Unified Transfers Flow (UTF)

Unified Transfers Flow (UTF) provides the capability for the customers to initiate a transfer or payment from online or mobile banking. Customers can move money efficiently between their own accounts or send money to other accounts, with minimum clicks for the transfer or payment operations. You can save time by choosing an already saved beneficiary from the list.

The application supports the following:

- Transfers to user's own accounts in the same bank

- Transfers to other members of the same bank

- Transfers to other banks

- International transfers

- Pay a Person Transfers

- Add, Edit, or Remove beneficiaries

- Manage Transactions

Menu path:

- Web Channel: Side Menu > Unified Transfers Flow

- Mobile Native: Hamburger Menu > Unified Transfers Flow

- SEPA, INSTANT Payments are end to end Integrated.

- The implementation configuration is needed for ACH, FEDWIRE, CHAPS, FASTER PAYMENTS, RINGS, and BISERA. In the application, these are kept as a placeholder.

Multi Entity Support: Customers can view the dashboard, perform transfers, or view any request summary and submit requests against the entity associated with the customer during login. The feature is enhanced with Experience APIs to retrieve and post based on the Entity ID of the signed-in user.

- The Entity ID selected by the signed-in user flows through the application through the respective Experience API.

- For all fetch (GET) API calls, the system retrieves the results based on the Entity ID of the signed-in user.

- For all add/update/delete calls, the system passes and posts requests against the Entity ID of the signed-in user.

The feature supports the following modules:

| Authentication | Dashboard | Account Overview |

| Credit Card overview | Cheque Management | Card Management |

| Statements | Dispute Transactions | Service Requests |

| PFM | Savings Pot | Account Settings |

| Sign In Settings | Profile Settings | Consent Management |

| Unified Transfers | Manage Transfers | Manage Beneficiaries |

| Bulk Payments | Bill Payments | Foreign Exchange |

| Portfolio Management | WealthOrder | Approval Matrix |

Business Process Diagram - Transfer

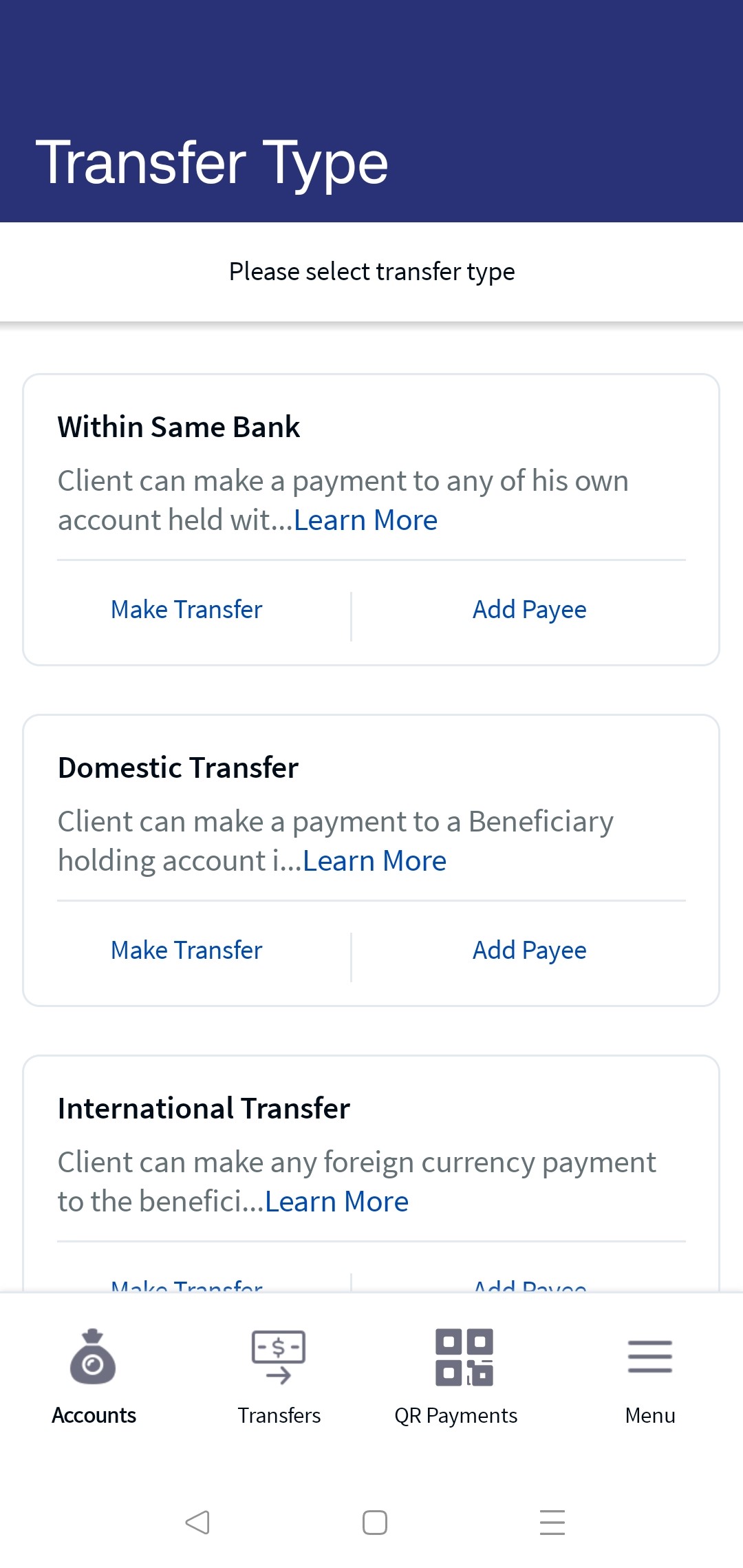

UX Overview

The Unified Transfers feature provides different options for the customers to initiate transfer from online or mobile banking.

The Payments and Transfers feature displays the following tabs:

- Make Transfer. Initiate a payment to other accounts within the same bank, to other bank accounts, to international accounts, and to Pay a Person accounts.

- Add New Beneficiary: Add members as beneficiaries to perform transfer in the same bank, other banks, international banks, and Pay a Person. You can add the following beneficiaries:

- Add Same Bank Payee. You can add a beneficiary who has an account within the bank by providing the details such as account number, account beneficiary's name, and nickname.

- Add Domestic Payee. You can add a beneficiary who has an account in another bank (domestic) by providing the details such as bank name, account number/IBAN, account beneficiary's name, and nickname.

- Add International Payee. You can add a beneficiary who has an account in an international bank by providing the details such as SWIFT BIC code, account number, account beneficiary's name, and nickname.

- Add Pay a Person Payee. You can add a Pay a Person beneficiary to transfer money using the person's email ID or mobile number.

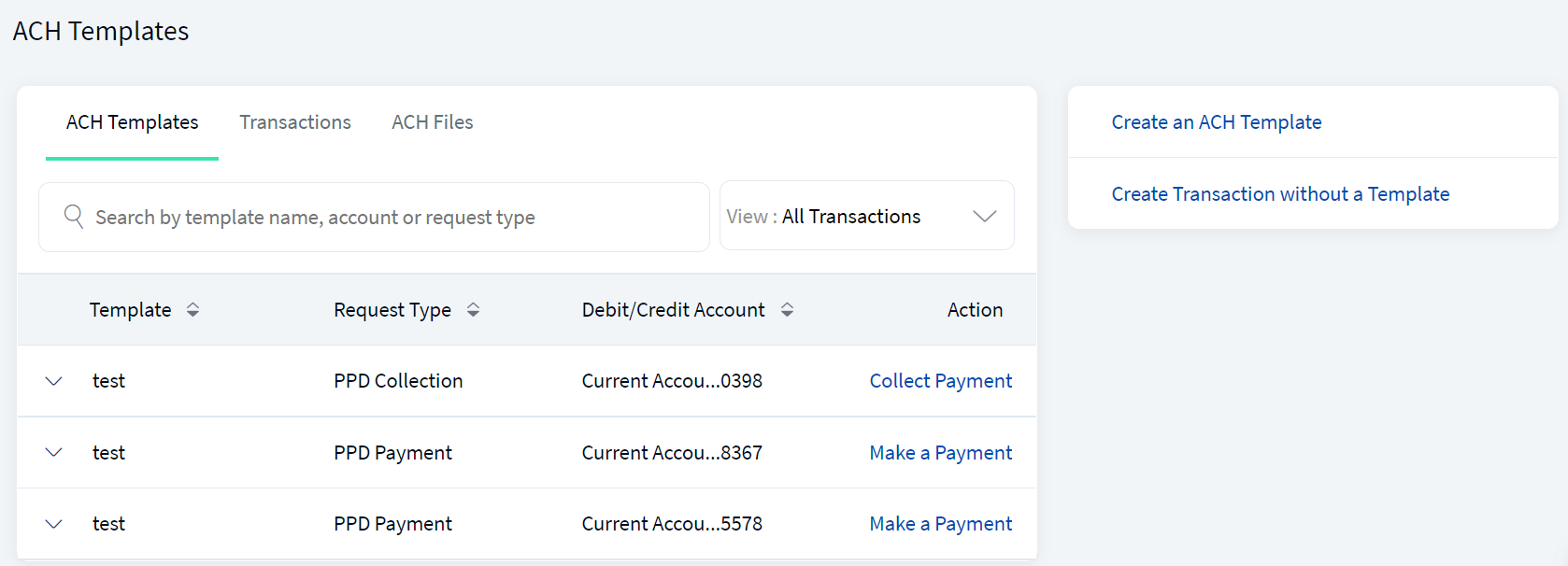

- Manage Transactions. You can manage your transactions performed within the same bank or with the other banks.

Configuration

Backend Integration - Transact/MS/Mock

Using the runtime configurable parameter (Payment_Backend server property) at the Micro App level, an implementation team can configure the backend integration endpoint as Transact, or Mock as per customer needs for the following. The Payments Fabric MA supports the integration.

- The backend integration for all the APIs is mocked (DBX DB) or SRMS based on customer needs.

- The validations are avoided if the module is directly integrated with Transact endpoints.

- When records are created, use these options: Use the DBX DB table records that already exist, or use the Fabric Java layer to build a stubbed or JSON data response directly.

Follow these steps:

- Sign-in to your Fabric console.

- From the left pane, select Environments.

- For your Fabric run-time environment, click App Services.

- Navigate to Settings > Configurable Parameters.

- On the Server Properties tab, go to

PAYMENT_BACKENDField Name and set the Field Value depending on the integration (for example, MOCK or SRMS or SRMS_MOCK). - Click Save.

In this topic