Balance Availability

The Balance Availability Property Class holds the settings related to the available balance updates, credit checking and notice conditions.

Product Lines

The following Product Line uses the Balance Availability Property Class;

- Accounts

- Deposits

Property Class Type

The Balance Availability Property Class uses the following Property Class types:

- Dated

- Tracking

Property Type

The Balance Availability Property Class is not associated with any property type.

Balance Prefix and Suffix

The Balance Availability Property Class is not associated with balance prefix and suffix.

The Balance Availability conditions are usually defined at the product level and are rarely changed or negotiated at arrangement level. Attribute level explanation of the product condition is given below.

The following attributes are related to the notice withdrawal functionality in Accounts and Deposits. For a deposit product, only these fields can be configured in the Balance Availability product condition.

Configures the notice conditions applicable within and outside cooling period.

- Cooling – Denotes notice conditions specified in Cooling are applicable if notice is captured within cooling period.

- NULL – Denotes notice conditions specified in NULL are applicable if notice is captured outside cooling period.

When a period type is not defined for Cooling and defined for NULL, then the notice conditions defined in NULL are applicable from the arrangement creation date, that is, applicable for within and outside the cooling period.

- Identifies if an account or deposit is a notice account.

- The system throws the ‘Account not a notice account’ error , when any notice withdrawal activities are triggered without setting this field to Yes.

- All Notice related attributes can be configured only when this field is set to Yes.

It allows the user to designate the maximum amount which can be withdrawn without notification being required. Maximum local currency amount that can be withdrawn in a single transaction without incurring an override message. Override message is generated when this value is exceeded.

- It indicates the notice to be given for withdrawing an amount above the notice amount.

- It has to be indicated in days or weeks or months or year.

- It indicates only the working days.

- It indicates the period for which the funds subject to notice conditions is available. Example: Notice Period is defined as 1M and Availability is defined as 5D, now the fund is available for withdrawal for 5 days after the Notice Period.

- It is an associated multi-valued attribute with Notice Amount and Notice Period.

- It indicates only the working days.

This field identifies the start date of funds availability to be a business or a calendar date for a notice account. The allowed values are:

- Forward – The available start date moves forward to the next working day if the resultant calculated date is a holiday.

- Backward - The available start date moves backward to the previous working day if the resultant calculated date is a holiday.

- Blank or Calendar – This is the default option, that is, the funds availability date can be a calendar date.

It identifies balance on which, overdraft and limit checking has to be made. It can be set at the:

- Arrangement level (AA.ARR.BALANCE.AVAILABILITY)

- Product Level (AA.PRD.DES.BALANCE.AVAILABILITY)

- ACCOUNT.PARAMETER Level.

Available options are:

- Available - Credit checking is made using AVAILABLE.BAL

- Working - Credit checking is made using WORKING.BALANCE

- Forward - Credit checking is made using WORKING.BALANCE plus today's forward movements.

- Availwork - Credit checking is made using AVAILABLE.BAL and WORKING.BALANCE.

- Availfwd - Credit checking is made using AVAILABLE.BAL and WORKING.BALANCE plus today's forward movements.

- Component - Allows the user to define component based balance checking during transaction processing, this is possible by setting the Attribute value as COMPONENT. When set to component, Activity Class specific and Activity specific choice, of Credit Check and Limit check is possible. The attributes from Activity Class to OD Charge Action is a set of associated attributes which define the rules for the Activity defined in the Activity Class.

- BLANK - The default checking is against WORKING.BALANCE.

- It allows the user to designate the unauthorised entries to be included in available balance.

- Available options are:

- Both - Unauthorised debits and credits to be included in the available balance

- None - No unauthorised movements to be included in the available balance

- Debits - Only unauthorised debits to make up available balance

- Credits - Only unauthorised credits to make up available balance

It indicates the grace amount which is the allowed overdraft before the bank imposes NSF or OD fees.

It indicates the corresponding currency for the Tolerance Amount.

It indicates if the account supports NSF processing. Available values are:

- Null - no overdraft processing is triggered for the account.

- Yes - enhanced overdraft processing is performed by the system.

This optional field indicates if the balance cure service is enabled for the account or not when a debit transaction is posted to an account with insufficient funds. Currently, only 1D, 2D, and blank are the allowed options. If this field is set as:

- Null or blank - The balance cure service is not enabled for the account.

- 1D or 2D - The balance cure service is enabled for the account. In this case, the value in this field determines the number of working days within which the customer should clear the debit balance on the account to waive the NSF charges either fully or partially.

- Balance cure service can be enabled for an account only when O/D Processing is set. That is, the O/D Grace Period (OVERDRAFT.GRACE) can be set to either 1D or 2D only when the O/D Processing (OVERDRAFT.PROCESSING) field is set as Yes.

It indicates the Activity Class for which NSF setup is applicable. Mutually exclusive with the On Activity attribute.

- Input is not allowed when Credit Check attribute is not designated as Component.

- Has to be Null for first multi-value to indicate default NSF setup.

- This cannot be specified when On Activity is given.

- Activity class or On Activity has to be null.

- Act Credit check input is mandatory.

- Limit Check input is mandatory.

- Overdrawn Action, OD Charge Action & OD Charge Rev Action are mandatory only if Overdraft Processing field is set.

It indicates the activity for which NSF setup is applicable. Mutually exclusive with the Activity Class attribute.

- Input is not allowed when Credit Check attribute is not designated as Component.

- Has to be Null for first multi-value to indicate default NSF setup.

- This cannot be specified when Activity Class is given.

- Activity class or On Activity has to be null.

- Act Credit check input is mandatory.

- Limit Check input is mandatory.

- Overdrawn Action, OD Charge Action & OD Charge Rev Action are mandatory only if Overdraft Processing field is set.

It allows to identify balance on which, overdraft and limit checking is to be done for all accounts. The choices are:

- Available - credit checking is made using AVAILABLE.BAL.

- Working - credit checking is made using WORKING.BALANCE.

- Forward - credit checking is made using WORKING.BALANCE plus today's forward movements.

- Availwork - credit checking is made using AVAILABLE.BAL and WORKING.BALANCE.

- Availfwd - credit checking is made using AVAILABLE.BAL and WORKING.BALANCE plus today's forward movements.

- Blank – credit checking is made using WORKING.BALANCE

It indicates if Limit (Courtesy Overdraft Limit) has to be used. Available values are:

- Opt-In – Limit is used for honoring debit transactions for funds decision by user.

- Opt-Out – Limit is not used for honoring debit transactions.

- Blocked – Bank does not want to use the limit even though it is available.

- Input is not allowed when Credit Check attribute is not designated as Component.

- Input is not allowed when Activity Class or On Activity is not specified.

- Has to be input for first multi-value as default setup.

It indicates the action to be performed by the system for the given Activity or Activity Class, in the event of insufficient funds while performing balance check. Available values are:

- Post – Reduces account balance & exception record is created for funds decision by user.

- Reject – Rejects transaction at source and does not post in Temenos Transact. No charge is assessed.

- Settle – Transaction is paid and updates Account balance. Exception is logged as system decision and charge is assessed.

- Input is not allowed when Credit Check attribute is not designated as Component.

- Input is not allowed when Activity Class or On Activity is not specified.

- Has to be input for first multi-value as default setup if Overdraft Processing field is set.

- Input is not allowed when Overdraft Processing field is not set.

It indicates if the charges related to overdraft have to be assessed or waived for the given activity or activity class. Available values are:

- Assess

- Waive.

- Input is not allowed when Credit Check attribute is not designated as Component.

- Input is not allowed when Activity Class or On Activity is not specified.

- Has to be input for first multi value as default setup if Overdraft Processing field is set.

- Input is not allowed when Overdraft Processing field is not set.

It allows the user to specify how a charge reversal has to be treated when the original transaction is reversed. Available values are:

- Reverse – The linked charge is also reversed.

- Re-Book – A new credit entry is posted of the same charge value.

- Input is not allowed when Credit Check attribute is not designated as Component.

- Input is mandatory if Overdraft Processing field is set.

These attributes are allowed only for MCY product line and the system raises proofing errors on violation.

-

Position Adjustment – When this field is set as Yes, the system processes an automatic internal position transfer from one currency to another under the MCY structure based on a list file update. That is, on setting this field to Yes, for the sub-account with debit balance in the list file, the system processes an automatic position transfer between the currencies such that all the sub-accounts under the MCY structure have either zero or positive balance.

-

Adjustment Order – It is a multi-value field which allows the user to input any valid record from the CURRENCY application. It specifies the order in which the automatic position transfer is to be processed from the other currency sub-accounts to the sub-account holding the debit balance.

- Include Limit - When this field is set as No, the limit available at the sub account level is not included while considering balances for Automatic Position Transfer. When set as Yes, the limit available at the sub account level (as a secondary limit) can be added to the sub account balance to clear the debit balance in another sub account.

The No and Blank option have the same result.

Balance Availability has specific attributes for NSF processing used in AR Accounts. The Overdraft processing attribute set as Yes enables processing the debit items in an account using NSF functionality.

A currency limit called grace limit can be set for an account using the Tolerance Amount attribute.

The customer can be offered with a grace period within which they can clear the debit balance in the account to waive the NSF charges (either fully or partially). The number of working days within which the customer should clear the debit balance is defined in the O/D Grace Period field.

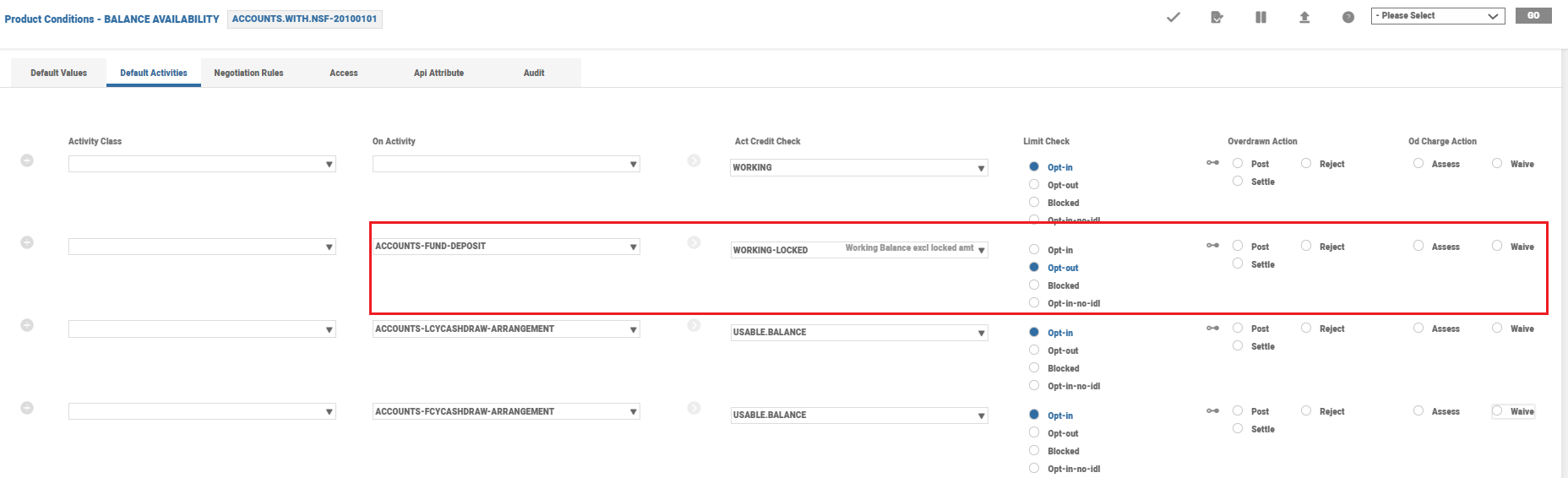

Component based balance checking during transaction processing is possible by setting Credit Check attribute as Component. When set to Component, Activity Class specific and Activity specific choice of Credit Check and Limit check is possible. The attributes from Activity Class to OD Charge Action is a set of associated attribute, which define the rules for the activity defined in the Activity Class.

- Activity Class and On Activity – defines the arrangement activity class or activity that is triggered by the transaction processing

- Act Credit Check – a record for AC.CREDIT.CHECK to indicate the balance components that has to be checked during the credit check processing for this specific activity.

- Limit Check – Checks whether limit check can be opted in. When the ‘Opt-In’ option is chosen, limit check is performed. When Opt-Out or Blocked option is given, limit check cannot be performed during the transaction processing

- Overdrawn Action – defines the action to be performed by the system for the given Activity or Activity Class, in the event of insufficient funds while performing balance check. Possible values are Post, Reject or Settle.

- OD Charge Action – Checks whether the activity charges are accessed or waived for this transaction. Possible values are Assess or Waive.

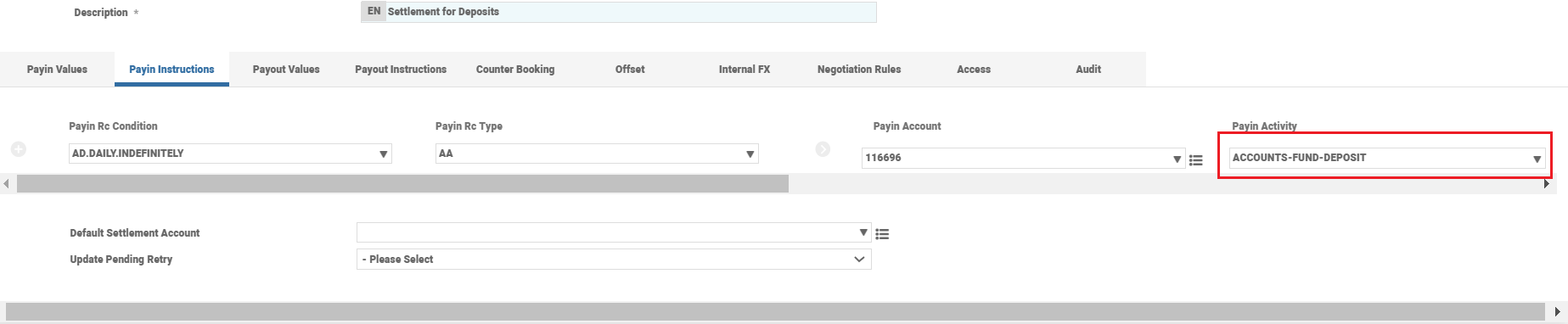

Similar to normal debit activities, activities specified as Settlement activities might also perform debits on an account. Hence, component wise credit check feature also supports the definition for Settlement activities.

In the Balance Availability setup, the user has to set the Credit Check field as Component to enable component based credit check.

The bank should specify the Settlement activity in the On Activity field and the balance for limit and overdraft check in the Credit Check field. The bank should use the Limit Check field to specify whether the system should use limit balance for honouring the settlement.

Consider a customer chooses to provide an account number for automatic funding of a deposit. The bank prefers automatic funding only from the available balance in the account and should not include the available limit balance. However, for all the other debit transactions, the limit balance can be included for the credit check. To configure this, the bank has to create a named instance for the Account Debit activity and use it in the Settlement Property Class.

For the named instance, the bank has to configure credit processing to exclude limit. For all other debit activities, the credit check includes the limit.

However if the bank prefers to configure it along with Overdraft Processing, it can set values in these fields. Using this setup, the following cases illustrate the functioning of the system for a deposit funding.

|

Working (USD) |

Limit (USD) |

Locked (USD) |

Credit Check Value (USD) |

Settlement Amount (USD) |

Funded (USD) |

Unfunded (USD) |

|

|---|---|---|---|---|---|---|---|

|

Case 1 |

7,000.00 |

- |

- |

7,000.00 |

10,000.00 |

7,000.00 |

3,000.00 |

|

Case 2 |

7,000.00 |

- |

2,500.00 |

4,500.00 |

10,000.00 |

4,500.00 |

5,500.00 |

|

Case 3 |

7,000.00 |

5,000.00 |

- |

7,000.00 |

10,000.00 |

7,000.00 |

3,000.00 |

|

Case 4 |

7,000.00 |

5,000.00 |

2,500.00 |

4,500.00 |

10,000.00 |

4,500.00 |

5,500.00 |

For each case, the Working, Limit and Locked columns specify the corresponding balance in the account. The credit check value is determined based on the above configuration. The Settlement Amount column specifies the funding required for the deposit. Funded and Unfunded columns specify the corresponding funded and unfunded portions.

Similar to normal debit activities, capitalisation activities might also perform debits on an account. Transact allows to capitalise amounts only until the available amount. If the capitalisation amount is greater than the available amount, then the system produces an invoice for the remaining amount and collects it from the customer.

Read Invoicing Charges that cannot be Capitalised due to Insufficient Funds section in Charge Property Class user guide for more information.

To allow capitalisation, the activity needs to perform a credit check to arrive on the capitalisation and the invoice amount. This credit check is governed by the Balance Availability Property Class.

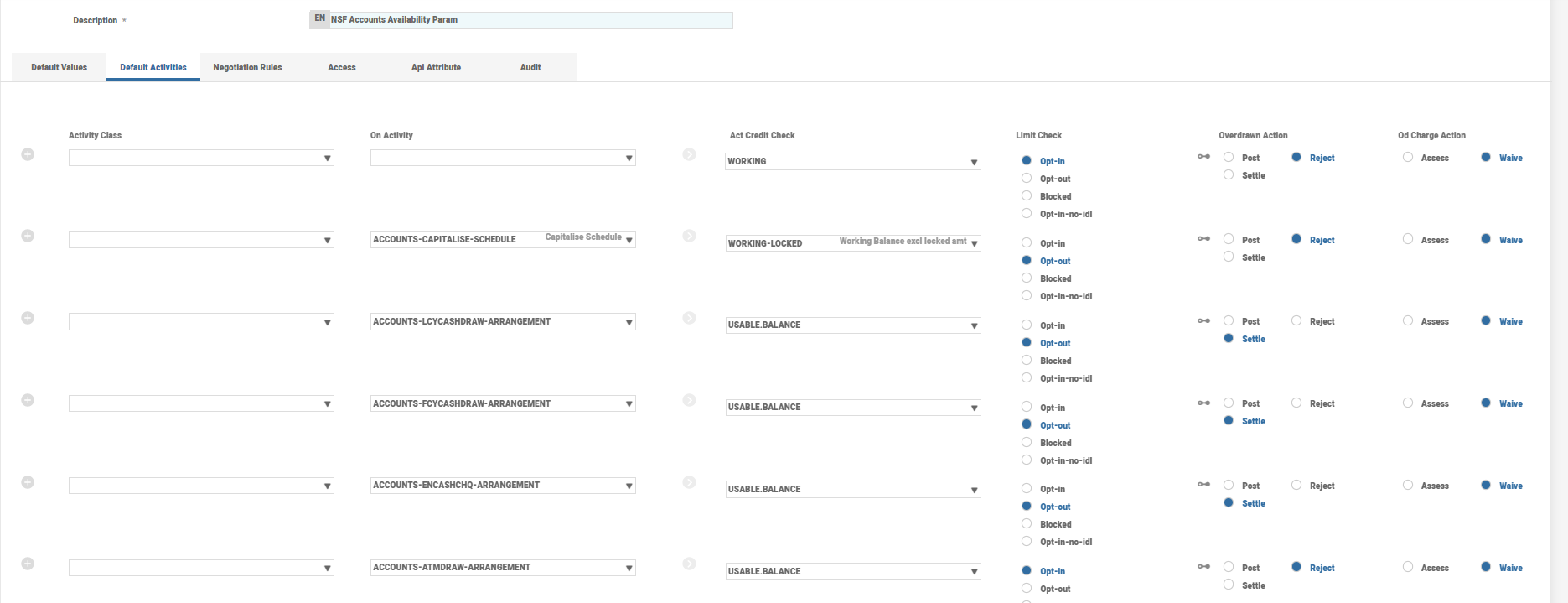

In the Balance Availability setup, the Credit Check field should be set as Component to enable the credit check feature.

The bank should specify the capitalisation activity class in the Activity Class field or the capitalisation activity in the On Activity field and specify the balance for limit and overdraft check in the Credit Check field. The bank should use the Limit Check field to specify whether the system should use limit balance for honouring settlement.

Consider the bank chooses to perform capitalisations only to the extent of an account’s available balance excluding the limit balance. Then the bank can set up component wise credit check for capitalisation activity as shown below.

The bank can configure the credit check for capitalisation without Overdraft Processing. With this configuration, the following case illustrates the functioning of the system if the configuration were to capitalise only to the extent of available balance.

|

Working (USD) |

Limit (USD) |

Locked (USD) |

Credit Check Value (USD) |

Charge (USD) |

Capitalized (USD) |

Invoiced (USD) |

|

|---|---|---|---|---|---|---|---|

|

Case 1 |

10.00 |

- |

- |

10.00 |

50.00 |

10.00 |

40.00 |

|

Case 2 |

10.00 |

- |

3.00 |

7.00 |

50.00 |

7.00 |

43.00 |

|

Case 3 |

10.00 |

50.00 |

- |

10.00 |

50.00 |

10.00 |

40.00 |

|

Case 4 |

10.00 |

50.00 |

3.00 |

7.00 |

50.00 |

7.00 |

43.00 |

For each case, the Working, Limit and Locked columns specify the corresponding balances in the account. The credit check value is determined based on the configuration done by the bank. Charge column specifies the charge that is to be capitalised. Capitalised and Invoiced columns specify the capitalised and the invoiced amount respectively.

Add Balance Availability Property to Existing Arrangements

The financial institutions can add the Balance Availability property to the existing arrangements of the Accounts, Deposits, and Multi-Currency Accounts product lines using the Add New Property, New Prop Avl, and New Prop Avl Date fields in AA.PRODUCT.MANAGER.

Read Add New Property for more information on the configuration.

Periodic Attribute Classes

The Balance Availability Property Class is not associated with any Periodic Attribute Class.

Actions

The Balance Availability Property Class supports the following actions:

| Action | Description |

|---|---|

| UPDATE | The update action is initiated as part of the NEW-ARRANGEMENT activity. |

Accounting Events

The Balance Availability Property Class does not perform any actions that generate accounting events.

Limits Interaction

The Balance Availability Property Class does not perform any actions that impact on the limits system.

In this topic