take decision to approve or decline accordingly.

- The decision makers at this stage have the appropriate rights.

- Approved Cases move to the next stage Offer acceptance.

- The application is marked as Completed for Rejected cases.

- Task is routed to Mortgage Underwriting Tasks if the Loan Amount > 1 million.

Rule: This task is created if the Product does not meet the rules for auto approval or auto decline.

Credit Approver updates the final decision after the review. Once the user completes the activities, the task is marked as completed, the application moves to next task Integration to Transact.

Review Credit Decision task is created only when the decision engine outcome is Under Review stage. After the Decision is taken Review Credit Decision task, Underwriter can manually close the task. If Underwriter Approves the Review Task, the underwriter can manually close the task. If Underwriter Declines the Review Task, the underwriter can manually close the task and the Decision status in Product is automatically Rejected. Product stage moves to completed and is highlighted in Red.

Review Signed Deed

When loan processing is complete and Ops user addresses the manual task, System creates Review Signed deed task.

Review Executed Documents

When the customer accepts the offer and when the status of the offer document is not Approved, System creates and assigns a review task to OPS user. After the Ops user reviews, the user manually closes the task. If the customer rejects the offer, the Ops user withdraws the application on behalf of the customer and closes the task.

Tagging Agreement document with Arrangement Account

When a user uploads the documents in any Origination journey, documents are classified and stored as Entity level documents(with entity reference) and Product level documents(with product reference) in the respective Microservices.

When the application is submitted party related documents will be updated with Party reference and Product related documents will be updated with Facility/Product reference.

Also, when the application crosses the fulfilment stage, all the entity related documents will be updated with transact customer reference and the product related documents will be updated with the Account reference from transact.

Offer Acceptance

In case of Online Mode: Once the customer submits the offer acceptance, this task gets created. As part of the task, RM reviews the customer acceptance/rejection, signed offer letter and completes the task.

In case of Offline Mode: On completion of all the tasks in the Underwriting stage, an Offer Letter Acceptance upload task gets created.

The activities that are carried out by the RM as part of this task includes but is not limited to:

- Download/ Print Offer Letter and other relevant documents.

- Deliver all relevant documents including the Offer Letter to the end-customer and update document status to Delivered.

- Get wet signature of the customer on the Offer Letter and other required documents

- Upload signed legal and related documents to document repository

- Add narratives and update status to Offer Accepted or Offer Rejected.

The task is in the Mortgage Processing Tasks queue. Clicking the task navigates the user to the Documents section under Product Overview.

Bank user can configure if the Offer Acceptance can be done through the offline mode. If the offer mode is Offline, then a RM task is raised to handle the offer acceptance from the customer.

Rule: Offer letter generated and awaiting decision.

Integration to Transact: Once the credit decision is Approved, the system triggers an integration with the Transact for getting the New Offer created. This is an auto task executed by the system.

The system triggers the same Simulation API used in the Origination - Mortgage Composition process for the Offer Generation.

Offer Generation : Once the offer is approved by the bank, the system generates Final ESIS and the offer letter with the new facility and drawings.

- The API used to create facility offer : /holdings/creditAgreements/facilities/offers

- The Mortgage parent contract holds the term and amount of the entire mortgage, that are captured in the facility arrangement.

- The API used to create drawing offer : /holdings/loans/drawdowns/offers

- Since the customer can choose to have multiple mortgage parts, the mortgage arrangements in core banking are created depending on the number of parts selected by the customer in the mortgage composition screen.The captured mortgage parts are created as mortgage arrangements in the core banking system.

- The API used to combine payment schedules : /holdings/creditAgreements/facilities/{facilityId}/combinedSchedules

- Once the combined payment schedule API call is successful, the loan offer and ESIS basis is fetched from the transact.

The same set of Input fields is used in this simulation, the output has the simulated values and the repayment schedule from Transact for the respective drawing.

This is an illustrative repayment schedule drawn based on the standard Transact API output.

The output values is stored and shown as part of the offer letter & ESIS Document.

Rule: Credit Decision is Approved.

Once the auto task gets completed, the application moves to the next task Generate Offer Letter/ESIS.

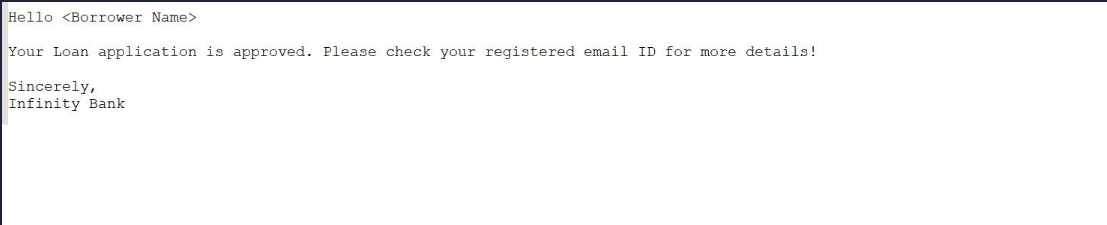

Generate Offer Letter / ESIS: The Offer Document gets generated automatically as soon as the Decision is marked Approved or Auto Approved. The Offer Letter and documents is added in the document section under the Product Overview.The System sends an email notification to the customer for Offer Approval.Once the Offer document is successfully generated and an email is sent to the customer,this task gets closed automatically.

Once the integration to transact is successful, the Generate Offer Letter task is created via Formpipe. This is an auto-task and gets completed automatically after the offer letter along with all relevant documents is generated. The Offer letter is added in the documents section under the Product Overview.

In case of Multi Part applications, when the Offer Letter and ESIS document is generated through Formpipe the system adds the New Offer & its Repayment Schedule for each Mortgage Drawing Product (Part) in the ESIS document and sends the offer letter notification to the customer.

Offer letter is automatically generated once the Decision is Approved or Auto Approved. System sends an email notification to Customer along with link to download the Offer document. The task is automatically closed after the offer letter is sent to the customer.

Rule: The application has satisfied all the business policies, rules and score card values. APIs are triggered successfully and the New Offer data is received from the Transact.

Once the task is completed, the application moves to the next task Notification to RM.

When the Core banking integration happens, System updates Collateral details in Temenos Digital assist to ASSET.REG.PROPERTY table in Transact.

| ASSET.REG.PROPERTY | |

|---|---|

|

DESCRIPTION |

PROPERTY.TYPE |

|

ASSET.TYPE |

COLLATERAL TYPE |

|

ASSET.OWNER |

Main Applicant Reference |

|

OWING.PERCENTAGE |

Default 100% |

|

PLOT.NO

|

PLOT NO |

|

SIZE

|

SIZE IN SFT |

|

COUNTRY

|

COUNTRY |

|

POSTAL.CODE |

ZIPCODE |

|

VILLAGE |

|

|

TOWN

|

CITY |

|

DISTRICT

|

STATE |

|

ADDRESS

|

ADDRESS LINE 1 |

|

ADDRESS (MULTIVALUE)

|

ADDRESS LINE 2 |

|

MARKET VALUE

|

PROPERTY VALUE |

|

COEFFICIENT

|

ADVANCE RATE |

|

ADJ.MARKET.VALUE

|

ADJUSTED COLLATERAL VALUE |

|

ASSET.CURRENCY |

Facility Currency |

When the Core banking integration happens, System updates Collateral details in Temenos Digital assist to COLLATERAL table in Transact.

|

COLLATERAL |

|

|

COLLATERAL.TYPE

|

New collateral Type

|

|

NOMINAL.VALUE

|

Updated by System

|

|

EXECUTION.VALUE

|

Updated by System

|

|

COLLATERAL.CODE

|

NEW CODE

|

|

CUSTOMER APPLICATION.ID |

Main Applicant Reference ASSET.REG.PROPERTY |

After the mortgage application is approved and offer is accepted by the customer creating contract in the core banking is the done, the below products must be considered for Transact integration.

• Mortgage Seasonal

• Mortgage Cashback

After the Core banking integration happens, System updates Collateral details in Temenos Digital assist to COLLATERAL.RIGHT table in Transact.

|

COLLATERAL.RIGHT |

|

|

COLLATERAL.CODE

|

New Code

|

|

COMPANY

|

BNK( Defaulted)

|

|

LIMIT. REFERENCE |

Facility Arrangement ID

|

|

CUSTOMER.ID

|

Main Applicant Reference

|

|

COLLATERAL.ID |

Collateral ID |

Notification to Customer/RM :Once the offer letter is generated a notification gets triggered to the respective RM and Customer. The RM/Customer can view the offer letter / download or the RM can share it with the customer if required. This is an auto task executed by the system. When the notification is sent this task gets closed automatically.

Once the notification task gets completed, the application moves to the next task Customer actions.

Notification Template for the RM:

Dear <Entity Name> (Display Entity name of RM)

Offer Letter and ESIS generated for the loan application number <>.

Regards,

Temenos Digital Bank.

Notification template for the Customer:

Dear <Customer Name>

We are pleased to offer you Mortgage Loan for <Currency> <Approved Loan Amount>. Please read the offer letter fully before you Accept or Reject the Offer. Offer is Valid till 3 months <offer valid date> from the receipt of this email.

Regards,

Temenos Digital Bank.

Automatic customer action for Offer Acceptance:

Origination: The system initiates automatic customer action when the Offer document is generated. The customer action raised is used to capture the customer consent along with the Offer document. As soon as the customer action is raised an email is sent to the customer indicating a customer action is raised.

When the customer answers the customer action the system sends a mail to the RM indicating the customer has addressed the customer action.

If the customer accepts the offer, it is mandate for the user to submit the signed offer document.

If customer rejects the offer, the system allows the user to submit the customer action.

Temenos Digital Assist: When the automatic customer action is raised it displays in the Customer action summary screen which is under Customer actions Menu available in both Request and Product Overview with status updated as Pending with Customer.

When the customer answers the customer action the status is changed to complete.

Clicking the customer action in the Summary page, the RM views a link to Product Overview page where we see the Consent provided by the customer.

Customer actions - Accept/Reject Offer,Capture Disbursement and Repayment Details(Sign/e-sign): The Customer reviews the offer details based on the notification received and takes action in the origination app.

Customer marks the status as Accepted and uploads the signed Offer letter, captures the disbursal instruction and the funding details and Submits.

If the approval conditions are not satisfied, the customer rejects the offer - Captures the Reason for rejection and Submits.

Customer submits the decision in the Origination app. Once the customer provides their decision, if the offer is accepted, the task is marked as completed and the application is moved to the next task Offer Letter Acceptance/Rejection (Review Customer Action). If the customer has rejected the offer - Offer Letter Acceptance/Disbursement task is created for RM to review the customer decision and Acceptance status in PO is marked Rejected and the Offer letter document in Uploaded document section in PO is updated as Rejected and on completion of this task, the application status is marked as completed and moved out of the workflow.

Offer Letter Acceptance/Rejection (Review Customer Action): The RM updates the status of the offer in the system if the customer directly reaches the Bank for updating their decision. This is a manual task to be processed by the respective user. This task is created for both Online and offline Mode.

In case of Online mode: When the customer accepts the offer, the acceptance status is shown as Accepted. If the customer rejects the offer the acceptance status is shown as Rejected. If accepted, signed offer letter uploaded by customer is shown under PO > Documents > Uploaded Documents and RM to update the status of Offer Letter document as Signed, If rejected, RM should upload the Offer letter and update the status as Rejected.

In case of Offline mode: When the customer accepts the offer, RM updates acceptance status as Accepted. If the customer rejects the offer RM updates the acceptance status as Rejected. If accepted, RM upload the signed offer letter under PO > Documents > Uploaded Documents and RM to update the status of Offer Letter document as Signed, If rejected, RM should upload the Offer letter and update the status as Rejected.

Once above steps are done, on completion of this task, if Offer accepted, next task gets created as configured in the workflow. If Offer rejected, application status is updated as complete.

Reject the offer: When the RM closes the task as completed and the offer letter is still in the rejected status the system declines the loan process and the loan stands cancelled. The acceptance status is updated as rejected in Rejected for Facility in the Product Overview.

- The system cancels the offer facility and offer drawing by calling renegotiate API with

- FACILITY-CANCEL.OFFER-ARRANGEMENT

- LENDING-CANCEL.OFFER-ARRANGEMENT

- API for Facility cancellation : /holdings/creditAgreements/facilities/offers/cancellations/{arrangementId}

- API for Drawing cancellation : /holdings/creditAgreements/drawdowns/offers/cancellations

If the customer rejects the offer,a manual task is created for the RM by negotiating the loan amount,tenure and facility drawings with the customer.

Customer rejects the Offer Letter / Final ESIS asking for higher or lower loan amount, lower interest rate or reduction of fees / charges: In this case the system,

- Creates an Offer Letter Acceptance / Rejection task for the RM.

- Revises the loan amount and/or interest rate in the Assist.

- Reduces the fees/charges in the Transact through offer amendment.

- Re-trigger the simulation with the revised loan attributes.

- Resend the Offer Letter & Final ESIS documents to the primary applicant and co-applicants (if any).

- Retrigger an automatic mandatory customer action with the latest Offer Letter & Final ESIS documents.

Customer neither accepts nor rejects the Offer Letter and Final ESIS documents and validity period expires:In this case the system,

- Sends a notification to the RM stating the validity period of the Offer Letter and Final ESIS documents has expired.

- Creates a Review Offer Acceptance / Rejection task for the RM to check with the customer regarding the decision and do the following:

- If the customer requests for more time to decide, the RM retriggers simulation.

- The system closes the open customer action (with the expired Offer Letter & Final ESIS) as Expired before retriggering a new automatic mandatory customer action with the latest Offer Letter and Final ESIS documents for the primary applicant to accept / reject the bank’s offer.

Customer actions: All scenarios where customer action is triggered to capture AIP / Offer Letter acceptance / rejection from the customer

When the customer rejects an AIP / Offer Letter, the system displays a Reason for Rejection field with the following dropdowns,

- Higher Loan Amount

- Lower Interest Rate

- Reduced Fees/Charges

This field value is stored in the ODMS and copied to OPMS as part of copyToOPMS service at the time of application submission.

Reason for Rejection - visibility in Assist app: If the customer rejects an AIP / Offer Letter through the Customer Action in the Origination, the reason for rejection is captured and displayed in the Product Overview section of the Assist app in the AIP Rejection Reason (if AIP was rejected) and Offer Rejection Reason (if Offer was rejected) fields. Both the fields are non-editable in the Assist app but can be edited only if the customer chooses the offline mode for offer acceptance / rejection.

Reason for Rejection - editability in Assist app: If the customer chooses the offline mode for offer acceptance / rejection, the RM enters the reason for rejecting the bank’s offer on behalf of the customer.The Offer Rejection Reason field displays the below dropdowns.

- Higher Loan Amount

- Lower Interest Rate

- Reduced Fees/Charges

The Offer Rejection Reason field is editable only in the Offer Acceptance stage of the Mortgage/Remortgage application and is non-editable at all other times.

Automatic customer action for Disbursement and Repayment Instructions:

Origination: The system initiates Automatic customer action when the Offer is accepted by the customer. The customer action raised is used to capture the Funding and repayment. As soon as the customer action is raised an email is sent to the customer indicating a customer action is raised.

When the customer answers the customer action the system sends a mail to the RM indicating the customer has addressed the customer action.

- If the customer accepts the offer, it is mandate for the user to submit the signed offer document.

- If the customer rejects the offer, the system allows the user to submit the customer action.

Temenos Digital Assist: When the automatic customer action is raised it displays in the Customer action summary screen which is under Customer actions Menu available in Request and Product Overview with status updated as Pending with Customer.

When the customer answers the customer action, the status gets changed to complete.

When Clicked customer action in the Summary page, the RM can view a link to the Product Overview page which displays the Funding details provided by the customer.