Reporting

The Reporting Property Class is used as an interface to the common cash flow engine, which provides information on cash movements of assets and liabilities. The EB.CASHFLOW file updates the cash movements details. The key to the file is the Account ID. All the activities that affect the cash movement of the bank through a contract can update the EB.CASHFLOW file. However, either at product level or arrangement level, activities or properties can be excluded from updating the EB.CASHFLOW file. This Property Class is used for reporting IFRS cash flows and also data to Position Management (PM) applicable for the arrangement.

Product Lines

The following Product Lines use the Reporting Property Class:

- Accounts

- Asset Finance

- Deposits

- Lending

- Safe Deposit Box

Property Class Type

The Reporting Property Class uses the following Property Class types:

- Currency Optional

- Dated

- Tracking

Property Type

The Reporting Property Class is associated with Product.Only type.

Balance Prefix and Suffix

Reporting Property Class does not hold any balances.

A user can opt not to update the EB.CASHFLOW file for select Activities or Properties. This can be achieved by entering an Activity name in the Activity Name field and setting the Cash Flow field is to No. If the user wants to exclude any Property, then the user must set the Property and Exclude EIR fields to the value of the Property and Yes, respectively. The user can exclude any Activity by mentioning the name of the activity in Exclude Activity for the respective APR type.

IAS.CLASSIFICATION - The IFRS Classification field holds the classification of contract based on IFRS standard.

IAS.SUBTYPE - The IFRS Subtype field displays the sub type for the corresponding classification defined in the IFRS Classification field. It has to be a valid sub type for the corresponding classification defined in the IAS.CLASSIFICATION file. This field cannot be amended at arrangement level.

For any type of substantial modification based on the quantitative test on a loan, except ‘IBOR to RFR’ migration, the system raises an override for the user to know that the contract is Derecognised.

Read Introduction to Modification and Derecognition of Loans for more information.

MARKET.KEY - The Market Key field specifies the market rate to calculate the NPV based on future cash flow information. The field can either be a fixed rate or Periodic.Interest key with prefix P. This field is mandatory if value is entered in IFRS Classification field.

MARKET.MARGIN - The Market Margin field calculates the NPV based on future cash flow information.

MARGIN.OPERAND - The Market Operand field is to be used while arriving rate using Market Margin field. Allowed values are ADD, SUB.

EXPECTED.TERM - The Expected Term field displays the values in terms of period such as XXD (Days), XXW (Weeks), XXM (Months) and XXY (Year), where XX denotes any number. When the expected term is beyond the maturity date, maturity is considered as expected end date.

ACTIVITY.NAME - All Activities with related AA.ACTIVITY.CLASS containing Activity Type as CASHFLOW triggers cash flow event by default. But if any activity need not trigger a cash flow then the Activity name has to be input in the Activity Name.1 associated multi-value field and the Cash Flow.1 associated field has to be set as No.

CASH.FLOW - The Cash Flow.1 field is used in association with the Activity Name.1 field wherein Activities that need not trigger a cash flow is selected. In order to ensure that the system does not trigger the cash flow, the Cash Flow.1 field has to be set to No for all Activities that are selected in Activity Name multi-value field.

If Cash Flow.1 field is set to Yes or Null then the activity mentioned against the Activity Name.1 field triggers cash flow.

PROPERTY - All the properties of the Activity for which Cash Flow field is not set to NO is included in cash flow. If a Property is not required to be included in cash flow calculations, then the Property name has to be specified in the Property.1 field associated multi-value field and the Exclude Eir.1 associated field has to be set to Yes. For example, Penalty Interest Property of Interest Property Class need not be included in EIR calculations.

EXCLUDE.EIR - The Exclude Eir.1 field is used in association with the Property.1 field wherein Property that need not be included in the cash flow is selected. If the selected Property has to be excluded from the cash flow, then this field value has to be set to Yes. If the value is set to No or Null then the Property selected against the Property.1 field is included for the cash flow.

PROPERTY.CLASS - The user can specify the Property Class to which the Position Classes are to be associated within the Property Class field. This gives the flexibility to the user to define the relevant Position Classes for each of the Property Classes. The Property Class should be a valid record in the AA.PROPERTY.CLASS record.

For example, the user can configure different set of position classes for interest and principal. If the Property Class is defined then Properties related to this Property Class is not allowed in PROPERTY.ID.

Optionally, the position classes can be defined for a Property Class, in which case all the Properties of that class goes with the same position classes. In case of Interest Property Class, it is advisable to define Interest Property wise only so that any other Interest Properties, such as Penalty can be excluded. It might be observed that some position classes are appropriate for certain Property Class or Property such as ACCOUNT having AAPMS, AAPMI, AAPMD and AAPMM. Currency in Reporting Property ID for PM is optional.

PROPERTY.ID - The Property field specifies the Property to which the user relates the position class. This definition allows users to configure different combination of position class for each Property. The selected Property should be a valid record in AA.PROPERTY and the Property Class relating to this Property should not have been defined in the Property Class field.

For example, the user can configure different set of Position Class for admin fee and processing fee. If the Property is defined then Property Class of this Property is not allowed in Property Class field.

POS.CLASS.START - PM Position Class for Principal Start event for GAP is specified in the Pos Class.1 Start field. The value must exist in PM.POSN.CLASS and mandatory for Principal Property Class or Property. From the Position class defined here, the Position class for Start event for CAS is derived by replacing the 3rd and 4th characters with those of the Position class defined for the category code of the settlement account in PM.AC.PARAM. The Position classes built, display the fourth character as E, where the timing for disbursal or funding event is not certain.

The user defines AAPMS for GAP Start event, the CAS position class is derived as AAXXS, where XX are taken from PM.AC.PARAM corresponding to the category code of the settlement account. The Position class for expected event is then built as AAPES for GAP and AAXES for CAS (X is from PM.AC.PARAM).

POS.CLASS.MATURITY - PM Position Class for Principal Maturity event for GAP is specified in Pos Class.1 Maturity field. The value must exist in PM.POSN.CLASS and mandatory for Principal Property Class or Property. From the Position class defined here, the Position class for Start event for CAS is derived by replacing the 3rd and 4th characters with those of the Position class defined for the category code of the settlement account in PM.AC.PARAM. The Position classes built for maturity , displays the 4th Character as E, where the timing for disbursal or funding event is not certain.

The user defines AAPMM for GAP Start event, the CAS position class is derived as AAXXM, where XX are taken from PM.AC.PARAM corresponding to the category code of the settlement account. The Position class for expected event is then built as AAPEM for GAP and AAXEM for CAS (X is from PM.AC.PARAM).

POS.CLASS.INCREASE - PM Position class for Principal Increase event for GAP is specified in Pos Class.1 Incr field. The value must exist in PM.POSN.CLASS and mandatory for Principal Property Class or Property. From the Position Class defined here, the Position class for Principal Increase event for CAS is derived by replacing the 3rd and 4th characters with those of the Position class defined for the category code of the settlement account in PM.AC.PARAM. The Position classes built, displays the 4th Character as E, where the timing for disbursal or funding event is not certain.

The user defined AAPMI for GAP event, the CAS position class is derived as AAXXI, where XX are taken from PM.AC.PARAM corresponding to the category code of the settlement account. The Position class for expected event is then built as AAPEI for GAP and AAXEI for CAS (X is from PM.AC.PARAM).

POS.CLASS.DECREASE- PM Position class for Principal Decrease event under GAP is specified in the Pos Class.1 Decr field. The value must exist in PM.POSN.CLASS and mandatory for Principal Property Class or Property. From the Position class defined here, the Position class for Principal Decrease event under CAS is derived by replacing the 3rd and 4th characters with those of the Position class defined for the category code of the settlement account in PM.AC.PARAM. The Position classes built displays the 4th Character as E, where the timing for disbursal or funding event is not certain.

The user defines AAPMD for GAP event, the CAS position class is derived as AAXXD, where XX are taken from PM.AC.PARAM corresponding to the category code of the settlement Account. The Position class for expected event is then built as AAPED for GAP and AAXED for CAS (X is from PM.AC.PARAM).

POS.CLASS.REPAYMENT - The Pos Class.1 Repay field specifies the Position Class to which the user wants to relate the Principal Instalment Payment event (a loan instalment or a savings plan instalment). If AAPMR is the position class defined for GAP, then the Position class for CAS is derived as AAXXR (XX is taken from the position class defined in PM.AC.PARAM for the category code of the settlement account). The value must exist in PM.POSN.CLASS and mandatory for Principal Property Class or Property.

To show expected movements for undisbursed or unfunded contracts without any schedule, the 4th character is replaced by E that is, AAXER (X is taken from PM.AC.PARAM).

POS.CLASS.CAPITALISE- Where a Charge payable or Charge receivable and Interest Payable or receivable is capitalised, the Position Class corresponding to the nature of item ,that is, charge or interest, a position class is defined in Pos Class.1 Capitalise field. The value must exist in PM.POSN.CLASS and mandatory for Principal Property Class or Property other than Principal Property Class or Property. To show expected movements for these capitalisation events in case of undisbursed or unfunded contracts the 4th character is replaced by "E", that is, AAPEC or AAPEN.

For example, in case of Charge, it can be AAPMC and in case of interest it can be AAPMN.

POS.CLASS.OVERDUE- The Position Class defined in the Pos Class.1 Overdue field represents the overdue amount receivable either in a loan or a savings plan instalment in CAS report under CAL line. The value must exist in PM.POSN.CLASS and is mandatory if overdue balances are opted to be shown in CAS report.

POS.CLASS.FX- The Pos Class.1 Fx Pos field specifies the Position Class used to show the currency Position in FXP Position reference if the transaction gives raise to currency Position. The Currency Position so shown is real FX position and not Forward FX Position. The value must exist in the PM.POSN.CLASS table.

INCLUDE.FORWARD.RATES- The Fwd Proj field defines whether interest events are to be projected into the future. The next interest movement is always shown in the Position Management system. Subsequent events are not included unless this field is defined. It may take any one of the following values:

- Variable—Show only future payments for variable interest contracts.

- Fixed—Show only future interest and commission payments for fixed rate contracts. A fixed rate contract is a contract where only FIXED.RATE is present in the Interest Property.

- Both—Show fixed and variable rate contract future payments.

POS.CLASS.ROLLOVER.START- The Position Class Rollover Start field specifies the Position Class to which the user wants to relate the rollover start movement for the deal. The value must exist in the PM.POSN.CLASS table and it is mandatory for principal Property Class or Property is defined.

POS.CLASS.OLD.ROLLOVER- The Position Class Rollover Old field specifies the position class to which the user wants to relate the Previous Maturity movement for the deal. The value must exist in the PM.POSN.CLASS table and it is mandatory for principal Property Class or Property is defined.

POS.CLASS.NEW.ROLLOVER- The Position Class Rollover New field specifies the Position Class to which the user wants to relate the rollover maturity event for the deal. The value must exist in the PM.POSN.CLASS table and it is mandatory for principal Property Class or Property is defined.

POS.CLASS.UNALLOCATED- The Position Class Unallocated field specifies the Position Class to build the Balances in UNC (Unallocated Credit Balance) if the same are opted to be included in the CAS report under CAL line. The value must exist in the PM.POSN.CLASS table and it is mandatory for principal Property Class or Property is defined.

DEFAULT.POS.CLASS.CAT- The Default Settlement field specifies a category to build the default settlement account if the liquidation account is not defined in Settlement Condition for the Property Class or Property.

DEALER.DESK- The Dealer Selection field, if provided by the user, the same defaults to the Reporting Property attached to an arrangement. Else, it defaults to ‘00’. Alpha or Numeric or combination of both as allowed in DEALER.DESK table. The value selected from Dealer Selection field must be an existing ID on the DEALER.DESK table.

Assigning a separate dealer desk for each sub-product is a better idea to view the PM data in enquiry output corresponding to each such sub-product.

UPDATE.OVERDUE.POS- The Overdue Update field indicates whether the user wants to include the overdue movements for the contract balances in CAS report. To enable the inclusion, the check box must be selected.

The Linkage between AA module for Loans and Deposits and Position Management grants inclusiveness to the data presented by PM to its users.

While no changes were needed on PM side to enable the data inflow from AA, as the framework is generic, the design of AA PM Link, compared to other modules, is different in many ways. This is because of the Architecture and the flexibility AA offers in building Products and the Product Conditions.

To interface an application to PM, the same should be included in PM.PARAMETER using PM.UPDATE.APPL application and one COB to give effect to the change. The Applications to be added in PM.PARAMETER are AA loans (AL) and AA Deposits (AD). When new clients migrate to Temenos Transact or existing clients upgrade to a release with AA PM Link, it has be ensured that AL and AD are included in PM.PARAMETER and necessary parametrisation is in place before migration or upgrade.

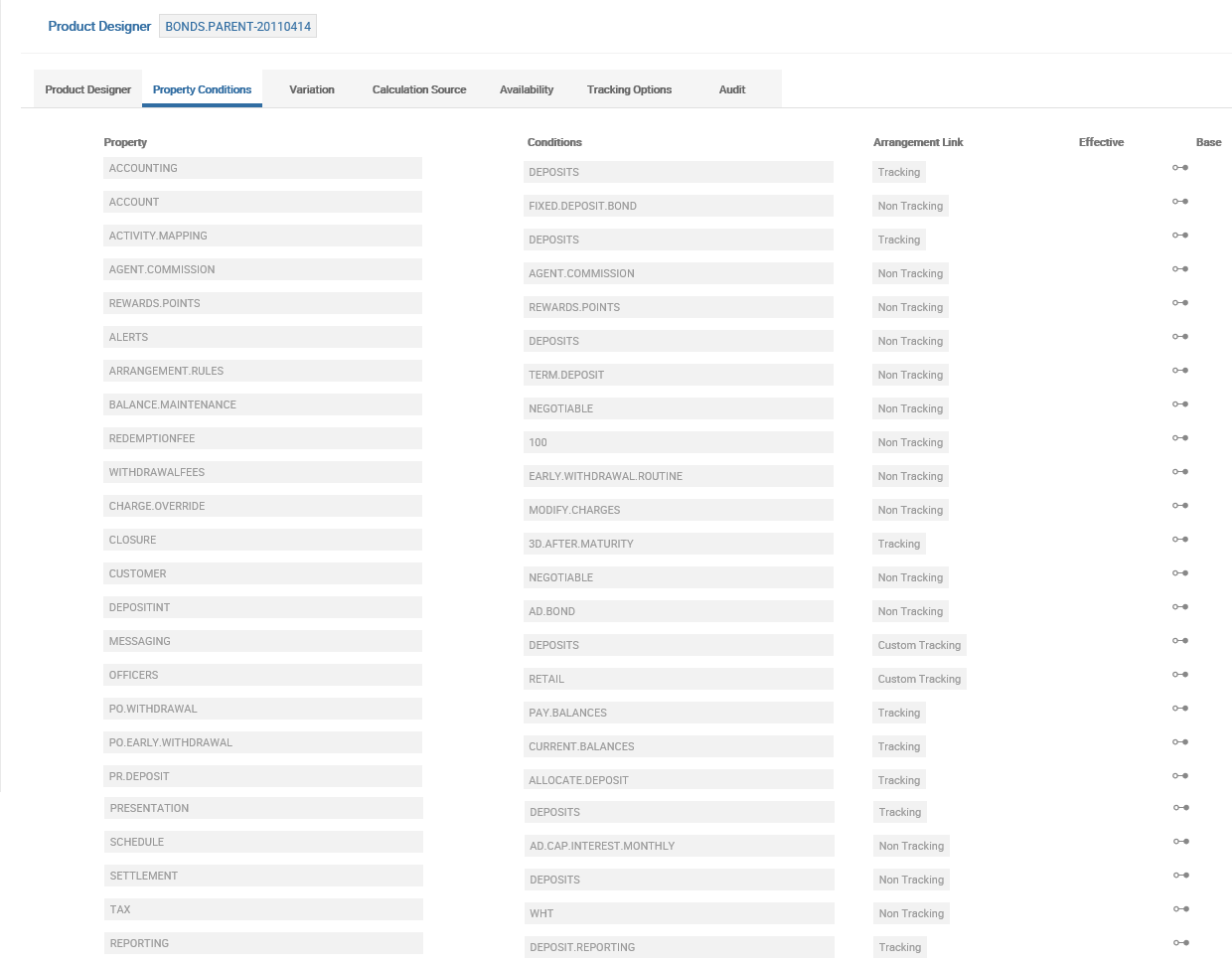

Different from the way the other Temenos Transact applications are interfaced to PM, parameterisation is held within AA module in the Reporting Property Class. The following is a sample configuration.

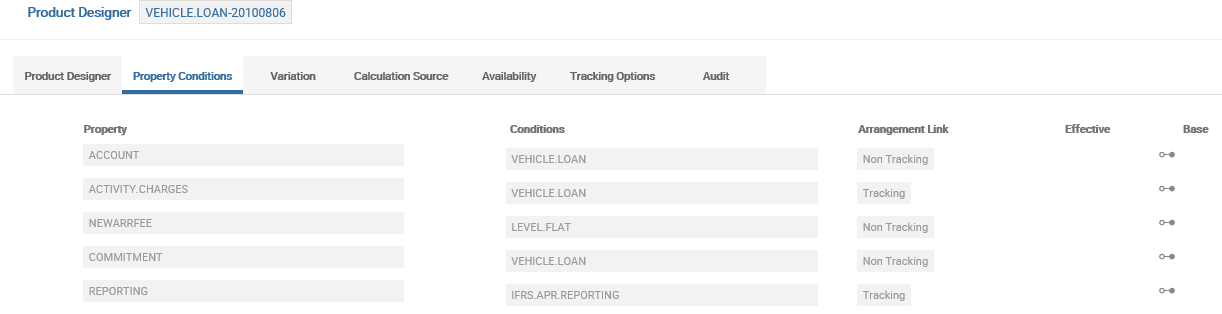

Reporting Property Conditions for PM need to be set as displayed.

Below is a generic record is applicable for all Loan products. Multiple records are created for each product or sub product, as per the user’s preference and is attached to Product or Sub-product.

Similar to the above, for Deposits another record is created as under.

The Dealer selection in the above screenshots represent the identity of the data related to loans and deposits in PM. Assigning a separate dealer desk for each subproduct enables the user to view the PM data in enquiry output corresponding to each such sub product.

The user definable Position Classes as displayed above are related to GAP except for Position class for UNC balances, overdue balances and tax, which are CAS related and FXP for currency position.

Property Class and the Property ID field is a multi-value field. Property class or Property ID field, which impact the Position Management data are included here along with the Position Classes relevant to such Property class or Property. Optionally, the Position classes can be defined for a Property Class, in which case all the properties of that class go with the same position classes. In case of Interest Property Class, it is advisable to define Interest Property wise only so that any other interest Properties such as Penalty can be excluded. It can be observed that some position classes are appropriate for certain Property Class or Property such as ACCOUNT having AAPMS, AAPMI, AAPMD and AAPMM. Currency in Reporting Property ID for PM is optional.

The FwdProj attribute is relevant only for Interest Property Class or Property. It denotes the user’s choice to whether or not the interest or coupon payments can be projected in PM for the current period or for future period too. In future period either fixed or floating or both are included.

The Reporting Property Class type is TRACKING, meaning a Reporting Property attached to a product or sub-product can be set to Product only type and the conditions thereof are applicable to arrangement including the dealer desk.

From the GAP Position classes system derives the CAS Position classes as under.

First two Characters are AA, second and third characters are derived from PM.AC.PARAM based on the category of the settlement account and the overnight position class mentioned therein. The last character is same as applicable for the GAP position.

If the Position Class for GAP for Principal increase is AAPMI, the CAS position class is AAASI, the third and fourth characters taken from overnight position class defined for the category of the settlement account.

Dealer Desk, introduced in AA.REPORTING.PROPERTY for PM, is assigned to an arrangement from the Reporting property attached to the product. If the field is blank in AA.REPORTING.PROPERTY, an arrangement is identified with default 00 dealer desk. The data passed from AA to PM is identified with this dealer desk. AA user might want to assign different dealer desks at sub-product level to be able to drilldown to PM data relevant to that sub-product or Product (by grouping the dealer desks of the sub-products).

As the dealer desk associated with an arrangement in relation to PM essentially represents a product or sub-product for facilitating PM Drilldown to product or sub-product level, it is not considered necessary to provide an option to change the dealer desk at arrangement level.

Using the PM.GRP application, dealer desks assigned to sub-products can be grouped to reflect a Product and using that Dealer desk group a separate PM.CAS or GAP enquiry can be created to view the data pertaining to such Product.

CAS related Position Classes are built in PM based on the category code of the settlement account present in the Loan or Deposit contract. Unlike in other modules, presence of settlement account is not mandatory in an AA loan or deposit. To cater to this scenario, a default suspense category code is defined in Reporting Property, which is linked to PM.AC.PARAM in order to be able to build the position classes based on the Overnight Position Class mentioned for that Suspense category. It is not mandatory that a suspense account must be created with the suspense category defined here.

Upon giving the settlement account in the arrangement subsequently, the system rebuilds the position classes considering the category code of the settlement account.

It might be observed in the PM.PC.PARAM setup in Model Bank the category code range 3000 to 3999 and 3600 to 3999 are excluded as the same are meant for AA Deposit and AA Loan Account category codes. On the other hand, the category codes used for AA Retail accounts have to be included in PM.AC.PARAM as they hold customer cash balances.

The Suspense category defined in Reporting Property Conditions is 14008 and in PM.AC.PARAM, it can be observed that 14008 goes with overnight position class ‘ACASC’.

Based on the Product Conditions, an AA Loan account can contain unallocated credit balance, which represents excess money received from the borrower over and above the actual due. As this money belongs to the customer and is susceptible to utilization anytime, it is shown under CAL bucket as a likely outflow until it is utilised or adjusted.

Similarly, an overdue balance represents the amount due from the customer but not paid on due date. The projection shown as a likely inflow disappears from CAS statement once it crosses the due date. Such overdue balances, are considered as likely inflows and shown under CAL bucket. Although over dues arise mainly on account of loans it is also possible to observe over dues in a savings plan account where the monthly instalments become overdue if not paid on due date.

The two Position classes for both UNC and Overdue balances are also user definable in the Reporting Property Class. Option to or not to include them is again a user’s choice.

AA Arrangement for a loan or deposit allows use of applications like FT, TT or DD for funding, disbursements and repayments. When auto settlement or a schedule for funding or disbursal is not defined and Fund transfer application or an equivalent is contemplated to do the principal funding or disbursal subsequently, it is not clear to PM as to when the cash flow in or out happens. In such scenarios, the cash flow in or out can only be projected on anticipated basis. In order to give the flexibility to the PM users, whether to include or not such undisbursed or unfunded arrangements, two sets of Position classes are used to represent the data called optional and mandatory position classes. Optional position classes represent data in PM on account of undisbursed or unfunded arrangements with no certainty about disbursal or funding dates while mandatory position classes are used where there is certainty.

The difference between mandatory and optional position classes is the fourth character in a Position class which is always “E” for optional position class. The system has the intelligence to use either optional or mandatory position classes based on the certainty about principal funding or disbursal dates. Both the Position classes have to be defined in PM.POSN.CLASS and also included in CAS and GAP records in PM.POSN.REFERENCE, if the PM user opts to include the optional position classes also in PM projections. For example, if the mandatory position class is built with AAPMS (Start event for a loan or deposit with timing certainty) an optional position class is built with AAPES (start event with no timing certainty).

It needs to be mentioned here that once a partial funding or disbursal is done under the arrangement, system builds the mandatory position classes for the actual amount funded or disbursed and no data is built for the balance commitment amount using the optional position classes any more.

Similar to the way the position classes are defined for all other applications in PM.POSITION.CLASS and included in PM.POSN.REFERENCE, the Position classes need to be defined for AA too and included in PM.POSN.REFERENCE.

Following table contains the sample Position classes for AA to PM. User has the flexibility to define the GAP Position classes and CAS Position classes relating to UNC, Overdue, Tax and FXP position class.

| Suggested Position Classes for AA in PM | CAS | |||

|---|---|---|---|---|

| Event | GAP | Cust/Susp A/C | Nostro A/C | FXP |

| Deposit/Loan start event | AAPMS | AAASS | AABSS | |

| Deposit/Loan mat event | AAPMM | AAASM | AABSM | |

| Principal Increase event | AAPMI | AAASI | AABSI | |

| Principal Decrease event | AAPMD | AAASD | AABSD | |

| Principal Repayment | AAPMR | AAASR | AABSR | |

| Interest Capitalisation | AAPMN | |||

| Interest Pay out | AAASN | AABSN | ||

| Charge Capitalization (Payable or Receivable) | AAPMC | |||

| Charge Liquidation (Payable or Receivable) | AAASC | AABSC | ||

| Rollover Start | AAPRS | |||

| Rollover Old maturity | AAPRN | |||

| Rollover New maturity | AAPRM | |||

| UNC Balances | AAUNC | |||

| Overdue Balances | AAASO | |||

| FX Position | AAAST | |||

| Tax | AAFXP | |||

Relevant CAS position classes, corresponding to the GAP position classes defined by the user, are built by the system where the 3rd and 4th Characters are replaced with that of the overnight position class defined in PM.AC.PARAM against the category code of the settlement Account used in AA Deposit or Loan. If the settlement account used is a Nostro Account, the Position class built is based on overnight position class meant for the Nostro Category.

Optional Position classes representing anticipated events are built by the system by replacing the 4th character with E. Where the user opts to include them in PM data, Position classes with “E” should also be defined in PM.POSN.CLASS and included in PM.POSN.REFERENCE. As stated already, the optional position classes are used until the first funding or disbursal either partially or fully.

Where the settlement Account is a Nostro, the Position classes, based on the setup in PM.AC.PARAM, is different from the ones representing Non-Nostro accounts.

The enquiry PM.NOS is meant to show the cash flows pertaining to the Nostro accounts. Therefore, only the position classes relating to Nostro account are included. The following Position classes, based on the setup in Model Bank, are included in PM.NOS on account of AA.

- Mandatory position classes: AABSC, AABSS, AABSD, AABSI, AABSM, AABSN, AABSR

- Optional position Classes: AABEC, AABES, AABED, AABEI, AABEM, AABEN, AABER

Read the PM Link to AA section for more information.

The system computes APR as an annualised rate. Temenos Transact calculates the APR for all the cash flow activities. APR is also calculated at the time of creating a new arrangement and for simulated contracts. APR can be calculated for different scenarios by excluding a Property (say solicitor fee in Internal APR calculation) type.

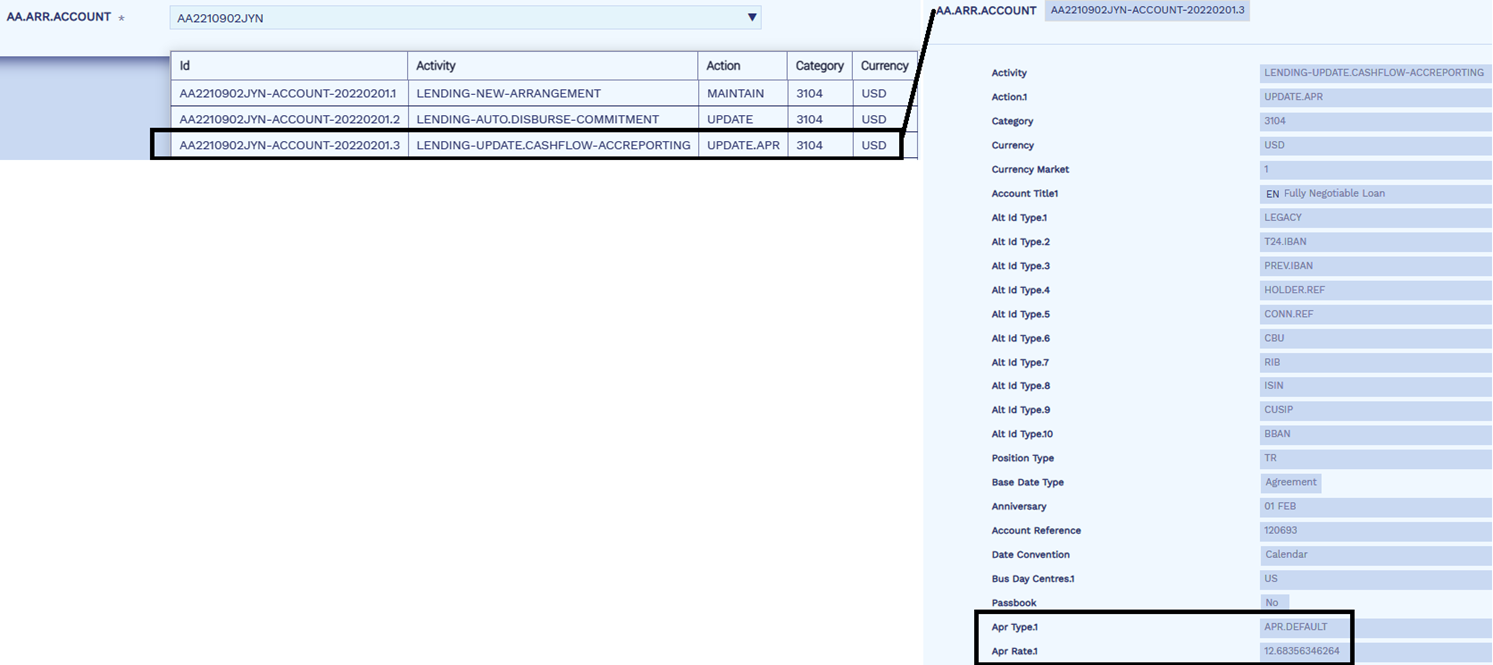

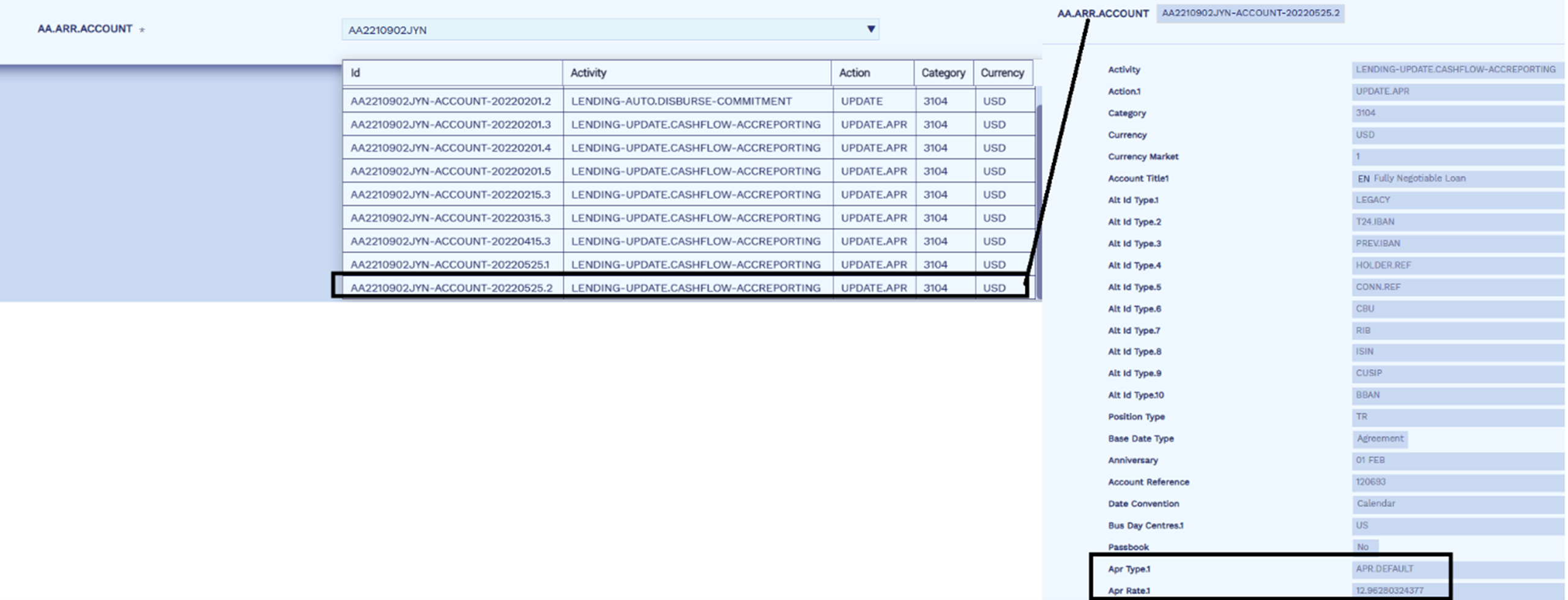

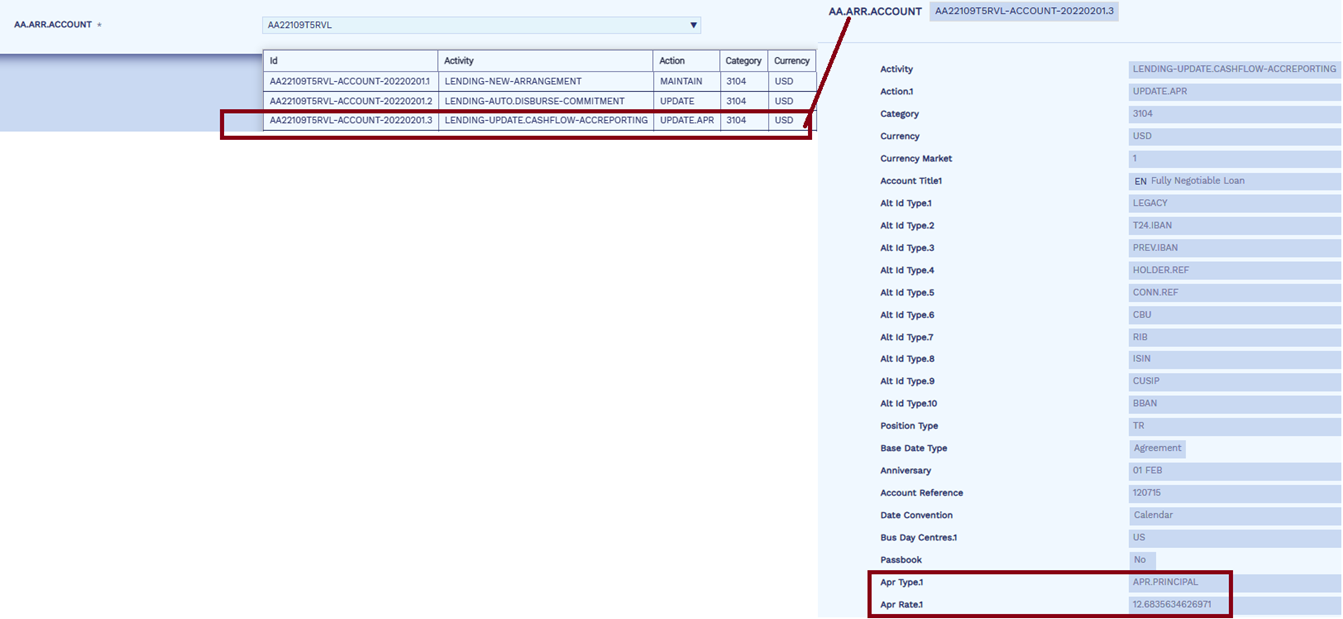

The APR is calculated and stored in the APR Type and APR Rate fields of the Account Property Class as follows:

- In Loans and Deposit contracts, the <PRODUCT.LINE>-UPDATE.CASHFLOW-<REPORTING> activity updates the APR when cashflow type of activities are processed.

- In all other cases, the <PRODUCT.LINE>-UPDATE.APR-<ACCOUNT> activity updates the APR for the arrangement.

If a forward-dated change is captured after the arrangement is created, then the APR is recalculated and stored as of the future effective date, that is, the effective date of the change. The system updates the recalculated APR in the APR Type and APR Rate fields as a forward-dated account condition for the arrangement. Read here for more information about recalculation of APR for forward dated changes.

The different APR scenarios can be configured in the Product definition through Reporting Property Class with the help of the attributes:

- APR Type - Used to specify the APR type (For example, internal, external).

- Exclude Property - Used to exclude a Property type from APR calculation.

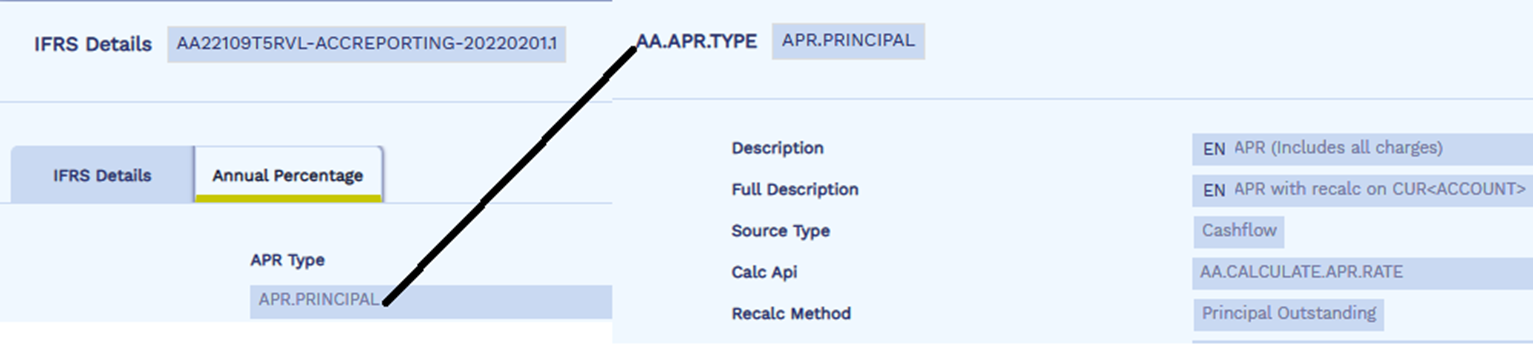

APR Type

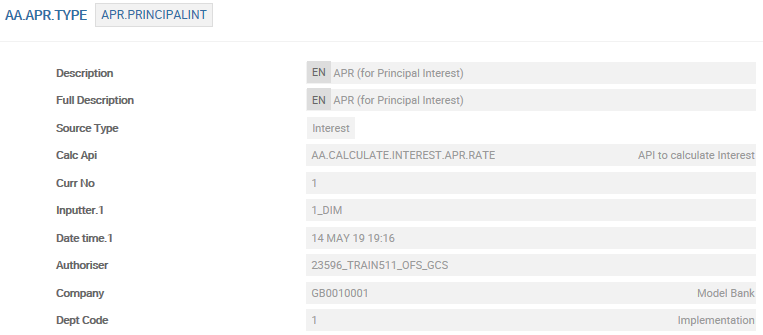

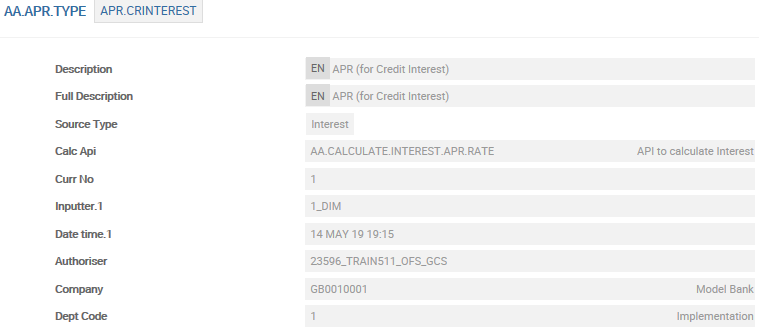

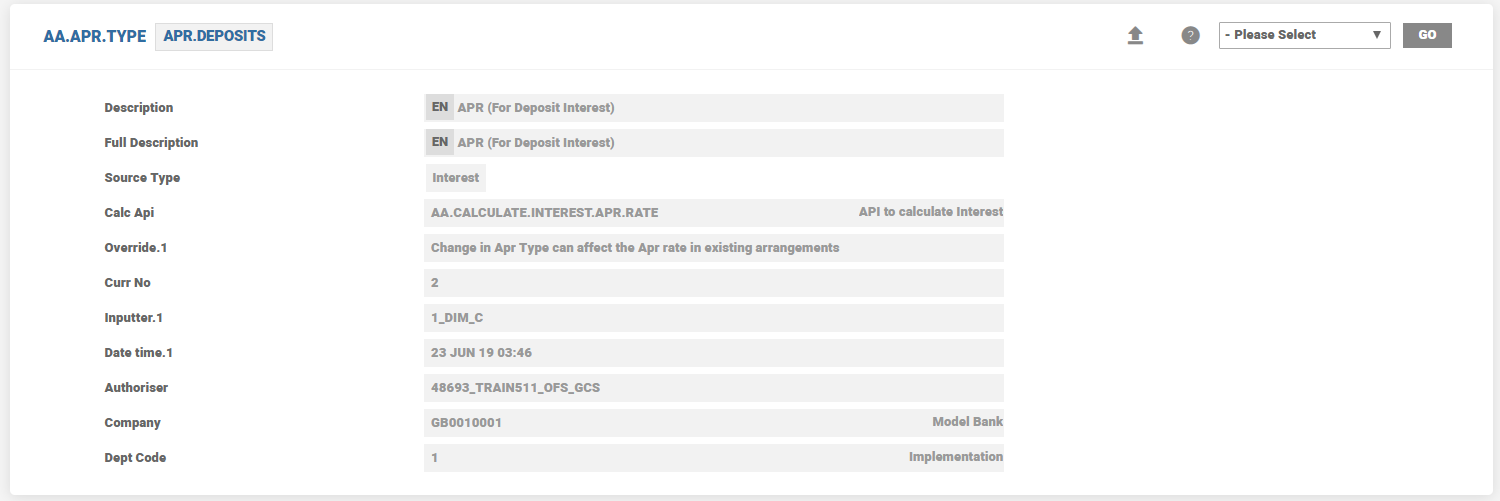

The APR Type field indicates the reference for APR calculation. It must map to ID of AA.APR.TYPE, which defines the source type, calculation routine, and recalculation method for APR calculation.

- Source used for APR calculation can either be cashflows of the contract or interest rate.

- User-defined routine to calculate the APR based on the source type.

- Derive the APR of a contract based on its cash flow.

- Recalculate APR whenever there is a change to the components forming the Cash flow or Interest rate sources (Principal balance, Charge amount, Interest rate conditions, Payment schedule and so on).

- APR for a contract based on the cashflow option in Source Type is recalculated using either the net present value or the outstanding principal.

- Calculates multiple APR types for an arrangement, when the different APR calculations are made of different components.

- Triggers APR calculation for cash flow activities except for the activities which are excluded.

-

The APR Type and APR Rate are stored in the Account Property Class through:

- <PRODUCT.LINE>-UPDATE.CASHFLOW-<ACCOUNT> activity when cashflow type of activities are processed in loans and deposits.

- <PRODUCT.LINE>-UPDATE.APR-<ACCOUNT> activity in all other cases.

- Displays the date on top of the list continued with other dates in a chronological order.

Exclude Property

The Exclude Property field indicates the Properties, which are excluded for APR calculation for the given APR scenario. The value must have a valid entry in AA.PROPERTY table and must be a valid Property of the arrangement. This field cannot be input when the corresponding APR Type is not input.

The Exclude Activity field indicates the activities, which are excluded for APR calculation for the given APR scenario. The value must have a valid entry in AA.ACTIVITY table and must be a valid activity of the arrangement.

This field allows the user to input only when the corresponding Apr Type has been specified. It applies only for the cashflow based APR types.

Activity | EIR | APR.DEFAULT | APR.INTERNAL | APR.INTEREST |

|---|---|---|---|---|

| LENDING-APPLYPAYMENT-PR.REPAYMENT | No | No | No | No |

| LENDING-APPLYPAYMENT-PR.PREPAY | No | Yes | Yes | No |

Compounding of interest is an effective way to increase the earnings of a deposit product. When interest is compounded, interest on interest can be earned and with longer investment periods, there is more potential for the investment to grow. On the contrary, the banks charge more interest on loan products when they compound interest.

Annual Percentage Rate (APR) is once such compounded rate that is calculated and stored at every arrangement and is commonly used to reflect the interest rate paid on a savings account, loan, money market or certificate of deposit. APR is stored for information and reporting purpose and is not used for any calculations. APR rate can be different from the interest rate that is used for calculating the daily interest accruals.

APR is also used as an indicator by customers and prospects to choose the product with the highest or the lowest yield depending on the product.

APR=(1 + r / n)^ n -1

Where , r is the gross interest rate and n is the interest frequency

The frequency is considered in the following order

- Compound Frequency

- Interest Frequency

- Renewal term or date

- Maturity period or date

- APR is calculated at the time of creating a new arrangement and at every instance there is a change to interest rate or the interest payout frequency.

- When the interest rate changes and there is no change to the interest payout frequency, then the model calculation API makes use of a weighted average rate to calculate the APR.

Example 1

A deposit is created for 12 months with a monthly interest payout. The initial rate of interest is 5%. After 6 months, the interest rate changes to 6%. In this arrangement:

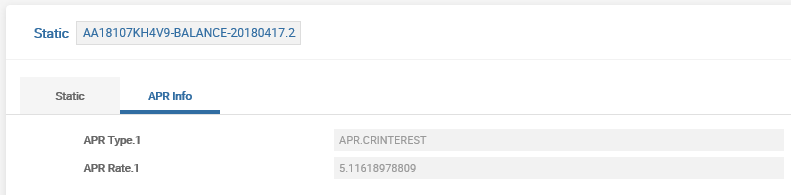

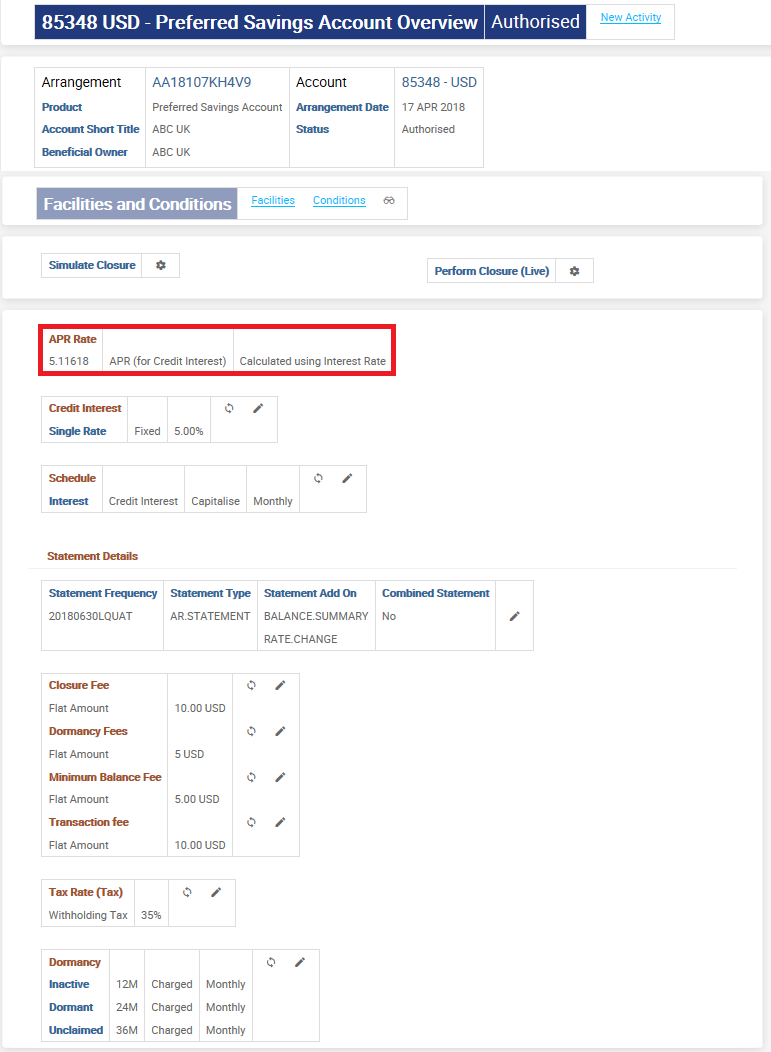

- The initial APR is calculated as 5.1162% using the contract rate of 5%.

- Upon rate change, the system calculates the interest rate by making use of a weighted rate between 5% and 6% and its corresponding term.

- Weighted Average Rate (WAR) is calculated as 5.5% ((5% * 6M) + (6% * 6M)) / 12M.

- APR is calculated as 5.6408% using the WAR of 5.5%.

-

When there are forward dated conditions for interest, then the initial rate itself is calculated using WAR.

Example 2

Consider the same scenario mentioned above with the rate change defined as a forward dated condition at the time of new arrangement itself. Then, the system calculates the WAR as 5.5% and calculates APR as 5.6408%.

- If a forward-dated rate change is captured after the arrangement is created, then the APR is calculated and updated in the APR Type and APR Rate fields as a future-dated account condition which is effective on the same day as the forward-dated rate change.

- Whenever there is a change in compound type or interest frequency, interest based APR calculation cannot arrive at an accurate APR. In this case, the default calculation is based on the existing frequency. For such products, it is recommended to make use of cashflow-based calculation for accurate APR.

- Interest based APR calculation works only for simple payment schedule definitions that has only one payment type for interest and does not have start, end and number of payments. If there are multiple payment types, say 6 monthly constant payments and then the arrangement is set to follow quarterly interest-only payments, then it is recommended to make use of cashflow-based APR calculation.

- If there are periodical account payments on a deposit, be it additional funding or withdrawals, then interest-based APR is not accurate and cashflow-based calculation is used.

- In case of discounted deposits or loans, the interest is paid at the beginning. The formula used for APR calculation does not consider this factor. This is blocked until there is a means to mathematically derive the APR. If the Mode (accounting mode) in interest is set to Advance, it is an exception and cashflow-based calculation is recommended.

- While calculating interest based APR for takeover contracts, the calculation makes use of a weighted average method. Original Contract Date is a key component to the calculation. If the contract is set-up for renewal, then Original Contract Date should be set as last renewal date at legacy, else, APR calculated turns to be incorrect.

- By default, the system always raises an override that APR calculation was based on Original Contract Date.

- New APR type records released

- Model API to calculate APR

- Reporting Conditions

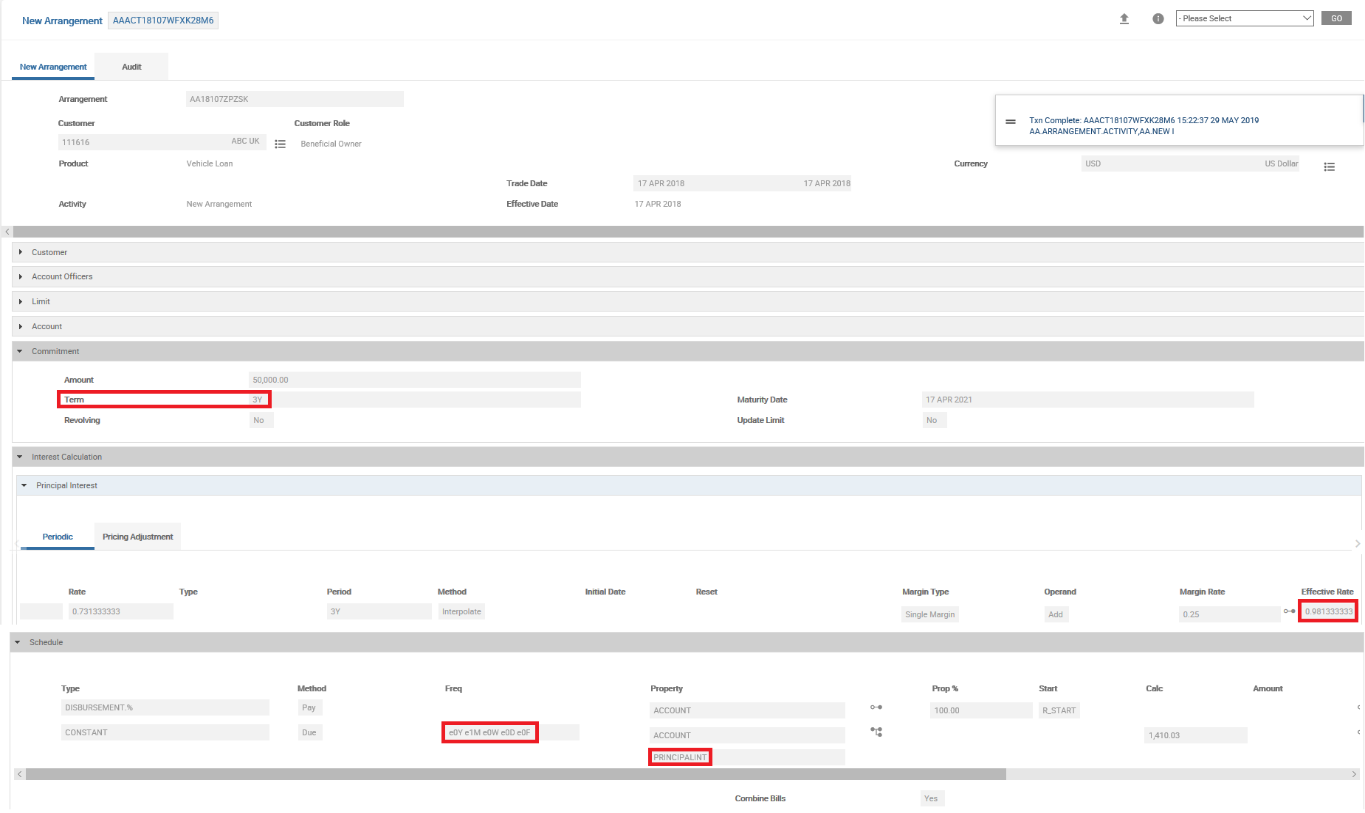

- Product: Vehicle Loan

- Reporting Condition: IFRS.APR.REPORTING

Create an arrangement under Vehicle Loan product.

- Check the interest rate that is defaulted for the loan.

- Verify if the APR is calculated based on the interest payout frequency.

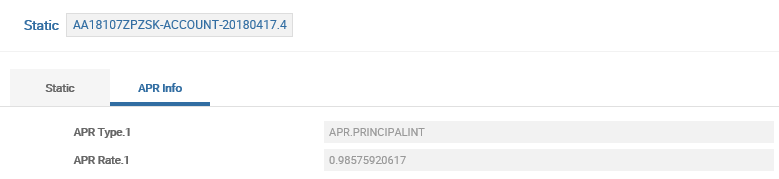

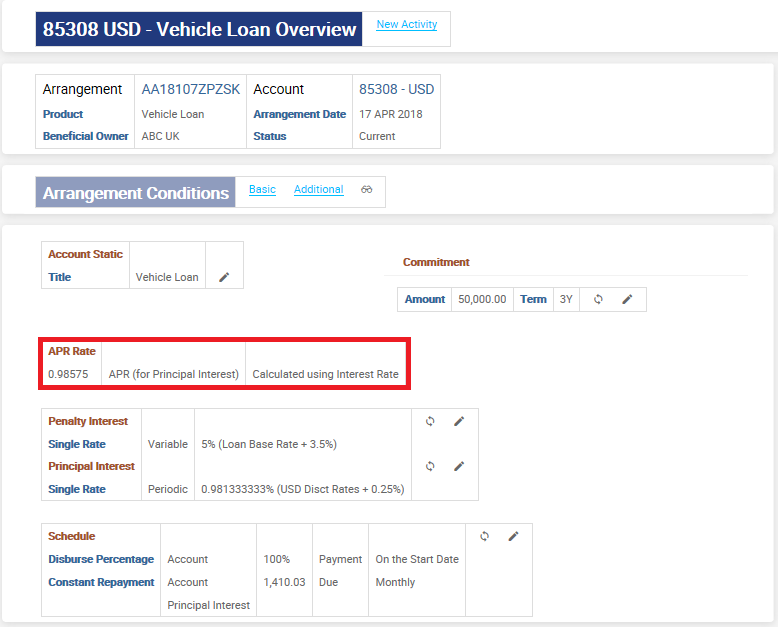

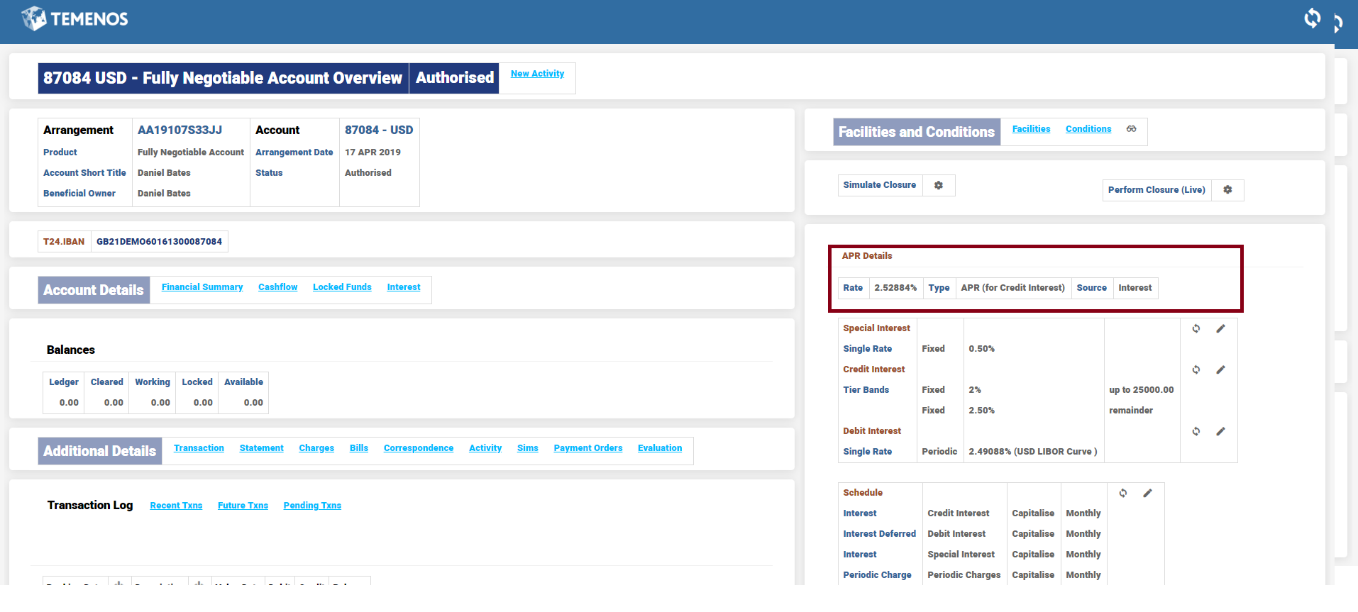

- Confirm if APR is updated in the account conditions and is displayed in the overview screen.

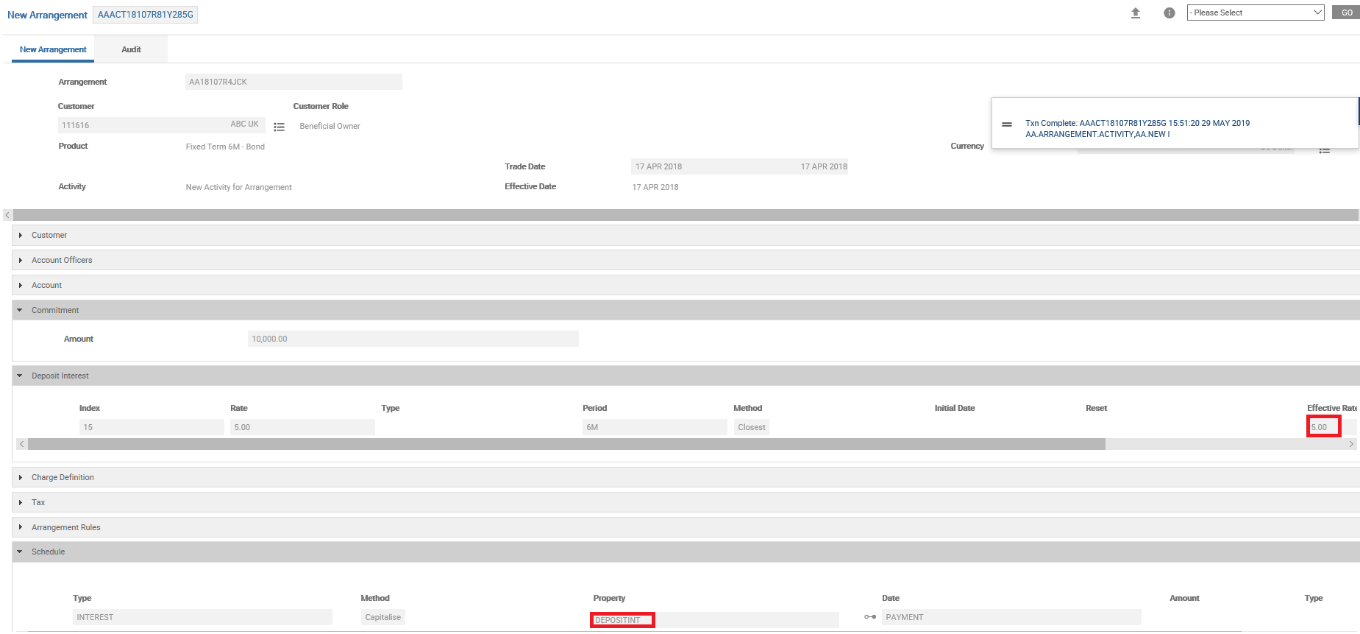

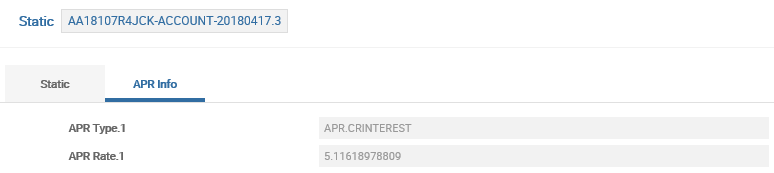

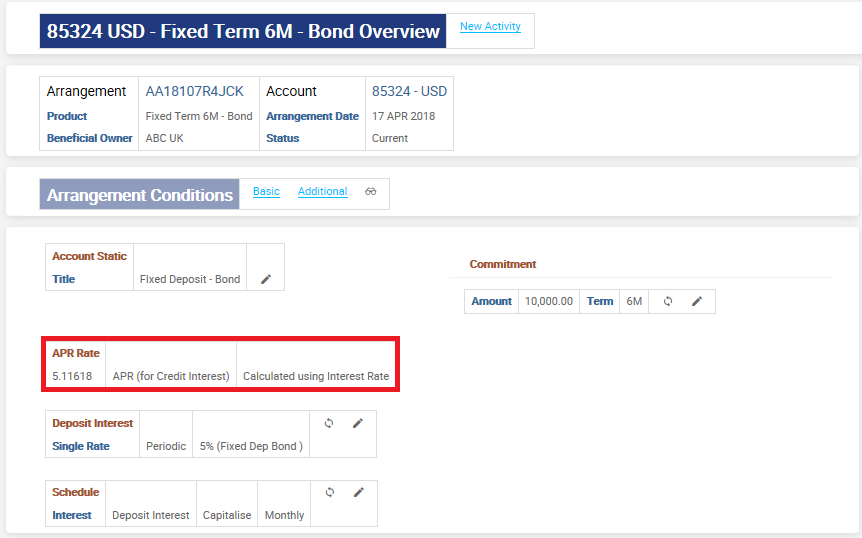

APR updated at ACCOUNT conditions

Product: Fixed Term 1 Year – Bond

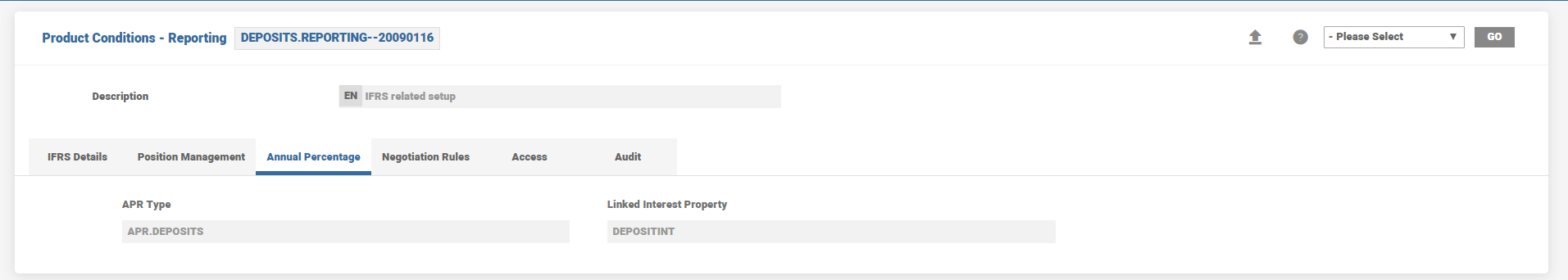

Reporting Condition: DEPOSITS.REPORTING

Create an arrangement under Fixed Term 6M - Bond product.

- Check the interest rate that is set as default for the deposit.

- Verify if the APR is calculated based on the interest payout frequency.

- Confirm if APR is updated in the account conditions and is displayed in the overview screen.

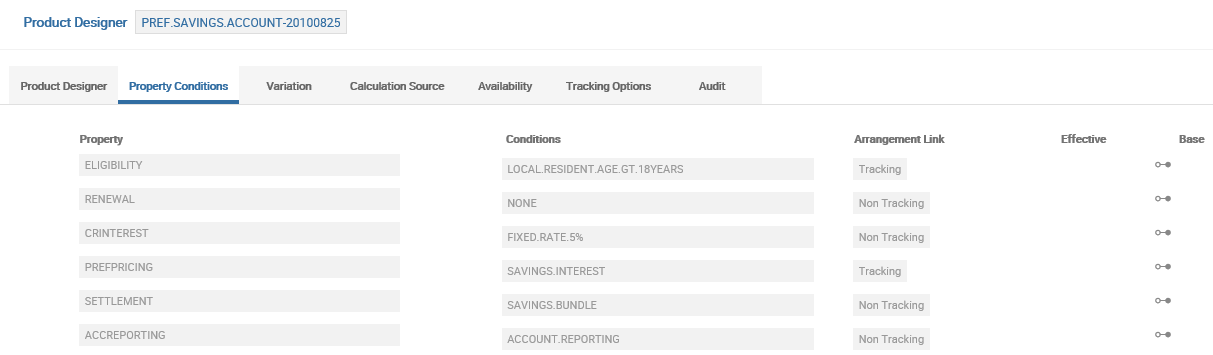

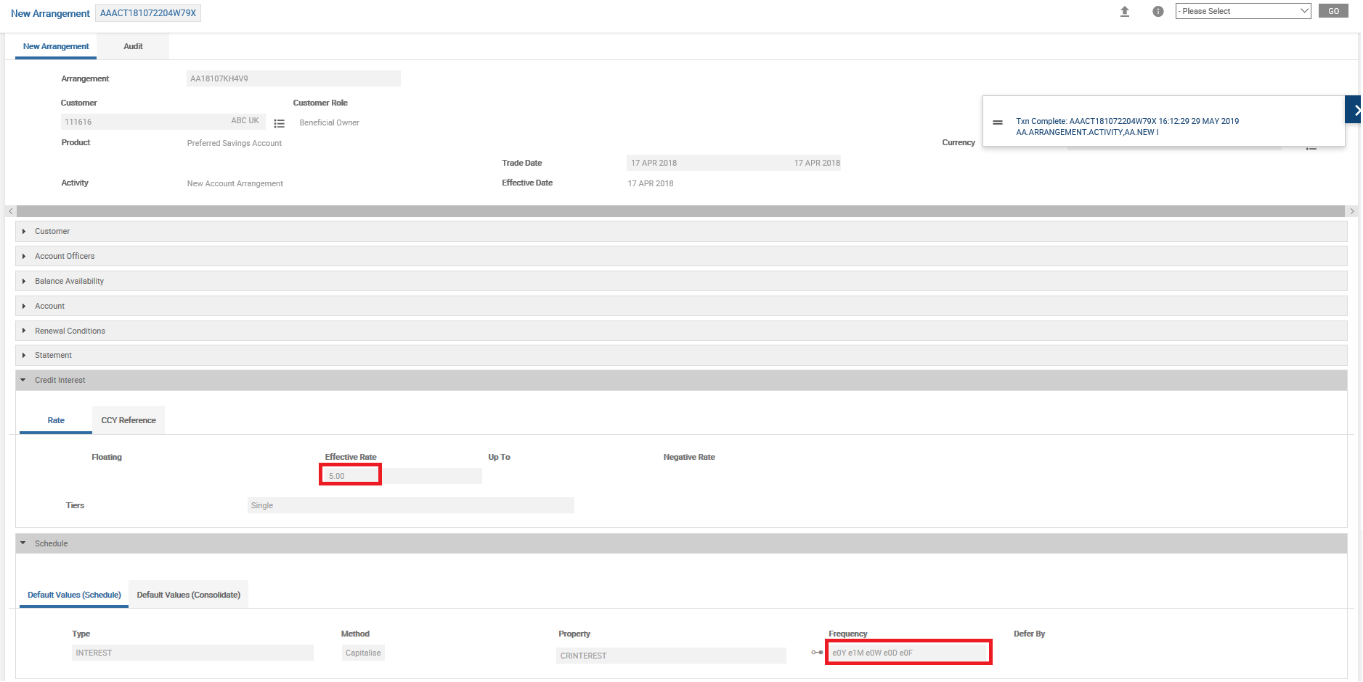

Product: Preferred Savings Account

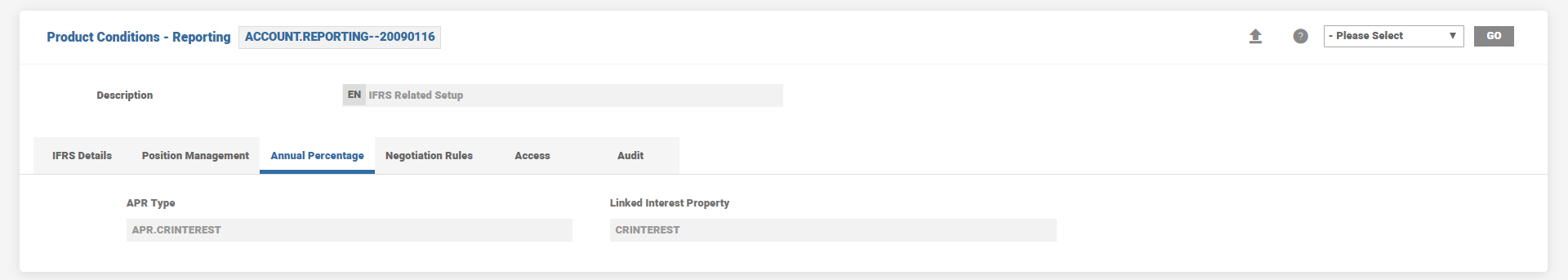

Reporting condition: ACCOUNT.REPORTING

Create an arrangement under Preferred Savings Account product.

- Check the interest rate that is defaulted for the account.

- Verify if the APR is calculated based on the interest payout frequency.

- Confirm if APR is updated in the account conditions and is displayed in the overview screen.

Banks use Annual Percentage Rate (APR) to provide the true interest rate on a banking product. Financial products in which interest is calculated based on banded rate definition, products with teaser or promotional offers with multiple interest rate conditions over the life cycle of the product make use of APR. It indicates the effective rates applied on the product. In case of banded and forward dated interest definition, the system calculates the combined weighted average interest rate which is used for APR calculation. A new APR is recalculated and updated as a forward-dated account condition which is effective on the same day as the forward-dated interest definition.

The system supports calculation of APR of financial products that have banded interest rates based on the commitment amount (excludes accounts). The calculation is performed in the following sequence

- Based on the commitment amount, the system ascertains the different interest bands that are applicable

- Derives the interest rate that is applicable for each tier of interest definition

- Calculates combined APR based on weighted average method

In the case of split banding of interest, the principal amount is the key to the calculation. In a financial product, there is every possibility for a change in the principal amount. This can be due to an increase or decrease in commitment amount. In both cases, the applicable interest rates and the weighted average is directly impacted and APR is recalculated.

During recalculation, the system considers the modified principal and current applicable interest rates to calculate the APR. The calculation does not consider interest rates applicable on the previous principal balance and retrospects the calculation based on that.

In the case a product that has multiple interest conditions then the APR is calculated taking into account the different interest rates those are applicable. The APR is calculated based on a weighted average basis. This is supported only for accounts with a fixed end date.

- Allowed for a deposit or loan product with a fixed maturity date and a promo rate for the initial period

- Not allowed for a savings account with a promotional interest rate for the initial period

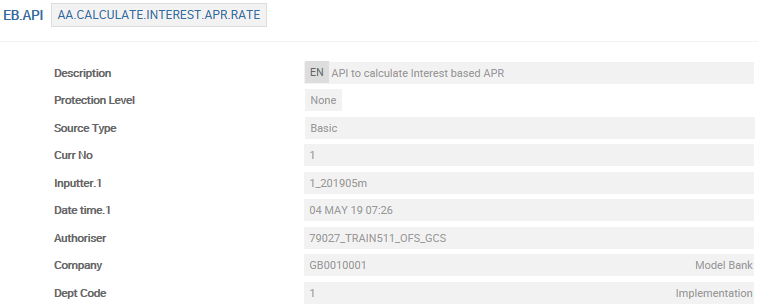

The AA.CALCULATE.INTEREST.APR.RATE model API is used for calculation of APR based on Interest definition. The same API is used for both single interest definition as well as banded interest definition.

Note that the APR calculations are processed by a model API such as the one above and the calculation processing is not embedded in the system. The model API drives the APR calculations.

Only the weighted average interest calculations are arrived by the system and supplied to the API.

- APR is calculated at the time of new arrangement and whenever there is a change to the interest rate or the interest payout frequency.

- When the interest rate changes and there is no change to the interest payout frequency, then the model calculation API makes use of a weighted average rate to calculate the APR.

Example 1

A deposit is created for 12 months with a monthly interest payout. The initial rate of interest is 5%. After 6 months, the interest rate changes to 6%. In this arrangement:

- The initial APR is calculated as 5.1162% using the contract rate of 5%.

- Upon rate change, the system calculates the interest rate by making use of a weighted rate between 5% and 6% and its corresponding term.

- Weighted Average Rate (WAR) is calculated as 5.5% ((5% * 6M) + (6% * 6M)) / 12M.

- APR is calculated as 5.6408% using the WAR of 5.5%.

- When there are forward dated conditions for interest, then the initial rate itself is calculated using WAR.

Example 2

Consider the same scenario mentioned above with the rate change defined as a forward dated condition at the time of new arrangement itself. In such a case, the system calculates the WAR as 5.5% and calculates APR as 5.6408%.

- If a forward-dated rate change is captured after the arrangement is created, then the APR is calculated and updated in the APR Type and APR Rate fields as a future-dated account condition which is effective on the same day as the forward-dated rate change.

Example 3

A deposit is created on Jan 1, 2022 for two years with a monthly interest payout. A floating index is used for the deposit and has an initial interest rate of 10%. Based on this, the initial interest-based APR for the deposit is calculated as 10.47%.

On Mar 1, 2022, the user inputs a forward-dated BASIC.INTEREST record for the floating index with effective date as Jul 15, 2022 and rate as 10.25%. On running COB, the system triggers the APPLY.RATE activity and the interest-based APR for the deposit is calculated as follows:

- The weighted average rate is calculated using the interest rates 10% and 10.25% for the corresponding periods of the deposit’s term.

- Weighted Average Rate (WAR) is calculated as 10.18% ((10% * 195 days) + (10.25% * 535 days)) / 730 days.

- APR is recalculated as 10.67% using the WAR as 10.18% based on the calculation logic attached in the corresponding AA.APR.TYPE record. This recalculated APR is updated as a forward-dated account condition for the deposit with effective date as Jul 15, 2022.

- The weighted average rate is calculated using the interest rates 10% and 10.25% for the corresponding periods of the deposit’s term.

- Whenever there is a change in compound type or interest frequency, interest based APR calculation cannot arrive at an accurate APR. In this case, the default calculation is based on the existing frequency. For such products, it is recommended to make use of cashflow-based calculation for accurate APR.

- Interest-based APR calculation works only for simple payment schedule definitions, that has only one payment type for interest and does not have start, end and number of payments. If there are multiple payment types, say 6 monthly constant payments and then the arrangement is set to follow quarterly interest-only payments, then it is recommended to make use of cashflow-based APR calculation.

- If there are periodic account payments on a deposit, be it additional funding or withdrawals, then Interest-based APR is not accurate and cashflow-based calculation has to be used.

- In case of discounted deposits or loans, the interest is paid at the beginning. The formula used for APR calculation does not consider this factor. This is blocked until there is a means to mathematically derive the APR. If Mode (accounting mode) in interest is set to Advance, it is an exception and cashflow-based calculation is recommended.

- While calculating interest based APR for takeover contracts, the calculation makes use of a weighted average method. Original Contract Date is a key component to the calculation. If the contract is set-up for renewal, then Original Contract Date should be set as last renewal date at legacy, else, APR calculated is incorrect.

- By default, the system always raises an override that the APR calculation was based on Original Contract Date.

- In case of banded interest definition,

- For Deposits and Lending PL, the weighted average rate is arrived exactly based on the Commitment Amount.

- For Accounts PL, the weighted average rate is arrived at best benefit scenario of the customer.

- In case of credit interest (say, savings account), the highest rate in the banded rate definition is considered for WAR calculation.

- In case of debit interest (say, overdraft account), the lowest rate in the banded rate definition is considered WAR calculation.

- In case of APR for the Account PL in Banded Interest, the APR is calculated as a deemed or notional benefit which a customer receives in the best benefit scenario. The actual APR for account product can only be arrived based on the balance maintained at the account level. Unlike loans or deposits which have a commitment amount defined its not possible to gauge the exact balance in an account and hence the model API arrives at the APR based on best benefit scenario discussed above.

- The basic APR related setup and background is covered in an earlier release.

- The APR calculation is supported for Deposits, Lending and Account product lines.

- Setup for APR calculation in AA.APR.TYPE is shown below

- Setup for Reporting Product Condition which is attached to the Reporting property of the Deposit product is as follows

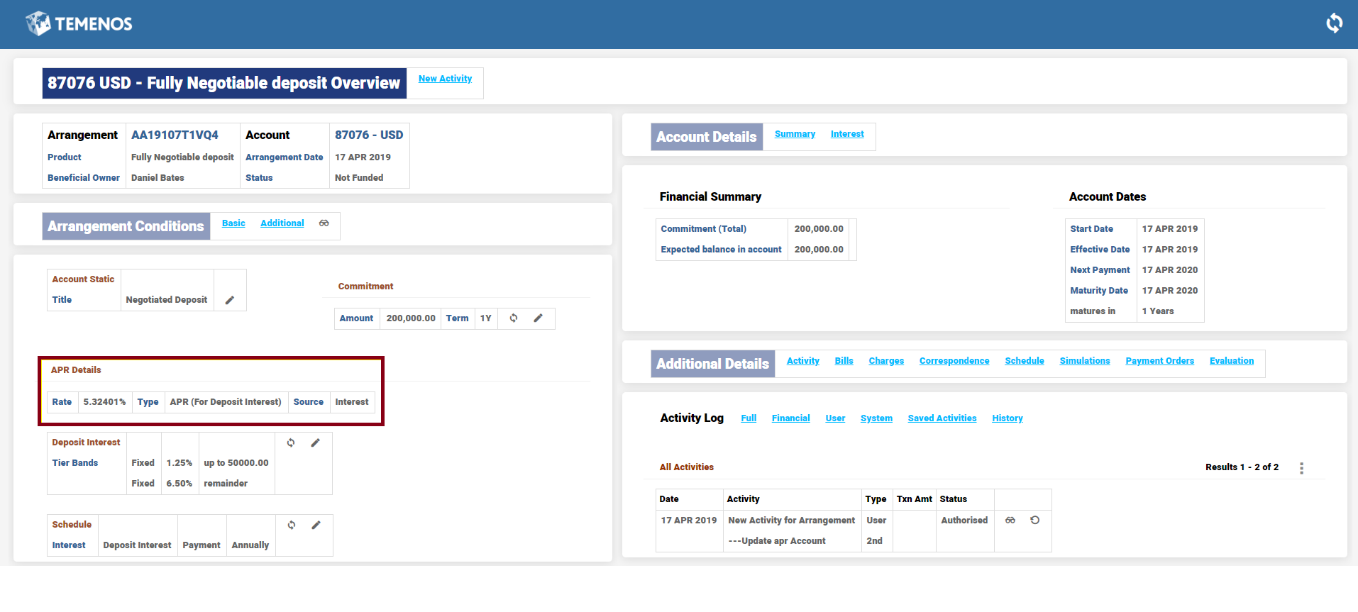

- Consider a banded interest condition with fixed rate of 1.25% up to 50,000 commitment amount and fixed rate of 6.50% for remainder amount.

A call deposit is initiated for USD 200,000.

For the first 50,000, interest is calculated at 1.25%, 625

For the remaining 150,000, interest is calculated at 6.50%, 9750

Weighted Average is calculated as ((625 + 9750) / 200,000)*100 = 5.1875

The APR is arrived from the above WAR which is ((1+(5.1875% / 12))^12) -1=5.32

When a deposit is created for USD 200,000, the APR is calculated at 5.32% and presented in the Arrangement Overview.

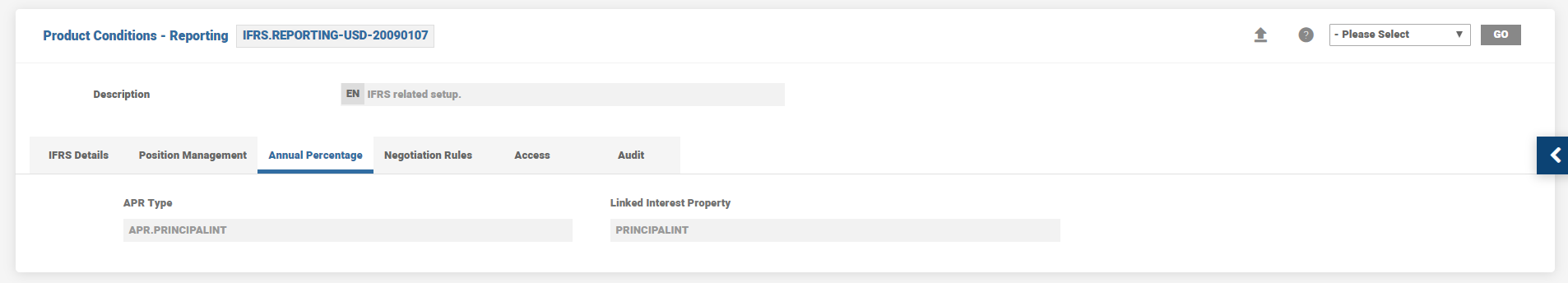

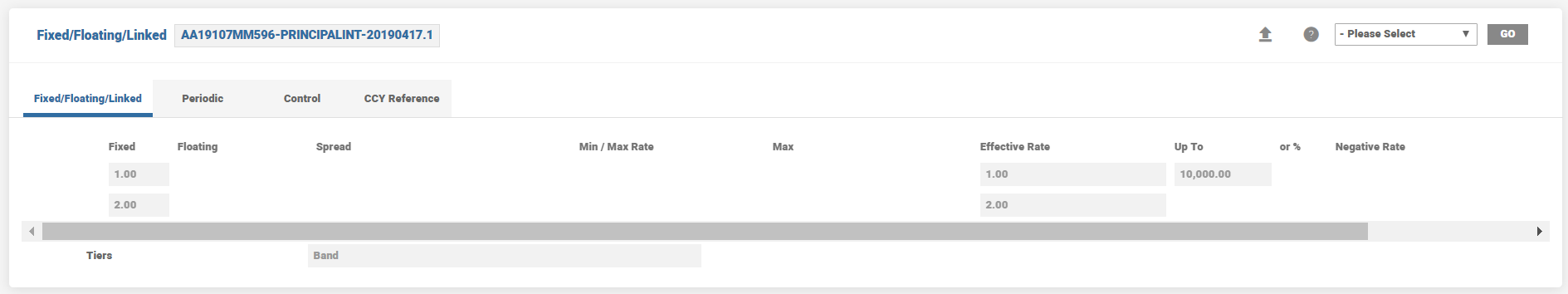

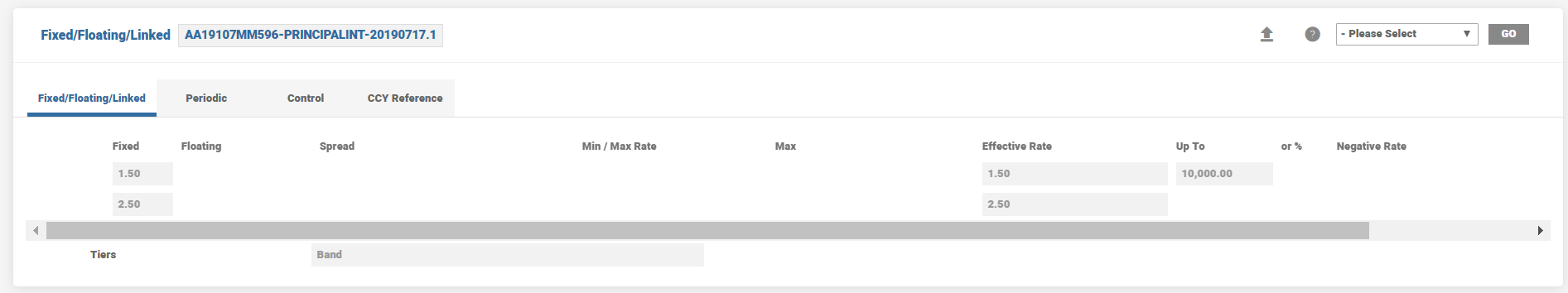

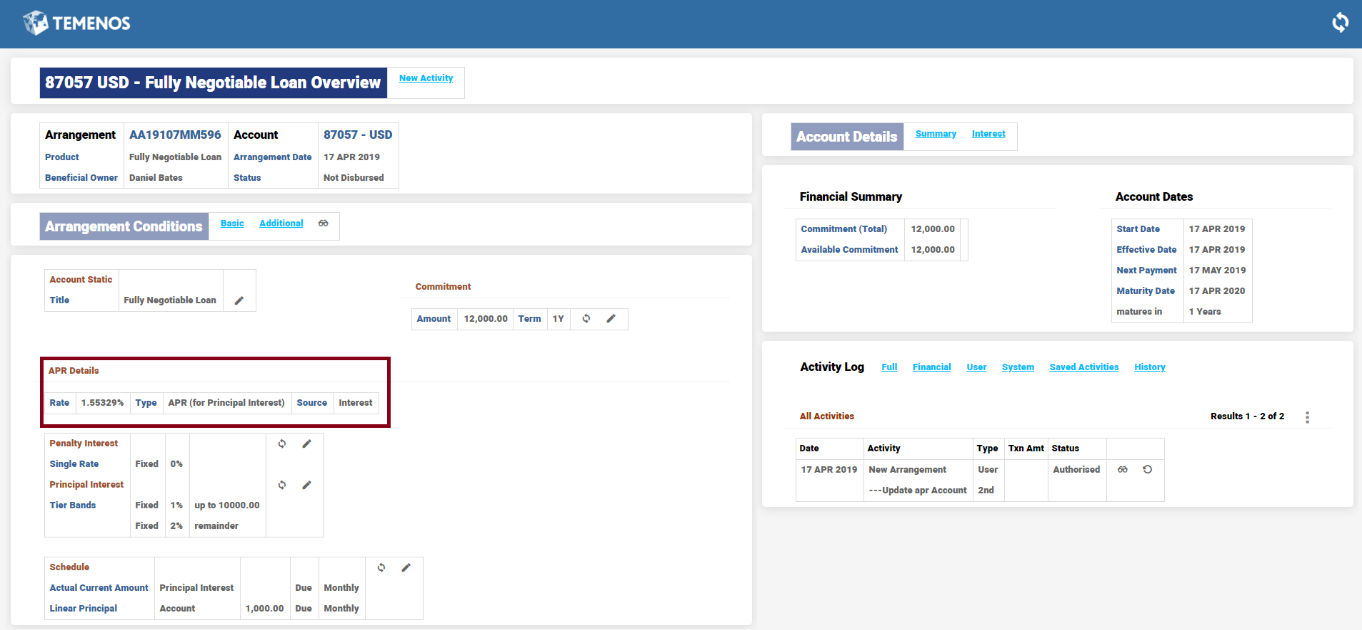

- Reporting Condition for loan principal interest which is attached in a Negotiable Loan product.

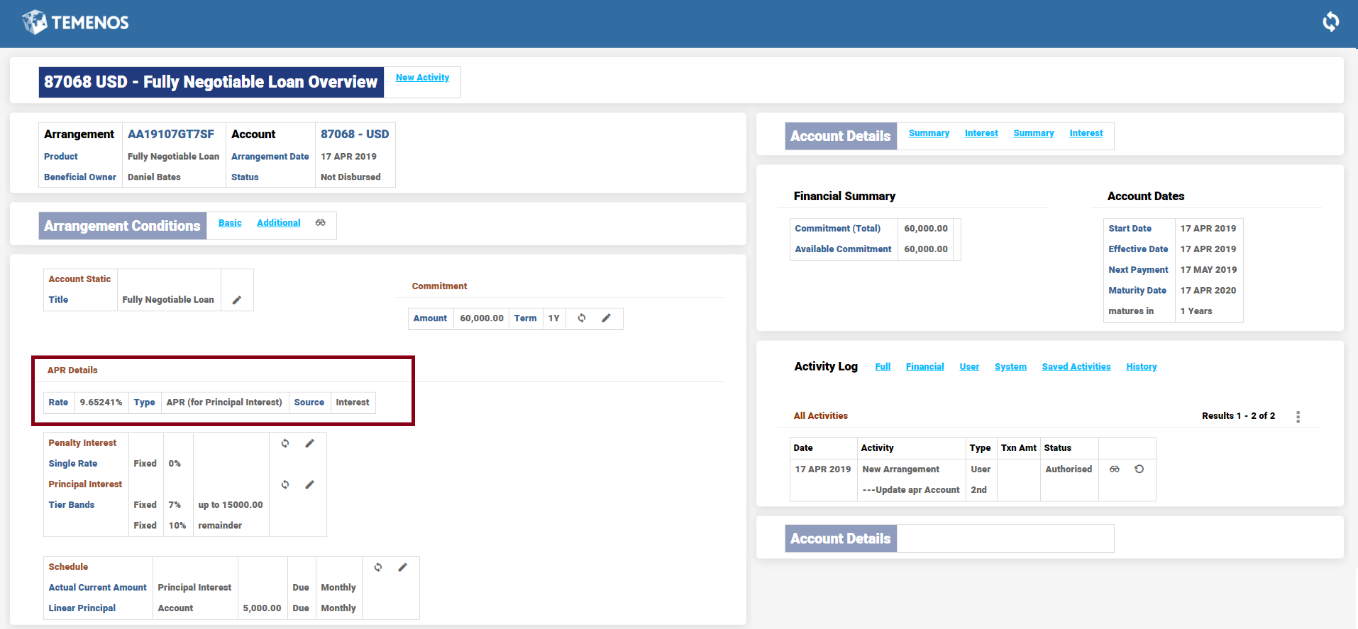

- Consider a banded interest condition with fixed Rate of 7% up to 15,000 commitment amount and fixed rate of 10% for remainder amount.

A personal loan is initiated for USD 60,000.

For the first 15,000, interest is calculated at 7%, 1050

For the remaining 45,000, interest is calculated at 10%, 4500

Weighted average is calculated as ((1050 + 4500) / 60,000)*100 = 9.25

APR arrived from the above WAR is ((1 + (9.25% / 12))^12) -1 = 9.65

When a personal loan arrangement is opened for USD 60,000, APR is calculated at 9.65% and presented in the arrangement overview.

- Reporting condition for Credit Interest property which is attached in a Savings Account product is as follows

Consider a banded interest condition with variable rate of 2% up to 25,000 balance and rate of 2.5% for the amount over 25,000

When a savings account is opened. For APR calculation, the highest rate among the tiers (2.5%) is considered as the weighted average irrespective of the multiple tier definitions.

APR arrived from the above WAR is ((1+ (5% / 12))^12) - 1 = 2.53

When a savings account is opened based on the above setup, the APR is arrived at 2.52 and presented in the arrangement overview.

Consider a promotional personal loan product which has lower interest rate for the first 3 months and higher rate beyond 3 months. Assume both are banded interest definitions.

Multiple Interest Definition

For the first 3 months, banded interest condition with fixed rate of 1% up to 10,000 commitment amount and fixed rate of 2% for remainder amount.

Loan arrangement date is 17-04-2019 with promotional interest rates

For the period beyond 3 months,

Banded interest condition with fixed rate of 1.5% up to 10,000 commitment amount and fixed rate of 2.5% for remainder amount.

After 3 months, on 17-07-2019, the interest conditions are scheduled to be fixed at regular rates.

When a personal loan is created for USD 12,000, the weighted average for each band is arrived individually.

Step 1:

For the initial period of 3 months,

- For the first 10,000, interest is calculated at 1%, 100

- For the remaining 2,000, interest is calculated at 2%, 40

- Weighted average is calculated as ((100 + 40) / 12,000) * 100 = 1.166

Step 2:

For the subsequent period,

- For the first 10,000, interest is calculated at 1.5%, 150

- For the remaining 2,000, interest is calculated at 2.5%, 50

- Weighted average is calculated as ((150+50)/12,000)*100 = 1.666

Step 3:

- Combined weighted average is calculated next.

- Combined WAR, ((1.166*3) + (1.666*9))/12 = 1.542

Step 4:

- APR is finally arrived based on the above Combined WAR

- APR arrived from the above WAR is ((1 + (1.542% / 12)) ^ 12) -1 = 1.55

When a personal loan arrangement is opened for a customer with teaser or promotional rates for an initial period similar to the above illustration, the final APR arrived from the combined weighted average interest is calculated and displayed on the arrangement overview.

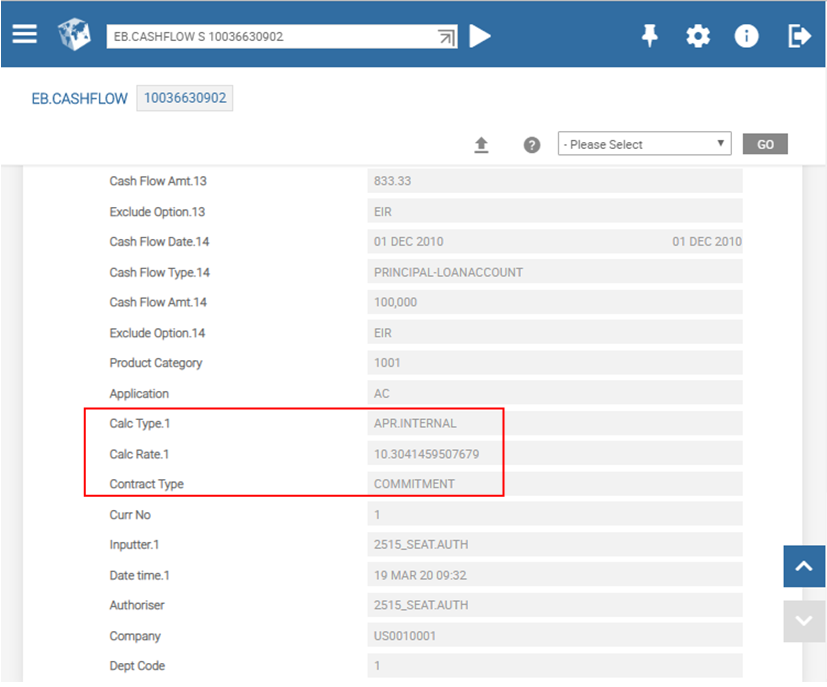

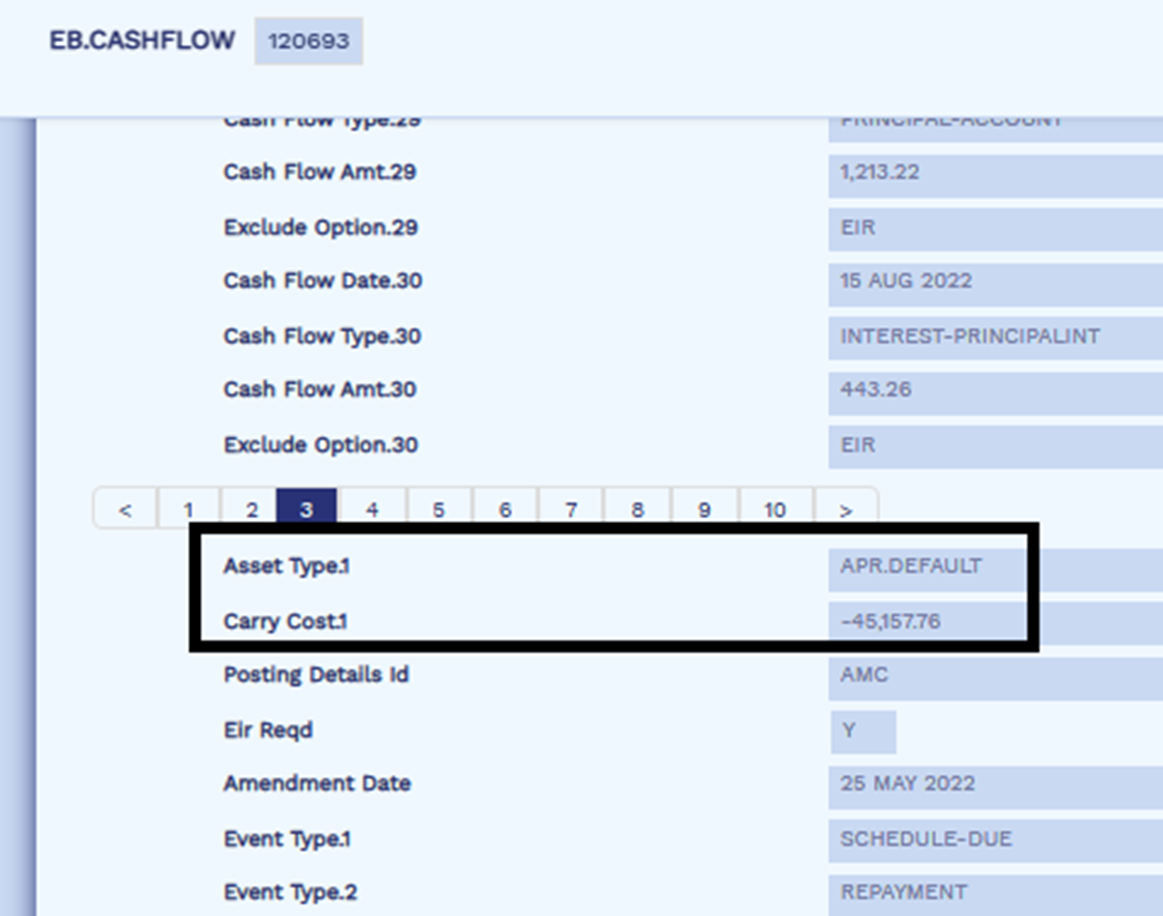

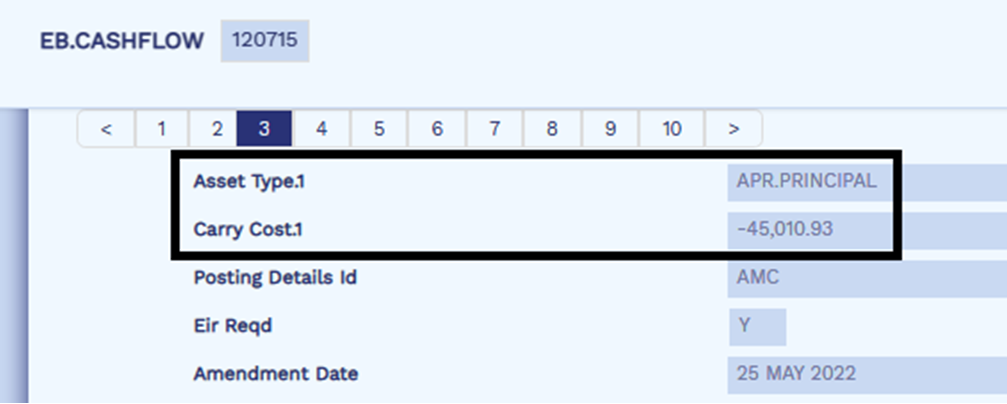

- The system uses EB.CASHFLOW as a central table to store:

- The rates calculated by EIR and APR calculation methods.

- All future cash flows of an arrangement.

- The following are the attributes in EB.CASHFLOW table:

- Exlcude Optionfield—Identifies which of the calculations excluded a particular cash flow. The attribute is added to the Cash Flow Date multi-value set.

- Calc Type field—Differentiates EIR and APR calculation methods. This attribute holds EIR or an APR type configured in Reporting Property Class.

- Calc Rate field— Calculates for the respective calculation method.

- Initial APR (excluding commitment and simulation) is calculated based on CUR<ACCOUNT> and future cashflows. When there is a change that requires recalculation of APR, there are two options based on which the new APR can be calculated. This can be configured in the Recalc Method attribute of AA.APR.TYPE application.

- Net present value - During recalculation, the system discounts current cashflows using current APR to calculate the present value of the loan. The APR is recalculated using the present value and future cashflows (based on the new rate).

- Principal outstanding - The system uses the projected CUR<ACCOUNT> balance and future cashflows (based on the new rate) to recalculate the APR.

- Only the interest amount based on the new rate is considered for APR recalculation. If the interest change is in the middle of an interest period, then the entire interest amount is not used for recalculation and only the period covered by the new rate is used for APR recalculation.

- Change in Charges (internal and external based on APR type definition)

- Change in Interest

- Fund Deposit

- Prepayment

- Deposit of Fund

- Change in Commitment Term

The system recalculates the APR of an arrangement whenever the cash flow is affected by an eligible Activity.

Following are few transactions that affects the cash flow and initiates the recalculation of APR.

Scenario: A Commitment Savings Plan with a deposit of USD 100,000. In the above example, the cash flow is updated during,

The cash flow update initiates the UPDATE.CASHFLOW-<REPORTING> activity, which recalculates the APR and stores it. The system updates the re-calculated APR Rate and APR Type fields in the EB.CASHFLOW table.

EB.CASHFLOW is built with commitment cashflows sent from AA (new arrangements). APR is calculated based on the commitments cashflows sent. The Contract Type field holds the COMMITMENT value, until the loan is disbursed. Once the commitment contract is disbursed, the Contract Type field is cleared and EB.CASHFLOW is built based on the real cashflows sent.

EB.CASHFLOW built for Commitment Arrangement

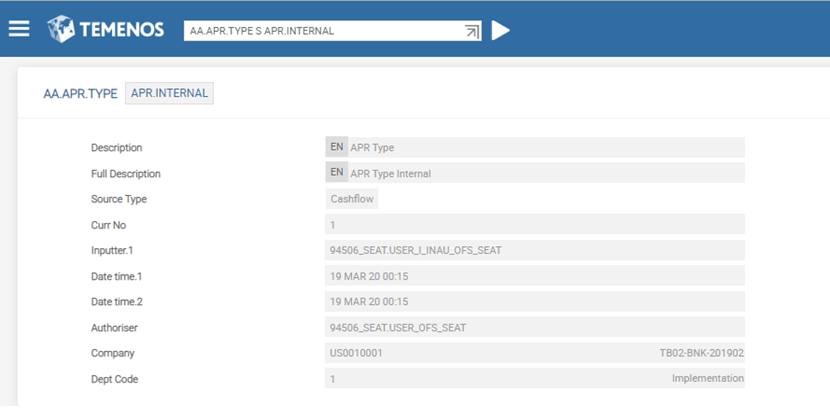

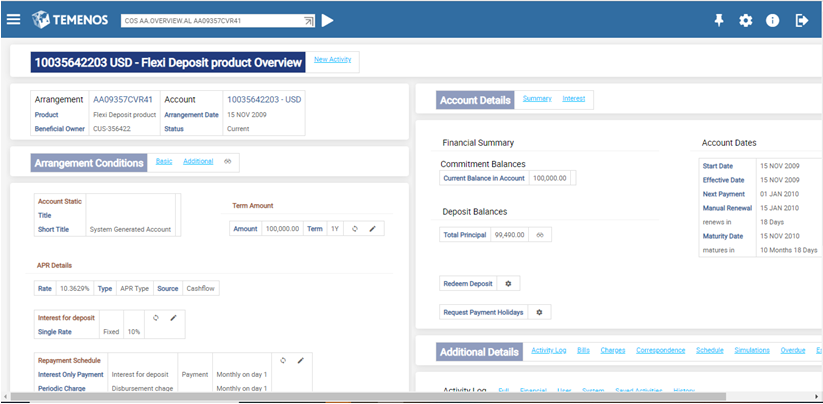

The following screenshot shows the Source Type field set as Cashflow.

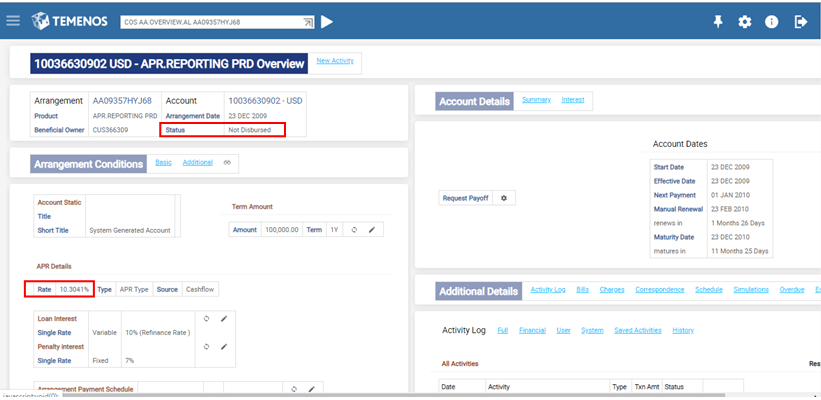

The following screenshot shows the arrangement overview APR.INTERNAL record of the AA.APR.TYPE application entered during new arrangement creation in the Reporting Product Condition.

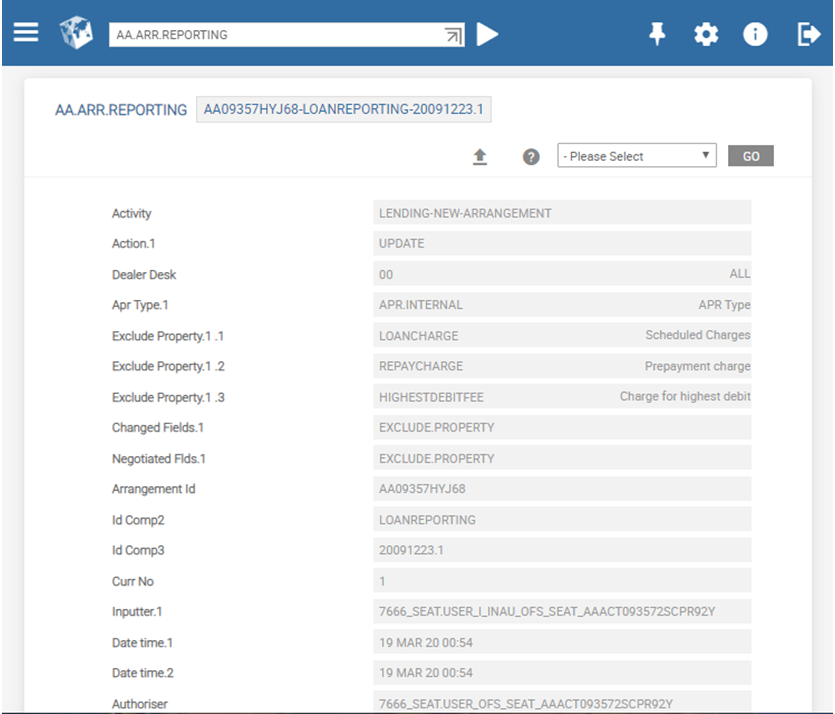

The following screenshot shows the Apr Type field (in the AA.ARR.REPORTING application) set as APR.INTERNAL.

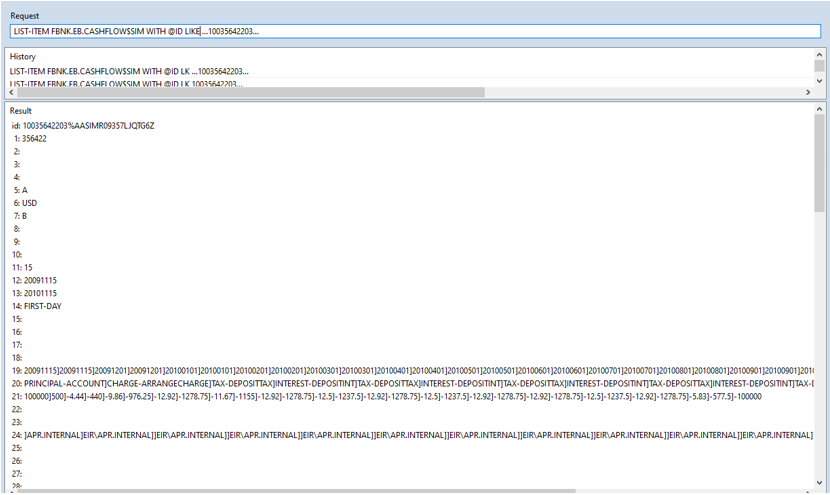

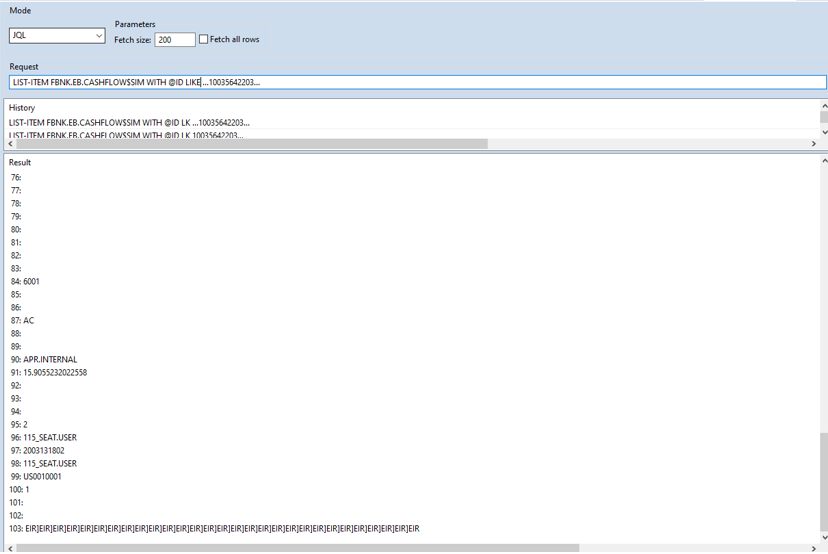

The following screenshot shows the Contract Type field (in the EB.CASHFLOW application) set as COMMITMENT and the APR calculated in the Calc Rate field.

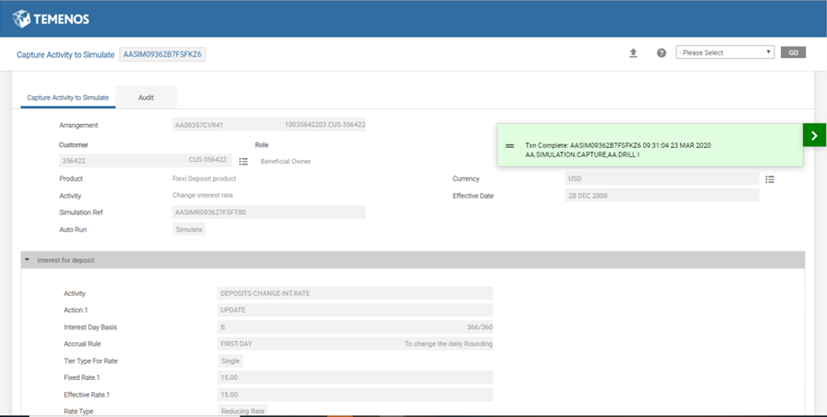

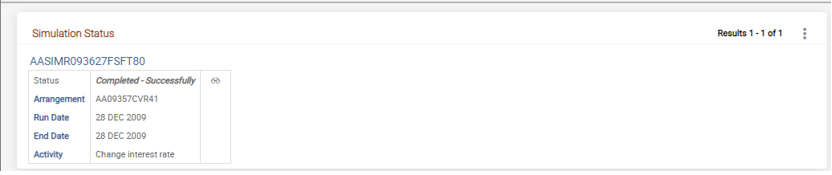

In the simulated scenario, cashflow information and APR details are maintained in the EB.CASHFLOW$SIM file. When the simulation is executed, the EB.CASHFLOW table is updated.

EB.CASHFLOW$SIM built on Simulation

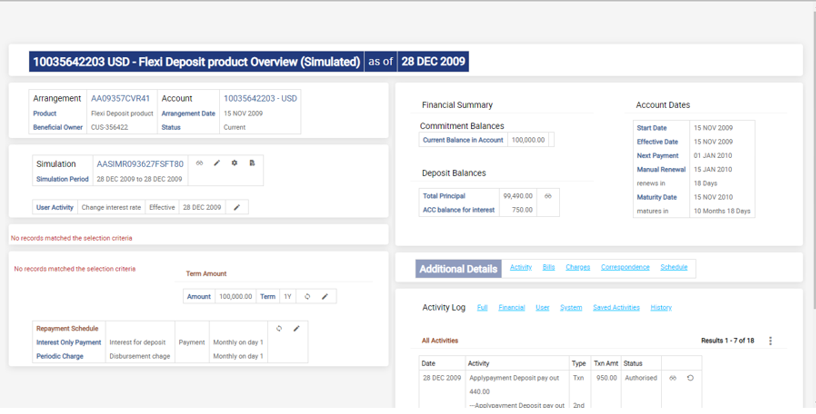

The following screenshots show the simulation of rate change activity on disbursed arrangements. APR is calculated based on the new rate in the simulating rate change activity.

The following screenshot shows the simulation capture record.

The following screenshot is a pop-up from the simulation screen, which appears after the simulation capture record is committed.

The following screenshot is an overview of a simulated arrangement.

The following screenshot shows the EB.CASHFLOW$SIM file with APR calculated based on the new interest rate given during simulation.

The following section illustrates the recalculation of cashflow based APR when there is a forward dated rate change. The cashflow based APR is recalculated using either Net present value or Outstanding Principal.

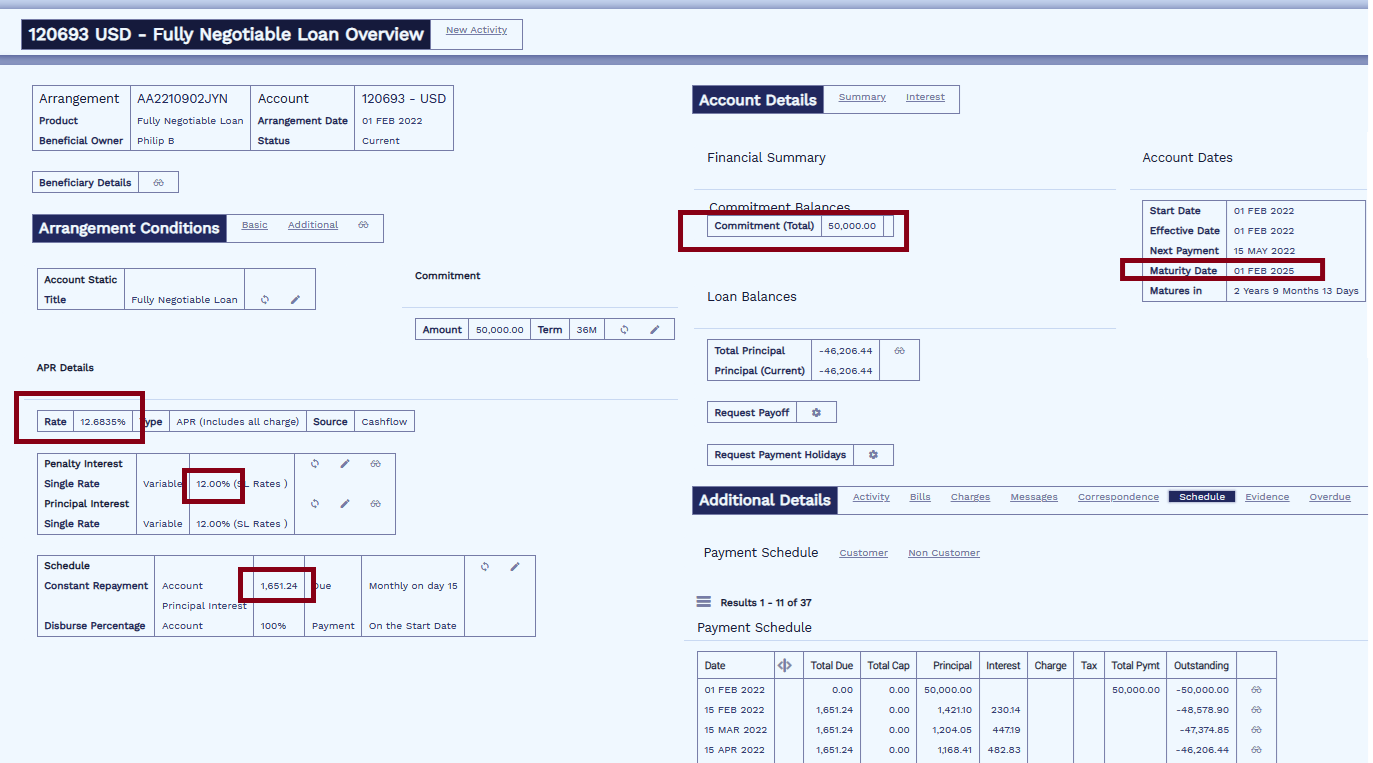

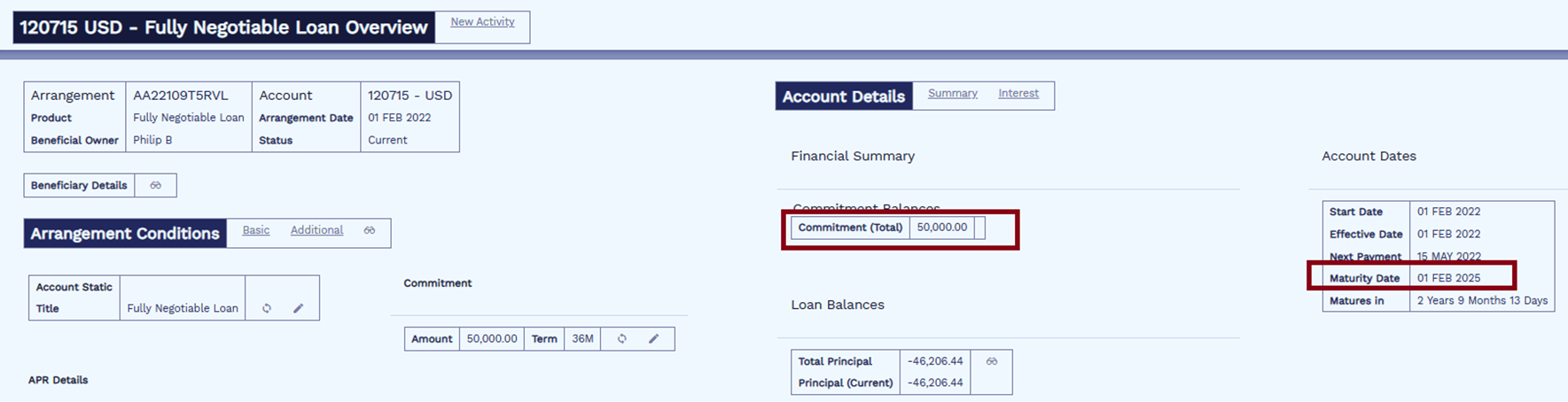

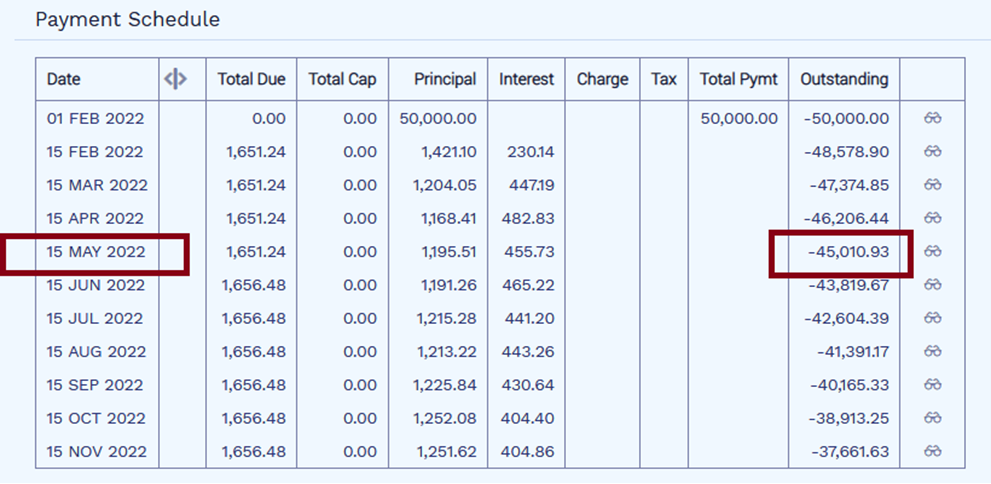

Consider a lending contract is created for USD 50,000 on Feb 1, 2022. The tenor of the loan is 36 months.

The repayment schedule is on the 15th of every month with an instalment amount of USD 1651.24.

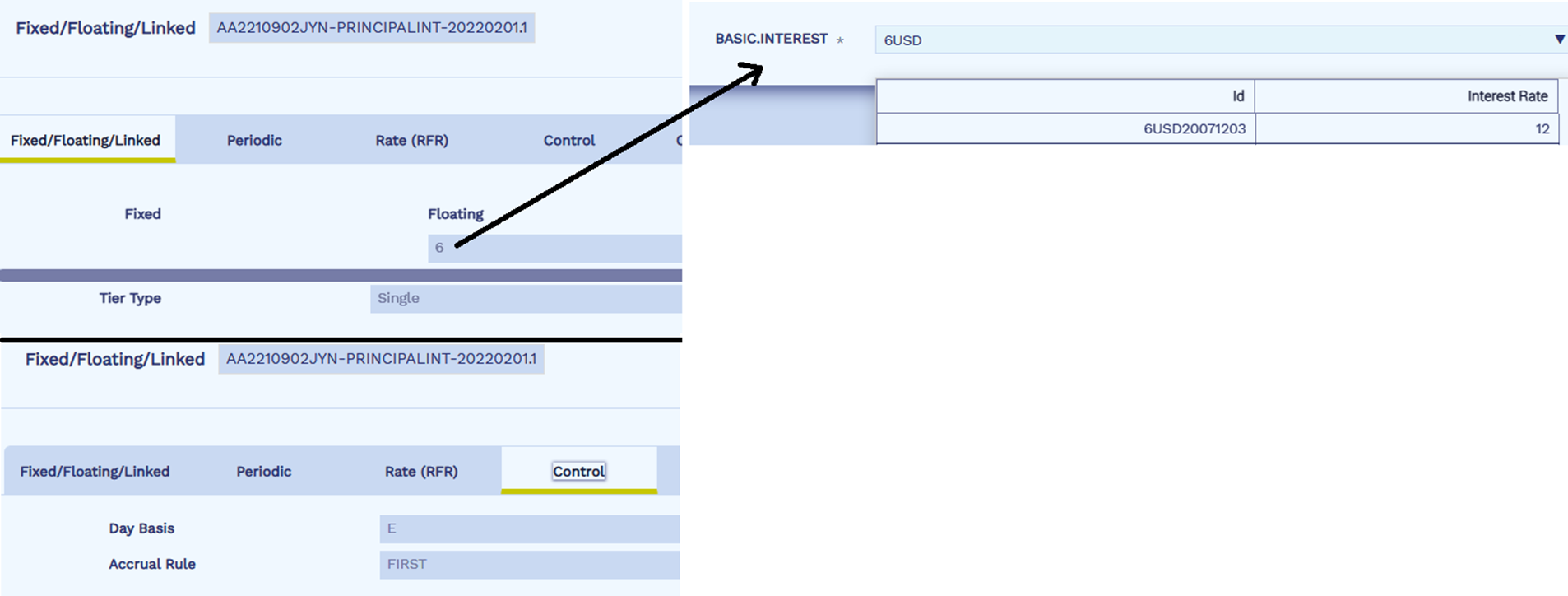

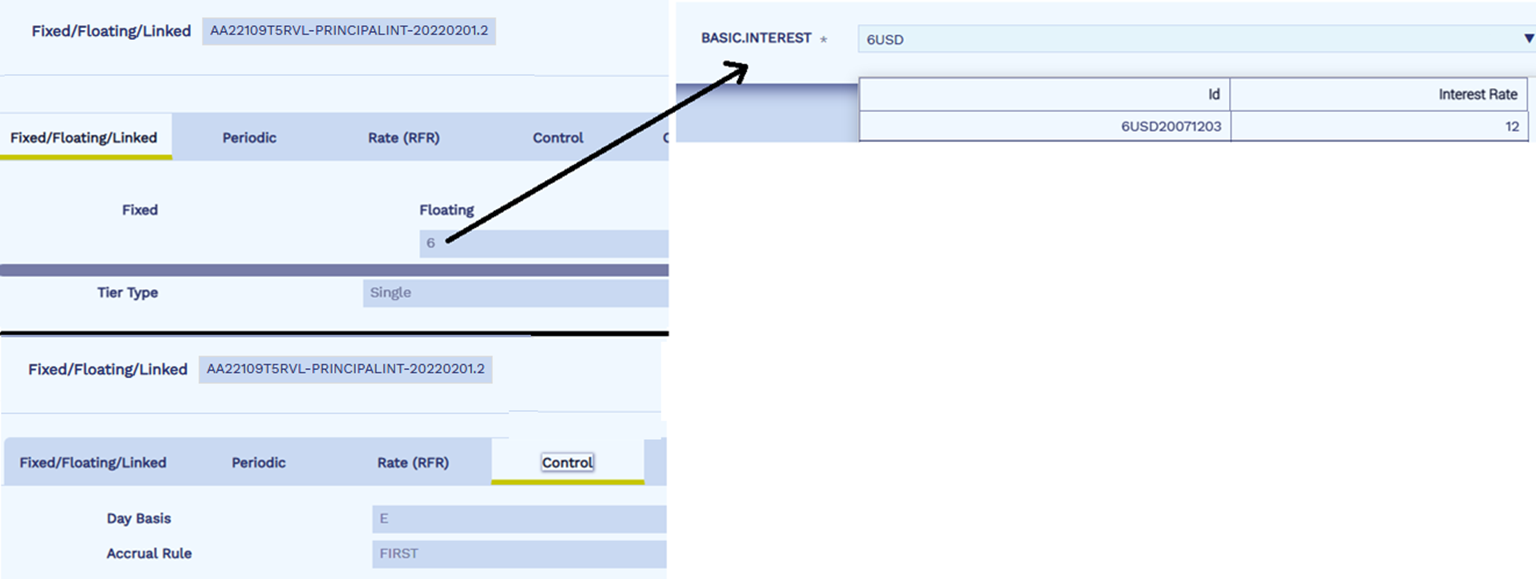

At the time of creating a new arrangement the interest rate is defined as 12% that refers to a floating rate index. The Interest Day Basis is set as E (366/365) and Accrual Rule is set as FIRST.

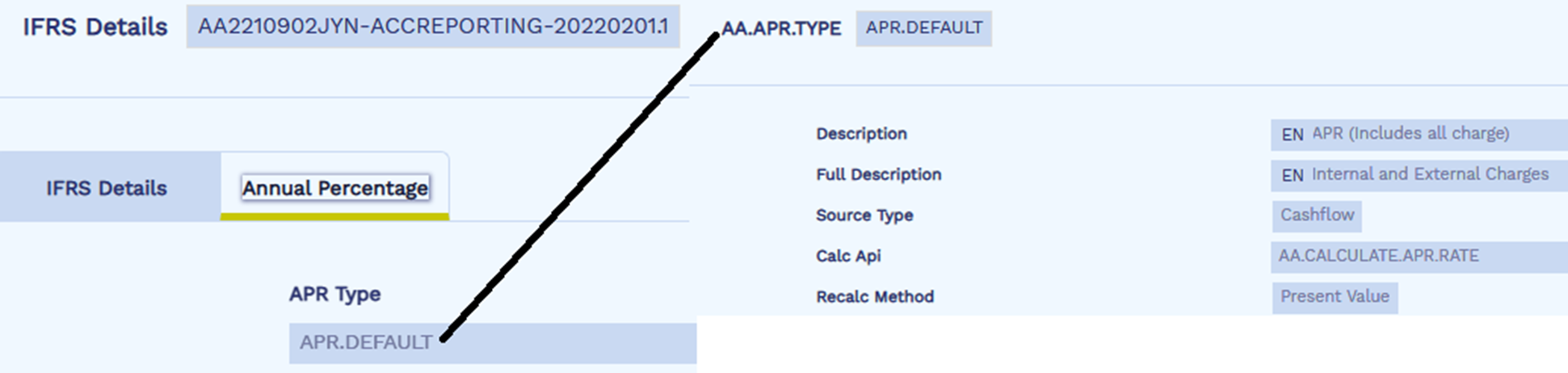

The Reporting condition is configured to calculate the APR for the contract, based on the cashflow with Recalc Method set as Present value in the AA.APR.TYPE application.

The cashflow based APR is calculated as 12.6835% once the loan is fully disbursed.

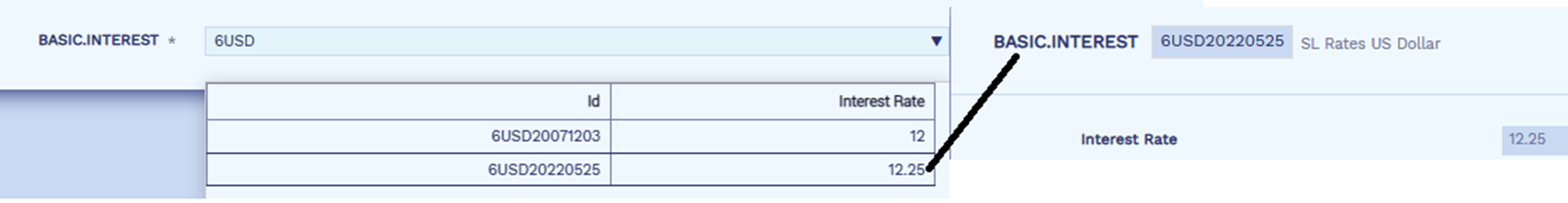

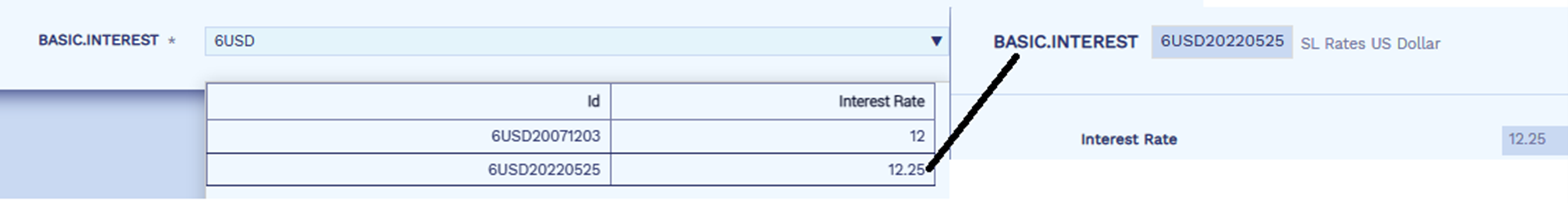

On Apr 19, 2022, the bank decides to increase the interest rate from 12% to 12.25% effective from May 25, 2022. This is done by creating a forward dated record in BASIC.INTERESTeffective from May 25, 2022 for the floating index used in the loan contract.

During the COB on Apr 19, 2022, the system triggers the APPLY.RATE activity, the APR is recalculated as 12.9628% based on the new instalment amount of USD 1656.48 and is effective from May 25, 2022. The recalculated APR is updated as a forward dated account condition for the loan arrangement.

The APR is calculated considering:

- Cashflow for the period between May 25, 2022 to Feb 1, 2025.

- Present value as on May 25, 2022 which is 45,157.76

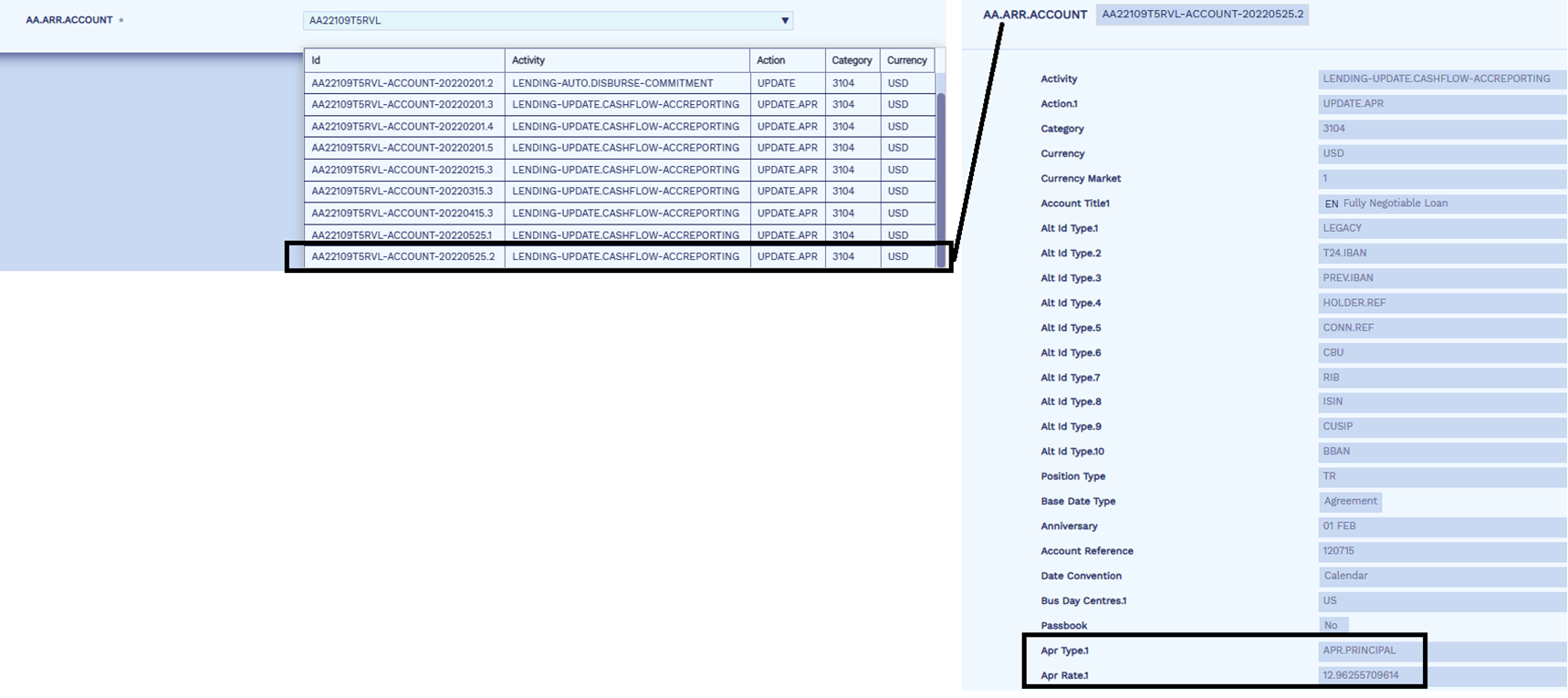

Consider a lending contract is created for USD 50,000 on Feb 1, 2022. The tenor of the loan is 36 months.

The repayment schedule is on the 15th every month with an instalment amount of USD 1651.24.

At the time of creating a new arrangement the interest rate is defined as 12% that refers to a floating rate index. The Interest Day Basis is set as E (366/365) and Accrual Rule is set as First.

The Reporting condition is configured to calculate the APR for the contract based on the cashflow with Recalc Method set as Principal outstanding in the AA.APR.TYPE application.

The cashflow based APR is calculated as 12.6835% once the loan is fully disbursed.

On Apr 19, 2022, the bank decides to increase the interest rate from 12% to 12.25% effective from May 25, 2022. This is done by creating a forward dated record in BASIC.INTEREST effective from May 25, 2022 for the floating index used in the loan contract.

During the COB of Apr 19, 2022, the system triggers the APPLY.RATE activity, the APR is recalculated as 12.9625% based on the new instalment amount of USD 1656.48 and is effective from May 25, 2022. The recalculated APR is updated as a forward dated account condition for the loan arrangement.

The APR is calculated considering:

- Cashflow for the period between May 25, 2022 to Feb 1, 2025.

- Outstanding balance as on May 25, 2022 which is USD 45,010.93.

- Cashflow for the first period (that is, Jun 15) considers only the interest component from the date of the rate change (that is, interest for May 25 to Jun 15).

- That is, the interest component for the first period (May 15 to Jun 15) is USD 465.22.

- Out of this, the interest for the period between May 15 to May 25 (that is, 10 days) which is (12%*10*45,010.93)/365 = USD 147.99 is not considered for re-calculation of the APR. It can be seen in the below screenshot that the Apr Calc Exclude field in EB.CASHFLOW is set to Yes to represent the same.

- Only the interest for the period between May 25 to Jun 15 (that is, 21 days) which is (12.25%*21*45,010.93)/365 = USD 317.23 is considered for re-calculation of the APR.

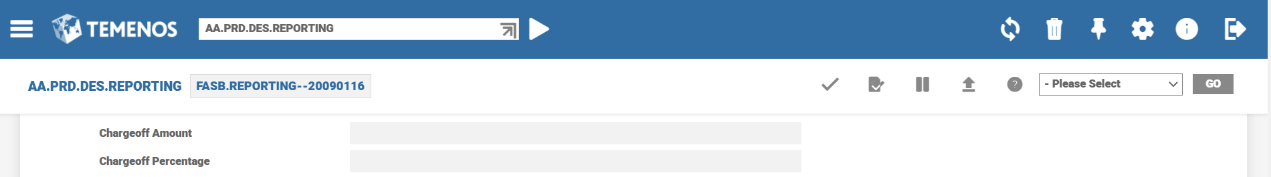

The Charge Off Amount and Charge Off Percentage attributes in the Reporting Property Class are shown below:

| Field | Description |

|---|---|

|

Chargeoff Amount |

User can specify the charge off amount for the arrangement. |

|

Chargeoff Percentage |

User can specify percentage for loan outstanding which needs to be considered for charge-off. Example: 100 for full charge off. |

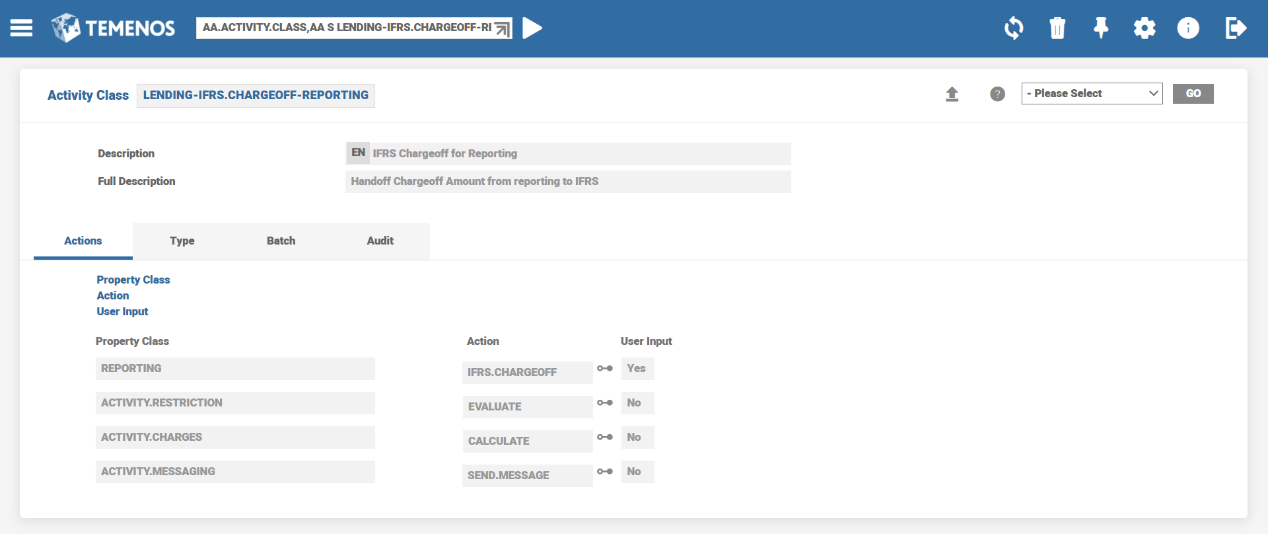

AA Activity Class

To handle loan charge off under FASB regulation the CHARGEOFF-REPORTING activity class is used.

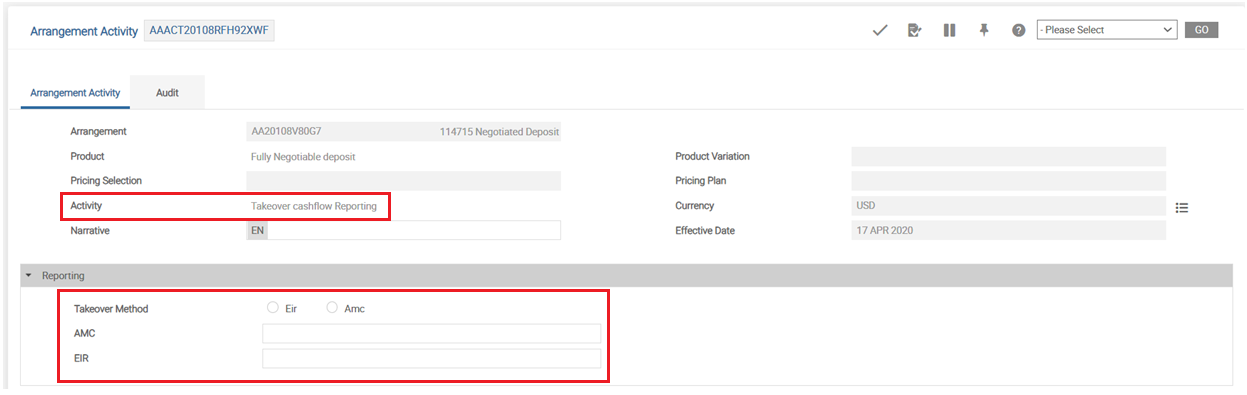

This functionality enables the user to handoff the cashflow along with EIR/Carry Cost details using the TAKEOVER.CASHFLOW-REPORTING activity . The following are the related attributes:

- Takeover Method - Indicates the takeover method used for EIR calculation. EIR and AMC are the options available for takeover.

- EIR- Accepts a valid rate and input is permitted only when Takeover Method is chosen as AMC, that is EIR is calculated based on AMC value input by user.

- AMC – Accepts a valid amount and input is permitted only when Takeover Method is chosen as EIR, that is AMC is calculated based on the EIR input by user. Usage of this option is validated for expired contracts.

Read Capturing EIR/AMC during Migration-Working with for more information.

These fields can be updated only through the TAKEOVER CASHFLOW REPORTING activity.

The list of activities for which EB.CASHFLOW activity is generated for the first instance are shown below. All other AA.CASHFLOW.TYPE activities only update the existing cash flow record and does not generate new cash flow record.

- Lending Product Line

- NEW,

- DISBURSE,

- TAKEOVER.CASHFLOW,

- CHANGE.PRODUCT,

- UPDATE.PROPERTIES

- Deposit Product Line

- TAKEOVER.CASHFLOW,

- APPLY.PAYMENT

- CHANGE.PRODUCT,

- UPDATE.PROPERTIES

Add Reporting Property to Existing Arrangements

The financial institutions can add the Reporting property to the existing arrangements of the Accounts, Deposits, and Lending product lines using the Add New Property, New Prop Avl, and New Prop Avl Date fields in AA.PRODUCT.MANAGER.

Read Add New Property for more information on the configuration.

Periodic Attribute Classes

There are no periodic attribute classes associated with Reporting Property Class.

Actions

The Reporting Property Class supports the following actions:

| Action Name | Description |

|---|---|

| UPDATE | This action allows the user to modify the attributes of Reporting. This action can initiated as part of UPDATE-REPORTING and NEW-ARRANGEMENT. |

| UPDATE.CASHFLOW |

This action is triggered during the UPDATE.CASHFLOW-REPORTING activity, that is when activity class type is cashflow based. This activity,

|

| UPDATE.STAGE | Update Risk Stage in AA Account Details. |

Accounting Events

The Reporting Property does not perform any actions that generate Accounting Events.

Limits Interaction

The Reporting Property does not perform any actions that impact the Limits System.

In this topic