Accounts Details and Transactions List

Use the feature to view the details of the selected account and manage transactions. From the accounts dashboard screen, tap any account row (for example, Savings account) to view the account details and get the required information. A user with access to both retail and business accounts can view the details of an account for the accounts to which the user has been given permission. The accounts are segregated by personal and business type at all relevant places in the application during transfers and other flows and icons against each account indicates the type of account.

For authorized users, the account details including the list of all the transactions and balances pertaining to the selected account are integrated with Transact using IRIS APIs. See integration for more information.

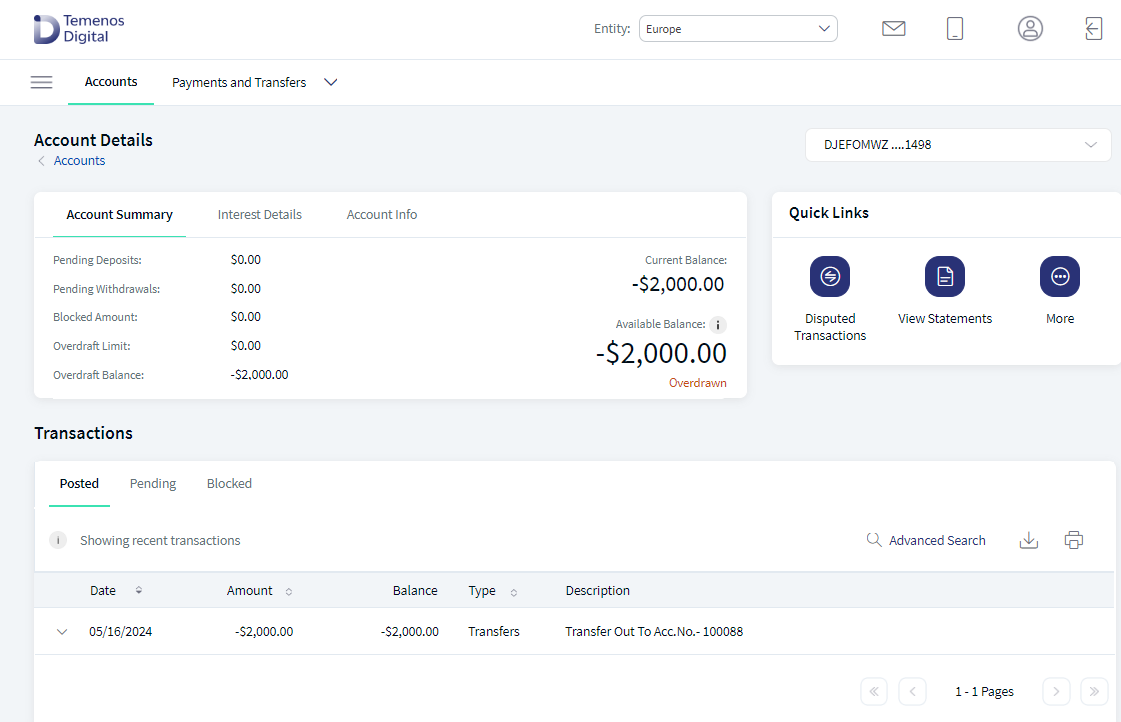

User have an option to switch between the entities. A Multi entity customer is someone who has digital banking for entities in multiple regions. For more information, see Multi Entity and Entity login.

The account transaction listing screen for responsive has been redesigned for a better user experience and performance handling.

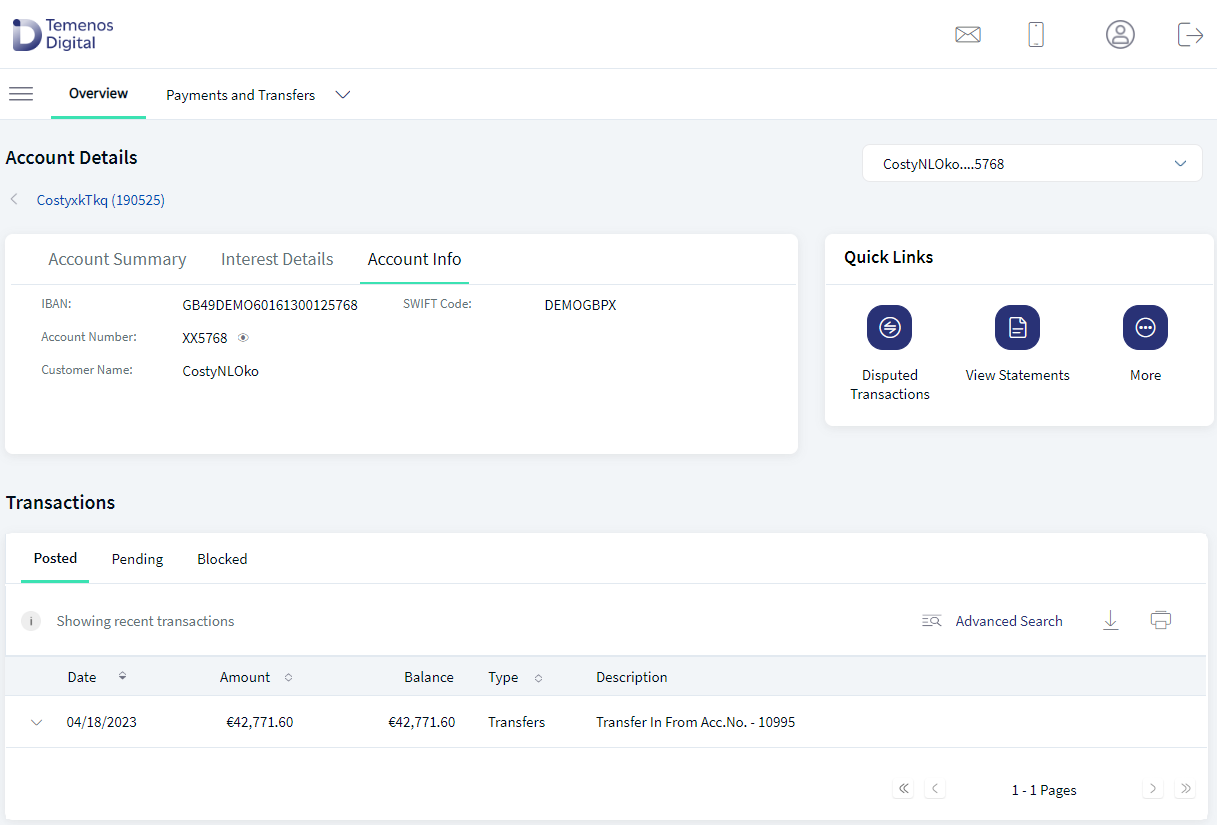

UX Overview

A. Account summary tab

B. Interest detail tab

C. View account information

D. Transaction details - Posted, Pending, Blocked

E. Quick links

F. Other actions (What else you want to do)

Business Process Diagram - View and Manage Accounts and Transaction Details

Web Channel

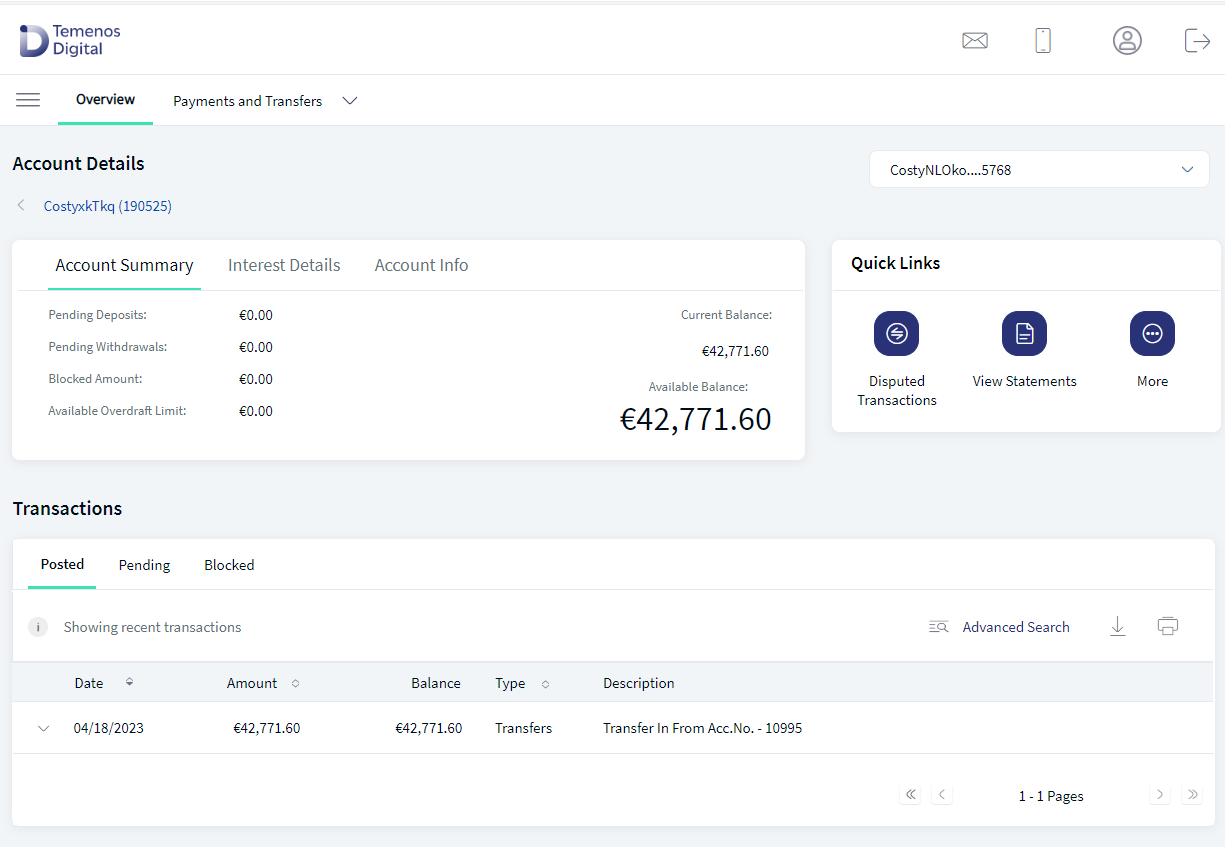

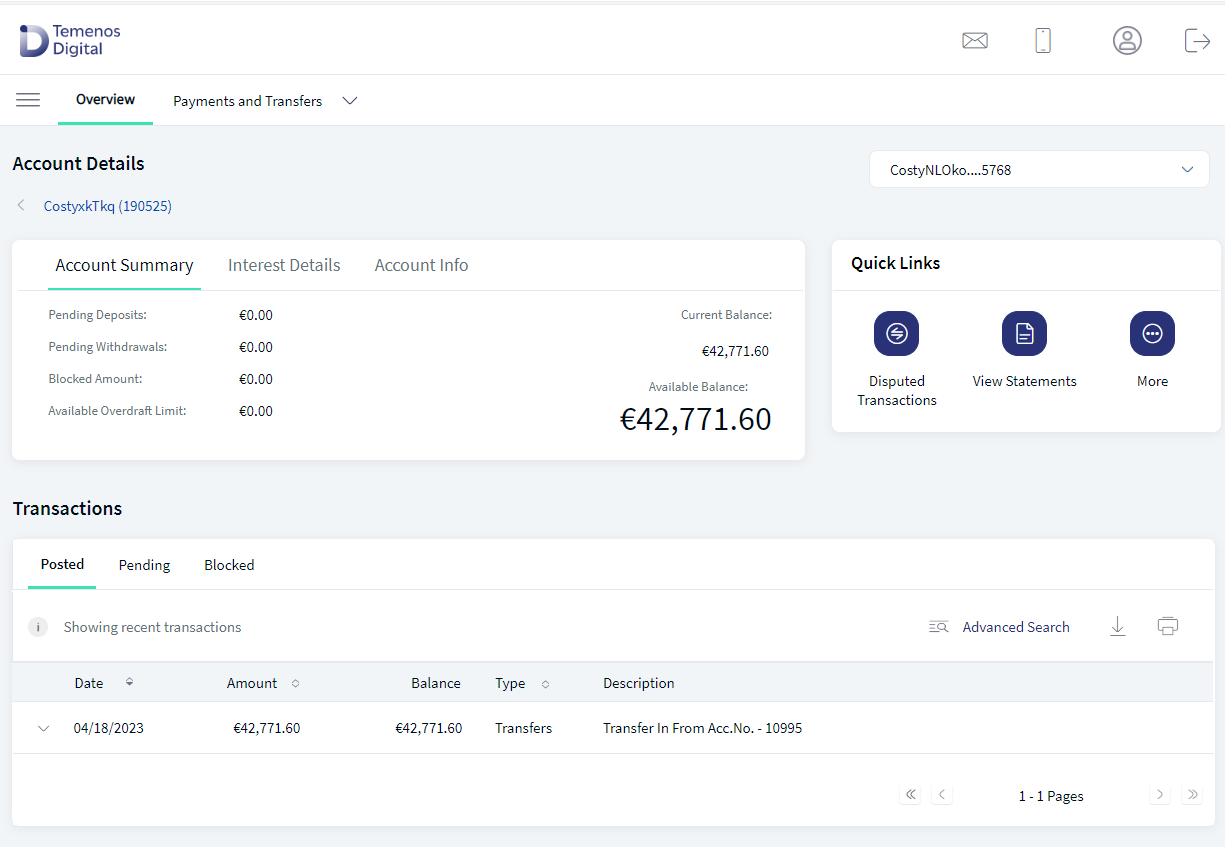

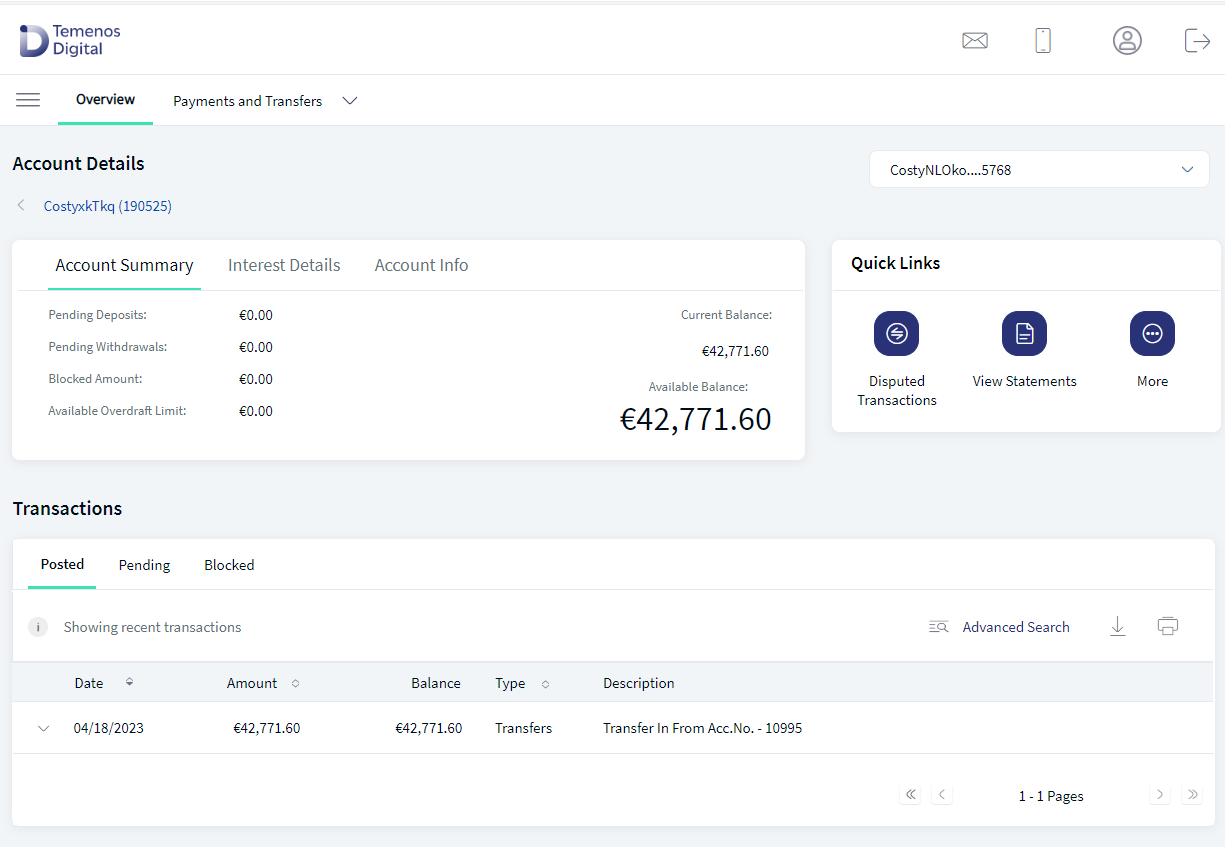

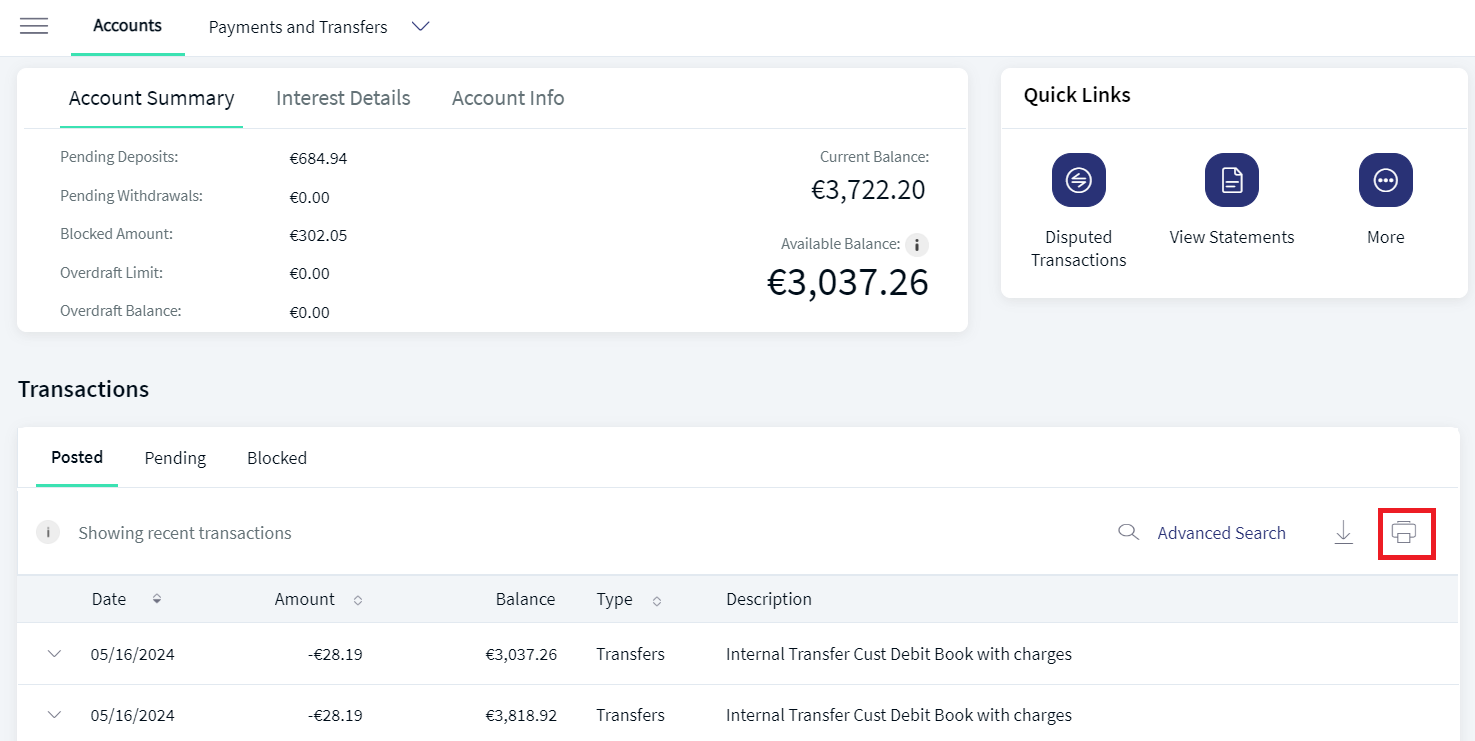

The application displays the details of the selected account and you can do the following:

- View the account summary, interest details, and account info of the selected account.

- View recent pending, posted and blocked transaction details.

- Perform quick actions such as pay money, pay a bill and more.

Account Summary Tab

In the Account summary tab, user can see the account name with last four digits account number and few details such as:

- Pending Deposits

- Pending Withdrawals

- Blocked Amount

- Overdraft Limit

- Overdraft

- Current Balance

- Available balance

If the available balance of an account is negative due to an overdraw, the application displays the overdraft limit and the expected overdraft balance. If the available balance is positive and the overdraft is linked to the account, the overdraft balance and overdraft limit are displayed accordingly. If the available balance is positive and the overdraft is not attached to the account, overdraft limit will display as zero and overdraft balance field will not be displayed.

This feature is integrated with Transact using IRIS APIs and also with Holdings Microservices to pull and display the details of a selected account (includes Savings, Checking, Loans, and Deposits) to which the authorized user has access.

The Account Info tab displays the following details.

| Account Type | Summary Details |

|---|---|

| Savings |

|

| Checking |

|

| Credit Card |

|

| Loan/Mortgage |

|

| Deposits, IRA, Certificate Share/Deposits |

|

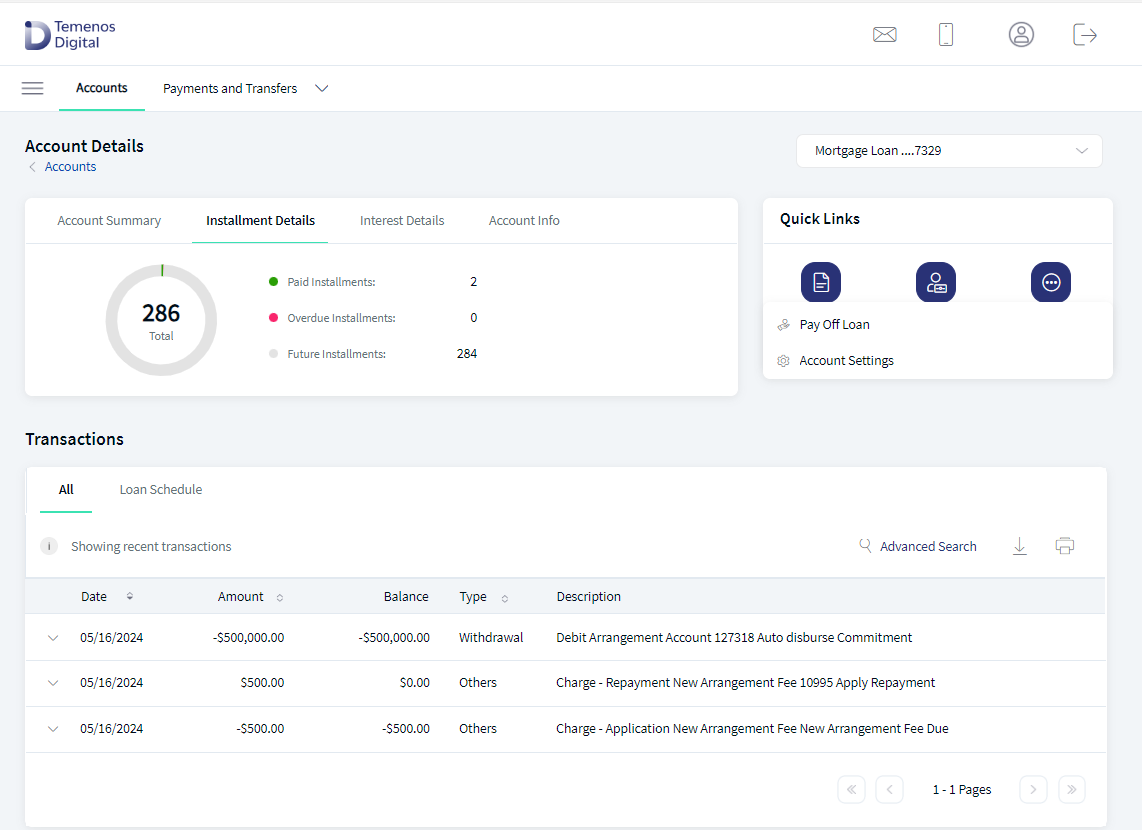

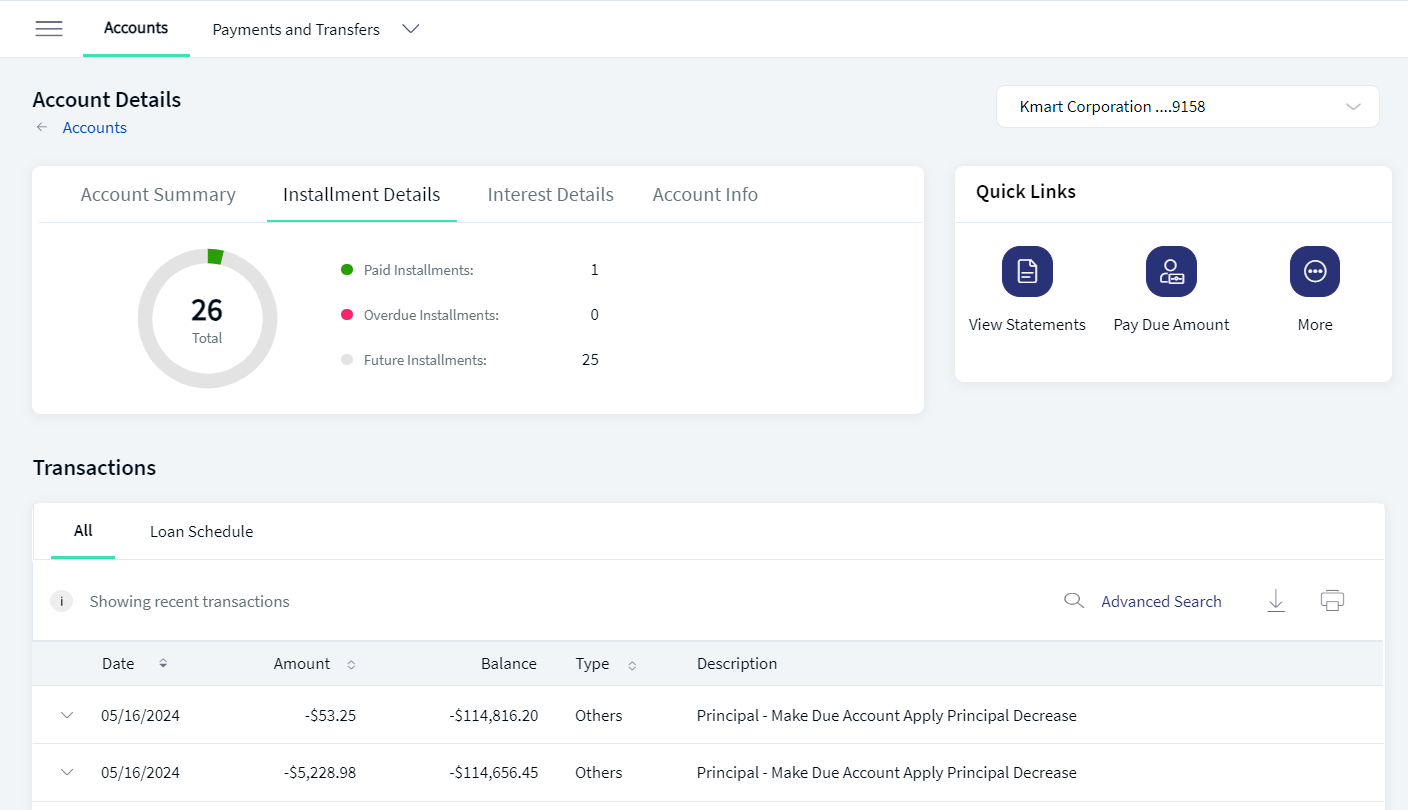

Installment Detail (for Loan Accounts)

This section is applicable only for loan account.

You can view the summary of paid installments, overdue installments, and the installments you must pay in the future on your loan account.

This tab displays the following details:

- The total summary of all the installments (paid, overdue, and future) is represented in the form of a pie chart with the count.

- Each type of installment is represented in a different color.

For example, if Charles has an active loan account of total 240 installments out of which 37 are paid, 03 overdue, and 200 for the future. The pie chart is represented in three colors with each color representing the type of installment.

Installment Type Color code Paid Green Overdue Pink Future White

This feature is integrated with Transact using IRIS APIs and also with Holdings Microservices to pull and display the details of a selected account (includes Savings, Checking, Loans, and Deposits) to which the authorized user has access.

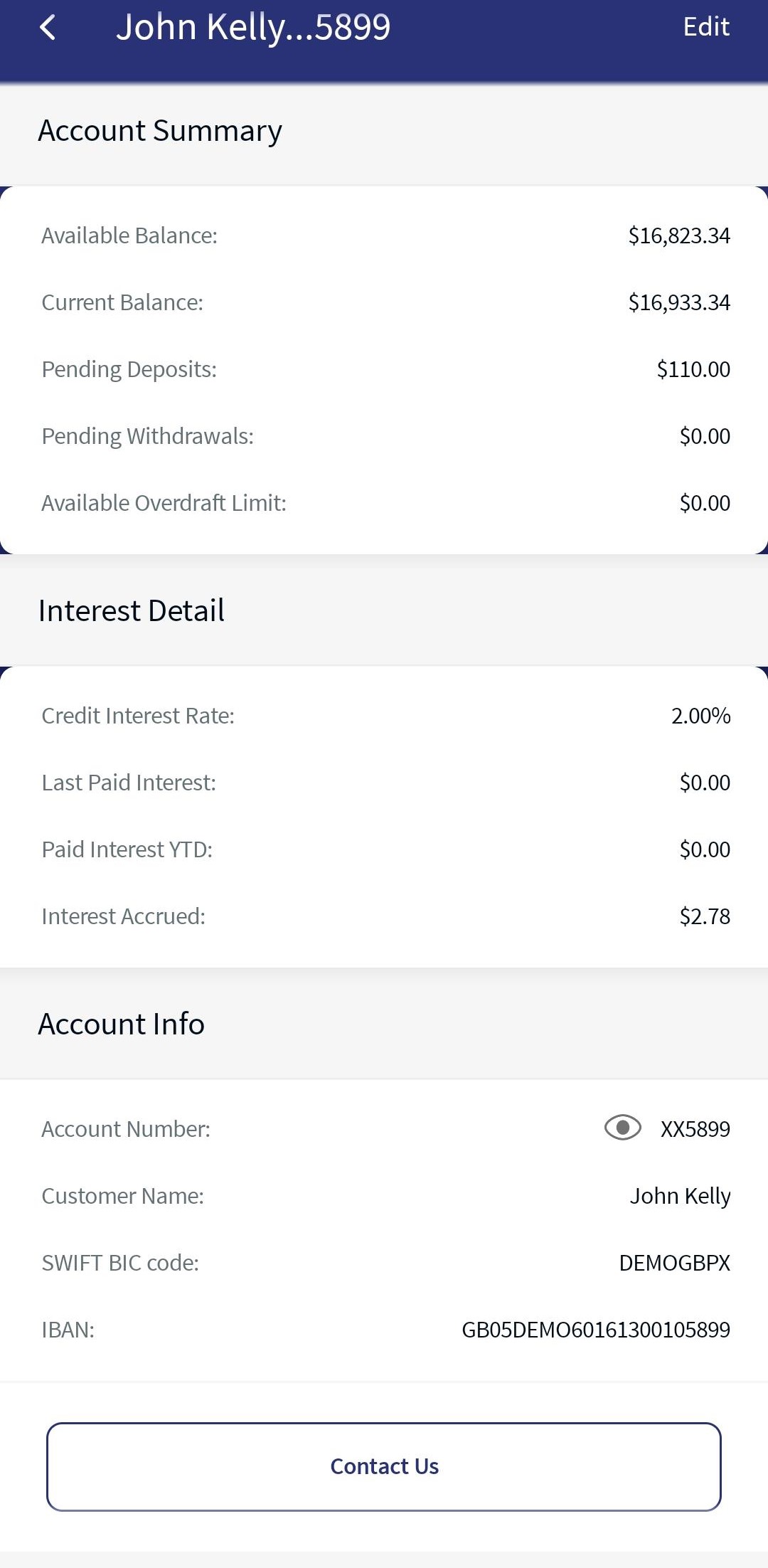

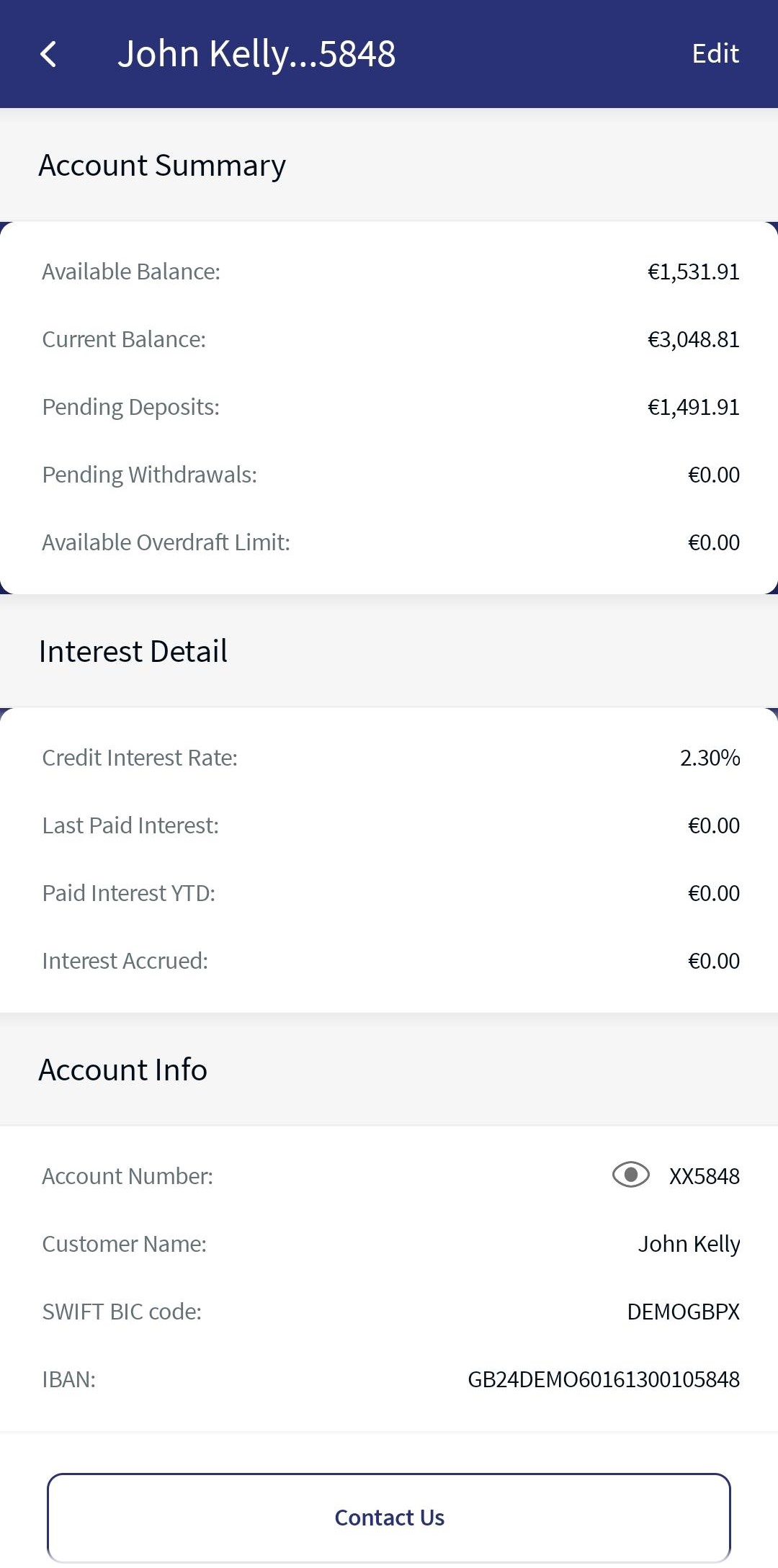

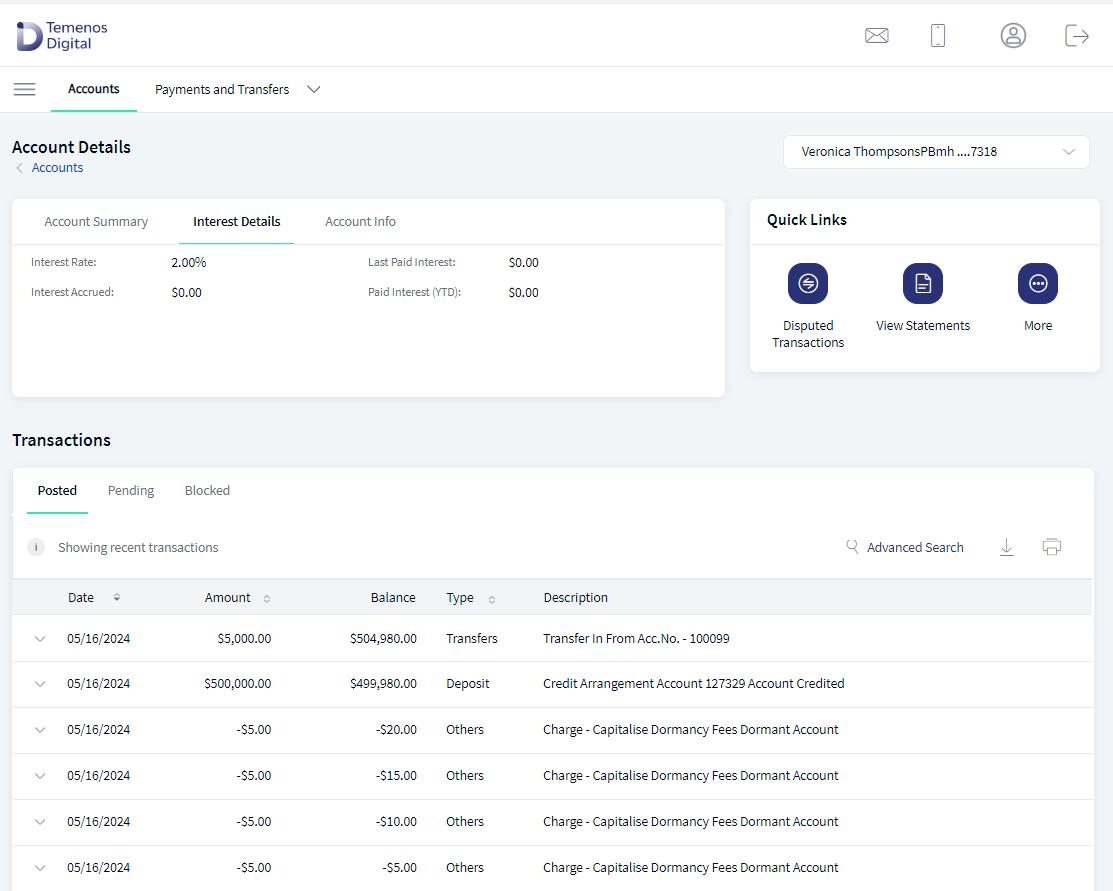

Interest Detail Tab

This tab is applicable only for credit and loan accounts. View the account balance and interest details with the following details.

This feature is integrated with Transact using IRIS APIs and also with Holdings Microservices to pull and display the details of a selected account (includes Savings, Checking, Loans, and Deposits) to which the authorized user has access. The date format shown in the Account details screen can be configured in the Fabric app based on which the format can be changed between DD/MM/YYYY and MM/DD/YYYY.

The Account Info tab displays the following details.

| Account Type | Balance and Interest Details |

|---|---|

|

Savings and Checking |

|

|

Credit Card |

|

|

Loan/Mortgage |

|

|

Deposits, IRA, Certificate Share/Deposits |

|

View Account Information

If the account is associated with a business CIF which is business/corporate, the company name is displayed. If the account is associated with a CIF which is retail/personal, the Primary Account Holder name is displayed.

This feature is integrated with Transact using IRIS APIs and also with Holdings Microservices to pull and display the details of a selected account (includes Savings, Checking, Loans, and Deposits) to which the authorized user has access. The Account Info tab displays the following details.

The fields vary depending on the account type:

| Account Type | Summary Details |

|---|---|

| Savings/Checking |

|

| Credit Card |

|

| Loan/Mortgage |

|

| Deposits, IRA, Certificate Share/Deposits |

|

Transaction Details

Posted and Pending Tabs

The users can see an icon with showing recent transactions. This displays the list of posted and pending transactions linked with the account, grouped by the transaction type ( date, description, type, transaction amount, and account balance details, reference number and actions). The list is sorted by date (most recent transaction on top) by default. User have an option to sort the date and amount fields. If the user has no transactions, a "No transactions found" message is displayed. The date format shown in the Account details screen can be configured in the Fabric app based on which the format can be changed between DD/MM/YYYY and MM/DD/YYYY.

This feature is integrated with Transact using IRIS APIs and also with Holdings Microservices to pull and display the list of posted transactions of a selected account to which the authorized user has access.

Pending transactions are integrated with Transact using IRIS APIs for selected account to which the authorized user has access.

The number of transactions and list of transactions per page are maintained as a configuration and fetched from the backend system in the Spotlight. For more details, see the pending transaction and posted transaction.

The tabs change based on the selected account type.

| Account Type | Transaction Details |

|---|---|

| Savings |

|

| Checking |

|

| Credit Card |

|

| Loan/Mortgage |

|

| Deposits, IRA, Certificate Share/Deposits |

|

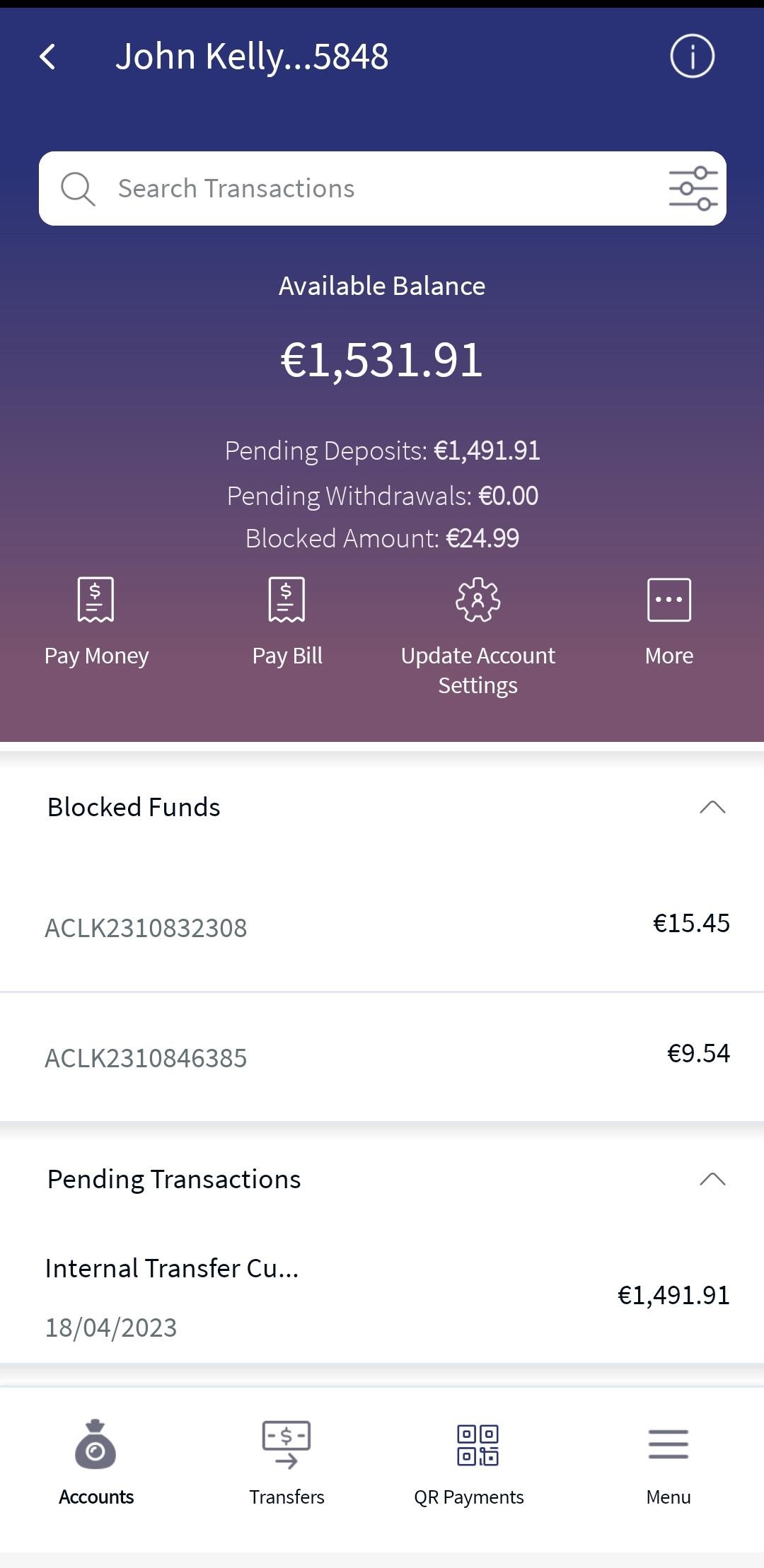

Blocked Funds

The users can see an icon with showing recent transactions. The blocked amount refers to the funds that are blocked by the government or external organizations in the customer's account. This amount cannot be accessed by the customer. The blocked amount can be lifted only by the external organization which placed it. The customer can only view the blocked amount. If there are no blocked funds, "no transactions found" message is displayed.

- Select a particular account from the accounts dashboard.

- Under Transactions list, click the Blocked Funds tab. The application displays the list of blocked transactions for the selected account.

The following details are displayed

- Reference Number

- Blocked Amount

- From Date

- To Date

- Description

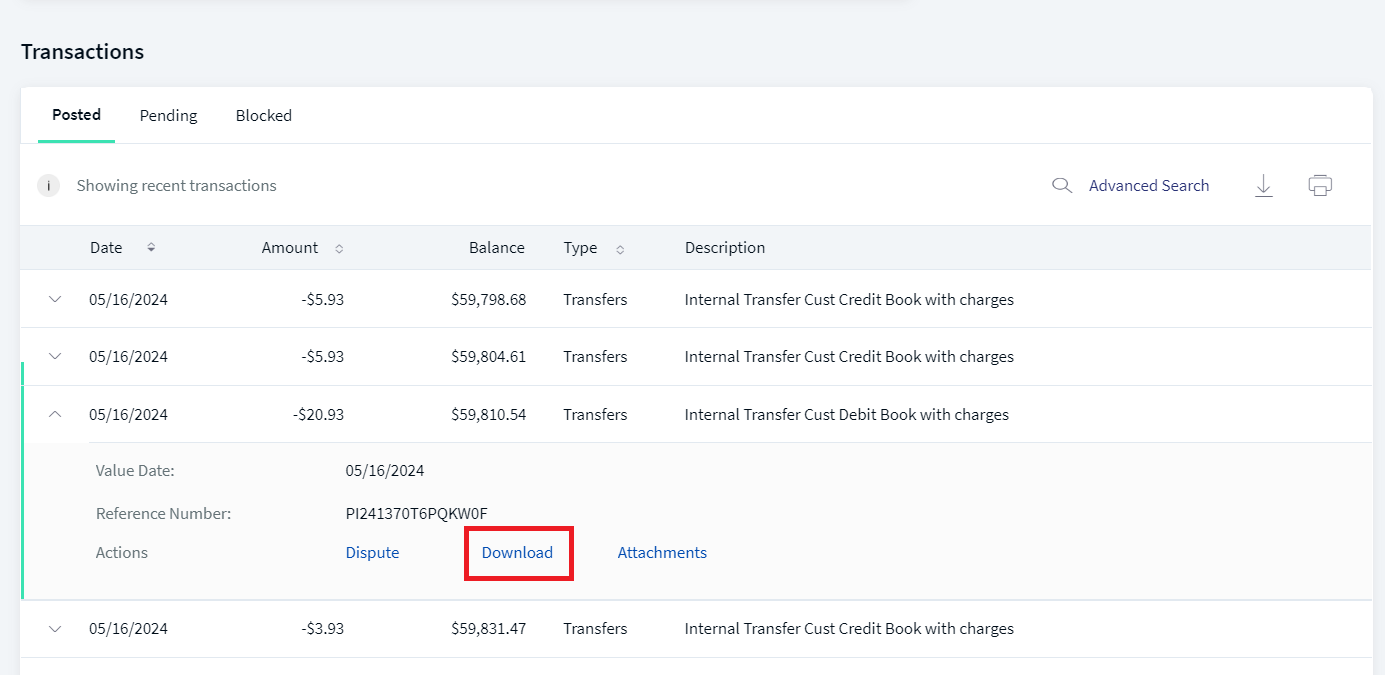

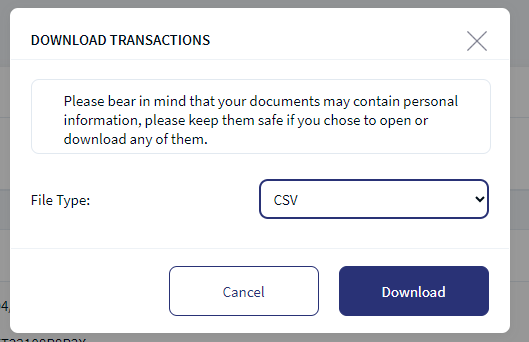

Transaction Download

If the user needs to download the single transaction in the pending or posted tab, the user must click the drop-down and download button. The statement is downloaded in the PDF format.

The user have an option to download the transactions for the selected account. The downloaded transaction contains the list of transactions fetched from backend based on the configuration. The user can download the transactions from Posted, Pending and Blocked Funds. The date format shown in the Account details screen can be configured in the Fabric app based on which the format can be changed between DD/MM/YYYY and MM/DD/YYYY.

The following table shows the transaction description and transaction type displayed under posted and pending tab.

Example: If the Savings account is selected, the application shows the Transfers, Deposits, Checks, and Withdrawals tabs.

| Account Type | Transaction Description | Transaction Type |

|---|---|---|

| Checking | Outgoing Fund Transfer | Transfers |

|

|

Incoming Fund Transfer | Deposits |

|

|

Check Deposit to Account | Deposits |

|

|

Check issued from the account | Checks |

|

|

Cash Withdrawal | Withdrawals |

|

|

Debit Card Transactions | Withdrawals |

|

|

Fees /Charges debit | Withdrawals |

|

|

Interest Deposited | Deposits |

|

|

Outgoing P2P | Transfers |

|

|

Incoming P2P | Deposits |

|

|

Bill Payment | Withdrawals |

|

|

Online Payments (Amazon, etc.) | Transfers |

| Savings | Outgoing Fund Transfer | Transfers |

|

|

Incoming Fund Transfer | Deposits |

|

|

Check Deposit to Account | Deposits |

|

|

Check issued from account | Checks |

|

|

Cash Withdrawal | Withdrawals |

|

|

Debit Card Transactions | Withdrawals |

|

|

Fees /Charges debit | Withdrawals |

|

|

Interest Deposited | Deposits |

|

|

Outgoing P2P | Transfers |

|

|

Incoming P2P | Deposits |

|

|

Bill Payment | Withdrawals |

|

|

Online Payments (Amazon, etc.) | Transfers |

| Credit Card | Debits | Purchases |

|

|

Credits | Payments |

| Deposits | Interest Added | Interest |

|

|

Amount Deposited | Deposits |

|

|

Amount Withdrawn | Withdrawals |

| Loans |

|

Loan Schedule |

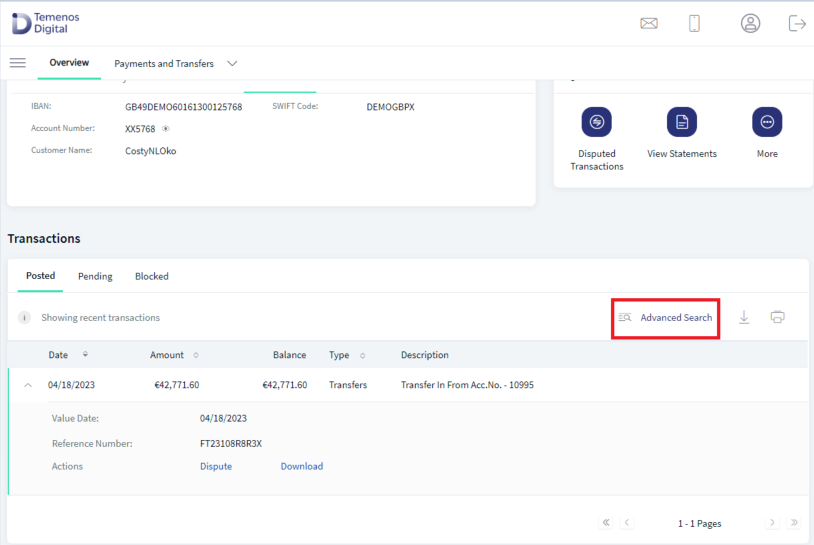

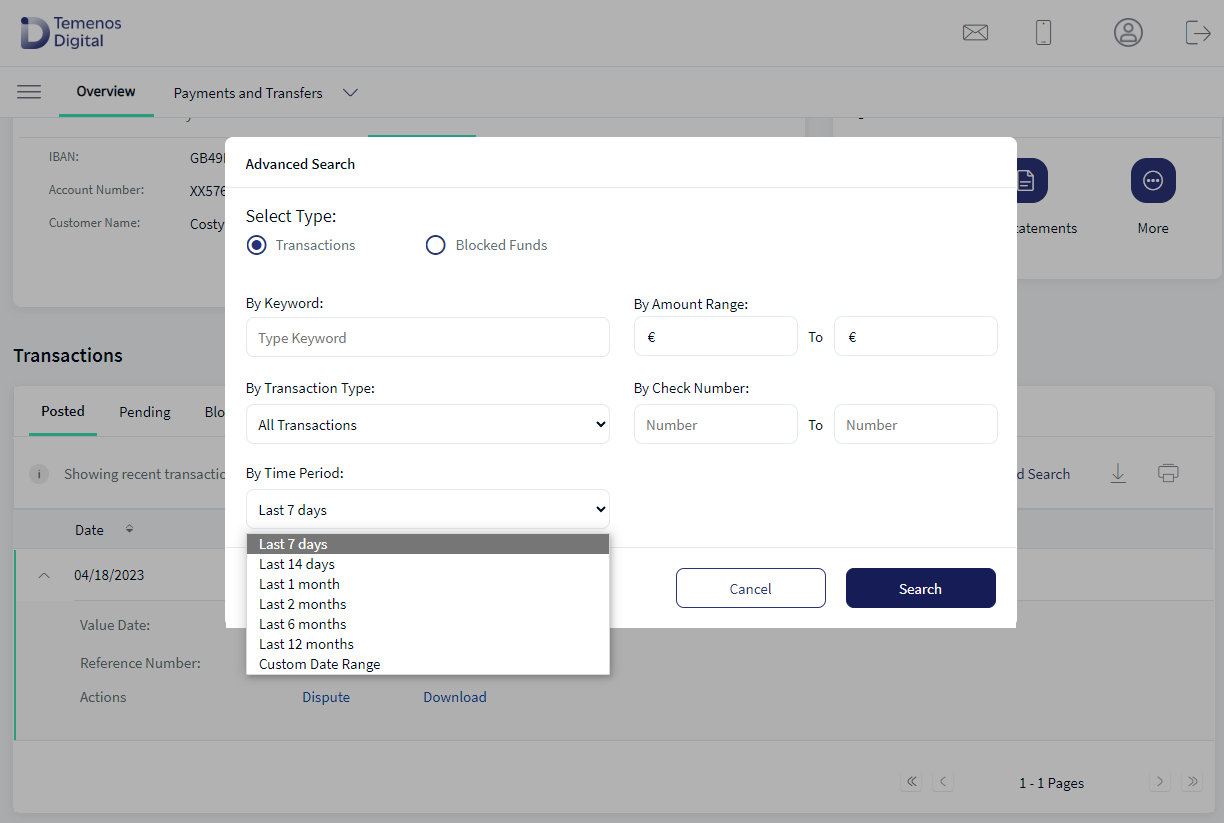

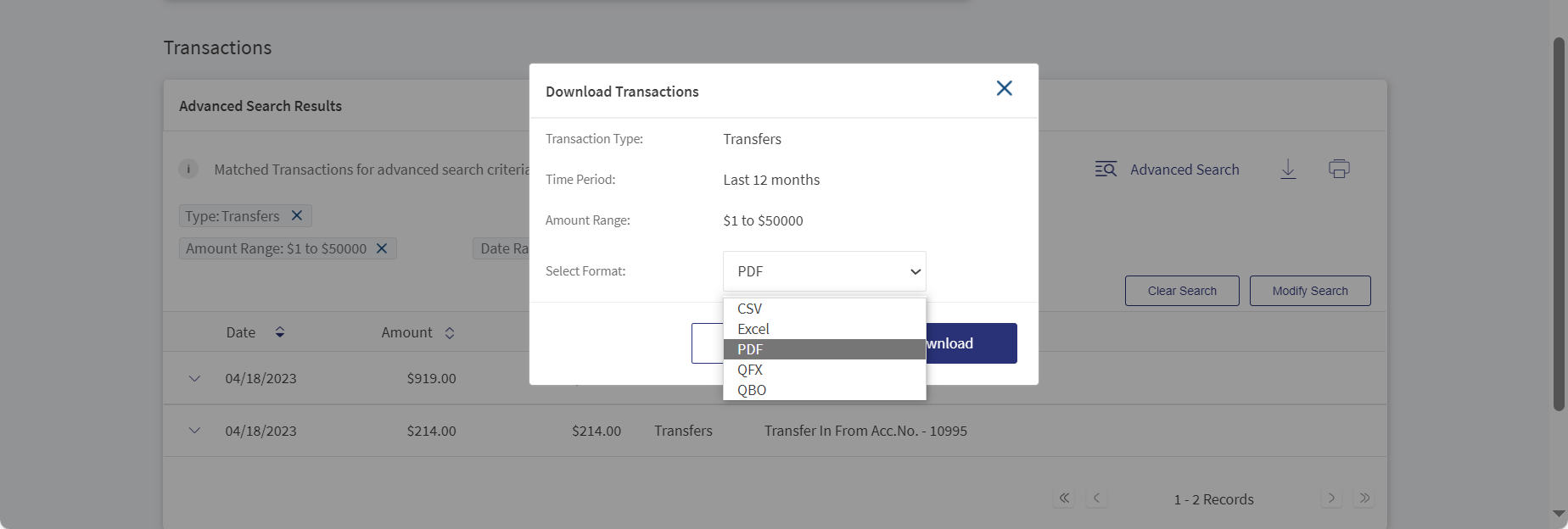

Advanced Search

User can do the following actions in the advanced search. User can perform advanced search for Transactions and Blocked funds.

- Click any of the tabs to view the corresponding transactions.

- Click the advanced search

icon to search and filter transactions.

icon to search and filter transactions. Advanced Search for Transactions

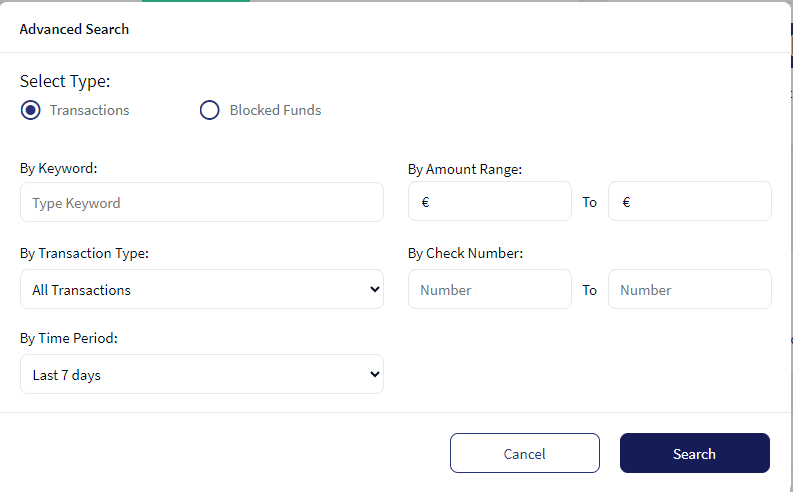

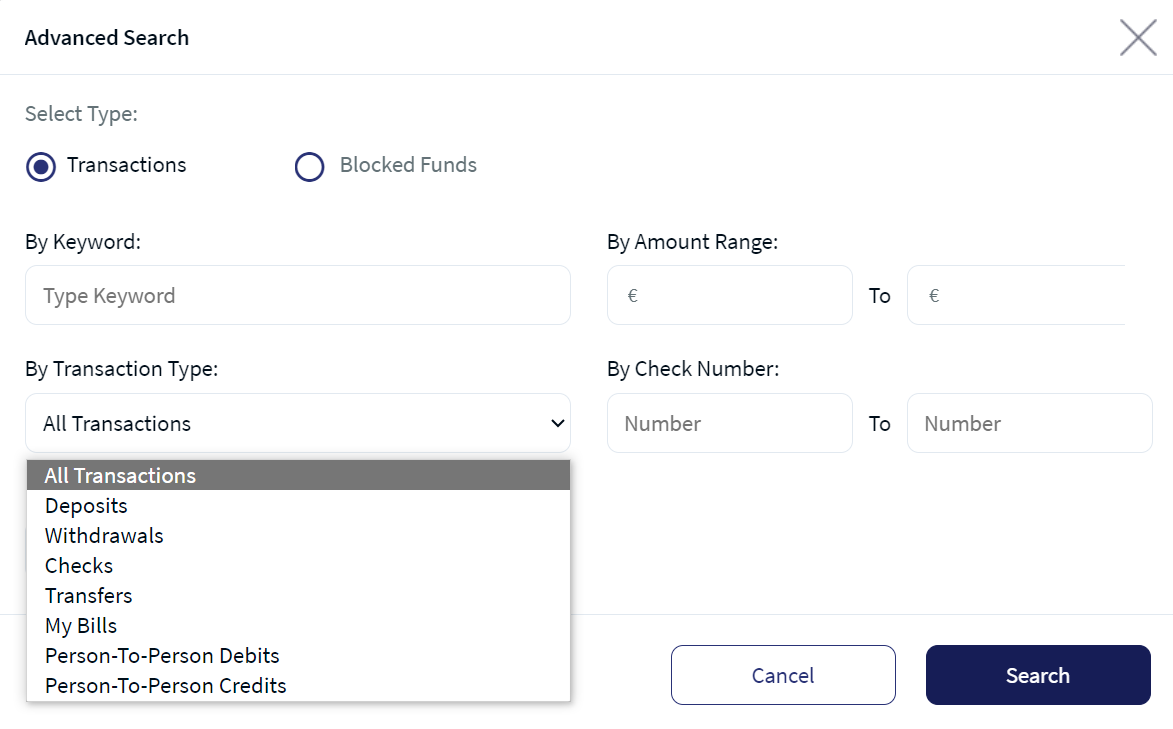

User have an option to perform an advance search in the transactions with the following parameters:

- Click on advanced search and enter the required inputs in the fields.

- By Keyword

- By Account range

- By Transaction Type (All Transactions, Mandatory field)

- By Check Number

- By Time Period such as: (Mandatory Field)

Last 7 days (Default)

Last 14 days

Last 1 month

Last 2 months

Last 6 months

Last 12 months

Custom Date Range (calender widget is displayed to select the date).

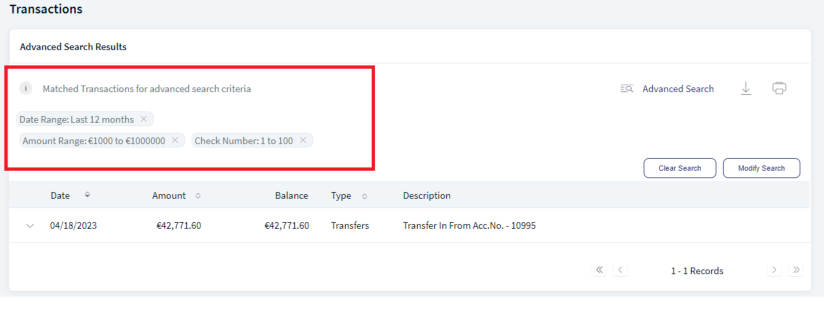

- Click on Search, the user will see the results on the screen based on pagination.

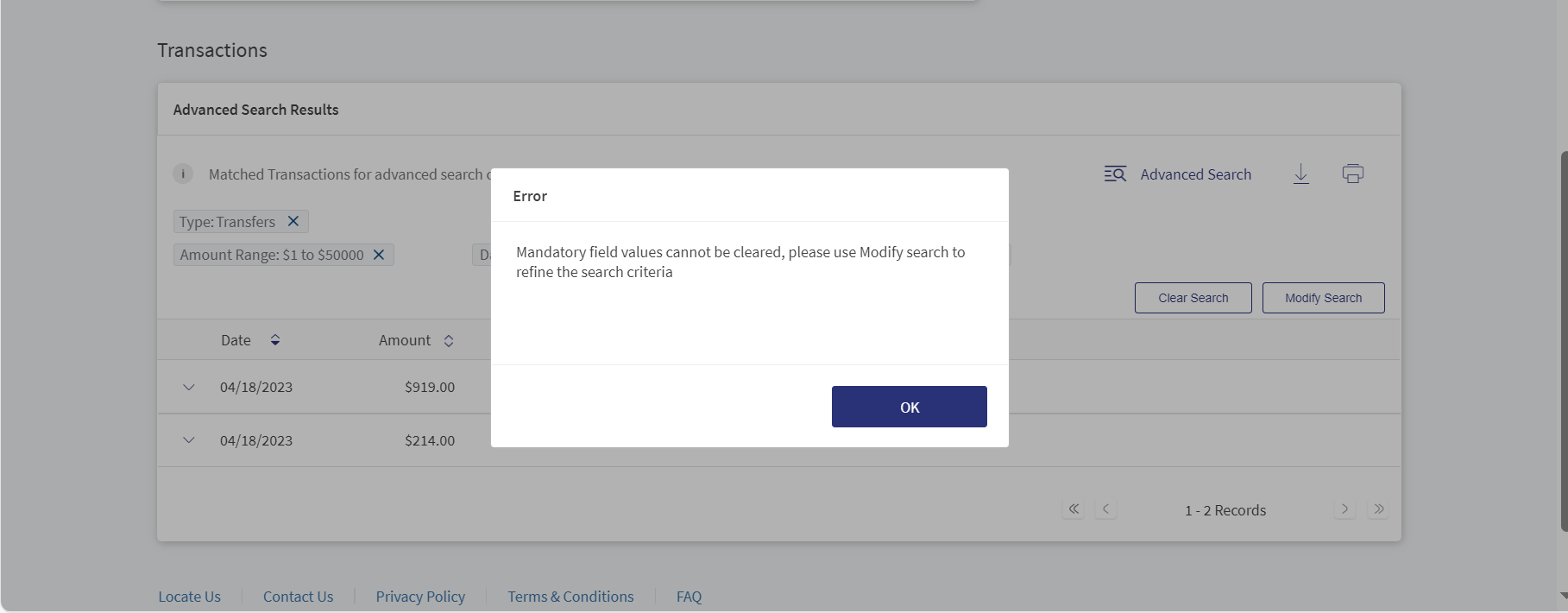

When the user performs an advanced search, the fields Transaction Type and Time Period are mandatory. After the search, if the user cancel these fields the application displays an error with the pop-up message Mandatory fields values cannot be cleared, please use Modify search to refine the search criteria.

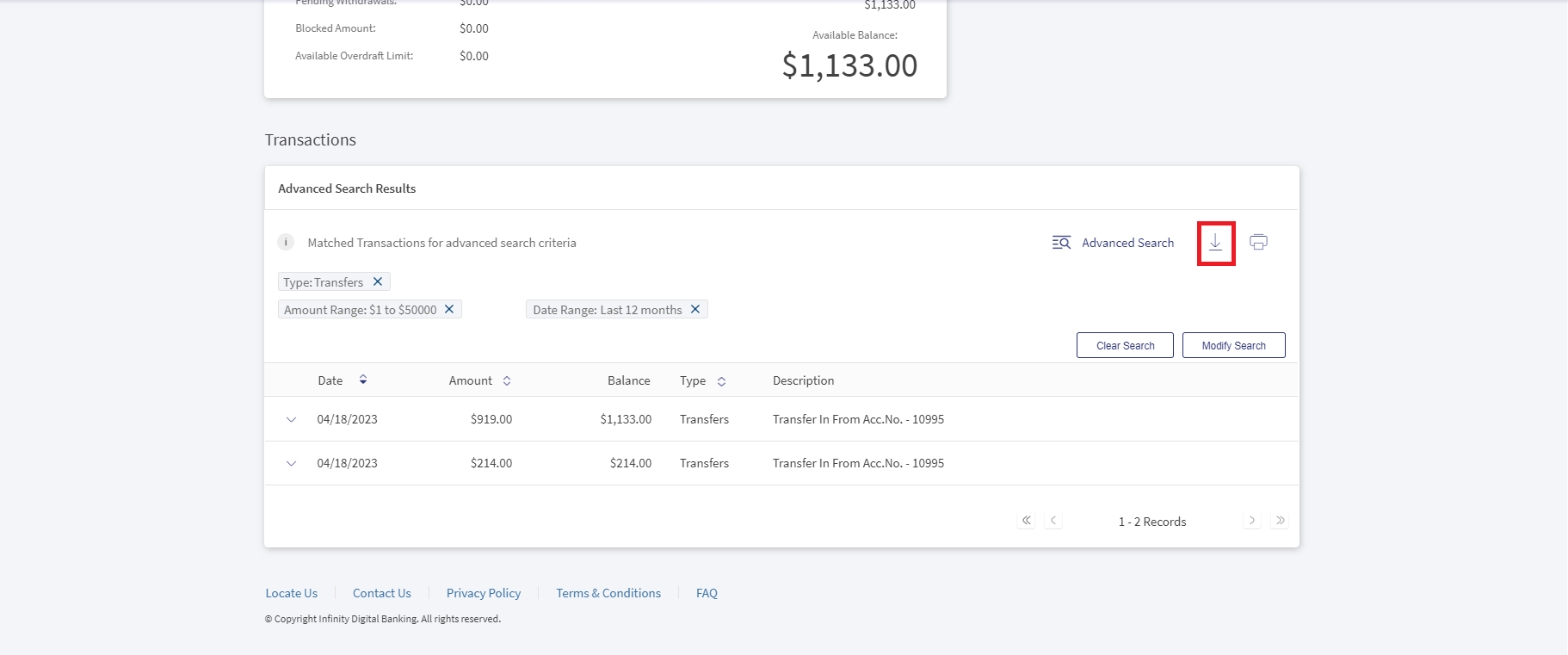

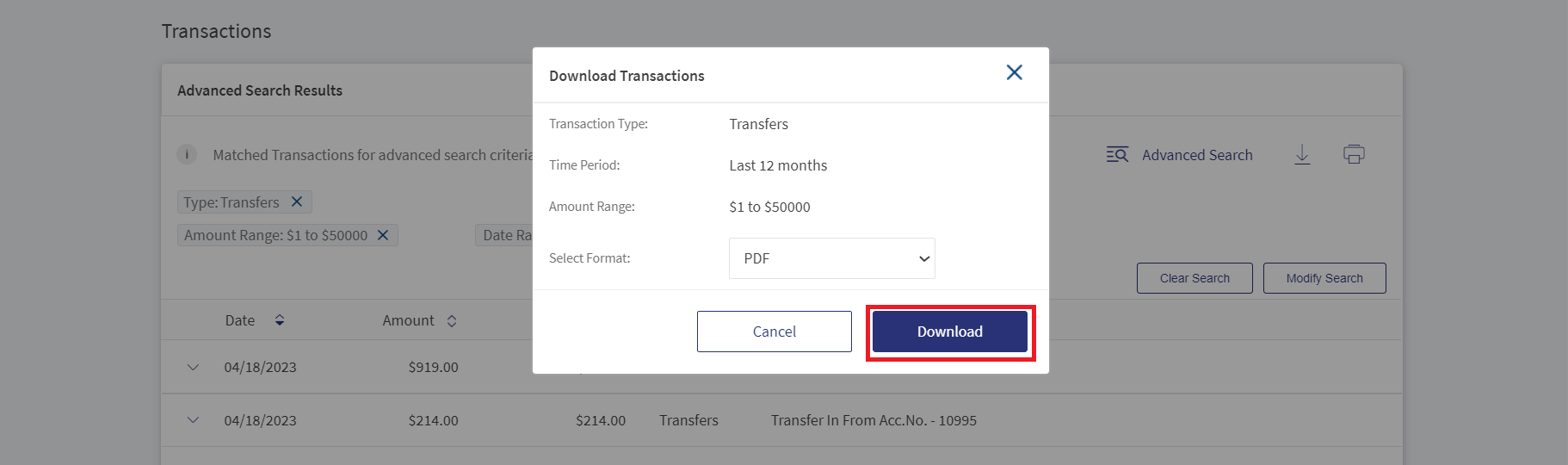

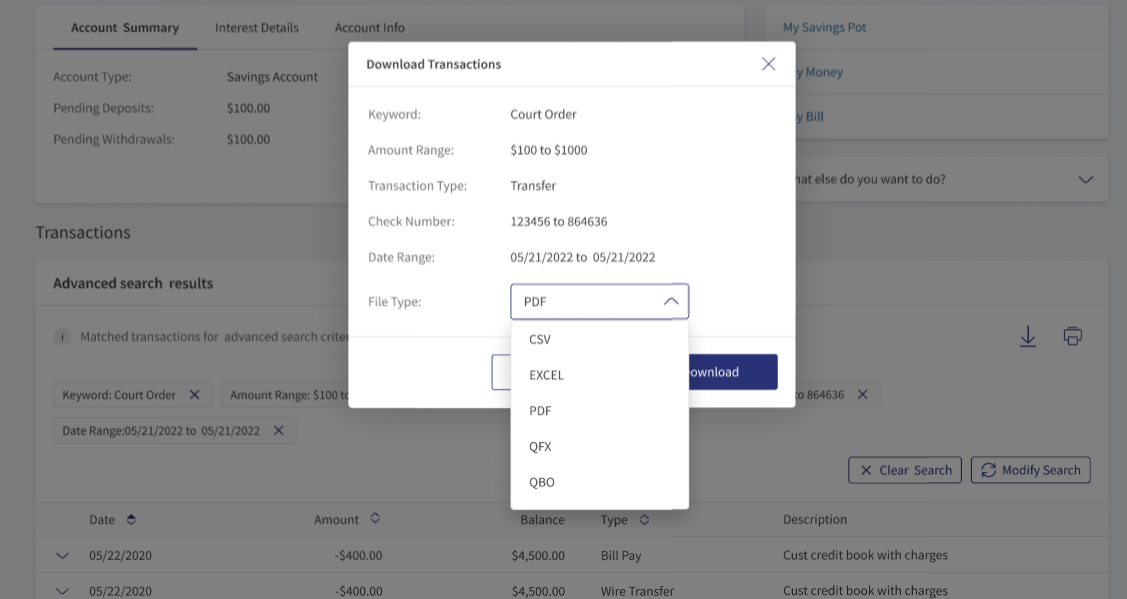

- Click download and select the required format.

- Excel

- CSV

- QFX

- QBO

- Click Download.

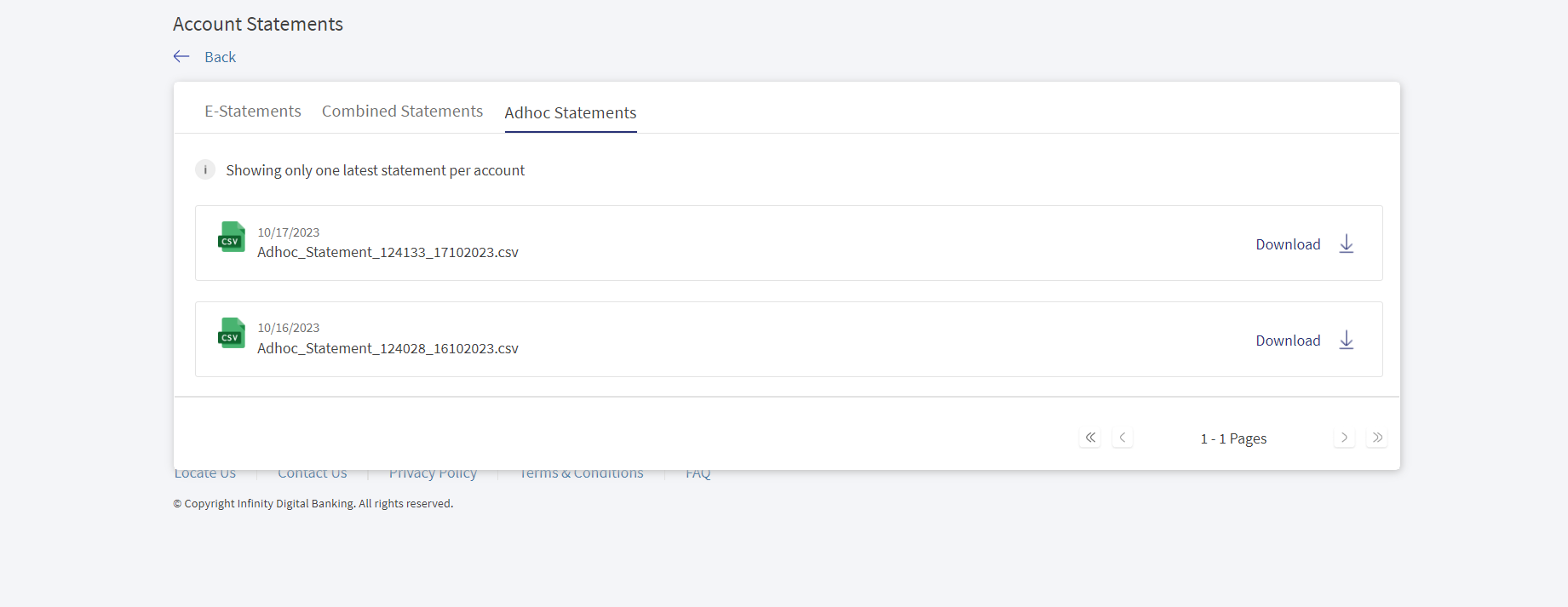

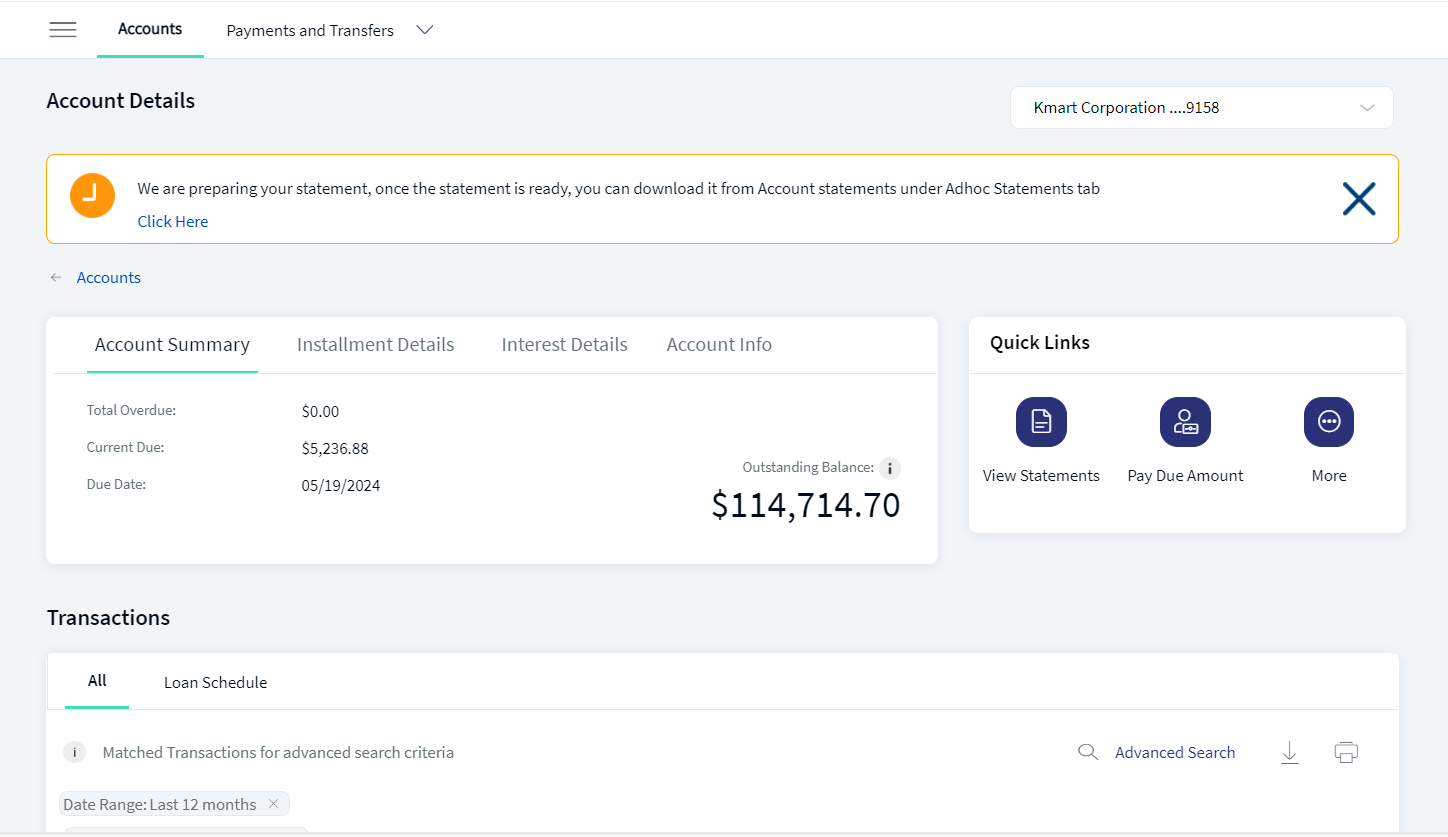

If the download time exceeds the configured time, the application displays a dialog box with a message. - When the user click on Click Here, the application navigates to the Adhoc Statement tab with the downloaded file. For more information see Adhoc Statements.

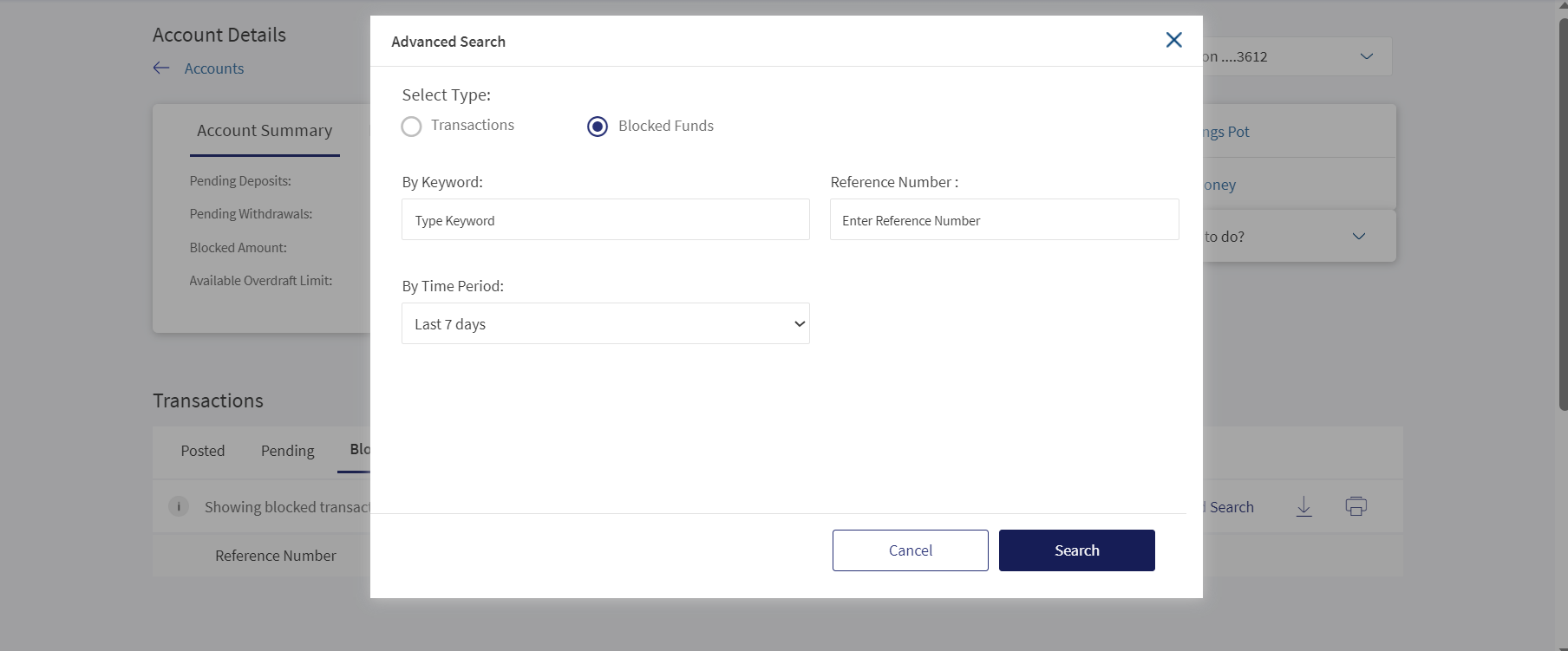

Advanced Search for Blocked Funds

User have an option to perform an advance search in the blocked funds with the following parameters:

- By Keyword

- By Reference Number

- By Time Period such as:

Last 7 days (Default)

Last 14 days

Last 1 month

Last 2 months

Last 6 months

Last 12 months

Custom Date Range (calender widget is displayed to select the date).

- Click on advanced search and enter the required inputs in the fields.

Print Account Transactions

Use the feature to view and print the entire transaction details of an account. This feature is available only in online banking application.

Menu path: Accounts > Select an account > Account details and transactions > Print

On the accounts details and transactions list screen, click the Print icon in the Transactions section.

The application displays the print preview screen. Specify the required details and click Print. The application prints the transaction activity of the entire account.

Advanced Search Download

User can download the statements from advanced search downloads. In advanced search download, the user can provide the required information to download the statement such as:

- Keyword

- Amount Range

- Transaction Type

- Check Number

- Date Range

- File Type

If the download time exceeds the configured time, the application displays a dialog box We are preparing your statement, once the statement is ready, you can download it from Account statements under Adhoc Statement tab Click Here.

From 23.09, the date selection in the Download pop-up screen has been removed. If the user need to download the statement of specific time period, the user need to use the Advance search option.

Loan Schedule

The transaction view for Loan Account types is categorized into two types.

- All (which lists every transaction posted to the Loan Account)

- Loan Schedule

The loan schedule tab displays the loan/amortization schedule that includes the previously paid installments, past overdue installments, summary of the future payments. The advantage of the loan schedule feature is to provide the customers a clear view on past as well as future payments for the loan account.

You can view the following from the Loan schedule feature:

- The list of previously paid installments on your loan account to keep a track of the paid payments towards the principal, interest, tax, or charges.

- The list of installments that are overdue on my loan account to keep a track of payments that need to be paid and avoid further charges. You can also check how much money needs to be paid towards the principal, interest, tax, or charges.

- Summary of installments paid in the past, overdue Installments, and the installments to be paid in future to get a clear view on the status of your loan account.

You will not be able to view the loan schedule if you do not have the permissions enabled at the account level. These permissions are configured in Spotlight.

Paid Installments. You can view the list of installments (with the count) that are paid against the selected loan account. The paid installments are displayed in the descending order of the payment date.

The following details are displayed in the Loan Schedule for paid installments.

- Payment Date

- Amount paid

- Principal amount paid

- Interest amount paid

- Outstanding Balance

Click the down arrow displayed beside each row to view the additional details of an installment. The following additional details are displayed:

- Charges paid

- Property tax paid (applicable only for mortgage accounts)

- Property insurance paid

- Actions- Pay Overdue (with link)

Error Messages: If there are no paid installments to be displayed, a message is displayed as "No payment schedule available for the selected account".

Overdue Installments: You can view the list of installments (with count) that are overdue on your loan account. The following details are displayed:

- Payment Due Date

- Installment amount to be paid

- Pending principal amount to be paid

- Interest amount to be paid

- Outstanding Balance

The list is sorted by date (most recent transaction on top) by default.

Click the down arrow displayed beside each row to view the additional details of an installment. The following additional details are displayed:

- Charges - pending amount to be paid towards the charges of the loan

- Tax - pending amount to be paid towards property tax (applicable only for mortgage accounts).

- Insurance - pending amount to be paid towards the property insurance (applicable only for mortgage accounts).

You can perform the following actions in this screen:

- Click the Print icon to print the loan schedule that is currently displayed on the screen.

- Click the Download icon to download or export the loan schedule to CSV or PDF format.

- Download the complete list of paid and overdue installments.

- Download only the Overdue, Paid or Future Installments separately or All of them together.

- Configure the number of rows to view at a time.

- Click the drop-down list displayed on the top right corner of the transactions list.

- Select 10, 25, 50, or 100 rows to be displayed at once.

- Easily navigate to first, next, previous, and next pages.

If there is only page, the option to navigate between pages is not displayed.

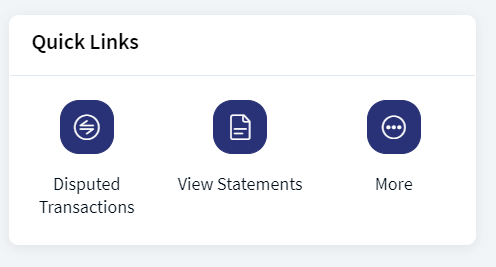

Quick Links

A one-stop section that contains logically grouped actions that you can perform from here. The actions change based on the selected account type. A few such actions are Disputed Transactions, View Statements, and More.

More

The list that contains actions that you can perform from this screen. The actions change based on the selected account type:

- Pay Money

- Cheque book request

- Update account settings

- Create Sweep

- Stop Check Requests

| Account Type | Available Quick Links | Available Other Actions |

|---|---|---|

| Savings |

|

|

| Checking |

|

|

| Credit Card |

|

|

| Deposit |

|

|

| Loan |

|

|

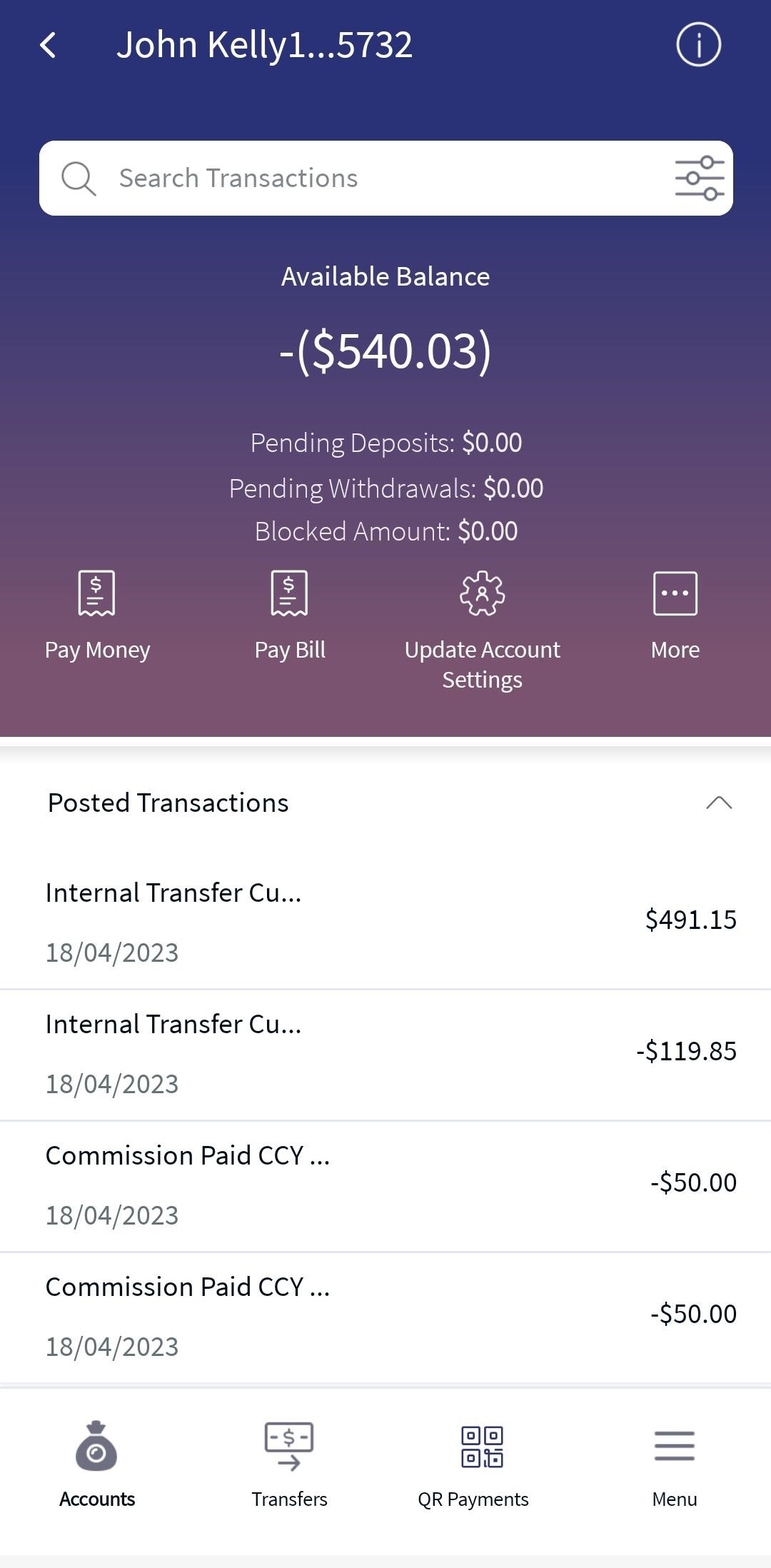

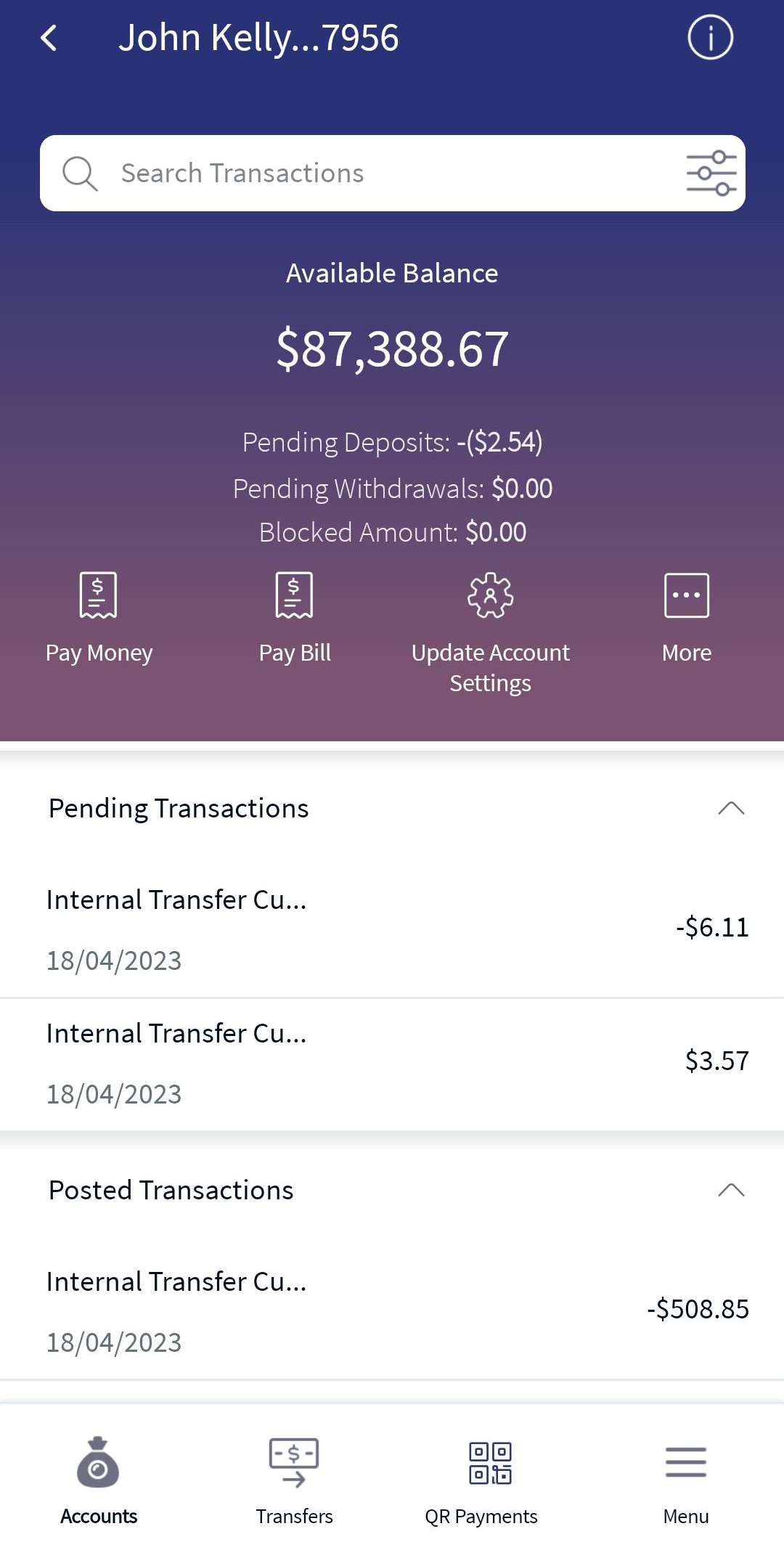

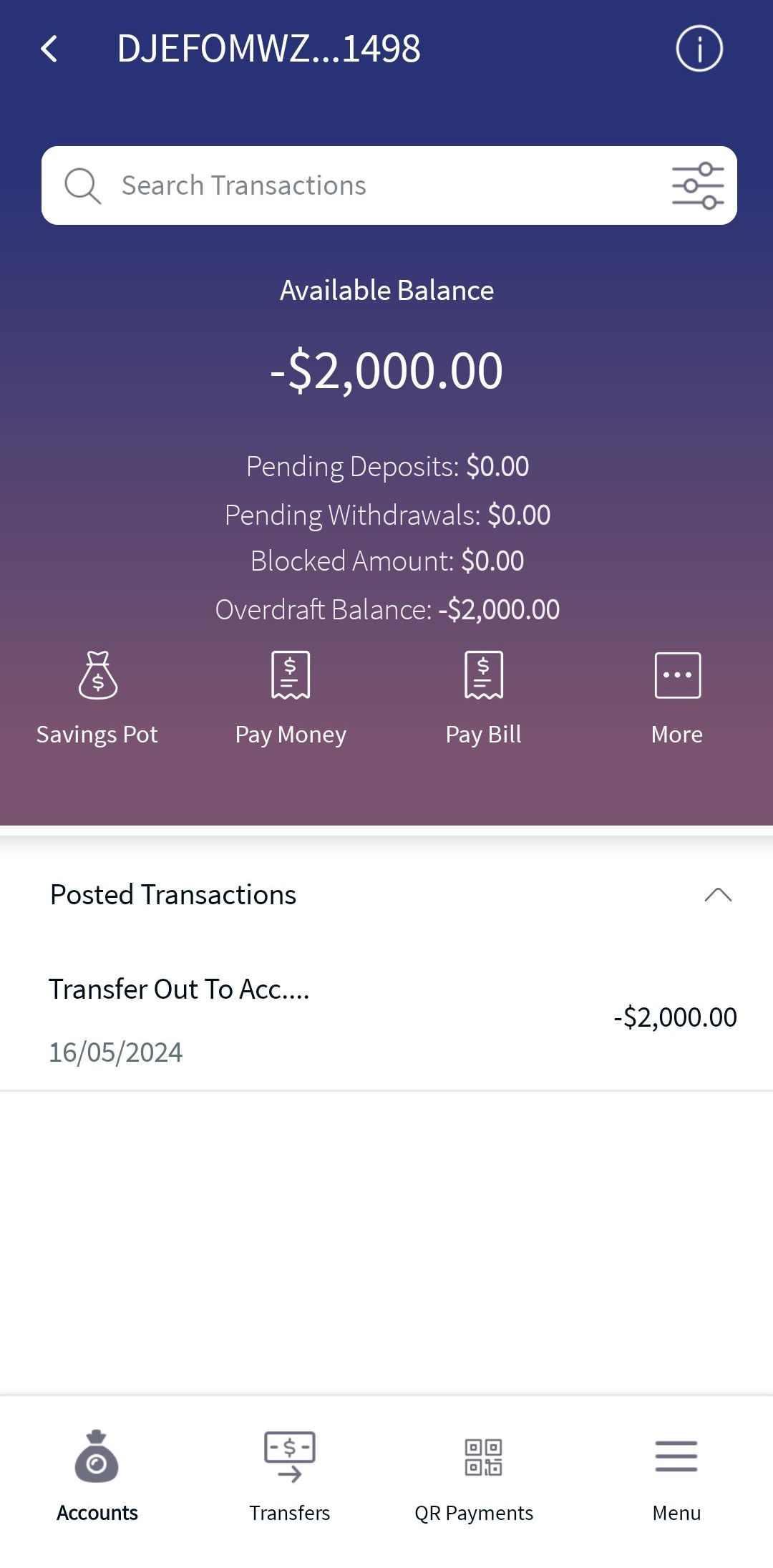

Mobile Native

Use the feature to view the account summary of the selected account. From the accounts dashboard screen, tap any account row (for example, Savings account) to view the summary details.

The summary screen displays the balances or relevant details of the selected account, based on the account type. The accounts are segregated by personal and business type at all relevant places in the application.

You can do the following in the account summary screen:

- Tap < to return to the accounts dashboard.

- Tap Search to search for transactions using filter criteria in the selected account.

- Tap

to view and edit the account details.

to view and edit the account details. - Tap the contextual menu to view the statements from the quick actions menu. The account statements are available for all account types (checking, savings, investment, credit card, and loan) except external accounts and does not have any restrictions in the product, but if a bank does not want to offer statements for a specific account type, the bank can do so by hiding the Statements button for that specific account type.

- Tap any recent or pending transaction row (record) to view the transaction details.

The summary screen displays the list of Recent and pending transactions in the selected account with date, transaction notes, and amount. The list is sorted by date (most recent transaction on top). Tap any row (transaction record) to view the transaction details.

You can call the bank if you have the necessary permission to do so. The permission is tied up at user level. The Contact Us in the account info tab is visible if permission is enabled.

Account Summary screens for various Account Types

Account Details

Use the feature to view in-depth information of the selected account. This page also provides options to contact the bank if you want to clarify any queries.

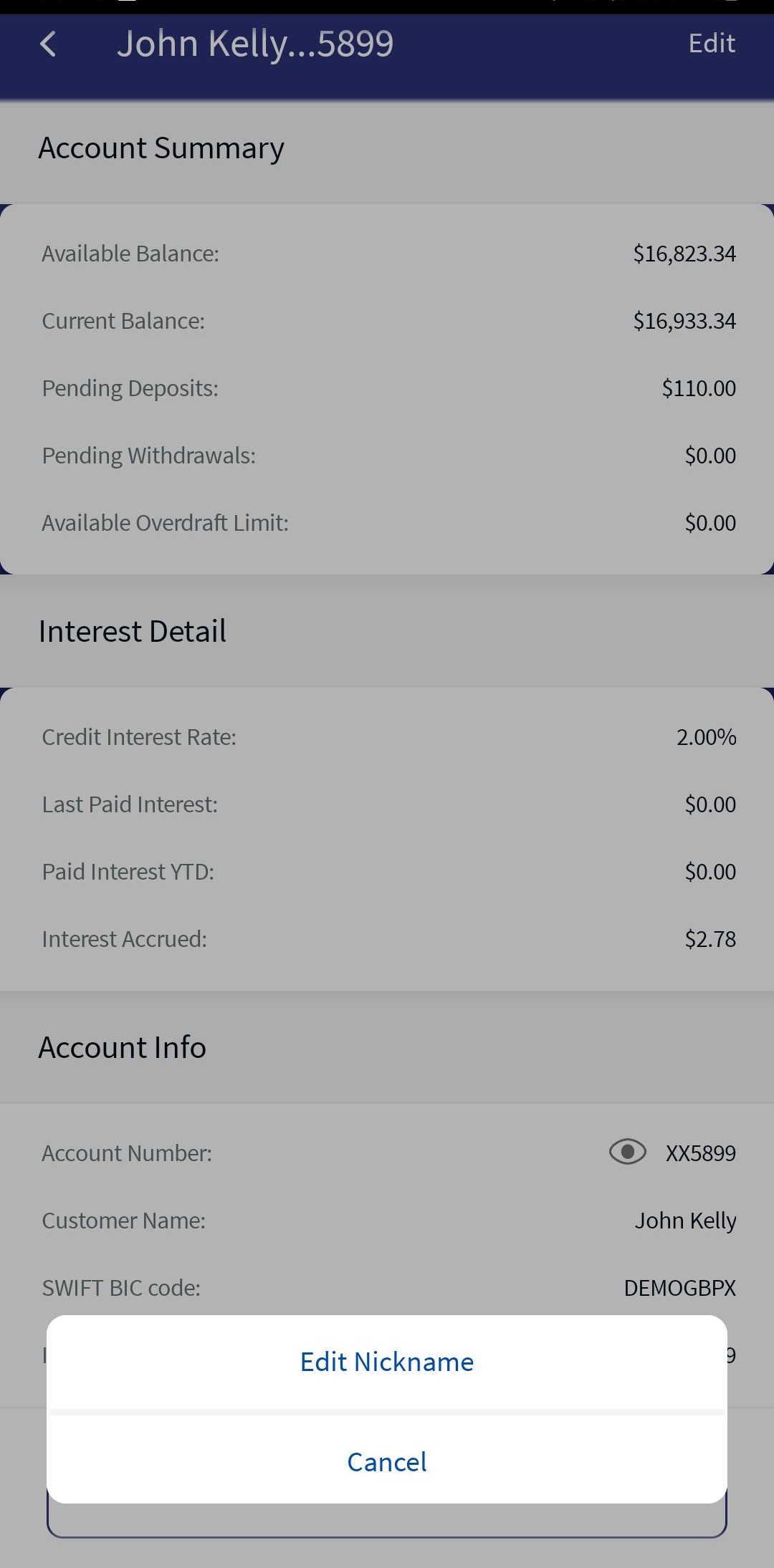

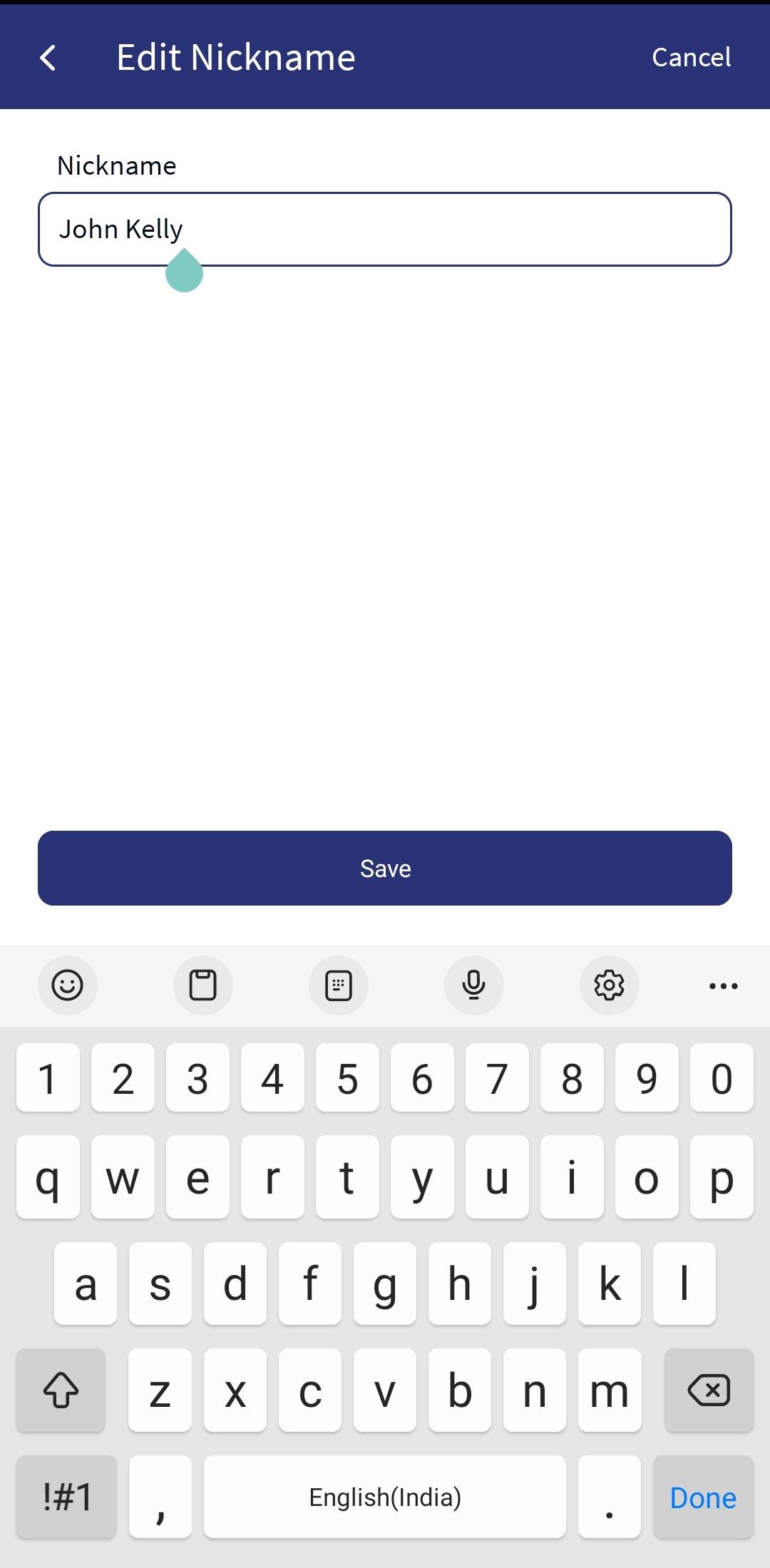

You can change the nickname to be used to identify the account. You can do the following:

- Tap Edit, and select Edit Nickname.

- Edit the nickname and Tap Save. The change will be reflected across all devices wherever the account name is displayed.

Tap < to return to the account summary.

Account Details

Edit Nick name

Recent Transactions

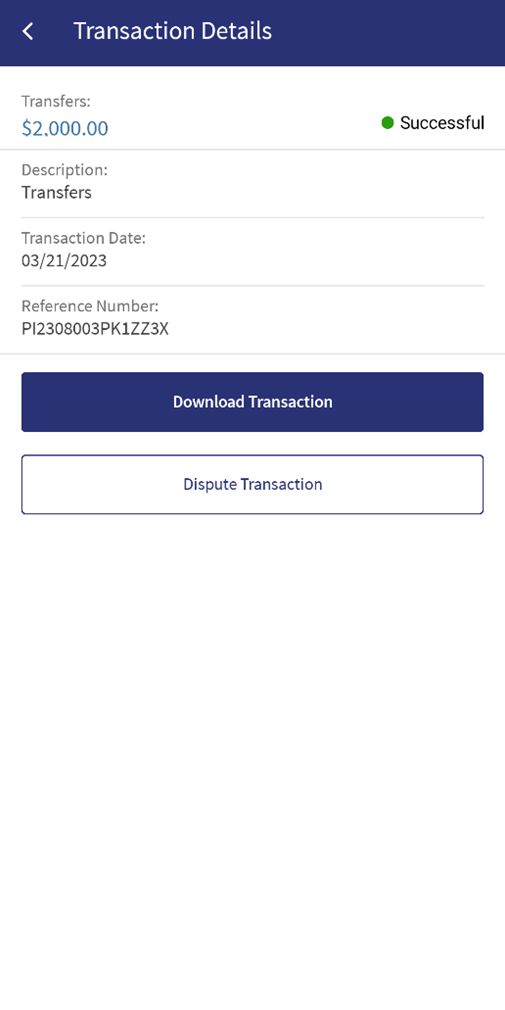

View the details, such as the transaction amount, transaction description, transaction date, reference number and type of transaction.

For transactions where a check is involved (check deposit or check issued to a beneficiary), the app displays the check images in the Transaction Details screen. Tap the respective check images (front and back) as part of the transaction.

You can perform the following actions on this screen:

- Download Transaction. Tap the button to download the transaction. The transaction report is downloaded in PDF format, by default.

- Dispute Transaction. Tap the button to dispute the transaction.

- Tap the back button to navigate to the previous screen.

Blocked Funds

The blocked amount refers to the funds that are blocked by the government or external organizations in the customer's account. This amount cannot be accessed by the customer. The blocked amount can be lifted only by the external organization which placed it. The customer can only view the blocked amount.

The user sees a pop-up message warning that the session is about to expire before the application logs out. This is applicable to web channel and mobile native. The user can then choose to either sign out or extend the session.

Configuration

Permissions

- The visibility of each feature is controlled through the permissions defined for the user. The permission are defined in the Spotlight application.

- The elements on the screen depends on the user account type and the permissions to access features and perform associated actions.

- The capability to revoke or restore the features is available in the Spotlight application.

Integration with Transact using IRIS APIs

The following are integrated with Transact using IRIS APIs to pull and display the information:

- Account Summary tab: To pull and display the details of a selected account (includes Savings, Checking, Loans, and Deposits) to which the authorized user has access.

- Interest Detail tab: To pull and display the details of a selected account (includes Savings, Checking, Loans, and Deposits) to which the authorized user has access.

- Account Info tab: To pull and display the details of a s elected account (includes Savings, Checking, Loans, and Deposits) to which the authorized user has access.

- Transaction Details: To display the list of posted and pending transactions of a selected account to which the authorized user has access.

- Pending Transactions: To display the upcoming, scheduled, and recurring transactions of accounts to which the authorized user has access and updating the modified date in Transact for business and combined users.

Backend Integration - Transact/MS/Mock

Using the runtime configurable parameter (Arrangements_Backend server property) at the Micro App level, an implementation team can configure the backend integration endpoint as HMS/AMS/SRMS, Transact, or Mock as per customer needs for the following. The Arrangement Fabric MA supports the integration.

- The backend integration for all the APIs is mocked (DBX DB) or SRMS based on customer needs.

- The validations are avoided if the module is directly integrated with Transact endpoints.

- When records are created, use these options: Use the DBX DB table records that already exist, or use the Fabric Java layer to build a stubbed or JSON data response directly.

Follow these steps:

- Sign-in to your Fabric console.

- From the left pane, select Environments.

- For your Fabric run-time environment, click App Services.

- Navigate to Settings > Configurable Parameters.

- On the Server Properties tab, go to

Arrangements_BackendField Name and set the Field Value depending on the integration (for example,Possible Values for Arrangments_Backend : MOCK, t24, MS).If Arrangments_Backend is set to MS, the Pending Transactions will return from transact.

- Click Save.

| Modules | Integration |

|---|---|

|

SRMS or Mock (DBX DB) |

| Pre-login accounts preview (Native) | Mock, AMS and HMS, or Direct Transact integration |

| Cheque Management | Transact via SRMS |

| Account Setting | Transact via SRMS |

| Service Request History | SRMS |

| Dispute Transaction | Mock (DBX DB) via SRMS |

| Remote Deposit Capture | Mock (DBX DB) |

| Cardless Cash Withdrawal | Mock (DBX DB) |

| Bill Pay Registration | Mock (DBX DB) |

| Person to Person Registration | Mock (DBX DB) |

System Configurations

System configuration (Bundle-: DBP) is available in the Spotlight application to define the number of transactions(Posted, Pending, and Blocked funds) fetched from the backend and determine the number of transactions to be listed per page.

Transaction Per Page

Transaction per page defines the number of transactions to be listed per page. This configuration is applied when the user views the Recent Transactions and Advance search results.

Pending Transaction

This defines the number of pending transactions to be fetched from the backend system. This configuration is applied when the user views the Recent Transactions.

The configuration for the number of pending transactions is fetched from the backend system when the user view the recent transactions.

If the system configuration is set has 30, and transactions per page is set as 15, the user can see 15 records on page 1 and other 15 transactions on page 2.

- If the user has no pending transactions, it shows no transaction found.

- If the user has 25 records, the user can see 15 records on page 1, and 10 records on page 2.

Posted Transactions

The configuration for the number of posted transactions and advance search is fetched from the backend system when the user view the recent transactions. However, in advance search, paginated calls, number of transactions, and other information is fetched as per the configuration for the defined time period.

If the system configuration is set has 30, and transactions per page is set has 15, the user can see 15 transactions on page 1 and other 15 transactions on page 2.

- If the user has no posted transactions, it shows no transaction found.

- If the user has 25 records, the user can see 15 records on page 1, and 10 records on page 2.

API

For the complete list of APIs shipped as part of this feature, see Experience APIs documentation.

In this topic