Closure

The Closure Property Class defines the rules and behaviour for processing closure of an arrangement.

The Closure Property Class is used to close an arrangement if no more transactions happen in that account. In case of non-revolving arrangements, once all balances are settled, arrangement account closure can be triggered anytime manually or automatically. For revolving arrangements, the activity can be triggered on or after maturity. On reversal of a new arrangement, account closure is triggered automatically.

Product Lines

The following Product Lines use the Closure Property Class:

- Accounts

- Deposits

- Facility

- Lending

- Rewards

- Safe Deposit Box

Property Class type

The Closure Property Class uses the following Property Class Types:

- Dated

- Tracking

- Enable External

- Enable External Financial

- Enabled For Memo

Property Type

The Closure Property Class is associated with the Product Only Property Type. The users can create and maintain properties.

Balance Prefix and Suffix

Closure Property Class does not hold any balances due to which there is no associated balance prefix.

A status is updated on the AA.ARRANGEMENT record to indicate whether the arrangement is currently ‘live’ or not.

When the maturity date is passed and all balances are now zero, the status is set to Matured to indicate that the loan in now finished. At this point a maturity activity is processed which results in removing the arrangement number from the underlying account record.

At this point the arrangement can no longer be used.

The Closure Type field defines when the Closure Activity has to be triggered. User can select any one of the below options:

- Maturity - Closure activity is scheduled on or after maturity date based on Closure Period, provided all balances are settled.

- Balance- Closure activity is scheduled once all balances in the arrangement become zero.

- Defer Closure - The closure process for the arrangement is deferred based on the value specified in Defer Period. The defer closure date is calculated based on the arrangement date and the Defer Period (DEFER.CLOSURE.PERIOD) specified in Closure condition.

- Null - If Closure Method is Manual, then Closure Type has to be null.

The Closure Method field defines whether the arrangement account would get closed automatically or would be closed manually.

- MANUAL - Closure activity can be triggered manually when all balances get settled.

- AUTOMATIC – Closure activity will be triggered on the day in which the activity has been scheduled in AA.SCHEDULED.ACTIVITY.

When Closure Method is set to Automatic, then the Closure.Activity attribute specifies the Activity that can automatically trigger the Close Arrangement Activity.

The Closure Period field specifies the period after which closure activity needs to be scheduled once the arrangement account is identified for closure. It is based on closure Method and Closure type settings.

This field is considered if close activity is triggered manually. For example, if Closure Period is 10 Days, closure activity is scheduled 10 days after the balances are settled or after maturity date depending on the Closure Type.

If Closure Period is ‘NULL ‘, close activity is scheduled on the date on which all balances are settled.

The Posting Restrict field specifies the account closure posting restriction code (defined in POSTING.RESTRICT). This is used to update the ACCOUNT.CLOSURE record that is automatically created by the system once the close activity is triggered. POSTING.RESTRICT should be between 90 and 99.

The Close Online field indicates whether the account gets closed immediately or in COB. This field can be:

- NULL: It means that the account gets closed during COB

- YES: Account is closed immediately

The bank can opt to waive the accrued interest or charges or periodic charges which are made-due,paid or capitalised during account closure. The associated multi-value field set namely Closure Waive Class and Closure Waive Prop are configured to specify the interest, charges and periodic charges that are to be waived.

This field is used to define the list of property classes that should be waived during closure. The options allowed are Interest, Charge and Periodic charge.

- Interest –Waives all accrued interest during account closure.

- Charge –Waives all scheduled charges, activity charges and rule break charges that are collected or paid during account closure.

- Periodic charge –Waives all periodic charges that are collected or paid during account closure.

This field is used to define the list of interest, charge or periodic charge properties that should be waived during closure. The properties defined in this field should be a valid Interest, Charge or Periodic Charge property that are defined in the product.

The closure waiver set of fields are enabled only for the Accounts product line.

The following are attributes related to Cooling Setup.

The Cooling Date Adj field allows user to choose whether the date should be adjusted to the next working day in case the Cooling Date falls on a holiday.

While setting this field to the option FORWARD, the Cooling date is adjusted to the next working day if the calculated date falls on a holiday. A NULL value is treated as NO and results in no adjustment to a calculated cooling date.

The Cooling Period field is used to specify the cooling period of the contract within which the bank can opt to waive the accrued interest or billed charges. It is mutually exclusive with COOLING.PERIOD in Term Amount Property Class. It is an associated multi-value field for Waive Class, Waive Prop and Waive Bill Type. If Cooling Period field is populated, then either Cooling Waive Class or Cooling Waive Prop has to be mandatorily updated along with Cooling Bill Type.

The Waive Class field is used to define the property classes for which waive or refund has to be opted. The options available are:

- To waive accrued interest.

- To waive billed charges. The settled charges are refunded too.

The Waive Prop field is used to define the list of charges or interest Property to be defined in order to choose waive option at property level. The applicable charges or interest property must have a valid entry in AA.PROPERTY; and the associated property should belong to Interest or Charge Property Class.

The Waive Bill Type field is used to specify if the current, billed or all the components of Charge or Interest are to be waived.

The Cooling Convention field indicates if the calendar days or working days should be considered while arriving at the cooling date for a loan contract.

The field has the following two options:

- Working Days - Only working days are considered while calculating the cooling date.

- Blank - This is the default option. It considers all the days. Both holidays and working days are considered while calculating the cooling date.

- Once Cooling Convention is set, it cannot be changed during the life cycle of the contract.

- The cooling period can be mentioned only in days and it cannot be in weeks, months, and year.

A loan contract is created for Herry Crisp on Apr 17, 2019 with Cooling Period as 7D and Cooling Convention as working days. The arrangement is disbursed on Apr 17, 2019. Apr 20, 2019 and Apr 21, 2019 are holidays.

Then the Cooling Period arrived by the system is Apr 26, 2019 as the holidays are ignored on setting the Cooling Convention as working days.

At present, when a loan attains maturity and holds zero balance, the loan moves to ‘Pending Closure’ status and banks are not able to perform any transaction except closure of the loan.

Maturity Processing can be deferred until the agreed period for any type of loan. This is not available for other product lines.

The defer closure functionality allows the banks to process refunds and credit the refund amount to the loan account beyond maturity, since customers are allowed to return the purchased products even beyond loan maturity until the return or dispute period agreed for the product. With deferred date being defined, the maturity processing of the arrangement is as follows:

- Maturity processing would be deferred (until a defined period) to allow returns and refunds.

- Until the defer period is reached, the arrangement continues in the same status whereby, banks can perform regular transactions and static changes within this defer period window.

The below example illustrations details out the arrangement statuses with different maturity and defer period.

When loan maturity is defined as 90 days and Defer Closure Period is defined as 120 days.

Status:

- When loan is fully repaid by Day 90, the Current status is maintained until Day 119 and turns to Pending Closure on day 120

- When loan is not paid by Day 90, the Expired status is maintained until Day 119 and remains in Expired status on day 120

- When loan fully repaid

- On Day 105, the status changes to Current and remains in status until Day 119. On Day 120 the status moves to Pending Closure

- On Day 125, the status changes to Pending Closure from Expired

When loan maturity is defined as 120 days and Defer Closure Period is defined as 90 days.

Status:

- When loan is fully repaid by Day 120, the Current status is maintained until Day 120 and turns to Pending Closure on day 121

- When loan is not paid by Day 120, the Expired status is maintained until Day 120 and remains in Expired status on day 121

- When loan is fully repaid by Day 60, the Current status is maintained until Day 89 and remains in Current status until Day 120 (since loan maturity is 120 days). On Day 121, the status moves to Pending Closure

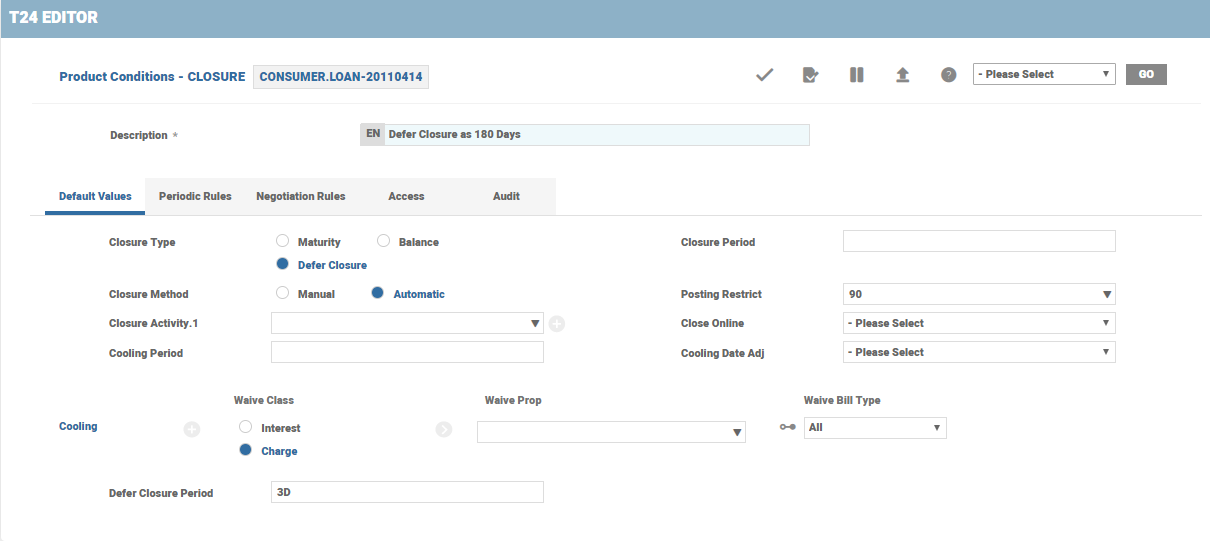

For deferring the closure of loan products beyond maturity, the following inputs are required in Closure Product Condition, depending on the Closure Method selected:

|

Closure Method |

Description |

|---|---|

| Manual | Defer Period can be updated directly on the Defer Closure Period field |

| Automatic | CLOSURE.TYPE should be enabled with Defer Closure option and the Defer Period should be updated on the Defer Closure Period field |

The following is an example screenshot of Defer Closure Period specified with Automatic Closure Method under Closure Product Condition for a loan contract:

- The base date for calculating Defer Closure Period calculation is based on the configuration in the ACCOUNT Product Condition Base Date Type field.

- Agreement - Denotes start of Defer Period from Arrangement Creation date.

- Start - Denotes start of Defer Period from Arrangement First Disbursement date.

- Blank - Denotes start of Defer Period from Arrangement Creation date.

- The final Deferred Maturity Date scheduled on Mature-Arrangement Activity is identified taking into consideration the Date Convention definition in Account Product Condition along with the definition in Base Date Type field, when the Defer Closure Period defined falls on a holiday. The following are the options available in Date Convention field within Account Product Condition

- Backward - Denotes the Deferred Maturity Date moves backward to previous working day.

- Forward - Denotes the Deferred Maturity Date moves forward to next working day.

- Forward same month – Denotes the Deferred Maturity Date moves forward to next working day within same month. If it is not within the same month, then it moves backward to the previous working day.

- Calendar – Denotes the Deferred Maturity Date will not move regardless of it falling on a holiday.

- The Defer Closure Period is a no-change field after initial authorisation of the arrangement. Thus, if the bank needs to perform regular transactions and static changes for 180 days for example, then it is recommended to capture the Defer Closure Period as 181 days on the arrangement.

During the reversal of an Apply Payment Activity, the system creates an imbalance in AASUSPENSE. This imbalance can be offset and cleared off using the activity, which is in the format of <<PL>>-ADJUST.SUSP.BALANCE-BALANCE.MAINTENANCE.

Add Closure Property to Existing Arrangements

The financial institutions can add the Closure property to the existing arrangements of the Accounts, Deposits, and Lending product lines using the Add New Property, New Prop Avl, and New Prop Avl Date fields in AA.PRODUCT.MANAGER.

Read Add New Property for more information on the configuration.

Periodic Attribute Classes

There are no periodic Attribute Classes associated with Closure Property Class.

Actions

The Closure Property Class supports the following actions:

| Action Name | Description |

|---|---|

| CLOSE | Used in the actual closure process. |

| DATA.CAPTURE | Used in capturing the details while migrating from Legacy to AA. |

| EVALUATE | Used in the evaluation prior to the actual closure process. |

| MAINTAIN | Used in the maintenance tasks for the closure process. |

| UPDATE | Used in modification and creation of a new CLOSURE Property for an arrangement. It can be performed as part of the NEW-ARRANGEMENT and UPDATE-CLOSURE Activities. |

Accounting Events

The Closure Property does not perform any actions that generate accounting events.

Limits Interaction

The Closure Property does not perform any actions that impact the limits system.

In this topic