Working with Portfolio Valuation

This section deals with the working mechanism of this feature in Temenos Transact.

SC.VALUATION.EXTRACT

This table is used to export the portfolio valuation information in a flat table format (that is, without multi-values). This enables the compilation of various external reporting tools, such as crystal reports. This table is built from the information in the SC.POS.ASSET record and generates a record in SC.VALUATION.EXTRACT for each security holding, account or contract linked to a portfolio.

Portfolio Valuation Enquiries

The online valuations in the Securities (SC) module are run using the Portfolio Valuation - Cost (SC.VAL.COST) enquiry with the values of the Include Nau Txns field in SC.PARAMETER. The resultant output, which is sent to the SC.POS.ASSET record, is used by other enquiries such as Portfolio Valuation with P&L (SC.VAL.PL), Portfolio Valuation - Margin (SC.VAL.MARGIN) enquiry and so on.

The Include Nau Txns field indicates how the unauthorised transactions are dealt in the portfolio valuation. The values in this field are:

- Yes - Unauthorised transactions are included in the valuation

- No - Unauthorised transactions are not included in the valuation

- Auth - Authorised transactions are included in the valuation. The changes made after authorisation (if any) are excluded and the valuation displays the previously authorised values. This applies to unauthorised amendments and unauthorised reversals. This also affects any cost fields relevant to the valuation in progress. This value is applicable only to the

SEC.TRADEandSECURITY.TRANSFERapplications.

For example, if this field is set to No, a forward dated SEC.TRADE record is input and authorised followed by an online valuation. However, if the same trade is amended and left unauthorised, the trade is not taken into account in the subsequent valuation. The cash account remains unaffected.

If the value is set to No or Auth, the values of the unauthorised transaction are deleted from the valuation. If it is set to Auth, the previous live transaction is used to reconstruct the details required by the program and rebuilds the position prior to amendment. Further, these values are used to update the valuation.

Temenos Transact supports a number of standard portfolio valuation enquiry, out of which some are explained in the below table.

| Enquiry Name | Trade/Value Dated | Description |

|---|---|---|

| Portfolio Valuation - Cost (SC.VAL.COST) | Trade | Displays the position and its description, estimation, cost and market prices. |

| Portfolio Valuation - Margin (SC.VAL.MARGIN) | Trade | Trade Displays the position and its description and, estimation and margin value of the portfolio. |

| Portfolio Valuation with P&L (SC.VAL.PL) | Trade | Displays the position and its description, estimation and market price and the unrealized Profit and loss of each position |

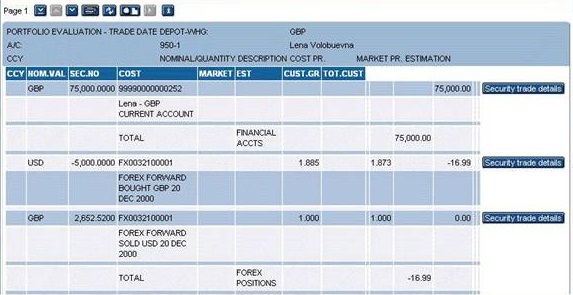

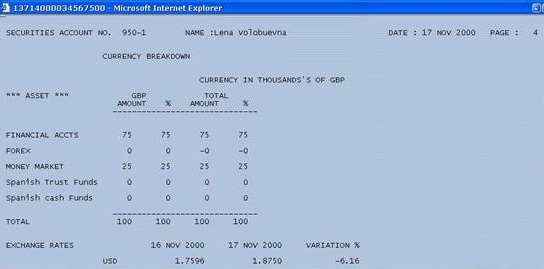

The below screenshot displays the example of a portfolio valuation enquiry. The Portfolio Valuation - Cost (SC.VAL.COST) for the portfolio is 950-1, whose SEC.ACC.MASTER record is displayed in the below screenshot. The enquiry is broken down by SUB.ASSET.TYPE with the sub-totals for each.

As shown in the enquiry, any forex contract linked to a portfolio in Temenos Transact are split into two sides (buy and sell) and both are displayed separately. The portfolio value includes only the profit and loss due to differences in the exchange rate between the contract and current system exchange rates (or system forward rates, for a forward contract).

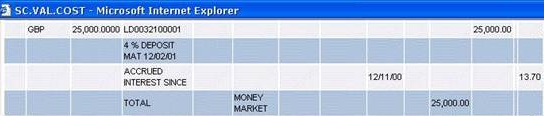

There is no value against the British Pound Sterling (GBP) side of the contract as the reference currency of the portfolio is GBP. There is always an exchange rate of one between the portfolio currency and contract currency. A loss is shown against the USD side of the contract, as the contract is to buy USD at a rate of 1.885, whereas the current forward rate for GBP-USD is 1.873. The exchange rate against the portfolio reference currency is used. The difference between the contracted and current forward rates provides the resultant valuation amount. The valuation enquiries also include the relevant information to a particular transaction and the amount of the accrued interest to date, as shown in the below screenshot.

The accrued interest is displayed against the LD.LOANS.AND.DEPOSITS transactions that are linked to the portfolio. This enquiry also includes the MM.MONEY.MARKET and other transactions against which the accruals are made. For interest bearing bond positions, the Temenos Transact enquiries list the interest amount due as of the enquired date but does not accrue customer interest.

Viewing Daily Interest Accrual on Cash Accounts After a backdated transaction

The SC.POS.ASSET application shows the accrued interest on cash accounts. When there is a backdated transaction affecting the cash account balance, the interest accrual is recalculated based on the day the backdated transaction was input. The SC.BACK.VAL.INT application displays the accruals for a backdated transaction for each day from back value date till current date.

When a backdated transaction is input, the system automatically updates the Module field as SC in the ACCT.BACK.VALUE table. As a part of COB, the SC.BACK.VAL.INT.ACCRUAL job fetches the details from ACCT.BACK.VALUE table and updates the SC.BACK.VAL.INT table for each day from back value date till date.

The SC.BACK.VAL.INT table holds the recalculated balance and accrued interest for each day when there is a back value transaction on an account. The ID of the table is a valid account number. The Co Code field denotes the company code to which the account belongs. The Date field holds the date on which the accrued interest is calculated.

If there are three back dated transactions on the same day, then the system calculates the accrued interest from the earliest back date. The system updates the accrual interest in the same record for all working dates from the earliest back date.

Assume that today is Feb 7, 2022. Consider the following scenario

- The capitalisation date was Jan 31, 2022.

- Assume that Feb 5, 2022 and Feb 6, 2022 were holidays.

- Three backdated transactions are input for Feb 4, 2022, Feb 2, 2022 and Feb 1, 2022 for portfolio 100291-1 with 123567 account number.

During COB, the system builds the SC.BACK.VAL.INT table. This table contains multi-value sets of accrued interest starting with Feb 1, 2022. So, this table consists the data for Feb 1, 2022 to Feb 4, 2022. The accrued interest for Feb 4 includes the interest of Feb 5 and Feb 6 which were holidays.

This accrued interest for each day from the back date of the transaction till the day of input is passed on to the Wealth Suite Front Office TAP, to ensure that the daily valuation and performance are calculated using the recalculated accrued interest.

Suppression of Unsettled Trades from Valuations (Additional Information)

Temenos Transact performs valuations and includes the receipts or withdrawals (if any) into a customer’s SECURITY.POSITION, irrespective of whether the underlying source transaction is settled or not.

The unsettled trades can be excluded from customer valuations and by default, the SECURITY.POSITION and the Closing Bal No Nom field is in the same record. The below section deals with the setup of this functionality.

The Sect Pend field in SC.PARAMETER is set to Yes, Post or All to exclude the unsettled trades from customer valuations. The following are the possible values in this field.

- Yes - The unsettled positions are excluded from customer valuations only for the SECURITY.TRANSFER transactions.

- Post - The unsettled positions is excluded from customer valuations for both SECURITY.TRANSFER and POSITION.TRANSFER transactions.

- All - The unsettled positions are excluded from customer valuations for SEC.TRADE, SECURITY.TRANSFER and POSITION.TRANSFER transactions.

The Sc Trans Name field in SECURITY.PARAMETER identifies the transaction types from the SC.TRANS.NAME record to be included or excluded from any valuations of the unsettled source transaction.

The SC.TRANS.NAME records are linked to SC.TRANS.TYPE records, which indicates whether a SC.TRANS.NAME is a receipt or a delivery of security. Multiple SC.TRANS.NAME records linking to one SC.TRANS.TYPE can be setup. This enables the differentiation by name for different purposes as in this case, whether or not to include in customer revaluations.

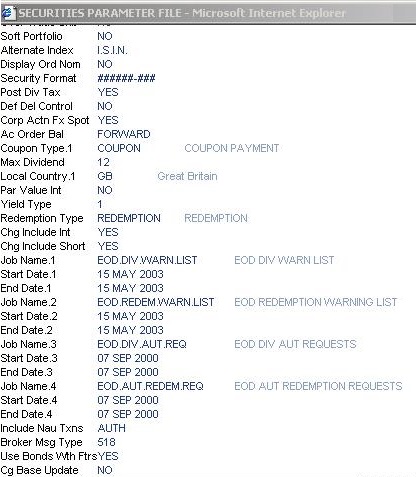

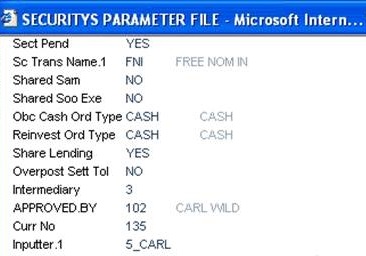

The below screenshot displays the SC.PARAMETER record for the Sect Pend and Sc Trans Name fields.

The Sc Trans Name is a multi-value field enabling the user to specify more than one value, if required. In the above example, SC.TRANS.NAME is allied to the SC.TRANS.TYPE - FNP as shown in the below screenshot.

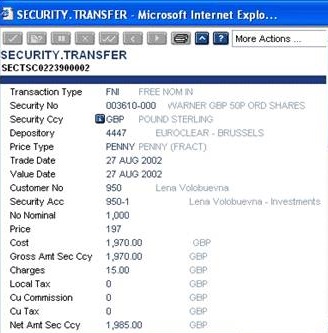

The user has to input a SECURITY.TRANSFER using the Security Dr Code field as shown in the above screenshot and this is recorded in the SC.PARAMETER application.

The Transaction Type field indicates the SC.TRANS.NAME used to record the security receipt on behalf of the customer 950 for delivery into SEC.ACC.MASTER portfolio 950-1.

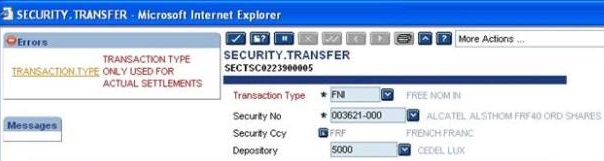

The SC.TRANS.NAME is defined in the Sect Pend and Sc Trans Name fields in SC.PARAMETER, which forces the usage of SC.SETTLEMENT. The user can input through a version, which sets the Sec Hold Settle field in SECURITY.TRANSFER to Yes.

In the above example, Temenos Transact displays an error. For the input to be effective, it is necessary to set the Sec Hold Settle field to Yes.

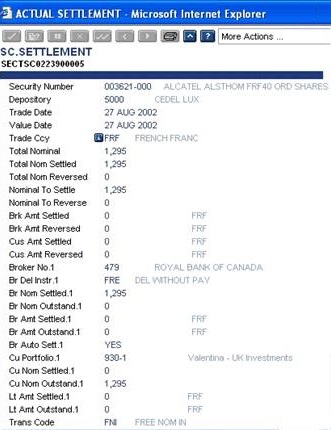

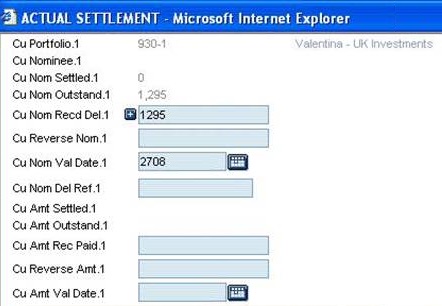

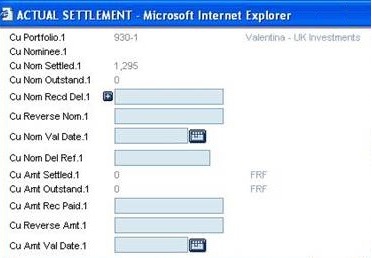

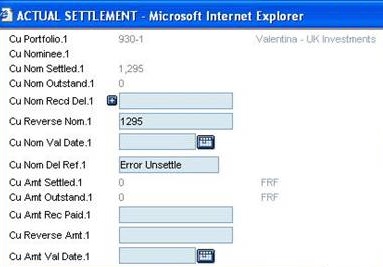

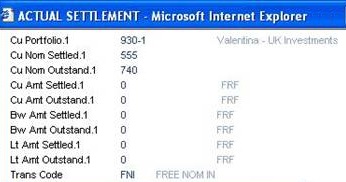

The Cu Nom Outstanding field confirms the customer transfer of 1,295 unsettled shares. The Trans Code field also confirms the SC.TRANS.NAME used (FNI in this case) in the source SECURITY.TRANSFER.

This process of inhibiting unsettled trades is used in several locations. For example, within SECURITY.POSITION for the security and customer.

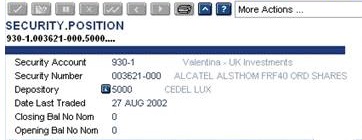

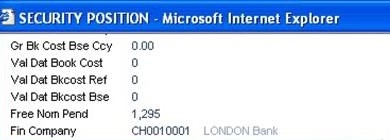

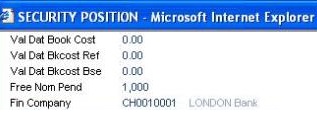

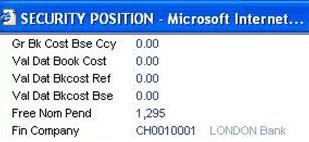

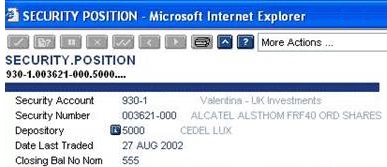

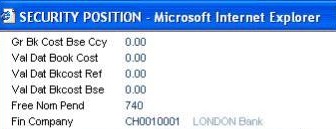

The position above, for security 003621-000 in portfolio 930-1, displays zero in the Closing Bal No Nom field though the securities are added through an authorised SECURITY.TRANSFER. The position is updated in the Free Nom Pend field, as shown in the below screenshot.

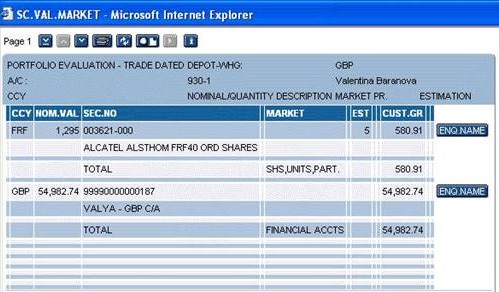

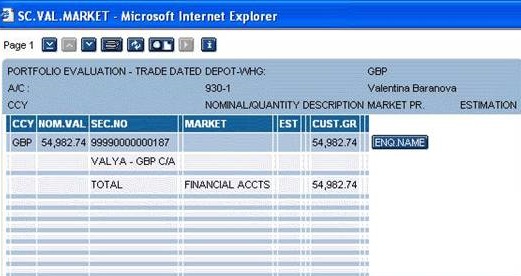

The unsettled transactions are avoided from appearing in the customer valuations by running a valuation for the portfolio 930-1.

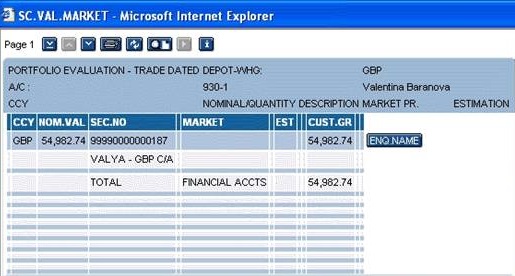

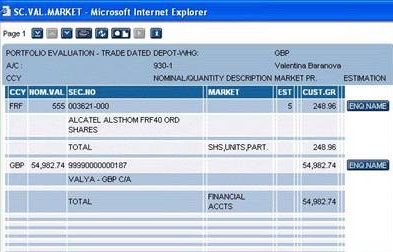

The above screenshot displays the customer portfolio contents. The data displayed in this view is connected to the current account with the SEC.ACC.MASTER portfolio displaying the current balance.

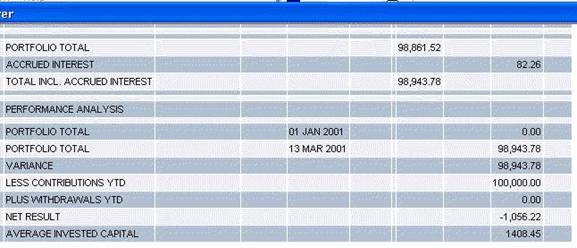

The below screenshot displays the valuations summary for the same portfolio.

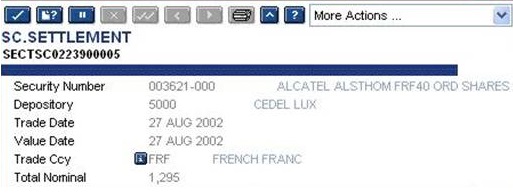

There is no reference to the unsettled security transferred into the account. The security is included in the revaluation after settled. The user can settle the transfer to view the result. The relevant SC.SETTLEMENT record pertaining to the SECURITY.TRANSFER is located.

The above screenshot displays the first portion of the SC.SETTLEMENT. The customer settlement details are updated, as shown in the below screenshot.

The settlement amount and value date are updated, and the transaction is authorised after input. In this example, the system date is used for illustrative purposes. The valuation enquiry is run once again to check whether the security settled appears on the screen.

The effect of confirming the receipt of the unsettled security-003621-000 in the customer portfolio is shown in the above screenshot.

The valuation enquiries updates the SC.POS.ASSET record on settlement of the transactions matching the specified Sect Pend or Sc Trans Name field settings in the SC.PARAMETER record.

The unsettled transactions to be withheld from valuations based on the transaction type updated in SC.PARAMETER are collated and recorded in the Free Nom Pend field in the underlying SECURITY.POSITION.

SC.TRANS.NAME is specified in the Sect Pend and/or Sc Trans Name fields in the SC.PARAMETER record.If the securities are settled incorrectly, the relevant SC.SETTLEMENT record is updated to reverse the earlier settlement. The Temenos Transact system recognises this action and any further valuations again excludes the nominal or amount of the security.

The above scenario is illustrated in the below series of screenshots.

The SC.SETTLEMENT used in the above example is settled incorrectly.

- The reversal of the settlemepnt amount is initiated and the

SC.SETTLEMENTis updated.

- The updated record is authorised and a further revaluation enquiry on the Customer Portfolio is carried out.

- The security details are omitted from the portfolio holdings. This happens irrespective of whether the underlying

SC.SETTLEMENTis authorised or not. The unsettlement amount entered has an immediate impact on any subsequent valuation as the Free Nom Pend field in theSECURITY.POSITIONis updated immediately and the change is made to theSC.SETTLEMENTrecord.

- As partial settlements are permitted within the

SC.SETTLEMENTrecord, any amount settled is immediately eligible for reporting within a valuation. The same applies if a partial-unsettlement occurs.

In the above example, 1,295 stocks is settled, which is followed by an unsettlement of 740 stocks.

The Free Nom Pend field records the unsettled amount of stock.

The original settlement is 1,295 stocks out of which 740 stocks are unsettled resulting in 555 settled positions. The on-line valuation for the portfolio is run again as shown in the below screenshot.

This valuation includes only the amount of security actually settled as shown in the above screenshot.

When the Sect Pend field is set to Post, even POSITION.TRANSFER with transaction type defined in SC.TRANS.NAME undergoes the processing. When a POSITION.TRANSFER is placed, the Free Nom Pend field in SECURITY.POSITION is updated for both source and target portfolio. Both the source and target portfolio are updated with nominal in Closing Bal No Nom field in SECURITY.POSITION, only after the settlement of the POSITION.. The Sec Hold Settle field must be set to Yes, for the processing to be applicable.

When the Sect Pend field is set to All, and when a SEC.TRADE is input with a transaction code given in the Sc Trans Name field in SC.PARAMETER, then the respective trade behaves as a pending settlement transaction. When the record in SEC.TRADE is authorised, the system updates the Free Nom Pend field in SECURITY.POSITION with the unsettled nominal balance. The securities are not included in Portfolio Valuations and Corporate Actions as they are not available.

Forward entry amount is not included in the cash balance which is displayed in the Forward Acc Amt field in SC.POS.ASSET. Therefore, Portfolio Valuation is not be affected.

The system clears the Free Nom Pend field and updates the value in the Closing Bal No Nom field when the securities are delivered and settled using the SC.SETTLEMENT.

Portfolio Valuation Reports

In addition to the screen enquiries, a number of customised portfolio valuation reports are created to run within Temenos Transact. The portfolio valuation report(s) used by an individual system is specified in the Valuation Subr field in SC.PARAMETER. The JBC programs generates these reports and the required customisation can be created by their local Temenos Regional Development Department. The default report is SC.ASSET.VAL.REPS but the SC.ASSET.VAL.REPORTS.SIM or SC.ASSET.VAL.REPORTS.CAMBIO reports can also be used.

The below screenshot illustrates the request of a valuation report during the on-line phase. The request entered in the Account Officer field must be updated in the SEC.ACC.MASTER record for which the valuation is required.

The Online Val field must be set to Y to ensure that all the relevant records are up-to-date. The user must specify the current month numerically (for example, the value 11 in the above screenshot to indicate November). The user can also request historic valuation data (Read Historical Portfolio Valuation Reports for more information). This request is raised on behalf of the portfolio 888-1 and the valuation is for the current record. The record entered is validated to build the report.

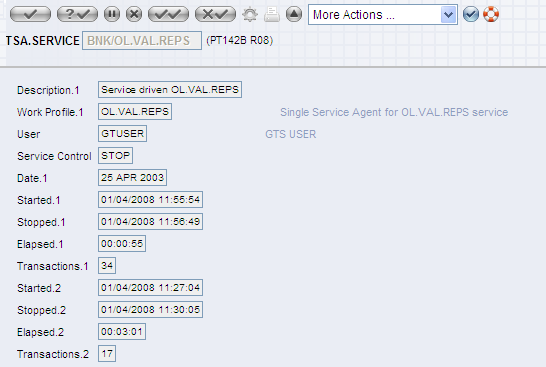

The TSA.SERVICE initiates the online valuations using the OL.VAL.REPS application. This service starts and stops automatically if the TSM keeps running.

After the service agent is completed, the relevant SEC.ACC.MASTER reflects the current valuation.

The valuation reports are produced online by the OL.VAL.REPS application or automatically by the system during the COB stage in the frequency defined in theCUSTOMER.SECURITY record for the customer of the concerned portfolio. These automatic reports are produced as part of the securities price feed, when they are produced after the frequency date (that is, with the previous day’s closing prices).

There are two frequencies inCUSTOMER.SECURITY (internal and external). This allows the bank to specify separate frequencies for a report for the account officer (internal) and customer (external). For example, the account officer may review the portfolio weekly while the customer wants it monthly.

The various types of reports and statements requested for the external and internal sources are indicated in the External Reps and Internal Reps multi-value fields inCUSTOMER.SECURITY, respectively. The valuation formats are available in the SC.REPORT.TYPE application and allows different versions of the same report to be specified. The OL.VAL.REPS requires a report type to be specified. The customised valuation reports produce specific layouts to suit different requirements. For example, the customer and the account officer wants to view different information in the report.

The valuation reports can be quite large, depending on the number of components a customer holds within his portfolio. The following examples display a small portion of a valuation report.

Historical Portfolio Valuation Reports

In addition to the portfolio valuation reports, Temenos Transact also retains information regarding the end of month position of all the customer portfolios for the last twelve months. These historical valuations are printed by OL.VAL.REPS or viewed through the screen enquiries such as SC.HIST.VAL.COST. The information behind these historical valuations is stored at the end of the month concerned and other than being updated with the end of month closing prices on the first security price update of the new month, left unchanged so that they are a true valuation as at the end of month.

The user can indicate the month of the report required in the Report Month field in OL.VAL.REPS record. For example, the current month is September and the user wants the report for April, the Report Month field is set to four. If the user enters, 10, then Temenos Transact assumes October of the previous year.

FIFO based Valuation and Average Price Calculation for Customer and Own Book Portfolio

The Val Method field in SC.PARAMETER determines the valuation and average price calculation method at a system level. This field accepts FIFO or null as values. If the Val Method field is set to FIFO, the system uses the FIFO valuation method for all the portfolios.

The Val Method field in SEC.ACC.MASTER also determines the valuation and average price calculation method at a system level. This field accepts FIFO or null value and is defaulted from SC.PARAMETER when a portfolio is opened. The user can change the valuation method for specific portfolios or business models by updating the Val Method field before the first transaction is done for the portfolio. Before trading in own book or customer portfolio, this field needs to be setup as no further change is allowed once a trade is booked for the portfolio. If the valuation method is set to FIFO, the realised gains and average price are updated in the below tables based on the FIFO method:

SECURITY.POSITIONSC.TRADING.POSITIONSC.TRADE.POS.HISTORY

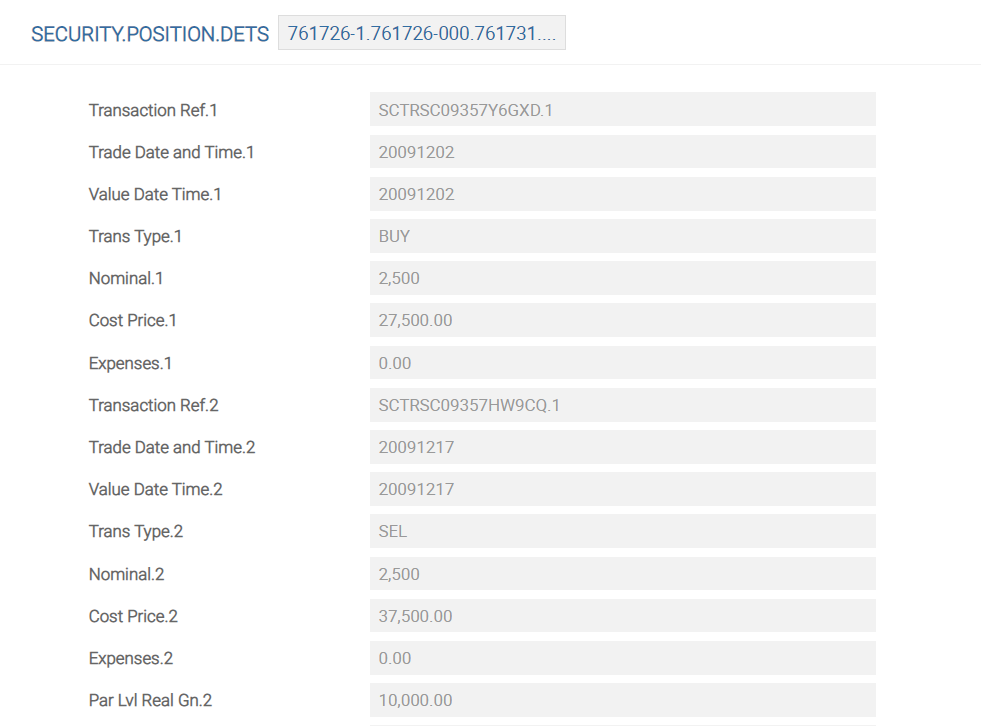

SC.PARAMETER and FIFO in SEC.ACC.MASTER for a specific portfolio, then the system updates the cost of position on FIFO basis only for the FIFO portfolios while for other portfolios the existing weighted average method is used.The SECURITY.POSITION.DETS table is created for all the portfolios where the Val Method field is set to FIFO. Every purchase transaction is recorded in this table as a security line or parcel. Any sell transaction is recorded below the allocated purchase transaction based on the FIFO method. The ID of this table is similar to SECURITY.POSITION. (PORTFOLIO.SM.DEPOSITORY.SUBACCOUNT)

When a security is sold under a FIFO managed portfolio, the system should dispose the parcel acquired first and the realised gain should be updated using the acquisition price of the parcel acquired first. After the sale, the average price for rest of the parcels should be updated based on the FIFO method.

Before the sale transaction, FIFO managed portfolio for customer holds the equity parcels as displayed below.

| Buy or Sell | Transaction Date | Security Number | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100048-000 | 100 | 234 | 23,400 |

| BUY | 2/3/2020 | 100048-000 | 200 | 236 | 47,200 |

| BUY | 2/5/2020 | 100048-000 | 300 | 222 | 66,600 |

| BUY | 2/6/2020 | 100048-000 | 40 | 235 | 9,400 |

| 640 | 146600 | ||||

| Weighted Average Cost | 229.0625 |

On Feb 8, 2020, customer sells 100 units @ 240. The realised gain after the sell should be calculated as below:

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100048-000 | 100 | 234 | 23,400 |

| SELL | 2/8/2020 | 100048-000 | 100 | 240 | 24,000 |

| Realized Gain | 600 |

After the sell transaction, the average price for rest of the portfolio is recalculated as below.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/3/2020 | 100048-000 | 200 | 236 | 47,200 |

| BUY | 2/5/2020 | 100048-000 | 300 | 222 | 66,600 |

| BUY | 2/6/2020 | 100048-000 | 40 | 235 | 9,400 |

| 540 | 123200 | ||||

| Weighted Average Cost | 228.1481 |

Before the sale transaction, own book FIFO managed portfolio held the below parcels of bond security. Accrued interest is calculated from last payment date Oct 28, 2018 till current date Apr 11, 2019. The coupon rate for the bond is 4.15%.

| Buy or Sell | Trans Date | Security No | Maturity Date | Quantity | Price | Cost | Accrued Int | Prem/Disc |

|---|---|---|---|---|---|---|---|---|

| BUY | 3/25/2015 | 991010-000 | 10/28/2019 | 4,000,000 | 115.975 | 4,639,000 | 75,041 | -562,838 |

| BUY | 6/7/2018 | 991010-000 | 10/28/2019 | 8,650,000 | 113.05 | 9,778,825 | 162,276 | -684,406 |

| 12,650,000 | 14,417,825 | |||||||

| Average Price | 1.13975 |

On Apr 11 2019, own book sells 4000000 units @ 102.3900. The realised gain after the sell should be calculated as below:

| Buy or Sell | Trans Date | Security No | Maturity Date | Quantity | Price | Cost | Accrued Int | Prem/Disc | Carrying Amount |

|---|---|---|---|---|---|---|---|---|---|

| BUY | 3/25/2015 | 991010-000 | 10/28/2019 | 4,000,000 | 115.975 | 4,639,000 | 75,041 | -562,838 | 4,151,203 |

| SELL | 4/11/2019 | 991010-000 | 10/28/2019 | -4,000,000 | 102.39 | 4,095,600 | 75,041 | 4,170,641 | |

| Profit | 19,438 |

After the sell transaction, the average price for rest of the portfolio should be recalculated as below.

| Buy or Sell | Trans Date | Security No | Maturity Date | Quantity | Price | Cost | Accrued Int | Prem/Disc |

|---|---|---|---|---|---|---|---|---|

| Buy | 6/7/2018 | 991010-000 | 10/28/2019 | 8,650,000 | 113.05 | 9,778,825 | 162,276 | -684,406 |

| 8,650,000 | 9,778,825 | |||||||

| Average Price | 113.05 |

When a security is sold partially under a FIFO managed portfolio, the realised profit or loss is calculated and booked in proportion to the sold quantity, the remaining quantity from the parcel line remains in portfolio with original purchase dates and price. In case of debt securities, the premium or discount amount already accrued at sale transaction date must be considered in proportion to the sold quantity for gain or loss calculation and booking and accruing of premium or discount amount yet continues in proportion to the line quantity remaining in portfolio. After the sale, the average price for rest of the parcels should be updated based on the FIFO method.

Before the sale transaction, FIFO managed portfolio for customer holds the below equity parcels.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100048-000 | 100 | 234 | 23,400 |

| BUY | 2/3/2020 | 100048-000 | 200 | 236 | 47,200 |

| BUY | 2/5/2020 | 100048-000 | 300 | 222 | 66,600 |

| BUY | 2/6/2020 | 100048-000 | 40 | 235 | 9,400 |

| 640 | 146600 | ||||

| Weighted Average Cost | 229.0625 |

On Feb 8, 2020, customer sells 250 units @ 240. The realised gain after the sell should be calculated as below:

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100048-000 | 100 | 234 | 23,400 |

| BUY | 2/3/2020 | 100048-000 | 150 | 236 | 35,400 |

| SELL | 2/8/2020 | 100048-000 | 250 | 240 | 60,000 |

| Realized Gain | 1,200 |

After the sell transaction, the average price for rest of the portfolio should be recalculated as below.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/3/2020 | 100048-000 | 50 | 236 | 11,800 |

| BUY | 2/5/2020 | 100048-000 | 300 | 222 | 66,600 |

| BUY | 2/6/2020 | 100048-000 | 40 | 235 | 9,400 |

| 390 | 87800 | ||||

| Weighted Average Cost | 225.1282 |

For own book portfolios, revaluation entries should be posted based on the FIFO average cost price method.

The revaluation price is 270. The revaluation entry should be posted for 26,200.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost | Revaluation Rate | After Revaluation | Mark To Market |

|---|---|---|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100048-000 | 100 | 234 | 23,400 | 270 | 27000 | 3,600 |

| BUY | 2/3/2020 | 100048-000 | 200 | 236 | 47,200 | 270 | 54000 | 6,800 |

| BUY | 2/5/2020 | 100048-000 | 300 | 222 | 66,600 | 270 | 81000 | 14,400 |

| BUY | 2/6/2020 | 100048-000 | 40 | 235 | 9,400 | 270 | 10800 | 1,400 |

| 640 | 146,600 | 172,800 | 26,200 | |||||

| Weighted Average Cost | 229.0625 |

Consider a sale transaction done on Feb 8 for 250 units @ 240. After the sale transaction, the average price for rest of the portfolio should be recalculated as below. The revaluation entry should be posted for 17,500 based on the new average cost.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost | Revaluation Rate | After Revaluation | Mark To Market |

|---|---|---|---|---|---|---|---|---|

| BUY | 2/3/2020 | 100048-000 | 50 | 236 | 11,800 | 270 | 13500 | 1,700 |

| BUY | 2/5/2020 | 100048-000 | 300 | 222 | 66,600 | 270 | 81000 | 14,400 |

| BUY | 2/6/2020 | 100048-000 | 40 | 235 | 9,400 | 270 | 10800 | 1,400 |

| 390 | 87,800 | 105,300 | 17,500 | |||||

| Weighted Average Cost | 225.1282 |

The Ownbook Val Method field in DIARY.TYPE determines the valuation method for the corporate action event. This field accepts the value as null or prorate. If this field is set to prorate, the system allocates the security purchase line or parcel for own book portfolio based on prorate method. If the field is set to null, the default allocation method from SEC.ACC.MASTER is used. This field can only be setup for the corporate actions where Retain Original field is set to No.

No sale during the corporate action ex-date and pay date. Below are the security position for own book portfolio before the partial redemption corporate action ex-date.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100049-000 | 1000000 | 20 | 20000000 |

| BUY | 2/3/2020 | 100049-000 | 500000 | 26 | 13000000 |

| BUY | 2/5/2020 | 100049-000 | 1200000 | 31 | 37200000 |

| 2700000 |

Assume that there is a partial redemption event where 50% is redeemed. So, 1350000 nominal is redeemed. On the pay date, the allocation of 1350000 is done using a prorate method. The customer security position at end of the allocation should be calculated as below.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100049-000 | 500000 | 20 | 10000000 |

| BUY | 2/3/2020 | 100049-000 | 250000 | 26 | 6500000 |

| BUY | 2/5/2020 | 100049-000 | 600000 | 31 | 18600000 |

| 1350000 |

Sale during the corporate action ex-date and pay date. Below are the security position for own book portfolio before the partial redemption corporate action ex-date.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100049-000 | 1000000 | 20 | 20000000 |

| BUY | 2/3/2020 | 100049-000 | 500000 | 26 | 13000000 |

| BUY | 2/5/2020 | 100049-000 | 1200000 | 31 | 37200000 |

| 2700000 |

Assume there is a partial redemption event for redeeming 50%. So 1350000 nominal is redeemed. And the own book also sold 1200000 quantity between the ex-date and pay date. The sale of 1200000 should be allocated based on FIFO method and on the pay date, the allocation of 1350000 should be done using a prorate method. The customer security position after the sale is shown below. After the Sell, the 1200000 nominals allocated on FIFO basis.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100049-000 | 0 | 20 | 0 |

| BUY | 2/3/2020 | 100049-000 | 300000 | 26 | 7800000 |

| BUY | 2/5/2020 | 100049-000 | 1200000 | 31 | 37200000 |

| 1500000 |

On pay date, the redemption nominal is disposed on pro-rata basis and balance is calculated as below.

| Buy or Sell | Trans Date | Security No | Quantity | Price | Cost |

|---|---|---|---|---|---|

| BUY | 2/2/2020 | 100049-000 | 0 | 20 | 0 |

| BUY | 2/3/2020 | 100049-000 | (300000-270000)=30000 | 26 | 780000 |

| BUY | 2/5/2020 | 100049-000 | (1200000-1080000)= 120000 | 31 | 3720000 |

| 150000 |

If the Ownbook Val Method field is setup for corporate actions where the redeem percentage is not given, system calculates the percentage in the fields (Option Nominal in ENTITLEMENT or Qualifying Holding in ENTITLEMENT).

In this topic