Working with Interest Related Reference Tables

This topic explains the workflow of interest related reference application in Temenos Transact. The four major rates defined are as follows:

- Fixed Rate

- Floating Rate

- Periodic Rate

- Risk-free Rate

Fixed Rate

The fixed rate is the rate agreed with the borrower at the time of loan creation and it does not change during the life cycle of the loan. The fixed interest rate agreed with the borrower is defined in the loan contractual agreement. Floating rates and periodic rates are stored in centralised core application, so that market rate changes can be realised on all affected loans instead of the need for a manual intervention on each individual loan.

Floating Rate

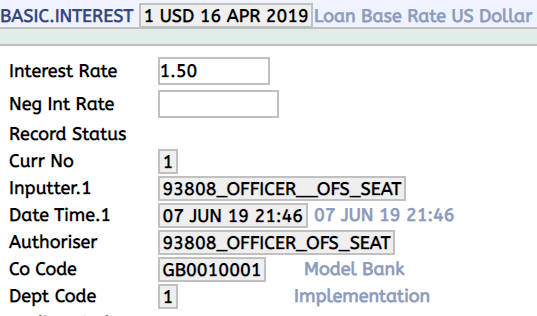

The floating rate fluctuates according to the market movement. The frequently used floating rates, for example, base rate, prime rate, and overnight rate are defined in the BASIC.INTEREST application for each currency. The BASIC.INTEREST application stores the interest rates which are applicable across loans regardless of the loan duration. The rates in this application may be updated automatically through external feeds.

The interest conditions can be linked directly to a basic interest record in this application, rather than defining the interest rate details on each transaction record.

When a rate change takes place, only the BASIC.INTEREST record defined in this application should be updated with the new rate(s) and the effective date. This automatically updates all the transaction records, which are tied to that rate.

Periodic Rate

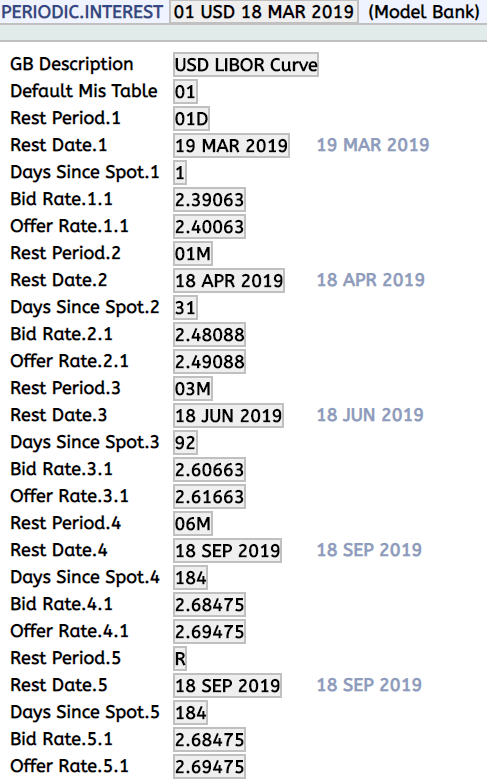

The PERIODIC.INTEREST application defines, for each currency, interest rates for any time period desired by the user for example, 10 days, 15 days, and 30 days. For each period defined by the user, both a bid and offer rate can be entered. Interest rates can also be defined by amount slabs, so a different rate can be entered for ranges from USD1 to 10,000 and between USD10,000 to 25,000.

The PERIODIC.INTEREST application is used by applications such as FOREX to default interest rates on forward contracts using the interest revaluation method or the Money Market (MM)/Lending Deposits (LD) applications to perform automatic rollovers.

The Last Wrkng Day field is set to instruct the system to check whether the current system date is the final working day of the month. If this is the case, when the rest period is defined as number of months, the system looks for the final working day of the appropriate month, rather than selecting the equivalent working day.

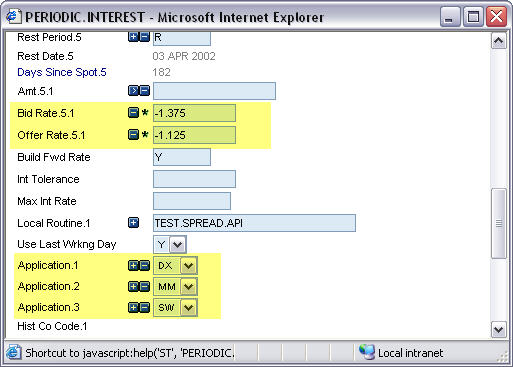

It is possible to hook an API to apply rates or spreads based on user-specific criteria through the Local Routine field that enables the core routine to be overridden. Negative interest rates can also be input in the PERIODIC.INTEREST application. The Application field is used to specify the application ID(s) that can use negative interest rates.

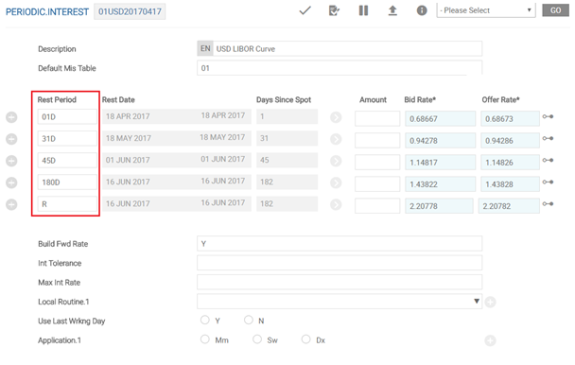

The following screenshot shows the Bid Rate and Offer Rate fields:

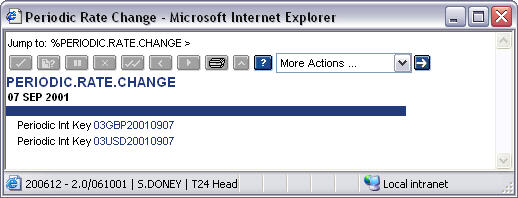

It is possible to modify the Rest Period fields, Amt, Bid Rate and Offer Rate field of existing PERIODIC.INTEREST records of a past date. The use of such modified records is application dependent. Whenever a PERIODIC.INTEREST record of a past date or processing date is modified and authorised, the ID of such records are written in the PERIODIC.RATE.CHANGE application. The ID of this application is the processing date.

To create a PERIODIC.INTEREST record with interest rates expressed in number of days greater than 31D, the Rest Period field must be set with the values expressed only in days and up to three digits as shown in the below screenshot.

The system does not allow the Rest Period field to have values greater than 31D and the values expressed in months or years in the same record. If the values in months or years have to be used, then the record can hold the values expressed in days only up to 31D.

Risk-free Rate

The PERIODIC.INTEREST application supports Risk-Free Rates.

Risk-Free Rates are overnight, backward-looking rates derived from actual market data for a given business day. They are published on each business day with a delay (that is, a rate published this business day is effective for the previous business day). These rates do not have a term structure (they are overnight rates published on each business day) and credit risk element.

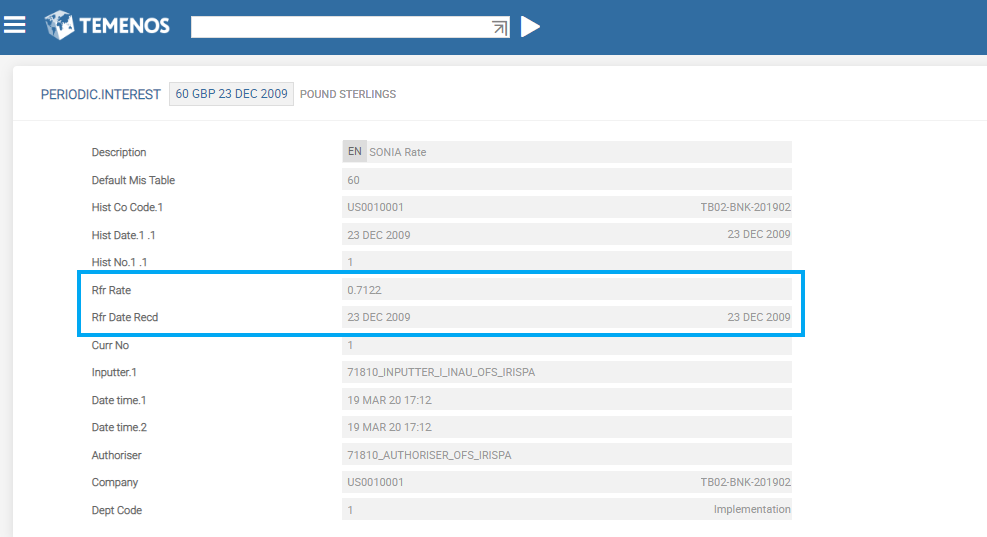

The PERIODIC.INTEREST application stores overnight Risk-Free Rates in the following fields:

- Rfr Rate – Stores the overnight Risk-Free Rate for the given

PERIODIC.INTERESTrecord. - Rfr Date Recd – Stores the date on which the overnight Risk-Free Rate is received.

ID of a given Risk-Free Rate PERIODIC.INTEREST record holds the effective date (the date for which the rate is applicable).

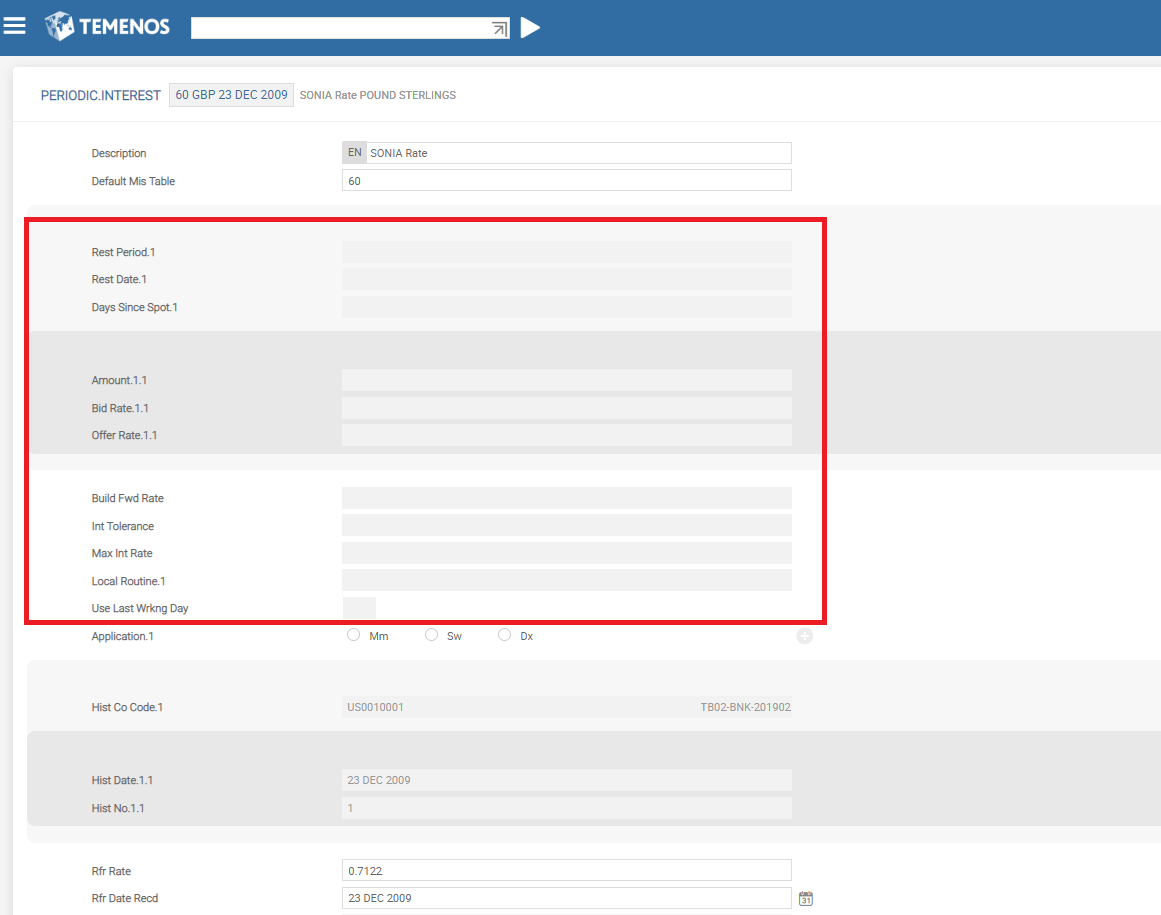

When there is a Risk-Free Rate stored in a given PERIODIC.INTEREST record, the Amount, Bid Rate and Offer Rate fields are not required. The overnight Risk-Free Rates are published as a single rate with no Bid or Offer options.

The fields used for forward-looking terms are not allowed. The fields such as Rest Period, Rest Date, Days Since Spot, Build Fwd Rate, Int Tolerance, Max Int Rate and Use Last Wrkng Day are disabled accordingly.

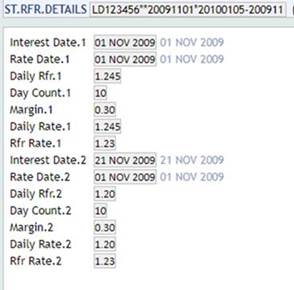

The RFR interest calculation is performed using two different methods such as Rate Compounding and Amount Compounding depending on the setup in the relevant business application. In case of the Rate Compounding, the system calculates the average compounded rate for the period.

Results of the RFR calculation are recorded in the ST.RFR.CONTRACT.DETAILS and ST.RFR.DETAILS tables in Temenos Transact.

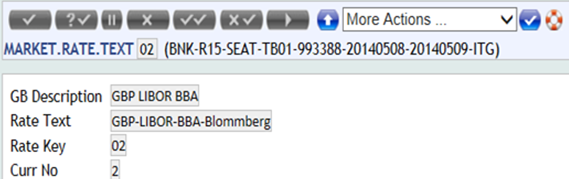

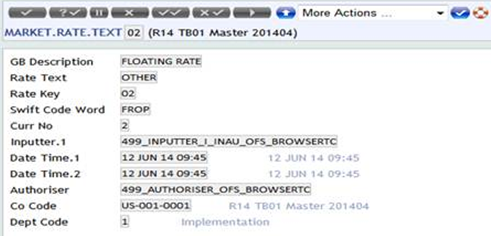

Market Rate Text

The MARKET.RATE.TEXT application contains the descriptions of tradable interest rates that are recognised by SWIFT.

Each description is used as the enrichment to the corresponding ID when it is displayed or printed during Temenos Transact processing. The Rate Text and Swift Code Words fields are used to populate the values in Tag 14 F in SWIFT MT 340, 360 and 361 messages. The Rate Text defined should be as guided by the SWIFT standards.

If the FLOATING RATE option is chosen as OTHER in the sequence C, the SWIFT standards expect the user to provide additional information in Tag 37N of MT360 and MT361 messages. Temenos Transact is enabled to auto default the additional information which includes a code word 'FROP' that is part of SWIFT.CODE.WORDS application.

In this topic