Term Amount

The Term Amount Property Class is used by financial products, which involves money that is lent or deposited for a specific period. This Property Class controls the commitment made by the bank and the customer.

Product Lines

The following Product Lines use the Term Amount Property Class:

- Deposits

- Facility

- Lending

Property Class Type

The Term Amount Property Class (mandatory) uses the following Property Class Types:

- Currency Specific

- Dated

- Enable External

- Enable External Financial

- Enabled For Memo

- Non-Tracking

- Variations Supported

For each arrangement contract, the initial product default values are stored in the arrangement and cannot track the product definition.

Property Type

The Term Amount is associated with Variations Supported Property Type.

Balance Prefix and Suffix

The Term Amount Property Class holds the below balance prefixes:

- Lending: Current and Total

- Deposits: Total

For a loan contract, this reflects the amount of the loan commitment available for disbursal. This balance is reported as a contingent balance type and is a negative (contingent asset) figure.

The current committed principal has CUR as prefix.

The following are the associated attributes:

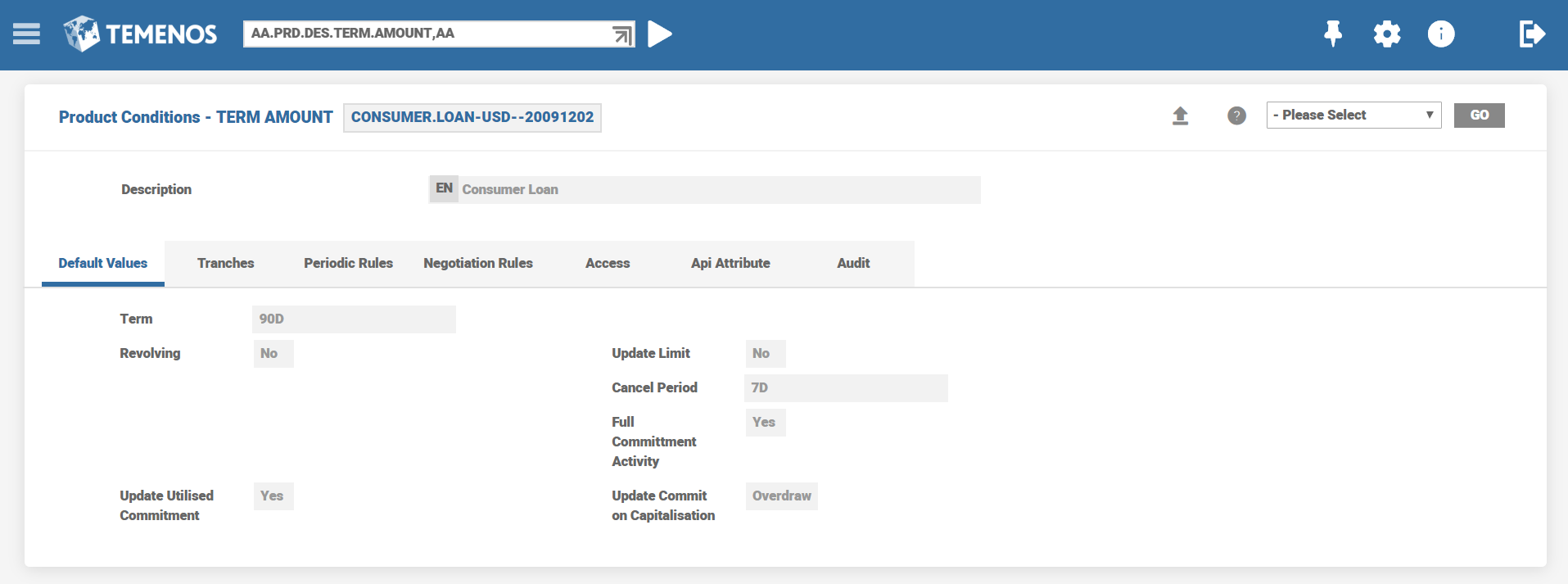

The user enters the total amount lent or deposited for the term (the committed amount), in the Amount field. During product definition, the system restricts the initial amount through Negotiation Rules. For example, 1000 < Amount < 5000.

In order to disburse or deposit this amount, or a portion thereof, the user credits or debits the arrangement through one of the standard Temenos Transact applications. For example, TELLER, FUNDS.TRANSFER.

Alternately, the system automatically performs this through settlement instructions and PAYOUT.RULES Property definition. The user can restrict these transactions using the rules defined in the Product. For example, Transaction Rules and Notice Rules.

When performing the INCREASE and DECREASE activities, the user records the increase or decrease of the committed principal in the Change Amount field.

The Term field determines the period of time by which the amount must be repaid (either to the bank in the case of a loan or to the customer in the case of a deposit). During product definition, it is common to default the term. For example, 30-year mortgage.

The user can enter the term in the following frequencies:

- Days (calendar1) (nnnnD)

- Weeks (nnnnW)

- Months (nnnnM)

- Years (nnY)

- Null (for call contracts)

The customer can choose to rollover the products at the end of the term. This can be performed manually or automatically using the CHANGE.PRODUCT Property.

The Term field is used to calculate the date that displays in the Maturity Date field for the arrangement contract. This user can enter the date directly or set it as default value based on the effective date of the property and by applying the defined value in the Term field.

For call contracts, both Term and Maturity Date fields can be left blank, provided the payment types (Linear or Annuity) are not specified and Amortisation Termfield is left blank in Payment Schedule Property.

To schedule the maturity of an arrangement, the system triggers the LENDING-CHANGE.TERM-TERM.AMOUNT Activity to input a value either in the Term field (updates the Maturity Date field with the term in the Term field with an effective date of the Change Term Activity) or in the Maturity Date field.

The call contracts are not allowed for the products with IFRS classification. This validation is required as future cash flow predications are not possible without defining the term. The IFRS classification is established in the Reporting Property Class.

Temenos Transact allows the user to define the revolving term amounts for lending products. The effect of a revolving product is to increase the available amount from which a customer may drawdown as a result of certain payments. The user can set either revolving loan or line of credit in the Revolving field.

A non-revolving contract can never reinstate the available commitment amount on repayment, whereas a revolving contract can reinstate the available amount on repayment. The following options are available:

- No—the available amount does not increase on repayment of principal amount.

- Payment—any payment against the outstanding principal (due or not due) increases the available amount. Typically, this setting is used for fully revolving credit facilities.

- Prepayment—only repayments against the outstanding principal (balance not yet due), such as an ad-hoc payment, result in increase in the available amount. Repayments against due do not reinstate the committed amount. Typically, this setting is used when a product allows over payment and subsequent redrawing of the overpaid amount.

In the Update Commt Limit field, the user can specify whether the commitment amount of the limit used for the arrangement has to be updated when the initial commitment is granted. If the user updates the field as Yes, the limit available to the customer is reduced before disbursal.

During disbursal, the limit is always updated for the loan irrespective of the setting. If the user sets this field as Yes at disbursement time, the limit is updated to reflect that the disbursed amount is an available amount and not the committed.

The Final Term, Final Mat Date and Recalc Maturity On fields can be used for loan renewal. When the user enters values in the Final Term field, the final maturity date displays in the Final Mat Date field, which restricts any renewal activity beyond this date. In addition, the system calculates the payment amount for the arrangement based on the value set in the Final Term field. The term value cannot be greater than the value in the Term field. If the user enters values in both Amortisation Term (in Payment Schedule Property) and Final Term fields, the value set in the Amortisation Term field takes precedence for calculating the payment amount. However, the renewal can be done only till the final maturity date.

At the time of renewal, the maturity date is recalculated based on the value in the Recalc Maturity On field. This field displays the following values:

- Lending-Rollover-Arrangement

- Lending-Reset-Arrangement

- Lending-Change.Product-Arrangement

The user can choose the residual amount on maturity to be made due or remain as outstanding by entering the corresponding value (Due or Null) in the On Maturity field. The residual amount is made due at the end of the arrangement term.

- Purchase the Asset – Allows the lessee to purchase the asset by paying the residual amount at the end of the arrangement term. This option can be used only for Finance Lease contract and not for Operating Lease. If the On Maturity field is left blank, Purchase The Asset option is used for the Finance Lease by default.

- Return the Asset – Allows the lessee to return the asset to the lessor at the end of the arrangement term.

The system calculates the maturity date based on the value defined in the Mat Date Convention field. It is used when the maturity date calculated from term falls on a holiday. When the user sets Yes in this field, then the system calculates the maturity date by applying the Date Convention setup of Account Property to the date arrived from the term.

If the user does not select Yes, then the system checks the maturity date against business day definition and raises an override if it falls on a holiday. If a holiday event is declared after the adjustment of maturity date, the system does not automatically adjust the date.

The value in the Tolerance field is set in days (between 0 and 999 days). It indicates that the value in the Term field can be recalculated only if the adjustment value in the Maturity Date field is greater than that of the Term Tol Days field. If it is less than or equal to the value of the Term Tol Days field, then the Term field is not recalculated. If this field is not populated and is set as Null, then 0 days is considered as the Tolerance value.

During the period specified in this field, the amount can be redeemed without making due any accrued interest in case of pre-closure of an arrangement. In the case of interest already made due, Redeem Arrangement Activity during cooling period can only stop paying the accrued interest and the due interest paid is not reversed.

The system can trigger the cancellation of deposits or loans if the customer does not pay the full committed deposit amount or disburse the full loan amount within the defined Cancel Period. This Cancel Period can be amended or removed after the creation of an arrangement on a case-to-case basis if the attribute is Negotiable, and Accounting Mode is not set as Advance or Upfront Profit.

Arrangements with Cancelled status can also be amended through Backdated Change Term and Renegotiate Arrangement Activities. For cancelled arrangements, the effective date of the activities for amending the Cancel Period should be prior to the original Cancel Period End Date of the arrangement. In this case, the system triggers the reversal of the cancelation of the arrangement and the arrangement reinstates its previous status along with the amendment of the Cancel Period End Date.

This attribute defines the claim expiry period for the Guarantee or SBLC arrangement. It can be either in days, weeks, months or years. The bank/financial institution is released of its liability after the claim expiry period. It is applicable only for Guarantees Product Line.

This attribute defines the last date after which new drawings cannot be created under the facility or further disbursement cannot be made under a lending arrangement. The available commitment of the facility and lending arrangements are reduced to zero after the expiry date. The Expiry date can be a fixed date, or a relative date based on the start date or maturity date of an arrangement.

The Maturity Date Type attribute has the options PAYMENT.END.DATE or NUL – with NULL as default behavior. When Mat Date Type field is left blank or Null, the regular option of indicating the Term of the Loan continues. When the value is set to PAYMENT.END.DATE, the maturity date is based on Installment Start Date and the number of Payments. Choosing the option PAYMENT.END.DATE makes the Payment Schedule attributes such as Payment Frequency and Num Payments or End Date are mandatory. In this scenario, the date of the last schedule of Account Property is updated as Maturity date of the loan.

- The Mat Date Type field isano-change field after authorisation.

- The Term, Maturity Date, Maturity Date Convention and Tolerance Days fields are no-input fields, when Mat Date Type field is set.

This feature is applicable for Lending Product Line and does not have any impact on Deposit Product Line. This feature is applicable for arrangements booked in Islamic banking.

This feature is applicable only for Linear, Constant and Percentage Payment Types.

The update to commitment balances are controlled by two attributes in Term Amount Property Class.

- Update Utilised Commitment - indicates whether to raise Utilised Commitment Balance Commitment or not.

- Update Commit on Capitalisation - indicates how capitalisation impacts various the Commitment Balances.

Read Configuring Overdrawn Commitment For Loans for more information.

In the Commitment Drawdown field, the user can specify whether the loan drawdown should have automatic, scheduled or manual disbursement. The user can choose one of the following options based on which funds are disbursed.

- Manual - The funds waits for manual disbursement

- Automatic - The funds would get automatically disbursed based on the settlement instructions given in the Settlement Property Class.

- Schedule - The funds get disbursed based on the defined schedule conditions in Payment Schedule Property Class

In the Commitment Reversal attribute, the user can specify whether the total commitment balance should be reversed either at the maturity of the term or during the pending closure process. The allowed options are:

- On Closure – Total commitment balance is reversed during the pending closure process.

- On Maturity – Total commitment balance is reversed at maturity.

- None - Total commitment balance is reversed at maturity.

This attribute can be used only by a Conditions by Term product which can be created using TPM. During an arrangement creation:

- If the Rollover attribute is selected, the system defaults the term defined in AAA to the Change Period attribute in the Change Product condition.

- If the Rollover attribute is not set, the system defaults the term defined in AAA to the Term attribute in the Term Amount condition.

Commitment Utilization allows the user to specify whether the commitment can be utilized beyond the available amount. It applies only to the facility product Line. The following options are available:

- NULL - This is a default value.

- Allow Overdraw - The facility can be utilized for an amount more than the available amount.

Term Amount for Savings Plan

For Savings Plan Product Line, the Term Amount field is not mandatory and the system does not consider this amount as the principal amount of the savings plan deposit. For Savings Plan, the user specifies the actual amount in the payment schedule with a particular frequency in which the customer has to pay the principal amount. The sum of these amounts is raised as a Pay bill on the maturity date.

The following fields are available in Term Amount Property Class. These fields enable the definition of commitment tranches. By default, only the Tranches field is available for input and visible. The multivalue set of fields are made available and visible only when the Tranches field is set to Yes.

Tranches: Specifies if tranches are defined for this arrangement. The purpose of this field is to allow control via product conditions and conditional availability (progressive disclosure) of the following set of multivalue fields.

- Standard Temenos Transact ‘Yes or No’ field. A Null value is equivalent to No, which means no change.

XX< TRANCHE.START.DATE: Specifies the date from which tranche amount is made available for disbursements.

- Available when TRANCHES field is set to Yes

- Standard Temenos Transact Date field

- Associated multivalue field with Tranche End Date and Tranche Amount fields

- Mandatory when Tranche Amount or End Date field is defined

- Date entered must be greater than or equal to the arrangement creation date

- Date entered must be less than or equal to final maturity date

- Date entered must be less than or equal to the date defined in End Date field

- Date entered must be greater than or equal to Activity Effective Date field

XX->TRANCHE.END.DATE: Specifies the date after which tranche amount is not available for disbursements.

- Available when TRANCHES field is set to Yes

- Standard Temenos Transact Date field

- Associated multivalue field with Tranche Start Date and Tranche Amount fields

- Optional input, the system generates override when not defined

- Date entered must be greater than or equal to the arrangement creation date

- Date entered must be less than or equal to final maturity date

- Date entered must be greater than or equal to the date defined in Start Date field

- Date entered must be greater than or equal to Activity Effective Date field

XX> TRANCHE.AMOUNT: Specifies the tranche amount allotted for the tranche period defined in Tranche Start Date and Tranche End Date fields.

- Available when TRANCHES field is set to Yes

- Standard Temenos Transact Amount field

- Associated multivalue fields with Tranche Start Date and Tranche End Date fields

- Aggregate of the Tranche Amount field should be less than or equal to the total loan amount

- Displays error message if the total of yet-to-be started tranche amount is greater than the available commitment amount

- Displays override message if the total of yet-to-be started tranche amount is less than the available commitment amount

- Mandatory input when Start Date or End Date is defined

To make the tranche amount available for drawdowns based on the definition in the above fields, a Tranche bill is generated for the tranche amount.

- The system creates a Tranche Bill on the tranche start date through an Activity Class. The bill creation is,

- Performed online if the tranche start date is equal to today.

- Scheduled and processed during Start of Day (SOD) phase of Close of Business (COB) if the tranche start date is a future date.

- The system issues the bill for the tranche amount after checking the available commitment amount namely the CUR<TERM.AMOUNT> that is

- If the entire tranche amount is available, then the bill is created for the tranche amount.

- If the entire tranche amount is not available, then the bill is created for the available commitment amount.

- If the commitment balance is zero, then no bill is issued.

- The system creates the Tranche bill and makes the tranche amount available for drawdown through a single activity with the underlying accounting entry.

- The system makes available a TRANCHE Payment type and Bill type and the same are used in the TRANCHE bills.

- The system issues the Tranche bills that are made available for drawdown using the existing PayOut Rules activity, if any to drawdown, the amount available for the period.

When a tranche bill expires the tranche amount associated is not available for drawdowns after the tranche end date.

- The End Date field is available in the AA.BILL.DETAILS table records the end date of the tranche bill.

- An activity is scheduled for the end date and when the activity is processed on the end date, the following is done:

- Bill status is marked as Expired.

- Accounting is raised to reverse the remaining available tranche amount, that is, Dr. AVL<ACCOUNT> for the remaining balance.

- Accounting is raised to increase the current available commitment amount if there are any unutilized tranche amount, that is, Dr. CUR<TERM.AMOUNT>.

Payout Rules Property Class ignores the expired bills when drawdown is performed using a Payout Rule Activity.

During the lifecycle, the user can make amendments to tranches subject to the following rules.

- Prior to a tranche start date, the entire Tranche can be amended or removed.

- After the tranche’s start date but prior to its end date the following rules can apply:

- The tranche cannot be removed

- The end date can be amended but cannot be a date in the past.

- The amount can be amended but cannot be decreased to an amount less than the amount that has been drawn from the tranche.

- After the tranche’s end date, no amendments are allowed to the tranche.

- During the lifecycle, the user can make amendments to tranches subject to the following rules.

To enable automatic tranche disbursements, the system invokes settlement processing whenever a tranche bill is issued.

- When the Payout Settlement instructions are defined for Account Property Class or Property, then the system uses the specified Payout Rule activity to credit the settlement account.

- Once the entire tranche bill has been drawdown, the system marks the bill as Settled.

To enable manual tranche disbursements, the system processes drawdowns using the existing Payout Property Class functionality.

When an arrangement has tranches defined (Tranches field is set to Yes), the standard disbursement LENDING-DISBURSE-TERM.AMOUNT activity is not allowed. All disbursements are required to be made through the Payout Rules, which respect the definition of the tranches.

There can be overlapping tranches and there can be more than one tranche bill with an available amount. When a withdrawal occurs, the system determines the order of the tranche bills to process. In Payout Rules, this is controlled with the Application Order setting, which can be set to Oldest First or Oldest Last.

- For a setting of Oldest First, the system processes the bills by ordering,

- From earliest start date to latest start date.

- With the same start date, from the earliest end date to the latest end date. A bill without an end date is equivalent to having an end date of the maturity date.

- For a setting of Oldest Last, the system processes the bills by ordering,

- From the latest start date to oldest start date.

- With the same start date, from the latest end date to the earliest end date. A bill without an end date is equivalent to having an end date of the maturity date.

Periodic Attribute Classes

The Term Amount Property Class has the below Period Attributes. The associated actions are also mentioned for each attribute.

| Periodic Attribute | Description |

|---|---|

| Full Disbursement | On TERM.AMOUNT-DRAW Action, this

field defines if partial disbursement

is allowed. The value Yes specifies when the arrangement is disbursed, the

system disburses all committed principal for the effective date. To apply this restriction for the lifetime of the arrangement, the AA.PERIODIC.ATTRIBUTE is created with a Type as LIFE. The Rule Start field that is set to Agreement can be used if the restriction only applies to the duration of the current arrangement product. The Pr Value field must be set to Yes for full disbursement to be checked. |

| Term Amount Decrease | This field restricts the maximum

amount of the committed principal that can be decreased over a specified

period. The system validates this rule when a Decrease Activity takes place

on the Term Amount Property. The system compares the amounts from the value

in the Amount field in the Term Amount Property. The Pr Value field must

specify the maximum decrease amount. For example, Applicable rule:maximum decrease in principal of 1,000 is allowed over a 6-month period. Committed amount 6 months ago is 20,000, Allowed decrease in 6 months period is 1,000 . If the new amount is less than 19,000, the rule is broken. |

| Term Amount Increase | This field restricts the maximum

amount of the committed principal that can be increased over a specified

period. The system validates this rule when the Increase Activity takes place

on the Term Amount Property. The system compares the amounts available in the

Amount field in the Term Amount Property. The Pr Value field must specify the

maximum increase amount. For example, Applicable rule: maximum increase in principal of 1,000 is allowed over a 6-month period. Committed amount 6 months ago is 20,000 , Allowed increase in 6-month period is 1,000. If the new amount is more than 21,000, the rule is broken. |

| Term Amount Increase Tolerance | This field specifies the

percentage increase allowed over time rather than a specific amount. The

system calculates the percentage increase as the percentage of the value at

the start of the restriction period. It validates this rule when the Increase

Activity takes place. The Pr Value field must specify the maximum increase

percentage. For example, Applicable rule: 5 percentage increase is allowed over a 6-month period. Available balance 6 months ago is 10,000 Allowed increase in the 6-month period is 5 percentage of 10,000 = 500. If the new amount value in the Property is more than 10,500, the rule is broken. |

| Term Amount Decrease Tolerance | The field specifies the

percentage decrease allowed over time rather than a specific amount. The

system calculates the percentage decrease as the percentage of the value at

the start of the restriction period. It validates this rule when the Decrease

Activity takes place. The Pr Value field must specify the maximum decrease

percentage. For example, Applicable rule: 5 percentage decrease is allowed over a 6-month period. Available balance 6 months ago is 10,000 Allowed decrease in the 6-month period is 5 percentage of 10,000 = 500. If the new Amount value in the property is less than 9,500, the rule is broken. |

Actions

The Term Amount Property Class supports the following actions:

| Action Name | Description |

|---|---|

| ACT.CAPITALISE | The ACCT.CAPITALISE action handles the capitalisation of Activity Charges and executes as part of Term Amount Property Class. |

| BALANCES | The TERM.AMOUNT Property Class and linked Property has as an associated balance the current available committed balance for the arrangement. For a loan contract this will reflect the available amount of the loan commitment available for disbursal. This balance would normally be reported as a contingent balance type and is a negative (contingent asset) figure. The current committed principal has a prefix of CUR. |

| CANCEL.DEPOSIT | The CANCEL.DEPOSIT action handles the cancellation of deposit liability commitment amount and executes as part of Term Amount Property Class. |

| CAPITALISE | The CAPITALISE action handles the capitalisation of interest or charges and executes as part of Term Amount Property Class. |

| CHANGE.TERM | The CHANGE TERM action allows the user to increase or decrease the Term of an arrangement subject to the negotiation rules. |

| CHECK.CANCEL | The CHECK CANCEL action checks for the applicable Cancel Period and determines if the loan contract is getting cancelled within the number of days as mentioned against the Cancel Period post disbursement. |

| CREDIT | The Credit action handles the adjustment or write-off of commitment amount and executes as part of Term Amount Property Class. |

| DATA.CAPTURE | As part of the DATA CAPTURE action, during migration to AA, the contract details captured in the LENDING application including the Term Amount field is updated in AA Arrangement. |

| DEBIT | The DEBIT action handles the debit or adjustment of commitment amount and executes as part of Term Amount Property Class. |

| DECREASE | The system manually initiates the Decrease action. It allows the user to decrease the commitment amount of the arrangement subject to any negotiation rules, periodic rules and the current outstanding amount. This system initiates this action as part of the DECREASE-TERM.AMOUNT Activity. |

| DEP.CAPITALISE | Capitalise action for the Term Amount. |

| DEPOSIT | The DEPOSIT action handles the new deposit accounting for the commitment amount (deposit) and executes as part of Term Amount Property Class. |

| DETERMINE.CANCEL | The Determine Cancel action works in conjunction with the Check Cancel Action and determines if the loan contract can be cancelled. |

| DRAW | The system processes the Draw action when a loan is disbursed. The action, Validates if the amount to be disbursed is available. Raises the accounting event to reduce the available commitment amount. Updates limits to reflect the reduced commitment amount if the system updates the commitment limit. |

| EXPIRE | To check for the expiry date of the applicable term amount. |

| EXPIRE.BILL | The EXPIRE.BILL action settles the CUR Commitment balance of Tranche Bill. |

| INCREASE | The system manually initiates the Increase action. It allows the user to increase the commitment amount of the arrangement subject to any negotiation rules and periodic rules. The system initiates this action as part of the INCREASE-TERM.AMOUNT Class. |

| LINK | This action links the Sub-arrangement with its Master Deal Arrangement. The Sub-Arrangement Property Class allows the user to define the conditions for the Sub Arrangements (drawings) of the facility. Sub-Arrangement rules are used to apply conditions while creating new lending arrangements under a facility. Customer, currency and product of the drawings arrangements created under the facility can be restricted. The Sub-Arrangement Rules Property Class is available for the Facility Product Line. This Property Class enables to set rules for the sub-arrangements under a master arrangement. The Sub-Arrangement Rules Property Class controls the following: Borrowers. Allowed currencies and products for the sub-Arrangements under a master arrangement. |

| MAKE.AVAILABLE | This makes the Commitment balances maintained at the Facility level to be available for utilisation by the Customer. |

| MAKE.UNAVAILABLE | This makes the Commitment balances maintained at the Facility level to be unavailable for utilisation by the Customer. |

| MATURE | The MATURE action handles the maturity of commitment amount and executes as part of Term Amount Property Class. |

| REDEEM | The REDEEM action handles the early maturity (redemption) of deposit and executes as part of Term Amount Property Class. |

| REINSTATE | A non-revolving contract will not reinstate the available commitment amount on repayment, whereas a revolving contract will reinstate the available amount on repayment. The following options are available: NO – the available amount will not increase when any repayment of principal is made. PAYMENT – any payment against the outstanding principal (due or not due) will result in the available amount increasing. Typically this setting would be used for fully revolving credit facilities. PREPAYMENT - only repayments against the outstanding principal (balance not yet due) – such as an ad-hoc payment will result in the available amount increasing. Repayments against due will not reinstate the committed amount. Typically this setting would be used when a product allows over payment and subsequent redraw of the overpaid amount. |

| REPAY | The system triggers the REPAY action from a repayment transaction or as a result of a Payment Rule. It runs the corresponding accounting rules and updates the available amount according to the Revolving attribute condition. |

| RESUME | Resume the Term Amount utilisation for the Facility. |

| SCHEDULE | Schedule the Term Amount repayment based on the sanctioned and utilised amount. |

| SUSPEND | Suspend the utilisation of the facility commitment. |

| TRANCHE.START | The system disburses the term amount as per the defined schedule, if any, and this action determines the date of the first tranche of the disbursement. |

| UPDATE | The system manually initiates the UPDATE action. It allows the user to change any of the Term Amount attributes. The system initiates the action as part of the NEW-ARRANGEMENT and UPDATE-TERM.AMOUNT Activities. |

| UPDATE.COMMITMENT | The update to commitment balances is controlled by the following two attributes in Term Amount Property Class. Update Utilised Commitment - indicates whether to raise utilised commitment balance or otherwise. Update Commit on Capitalisation - indicates how capitalisation impacts various commitment balances. |

| UTILISE | To determine whether the Utilized Commitment balance accounting has to be raised or otherwise. This will be applicable for Lending and Facility Product Lines. For a drawing under a Facility, this field should have the same value for as that of the facility. The allowed options are : Null or No - Utilised balance accounting will not be raised. Only total and current available commitment will be accounted. Yes - Utilised balance accounting will be raised. This will show the total utilization of the arrangement. |

Accounting Events

The following actions generate accounting events as defined in the Accounting field.

- DECREASE

- DRAW

- INCREASE

- REPAY

- MATURE

- CAPITALISE

- DEBIT

- CREDIT

- ACT.CAPITALISE

Limits Interaction

Temenos Transact enables the definition of revolving term amounts for lending products. The following options are made available:

- No

- Payment

- Prepayment

In Update Commt Limit field, the system allows the user to specify whether the commitment amount of the Limit field used for the arrangement is to be updated when the initial commitment is granted. If this field is set Yes, it reduces the limit available to the customer before disbursal.

In this topic