Introduction to Forward Rate Agreements

ⓘContent enriched:New structure and revised (Docs 2.0)

The Forward Rate Agreement (FRA) module facilitates processing of standard Forward Rate Agreement deals.

FRA is an agreement between two parties to protect themselves against future movements in interest rates. It is a cash-settled over the counter contract, where the buyer borrows (and seller lends) a notional sum at a fixed interest rate (the FRA rate) for a specified period starting at an agreed date in the future. It is a flexible instrument that can be customised to meet the needs of both the buyer and seller. In short, a FRA is a forward-forward deposit or loan.

The parties lock in an interest rate for the stated period of time starting on a future settlement date, based on a specified notional principal amount (to calculate interest payment). For example, three to six months FRA deal at a fixed interest rate on a notional sum is entered on the trade date.

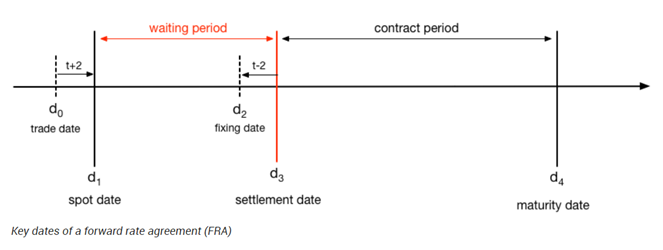

The waiting period of the contract is considered from the calculated spot date (generally T+2) to three months, and the start date of the contract commences only after three months. The maturity date of the contract is six months from the calculated spot date.

Fixing date is the date on which the prevailing interest rate for the period is determined. It is calculated for the currency contracts as follows:

- Foreign currency contracts – Two days prior to the start date

- Local currency contracts – Same day as start date

FRA effectively ends on the settlement date, which is same as start date, as there is no contractual agreement between counterparties henceforth. The contract period is one of the calculation parameters to determine the settlement amount.

| Field | Description |

|---|---|

| Contract Rate (or FRA Rate) | The interest rate that the two contracting parties negotiate on trade date. This rate is compared to the settlement rate during the calculation of settlement amount. It starts on the settlement (d3) date and ends on maturity date (d4). |

| Contract Period | The time between the settlement and maturity dates of the notional loan. This period can go upto 12 months. |

| Currency | The currency in which the FRA's notional amount is denominated. |

| Fixing Date | This is the date on which the reference rate is determined, that is, the rate to which the FRA rate is compared. |

| FRA Buyer | The buyer of an FRA is the contracting party that borrows at the FRA rate (contract rate). |

| FRA Seller | The seller of an FRA is the contracting party that lends at the FRA rate (contract rate). |

| Master Agreement | Usually counterparties sign a master agreement between each other before entering into an Over the Counter (OTC) contract because huge amount of paperwork is generated and processed for every single deal without a master agreement in place. |

| Maturity Date | The date on which the notional loan is deemed to expire. |

| Notional Amount | The notional sum for which the interest rate is guaranteed and all interest calculations are based. |

| Reference Rate | The interest rate index to which the FRA rate is compared to determine the settlement amount. This is generally an IBOR-type rate index with the same duration as the FRA's contract period. For example, six months EURIBOR for an FRA in euros with a six-month contract period). |

| Settlement Amount | The amount calculated as the difference between the FRA and reference rate, as a percentage of the notional sum paid by one party to the other on the settlement date. The settlement amount is calculated after the fixing date for payment on the settlement date. |

| Settlement Date | The date on which the notional loan period (the contract period) begins and settlement amount is settled. |

| Spot Date | The market spot date applicable on the contract is usually two business days after the trade date. |

| Trade Date | The date on which the FRA is negotiated between the two counterparties. |

| Waiting Period | The period between the value date (d1) and settlement date (d3). |

FRAs are settled using cash on the settlement date. The exposure to each counterparty is determined by the interest rate differential between the market rate on settlement date and the rate specified in the FRA contract and there are no principal flows.

FRAs allow market participants to trade today at an interest rate that will be effective in the future. Thus, FRA is a tool to hedge interest rate exposure on future engagements.

The buyers of the FRA believe in locking-in a borrowing rate that protect them against a rise in interest rates. The sellers believe that obtaining a fixed lending rate protect them against a fall in interest rates. If the interest rates neither fall nor rise, there are no benefits for buyers and sellers.

The following definitions describe the terms used in this document:

PROFIT where the settlement rate is HIGHER than the FRA.DEAL contract rate.

LOSS where the settlement rate is LOWER than the FRA.DEAL contract rate.

PROFIT where the settlement rate is LOWER than the FRA.DEAL contract rate.

LOSS where the settlement rate is HIGHER than the FRA.DEAL contract rate.

The FRA application in Temenos Transact supports recording, administration and processing of FRAs. This application automates accounting, limit exposure, position updating, control and administration of trading activity and ensures efficient delivery of the related advices and payments.

Product Configuration

This section describes the configuration options the system offers in FRA.

FRA Dependency

FRA module uses the following tables:

CUSTOMERACCOUNT

These records are dependencies for FRA deals. The CUSTOMER records are necessary for any transaction, and to draw details of the counterparty. The ACCOUNT records are opened for payment and receipt of foreign currencies, settling brokerage, collecting charges and commissions.

Following are the other core dependencies tables:

ACCOUNTINGDELIVERIESLIMIT

DELIVERIES is a core Temenos Transact module, which helps in generating messages and advice for FRA transactions. The accounting entries for FRA transactions are generated during Close of Business (COB). On validation of the transaction, the system updates the position. Limits for transactions are set up before or after the input of transactions. If the limit is not set up, system creates an override message notifying the absence of a limit. On authorisation, the system automatically creates a limit for the customer for the relevant limit product.

FRA also uses other static tables, such as:

CURRENCYCOUNTRYHOLIDAYREGIO

Implementation of FRA module begins with configuration of various parameter tables. Below are the set of files in their respective build sequence that are required for FRA setup. Mandatory files are marked with a (*) mark.

Illustrating Model Parameters

The model parameters consists of the following:

| S.No | Parameters | Description |

|---|---|---|

| 1 | FRA.PARAMETER |

This table contains the parameter definition for FRAs to determine the valuation formula and frequency. Using this parameter users can define the following:

|

| 2 | MARKET.RATE.TEXT | This table allows users to define the floating rate option. The system populates user defined Floating Rate option code while populating the delivery related details. |

Illustrating Model Parameters

The model parameters consists of the following:

| S.No | Parameters | Description |

|---|---|---|

| 1 | FRA.PARAMETER |

This table contains the parameter definition for FRAs to determine the valuation formula and frequency. Using this parameter users can define the following:

|

| 2 | MARKET.RATE.TEXT | This table allows users to define the floating rate option. The system populates user defined Floating Rate option code while populating the delivery related details. |

llustrating Model Products

Forward Rate Agreements are over the counter contracts between parties that determine the rate of interest to be paid on an agreed upon date in the future. The contract determines the rate to be exercised along with the duration of the contract for termination and the contract notional value. In this type of contract, only the differential amount is paid or received. The following products are available in the FRA module:

| S.No | Parameters | Description |

|---|---|---|

| 1 | FRA Trade Buy | An FRA Trade Buy (Purchase) is a contract where the buyer is borrowing a notional sum at a fixed interest rate and for a specified period starting at an agreed date in the future. |

| 2 | FRA Trade Sell | An FRA Trade Sell (Sale) is a contract where the seller is lending a notional sum at a fixed interest rate and for a specified period starting at an agreed date in the future. |

| 3 | FRA Hedge Buy | An FRA Hedge Buy is a contract where the buyer gets into the agreement to borrow the notional amount with an aim of hedging the risk of loss due to variation in rate of interest, which is fixed at the start of the contract. |

| 4 | FRA Hedge Sell | An FRA Hedge Sell is a contract where the seller gets into the agreement to lend the notional amount with an aim hedging the risk of loss due to variation in rate of interest on it, which is fixed at the start of the contract. |

In this topic