Introduction to Nostro Reconciliation

Nostro account is the record of the bank that has deposited money at another bank. It differs from standard demand deposit bank accounts in that it is held by financial institutions, and is normally denominated in foreign currency. Nostro means ‘our money that is on deposit at your bank’. These accounts are often used to simplify settlements of trade and foreign exchange transactions.

Nostro Reconciliation involves the matching of the debit and credit activity in the domestic bank’s account with the statement of the account provided by the nostro account holding bank. This matching is done by the Nostro Reconciliation module and depends on the matching criteria defined by the user, such as matching by value date, currency, amount, transaction reference and reporting un-reconciled postings. Nostro Reconciliation module is used across any module (in Temenos Transact) that uses nostro accounts for its transaction processing.

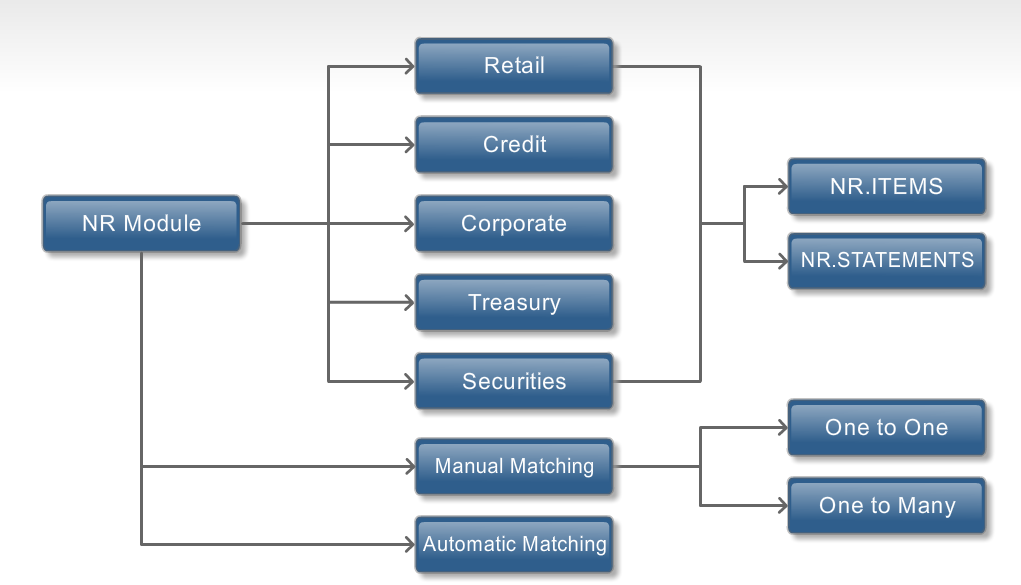

The following image shows the process map for Nostro Reconciliation.

Product Configuration

The nostro reconciliation module consists of the following processes:

- Message capture for incoming SWIFT MT940 and MT950 messages

- Capture of nostro ledger data in the form of MT940 messages diverted from DELIVERY module

- Statement extraction from aforementioned messages into Temenos Transact files

- Definition of matching parameters and controls

- Automatic matching procedure

- Manual matching procedure

- Manual unmatching procedure

- Manual statement input procedure

Nostro Reconciliation dependencies:

- Customer application for creating customer (counter parties) records of nostro banks.

- Account application for creating internal and nostro accounts meant for reconciliation purpose.

- Accounting application for generation of ledgers and receiving statements from nostro banks.

- Agency file for creating nostro agency arrangements.

- Delivery module for sending and receiving statements, that is, MT940/MT950 from nostro banks for reconciliation.

- Static tables like country and currency.

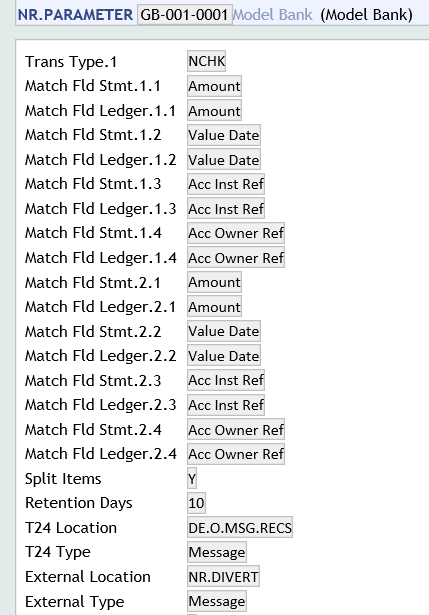

The NR.PARAMETER is the main application for the reconciliation process. User should setup the incoming and outgoing requirements before the user can input and authorise this record.

- One record is created for every company.

- Specifies matching rules for reconciliation process.

- Transaction codes for automatic matching process to be identified in Trans Type (transaction) field. This field allows determining how certain transactions are matched. For example, for items in SWIFT statement the user may wish to match miscellaneous transactions by value date and amount but matching cheques by amount only. The items are matched in the automatic matching process.

- The code to be prefixed with N (for nostro) and for entries which are advised first by the statement starts with F followed by any of the following:

- BOE – Bill of Exchange

- BRF – Brokerage Fee

- CHG – Charges and other Expenses

- CHK – Cheques

- CLR – Cash Letter or Cheques Remittance

- COL – Collections

- COM – Commission

- DCR – Documentary Credit

- DIV – Dividends Warrants

- EQA – Equivalent Amount

- ECK – Euro Cheques

- FEX – Foreign Exchange

- INT – Interest

- LBX – Lock Box

- LDP – Loan Deposit

- MSC – Miscellaneous

- RTI – Returned Items

- SEC – Securities

- STO – Standing Order

- TCK – Traveller’s cheque

- TRF – Transfer

- VDA – Value Date Adjustment

- Match Field Stmt and Match Field Ledger fields contain values from

NR.STATEMENTS, which should be matched with the ledger from the system and statement from the nostro bank in case of automatic matching. This is a multi-valued field and any kind of combinations for matching processing can be specified. - Split Items field allows to determine whether item splits are allowed in the manual matching process. Item splits are not allowed for auto matching process. This is used in cases where amounts are received with unexpected charges deducted. Larger amount can be allowed to split into two items. Main amount is matched with the statement amount received and the charge amount is to be left as outstanding one which is awaiting resolution. This is result of manually matching unequal amounts and acknowledging override messages.

- Number of days that a matched item needs to be in live file before moving into history file is specified in Retention Days field.

- T24 Location field defines the place from where these statements are located.

- External Location field defines the place from where these statements are located.

- Provides for usage of local reference fields to facilitate local customisations to cater to specific bank requirement.

Message capture uses MT940 and MT950 formats. The MT940 (customer statement) and MT950 messages are quite similar, with the exception being additional fields on the MT940 message namely, forward available balance and information to the account owner. Messages in the MT950 format can be produced from the nostro ledgers to pass a controlled set of postings to the reconciliations product. The messages are not sent to SWIFT. Within Temenos Transact, the Delivery module performs the function of mapping and formatting messages for delivery of outgoing and incoming messages either by SWIFT or other proprietary transfer mechanisms.

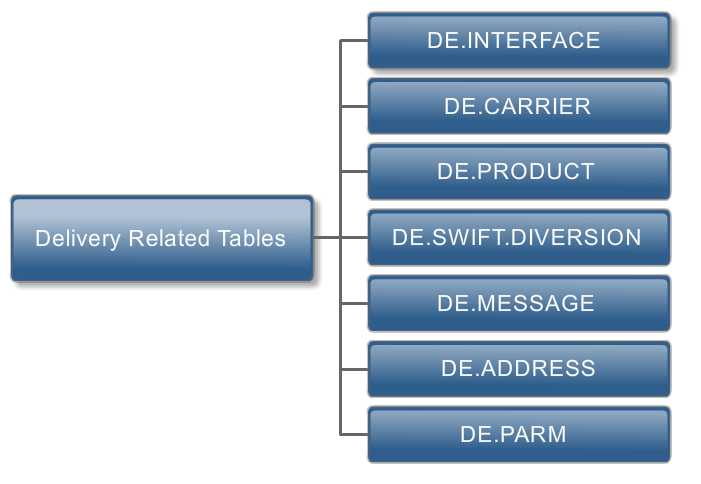

The following should be setup in Delivery module and the below section illustrates the required configuration.

DE.INTERFACE

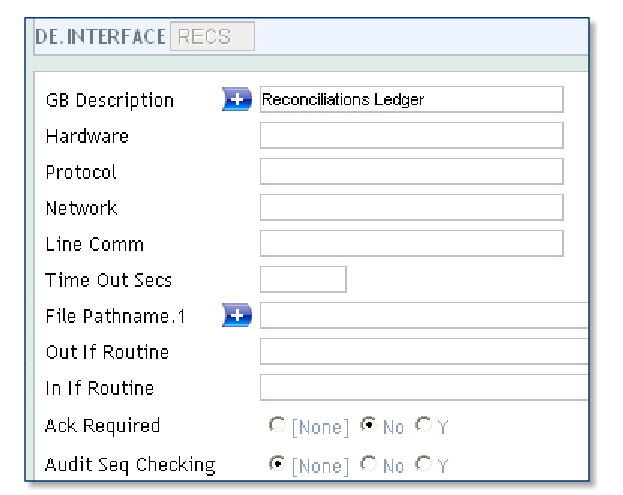

DE.INTERFACE contains details of the protocols for all interfaces, which use the generic delivery interface. The ID of the file is the interface as defined in the Interface field on DE.CARRIER. For reconciliation, a RECS record needs to be setup.

The following screenshot shows the RECS record in Delivery Interface Parameter.

The messages to this interface is written to the F.DE.O.MSG.RECS file. Delivery interface parameter record name is entered in the record of NR.PARAMETER to instruct the statement decoding process find the messages location.

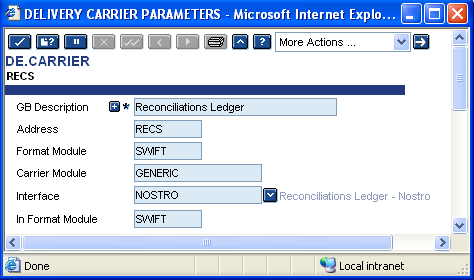

DE.CARRIER

The DE.CARRIER contains details of all the carriers available in delivery. The user can enable a carrier by specifying it in the DE.PARM application. This contains formats, interface and address for every specific carrier record.

A record must be setup for defining the carrier to which the user route’s ledger MT940 or 950 messages.

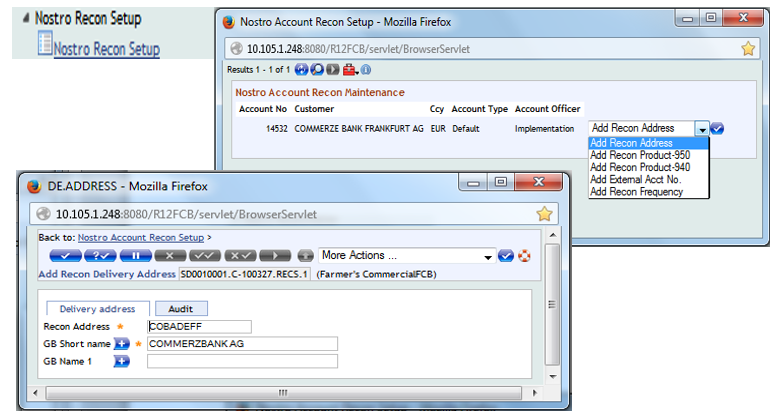

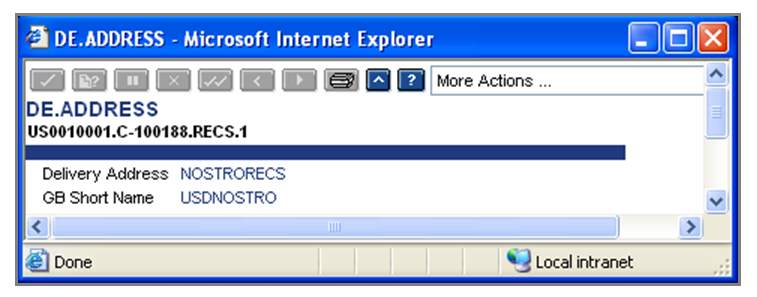

A record should be available for each correspondent customer in DE.ADDRESS for the RECS carrier.

The following screenshot shows the DE.ADDRESS details.

The DE.CARRIER contains names and address of bank’s customers and each company within the banking organisation. This table is used for entering all addresses like SWIFT address, TELEX address and special postal address. ID to be used for reconciliation is <COMPANYCODE>.<CUSTOMER NO>.<RECS.SLNO> (for example, US001001.C-100188.RECS.1) where RECS is ID in DE.CARRIER application.

If statements for internal accounts are produced for reconciliation, there must be a similar address record without customer component. For example, US001001.C-100188.RECS.1.

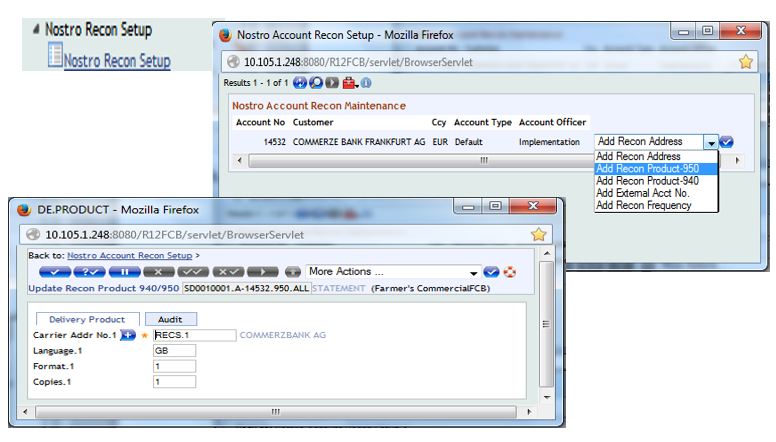

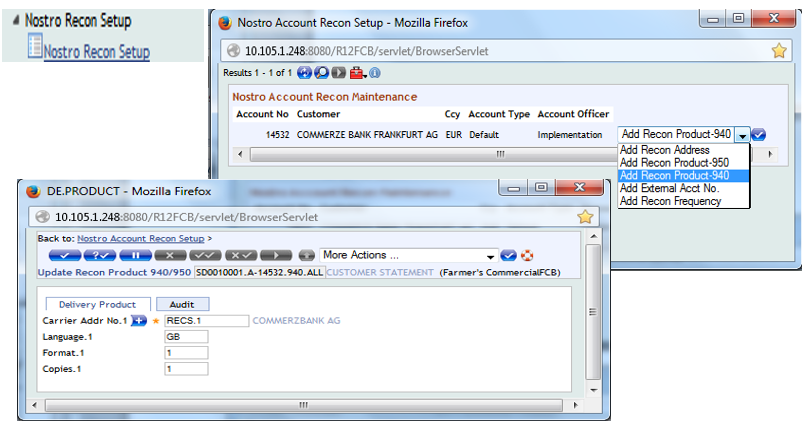

A record should be setup for each nostro account to be reconciled on DE.PRODUCT, to send the messages to the reconciliations carrier.

The following screenshot shows the MT950.

The following screenshot shows the MT940.

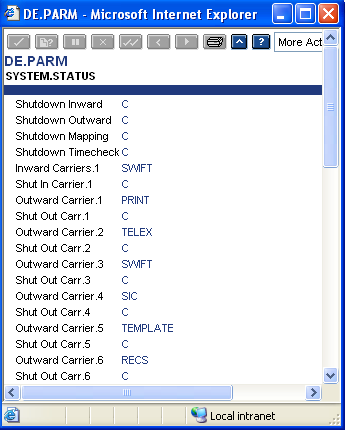

DE.PARM

DE.PARM contains a single record that holds a number of parameters for controlling the processing of messages. The file contains the parameters that allow the operator to shut down the carrier control modules and the inward and outward formatting modules.

For nostro reconciliation, the RECS record created in DE.INTERFACE is added to the record in DE.PARM providing appropriate Shut Out Carr field.

The following screenshot shows the delivery carrier parameter record.

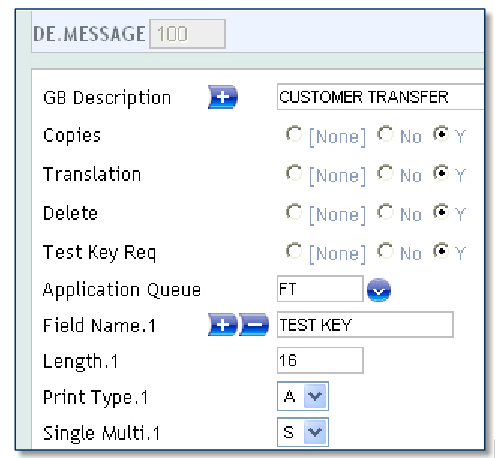

DE.MESSAGE table defines the contents of each basic message type. It lists the fields and describes them as single or multi values and states whether each field is mandatory or optional. ID is a valid swift type and MT950 is used for reconciliation.

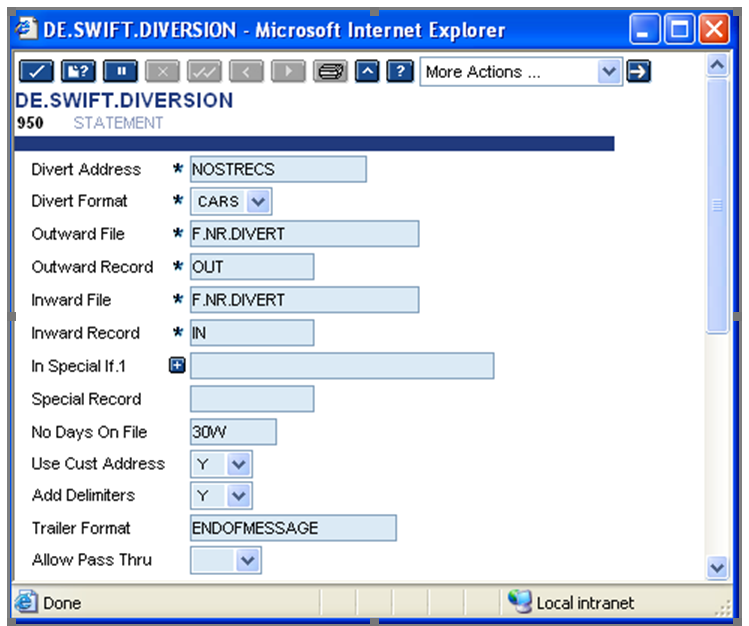

The DE.SWIFT.DIVERSION application enables both inward and outward message to divert SWIFT message for given SWIFT message type and SWIFT address from SWIFT carrier to another file. The inward parameter is used to divert a copy of all incoming MT950 message to IN record in F.NR.DIVERT. If the user is diverting a copy of outgoing message for some other purpose, the user can leave the outward parameters unchanged. The outward fields are mandatory. The generic carrier is used to capture outgoing records for reconciliation.

For the reconciliation activity to begin, a record '950' must be setup.

The SWIFT carrier is expected to be running for the messages to be diverted to the diversion file.

The file that contains the incoming messages is named in DE.SWIFT.DIVERSION and in the External Location field in NR.PARAMETER. This is required for both incoming and outgoing delivery requirements before NR.PARAMETER is created.

Illustrating Model Parameters

This section covers the high-level specifications required for Nostro Reconciliation (NR) Module.

| S.No. | Parameters | Description |

|---|---|---|

| 1. | NR.PARAMETER

|

This application allows the user to specify matching rules for reconciliation process. It also allows the user to define transaction codes, which determine how transactions are matched.

|

| Apart from the specification in NR module, the following setup is also required in Delivery (DE) module. | ||

| 1. | DE.INTERFACE

|

The delivery interface parameter record is required to instruct the statement decoding process. |

| 2. | DE.CARRIER

|

This application allows the user to define the formats, interface and address required for the reconciliation carrier record. |

| 3. | DE.ADDRESS

|

This application allows the user to define the name and address of the bank’s customer for reconciliation delivery carrier record. User can also define delivery addresses for other carriers like SWIFT, TELLEX and special postal address. |

| 4. | DE.PRODUCT

|

This application allows the user to define a record for each Nostro reconciliation account to send messages to reconciliation carrier. |

| 5. | DE.PARM

|

The delivery parameter application allows user to shut down the reconciliation carrier control modules and inward, outward formatting modules. |

| 6. | DE.MESSAGE

|

This application allows the user to define the contents of message type MT940 and MT950 that used for reconciliation. |

| 7. | DE.SWIFT.DIVERSION

|

This application allows the user to divert SWIFT messages MT940 and MT950 from the SWIFT carrier to the diversion file for reconciliation purpose. |

In this topic