Configuring Loan Commitment

The Term Amount Property Class is used to define the commitment given to a contract.

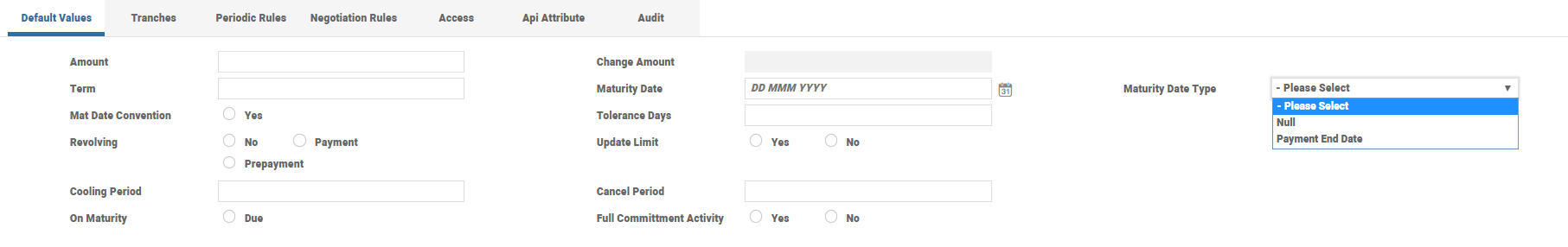

- The Amount attribute in the Term Amount Property Class is used to define the commitment (maximum) amount of the Arrangement.

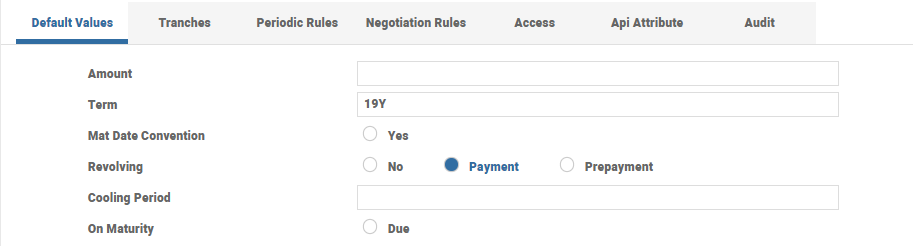

- The Term attribute in the Term Amount Property Class is used to define the commitment term of the Arrangement.The Amount attribute is currency specific, that is, the user must have one instance of each Product Condition for each currency of the product (or products) that use the Product Condition.

- The Commitment Drawdown attribute in the Term Amount Property class is used to define the disbursement method for the arrangement with options as Manual, Auto or Schedule.While the Schedule option disburses funds based on the schedule definitions in Payment Schedule property conditions, the Auto option disburses the funds through Term Amount property conditions with no dependency on Payment Schedule.

- The Change Amount attribute in the Term Amount Property Class is used to increase or decrease the commitment amount of the arrangement during the life cycle using the INCREASE or DECREASE action.

- The Change Amount attribute represents the amount to be increased or decreased on the original amount.

- To increase, the input in this attribute has to be greater than zero.

- To decrease, the input in this attribute has to be lesser than zero.

- The Change Term Activity allows the user to modify (that is, increase or decrease) the term of an arrangement, subject to the negotiation rules.

The Commitment Reversal attribute in the Term Amount condition enables the user to configure the reversal of the total commitment balance either at maturity or during the pending closure process. This attribute has the following options :

- None or On Maturity - The system reverses the total commitment balance at term maturity.

- On Closure - It reverses the total commitment balance only during pending closure process.

When a loan is pre closed (early matured) within the Cooling Period defined for the product, its interest and charges can be waived. This cooling period can be defined as the number of calendar days in the Closure and Term Amount Property Classes. These features are mutually exclusive.

The Cooling Period attribute in the Term Amount Property Class determines the time period during which the amount can be redeemed without making due any accrued interest in the case of pre-closure of an arrangement. In the case of interest already made due, redeem Arrangement Activity during the cooling period only stops paying the accrued interest and due interest paid is not reversed back.

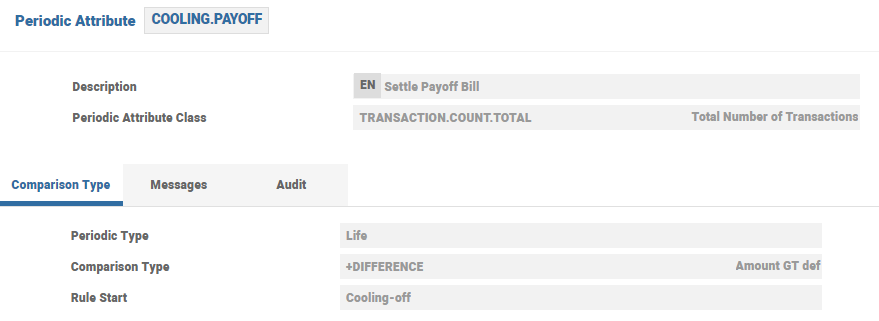

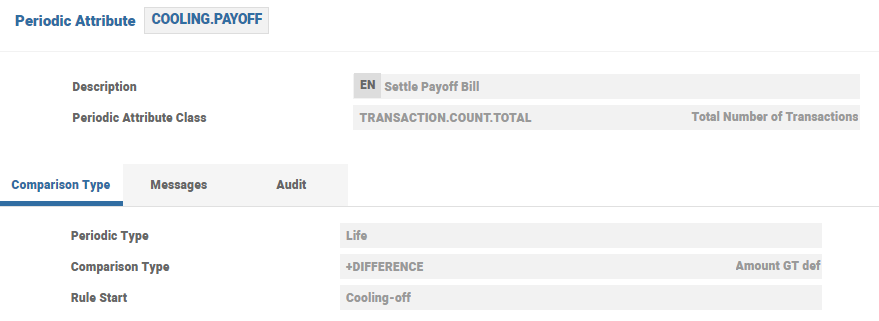

With respect to the pre-closure charges, the charges have to be configured as Rule Break Charges with Rule Start attribute set to Cooling-off.

In AA.PERIODIC.ATTRIBUTE, the value for the Rule Start attribute set as Cooling-off calculates the start date from which restriction has to be applied. If Cooling-off is opted, then the periodic restriction starts from the cooling date as specified in the AA.ACCOUNT.DETAILS.

The below screen shot displays the Periodic Attribute setup for charge trigger after the cooling period.

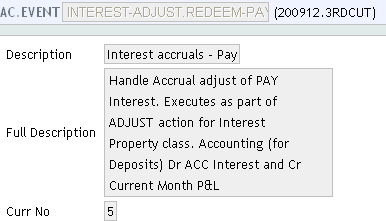

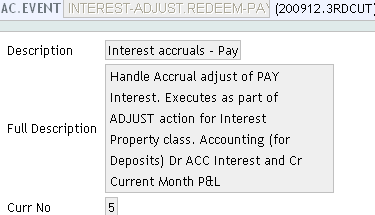

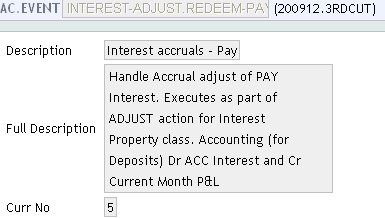

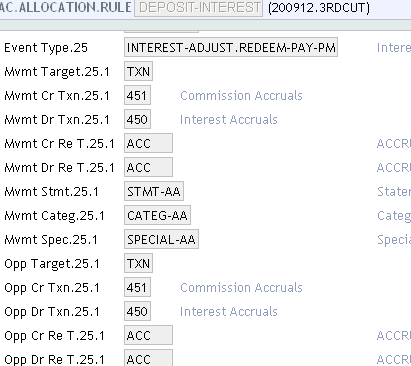

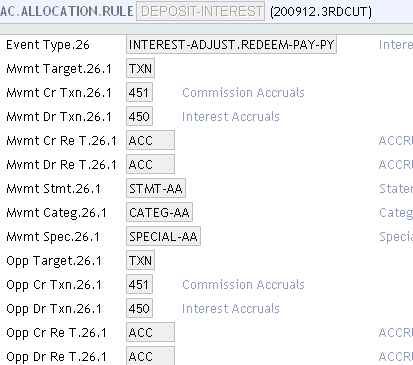

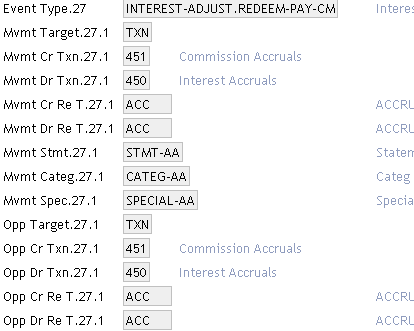

The following AC.EVENT records are used in AC.ALLOCATION.RULES.

The below screen shot displays INTEREST-ADJUST.REDEEM-PAY.

The below screen shot displays the INTEREST-ADJUST.REDEEM-PAY-CM record.

The below screen shot displays the INTEREST-ADJUST.REDEEM-PAY-PM record.

The below screen shot displays INTEREST-ADJUST.REDEEM-PAY-PY event type in the AC.ALLOCATION.RULE.

The AC.ALLOCATION.RULE set up should be as done as indicated in the above screenshots for the AC.EVENT records.

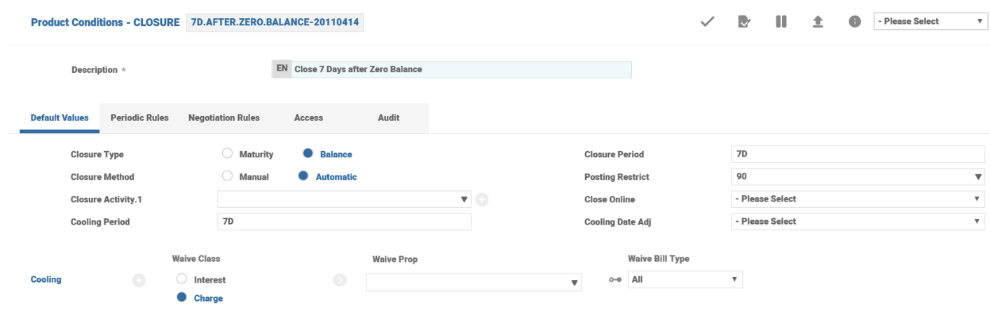

The Closure Property Class is used to define the cooling period for loan pre-closure without interest and charges. The Cooling Period field of a loan is defined as number of days (calendar) and in case it is a holiday, the Cooling Date Adj field can be used to adjust the cooling period to the next working day.

Property Class wise or Property wise choice is available for waiving or retaining the charge or interest applied during the cooling period using the Waive Class, Waive Prop and Waive Bill Type attributes. The Waive Bill Type attribute can be set to waive accrued amount, billed amount or both.

- For interest, only the current interest (accrued) can be waived. For charges, the waiver has to be applied on both billed and current (accrued) charges.

- The Cooling Period attribute in the Term Amount Property Class is mutually exclusive of the Cooling Period attribute in the Closure Property Class. If found in both the places, the system raises an error at the proofing stage.

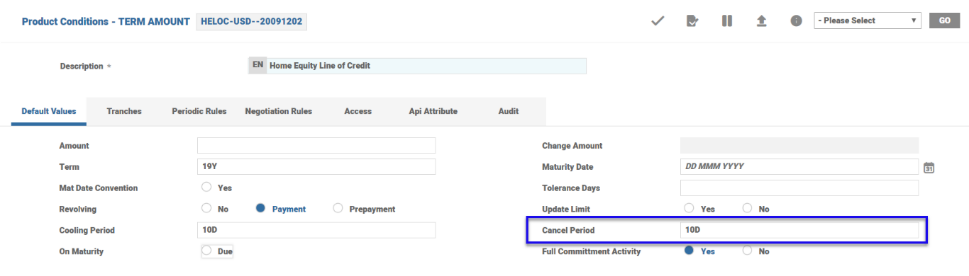

The Loan Cancellation functionality allows a loan to be automatically cancelled if the commitment amount is not fully availed by the customer in the stipulated time period. The stipulated time is defined as the number of days under Term Amount Property Class.

The system schedules the LENDING-CANCEL-ARRANGEMENT Activity, which triggers the cancellation if the loan is not fully disbursed by that cancel period.

The banks can configure a pre-advice to be sent to the customer to indicate the cancellation that would come up due to the pending disbursement. The pre-advice configuration is achieved through the Activity Messaging Property which has associated multi-value attributes, such as Pre Notice Activity and Pre Notice Days. The Pre Notice Activity attribute has to be LENDING-CANCEL-ARRANGEMENT and Pre Notice Days attribute controls the time in advance when the notification has to be sent.

Certain type of loan products require the loan to be made available in tranches over multiple time frames, this enables the borrowers to withdraw the loan amount in a phased manner to meet the periodic requirement of cash flows.

The Full Commitment Activity attribute in the Term Amount Property Class when set to Yes triggers the LENDING-FULL.DISBURSE-ARRANGEMENT Activity when the loan is fully disbursed.

Overdrawn Commitment

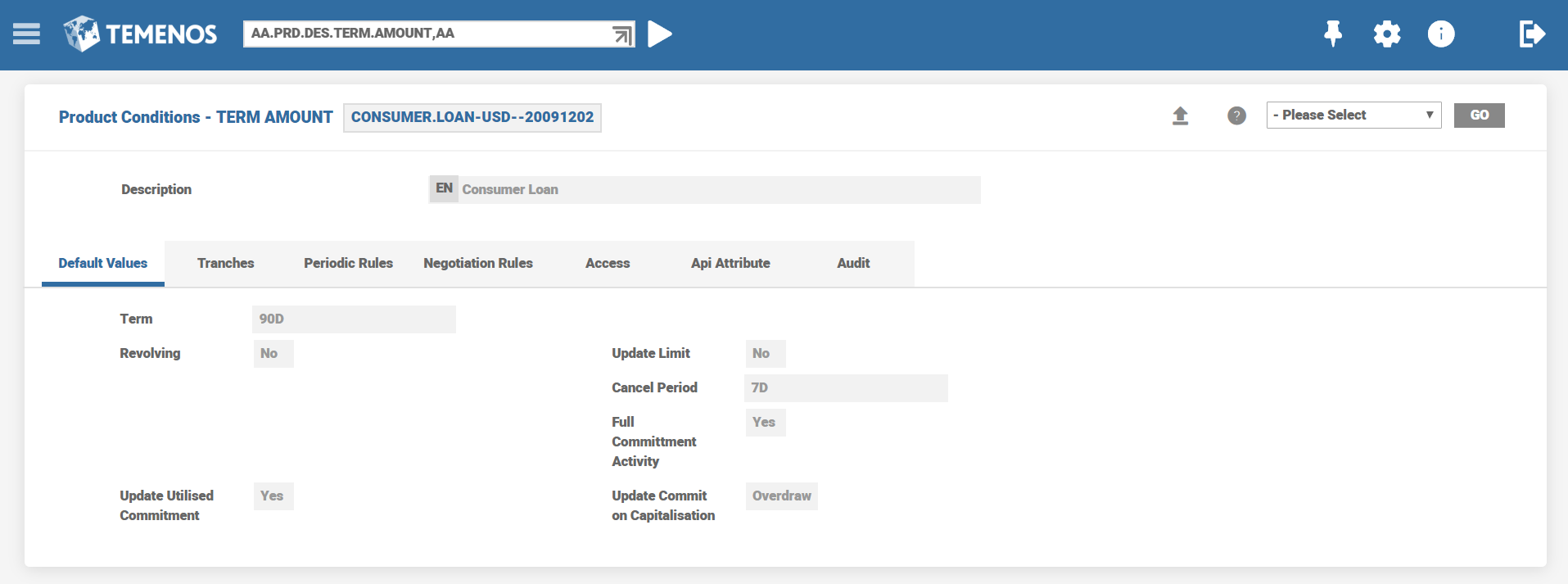

The update to commitment balances is controlled by two attributes in the Term Amount Property Class.

- Update Utilised Commitment- indicates whether to raise utilized commitment balance or not.

- Update Commit on Capitalisation - indicates how capitalisation impacts various the commitment balances.

For Retail Loans, the setup of the two attributes below can be configured in two ways

| Scenario | Update Utilised Commitment | Update Commit On Capitalisation | System Behavior |

|---|---|---|---|

| A | No | Current | Follows existing behavior and capitalised charges are maintained in CUR balance of TERM.AMOUNT. |

| B | Yes | Overdraw | Utilisation and Capitalised amounts are maintained in new balances, UTL and OVD respectively.OVD represents the capitalised amounts while UTL represents the utilised commitment amount, excluding the capitalised amount. |

Scenario A

Impact of Loan Commitment Balances during Multiple Disbursements and Fee Capitalization

A loan is disbursed in multiple tranches with a linked disbursement fee that is capitalised. The impact on commitment balance is described below.

The configuration in Term Amount product condition for Scenario A is presented below.

- Update Utilised Commitment - No

- Update Commit on Capitalisation - Current

In the Revolving loan scenario below, when a full disbursement happens and subsequently when a Repayment activity is triggered in Step 4, the Unutilised Commitment balance of the loan gets reinstated.

Similarly for Repayment activities triggered in Step 7 and 8 the CUR commitment balance is reinstated.

| Step | Nature of Activity (or) Transaction | Transaction

Amount (USD) |

TOT (Total

Commitment) (USD) |

CUR

(Unutilised Commitment) (USD) |

CUR Account

(Current Account Principal) (USD) |

Due

Outstanding (Due Account) (USD) |

|---|---|---|---|---|---|---|

| 1 | New Loan | 1,000,000 |

1,000,000 |

1,000,000 | - | - |

| 2 | Disbursement | 1,000,000 | 1,000,000 | - | 1,000,000 | - |

| 3 | Due | 200,000 | 1,000,000 | - | 800,000 | 200,000 |

| 4 | Repayment | 200,000 | 1,000,000 | 200,000 | 800,000 | - |

| 5 | Disbursement | 100,000 | 1,000,000 | 100,000 | 900,000 | - |

| 6 | Capitalisation | 500,000 | 1,000,000 | - | 1,400,000 | - |

| 7 | Repayment | 300,000 | 1,000,000 | 300,000 | 1,100,000 | - |

| 8 | Repayment | 300,000 | 1,000,000 | 600,000 | 800,000 | - |

In the case below, observe that when the fee is capitalised in Step 3, the Unutilised Commitment balance reduced by the quantum of capitalised amount, hence for subsequent disbursement at Step 4 the available commitment balance is lesser.

| Step | Nature of Activity (or) Transaction | Transaction

Amount (USD) |

TOT (Total Commitment) (USD) |

CUR

(Unutilised Commitment) (USD) |

CUR Account

(Current Account Principal) (USD) |

|---|---|---|---|---|---|

| 1 | New Loan | 100,000 | 100,000 | 100,000 | - |

| 2 | Disbursement | 60,000 | 100,000 | 40,000 | 60,000 |

| 3 | Capitalisation | 2,000 | 100,000 | 38,000 | 62,000 |

| 4 | Disbursement | 38,000 | 100,000 | - | 100,000 |

| 5 | Capitalisation | 2,000 | 100,000 | - | 102,000 |

| 6 | Repayment | 10,000 | 100,000 | - | 92,000 |

Also observe that in Step 6, when the Repayment activity is triggered, since the Revolving field is set to No, the Unutilised Commitment does not get reinstated.

Scenario B

In certain Lending businesses, especially in Consumer Lending scenarios, when the loan disbursement happens in multiple stages, requirement is that commitment is not to be affected when the fees are capitalised during disbursement and is handled separately without affecting the available commitment for future disbursement . This allows the bank to fully disburse the sanctioned loan amount to the customer.

A loan of USD 100 is sanctioned with two disbursements (USD 70 and USD 30). A disbursement fee of USD 5 is capitalised each time a disbursement happens. Assume there are no other interest, fees or charges.

When 70 USD is disbursed, a fee of USD 5 is capitalised on the loan and the commitment reduces from 100 USD to USD 25 . This means, only 25 USD is available for subsequent disbursement against a required amount of 30 USD.

Similar to the above scenario, when a loan is Revolving, say a loan of 100 USD is fully disbursed and subsequently an activity charge is capitalised for 5 USD. At this point the principal outstanding is 105 USD and when a repayment is triggered for say 5 USD towards the fee portion, the available commitment gets reinstated by 5 USD. This means that against a 100 USD loan, 105 could be drawn since commitment was reinstated for the repaid amount towards the capitalised fees.

For loans in which the bank wants to overcome the above behaviour, the Term Amount product condition is configured with Update Utilised Commitment field set as Yes and Update Commit on Capitalisation set as Overdraw.

When the Update Utilised Commitment field is set as Yes, the Update Commit on Capitalisation field must be set to either Overdraw or Current And Overdraw. These are the only combinations allowed at this point of time for the Lending product line when the Update Utilised Commitment field is set as Yes. For other combinations the system raises a validation or proofing error.

The UTL and OVD commitment balance types are used for the above configuration.

Impact of Loan Commitment Balances during Multiple Disbursements and Fee Capitalization

A loan is disbursed in multiple tranches with a linked disbursement fee that is capitalised. Impact on commitment balance is described below.

The configuration in Term Amount product condition for Scenario B is presented below.

- Update Utilised Commitment - Yes

- Update Commit on Capitalisation - Overdraw

In Step 4, when a Repayment activity is triggered, since the loan is Revolving in nature the Unutilised Commitment Balance (CUR) gets reinstated for the repayment amount.

In Step 6, when Capitalisation activity is triggered, the Overdrawn Commitment Balance (OVD) is impacted for the entire capitalised amount.

In Step 7, when a Repayment activity is triggered for a partial amount, only the OVD Commitment Balance is impacted and since it’s a repayment towards Overdrawn Commitment the Unutilised Commitment Balance (CUR) remains unchanged.

In Step 8, when a Repayment activity is triggered for an amount greater than the OVD Commitment Amount, the OVD balance is adjusted first (USD 200,000 ) and subsequently the Unutilised Commitment Balance (CUR) gets reinstated for the excess remaining amount (USD 100,000).

For an example on the calculation

In Step 3, when a Capitalisation Activity occurs, the Overdraw Commitment Balance (OVD) is impacted and Unutilised Commitment (CUR) is unaffected while the entire amount is available for further disbursement in Step 4.

In Step 5, when a Capitalisation Activity is triggered, the OVD balance is impacted.

In Step 6, when a Repayment Activity is triggered, the OVD balance is settled, however since the Revolving field is set No, the CUR balance is not reinstated.

The above setup explained for Scenario B helps overcome the behaviour observed in Scenario A.

For an example on the calculation

A validation is introduced to restrict the below configuration.

- Update Utilised Commitment - Yes

- Update Commit on Capitalisation - Overdraw

- Revolving - Prepayment

In this topic