Introduction to European Savings Directive

The EU COUNCIL DIRECTIVE 2003/48/EC dated June 3, 2003 on taxation of savings income in the form of interest payments (known as the European Union Savings Directive) came into force on July 1, 2005.

“The ultimate aim of the Directive is to enable savings income in the form of interest payments made in one Member State to beneficial owners who are individuals resident for tax purposes in another Member State to be made subject to effective taxation in accordance with the laws of the latter Member State.”

The European Union (EU) taxation on savings income is a system of tax retention initially of 15%, rising to 20% and then to 35% from 2011. The system of tax retention applies to all interest payments which a paying agent makes to an individual resident for tax purposes in an EU member state. It also allows the foreign bank customers to choose between a system of tax retention and a declaration to the tax authorities (voluntary declaration). The directive includes detailed descriptions regarding to whom this applies and where, as well as exceptions and special cases.

Directive Scope

All banks resident within the EU or in countries intending to comply with the directive (that is, Switzerland and other off-shore banking centers) is obliged to report the interest earned on all debt instruments. Certain specified funds fall within the scope of the directive or to calculate retention tax on such instruments held by EU citizens who are resident in another member state according to new rules as stated in the directive. In all cases, the new calculation rules is used to calculate the amount of taxable income which must be either reported to the customer's home country, or in the case of certain countries used to deduct retention tax. Where retention tax is deducted, the taxable income is split between the countries of residence of the bank and beneficial owner.

Affected Countries

The EU Savings Directive has an impact in the following countries:

- All member states of the EU (including new joiners)

- Austria, Belgium and Luxembourg are allowed to charge withholding tax, all other EU countries report the tax earnings

- Andorra

- Cayman Islands

- Caribbean Territories

- Gibraltar

- Guernsey

- Isle of Man

- Jersey

- Liechtenstein

- Monaco

- Netherlands Antilles

- Switzerland

Temenos Transact handles the withholding of tax to comply with the EU Savings Directive. This feature requires to install the European Tax (ET) module.

Product Configuration

This feature explains the necessary setup required in Temenos Transact for EU savings tax calculation.

Follow the below steps to do the initial installation:

- Install the latest appropriate service pack and any subsequent patches.

- Add the European Tax (ET) and Tax Engine (TX) products in the

SPFapplication, along with the required license codes. - Add the ET and TX product codes to the required record in

COMPANY. - Authorise the following released records in:

STANDARD.SELECTIONBATCHTSA.WORKLOAD.PROFILETSA.SERVICE

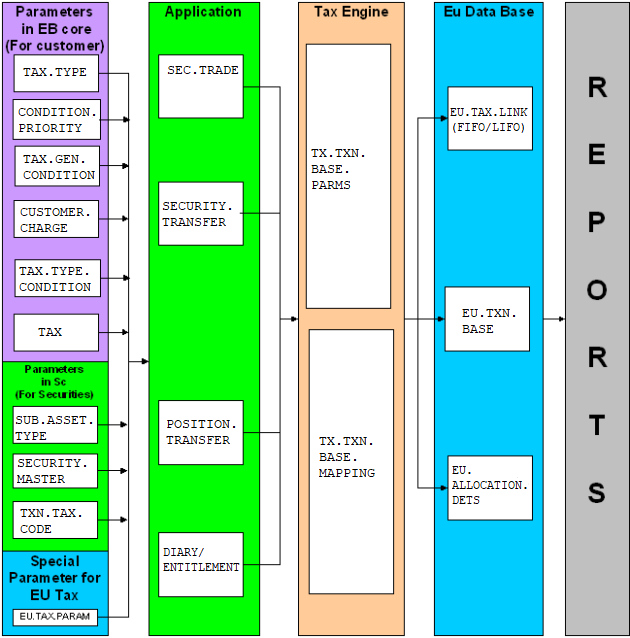

TX.TXN.BASE.PARMS and TX.TXN.BASE.MAPPING are examples only. It must be authorised only after ensuring that the structure of the base is satisfactory. The design workflow of EU Savings Directive is explained in the below flowchart.

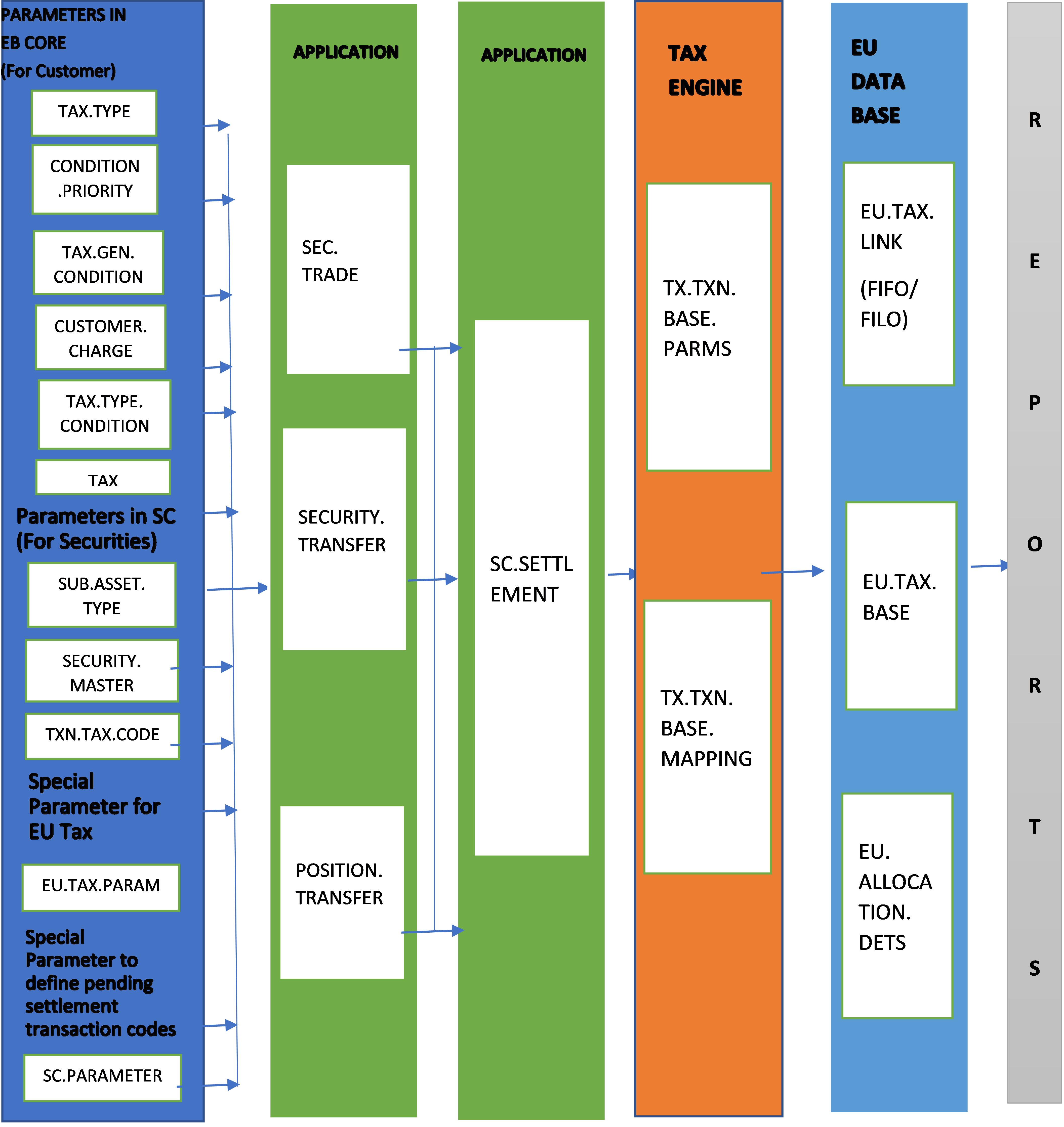

For transactions that are considered as ‘pending settlements’, the system updates the EU.TAX.LINK on the settlement date. For transactions in SEC.TRADE, SECURITY.TRANSFER and POSITION.TRANSFER with the transaction codes for pending settlement transactions, the system updates the EU.TAX.LINK from SC.SETTLEMENT. To enable the pending settlement transaction for SEC.TRADE, SECURITY.TRANSFER and POSITION.TRANSFER, the user should set the Sect Pend field as All in SC.PARAMETER. The transaction codes for such transactions are defined in the Sc Trans Name field in SC.PARAMETER.

The image below shows the design workflow of EU.TAX.LINK update for pending settlement transactions.

The details about the parameters are provided in the following sections.

Customer

Recording of the effective date for in-scope customers is mandatory. In-scope customers are further classified as those who are subject to retention tax and those who are only reporting (info customers). The classification of customers can be based on any of the existing core or local reference fields in CUSTOMER or a new local reference field is to be created for this purpose. It is recommended to create a Local reference field to hold the EU Status (used to record the customer’s status with regard to EU retention tax, for example, WHT applicable or EXEMPT).

The user must ensure the fields created for grouping customers for tax, are populated for existing customers before the initial base is built. This can be done either manually or through local routines. When new customers are created, ensure these details are populated for in-scope customers and the user can have version level checks for this.

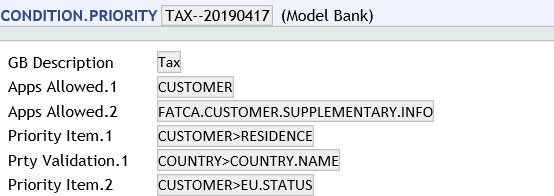

Condition.Priority

The CONDITION.PRIORITY application details the conditions to be considered to create customer groups. This application needs to be amended for tax if the bank requires addition of new conditions on which the grouping of customers are based on. If the existing grouping conditions are sufficient, then amendments are not required. A combination of the Residence field and EU.STATUS local reference can be used to define the customer groups and route tax postings to separate accounts per EU member state. Therefore, these two fields must be added to the CONDITION.PRIORITY with the appropriate record in TAX as shown below.

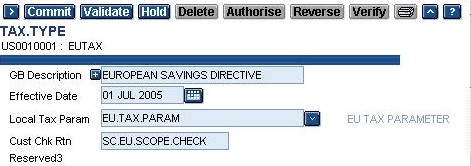

Tax.Type

The following fields in the TAX.TYPE application relates to the EU Savings Directive:

- Effective Date - Holds the effective date from which tax is applicable. An appropriate back-date may be setup for testing purpose.

- Local Tax Param - If EU tax is to be calculated, this field should be set to

EU.TAX.PARAM. The name of this application cannot be changed and is hard-coded in the system. If any value other than EU.TAX.PARAM is set-up, EU tax is not calculated. - Cust Chk Rtn - Contains the routine which checks whether the customer is liable for this tax or not. The SC.EU.SCOPE.CHECK routine is provided as part of the ET module. This routine needs to be specified in this field.

The TAX.TYPE record for the EU Savings Directive is set-up as follows:

Tax.Gen.Condition

The TAX.GEN.CONDITION application defines the customer groups for each type of tax. The groups are defined using the factors listed in CONDITION.PRIORITY record called TAX. The user must input a record for each customer group for EU retention tax. The record in CUSTOMER.CHARGE for each customer confirms the group applied for a specific customer.

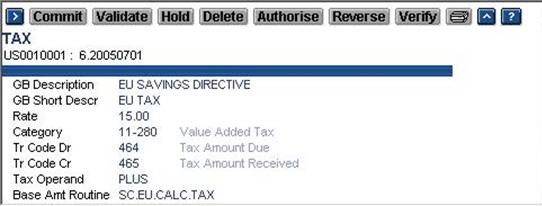

TAX

The TAX application defines the specific characteristics of the tax itself, including the rate, category and transaction codes. For EU savings, the Base Amt Routine field is populated with the routine SC.EU.CALC.TAX.

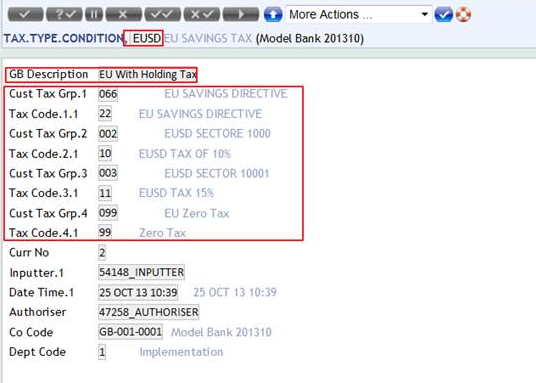

Tax.Type.Condition

The TAX.TYPE.CONDITION application establishes which record in the TAX application is to be used for the customer groups for this specific type of tax.

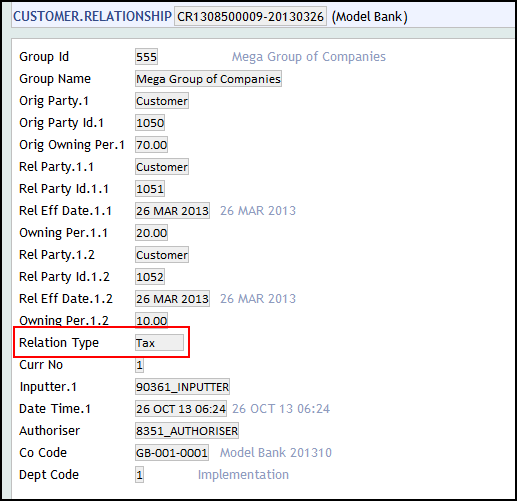

When there are joint holders in a portfolio, the EU tax is split between the holders in the ratio of their holdings. To achieve this, in the CUSTOMER.RELATIONSHIP application, the joint relationships are specified and the Relationship Type field is set to Tax.

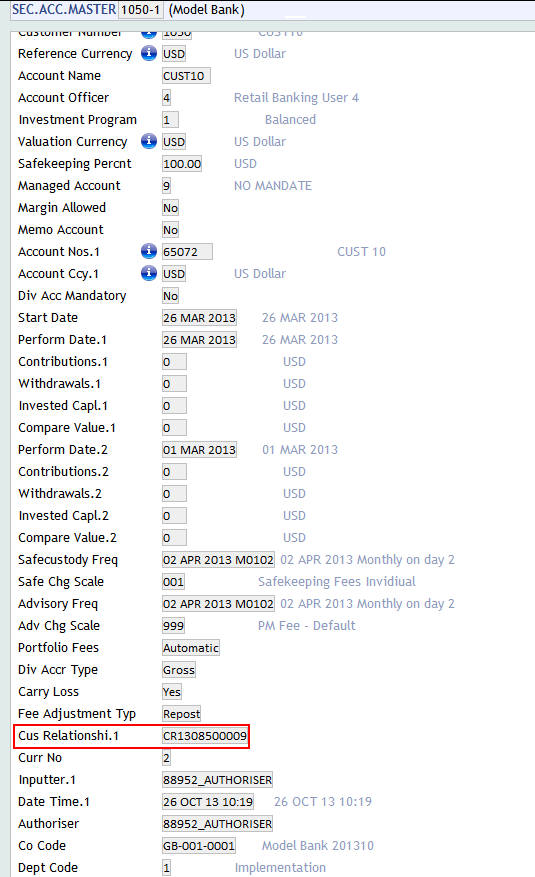

Then, the CUSTOMER.RELATIONSHIP application is linked to portfolio using the Cus Relationship field in the SEC.ACC.MASTER application. The CUSTOMER.RELATIONSHIP application has the effective date as part of the ID, so that the underlying application can process the tax by considering the latest record. It also ensures that the existing record is not changed even if there are any amendments in the customer.relationship application. The amendments are done through a new record in CUSTOMER.RELATIONSHIP, so that the historical information are retained in the system.

The system splits the EU taxes in the ratio of holdings specified in the CUSTOMER.RELATIONSHIP application. An example screenshot of Customer Relationship Id linked to the SEC.ACC.MASTER application is illustrated below. This determines the joint holders of a portfolio and the percentage of holding.

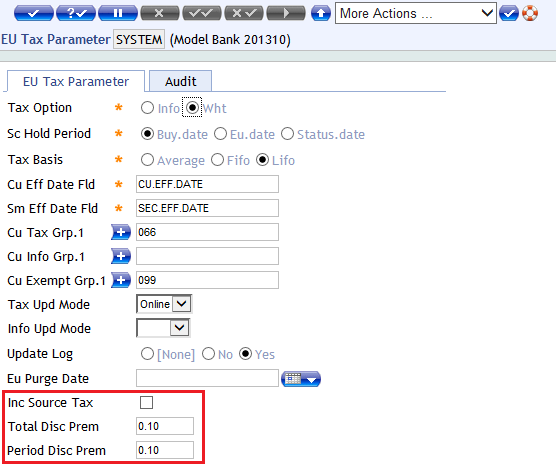

EU.TAX.PARAM

The EU.TAX.PARAM application is used for company level settings in relation to EU retention tax. If identical settings are to be used across a multi-company environment, the SYSTEM record can be used instead of inputting a record for every company.

| Fields | Description |

|---|---|

| Tax Option | Defines the company level settings on the levy of EU tax or exchange of information. Allowed values are Wht or Info. |

| Sc Hold Period |

Allowed values are Buy Date, Eu Date or Status Date.

This is a no change field, once the transaction base is built.

|

| Tax Basis |

Defines the method used to build the base amount for tax calculation. Allowed values are Fifo, Lifo or Average.

This is a no change field, once the transaction base is built.

|

| Cu Eff Date Fld |

Holds the effective date for the customer in CUSTOMER application.

|

| Sm Eff Date Fld |

Holds the effective date for the security in SECURITY.MASTER application.

|

| Cu Tax Grp | Specifies the customer group based on the revised condition priority which is under EU tax. For these customers, WHT is deducted. Customers falling under this group has the EU.TXN.BASE updated and it facilitates report generation. The calculated tax is also updated in the base. |

| Tax Upd Mode |

Indicates whether tax needs to be updated online or during batch(COB).

Temenos Transact now supports online mode only. |

| Cu Info Grp | The customer group based on the revised condition priority which is under the exchange of information. These are customers who have opted to report, instead of tax being withheld. This overrides the default setting in the Tax Option field. Customers falling under this group has the EU.TXN.BASE updated and it facilitates report generation. However, tax is not calculated and only allocation details of each buy against a specific sale is updated in the base. |

| Info Upd Mode |

Indicates whether the EU.TXN.BASE needs to be updated online or in batch(COB).

Temenos Transact now supports online mode only. |

| Cu Exempt Group | Holds the customer group which is exempt from EU tax. EU.TXN.BASE is not updated for this group. |

| Update Log |

Is a Yes or No field. If the field is set to Yes, then the log is maintained for the sequence of updates to a specific holding. The log can be viewed in the EU.UPDATE.LOG application.

|

| Total Disc Prem | Holds the threshold percentage below which tax is not deducted for interest earned on debt instruments. |

| Period Disc Prem |

Holds the threshold discount or premium percentage per period below which tax is not deducted for interest earned on debt instruments.

If different countries have different exemption percentages, the EU.TAX.PARAM application must be set company wise with respective values. |

| Inc Source Tax | This field determines if source tax that is already deducted on interest, must be included or excluded for tax calculation. |

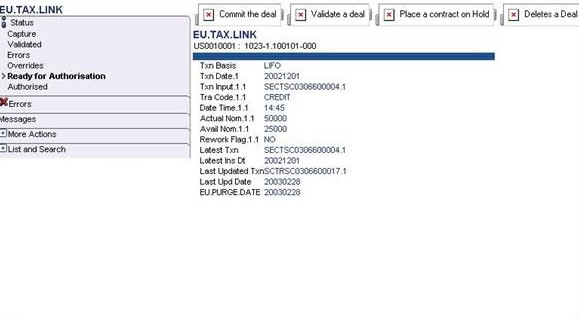

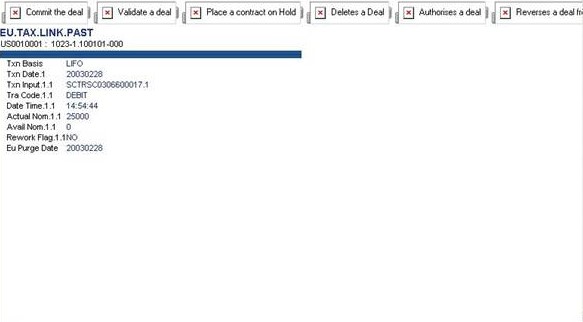

| Eu Purge Date |

Allows the user to purge transactions from the EU.TAX.LINK application and move them to the EU.TAX.LINK.PAST application.

|

All transactions prior to the purge date that has an available nominal of zero are purged and moved during the course of next COB. The below screenshots show the Eu Purge Date field in EU.TAX.PARAM, EU.TAX.LINK and EU.TAX.LINK.PAST application.

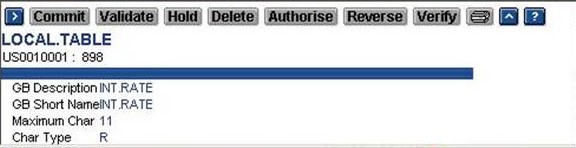

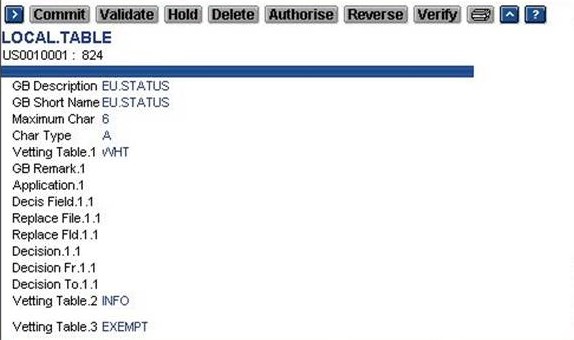

The following records in LOCAL.TABLE are mandatory.

EU.SEC.ACCTEU.SECURITY.NOINT.RATE

The following records in LOCAL.TABLE application are optional.

EU.STATUSEU.EXEMPT.DATE

Local.Ref.Table

The records in LOCAL.TABLE are linked to the CUSTOMER and POSITION.TRANSFER applications by adding them to the records in LOCAL.REF.TABLE application as shown in the below screenshot.

The following version routines are available:

| Application Name | Routine | Description |

|---|---|---|

SUB.ASSET.TYPE

|

V.SC.EU.TAXBASIS.CHECK | Input routine which allows the change only if the record in EU.TAX.LINK does not exist. |

SECURITY.MASTER

|

V.SC.EU.TAXBASIS.CHECK | Input routine which allows the change only if the record in EU.TAX.LINK does not exist. |

| V.SC.EU.ORIGYIELD.CHECK | Input routine which calculates and populates the yield value. | |

| V.SC.EU.PRICE.CHECK | Validation routine for which Issue Price and/or Redem Price fields allows input only for bonds. | |

| V.SC.EU.PRICE.CHECK | Input routine, if EU retention tax is included in SC Tax Code and Issue Price fields. These are mandatory fields. | |

| V.SC.EU.INTCTR.CHECK | Validation routine for Interest Counter field. Input allowed only for shares. | |

SEC.OPEN.ORDER |

V.SC.EU.INTCTR.CHECK | Validation routine for Cu Int Ctr field which allows input only for shares and the value is defaulted from SECURITY.MASTER. |

SC.EXE.SEC.ORDERS |

V.SC.EU.INTCTR.CHECK | Validation routine for Cu Int Ctr field which allows input only for shares and the value is defaulted from SECURITY.MASTER. |

SEC.TRADE |

V.SC.EU.INTCTR.CHECK | Validation routine for Cu Int Ctr field which allows input only for shares and the value is defaulted from SECURITY.MASTER. |

SECURITY.TRANSFER |

V.SC.EU.INTCTR.CHECK | Validation routine for Cu Int Ctr field which allows input only for shares and the value is defaulted from SECURITY.MASTER. |

| V.SC.EU.TRFRDATE.CHECK | Validation routine for Trfr Eff Date field and the value should not be a future date. | |

POSITION.TRANSFER |

V.SC.EU.INTCTR.CHECK | Validation routine for Interest Counter field which allows input only for shares. |

| V.SC.EU.TRFRDATE.CHECK | Validation routine for Trfr Eff Date field and the value should not be a future date. | |

DIARY |

V.SC.EU.INTCTR.CHECK | Validation routine for Interest Counter field which allows input only for shares and the value is defaulted from SECURITY.MASTER. |

| V.SC.EU.INTDIST.CHECK | Validation routine for Int Dist Factor field and allows input only for shares. | |

ENTITLEMENT |

V.SC.EU.INTCTR.CHECK | Validation routine for Interest Counter field which allows input only for shares and the value is defaulted from SECURITY.MASTER. |

| V.SC.EU.INTDIST.CHECK | Validation routine for Int Dist Factor field which allows input only for shares. |

Illustrating Model Parameters

The parameters configured in Model Bank are given below:

| S.No. | Parameters | Description |

|---|---|---|

| 1. | EU.PARAMETER

|

This is a company-level parameter containing the details of each company that has to be converted. Each company must be converted sharing a currency file at the same time. This holds the following details:

|

| 2. | EU.TAX.PARAM

|

This is a company-level parameter containing the details to be set up for EU Retention Tax. This holds the following details:

|

Illustrating Model Products

Model products are not applicable for this module.

In this topic