SME Banking Overview

Temenos Digital SME Banking is used to meet the needs of business owners of small and medium business establishments with a set of features that allow for efficient management of business finances across any device. The Temenos Digital Retail Banking and Temenos Digital SME Banking are now combined into a single code-base such that it can be deployed as a common online banking application and mobile banking application for Retail and Business customers to perform their banking activities.

Introduction

The Temenos Digital banking application is an amalgamation of retail banking and business banking modules available as a single code base. This is a common banking application (Responsive Web and Mobile channels) for Retail and Business Banking customers to perform their banking activities. The banking services are available within the application based on the type of customer signed in into the application. The combined application can also be deployed separately as standalone retail and business banking applications.

All valid users with active login credentials can sign in to the single banking application. The eligibility to sign in to the application depends on the permissions assigned to the user.

Based on the contract architecture, a user can fall into the following categories.

- User having access to only one Customer ID which could be business or retail can see all own accounts on the dashboard.

- User having access to own personal accounts and multiple Customer ID can see own personal, business, and retail accounts distinctly on the dashboard.

- User having access to multiple Customer IDs can see the accounts grouped by customer name/ID and whether they belong to retail or business IDs distinctly on the dashboard.

Every module is fashioned as a feature and every feature is associated with a set of actions. The actions associated with each feature is visible to users based on the assigned permissions. The entitlements or permissions relate to the features and their corresponding actions. When a user signs in to the application, the elements on the screens (features and actions) vary from user- to-user depending on the permissions defined to access the features and corresponding actions.

The Spotlight service center enables the bank to support the businesses:

- Business creation (company)

- Business user creation and management

- Business banking roles creation and management.

For information on the Revision History of this guide, click here.

Reference Documents and Library

Quick links to associated documentation:

- Retail Banking documentation

- Spotlight documentation

- Release Notes

- Installation Guide

- API documentation

- Microservices documentation

- Components documentation

Documentation Library: To learn more about Temenos Digital documentation, read the base camp article (click here) that provides the user a walk-through of the Temenos Digital documentation through a voice-over video and instructional content.

Release and Installation Information

For release notes and information on installing the Temenos Digital suite of applications, see the release and installation guide.

- Release notes

- Prerequisites - Software, Network, Security, and Storage

- Download software assets

- Temenos Digital platform installation - On-premise and Stack-based

- Temenos Digital developer environment installation

Experience APIs

In Temenos Digital architecture, the Experience APIs are exposed from Quantum Fabric to the users and are consumed by Quantum Visualizer and used in any self-service customer application. The Experience APIs are a gateway to access the Temenos Digital resources and retrieve data. As the name suggests, the Experience APIs determine the experience of third-party developers when they interact with Temenos Digital systems.

Using the Virtual Data Object model in Fabric, the Experience APIs can be mapped to different underlying implementations. Out of the box, the Experience APIs are configured to communicate with the Distribution Services and their respective API implementations (the Enterprise APIs).

See Experience APIs documentation for more information.

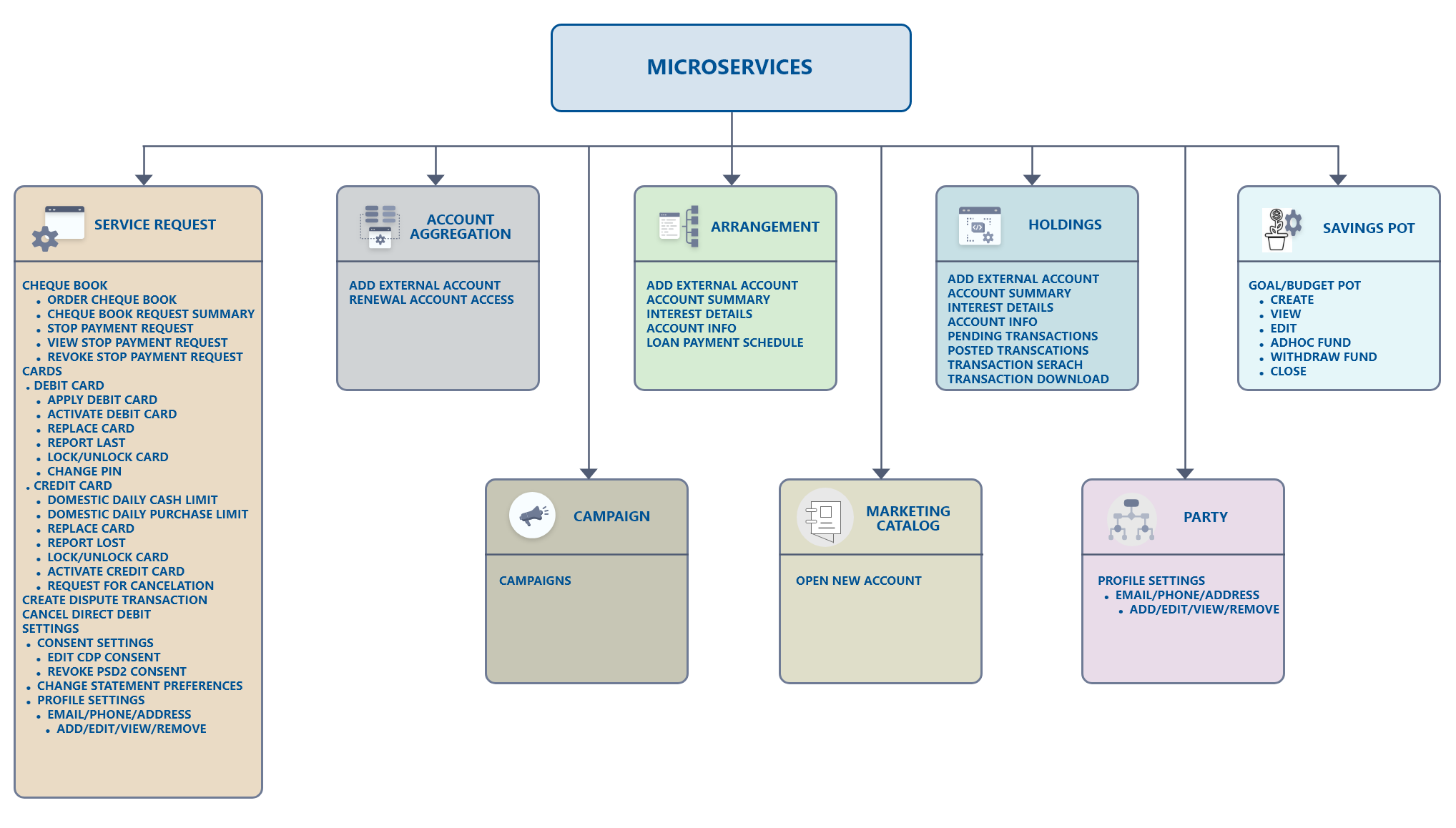

Microservices

Microservices is an architectural style that structures an application as a collection of small autonomous services, modeled around a business domain. Each service is self-contained and implements a single business capability. Microservices can be reused in more than one different process or over different business channels. These services exist as independent artifacts, that can be scaled without any dependence on other microservices.

The diagram displays the list of microservices tagged feature-wise in the banking application. See Microservices documentation for more information.

Temenos Digital Components

Temenos Digital consists of a wide range of Fintech apps that provide customers with a single experience platform using open APIs and extensible architecture. The apps are customized for the clients based on their business requirements. While the apps can be customized rapidly, Temenos Digital keeps looking for ways to improve the ship-to-market timelines by using components.

See Components documentation for more information on components and how to use them.

In this topic