Working with Loan Charges

The following are different scenarios encountered while processing loan charges.

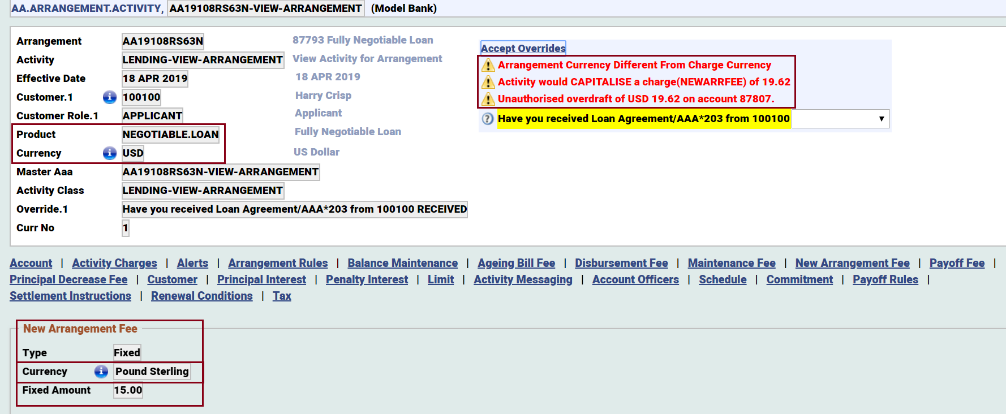

Charge Currency Different from Arrangement Currency

When the charge currency is different from arrangement currency , an override message is displayed as below.

Rule Break Charges

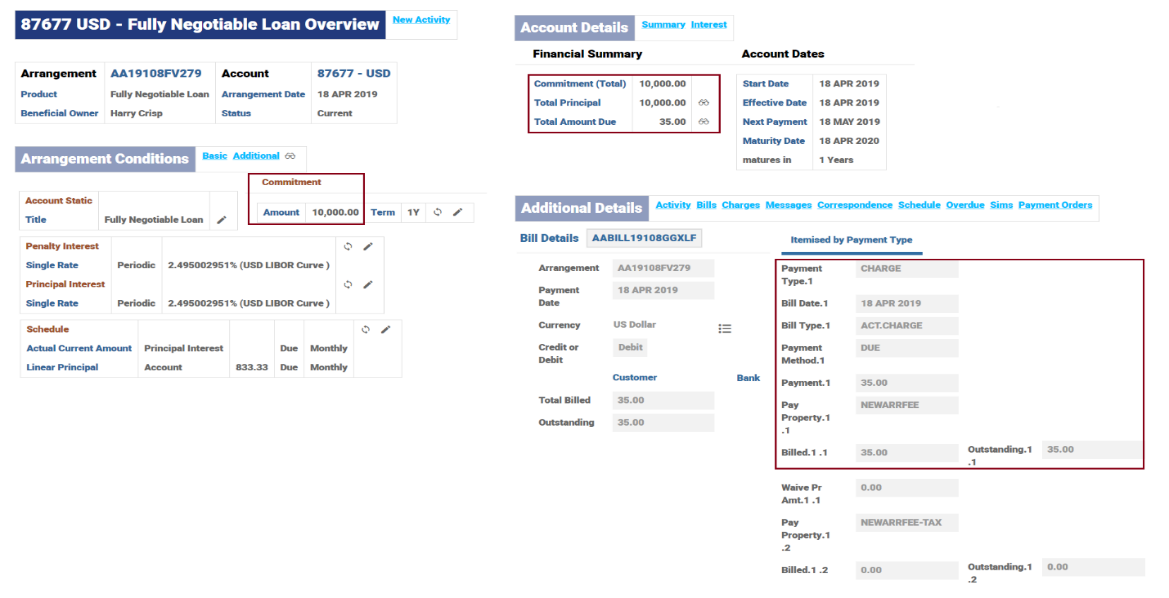

The below screenshot displays the Arrangement Overview.

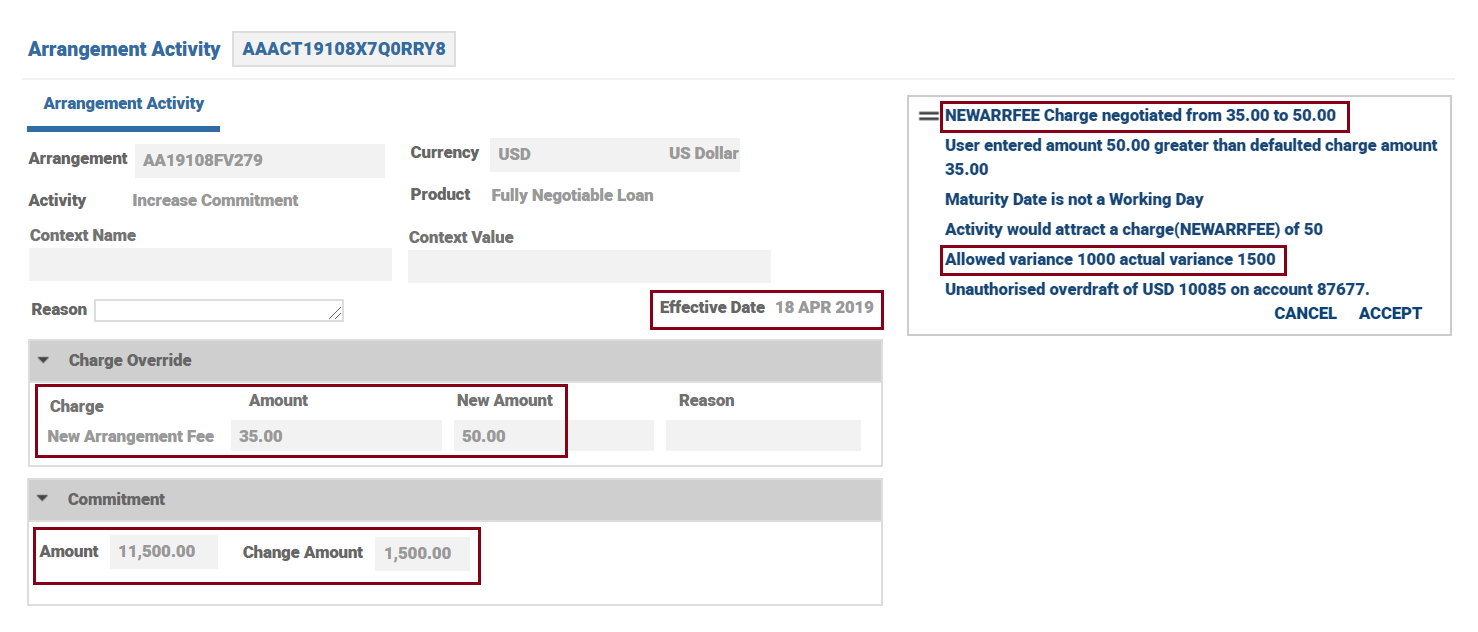

The Term Amount increases AA activity and the associated override message is seen when the activity is committed.

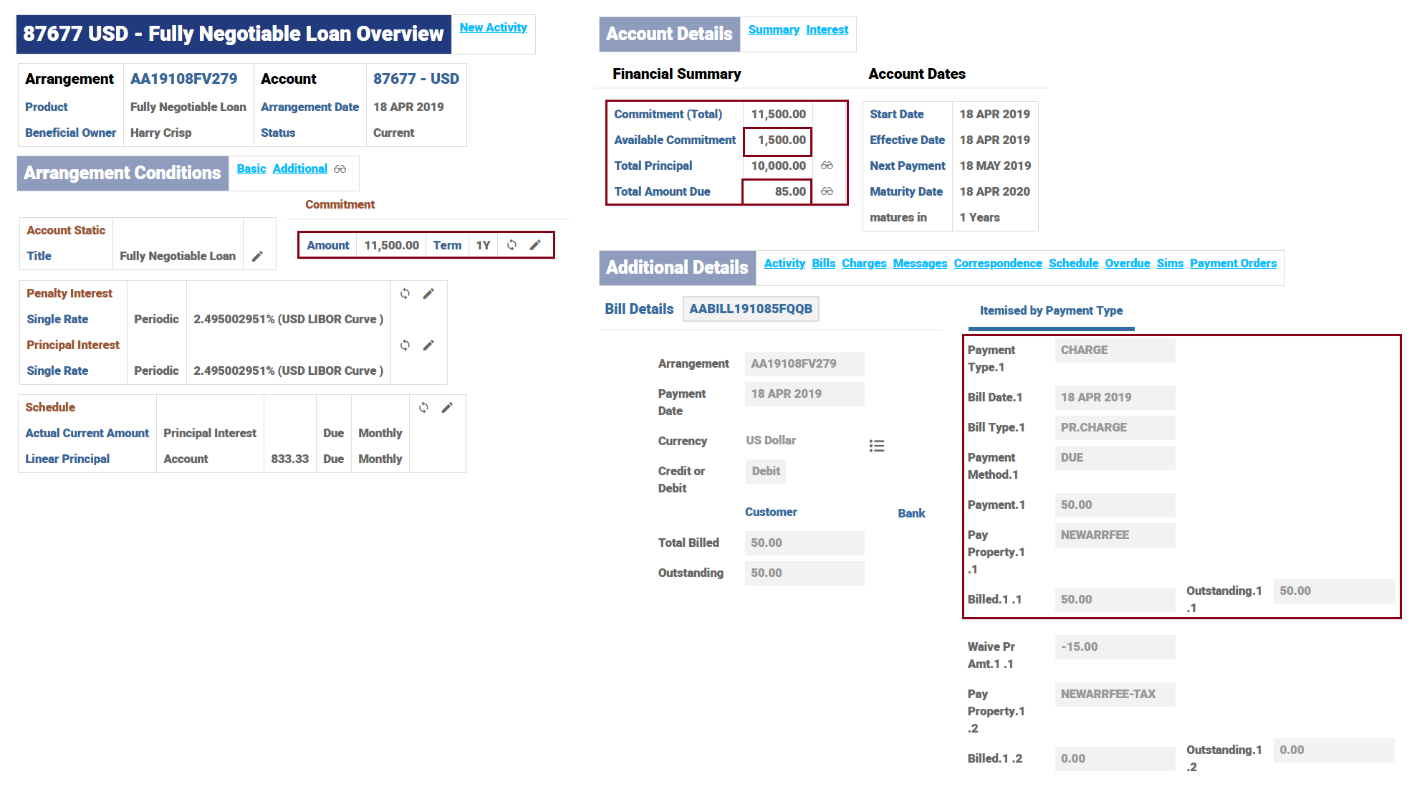

Changes can be seen in the Total Commitment and the charges that were associated with the increase in Term Amount can be seen.

Amortisation of Charges

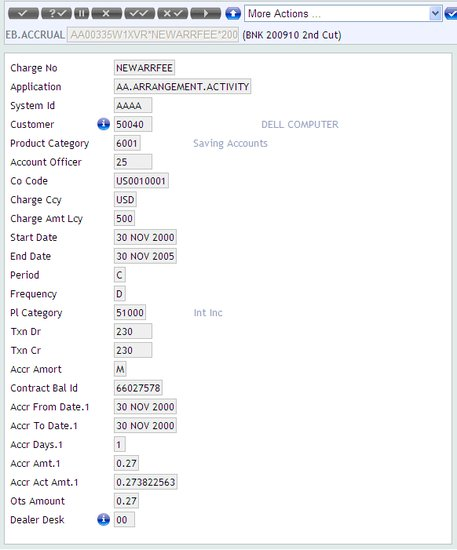

Once an arrangement has been created, an EB.ACCRUAL record is created per configuration for the amortisation process. Each record shows certain information, such as the daily accrual to date and the start and the end date of accrual.

The below screenshot displays EB.ACCRUAL record.

Stop Suspend / Resume Amortisation of Charges

Consider a loan product with Processing Fee (Debit charge) of $100 fee collected from customer upfront and amortised from the loan creation date until maturity. Loan Term is 100 days. The daily amortised fee amount is $1.

The fee amortisation is set to Stop Suspend from the day the loan is moved to non-performing stage. The amortisation of the said Processing Fee when the charge is Stop Suspend is tabulated below. The amortisation of the fee for Suspend charge type is also illustrated to draw comparison between the accounting entries booked against both charge types.

| TERM DAYS | SUSPEND | STOP.SUSPEND |

|---|---|---|

| Day 1 | Dr ACC<PROCESSINGFEE> 100 Cr P/L 0 | Dr ACC<PROCESSINGFEE> 100 Cr P/L 0 |

| Day 5 (COB) | Dr ACC<PROCESSINGFEE> 95 Cr P/L 5 | Dr ACC<PROCESSINGFEE> 95 Cr P/L 5 |

| Day 60 (COB) | Dr ACC<PROCESSINGFEE> 40 Cr P/L 60 | Dr ACC<PROCESSINGFEE> 40 Cr P/L 60 |

| Day 61 | Loan moved to ‘Non-Performing’ status | |

| Day 61 (COB) | Dr ACC<PROCESSINGFEE> 39 Cr P/L 60 Cr ACC<PROCESSINGFEE>SP 1 | Amortization is stopped until Resume is triggered. |

| Day 80 (COB) | Dr ACC<PROCESSINGFEE> 20 Cr P/L 60 Cr ACC<PROCESSINGFEE>SP 20 | Amortization is stopped until Resume is triggered. |

| Day 81 | Loan Resumes to 'Performing' status | |

| Day 81 (COB) | Dr ACC<PROCESSINGFEE> 19 Cr P/L 81 Cr ACC<PROCESSINGFEE> SP 0 | Dr ACC<PROCESSINGFEE> 38 Cr P/L 62 |

| Day 91 (COB) | Dr ACC<PROCESSINGFEE> 9 Cr P/L 91 | Dr ACC<PROCESSINGFEE> 18 Cr P/L 82 |

| Day 100 (COB) | Dr ACC<PROCESSINGFEE> 0 Cr P/L 100 | Dr ACC<PROCESSINGFEE> 0 Cr P/L 100 |

Suspend or Resume Accrual or Amortisation of Credit Charge

Consider an example where a loan product is set with a Charge property that is payable (Credit type) and set to Suspend. The charge is set to be amortized until maturity.

For illustration, the arrangement created for this loan product with Agent Expense (Credit charge) with a Pay bill for $100. The amortisation is configured for $1 daily and set to happen from the loan creation date until maturity. Loan Term is 100 days. Assume the charges are booked upfront and amortized over the term.

Further, the amortisation of the charge is set to Suspend from the day the loan becomes non-performing.

The below illustration tabulates the amortisation of the said ‘Agent Expense’ when the charge is Suspend. The amortisation of a debit charge with property type Suspend is also illustrated to draw comparison between the accounting entries booked against both credit and debit charge.

- ACC <PROCESSINGFEE> represents unamortized fee balance.

- ACC <PROCESSINGFEE> SP represents suspended fee balance.

- Income P/L represents the income account/head into which fee income is amortized.

- ACC <AGENTEXP> represents unamortized agent expense balance.

- ACC <AGENTEXP> SP represents suspended expense balance.

- Expense P/L represents the expense account/head into which expense is amortized.

All amounts in the table below indicate closing balances under the respective heads. Assume income and expense heads are zero to begin with.

| TERM DAYS | AMORTISATION OF CREDIT CHARGE[BG1] [SN2] | AMORTISATION OF DEBIT CHARGE |

|---|---|---|

| Day 1 | Expense

P/L 0 ACC<AGENTEXP> -100 |

ACC <PROCESSINGFEE> 100 Income P/L 0 |

| Day 5 (COB) | Expense

P/L -5 ACC<AGENTEXP> -95 |

ACC <PROCESSINGFEE> 95 Income P/L 5 |

| Day 60 (COB) | Expense

P/L -60 ACC<AGENTEXP> -40 |

ACC <PROCESSINGFEE> 40 Income P/L 60 |

| Day 61 | Loan Suspended due to ‘Non-Performing’ status | |

| Day 61 (COB) | Expense

P/L -60 ACC<AGENTEXP> -39 ACC<AGENTEXP>SP -1 |

ACC <PROCESSINGFEE> 39 Income P/L 60 ACC <PROCESSINGFEE >SP 1 |

| Day 95 (COB) | Expense

P/L -60 ACC<AGENTEXP> -5 ACC<AGENTEXP>SP -35 |

ACC< PROCESSINGFEE > 5 Income P/L 60 ACC< PROCESSINGFEE >SP 35 |

| Day 96 | Loan Resumes to 'Performing' status | |

| Day 96 (At Resume) | Expense

P/L -95 ACC<AGENTEXP> -5 ACC<AGENTEXP>SP 0 |

ACC< PROCESSINGFEE > 5 Income P/L 95 ACC< PROCESSINGFEE > SP 0 |

| Day 96 (COB) | Expense

P/L -96 ACC<AGENTEXP> -4 ACC<AGENTEXP>SP 0 |

ACC< PROCESSINGFEE > 4 Income P/L 96 ACC< PROCESSINGFEE > SP 0 |

| Day 100 (COB) | Expense

P/L -100 ACC<AGENTEXP> 0 ACC<AGENTEXP>SP 0 |

ACC<

PROCESSINGFEE > 0

Income P/L 100 ACC< PROCESSINGFEE > SP 0 |

Income Recognition Using Cost-Recovery Method

Read Income Recognition Under Cost Recovery Method section in Interest property class for more information on the underlying configuration.

Consider the following example where a contract is booked with the following details.

- Tenure -150 Days.

- Per-day daily accrual in the account - 1.

- Interest property type for PRINCIPALINT - SUSPEND,SUSPENDOVERDUE,AMORT RECOVERY SUSPEND.

- Interest property type for PENALINT - SUSPEND, AMORT RECOVERY SUSPEND.

The following table shows how the income recognition works under Cost-Recovery method:

| Activity | Principal Interest (Set to Suspend Overdues) | Remarks for Principal Interest balance movement | Penal Interest (Set to Suspend) | Remarks for Penal Interest balance movement |

|---|---|---|---|---|

| Day 1 | Accrued Principal Interest [ACC PRINCIPAL INT] – 0

P/L - 0 |

Daily Accruals happen from Day 1 to day 90 | Accrued Penalty Interest [ACC PENALINT] – 0

P/L - 0 |

|

| Day 10 | ACC PRINCIPALINT – 10 Dr

P/L – 10 Cr |

ACC PENALINT – 0

P/L - 0 |

||

| Day 90 | ACC PRINCIPALINT – 90 Dr

P/L – 90 Cr |

ACC PENALINT – 0

P/L - 0 |

||

| Day 91 – Loan suspend due to prolonged delinquency | ACC PRINCIPALINT – 90 Dr

Suspended Principal Interest

ACC PRINCIPALINT SP – 90 Cr

P/L - 0 |

On Day 91, the loan is suspended. The balance from P/L is moved to ACCPRINCIPALINTSP | ACC PENALINT – 0

Suspended Penalty Interest

ACC PENALINT SP – 0 P/L - 0 |

|

| Day 100 | ACC PRINCIPALINT – 100 Dr

ACC PRINCIPALINT SP – 100 Cr |

ACC PENALINT – 10 Dr

ACC PENALINT SP – 10 Cr |

Daily Accruals for PENALINT happen from Day 100 | |

| Day 101 – Repayment 35 | ACC PRINCIPALINT – 70 Dr

Repayment applied as per payment rule to due interest

ACC PRINCIPALINT SP – 70 Cr Based on repayment amount 30 debited from SP and credited to IAP Interest applied to principal [RSP PRINCIPALINT] – 30 Cr P/L - 0 |

Repayment of principal interest is done on Day 101. The balance from ACCPRINCIPALINTSP is moved to RSP PRINCIPALINT | ACC PENALINT – 5 Dr

Repayment applied as per payment rule to due interest

ACC PENALINT SP – 5 Cr Repayment amount of 5 debited from SP and credited to IAP Interest applied to principal [RSP PENALINT] – 5 Cr P/L - 0 |

Repayment of penal interest is done on Day 101. The balance from ACC PENALINTSP is moved to RSP PENALINT |

| Day 110 EOD | ACC PRINCIPALINT – 80 Dr

ACC PRINCIPALINT SP – 80 Cr RSP PRINCIPALINT – 30 Cr P/L - 0 |

ACC PENALINT – 15 Dr

ACC PENALINT SP – 15 Cr RSP PENALINT – 5 Cr P/L - 0 |

||

| Day 111 – Repayment 95 (principal interest – 80 and penal interest - 15) | ACC PRINCIPALINT – 0 ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 110 Cr P/L – 0 |

ACC PENALINT – 0

ACC PENALINT SP – 0 RSP PENALINT – 20 Cr P/L - 0 |

||

| Day 111 – RESUME | ACC PRINCIPALINT – 0

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 0 Amortization record (ACR) generated for RSP balance. ACR PRINCIPALINT – 110 Cr Straight line amount calculated at 110/40 = 2.75 per day P/L – 0 |

On day 111 the loan is resumed. Amortization record is generated for RSP. The balance is moved from RSP PRINCIPALINT to ACR PRINCIPALINT | ACC PENALINT – 0

ACC PENALINT SP – 0 RSP PENALINT – 0 Amortization record (ACR) generated for RSP balance ACR PENALINT – 20 Cr Straight line amount calculated at 20/40 = 0.50 per day P/L - 0 |

On day 111 the loan is resumed. Amortization record is generated for RSP. The balance is moved from RSP PENALINT to ACR PENALINT |

| Day 111 EOD | ACC PRINCIPALINT – 1 Dr

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 107.25 Cr P/L – 3.75 Cr [1 from daily accrual and 2.75 from recovery interest] |

Straight line amount calculated at 110/40 = 2.75 per day

ACR PRINCIPALINT is debited by 2.75 and Income a/c is credited. |

ACC PENALINT – 0

ACC PENALINT SP – 0 RSP PENALINT – 0 ACR PENALINT – 19.50 Cr P/L – 0.50 Cr [from recovery interest] |

Straight line amount calculated at 20/40 = 0.50 per day

ACR PENALINT is debited by 0.50 and Income a/c is credited |

| Day 120 EOD | ACC PRINCIPALINT – 10 Dr

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 82.5 P/L – 37.5 [10+27.50] |

ACC PENALINT – 0

ACC PENALINT SP – 0 RSP PENALINT – 0 ACR PENALINT – 15 P/L – 5 |

||

| Day 130 EOD | ACC PRINCIPALINT – 20 Dr

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 55 P/L – 75 [37.50+10+27.50] |

ACC PENALINT – 0

ACC PENALINT SP – 0 RSP PENALINT – 0 ACR PENALINT – 10 P/L – 10 |

||

| Day 131 – Loan Suspend due to market conditions – EOD | ACC PRINCIPALINT – 21 Dr

ACC PRINCIPALINT SP – 21 Cr [20+1] RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 52.25 ACR PRINCIPALINT SP – 2.75 P/L – 55 (20 reversed to ACC SP) |

Loan is suspended from day 131. The property PRINCIPALINT is configured as “SUSPEND OVERDUES”.

The income which is booked so for is reversed to ACCSP.

P/L is debited and ACC PRINCIPALINT SP IS credited. |

ACC PENALINT – 1 Dr

ACC PENALINT SP – 1 Cr RSP PENALINT – 0 ACR PENALINT – 9.50 ACR PENALINT SP – 0.50 P/L – 10 |

Here the PENALINT property is configured as ‘SUSPEND’. Here no income is booked so far and hence reversal is not required. |

| Day 140 EOD | ACC PRINCIPALINT – 30 Dr

ACC PRINCIPALINT SP – 30 Cr RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 27.5 ACR PRINCIPALINT SP – 27.5 P/L – 55 |

ACC PENALINT – 10 Dr

ACC PENALINT SP – 10 Cr RSP PENALINT – 0 ACR PENALINT – 5 ACR PENALINT SP – 5 P/L – 10 |

||

| Day 141 – Repayment – 40 (30 repaid towards Principal Interest+10 repaid towards Penal Interest) | ACC PRINCIPALINT – 0

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 30 Cr ACR PRINCIPALINT – 27.5 Cr ACR PRINCIPALINT SP – 27.5 Cr P/L – 55 |

ACC PENALINT – 0

ACC PENALINT SP – 0 RSP PENALINT – 10 Cr ACR PENALINT – 5 Cr ACR PENALINT SP – 5 Cr P/L – 10 |

||

| Day 141 – Resume 2nd time | ACC PRINCIPALINT – 0 Dr

ACC PRINCIPALINT SP – 0 Cr RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 85 Cr (27.5+27.5+30) ACR PRINCIPALINT SP – 0 P/L – 55 |

Each time resume is triggered, based on RSP and ACRSP balance a new amortization record is generated in EB Accrual application.

|

ACC PENALINT – 0 Dr

ACC PENALINT SP – 0 Cr RSP PENALINT – 0 ACR PENALINT – 20 (5+5+10) ACR PENALINT SP – 0 P/L – 10 |

|

| Day 141 EOD | ACC PRINCIPALINT – 1 Dr

ACC PRINCIPALINT SP – 0 Cr RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 76.5 Cr Amortization resumed at 85/10 =8.50 per day ACR PRINCIPALINT SP – 0 P/L – 64.50 [55+8.50+1] |

ACC PENALINT – 0 Dr

ACC PENALINT SP – 0 Cr RSP PENALINT – 0 ACR PENALINT – 18 Amortization resumed at 20/10 = 2 per day ACR PENALINT SP – 0 P/L – 12[10+2] |

||

| Day 145 EOD | ACC PRINCIPALINT – 5 Dr

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 32.5 Cr ACR PRINCIPALINT SP – 0 P/L – 102.5 [64.50+(8.50*4)+(1*4)] |

ACC PENALINT – 0 Dr

ACC PENALINT SP – 0 RSP PENALINT – 0 ACR PENALINT – 10 Cr ACR PENALINT SP – 0 P/L – 20 [12+(2*4)] |

||

| Day 150 EOD – Loan Maturity | ACC PRINCIPALINT – 10 Dr

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 0 A CR PRINCIPALINT SP – 0 P/L – 150 [102.50+(8.50*5)+(1*5)] |

ACC PENALINT – 0 Dr

ACC PENALINT SP – 0 RSP PENALINT – 0 ACR PENALINT – 0 ACR PENALINT SP – 0 P/L – 30 [20+(2*5)] |

||

| Day 150 – Payoff | After loan is payoff | |||

| After payoff | ACC PRINCIPALINT – 0

ACC PRINCIPALINT SP – 0 RSP PRINCIPALINT – 0 ACR PRINCIPALINT – 0 ACR PRINCIPALINT SP – 0 P/L – 150 |

ACC PENALINT – 0

ACC PENALINT SP – 0 RSP PENALINT – 0 ACR PENALINT – 0 ACR PENALINT SP – 0 P/L – 30 |

Preferential Pricing

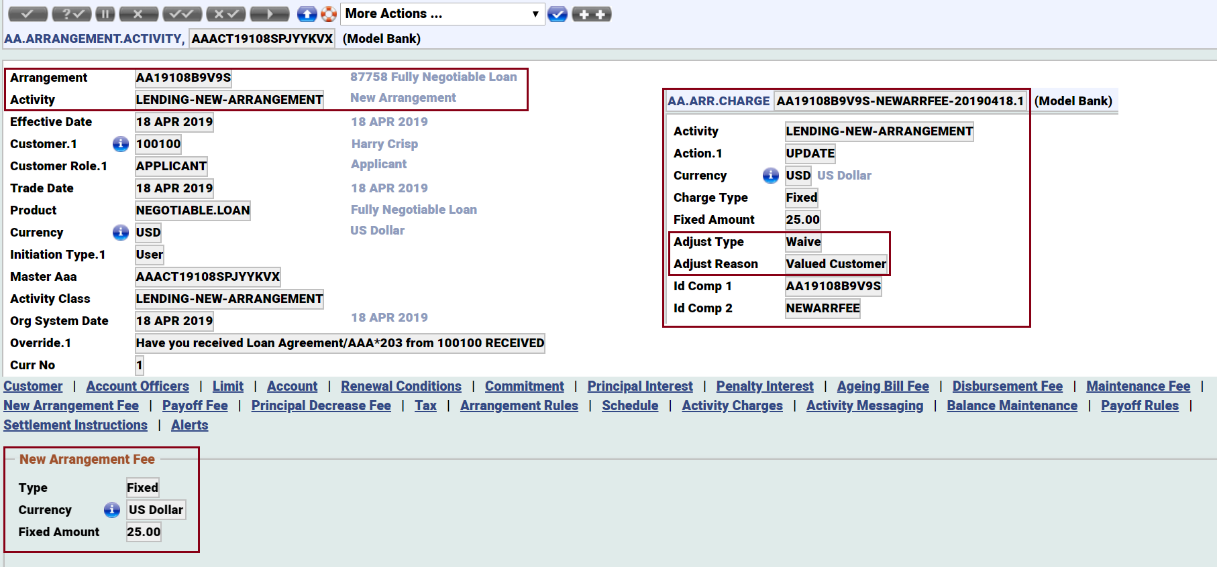

The below screenshot displays the New Arrangement Fee waived off because the arrangement has been created as a Valued Customer.

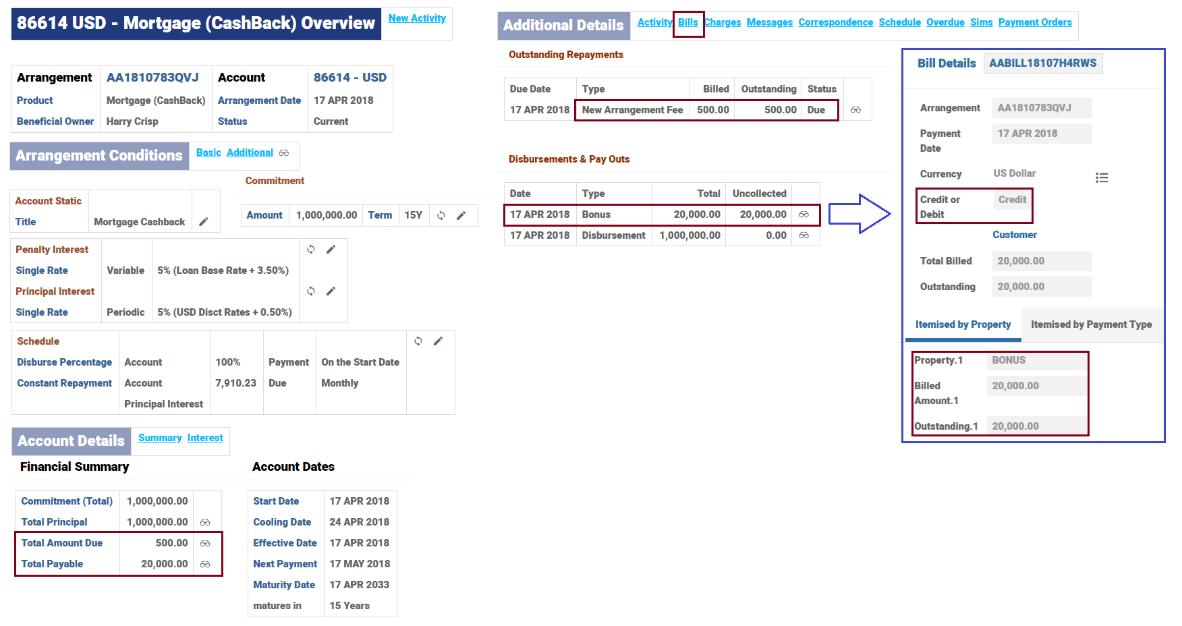

Rebate Processing

The below screenshot displays the rebate processing.

For some loan products, the customers protect their loan commitment with the help of insurance covers against risks such as death and disability. The insurance policy can be for the entire loan term or particular period such as yearly and then it is renewed at the end of every period. Rebate processing provides a facility to rebate the outstanding amount of premium for loan insurance on pre-closure or on cancellation at a later stage or cancellation within a certain grace period.

The aim of the rebate processing feature is, to render the ability to use a local routine for certain types of amortisation calculation. However, in AA, the generic accrual processing mechanism allows the user to amortise or accrue fixed amounts supplied by applications through a direct API or accounting entries. The standard method of processing is to straight line the amount on a daily basis.

It is possible to post to an internal account category (instead of PL) in the Accounting version.

The user can define the start date of accrual calculation. From that day, the accrual and account postings begin. On the first day, the calculation is based on the beginning of the accrual period – Start Date in the EB.ACCRUAL record. The changes to the grace period is considered only if the record is reversed, and if the record is reversed, no accounting activity takes place.

This feature provides an option to rebate the outstanding amount of premium for loan insurance on pre-closure or on cancellation at a later stage or cancellation within a certain grace period.

Home loan insurance, or any mortgage redemption insurance plan, is part of a banker's sales pitch when extending sizable long-term credit, such as a home loan. These plans hedge the risk of loss in case the borrower dies or becomes disabled during the loan term, especially an unsecured loan. The banks fund the insurance portion as part of the loan amount, which is repaid by the customers as part of the loan. The insurance policy can be done for the entire loan term or particular period.

The solution deals with the option to define the grace period, rebate on cancellation of an insurance contract and insurance rebate on pre-closure of a loan.

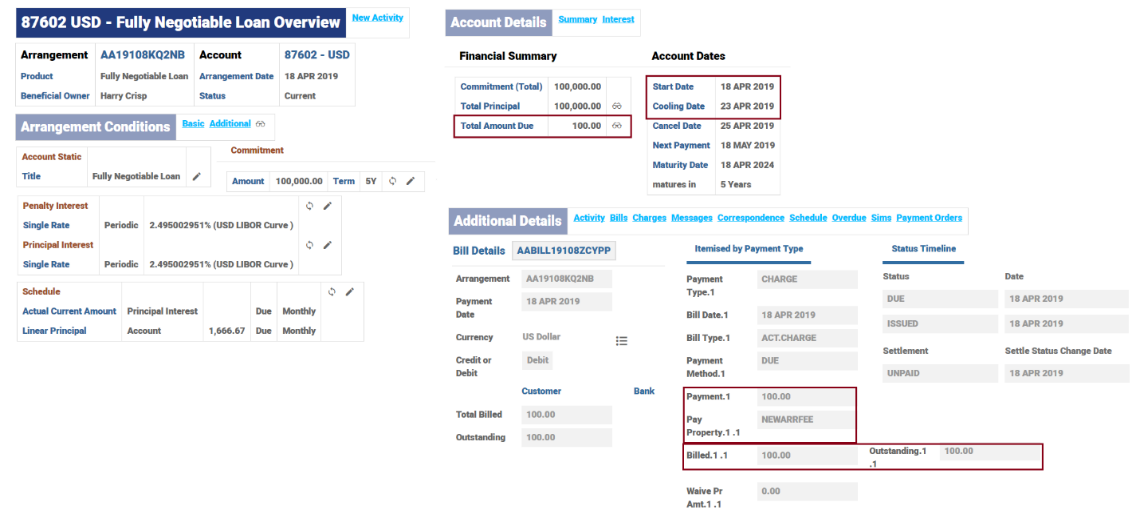

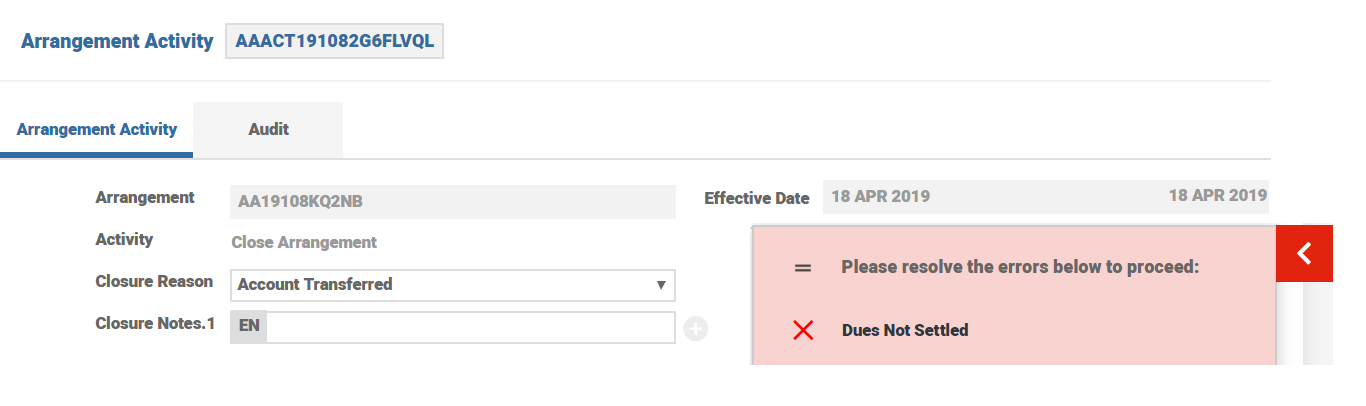

Pre-Closure and Dues Settlement

The below arrangement has a start date of 18 Apr with cooling date set as 23 Apr. As the customer opted not to proceed with the loan, the user closes the arrangement before the cooling date and the system displays the error message that the dues are not settled. Unless the dues are either settled or waived, the system does not allow the user to close the arrangement.

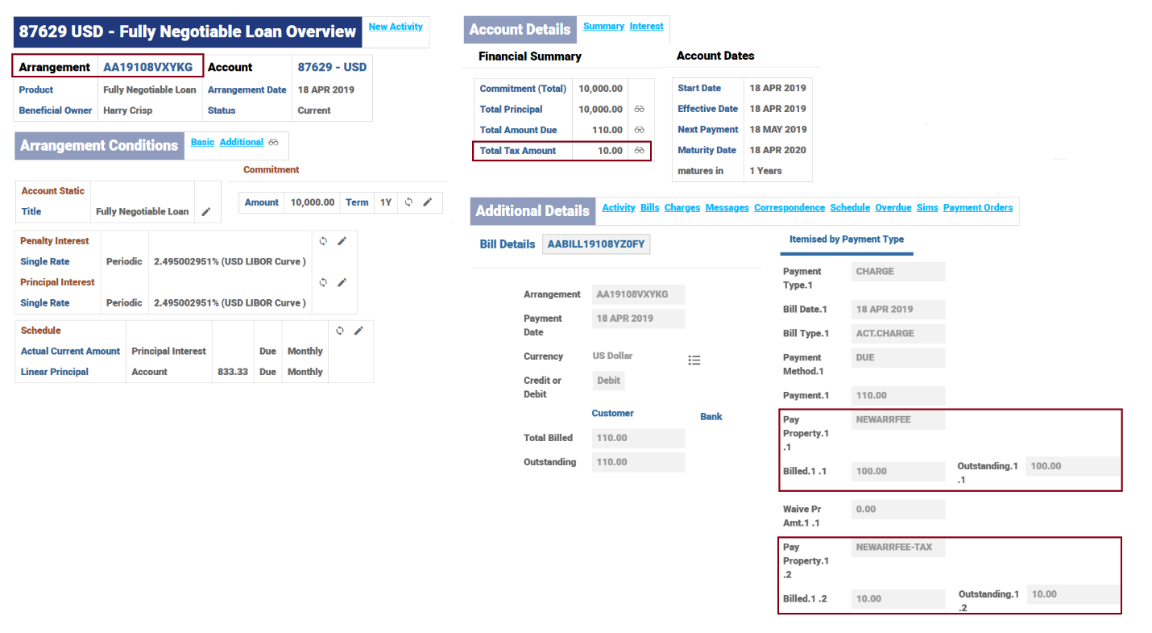

Tax on Charges

It is possible to levy a tax on charge if necessary. The below screenshot displays the Tax on Charges.

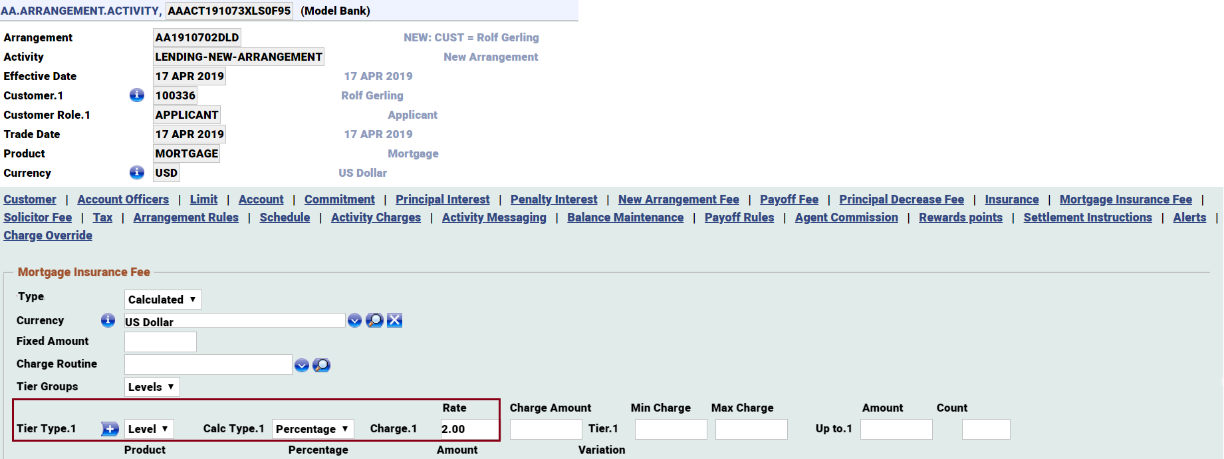

Pre-Closure of a Loan and Rebate Processing

An arrangement is created with Insurance Property as shown in the below screenshot.

The charge percentage is negotiable at arrangement level to add or less value based on the customer’s credibility.

In this topic