The following set of files are required to setup Forward Rate Agreement (FRA):

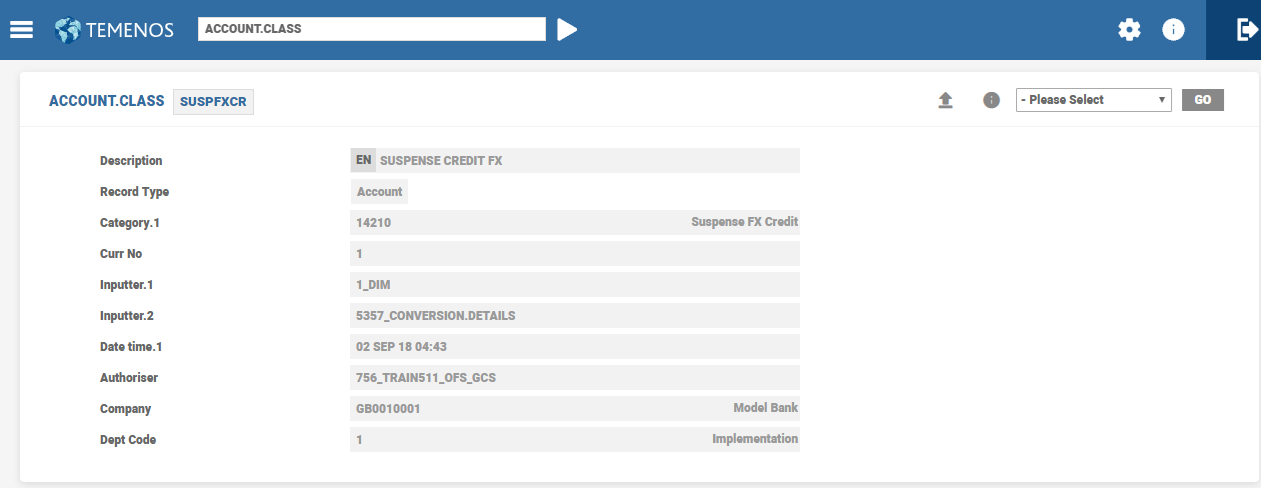

ACCOUNT.CLASS

An ACCOUNT.CLASS entry can be of two types:

ACCOUNTprovides the category code portion while building an Internal Account Number (such as Internal Suspense Accounts).CLASSprovides the parameters to identify the group of accounts (such as NOSTRO) by matching the account details against those held in the account class record.

SUSPFXCR and SUSPFXDR are records of ACCOUNT.CLASS used in FRA module. A sample ACCOUNT.CLASS record is illustrated below:

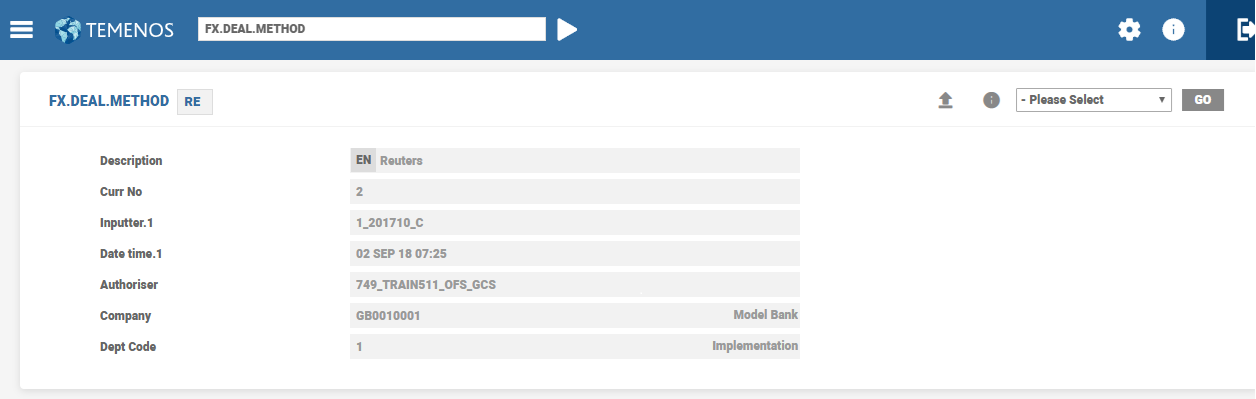

FX.DEAL.METHOD

Initiation of deals happen over multiple ways. This can be through an intermediary such as a Broker (in which case the BROKER record is setup), or through other means, such as Reuters or Bloomberg dealing systems, Telex or telephone. The FX.DEAL.METHOD table allows users to define which deal methods are applicable and use the information on advices.

FRA.AGREEMENT.TYPE

FRA.AGREEMENT.TYPE file stores different types of agreements used in FRA.DEAL contracts. For example, ISDA, FRABBA, etc.

Every contract is linked to an agreement type and the agreement type that is linked to a FRA.DEAL is validated against the definition on FRA.AGREEMENT.TYPE file and enriched with the associated description.

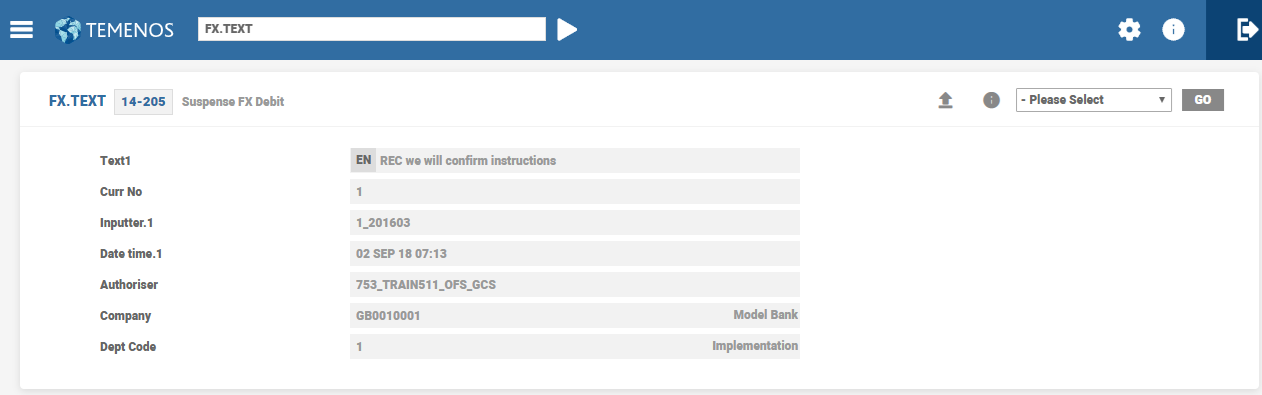

FX.TEXT

FX.TEXT is a table of advice texts printed on advices or confirmations when settlement information for a counterparty is not known. This is used where the counterparty has not specified settlement details. If the settlement details are not completed by the value date, the entries are posted to an internal account.

Nine options are available within this table and each has a unique text that is printed on the advice confirmation. The user then chooses which text to print by entering a number between 1 and 9 at the appropriate account field when a deal is input.

This message is then printed automatically on the advice confirmation corresponding to the deal. In this case, ACCOUNT.CLASS records with SUSPFXCR and SUSPFXDR IDs hold the category of internal suspense accounts to credit or debit amounts. Only two records can be created in FX.TEXT table with IDs equal to the categories defined in SUSPFXCR and SUSPFXDR ACCOUNT.CLASS records. These records hold the instructions for the credit and debit amounts, respectively.

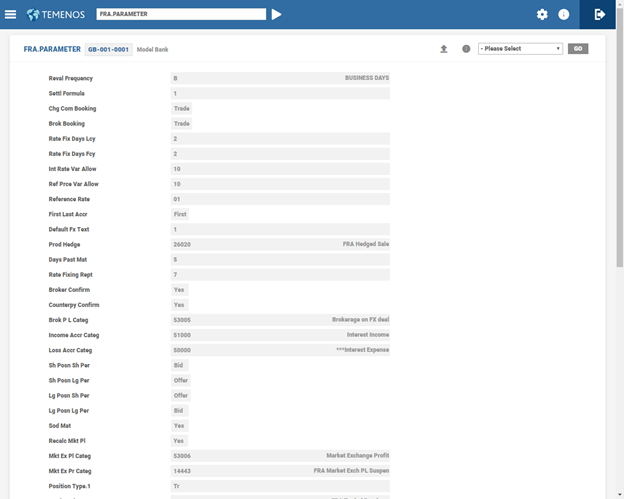

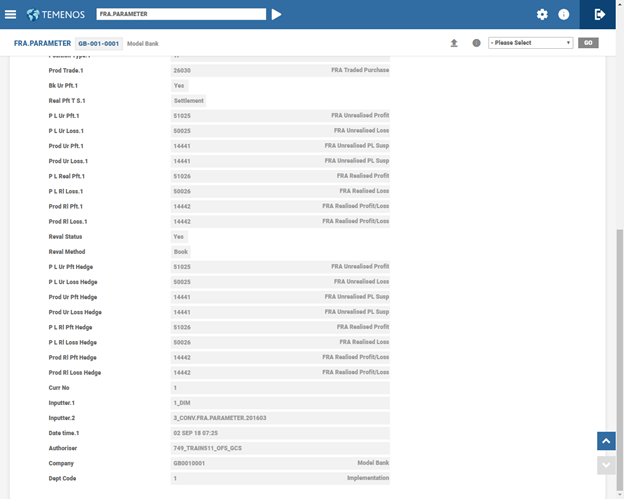

FRA.PARAMETER

FRA.PARAMETER file defines the basic information to process the FRA deals. Every Company has its own FRA.PARAMETER record that allows FRA processing to be specific to its business environment. Information such as default FX text, interest rate variance, rate fixing days, rate fixing report, settlement formula, revaluation rules, etc. are part of the table.

All FRAs are classified as either trade or hedge on input. It is not possible to change the classification of a FRA. If an FRA is booked incorrectly, it needs to be reversed and re-inputted.

Processing differs between trading and hedge FRAs in Temenos Transact:

- Trading FRAs are part of

FRA.POSITIONeither on consolidated or individual deal basis. They are revalued depending on the rules setup withinFRA.PARAMETERtable. The booking of such revaluation profit and loss are also defined in theFRA.PARAMETERtable. - By default, Hedge FRAs are not part of the

FRA.POSITIONand are always subjected to fair value principle, that is, marking-to-market. However, there is an option to include hedge deals to revaluation process and book resulting unrealized profit or loss. An option is available whether or not to amortise the P&L arising out of the rate fixing event.

Reval Status, Reval Method and Amort Hedge fields in FRA.PARAMETER determine the above choices.

When hedge deals are decided to be revalued, the Reval Status field in FRA.PARAMETER needs to be defined. These positions appear in FRA.HEDGE.POSITION and the profit or loss at settlement is accrued over the life of the contract.

The unrealised profit or loss due to revaluation can either be booked or calculated and not booked. When decided to book unrealised profit or loss, the category codes for the same are also available in FRA.PARAMETER table.

- If the Reval Status field is set to Yes, either Book or Calc is to be provided in the Reval Method field. There is no option to book only unrealized loss.

- If Reval Status field is set to Yes and Reval Method field to Book, the unrealised profit or loss on revaluation is booked using the category codes defined in P L UR PFT Hedge, P L UR Loss Hedge, Prod UR PFT Hedge and Prod UR Loss Hedge fields.

On authorisation, the codes can only be modified as clearing them affects the live deals (if any) that undergoes revaluation. The setting in Reval Status and Reval Method fields can be changed but the changes affect only the future deals and not the existing deals.

The value in the Amort Hedge field can be set to No, if Reval Status method is set to Book. This means that the realised profit or loss on fixing is not amortised from start date and is booked using the category codes defined in the P L RL PFT Hedge, P L RL Loss Hedge, Prod RL PFT Hedge and Prod RL Loss Hedge fields.

Once entered, these codes can only be modified, as clearing them affects the live deals, if any. The setting in Amort Hedge can be changed but the changes affect only the future deals.

FRA.PARAMETER also has accounting and processing rules relating to all FRA contracts, and specific to hedges and trades.

FRA.PARAMETER file also records the following information:

- Variance % allowed for tolerance checking

- Periodic interest rate key to check interest variance against contract rate

- Whether confirmation from broker and counterparty is required to be monitored

- Number of days in advance for rate fixing and report production

- Settlement formula used for each currency

- Category codes for brokerage expense

- First or last day accrual

- Revaluation rates for long or short positions and periods

- Category codes and rules for booking realised and unrealised P&L from revaluing FRA positions

- Option to revalue and book the profit or /loss

- Transaction category codes

- Category codes for booking settlement P&L

Any transaction processed for a non-treasury customer can have exchanges between the treasury and a branch at one rate (treasury rate) and the branch and customer at another. The difference between the two constitutes marketing exchange.

Where,

P – Principal

N – Number of days from start to maturity

Rt – Treasury interest rate

Rc – Contract interest rate

The following rules are applied to the above calculation to determine if it is a marketing exchange profit or loss:

Profit to marketing department when, Contract interest rate < Treasury interest rate

Loss to marketing department when, Contract interest rate > Treasury interest rate

Profit to marketing department when, Contract interest rate > Treasury interest rate

Loss to marketing department when, Contract interest rate < Treasury interest rate

When the market exchange profit or loss figure is posted on the trade date, it is not discounted because the settlement rate is not known at this time. If recalculation of market exchange profit or loss is required on the settlement date, that is, when the settlement rate is known, the Recalc MKT PL field on FRA.PARAMETER is set as Yes.

Mkt Ex PL Categ and Mkt Ex PR Categ fields within FRA.PARAMETER file holds either a Null value or relevant category codes. By default, these fields hold a Null value. When internal account categories are recorded in these fields, they are used for accounting entries for marketing department profit or loss. Both the fields are populated with values to enable the user to commit the record.

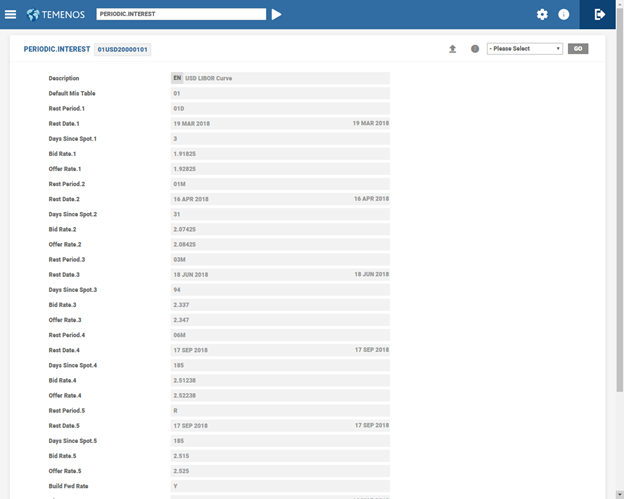

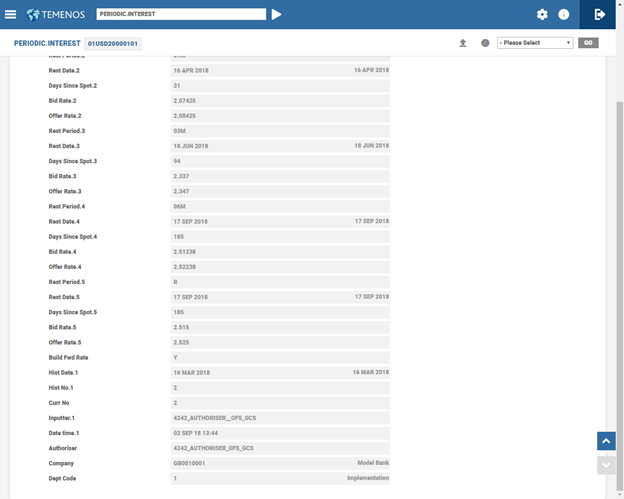

PERIODIC.INTEREST

PERIODIC.INTEREST file is a core Temenos Transact file, which stores interest rates for several time periods (curve) or one period rate, such as 3M Libor or 6M Libor.

The usage of PI rate key in FRA module can be summarised as follows:

- For rate tolerance check

- To derive the implicit forward rate and discounting rate, the revaluation logic requires the short and long rates (while revaluing an FRA)

- To refer to the rate index, the FRA is linked to that is LIBOR 3M or EURIBOR 6M and so on.

- To automatically fix the FRA contract using

ST.GROUP.FIXapplication

To know more, refer to the user guide on Periodic Interest Rate in system tables of Banking Framework.

In this topic