Working with Arrangements COB Processing

The following section describes the unauthorised activities, scheduled activities and their sequence during COB processing along with other technical information.

Unauthorised Activities in COB processing

The AA framework unlike other applications performs all the activities considering and including unauthorised activities. For example, a secondary activity like a scheduled disbursement is triggered in Unauthorised status even when the new arrangement is pending authorisation. It does not allow the user to create yet an activity when another activity is Unauthorised status because of this reason.

Any transaction activity in the Retail Accounts module is a financial transaction initiated from other applications and is usually in Unauthorised status (considering the maker-checker concept). It is possible to trigger another regular activity or transaction activity in unauthorised status when a debit arrangement or a credit arrangement activity is unauthorised. The system differentiates the debit arrangement and credit arrangement activity using the Direct Accounting Activity Type in AA.ACTIVITY.CLASS.

During COB, no unauthorised activity across the AA framework should be considered for batch processing. The system deletes all the unauthorised AA activities when COB is initiated and re-creates these activities when COB process is completed.

This ensures that the unauthorised activities do not affect the system processing like day-end accruals on the authorised balance and scheduled payments.

For certain HVT account products, as part of business there can be a huge number of unauthorised transaction activities in the system when COB is initiated. Deleting these activities and re-creating them might result in huge performance issues.

AA.DECISION.PARAMETER is used to configure these Account products from which the unauthorised debit and credit arrangements can be retained during the COB processing.

Batches and Jobs

The following section describes the handling of Scheduled Activities in AA.

Scheduled Activities

Arrangement activities are processed using the AA.ARRANGEMENT.ACTIVITY application and these can be initiated in a number of ways:

- User initiated request

- Non AA-transaction initiated – For example when crediting or debiting an arrangement account from an existing application.

- As a scheduled process – The activity should be processes automatically according to a some schedule defined for the product or arrangement

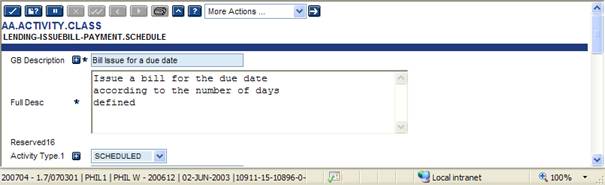

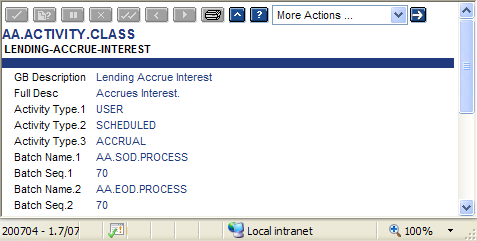

Some activities may be initiated in more than one way. The valid initiation types are defined in the AA.ACTIVITY.CLASS definition which is released by Temenos. The definition is contained in the Activity Type field. The initiation method of activities is pre-defined and cannot be amended.

Scheduled activities are processed as part of the Close of Business (COB) and specific BATCH records are released with the relevant jobs required to perform the contract processing.

Sequence of Activities in Batch Processes

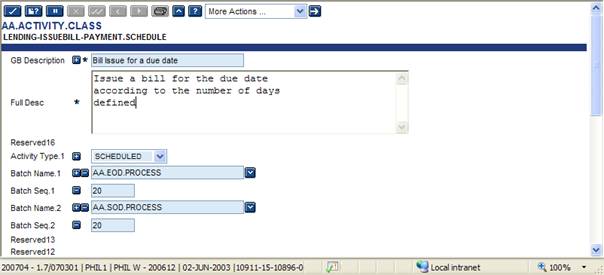

Several activities may be scheduled to be processed for an arrangement on the same date, the sequence the activities are performed in is important and this is defined as part of the AA.ACTIVITY.CLASS definition.

Each batch process that should perform the scheduled activity is specified in the AA.ACTIVITY.CLASS record together with a numeric sequence which is used to determine the order that the activities are executed for an arrangement.

The definition of the batch and sequence are pre-defined and cannot be amended.

Arrangement Contract Scheduled Activities

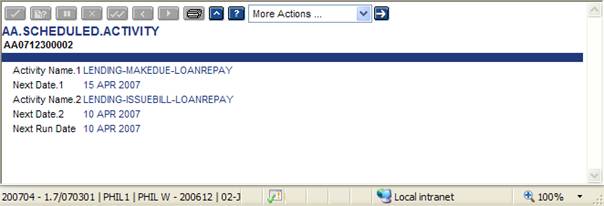

Arrangement contracts for products that have scheduled activities maintains a list of scheduled activities to be performed for that arrangement together with the next scheduled event date and the last time it was performed.

These details are maintained in AA.SCHEDULED.ACTIVITY. The details are updated as part of the activity processing for arrangement property maintenance and the scheduled activity itself. For example, the creation of a new loan contract updates the next scheduled MAKEDUE activity when the PAYMENT.SCHEDULE is initially defined or subsequently modified. The MAKEDUE activity itself cycles forward to the next due date and ensure that AA.SCHEDULED.ACTIVITY reflects this.

Accrual Frequency

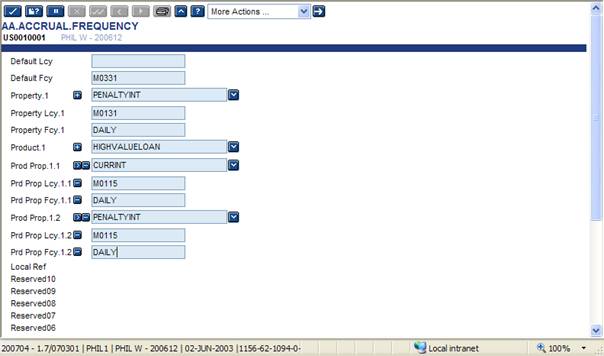

Activities such as Accrual and Amortisation perform internal accounting processing (that is, the booking of P&L) rather than actions that relate to the customer of the contract. The frequency for performing these activities does not form part of the product definition and is instead controlled by a central accrual frequency definition in AA.ACCRUAL.FREQUENCY.

A single definition exists for each financial company that allows the frequency to be defined at the following levels for properties that can be accrued:

- For a specific property of a specific product.

- For a specific property in any product.

- For any property.

For each of theses combinations different frequencies can be defined for local and foreign currency contracts.The following frequency options are allowed for accrual:

- DAILY – The accrual processing takes place for each Calendar day, that is, on a Friday COB for a normal weekend, there are three accrual activities processed for a contract.

- BSNSS – The accrual processing takes place for each business day, that is, on a Friday COB for a normal weekend, there is one accrual activity for a contract that covers the period Friday – Sunday inclusive.

- Mnndd – The accrual is performed every nn months on the dd day of the month. If 31 is defined as the day, this indicates that processing must take place on the last day of the month.

- Null – No accrual is to be processed on scheduled basis at all.

Only properties that belong the Interest or Charge Property Classes can be defined in AA.ACCRUAL.FREQUENCY. It is also possible to reverse the earlier accruals/amortisation and rebook them daily by setting up ACCR.REV.PARAM. For more details, refer to the Reporting user guide.

In the above example, the following frequencies are applied:

- Product HIGHVALUELOAN.

- Interest property CURRINT for local currency contracts is accrued monthly on the 15th of the month.

- Interest property CURRINT for foreign currency contracts is accrued on a daily basis.

- Interest property PENALTYINT for local currency contracts is accrued monthly on the 15th of the month.

- Interest property PENALTYINT for foreign currency contracts is accrued daily.

- Any product other than HIGHVALUELOAN using PENALTYINT interest property.

- Local currency contracts are accrued monthly on the last day of the month.

- Foreign currency contracts are accrued daily.

- Any other interest property or product.

- Local currency contracts perform no scheduled accrual.

- Foreign contracts are accrued quarterly on the last day of the month.

Activities that determine their processing frequency as scheduled tasks are defined in the AA.ACTIVITY.CLASS record. The Activity Type field contains ACCRUAL to indicate this. This is pre-determined and cannot be modified.

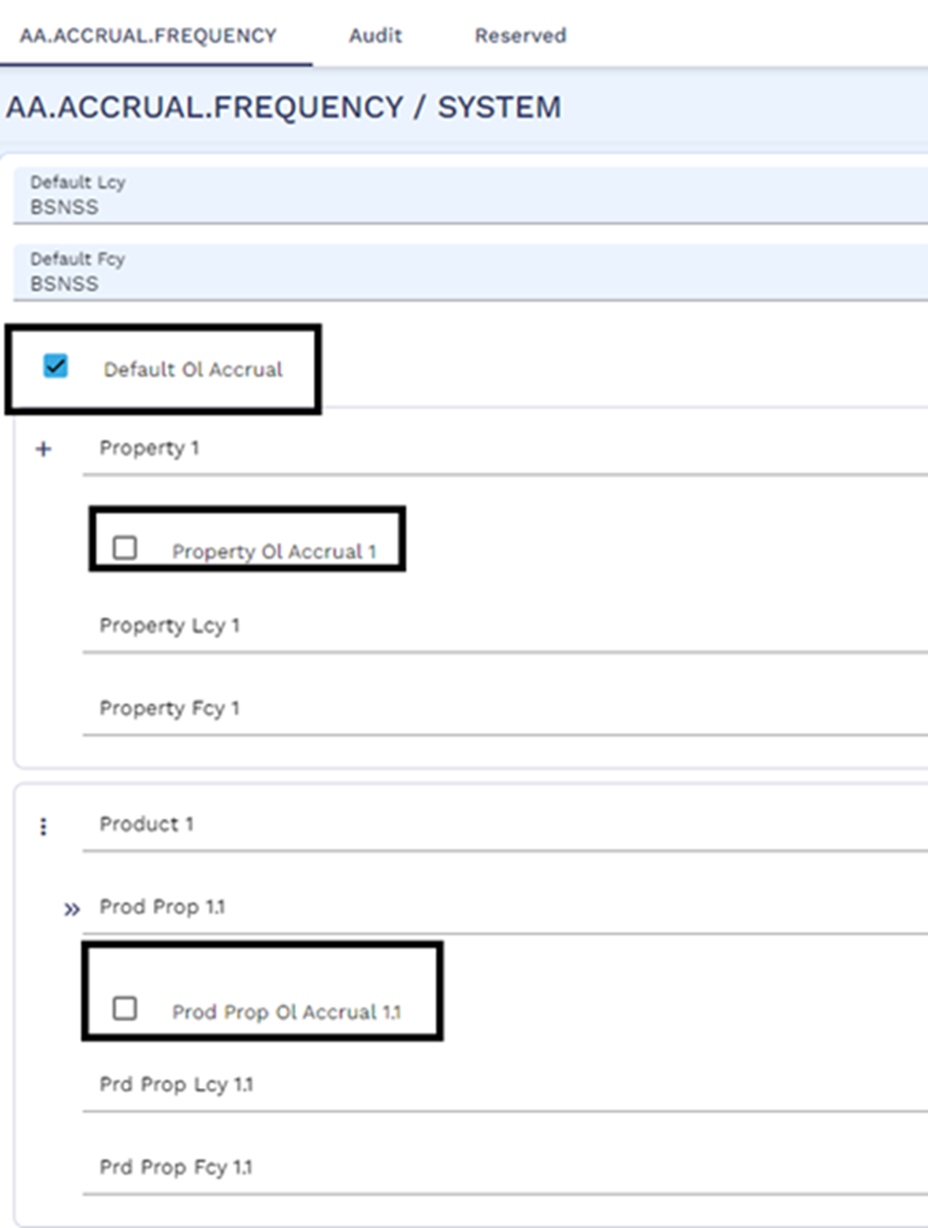

The accrual of interest and charges is processed as part of the AA.SERVICE.PROCESS during COB. However, the system can process the interest and charge accruals online, by setting the Default Ol Accrual, Property Ol Accrual, and Prod Prop Ol Accrual fields in the record in AA.ACCRUAL.FREQUENCY. In this case, the online accrual of interest and charges is processed by running the AA.ONLINE.ACCRUAL.SERVICE service. Read here to know more about the online processing of accruals.

Processing the Activity

When a scheduled activity is processed, an AA.ARRANGEMENT.ACTIVITY transaction gets performed the transaction request contains the arrangement number, required activity and effective date for the request. The effective is the actual date that the activity should be processed on.

The activity request is performed by the TSA service running the process through OFS. Scheduled activities are processed without the need to separate authorisation, in the case of processing error or exception the activity request leaves in HLD status and can be completed manually. The detail of error and exception (for example, override) processing depends on the operation of the specific activity.

For frequently repeated activities such as accrual, the same AA.ARRANGEMENT.ACTIVITY transaction is used for each scheduled event. For all other scheduled activities, separate AA.ARRANGEMENT.ACTIVITY transactions gets generated.

It is possible to reverse scheduled activity requests after the scheduled activity has taken place (subject to any restrictions that a specific activity may have).

Transaction Management

For each arrangement and processing date, the system processes all scheduled activities together. Activities are performed in the correct sequence and forms a single database transaction, Any error or failure of an activity means that all activities for that arrangement and processing date are not going to be processed.

AA.EOD.PROCESS

This batch performs arrangement processing in the End of Day section of the close of business. The Batch is defined for each Financial company in a multi-company implementation and runs in the system wide section of the close of business.

The following processes are run as part of this batch:

- Processing of Payments in and out of arrangement accounts generated as part of the close of business.

- Processing of scheduled activities for the products.

AA.SOD.PROCESS

This batch performs arrangement processing in the Start of Day section of the close of business. The Batch is defined for each Financial company in a multi-company implementation and runs in the start of day section of the close of business.

The following processes are run as part of this batch:

- Processing of Payments in and out of arrangement accounts generated as part of the close of business.

- Processing of scheduled activities for the products.

AA.SERVICE.PROCESS

This job performs the processing of all scheduled activities. The process checks for all current arrangement contracts to see if there a scheduled activity due to be processed as part of the Close of Business.

Activities are processed by generating AA.ARRANGEMENT.ACTIVITY records as described above.

When run in the End of Day close of business, this process is repeated for each calendar date between and including the current system date and the period end date. For each processing date, all contracts are processed.

When run in the Start of Day close of business the process can only be performed in the case of a month end that is, the last working day was in the previous month). The processing gets repeated for each calendar date between and including the 1st day of the month up to the calendar date before the current system date.

Online Processing of Accruals and Rate Changes

The following activities which are triggered as part of the AA Service Process during COB, can be triggered online by running the AA.ONLINE.ACCRUAL.SERVICE service thereby reducing the execution time of COB.

- Applying Basic and Periodic Interest rate changes on the arrangements.

- Accrual of interest and charges.

When the ONLINE.ACCRUAL.SERVICE is run, the system triggers the Rate Change processing first, followed by the Online accrual processing.

When there is a change to the records in BASIC.INTEREST and/or PERIODIC.INTEREST , associated arrangements are updated with the changes. The system performs this as part of AA Service Process during COB where it triggers the corresponding activities in those associated arrangements. The process of applying the rate changes to the associated arrangements can be performed online by running the AA.ONLINE.ACCRUAL.SERVICE online service. When this service is run, the system tracks any changes to the BI/PI keys. For all the associated arrangements using these keys, the system updates the rate changes by triggering the corresponding activity, similar to how the rate changes are processed during COB.

When the activity to update the arrangement is triggered, the system validates if the accrual for the day is already processed. If the accrual for the day is already processed in the arrangement, then the system performs a reverse-replay to recalculate the accrual amount and posts the adjustments for the arrangement. These recalculations and adjustments are processed as follows:

- As part of the update activity itself for loans and deposits (or)

- By updating the AA.RR.SERVICE.LIST for accounts. This list is cleared when the reverse-replay service namely AA.RR.SERVICE is run.

- The accruals on the current date are processed using the latest prevailing effective rate.

The user can perform the online accrual of interest and charges by setting the Default Ol Accrual, Property Ol Accrual, or Prod Prop Ol Accrual fields to Yes in the record in AA.ACCRUAL.FREQUENCY.

- Prod Prop Ol Accrual - For a specific property of a specific product.

- Property Ol Accrual - For a specific property in any product.

- Default Ol Accrual - For all interest and charge properties belonging to any product.

In this case, the user must run the AA.ONLINE.ACCRUAL.SERVICE service during which the system processes the accruals:

- Accrues the interest and charges.

- Updates the records in AA.INTEREST.ACCRUALS and/or EB.ACCRUAL for the properties.

- Raises the accounting entries for the accruals in the arrangement.

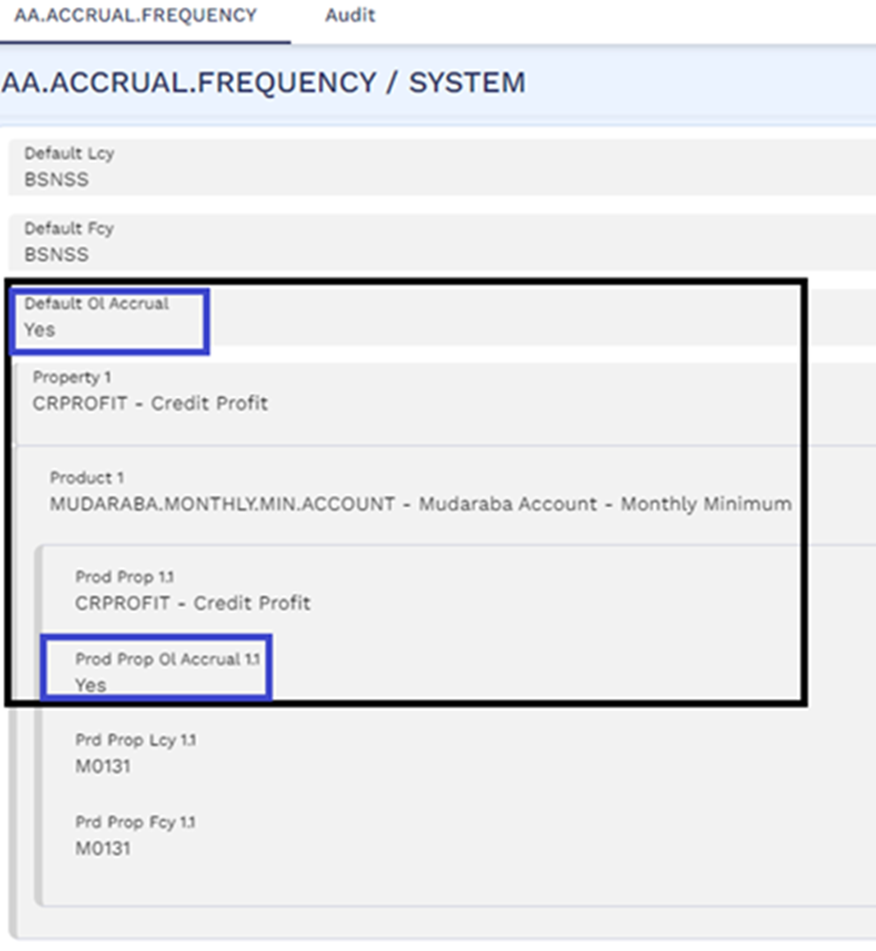

The user can enable online accrual processing for all interest and charge properties by defining the Default Ol Accrual field as Yes in the record in AA.ACCRUAL.FREQUENCY. If the user does not choose to enable online accrual processing for a specific property or a specific property from a specific product, then the user can set the Property Ol Accrual and Prod Prop Ol Accrual fields to Null. In this case, only for those specific properties that belong to the specific products, the system skips online processing of accruals. For these properties, the accruals are processed as part of the AA Service Process during COB. The vice versa is also possible, where the user can set Default Ol Accrual as Null and enable online accrual processing for a specific property or a specific property from a specific product by setting the Property Ol Accrual and Prod Prop Ol Accrual fields to Yes respectively. In this case, only for those specific properties the accruals are processed online, and for all other properties the accruals are processed during COB.

As an example, in the below screenshot, since the Default Ol Accrual is set as Yes, online accrual processing is enabled for all interest and charge properties belonging to all products. Further, since Prop Ol Accrual is set as Null for CRPROFIT property and Prod Prop Ol Accrual is set as Yes for CRPROFIT property that belongs to the MUDARABA.MONTHLY.MIN.ACCOUNT product.

Hence, the online accrual processing is skipped for all arrangements using the CRPROFIT property except for the arrangements under the MUDARABA.MONTHLY.MIN.ACCOUNT product. For the arrangements belonging to the MUDARABA.MONTHLY.MIN.ACCOUNT product, the system performs online accruals for the CRPROFIT property. For all other arrangements, the accrual for the CRPPROFIT property is processed during COB.

If an activity is scheduled for the day which affects the balance or the rate, then the online accruals are skipped for that day. In such cases, the system performs the accrual for the day during COB after the scheduled activity is processed. This is because the change in balance or rate necessitates an adjustment and recalculation to the accrued interest or charge amount. When processed during COB, the system performs the accrual after the scheduled activity is processed and therefore, the accrual amount is calculated using the correct balance or rate.

- When online accrual processing is enabled using the AA.ACCRUAL.FREQUENCY setup, it is mandatory to run the AA.ONLINE.ACCRUAL.SERVICE service.

- The user should configure the system to mandate that the AA.ONLINE.ACCRUAL.SERVICE service is run at least once for the day for the user to be able to run the Close of Business (COB).

- The Pre Cob Check field of the record in TSA.SERVICE for the AA.ONLINE.ACCRUAL.SERVICE service, must be set to Yes when the online accrual functionality is used. This ensures the rate fixing and the online accruals are processed before COB is initiated.

- Otherwise, the accruals for the day are skipped all together.

- When both online accrual and early schedule processing (set at the account arrangement level) are enabled, then the processing of accruals and rate change are handled by the Intraday service (AA.INTRADAY.PROCESS) for those accounts. In this case, the user must run the Intraday Process service everyday.

- The Pre Cob Check field of the record in TSA.SERVICE for the service AA.INTRADAY.PROCESS, must be set to Yes when the early schedule processing is enabled.

Technical Details

The selection of contracts is driven from the AA.NEXT.ACTIVITY internal table . This contains one record for each arrangement contract with the contract number and next scheduled activity date of any type, it is maintained with the AA.SCHEDULED.ACTIVITY table. A filter routine is used to ensure that only arrangements with an activity due for that process date, or with a possible accrual frequency are added to the JOB.LIST for processing.

AA.COB.PAY.IN.OUT

This job submits and completes processing of AA.ARRANGEMENT.ACTIVITY requests generated by non-AA transactions during close of business. During close of business processing, the payment transactions generates AA.ARRANGEMENT.ACTIVITY requests in HLD status.

The processing checks all AA.ARRANGEMENT.ACTIVITY records in HLD status that are for activities relating to payment types. Payment Type activities are identified by the definition of ACCOUNTING in the Activity Type of the underlying ACTIVITY.CLASS.

The requests are submitted to OFS in zero authoriser mode. In the case of error or override, the transaction remains in HLD status and must be processed manually.

The AA.ARRANGEMENT.ACTIVITY $NAU table is selected. The record processing determines that:

- The record status is HLD

- The activity is a payment type

If both cases are true, then the activity starts processing.

In this topic