Introduction to Letter of Credit

ⓘContent enriched:New structure and revised (Docs 2.0)

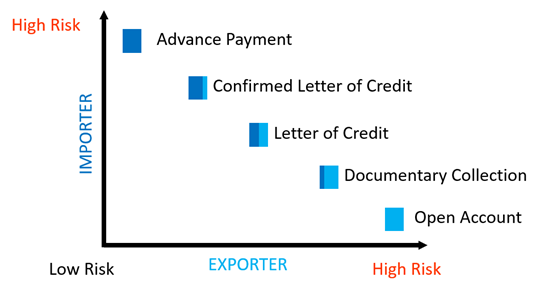

International trade is conducted between or among individuals or organisations not well known to each other and/or located in different countries. The seller requires the confidence that the buyer is credit worthy and pays on time; on the other hand, the buyer needs an assurance that the seller supplies goods as per contracted terms. The seller in such cases would prefer a well-known bank to provide a commitment for payment and the buyer likewise would like to include appropriate terms, conditions and documentation that would assure description, quality and quantity of goods.

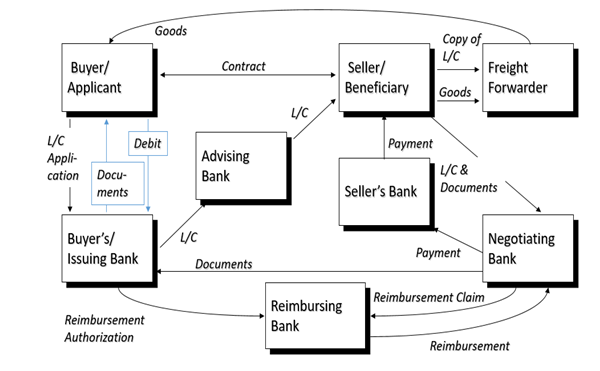

A Letter of Credit (LC) is a widely used instrument in international trade that meets the requirements of both the buyers and sellers. It is an undertaking by the issuing bank to the beneficiary of the credit, made on behalf of the applicant to pay irrevocably, on fulfillment of terms and conditions mentioned. Additionally, the banks play different roles (issuing, advising, confirming, negotiating and reimbursing bank) in the LC cycle to fulfill the LC conditions along with the parties mentioned in the credit.

The International Chamber of Commerce (ICC) is the world’s largest business organisation working to promote international trade, responsible business conduct and a global approach to regulation to accelerate inclusive and sustainable growth to the benefit of all members. ICC governs documentary credits (also known as LCs) in form and content. The Uniform Customs and Practices for documentary Credits (UCPDC) publication is a set of rules on the issuance and use of LC.

The below topic describes the different payment methods used in trade finance, work flow, list functionalities supported in different modules and LC in Temenos Transact.

LC is a financial instrument that is widely used in the international trade. It is issued by the importer’s bank at the request of the importer (buyer or applicant) in favour of the exporter (seller or beneficiary). It is a commitment to make payments, provided the exporter submits the required documents and complies with the terms and conditions stated in the LC. It is customary for the LC to be advised to the beneficiary through a bank, called the advising bank. It is one of the most secure methods for a seller to receive payment and the buyer to receive goods as per contracted terms and conditions. LC from a risk management perspective mitigates trade and payment risks.

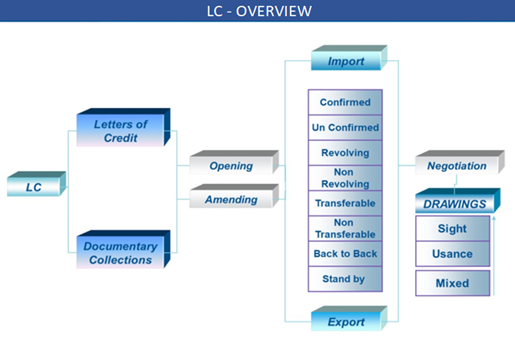

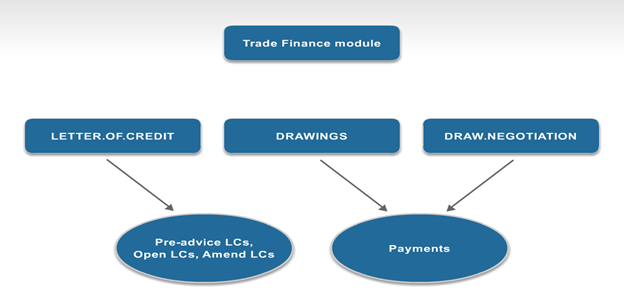

The LETTER.OF.CREDIT and DRAWINGS applications are closely coupled to provide a wide range of support for trade finance business. This ensures a seamless automated business process flow starting from issuing an LC and concluding with drawings.

The LETTER.OF.CREDIT application supports opening and amending LCs and documentary collections (import and export). It suits all the roles of a bank (issuing, advising, confirming and negotiating). The DRAWINGS application records the presentation of documents under the LC and makes the actual payments under the LC or collection, that is, negotiation of LCs and collections are handled through DRAWINGS application.

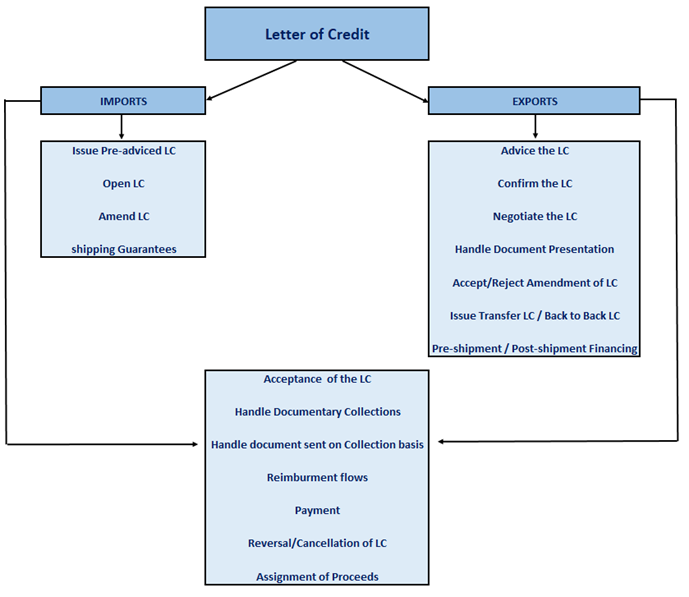

The following are the list of functionalities supported in the LETTER.OF.CREDIT, LC.AMENDMENTS and DRAWINGS module:

- Pre-advice of a LC

- Issue or Register and Advise of an LC

- Sight or Usance LC

- Payment or Acceptance

- Back to Back LC

- Confirmed LC

- Transfer LC

- Revolving or Reinstatement LC

- LC Amendments

- Drawings

- Mixed Payments (with limited functionality)

- Payment handled through Payment order

- Payment handled through LC module

- Brokerage

- Reversal or Cancellation of LC

- Charges

- Commission

- Margin or Provision

- Pre-shipment Finance

- Post-shipment Finance

- Assignment of Proceeds

- Shipping guarantee

- Ticklers and Tracers

- Syndicated Letter of Credit

- Swift Messages

- Collections

- Direct Export Collections

- Collection Amendments

- Shipping Guarantee against Import Collections

- Outward or Inward Collection Avalisation

- Clean Collection

- Open Account Trade

- Trade Evidence for Advance Payments

Trade finance module supports the recording and administration of LCs and documentary collections. It records the full details of the credit including amounts, dates, parties involved, charges, commission, margin and so on. Additionally, the trade finance module includes LETTER.OF.CREDIT, LC.AMENDMENTS, DRAWINGS and DRAW.NEGOTIATION that support the processing and management of both import and export LC cycle.

LETTER.OF.CREDIT application is used to send pre-advices, open LCs and make amendments. LC.AMENDMENTS application is used to send amendments. DRAWINGS and DRAW.NEGOTIATION applications are used for negotiations and payments.

The LC cycle starts from issuance of the LC and ends on payment realisation (including the principle features governing the LC). The flow and features differ between import and export type of LC. Not every LC needs to go through the entire cycle and this depends on the type and requirement of the LC. The LETTER.OF.CREDIT application records the initial liability of an LC (that is, the amount of the facility) or the request to make a collection. The DRAWINGS application makes the actual payments and drawings under the LC or collection.

Additionally, for high value transactions most banks participate in syndicated LC deals. Both LC and SL module support the processing and management of import and export LC under a syndicated facility. Large number of VERSION and ENQUIRY records are supplied with Temenos Transact Model Bank (MB) for trade finance products supporting flows in line with each features, and these are detailed within the Model Bank Reference Documentation.

- A

LETTER.OF.CREDIThas to exist for the user to enter the details in theDRAWINGSapplication. - An efficient delivery system is the backbone of the entire module. It is linked on-line with soft delivery, which means the user has the option to verify delivery messages before being transmitted.

- Trade finance transactions can be handled in any currency. Drawings made and/or charges collected can be denominated in a currency different from the LC currency. All foreign money entries automatically update foreign exchange positions if necessary.

Documentary credits are often a preferred method of payment in international trade. An LC, also referred to as a documentary credit, is a contractual agreement whereby the issuing bank (importer’s bank), acting on behalf of its customer (the importer or buyer), promises to make payment to the beneficiary or exporter against the receipt of complying stipulated documents. The issuing bank typically uses intermediary banks to facilitate the transaction and make payment to the exporter. In import LC, issuing bank take the main role of issuing the LC.

LETTER.OF.CREDIT application. This automatically checks and updates the customer’s credit limit, advises the various parties by SWIFT or printed advice, and takes any initial charges, etc. When Temenos Transact bank is requested to make a payment under the LC the details are entered in the DRAWINGS application, which makes any necessary accounting entries, send all required payment messages, advise the various parties and reduce the LC by the drawing amount.

DELIVERY application. The outward messages for an LC can be previewed at the input stage.

The following are the roles of the issuing bank, the type of operation performed in Temenos Transact aligning with the business function.

The Issuing bank can perform the following through LETTER.OF.CREDIT or LC.AMENDMENTS applications:

- Issue a re-advice by SWIFT

- Issue the actual LC based on the pre-advice

- Amend the LC terms and conditions

- Authorise a reimbursement

- Amend a reimbursement

- Reverse or cancellation of LC

The Issuing bank can perform the following through DRAWINGS application:

- Receive and pay drawings

- Send advice and effect a payment

- Authorise reimbursement or payment

The issuing bank requests the exporter’s bank to advice (with or without adding confirmation) and in due course exporter’s bank may undertake to accept documents from the beneficiary under the terms of the credit.

Temenos Transact supports the creation of the LC manually or on a semi-automatic basis on the receipt of an incoming SWIFT message (MT700 or 710 or 720 or 705). The same processing is done as in the example used for import, but in this instance, it is in the opposite role. The same conditions applies for sight, acceptance or deferred payments and the scale of charges is related to the role of the exporter's bank. The exporter’s bank can perform the following using the LETTER.OF.CREDIT or LC.AMENDMENTS applications.

They can act as advising bank and/or confirming bank and/or negotiating bank. The basic role is listed below:

- Advise a pre-advice to beneficiary or by SWIFT to second advising bank

- Advise the LC to beneficiary or by SWIFT to second advising bank

- Advise the amend under the LC to beneficiary or by SWIFT to second advising bank

- Request reimbursement

- Send acceptance or rejection of amendment message

- Confirm or negotiate the LC

- Transfer of LC

- Issue back to back LC

- Handle the documents presented under LC or collections

Configuring Letter of Credit

To support the recording and administration of LC and documentary collections, various parameter files and system tables need to be set up. This section provides a brief overview of the system and parameter set-up for holding the static data that is standard for LC and drawings processing. This section explains the various parameters and system core table setup that need to be set for operation of the LC and related modules.

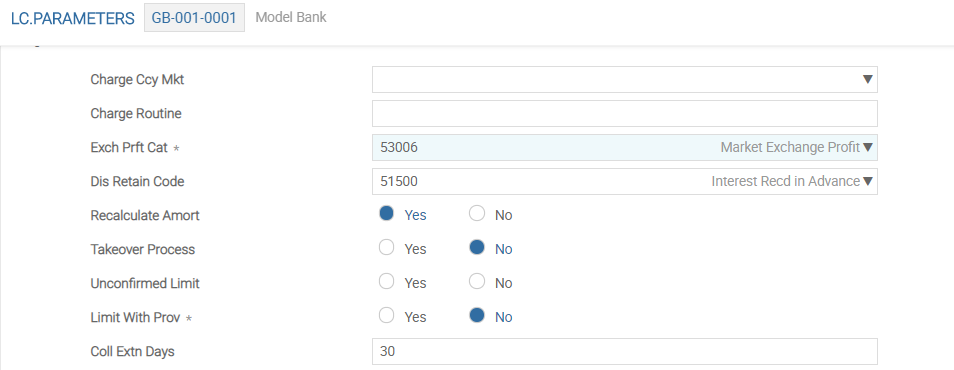

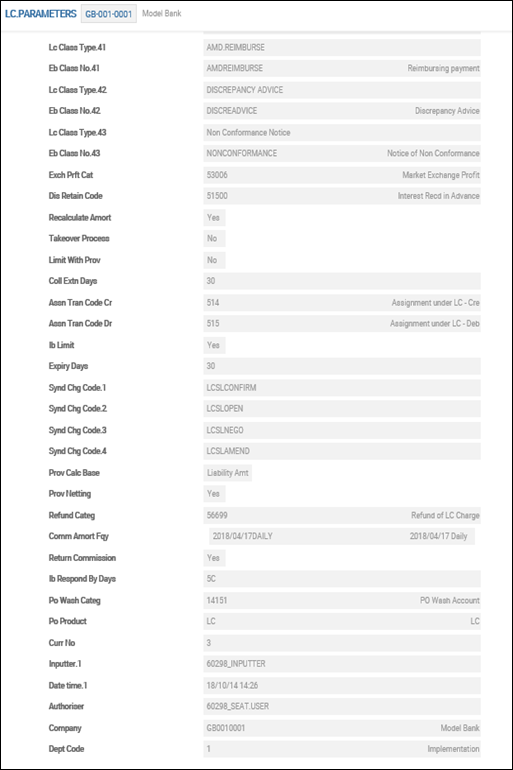

LC.PARAMETERS

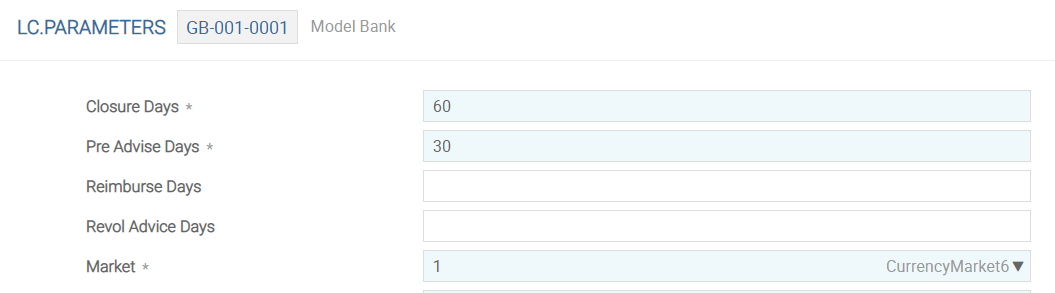

This application takes the record ID as company code and is the foundational file at the bank level. Each bank have one record of this file, and for each company the bank can create parameter file. The application provides the user with the option to specify where the Temenos Transact accounting entries are passed, what accrual cycles are set, and the transaction codes used.

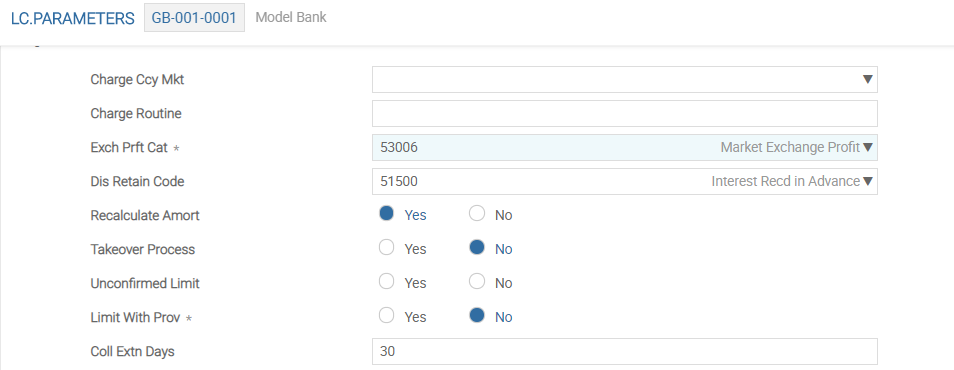

The CURRENCY.MARKET table is defaulted for LC transactions. Markets up to 99 can be defined in this file and one can be picked up for LC transactions. The value defined in the Currency Market field of LC.PARAMETERS is defaulted in the Currency Market field of LETTER.OF.CREDIT, if left blank. Another currency market can be picked up in the Charge Ccy Mkt field when the charges are different from the LC currency. This is an illustration of using two different currency markets defined at LC.PARAMETERS tables for LC or collection transactions and charges.

Closure Days field indicates the number of days after the expiry date, when LC or Collection is moved from LIVE to history file. The number of days is added to Expiry Date field of the LC or collection to determine the Closing Date field. On this date, if there are no drawings or charges outstanding under the said LC or collections, the LC Live file is moved to history.

For pre advised LCs, the number of days indicated in Pre Advise Days field is added to Issue Date field to produce the Closing Date field in LC. When Operation is set as P, Closing Date = Expiry Date + Pre Advise Days.

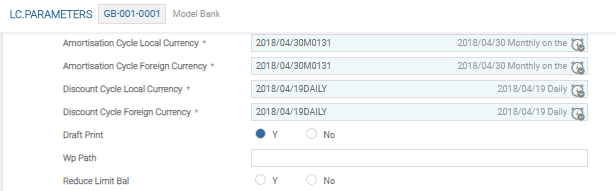

The Amortisation Cycle Local Currency or Amortisation Cycle Foreign Currency fields in LC.PARAMETERS defines the frequency of amortisation under LC transactions in local and foreign currency. When this field is set to Daily (amortisation process can be daily or monthly), and the Amortise Charges field in LETTER.OF.CREDIT or DRAWINGS application is set to Yes, the system credits the charge amount to the internal account created using the category code defined in LCAMORT record of ACCOUNT.CLASS. Amortisation to Profit and Loss (P&L) takes place from this internal account on daily or monthly basis. The user can define the day on which the amortisation process is to be run. Similarly, the interest accrual on discount drawing can also be done daily or monthly for local and foreign currency.

The Recalculate Amort field indicates whether amortisation of charges has to be reversed and recalculated, if a discount drawing is amended. The recalculation is done only when this field is set to Yes.

The Coll Extn Days field helps keep the collection document live as long as it is not fully utilised. On the actual expiry date, the system rolls over the expiry date by the number of days mentioned in this field. This reset is carried out on the closing date and the limit line.

Sometimes, due to non-availability of credit line or any other business reasons, advising or nominated bank adds confirmation to an export LC only for a part amount. This means that the amount confirmed only needs to be updated in credit limit of the issuing bank, not the full amount of the LC. This could be either a fixed amount or a percentage of the LC amount.

In an unconfirmed LC, limit line defaults to the info line unless and otherwise defined in LIMIT.PARAMETER. Similarly, in the case of confirmed LC the limit line goes as per the definition in the LIMIT.PARAMETER. However, with partial confirmation, an option is available with the user to choose to hit the info line and not for the unconfirmed portion of the LC. This is setup in LC.PARAMETERS by setting the Unconfirmed Limit field to Yes or No.

When an export LC is partially confirmed, the limit line is split and one is set against the confirmed portion and the other against the unconfirmed. When this information limit line is considered redundant in a partially confirmed LC, it is suppressed by setting this field to No. When set to Yes, the information limit line appears. Suppression of information limit line is done only if the LC is partially confirmed.

This field indicates the tolerance that can be ignored while calculating the limit amount minus provision amount.

- When 100% provision is taken on a foreign currency LC, the limit when calculated in limit currency may work out to 100.01% or 99.78% depending on the exchange rate.

- An input of a tolerance figure in this field is by the system as a limit to be ignored and when the difference falls within the parameter value it is ignored.

The below advice and report related fields are defined in LC.PARAMETERS to determine how many number of days prior to an event a message should be sent or reported:

| Field | Description |

|---|---|

| Reimburse Days | Sends reimbursement message in case of usance drawing before maturity. It is also used to decide when to send a MT 742 and MT754 SWIFT messages. |

| Revol Advice Days | Sends a revolution advice before the next revolution. |

| Maturity Usance | Reports imminent maturity of usance drawings. |

| Collections Due | Reports imminent due date of collections. |

Delivery process in LETTER.OF.CREDIT and DRAWINGS module enables to produce additional messages or advices other than standard ones provided by the system. Through the soft-delivery mechanism, the user can attach any additional message and send it via delivery. For a soft delivery option, the Backward Delivery field to be set to No. The Lc Class Type and Eb Class No multi value fields are necessary for soft delivery set-up. It is recommended to use the MB data for the initial build.

If Takeover Process field is set to Yes, then no delivery message is produced. This can be used during take over from existing system. A customer record can be created for the bank using the system by input in the Cust By Order field. Information in this field is used in Swift messages Tag 50 – Ordering Cust. After the introduction of soft delivery, certain existing fields are not used. For export LC, When the Del With No Discrep field is set to Yes, MT 750 and 1750 messages are produced whether drawings are discrepant or not. When set to No, MT 750 message is produced only if drawings have discrepancies.

Transaction codes are used in STMT.ENTRY and CATEG.ENTRY for narrating the underlying transactions affecting accounts and PL heads are attached to the LC.PARAMETERS as below:

| Field | Description |

|---|---|

| Pay Trans Cr | Narrative or transaction code when passing credit entry for payment account |

| Pay Trans Dr | Narrative or transaction code when passing debit entry for payment account |

| Reimb Trans Cr | Narrative or transaction code when passing debit entry for draw down account |

| Disc Tran Code Cr and Disc Tran Code Dr | Discount fields |

| Load Tran Code Cr and Load Tran Code Dr | Discount spread fields |

| Uncollected Tr Cr | Narrative to be used when entries have been created relating to charges under LCs that are uncollected |

| Write Off Tr Cr | Narrative to be used when entries have been created relating to written off charges made under LCs |

| Amort Trans | Narrative used when entries have been created in the amortisation of charges at close of business |

| Provision Cr and Provision Dr | Narrative to be used when provision (cash margin) credit or debit entries are passed |

| Disc Cat Code | PL category code to be debited or credited with the discount amount for discounted drawings |

| Load Cat Code | PL category code to be debited or credited for discount spread amount of discounted drawings |

| Uncollected Catrg | PL category for charges claimed and booked to PL and yet to be collected from the party concerned |

| Write Off Pl | The value is PL write off category code for claimed charges. This identifies the PL category code to be used when claimed and booked charges are written off |

| Exch Prft Cat | The exchange profit or loss arising because of spread on the exchange rate specified at the drawings is credited to this PL category. This spread actually represents the difference between the rate collected from the customer and the treasury rate and is meant for the trade finance department |

| Dis Retain Code | Identifies the category code where excess interest is posted, if discounted drawings is amended and excess interest is not paid back to the customer |

Internal accounts in local currency should be opened using these category codes. The system opens in other currencies, when needed. If the provision is kept at the customer (account) level, then Internal account opened using the category code indicated in Pro Category field is used as credit provision account. Currency of this account is that of debit provision account.

The Pay Subdivision field identifies the subdivision to be used whenever an internal account number is generated by the system for accounting entries related to LC payments (it is the equivalent of a G/L sub-ledger number). If 1 is indicated here, and 16505 category code is proposed to be used for internal account, the system uses USD165050001 for USD provision and GBP165050001 for GBP provision.

This field in LC.PARAMETERS application defines, if the provision is to be calculated for LC or liability amount at parameter level.

- This field in the

LETTER.OF.CREDITapplication defaults the value defined at the parameter level. If the user wants to modify the defaulted value, it can be done at LC contract level. Temenos Transact calculates and collects provision from customer based on these settings. - Validations are provided with error message.

- When the user selects a value in Prov Calc Base field, but the Provision field is not set to Yes in

LCapplication, the system displays an error message to set the Provision field to Yes.When the user opens an Import LC for USD 10000 with 50 % cash margin and the provision calculation base is LC amount, the system calculates USD 5000 as cash margin. If the user has given 10% credit tolerance and the calculation base is the liability amount, then the amount of provision calculated by using the same example works out to USD 5500. LC value is 10000 plus 10% tolerance, which is 1000. Margin is calculated at 50 % on 11000, which works out to 5500.

The user can net the proportionate cash margin released with the drawings amount and debit the balance amount from the drawdown account when drawings are initiated using this field.

- The value defined in

LC.PARAMETERSis defaulted and the user can amend the defaulted value - The user can amend the defaulted value.

- This field assumes significance only if provision is collected in the underlying LC. This is a no change field.

- Drawings payment entries are netted with the proportionate amount of cash margin released only when the drawings currency and credit provision account currency are the same.

In LC.PARAMETERS, the multi value field Synd Chg Code allows the user to enter a valid FT.COMMISSION.TYPE or FT.CHARGE.TYPE ID and these specific charges work in conjunction with the Syndicate Charge field in LC. When Syndicate Charge is set to Yes, the system checks that the respective charge code is specified in the Synd Chg Code field of LC.PARAMETERS.

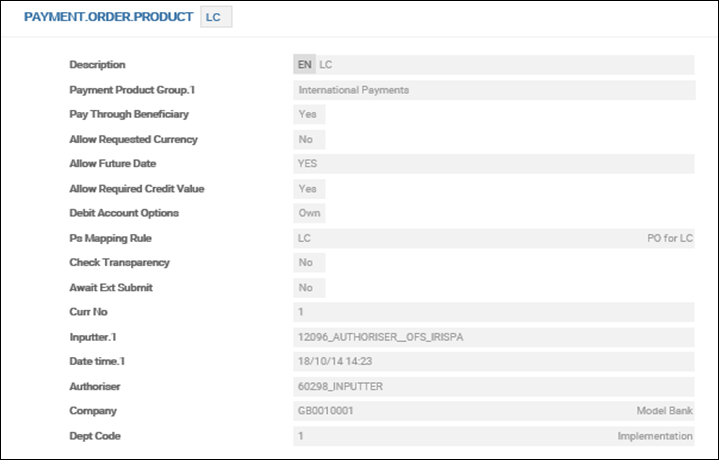

PAYMENT.ORDER to DRAWINGS

An initial setup is done at the parameter level, to enable the settlement of Import or export drawings through PAYMENT.ORDER. The Po Wash Categ and Po Product fields under LC.PARAMETERS has to be defined for linking the PAYMENT.ORDER (PO) application to import or export drawings. When a settlement is routed through PAYMENT.ORDER, the system credits or debits a wash account created in the respective currency. To define the category for this wash account, Po Wash Categ field is used. When these fields are defined at parameter, the system allows the integration of DRAWINGS and PAYMENT.ORDER module. However, the user can choose at the transaction level, the option to settle a particular drawing via PAYMENT.ORDER.

The Po Wash Categ lists all the internal account category codes. This field identifies the category code of the internal wash account to which the proceeds under the LC drawings is taken for settlement, when the payment method is N in DRAWINGS application.

The Po Product field lists the record ID of a valid PAYMENT.ORDER.PRODUCT. Payment features that are specific to DRAWINGS application is defined in PAYMENT.ORDER.PRODUCT at the parameter level for the application to refer, when a payment is initiated. The PAYMENT.ORDER.PRODUCT maps the data among the PAYMENT.ORDER, DRAWINGS and third party or integrated payment application. When the linking of POA with DRAWINGS is not defined at the parameter level, the existing feature continues to settle the payment within the DRAWINGS application.

PAYMENT.ORDER.PRODUCT defines payment features that are specific to LC settlement with values such as Allowed, Optional and Mandatory. Besides, it defines the mapping rule and conditions that specify how the requests from the payment order is routed to the corresponding payment system. Based on this definition in the LC.PARAMETER, the Payment Order product field in the PAYMENT.ORDER application defaults with respective input when PAYMENT.ORDER record is created at the time of settlement of the LC from DRAWINGS module.

Fields in LC.PARAMETERS |

Values in the Field |

|---|---|

| Po Wash Categ | Holds valid PO wash account category code as defined in the CATEGORY table. |

| Po Product | Holds valid record ID of the PAYMENT.ORDER.PRODUCT table. |

The below screenshot defines a LC.PARAMETERS record for linking PO application:

The below screenshot shows a record created in PAYMENT.ORDER.PRODUCT:

DRAWINGS.

The Switch Limit field controls the change of limit lines from customer-to-bank or bank-to- customer in DRAWINGS. The allowed values are:

- Yes - The Risk Party field allows for user input.

- No - The Risk Party field behaves as a system populated field and the value defaults from Risk Party field of the

LCapplication. - NULL - Default value

This Switch Limit field becomes a no-change field after authorization if the value is YES or NO.

Following sections detail various System Tables available in LC:

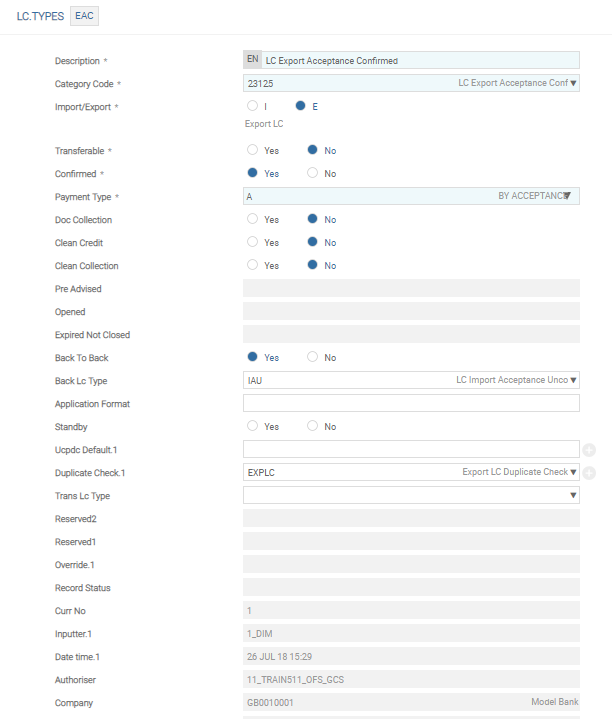

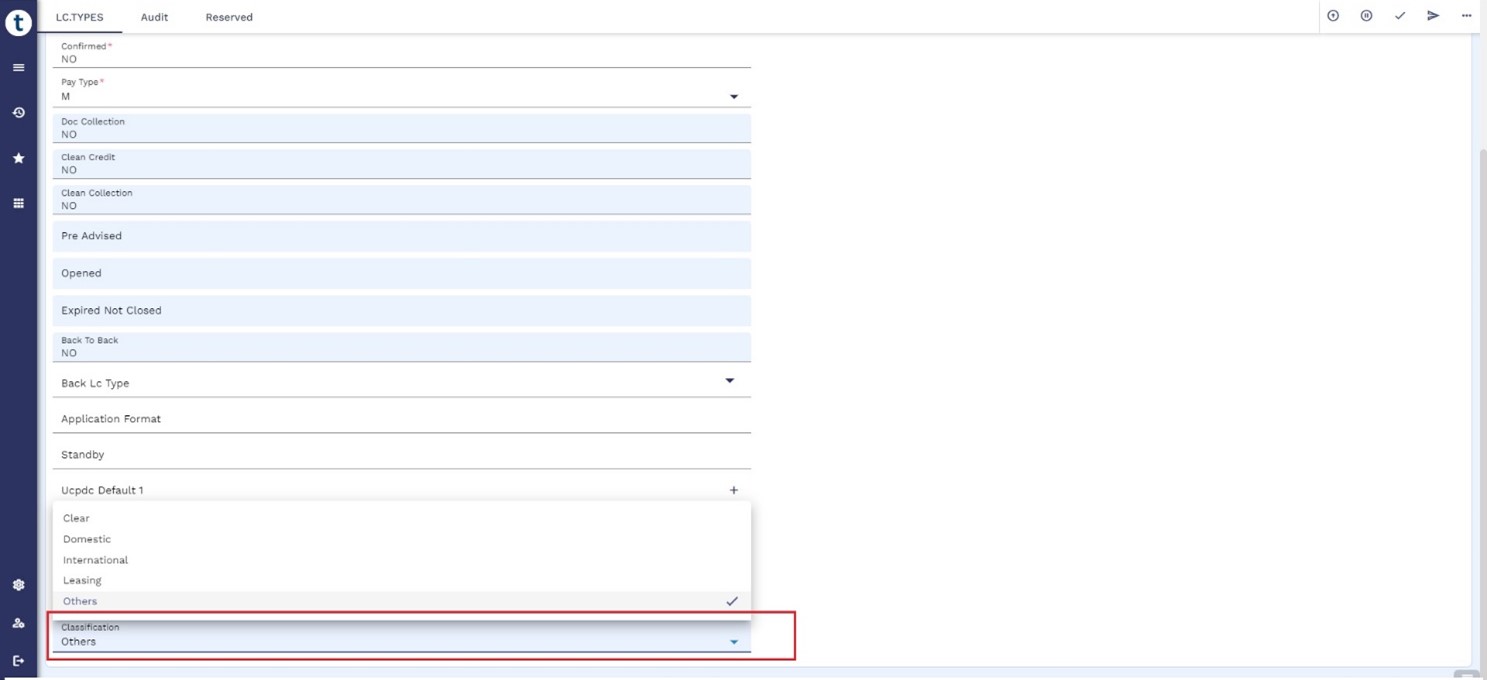

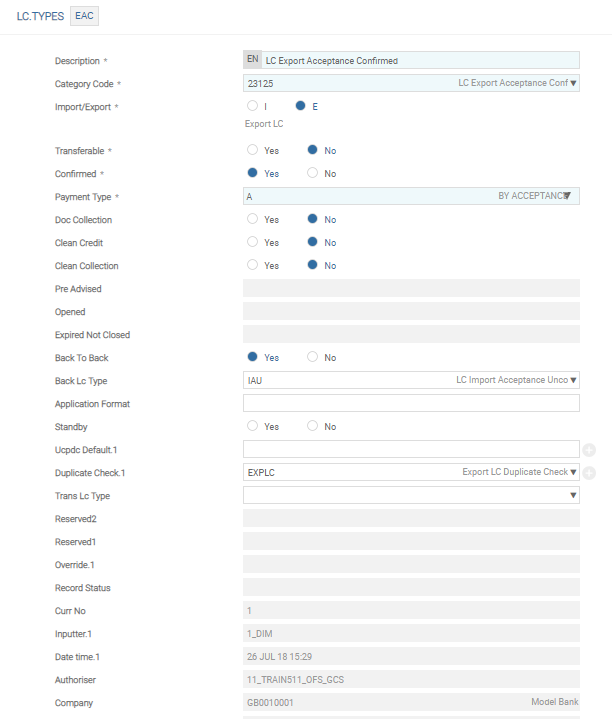

LC.TYPES

This file is used to set the type of LC and the way Temenos Transact treats the transaction through its various phases from opening, drawing, to maturity. It defines and describes the LC (and collection) types required in the system, and the setting up of the default category code for each type. The characteristics of each LC and collection type are recorded in this file.

Generally, banks have minimum LC.TYPES, such as, one for any pre-advices, actual advices and for adding confirmations. Depending on each pay-type, further LC.TYPES can be added. The records provided with the Temenos Transact installation should be treated as a starting point and each one must be reviewed or amended, and new ones entered according to the type of trade finance business. The code defined in the Category Code field is defaulted, when the category code is not entered as part of LC input data. If any LC transactions existing under this LC.TYPES are in the live or unauthorised file, this field cannot be modified as that would lead to conflict in ASSET.TYPE in consolidated CRF entries.

From the Import/Export field, the user can select either I or E, where:

- I – Import (issuance)

- E – Export (advising or confirming)

Based on the user selection, the process treats the LC as import or export. Temenos Transact uses this setting to dynamically configure which fields are available and mandatory when opening or amending an LC. This field cannot be modified once LC transactions under this LC type has been entered. For DRAWINGS, the LC.TYPES is taken from the parent LC LETTER.OF.CREDIT record.

The LC.TYPES record defines whether the transaction is:

- Import or export

- Transferable LC or non transferable

- Standby LC

- Confirmed or unconfirmed

- Back to back and with what type import back to back LC is generated

- Documentary collection

- Clean collection

- Clean credit

- Different pay types, that is, payment method - by payment, acceptance, negotiation, direct credit, mixed payment or deferred payment.

- Enabling the duplicate check

- Define a group of message formats

- Add exceptions to field defaulting rules

Apart from defining the above characteristics of LC in LC.TYPES, there are few system-populated fields, which provide,

- Information on the number of pre-advised LCs outstanding for an

LC.TYPE(pre advised). - Count of the number of LCs opened for an

LC.TYPE(opened) - Count of the number of LCs which have expired but have not yet been closed in the system for an

LC.TYPE(expired not closed)

LC.TYPE can be deleted.

In conjunction with the LC.TYPES key, Temenos Transact uses an operation type to decide the event, accounting and charges to be applied. The codes are entered both in the Operation field in the LETTER.OF.CREDIT transaction and LC.TYPES, as part of the key to the charges conditions file LC.TXN.TYPE.CONDITION. Similarly, the DRAWINGS transaction uses the Drawings Type after the LC.TYPES to find a matching LC.TXN.TYPE.CONDITION.

The below codes are used:

| Code | Description of Use |

|---|---|

| P |

|

| O |

|

| A |

|

| C |

|

| T |

|

LC.TYPES parameter table is essential in building the foundation of the trade finance set-up to accommodate range of transactions from clean collections to complex documentary credits.

The following are the different types of LC:

| Code | Description | Code | Description |

|---|---|---|---|

| LEAC | LC Export Acceptance Confirmed | CAU | LC Acceptance Confirmed Export |

| LEAU | LC Export Acceptance Unconfirmed | CCA | Clean Collection Acceptance Export |

| LEDC | LC Expos Deferred Confirmed | CCS | Clean Collection Sight Export |

| LEDU | LC Export Deferred Unconfirmed | CDU | LC Deferred Panned Confirmed Export |

| LEMC | Export Mixed Confirmed | CEA | Outgoing Documentary Collection Acceptance |

| LEMU | Export Mixed Unconfirmed | CEC | Outgoing Clean Collection |

| LEP | Pre-advice Export Letter of Credit | CES | Outgoing Documentary Collection Sight |

| LESC | LC Export Sight Confirmed | CIA | Incoming Documentary Collection Acceptance |

| LESU | LC Export Sight Unconfirmed | CIC | Incoming Dean Collection |

| LIAC | LC Import Acceptance Confirmed | CIS | Incoming Documentary Collection Sight |

| LIAU | LC Import Acceptance Unconfirmed | CAU | LC Acceptance Confirmed Export |

| LIDC | LC Import Deferred Confirmed | LISU | LC Import Sight Unconfirmed |

| LIDU | LC Import Deferred Unconfirmed | LISC | LC Import Sight Confirmed |

| LIP | Pre-advice Import Letter of Credit | – | – |

The Classification field allows the user to categorise the LC.TYPES based on the bank’s business requirements. Following are the available values for the Classification field,

- Leasing

- Domestic

- International

If required, banks can add a new type of classification value using EB.LOOKUP record.

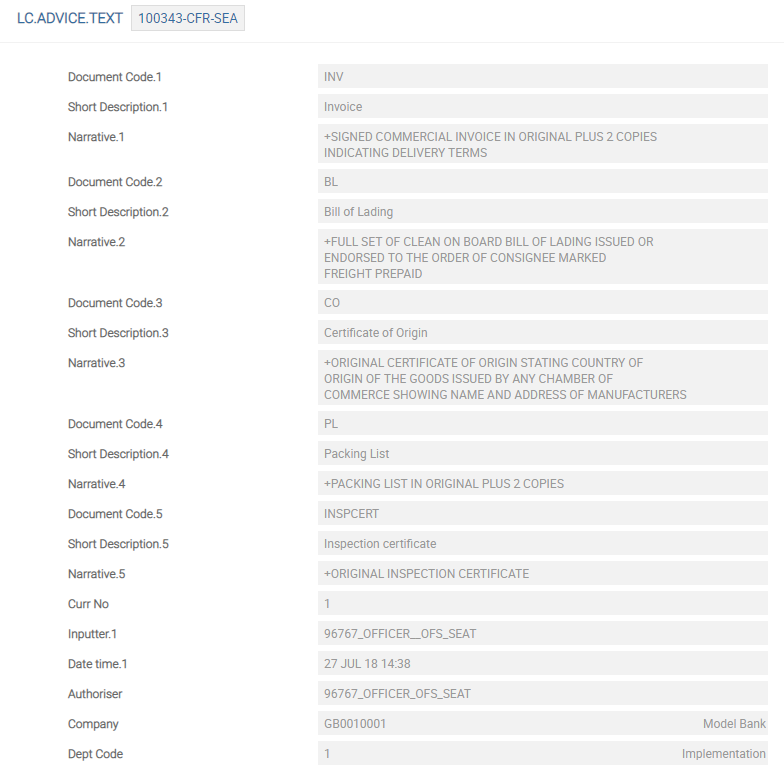

LC.ADVICE.TEXT

While creating LC (Import), the user has to enter lengthy document descriptions. These descriptions are used frequently for most of the transactions generated every day. To assist and speed up the processing, Temenos Transact has LC.ADVICE.TEXT, which enables the user to record the standard document details required for different types of LC under a coded ID. The values are entered in the Document Code multi-value field in LC and DRAWINGS to get the document text defaulted in the transaction.

Record ID of LC.ADVICE.TEXT accepts the following formats:

- Customer ID-Inco Terms-Mode of Shipment

- Inco Terms-Mode of Shipment

- Customer ID

- Customer ID-Free Text

- Free Text

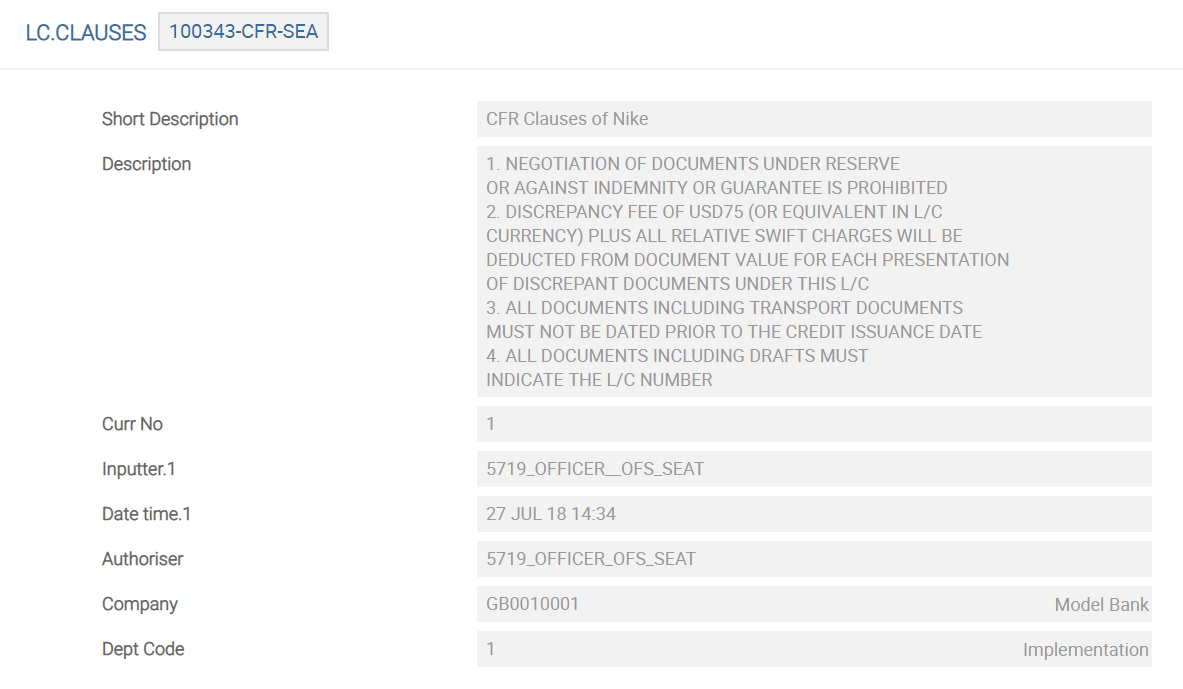

LC.CLAUSES

In addition to document descriptions, trade finance also requires the input of many lengthy additional clause. Standard LC clauses are held in this table, which holds static information for construction of LC transactions within Temenos Transact. They are included in a LC or collection by the use of a code, avoiding the need for retyping.

The codes defined in LC.CLAUSES is invoked in the Clauses Text multi-value field in LC and DRAWINGS based on the record ID. They are then expanded into the actual text, which can be modified for the contract.

Record ID of LC.CLAUSES accepts the following formats:

- Customer ID-Inco Terms-Mode of Shipment

- Inco Terms-Mode of Shipment

- Customer ID

- Customer ID-Free Text

- Free Text

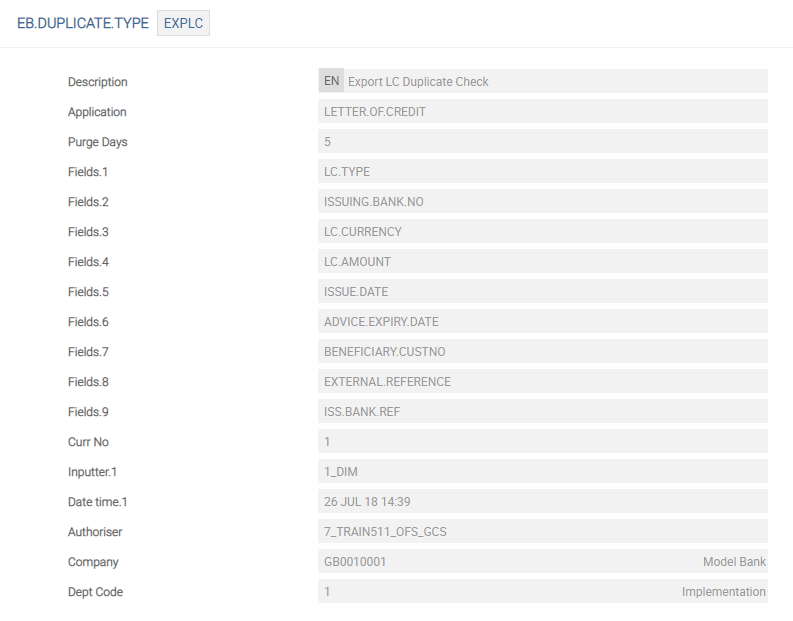

EB.DUPLICATE.TYPE

The core feature of validating duplicate input is now available in LETTER.OF.CREDIT. Set of rules for checking whether an LC transaction is likely to be a duplicate of another similar transaction can be defined in EB.DUPLICATE.TYPE. The ID of this record is alpha-numeric. For example, LCEXPLC is used to check for duplicates in export LC.

The application for which a duplicate check is intended should be indicated in the Application field in EB.DUPLICATE.TYPE. The values that are to be compared for determining if the transaction is duplicate, should be indicated in multi-value field Fields. This can be a user-defined field or a user-defined calculated value (field type I) on STANDARD.SELECTION. When Lc Currency and Lc Amount fields are indicated, a transaction is termed as duplicate, if its currency and amount are the same as that of another transaction.

Once the EB.DUPLICATE.TYPE is defined, the record has to be attached to the respective LC.TYPES appropriately. The Duplicate Check field in LC.TYPES accepts a valid EB.DUPLICATE.TYPE and based on the definitions to be validated, the overrides are raised when the transaction is input.

One or more records of EB.DUPLICATE.TYPE can be attached to required LC.TYPES records. When a LC of the chosen type is entered, subsequent transactions for possible duplicates can be identified. The ID of EB.DUPLICATE depends on the field defined in EB.DUPLICATE.TYPE file. When only one field is defined in the EB.DUPLICATE.TYPE file, the key is composed of that one field. When more than one field is defined, the key is composed of the number of fields defined, joined together with asterisks (*).

Any contract that matches this key while it is held on file causes a possible duplicate override, and are added to the Trans Ref field. For example, GBP*11000.00. When the currency and amount have been selected as above, when the next LC is entered, the system checks EB.DUPLICATE for similar ID, and if present, generates override and when approved, records details of that transaction also in EB.DUPLICATE under the same record. The record is deleted from the EB.DUPLICATE file based on the number of days defined in the Purge Days field of EB.DUPLICATE.TYPE file.

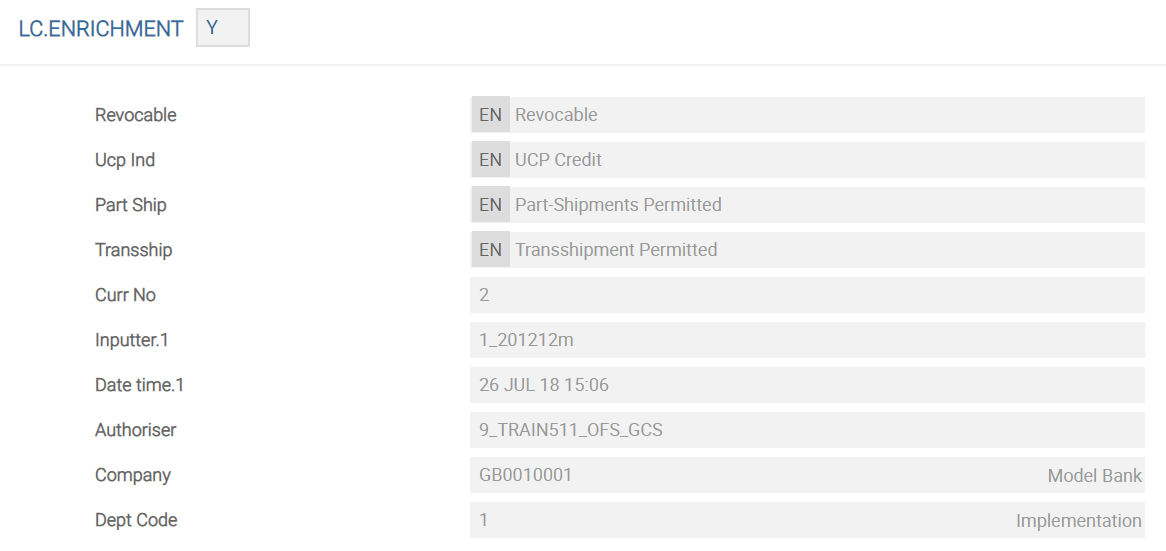

LC.ENRICHMENT

The trade finance application makes extensive use of short codes (such as O for open) to enable fast and accurate input. However, these codes are not understood if referred elsewhere. When customer advice is printed on customer confirmations. The LC.ENRICHMENT application holds longer descriptions for these codes and abbreviations giving the opportunity to expand the meaning of each of these codes into the user's own terms.

The response Y to certain fields such as, Revocable (Y/N) allows the user to create a transaction more speedily. However, the text required for advices needs to be expanded to 'This LC is Revocable'. The file is fully multi-lingual. A single code may have different meanings when used in different places in the trade finance application. Each place where a code may be used is identified in the LC.ENRICHMENT application.

The screenshot below shows the texts substituted for Y under several circumstances:

In the above screenshot, the code Y when used in the Revocable field in LETTER.OF.CREDIT means revocable, but when used in the Part Shipments field it means part-shipments allowed.

LC.ENRICHMENT S.Y BASIC.INTEREST and BASIC.RATE.TEXT

BASIC.INTEREST table allows various frequently used floating rates. For example, base rate, prime rate, overnight rate, etc. It has to be defined separately for each currency and stored in a central place where they can be accessed by Temenos Transact applications as required. Prime records with the same interest conditions can be linked directly to a basic interest ID in this table, rather than defining the interest rate details in each transaction record.

When a rate change takes place, the user has to update the basic interest rate IDs defined in this table with the new rate(s) and the date on which it is to become effective. This is then automatically update all the transaction records, which are tied to each Interest ID. A description of each rate is held in the BASIC.RATE.TEXT table to allow the user to easily identify each one of the basic interest rate table ID's. For this reason, a description is not included in the input parameters of this table. The BASIC.RATE.TEXT table of descriptions must be defined prior to creating this table.

E.B.S. provides a PERIODIC.INTEREST rate table to cater for transactions where the interest rate conditions may change on a pre-defined periodic basis, for example, LIBOR, and also according to the current balance on the prime record. The linking of prime record to a basic interest rate or a periodic rate ID depends on the conditions existing for various products within the bank.

BASIC.RATE.TEXT table defines descriptions of the basic interest rate table IDs to enable the user to identify each one of them easily. Each description must be defined prior to creating rate records for the corresponding ID in the BASIC.INTEREST rate table and is used as the enrichment to the corresponding ID when it is displayed or printed during Temenos Transact processing. Up to 999 descriptions can be defined.

PERIODIC.INTEREST(PI)

PERIODIC.INTEREST is used by applications such as foreign exchange to default LIBOR types of rates on forward contracts. It uses interest revaluation method or the loans and deposits applications to perform automatic rollover. Rates vary depending on the length of time and for bid and offer purposes. This table can be automatically updated or interfaced daily with an external feed, like reuters, or maintained manually by the user. PERIODIC.INTEREST records are generated daily by the system. These periods can be defined in either months or days. For example, 1 month, 2 months, 3 months, 6 months, etc. or 7 days, 15 days, 30 days, etc.

This table is used for discounted drawings using tiered system of rate calculation:

PERIODIC.INTEREST table:

| Number of days | Interest Rate |

|---|---|

| 1 | 4.5178 |

| 31 | 4.51275 |

| Rest | 4.52758 |

That is, the interest for the first day is 4.5178%, next 31 days is 4.51275% and the balance 13 days is 4.52758%. However, interpolating all the above rates, a single rate is populated.

In LD contracts, where the Int Rate Type is set to PERIODIC.AUTOMATIC, on the R (rate revision) schedule dates, the PERIODIC.INTEREST table is referred to, for the interest rate from the appropriate key (record).

Changes can be made to keys which were created before current date, and contracts, which have accessed these keys, are updated with the changes, provided the R schedules were not prior to any principal or interest movements on the contract. Whenever a back-valued key in PERIODIC.INTEREST is changed, the ID of such key is stored in an internal file called PERIODIC.RATE.CHANGE.

INTEREST.BASIS

Interest day basis is defaulted to transaction records as per the currency used. However, it can be modified at contract level. Choices are available in LC application to indicate the interest day basis. This is useful while discounting usance drawing to calculate the amount of discount. When charges are collected in advance, but proposed to be amortised over the life of an LC, the basis for amortising is decided by this choice. This is defaulted from CURRENCY table, but can be changed by the user.

The following choices available for interest day basis at LC level:

| Interest Day Basis | |

|---|---|

| A | 360/360 |

| B | 366/360 |

| C | 366/366 |

| D | 360/366 |

| E | 366/365 |

| F | 366/365 and |

| S | Special |

| W | 252/252 |

| W1 | 252/252 |

To support the 252-day interest basis (specific to Brazilian market), two-interest day basis, W and W1 are introduced.

- W – 252/252: The numerator represents the number of business days between the start and end dates of the contract.

- W1 – 252/252: The number of days in the numerator represents the number of business days between the start and end days of the contract. If the number of business days is less than 21 days in a month, then the number of business days in a month is considered as 21. If the number of business days is more than 21, system accrues only until the 21st day.

- Interest day basis is used for calculation of discount and Load amounts on drawing contracts and also for amortizing charges over the life of LC.

- Interest day basis is defaulted from currency record but can be changed by the user at LC level.

In the DRAWINGS application, the user can define the type of rounding that should take place while debiting or crediting the customer’s account using the Round Rule field. This is a no change field. The value entered in this field overrides the condition defined at the product level, that is, in LC.PARAMETERS.

This rounding rule is already predefined in EB.ROUNDING.RULE. Natural, Round up, Round down, Tax Up, Tax down or None are options already available in EB.ROUNDING.RULE.

The trade finance application allows to set up charges either at,

- The time of LC issuance or advising

- Any time later

- The time of LC payment or negotiation (or after wards as long as the record is still available for drawing)

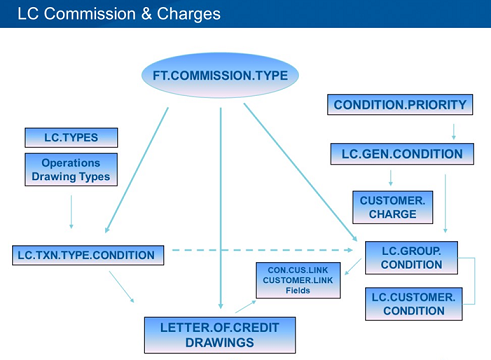

For certain types of LCs it is possible to take additional charges until they mature. The types of charges or commission has to be defined in FT.COMMISSION.TYPE and other related LC charge tables as shown in the below flow chart:

The links between the various files making up the condition group structure for LC charges and commissions are shown above. The charges and commission applies to the contract in the below flow:

- Details in the

LC.CUSTOMER.CONDITIONapplication is applied in the LC contract and works likeLC.GROUP.CONDITION(this is specific to a single customer rather than a group of customers). - Details in the

LC.GROUP.CONDITIONapplication is applied in the LC contract in the absence ofLC.CUSTOMER.CONDITION. - Details in the

LC.TXN.TYPE.CONDITIONapplication (default charges) is applied in the LC contract in the absence ofLC.CUSTOMER.CONDITIONandLC.GROUP.CONDITION. - Details in the application

FT.COMMISSION.TYPEis applied in the LC contract in the absence ofLC.TXN.TYPE.CONDITION,LC.CUSTOMER.CONDITIONandLC.GROUP.CONDITION.

LC and DRAWINGS applications. For the customer ID appearing in these fields, if any concessional rates have been stipulated in LC.GROUP.CONDITION, then that is applied to the respective LC or DRAWINGS.

FT.COMMISSION.TYPE

FT.COMMISSION.TYPE table defines the conditions relating to all types of commission used in applications. Each commission type can be defined as a flat amount or percentages can be defined for different bands or levels or flat calculation. Minimum and maximum commissions can be specified for each band or level. Regardless of the percentages set and the transaction value, the bank has to guarantee a minimum commission receipt. The Overall Min Amt field is used to set the minimum commission to be collected. A maximum can also be set, if required, in Overall Max Amt field. Commissions in local currency must be entered and special foreign currency commissions can also be defined if required. It is possible to accrue or amortise the charges and commissions over a period, by suitably defining in FT.COMMISSION.TYPE.

The entire commission may not apply depending on whether the ordering customer is resident or non-resident within certain countries. Additionally, FT.COMMISSION.TYPES can be linked to allow different commission structures, tax codes to be applied depending on the residence of the ordering customer. For example, commissions can be defined for EEC and NON-EEC resident customers.

This field defines the minimum number of months, which comprise the smallest allowable charging period, used in conjunction with the charge period defined. This can be defined as monthly, quarterly, half-yearly, nine-monthly, annually, or bi-annually. The contract period is divided into a number of charging periods as defined in Charge Period. This is then compared against the Minimum Period. If the minimum period yields a large value, this is used to calculate the final chargeable amount. For LCs charges or commission are collected based on the LC period.

This field defines the number of months that constitute a charging period. In the above FT.COMMISSION.TYPE case, if the contract is for 6 months, it consists of six charge periods, and hence six times charges defined is taken.

It is possible to collect charges at one exchange rate and the document amount at a different exchange rate. It is also possible to use different accounts for collection of charges. Flexibility to take charges immediately on an acceptance or deferred payment drawing instead of waiting until maturity is available.

The currency codes specified in this table, in association with the percentage or the amount of charges are always refer to the currency of the transfer, that is, the debit currency for the inward payments and the credit currency for all other types of payment. As a minimum, the local currency must be specified and any currency, which has not been defined is then default to these conditions and create the appropriate equivalent amount using the rates held on the currency file.

Charges can be collected multiple times before the contract is moved to history. A charge may be made periodically applied or due. For example, monthly, quarterly, etc. This field determines the length of time for which the commission type record applies. The period of the contract is split into the number of periods defined in this field to calculate the total commission amount. The input in this field is shown as 1, 3, 6, 9, 12 or 24 indicating monthly, quarterly, half-yearly, nine-monthly, yearly or bi-annually.

LC.PARAMTERS and FT.COMMISSION.TYPE.

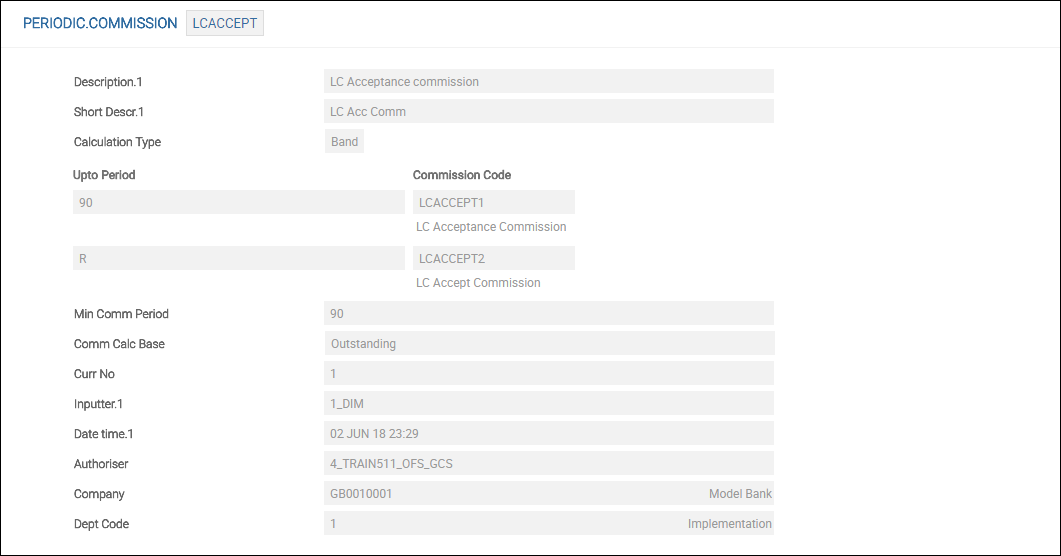

PERIODIC.COMMISSION

Banks normally collect commission for the issuance of LC and for usance drawings. Trade finance module supports calculation and collection of commission based on the tenure of the contract. The tenure-based commission can be collected either upfront or on a predefined frequency. An option to collect or claim the commission is available. The system supports fixed, band and level method of calculation of commission.

The following tables and fields cater to this functionality. The PERIODIC.COMMISSION table defines the period bands of the commission, which links the FT.COMMISSION.TYPE records created for amount bands.

The steps below are defined for a periodic commission:

- Define

FT.COMMISSION.TYPErecords for amount band for each period. Maximum and/or minimum amounts is not defined. - Define the period bands in the

PERIODIC.COMMISSIONtable attaching theFT.COMMISSION.TYPErecord IDs for the respective bands. - Create another

FT.COMMISSION.TYPErecord with the same ID as that ofPERIODIC.COMMISSION. - Attach transaction codes, category, minimum and maximum commission amount, tax code, etc. In the Charge Routine field, define the routine as @PERIODIC.COMM.TYPE.

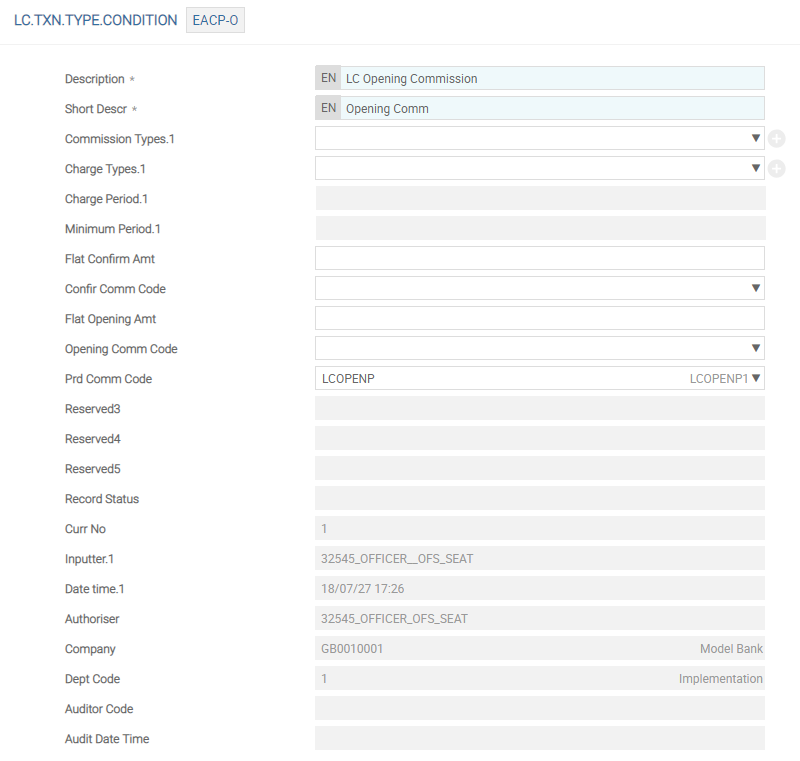

LC.TXN.TYPE.CONDITION (Default Trade Finance Charges)

The LC.TXN.TYPE.CONDITION table is used to define default charges for trade finance products. Each input into the LC system has a set of default charges in this file set up. The default mechanism works by defining in this file, a record corresponding to each type of LC (LC.TYPE), together with the operations that can be performed.

Charges are defined for each product (as defined in the LC.TYPES application), for each operation on those products (such as pre-advising, opening and amending the LC, etc.), and for each drawing and type of drawing made under an LC product. The key to an LC.TXN.TYPE.CONDITION record is the LC.TYPES key, followed by either the Operation for LETTER.OF.CREDIT or the Drawing Type for DRAWINGS.

Whenever a transaction is entered through the LETTER.OF.CREDIT (including documentary collections) or DRAWINGS applications, a key is built up of, the current LC.TYPE, the current Operation (for LCs), or the Drawing Type (for drawings). This key is then used to retrieve a record from the LC.TXN.TYPE.CONDITION file in order to set up all the default charges for the current transaction. These settings are used for general customers.

To amend the default charges for special clients or those belonging to a pre-defined group, the below condition group files should be setup:

| Table | Description |

|---|---|

LC.GEN.CONDITION

|

The general conditions |

LC.GROUP.CONDITION

|

The group conditions |

These impact the file CUSTOMER.CHARGE, where the effect of these is seen and additional changes are made. Periodic commission can be defaulted from LC.TXN.TYPE.CONDITION. For LCs, based on operation defined (O, A, P), the commission code is defaulted at the contract level. For drawings, based on drawing type defined (AC, DP), the commission code is defaulted at the contract level.

LC.GROUP.CONDITION and LC.GEN.CONDITION

Temenos Transact can default charges directly on to a LC transaction using LC.TXN.TYPE.CONDITION. The defaulted charge is not based on the customer but the LC type and operation. This structure is ideal for the use of standard tariffs, but in a bank, customers are given benefit in the form of preferential tariff.

To amend the default charges for special clients or those belonging to a pre-defined group the condition group files are setup in the below order:

| Table | Description |

|---|---|

CONDITION.PRIORITY

|

The criteria used and their order of priority for grouping the customers. |

LC.GEN.CONDITION

|

The general conditions – assign a general code and attributes based on the selection criteria set at CONDITION.PRIORITY table to define a group of customers. |

LC.GROUP.CONDITION

|

The group conditions – define the preferential tariffs for that group of customers. |

Temenos Transact allows the user to create groups of customers for the defaulting of non-standard tariffs. The CONDITION.PRIORITY file is set at implementation stage and determines what Temenos Transact looks at, to assign a customer to a particular condition group. The determinants are chosen based on trade finance business needs of the bank hence; it varies from the other CONDITION.PRIORITY files.

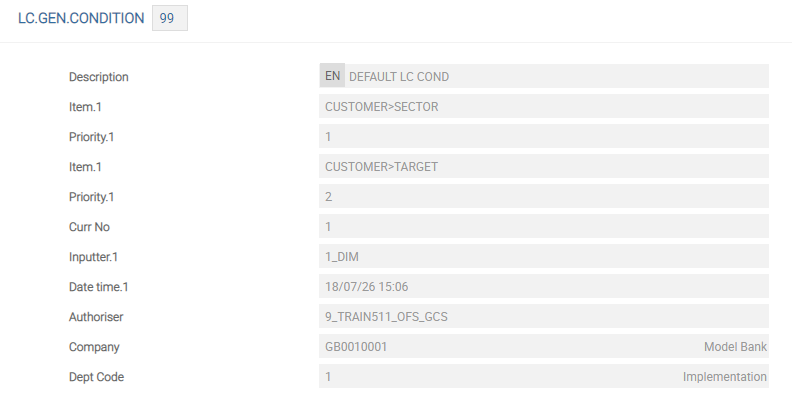

LC.GEN.CONDITION

The LC.GEN.CONDITION application defines default general conditions for trade finance transactions. The conditions are specified in the related application LC.GROUP.CONDITION. The purpose of this table is to assign a general code and attributes based on the selection criteria set at CONDITION.PRIORITY table to define a group of customers. Groups can be determined based on customer details such as residence, target, sector or any other customer attribute as per bank's policy.

The criteria used and their order of priority are specified in the CONDITION.PRIORITY application. A maximum of four priority conditions can be set. These are defaulted in LC.GEN.CONDITION and cannot be changed. The ID of the LC.GEN.CONDITION is referenced in other applications in Temenos Transact.

CUSTOMER.CHARGE application. It is also possible to effect change in any other group at this level. The record ID is a two digit numeric code. A 100 records can be created starting from 00 to 99.

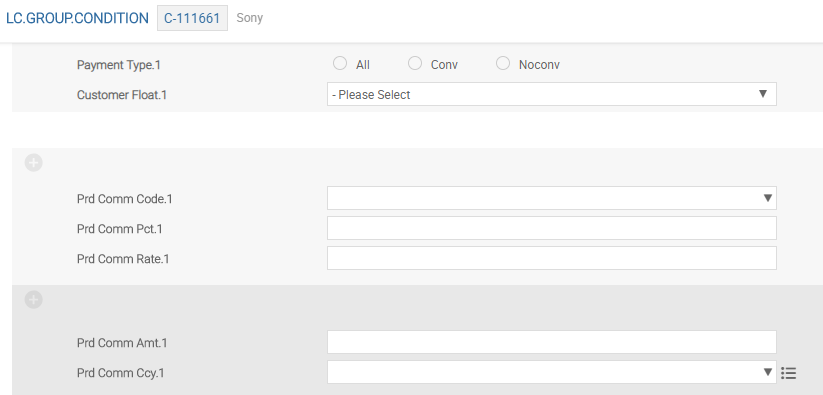

LC.GROUP.CONDITION

The LC.GROUP.CONDITION application defines special conditions applicable to specific groups of customers or individual customers and overrides the normal conditions used by the trade finance application. The ID of the record must be an existing record on the LC.GEN.CONDITION file, if the conditions are for a group of customers. An individual customer is specified by using the ID format <C-customer number>. For example, C-100014 is used to specify an individual charge regime for customer 100014.

The special conditions that apply are divided into four categories:

- Exchange spread – The

CURRENCYtable contains the conditions applicable to the exchange spread to be taken on transactions involving conversion of currencies. - Commissions – The

FT.COMMISSION.TYPEtable contains the standard conditions applicable to all types of commissions that is used in theLETTER.OF.CREDITapplication. - Charges – The

FT.CHARGE.TYPEtable contains the standard conditions applicable to all types of charges that is applied in theLETTER.OF.CREDITapplication. - Value Date – The transaction type condition

LC.GROUP.CONDITIONtable contains standard customer value date conditions, according to each Transaction Type existing in theLETTER.OF.CREDITapplication.

This file also allows the user to indicate if the charges have to be booked as a separate entry. If the charges related fields are left blank, then the default is taken from the Transaction Type and CURRENCY files. In the case of commissions and charges it is possible to define maximum and minimum amounts, together with a discount or premium, at an individual customer level or for a group of customers. This overrules any maximum and minimum amounts specified in the generic commission and charges records.

The following fields of the LC.GROUP.CONDITION application define the special conditions applicable to specific groups of customers or to individual customers. The value in the below fields specifies:

| Field | Description |

|---|---|

| Comm Maximum Amt and Chg Maximum Amt | The maximum amounts to be applied on transfers to which this commission or charge applies. |

| Comm Minimum Amt and Chg Minimum Amt | The minimum amounts to be applied on transfers to which this commission or charge applies. |

| Comm Discount Amt and Chg Discount Amt | The amounts to be deducted from the commission or charge amounts calculated. |

| Comm Premium Amt and Chg Premium Amt | The amounts to be added to the commission or charge amount calculated. |

LC.GROUP.CONDITION for a specific customer or a group of customers.

The Payment Type and Customer Float fields are optional.

- When the Customer Float field is set for a specific customer, the system updates the value date when the drawings transaction is settled.

- The Payment Type field is used to define whether conversion is involved in the transaction, in order to determine if a different value date condition is to be applied.

LC.CUSTOMER.CONDITION

LC.CUSTOMER.CONDITION can also be used to store information with ID as Customer ID. This table has additional facilities to indicate the provision related information in Provis Acct, Prov Percent, Lc Type and Credit Prov Acc fields. Provision percentage can be indicated LC.TYPE wise or as common percentage for all types by indicating DEFAULT in LC.TYPE field. Accounts, if entered, must belong to the same customer and currency.

For a customer with a standard provision account and percentage, the bank can setup the LC.CUSTOMER.CONDITION file with defaults for the provision account or percentage by LC type. Trade finance module provides for a refund or release of the provision at the time of settlement or as required at any time earlier. The provision can be collected from the customer’s account in any currency. The Provision Rate field displays the mid-rate between the LC currency and the provision credit account currency.

LC.ADVICE.TEXT

This section explains the various other user maintained tables that need to be set for operation of the LC and related modules.

The core tables that are to be set for operation of the LC and related modules are explained below:

DELIVERY

Delivery message to the customers for debit or credit of his account, broker for confirmation of trade and depository for completion of settlement of the trade are generated.

ACCOUNTING

Accounting entries are generated on the authorised transactions.

LIMIT and COLLATERAL

The limit system is designed to monitor the availability and utilisation of limits. Customer limits are monitored in real-time. Back end reports are used to monitor limits for commodities, countries, country groups and currencies. The system caters to defining both simple and complex limits. LC can be issued after setting up of limits and collateral.

Transactions can be done without creating limits. Temenos Transact creates a limit record for the customer for the relevant limit product automatically on authorisation of the LC contract, in the absence of the limit reference with notification message.

The core static tables that need to be set for operation of the LC and related modules are explained below:

CATEGORY

Separate category codes are used judiciously to indicate different types of LCs and collection instruments from reporting angle. Care should be taken when defining additional sub-classifications, that sufficient detail is not available to provide the required breakdown.

CATEGORY codes for resident and non-resident customers or for local and foreign currency transactions, since this information is already available on an individual prime record.

LC and DRAWINGS applications use hard coded category range 23000-23999. Each type of LC (and collection) can be defined with a default category code. These codes are used to reflect various LC and collection type in line with the reporting requirement like LC import sight, LC export sight confirmed LC, etc. Further, P/L category code for collecting and writing off charges, commission and internal provision account, category codes used are indicated in LC.PARAMETERS. Default internal accounts in local currency can be opened using the category codes as defined. Category codes between 10000 and 19999 can be used.

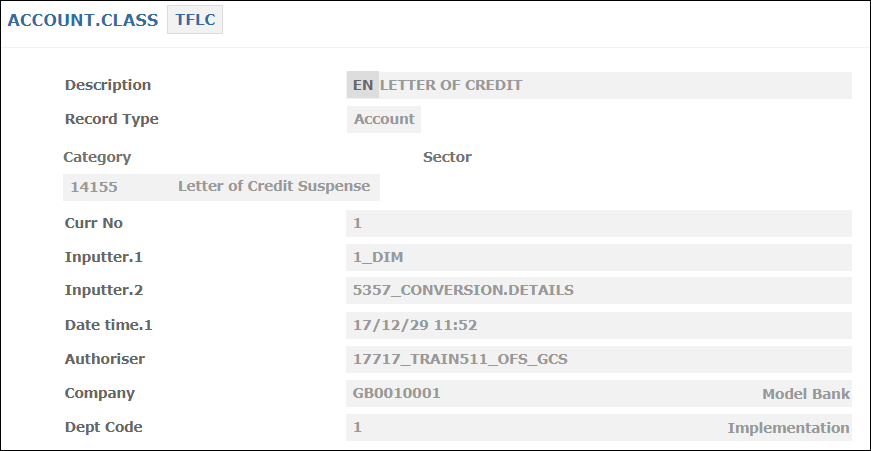

ACCOUNT.CLASS

ACCOUNT.CLASS records are required for automatic debit or credit by the system.

Temenos Transact opens an account in the local currency in the internal category mentioned in ACCOUNT.CLASS. Even if present business does not warrant such setup, it is better to create them. They can be used only if needed.

Duplications of category and sector code combined are not allowed within one entry on the ACCOUNT.CLASS table.

- LCAMORT record indicates the internal account for amortisation of charges and commissions if required by the user.

- LCDIFF record to post the differential amount of 0.01 or 0.02 on account of application of exchange rate for the currencies involved in the transaction.

- TFLC record is to default a suspense account in case there is no Nostro account for the credit currency, when bill proceeds are remitted within

DRAWINGSapplication. - CUSDEBIT record is an internal suspense account used when a customer account is not available for debit in case of sight bills.

NOSTRO.ACCOUNT

There is no standard rule or order for defaulting settlement accounts in LC application. If account numbers are entered for opener, beneficiary and advising bank, then they are defaulted while collecting charges. They are also defaulted in DRAWINGS application.

DRAWINGS, the payment account is defaulted using NOSTRO.ACCOUNT for the payment currency.

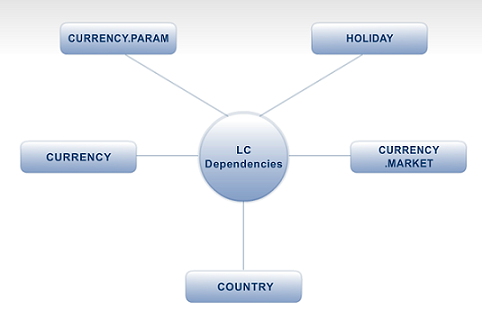

CURRENCY

CURRENCY table contains all details of each individual currency. For example currency name, number of decimal places together with other information such as the buy and sell rates.

CURRENCY.MARKET

The markets defined in this table are used to identify the correct exchange and revaluation rates to be applied to each currency. Different rates are used in instances where specific currency markets exists. For example, financial and convertible markets or where pricing considerations require separate rates like normal market rates or notes or travellers cheque.

DATA.CAPTURE and FUNDS.TRANSFER.

CURRENCY.PARAM

This table contains common elements of each currency. This table ensures that the same numeric codes and number of decimals are used for a currency across different companies in a multi-company environment.

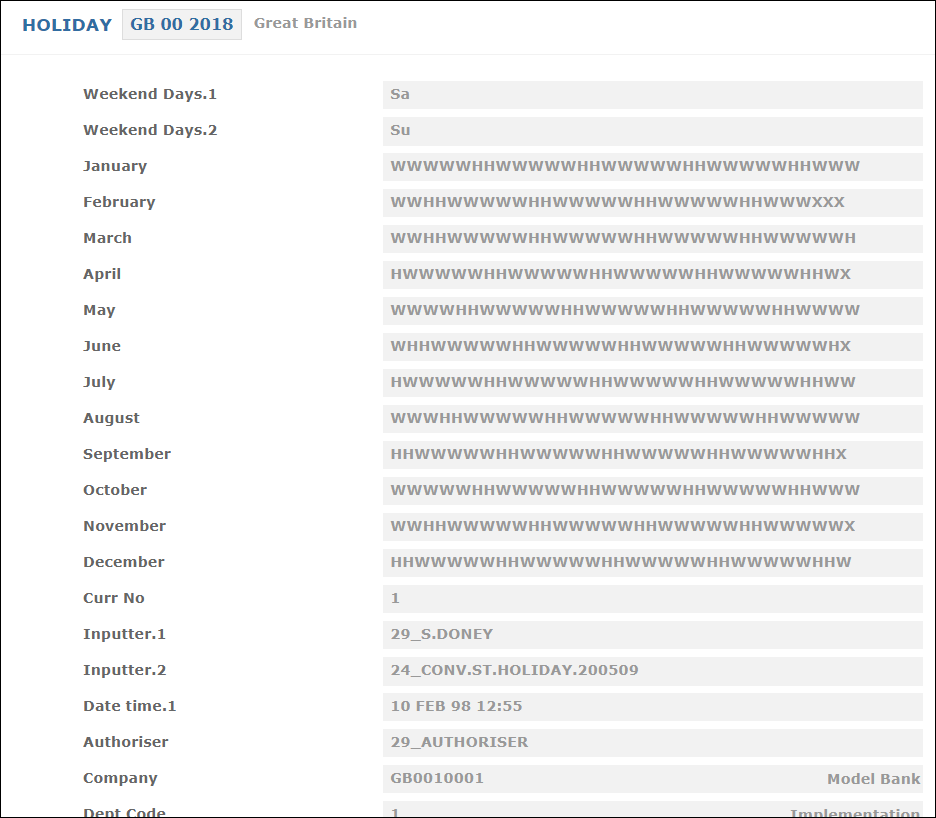

HOLIDAY

HOLIDAY table is used to check whether the maturity or other schedule activity date is a working day at the time of entering a contract. It is possible to indicate the business day definition while entering the contract and Temenos Transact checks the scheduled activities and suitable overrides are generated.

HOLIDAY table is to indicate the public holidays for each country or region within the country. REGION and COUNTRY table must be defined before creating the HOLIDAY table.

COUNTRY

The COUNTRY table contains static details of each country, the currency codes, etc.

The LETTER.OF.CREDIT module is dependent on many other applications or functionalities in Temenos Transact.

CUSTOMER

Customer records are necessary to have details of the underlying party to the LC transactions, counterparty, correspondent banks and broker.

ACCOUNT

The banks need accounts for payment and receipt into customer and brokerage settlement accounts.

Illustrating Model Parameters

Model parameters consists of the below tables:

| Table Name | Description |

|---|---|

LC.TXN.TYPE.CONDITION

|

This parameter file is used to setup the default charges

for all LC or documentary collections and drawing types.

|

LC.GROUP.CONDITION

|

|

LC.TYPES

|

|

LC.ADVICE.TEXT

|

The record ID is as follows:

When opening an import LC in Temenos Transact, the user can select document code against Documents Required field (Swift field 46-A) instead of typing text message. When the user wants to edit the text message, it can be done at contract level. |

LC.CLAUSES

|

The preferential order of the record ID is:

|

DR.DISCREPANT.TYPE

|

|

LC.GEN.CONDITION

|

|

LC.PARAMETERS

|

|

Illustrating Model Products

A LC is a document issued by financial institution on behalf of its customer, which provides a payment undertaking to beneficiary against complying presentation of the documents as stated in the credit.

LC Module supports the below products:

| Product Name | Features |

|---|---|

| Issuance of import LCs |

The LC module within model bank (Temenos Transact) is used to record the contingent deals that are required to record LC type transactions in the banks’ books. A bank user opens a credit record in Temenos Transact based on the application received from the customer. The initiation to issue a LC can be directly from the corporate client through Corporate Internet Banking channel. The following types of import LCs are issued:

The following types of export LCs are advised to the beneficiary:

|

| Maintenance of import LCs |

|

| Drawings under import LCs |

|

| Discounting of usance bills under LC | Issuing bank makes the payment to the beneficiary or negotiating bank before the accepted maturity of the said drawing or bill and then recovers the payment amount from the applicant on the accepted maturity date. |

| Collections | The LC module within model bank (Temenos Transact) also facilitate documentary

collections (outward and inward). The following types of collections are processed:

|

| Open Account Trade | The LC module within model bank (Temenos Transact) also facilitates Open Account Trade (Import and Outward). The following types of contracts are processed:

|

| Trade Evidence for Advance Payments | The LC module within model bank (Temenos Transact) also facilitates registering of trade evidence against the advance payments. |

In this topic