Introduction to Non-Deliverable Forward

ⓘContent enriched:New structure and revised (Docs 2.0)

The Non-Deliverable Forward (NDF) module facilitates the processing of standard Non-Deliverable Forward transactions or deals.

This section is designed to help the Temenos Transact users to understand the application features, navigation and functionalities related to the NDF module of Temenos Transact. The intended audience of this module are as follows:

| Role | Function |

|---|---|

| Dealer | Executes deals with counterparty and records the deal details in the system |

| Treasury Back Office Personnel | Ensures authorisation, confirmation and settlement of payments |

| Risk Manager | Enforces and monitors risk limits |

| IT Personnel of Bank or Financial Institution | Maintains computing infrastructure and upgrade of computer applications |

NDF is an outright forward contract in which counterparties settle the difference between the contracted NDF price or rate and prevailing spot price or rate, on an agreed notional amount.

It allows the investor to take a position in the currency, even when the currency is not fully convertible, that is, restrictions apply on settlement. The investor uses the non-deliverable foreign currency but foreign exchange (FX) gain or loss is paid in a deliverable currency, generally US dollars. Sample of currencies that are not allowed to be freely exchanged are Argentinean peso, Brazilian real, Chinese renminbi (yuan), Egyptian pound, Israeli shekel, South Korean won, and Taiwanese dollar.

The profit or loss is based on the difference between agreed settlement and spot currency prices on the settlement date. Conventionally, the settlement date is two days prior to the expiry of the contract. The settlement currency are usually US dollars. International business often uses NDF to hedge currency that trades thinly or is non-convertible.

The rate used to fix the contract (generally two days before the expiry of the contract) is a key contractual term in terms of its source and time at which the rate prevails.

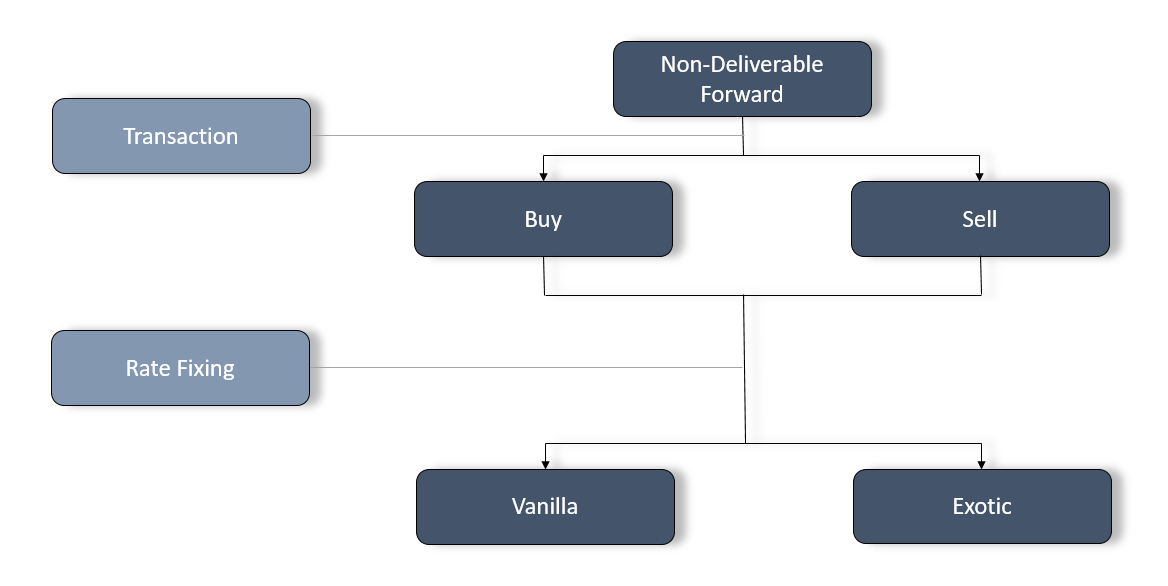

NDF are of two types:

The rate fixing on spot basis, that is, commonly two business days before the maturity or value date of the contract.

This is similar to Vanilla NDF, except allowing the fixing date to be set at any date during the life of the transaction before the value date.

Fixing profit or loss is discounted when the NDF is fixed and settled early. The P&L on account of discounting is amortised from the settlement date to value date of the NDF. The ND.DEAL application is used to input the NDF transactions.

Product Configuration

This section describes the configuration options the system offers in NDF.

The ND module uses the following tables:

CUSTOMERACCOUNT

These records are dependencies for NDF deals. The CUSTOMER records are necessary for any transaction, and also to draw details of the counterparty. The ACCOUNT records need to be opened for settlement of profit or loss arising in the ND deal transactions.

Following are the core dependencies tables:

ACCOUNTINGDELIVERYLIMITPOSITION.MANAGEMENT

DELIVERY is a core Temenos Transact module, which helps in generating confirmation messages and payment advices for NDF transactions. The accounting entries for NDF transactions are generated online. On validation of the transaction, the system updates the Position Management module. Limits for transactions are setup before or after inputting the transactions, and if not set, system creates an override message notifying the absence of a limit. On authorisation, the system creates a limit for the customer for the relevant limit product, automatically.

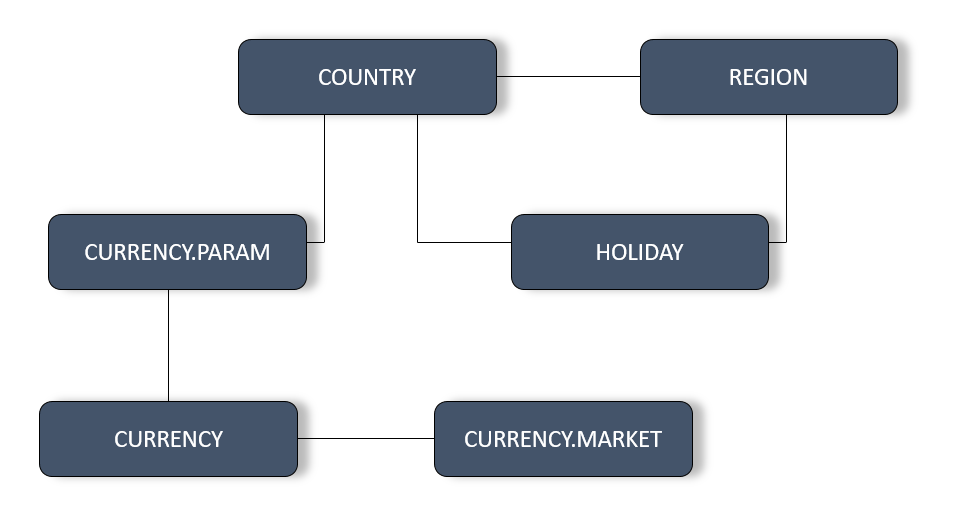

NDF also uses other static tables, such as:

CURRENCYCOUNTRYHOLIDAY

The HOLIDAY table specifies the public holidays for the particular country and region. It helps the user to:

- Calculate the value date of the contracts

- Define more than one country or region to accommodate additional holidays

Implementation of the ND module begins with the configuration of various parameter tables. The following files are required for NDF to setup in their respective build sequence:

Illustrating Model Parameters

The model parameters consists of the following:

| S.No | Parameters | Description |

|---|---|---|

| 1 | ND.PARAMETER

|

This table allows the user to define the parameters to process all NDF deals. It also consist of the category codes that user needs to configure for accounting and revaluation of the results. This file must be defined before the creation of the NDF deal. |

| 2 | ENQ ND.SETTLE.RATE.SRC

|

This table allows the user to define the ND Settlement rate source for processing the NDF. This file must be setup before the NDF deal input can be used. |

llustrating Model Products

Following products are available under NDF module:

| S.No | Parameters | Description |

|---|---|---|

| 1 | NDF Vanilla Deals |

NDF is a Hedging strategy where the parties in contract agree to settle the profit or loss prior to the expiration date of the contract. A Vanilla NDF transaction has an agreed rate fixing date, which is usually two working days before the settlement date. |

| 2 | NDF Exotic Deals |

An Exotic NDF allows fixing date to be set at any date during the tenure of the transaction before the Vanilla date. The fixing profit is discounted if the NDF is fixed and settled early. The discount amount will be amortised from the settlement date to the value date of the NDF. |

In this topic