Introduction to Factoring and Forfaiting

Bills are receivables represented by invoices or bills of exchange. A business corporate (startups or SMEs or multinational corporates) can sell its bills to a Temenos Transact bank at a discount for a fee. The bank then collects the payments from the corporates customers, which is referred as factoring or receivables financing.

The risk department in a bank may not approve financing of all bills. Such bills are sent for collection with the bank acting as an agent. Occasionally, banks consider accepting a bill as a collateral for extending a line of credit. A bank can extend their services to a corporate customer on the strength of bills. For example, factoring, collections and bill discounting.

Classifying Bills

The bill business from a bank's perspective are classified as follows:

The below are the different types of bills:

- Trade Bills – The bills that are a consequence of trade finance business by a corporate. This can further be sub classified into:

- Demand Bills – Payable on demand

- Usance Bills – Paid after a specified number of days. For example, the days count starts from the date of transport document

- Direct Bills – The drawer and drawee are the same. These bills have a definite maturity date

- Clean Bills – These are essentially cheques issued by a bank

After lodgment, the following operations can be performed on bills for a customer of a bank:

- Collecting invoice amount in part or full and crediting the operative account

- Discounting or purchase

- For factoring, individual bills are grouped together and collectively discounted or purchased

- Using bills as collateral to secure limits

Additionally, the bills module also supports:

- Retention of margin during advance disbursement

- Partial disbursement

- Partial or rebate type of settlement

- Cross currency disbursement or settlement

Configuring Factoring and Forfaiting

The individual bill types and their nomenclature differs from country to country. The parameters tables (also known as applications in Temenos Transact) are the building blocks for designing the business process flow. It defaults common values to improve accuracy and efficiency.

Setting up Parameter Tables

The parameter tables in the bills module for transaction processing are listed below:

| Table Name | Short Name | Description |

|---|---|---|

BL.PARAMETER

|

BP | Company level parameter |

BL.TYPE

|

BT | Bill type definitions |

BL.TXN.TYPE.CONDITION

|

BTTC | Bill types and transactions |

APPL.GEN.CONDITION

|

AGC | Bill contract group definition |

BL.GROUP.CONDITION

|

BGC | Defining customer or group conditions |

The explanation on each of the parameter files and its content is given below:

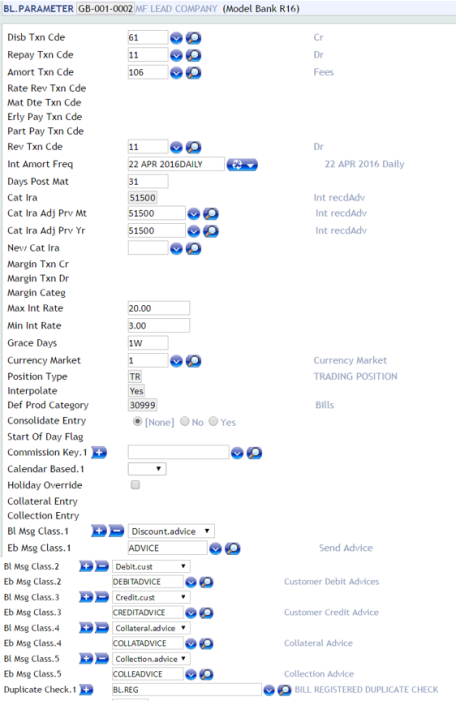

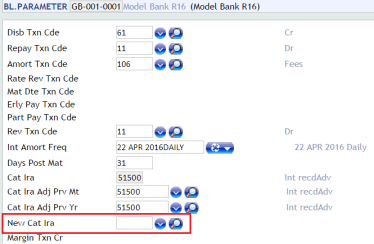

BL.PARAMETER

This is the highest-level table defined at the company level in the bills module setup at the time of implementation. The processing characteristics for bills are determined from the settings defined in this section.

Some of the fields in BL.PARAMETER are explained below:

| Field | Description |

|---|---|

| Int Amort Freq |

|

| Days Post Maturity | Defines the number of days post maturity of the contract after which the records are moved to the history file. |

| Max Int Rate |

|

| Minimum Interest Rate |

|

| Grace Days |

|

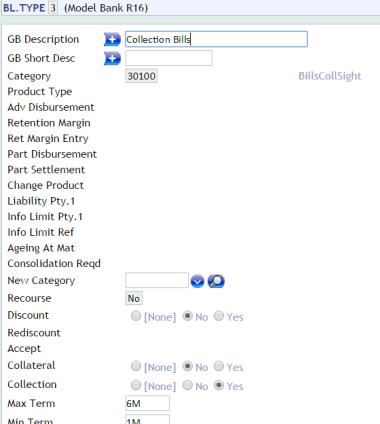

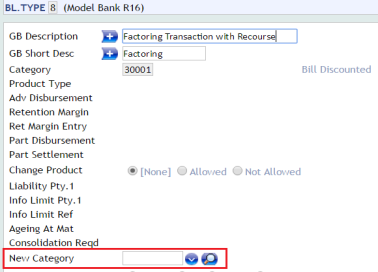

BL.TYPE

This table defines the parameters defaulted, while lodging a bill. (On daily basis, the bills received at the bank are lodged in BL.REGISTERapplication). The field values are defaulted when a bill is processed. Defines the category for various bill type records (for reporting purposes) and determines the liability customer (in case of dishonour of a bill). One-time setup is done at implementation. However, new BL.TYPE records are subsequently added based on business imperatives.

The beow table displays various BL.TYPE values and their description.

BL.TYPE

|

Description |

|---|---|

| 1 | Discounted bill with recourse |

| 2 | Discounted bill without recourse |

| 3 | Collection bills |

| 8 | Factoring transaction with recourse |

| 9 | Factoring transaction non-recourse |

Some of the fields are in BL.TYPE are explained below:

| Field | Description |

|---|---|

| Category |

|

| Collateral | Allowed values are Yes or No. On selecting Yes, the bills type is considered as a collateral. |

| Liability Pty | Defines the party to be defaulted as liability customer in BL.REGISTER. |

| Part Settlement |

|

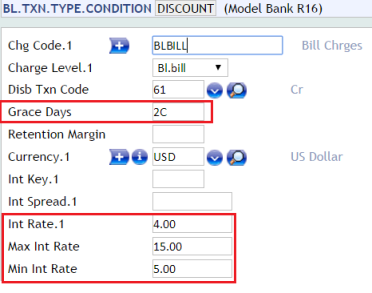

BL.TXN.TYPE.CONDITION

This table define the default values for specific BL.TYPE and bill operation combinations. The possible bill operations are collections, discounting or collateral. The default values for each of these operations can be different from each other. The ID of a record in this table are appropriately structured as collection or discount or collateral. Additionally, it is used to define the default values in combinations of bill types and operations.

This table contains conditions for transactions. Therefore, a charge or commission code required in bill transactions is defined in the FT.CHARGE.TYPE or FT.COMMISSION.TYPE.

BL.REGISTER, BL.BATCH and BL.BILL to be defaulted into the respective application.

Some of the fields in BL.TXN.TYPE.CONDITION are explained below:

| Field | Description |

|---|---|

| Grace Days |

|

| Currency |

|

| Interest Rate | Determines the interest rate that is used at the transaction processing level. This is an optional field associated withCurrency,Interest Key andInterest Spread. |

| Max Int Rate |

|

| Minimum Interest Rate | Checks if the calculated effective rate of interest is within the permissible limits. When the interest rate is defined, the minimum interest rate should not breach the rate specified in this field. An override message is generated when the effective rate is breached. |

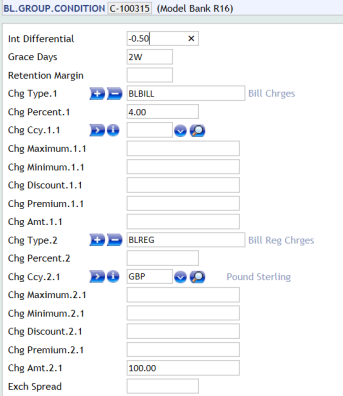

BL.GROUP.CONDITION

Modifies or overrides the values defaulted from a BL.TXN.TYPE.CONDITION. Using this application, different default values (of charge, commission and interest) are defined for an individual or a group of customers, as defined in APPL.GEN.CONDITION.

The record ID is <C-customer number> or <GROUP>. For example, C-100315, GROUP1, GROUP2.

The following fields define the special conditions applicable to specific groups or individual customers:

| Field | Description |

|---|---|

| Chg Maximum Amt | Defines the maximum amount charged for the applicable charge type. |

| Chg Minimum Amt | Defines the minimum amount charged for the applicable charge type. |

| Chg Discount Amt |

|

| Chg Premium Amt |

|

APPL.GEN.CONDITION

Allocates group codes, based on a number of defined conditions and/or local routines for any Temenos Transact application with a STANDARD.SELECTION.

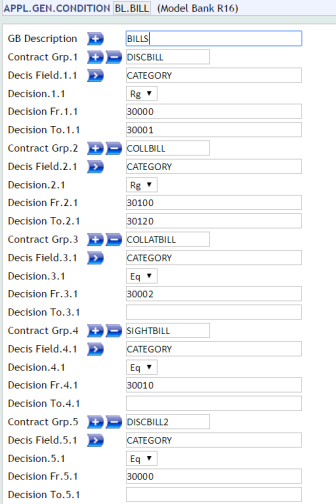

A contract group is defined in this application, and created based on the category. For example, DISCBILL and COLLBILL is in the category range code from 30000 to 30001 and 30100 to 30120, respectively. The APPL.GEN.CONDITION requires a record with an ID of BL.BILL.

BL.STATUS

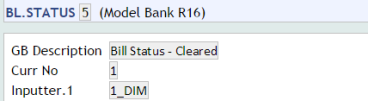

Defines the status of a process step in the life cycle of a bill. This status is entered at BILL.REGISTER or BL.BILL level. The status of a bill is monitored on a daily basis, when a report is generated from this application. Once the status is defined, the same is used in BL.REGISTER or BL.BATCH application.

The other setups done at the parameter level are:

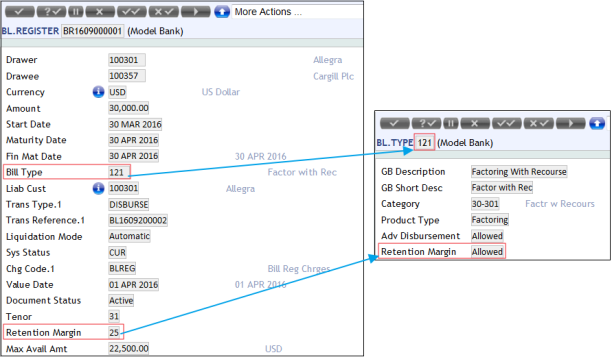

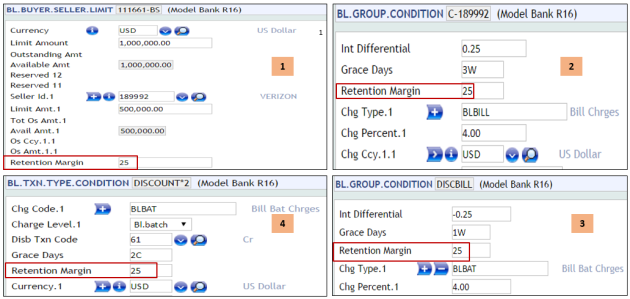

This is a percentage of invoice or bill amount retained by the bank at the time of making advance disbursement to the seller. The value in theRetention Margin field defaults in BL.REGISTER when theBill Type is attached, and theRetention Margin field is set to Allowed in the BL.TYPE application.

The system calculates and updates the maximum available amount for disbursement based on the retention margin. The retention margin is defined for:

- Product type in

BL.TXN.TYPE.CONDITION - Customer level in

BL.GROUP.CONDITION - Buyer in

BL.BUYER.SELLER.LIMIT

The order in which theRetention Margin field is defaulted in BL.REGISTER are as follows:

BL.BUYER.SELLER.LIMITBL.GROUP.CONDITION– Customer specificBL.GROUP.CONDITION– GroupBL.TXN.TYPE.CONDITION

The Cat Ira defines the profit and loss category code in BL.PARAMETER application to which the interest received in advance is posted. On authorisation, this field cannot be modified. However, the change in the existing profit and loss category can be specified in the New Cat Ira field. During COB, the category code is updated as the new category code. Henceforth, the new profit and loss category is used for reporting.

Similarly, the category of the bill in which it is reported is entered in the Category field of BL.TYPE application. On authorisation, this field cannot be modified. However, to change the existing category code the New Category field is used. At COB, the category code in this field is updated as the new category code Henceforth, all transactions are reported in this category code.

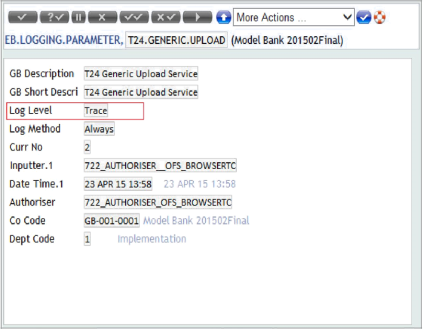

The E.UPLOAD.BL.REG.ERR.DTLS enquiry displays all the BL.REGISTER records in IHLD status, which can be amended or deleted.

The following setup is done in the system for the enquiry to display the error text and upload record line number.

The Log Level field in the record Temenos Transact.GENERIC.UPLOAD of EB.LOGGING.PARAMETER is set to Trace.

TheInt Log File field in SPF is set to Yes.

Illustrating Model Parameters

Model parameters consists of the below tables:

| Table Name | Description |

|---|---|

BILL.PARAMETER |

|

BILL.TXN.TYPE.CONDITION

|

|

APPLICATION.CONDITION ;

|

|

BILL.GROUP.CONDITION |

|

BILL.TYPE |

|

BILL.STATUS

|

|

EB.DUPLICATE.TYPE

|

|

FILE.UPLOAD.TYPE

|

|

PRODUCT.CONDITIONS

|

|

CHANGE.PRODUCT.CONDITIONS

|

|

BATCH.CONDITIONS

|

|

BUYER.SELLER. LIMIT |

|

Illustrating Model Products

Factoring and Forfaiting (FF) involves the sale of the receivables by the seller to meet their immediate cash needs. FF module supports the below products:

| Product Name | Features |

|---|---|

| Bills for collection |

|

| Bills for discounting |

|

| Bills for collateral | Bill collateral product is a trade bill that is taken as a collateral for establishing an account limit for lending. |

| Creation of bills contract |

|

| Manual upload and batching |

Manual upload and batching provides the users with the options to register, batch and rebatch the receivables with authorisation.

|

| Automatic upload and batching | Automatic upload and batching provides the users with the options to register, batch and rebatch the receivables with zero authorisation. |

| Disbursement and settlement | Disbursement and settlement provides the users with the options to input, amend, reverse and delete the disbursed and settled records. |

In this topic