Document Checklist for Bridge Loan

The Documents section consists of the document checklist for Bridge loan which an existing customer or prospect uploads as evidence in the Origination App. The documents collected in Origination application is stored in the respective document section in Temenos Digital Assist. The document list varies depending on Journey type and the product selected.

UX Overview

This section provides an overview of the documents required for Bridge Loan processing.

Bridge Loan Document Checklist

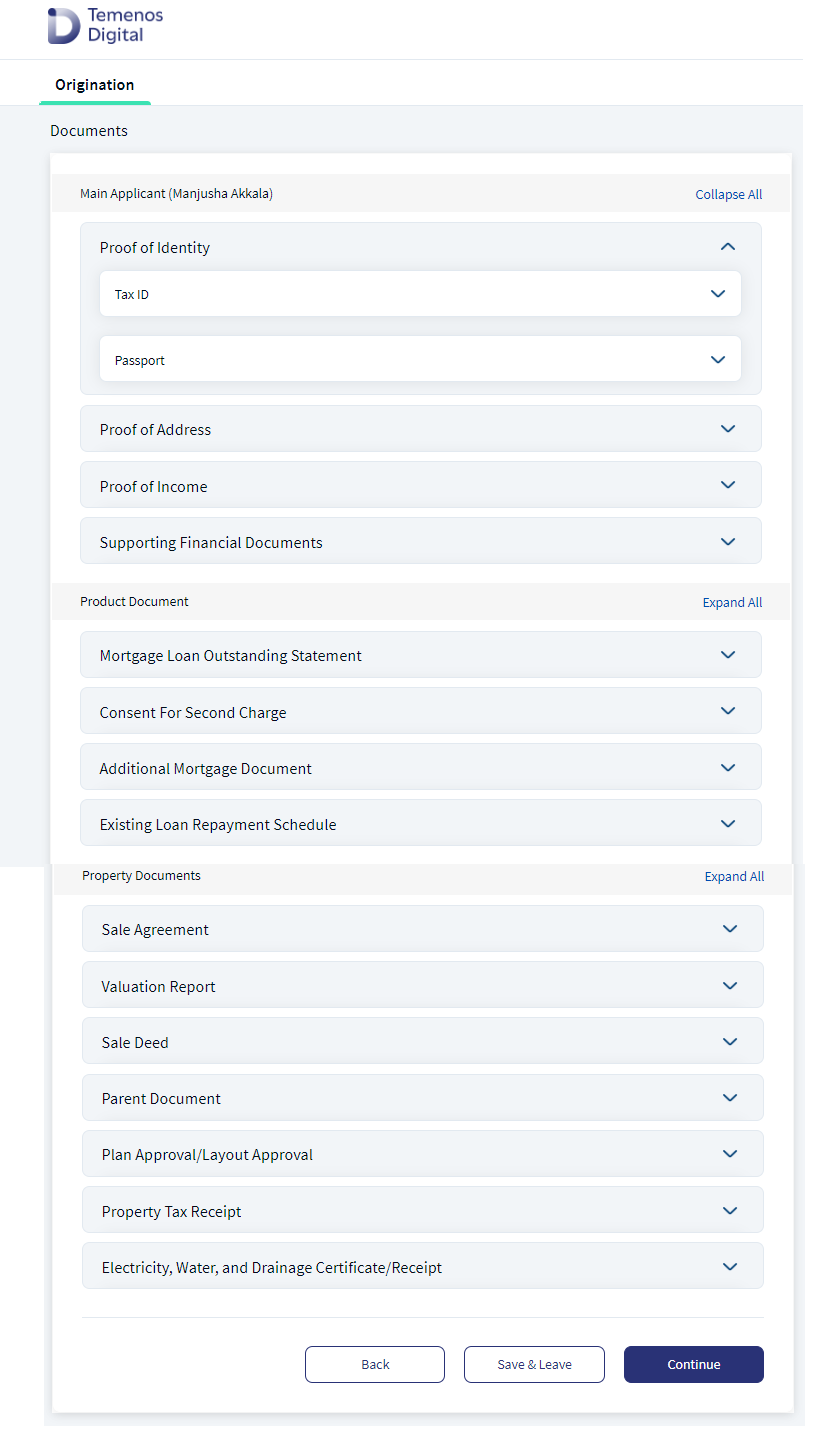

On the Sign In section of the Origination App, Useful Information section displays to the right side of the screen. Click Check documents to carry and the document checklist for Bridge Loan displays on the screen. Document checklist displays the following documents required for Bridge Loan: Proof of Identity, Proof of Address, Proof of Income, Supporting Financial documents , Product Document and Property Document and sub-sections display under each category of the document.

Bank user has the capability to configure the details which display in the Document checklist for Bridge loan in the sign-in page, so that each bank can choose to modify the Bridge Loan document checklist as required.

The configuration is separate for each document checklist for the following journeys: Mortgage, Remortgage, and Bridge Loan.

For Bridge Loan journey, the document section contains the following sub-sections:

- Main Applicant

- Co-Applicant (if applicable)

- Product Document (Optional)

- Property Documents (Optional)

- Proof of Identity

- Tax ID ( mandatory) : A document as proof of unique tax identification number.

- The document type such as Passport and Driving License is pre-selected depending on the identity type previously chosen in the Address & Identification Details section.

- Driving License

- Passport

- Employee ID

- Photo ID card issued by Local Government

2. Proof of Address : Proof of Address contains a drop-down list of the various documents supported as proof of Address (Any one document from below is Mandatory). If the selected document is already uploaded as a part of Proof of Identity, primary applicant can select the check box below the Document Type field indicating the document uploaded under the previous category (Proof of ID) will suffice for this category (Proof of Address) as well.

- Driving License

- Passport

- Utility Bills

- Employer/HR letter

- House Rent Contract

3. Proof of Income: The documents under this section vary based on the employment type

- For Status (Employment Status) - Salaried (Full Time Employee, Part Time Employee, Contract Employee, Casual Employee)

- Pay-slips(mandatory)

- Salary Account statement ( optional)

b. For Status (Employment Status) - Non-Salaried (Self-Employed, Retired, Unemployed, Trainee)

- Tax Return Statements(mandatory)

- Account Statements ( optional)

4. Supporting financial documents(Optional)

- Bank statements

- Credit card statement

- Proof of deposit

- Proof of Assets

- Car finance agreement

- Loan statements held with third parties

5. Product Document: Bridge Loan: (All the below mentioned documents are optional)

- Mortgage Loan Outstanding Statement

- Consent for Second Charge

- Additional Mortgage Document

- Existing loan Repayment Schedule

6. Property Document : (All the below mentioned documents are optional)

- Sale Agreement

- Sale Deed

- Parent Document

- Plan Approval/Layout Approval

- Property Tax Receipt

- Electricity, Water and Drainage Certificate/Receipt

Evidence MS Consumption

Evidence MS Consumption is applicable for Bridge Loan. Evidence MS Consumption is designed to resolve the rule-based requirements for evidence submission, evidence fulfilment and evidence reuse capability by the Origination and Assist app.

- If the evidence which the applicant submitted is valid, Origination App prompts that the documents uploaded is valid and documents need not be uploaded again.

- If the applicant does not choose to re-use the same evidence for the current application, applicant must submit fresh evidence towards the same requirement.

- If the applicant chooses to upload a new evidence, the old evidence is marked as rejected after the applicant deletes and uploads a new file. Once the applicant uploads a new evidence, the selection cannot be changed as the old evidence has been rejected already.

- If the evidence submitted earlier by the logged in applicant is not valid, a notification displays as Document(s) provided earlier are not valid for use. Kindly upload new document(s). To know more about Evidence MS Consumption, click here.

When an applicant selects Bridge loan and navigates to the Document section, then the document checklist displays based on the journey selected and application data must be a DMN configuration in PAM. System Administrator has the capability to define document checklist specific for each journey and also based on the application data. These DMN rules are configurable as each Bank has its own DMN rules for their journeys.

Table 1: Document Category & Documents for Bridge Loan.

System Administrator has capability to categorize the documents in the checklist required, so that each document belongs to a specific category. When the applicant is in Bridge Loan Origination journey and moves to the document checklist section, only the list of documents specific to Bridge Loan display in the document section given below in Table 1.

The following table lists the document categories and documents defined for in the retail user journey as part of the Out of the Box (OOTB) configuration.

| S.No | Document Category | Document Type |

|---|---|---|

|

|

Proof of Identity |

Apart from Tax ID, any one document from below is Mandatory.

|

|

2. |

Proof of Address |

Any one document from below is Mandatory.

|

| 3. | Proof of Income |

|

| 4. | Supporting Financial Documents |

All the mentioned documents are optional.

|

| 5. | Product Documents |

All the mentioned documents are optional.

|

| 6. | Property Documents |

All the mentioned documents are optional.

|

|

7. |

Agreement Documents (Agreement documents applicable only post submission flow) |

|

The below Document Category is introduced in Origination Document Checklist DMN for all Lending journeys:

| Rule | Checklist additions |

|---|---|

| Retail Lending journeys |

|

Mandatory and non mandatory Classification in DMN Rules in Origination :

- System administrator must classify the documents as mandatory and non-mandatory documents for each journey type.

- The Document Checklist available in the PAM is controlled by the DMN rule for Mandatory and Non Mandatory classification.

- The mandatory and non-mandatory classification is not configured in the MS, as one document which is mandatory for one journey can be optional for another journey.

Table 2 - Bridge Loan : DMN Rules and Document Checklist

| DMN Rules | Document Checklist |

|---|---|

|

Bridge Loan DMN Rule 1 Journey Type: Retail Entity Type: Individual Purpose: Bridge Loan |

Document Checklist 1

|

Table 3: Generic Document Checklist for Bridge Loan

| Document Checklist for Bridge Loan |

|---|

|

| a. Tax ID ( mandatory) |

| b. The ID which is entered under ID section to be pre populated (Any one document from below is Mandatory) |

| i. Driving License |

| ii. Passport |

| iii. Employee ID |

| iv. Photo ID card issued by Local Government |

|

2. Proof of Address : (Any one document from below is Mandatory) |

| a. Driving License |

| b. Passport |

| c. Utility Bills |

| d. Employer/HR letter |

| e. House Rent Contract |

| 3. Proof of Income : |

| a. For Status (Employment Status) - Salaried (Full Time Employee, Part Time Employee, Contract Employee, Casual Employee) |

| i. Pay-slips(mandatory) |

| ii. Salary Account statement ( optional) |

| b. For Status (Employment Status) - Non-Salaried (Self-Employed, Retired, Unemployed, Trainee) |

| i. Tax Return Statements(mandatory) |

| ii. Account Statements ( optional) |

| 4. Supporting Financial Documents : (All are optional) |

| a. Bank Statements |

| b. Proof of Deposit |

| c. Proof of Assets |

|

d. Car Finance Agreement |

|

e. Loan statements held with third parties |

| 5. Property Document : (Add below documents if available) |

| a. Sale Deed |

| b. Parent Document |

| c. Plan Approval/Layout Approval |

| d. Property Tax Receipt |

| e. Electricity, Water and Drainage Certificate/Receipt |

|

6. Product Document : Bridge Loan |

|

a. Mortgage Loan Outstanding Statement |

|

b. Additional Mortgage Document |

|

c. Existing Loan: Repayment Schedule |

| Note : Proof of ID, Proof of Address and Proof of Income mentioned above is required for all applicant (Main applicant and co-applicants). |

CRUD Operations of Documents:

Upload documents: To upload a document, click on Add Documents to add/upload single or multiple documents as per the requirement. Then provide the file information, if any. After adding the required documents and file information, click Upload to upload the documents successfully. The applicant can delete the document by clicking on the cross (X) icon.

After uploading a document, the cross icon changes to the Download icon, using which the primary applicant can download the document, if required. Primary applicant can edit the uploaded files or the file information by clicking on the Edit Information.

View uploaded documents: Post uploading the documents, you can view the uploaded documents in the Document Section by clicking on the download icon. All the uploaded documents are available in the Summary screen under the Document section.

- Applicant can select multiple documents and upload them. Also, the applicant can download and view the uploaded documents to verify by clicking on the download icon.

Edit document: After uploading a document, the upload icon changes to the Edit information icon, using which the applicant can edit the document. While editing a file, the document is deleted in the back end, and the new document is uploaded.

Download document: After uploading a document, the cross icon changes to Download icon. Click the download icon to download the document. If the applicant wants to edit the uploaded files or the file information, click Edit Information.

Applicant will not be able to upload documents in the Summary screen document section.

Replace document type: To replace the already uploaded documents under the document category only (if multiple document types are applicable under a document category)

- Click Edit Information, and applicant can replace a document type within a document category.

- If the applicant wants to change or replace the document type, a notification displays If applicant changes the Document Type, existing files under the previously selected category will be deleted. Click Yes, to select the new document type and upload the documents to proceed further.

- If applicant clicks No, the existing screen with already uploaded documents will display.

Delete document: To delete the uploaded document on the document section.

- Click Edit Information, delete option displays against the uploaded document. Click the delete button to delete the document.

- When applicant clicks Delete, a notification displays If you click Yes, document will be deleted. If you click No, you will return to the previous page.

- If applicant has deleted a Mandatory document, the Continue button remains disabled until you upload another document in the document page.

In the documents screen, the applicant must upload all the mandatory documents. Next button is enabled only after the applicant has uploaded the mandatory documents in the Documents section.

After the applicant has uploaded all the documents in the document section, applicant can view the document by clicking on it. Summary section allows the applicant to verify all the uploaded documents. The applicant cannot edit, delete or modify the already uploaded documents. Click Back button to make the required changes and the same changes will reflect in the Summary Screen.

In the documents section, if the applicant has missed to upload any mandatory document and on click of Continue button, the system highlights the section in red so that the applicant can easily identify and can upload the missed document.

System stores all the Property related documents under entity reference, but if the documents displays under documents section it displays as a separate section under the product document and must display only for the primary applicant. When the applicant uploads property documents, the property documents are stored under the main applicant.

After uploading all the mandatory documents in the checklist, click Continue button and control navigates to the Summary screen.

If you want to quit the application temporarily and resume later, click Save & Leave. Then, click Yes on the Save & Leave confirmation pop up. If you are a prospect user, you will receive the following email with an application resume link, user name, and application number. A temporary password is sent to the registered phone number.

If you are existing user, you will receive the following email with an application resume link and application number. You can login to the application by using your login credentials.

Components

The Documents section contains the following list of components:

| Component Name | Instance Name |

|---|---|

| com.dbx.uploadFiles3 | uploadFiles3 |

| com.nuo.Roadmap | Roadmap |

| com.dbx.bannerError | bannerError |

| com.dbx.customheaderNUOV2 | customheaderNUOV2 |

| com.dbx.customfooter | customfooter |

| com.nuo.loadingV3 | loadingV3 |

| com.dbx.popup | popup |

Configurations

The system administrator will have the capability to configure this module from the Spotlight app. For more information about configuring the Documents section, click here.

Extensibility

By using the Extensibility feature, you can customize the modules based on your requirements. For more information, refer to Extensibility.

In this topic