Working With Interest and Charges - Posting

The accrued interest and charges are billed or invoiced at regular frequency to the customer. The bills generated on the same day can be combined. The billed amount can be capitalised to the same account or collected from another account within or external to the bank. It is possible to defer and offset the bills if required. On the scheduled date, it is possible to evaluate certain transaction rules set on the account; if the evaluated rule is satisfied or broken, the bill can be waived or a different amount can be billed as penalty or bonus paid.

Scheduling Interest and Charges

The Payment Schedule Property Class is used to capitalise or collect or pay interest and charges. These events happen on a frequency as defined in the Pay Freq field. A bill is generated on the schedule date for the interest and charge amount. If required, the bill can be deferred for a certain period in the Defer by.

Liquidation of Interest and Charges

On the scheduled date, during COB, account interest and charges are either capitalised, paid or received to another account.

- When the interest accrual rule includes the last day of the interest period, the interest entry is capitalised or the Make Due Activity is executed with interest postings having value date as next calendar date.

- When the property type is set as VALUE.NEXT.DAY, the charge entry is capitalised or the Make Due Activity is executed with value date as the next calendar date while the PL side for income or expense is booked on original value date itself.

- When the property type is FORCE CAPITALISE, the activity or rule break charge associated with the future value dated transaction (booking and processing date as current date) is collected during the SOD process of that value date. Else, the charge is collected during the EOD process of that value date.

This account can be an arrangement account, internal account or customer account created in Accounts (AC) module.

The settlement account for interest and charges can be another account within the TBC or forwarded as a settlement request, by publishing an event, to an external payments system.

Payment type wise settlement options are possible while collecting funds from another account. The bills are settled based on the available funds and can be retried in case of failed or partial settlement. It is possible to force settle the bills in case of insufficient funds. Likewise, Property-specific choice is possible while paying out the interest or charges to another account. It is possible to disable the settlement instructions temporarily using Payin Settlement/Payout Settlement set to No.

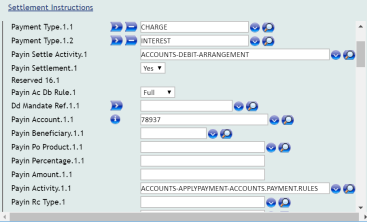

A sample screenshot with Payin Settlement is shown below.

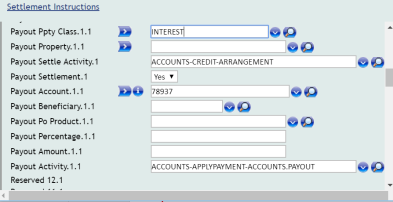

A sample screenshot with Payout Settlement is shown below.

The amount billed under the same payment date can be combined and settled as a single settlement when automatic settlement with the same account is defined.

In the TBC, the settlement account for interest and charges can be another account within the TBC or forwarded as a settlement request, by publishing an event to an account or beneficiary outside the TBC, which should be consumed by an external payments system for further processing.

Offset Interest and/or Charges

It is possible to offset outstanding Due bill raised against a Pay bill being raised now using the ACCOUNTS– OFFSET–<Payment Rule Property Class> Activity Class. When a Pay bill is raised, the Due bill outstanding for the Property indicated is settled immediately and the remaining is paid.

It is possible to offset outstanding Pay bill against Due bill being raised now using the ACCOUNTS-OFFSET–<PayOut Property Class> Activity Class. When a Due bill is raised, the Pay bill outstanding for the Property indicated is settled immediately and the remaining is made due.

Adjust/Waive Interest or Charge Amount

The following options are available for waivers.

Transaction based rules are set in the Activity Restriction Property Class. On the scheduled date, it is possible to evaluate certain transaction rules set on the account; if the evaluated rule is satisfied or broken, the bill can be waived or a different amount can be billed as penalty or bonus paid.

Once the accruals are billed, the billed amount can be adjusted for a partial or full waiver using the Adjust Bill Activity (ACCOUNTS-ADJUST.BILL-BALANCE.MAINTENANCE). If the bills are already settled before passing the waiver, this Activity triggers a reverse replay or interest adjustments of prior period. Adjust All Balances and Bills Activity (ACCOUNTS-ADJUST.ALL-BALANCE.MAINTENANCE) is used for adjusting balance or bills to a new amount or making balance or bills to zero.

Early Schedule Processing of Interest Capitalisation

Early Schedule processing is the process of scheduling interest and charges on the scheduled date but earlier than the COB. This process gives flexibility to the financial institutions in dealing with inter-dependencies between the system and other existing systems in the banks ecosystem with respect to interest and charges posting.

When a financial institution enters into cash pool facility, there is a possibility that relevant account resides in different systems. In this case, each account is replicated by a mirror account in the system and all their transactions are replicated into the Temenos' system. In case the Temenos's system is responsible for Interest and Charges assessment and posting even for these mirror accounts, it is possible to configure the system to perform the interest posting through an online service instead of COB. The posting by the service is still done only on the scheduled date when opted for the early schedule processing.

To address this complexity, set Early Processing to Yes to enable mirror account product.

The scheduled activity to Make-Due Schedule or Capitalise Schedule is triggered immediately on running the AA.INTRADAY.PROCESS service and dropped from the scheduled activity. The interest entry is capitalised or Make Due Activity is executed with interest postings having value date as next calendar date.

When an account is enabled for early schedule processing and online accrual processing, then the online processing of accruals and interest rate change are handled by the Intraday service (AA.INTRADAY.PROCESS) for those accounts. In this case, the user must run the Intraday Process service everyday. The Pre Cob Check field of the record in TSA.SERVICE for the AA.INTRADAY.PROCESS service, must be set to Yes when early schedule processing is enabled.

The cash pool related features are not applicable in Deposit TBC and are handled through an external solution.

AR Capitalisation - EOD or SOD

- Back dated interest adjustment is a configurable option, as a substitute for the standard AA Reverse and Replay functionality.

- Unlike Reverse and Replay (which reverses and re-books entire amount), any adjustments to interest in previous periods as a result of back dated transactions or rate change etc, are re-assessed and posted on the Next Capitalisation date. Only the difference amount is posted as one entry per Interest Property, per period affected (in case the back dated transaction goes across more than one interest period)

- Where the AA Scheduled Capitalisation of Interest is in SOD (Start of Day), this Adjustment at Next Cap poses a problem as it effectively happens on the first day of next month thereby not reflected in the previous month’s EOM (End of Month) GL.

- This section describes the key features that has to be considered during Implementation with respect to interest processing in AA for Accounts functionality and the differences in behaviour based on certain factors such as COB stage, accrual rules and attempts to provide clarifications for common implementation questions on which mode to choose.

Accrual Rule

- Dictates whether to include First Day, Last Day or both Days of the Period when calculating or posting the interest.

- In a Monthly interest period for the month of May 2018,

- First means interest is calculated from May 01 – May 30

- Last means interest is calculated from May 02 – May 31

- Both means Interest is calculated from May 01 – May 31

- In a Monthly interest period for the month of May 2018,

- For current and savings accounts, the interest for both first and last day of the period is included when calculating interest.

Correlation of Accrual Rule and Capitalisation Stage

- When the system capitalises the interest, during the Close of Business (COB) stage has a correlation with the Accrual Rule setup in terms of getting the required results from the system.

- It is possible to have the interest capitalisation on Accounts at SOD of the COB or EOD of the COB process.

- Where the capitalisation is done in SOD, the Booking Date and Value Date of the Capitalisation entry remains same.

- Where the capitalisation is done in EOD, the Booking Date is the same day while Value Date is Booking Date + 1C.

- An Interest Period is deemed closed when it is capitalised. Consider an account is opened on May 01, with Capitalisation as End of Every Calendar month. The Interest Period is deemed closed on May 31. The key difference in setup to achieve the required results are shown below:

- In an SOD Capitalisation, setting Accrual Rule to Both yields wrong results because it does not consider the subsequent online transactions.

- For example, if Capitalisation happens on May 31 and if it is set to include May 31 interest as well, it’s based on the May 31 starting balance and not closing balance. Any subsequent movements during May 31 are not considered for interest adjustment.

- However, to achieve the required results in a SOD Capitalisation, the setup pays interest on the first day of next month and sets Accrual Rule to include only the First day.

- It means, interest capitalisation is configured to happen on June 01 (the system considers the period as 01 May – 01 Jun but because the Accrual rule is set to First, it includes interest for 01 May – 31 May).

- The Booking Date and Value Date of this Capitalisation entry is 01 June.Similarly, the June 01 interest is included in the June Interest period, and posted on July 01, and so on.

- Statement generated on May 31 does not include this interest.

- In an EOD Capitalisation, setting Accrual Rule to Both, yields the required results with the interest being capitalised at EOD of May 31. Because the capitalisation happens at EOD, the system raises this capitalisation entry with a Value Date +1C (here, June 01)

- The Interest Payable/Receivables for the month of May is reported as Capital in the balance sheet on May 31.

- Customer statement generated on May 31 shows this interest capitalised.

- In an SOD Capitalisation, setting Accrual Rule to Both yields wrong results because it does not consider the subsequent online transactions.

Illustration of SOD and EOD Capitalisation in Accounts.

- Capitalisation SOD

- Capitalisation Stage: SOD of COB

- Accrual Rule: First

- Capitalisation Date: first day of every month

- Capitalisation EOD

- Capitalisation Stage: EOD of COB

- Accrual Rule: BOTH (first and last day inclusive)

- Capitalisation Date: Last day of every month

- Changing from SOD to EOD of COB means changing the Capitalisation date to be End of the month – factors such as customer impact has to be considered.

|

Interest Capitalisation in SOD of COB |

Interest Capitalisation in EOD of COB |

|---|---|

| April 20- Bal $1,000 | April 20- Bal $1,000 |

April 20 – April 30

|

April 20 – April 30

|

April 30 - COB

|

April 30 - COB

GL for April 30 contains the Interest and Charges Capitalisation entries.

|

May 1 - COB

|

May 1 - COB

|

May 15

|

May 15

|

| May 15 onwards

The interest accrual is for the balance of $1500 and the same reflects in PL. |

May 15 onwards

The interest accrual is for the balance of $1500 and the same reflects in PL. |

| May 15

The system selects the account for pending adjustment. |

May 15

The system selects the account for pending adjustment. |

May 31 – COB

During SOD Process (June 1)

|

May 31 – COB

During SOD Process (June 1)

|

June 1 - COB

|

June 1 - COB

|

Invoicing Capitalise Bills due to Insufficient Funds

During a back dated rate reduction, if interest capitalisation results in a negative balance in the savings account due to insufficient funds, an Invoice balance bill is generated for the delta amount, which can be settled using appropriate Settlement Instructions.

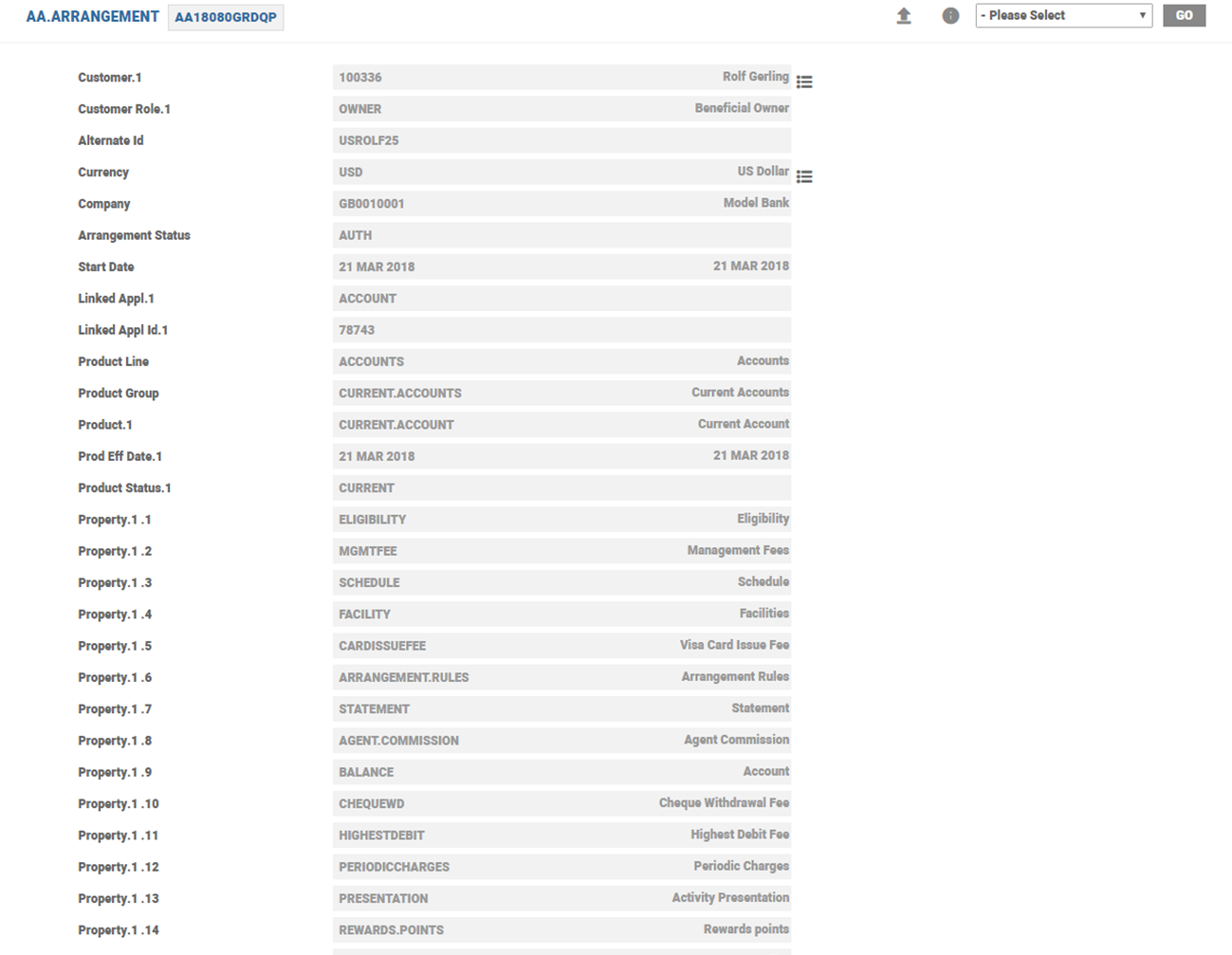

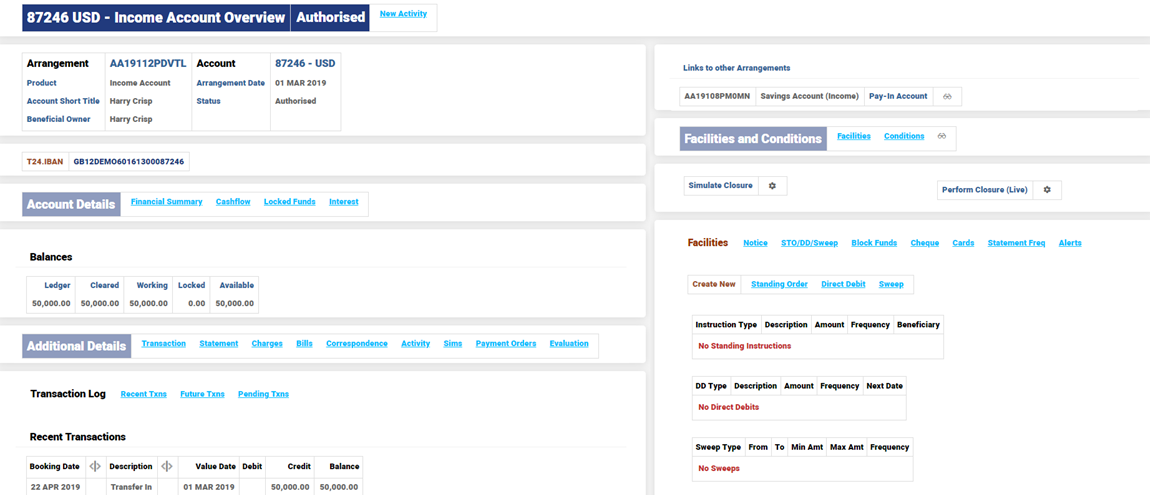

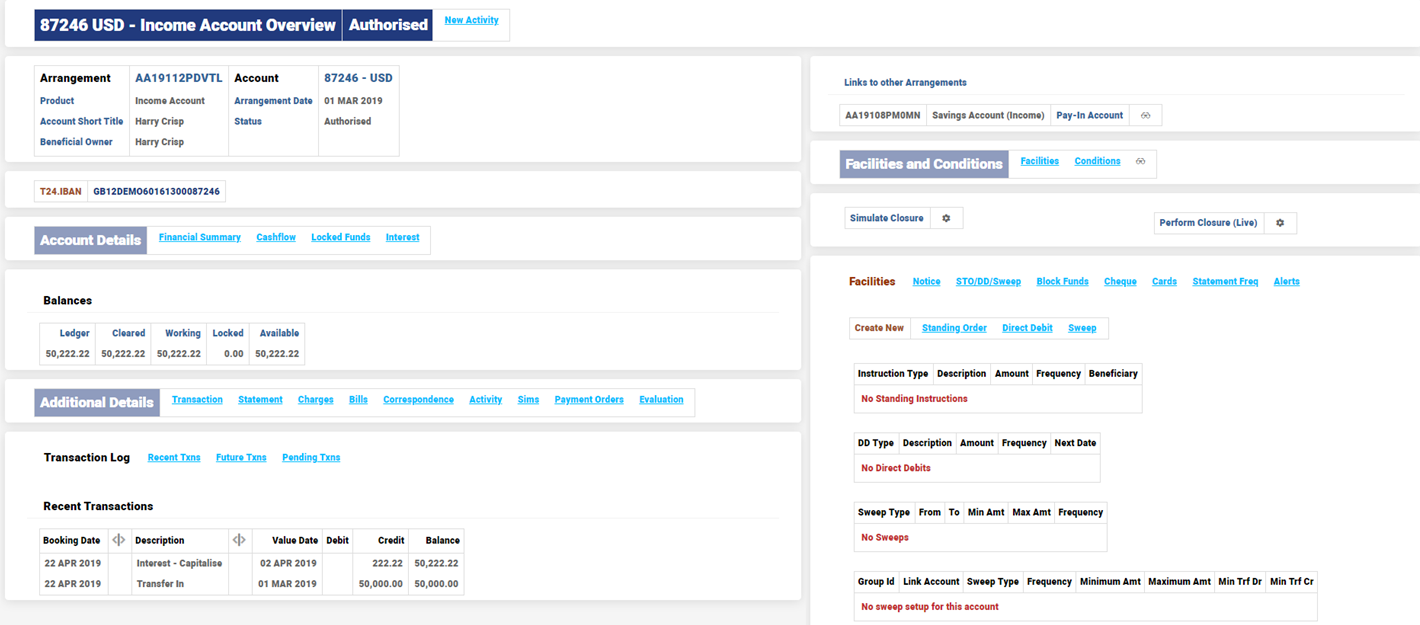

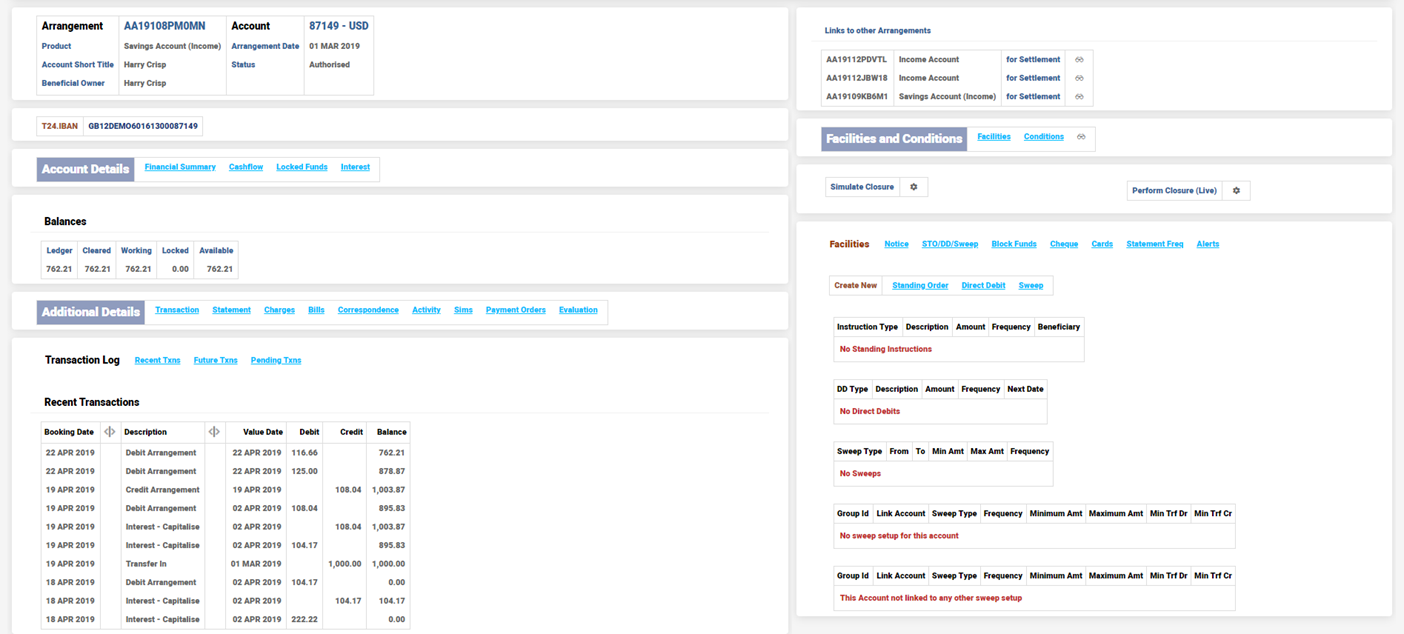

The below example shows a savings account funded on 1st March 2019.

The interest gets capitalised on the 2nd April.

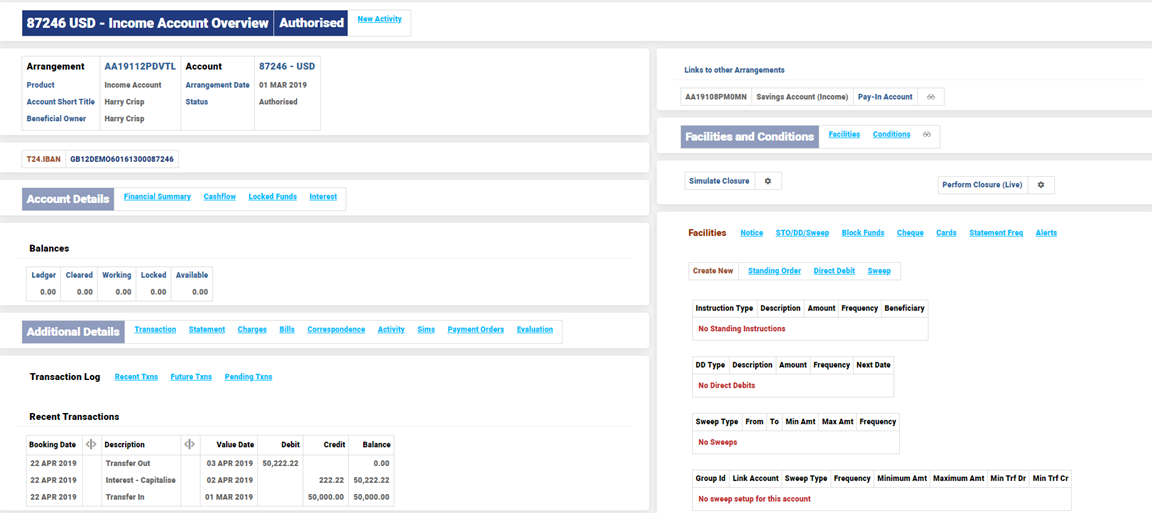

The available balance in the account is fully drawn on 3rd April.

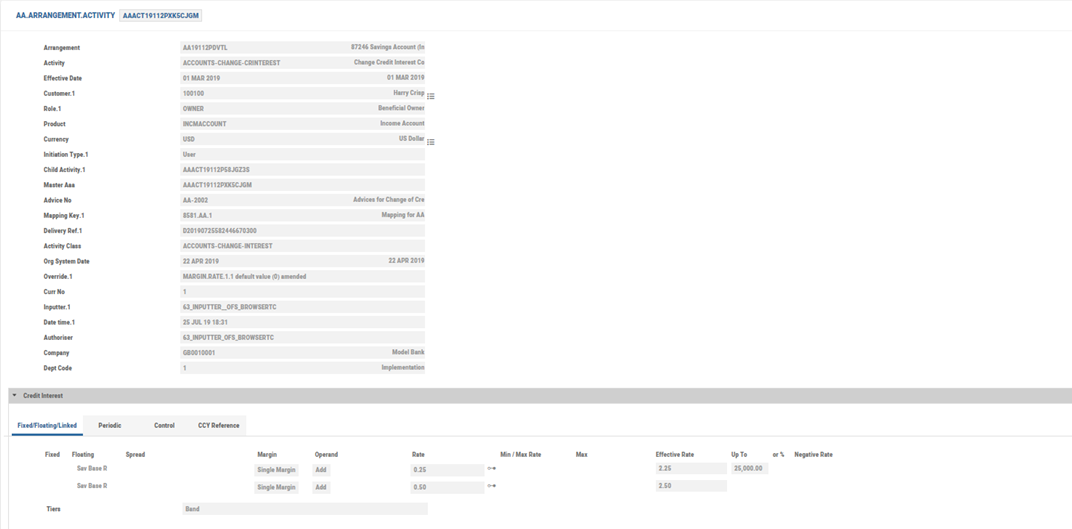

A backdated interest rate change (decrease) is triggered with value date as 1st March 2019.

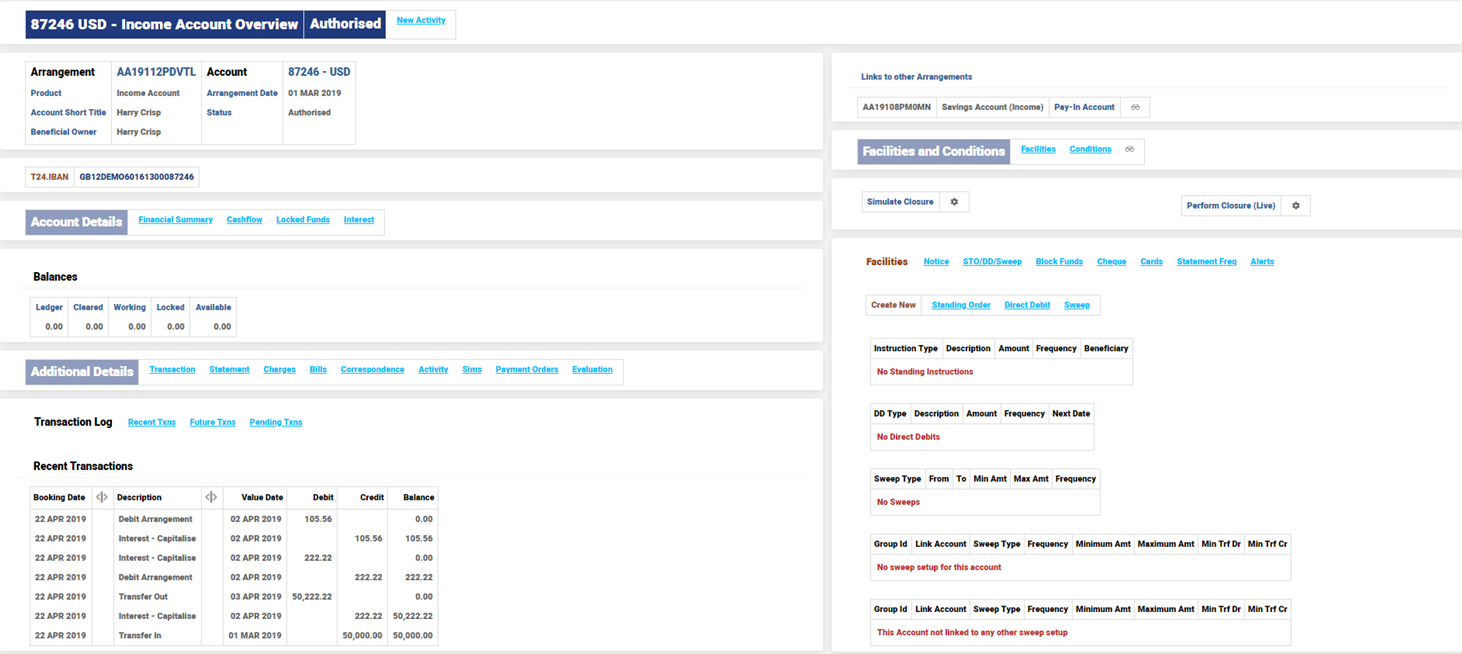

When a Retrospect Activity is triggered (to identify the impact of interest change), the differential amount which was already drawn out by the user is represented in the form of a INV balance bill. Since a settlement account is also configured, the INV balance bill is settled from the settlement account and the savings account balance is stopped from moving into negative balance.

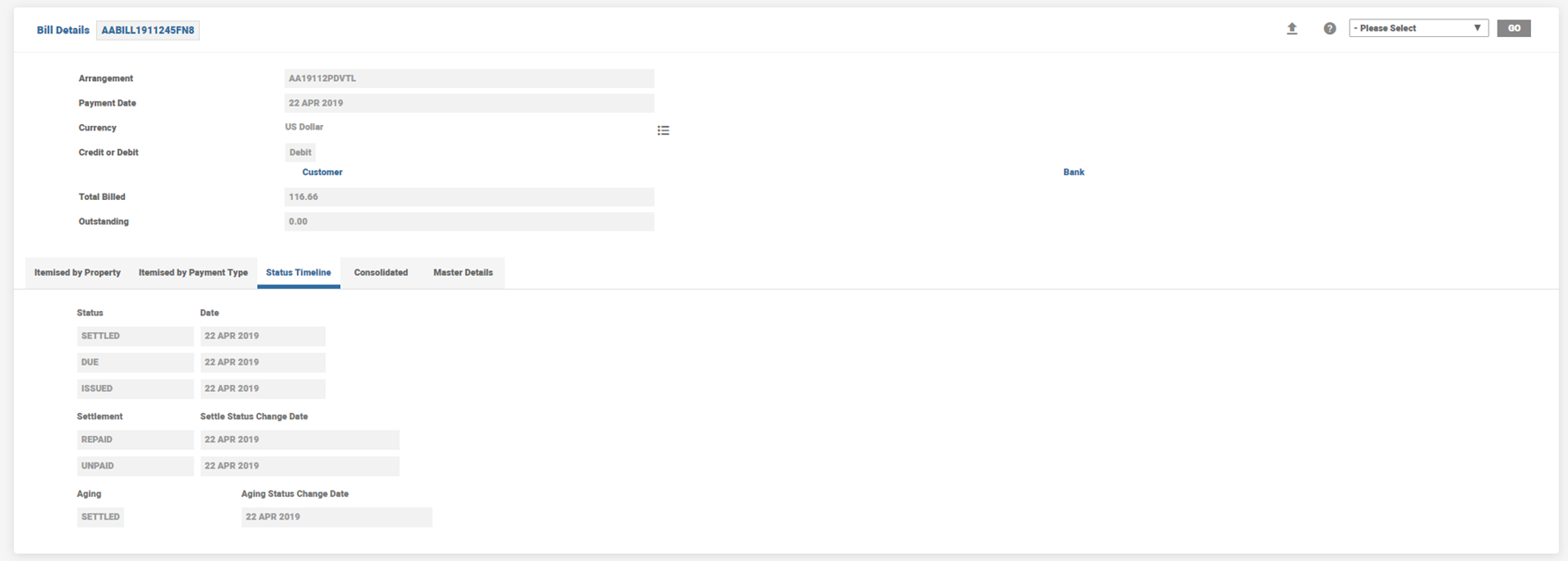

The bill details are shown below.

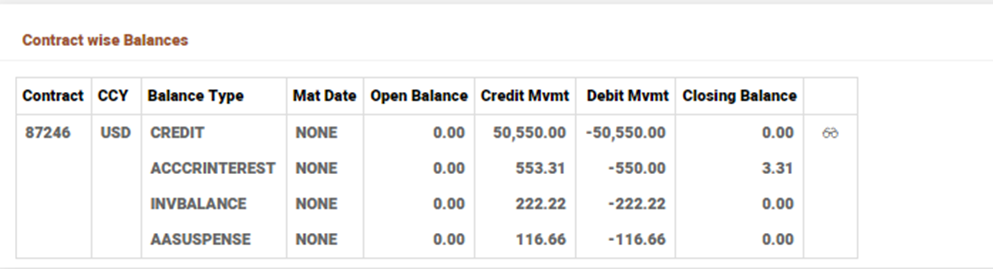

The EB.CONTRACT.BALANCES record shows the relevant balances.

The debit entry in the settlement account is shown below.

The system can automatically settle the invoice bills, which are generated due to insufficient funds in the account during capitalisation, to another account within the TBC or publish an event for a settlement request to an account or beneficiary outside the TBC, which should be consumed by an external payments system for further processing.

Interest Capitalisation Process with Restrictions

While capitalisation processing and in a Pay situation, if the nominated account has a posting restriction, the Transaction Cycler is triggered to retry the process. Based on system configuration in the RC setup, the system retries the posting, the nominated number of times and if the posting restriction has been lifted, the transaction is completed.

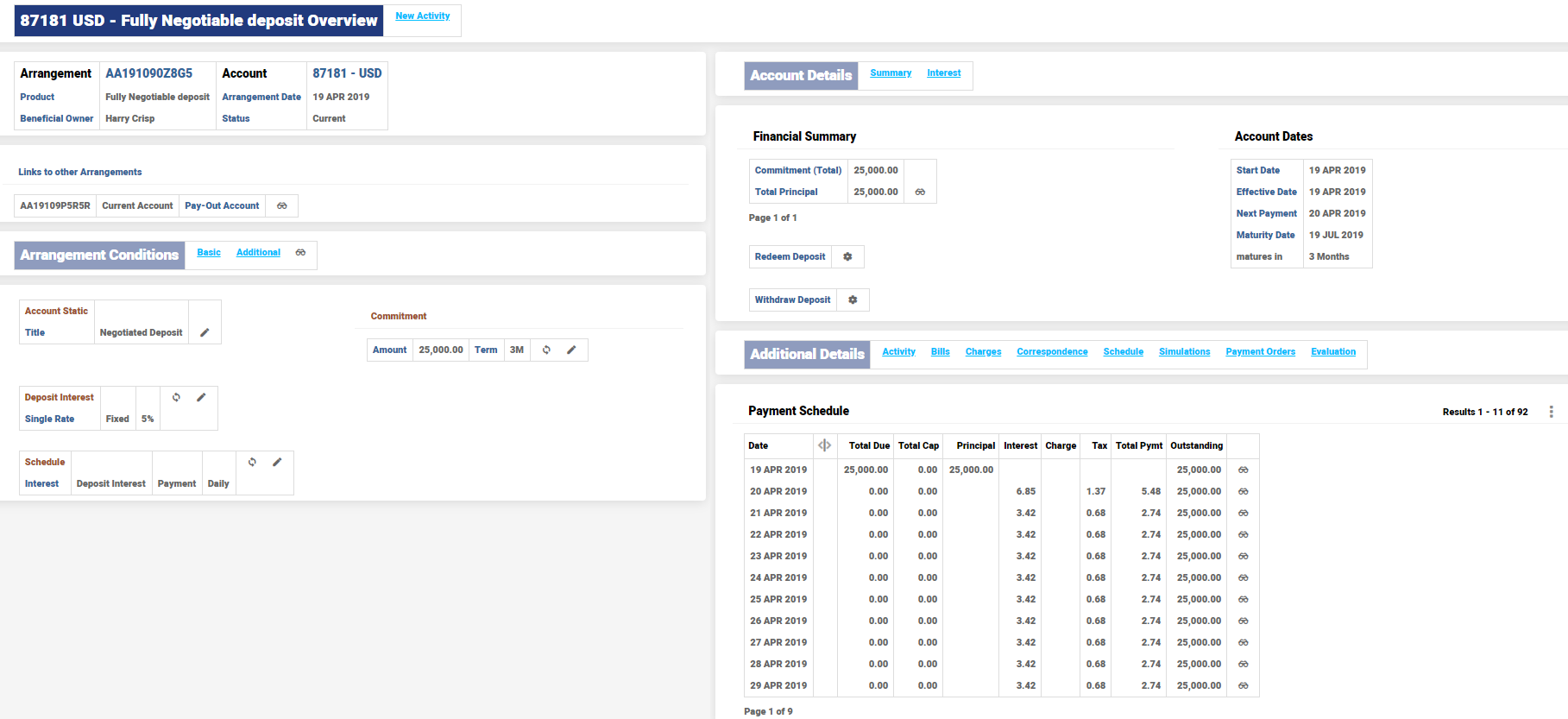

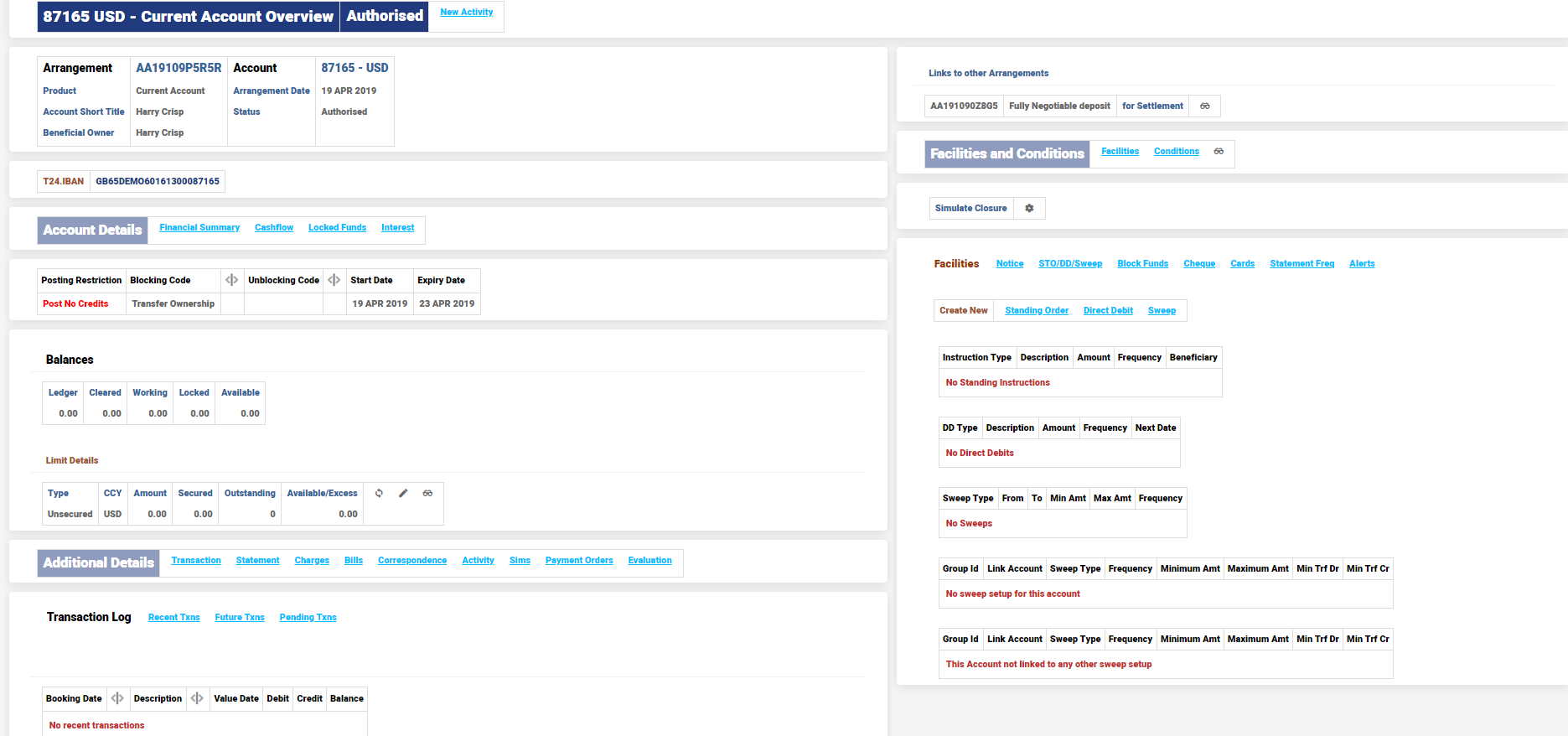

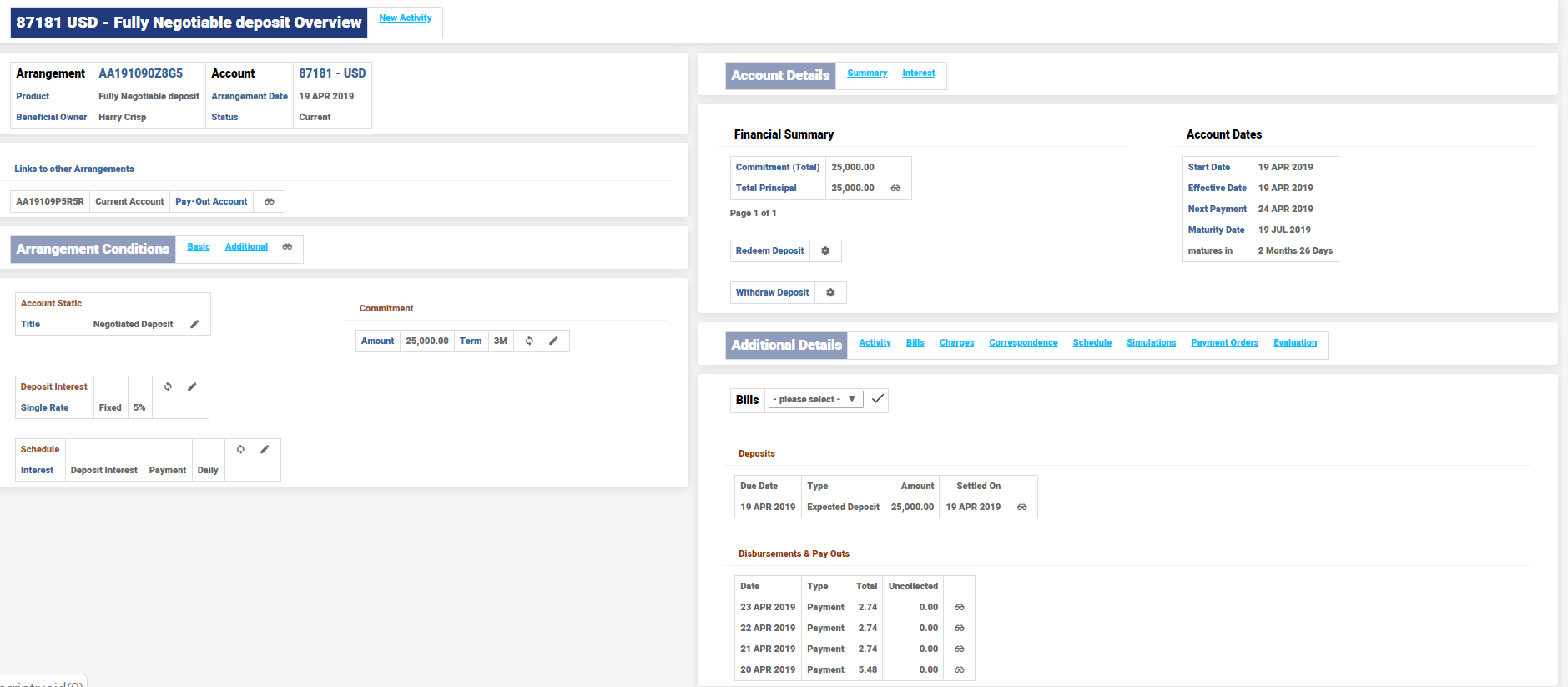

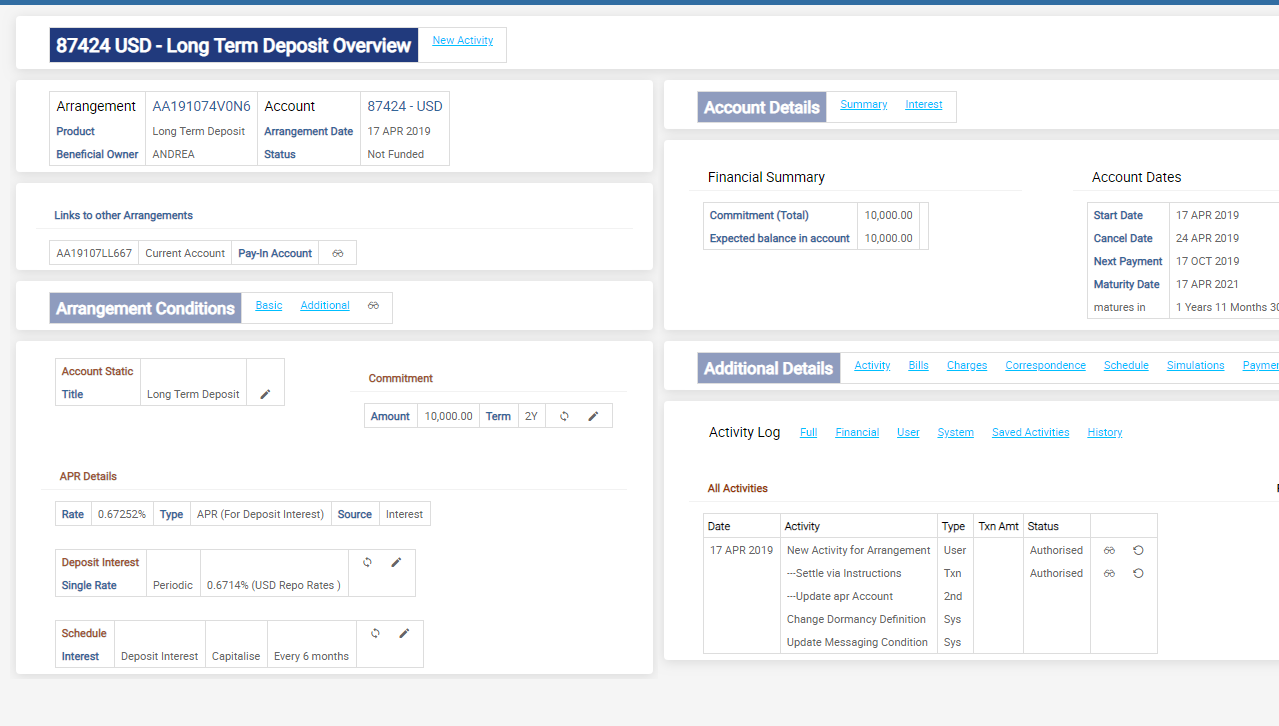

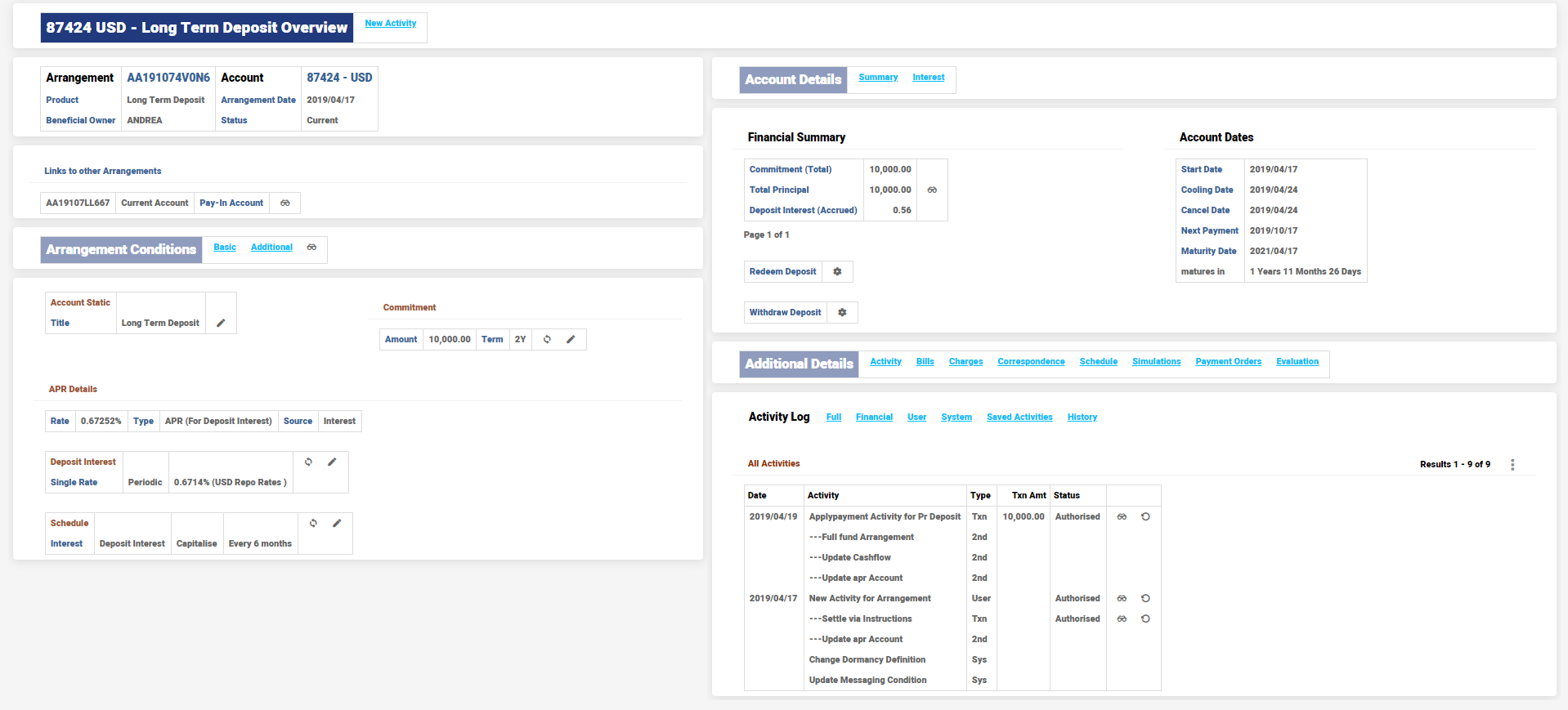

A deposit is created with daily interest payout and a Settlement account which has a posting restriction. The arrangement start date is 19th April 2019.

The Settlement Account Overview with Posting Restriction from 19th to 23rd April 2019 is shown below.

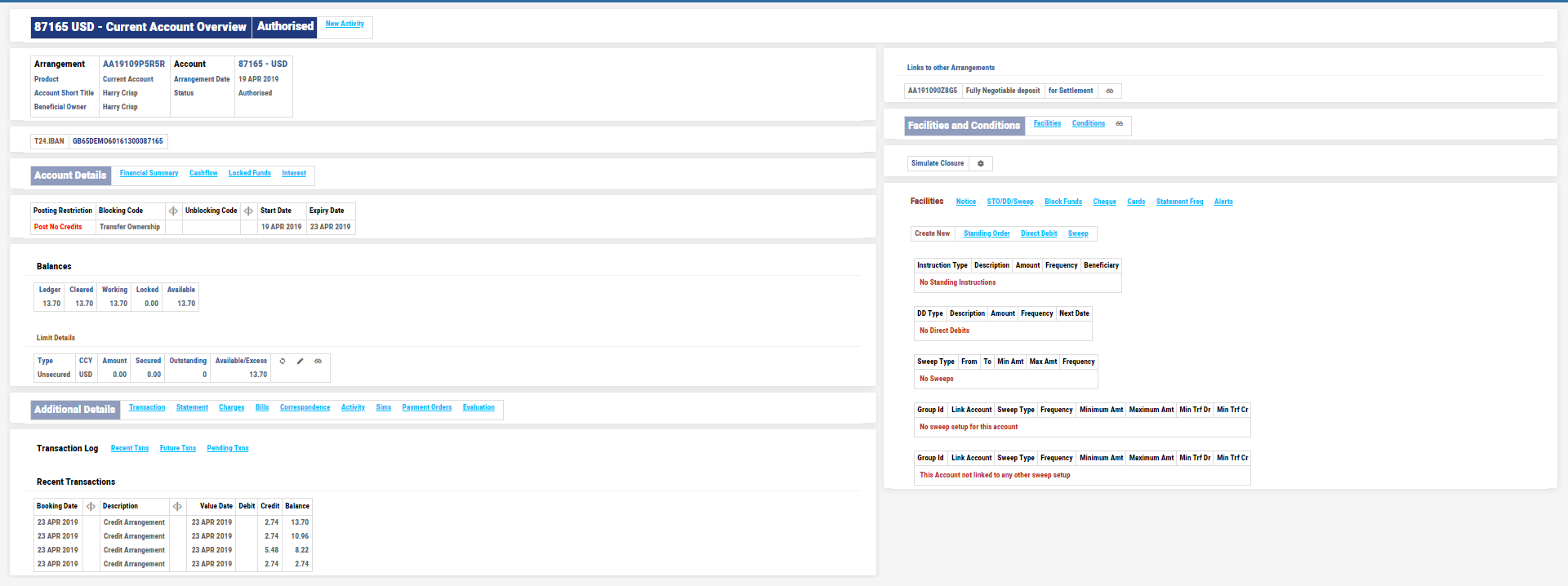

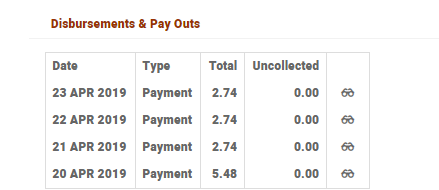

On 23rd April the posting restrict is lifted from the account. When COB is triggered on 22nd April, observe that the interest payout has been successfully settled for all four days.

On 23rd April, credits are posted on the Settlement account.

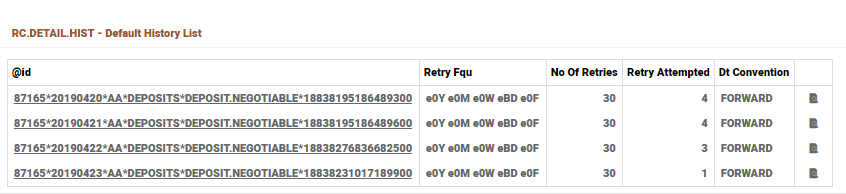

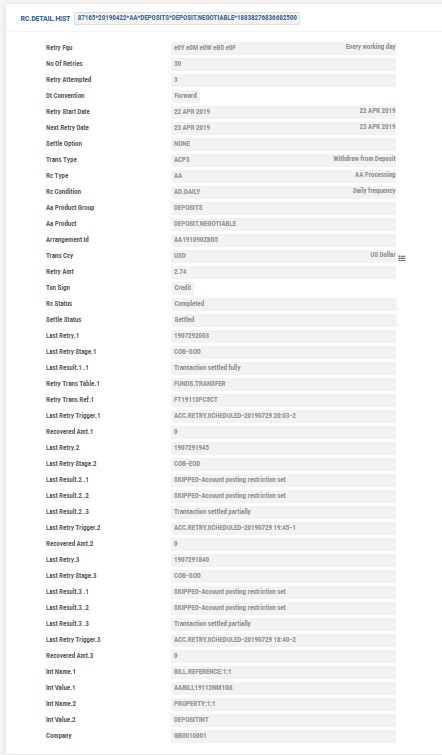

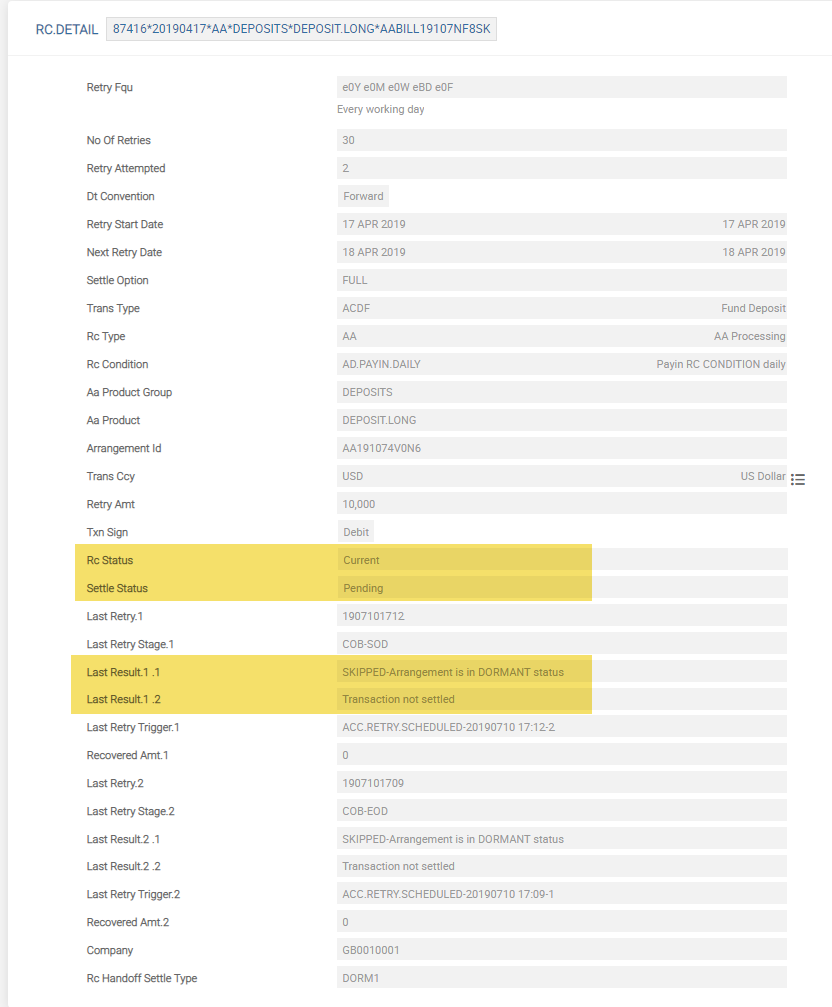

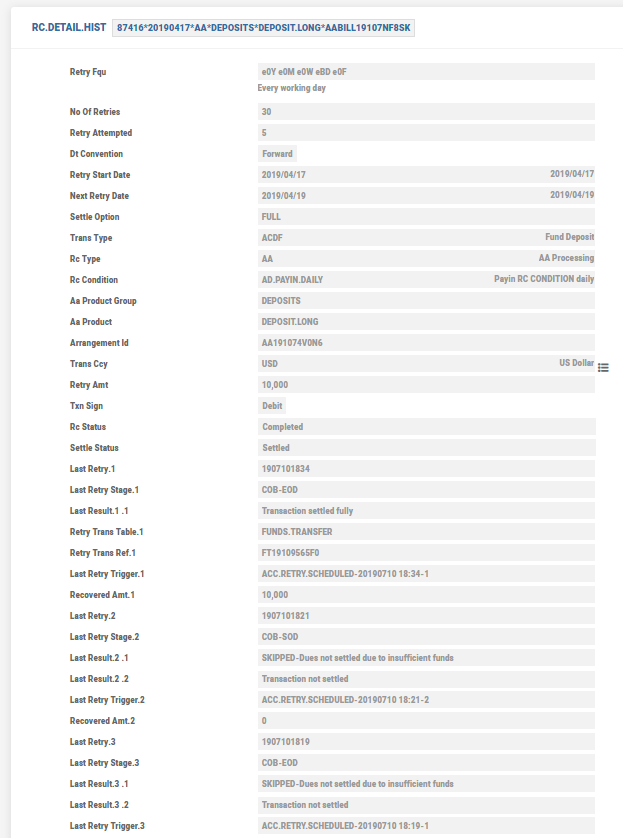

The RC.DETAIL.HIST holds the information on the retry details and settlement status when each interest payout bill was triggered by the system.

Observe in RC.DETAIL.HIST entry the settlement status and retry history is stored. Until the bill gets settled the RC record is held in RC.DETAIL table. Upon successful settlement it moves to the RC.DETAIL.HIST.

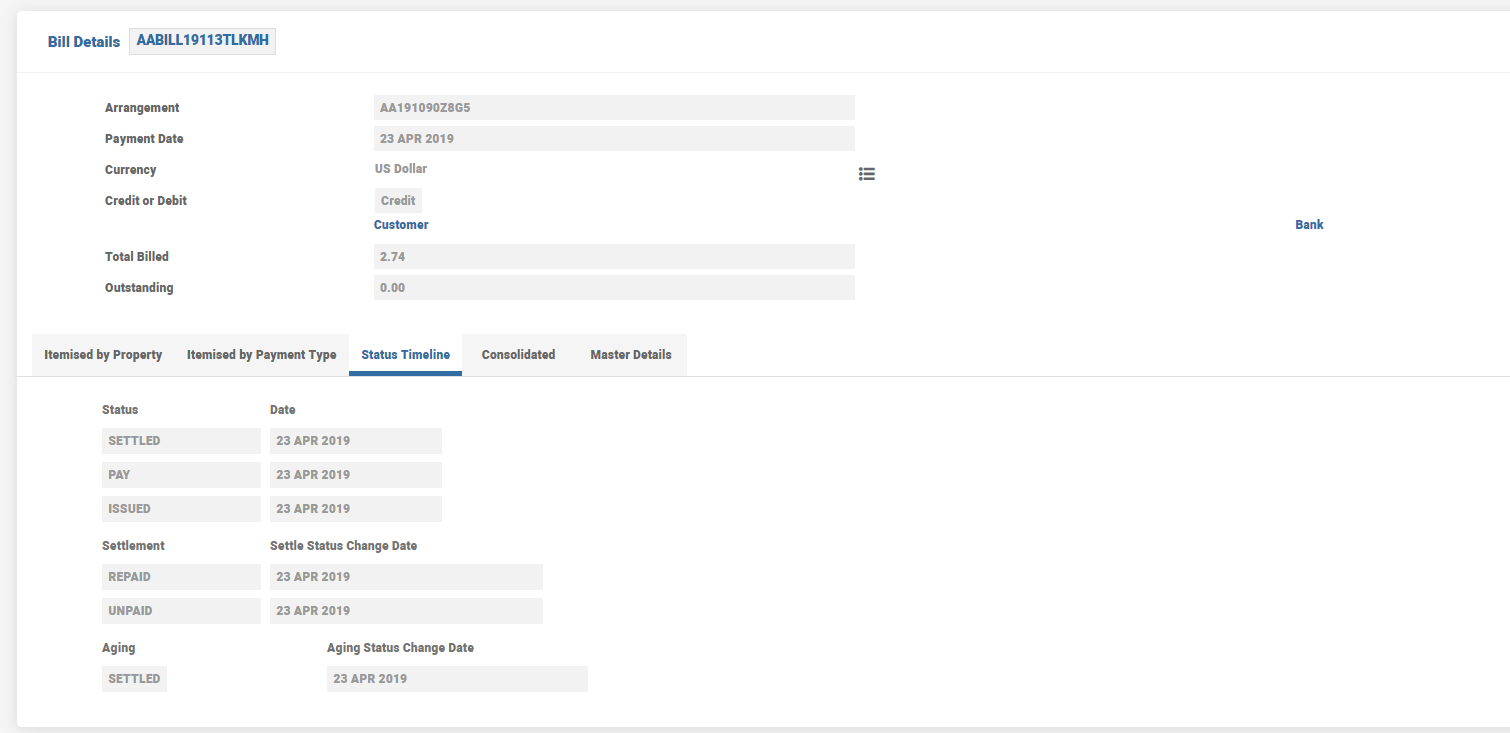

The AA.BILL.DETAILS record is updated as below.

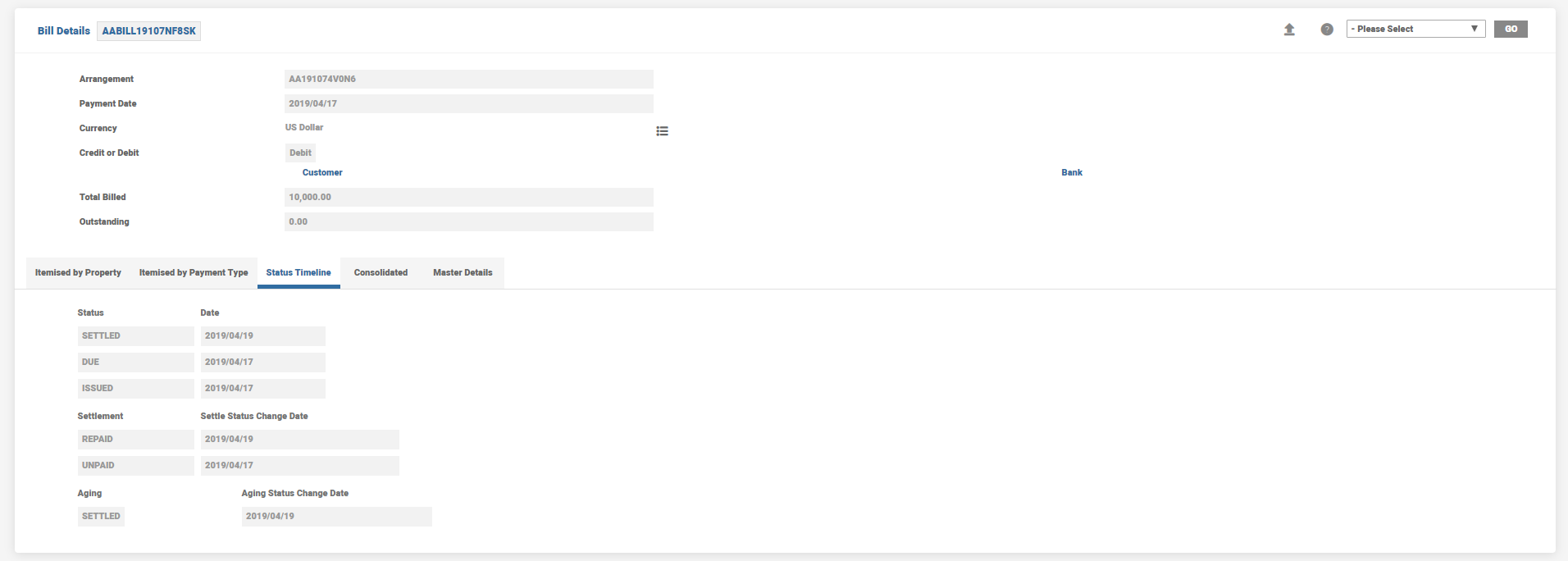

The status and timeline details of the bill are shown below.

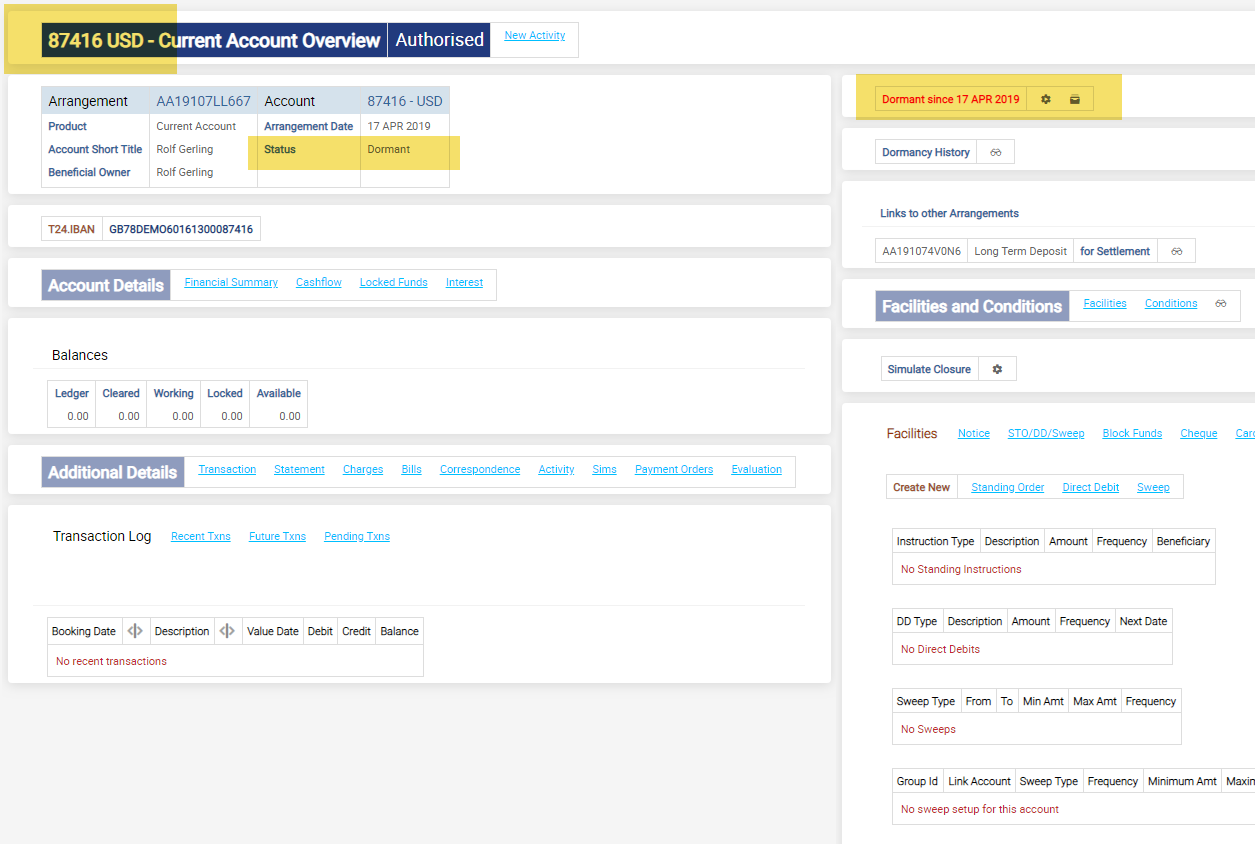

A deposit is linked to a Pay In settlement account which is dormant. A Recycler Condition to retry deposit funding on a daily basis is shown below.

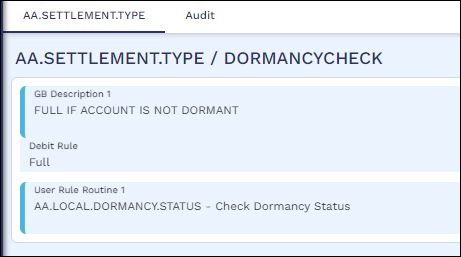

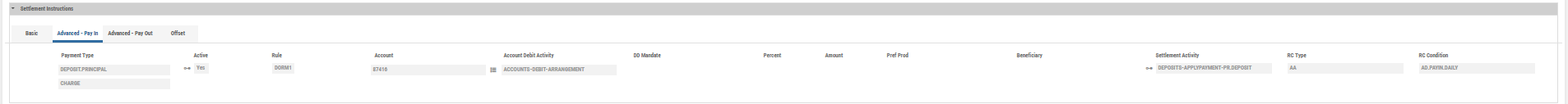

A Settlement Type record for dormancy evaluation is created.

A deposit is created with Pay-In Account which is Dormant.

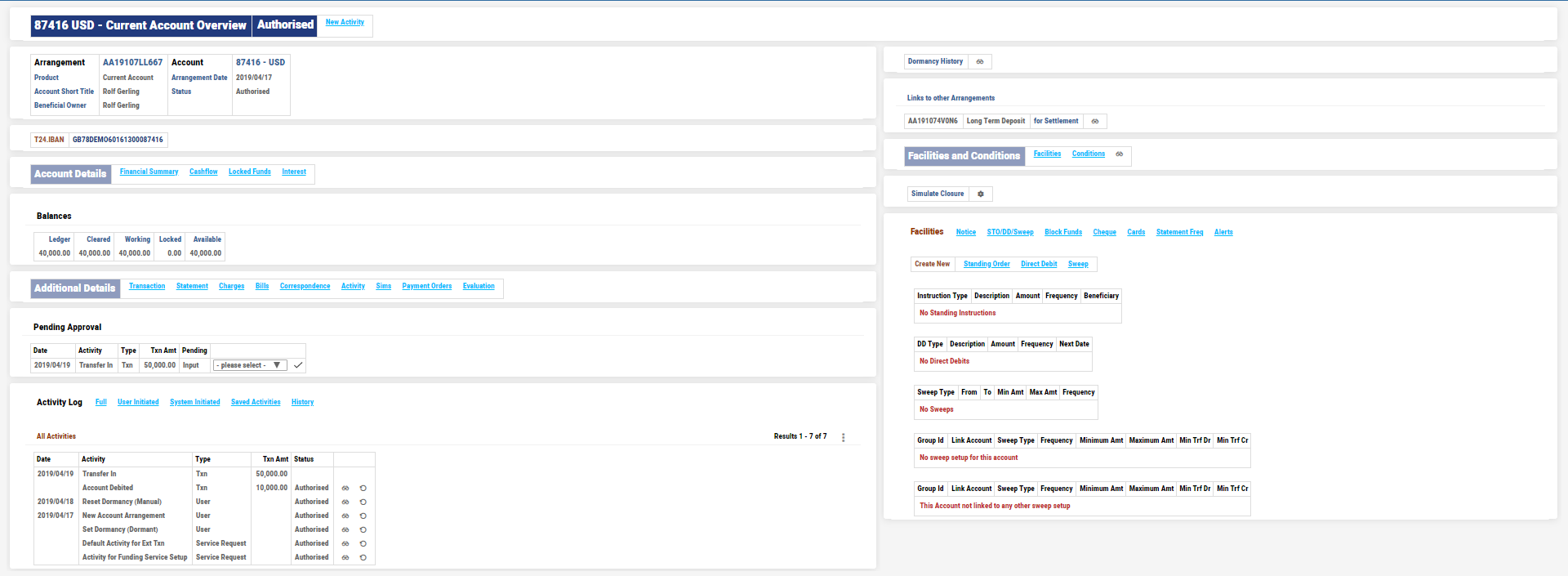

The Settlement Account overview is as shown below.

The RC.DETAIL record is in PENDING status since deposit funding is on hold, due to a dormant settlement account .

The Settlement Instructions are shown below.

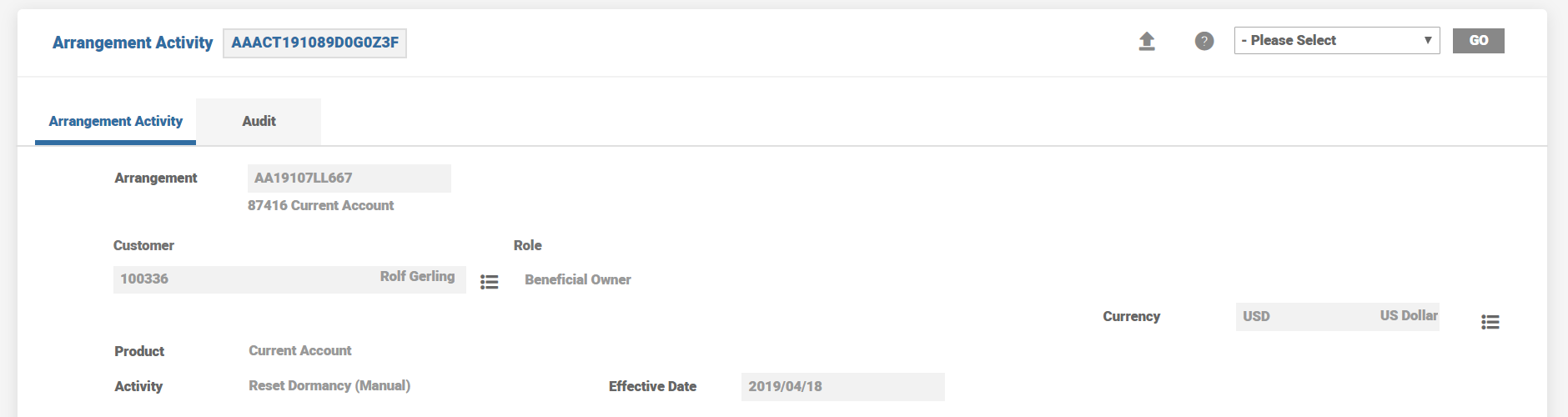

The Dormancy status of the Settlement is changed to Active through a manual Dormancy Reset Activity. This is achieved by triggering a funding on the account for USD 50000. The account which was dormant on 17th April becomes active on 18th April after the Dormancy Reset Activity.

Once the account becomes active, during the subsequent retry cycle (COB) the Deposit is funded with USD 10000 and the account balance reduces to USD 40000 on 19th April.

The fully funded deposit overview is shown below.

Relevant bill details are displayed as shown below.

RC Details in history after the Settlement is as shown below.

The system validates for any posting restrictions, during settlement of interest and charges for an account, within the TBC itself. It is possible to retry the failed postings, using the Transaction Recycler configured at the GAI (Generic Accounting Interface) level.

In other cases, the system publishes an event for a settlement request to an account or beneficiary outside the TBC, which should be consumed by an external payments system, for further processing.

In this topic