Working with Trade Creation

This section details the methods for trade creation in Temenos Transact.

Creating a Trade using SEC.TRADE

The basic SEC.TRADE transaction enables direct input to the system by the dealers who supply the key elements of the deal. The SEC.TRADE records both the buy and sell details of a transaction as well as allows more than one broker or counterpart and customer. Therefore, it is possible to perform multiple trade permutations as illustrated in the below table.

| Security Transaction Type | CUSTOMER.SECURITY Type |

|---|---|

|

Buy or sell |

For own account |

|

Buy or sell |

For customer account |

|

Buy or sell |

For own account |

The example above is known as a bulk security trade as it comprises many individual trades using just a single transaction, which may involve numerous screens of input.

This facility allows the input of multiple purchases and sales on the same transaction and is particularly useful within a portfolio management operation, where a single purchase from or sale to a broker can contain an almost unlimited number of opposite customer sales or purchases. As Temenos Transact generates the accounting entries online, it facilitates the processing of large security transactions containing multiple transactions as a background process, thereby freeing up the terminal for other tasks.

Also, it is possible for the system to accept a basic transaction with a minimum input of ten items (post validation). For example, a basic transaction to record a purchase or sale of a security may require only the following information entered at the deal input stage. The basic fields to commit a trade are:

- Security

- Depository

- Customer

- Sell / Buy

- Nominal / Amount

- Price

- Broker

- Sell / Buy

- Nominal / Amount

- Price

It is also possible to have the trade price defaulted to the latest price held on the SECURITY.MASTER application. In common with other Temenos Transact business applications and indeed most of the securities application transactions, the usage of a special version enables the setting-up of user defined input screens. If the user knows that a field might receive a default, this field can be omitted from the display. Equally, other version records may be defined for transactions using brokers and customers with whom the user entity deals frequently. In the latter instance, these defaults are supplied by the version itself.

To ensure that Temenos Transact is able to provide as many accurate defaults as possible, it is in turn necessary to ensure that all the underlying information held in master files and other tables are kept complete and up-to-date as possible. For example, a portfolio customer may require that they finance their purchases out of one particular account, whereas the proceeds of any sales are credited to another. The capability for recording this sort of information exists in many different files within the Securities module and in some cases general files (those shared by other Temenos Transact modules).

The structure of the SEC.TRADE ID consists the following:

| ID component | Description |

|---|---|

| SCTRSC | Identifies the transaction as a SEC.TRADE |

| yy | Indicates the year that the transaction is being entered, that is, 04 indicates year 2004 |

| ddd | Indicates the Julian day that the transaction is being entered, that is, the number of days since the beginning of the year, so 2, January is represented as 002. |

| nnnnn | Indicates the transaction sequence number |

A common array of lead prefix (0-9, A-Z) excluding vowels are built-up. These lead prefix values are based on the session number depending upon the session number in the sequencing are shown below, where the bold letters indicates the lead prefix. Example - SCTRSC00335B0003.The initial details necessary to the record the security being transacted is shown in the below screen shot.

The no-input fields can indicate the choice the user made in an earlier field or display the defaulted or no-change system calculated amounts and so on. For example, the Security Ccy and Price Type fields are obtained from the SECURITY.MASTER application appertaining to the security that the user enters in the Security Code field. These assist the user during the completion of the remainder of the transaction and are an aid to ensure that the user has selected the correct security. The above example uses a Bond type Security, which happens to be non-interest bearing. However, had the transaction been an interest bearing security then the details such as Interest Rate and Interest Days must have indicated that the current interest rate and the number of days are elapsed as the last coupon date and the value date of the trade respectively. For share type transactions, interest is non-applicable.

Most of the information can be made to default although the user can always overtype an alternative permissible value. For example, the depository is defaulted from the underlying SECURITY.MASTER record, provided it is recorded within the Default Depository field in that application. This field allows input and the user can select a different depository if it is found necessary. This particular field advises Temenos Transact as to where theto where the bank requires the securities are to be delivered to or from where they are to be fetched.

The user cannot combine different depositories on the same transaction in respect of securities being delivered into or withdrawn from control by the organization. After advising Temenos Transact that the security is being transacted (mentioning the trade, value dates and depository) the user has to describe the customers’ details. In case, of a bulk security trade, it contains more than a single customer.

Updating the Customer Details

The fields related to customer information are described below:

| Field | Description |

|---|---|

| Customer No | Allows only those customers setup as customers in the CUSTOMER.SECURITY application |

| Cust Trans Code | Helps the user to tell Temenos Transact if the customer is

buying or selling the security, by entering the particular SC.TRANS.NAME applicable to buy or sell. If the

user is not sure of the value, he can drill down to the SC.TRANS.NAME application to obtain the required

transaction code.

Then, the customer’s portfolio is updated. Temenos Transact always defaults to the first portfolio belonging to the customer. For example, a customer (1250) owning 1250-1 and 1250-75 portfolios always has the securities defaulted to portfolio 1250-1. If the user requires the securities held in or withdrawn from the other portfolio, it must be entered manually always. |

| Cu Account No | Specifies the identification of the customer’s financial account to be used to either obtain or pay the funds required. This field can be the subject of a very elaborate defaulting process (Read Portfolio Valuation for more information). The defaults are already setup and the user has to enter the <CR> key to view them if the user prefers to enter an alternative account that does not belong to that customer. For example , a customer is allowed to pay for securities using any preferred currency, so that the user can enter any financial account if it is pre-defined in the SEC.ACC.MASTER application. Temenos Transact uses the current forex rates to arrive at the amount of currency required but the user is able to type in own specified conversion rate, if required. The definition of an account not belonging to the portfolio customer causes an override during the opening or changing of a portfolio record. Also, when a particular transaction is designated to use another customer's account, any occurrence of that transaction also raises an override. |

| Cust Nominal | Indicates the number of share-type or quantity of nominal bond-type security the customer is buying or selling. Once the user enters the amount in this field, it is immediately validated to ensure that it complies with the trading units recorded in the underlying SECURITY.MASTER application’s Trading Units field. Therefore, the user must ensure that this amount is divisible by the trading unit and that it is equal to or greater than the trading unit. In case of unit trust and fund type securities, which can be traded in fractions, the Trading Units field must be set to zero to enable the user to process these particular types. |

| Cust Price | Specifies the the buy or sell price, that is, the price at which the trade is transacted. However there may be instances, especially when entering a large number of customer transactions (as in a bulk SEC.TRADE) when the user may utilise a price defaulting procedure. |

| Customer Total Nominal, Cu Gross Am Sec, Customer Gross Amount | Indicates the total number of the security and the value of the transaction (before addition of other items such as tax, charges and interest) in both security and trade (settlement) currency. As the user progresses through the transaction and if the user validates the record, Temenos Transact automatically calculates various information. For example, post input of the price relative to the trade, the next three fields Customer Total Nominal, Cu Gross Am Sec, Customer Gross Amount Trade are populated depending upon the amount of the security traded and the price . As both the nominal and price fields are sub-values, the user can enter tranches of purchases or sales for the same customer portfolio. |

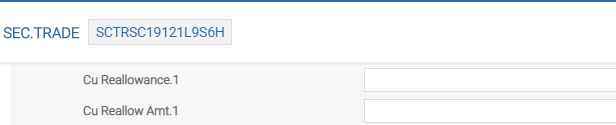

Specifying Reallowance Rate

The Cu Reallowance field is used to specify the reallowance rate allowable against the price paid. Since this is a rate field, an entry is applicable for bond type instruments where the reallowance is calculated as a percentage of the nominal amount.Therefore, if the user prefers to grant a re-allowance with respect to a share-based transaction, the user may enter the re-allowance amount directly into the Cu Reallow Amt field immediately.

The Cu Reallowance field is special field that allows the user to enter the rate together with a leading - (minus) sign. Omitting the minus sign indicates that the user is granting an allowance, therefore, reducing the amount that the customer has to pay for his securities. If the user does not enter the minus sign, Temenos Transact adds the calculated re-allowance to the amount that the customer has to pay.

The entry of a rate in the Cu Reallowance field causes the system to calculate the re-allowance amount automatically. This is displayed in the Cu Reallow Amt field. If the user does not require a re-allowance amount, there is no defaulting and so the user must continue to the Customer Interest Amount field.

Defining Customer Interest amount

This field displays a value only if the underlying security is an interest-bearing instrument. In this case, validating the record causes Temenos Transact to default the transaction interest based on the number of days from the last coupon date to the actual value date of the transaction. The number of days that the system uses can be seen by reference to the Interest Days field at the beginning of the transaction.

The components of any interest calculations are all obtained from the underlying SECURITY.MASTER record. However, the user must be aware that Temenos Transact allows to over type the values in both the Interest Days and Customer Interest Amount fields with user preferred values. Transaction is affected only by any manual intervention.

For a change to the calculated amounts on a transaction affecting the organisation’s own portfolio, Temenos Transact recovers the differences during the COB batch run to ensure that the data held in respect of portfolio Profit and loss (P/L) is consistent with the details recorded in the SECURITY.MASTER along with any static data. The purpose of allowing these changes is to enable successful input of any non-standard security trades, which the user may encounter from time-to-time. Any changes made is followed through the system delivery advices. Therefore, it is important to be careful while using this facility.

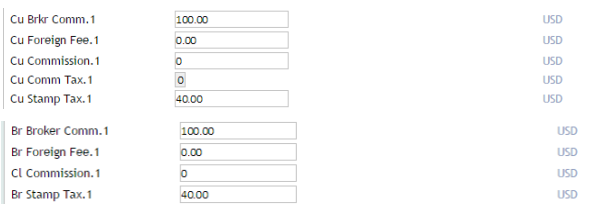

Defining Customer Fees and Charges

Other fields of the SEC.TRADE such as Fees, Commission and Stamp Tax can be made to address other Temenos Transact files to obtain the relevant amounts.

Refer to the online help text in respect of each field for precise details as Temenos Transact provides a flexible means to practically capture every charge that the user encounters day-to-day.

In an unlikely event, where the user cannot effect a successful default for the type of charge required, the user can use the Customer Miscellaneous Fees field to record any ad hoc fees to be added to the transaction (enter the required amount). To cover every possibility, this field supports both positive and negative input. However, at the same time the user must be aware that Temenos Transact allows overtyping a defaulted amount with either a different value or zero if the user does not require any of these amounts to be charged to the customer.

In those cases where the customer in the transaction is an internal portfolio belonging to the Temenos Transact user organisation itself, the system is aware that charges must not be made. Apart from the above named commission and fee fields, system can be parameterised to charge any number of different fees and taxes. Read Multiple Charges on Trades and Transfers for more information.

The system allows different commission to be applied based on the channel (for example, lower fee for online transactions when compared to transactions through the Relationship Manager) through which the customer placed the order. The channel is identified based on the Txn Channel field. SCTR.GROUP.CONDITION allows to setup different charges for the various products based on the channel.

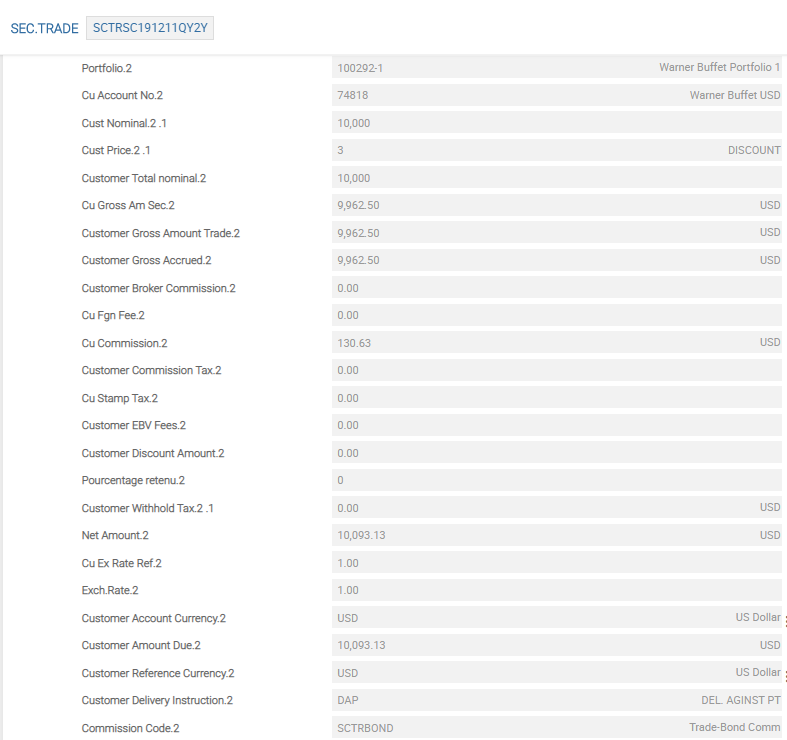

After providing the details of the first customer, the user can input details for the second customer. The following screenshot displays the second customer portion of the SEC.TRADE record, when completed.

Once all customer details of the transaction are input, the user has to provide the broker details by completing the details in the Broker No and subsequent fields.

Trading from Customer to Customer and Customer to Own Book Portfolios

If the organization trades off its own portfolios directly to customers, then the user must expand the customer side so that a second set (or more if necessary) of customer fields are given. It is not necessary to provide any broker details. The same applies when a sale has been arranged from one customer to another. If two or more customer nominal fields in conjunction with their relative transaction type values net out to be zero, the user can effect successful input of the transaction to the system.

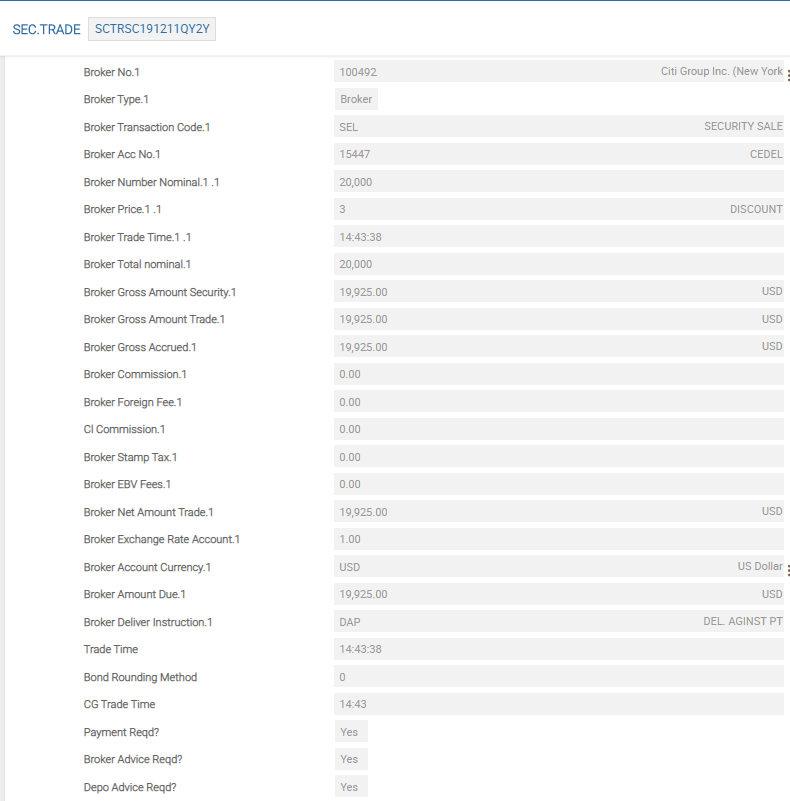

However, if the user has arranged to make a purchase or sale of the securities on behalf of the customer(s) and/or the organisations’ own portfolios through either a counterpart or counterparts, broker or brokers, the user has to complete the Broker No field and most of those following fields. The following screenshot displays the broker portion of the SEC.TRADE when completed.

Defining Broker Details

The following portion of the user guide uses the term broker, to include both broker and counterpart in the role as specified in the relative record in CUSTOMER.SECURITY.

Unlike the customer side of the transaction, the broker details other than the commissions, taxes and charges are not amended. It is not possible to carry out certain amendments as shown below in the SEC.TRADE application:

- Amendment of total customer nominal, which would require an increase in broker side nominal

- Change of broker on the trade

- Change of nominal split between brokers in a multiple broker trade

- Change of broker price

The original trade must be reversed and a new transaction to handle the amendments is required. The differences between the transactions could occur in case of an exchange rate change, as it is not possible to enter the exchange rate between the security currency and base currency in a trade. This is achieved by a contra transaction and the Contra By Ref and To Contra Ref fields in the SEC.TRADE application. With these fields, Temenos Transact supports entry of contra transactions by using the versions. Versions and version routines can be used to populate the transaction details of the original transaction on the contra transaction and other related functionality as required. These version details are not part of the release, but example versions are available through the Data Library, which can be downloaded and configured onsite. The below table illustrates ad hoc fields that are relative to the trade.

|

Field |

Description |

|---|---|

| To Contra Ref | Specifies whether the trade entered is contra to an existing transaction and the transaction reference of the original trade. |

| Contra By Ref | Specifies the transaction reference of the contra trade on the original transaction. |

| Exch Rate Sec | In a contra transaction, this is an input field and the user can amend the default rate to a rate applicable to the original transaction. |

The Cum Ex Ind field is used to specify the price conditions applicable to the transaction. If the Price Qual Format field in the SM.PARAMETER application is set to SWIFT, input is validated against the Cum Indicate and Ex Indicate fields in SM.PARAMETER. If not, input is only validated against the DE.TRANSLATION application. Any values entered in the Cum Ex Ind fields in the SC.EXE.SEC.ORDERS application are carried forward, but the user can make amendments at this stage. If the Price Qual Format field in SM.PARAMETER is set to SWIFT, the values entered in the Cum Ex Ind field affect the holding balance for a corporate event. This is dependent on the parameter set up within corporate actions.

The Suppress Misc Susp field can be set to either Yes or No. This allows input only if the Hold Cash? field is set to Yes, that is, for actual settlement. This field indicates whether the miscellaneous entries like tax, P/L and so on.. are raised from SEC.TRADE and must be posted to miscellaneous suspense category defined in the Misc Cash Susp field for the actual settlement or must be raised directly. If this field is set, these entries are raised directly from the transaction instead of being raised in settlement of the transaction. This allows immediate recognition of P/L and taxes.

There are certain fields that are used in SWIFT MT540 to MT543 settlement instruction messages. These fields are explained below:

|

Field |

Description |

|---|---|

| Stamp Indicator | Defaults from SC.SETT.INSTRUCT based on the transaction code of broker, but can be manually overridden. The value must be in AAAA/BBBB or BBBB format. The value is mapped to 22F Tag and the Stamp Duty indicator in sequence E of MT54X(X = 0 to 3). This is a free format field and validation is not done. |

| Sparty Narr Qual | Qualifier pertaining to narrative in 70a Tag of SETPRTY block in MT540 to MT543. |

| Sprty Narrative | This free format narrative is mapped to 70a Tag of SETPRTY block in MT540 to MT543. If narrative is entered with DECL qualifier, it is mapped to 70E Tag in SETPRTY block. If narrative is entered with PART or REGI qualifier, it is mapped to 70D Tag in SETPRTY block. If narrative is entered with PACO qualifier, it is mapped to 70C Tag in SETPRTY block. |

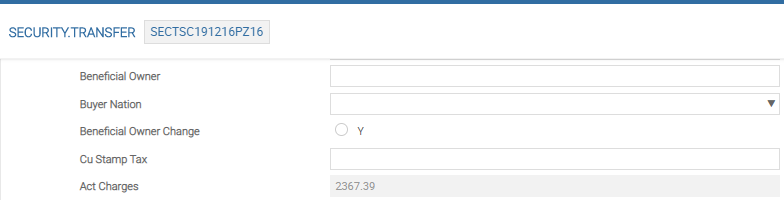

| Bene Owner | The user can enter a beneficial owner and this is mapped to 22F Tag qualifier BENE in SETDET block. The value must be entered as per SWIFT guidelines. |

| Buyr Nation | The user can enter a valid country code of the buyer and this is mapped to 95C tag in the qualifier INVE of OTHRPRTY block. |

Accounting entries are raised in the transaction company for all the charges, commissions and taxes on the customer and broker side at the time of trade.

When trades and transactions take place in a centralised HUB (Port Company Id field in the SEC.ACC.MASTER application) which is different from the portfolio's own company (Own Company Id in SEC.ACC.MASTER application), the Interco Parameter fields determines where the accounting and P&L entries must be raised. Based on this set-up, the customer side P&L and taxes are directly booked in the company of the account from which such charges are taken and the broker side P & L and taxes are re-invoiced to the portfolio's own company through inter-company accounting.

When there are multiple customers in a trade belonging to different companies, the entries mentioned are posted to respective companies in a pro-rata basis.

Calculating Stamp Tax on Security Trade

Stamp tax can be automatically calculated based on settings in SC.TAX.PARAMETER. It can be based on different parameters like stock exchange (for example, if stamp tax is applicable only on trades in specific exchanges, the same can be configured using SC.TAX.PARAMETER), security domicile, security type and transaction.

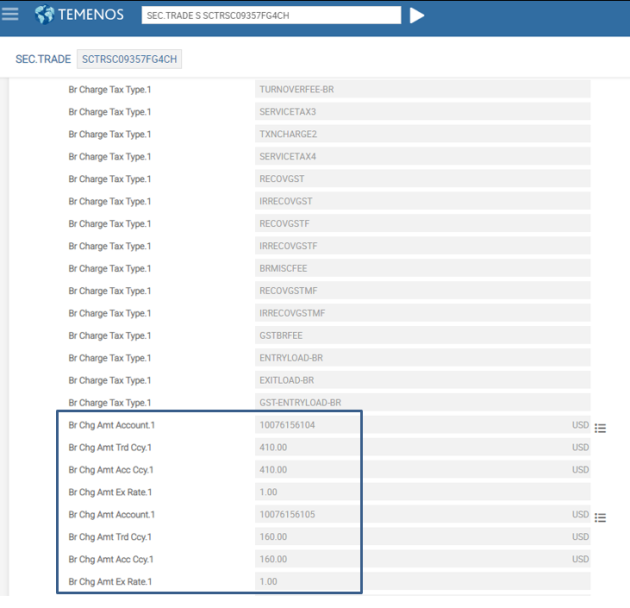

Posting Direct Charges to Broker

Certain charges can be paid directly to the broker instead of paying via the custodian. The broker has to be flagged in CUSTOMER.SECURITY to receive charges directly. The charges and the accounts where they need to be paid are parameterized in SC.SETT.INSTRUCT application. In such cases, the trade consideration is split into the amount due directly to the broker and amount to be paid to or received from the custodian. The instruction sent to the custodian from the trade carries only the amount to be paid or received from the custodian.

Different charges can be posted to different accounts of the broker.

Accounting entries are raised to credit the broker’s account or accounts with the direct charges. The amount due from or to the custodian is handled as usual based on whether settlement is contractual or actual.

Specifying Transfer Agency Account Details

In SC.SETT.INSTRUCT, the default beneficiary and beneficiary account details (Beneficiary Bank and Beneficiary Account) are specified. These fields in SEC.TRADE are used as payment instructions for making payment to the fund house or transfer agency.

The details can be specified for:

- Group of funds (prefixed with ‘S-‘ for sub-asset type and ‘A-‘ for asset type)

- A specific fund (

SECURITY.MASTERID) or - All funds

The defaults can be specified by currency in which the fund is denominated.

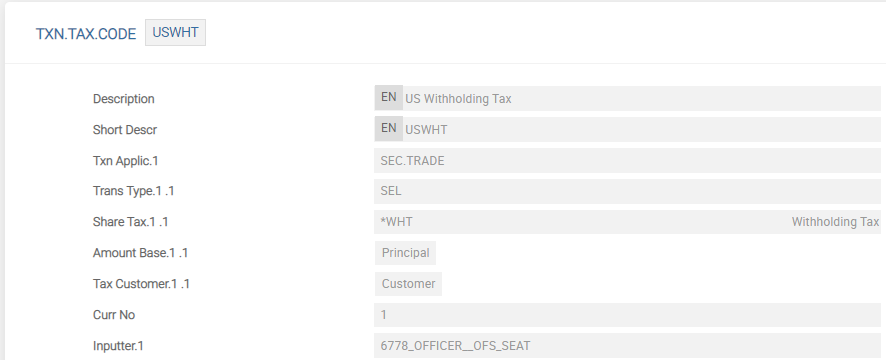

Defining WHT on Sales

It is also possible to define a withholding tax (WHT) on security sales using SEC.TRADE. The tax to be applied is based on the conditions in the TXN.TAX.CODE record linked to the SECURITY.MASTER for this purpose.

If the TXN.TAX.CODE record US (as shown in the above screenshot) is specified in the Txn Tax Code field in SECURITY.MASTER, WHT is computed for trades involving the security based on the conditions specified here. This table allows a separate TAX or TAX.TYPE.CONDITION record to be defined for shares and bonds and the base amount must be used for computation of tax which can be the principal or both (principal + accrued interest). The following fields are also related to withholding tax.

| Field | Description |

|---|---|

| Cu Wht Perc | Signifies the tax rate applicable as defaulted from the tax rate in the TAX application. The tax rate in the Cu Wht Perc field defaults from the TAX.TYPE.CONDITION application. |

| Customer Withhold Tax | Indicates the amount after computing the tax value based on the tax rate in the Cu Wht Perc field and the amount. The net amount trade is computed after deducting the WHT, if any. |

| Wht Tax Code | The Wht Tax Code defaults from the Share Tax or Bond Tax field from TXN.TAX.CODE, if the security code is share or bond, respectively. |

| Cu Wht Perc, Cu Wht Tax and Wht Tax Code | The fields in ORDER.BY.CUST, SEC.OPEN.ORDER, SC.EXE.SEC.ORDERS and SEC.TRADE indicate the amount of taxation in trade currency. A linked tax is applied on this amount. |

| Cu Net Am Trd | The deduction amount is included in the amount defined in this field in each of these applications. |

| Cu Gross Am Trd or Cu Gross Accr | The value is used as the base amount depending on the accrued interest. This is indicated in the Amt Base field in TXN.TAX.CODE. |

APPL.GEN.CONDITION to Set Contract Groups

The TAX.TYPE.CONDITION application can be set based on customer groups as well.

The customers can be grouped into contract groups based on the APPL.GEN.CONDITION with respect to the standard selection of fields. Contract groups can be defined based on the fields in SECUIRTY.MASTER, ENTITLEMENT, DIARY, SEC.TRADE and SECURITY.TRANSFER. Tax derived from the TAX.TYPE.CONDITION is based on the combination of parameters set in TAX.GEN.CONDITION and respective customer group set in APPL.GEN.CONDITION.

Storing Exchange Rate for Cross Currency Accounts

There are two fields namely Cu Ex Rate Ref and Cu Ex Rate Acc , which stores the exchange rates. The former defaults the exchange rate between the system base currency and the customer’s portfolio reference currency. The latter defaults the exchange rate between the security trade currency and the customer’s financial account that is being used to settle the transaction. These rates are obtained from the CURRENCY application and are based on the latest rates entered.

If the organisation frequently has to process bulk security transactions, the user may wish to take advantage of the facility, which enables the user to enter a single bulk forex (FX) rate as obtained from the dealers based on the total FX requirement for each currency. This facility is offered as an alternative for having Temenos Transact default individual FX rates for each customer, as currently stored in the currency rates. If the user wishes to utilise the totaling of each currency, the user is not able to enter any individual exchange rates in the Cu Ex Rate Acc field as this is protected from the user input. Instead, the user has to supply any required FX rates through the Consolidate Rate fields.

Read about SC.STD.SEC.TRADE application for more information of this facility.

As the trade components relative to the customer side of SEC.TRADE are supplied,the total contract value amount must be displayed in the Customer Amount Due field - a system generated no-input field. This amount always displays the actual amount to be debited or credited to the customer’s financial account.

If the user has elected to use the consolidated FX rate facility, Customer Amount Due field remains empty until the user has supplied the required FX rate in the Consolidate Rate field.

The customer fields that follow the trade component amount fields deals with how Temenos Transact handles the actual delivery. This includes the building of the SEC.DEL.CONTROL records, advices and if available on the particular system, the generation of SWIFT and other automated messaging facilities.

To round off the customer side of the SEC.TRADE, Temenos Transact displays the identification of the particular commission type that is used to compute the charge made in the Cu Commission field, if applicable. This is further complemented by adding the specific charge details displayed in the Comm Code and Comm % fields relative to FT.COMMISSION.TYPE record used and the particular charge group to which the customer is allocated so that the user can validate if he wishes to enter a different charge altogether.

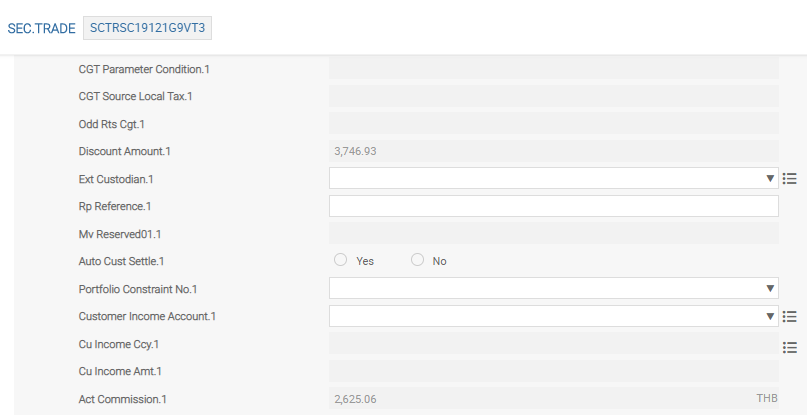

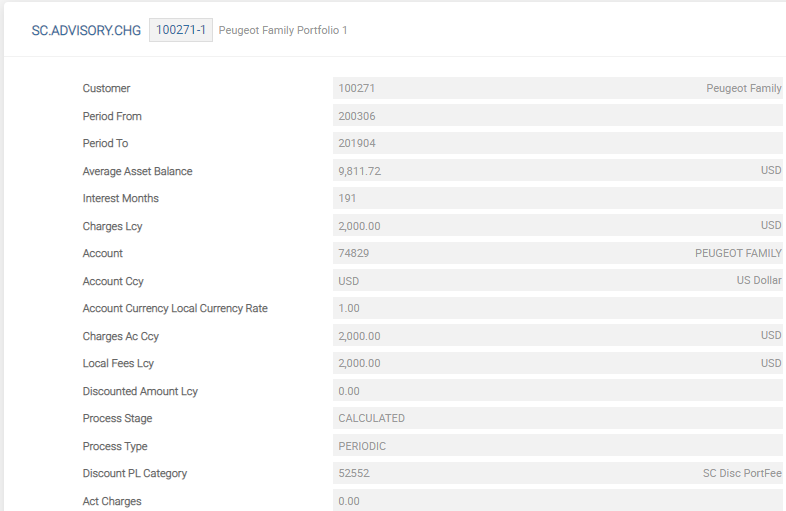

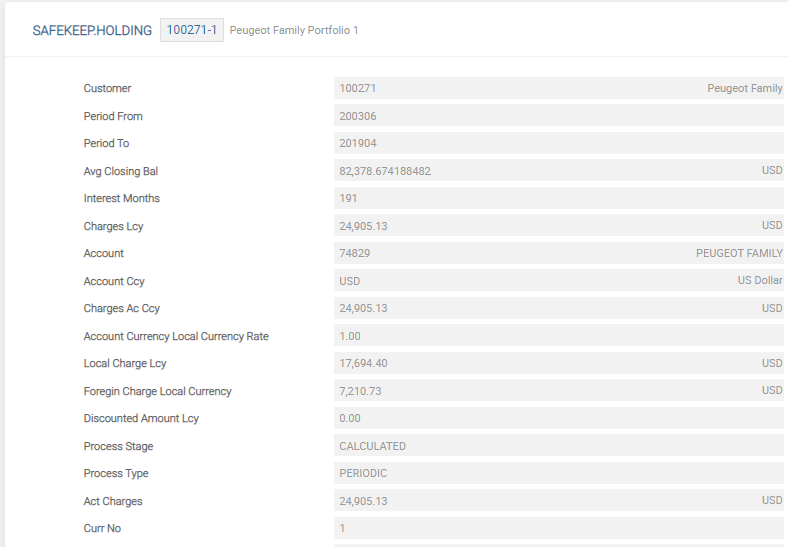

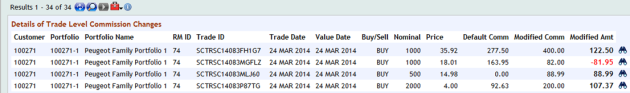

Tracking of Changed Commission and Reports

SEC.TRADE holds the details of actual commission applicable if the Relationship Manager (RM) changes the default commission. The system produces the reports of commission changed or waived by the RM. Similar tracking is also available for transfer charges, safekeeping and advisory fees.

The user can view the list of trades for which the actual customer commissions are different from the commissions actually paid by the customer.

The user can view the list of transfer transactions for which actual transaction charges are different from the actual charges paid by the customer.

Calculating Channel Fees

While calculating the commission, the system checks SCTR.GROUP.CONDITION for any specific commission defined for the channel and calculates the commission accordingly.

The priority order based on the charges to be applied based on Security Type definition is shown below:

| No | Security Type | Example |

|---|---|---|

| 1 | Security.Master*Stock exchange country*Channel (fee for a specific instrument traded in a specific country’s exchange through a specific channel) |

100040-000*US*RM |

| 2 | Security.Master*Stock exchange country (fee for a specific instrument traded in a specific country’s exchange) |

100040-000*US |

| 3 | Security.Master**Channel (fee for a specific instrument traded through a specific channel) |

100040-000**RM |

| 4 | Security.Master (any trade in a given instrument) |

100040-000 |

| 5 | Sub Asset Type*Stock exchange country*Channel (fee for a specific product group traded in a specific country’s exchange through a specific channel) | S-302*US*RM |

| 6 | Sub Asset Type*Stock exchange country (fee for a specific product group traded in a specific country’s exchange) | S-302*US |

| 7 | Sub Asset Type**Channel (fee for a specific product group traded through a specific channel) | S-302**RM |

| 8 | Sub Asset type (any trade in a given product group) | S-302 |

| 9 | Asset Type*Stock exchange country*Channel (fee for a specific product class traded in a specific country’s exchange through a specific channel) | A-30*US*RM |

| 10 | Asset Type*Stock exchange country (fee for a specific product class traded in a specific country’s exchange) | A-30*US |

| 11 | Asset Type**Channel (fee for a specific product class traded through a specific channel) | A-30**RM |

| 12 | Asset type (any trade in a given product class) | A-30 |

| 13 | ALL*Stock exchange country*Channel (fee for other product classes traded in a specific country’s exchange through a specific channel) | ALL*US*RM |

| 14 | ALL*Stock exchange country (fee for other product classes traded in a specific country’s exchange) | ALL*US |

| 15 | ALL**Channel (fee for other product classes traded through a specific channel) | ALL**RM |

| 16 | ALL (any trade in other products) | ALL |

Setting Default Values for Depository and CU Depository

The defaulting of Depository and Cu Depository uses the following sequence:

SEC.ACC.MASTER- Defaults a value based on the selection criteria defined the fields from Default Depository to Application Value fields.CUSTOMER.SECURITY- Defaults the value in Default Depository field.SC.CU.DEPO.DEFAULT- Enables the depository default at customer or portfolio or stock exchange level

The various options available in sequence are:

- COMPANY*PORTFOLIO*STOCK EXCHANGE

- COMPANY*CUSTOMER*STOCK EXCHANGE

- COMPANY*PORTFOLIO

- COMPANY*CUSTOMER

- COMPANY**STOCK.EXCHANGE

- COMPANY

SECURITY.POSITION- Defaults the Default Depository from the existingSECURITY.POSITION(if exists), if no default value is obtained from the above applications.SECURITY.MASTER- Defaults the value in Default Depository field.

Applying Trade Consideration Rounding

In the SEC.TRADE and SECURITY.TRANSFER applications, it is possible to apply a special rounding and truncate the trade consideration. The Customer Gross Amount Trade and Broker Gross Amount Security fields in the SEC.TRADE and the Gross Amount Security Currency field in SECURITY.TRANSFER application reflects this truncated amount.

To enable this functionality the following set-up is done.

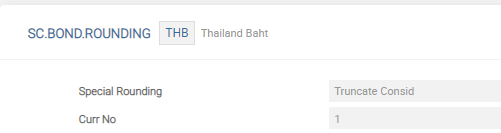

SC.BOND.ROUNDING

A suitable table is created which is then linked to the SECURITY.MASTER record. This record ID can be inputted in three formats: SECURITY, SUB.ASSET.TYPE or by CCY. When the SECURITY.MASTER record is flagged for bond rounding, the system automatically chooses the nearest record ID and applies to that table.

It is still possible to create the table to handle both consideration rounding and trade Interest rounding, if required.

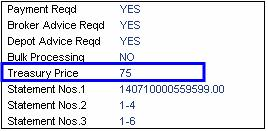

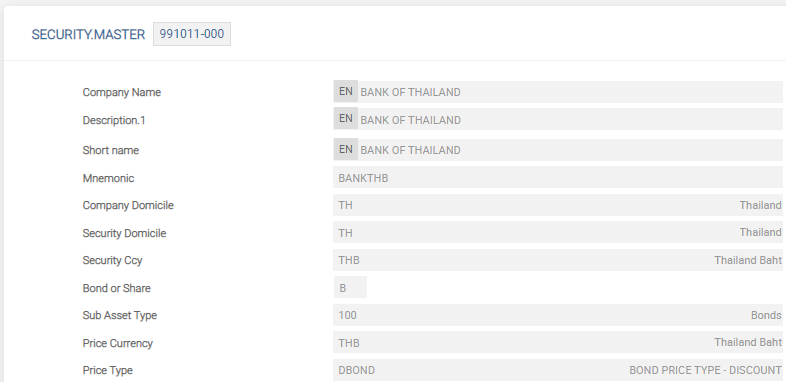

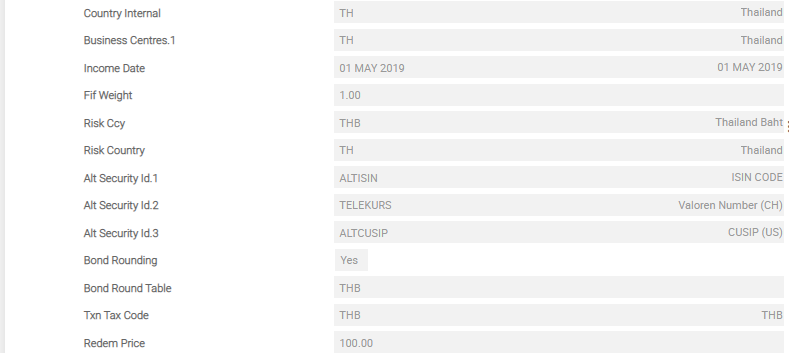

SECURITY.MASTER

Once the SC.BOND.ROUNDING is created, it must be linked to the SECURITY.MASTER record (as shown in the below screen shot) by setting the Bond Rounding field to Yes, then the system applies the nearest match.

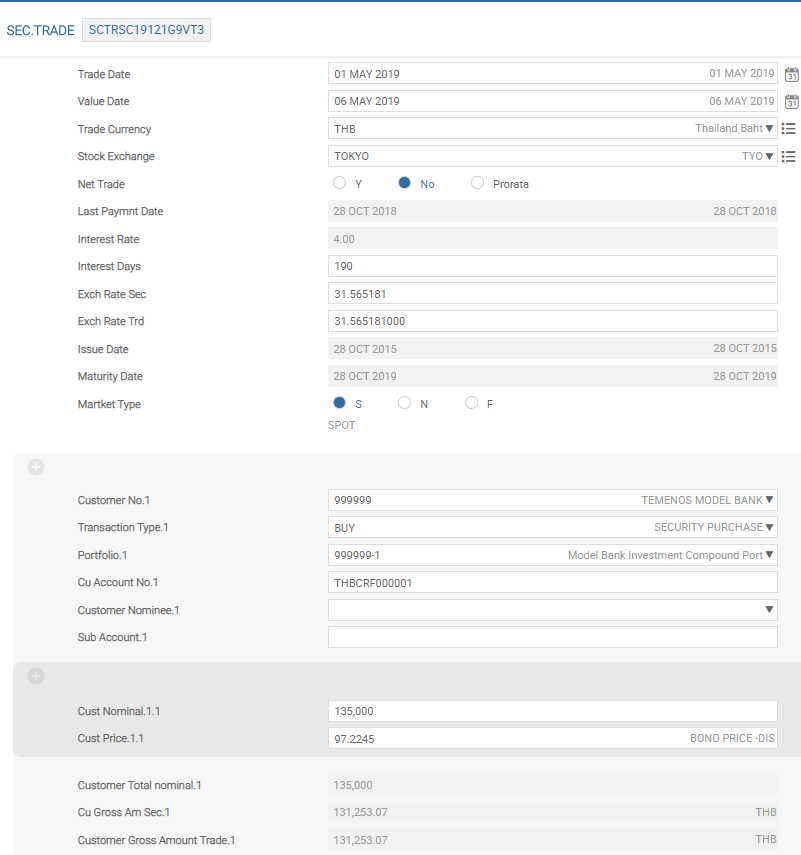

SEC.TRADE

Once the above records are established the consideration rounding is applied to SEC.TRADE transactions for purchase and sales.

In the below example, the Customer Gross Amount Security field and its value is truncated to 131,253.07. The value is rounded as 131,253.08, that is, 135,000 * 97.2245% = 131,253.075.

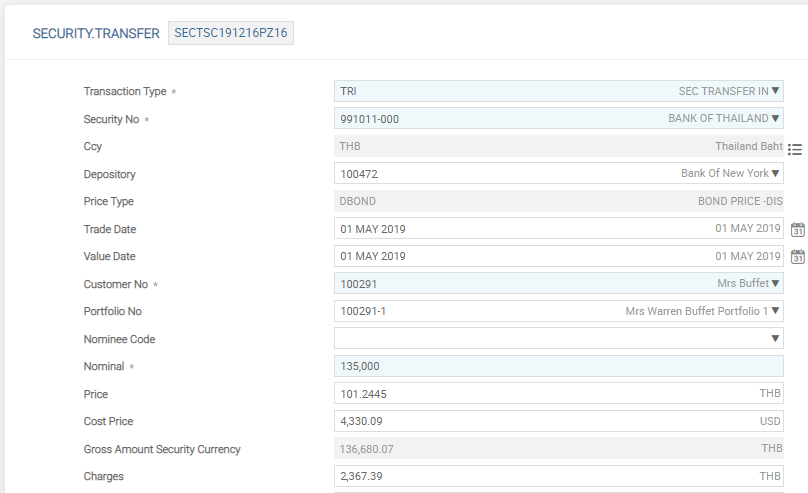

SECURITY.TRANSFER

The same rounding is applicable to the SECURITY.TRANSFER transactions for purchase and sales.

In the below example, the Gross Amount Security Currency field and its value has been truncated to 136,680.07. Without this functionality, the value is rounded as 136,680.08, that is, 135,000 * 101.2445% = 136,680.075.

The Chf Rounding field in SC.PARAMETER application controls the CHF rounding. This field must be populated prior to commencement of transaction input after the upgrade is taken. If CHF rounding is required, set the field to Yes, else set it to No. Null indicates as YES.

This functionality enables the correct posting of amount over customer and nostro accounts (STMT.ENTRY records), where CHF currency rounding is required and the Temenos Transact user entity was both non-CH resident and local currency was not CHF.

Calculating Broker Charges

The Charge Calc Method field in the SC.EXE.SEC.ORDERS application indicates how broker charges are calculated when the SEC.TRADE record is created. This field is available for input only if the SC.EXE.SEC.ORDERS is set to calculate charges, taxes and commissions when the SEC.TRADE is created in the HOLD status. The two methods to calculate the broker charges are:

This method calculates the total amount executed for each broker and applies the charges, taxes and commissions to each broker total. The gross amount for each execution is calculated and the gross amount for each broker is then added. The charges, taxes and commissions are calculated against these totals. Then, SEC.TRADE is updated with the calculated amount, where multiple SEC.TRADES are created, either by setting the Trade Create field in SC.EXE.SEC.ORDERS or by multi-company trade routing. The charges, taxes and commissions are pro-rated across the resulting SEC.TRADE records in accordance with the broker nominal.

This method calculates the value of each execution, applies the charges, taxes and commissions and totals the charges, taxes and commissions for each broker. The gross amount for each execution is calculated. The charges, taxes and commissions are calculated against each gross amount. The broker totals each charge, tax or commission to give the amounts in SEC.TRADE. For multiple SEC.TRADE records, the amounts are calculated either by setting the Trade Create field in SC.EXE.SEC.ORDERS or by multi-company trade routing. The charges, taxes and commissions are pro-rated across the resulting SEC.TRADE records in accordance with the broker nominal.

The charge, tax and commission amounts calculated by the above two methods are different when minimum amounts are involved.

- If the By Broker method is used, the minimum amount is only applied when the total execution for a broker is below minimum.

- If the By Tranche method is used, the minimum amount is applied to each broker execution that is below minimum.

The value in the Charge Calc Method field in SC.STD.SEC.TRADE is used as a default value for the Charge Calc Method field in SC.EXE.SEC.ORDERS. The valid values are Null, By Broker or By Tranche.

The routines that generate SEC.TRADE transactions from SC.EXE.SEC.ORDERS are grouped together for broker executions for the same broker, by sub-valuing the fields Br No Nom to Br Trd Time in SEC.TRADE. Where there is more than one execution through the same broker with the same price, then these are combined when the SEC.TRADE is created. However, when the Charge Calc Method field is set to the By Tranche method, the charges, taxes and commissions are calculated before combining the executions. The commissions and charges entered in SC.EXE.SEC.ORDERS are taken into account when grouping the tranches and calculating the commissions and charges. The updates to these routines also consider the value in the Trade Create field in SC.EXE.SEC.ORDERS and the multi-company trade routing process.

Calculating Charges for HOLD Records

The Calc St Chgs Ihld field in SC.PARAMETER indicates whether the accrued interest, fees, charges and taxes are calculated when a SEC.TRADE transaction is created in HOLD status by SEC.OPEN.ORDER or SC.EXE.SEC.ORDERS. If the value in this field is set as Yes, the SEC.TRADE created continues to be in HOLD status, but the accrued interest, fees, charges, taxes and customer net amount (in the trade currency) are calculated. The foreign exchange rates between the customer's account currency and trade currency are defaulted at this stage. This makes the customer's net consideration available, when the SEC.TRADE is created, and makes the details available to the forex dealers, without the need to enable the transaction.

Configuring Pending Settlement Transaction

When banks act as a settlement agent, it monitors only the settlement process, and the order and execution happens externally. The position and accounting must take place only on the date when the settlement is completed to ensure that the portfolio valuations of the customers remain unaffected. The Sect Pend field in SC.PARAMETER controls this functionality. This functionality is used along with the actual settlement method to update the record in SECURITY.POSITION, only after the nominal is actually settled.

When the Sect Pend field is set to all, and when SEC.TRADE is input with transaction code given in the Sc Trans Name field in Sc Parameter, then the respective trade behaves as a pending settlement transaction.

When SEC.TRADE is authorised, the system updates the Free Nom Pend field in SECURITY.POSITION with the unsettled nominal balance. The securities are not included in Portfolio Valuations and Corporate Actions as they are not available.

Forward entry amount is not included in the cash balance which is displayed in the Forward Acc Amt field in SC.POS.ASSET. Therefore, Portfolio Valuation is not affected.

The system clears the value in the Free Nom Pend field and updates the Closing Bal No Nom field when the securities are delivered and settled using the SC.SETTLEMENT process.

In this topic