Product Details

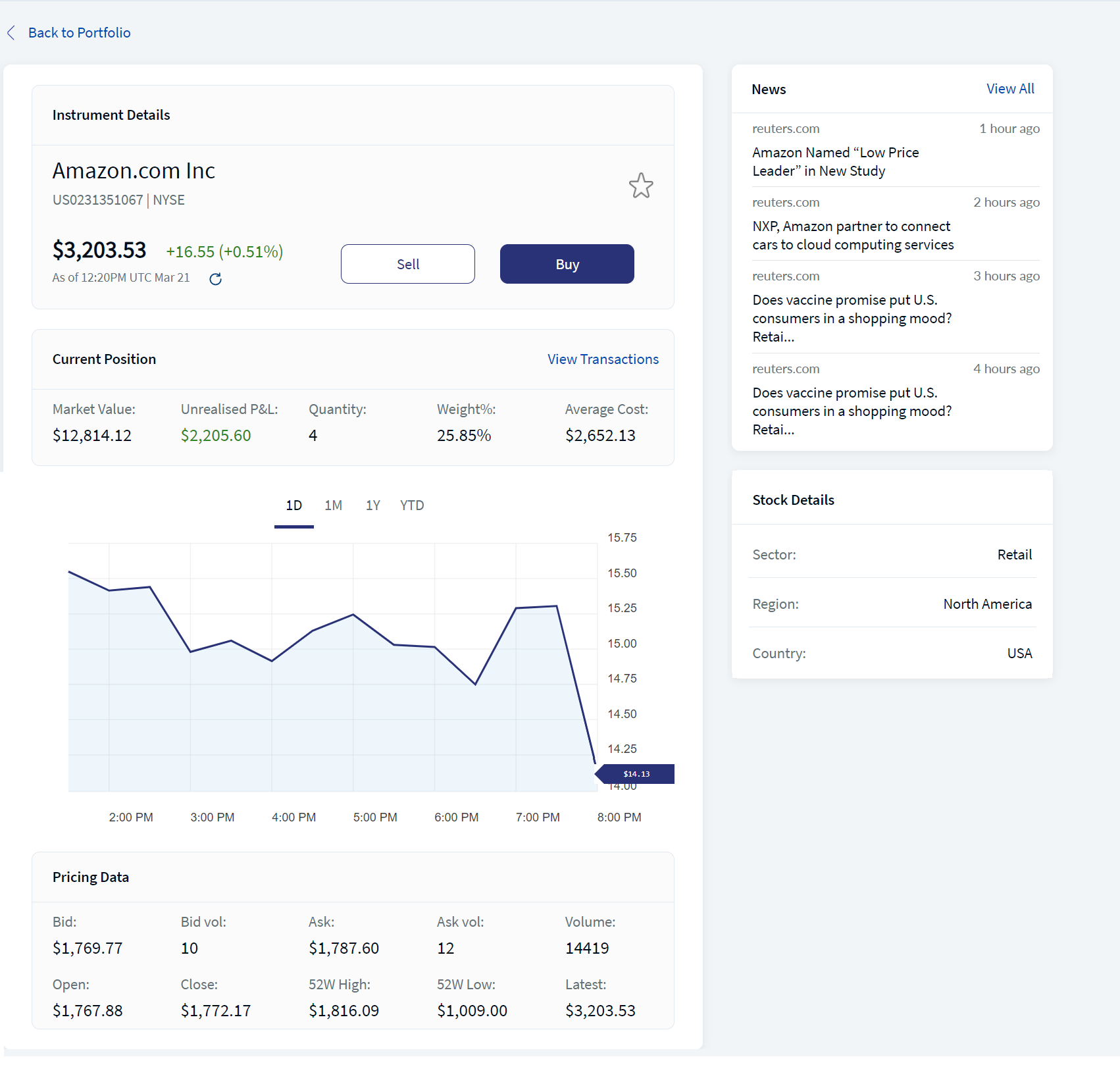

The Product Details page displays the details of a given instrument.

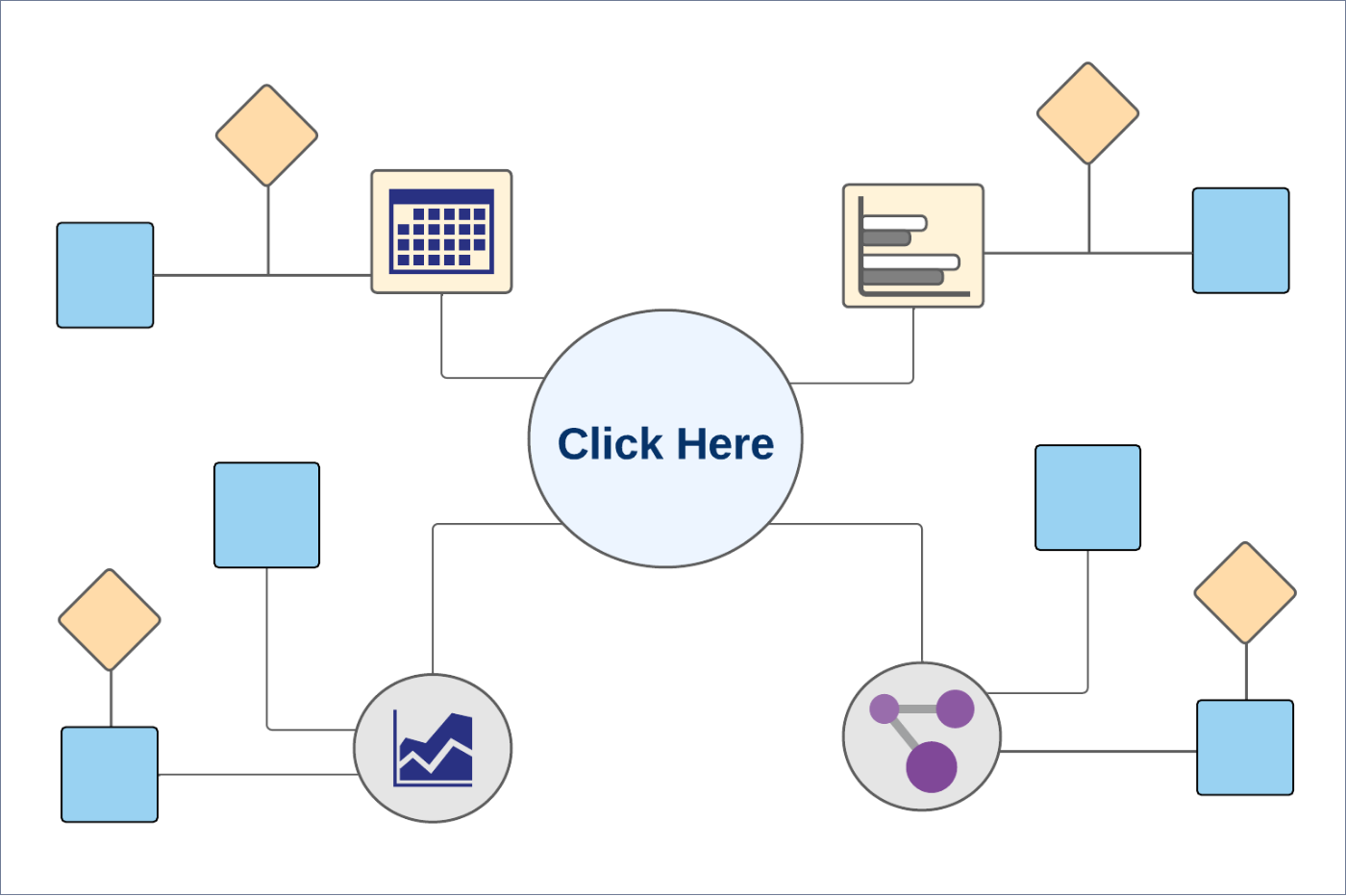

UX Overview

Product Details

| Section | Component | Configurable Elements |

|---|---|---|

|

Instrument Details: This section displays details of the instrument such as Instrument Name, ISIN, and Exchange. You can also choose to buy or sell the instrument from this section.

The history of the instrument price is also displayed in the form of a graph. |

com.temenos.infinityWealthComponents.instrumentDetails | NA |

| Current Position: This section displays details of the current status of the instrument. | NA | NA |

| View Transactions: This section displays details of the transactions associated with a specific instrument. | com.olb.wealth.viewTransactions | NA |

|

Pricing Data: This section displays the pricing information of the instrument. The data for the Pricing Data section is retrieved from the Market Data Provider. |

NA | NA |

| Stock News: This section displays the stock news that is associated with the instrument or asset. The data for the Stock News section is retrieved from the Market Data Provider. |

NA | NA |

| Documents: This section displays the documents that are associated with the instrument. The data for the Documents section is retrieved from the Market Data Provider. |

NA | NA |

| Asset Class Details: This section displays the details of the asset class to which the instrument belongs. | NA | NA |

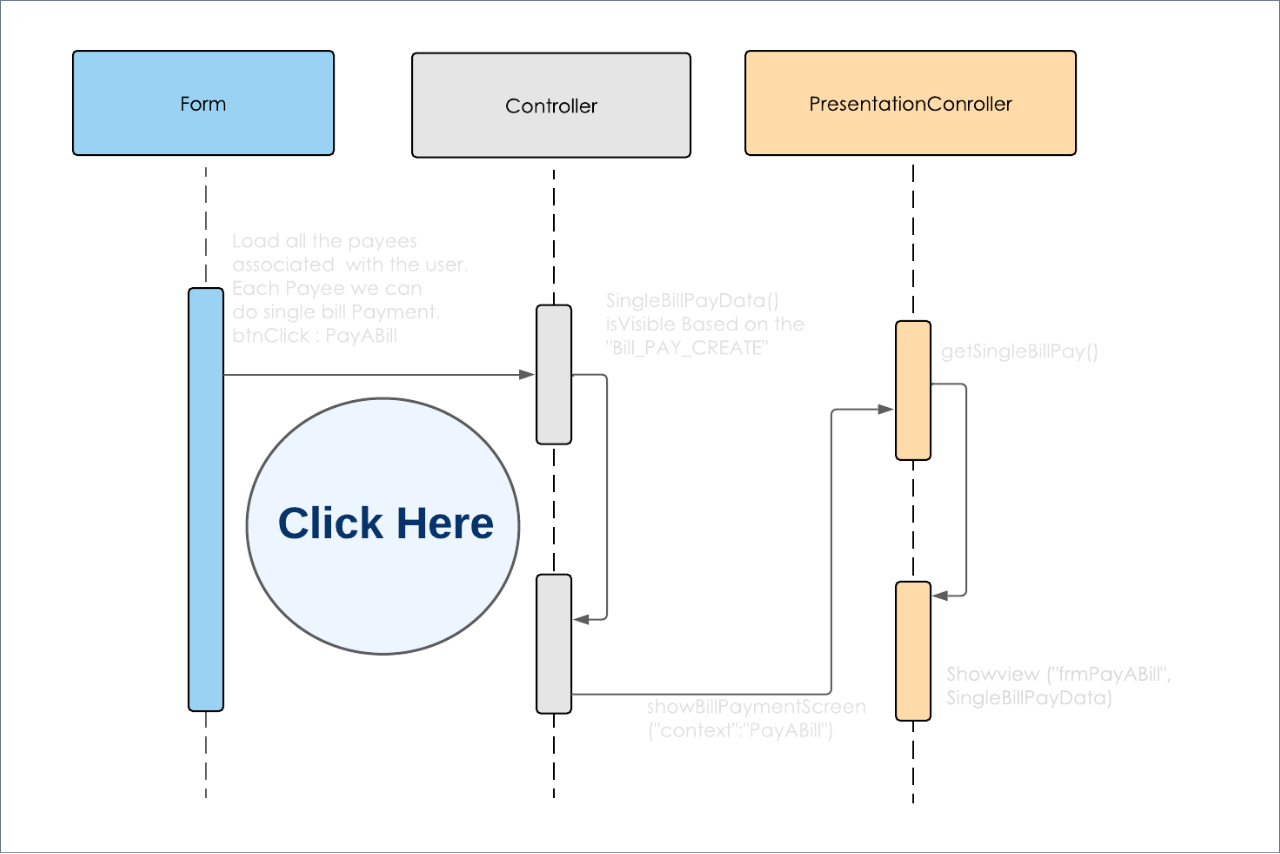

Sequence Diagram - Product Details

Feature Description

The Product Details module contains the following sections:

The mentioned information is provided by the Market Data Provider.

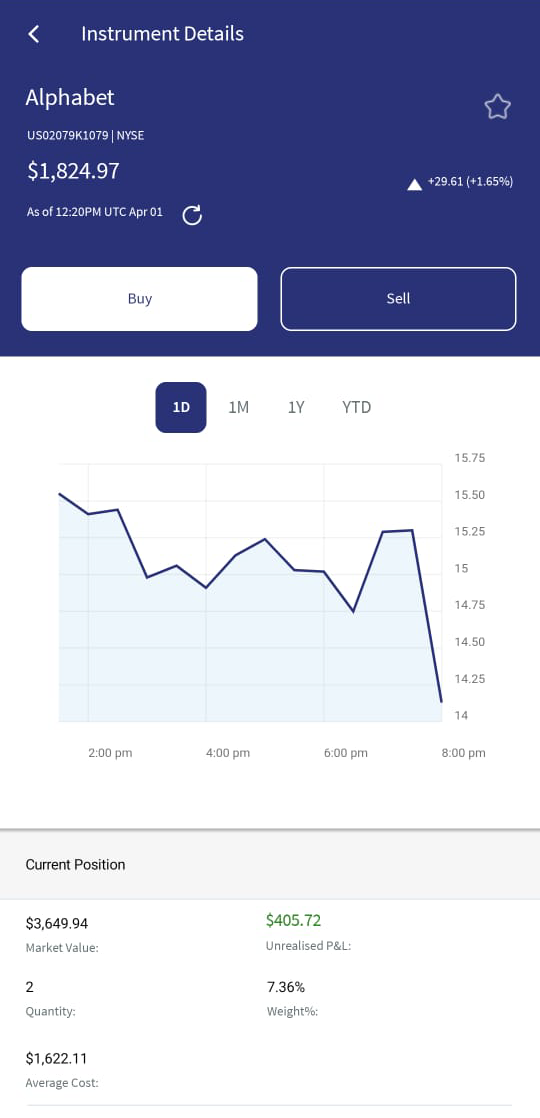

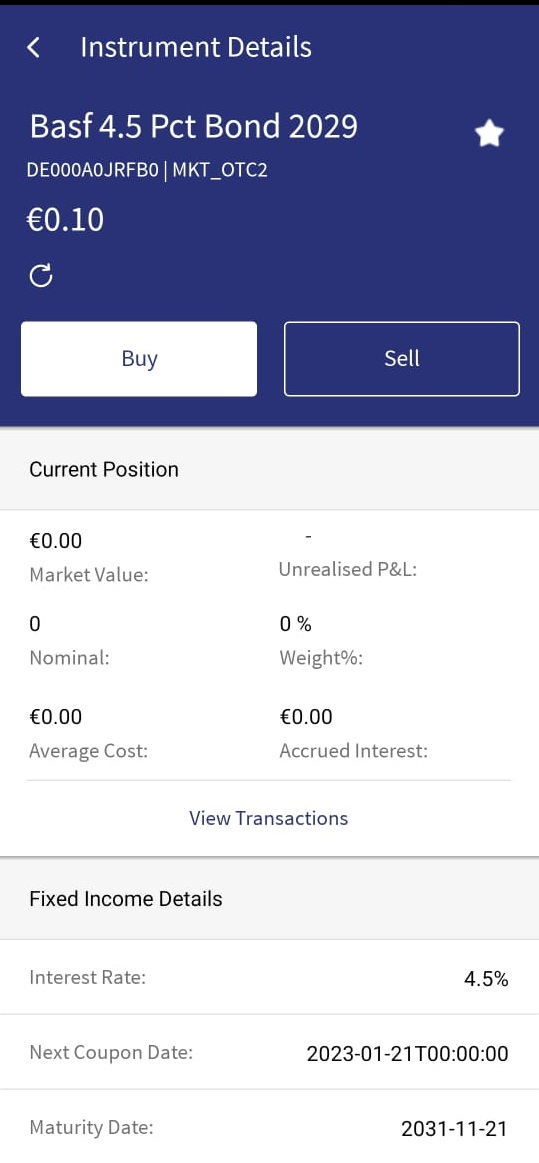

Instrument Details

The Instrument Details section displays the following details about an instrument:

- Instrument Name is the name of the product or instrument.

- ISIN is a unique identification number for the instrument.

- Exchange is the position where the stock is listed.

- Price is the latest price of the instrument.

- Change displays the date and time at which the instrument price changed. The price change can be either positive or negative. The price change is also displayed in terms of percentage.

To view the latest price of the instrument, click the Refresh icon.

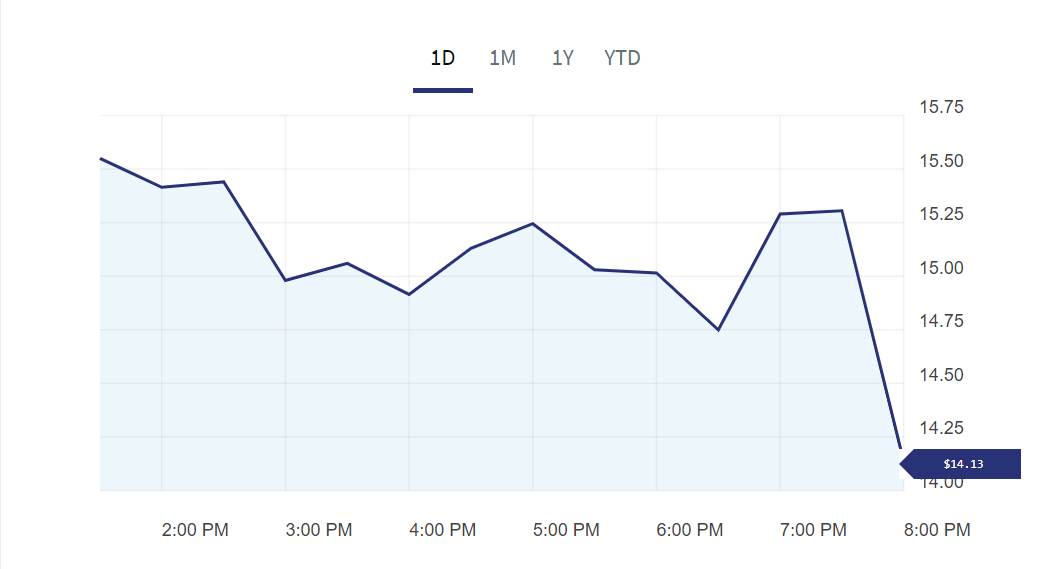

You can also view the history of the instrument price in the form of a graph. It is displayed as follows:

Graphical Instrument Details

- Current Day (1D): The graph displays the price information for the current day.

- The last month (1M): The graph displays the price information for the last one month from the current day.

- The last year (1Y): The graph displays the price information for the last year from the current day.

- The last five years (5Y): The graph displays the price information for the last five years from the current day.

- From the beginning of the year (Year to Date): The graph displays the price information from the day on which the total value was available.

The Instrument Details section also provides options to buy and sell the instrument. For more information about buying and selling an instrument, click here.

Mobile Native Screens

Business Process Diagram - Instrument Details

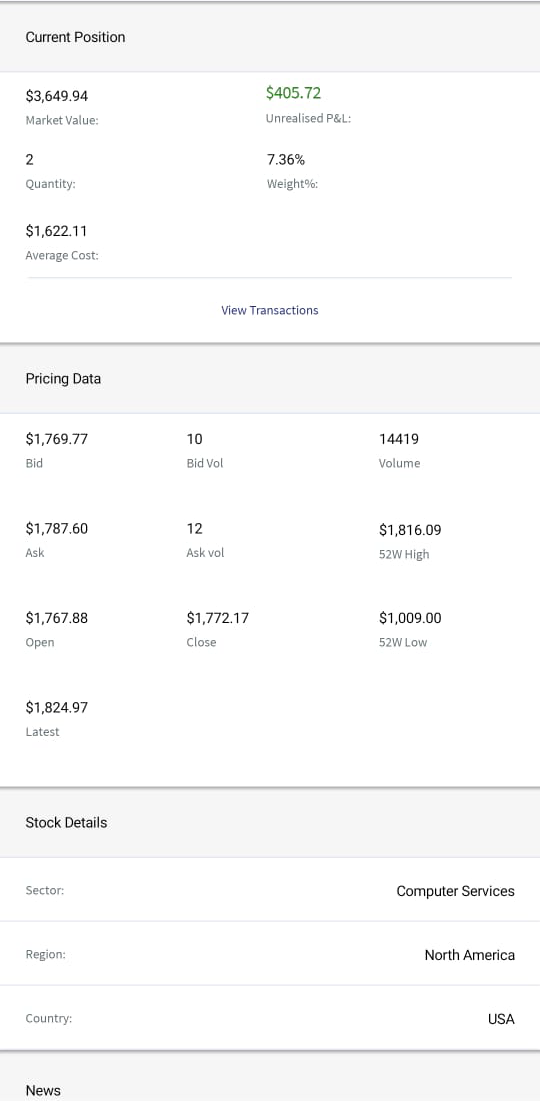

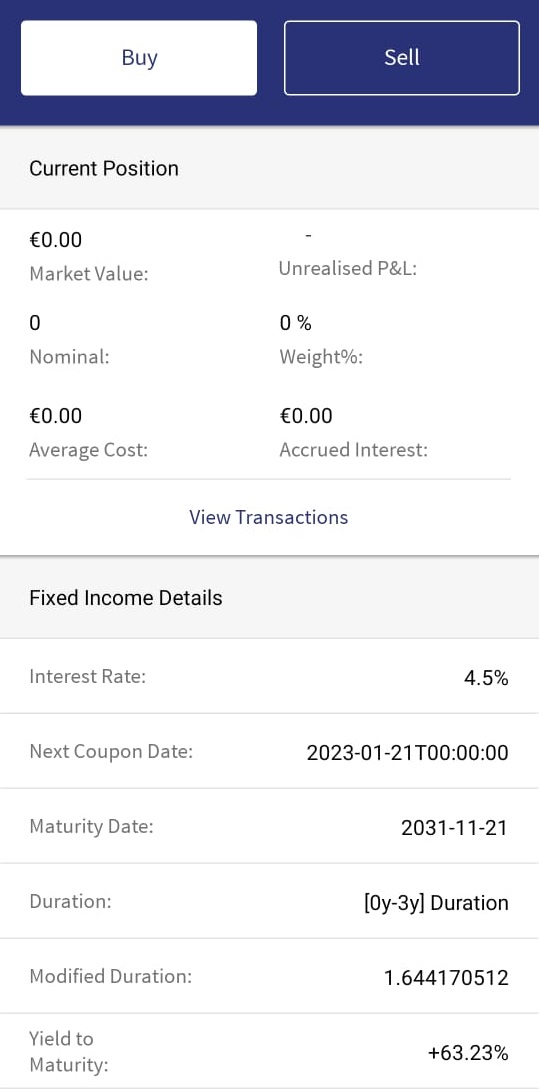

Current Position

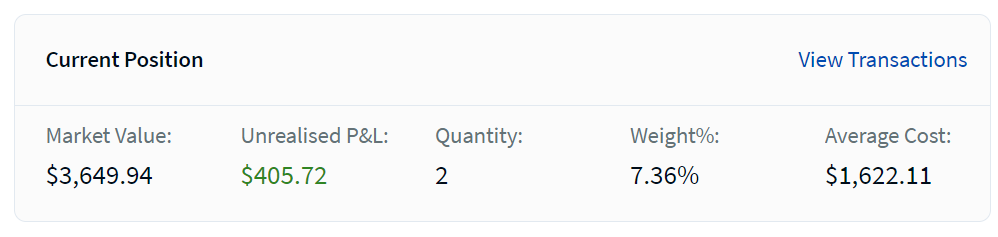

The Current Position section specifies the attributes that are associated with the current status of the instrument.

Current Position

It displays the following details:

- Market Value: Specifies the current market value of the instrument in the portfolio. It displays the product of the current market price and the quantity of the instrument.

- Unrealized P&L: Specifies the difference between the current market value and the weighted average cost of the buy. Profit is displayed in Green and loss is displayed in Red.

- Quantity: Specifies the total quantity of the instrument in the portfolio.

- Weight %: Specifies the weightage or the proportion of the instrument in the portfolio.

- Average Cost: Specifies the average cost of the instrument in the portfolio.

- Accrued Interest: Accrued interest refers to the amount of interest that has been incurred, as of a specific date

- Nominal: Specifies the quantity that is held in the instrument

- Balance: Specifies the balance available for the instrument.

- Amount Bought: Specifies the value at which the instrument is purchased.

- Quote: Specifies the quote available for the instrument.

- Cost Quote: Specifies the cost quote available for the instrument.

- Counterpart Amount: Specifies the amount that must be paid/received by the counterpart.

The earlier mentioned attributes are displayed based on the asset class of the product. The attributes of the different asset classes are as follows:

-

Bond

Bond

- Market value

- Unrealized PL

- Quantity

- Nominal

- Weight %

- Average cost

- Accrued Interest

-

Forward

Forward

- Market value

- Unrealized PL

- Weight %

- Amount Bought

- Amount Sold

- Quote

- Cost Quotes

- Counterpart Amount

-

Fund

Fund

- Market value

- Unrealized PL

- Quantity

- Weight %

- Average cost

-

Futures

Futures

- Market value

- Unrealized PL

- Nominal

- Weight %

- Average cost

-

Money Market

Money Market

- Balance

- Unrealized PL

- Quantity

- Weight %

- Average cost

-

Options

Options

- Market value

- Unrealized PL

- Nominal

- Weight %

- Average cost

-

Stock

Stock

- Market value

- Unrealized PL

- Quantity

- Weight %

- Average cost

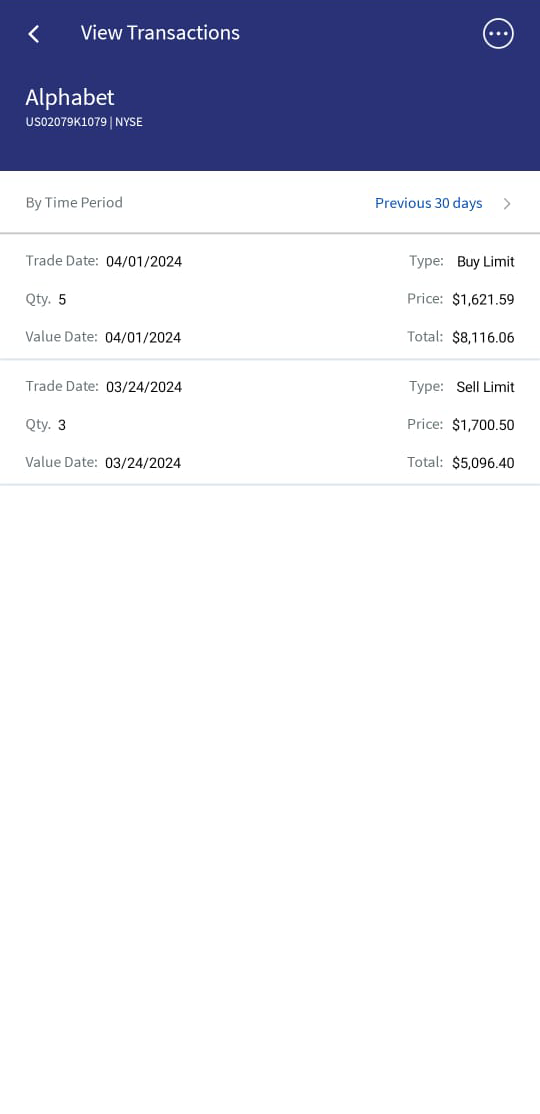

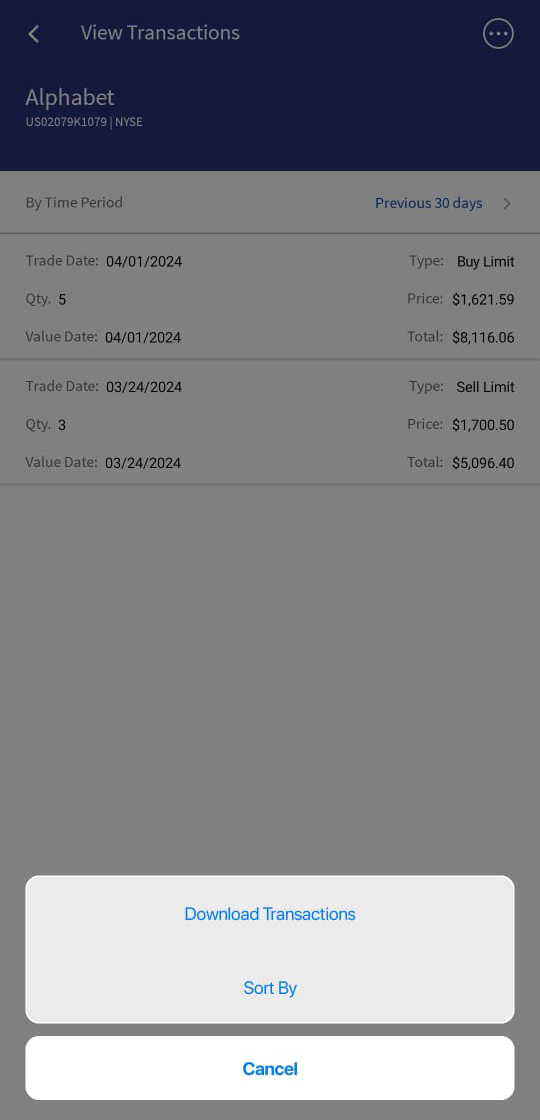

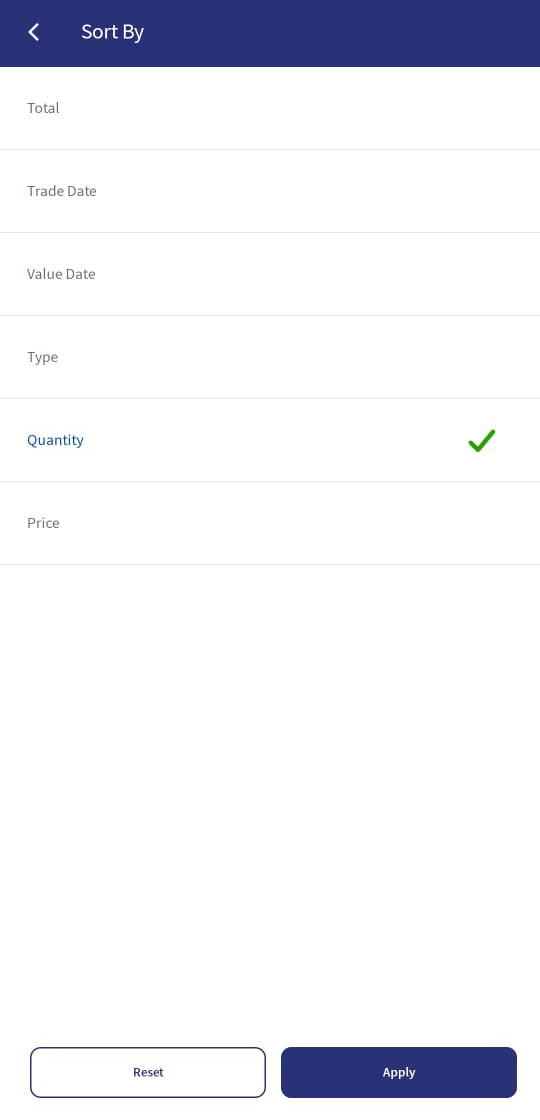

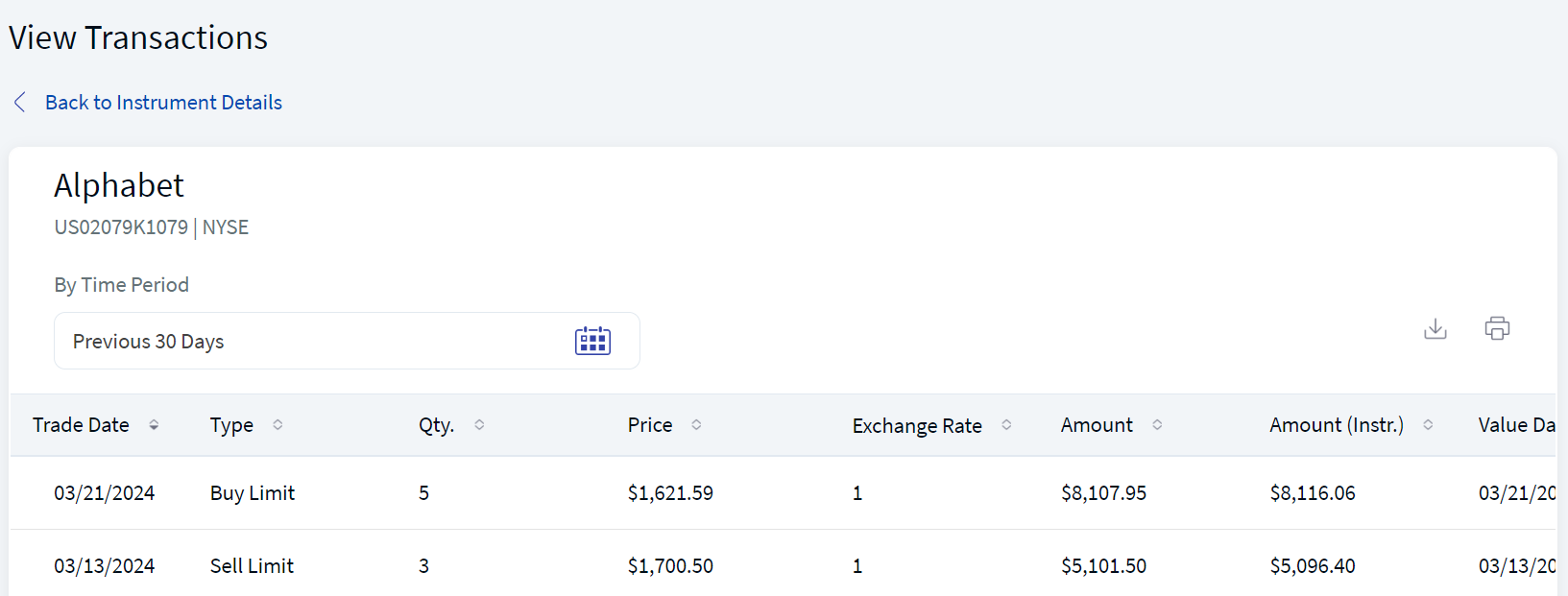

View Transactions

The View Transactions feature lets you to view the transactions that are associated with a specific instrument. It is similar to the Transactions section in the Portfolio Details module.

When you click on the View Transactions option on a specific Instrument Details module, the View Transactions section is displayed.

View Transactions

For more information about the details that are displayed and the actions that can be performed on the View Transactions section , refer to Transactions.

Mobile Native Screens

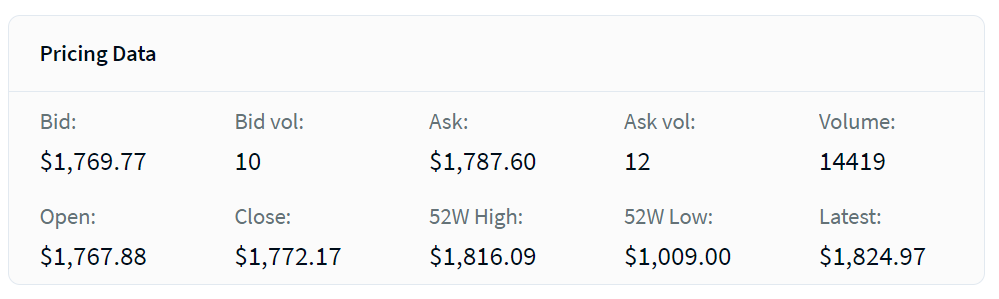

Pricing Data

Pricing Data provides the price information about an instrument.

Pricing Data

It displays the following details:

- Bid: Specifies the best available price to buy the instrument.

- Bid Vol: Specifies the total buy volume that is available in the order book.

- Volume: Specifies the total volume of both buy and sell.

- Ask: Specifies the best available price to sell the instrument.

- Ask Vol: Specifies the total sell volume that is available in the order book.

- 52 Week High: Specifies the highest price of the instrument in the last 52 weeks.

- Open: Specifies the opening price of the instrument.

- Close: Specifies the closing price of the instrument.

- 52 Week Low: Specifies the lowest price of the instrument in the last 52 weeks.

- Latest: Specifies the latest price of the instrument.

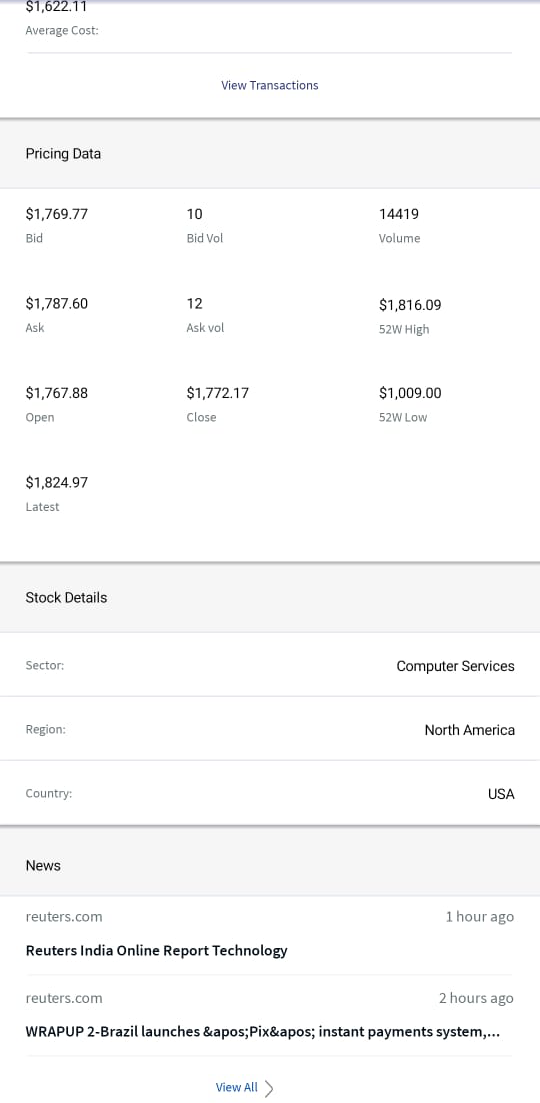

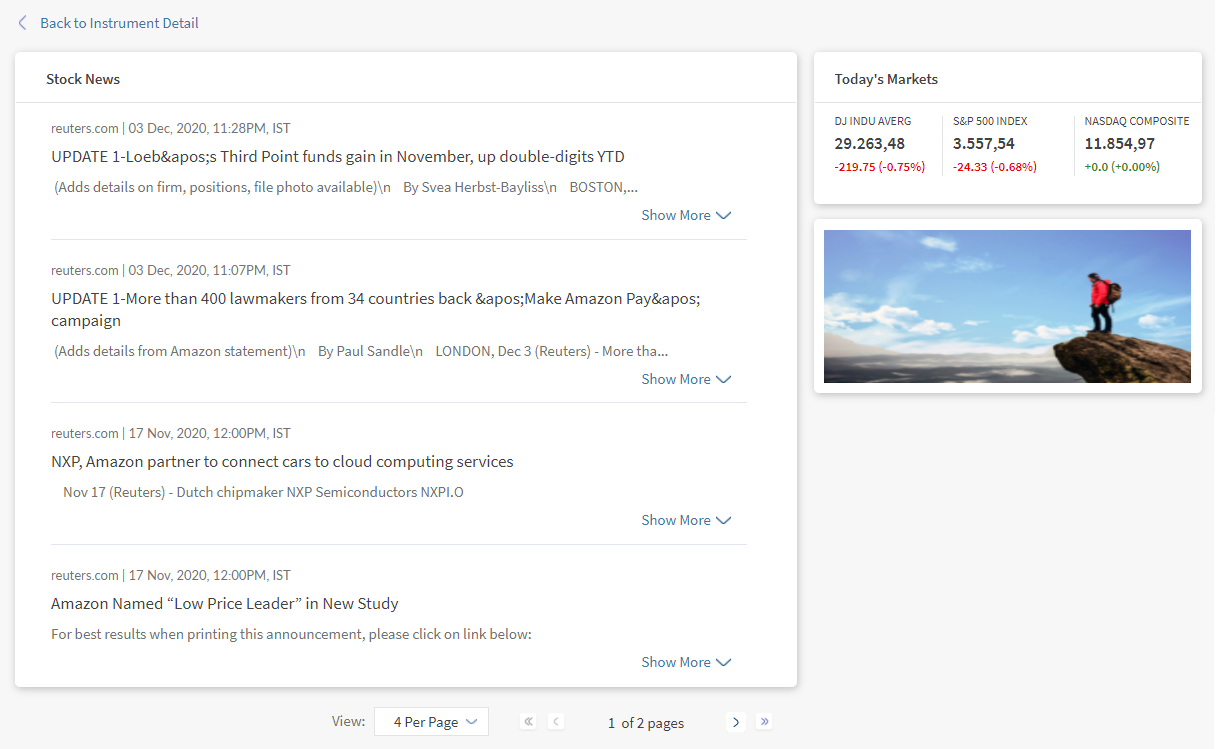

Stock News

The Stock News section displays the stock news that is related to the selected instrument. The data is retrieved from the Market Data Provider.

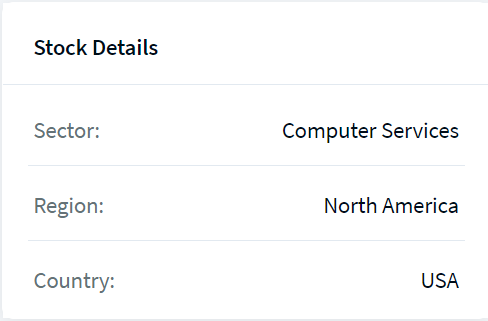

Stock Details

To view all the stock news, click View All. The Stock News screen appears.

The Stock News screen displays a list of news. To view the details of a specific topic, click Show More.

Stock News Detailed Screen

Documents

Documents

From the Documents section, you can view the documents and files that are associated with the selected instrument. This section is displayed only if there are any files related to the customer or the instrument.

You can open a specific document by clicking on it and save it by using the download option.

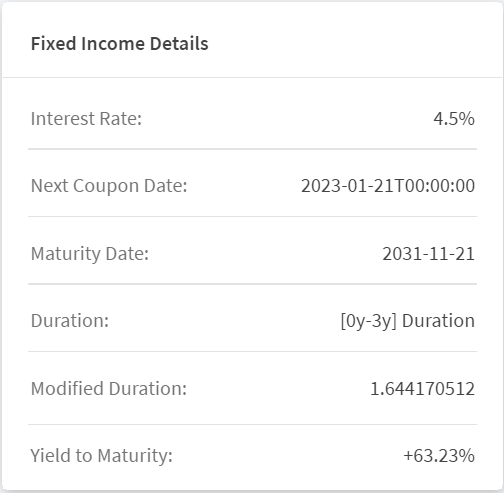

Asset Class Details

From the Asset Class Details section, you can view the details of various asset classes to which the product belongs. For example, if a product belongs to the asset class named Bond, the details that apply to the Bond asset class are displayed.

The asset classes are categorized as follows:

- Bond: Bonds are debt instruments that are issued by government to finance their operations.

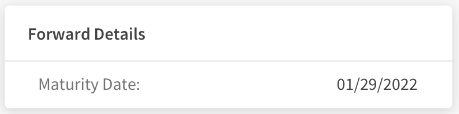

- Forward: A Forward contract is a contract between two parties to buy or sell an asset at a specified price on a future date.

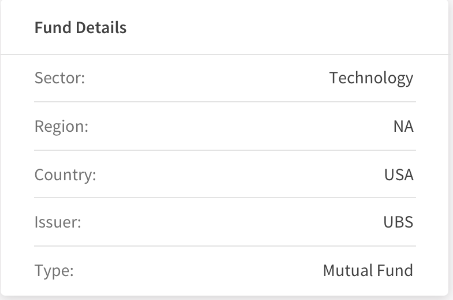

- Fund: A mutual fund is an investment fund that pools money from the investors to invest in different asset classes.

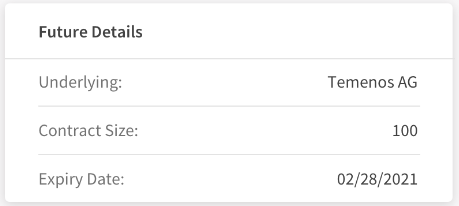

- Futures: Futures are derivatives contract that allows the buyers/sellers to transact an asset at a predetermined future date and price.

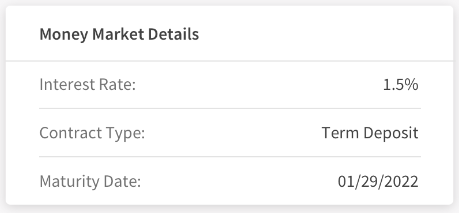

- Money Market: Money Market is a short term instrument type that is transacted between banks and other financial institutions.

- Options: Options are financial instruments that are derivatives based on the value of the underlying assets.

- Stock: A stock represents ownership of a fraction of the corporation. Stocks are also called Shares.

The following details are displayed based on the various asset classes:

- Interest Rate: Interest Rate is the amount that a lender charges for the use of assets expressed as a percentage of the Principal Amount.

- Next Coupon Date: Specifies the next date on which the bond holders are sent the coupon payments.

- Maturity Date: Specifies the date on which the instruments mature.

- Duration: Duration is a measure of the sensitivity of the price of a bond or other debt instrument to a change in interest rates

- Modified Duration: Specifies a measurable change in the value of a security in response to a change in the interest rates.

- Rating: Specifies the rating provided by the different rating agencies for a particular asset/instrument.

- Yield to Maturity: Specifies the expected annual rate of return on a bond if it is held until the maturity date. The yield to maturity field is displayed for a Bond Instrument or any other Fixed Income Instrument present in TAP.

- The mentioned attributes vary depending on the types of bonds. For example, the Interest Rate does not apply to Zero-Coupon Bonds and the Maturity Rate does not apply to Perpetual Bonds.

- The yield to maturity percentage value is displayed for all types of Fixed income instruments from TAP, including bonds.

- Maturity Date: Specifies the date on which the instruments mature.

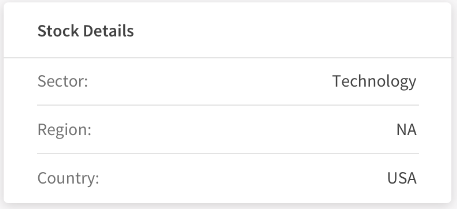

- Sector: Specifies the industry or the sector to which the stock belongs.

- Region: Specifies the region in which the country of the stock lies.

- Country: Specifies the country to which the stock belongs.

- Issuer: Issuer is a Corporation or Government that sells the stocks or bonds to raise funds for their operations.

- Type: Specifies the type of the fund issued.

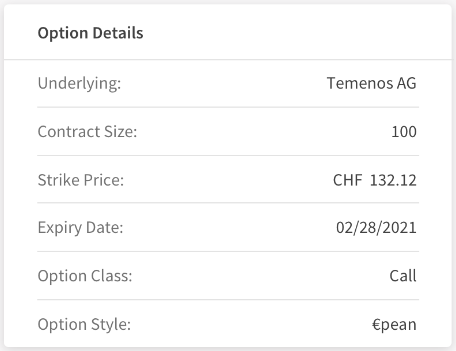

- Underlying: An underlying option security is a stock, index, bond, currency, or commodity on which an option's value is based.

- Contract Size: Specifies the quantity of the underlying instrument that the buyer of a call can buy.

- Expiry Date: Specifies the date on which the contracts expires.

- Interest Rate: Interest Rate is the amount that a lender charges for the use of assets expressed as a percentage of the Principal Amount.

- Contract Type: Specifies the type of a contract. For example, Term Deposit.

- Maturity Date: Specifies the date on which the instruments mature.

- Underlying: An underlying option security is a stock, index, bond, currency, or commodity on which an option's value is based.

- Contract Size: Specifies the quantity of the underlying instrument that the buyer of a call can buy.

- Expiry Date: Specifies the date on which the contracts expires.

- Strike Price: Strike Price is the price at which a derivative contract can be bought or sold when it is exercised.

- Option Class: Specifies the class of an option such as Call and Put.

- Option Style: Specifies the style of an option such as American and European.

- Sector: Specifies the industry or the sector to which the stock belongs.

- Region: Specifies the region in which the country of the stock lies.

- Country: Specifies the country to which the stock belongs.

Bond Details

Mobile Native Screens

Forward Details

Fund Details

Future Details

Money Market

Option Details

Stock Details

In this topic