Introduction to Money Market

ⓘContent enriched:New structure and revised (Docs 2.0)

The Money Market (MM) module enables the Treasury department to support deal capture and administration of the standard product types used in the interbank Money Market. This section is designed to help the Temenos Transact users to understand the application features, navigation and the functionalities related to MM module. The intended audience of this module are as follows:

| Role | Function |

|---|---|

| Dealer | Executes deals with counterparty and records the deal details in the system |

| Treasury Back office personnel | Ensures authorisation, confirmation, settlement of payments |

| Risk Manager | Enforces and monitors risk limits |

| IT Personnel of bank or financial institution | Maintains computing infrastructure and upgrades of computer applications |

Certain features specific to retail deposit and loan products are, generally, not applicable in interbank MM business. Therefore, it is essential that the functions and features of MM module are relevant to the standard interbank MM business.

The processing within the module is straightforward but flexible. Although MM module primarily supports taking and placement of contracts, it also offers a range of advanced features, such as auto rollover, contract merger, period interest payments, etc.

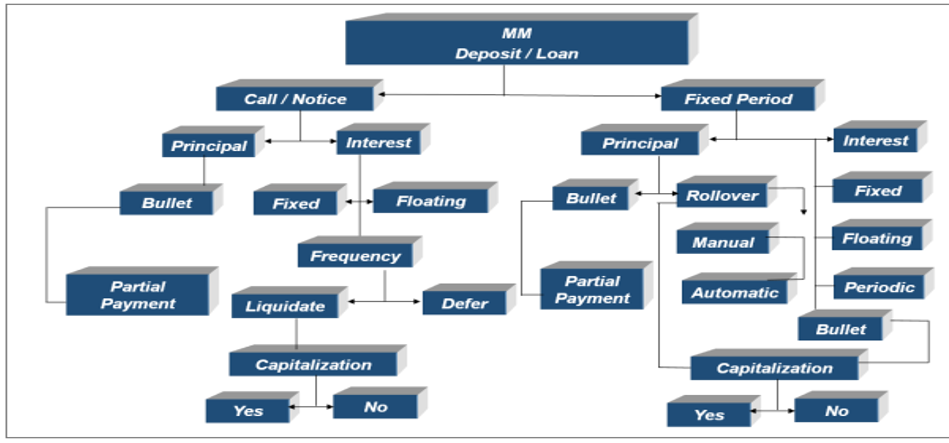

The below workflow diagram provides a view of the functional landscape of the MM module in Temenos Transact. It shows the products covered and features supported by the module. The brokerage calculation and processing is available in the BROKER application.

The MM module supports the following main products:

| Product | Description |

|---|---|

| Taking (Deposit) | Taking (also known as a deposit) is a contract between two financial organisations, mainly banks or financial institutions, where one bank or financial institution borrows money from the other bank or financial institution. The terms and conditions of taking could vary, such as fixed term or call or notice basis with a fixed or floating interest rate linked to a base rate using a key. |

| Sundry Deposit (Payable) | Sundry Deposit is a simple one-time deposit without interest, on a fixed or call basis. The purpose is to allow the bank to record amounts due to clients, without having to pay any interest. |

| Placement (Loan) | Placement (also known as Loan) is a contract between two financial organisations, mainly banks or financial institutions, where one bank or financial institution lends money to the other bank or financial institution. The terms and conditions of placement could vary, such as fixed term or call, notice basis with a fixed or floating interest rate linked to a base rate using a key. |

| Sundry Loan (Receivable) | Accounts receivable is a simple one-time loan, without interest on a fixed or call basis. The purpose is to allow the bank to record amounts or miscellaneous items due from clients without having to pay any interest. |

The key contractual terms are as following:

Fixed Term contracts, both taking and placement, shall have a fixed term or period to determine the maturity date. These contracts can be entered by using the fixed and floating rate of interest. A fixed rate can be referenced to PERIODIC.INTEREST table and floating rate to BASIC.INTEREST table.

Call or Notice contracts do not have a term or period, so the maturity date is not known until both parties agree to liquidate the contract. These contracts have on-call or on-notice (generally from 1 to 14 days, and could vary based on different markets) periods to determine the maturity date. These contracts allow fixed and floating rate of interest to the contractual terms.

Every MM contract has two parts: principal and interest. The maturity of the contracts determines the treatment of principal and interest components in the module as follows:

The principal is the contractual amount, which needs to be repaid or received on maturity depending on the underlying of the contract. The principal can be increased or decreased during the life of the contract. This happens in both fixed maturity as well as call or notice contracts.

In a call or Notice contract, the repayment of the principal can be bullet (one-shot) or early partial or total repayment. Rollover is not allowed on a call or notice contract.

Interest is the resultant monetary value arising from a placement or taking of the principal amount. Interest is always in arrears, and no interest is paid or received on sundry deposit or accounts receivable contracts.

Term contracts allow fixed, floating and periodic rate of Interest. Interest schedule defines the interim interest payment date and frequency cycle for future interest payout until maturity. Capitalisation of interest (addition to the principal) is possible along with rollover of the contract. Rollover is either manual or auto.

Call or notice contract allows fixed and floating rate of Interest. The due date and frequency at which the interest is paid or received is according to the contract terms. Interest payment can be liquidated or deferred on the interest due date.

Product Configuration

The MM deals are processed based on the below parameter files, which are also shared by Loans and Deposits (L&D) module:

The processing of MM transaction is handled by using the below three applications, after setting up all the required parameter information:

MM.MONEY.MARKETfor input and maintenance of placements and deposits.MM.PAYMENT.ENTRYfor early partial or full repayments.MM.RECEIPT.ENTRYfor early partial or full receipts.

Although the products supported by the MM module and L&D module are different, the basic accounting and delivery requirements are similar.

Illustrating Model Products

The following products are available in the MM module:

| S.No | Parameters | Description |

|---|---|---|

| 1 | Call or Notice Placement | To lend a fixed amount of money in a specific currency, where the tenure of the contract ends based on call or number of days of notice. The frequency of interest payment needs to be specified, which can be fixed or floating. |

| 2 | Fixed Maturity Placement | To lend a fixed amount of money in a specific currency to the counterparty. The length of the tenure is fixed at the time of agreement. Interest rate on the contract value can be fixed or floating. |

| 3 | Call or Notice Taking | To borrow a fixed amount of money in a specific currency where the tenure of the contract ends based on Call or Number of days of Notice. The frequency of interest payment needs to be specified, which can be fixed or floating. |

| 4 | Fixed Maturity Taking | To borrow a fixed amount of money in a fixed currency. The length of the tenure is fixed at the time of agreement. Interest rate on the contract value can be fixed or floating. |

In this topic