Introduction to Temenos Connect Internet Banking (TCIB)

TCIB provides 24/7 online access to core banking functions across all business lines. TCIB has the following advantages:

- Cost effective and resilient.

- Seamless integration with Temenos Transact.

- Support of a scalable internet banking infrastructure.

- Effortless navigation by customers to the required service or function.

Advancements in technology have raised the bar of expectations of the corporate customers. They prefer to reach out to banks, which can provide efficient, web driven, cohesive and integrated services to suit individual customer needs. Customers initiating banking transactions using various online channels such as, internet and mobile are gaining popularity. When it comes to trade finance, the corporate customers prefers to do their banking related business transactions using internet banking.

Corporate customers for whom TCIB is enabled, can do the following:

- Place requests online.

- View status of the transactions.

- Provide instructions for further action to the bank.

The bank can send queries or clarification and receive response from the corporate customer online. TCIB is a comprehensive solution and unique platform designed to meet the end-to-end requirements of our trade customers.

Trade finance customers expect banks to do the following:

- Provide solutions that allow them to seamlessly connect with the bank in order to complete their international trade transactions through web portals and/or handheld devices.

- Perform follow up activities required in completing life cycle of a trade.

- Be one-stop-shop for all trade instrument needs such as, documentary credits, guarantee products and collections.

- Meet SLAs for processing the trade transactions without any error.

Configuration

The below tables are setup for TCIB.

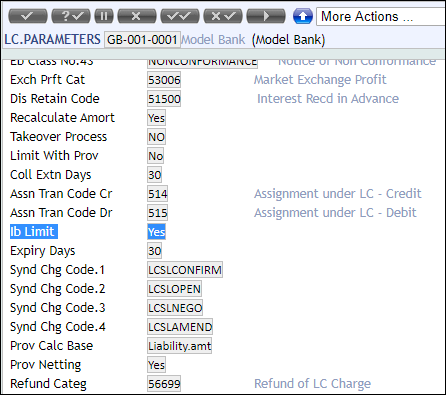

LC.PARAMETERS

When a LC issuance or amendment request is placed for an import LC by corporate customers using TCIB channel, the Ib Limit field in LC.PARAMETERS determines the stage at which the customer (applicant) limit is impacted. Allowed values are Yes or No and when set to,

- Yes – Limit entries are raised immediately after the transaction is entered by the corporate user.

- No – Limit is hit after authorisation of the transaction.

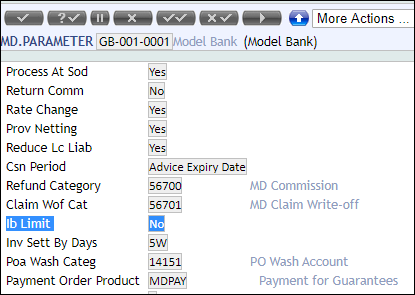

MD.PARAMETER

When a guarantee issuance or amendment request is placed by corporate customers using TCIB channel, the Ib Limit field in MD.PARAMETER determines the stage at which the customer (applicant) limit is impacted. Allowed values are Yes or No and when set to,

- Yes – Limit entries are raised immediately after the transaction is entered by the corporate user.

- No – Limit is hit only after bank authorisation of the transaction.

The below are the other requirements required to configure TCIB:

- Model bank environment.

- OFS.SOURCE>TCIB is mandatory and is available by default.

- Cache expiry in channel parameter (recommended).

The roles (Clerk and Manager) are released as part of model bank. However, the client or services team can configure by creating master arrangement with all permissions by default and restrict the sub arrangement based on the user roles or profiles.

Read Internet Banking Corporate - Channels user guide for Technology, Web Server and Channels related configuration.

In this topic