Introduction to European Union Financial Transaction Tax

The European Union Financial Transaction Tax (EU FTT) is a proposal made by the European Commission to introduce a Financial Transaction Tax (FTT) within the member states of the European Union. The tax impacts financial transactions between financial institutions and would result in charging 0.10% against the exchange of Shares and Bonds, and 0.01% across Derivative contracts, if just one of the financial institutions resides in a Member State (MS) of the EU FTT. The following modules in Wealth supports FTT in Temenos Transact:

Besides the above, FTT is also supported in SWAP, FOREX and FRA contracts. These modules generate the financial transactions, which falls under the preview of the FTT regulation.

Product Configuration

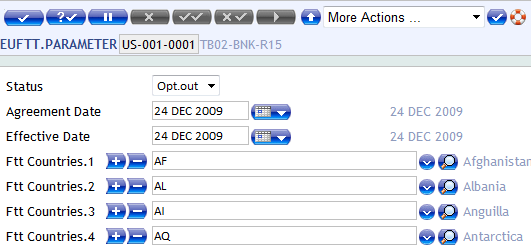

The EUFTT.PARAMETER is used to record the details of the institution’s agreement with the EFT, the effective date of the FI, status (opt-in or opt-out) and certain default conditions. It is necessary to state the countries opted for EU FTT regulation.

It is mandatory to update the Effective Date field, since when the FIs start complying to the provisions of EU FTT regulation and the Agreement Date field is updated when the respective countries agree to follow the EU FTT regulation. The value in the Agreement Date field must not be lesser than the value in the Effective Date field.

Illustrating Model Parameters

EUFTT.PARAMETER is a company-level parameter containing information about the institutions agreed for FTT with associated countries. This parameter holds the following details:

- Agreement and effective dates from when the respective financial institution agrees to follow the EUFTT regulations.

- Current status of the financial institution with respect to EUFTT compliance.

- List of countries that have adopted this regulation.

Illustrating Model Products

Model products are not applicable for this module.

In this topic