Introduction to Tax Lots

Capital Gain (CG) is a gain realised when an asset is sold or disposed at a price higher than the acquisition price. In most countries, CGs are taxed in the hands of the investor. The method of calculating CGs differs for each country. Many countries have different rules based on the period the asset was held.

Some regulations allow the acquisition price to be adjusted based on the consumer price or inflation index. Further, certain individuals or asset categories can be exempt from CGs.

The key basis for CG calculation is storing details of the asset particularly the date and time of acquisition, the cost and the number of units acquired. Assets such as equities are bought and sold multiple times. The acquisition cost varies from one lot to another. Therefore, each acquisition must be stored as separate parcels or lots. The gains differ depending on the lot selected for disposal.

CG calculation is a complex process and hence Temenos Transact is flexible to handle a variety of calculation methods.

Product Configuration

The following basic setup needs to be done in the system to calculate Capital Gains (CGs).

SC.PARAMETER

The CG Base Update field in the SC.PARAMETER indicates whether the CGs base is to be updated or not. If this field is set to YES, it indicates that the system maintains the CGs base (CG.TXN.BASE), where tax lot details are maintained and is the base for CG calculation.

CG.PARAMETER

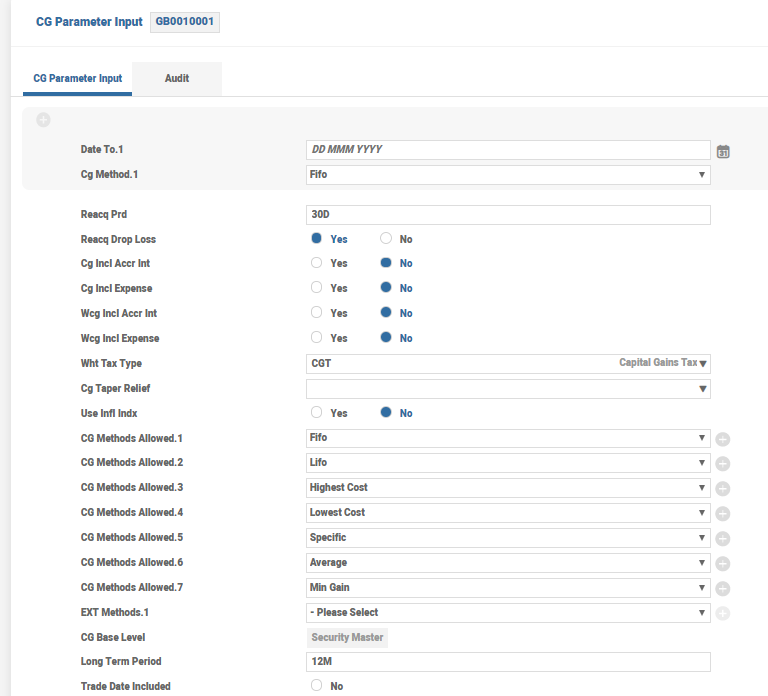

This application holds the details necessary for the calculation of CG. It is a basic parameter where the default tax method to be used and other company level attributes are set.

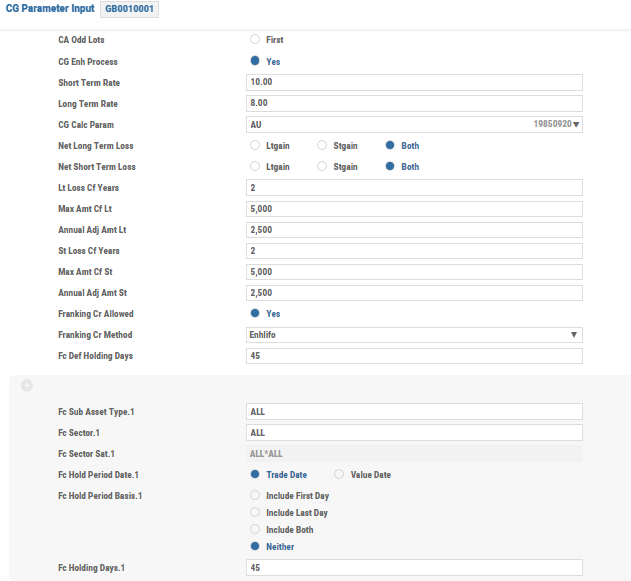

The CG Enh Process field is set to Yes for the working of all enhanced CG calculations.

The above settings indicate that the CG method to be used when calculating a gain is First in, First out (FIFO). The tax to be charged CGT is defined in the TAX.TYPE application. When the gain is calculated, the inclusion or exclusion of accrued interest and expenses in the cost is determined by setting the Cg Incl Accr Int, Cg Incl Accr Expense, Wcg Incl Accr Int and Wcg Incl Accr Expense fields. The setting of these parameters can also be specified at ASSET.TYPE or SECURITY.MASTER level, where the SECURITY.MASTER takes the high priority than the CG.PARAMETER.

The CG Method Allowed field holds various tax lot methods supported by Temenos Transact. But, there are few cases where the lots are determined by an external system, such as the front office. In these scenarios, Temenos Transact records the method in the EXT Methods field and uses the same lot as received. However, this field can accept only the values specified in the > CG Method Allowed field.

Different countries have different regulations regarding the number of years the capital losses can be carried forward, the maximum amount carried forward and also the maximum carried forward loss can be set-off against gains per year. To specify this, the following fields are set up.

| Field | Description |

|---|---|

| Net Long Term Loss and Net Short Term Loss | Indicate if the long- or short-term loss can be offset only against long- or short-term gain or both |

| Lt Loss Cf Years and St Loss Cf Years | Indicate the number of years that the long- and short-term loss can be carried forward |

| Max Amt Cf Lt and Max Amt Cf St | Specifies the maximum amount of long- and short-term losses carried forward per year |

| Annual Adj Amt Lt and Annual Adj Amt St | Specify the maximum carried forward long- and short-term losses that can be set-off against gains per year. |

| Long Term Period | Specifies whether the disposal of security falls under long or short term. Any holding less than this period is treated as a short-term holding. |

| Short Term Rate and Long Term Rate | Specify the rate applicable for holding. |

| CA Odd Lot | Specifies whether the odd nominal are to be adjusted in the first or last lot. |

| CG Calc Param | Holds the relevant data for a particular country’s CG calculation. |

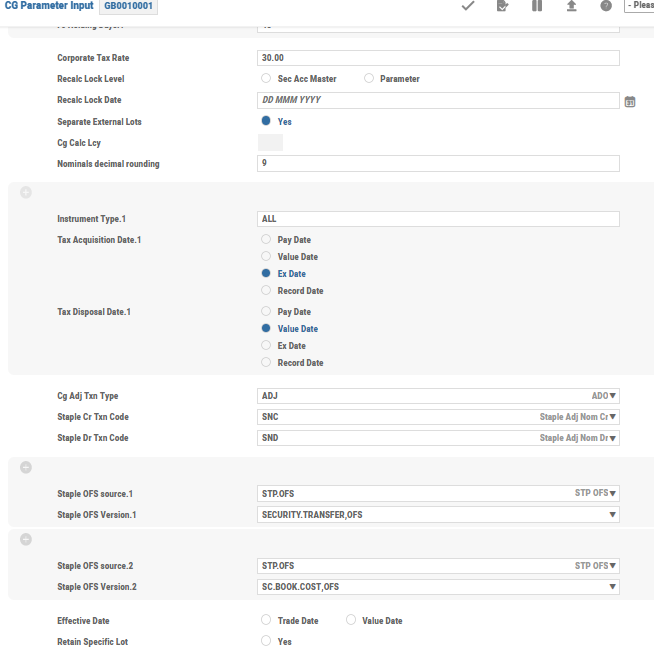

| Sep External Lots | This field is set to Yes to maintain separate tax records for external custody positions. If this field is left blank, then both the external and on-platform positions are updated in the same CG.TXN.BASE. |

| Franking Cr Allowed | This field is set to Yes only in countries where franking credits are allowed. |

| Retain Specific Lot | Ensures that any specifically selected lot remains untouched while reworking. It remains as originally allocated and only the other lots are reworked. |

| Recalc Lock Date | Reallocates and calculates capital gains or losses up to the mentioned date. |

- If the CG Enh Process field is set to Yes, then the Use Infl Indx field cannot be set. However, the CPI index specified in the CG Calc Param field in

COUNTRYis used for indexation method. - The user can set the default tax acquisition date and disposal date for lots created through corporate action (CA) event in the Ca Tax Acq Date and Ca Tax Disp Date fields. So ex-date, pay date or value date can be used. However, the date can also be specified at the individual event level in the

DIARYapplication.

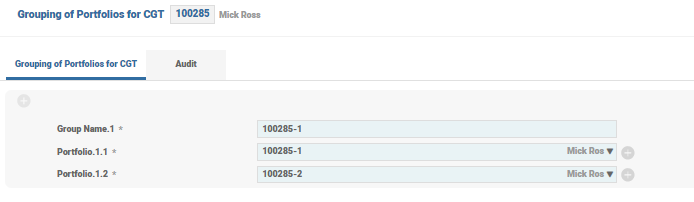

PORTFOLIO.GROUPING

This application supports the grouping of multiple portfolios into a group. The ID of the record is a valid customer ID. Only portfolios of the same customer can be grouped for CG calculation.

The name under which the portfolios are grouped is defined in the Group Name field. Under enhanced CG process, that is, where the CG Enh Process field is set to Yes in CG.PARAMETER, the portfolio grouping can allow only one portfolio in a group.

CG.INVENTORY.METHOD

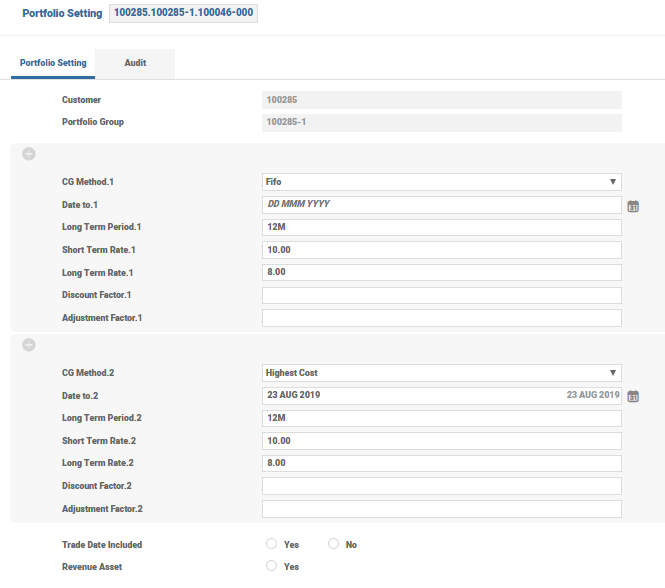

This application allows to define CG allocation methods at various level. The ID consist of the following three parts.

- The first part is a valid customer ID or ALL.The first part of the id is a valid portfolio grouping.

- The second part is a valid Portfolio ID or Portfolio Group Name or ALL.

- The third part can accept S-NNN (sub-asset type), A-NNN (asset type), NNNNNN (security master), NNNNNN (ISIN) or ALL.When the Cg Base Level field in the

CG.PARAMETERis set to ISIN, the system cannot accept Security Master ID.

Therefore, it is possible to set CG methods

- for all customers for all portfolios and asset types (ALL.ALL.ALL record)

- for a particular customer and for all asset types (CUSTOMER ID.ALL.ALL record)

- for a particular portfolio or group and for a particular sub asset type (ALL.PORTFOLIOGROUPNAME.SAT record)This application can be used only if the CG Enh Process field is set in the

CG.PARAMETER.

The fields from CG Method to Adjustment Factor forms a part of a multi-value set as explained in the below table.

| Field | Description |

|---|---|

| CG Method | Defines the tax lot method applicable for each set. Only the methods allowed in the CG.PARAMETER can be set here. |

| Date to | Denotes the date till when the values defined in the corresponding multi-value set are applicable. These dates must be given in descending order, that is the oldest date in the last multi-value set. The first date must be left blank. |

| Long Term Period | The tax lot held less than the period defined in this field is treated as a short-term holdings. If left blank, then the value is defaulted from the CG.PARAMETER. |

| Long Term Rate and Short Term Rate | The tax rate applicable for short and long term holdings are defined in these fields. |

| Discount Factor | Denotes the discount factor (in percentage) used to calculate discounted PL. |

| Adjustment Factor | Calculates the tax liability under TAFO method. |

Illustrating Model Parameters

CG.PARAMETER is a company-level parameter to define the tax methods and the relevant attributes for capital gains (CG) calculations. The fields available in this parameter are listed below.

| Field | Description |

|---|---|

| Cg Method 1 | Indicates the particular capital gains method applicable upto the date defined in the Date To field |

| Date To 1 | Used to set up the end dates for each of Cg Method. Dates need to be defined in descending order, that is, oldest date in the lowest sub-value. The Latest Date To 1 field cannot be populated with any value as it relates to the current period |

| Reacq Prd | Indicates the period of time elapsed between a sale and subsequent purchase, so that the purchase is not regarded as a repurchase of that sale |

| Reacq Drop Loss | Specifies whether this is a requirement to drop any loss associated with a sale |

| Cg Incl Accr Int | Indicates whether accrued interest is included in the calculation of the CG profit and loss or not |

| Cg Incl Expense | Indicates whether expenses are included in the calculation of the CG and loss or not |

| Wcg Incl Accr Int | Indicates whether accrued interest is included in the calculation of the CG withheld tax profit and loss |

| Wcg Incl Expense | Indicates whether expenses are included in the calculation of the CG withheld tax profit and loss |

| Wht Tax Type | Indicates the record from TAX.TYPE which is used for CG tax calculation |

| Use Infl Indx | Specifies whether inflation indexation is applied to the specified CG. If left blank, inflation indexation is not applied |

| CG Methods Allowed 1 | Indicates the list of methods allowed for tax lot allocation and CG calculations. The methods listed in this field can alone be used in setting up the portfolio-specific allocation |

| Long Term Period | Holds a time period that determines whether asset needs to be considered as long or short term. Any holding for less than this period is treated as a short-term holding |

| Trade Date Included | Determines the calculation of long-term period of holding |

| CG Enh Process | Set as YES for the working of all enhanced CG calculation |

| CG Calc Param | Holds relevant data for a particular country’s CG calculation |

| Tax Acquisition Date 1 | Indicates the acquisition date for the lots created through Corporate Action (CA) event |

| Tax Disposal Date 1 | Indicates the disposal date for the lots disposed through CA event |

| Cg Adj Txn Type | Defines the transaction codes used for CG adjustments |

| Retain Specific Lot | Indicates whether a specific tax lot needs to be retained or not during CG rebuild process. |

| Cg Fcy Acc | Indicates whether capital gain has to be calculated for movements in FCY account. |

Illustrating Model Products

Model products are not applicable for this module.

In this topic