Introduction to Repurchase Agreements

The repurchase agreement (REPO) is a short-term agreement between two parties in which one party sells the security at a price to the other party with an agreement to repurchase the security at a fixed time and price.

Product Configuration

The configuration of REPO module is explained in detail in the following sections.

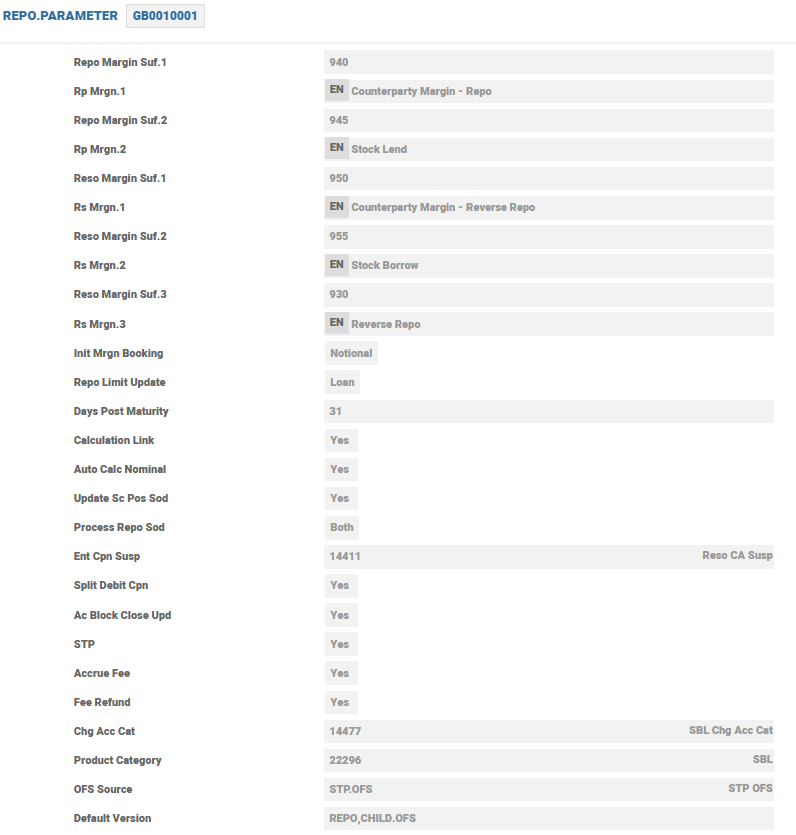

REPO.PARAMETER

This is the top-level record created by the ID of the company referred. This record controls the following items:

- The suffixes used for the creation of margin portfolio keys during a REPO and RESO contracts. These entries are used in REPO.TYPE for further configuration.

- Initial margin booking.

- Limit validation settings.

- Automatic population of fields during the creation of a REPO contract.

- Start-Of-Day (SOD) and Close-Of-Business (COB) settings.

- Corporate action settings.

The fields in this record used for this feature are listed in the below table.

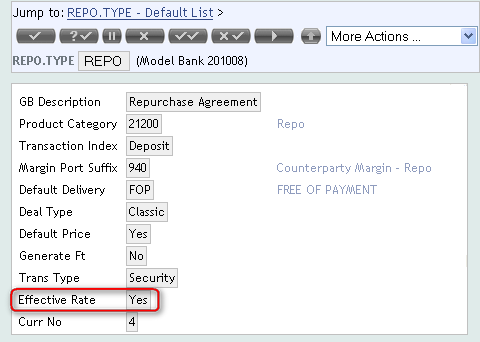

REPO.TYPE

This application holds the records, which control the processing of the REPO contracts. Each REPO contract must have a valid REPO.TYPE entered.

REPO.TYPEconfiguration as loan (REPO) or deposit (reverse REPO).- Product category used (CATEGORY record).

- Suffix for the margin portfolios.

- Definition of the customer REPO.

- Category of the suspense accounts for customer REPOs (CATEGORY record).

- Transaction type used for the customer REPOs (SC.TRANS.TYPE record).

- Default delivery instructions.

- Type of the REPO contract.

- Definition of the Effective Rate field

- The Link field links the opposite internal

REPO.TYPEto allow auto creation of opposite trade.

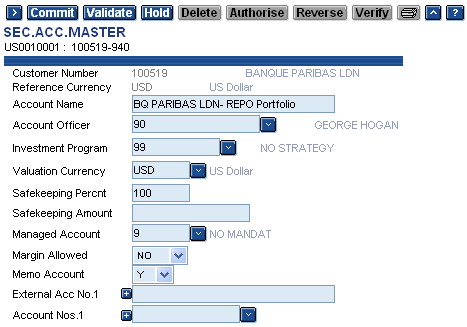

SEC.ACC.MASTER

A margin portfolio must be setup for any counter party used in the REPO contracts. This portfolio is used to run the valuations to determine whether a margin call is due or is to be expected.

Read the Securities User Guide for more information on setting the portfolio (SEC.ACC.MASTER) application. The suffix used to define the margin portfolio must match with the suffix defined in the REPO.TYPE record. If the bank performs both REPO and RESO transactions with any given counterparty, the user needs to open one portfolio for each operation.

The underlying CUSTOMER.SECURITY record for the REPO counterparty must have the value Customer in the Customer Type field before the user can successfully open the new portfolio.

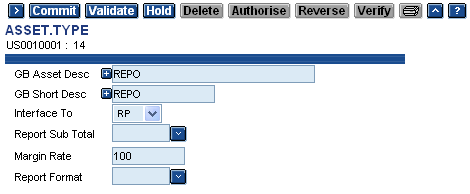

ASSET.TYPE

The ASSET.TYPE records are required to record the securities that are on hold or loan status as part of the REPO and RESO contracts.

The Interface To field configures the ASSET.TYPE record and there must be a unique ASSET.TYPE record as shown in the below table.

| Interface To | Requirement |

| RP | For REPO contracts |

| RS | For RESO contracts |

| RPM | If Init Mrgn Booking is set to Notional on REPO.PARAMETER required for REPO. |

| RSM | If Init Mrgn Booking is set to Notional on REPO.PARAMETER required for RESO. |

| RPC | For customer REPO contracts |

| RSC | For customer RESO contracts |

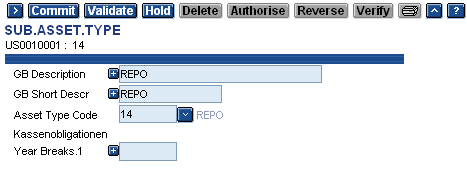

SUB.ASSET.TYPE

The SUB.ASSET.TYPE records are required to record the securities that are on hold or loan status as part of the REPO and RESO contracts.

The user must configure a SUB.ASSET.TYPE for each of the ASSET.TYPE records created in the previous section.

REPO.AGREEMENT.TYPE

This record provides additional details for the REPO agreement type.

The Description field indicates the free format description of the Repo Agreement Type field.

Both legs of the REPO contracts are often transacted under one agreement. The PSA agreement is used in the US, while in Europe the PSA/ISMA General Master REPO Agreement (GMRA) is the standard agreement used.

The standard agreement types must be defined in this record and referenced to the REPO contract, to avoid defining complex narrative of the contract used for delivery purposes. If required, additional conditions may be specified in the contract, or if the contract is not subjected to a standard agreement type.

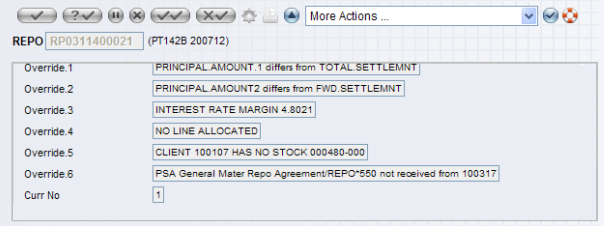

The REPO agreements can be tracked with the DOCUMENT.MANAGEMENT application. The REPO module can be linked to this application for the user to produce an override or stop the trading with new counterparty, until the full legal documentation is received and agreed.

Illustrating Model Parameters

The model parameters for Repurchase Agreements are explained below:

REPO.PARAMETER

System level parameter for processing REPO deals are defined in this application, which holds the following details:

- A Valid portfolio suffixes for the counterparty margin portfolio

- The Booking method of initial margin

- The limit update treatment for REPO deals

- The number of days post maturity when contracts are moved to history

- Processing of REPO deal at start of the day

REPO.AGREEMENT.TYPE

REPO deals are usually transacted under an agreement. PSA agreement type is used in the US and PSA/ISMA general master REPO agreement are used in Europe. Standard agreement types should be entered into this application, and referenced on the REPO contract in the field agreement type.

REPO.TYPE

Definition of all types of REPO contracts allowed in the system are defined in this application. It contains details such as category code, transaction index, default delivery, deal type etc.

Illustrating Model Products

Following products are available under REPO module.

| S.No | Product Name | Description |

|---|---|---|

| 1 | REPO | A REPO is an agreement of sale and repurchase of a security. The securities are sold to the counterparty at a fixed price and the seller has a commitment to repurchase those securities at a pre-agreed price at a fixed point of time in the future. The price difference can be seen as the interest to deposit and maybe defined as a cash price or as a repo rate. |

| 2 | Reverse REPO(RESO) | A RESO is an agreement of purchase and re-sale of a security, which is also a converse of a REPO agreement. The securities are purchased at a fixed price and the buyer has the commitment to re-sale those securities at a pre-agreed price at a future date. The price difference can be seen as interest to the loan and maybe defined as price. |

| 3 | Sell-Buy Back | A sell or buy back is an agreement of a spot sale and a forward repurchase of a security. This is different from REPO agreement as the sale and purchase are treated as two separate legs. Hence, an agreement is not required. |

| 4 | Buy-Sell Back | A buy or sell back is an agreement of a spot purchase and a forward sale of a security. This is different to REPO agreement as the purchase and sale are treated as two separate legs. Hence, an agreement is not required. |

In this topic