Definitions from the Regulation

Abbreviations

| Abbreviation | Description |

|---|---|

| FATCA | Foreign Account Tax Compliance Act |

| FFI | Foreign Financial Institution |

| GIIN | Global Intermediary Identification Number |

| IGA | Inter Governmental Agreement |

| IRS | Internal Revenue Service |

| NFFE | Non-Financial Foreign Entity |

| PFFI | Participating Foreign Financial Institution |

| TIN | Tax Identification Number |

| USFI | US Foreign Institution |

Financial Institutions

The FATCA defines those financial institutions as entities that,

- Accept deposits in the ordinary course of a banking business. It includes:

- Savings banks

- Commercial banks

- Thrifts

- Credit unions

- Other co-operative banking institutions

- Hold financial assets for others’ accounts as a substantial part of their business. It includes,

- Broker-dealers

- Trusts

- Custodial banks

- Engage in the business of investing, reinvesting or trading. It includes,

- Mutual funds

- Hedge funds

- Other managed funds

Therefore, FATCA has a direct impact on FFIs with US proprietary investments, US account holders or US financial dealings.

An FFI Agreement requires:

- Determining the accounts, which are United States Accounts.

- Complying with verification and due diligence procedures.

- Reporting annually on those United States Accounts to the US Treasury (excluding institutions in countries that are covered under IGA)

- Complying with additional IRS reporting requests, and withholding 30% wherever applicable (For example, recalcitrant account holders, non-participating FFIs and so on)

In the case of accounts held by entities, rather than individuals, PFFIs must have the information (substantial ownership) to determine whether accounts have to be treated as US accounts, or to be treated as accounts of:

- Participating FFIs

- Deemed-compliant FFIs

- Non-participating FFIs

- Exempt FFI

- Recalcitrant account holders

It is also necessary for any US withholding agent to make similar determinations with respect to the recipients of the relevant payments.

Recalcitrant Accounts

This section orients the user on recalcitrant account holders. A recalcitrant account holder can be an account holder who fails to comply with reasonable requests for information pursuant to IRS mandated verification and due diligence procedures for identifying US accounts or an entity that fails to provide details such as names, addresses and TIN of substantial owners and one who fails to provide the necessary waivers upon request.

US Accounts

This section orients the user on US accounts and its account holders.

A US account is a financial account held by one or more specified US persons or a US owned foreign entity. Under the new law, a specified US person is any US person other than any of the following:

- Corporation the stock of which is regularly traded in an established securities market

- Corporation that is part of the same expanded affiliated group as a public corporation

- Tax-exempt organisation

- Banks

- Real-estate investment trust

- State owned agency

- Trust that is exempt from tax

- Regulated investment company

The FFIs institutes procedures that determine if the account holder is a US citizen, holds a US green card, plans on spending 183, more days in the US in the current year, has spent 183 days or more in the US in any of the proceeding three years or has spent 121 days or more in the US in any of the preceding three years.

The NFFEs can avoid imposition of 30% withholding tax, if the entity provides the withholding agent with necessary documentation to the effect that it does not have substantial US owners or provides the withholding agent with the name, address and TIN of each US substantial owner.

US Substantial Owner

The term US substantial owner refers to any:

- Corporation or specified US person that owns, directly or indirectly, more than 10% of the stock of such corporation.

- Partnership or specified US person that owns, directly or indirectly, more than 10% of the profits or capital interest in such partnership.

- Trust or any specified US person treated as an owner of any portion of such trust.

Indicia of US Status

A PFFI must treat financial accounts held by specified US persons or US owned foreign entities as US accounts and report or withhold on such accounts.

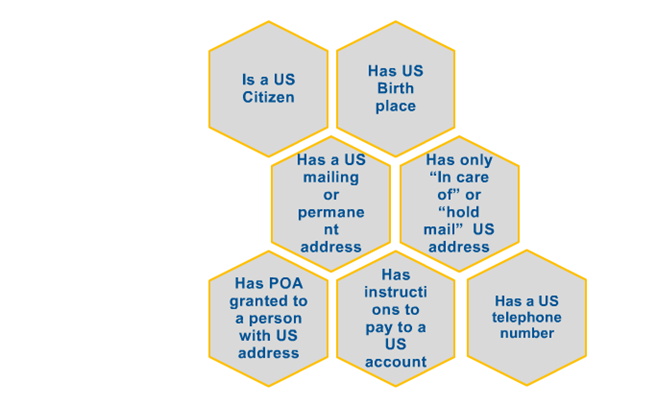

The new regulation lists seven indicia of US status, where an account holder:

Those accounts that have one of these indicia are subject to scrutiny to determine whether it belongs to a U.S person.

- The PFFI has to put in place the customer on-boarding and account opening procedures, which help in identifying U.S accounts that have been opened on or after the effective date of its FFI agreement.

- In the case of existing accounts, the law envisages, that all existing account relationships, which have been treated as U.S accounts, should continue to be treated as such for FATCA purposes.

- Small accounts (with monthly average balance of less than USD 50,000) can be treated as non-US accounts, unless the FFI elects otherwise.

- Accounts with a balance or value that exceeds USD 50,000 but does not exceed USD 1,000,000 are subject only to review of electronically searchable data for indicia of US status. No further search of records or contact with the account holder is required unless US. indicia are found through the electronic search.

- Accounts with a balance that exceeds USD 1,000,000 are subject to review of electronic and non-electronic files for US indicia, including an inquiry of the actual knowledge of any relationship manager associated with the account.

- The FFIs must request and receive documents of the account holders depending on the strength of the indicia. If the FFI does not receive the requested documentation within the specified time, the customer can be considered a recalcitrant customer and is subject to 30% withholding tax.

- For individual accounts opened after the effective date of an FFI’s agreement. The FFI is required to review the data provided during account opening, which includes identification and any documentation collected under AML/KYC rules.

- If US indicia are identified as part of that review, the FFI must obtain additional documentation or treat the account as held by a recalcitrant account holder.

- Exempt pre-existing entity accounts with account balances of USD 250,000 or less from review until the account balance exceeds USD 1,000,000.

- For remaining pre-existing entity accounts, FFIs can go with AML/KYC records and other existing account information to determine whether the entity is an FFI, is a US person, is excepted from the requirement to document its substantial US owners. For example, as it is engaged in a non-financial trade or business), or is a passive investment entity (referred to in the regulations as a passive NFFE.

- For pre-existing accounts, passive investment entities with account balances that do not exceed USD 1,000,000, FFI's can generally rely on information collected for AML/KYC due diligence purposes to identify substantial US owners.

- For pre-existing entity, accounts of passive investment entities with account balances that exceed USD 1,000,000, FFI's can obtain information regarding all substantial US owners or a certification that the entity does not have substantial US owners.

PFFI excludes the following new entity accounts from documentation of substantial US owners:

- Accounts of another FFI (other than an owner-documented FFI for which the participating FFI has agreed to perform reporting) and

- Accounts of an entity engaged in an active non-financial trade or business or otherwise exempted from documentation requirements.

FFIs determine if entities (passive investment entities) have any substantial US owners upon opening a new account, by obtaining a certification from the account holder.

- The identified US accounts were reported as a US account to the IRS by the 1st quarter 2015. Then FFIs report information with regard to accounts of specified US persons and US owned foreign entities.

- As per the terms of the agreement, the following information are reported to IRS:

- Name, address and TIN of each account holder in case the account belongs to a US tax payer

- Names, addresses and TINs of each substantial US owner of such entity in case the accounts are owned by entities,

- Account balances, incomes, credits and gross proceeds

- Account number

- The reporting of income was due only from 2016 and the reporting of gross proceeds began in 2017.

In this topic