Introduction to FATCA Regulations

The Foreign Account Tax Compliance Act (FATCA) is a tax law designed to prevent the US taxpayers from evading tax by allowing them to hold income-producing assets through accounts at Foreign Financial Institutions (FFIs). This results in a change in the rules governing cross-border payments and effects that are widely applicable.

Under FATCA, financial institutions must sign an agreement with the IRS in order to be designated as a Participating Foreign Financial Institution (PFFI). It is mandatory for Foreign Financial Institutions (FFIs) to identify and report these US accounts to Internal Revenue Service (IRS) on an annual basis. The US financial institutions (USFIs) and FFIs must also report certain information to the IRS about the major US owners of Non-Financial Foreign Entities (NFFEs).

The FFIs in the countries covered under the Inter Governmental Agreement (IGA) have to enter into an agreement only with their local regulators instead of the IRS and report to them on an annual basis. The regulator in turn reports the information to US (this is mostly on a reciprocal basis).

Purpose of FATCA

The objective of FATCA is reporting of foreign financial assets; withholding is the cost of not reporting. The legislative intent of FATCA is to ensure that there is no gap in the ability of the US government to determine the ownership of US assets in foreign accounts.

Withholding

Withholding is the cost of not reporting. The withholding taxes (30%) apply to specified US source income (dividend, interest payments and the gross sale proceeds resulting from sale of assets that give rise to US source income) in case of payments made to non-participating FFIs, recalcitrant account holders or NFFEs that have not provided information regarding its substantial owners. If the foreign institution is a PFFI, the U.S paying agent do not have to withhold the payment. However, the PFFI has to apply the withholding to its investors, both US and non-US persons if they do not comply with requirements of FATCA.

FATCA Focus

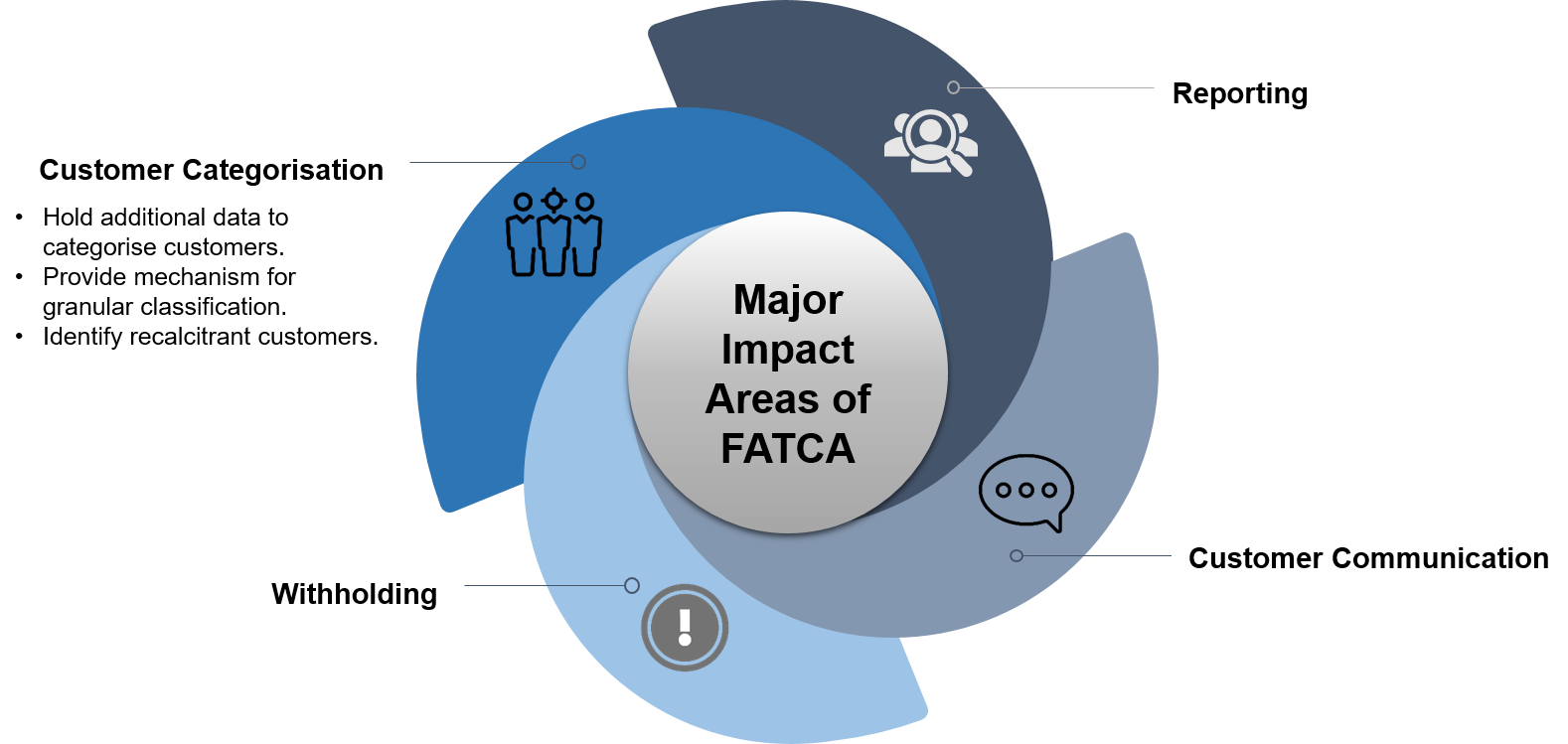

The major areas of impact as far as FATCA is concerned are as follows:

Product Configuration

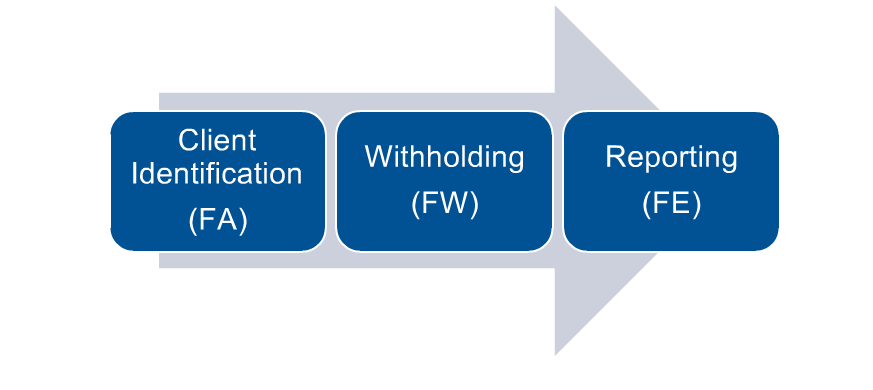

The FATCA functionality in Temenos Transact is licensed under the following modules:

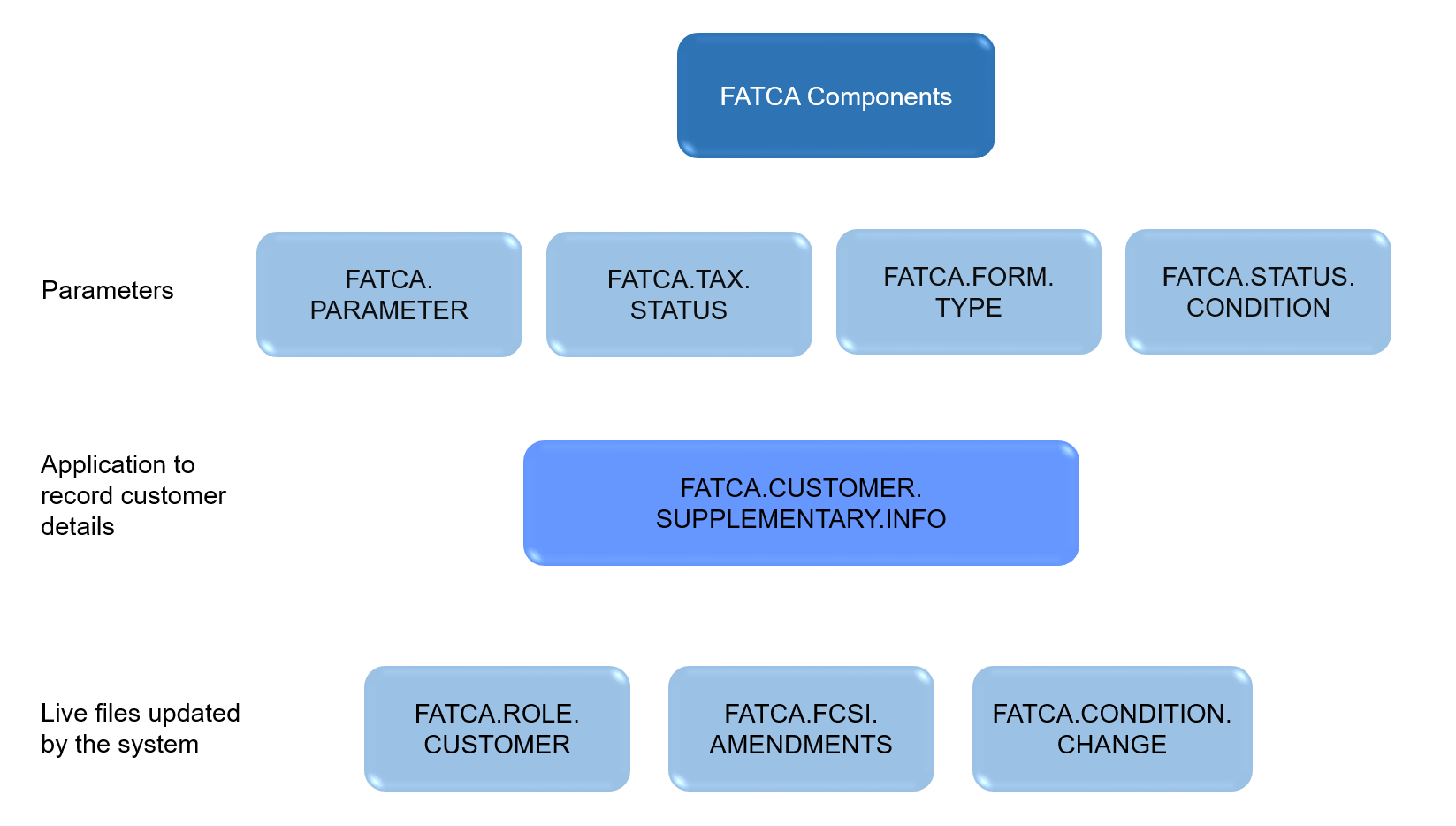

The FA module comprises the following parameters, application that record customer details, and details of live files updated by the system:

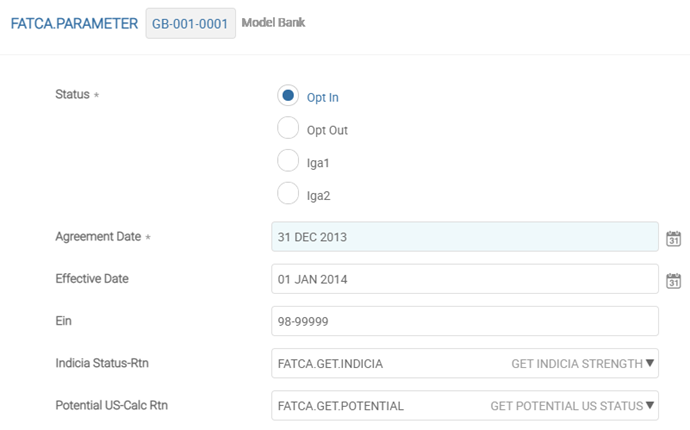

FATCA.PARAMETER

The FATCA.PARAMETER is used to record the following details of the:

- Institution’s agreement with the IRS

- Effective date of the FATCA provisions

- Status (opt-in/opt-out)

- Certain default conditions

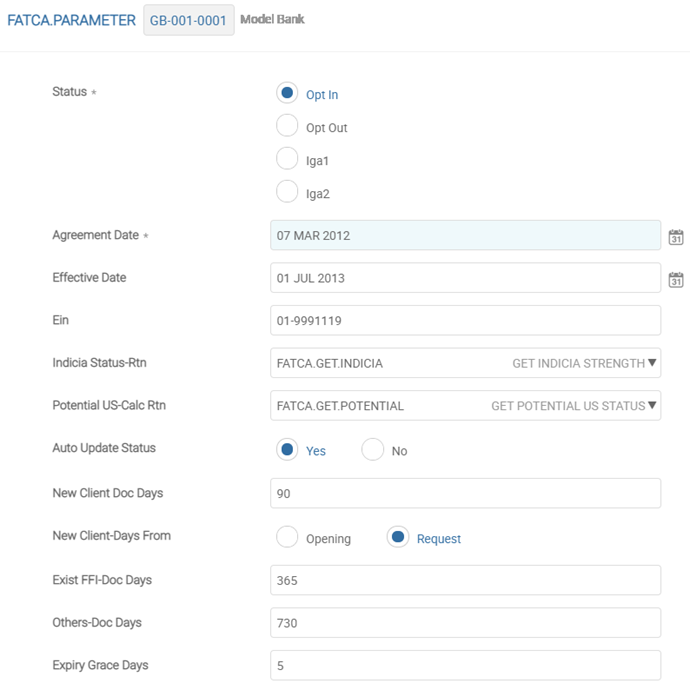

The following screenshot displays the record FATCA.PARAMETER.

The following table provides descriptions of key displayed on the above screen.

| Field | Description |

|---|---|

| Effective Date | With reference to the above screen, this field displays the date 31-Dec-2013 for agreements upto 01-Jan-2014.Displays the value in the Agreement Date field for agreements after 31-Dec-2013. |

| Indicia Status-Rtn | Displays the ID of the routine that calculates the Indicia Status.

The API FATCA.GET.INDICIA is supplied, but a client may use their own routine. If no routine is specified, the indicia strength is not calculated. |

| Potential US-Calc Rtn | Displays the ID to the routine that determine if the customer is assigned with a US status. Note: The API FATCA.GET.POTENTIAL is supplied, but a client can use their own routine in its place. If no routine is specified here, then the Potential US status is not calculated. |

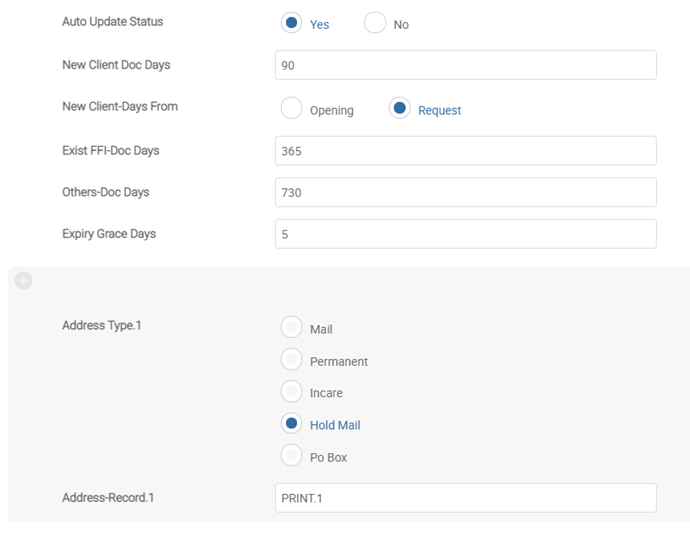

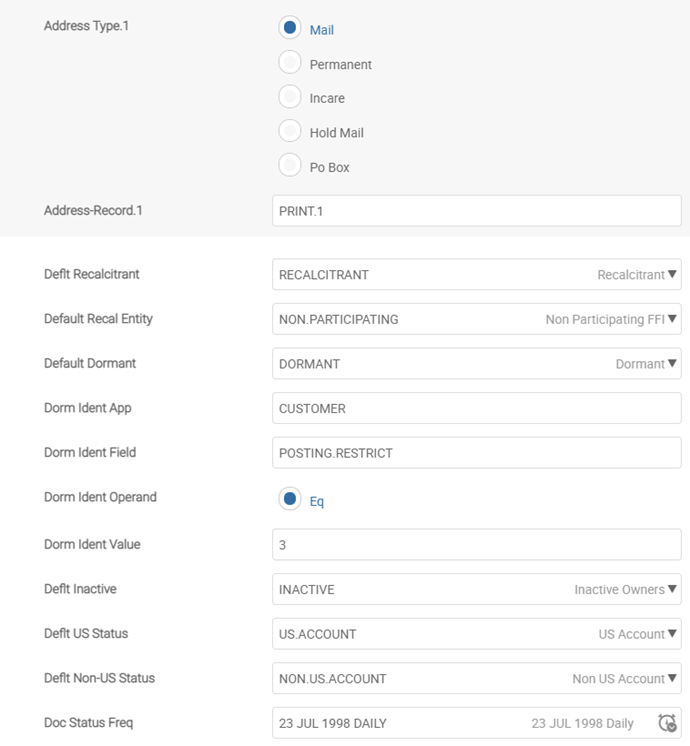

The following screenshot displays field that determine if the system can automatically update the FATCA Status (or Account Classification) based on the rules defined in FATCA.STATUS.CONDITION. The default status records for some of the standard classifications (US accounts, non-US accounts, non-participating FFIs, recalcitrant accounts and dormant accounts), the identifier for dormant accounts and defaulting logic for the various address types in FATCA.CUSTOMER.SUPPLEMENTARY.INFO, are also defined here.

The following table provides description on the key fields available in the above screenshot.

| Field | Description |

|---|---|

| Auto Update Status | Indicates if the system can automatically update the FATCA status. The values are None, No and Yes. If this field is set to Yes, then the system can automatically default the FATCA Status field in the FATCA.CUSTOMER.SUPPLEMENTARY.INFO record depending on the rules defined. When documents expire and if the Auto Status Update field is set to Yes, then the system automatically sets the account classification as recalcitrant, and adds an additional grace period can be added using the Expiry Grace Days field. |

| New Client Doc Days | Indicates the actual number of days to submit the documents for new clients. In the above screenshot, the document cut off has been set to 90 days from the opening date. |

| New Client-Days From | Indicates the number of days to set the receipt of documents from the date of opening or the request date for new clients. |

| Exist FFI-Doc Days | Indicates the number of days by when the existing clients can submit the documents required under FATCA. This date is set based on the Effective date of the FATCA Agreement along with the number of days entered in this field. It is currently set to one year. |

| Expiry Grace Days | Indicates the number of days grace days provided to customers to submit documents. |

| Address Type | Indicates the type of address provided in the Address Record field.

The example above shows that PERMANENT addresses are default from PRINT.1 in the DE.ADDRESS record.

|

| Address-Record.1 | Displays the address of the customer.

If the address details in FATCA CUSTOMER SUPPLEMENTARY INFO has to default from existing DE.ADDRESS records, the defaulting conditions can be specified in the Address Type and Address-Record.1 fields.

|

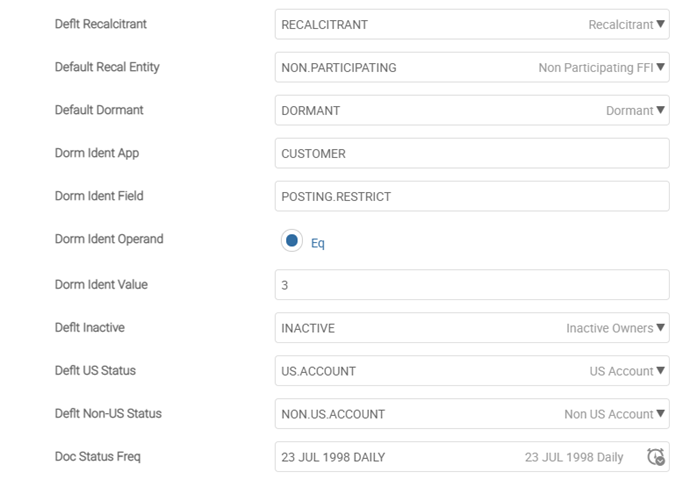

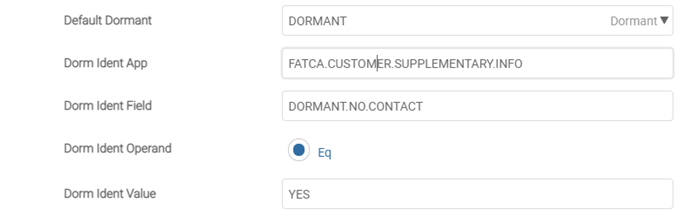

The following screenshot displays the default dormant information. The user can set up default dormant information from fields Dorm Ident App through Dorm Ident Value.

In the above example, any customer with the Posting Restrict field set to 3 is classified as Dormant. In the example below, the dormant details are being read from the record in FATCA.CUSTOMER.SUPPLEMENTARY.INFO.

As per the above setup, any record in FATCA.CUSTOMER.SUPPLEMENTARY.INFO with the Dormant No Contract field set to Yes is classified as DORMANT.

User-defined FATCA statuses can be captured in the FATCA.TAX.STATUS application. For example DORMANT is a FATCA status and a record for this is created in FATCA.TAX.STATUS application. With reference to the above example, the term DORMANT (as preferred by the bank) is specified in the Deflt Dormant field and the condition to be applied by the system to arrive at the dormancy status has further been defined.

The system can set up a default rule in the FATCA.PARAMETER record in the following fields:

- Deflt Recalcitrant

- Deflt Entity Recal

- Deflt Dormant

- Deflt Inactive

- Deflt US Status

- Deflt NonUS Status

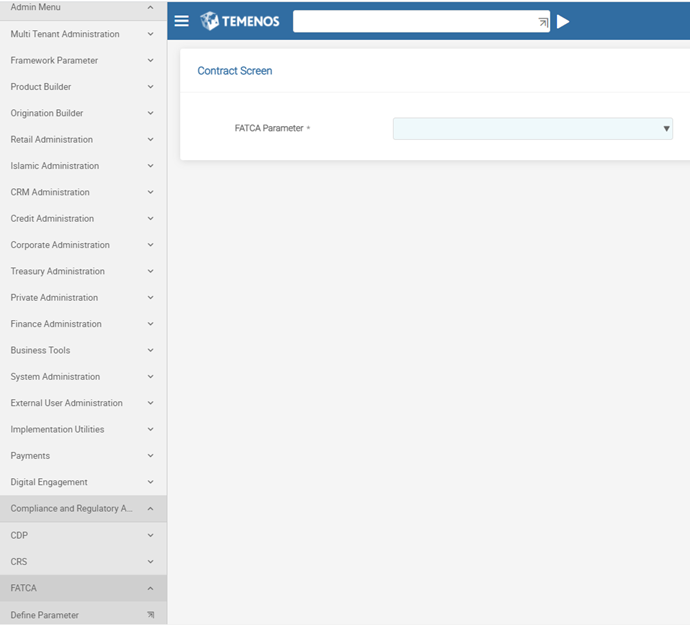

Perform the following steps to create a record in FATCA.PARAMETER for company GB0010001. From the Admin Menu, select Framework Parameter>Customer> FATCA Admin Menu>FATCA Parameter.

The following is a scenario to create a record in FATCA.PARAMETER record for company GB0010001.

Company GB0010001 has entered into an agreement with the IRS on 07MAR2012. The agreement is dated 07MAR2012. The company has an EIN of 01-9991119. The company has decided to use the Temenos API's to calculate Indicia and status. It is required that the Fatca Status field is automatically updated in the FATCA.CUSTOMER.SUPPLEMENTARY INFO record and the bank wants to set up various defaults.

Set dormant information based on the Posting Restrict field in the CUSTOMER application.

Enter the following information in the fields as provided in the table.

| Field | Description |

|---|---|

| FATCA Status | Opt.In |

| Agreement Date | 07 MAR YYY |

| Ein | 01-9991119 |

| Indicia Status-Rtn | FATCA.GET.INDICIA |

| Potential US-Calc Rtn | FATCA.GET.POTENTIAL |

| Effective Date | Defaults to 01 JUL YYYY as the agreement date is before 30 June YYYY |

| Auto Update Status | Yes. This allows the FATCA Status field to be updated automatically |

The following fields specify the duration within which the client has to produce the relevant documentation. Enter the fields Dorm Ident App to Dorm Ident Value to automatically identify dormant accounts. In this example, the fields should be set as following.

| Field | Value |

|---|---|

| Dorm Ident App | Customer |

| Dorm Idnt Field | Posting Restrict |

| Dorm Ident Operand | EQ |

| Dorm Ident Value | 3 |

With the above settings, the system identifies dormant customers with the Posting Restrict field set to 3. Referring to the FATCA.PARAMETER, the various records in FATCA.TAX.STATUS have been defined using the following set of specified fields.

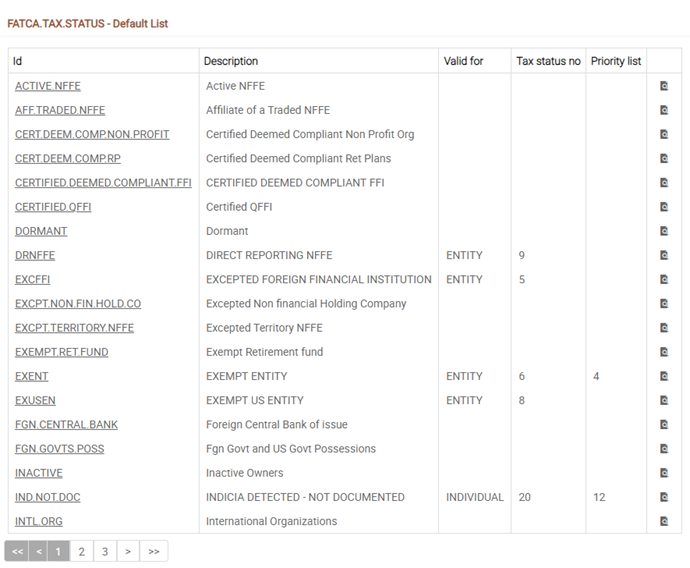

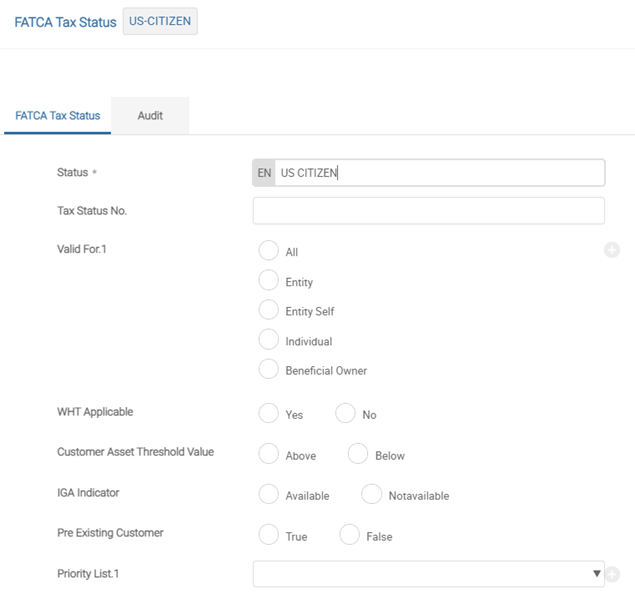

FATCA.TAX.STATUS

The FATCA.TAX.STATUS application records the various account classifications or FATCA Statuses. The status is first created in this application before it can be input in the FATCA Status field in the FATCA.CUSTOMER.SUPPLEMENTARY.INFO application. A number of standard status records have been pre-defined in FATCA.TAX.STATUS. New status records can be added where required using this application.

The below table contains the esample records with brief description.

| FATCA.TAX.STATUS record | TypeApplicability | Description |

|---|---|---|

| US National | Private Person | Is a US Citizen |

| Greencard | Private Person | Has a greencard |

| Substantial Presence | Private Person | Has a Tax Residence |

| US Domicile | Private Person | Domicile is normally determined at birth but can be changed. It is a distinct legal concept from Residence |

| Recalcitrant | Private Person or Entity | As per the provisions of FATCA, the information on the accounts are shared with IRS on a periodic basis. The FFIs obtain necessary waivers from the customers. This is important as the reporting can conflict with the local regulations and privacy laws. In case such a waiver is not provided by the clients, the accounts are considered recalcitrant accounts. |

| Participating | Entity | Under FATCA, financial institutions must sign an agreement with the IRS to be designated as a PFFI. Withholdable payments to FFIs are subject to withholding (30%), unless the FFI is a participating FFI or the FFI is a deemed-compliant FFI that are eligible, even without entering into an FFI Agreement, for exemption from withholding, or the FFI is exempt from withholding as per the provisions of the act. This requires US entities that make payment of US source income to maintain documentation on FFIs and other NFFEs and track how these entities are classified under FATCA. It must be noted that the FFIs and each of its financial affiliates must enter into an agreement with IRS. |

| Non Participating | ||

| Exempt | ||

| Deemed Compliant | ||

| US Ben Owner | Private Person or Entity | To record whether the account has a US beneficial owner. Unlike substantial ownership for NFFEs, this is recorded irrespective of the size of the beneficial interest. Besides, beneficial ownership can also exist for individual accounts. |

| NON US | Private Person or Entity | Any of the KYC details point to the customer as being Non- US (e.g.: nationality, place of birth, POA, address, W9 and so on) |

A recognised list of records in FATCA.TAX.STATUS have been pre-defined and released in from Transact as listed below. However, it is possible that additional status records may be required to be created. The FATCA.TAX.STATUS application also allows the creation of new status records.

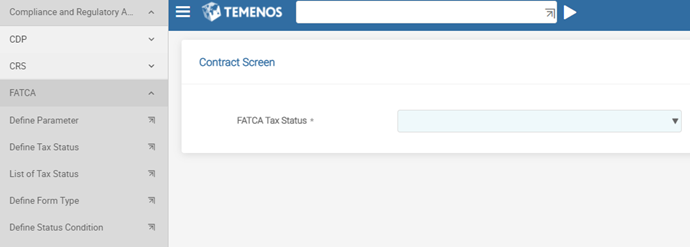

To create a new record in FATCA.TAX.STATUS, select Define Tax Status from the FATCA admin menu.

Enter the new ID in the FATCA Tax Status field and click  .

.

Enter a description for this record in the GB Status field.

Click  to authorise the record.

to authorise the record.

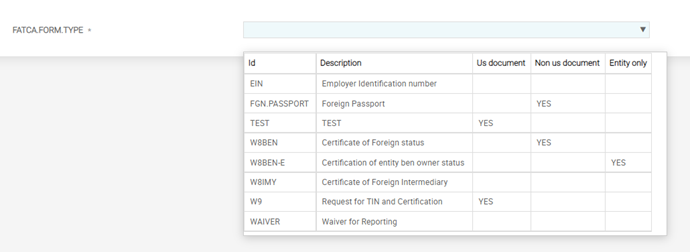

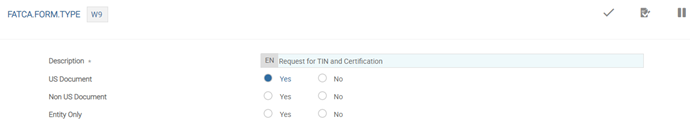

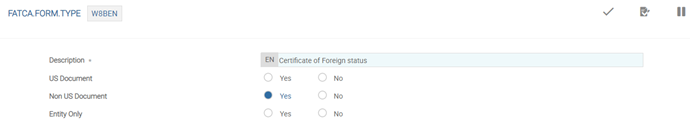

FATCA.FORM.TYPE

The FATCA.FORM.TYPE application records the allowed document types. The ID represents the document type that is being submitted. For example, W9, W8BEN, FGN.PASSPORT, ANNUAL.OWNER and so on.

These IDs display as part of the drop-down list in the Form Type field in FATCA.CUSTOMER.SUPPLEMENTARY.INFO.

The screenshot above displays the FATCA.FORM.TYPE page, which displays the fields that enable the user to classify the documents as US and Non US.

- The US Document field indicates whether this document establishes the US Status. This is set as ‘Yes’ for documents like W9 as shown above.

- The Non US Document field indicates whether this document establishes the foreign status. For documents like W8BEN, FGN.PASSPORT this is set to Yes as shown below:

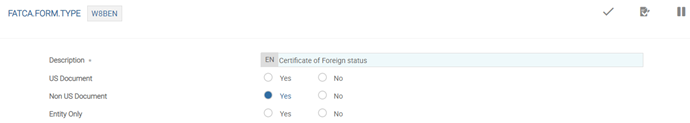

The Entity Only field indicates whether the documents are allowed for entities. This field should be set to ‘Yes’ as shown below for the W8BEN-E document.

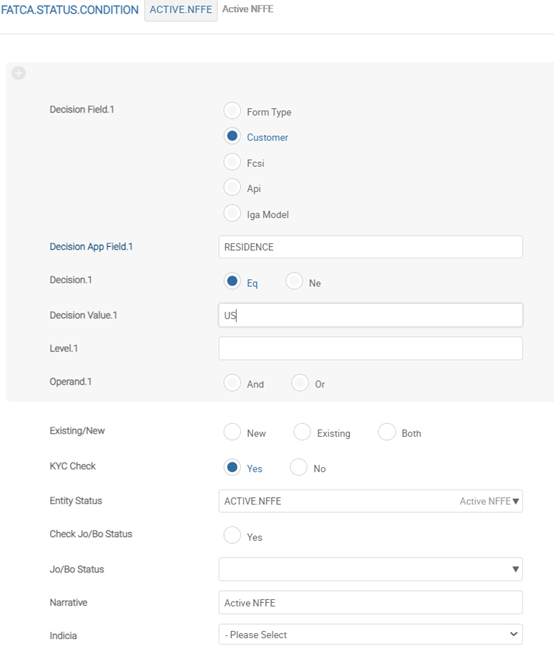

FATCA.STATUS.CONDITION

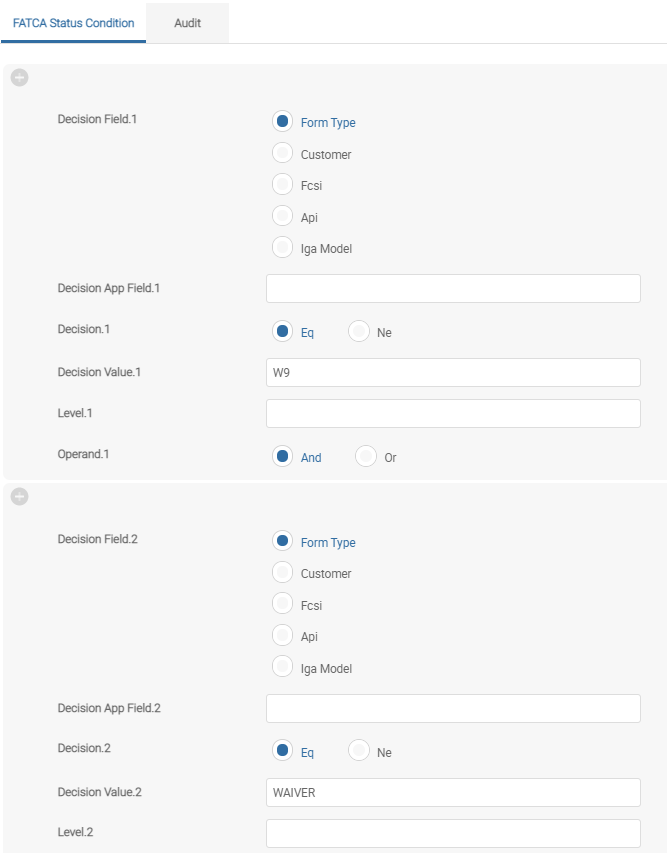

The FATCA.STATUS.CONDITION application captures the conditions for the automatic update of the FATCA Status field in the FATCA.CUSTOMER.SUPPLEMENTARY.INFO application. The fields from Decision Field through Operand, form a multivalue set. The user can set conditions using these fields around the different documentation that is required for each classification. In addition to documents, the application allows any fields from the CUSTOMER and the FATCA.CUSTOMER.SUPPLEMENTARY.INFO applications to be defined as APIs and IGA Models.

The rest of the fields are used for banks to set additional validation as required. For example, if the Existing New field is set to:

- Existing — The conditions apply to accounts opened before the FATCA effective date.

- New — The condition applies to accounts opened either on or after the FATCA effective date.

- Both — The condition applies to both new and existing customers.

The FATCA.STATUS.CONDITION application captures the conditions for the automatic update of the Fatca Status field in the FATCA.CUSTOMER.SUPPLEMENTARY.INFO application.

The Decision Field, Decision App Field, Decision, Decision Value, Level and Operand fields form a multi-value set.

- Decision Field — Allows the user to select one of the following options based on which the conditions are defined:

- CUSTOMER application

- FCSI (FATCA.CUSTOMER.SUPPLEMENTARY.INFO) record

- API

- IGA Model

- Decision App Field — Allows a valid field name (from the CUSTOMER application or FATCA.CUSTOMER.SUPPLEMENTARY.INFO record), or a valid API if Api is selected.

- Decision Value — Allows any free text to be entered if the Decision Field is set as Customer or Fcsi.

- If the Decision Field is set as Iga Model, the allowed values are MODEL.1 and MODEL.2.

- If the Decision Field is set as Api, the allowed value is TRUE.

In the following screenshot, the user has selected the Customer option from the drop- down list in the Decision Field. The Decision App Field contains a valid field name from CUSTOMER, for example, RESIDENCE. The value in the Decision Value field is US, which is based on the RESIDENCE field value in the Decision App Field.

A valid list of records in FATCA.STATUS.CONDITION have been released from Model Bank. It is also possible that additional records to define new conditions may be required. The new records in the application can be created using the menu described below:

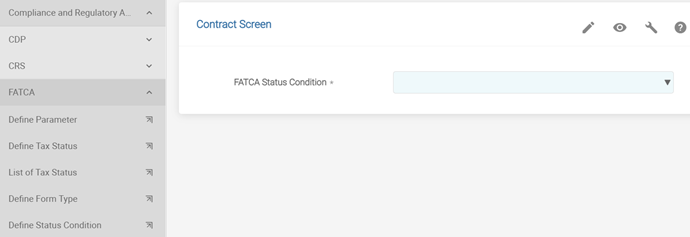

In the Admin Menu, select Compliance and Regulatory Administration>Customer> FATCA>Define Status Condition

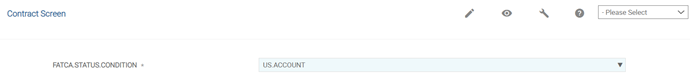

Create a condition for a valid FATCA tax status. For example, US.ACCOUNT is a valid FATCA.TAX.STATUS. It is required to define a condition based on which the system can classify an account as an US.ACCOUNT. In this example, for an account to be classified as US.ACCOUNT, it is necessary that both the W9 and WAIVER forms are received from the customer.

The record identifier for FATCA.STATUS.CONDITION application is a valid record ID from the FATCA.TAX.STATUS application and for which the conditions are required to be defined.

Click  and enter the conditions into the record. The Decision set of fields must be made a multi-valued set and enter 1 in the multi-value set.

and enter the conditions into the record. The Decision set of fields must be made a multi-valued set and enter 1 in the multi-value set.

| Field | Description |

|---|---|

| Decision Field 1 | FORM.TYPE |

| Decision 1 | EQ |

| Decision Value 1 | W9 |

| Decision Field 2 | FORM.TYPE |

| Decision 2 | EQ |

| Decision Value 2 | WAIVER |

Commit and authorise the record.

While the details are being entered into FATCA.CUSTOMER.SUPPLEMENTARY.INFO and these details satisfy any of the conditions defined on this application, subject to Auto Update Status field being set to Yes in the FATCA.PARAMETER, the Account Classification field is defaulted accordingly.

The conditions on FATCA.STATUS.CONDITION can be set up for couple of other requirements as well. For example, the Existing New field can be set so that this condition only applies to new customers, existing or both.

A number of LIVE files are updated by the system in order to track the changes and automatically carry out updates based on these changes. They are:

- FATCA.ROLE.CUSTOMER

- FATCA.CONDITION.CHANGE

- FATCA.FCSI.AMENDMENTS

Illustrating Model Parameters

The high-level configurations available in the Model Bank are listed below:

Illustrating Model Parameters

Model products are not applicable for this module.

In this topic