Introduction to Limits

The term Credit Limit refers to the maximum amount of credit a financial institution extends to a customer. A lending institution extends a credit limit on a line of credit. Usually, the lenders set the credit limits based on information in the application of the person seeking credit, that is, borrowers. Credit limit is one of the factors that affect the consumers' credit scores and can impact their ability to get credit in the future. A lender generally gives lower-credit limits to high-risk borrowers because they may not be able to repay the debt. Low-risk borrowers usually get higher credit limits, giving them higher flexibility to spend.

The limits are determined by banks, alternative lenders and credit card companies based on the information related to the borrower, such as

- Borrower's credit rating

- Personal income

- Loan repayment history and other factors

The line of credit is the maximum amount of money a lender allows a borrower to spend on a revolving or non-revolving credit limits.

The Limit (LI) module provides the credit limit or line of credit in Temenos Transact. All the business applications in Temenos Transact refer to the LI module for creation and maintenance of the line of credit facility applicable to the business scenario.

Product Configuration

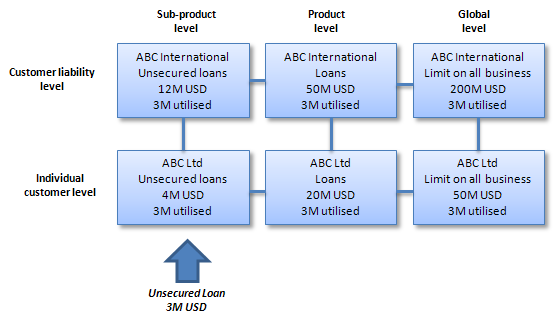

Credit limits are held by customer and product. Simple limits can be defined for a single customer and single product. However, more complex limits can also be configured with multiple levels.

Limits are held by the customer at two levels:

- Individual

- Liability group

Also, limits can be held by the product as 12 levels:

- 10 levels of sub-product

- Product

- Global

Thus, an individual trade can be updated as six limits.

In this example, bank provides an unsecured loan to ABC Ltd of 3 million USD. ABC Ltd is a part of the larger group, ABC International. Bank monitors the limits at both company and group levels. Unsecured loans are a sub-product within loans and the limits are monitored at both levels. Finally, the bank sets a limitation on all business with ABC Ltd and with ABC International, and these limits are held at the global-level.

Consequently, the unsecured loan has updated six limits. If any limit is exceeded, an override is raised during the input of loan.

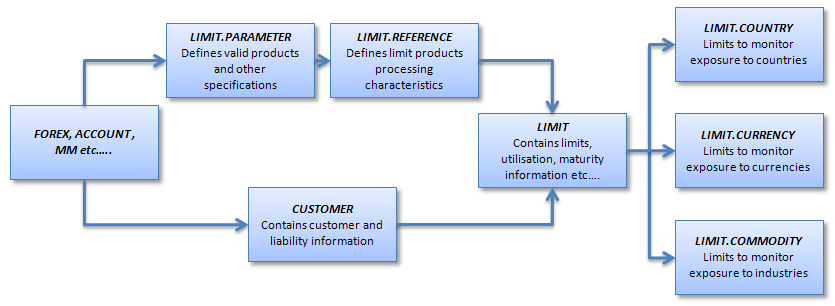

LIMITapplication holds the credit limits.LIMIT.REFERENCEapplication holds sub-products, products and global definitions.CUSTOMERapplication holds the customers and customer liability definitions.LIMIT.PARAMETERapplication defines the various high-level parameters regarding the application. It links contracts and accounts toLIMIT.REFERENCE.

The main limit parameters are shown in the below flowchart.

Limits can also be set to monitor the exposure against currencies, countries and industries. These limits are monitored overnight. The LIMIT application uses the parameter and product tables to define the structure of limits.

LIMIT.PARAMETER

This application defines the parameters that determine the way in which the limit system operates. LIMIT.PARAMETER record can have the ID as ‘SYSTEM’. The LIMIT.PARAMETER application controls the following:

- An indicator to specify if the foreign exchange contracts must be netted before limit comparison.

- A 'number of days' to define how many days prior to Limit Expiry Date and Review Date (can be fixed in the Review Frequency field) in the

LIMITapplication, the approach of these events must be reported. - A date and cycle to indicate when the first revaluation occurs and at what frequency thereafter.

- A date and cycle to indicate when a central liability report (including those liability numbers which did not move) must be produced in the back-end process.

- A date and cycle to indicate when the commodity, country and currency reports must be produced.

- A ‘number of days’, administrative Extension Days, define the maximum number of days by which the expiry date of a limit can be ’administratively’ extended before a new expiry date must be assigned to the limit.

- The LIMIT application is defined according to the specific requirements of the bank. The most important feature of this application is that it allows the bank (for each financial application) to define the precise rules applicable to an environment. In this way, the limit verification process can be established by the bank according to a bank’s own set of rules without any program maintenance.

The product group definition that allows the bank to specify the different products, (in bank’s opinion) must be part of the commodity, country and currency exposure.

Creation of Other Record IDs:

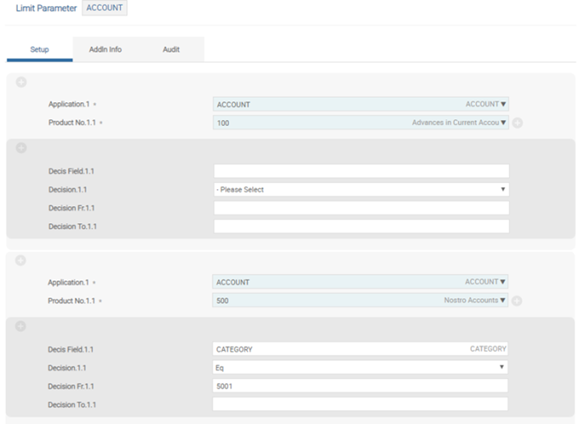

The LIMIT.PARAMETER application allows the creation of other record IDs besides SYSTEM. These record IDs can have a valid legacy application (that is, ACCOUNT, LD, MM and FOREX) as ID. The purpose of these records is to move their parametersation, which was initially done in the SYSTEM record, to new individual records for each application to improve system performance.

For example, for the ACCOUNT application, the user can create a new record, which includes all the necessary parametrisation for this particular application.

Business Events

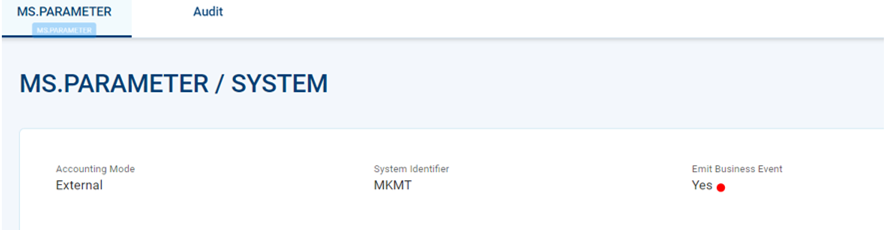

When the Emit Business Event field in MS.PARAMETER is set as ‘Yes’, the business events representing the state change are emitted.

The following business events are emitted for Limit related tables.

| Business Event | Description |

|---|---|

| creditLimits.createLimitParameter.limitParameterCreated | Event to create limit parameter |

| creditLimits.updateLimitParameter.limitParameterUpdated | Event to amend limit parameter |

| creditLimits.createProduct.productCreated | Event to create limit product |

| creditLimits.createUtilisationProduct.utilisationProductCreated | Event to create utilisation limit product |

| creditLimits.createValidationProduct.validationProductCreated | Event to create validation limit product |

| creditLimits.createIntradayProduct.intradayProductCreated | Event to create intraday limit product |

| creditLimits.createReservationProduct.reservationProductCreated | Event to create reservation limit product |

| creditLimits.updateLimitProduct.productUpdated | Event to amend limit product |

| creditLimits.updateIntradayProduct.intradayProductUpdated | Event to amend intraday limit product |

| creditLimits.cancelLimitProduct.productCancelled | Event to cancel limit product |

| creditLimits.createSecuredLimit.securedLimitCreated | Event to create secured limit |

| creditLimits.createUnsecuredLimit.unsecuredLimitCreated | Event to create unsecured limit |

| creditLimits.createGroupSecuredLimit.groupSecuredLimitCreated | Event to create secured group limit |

| creditLimits.createGroupUnsecuredLimit.groupUnsecuredLimitCreated | Event to create unsecured group limit |

| creditLimits.createReportingLimits.customerReportingLimitsCreated | Event to create reporting credit limit |

| creditLimits.updateIntradayLimit.intradayLimitUpdated | Event to amend intraday credit limit |

| creditLimits.createReservationLimit.reservationLimitCreated | Event to create reservation limit |

| creditLimits.limitExpiryDueDate.expiryDue | Event for limit expiry due date |

| creditLimits.limitExpiryFailure.expiryFailed | Event for limit expiry failure |

| creditLimits.limitReviewDate.reviewDateReached | Event to review limit on review date |

| creditLimits.limitReviewDueDate.reviewDue | Event to review limit |

| creditLimits.updateLimit.limitUpdated | Event to amend limit |

| creditLimits.updateLimitAmount.limitAmountUpdated | Event to update limit amounts |

| creditLimits.updateLimitAvailability.limitAvailabilityUpdated | Event to update limit availability |

| creditLimits.updateExpiryDate.limitExpiryDateUpdated | Event to update expiry date of limit |

| creditLimits.reportLimitIncrease.limitIncreased | Event to increase limit schedule |

| creditLimits.reportLimitDecrease.limitDecreased | Event to decrease limit schedule |

| creditLimits.reportLimitExpiry.limitExpired | Event to indicate limit expiry |

| creditLimits.reportLimitBreach.validationLimitBreached | Event to validate limit breach |

| creditLimits.cancelLimit.limitCancelled | Event to cancel limit |

| creditLimits.updateExposure | Transaction command event for exposure update |

| creditLimits.updateExposure.exposureUpdated | Event to update exposure in the limit |

| creditLimits.deleteExposure | Transaction command event for exposure delete |

| creditLimits.delinkContract | Event to be emitted when limit is delinked from contract |

| creditLimits.delinkContract.contractDelinked | Event to delink contract from the limit |

| creditLimits.recordContractClosure | Event to be emitted when contract is linked to limit closed |

| creditLimits.recordContractClosure.contractClosed | Event for limit contract closure |

| creditLimits.recordContractLink | Event to be emitted for the limit and contract link |

| creditLimits.recordContractLink.contractRecorded | Event to link contract to the limit |

| creditLimits.updateContractLimit | Event to be emitted to update limit property linked with contract |

| creditLimits.updateContractLimit.contractLimitUpdated | Event to update limit in limit contract |

| creditLimits.updateContractOwners | Event to be emitted when customer changes the contract linked to limit |

| creditLimits.updateContractOwners.contractOwnersUpdated | Event to update owner in limit contract |

| creditLimits.updateContractProperties | Event to be emitted when there is a change in contract linked to limit |

| creditLimits.updateContractProperties.contractDetailsUpdated | Event to update limit contract properties |

| creditLimits.updateContractTerm | Event to be emitted when there is a change in contract term |

| creditLimits.updateContractTerm.contractTermUpdated | Event to update term in limit contract |

| creditLimits.updateTransactionStatus | Transaction command event to authorise exposure |

Illustrating Model Parameters

This section covers the high-level specification required for Limits (LI) module.

Illustrating Model Products

The following are few examples of the LI products in the LIMIT.REFERENCE application.

| S.No. | Products |

|---|---|

| 1. | Advances for Current Account |

| 2. | Loans Secured |

| 3. | Loans Unsecured |

| 4. | Commercial Loans |

| 5. | Term Loans |

| 6. | Project Finance Secured |

| 7. | Project Finance Unsecured |

| 8. | Packing Credit Secured |

| 9. | Packing Credit Unsecured |

| 10. | Bills of Exchange |

| 11. | Securities |

| 12. | Facility Limit |

| 13. | Packing Credit |

In this topic