Working with Instrument Master

The SECURITY.MASTER application contains most of the information relative to each security on the system. The various security transactions obtain the latest information relating to the instrument that is featuring in the transaction. Thus, each record must be possibly up-to-date. Temenos Transact uses a high-level indicator to differentiate bond and share paper types within the SECURITY.MASTER application. The amount and type of information required to build a complete record in SECURITY.MASTER highly depends on the indicator selected.

Most master records can safely be ignored once set up. For example, ordinary shares requires less maintenance once a new record is authorised.

Recording Basic Details of the Security

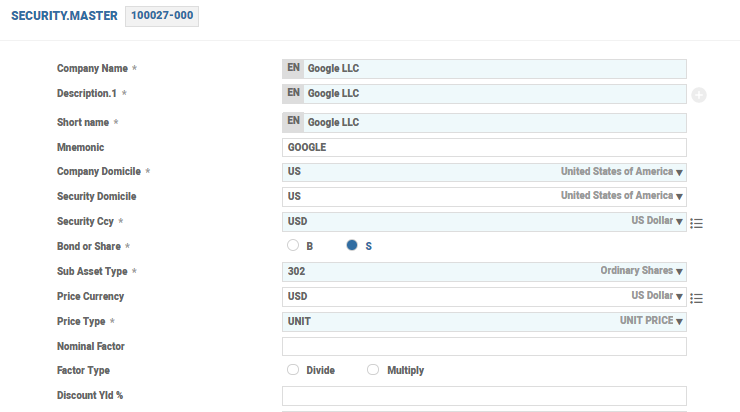

The Bond or Share field indicates whether the record is created for a share or bond. The below record is an example for equity share. The first set of fields allows the user to record the particulars of the issuing or the parent company. The Mnemonic field specifies a unique short code provided for each security for easy identification.

The Company Domicile field refers to the country of the parent company issuing the security. The Security Domicile specifies the country where the security is issued. The Security Ccy indicates the place where the security is issued and the Price Currency field indicates the currency in which the security is traded. This field accepts a valid record from the CURRENCY application. The below screenshot is an example of a record in SECURITY.MASTER.

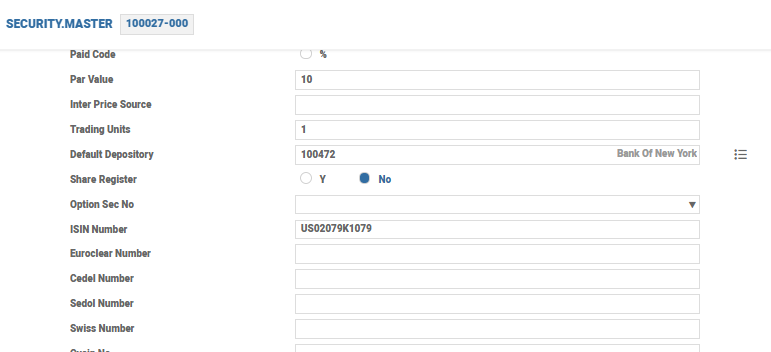

The Par Value field holds the face value of the stock. The smallest nominal amount that can be traded is provided in the Trading Units field.

If the Trading Units field value is 100, the system throws an error when an investor tries to place an order for 50 units. The Default Depository field specifies the depository where this particular stock is kept. The International Security Identification Number (ISIN) specifies the code as a code that uniquely identifies a specific securities issue.

Recording Price Details and Price Change for Securities

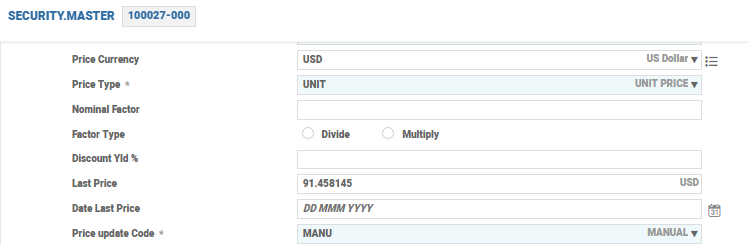

The current price of a security can either be updated manually or automatically (through Bloomberg, Reuters, Telerate feeds and so on). This can be specified in Price update Code field of the SECURITY.MASTER application. This field gives the list of the possible options. If the user selects the manual input, the user can change the price in Last Price field, therefore the system date automatically defaulted into the Date Last Price field. The Price Type field defines the calculation method that is used when calculating the price of a trade.

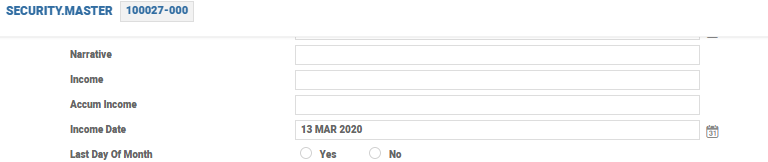

In addition, to update the prices, it may be a requirement with some forms of securities such as unit trusts and funds to record income and accumulated income. This can also be recorded manually or automatically in the Income, Accum Income and Income Date fields.

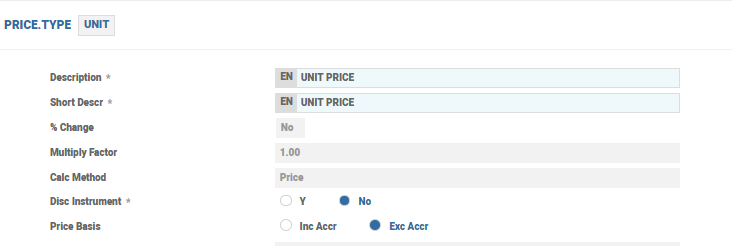

PRICE.TYPE

This application indicates the system how a price type calculation is to be performed within any given transaction in the Securities module. The Multiply Factor field indicates the weighting attached to the price quoted on a security. For example, if each unit of the nominal amount represents an option on 1000 shares, then the value in this field will be 1000. In order to accrue or amortise the discount amount when a security is traded, the Disc Instrument field must be set to Y. This process is carried out only for the bank’s own portfolios.

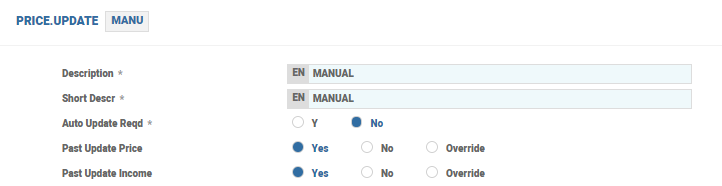

PRICE.UPDATE

The input of historic prices and income in SECURITY.MASTER can be controlled using the PRICE.UPDATE application. The Past Update Price and Past Update Income fields allow the user to input Yes, No and Override. Based on this setup when a historic price, income or accumulated income is input using the SECURITY.MASTER application, the input is either, disallowed, allowed or allowed upon the acceptance of a warning message.

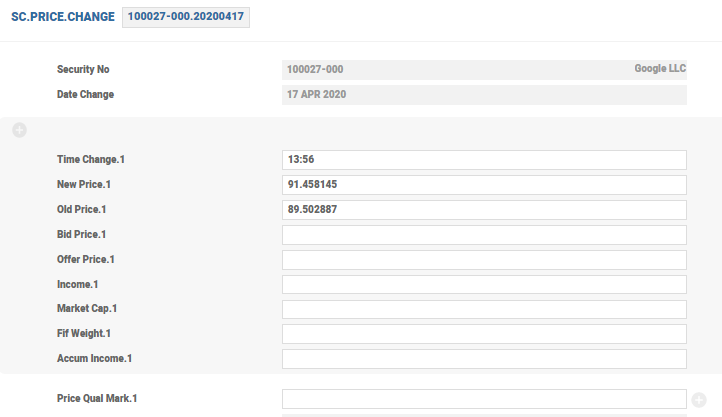

SC.PRICE.CHANGE

The SECURITY.MASTER application need not be launched every time when the user updates price or income. The SC.PRICE.CHANGE application allows the user to make any changes as required and stores the historic price or income data, whenever there is a change in the Last Price, Date Last Price and Price Qual Mark fields in SECURITY.MASTER.

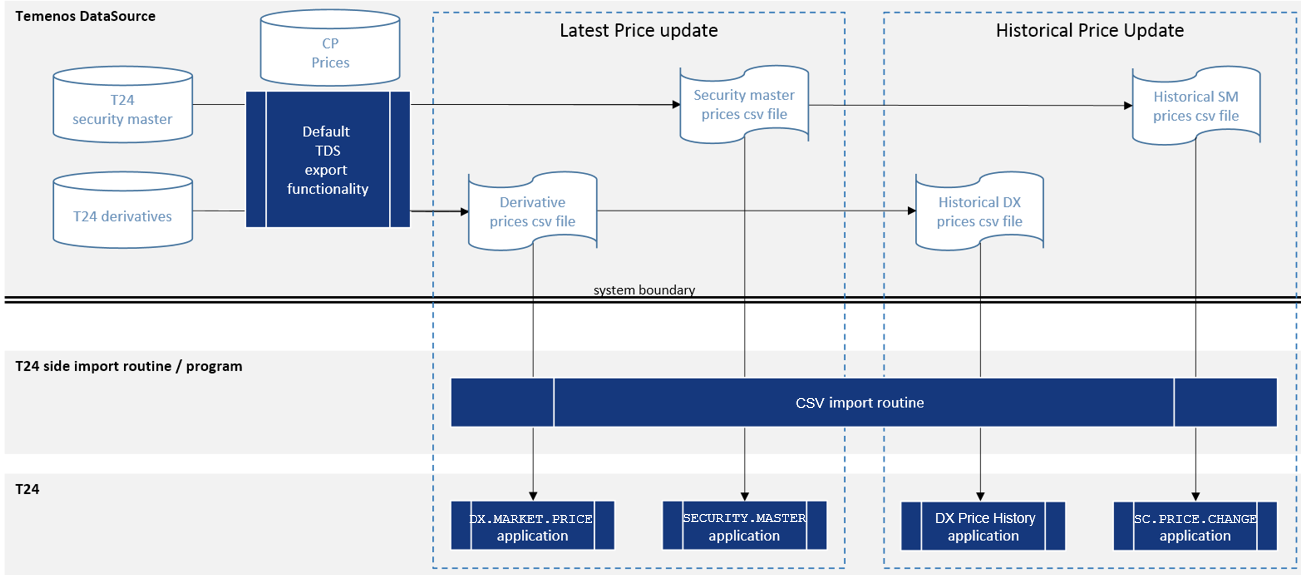

Price can also be updated automatically via TDS (Temenos Data Source). The below image demonstrates how price is updated in SECURITY.MASTER application and how historical prices are stored in SC.PRICE.CHANGE application through the TDS interface.

Defining Cum And Ex Markers

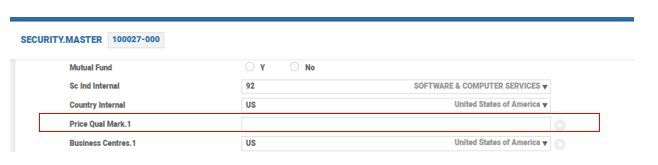

The price of a security is affected by cum and ex periods and the Price Qual Mark field reflects these markers in the SECURITY.MASTER application.

Input in this field is validated against SM.PARAMETER. The input allowed is NULL or a valid SWIFT. If the field is set to Swift, multi-value input is allowed and the values can be any of the value defined in the Cum Indicate and Ex Indicate fields in SM.PARAMETER if they are not conversing within the same multi-value set. That is, a price cannot be both cum and ex dividend (CDIV and XDIV) at the same time.

The historic details of the price conditions for a date are stored in the SC.PRICE.CHANGE application. This application is automatically updated with the values in the Price Qual Mark fields in the SECURITY.MASTER application, whenever there is a change in the field.

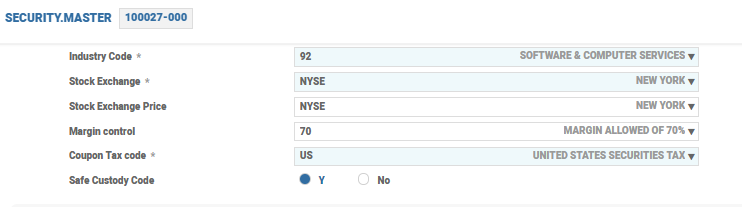

Recording the Industry and Stock Exchange Details

The Industry Code field defines the industry to which the instrument belongs too. This critical information is required for several regulatory reports, such as, for defining portfolio strategies and for rebalancing portfolios. This field links to the SC.INDUSTRY application. The stock exchange at which the security is normally traded is provided in the Stock Exchange field. This field accepts a valid record in STOCK.EXCHANGE.

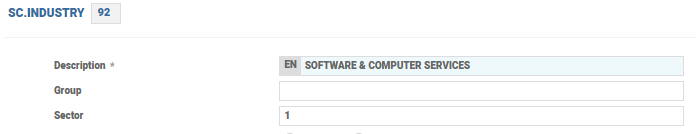

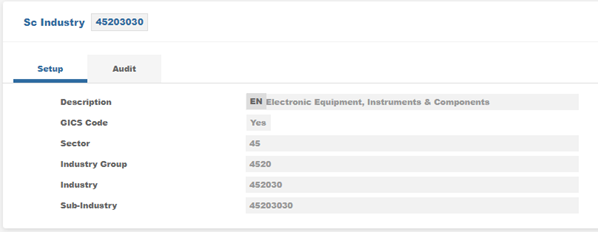

SC.INDUSTRY

The industry codes defined in this application are assigned to each record in SECURITY.MASTER to identify the industry to which the security belongs too. The Industry Code and Sc Ind Internal fields in the SECURITY.MASTER application are used to capture the industry code from the SC.INDUSTRY application. The below screenshot is the record in SC.INDUSTRY for the above SECURITY.MASTER.

The ID of this application can accept a maximum of eight characters. This application also supports GICS codes. If the Gics Code field in SC.INDUSTRY is set to Yes, the system updates the Global Industry Classification Standard (GICS) hierarchy fields automatically. The GICS hierarchy is as follows:

- The first two digits of the ID in the Sector field

- The first four digits of the ID in the Industry Group field

- The first six digits of the ID in the Industry field

- The complete ID in the Sub Industry field

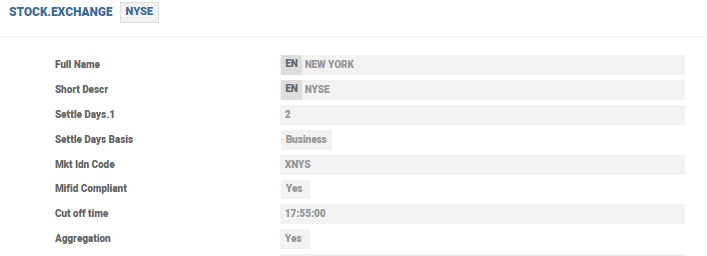

STOCK.EXCHANGE

This application records the details of the stock exchange in which the security trades. The cut-off time for the stock exchange in the Cut off time field for the stock exchange.

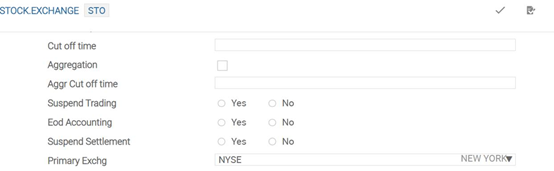

In global practice, many stock exchanges operate on different trading platforms. Therefore, each stock exchange is subject to have a primary trading venue and one or more secondary trading venues which are generally identified based on the Market Identification code (MIC). Each secondary trading venue is stored as a separate record in the STOCK.EXCHANGE application with respective MIC as their ID. All the secondary trading venue are linked to their primary stock exchange through the Primary Exchg field.

If the Primary Exchg field is blank, then trading venue is considered as the primary trading venue and the respective stock exchange as the primary stock exchange. If the Primary Exchg field has a valid ID, then the trading venue is considered as a secondary trading venue and the respective stock exchange is obtained from the Primary Exchg field.

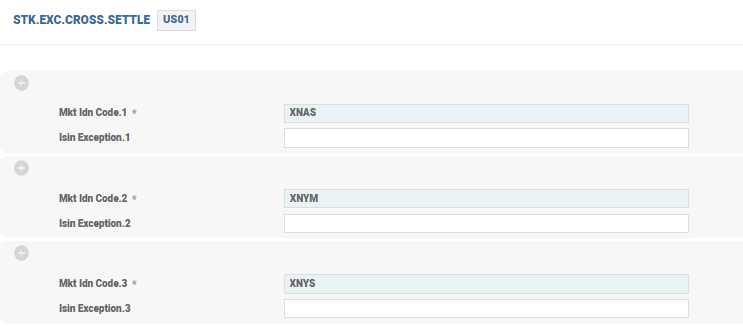

There are several stock exchanges, which allow cross settlement. This must be recorded and used to default the correct security master ID. The details of stock exchanges that allow cross settlement are recorded in the STK.EXC.CROSS.SETTLE application as shown in the below screenshot.

| Field | Description |

|---|---|

| Mkt Idn Code |

Sets the market identification code (MIC) as in STOCK.EXCHANGE

|

| Isin Exception | Indicates the ISIN code of the security for which cross settlement cannot be performed |

Recording Alternate Security Index

In Temenos Transact, securities are captured in the SECURITY.MASTER application with unique ID. However, the market securities are identified by their common identifiers such as ISIN and CUSIP ID. Therefore, it is important to record these alternate IDs and also provide a mechanism by which the system can identify the SECURITY.MASTER ID when the user enters a valid alternate ID while trying to input the values in the order related fields (such as Sec.Open.Order, Sec.Trade or Order.By.Cust application). There are multiple ways to capture the alternate IDs as explained below:

Method 1

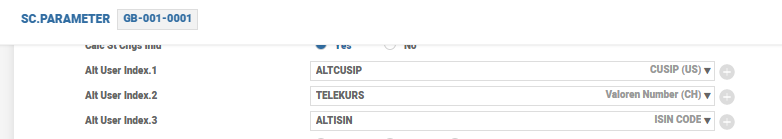

Using the Alternate Index field in SC.PARAMETER. Read SC.PARAMETER for more information. Two or more records in SECURITY.MASTER can have the same alternate ID if the Alt Index Dup field is set in SM.PARAMETER.

Method 2

A specific way to reference security identifications is to use the Alt User Index field in SC.PARAMETER application. This method of indexing the SECURITY.MASTER application is an alternative way for using the Alternate Index field (as detailed earlier in this user guide). The created records in ALT.SEC.PARAMETER must be added to the SC.PARAMETER application.

The Alt User Index and Alternate Index fields are mutually exclusive to one another. If the Alt User Index field is input, the Alternate Index field is disabled and vice-versa. Input to this multi-value field must be a valid key in the ALT.SEC.PARAMETER application.

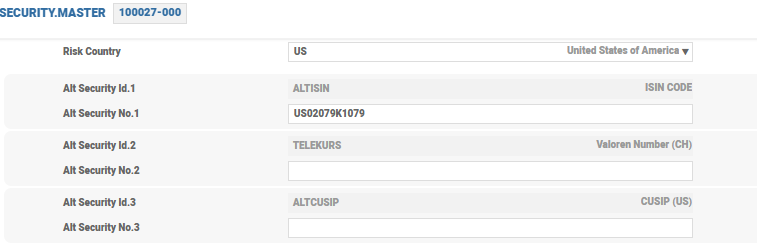

Once a record in ALT.SEC.PARAMETER is created, the system automatically updates all the records in SECURITY.MASTER and adds this value to the Alt Security Id multi-value field. A sample record of SECURITY.MASTER with the unique identifier added is shown in the below screenshot.

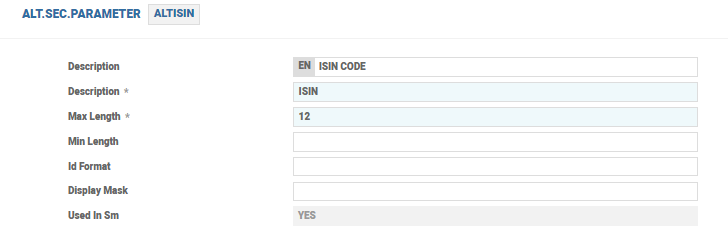

ALT.SEC.PARAMETER

This application is used to define alternative identifiers and their formats. The below screenshot shows a sample ALTISIN record in ALT.SEC.PARAMETER.

The various alternative identifier fields in the ALT.SEC.PARAMETER application are explained below.

| Field | Description |

|---|---|

| Max Length |

Determines the maximum length of the particular alternative ID. The value in the Max Length field is automatically adjusted when the alternative ID exceeds the length specified in the Max Length field in the EB.OBJECT.

|

| Min Length | Determines the minimum length of the alternative ID. This field cannot be more than the number specified in the Max Length field. |

| Id Format | Sets the format of the alternative ID For example, 2N3A3X would be two numeric followed by three alpha characters followed by three alpha numeric. The total number of characters entered here are validated against the value in the Max Length and Min Length fields. A link to a subroutine could also be input for validating the ID. This is achieved by prefixing the subroutine name with @. |

| Display Mask | Allows the user to setup a mask for the identifier. For example, if ### - ## - # is selected, the 123456 value that is entered is displayed as 123-45-6. |

| Used In Sm |

This system maintained field is set to YES when any record in the SECURITY.MASTER application has a value corresponding to this alternate index.

|

When the Alt User Index field is used and a user enters a valid alternate ID in the Security Number field in SEC.OPEN.ORDER, SEC.TRADE or ORDER.BY.CUST, the system automatically defaults the correct security master ID.

When a user enters the alternate ID in the Security Number field in SEC.OPEN.ORDER, SEC.TRADE or ORDER.BY.CUST, the system automatically defaults the correct SECURITY.MASTER ID. If there are two records in SECURITY.MASTER with same alternate ID, the system defaults the first record in SECURITY.MASTER. The user has to check and change, if required.

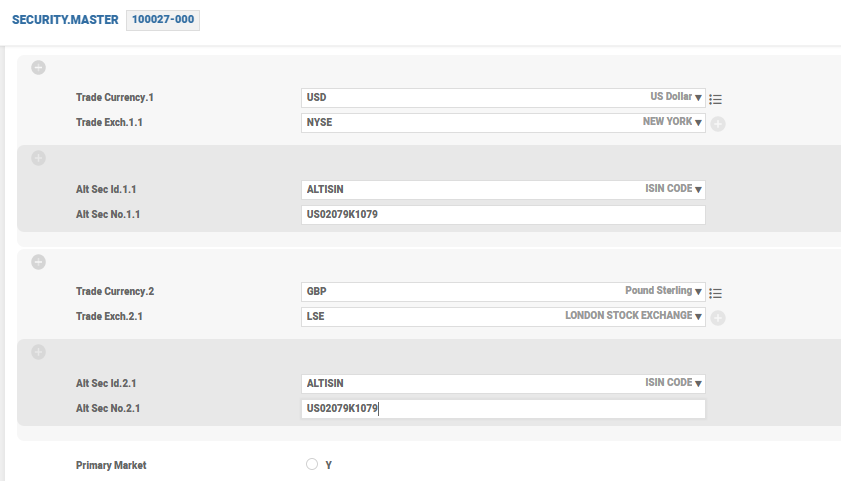

SECURITY.MASTER can have the same alternate ID, if the Alt Index Dup field is set in SM.PARAMETER application.The defaulting logic applies when the value in the Alternate Index field is used and the Alt Index Check field is set in the SM.PARAMETER application. There are multiple exchanges offering dual currency trading. Dual currency securities are fully fungible in the primary and secondary (dual) currency exchanges. An investor may hold long position in one currency and sell position in alternate currency. One way to handle securities that are traded in different currencies is to open separate records in SECURITY.MASTER for the same security with different trade currencies, and duplicate the alternate ID in them.

In this case, when a user enters the alternate ID in the Security Number field in the SEC.OPEN.ORDER, SEC.TRADE or ORDER.BY.CUST application, the system automatically defaults the first record in SECURITY.MASTER (immaterial of the trade currency) and the user has to manually check and input the correct security master IDs in other records. To enable a better defaulting logic, the following feature is enabled:

- In

SECURITY.MASTER, the user can set various currencies and/or exchanges in which the security can be traded. - In

SEC.OPEN.ORDERorSEC.TRADE, if the currency and exchange are entered followed by the ISIN, the system defaults theSECURITY.MASTERafter checking through these fields.

The Trade Currency, Trade Exch, Alt Sec Id and Alt Sec No fields are part of an associate multi-value set and can be used to define the various currencies and exchanges in which the security is allowed to be traded and also the relevant alternate index that is applicable. These fields can be set only if the Alt Index Check field is set to YES in the SM.PARAMETER.

If the user inputs a trade currency that is not defined in the SEC.OPEN.ORDER, ORDER.BY.CUST or SEC.TRADE application, an override is raised to indicate that the trade is not an approved trade currency. If a valid trade currency is input, then the system automatically defaults the stock exchange if it is set in these applications. The Primary Market field identifies the duplicate alternate index setup, and the SECURITY.MASTER with this field set-up is returned in order and trade screens when ISIN is inputted.

SC.ALT.ISIN.LIST

This live table is built when the above shown details are entered in the SECURITY.MASTER application and the record is authorised.

It is possible that a single ISIN could correspond to multiple records in SECURITY.MASTER in Temenos Transact. In such a scenario, the matching logic for determining the corresponding SECURITY.MASTER is based on the verification involving combination of:

- Case 1: Alternate identifier (other than ISIN) + cases, where only ISIN is provided without the MIC and trade currency.

- Case 2: ISIN + currency (trade) + exchange (MIC), when match is not found based on the above criteria. This is the next criteria to determine the match.

- Case 3: ISIN + currency (trade).

ISIN is checked based on the value in the ISIN Number field in SECURITY.MASTER. The matching logic selects only the securities that are not suspended, de-listed (security status and status date), blocked (blocking date), expired (expired) or matured (maturity date). The matching logic for determining the corresponding is explained below based on chronological order.

If an alternate identifier (other than ISIN) or ISIN alone is provided (without the Market Identifier Code (MIC) and trade currency) as part of the search criteria, the record in SECURITY.MASTER is identified based on the following steps:

- If the alternate identifier (for example, Reuters Instrument Code (RIC)) matches a record in

SECURITY.MASTER, select the record inSECURITY.MASTER. If there is no match,SECURITY.MASTERis returned and the order is not booked. - If the alternate identifier matches multiple records in

SECURITY.MASTER, proceed to step 2.

- If trade exchange details are available (stock exchange in the transaction), check whether the cross-settlement is allowed with the stock exchange of the SM (provided the trade exchange is not the same as exchange in SM). This includes the ISIN exception check.

- If the alternate identifier matches only one SM, based on the above criteria select the SM. If there are multiple matches, the system proceeds to step 3. If there is no match, records in SM are not returned.

- The verification of cross-settle record involves checking whether the MIC of the stock exchange (in transaction) is present in any cross settle record.MIC is a single cross settle record.

- If MIC is present, the system checks whether the trade exchange is the same as the exchange in SM. If there is a match with one SM and the value is not present in the Isin Exception field, then select the SM. The ISINs that are defined in the Isin Exception field are not allowed to cross settle with the MIC defined in the same record. However, if matches are not observed, proceed to step 3.

- Check if the customer holds the position in any of the security. If yes, select the SM. If there is a match with multiple SMs, proceed to step 4.

- If trade currency is available (in the transaction), check whether the trade currency is the same as the security currency of the SM. If there is a match with multiple SMs, proceed to step 5.

- Select the SM with the Primary Market field set to Y. If there is a match with multiple SMs, proceed to step 6.

- Prioritise the SM selection in the ascending order.

This case is invoked if the search input criteria includes the ISIN, Trade Currency and MIC fields.

- If the ISIN corresponds to only one SM and the trade currency or security currency of the SM matches with the trade currency of the transaction, the transaction is booked using that SM. If the order or trade exchange (in the transaction) is not defined as one of the stock exchange for the SM, and there is no existing cross-settle record, security is not returned and the order is not booked. If there is a cross-settle record and the trade exchange (from transaction) does not match the stock exchange defined for the SM, and is not a part of the same cross-settle group in

STK.EXC.CROSS.SETTLE, security is not returned and the order is not booked. ISIN exception check is also carried out as part of this evaluation. - The security and trade currency check are performed only for determining the security to be returned through the API, as mentioned above and not for direct input of

SEC.OPEN.ORDERorSEC.TRADE. - The verification of cross-settle record involves checking whether the MIC of the stock exchange (in transaction) is present in any cross settle record. If Yes is selected, the system checks the cross-settle record and process as mentioned above.

- If not, the system checks the trade exchange. If it is not the same as SM stock exchange, an override message (trade exchange does not match with SM exchange) is displayed.

- If there is a match with multiple SMs, it proceeds to step 2.

- If there are multiple records in

SECURITY.MASTERwith the same ISIN, check if the trade exchange (from transaction) is fungible with the stock exchange in SM based on the record inSTK.EXC.CROSS.SETTLE. If the trade exchange is not the same as the stock exchange of the SM, check whether the record inSTK.EXC.CROSS.SETTLEexists for the group. If Yes is selected, the check for the Isin Exception field must be done as defined in the previous section. If not, the exchanges are not considered fungible and security is not returned. - If the fungibility check returns one SM, select the SM. If there is a match with multiple SMs, proceed to step 3.

- The verification of cross-settle record involves checking whether the MIC of the stock exchange (in transaction) is present in any cross settle record and the ISIN not being in the ISIN exception list. If Yes, then the system checks the cross settle record and process as above. If not, proceed to step 3.

- If there is no match with any of the records in

SECURITY.MASTERas a part of step 2, security is not returned. If the stock exchange details are not available in the transaction, the validations are based on case 3 (ISIN + Currency (trade)).

- If there are multiple records in

SECURITY.MASTERreturned based on step 2, check whether the trade currency in the transaction matches with the currencies inSECURITY.MASTER(check the trade currency if it exists, otherwise check the security currency). - If there is a match with one record in

SECURITY.MASTER, the security master ID is returned. If there is no match, security master ID is not returned and the order is not booked. - If there is a match with multiple records in

SECURITY.MASTER, proceed to step 4.

- Check if the customer holds position in any of the security. If there is a match with one instrument, select the SM, else select the security where the security currency in SM is equal to the trade currency (from the transaction). If there is a match with multiple SMs, proceed to step 5.

- Check if the stock exchange in SM is the same as the exchange in the transaction. If Yes, select the SM. If there is a match with multiple SMs, proceed to step 6.

- Select the SM with the Primary Market field in SM set to Y. If there is a match with multiple SMs, proceed to step 7.

- Prioritise the SM selection in the ascending order.

If match is not found at the end of the process, security is not returned.

This is invoked if the search input criteria includes the ISIN Number and Trade Currency fields.

- If the ISIN corresponds to only one record in

SECURITY.MASTERand the trade currency or security currency of theSECURITY.MASTERmatches with the trade currency of the transaction, the transaction is booked using thatSECURITY.MASTER. If the order or trade exchange (in the transaction) is not defined as one of the stock exchange for theSECURITY.MASTER, and existing cross-settle record does not exists, security is not returned and the order is not booked. If there is a cross-settle record and the trade exchange (from transaction) does not match the stock exchange defined for theSECURITY.MASTERand are not part of the same cross-settle group in theSTK.EXC.CROSS.SETTLE, security is not returned and the order is not booked. ISIN exception validations are also carried out as part of this evaluation. - The security and trade currency check as mentioned above (step 1) is performed only for determining the security to be returned through the API and not for direct input of

SEC.OPEN.ORDERorSEC.TRADE. - The verification of cross-settle record involves checking whether the MIC of the stock exchange (in transaction) is present in any cross settle record and the ISIN not being in the ISIN exception list. If Yes, the system checks the cross-settle record and processes as above.

- If not, the system checks the trade exchange. If it is not the same as SM stock exchange, an override message ‘Trade exchange does not match with SM exchange’ is displayed.

- If there is a match with multiple SMs, proceed to step 2.

- Check the trade currency in the transaction with the currencies in the record in

SECURITY.MASTER(check trade currency if it exists, otherwise check security currency). - If there is a match with one or more records in

SECURITY.MASTER, then proceed to step 3. If match is not found, security master ID is not returned and the order is not booked.

- If there are multiple records in

SECURITY.MASTERwith the same ISIN, check if the trade exchange (from the transaction) allows cross-settling with the stock exchange in SM based on the record inSTK.EXC.CROSS.SETTLE(including ISIN exception check).- If the trade exchange (from transaction) is not the same as the stock exchange of the SM and if a record in

STK.EXC.CROSS.SETTLEdoes not exist for the group, the exchanges are not considered fungible and security is not returned. - If there is a match with only one SM based on the above criteria, select the SM. If there are multiple matches, proceed to step 4.

- If match is found, the order is not booked.

- The verification of cross-settle record involves checking whether the MIC of the stock exchange (in transaction) is present in any cross settle record and the ISIN not being in the ISIN exception list. If Yes, then the system checks the cross-settle record and processes as above. If not, proceed to step 4.

- If the stock exchange is not available in the transaction, this step is skipped and the system proceeds to step 4.

- If the trade exchange (from transaction) is not the same as the stock exchange of the SM and if a record in

- Check if the customer holds position in any of the security. If Yes, select the SM. If there is a match with more than one SM, proceed to step 5.

- Select the SM with the security currency in SM equal to the trade currency (from transaction). If there is a match with multiple SMs, proceed to step 6.

- Select the SM with the Primary Market field in SM set to Y. If there is a match with multiple SMs, proceed to step 7.

- Prioritise the SM selection in the ascending order.

If match is not found at the end of the process, security is not returned.

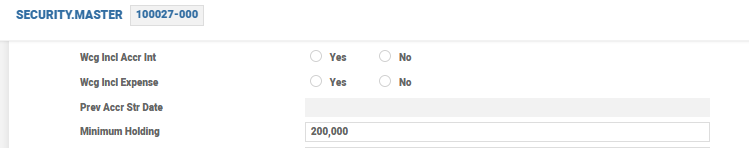

Recording the Details of Minimum Holding

The SECURITY.MASTER application allows the specification of a minimum nominal that a portfolio must have in the respective stock it trades. The below screenshot shows a sample of the record in SECURITY.MASTER with the Minimum Holding field set to 200,000.

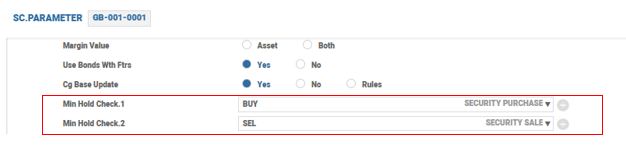

The multi-value field Min Hold Check in SC.PARAMETER contains the transaction codes against which the minimum holding validation is processed. The below screenshot shows a sample of a record in SC.PARAMETER with a value set in the Min Hold Check field.

The Min Hold Check field contains securities purchase (BUY) and securities sale (SEL). A SEC.TRADE utilising BUY for the purchase or SEL for a sale of a security validates against the minimum holding for the particular security and gives a suitable override message, if the total holding of the portfolio is less than the minimum holding. If the Min Hold Check field is left blank, minimum holding validation does not take place in the system.

The SECURITY.MASTER is shown above with the Minimum Holding field set to 200,000. Assume that the user wants to buy 100,000 of the stock through SEC.TRADE using BUY, the application checks whether the total holding for the security in the portfolio meets or exceeds the minimum holding requirement. In the above case, if the user already has 100,000 or more stocks, the total position for the security in the portfolio meets the minimum requirements. If it is not meet, the system generates an override message.

Similarly, when the user tries to sell the stock and if the total position for the stock in the portfolio falls below the minimum holding requirement, an override message is displayed. The only exception is that if the user tries to sell off all stocks in the portfolio, that is, if the position for the stock in the portfolio after the sale is zero, then override is not generated.

Blockage of All Activity in One Security

If the user enters a date in the Blocking Date field, the security is prohibited for any type of transaction from that date. The Narrative field can be populated with a free format text. As per the screenshot shown below the security is not available to trade from April 11, 2020.

Security Status

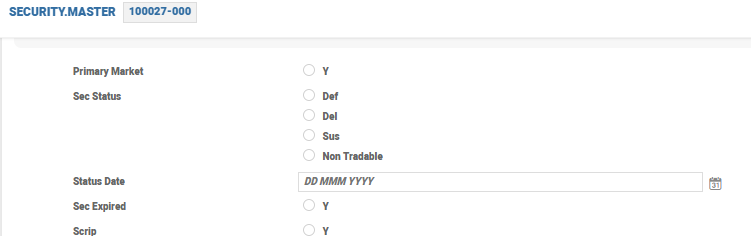

The status of the security is mentioned in the Sec Status field. The possible values are

- Def - Denotes that this security has defaulted coupon payments but the trading can continue.

- Del - Denotes that the security is de-listed from the exchange, or expired and trading cannot be performed on this security.

- Sus - Denotes that the security is suspended with an effective date and trading is not allowed.

- Non-Tradable - Denotes that the security is non-tradable with an effective date.

The date from which the Sec Status field is effective is defined in the Status Date field. The Sec Expired field denotes that it is an expired security, if marked as Y. The Scrip field denotes that this is a scrip, if it marked Y. Scrips denote a certificate that can be exchanged for a fractional share of stock. The security status fields are used to default the correct security master ID when an alternate index is used.

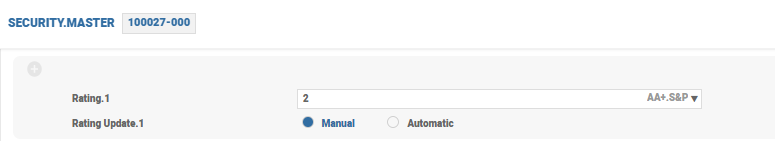

Ratings

In the SECURITY.MASTER application, the Rating field is used to describe the rating of a bond. Any input to this field must be defined on the EB.RATING application. The Rating Update field is used to identify the source of the bond rating recorded and is restricted to the following two options:

- Manual

- Automatic

The manual option indicates that the rating must be manually input by the user and the automatic option indicates that the rating is received through an external source as shown in the below screenshot.

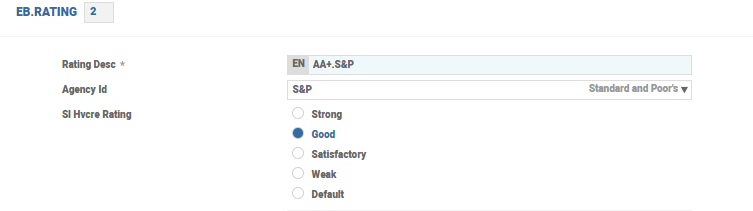

EB.RATING

The EB.RATING application is used to identify the rating of a bond or a particular record in SECURITY.MASTER application. The ID of this record is limited to five characters only.

The SI Hvcre Rating field can accept any of the following values:

- Default

- Good

- Satisfactory

- Strong

- Weak

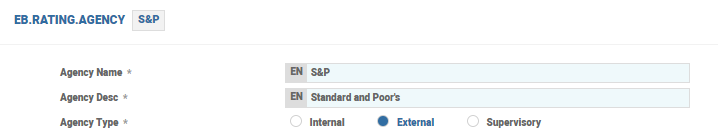

EB.RATING.AGENCY

The Agency Id field of EB.RATING can be linked to an EB.RATING.AGENCY application as shown in the below screenshot, if required.

Restricting Dealers Trading In a Security

The Grp Dept Code field in SECURITY.MASTER application captures the information regarding the dealers who can trade in that particular security. In most cases, these securities are not sourced from data providers, the usage of such securities are restricted. These securities can only be traded using SEC.TRADE or SECURITY.TRANSFER with external custody code defined in SC.PARAMETER or through SC.PERSONAL.ASSET.TXN. Normal trades or transfers are not allowed for the securities with Grp Dept Code field being set. This field indicates that only the dealers or users under this department code can trade in the corresponding SECURITY.MASTER.

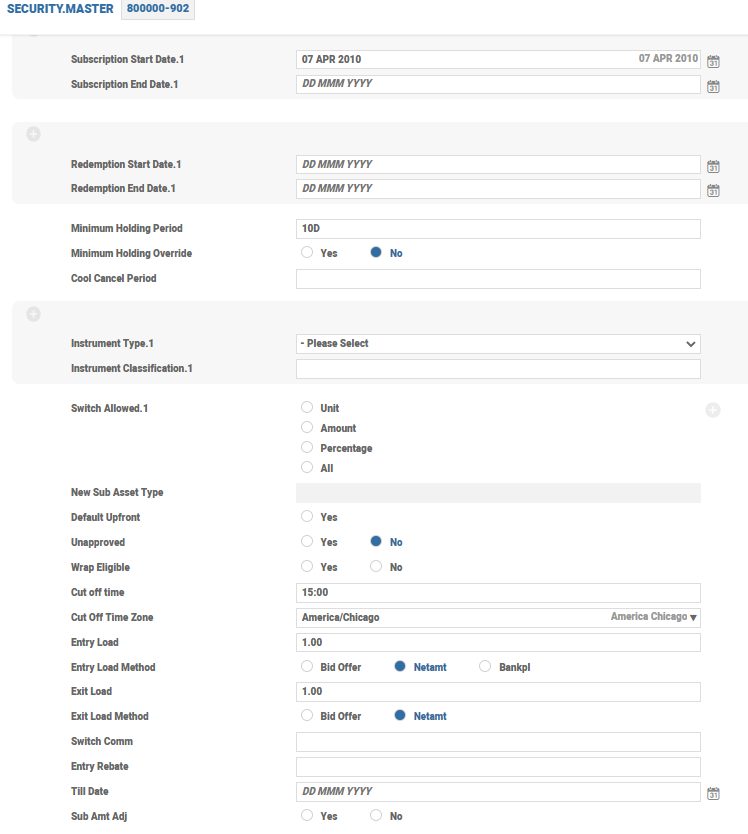

Attributes Relating To Funds

Funds are collective investments, which pools in the investor’s money. A fund manager uses that money to buy and sell a wide range of investments on behalf of the investor, in order to achieve a fund’s objective. The following fields allow the users to capture the fund attributes in the SECURITY.MASTER application.

| Field | Descriptions |

|---|---|

| Fund Inception | Holds the date of fund inception |

| Fund Issuer | Denotes the name of the fund issuer |

| Fund Advisor | Records advisors of the fund |

| Fund Sub-advisor | Records sub-advisors of the fund |

| Fund Manager | Records name of the fund managers |

| Registration Status | Indicates the countries where fund is registered |

| Trustee Name | Denotes the name of the trustee |

| Fund Classification | Defines any market categorisation or classification for the fund (based on investment objective, risk profile and so on) |

| Sub-Classification | Defines any sub-category or classification for the fund |

| Open or close ended | Denotes whether fund is open-ended or close-ended. The allowed values are OPEN and CLOSE. Open-ended funds allow the investor to invest anytime during the life of the fund, whereas the close ended funds allows the investor to invest only at the initial fund offer and does not allow the investor to redeem the fund until maturity. |

| Direct or Fund of Fund | Denotes whether it is a direct fund or a fund of fund. The allowed values are DIRECT and Fund of Funds (FOF). |

| Hedge Indicator | Denotes whether the fund is the hedge or not |

| Exchange Traded Fund | Denotes whether it is an exchange trade. The allowed values are YES and blank, where a blank field denotes non Exchange Traded Funds (ETF). |

| Derivatives Indicator | Indicates whether the fund uses derivatives as part of its investment or not. The allowed values are YES and NO. |

| Applicable Currencies | Defines the applicable currencies linked to the fund |

| Issue Size | Denotes the initial size in security currency |

| NFO Close Date | Denotes the initial fund offer closure date |

| Restriction | Allows the users to mention restrictions, if any |

| Closed To all | Denotes whether trading is not allowed. Allowed values are YES or NO |

| Closed To new | Denotes whether the fund is closed for new investors. Allowed values are YES or NO |

| Management Fee cap | Denotes the maximum stated management fee in percentage |

| Admin Fee Cap | Denotes the maximum stated admin fee in percentage |

| Currency related to minimum amount |

Denotes the currency related to investment or redemption check file of CURRENCY

|

| Amount of initial investment | Denotes the amount of initial investment |

| Amount of subsequent investment | Denotes the amount of subsequent investment |

| Minimum SIP amount | Denotes the minimum Systematic Investment Plan (SIP) amount |

| Minimum Redemption amount | Denotes the minimum redemption amount. This is an associated multi-value set from the Min Invt Ccy to Min Redem Amt fields. |

| 12M NAV High | Denotes the highest Net Asset Value (NAV) in last 12 months |

| 12M NAV Low | Denotes the lowest NAV in last 12 months |

| Subscription Start Date | Records the start date of subscription period. The hedge funds accept subscriptions on monthly basis, whereas, the others do on quarterly basis |

| Subscription End Date | Records the end date of the subscription period, which has to be filled along with the Subscription Start Date field |

| Redemption Start Date | Records the start date of the redemption period, whereas, some hedge funds allow redemption only during a certain period |

| Redemption End Date | Records the end date of the redemption period, which has to be filled along with the Redemption Start Date field |

| Minimum Holding Period | Denotes the allowed number of days the fund should be held before redemption or the number of notice days required for hedge funds |

| Minimum Holding Override | Indicates whether the minimum holding period can be overridden by paying a fee |

| Cool Cancel Period | Indicates the cooling or cancellation period, by when an investor can opt out of the contract |

| Switch Allowed | Indicates whether the switch is allowed for the fund and what type of switch is allowed. It is a multi-value field that accepts the values UNIT, AMOUNT, PERCENTAGE and ALL. |

| Unapproved | Denotes whether the fund is approved or not. If set to Yes, the fund is considered unapproved. If the field is blank, the fund is considered approved. Orders placed for unapproved funds are not allowed for grouping. |

| Wrap Eligible | Denotes whether fund is eligible for a wrap or not |

| Cut off time | Denotes the fund house cut-off time |

| Cut Off Time Zone | Denotes the time zone for the associated cut off time |

| Default Upfront |

Triggers the defaulting upfront security. If set to YES, the upfront security from SC.PARAMETER is defaulted based on security currency and sub-asset type.

|

| Entry Load | Indicates the entry load in terms of percentage |

| Exit Load | Indicates the exit load in terms of percentage |

| Switch Comm | Indicates the switching commission in terms of percentage. The switching commission is applicable on intra-fund switches and denotes the commission applicable while transferring from this fund. |

| Cool Cancel Period |

Denotes the cooling period duration for the fund

For example, if the cooling period is four days from the date of purchase of the fund, then the Cool Cancel Period field is populated with 4D.

If an order is placed with the fund mentioned above and executed, the respective record in SEC.TRADE is created. Read SEC.TRADE section in trade creation for more information.

|

| Entry Load Method |

Identifies how the entry load is calculated and handled. There are different options as shown below:

SC.STD.SEC.TRADE application for company level setting. The field at SECURITY.MASTER level overrides the company level setting.

|

| Exit Load Method |

Identifies how the exit load is calculated and handled. There are different options as shown below:

SC.STD.SEC.TRADE for a company level setting. The field at SECURITY.MASTER level overrides the company level setting.

|

| Entry Rebate | Indicates the rebate (if any) on entry load in terms of percentage. The rebate is applicable only when the Entry Load Method is Bankpl. |

| Till Date | Indicates the date until when the rebate on entry load is applicable |

| Sub Amt Adj |

Determines whether the customer’s investment (subscription amount) needs to be retained or reduced based on the rebate or discount offered, if rebate or discount is offered on the entry load.

If this field is set to No or left blank, the original subscription amount is retained (by grossing up the investment amount) and the customer is debited for the same after applying the rebate (and channel discount) on entry load.

If this field is set to Yes, the subscription amount is reduced in line with the rebate or channel discount. The field at SECURITY.MASTER level overrides the company level setting.

|

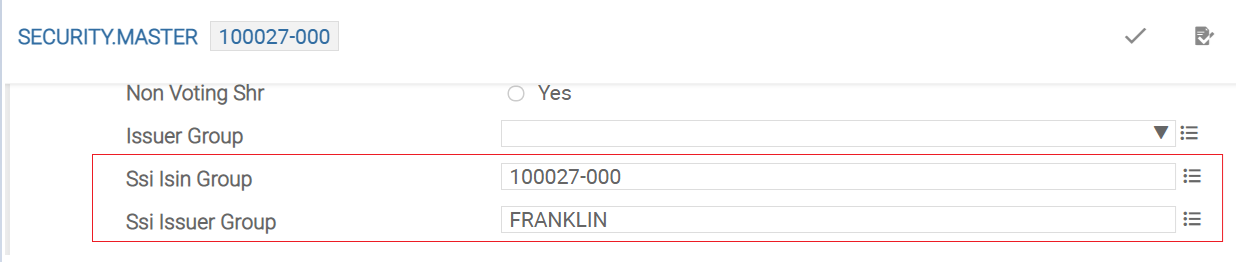

Determining SSI using Isin and Issuer Group

SSI can be set up for a group of ISINs or for all instruments issued by the same issuer. Where several ISINs or issuers need to be grouped together to set up a single SSI, then all the respective records in SECURITY.MASTER must have the same value updated in the Ssi Isin Group and Ssi Issuer Group fields.

If the values are not entered in the Ssi Isin Group field, then the SECURITY.MASTER ID is automatically defaulted in the Ssi Isin Group field and can be amended by the user. If value is not entered in Ssi Issuer Group field, the value in Issuer field is automatically defaulted in Ssi Issuer Group field and can be amended by the user.

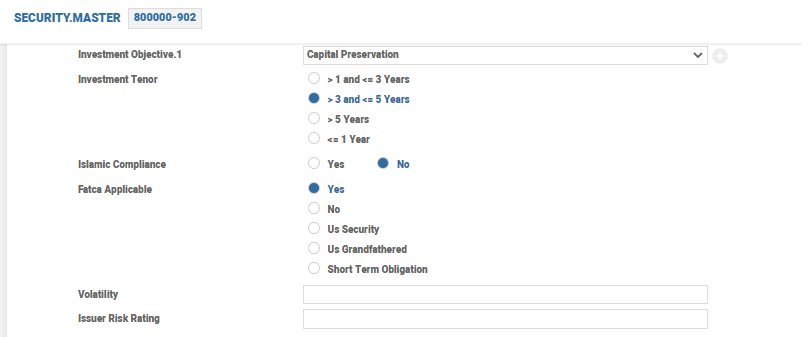

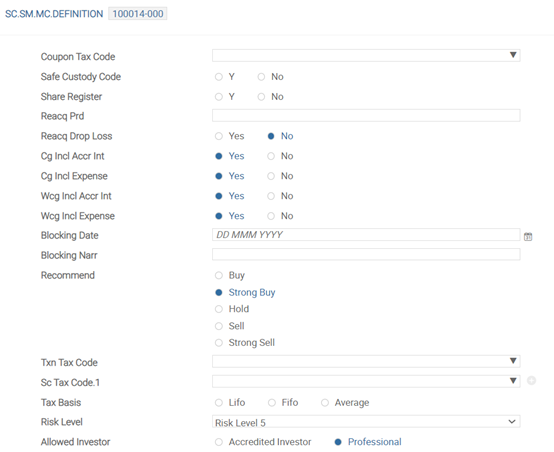

Regulatory Information for Pre-Trade Checks

The following fields are involved in handling the regulatory information for pre-trade checks. The pre-trade checks are not done in Temenos Transact but is done in the front office system using the values in these fields.

| Field | Description |

|---|---|

| Investment Objective | Indicates the different investment objectives based on the characteristic of the instrument |

| Investment Tenor | Indicates the investment time horizon of the instrument |

| Islamic Compliance | Indicates if instrument is compliant with Islamic sharia law |

| Fatca Applicable | Indicates if the instrument is in scope for FATCA tax |

| Volatility | Indicates the market volatility or price-risk of the instrument |

| Issuer Risk Rating | Indicates the risk level of the issuer of the instrument |

| Instrument Type | Indicates the type of instrument such as, Central Provident Fund (CPF) Investment Scheme (CPFIS) |

| Instrument Classification | Indicates the sub-classification of the instrument type |

| Field | Description |

|---|---|

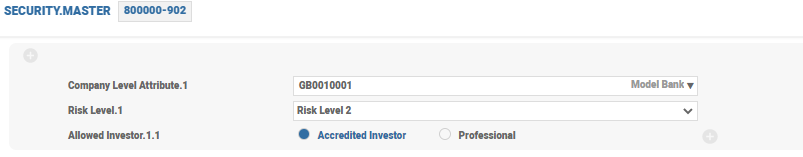

| Company Level Attribute |

Records the COMPANY ID. This field allows the customer to set company-wise risk level and company-wise allowed investors for this instrument

|

| Risk Level | Indicates the various types of risk level |

| Allowed Investor | Indicates the type of investors who can invest in the instrument |

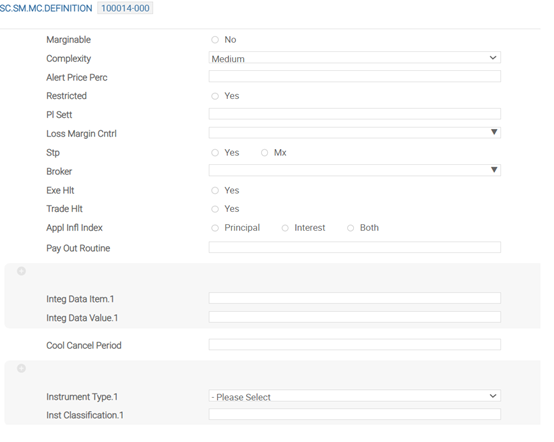

Other Fields

The following fields in the SECURITY.MASTER application are used to capture high and low advance ratio for security level.

| Field | Description |

|---|---|

| New Margin Rate | Margin rate must be within 100 |

| New Adj Margin Rate | Margin rate must be within 100 |

When there is a change in margin rates, the user need to trigger collateral margin recalculation. The user must check if the values in NewMargin Rate or NewAdj Margin Rate are different. If so, then update the trigger for CO.RECALC.CUST.COLL service by updating the CO.MARGIN.CHANGE application. The following fields in the SECURITY.MASTER application capture the concentration cap details.

| Field | Description |

|---|---|

| Concentration Cap | Must to be considered for the security. Concentration cap is a cap value defined for a collateral, with respect to total collateral value, to ensure that a single asset is not used extensively. |

| Bond Ranking | Bond ranking for the security used to apply bond cap |

| Price Frequency | Indicates whether the funds are daily, weekly, monthly, quarterly, semi-annually, or annually priced |

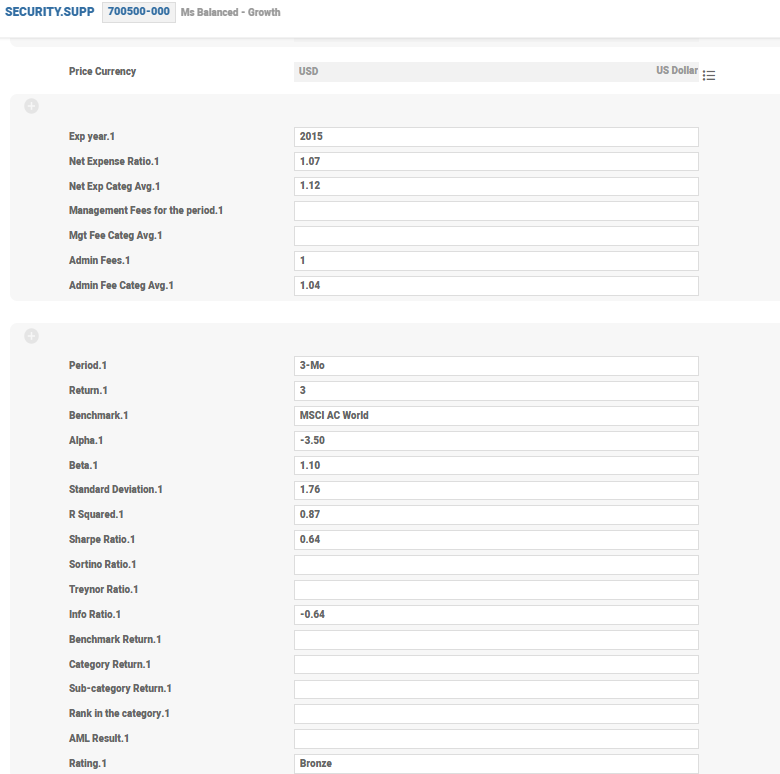

Capturing Performance Details of the Security using SECURITY.SUPP

The SECURITY.SUPP application is used to store additional information held in SECURITY.MASTER application. The following fields allow the users to capture performances, expenses and holdings details in the SECURITY.SUPP application.

| Fields | Descriptions |

|---|---|

| Exp year | Denotes the period or year to which the associated expenses and fees are related |

| Net Expense Ratio | Denotes the net expense ratio of the fund for the associated period |

| Net Exp Categ Avg | Denotes the net expense ratio of the fund for the associated period |

| Management Fee for the period | Denotes the management fees for the period |

| Mgt Fee Categ Avg | Denotes the average of the other funds in the category |

| Admin Fees | Denotes the admin fees for the period |

| Admin Fee Categ Avg | Denotes the average of the other funds in the category |

| Period | Denotes the period to which associated return is related. This can be 1-Mo, 3-Mo, 6-Mo, YTD, 1-Yr, 3-Yr, 5-Yr, 10-Yr or since Inception. |

| Return | Denotes the return for the period associated |

| Benchmark | Denotes the benchmark against which the performance is compared |

| Alpha | Denotes the associated measure for the fund. Denotes how much the fund has outperformed its benchmark index. |

| Beta | Denotes the associated measure for the fund. Denotes the volatility of the fund. |

| Standard Deviation | Denotes the associated measure for the fund |

| R Squared | Denotes the associated measure for the fund |

| Sharpe Ratio | Denotes the associated measure for the fund |

| Sortino Ratio | Denotes the associated measure for the fund |

| Treynor Ratio | Denotes the associated measure for the fund |

| Info Ratio | Denotes the associated measure for the fund |

| Benchmark Return | Denotes the performance of the benchmark |

| Category Return | Denotes the performance of the category |

| Sub-category Return | Denotes the performance of the sub-category |

| Rtn Catg Rank | Denotes the rank in the category in terms of performance |

| Risk | Denotes the risk free format (below average, above average and so on) |

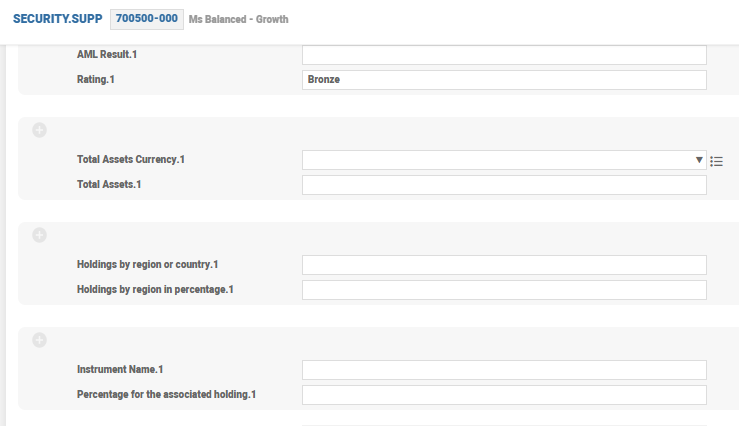

| Rating | Denotes the free format (for example, 4-Stars) |

| Total Assets Currency | Denotes the risk free format (below average, above average and so on) |

| Total Assets | Denotes the total assets |

| Geog Reg Cnty | Denotes the holdings by region or by country |

| Geog Perc | Denotes the holdings by region in percentage |

| Largest Hldng | Denotes the instrument name |

| Largest Hld Perc | Denotes the associated holdings in percentage |

A sample record in SECURITY.SUPP is shown in the below screen shot.

Non-Stop Security Master Update

Instruments like equities and funds are traded in exchanges spread across the globe. New instruments are introduced on a regular basis and existing product attributes undergo changes constantly. All these can be updated in the system on a real time basis to enable investors to trade seamlessly and allow quick feedback and actions. To enable non-stop updates to the SECURITY.MASTER application, the Non-Stop (NS) module needs to be licensed. When the NS module is installed, the new records in SECURITY.MASTER can be created 24x7 and existing records in SECURITY.MASTER can be amended 24X7.

The following settings need to be noted:

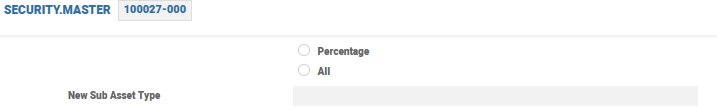

- The Last Price and Sub Asset Type fields in the

SECURITY.MASTERare required for calculations in terms of various COB processes. When these changes happen during a COB, it could lead to inconsistent calculations.

- Updates can continue to happen 24x7 to the Last Price field. In a multi-entity single instance installation, COB is initiated at different times during the day as the companies could be in different time zones. However, for any particular instance (company) where COB has started, the price in the Last Price field of the instrument at the beginning of the COB valuation batch, is used for all valuation and COB calculations until the COB is complete.

- Similarly, system uses the Sub Asset Type field at the beginning of the COB process for all COB related calculations. If the sub-asset type must be changed, it must be updated in the New Sub Asset Type field. Once the COB is completed, the value in the New Sub Asset Type field is updated as the Sub Asset Type field thus allowing the positions to be rebuilt.

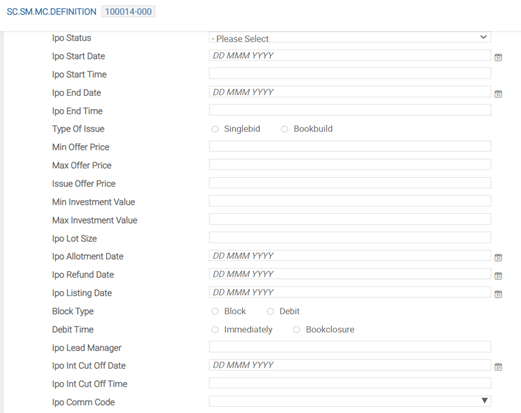

Multi-company SECURITY.MASTER Setup

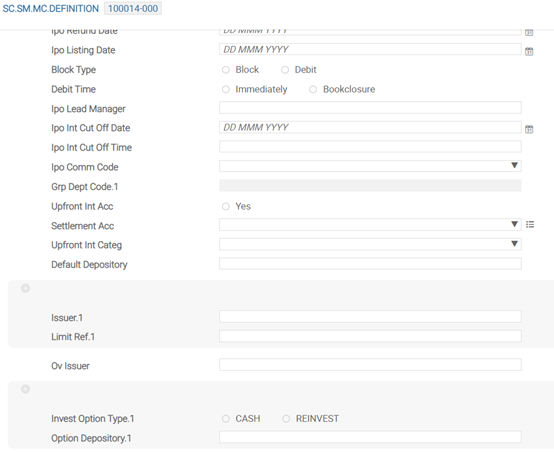

The SC.SM.MC.DEFINITION table allows users to set company-specific fields related to the SECURITY.MASTER application. The records in SC.SM.MC.DEFINITION should be manually created to capture the instrument level attributes specific to the company. The table contains only the SECURITY.MASTER fields that may vary by entity. Customer-related fields, such as Default Depository can be set in SC.SM.MC.DEFINITION, only when the respective customer records are not to be shared across the companies. The ID of a given record in the SC.SM.MC.DEFINITION table is the same as that in the SECURITY.MASTER application.

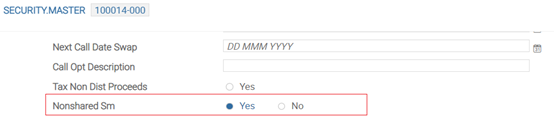

To create a record in the SC.SM.MC.DEFINITION table, the Nonshared SM field must be set to Yes for the respective record in SECURITY.MASTER. This can be set only when the Nonshared SM field in SM.PARAMETER is set to Yes.

SECURITY.MASTER and SM.PARAMETER to enable creation of a record in the SC.SM.MC.DEFINITION table.

Applications and routines that call the SECURITY.MASTER application first checks the SC.SM.MC.DEFINITION table for the required details of the given company, provided the Nonshared SM field is set to Yes in the respective SECURITY.MASTER record. For those required details that are not available in the SC.SM.MC.DEFINITION table, the system refers to the details provided in SECURITY.MASTER for the corresponding record.

SC.SM.MC.DEFINITION application is not meant for margin-related fields. To set up different margin rates per company, the SC.MARGIN.RATES application should be used.

In this topic