Manage Beneficiaries

In the digital banking application, the list of beneficiaries inside the Make Payment module, is displayed using the Beneficiary Management component. The bank users with required permissions can only add, edit, or remove a beneficiary and it is controlled in Spotlight. This component displays the list of beneficiaries based on the beneficiary type such as same bank account, Pay a Person, Business, and International.

In Manage Beneficiaries, confirmation of payee is also available. The bank application verifies new payee account details with central system or the third-party system. The confirmation of the payee will be validating during payee creation and payment initiation.

Use this feature to manage the beneficiaries added to your account.

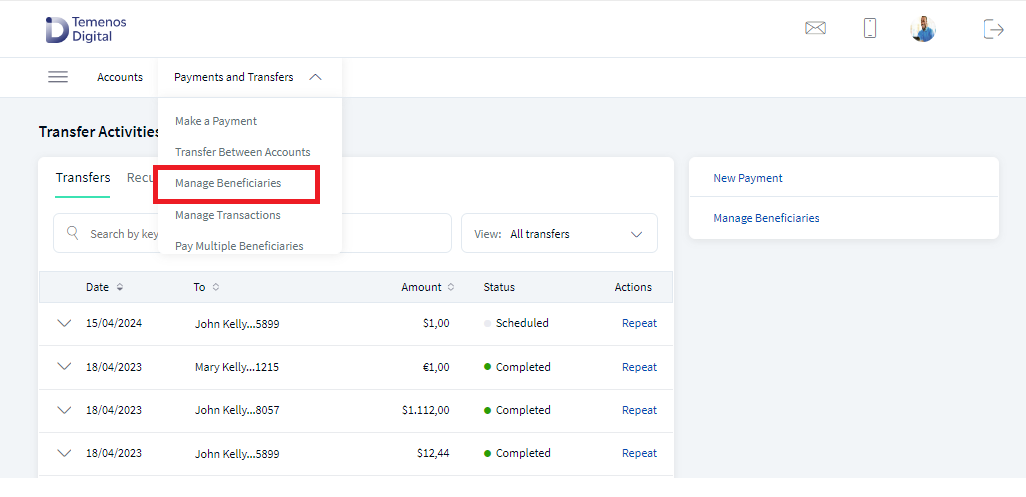

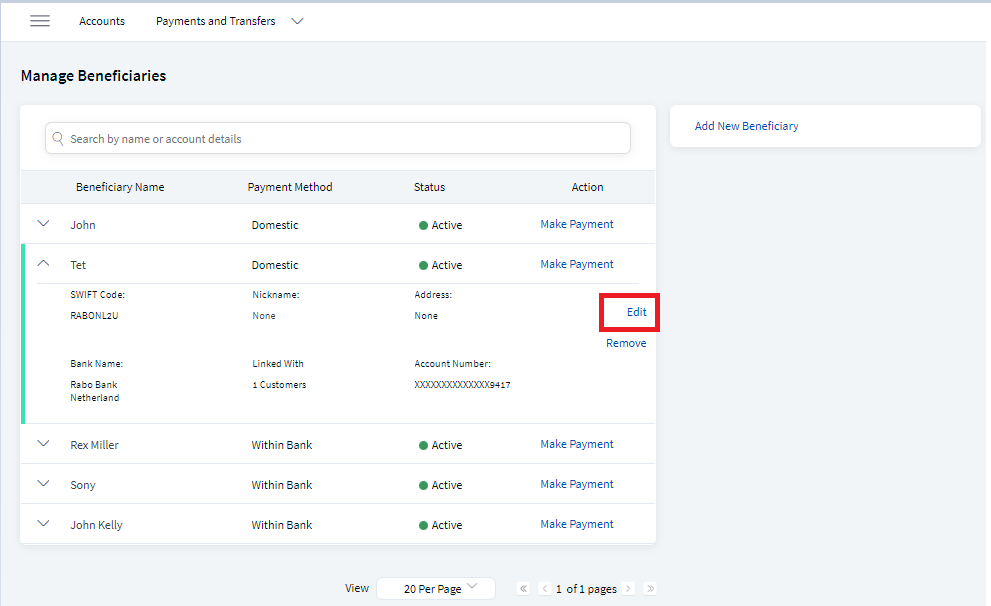

Web Channel: Accounts Dashboard > Payments and Transfers > Manage Beneficiaries

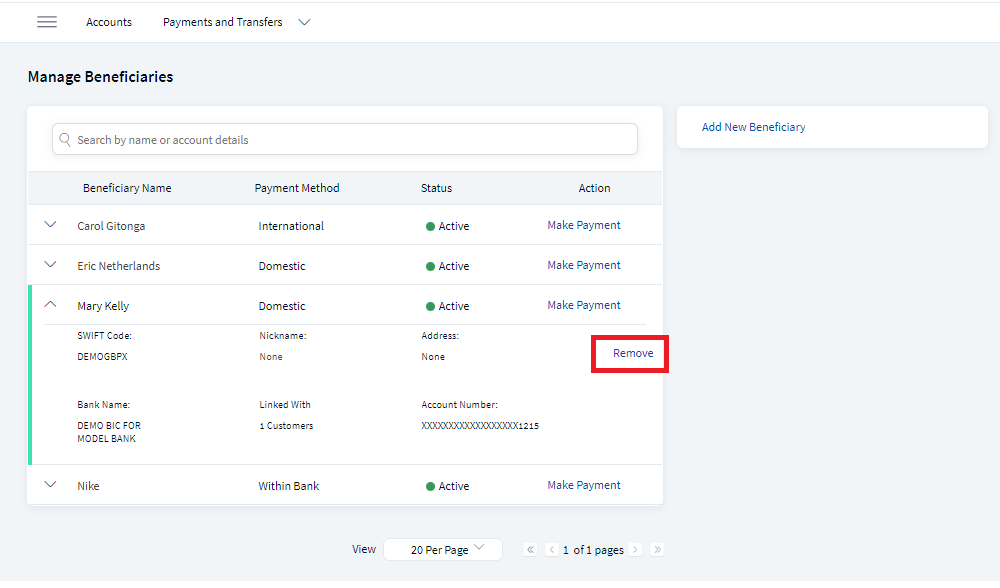

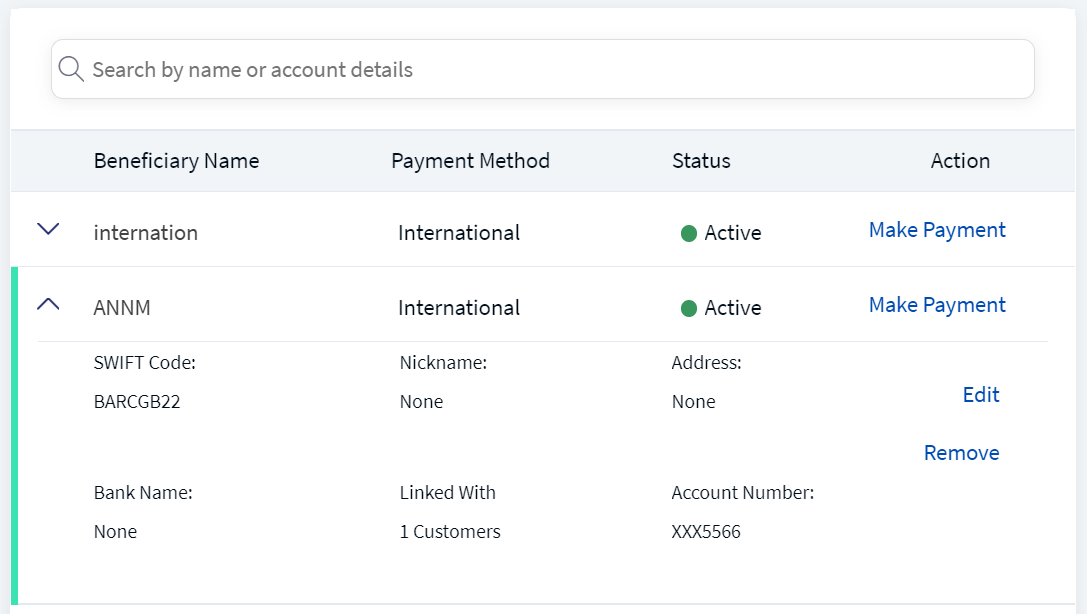

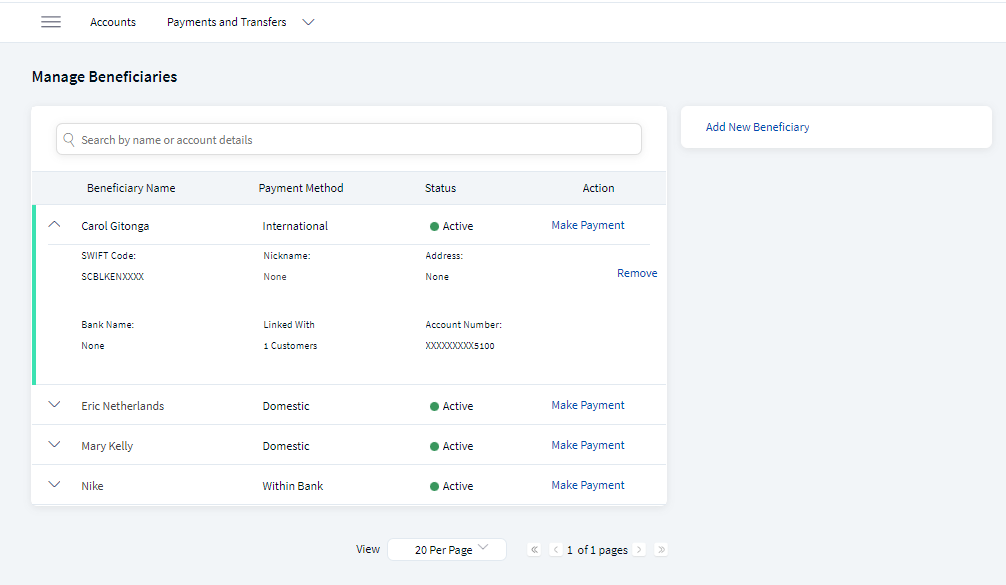

The Manage Beneficiaries screen appears. The following primary details are displayed in this screen:

- Beneficiary name

- Payment Method (International, Domestic, or Within bank)

- Status

- Actions that can be performed - Make Payment

Click the arrow displayed besides each row to view the additional details such as

- SWIFT Code

- Nick Name

- Address

- Bank Name

- Linked With (Contracts)

- Account Number

- Payee Verification

- Actions that can be performed such as

- Edit

- Remove

You can perform the following actions in this screen:

- Search for the beneficiary

- Make Payment to the existing beneficiaries

- Edit a beneficiary

- Remove a beneficiary

- Add a beneficiary

The approval is introduced in the Manage Beneficiary feature. As per the approvals the changes like add, edit, and remove needs to approved for further processing. See Approval and Requests for more information.

The Status column shows the current status of the record Active or Pending for Approval. The record is non-editable if the status of the record is Pending for Approval. If the user withdraws the request, the notification of withdraw request with reason is sent to all the approvers.

If the changes are rejected by the approver then

- the notification center displays a notification as declined.

- the payee is not added in case of the Add beneficiary.

- the changes are reverted in case of Edit.

- the payee exists in case of Remove.

Multi Entity Support: Customers can view the dashboard, perform transfers, or view any request summary and submit requests against the entity associated with the customer during login. The feature is enhanced with Experience APIs to retrieve and post based on the Entity ID of the signed-in user.

- The Entity ID selected by the signed-in user flows through the application through the respective Experience API.

- For all fetch (GET) API calls, the system retrieves the results based on the Entity ID of the signed-in user.

- For all add/update/delete calls, the system passes and posts requests against the Entity ID of the signed-in user.

The feature supports the following modules:

| Authentication | Dashboard | Account Overview |

| Credit Card overview | Cheque Management | Card Management |

| Statements | Dispute Transactions | Service Requests |

| PFM | Savings Pot | Account Settings |

| Sign In Settings | Profile Settings | Consent Management |

| Unified Transfers | Manage Transfers | Manage Beneficiaries |

| Bulk Payments | Bill Payments | Foreign Exchange |

| Portfolio Management | WealthOrder | Approval Matrix |

Business Process Diagram

Add Beneficiaries

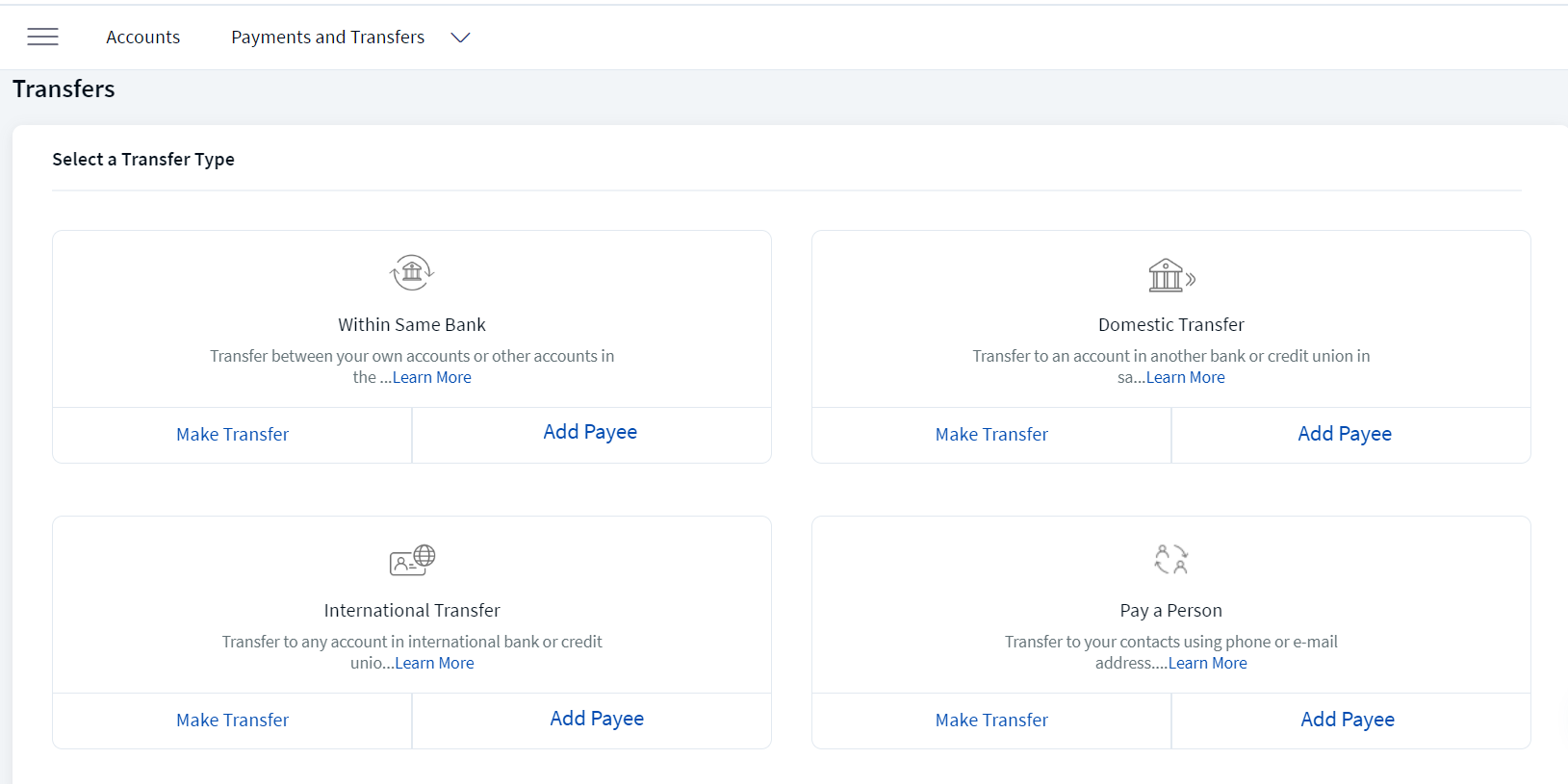

The list of beneficiaries added in the UTF is displayed under Manage Beneficiaries module. This screen displays the list of beneficiaries added based on the beneficiary type such as same account, domestic, Pay a Person, and International.

Menu path:

- Web Channel: Main Menu > Unified Transfers Flow

- Mobile Native: Hamburger menu > Unified Transfers Flow

The Unified Transfers Flow screen appears with the list of transfer types and actions that can be performed against each transfer type. Click Add Account displayed against each transfer type to add a beneficiary for the selected account type

You can add the following beneficiary accounts:

- Same Bank Payee who has an account in the same bank.

- Domestic Payee who has a domestic account in another bank.

- International Payee who has an account in an international bank.

- Pay a Person Recipient to transfer money using the person's email ID, mobile number, or National ID.

The user with required permissions can create, edit, and delete the beneficiary. For SME users, the Approval flow is enabled.

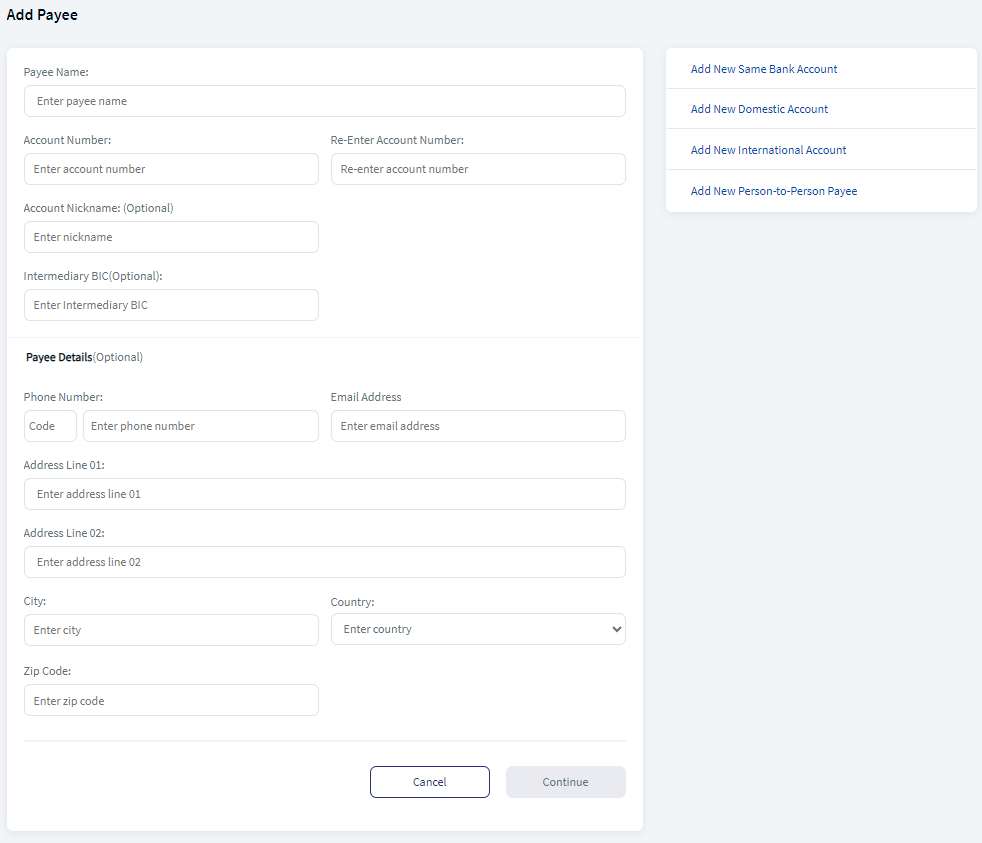

Add Same Bank Payee

Use the feature to add a beneficiary who has an account in the same bank. Click Add Payee under Within Same Bank on Unified Transfers screen.

The following is the procedure to add same bank account.

- Enter the following required information.

- Payee Name. Enter the name of the payee.

Once you enter the account number in the two fields, the correct payee name is fetched from the core and displayed. The back-end service verifies the account number against the payee name. In case they do not match, the app displays an error message Entered account number is incorrect. Please enter the valid account number.

- Account Number. Enter the account number of the recipient.

- Re-Enter Account Number. Re-enter the account number provided in the previous field.

- Account Nickname. Enter a nickname for the payee. This is an optional field.

- Intermediary BIC. Enter the Intermediary BIC details. This is an optional field.

- Payee Details (Optional). Enter the payee details. This section includes the following details:

- Phone Number

- Email Address

- Address details that includes Address Line 01, 02, City, State, Country, and Zip Code.

- Payee Name. Enter the name of the payee.

- Click Continue. This displays Link Payee screen.

This screen is displayed only if the user have access to at least two Customer IDs.

- Select the contract from the list of contracts to link the payee. This page displays the list of contracts available.

The following information is displayed:

The following information is displayed:- Contract

- Identity Number

- Selected CIF

You can do the following:

- Click the check box to select a contract.

- Click Select All to select all the contracts.

- Click the down arrow beside a contract to view the additional details such as:

- Customer Name

- Customer ID

The user can click Cancel to cancel the operation and click Back to go back to previous screen.

- Click Continue after selecting the contract(s). This displays the Confirmation screen.

Continue button will be enabled only after selecting a contract.

- Verify the entered details and click Confirm to add the payee.

- Click Cancel to cancel the operation. In the pop-up that appears, confirm the cancellation to return to Unified Transfers screen.

- Click Modify to modify the details before adding the account. You can also navigate to adding other recipient accounts by clicking the required option from the right pane of the screen.

The app displays the acknowledgment screen with an acknowledgment message and account details confirming that the payee has been added or sent for approval. Also an approval notification is sent to all the approvals across contracts in the approval matrix under non-monetary transactions

The acknowledgment screen displays the transaction details, unique reference number to the transaction, and provision to do the following:

- Transfer Activities

- New Transfer

The link payee screen is only SME bank users.

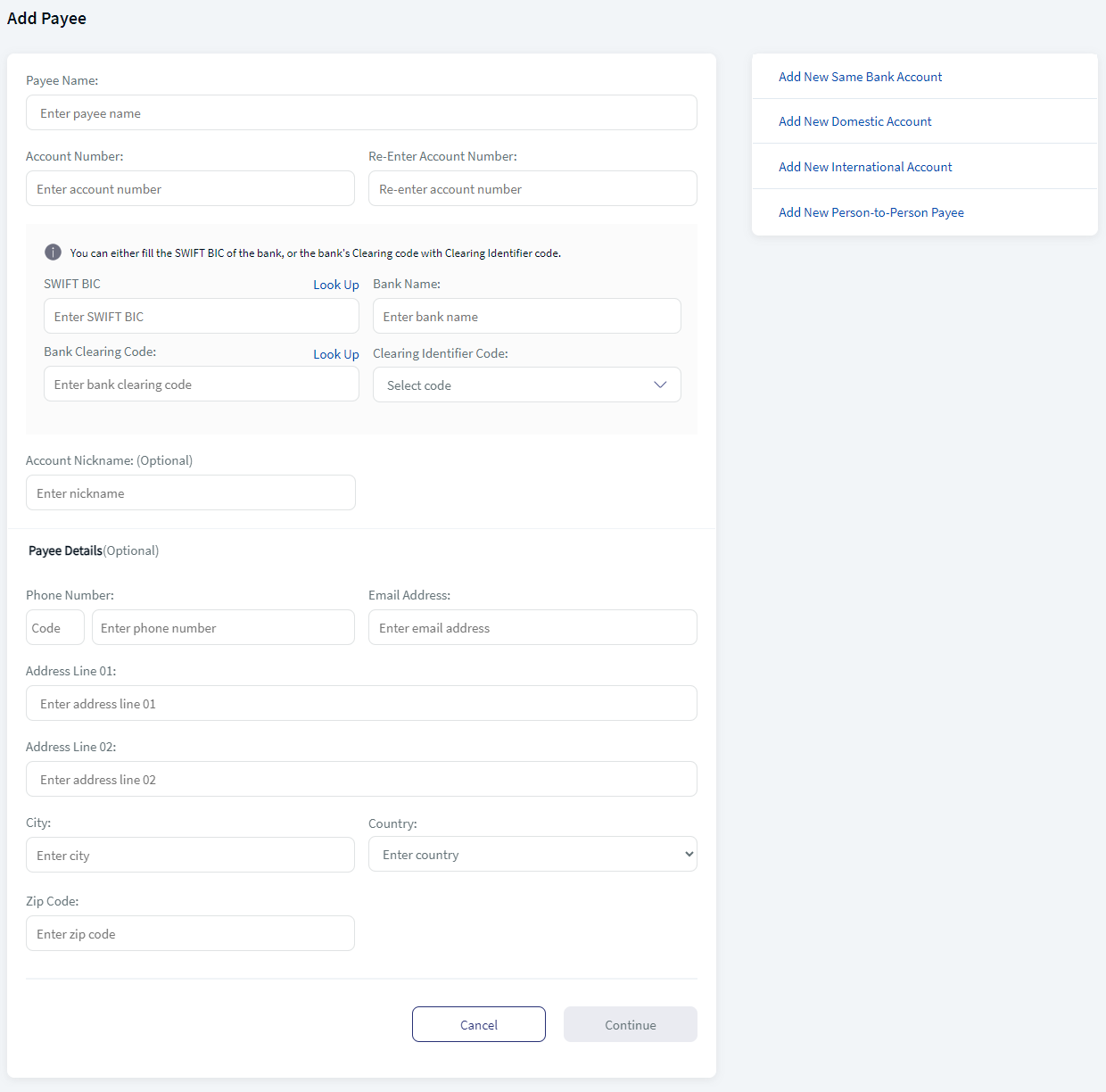

Add Domestic Payee

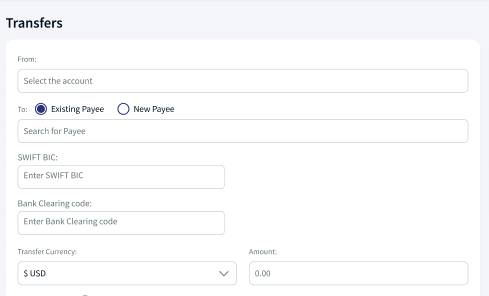

Use the feature to add a payee who has an account in another bank (domestic account) or add your own account available in another bank by providing the required information. Click Add Payee under Domestic Transfer on Unified Transfers screen.

The app displays the domestic account tab with a form to enter the account details. The following is the procedure to add Domestic bank account.

- Enter the following required information.

- Payee Name. Enter the name of the payee.

- Account Number. Enter the account number of the recipient.

- Re-Enter Account Number. Re-enter the account number provided in the previous field.

- SWIFT BIC: If the provided account number is part of cross border or international payment, then you must enter the SWIFT BIC number that contains alphanumeric characters. SWIFT BIC field does have a format and structure validations.

BIC must be either 8 or 11 characters only.

- Bank code (A-Z): 4 letter code

- Country code (A-Z): 2 letter code

- Location Code (0-9 or A-Z): 2 digit code – either letters or numbers

- Branch Code (0-9 or A-Z): optional 3 digit code – either letters or numbers

BIC is non-editable if it is derived from IBAN.

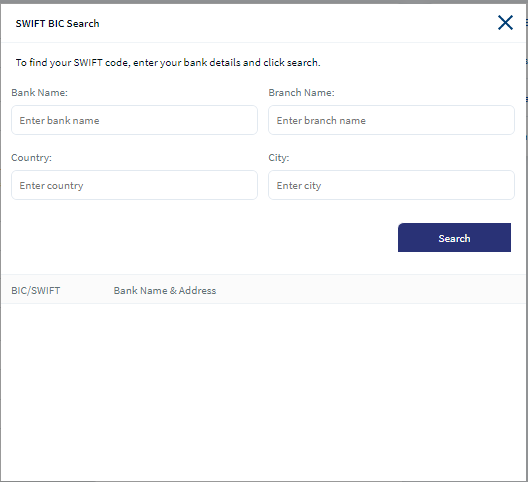

- Click on Look Up to automatically detect the SWIFT BIC. Clicking on Look Up will display a pop up with the privilege to search the SWIFT BIC details. Search by providing the following details to pick the right SWIFT BIC:

- Bank Name

- Branch code

- Country

- City

The Lookup feature is place holder which is to be integrated.

- Bank Name

- Bank Clearing Code. Enter the clearing code.

- Clearing code is the bank code that is used to perform the domestic transfer.

- The user need to enter either the Clearing code with clearing identifier code or SWIFT BIC.

- Click on Look Up to automatically detect the Clearing code. Clicking on Look Up will display a pop up with the privilege to search the Clear code details. Search by providing the following details to pick the right Clearing code:

- Bank Name

- Branch code

- Country

- City

- The Lookup feature is place holder which is to be integrated.

- Clearing Identifier Code. select the option from the drop down.

- Account Nickname (Optional). Enter a nickname for the payee.

- Payee Details (Optional). Enter the payee details. This section includes the following details:

- Phone Number

- Email Address

- Address details that includes Address Line 01, 02, City, State. Country. and Zip Code.

- Click Continue. The application performs payee verification and then displays Link Payee screen.

This screen is displayed only if you have access to at least two Customer IDs.

- Select the contract from the list of contracts to link the payee. This page displays the list of contracts available.

The following information is displayed:

The following information is displayed:- Contract

- Identity Number

- Selected CIF

You can do the following:

- Click the check box to select a contract.

- Click Select All to select all the contracts.

- Click the down arrow beside a contract to view the additional details such as:

- Customer Name

- Customer ID

The user can click Cancel to cancel the operation and click Back to go back to previous screen.

- Click Continue after selecting the contract(s). This displays the Confirmation screen.

Continue button will be enabled only after selecting a contract.

- Verify the entered details and click Confirm to add the payee.

- Click Cancel to cancel the operation. In the pop-up that appears, confirm the cancellation to return to Unified Transfers screen.

- Click Modify to modify the details before adding the account. You can also navigate to adding other recipient accounts by clicking the required option from the right pane of the screen.

The app displays the acknowledgment screen with an acknowledgment message and account details confirming that the payee has been added or sent for approval. Also an approval notification is sent to all the approvals across contracts in the approval matrix under non-monetary transactions

The acknowledgment screen displays the transaction details, unique reference number to the transaction, and provision to do the following:

- Transfer Activities

- New Transfer

The link payee screen is only SME bank users.

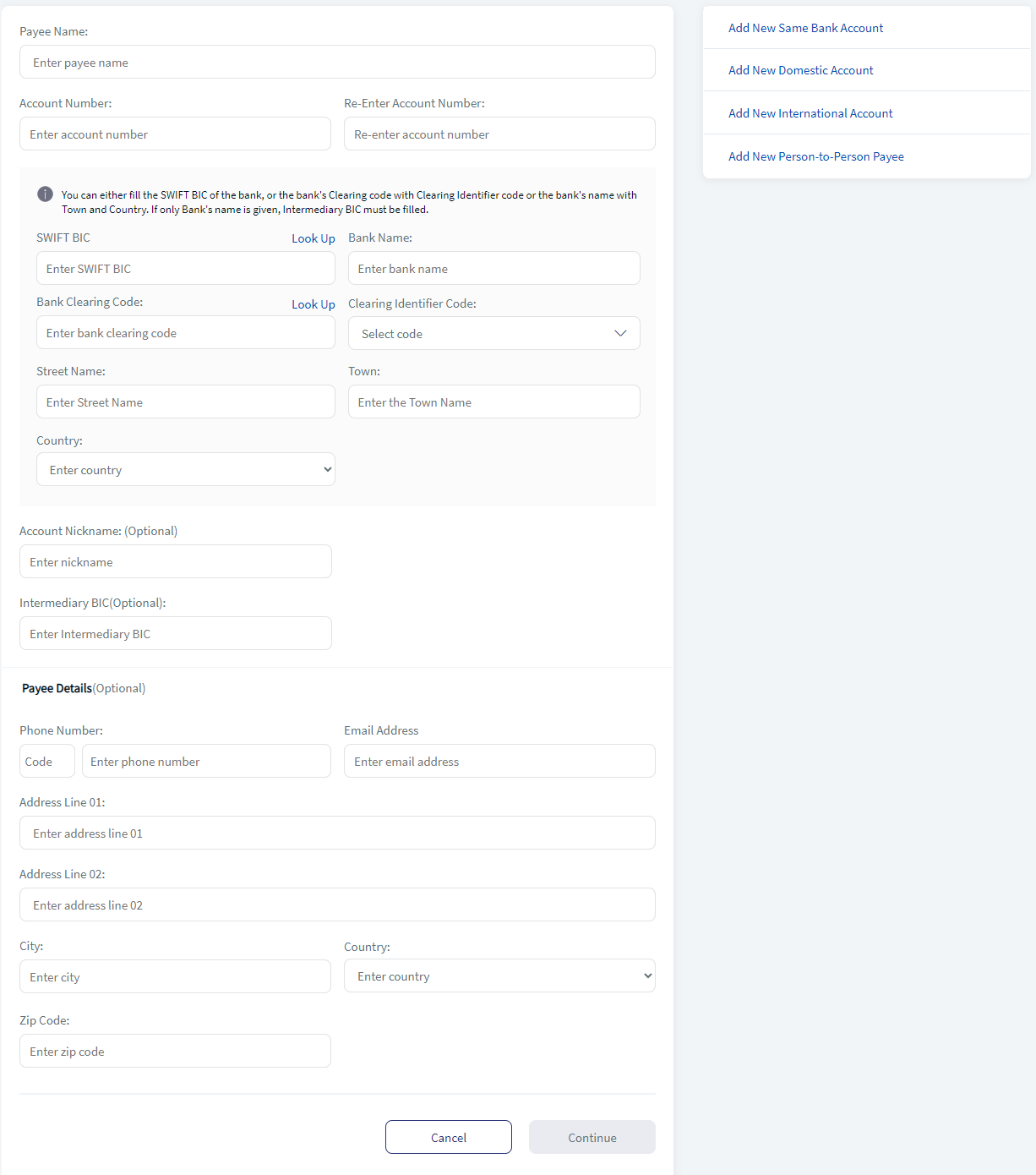

Add International Payee

Use the feature to add a payee who has an International account in another bank or add your own International account available in another bank by providing the required information. Click Add Payee under International Transfer on Unified Transfers screen.

The app displays the International account tab with a form to enter the account details. The following is the procedure to international bank account.

- Enter the following required information.

- Payee Name. Enter the name of the payee.

- Account Number. Enter the account number of the recipient.

- Re-Enter Account Number. Re-enter the account number provided in the previous field.

- SWIFT BIC: If the provided account number is part of cross border or international payment, then you must enter the SWIFT BIC number that contains alphanumeric characters. SWIFT BIC field does have a format and structure validations.

BIC must be either 8 or 11 characters only.

- Bank code (A-Z): 4 letter code

- Country code (A-Z): 2 letter code

- Location Code (0-9 or A-Z): 2 digit code – either letters or numbers

- Branch Code (0-9 or A-Z): optional 3 digit code – either letters or numbers

BIC is non-editable if it is derived from IBAN.

- Click on Look Up to automatically detect the SWIFT BIC. Clicking on Look Up will display a pop up with the privilege to search the SWIFT BIC details. Search by providing the following details to pick the right SWIFT BIC:

- Bank Name

- Branch code

- Country

- City

The Lookup feature is place holder which is to be integrated.

- Bank Name

- Bank Clearing Code. Enter the clearing code.

- Clearing code is the bank code that is used to perform the domestic transfer.

- The user need to enter either the Clearing code with clearing identifier code or SWIFT BIC.

- Click on Look Up to automatically detect the Clearing code. Clicking on Look Up will display a pop up with the privilege to search the Clear code details. Search by providing the following details to pick the right Clearing code:

- Bank Name

- Branch code

- Country

- City

- The Lookup feature is place holder which is to be integrated.

- Clearing Identifier Code

- Street Name

- Town

- Country

- Account Nickname (Optional). Enter a nickname for the payee.

- Intermediary BIC.

- Payee Details (Optional). Enter the payee details. This section includes the following details:

- Phone Number

- Email Address

- Address details that includes Address Line 01, 02, City, State. Country. and Zip Code.

- Click Continue. The application performs payee verification and then displays Link Payee screen.

This screen is displayed only if you have access to at least two Customer IDs.

- Select the contract from the list of contracts to link the payee. This page displays the list of contracts available.

The following information is displayed:

The following information is displayed:- Contract

- Identity Number

- Selected CIF

You can do the following:

- Click the check box to select a contract.

- Click Select All to select all the contracts.

- Click the down arrow beside a contract to view the additional details such as:

- Customer Name

- Customer ID

The user can click Cancel to cancel the operation and click Back to go back to previous screen.

- Click Continue after selecting the contract(s). This displays the Confirmation screen.

Continue button will be enabled only after selecting a contract.

- Verify the entered details and click Confirm to add the payee.

- Click Cancel to cancel the operation. In the pop-up that appears, confirm the cancellation to return to Unified Transfers screen.

- Click Modify to modify the details before adding the account. You can also navigate to adding other recipient accounts by clicking the required option from the right pane of the screen.

The app displays the acknowledgment screen with an acknowledgment message and account details confirming that the payee has been added or sent for approval. Also an approval notification is sent to all the approvals across contracts in the approval matrix under non-monetary transactions

The acknowledgment screen displays the transaction details, unique reference number to the transaction, and provision to do the following:

- Transfer Activities

- New Transfer

The link payee screen is only SME bank users.

Add Pay a Person Account

Use the feature to add a Pay a Person account by using the payee's mobile number or email ID.

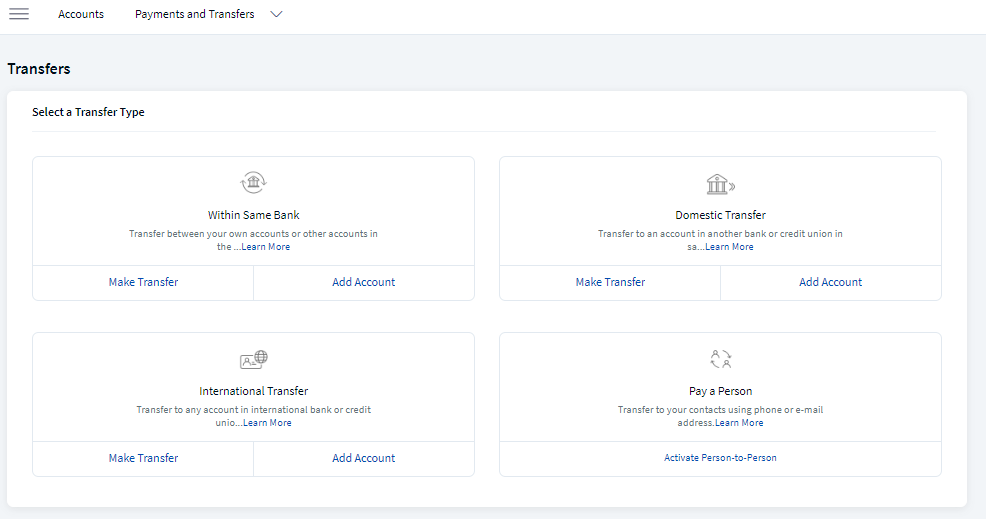

Activate Pay a Person

To perform a Pay a Person transfer, you must activate the Pay a Person feature.

To activate Pay a Person feature, perform the following steps:

- Click Unified Transfers Flow from the side menu. The Unified Transfers screen appears with the list of account types.

- Under Pay a person, click Activate Pay a Person.

- When you open the Pay a Person screen for the first time, the app displays the terms and conditions for you to activate the Pay a Person payment service.

- Click Proceed. The Pay a Person screen appears with your account details.

- The app displays the following details:

- Your name

- Registered Phone

- Registered Email

- National ID with text box for your input

- Default account for sending the amount

- Confirm the details to activate Pay a Person payments, but you can also edit them if required.

If you have multiple eligible accounts, you can select the preferred account for using the Pay a Person payment service (for sending and receiving money).

- Once Pay a Person is activated, a confirmation message is displayed with your details. You can send and receive money via your email ID or mobile number.

Add Pay a Person Account

Click Add Account from Unified Transfers screen under Pay a Person in Unified Transfers screen. The app displays the Pay a Person account tab with a form to enter the account details.

The following is the procedure to add Pay a Person Account

- Enter the following details.

- Payee Name. Enter the name of the payee.

- Contact Information Type (Phone Number, Email ID, or National ID):

- Phone Number. Enter the phone number of the payee.

- Email Address. Enter the email ID of the payee.

- National ID. Enter the National ID of the payee.

- Account Nickname (optional). Enter the nickname of the payee.

- Click Continue. This displays Link Payee screen.

This screen is displayed only if you have access to at least two Customer IDs.

- Select the contract from the list of contracts to link the payee. This page displays the list of contracts available.

The following information is displayed:

The following information is displayed:- Contract

- Identity Number

- Selected CIF

You can do the following:

- Click the check box to select a contract.

- Click Select All to select all the contracts.

- Click the down arrow beside a contract to view the additional details such as:

- Customer Name

- Customer ID

The user can click Cancel to cancel the operation and click Back to go back to previous screen.

- Click Continue after selecting the contract(s). This displays the Confirmation screen.

Continue button will be enabled only after selecting a contract.

- Verify the entered details and click Confirm to add the payee.

- Click Cancel to cancel the operation. In the pop-up that appears, confirm the cancellation to return to Unified Transfers screen.

- Click Modify to modify the details before adding the account. You can also navigate to adding other recipient accounts by clicking the required option from the right pane of the screen.

The app displays the acknowledgment screen with an acknowledgment message and account details confirming that the payee has been added or sent for approval. Also an approval notification is sent to all the approvals across contracts in the approval matrix under non-monetary transactions

The acknowledgment screen displays the transaction details, unique reference number to the transaction, and provision to do the following:

- New transfer

- Transfer Activities

Edit Payee

The bank user with required permissions can only edit payee. The edit option is available in the Manage Beneficiaries page. The Manage Beneficiaries page displays all Within bank, Domestic, and International bank account details. Expand any record and click Edit to edit the details.

The procedure for editing the payee is similar like creating payee with all the fields filled as per the payee details. See the following details for more information.

- Same Bank Account who has an account in the same bank.

- Domestic Account who has a domestic account in another bank.

- International Account who has an account in an international bank.

- Pay a Person Recipient to transfer money using the person's email ID, mobile number, or National ID.

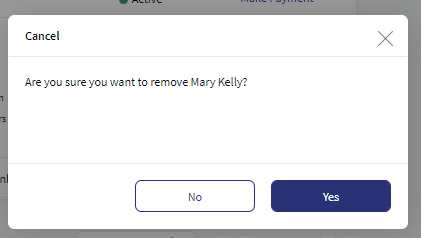

Remove Payee

The bank user with required permissions can only remove payee. The Remove option is available in the Manage Beneficiaries page. The Manage Beneficiaries page displays all Within bank, Domestic, and International bank account details.

The following is the procedure to remove payee.

- In the Manage Beneficiary page, use the search option to narrow down the results.

- Expand the record and click Remove.

- In the pop-up box, click Yes to remove the beneficiary.

- A success message displays on the top Beneficiary successfully removed or Beneficiary remove is sent for approval. Also an approval notification is sent to all the approvals across contracts in the approval matrix under non-monetary transactions

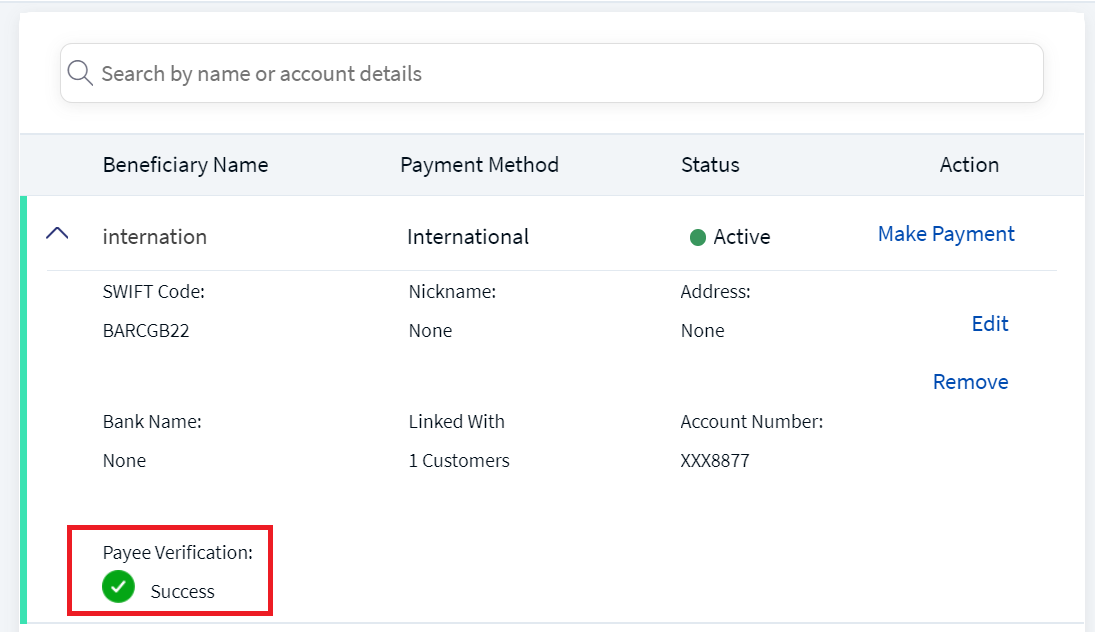

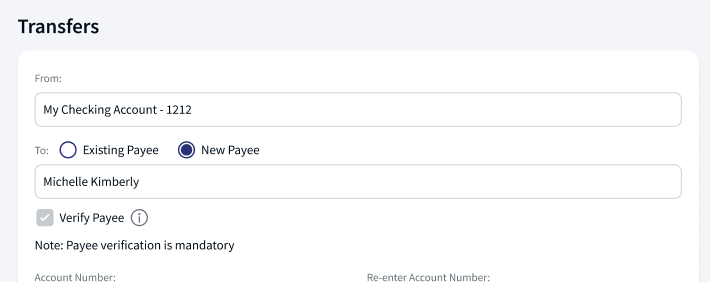

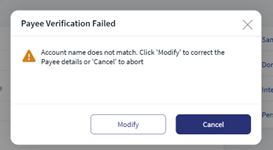

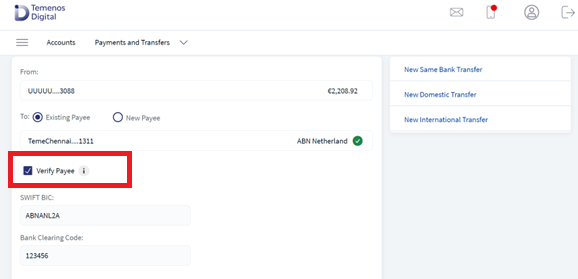

Confirmation of Payee

The feature Confirmation of Payee, helps the user to validate the payee account details. The bank application verifies these details with central system or the third-party system. The confirmation of the payee will be validating during payee creation and payment initiation. Based on the response, the user can proceed with payee creation or payment initiation. The result of the status can be seen in the manage beneficiary features. Expand the record for beneficiary details to see Payee Verification field. This option is only available while initiating transfers to New payee. For Existing Payee the user can see if the payee verification is success or failure as the user cannot edit the beneficiary details.

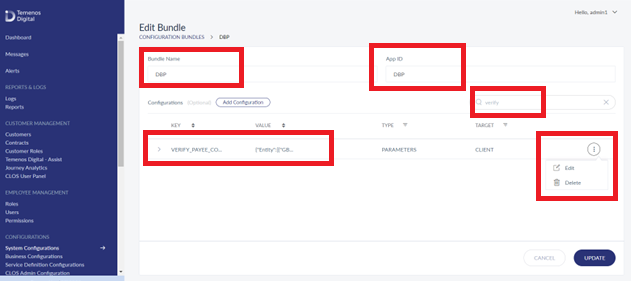

The bank admin user have to configure the Verify Payee. The admin user is also allowed to configure this Verify Payee at entity level, payment type level, and also country level. The following are the options available for the admin user. See Configuration section for procedure to activate Confirmation of Payee.

After enabling the configuration the payee verification field can be seen for the newly added beneficiaries, the application will not display payee verification field for existing beneficiaries.

- Mandatory. Must be validated and completed. If validation fails, the user must correct the payee details and verify again. The application will not allow the user to initiate a payment till Payee Verification is success. In the transfers page, by default the application checks the Verify Payee and the Continue will be activated only after the Verify Payee is checked and the user filled all the mandatory fields.

- Optional (Allowed) . The payee verification is optional, the user has an option to skip the validation. The application will allow the user to initiate a payment with or with out payee verification. In the transfers page, Verify Payee is available the user has an option to validate the payee information. The user needs to fill all the mandatory fields to initiate a payment.

- No Configuration. The application will not display the Payee Verification field in Transfers page, or Add Payee page, or Manage Beneficiary page.

The following are the Confirmation of Payee validations:

| Type of Transfer | Account Number Matched | Account Names Matched | Validation Outcome |

|---|---|---|---|

| Domestic or International | Yes | Yes | Payee Verification Success |

| Yes | No | Payee Verification Failed | |

| No | Yes | Payee Verification Failed | |

| No | No | Payee Verification Failed |

By default, the application has time out available and configurable by the bank user. If the verification time is elapsed then the application displays a time out message.

Configuration

Backend Integration - Transact/MS/Mock

Using the runtime configurable parameter (Payment_Backend server property) at the Micro App level, an implementation team can configure the backend integration endpoint as Transact, or Mock as per customer needs for the following. The Payments Fabric MA supports the integration.

- The backend integration for all the APIs is mocked (DBX DB) or SRMS based on customer needs.

- The validations are avoided if the module is directly integrated with Transact endpoints.

- When records are created, use these options: Use the DBX DB table records that already exist, or use the Fabric Java layer to build a stubbed or JSON data response directly.

Follow these steps:

- Sign-in to your Fabric console.

- From the left pane, select Environments.

- For your Fabric run-time environment, click App Services.

- Navigate to Settings > Configurable Parameters.

- On the Server Properties tab, go to

PAYMENT_BACKENDField Name and set the Field Value depending on the integration (for example, MOCK or SRMS or SRMS_MOCK. - Click Save.

Fabric Server Properties

Current Transfers is via SRMS, as per the requirement, configuration name and configuration values should be as following:

| Module | Configuration name | Configuration Possible Values |

|---|---|---|

| Payments | PAYMENT_BACKEND (Existing) | SRMS/STUB/T24 |

| Standing Orders | PAYMENT_BACKEND (Existing) | SRMS/STUB/T24 |

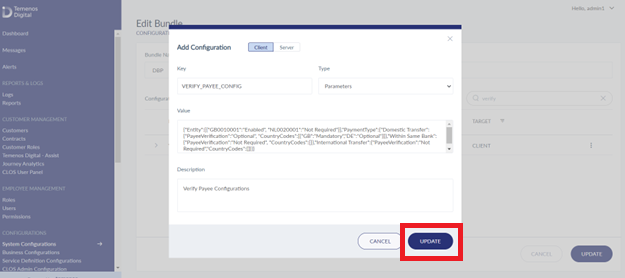

Confirmation of Payee

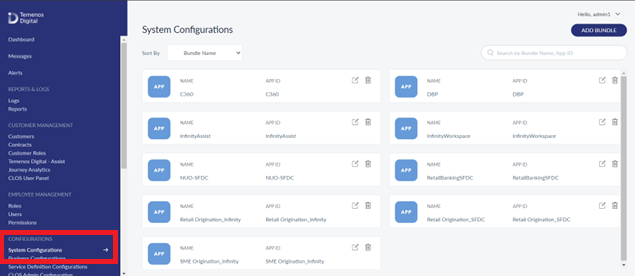

To enable the confirmation of payee, the bank user must have access to the spotlight application and perform the following steps.

- Sign-in to the Spotlight application, navigate to Configurations > System Configuration.

- Select DBP bundle, and search for VERIFY_PAYEE_CONFIG.

- Click ellipses and select Edit.

- Edit the configurations accordingly and select Update.

In this topic