Introduction to ISO20022-Account Reporting(IX)

The camt.053 (Bank to Customer Statement) message is a statement of account(s) sent by the bank to account holding customer (or nominated representative) on a periodic basis. The message format is one of the family of cash management messages (camt) of the ISO20022 (also known as UNIFI) standard. The camt.052 message is an intraday version of the camt.053, only showing movements generated since the last generation of camt.052 or camt.053.

Banks that participate in Single Euro Payments Area (SEPA) payments (either credit transfer or direct debit) acting for the ordering party or the beneficiary must be able to generate the camt.053 or camt.052 electronic statement if requested by the account holding customer or bank. The format must include complete details of the SEPA payment in the statement detail and details of other non-SEPA financial transactions.

This capability is mandatory in many European countries from February 1, 2014.

- The camt.053 and camt.052 are part of the cash management messages set by ISO20022 using an XML based schema.

- The camt.053 (Bank to Customer Statement) is sent by the bank to an account owner or a party authorised by the account owner on a periodic basis.

- The camt.052 (Bank to Customer Account report) is used for intra-day account reporting upon request by the account owner.

The CAMT messages are the ISO20022 equivalent of the MT9nn series:

- Camt.053 is the ISO20022 equivalent of MT940, which is sent by the bank to the account holder on a periodic basis.

- Camt.052 is the IS020022 equivalent of MT942 or MT941, which is an intraday version of the camt.053.

Product Configuration

The camt solution is packaged into the Temenos Transact ISO20022 XML Account Statement Module (IX - ISO20022 Statement). The IX product must be installed to use the camt statement functionality.

The camt message produced by Temenos Transact is aligned with the Dutch-specific usage rules, as set by the Dutch Banking Association (NVB).

The NVB guidelines include the usage rules for the reporting of SEPA credit transfers and Single Euro Payments Area (SEPA) direct debits. The SEPA details required under NVB are reported in the camt statement if the required information is available in Temenos Transact.

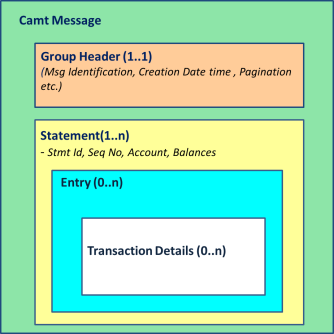

A camt message has a nested structure with the building blocks as shown in the image below. The Temenos Transact Camt module is responsible to assemble the data necessary to produce a camt message for each statement triggered.

The camt.053 and the camt.052 messages both have the same structure, except that the header name is different.

- Camt.053 message has the following structure:

Bank to Customer Statements:

- Group Header

- Statement

- Entry

- Transaction Details

- Camt.052 has the following structure:

Bank to Customer Account Report:

- Group Header

- Report

- Entry

- Transaction details

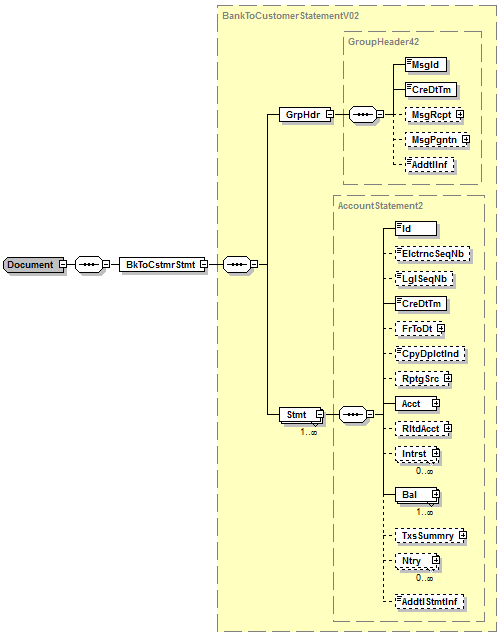

The following image shows the structure of a camt.053 message.

- Group Header (Statement Level Information):

The Group Header block of the camt message provides the information related to the statement and is specified for the camt message. This section of the message is mandatory.

It contains information like Message Identification, Pagination, Message Recipients and so on.

- Statement or Report (Account Level Information):

The Statement section of the camt message provides the details of the account(s) for which the statement(s) is being produced.

The camt message may contain information related to more than one account statement. However, Temenos Transact is producing one camt message for a single account statement.

Details required at this level are built from the Temenos Transact account and related statement production details. This includes details of the statement period, account identification, opening, closing and other account balances.

- Entry-Level Information:

One account statement can contain multiple account movements (a statement may have zero entries during the period). Information at this level is derived from the individual account movement from the Temenos Transact statement entry table.

Transaction-Level Information:

This section provides additional information for each entry displayed in the Entry Level section. The additional information may include:

- Additional details for an individual entry.

- Additional details for SEPA related transactions.

- Underlying entries of a netted entry which represents multiple debits and credits or a batch entry (this will be supported at a later stage).

The following screenshot shows the xml view of the camt.053 message.

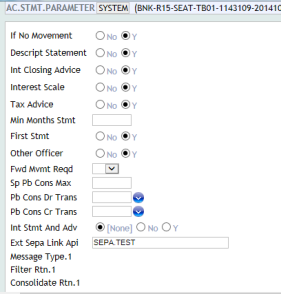

AC.STMT.PARAMETER

This table is used to define the default details for an account statement when opening new accounts. It also holds the high-level parameter that is applicable to account statement at the system level.

The AC.STMT.PARAMETER application is also used to define the following:

- Provide the link between an entry and the

EXTERNAL.SEPA.DETAILStable, which would hold the SEPA details from an external SEPA system. - Provide a hook to plug-in APIs to filter and consolidate the list of entries for a specific camt message.

Link between the Entry and the EXTERNAL.SEPA.DETAILS table:

To identify the corresponding EXTERNAL.SEPA.DETAILS record that holds the SEPA details for a STMT.ENTRY, the STMT.ENTRY and the EXTERNAL.SEPA.DETAILS record should be linked.

A hook is available based on each implementation to attach a local API with the logic to link the STMT.ENTRY record to the EXTERNAL.SEPA.DETAILS. The API returns the key to the EXTERNAL.SEPA.DETAILS table.

The External SEPA Link API field in AC.STMT.PARAMETER application is the hook that gets the link from the entry to the EXTERNAL.SEPA.DETAILS table. It is a valid key to EB.API to hold the API that returns the link key to the EXTERNAL.SEPA.DETAILS table.

Different variations of the camt.054 message are generated by filtering the list of entries to be reported. A filter API is invoked to exclude entry details based on the criteria the bank requires.

Entries for the statement or report period are combined into consolidated entries for the statement. The criteria and consolidation method used is determined by message types and decisions made through an API routine. This consolidates entries together according to the required rules and ensures that the consolidated entry is shown in the statement.

The following screenshot shows the hook in AC.STMT.PARAMETER to plug-in an API to return the link between the entry and the EXTERNAL.SEPA.DETAILS table.

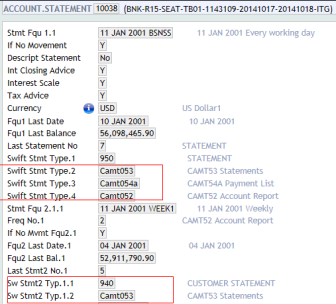

ACCOUNT.STATEMENT

The camt account statements and reports are generated using the standard account statement functionality.

ACCOUNT.STATEMENT table is used to specify the dates and frequencies for producing account statements. A record is automatically created with the default settings when an account is set-up. It can then be defined specifically for each account based on the customer’s requirements. User can define up to nine statement cycles, and within each cycle, a combination of different types of messages can be generated.

The Xml Stmt Type field in the ACCOUNT.STATEMENT application is used to request a camt or MT type message for the first cycle for an account.

The Swift Statement-2 Type field is used to define the message types for the additional statement cycles.

The following screenshot shows the set-up for camt and MT type messages for two statement cycles.

Each building block of the camt message has a list of tags to hold specific information for the statement. The tags have the following attributes:

- Occurrence – Mandatory or Optional and Single or Multiple occurrence.

- Value – Defined as per ISO20022 or may be configured by account service provider.

Temenos Transact supports the following camt tags defined under ISO20022:

- All mandatory tags.

- Some optional tags with non-SEPA related details.

- The optional tags that are required under the Dutch Banking Association (NVB) usage rules to report additional SEPA details from an underlying Payments Clearing and Settlement (PACS) message.

The tags are defined internally using the Temenos Transact naming convention and are mapped to the ISO20022 camt schema during the data transformation process.

Read the Camt Generation Process section for more details on data transformation.

Mandatory Tags Supported:

The following table shows the high-level mandatory tags that are supported by Temenos Transact with an indication of the tags, which can be configured by the bank based on the bank’s practice or local regulation.

| Camt Index | Description | User Configurable |

|---|---|---|

| Group Header | ||

| 1.1 | Message Identification | Y |

| 1.2 | CreationDateTime | |

| Statement | ||

| 2.1 | Identification | Y |

| 2.4 | CreationDateTime | |

| 1.2.1 | Account>ID>IBAN | |

| 1.2.2 | Account>ID>OtherId | Y |

| 2.24 | Balance>Type>Code | |

| 2.34 | Balance>Amount | |

| 2.35 | Balance>CreditDebitIndicator | |

| 2.36 | Balance>Date | |

| 2.78 | Entry>Amount | |

| 2.79 | Entry>CreditDebit Indicator | |

| 2.81 | Entry>Status | |

| 2.91 | Entry>Bank Transaction Code>Proprietary | Y |

| 2.99 | Entry>Issuer | Y |

Optional Tags Supported:

Optional tags are required under the NVB usage rules to report additional SEPA details.

The following table shows the list of high-level optional tags that are supported by Temenos Transact with an indication of which tags are required to report SEPA details and which tags may be configured by the bank based on the bank’s practice or local regulation.

| Camt Index | Description | Usage rule under NVB for reporting SEPA. Required: Y | User configurable |

|---|---|---|---|

| Group Header | |||

| 1.4 | Message Pagination | ||

| Statement | |||

| 2.2 | ElectronicSequenceNumber | Y | |

| 1.2.11,1.2.12,1.2.13 | Account>Currency/Name/Owner | ||

| 2.31 | Balance>Credit Line | ||

| 2.43 | Transaction Summary | ||

| 2.77 | Entry>Entry Reference | ||

| 2.8 | Entry>Reversal Indicator | Y | |

| 2.82 | Entry>Booking Date | Y | |

| 2.83 | Entry>Value Date | Y | |

| 2.84 | Entry>Account Servicer Reference | Y | Y |

| 2.3.14 | Entry>Additional Entry Information | Y | Y |

| 2.3.15 | Entry>Additional Statement Information | Y | Y |

| 2.143 | Transaction Details>References | Y | |

| 2.199 | Transaction Details>Related Parties | Y | |

| 2.211 | Transaction Details>Related Agents | Y | |

| 2.224 | Transaction Details>Purpose | Y | |

| 2.227 | Transaction Details>Remittance Information | Y | |

| 2.293 | Transaction Details>Return Information | Y | |

| 2.3.13 | Transaction Details>AdditionalTransactionInformation | Y | Y |

In this topic