Settlement

The Settlement Property Class supports selected settlement requirements for Lending, Deposits and Accounts arrangements. It enables the settlement of dues or payouts using another arrangement or a Temenos Transact Account or it creates a DD.ITEM by providing Dd Mandate Ref. A payment order can be generated and linked to internal payment settlement (FT), Payment Hub (TPH) or any other external payment system.

Payin Account (Receive) and Payout Account (Pay) can either be a Temenos Transact account or an arrangement account.

The Settlement Property Class allows specifying a drawdown account to receive funds from or specifying a liquidation account to pay funds to.

It is also used to link one or more payment types in AA to Direct Debit mandates. This is achieved by linking a mandate defined in the Direct Debit (DD) module to an arrangement account which is done through this Settlement Property.

Product Lines

The following Product Lines use the Settlement Property Class:

- Accounts

- Agent

- Asset Finance

- Bundle

- Deposits

- Facility

- Lending

- Rewards

- Safe Deposit Box

Property Class Type

The Settlement Property Class (mandatory) uses the following Property Class Types:

- Dated

- Enable External

- Enable External Finance

- Enabled For Memo

Property Type

There are no property types associated with the Settlement Property Class.

Balance Prefix and Suffix

The Settlement Property Class does not hold any balances as it is not financial in nature and therefore there is no associated balance prefix.

The Settlement Property Class processes due bills by either specifying the Temenos Transact account in Payin Account or by creating DD.ITEM and providing Dd Mandate Ref. In the SETTLEMENT Property, the user has to specify the Payment Type based on the bills that are to be settled by applying the Payin Settle Activity. The Settlement Property functions only if Payin Settlement is set to Yes.

During the settlement process, the system identifies bills to be settled, based on payment types that are defined in the payment schedule for the payment that are made to the arrangement. These payment types must be given in the Payment Type field.

For payments done out of the arrangement (payout from the arrangement), the settlement process happens based on the Property Class and Properties of the arrangement. These values must be given in the Property Class and Property fields.

The Active fields (Payin Settlement and Payout Settlement) can be used with field values Yes and No to switch off and on, the settlement instructions, without clearing other settlement related fields.

The following are the related attributes:

- The Default Settlement Account field can be used to specify the settlement account that can be used by the system to dynamically fill in, when processing any settlement instruction that doesn’t have a settlement account of its own, specified. This can be a valid record from the ACCOUNT application.

- Individual instructions can still have their own account(s) specified if they are different from the default settlement account.

- During the live closure of an account, if the user does not specify individual settlement instructions for PAYOFF or PAYOFF$CURRENT payment types (based on the account balance), then the entire account balance is settled using the default settlement account.

- The Default Beneficiary field is used to specify the settlement beneficiary, which is used by the system to dynamically fill in, when processing any settlement instruction that does not have a specified settlement beneficiary of its own. This can be a valid record from the BENEFICIARY application.

- During live closure of an account, if the individual settlement instructions for PAYOFF is not specified (in case of credit balance), then the balances for not specified individual settlement beneficiaries are settled using the default beneficiary. In this scenario, the default beneficiary uses the first pay-out payment order product specified in settlement instructions.

- During live closure of an account, if the individual settlement instructions for PAYOFF$CURRENT is not specified (in case of debit balance), then the entire account balance is settled using the default beneficiary. In this scenario, the default beneficiary uses the first pay-in payment order product specified in settlement instructions.

- Individual settlement instructions can still have their own specified beneficiary if they are different from the default beneficiary.

- When the Default Beneficiary field is defined, the user needs to mandatorily input the payment order product in settlement instructions.

The Settlement Property Class processes due bills with either specifying the Temenos Transact account in Payin Account or by creating a DD.ITEM by providing Dd Mandate Ref. A payment order can be generated that gets settled by FT, TPH or any other external payment system. In the Settlement Property, the user has to specify the Payment Types based on which bills are to be settled by applying the PAYIN.SETTLE.ACTIVITY. The Settlement Property functions only if Payin Settlement is set to Yes.

The Receive Settlement Instructions are meant for funds coming into the arrangement. The Payment Type field is the link between Payment Schedule and the Settlement Property. This can be sub valued for different types of interest and charges.

This field contains the Payment Type (with a valid entry in AA.PAYMENT.TYPE) based on which the repayment settlement instruction is processed. For loans, the payment types are defined in Payment Schedule (ANNUITY, LINEAR, and so on). Apart from the above, other specific types are:

- DEPOSIT.PRINCIPAL - Used to Payin (or fund) a deposit.

- CHARGE – Used to settle Activity charges or Periodic charges.

If the user wants to combine multiple payment types to one settlement account, this field can be sub-valued and all values in the set, can take funds from the account defined in this set.

PAYMENT.TYPE is the payment type that is specified in Payment Type field in AA.BILL.DETAILS.

It is possible to settle activity charges through the Settlement Property Class. All activity charges are grouped under the ACTCHARGES payment type. Activity Charges look in the Settlement Property for that payment type and fetches the corresponding settlement instructions. The Settle Activity is defined in Activity Charges PC. This settlement activity refers to the Auto Settle field of the respective Activity Charges property. If this field is set to Yes, then it looks up the Settlement property and fetches the settlement account corresponding to the same payment type.

The Active (Payin Settlement) field is used as a switch, to turn off the settlement instruction temporarily without having the need to clear or delete the field contents. If it is set to No, then it means the instructions are not active.

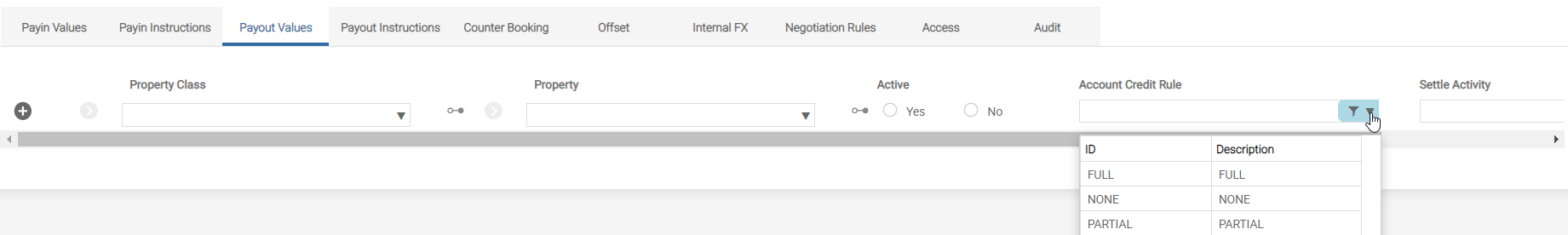

Account Debit Rule (PAYIN.AC.DB.RULE) can have one of the following values: FULL, PARTIAL or NONE. It can be either PARTIAL or NONE, if the Payin Account is an arrangement account reference.

- FULL: The entire bill of an arrangement gets settled even when the Payin Account has insufficient balance thereby overdrawing the account when limit is set.

- PARTIAL: The bill of an arrangement gets settled only up to available balance of the Payin Account when it has an insufficient balance.

- NONE: The entire bill of an arrangement gets settled only when the Payin Account has sufficient balance and no settlement happens in case of any shortfall of funds in the Payin Account.

It must be a valid record in AA.SETTLEMENT.TYPE.

The Settle Activity (PAYIN.SETTLE.ACTIVITY) field holds the activity that is run to receive funds, APPLYPAYMENT activity is allowed. A user activity can also be stated in this field. This settlement activity fetches the settlement account corresponding to the same payment type from the respective Payment Schedule.

Note that where there are funds available in UNC, the system has to be configured in Applypayment field of Payment Schedule Property Class to settle out of it during make due and the outstanding itself would be only the remaining amount of the bill.

It contains the account number from where funds are to be debited and credited against this payment type. Multiple accounts can be defined here and the rules of funding are governed by the Account Debit Rule field.

ACCOUNT DEBIT ACTIVITY is the Activity that can be triggered for sourcing the payment from the Payin Account. When Payin Account used is an arrangement account, then an Activity has to be specified to debit that arrangement as well. That Activity needs to be stated here. If the account is not an arrangement account, then this field is not required to be stated since the debit happens directly. Note that this activity happens on the arrangement from which funds are debited and is not relevant to this arrangement. It is only a definition on this arrangement.

For example, DEPOSITS-APPLYPAYMENT-PAYOUT.RULES Activity can be triggered to fetch the funds for settling the due bill of the lending arrangement for which the Settle Activity can be triggered to apply the payment received.

Defines the RC.CONDITION to be used for the payment type to allow variation of different retry conditions.

Defines the RC.TYPE reference to be used during handoff to inform the recycler the type of transaction that is being handed-off.

It has the DD mandate to be used if the settlement method is DD. The DD number must be the account of the arrangement. It has to be a valid mandate ref from DD.DDI.

This field allows the user to define only a percentage value. The system cascades from top-to bottom, down the multiple fields taking the percentages in order (a blank field is considered for processing last). The percentage defined is the percentage portion of the billed amount, which is settled from the respective account. The total percentages may not exceed 100 percent and it may not total 100% (the blank account number at last without percentage indicator collects the remaining amount)

In case of any rounding issues, the last account is the account to process any required adjustments. A blank field can be defined at last, in this case, the remainder of the bill is settled from this account.

This allows to define only a fixed value. The system cascades from top-to bottom, down the multiple fields taking the amounts defined in order (a blank field is considered for processing last). When a bill is generated, the individual amounts or total amounts defined, may exceed the billed amount. That is the case where the amount defined is an up-to amount. This is the maximum that can be taken and honours the Account Debit Rule field. To satisfy the bill, a lesser amount can also be taken. When a bill is generated, the individual amounts or total amounts defined, may not satisfy the billed amount. The amount defined is the amount to be taken. In this case, any remainder of the bill is made due.

This field is linked to the PAYMENT.ORDER.PRODUCT table and its value is passed through to the PAYMENT.ORDER application. Its main purpose is to control parameters for message processing.

- It is an optional field and is used in conjunction with Payin Beneficiary

- It drills down to the PAYMENT.ORDER.PRODUCT table.

- This field is a link to the core BENEFICIARY table and is used to define the debit account. The BENEFICIARY record is mapped through to the PAYMENT.ORDER application.

- When configured a payment order is generated and this can be used to link to an alternative DDA account system. Current functionality also allows for a Temenos Transact account to be defined in the beneficiary record which is debited.

-

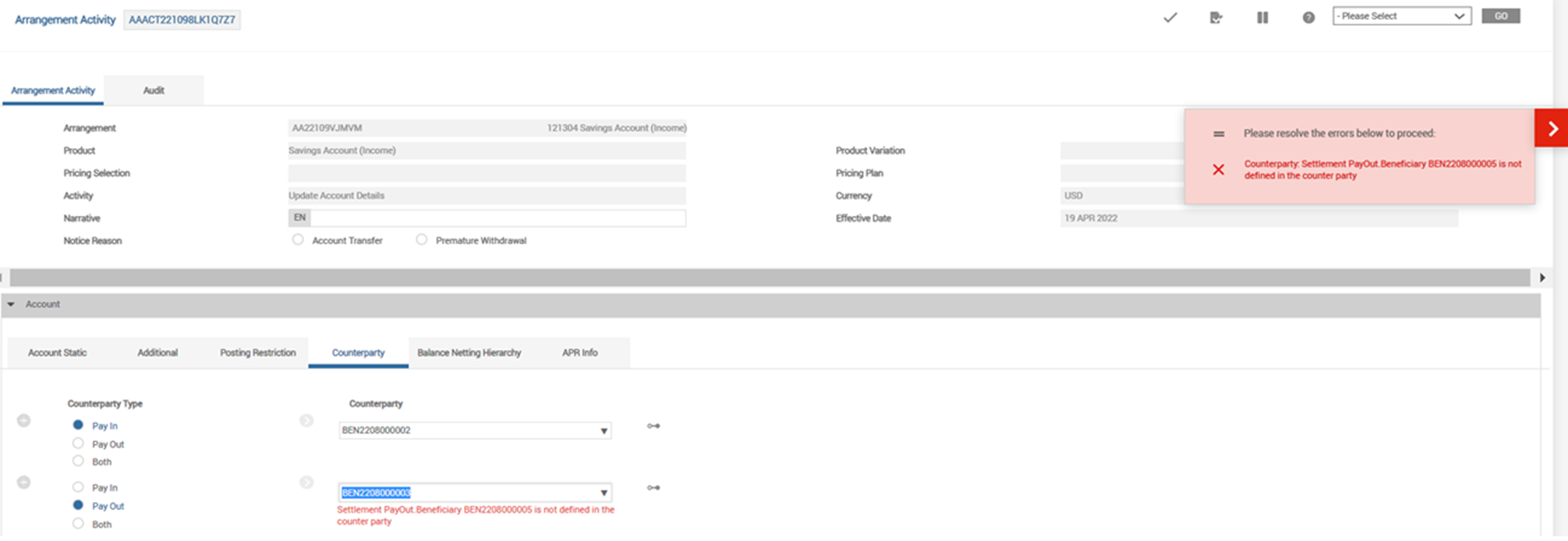

For an account or deposit with the Counterparty Type field as Payin or Both in the Account condition, the settlement details mentioned in Payin Beneficiary must be one of the Beneficiary in the Counterparty field of the Account condition for that Counterparty Type. When the settlement account defined is not a nominated counterparty, the system raises a validation error.

- It is an optional field with the below features:

- It is mutually exclusive with Payin Account and RC setup

- It is used in conjunction with Payin Po Product

- It drills down to the BENEFICIARY table

If Account Settlement (PAYIN.ACCT.SETTLE) is set to Combined and automatic settlement using Temenos Transact account is defined (irrespective of the settlement instructions whether they are multi-valued or sub-valued), the system combines the due bill amounts and generates a single settlement for the combined amount when the following criteria are met:

- Combine Bills in payment schedule condition is set as Yes.

- Bills are due on the same date.

- Bills are configured to be settled using the same Temenos Transact account (PAYIN.ACCOUNT).

- Same Settle Activity (PAYIN.SETTLE.ACTIVITY) is defined for all the bills.

When this field is not set or left blank, the above functionality is not applicable, and system continues to generate settlement entries based on whether the settlement instructions are multi-valued or sub-valued.

When pay bills like interest or disbursement or charge (bonus) bills are issued and settlement activities (CHECK.SETTLE and APPLYPAYMENT) are triggered to settle the bill, the system uses the payout rule mentioned in Settlement Property to settle the bill.

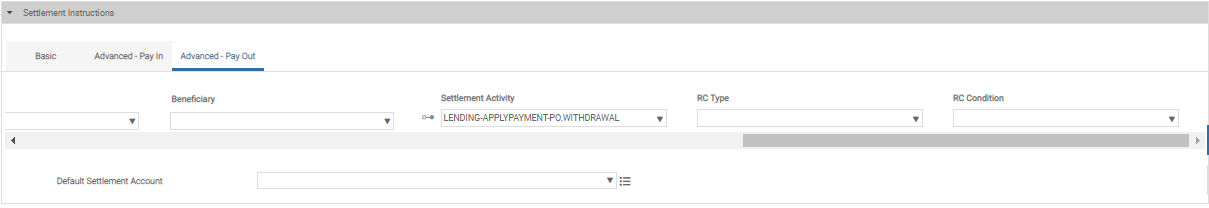

The Settlement property class processes Pay bills either by specifying the arrangement account reference, or by indicating a beneficiary with preferred payment order product to generate a payment order. In the Settlement Property, the user must specify the property class or property based on which bills are to be settled, by applying the Settlement Activity. If multiple property classes or properties are specified with settlement beneficiary in pay-out instructons, then the respective property class or property balances are settled to the specified beneficiary by triggering separate payment order transactions. The Settlement Property functions only if the Active field is set as Yes.

In the Settlement Property, the user has to specify the Property class or Property based on which bills are to be settled by applying the PAYOUT.SETTLE.ACTIVITY. Settlement property will function only if Payout Settlement is set to Yes. Payout Ppty Class is the field that enables the settlement of PAY balance of any of the properties of that property class. Whereas, if the property is specified in Payout Property, only the PAY balance relating to that specific property will be settled.

For example, if two charges are to be paid to the customer, and CHARGE1 and CHARGE2 Properties are used, if CHARGE is specified in the Property Class field, both the charges are paid and settled to the account, but if CHARGE1 alone is specified in Property, only the pay bill of CHARGE1 Property gets settled towards the account.

PAYOUT.ACTIVITY is the Activity that can be triggered for applying payment in the Account.

For example: DEPOSITS-APPLYPAYMENT-PAYOUT.RULES Activity can be triggered to apply the funds after settling the PAY bill of the deposit arrangement, for which Settlement Activity can be triggered to PAY the PAYBALANCE Property.

For Activity Charges, the settlement process can be controlled in Activity Charge Property by giving values as Yes Or No in the Auto Settle field in Activity Charges Property. If the field is set to No, the system does not process charge bills through the Settlement Property.

It contains the Property Class based on which the payout settlement instruction gets processed. This definition allows the users to configure multiple payouts happening to multiple accounts. For example, the user can configure interest to be paid out to one account, whilst the maturity deposit amount to be credited to another account. It has to be a valid record in AA.PROPERTY.CLASS.

It contains the PROPERTY based on which the payout settlement instruction is processed. This definition allows the users to configure multiple payouts happening to multiple accounts. For example, the user can configure current interest to be paid out to one account, whilst the maturity deposit amount may be credited to another account. It has to be a valid record in AA.PROPERTY.

This Active (PAYOUT.SETTLEMENT) field is used as a switch to turn off the settlement instruction temporarily without having to clear or delete the field contents. If the field is set to No, then the instructions are not active. Valid input is Yes or No.

Settlement Activity (PAYOUT.SETTLE.ACTIVITY) holds the values on the applicable Activity for payout, when payout of funds has to happen automatically. This is an APPLYPAYMENT-PAYOUT Activity or ones belonging to them. This activity is triggered on this arrangement every time payout happens to another account. It has to be a valid record in INACTIVITY.

This contains the account to which funds are to be credited from this arrangement. It has to be a valid Temenos Transact account number.

The Activity to be triggered to credit the account arrangement, when Account used is an arrangement account, is specified in this Account Activity (PAYOUT.ACTIVITY) field. If the account is not an arrangement account, then this field is not required to be stated since the credit happens directly.

This activity happens on the arrangement from which funds are debited and is not relevant to this arrangement. It is only a definition on this arrangement. It has to be a valid entry in AA.ACTIVITY, and must belong to the same Product line as stated in the Account.

The Account Credit Rule (PAYOUT.AC.CR.RULE) field is to define the user exception routine using the AA.SETTLEMENT.TYPE. It is possible to configure the payment rejection to accounts that are dormant or has posting restrictions. Without such rules being configured, the system completes posting to account that are dormant or has posting restriction. In such cases, we can further have transaction cycler for those transactions to be retried.

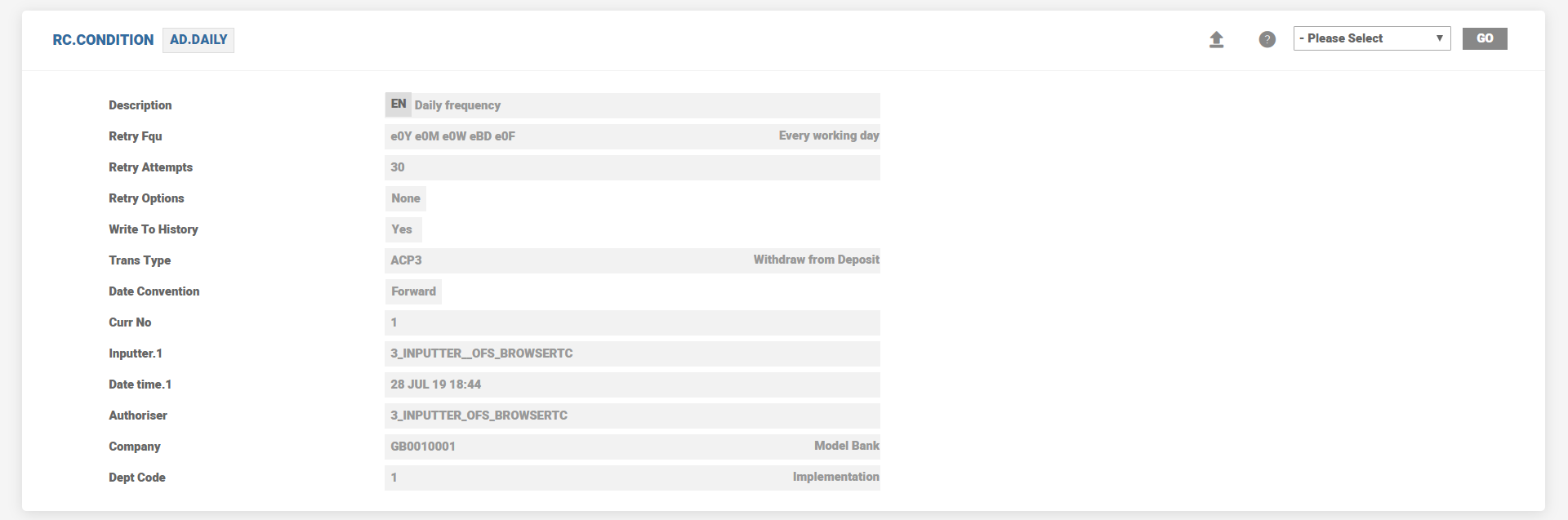

RC Condition (PAYOUT.RC.CONDITION) defines the RC Condition to be used for the payout property to allow variation of different retry conditions. For Payout, RC.CONDITION record with Retry option NONE is only allowed.

RC Type (PAYOUT.RC.TYPE) defines the RC.TYPE reference to be used during handoff to inform the recycler what type of transaction is being handed-off.

It allows the ability to define only a percentage value. The system cascades from top-to bottom, down the multiple fields taking the percentages in order (a blank field is considered for processing last). The percentage defined is the % portion of the billed amount, which gets settled from the respective account. The total percentages may not exceed 100% and the total percentages may not total 100%. In case of any rounding issues the last account is the account to process any required adjustments. A blank field can be defined at last, in this case the remainder of the bill is settled from this account.

It allows to define only a fixed value. The system cascades from top-to bottom down the multiple fields taking the amounts defined in order (a blank field is considered for processing last). When a bill is generated, the individual amounts or total amounts defined, may exceed the billed amount. In this case the amount defined is an up-to amount. This is the maximum that can be taken and honours the Account Debit Rule field. To satisfy the bill, a lesser amount can also be taken.

When a bill is generated, the individual amounts or total amounts defined may not satisfy the billed amount. The amount defined is the amount to be taken. In this case any remainder of the bill is made due.

This field is linked to the PAYMENT.ORDER.PRODUCT table and its value is passed through to the PAYMENT.ORDER application. Its main purpose is to control parameters for TPH processing and pass outgoing messages parameters.

- It is an optional field and is used in conjunction with Beneficiary.

- Drills down to the PAYMENT.ORDER.PRODUCT table.

- This field is a link to the core BENEFICIARY table and is used to define the credit account. The record in BENEFICIARY is mapped through to the PAYMENT.ORDER application.

- When this field is configured, a payment order is generated, and this can be used to link to an alternative DDA account system. The existing functionality also allows for a Temenos Transact account to be defined in the beneficiary record which is credited.

- It is an optional field with the following features:

- It is mutually exclusive with Payout Account and RC setup

- It is used in conjunction with Payout Po Product

- It drills down to the BENEFICIARY table

- For an account or deposit with the Counterparty Type field as Payout or Both in the Account condition, the settlement details mentioned in Payout Beneficiary must be one of the Beneficiary in the Counterparty field of the Account condition for that Counterparty Type. When the settlement account defined is not a nominated counterparty, the system raises a validation error.

When this Account Settlement (PAYOUT.ACCT.SETTLE) field is set to Combined and automatic settlement using Temenos Transact account is defined (irrespective of whether the settlement instructions are multi-valued or sub-valued), system combines the pay bill amounts and generates a single settlement for the combined amount if all the following criteria are met:

- Combine Bills in payment schedule condition is set as Yes.

- Bills should have the same payment date.

- Bills are configured to be settled using the same Temenos Transact account (PAYOUT.ACCOUNT).

- Same Settle Activity (PAYOUT.SETTLE.ACTIVITY) is defined for all the bills.

When this field is not set or left blank, the above functionality is not applicable, and system continues to generate settlement entries based on the settlement instructions whether they are multi-valued or sub-valued.

The Transaction Recycler provides the ability to retry failed financial transactions again at regular intervals. This is a generic retry mechanism which can be consumed by Temenos Transact applications.

The Transaction Recycler retry process runs as a COB job at a specific stage during both End of Day (EOD) and online phases. This job retries the transactions on scheduled dates until the transaction is settled or number of retry attempts allowed have been exhausted or retry end date is reached.

During each retry, the Transaction Recycler will take the amount available in the settlement account for settling the transaction amount in full or partial, based on the Transaction Recycler retry configuration.

It is possible for the banks to define the priority to settle the outstanding bills on a settlement account based on the aging of the bill or by bill type.

The Rank Info in RC.DETAIL is updated with the aging status or the bill type based on the Priority Rank Type in RC.CONTRACT.PRIORITY record.

When the system prioritises the RC.DETAIL record, it is based on the prioritisation rule defined using Due Rule and Priority Rank Type.

Contract Priority to Prioritise bills

The AA framework hands-off the bills to RC and the system retries to settle these bills on a regular frequency defined in RC.CONDITION. The RC.PRIORITY application allows to setup the priority of transactions at the company level by system ID or by product group or a defined product priority.

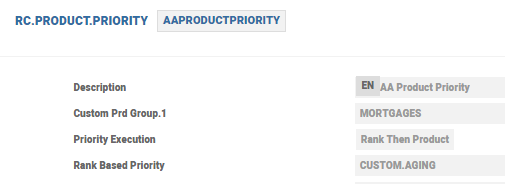

RC.PRODUCT.PRIORITY defines the priority rule for a specific system ID or product group or a defined product priority. The contract priority is linked to the product priority using the contract priority field in product priority. The RC.CONTRACT.PRIORITY defines the rules to prioritise the retry of bills in the arrangements for the product priority.

Using RC.PRODUCT.PRIORITY, the banks can define a custom criteria to prioritise the contracts that belong to a specific product group or a product. To set a custom priority, the contract priority attached to the RC.PRODUCT.PRIORITY record in Rank Based Priority must have the Due Type field set as Sort by Priority Attribute. When there is more than one retry request posted against the same account the choice defined in Priority Execution defines the priority order. The options are:

- Rank Then Product - The system orders requests based on the rank (status) defined in RC.CONTRACT.PRIORITY first and then by the product as defined in RC.CONTRACT.PRIORITY.

- Product Then Rank - The system orders the requests by product first and then by their rank from the RC.CONTRACT.PRIORITY application

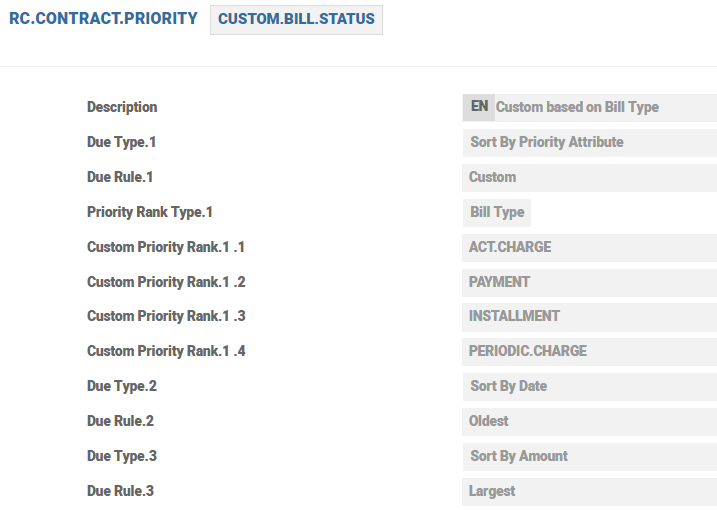

The RC.CONTRACT.PRIORITY sets the rank at transaction level for the same type of retry request. It sets the priority by value date, transaction amount or by a custom setting. The Repayment Rule in Payment Rule condition should be in-line with the contract priority set here for appropriate behaviour. For the Due Type based on Date can have the Due Rule as oldest or latest. Likewise, the Due Type based on Amount can have the Due Rule as largest or smallest amount.

For a custom setting, the Due Type is Sort by Priority Attribute and Due Rule is Custom. The custom setting can be based on the aging status of the outstanding bills or the bill types of the outstanding bills. The multi-valued Custom Priority Rank field must contain custom values namely the overdue status or the bill types based on which the outstanding bills must be sorted

Read the Configuring Transaction Recycler Priority to understand how the retry priority can be custom defined.

The Rank Info in RC.DETAIL record is passed from the business application and used in priority processing.

The below scenarios illustrate the way the Transaction Recycler prioritises and settles the bills for different set of configurations.

Scenario 1

| Due Type | Due Rule | RC Contract Priority Rank Type | RC Product Priority Execution |

|---|---|---|---|

| Sort By Priority Attribute | Custom | Bill Type | Rank Then Product |

| Custom Priority Rank | Custom Prd Grp | ||

| ACT.CHARGE | HOME.EQUITY.LOANS | ||

| INSTALLMENT | MORTGAGES | ||

| PAYMENT | |||

| PERIODIC.CHARGE | |||

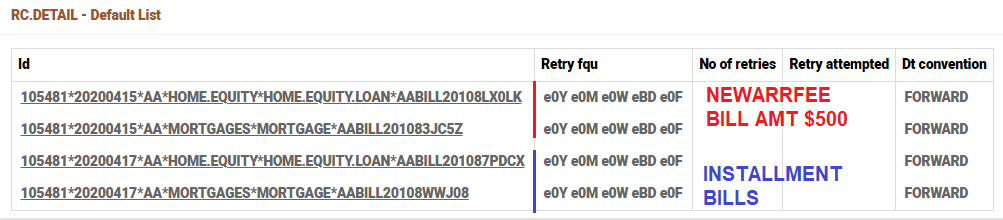

If the bill is generated for NEWARRFEE and INSTALLMENT, based on the above setup the system prioritises the bills as given below:

- HOME.EQUITY.LOANS-NEWARRFEE

- MORTGAGES-NEWARRFEE

- HOME.EQUITY.LOANS-INSTALLMENT

- MORTGAGES-INSTALLMENT

It is possible to configure the RC.CONDITION in-line with Settlement Payin Account Debit Rule as to Full or Partial. Consider an example where the RC Condition mapped to Charge does not allow partial settlement of bills, however, Installment bills can be settled partially. Accordingly, RC has not settled the NEWARRFEE bill, while the Installment bill is partially settled based on the available funds in the settlement account.

The details of retry result and if it has failed due to insufficient funds / partial payment not allowed are available in the RC.DETAIL. Also the Rank Info is updated in the RC.DETAIL. In this case, the Rank Info is the bill type and for priorities based on aging status, the respective aging status of the bills is stored.

Scenario 2

| Due Type | Due Rule | RC Contract Priority Rank Type | RC Product Priority Execution |

|---|---|---|---|

| Sort By Priority Attribute | Custom | Bill Type | Product Then Rank |

| Custom Priority Rank | Custom Prd Grp | ||

| ACT.CHARGE | HOME.EQUITY.LOANS | ||

| INSTALLMENT | MORTGAGES | ||

| PAYMENT | |||

| PERIODIC.CHARGE | |||

If the bill is generated for NEWARRFEE and INSTALLMENT, based on the above setup the system prioritises the bills as given below:

- HOME.EQUITY.LOANS-NEWARRFEE

- HOME.EQUITY.LOANS-INSTALLMENT

- MORTGAGES-NEWARRFEE

- MORTGAGES-INSTALLMENT

Scenario 3

| Due Type | Due Rule | RC Contract Priority Rank Type | RC Product Priority Execution |

|---|---|---|---|

| Sort By Priority Attribute | Custom | Bill Type | Product Then Rank |

| Custom Priority Rank | Custom Prd Grp | ||

| ACT.CHARGE | HOME.EQUITY.LOANS | ||

| INSTALLMENT | MORTGAGES | ||

| PAYMENT | |||

| PERIODIC.CHARGE | |||

| Sort By Date | Oldest | ||

| Sort By Amount | Largest | ||

In this case, if there are two bills of same type (say ACT.CHARGE) then it is:

- Sorted by Product (that is, HOME.EQUITY.LOANS then MORTGAGES)

- Then by Due Type and Due Rule, in this case,

- Sort By Date , and then Sort By Amount

- Then by Due Type and Due Rule, in this case,

Scenario 4

| Due Type | Due Rule | RC Contract Priority Rank Type | RC Product Priority Execution |

|---|---|---|---|

| Sort By Priority Attribute | Custom | Aging Status | Rank Then Product |

| Custom Priority Rank | Custom Prd Grp | ||

| NAB | HOME.EQUITY.LOANS | ||

| DEL | MORTGAGES | ||

| GRC | |||

| DUE | |||

If the bills generated are in NAB and DEL status, based on the above setup the system prioritises the bills as given below:

- HOME.EQUITY.LOANS-NAB

- MORTGAGES-NAB

- HOME.EQUITY.LOAN-DEL

- MORTGAGES-DEL

Scenario 5

| Due Type | Due Rule | RC Contract Priority Rank Type | RC Product Priority Execution |

|---|---|---|---|

| Sort By Priority Attribute | Custom | Aging Status | Product Then Rank |

| Custom Priority Rank | Custom Prd Grp | ||

| NAB | HOME.EQUITY.LOANS | ||

| DEL | MORTGAGES | ||

| GRC | |||

| DUE | |||

If the bills generated are in NAB and DEL status, based on the above setup, the system prioritises the bills as given below:

- HOME.EQUITY.LOANS-NAB

- HOME.EQUITY.LOANS-DEL

- MORTGAGES-NAB

- MORTGAGES-DEL

Payin Rc Condition – Defines the RC.CONDITION to be used for the payment type to allow variation of different retry conditions. It should be a valid entry in RC.CONDITION.

Payin Rc Type – Defines the RC.TYPE to be used during handoff to inform the recycler the type of transaction that is being handed-off. It should be a valid entry in RC.TYPE.

The Payin Rc Condition and Payin Rc Type fields available in the PAYIN payment type multi-value set define the frequency. Payin Rc Type is used to define the core and local routines that are called by the transaction cycler service to perform transaction specific processing. It also provides a link to RC.CONDITION table which defines the processing conditions for this type of transaction.

AA PAYMENT or PAYOUT rules order or sequence setup has to be in sync with the setup done in the recycler priority setup tables, that is, if the oldest bill setup is done in AA payment rules, then, the recycler contract priority should also be set in the same order.

Within settlement processing on the Due side individual or multiple accounts can be defined. The Transaction Cycler prioritises the retry of the individual accounts based on the order defined on the settlement record.

During the life cycle of the arrangement, based on the customer’s request there is a possibility that the user may prefer to change the settlement pay in account. In such a scenario setting the Update Pending Retry field to Yes indicates that the changed account number is considered to settle the existing outstanding overdue bills.

The Update Pending Retry field can have one of the following values:

- Yes - The change is applied to the existing older pending request also.

- No - Then the change is applied only to future bills.

- The settlement rule can be set as “partial “or “none”

- Does not apply to the rule “Full “

- Does not apply to percentage being defined.

- Does not apply to amount being defined.

- Does not apply when the Update Settlement activity is future dated. If the user tries to change the settlement account when the Update Pending Retry is set as Yes, then the system should throw the "Pending Retries cannot be updated for future dated activities" error.

The following are the options available for Retry Processing from multiple accounts:

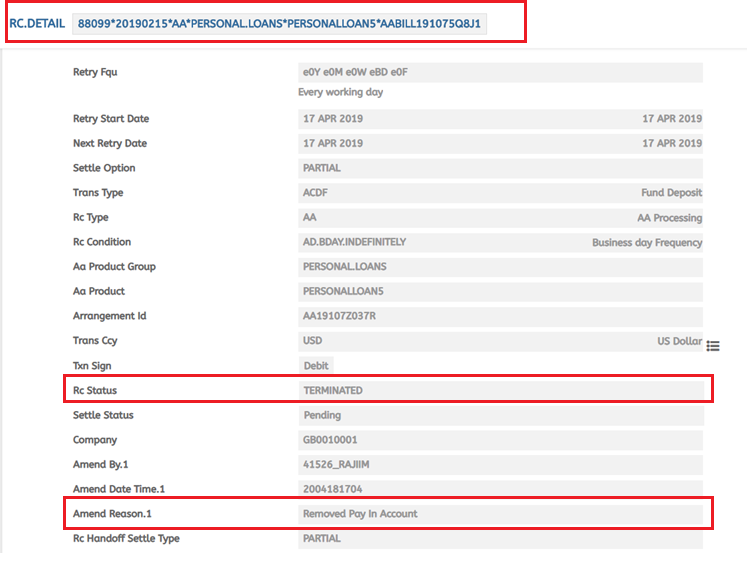

Where there is a change in the payin account number with Rc Type, Rc Condition enabled, Update Pending Retry set as Yes, and the user has updated the settlement activity, and replaced settlement account A with settlement account B the following occurs:

The system creates new pending request on settlement account B, by replicating all the pending request retry characteristics of settlement account A.

- The Take over Date field in RC.DETAIL stores the pending requests created on the new pay in settlement accounts.

- Rc Status on settlement account A is updated as TERMINATED, with a reason: Pay In Account Removed.

- During the update settlement activity, whenever the Rc Type and Rc Condition is removed from the payin side of settlement account and the Update Pending Retry field is set as Yes, the system removes all the requests linked to the overdue bill passed by AA.

- Rc Status is updated as TERMINATED, with the amend reason: Removed Retry Condition.

Account(s) are added to the payin conditions, changing the existing pay in order. For example, a loan is paid from settlement account A and settlement account B. A new settlement account C is added as the first repayment account, the settlement account A becomes the second repayment account, settlement account B, the third repayment account.

When the user has updated the settlement activity with the effective date as current date, changed the order of payin accounts as C first, then A and set the Update Pending Retry field to Yes, the following occurs:

- The system creates new pending request on settlement account C as priority 1, by copying all the pending request retry characteristics of settlement account A.

- The system creates new pending request on settlement account A as priority 2, by copying all the pending request retry characteristics of settlement account B.

- Rc Status on account B is updated as TERMINATED with reason: Pay In Account Removed

An existing loan is in Delinquent status with outstanding bills in RC. The user updates the settlement activity with a change in account number and sets Update Pending Retry as Yes.

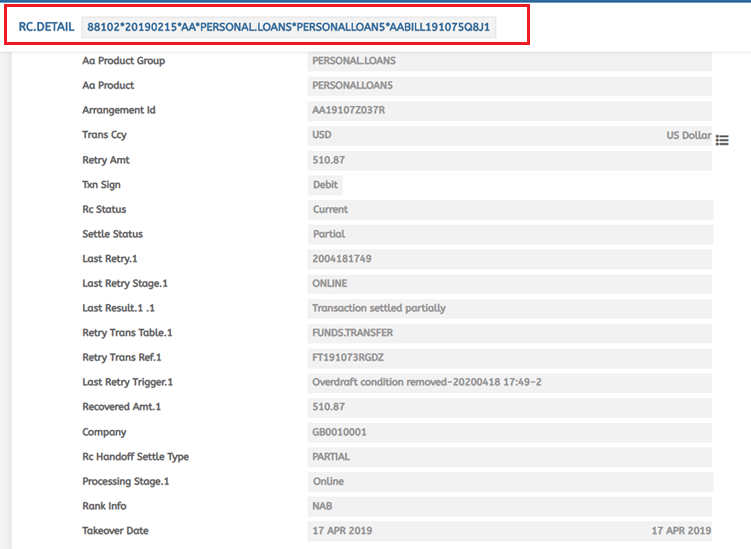

The RC.DETAIL before change in account number is shown below.

The RC.DETAIL after change in account number is shown below.

- Rc Status is updated as TERMINATED.

- RC.DETAIL is updated for the older bill for the changed account number and the bill is partially settled, based on the funds availability.

Read Retry Processing from Multiple Accounts for more information.

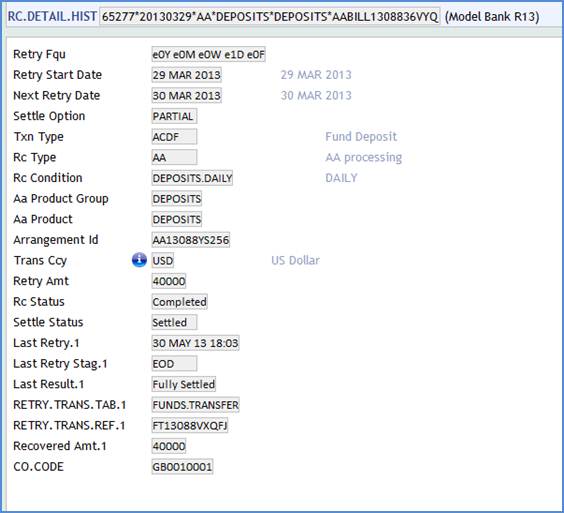

Sample configuration of Transaction Cycler for Mortgages and Long term deposits is shown below.

Setup up illustration using RC

The Payin Rc Condition and Payin Rc Type fields are available in the PAYIN payment type multi-value set to define the frequency and used to define the core and local routines that will be called by the transaction cycler service to perform transaction specific processing. It also provides a link to the RC.CONDITION table, which defines the processing conditions for this type of transaction

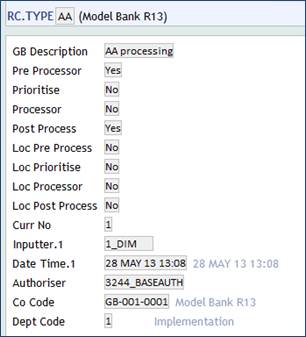

RC.TYPE

This table is used to define the core and local routines that would be called by the transaction cycler service to perform transaction specific processing. It also provides a link to RC.CONDITION table which defines the processing conditions for this type of transaction.

These records will be released by Temenos, but could be modified by the user

RC.CONDITION

Different records in RC.CONDITION are created with Retry Frequency (Retry Fqu) and Transaction Type (Txn Type), which can be attached under the Settlement product conditions.

If Write To History is set as Yes, and if the dues or funding is settled fully, then the record moves from RC.DETAIL to RC.DETAIL.HIST

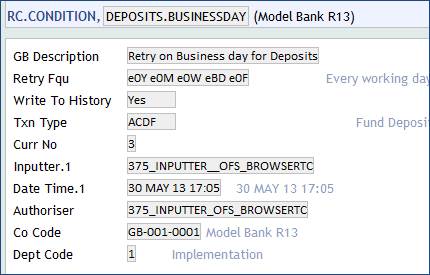

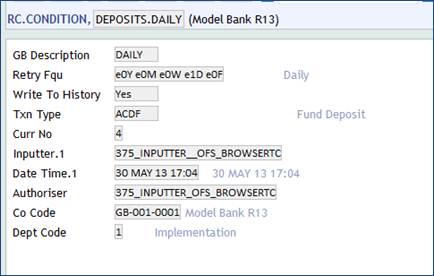

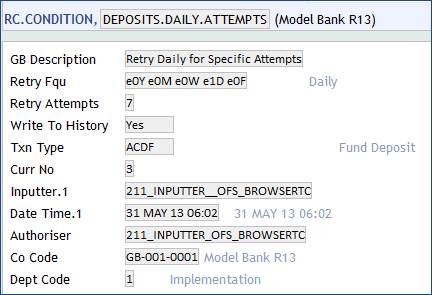

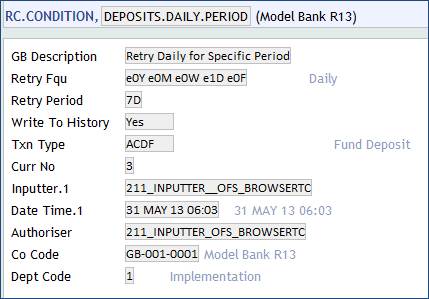

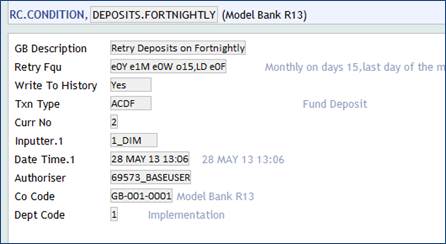

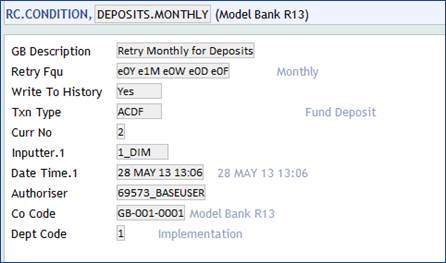

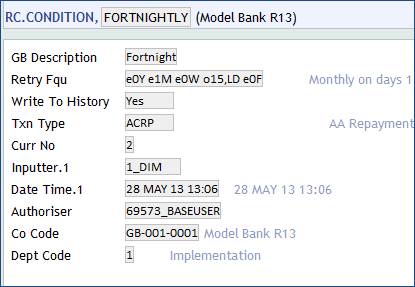

Some of the conditions (RC.CONDITION) configured are shown here.

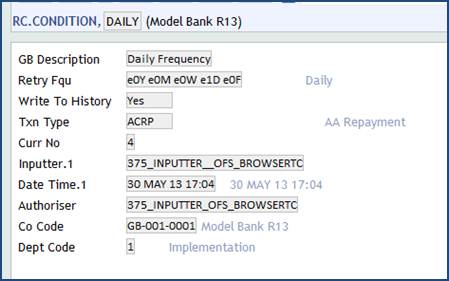

RC.CONDITION for daily frequency is shown below.

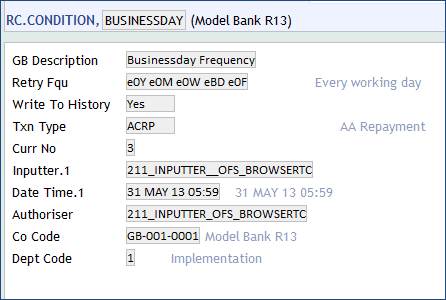

RC.CONDITION for business day is shown below.

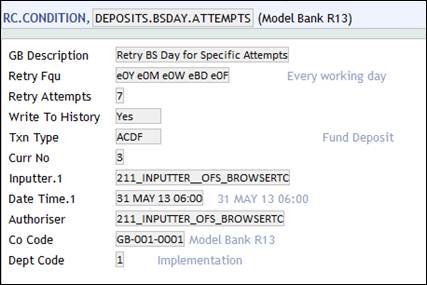

RC.CONDITION for deposit products with frequency set as Business Day with Retry Attempts is shown below.

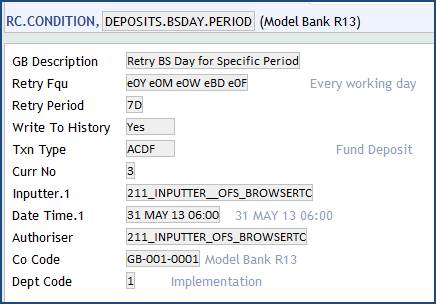

RC.CONDITION is set for deposits product with frequency as business day and Retry period is set as 7 days.

RC.CONDITION set for deposits with frequency as Business Day is shown below.

RC.CONDITION for deposits with Daily frequency is shown below.

RC.CONDITION for deposits with Daily frequency and Retry Attempts is set as 7

RC.CONDITION for deposits is set as Daily frequency, and Retry Period as 7 Days.

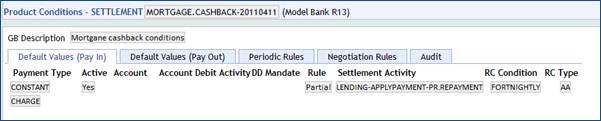

RC.CONDITIONS is set for deposits with Retry Frequency as Fortnightly.

RC.CONDITIONS is set for deposits with Retry Frequency as Monthly

RC.CONDITIONS is set for Retry Frequency as Fortnightly

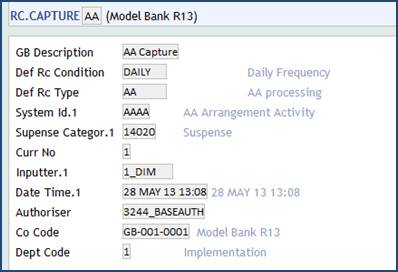

RC.CAPTURE

The table is used to define accounting entries which need to be captured and stored for recycling.

The RC.CAPTURE table is used configure conditions or rules based on which a transaction can be captured by the central accounting engine, that is, based on EB SYSTEM ID.

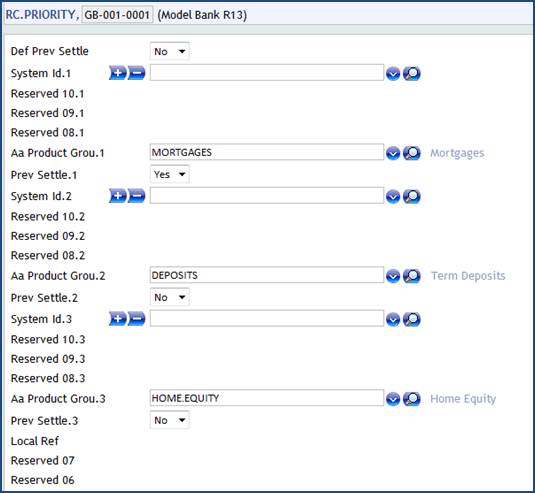

RC.PRIORITY

This table contains the rules regarding the types of transaction that take priority where there is more than one outstanding transaction against a settlement account

RC.PRIORITY is created with the product groups included to set the prioritisation level.

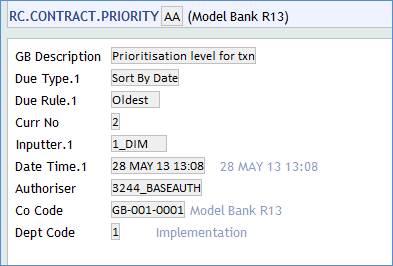

RC.CONTRACT.PRIORITY

This table contains the rules regarding the types of transactions that take priority where there is more than one outstanding transaction against a settlement account.

RC.CONTRACT.PRIORITY record is created to set the prioritisation level for transaction with Due Rule set as Oldest and Due Type set as Sort by Date.

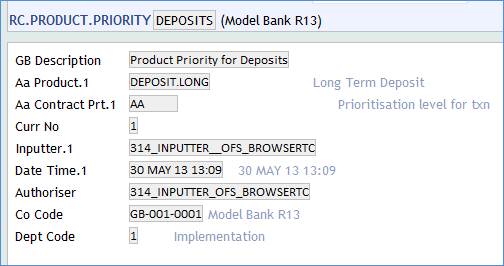

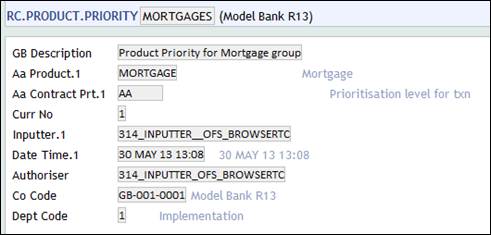

RC.PRODUCT.PRIORITY

This table contains the rules regarding the types of transactions that take priority where there is more than one outstanding transaction against a settlement account.

Product level priority is set using the RC.PRODUCT.PRIORITY for the Deposits and Mortgages Product Group. Records created in RC.CONTRACT.PRIORITY are shown below.

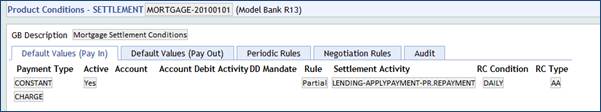

Settlement Condition

RC.CONDITION and RC.TYPE are attached under the Settlement Product Conditions at product level.

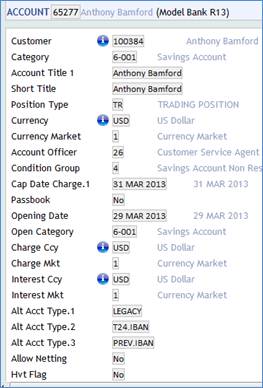

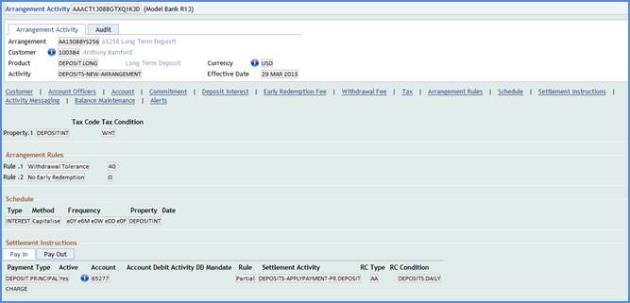

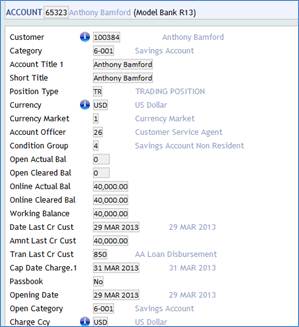

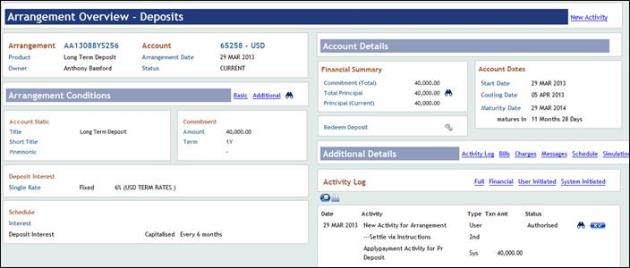

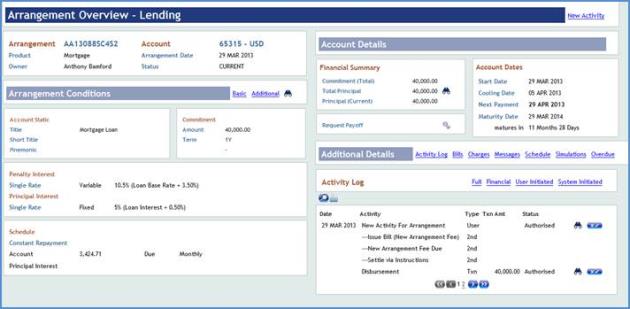

The deposit arrangement is created with PAYIN and PAYOUT account as 65277 which has no balance and the commitment amount for deposit is given as 40000.

As the account has no balance, the deposit account is not funded.

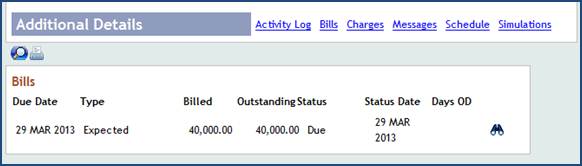

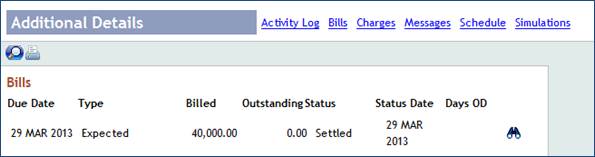

The bill gets generated with status as Expected, as deposit funding is not made.

The user has to check for the RC.DETAIL for the account given in Settlement conditions. The Settle Status field is updated as Pending and Retry Start Date as 29 Mar 2013.

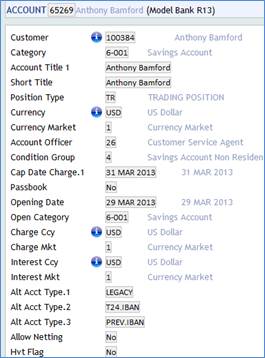

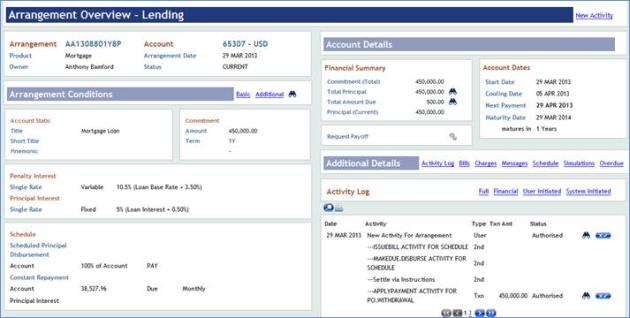

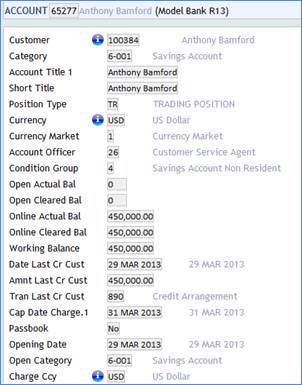

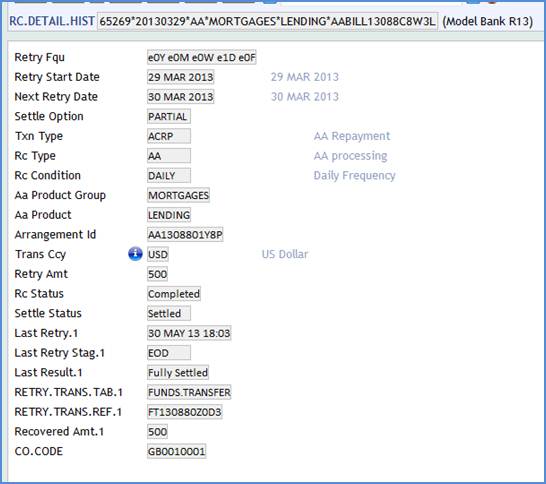

The loan arrangement has the same account for Payout (65277) and different account in Payin (65269) settlement conditions, and the commitment amount is input as 450,000 USD.

RC.CONDITION is set as DAILY by default (Retry frequency) from the settlement product conditions.

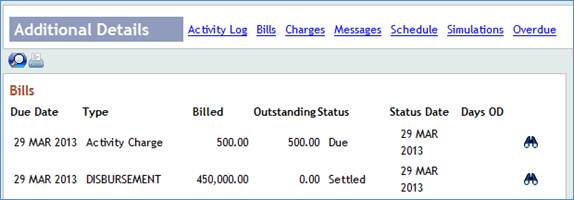

After authorisation, auto-disbursement is made to the account 65277 mentioned in the Payout Account, but the due charges are not settled as the Payin account has nil balance.

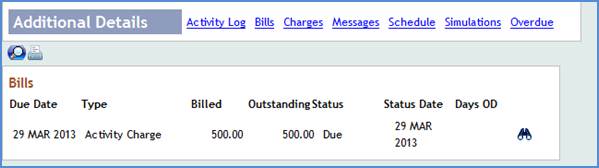

The bill gets generated for NEWARRFEE Activity charges and with status as Due, as Payin account has nil balance.

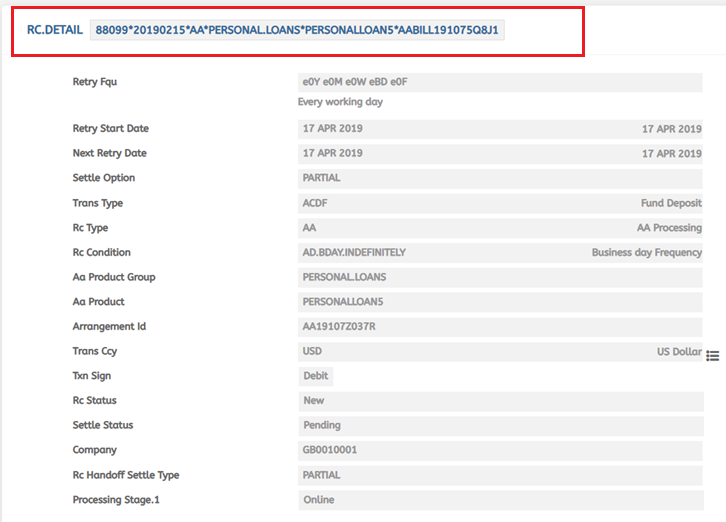

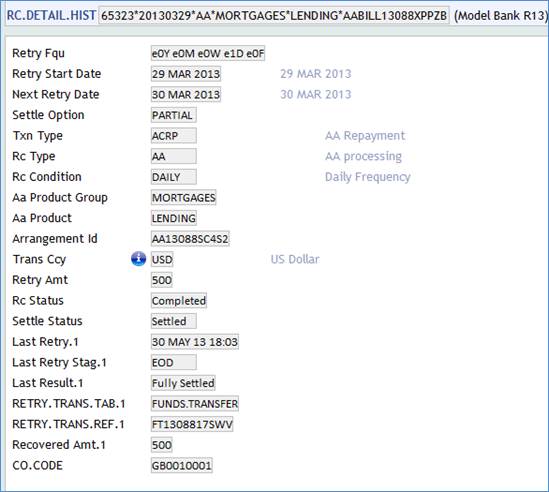

RC.DETAIL

RC.DETAIL records are found for account specified in PAYIN balances 65269. Since the charges are not settled, an RC.DETAIL is created.

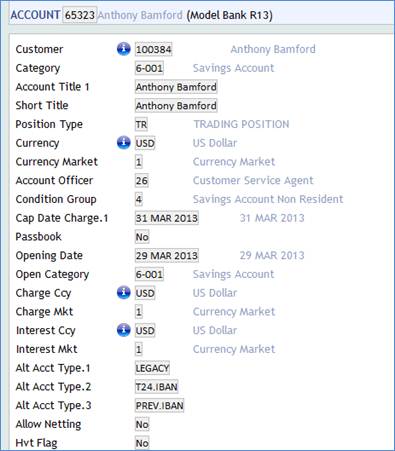

Another loan is created without auto-disbursement with PAYIN account, with account 65323 as settlement account. This account also has zero balance.

The commitment amount is 40,000. RC.CONDITION has DAILY set by default (Retry Frequency) from the Settlement product condition.

Payin account 65323 has no balances. Therefore, Due charge is created

The bill gets generated for Due Charges with status as Due.

Through FT, a disbursement for the arrangement is done.

RC.DETAIL

Check for RC DETAIL record for the new account. RC.DETAIL is created as the charges are due.

Before COB, note the balances in the respective Payin Account specified in Settlement conditions.

All the accounts have sufficient balances.

After running the cob, RC DETAIL is settled and moved to history as Write To History is set as Yes.

The RC record is moved to history now.

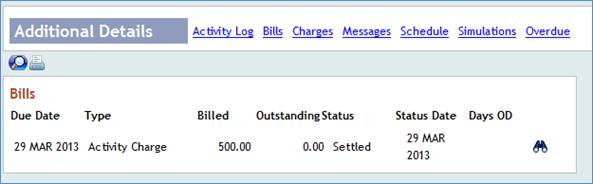

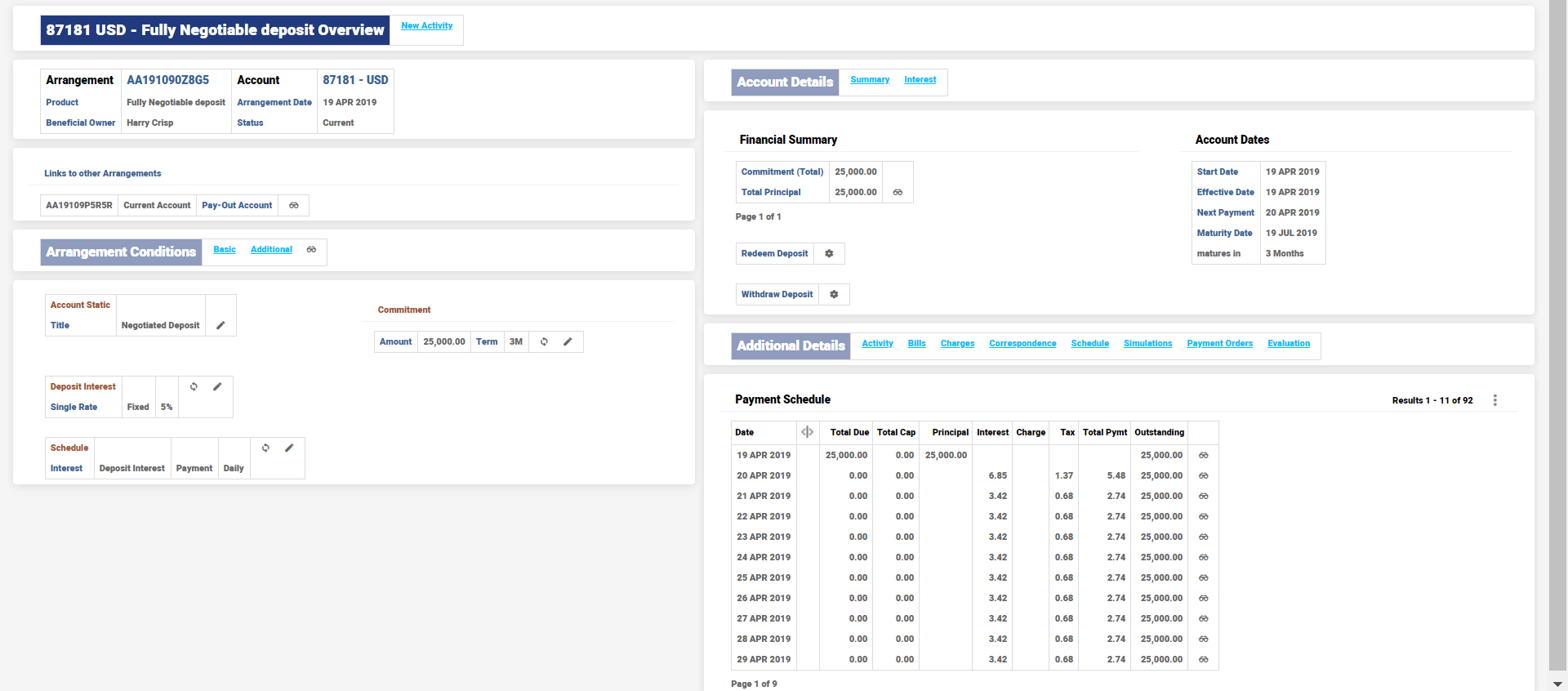

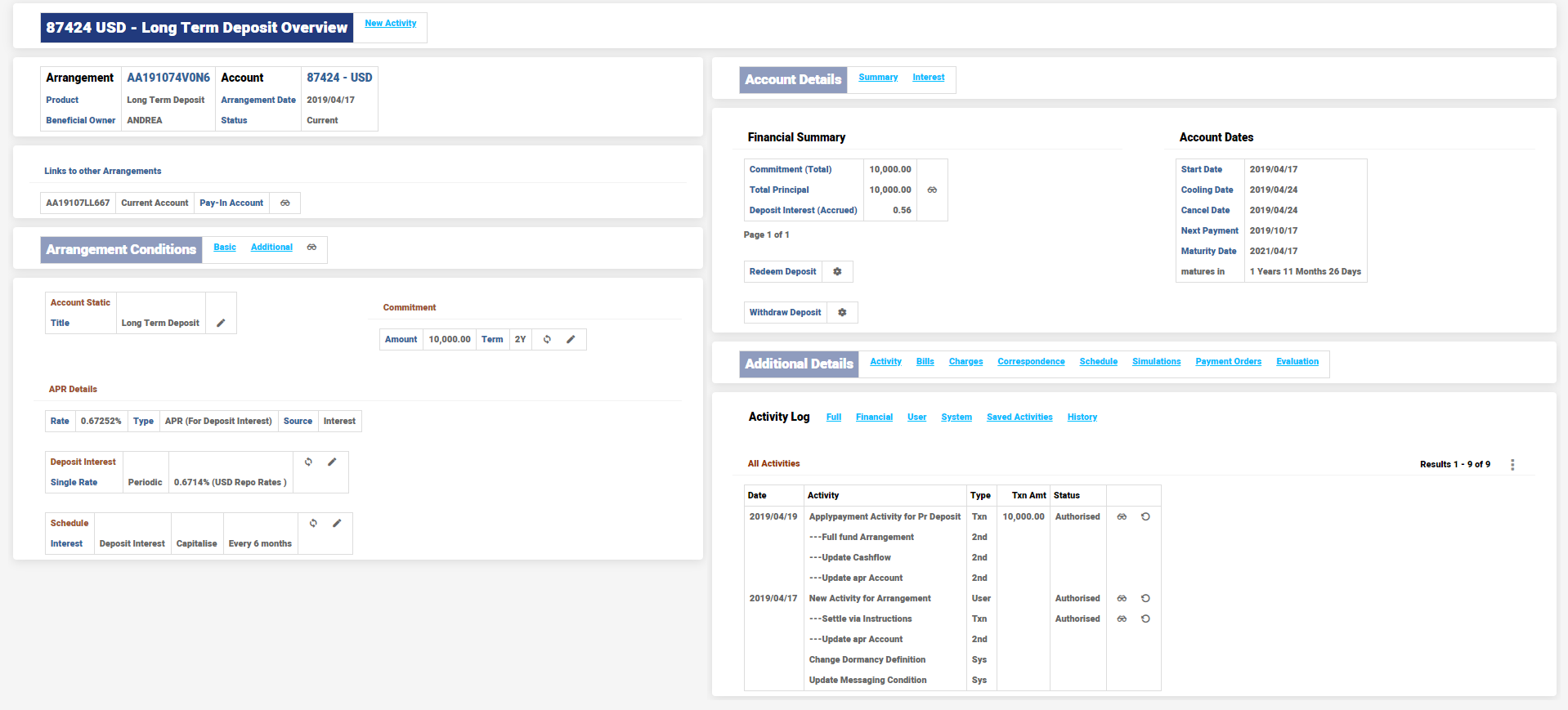

The user can view the Deposit arrangement after the bill is settled.

The bill status is updated as settled.

Deposit is funded and the expected bill is settled by the system, by Transaction Cycler.

The outstanding RC record is in history now.

View the arrangement after the settlement is made. The bills statuses are settled.

The RC record is moved to history now.

The user can view the arrangement after the settlement is made.

The bill status is updated as Settled.

Charge bill is settled by system through Transaction Cycler.

Activity Charges bill gets settled in Lending Arrangement if auto-disbursement is set and the same account is given in both settlement conditions.

During the capitalisation process to settle the interest or charges to credit an account, if there is a payment rejection, the same can be retried using the Transaction Cycler.

It is possible to configure the payment rejection to accounts that are dormant or has posting restrictions. In such cases, the user can further have transaction cycler for those transactions to be retried.

In Settlement condition the RC Condition and RC Type fields are there to choose the RC settings.

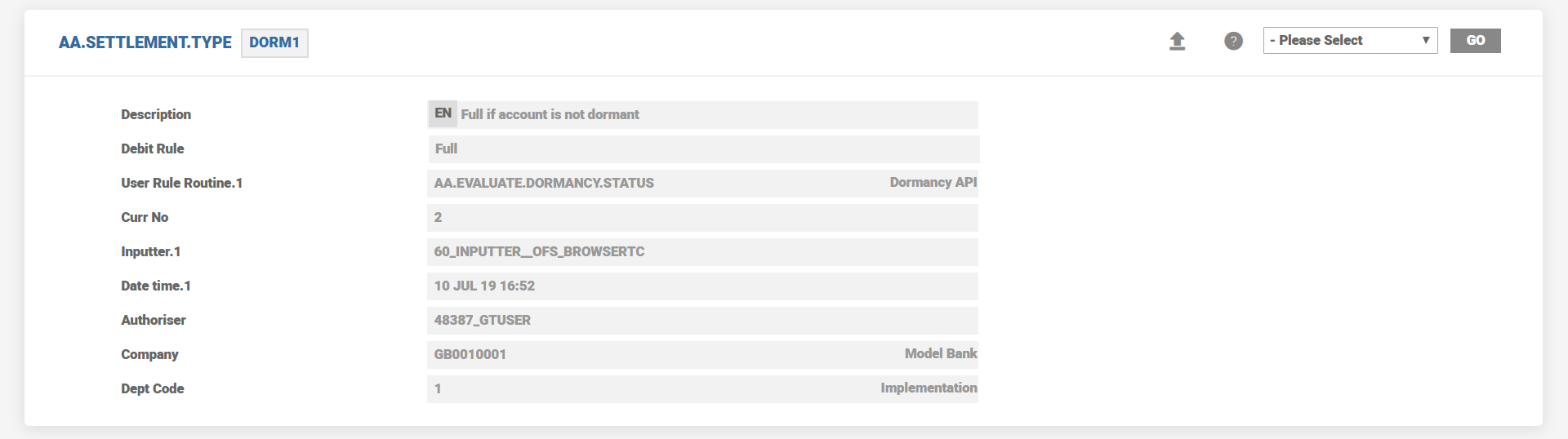

The rule to credit the account is indicated through PAYOUT.AC.CR.RULE

This rule can be setup using AA.SETTLEMENT.TYPE records.

Based on the configuration in AA.SETTLEMENT.TYPE and the defined RC.TYPE and RC.CONDITION in settlement conditions, the system periodically retries to post the debit (payin) or credit (payout) entry.

User-defined Rule Based Settlement Processing – AA.SETTLEMENT.TYPE

A user-defined rule routine can be defined in Settlement Type, which can be triggered during settlement and linked for Transaction Recycling. This can be attached to payin and/or payout condition to have an advanced rule in addition to Full, Partial or None.

Debit Rule

The field decides the manner in which system should utilise the funds available in Payin Account during settlement process with options as Full, Partial and None explained earlier.

User Rule Routine

User defined routine is attached here.

Before processing the Auto settlement or RC, this API is called and checked whether exceptions are raised.

1. If any exception raised, then further settlement processing by Auto Settlement or RC is skipped.

2. Only when no exceptions are thrown, further settlement processing continues either by RC or Auto Settlement.

The routine must contain the following arguments.

Input Arguments

- CallType: Indicates the calling application. Either RC or SETTLEMENT.

- CallApplicationRecord: Contains the calling application Record that is, if the call type is RC then the

RC.DETAILrecord or Settlement then settlement array of corresponding multi-value set is passed. - SettlementMethod: Indicates the settlement request - DEBIT (for Payin) or CREDIT (Payout).

- ArrangementAccount: Arrangement Account Reference.

- SettlementAccount: Settlement Account Reference.

- SettlementAmount: Settlement Amount to be collected from the settlement account.

- SettlementType: Reference of

AA.SETTLEMENT.TYPE

Output Arguments

Exceptions: Valid Temenos Transact error IDs for any exceptions raised. Multiple error IDs are separated by #

Given below is a settlement type that is a user rule routine which evaluates the dormancy status of the arrangement. This routine blocks the settlement from or to a dormant account.

Given below is a sample RC.CONDITION setup for handling Payout settlements.

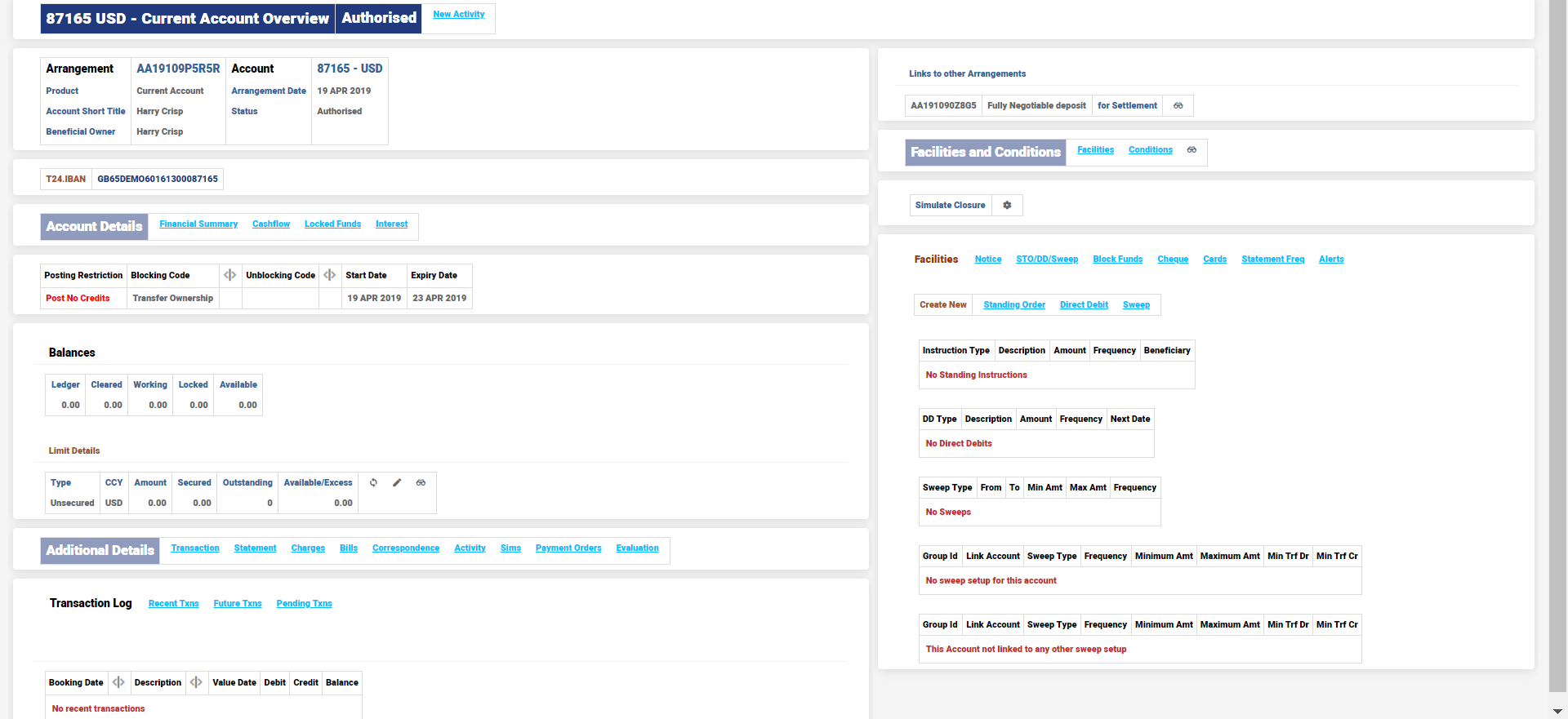

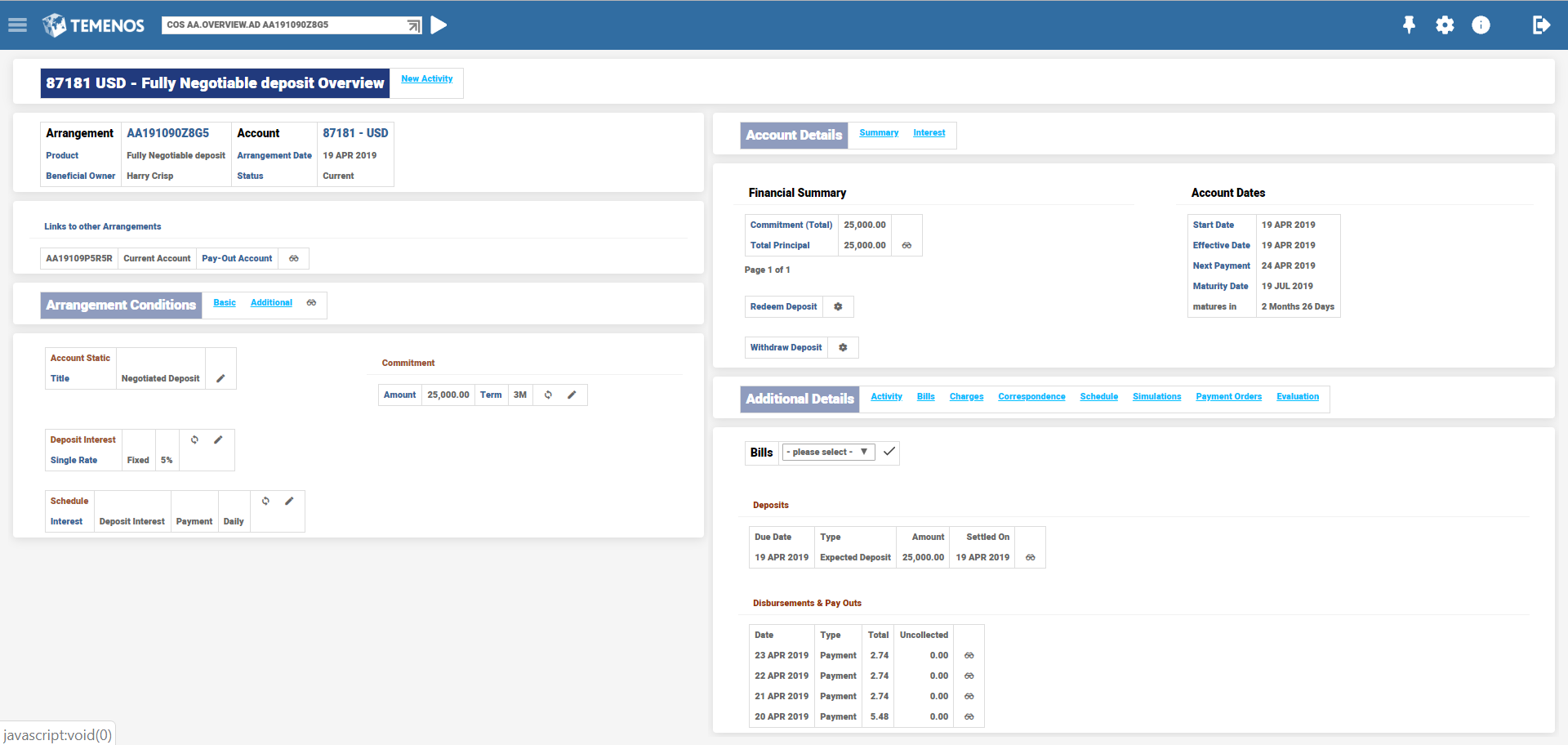

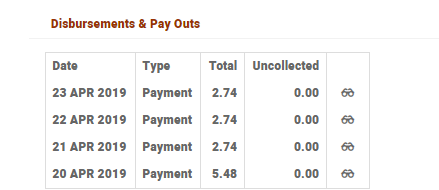

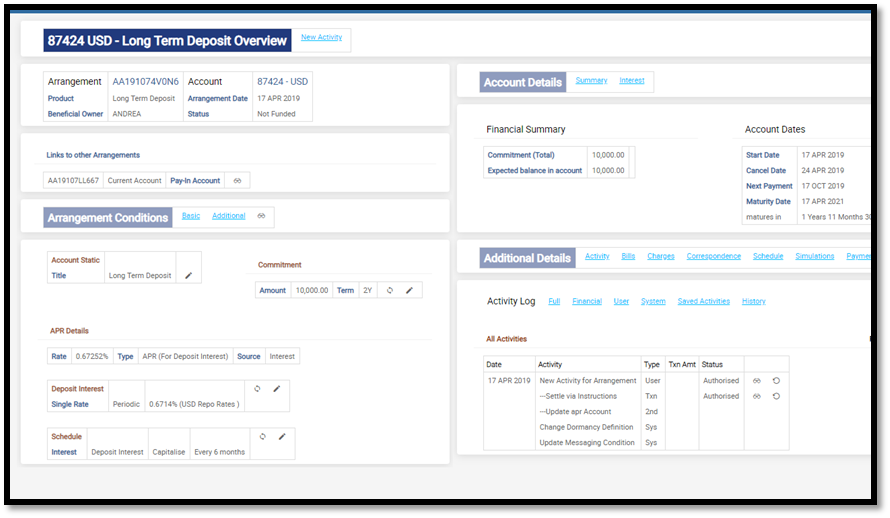

The deposit has Daily Interest Payout and a Settlement account which has a posting restriction. The arrangement start date is 19th April 2019.

Settlement Account Overview with posting restriction from 19th to 23rd April 2019 is shown below.

When a COB is triggered on 22nd April, note that the Interest Payout gets successfully settled until 23rd April, once the posting restrict is lifted from the account during Start of Day.

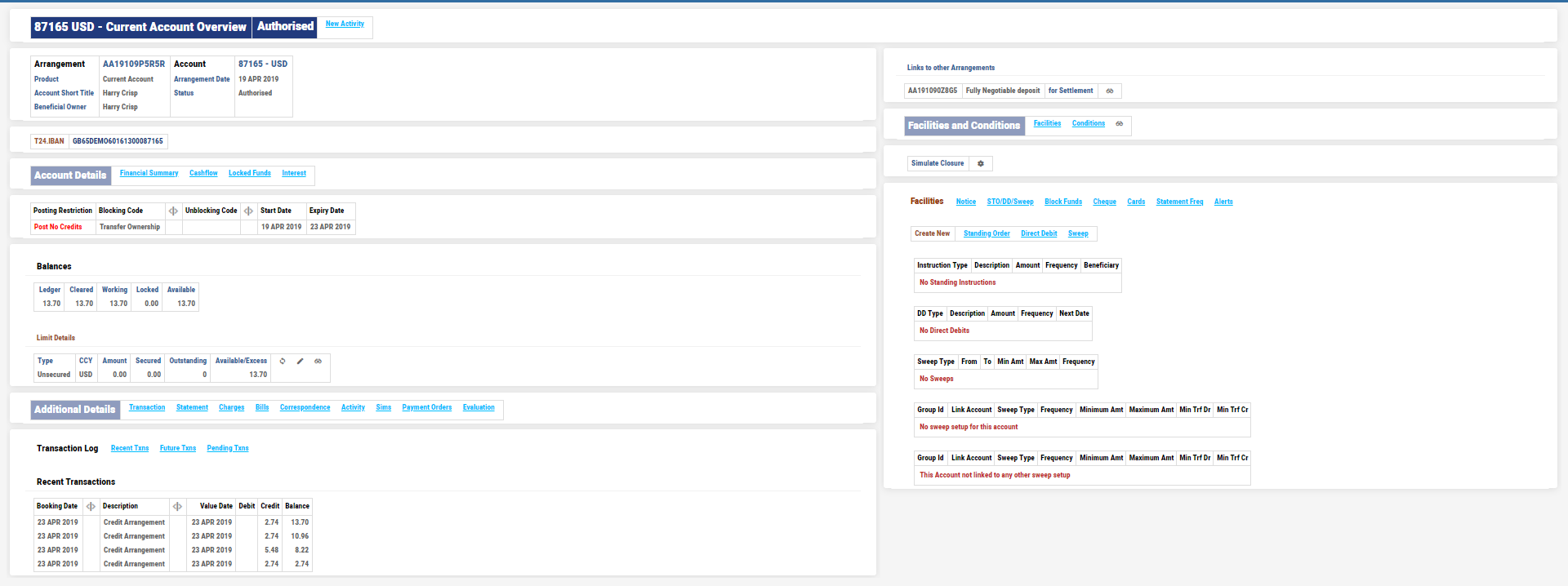

On 23rd April, the credits are posted on the Settlement account.

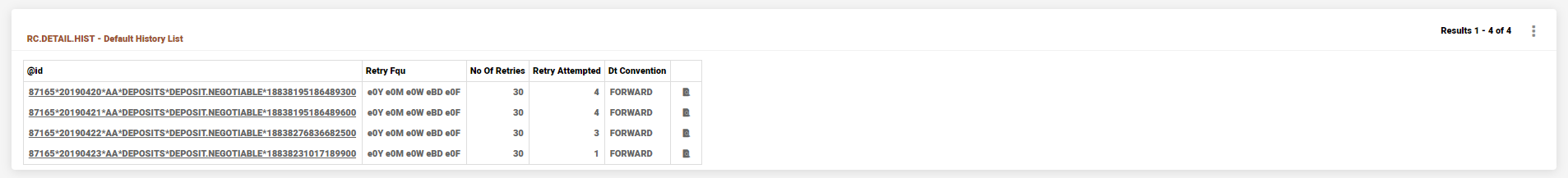

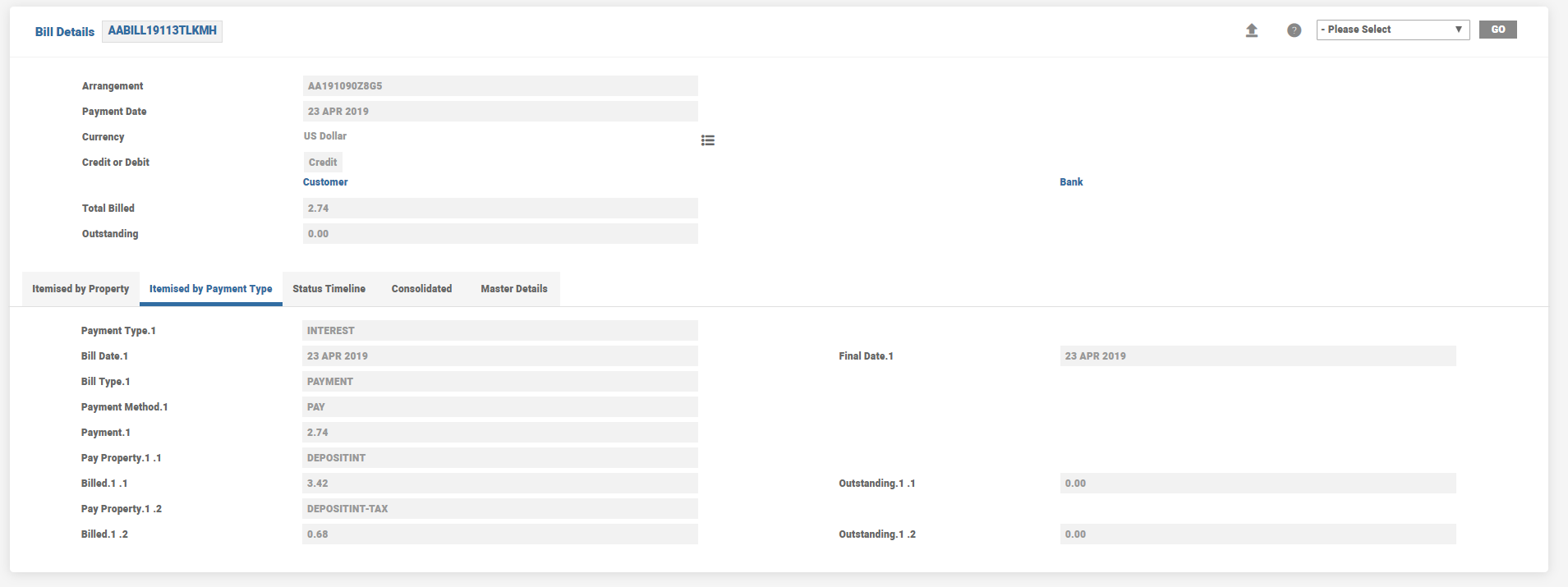

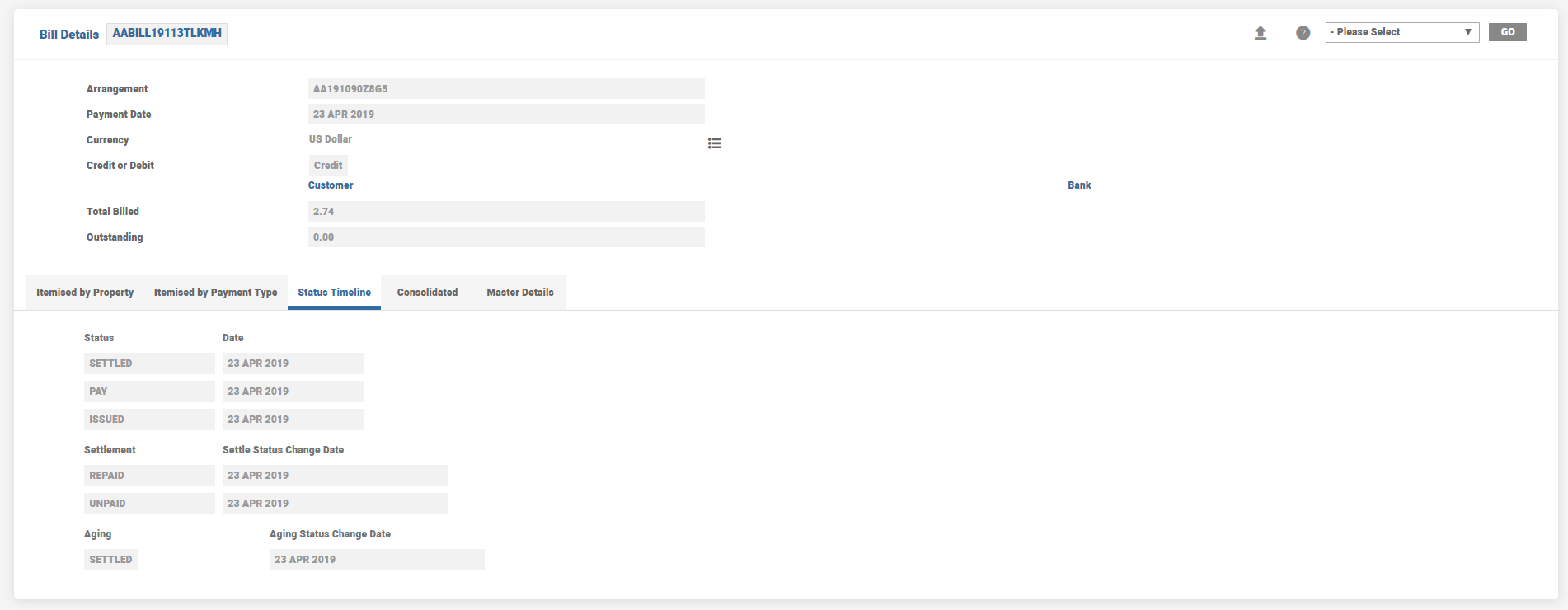

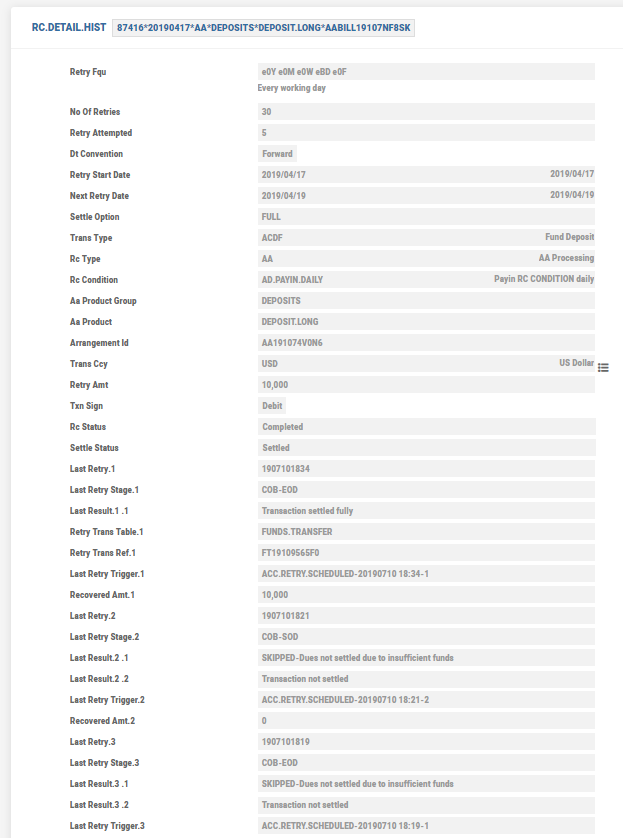

RC.DETAIL.HIST holds the information on the retry details and settlement status when each Interest Payout Bill is triggered by the system.

Observe in RC.DETAIL.HIST entry, the settlement status and retry history is stored. Until the bill gets settled the RC record is held in RC.DETAIL table. Upon successful settlement it moves to RC.DETAIL.HIST.

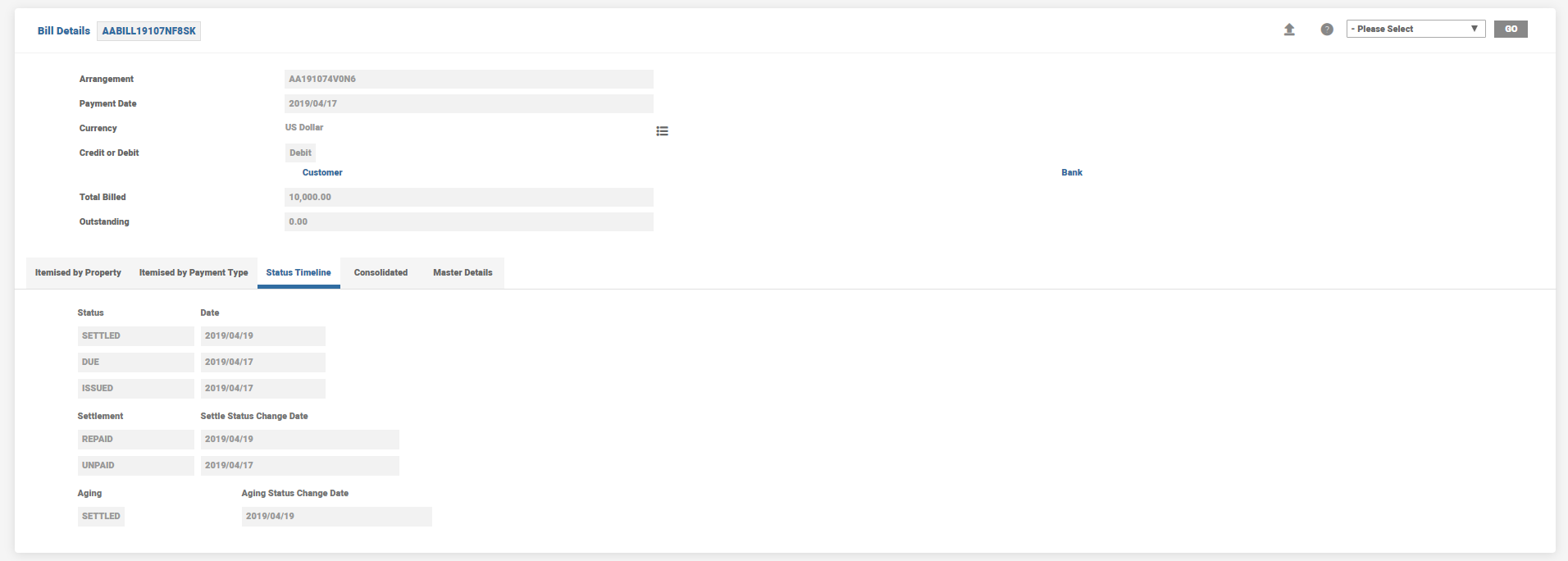

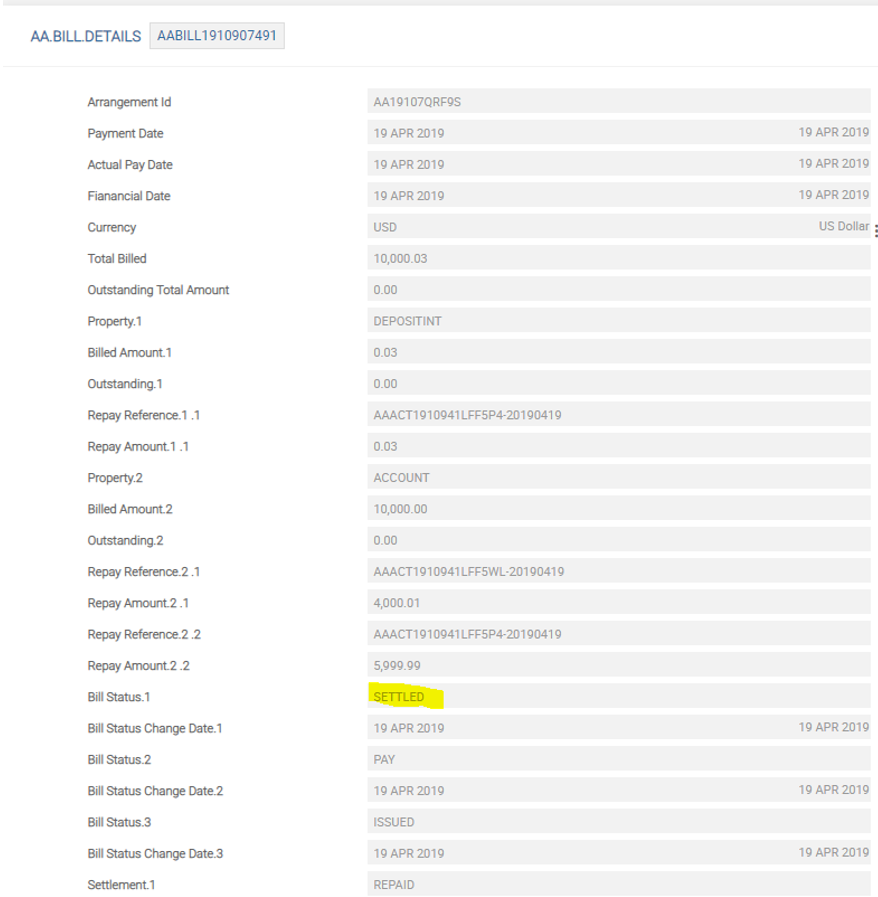

AA BILL DETAILS record is updated as below.

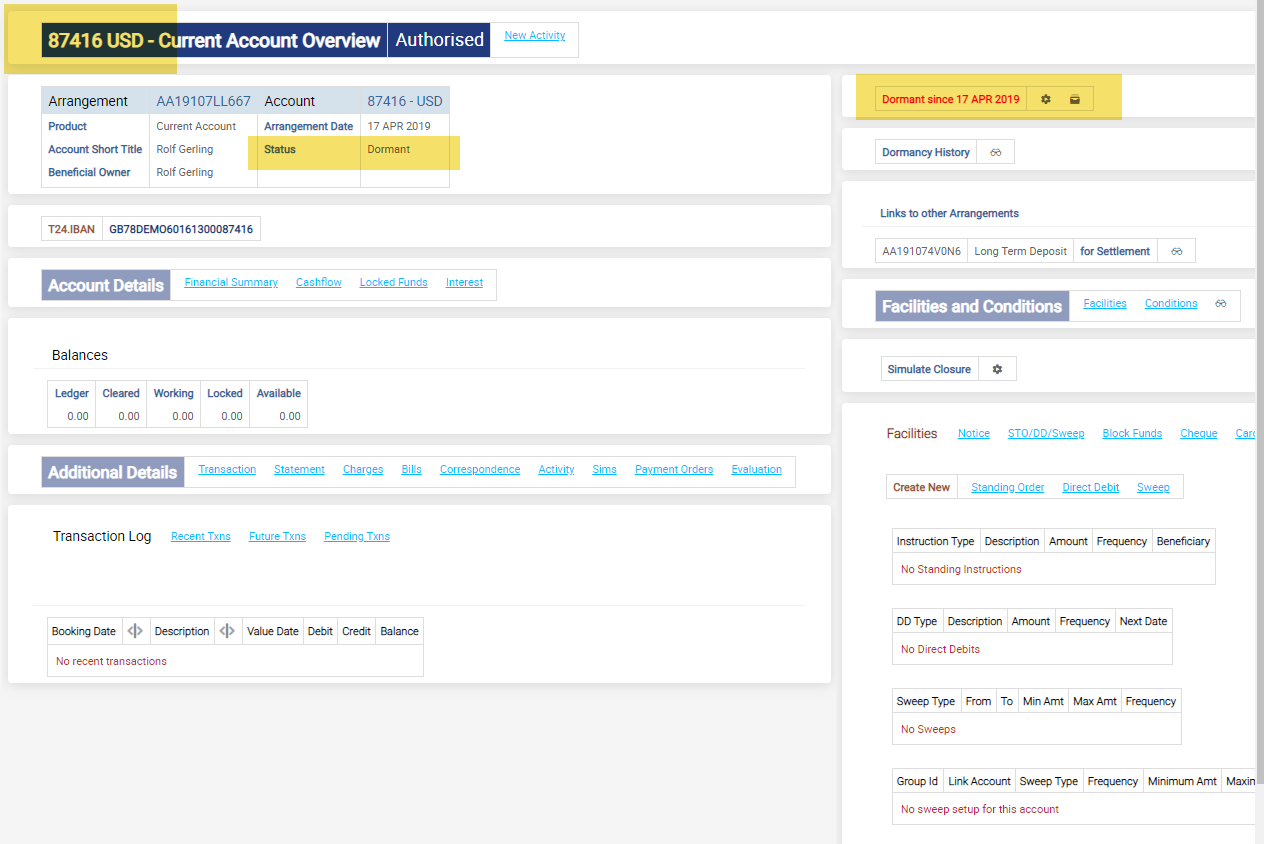

A deposit is linked to a Pay In settlement account which is dormant.

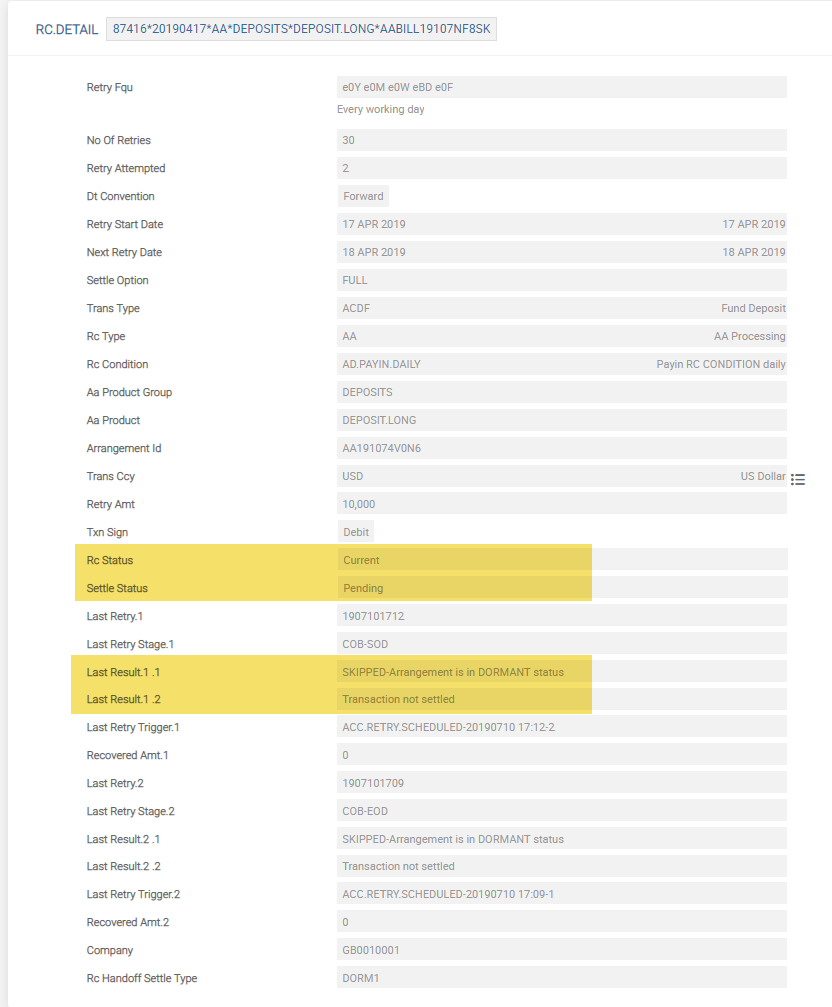

Recycler Condition retrying to deposit funding on a daily basis is shown below.

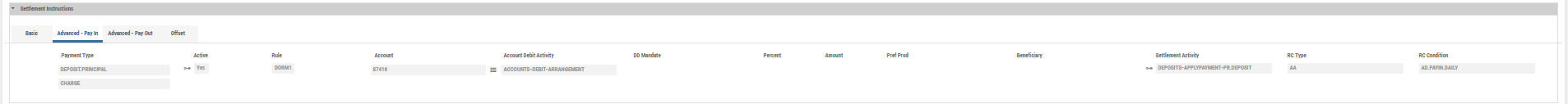

Settlement Type record for dormancy evaluation is created.

A deposit is created with Payin account which is dormant.

RC.DETAIL record for with Pending status since deposit funding is on hold due to a settlement account which is dormant.

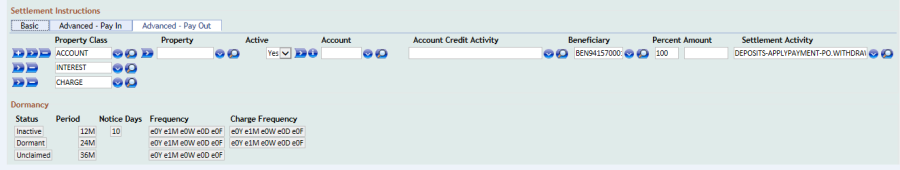

Settlement Instructions is shown below.

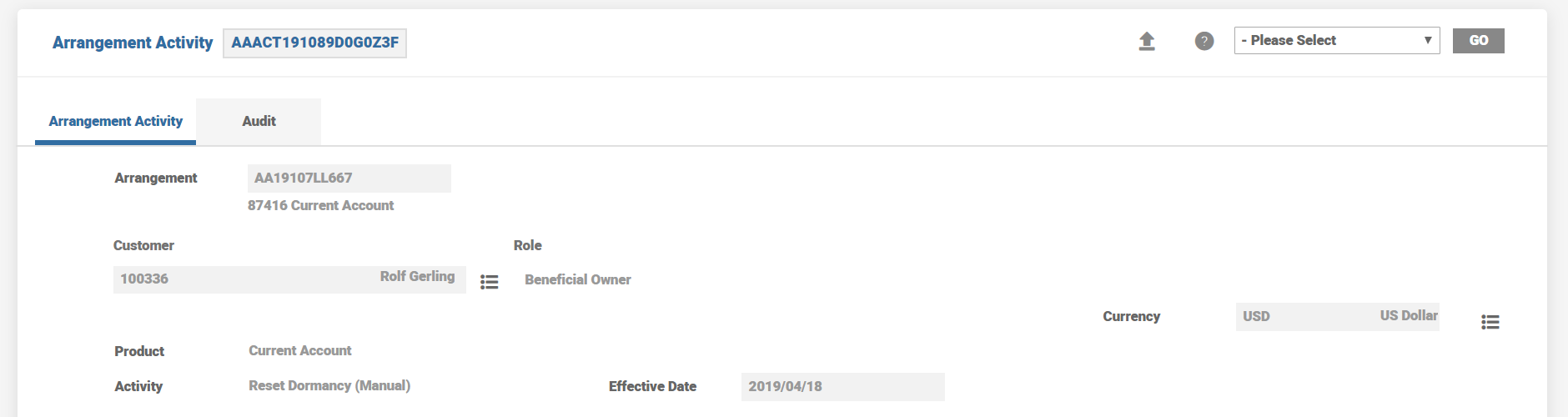

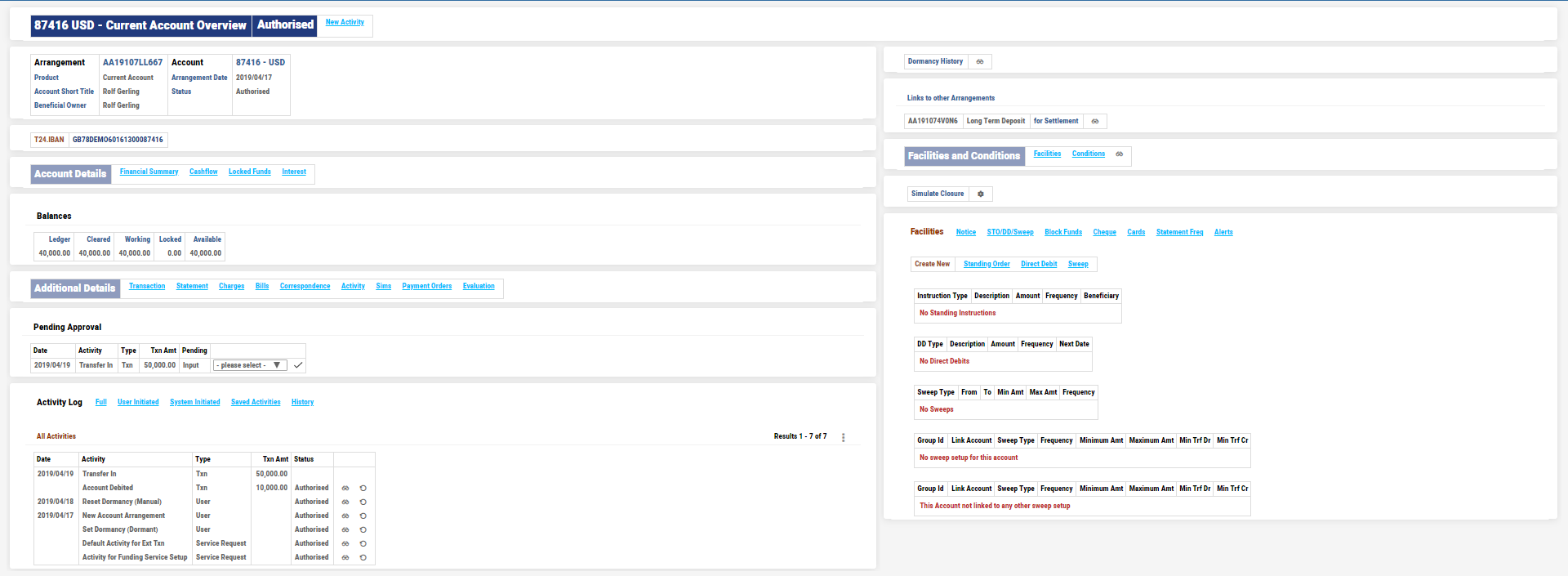

The Dormancy status of the Settlement is changed to Active through a Manual Dormancy reset activity. This is achieved by triggering a funding on the account for USD 50000. The account which was dormant on 17th April becomes active on 18th April after the Dormancy Reset Activity.

Once the account becomes active, during the subsequent retry cycle (COB) the deposit is funded with USD 10000 and the account balance reduces to USD 40000 on 19th April.

Fully Funded Deposit is shown below.

Bill Details screen is as follows.

RC Details in History after Settlement

Any financial arrangement that utilises the Settlement Property Class, that is, Loan, Deposit, Accounts or Agent can generate a payment order request automatically. Depending on the configuration in the arrangements settlement screens, either a request for funds (receipt) or a request to pay (payment) message is generated and sent to the payment system. The payment system can be either Temenos Transact Funds Transfer or Temenos Transact Payments Hub or an external payment system.

The PAYMENT.ORDER (outward flow of funds) is generated from the system when the ISSUE.ORDER activity is triggered either online or from a scheduled process. Its function is only to produce and send the required PAYMENT.ORDER. When the subsequent MAKEDUE activity is triggered, the accounting updates the CURxxxxxx and ACCxxxxxx balances and creates the PAYxxxxx balances.

The debit to the relevant PAYxxxxx balances are triggered only when the payment has been acknowledged as successful by the payment system.

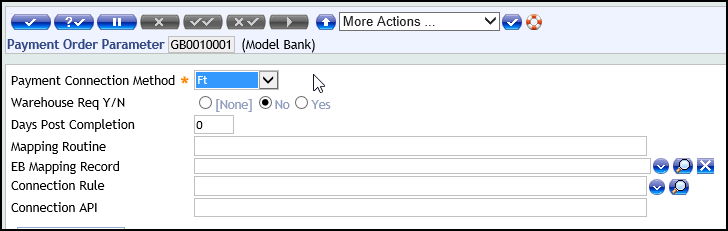

PAYMENT.ORDER.PARAMETER: This controls how the payment order is mapped to applications in Temenos Transact.

An example is that, Funds Transfer is the required Temenos Transact module used to generate the payment message. This decision is made as per individual implementation. If Funds Transfer is the decision (and as per this User Guide section it is) then the configuration is needed and the value of Ft is needed in the Payment Connection field as shown below.

PAYMENT.ORDER.PRODUCT: This table is used to ensure necessary payment products are defined for a particular implementation. Depending on the configuration in PAYMENT ORDER PRODUCT this drives how Temenos Transact processes and handles different payment order events.

Read Payment Order - User Guide for more information on Payment Order Product.

TheBeneficiary field is a link to the core BENEFICIARY table and is used to define the ultimate beneficiary of the funds. Along with values from the PAYMENT.ORDER.PRODUCT record the BENEFICIARY record is mapped to the PAYMENT ORDER application and to FUNDS.TRANSFER (FT) or TPH.

A Temenos Transact account which is to be credited, can be defined in the beneficiary record. The beneficiary can be customer or bank defined

It is an optional field with the below features:

- It is mutually exclusive with Account

- It is used in conjunction with Pref Product

- It drills down to the BENEFICIARY table

- The BENEFICIARY table captures and maintains customers’ most frequent payee details.

- A Payee once setup can be used while initiating payments, setting up a payment order, or used in settlement conditions for loan and deposit to indicate where the disbursement or deposit payment should be made.

- User can be cautioned when changing an account number in the payee instruction if this is used in any active contracts, that is, settlement conditions.

- To control this, set the option Validate Beneficiary Link as Yes in DE.BIC.PARAMETER. Once initiated, system uses the BENEFICIARY.LINKS record to generate a warning message during the account closure process or if a beneficiary record is changed, it produces an override message.

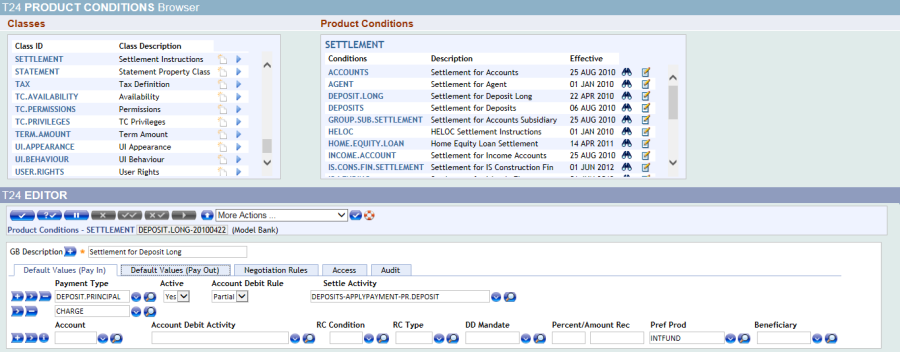

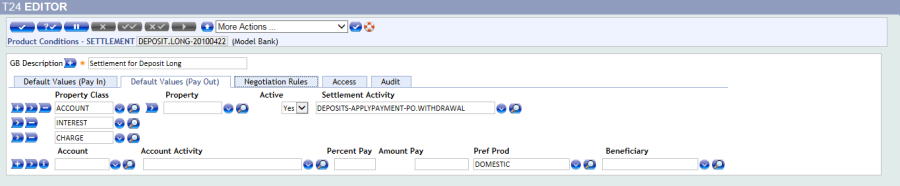

For example as shown below, a Long Term Deposit Product can be defined in this case for which the Settlement Product Condition is attached and defaulted with a preferred Payment order products as INTFUND and DOMESTIC.

As per product configuration, the above shown DEPOSIT.LONG Product Condition can be attached to the Deposit Product

In the following worked example, it is shown that a Payment order can be generated to fund the deposit arrangement. The same configuration and set-up can be used for other purposes like

- Funding a monthly deposit amount (recurring deposit)

- Deposit maturity – that is, pay interest to one beneficiary and principal amount to another.

- Regularly make a payment from a deposit on a scheduled basis

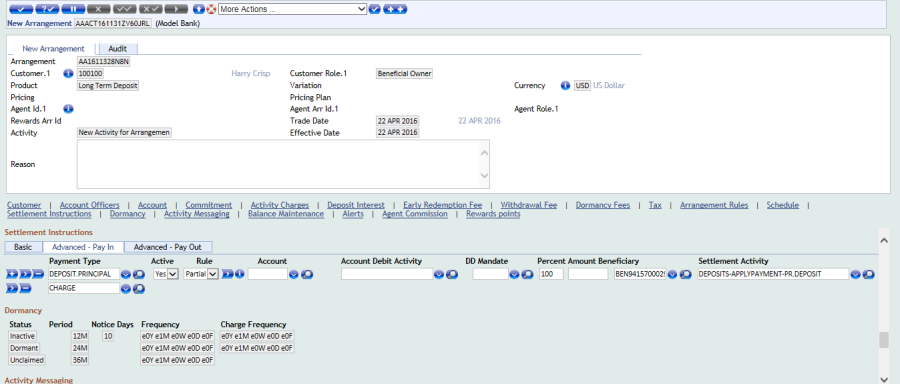

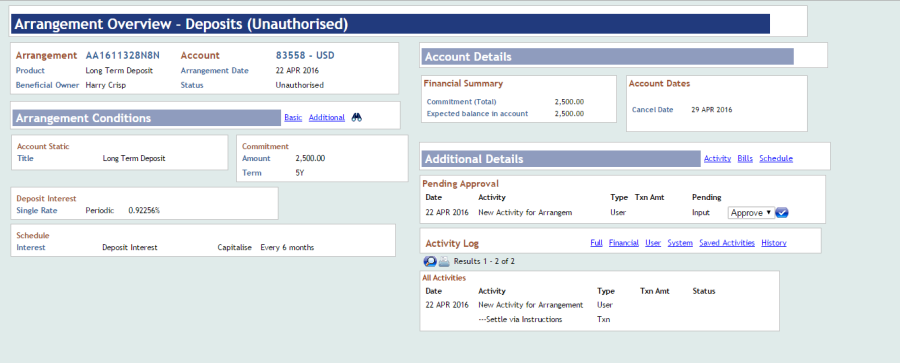

As shown below all the required details are captured in the input screen.

For settlement and funding, the following BENEFICIARY record has been defined.

For the Maturity deposit the following BENEFICIARY record has been defined and captured.

The deposit needs to be authorised in the usual manner.

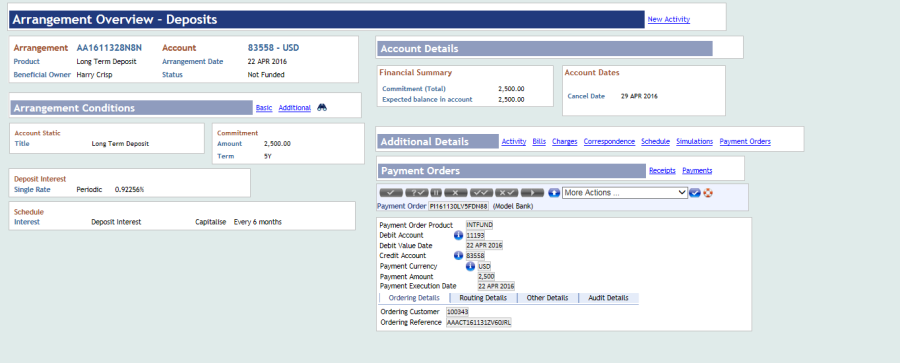

After authorisation of the Long Term Deposit arrangement, click on the Payment Order tab under the Additional Details banner.

On clicking this, the Payment order details are shown as below,

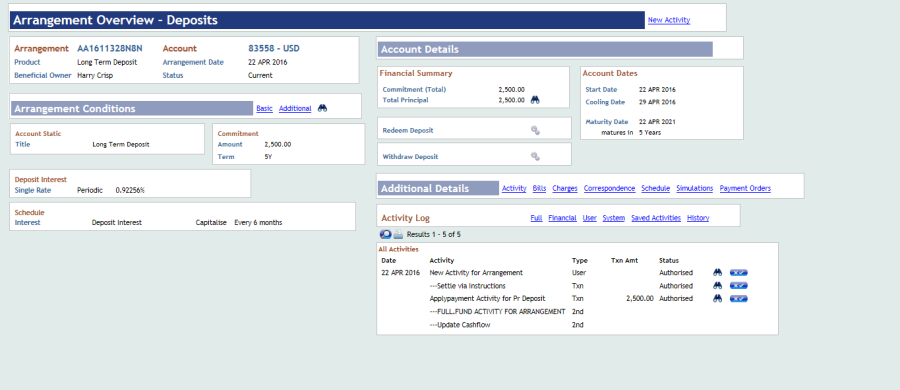

For the Long Term Deposit account no 83558-

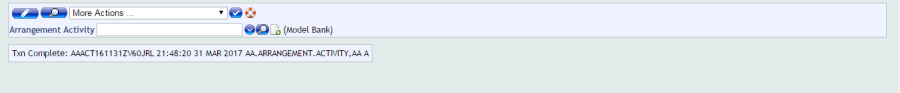

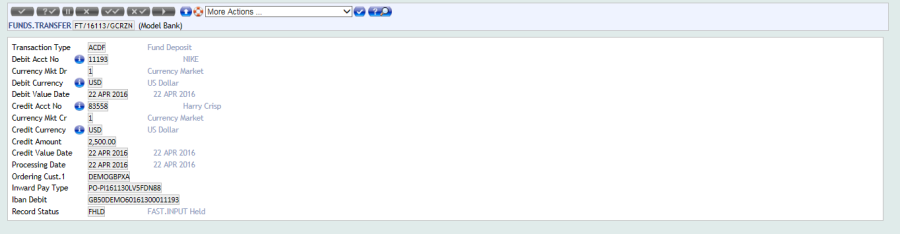

The following screen shot shows the details of P1161130LV5FDN88 payment order, which also consists of Payment System ID which is nothing but an FT ID – FT 16113GCRZN

Following screenshot shows the Funds Transfer details

After running necessary OFS service (BNK/OFS.MESSAGE.SERVICE) which processes the payment orders, the status in the Overview screen for the Deposit Account changes from Not Funded to Current.

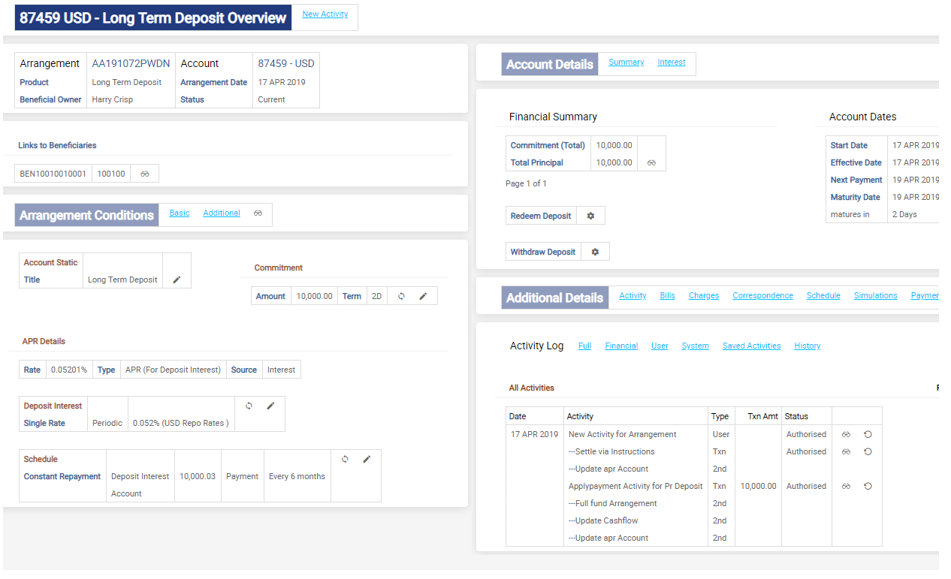

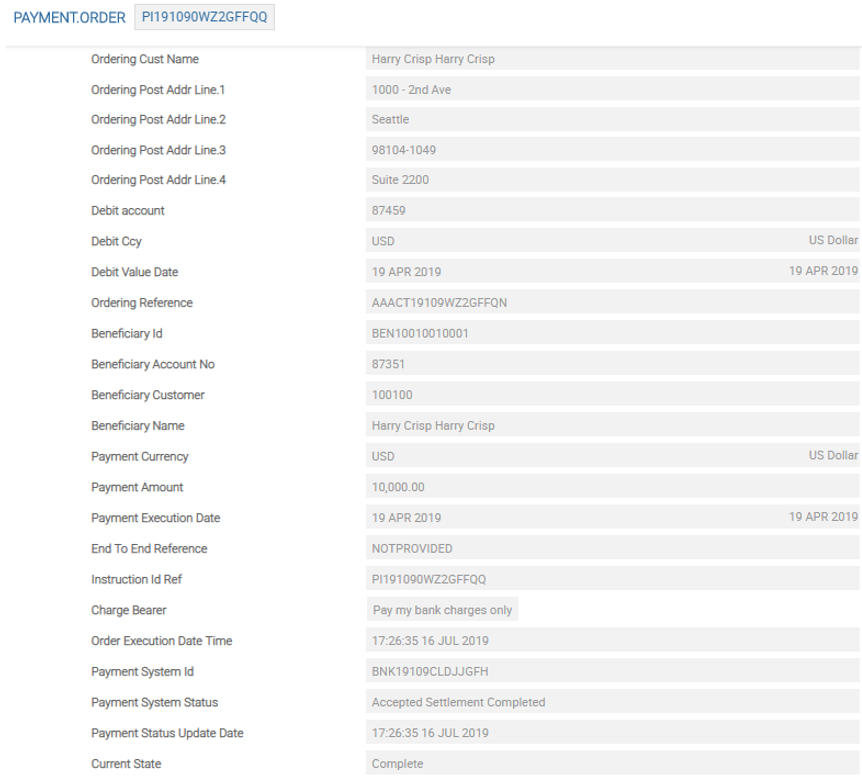

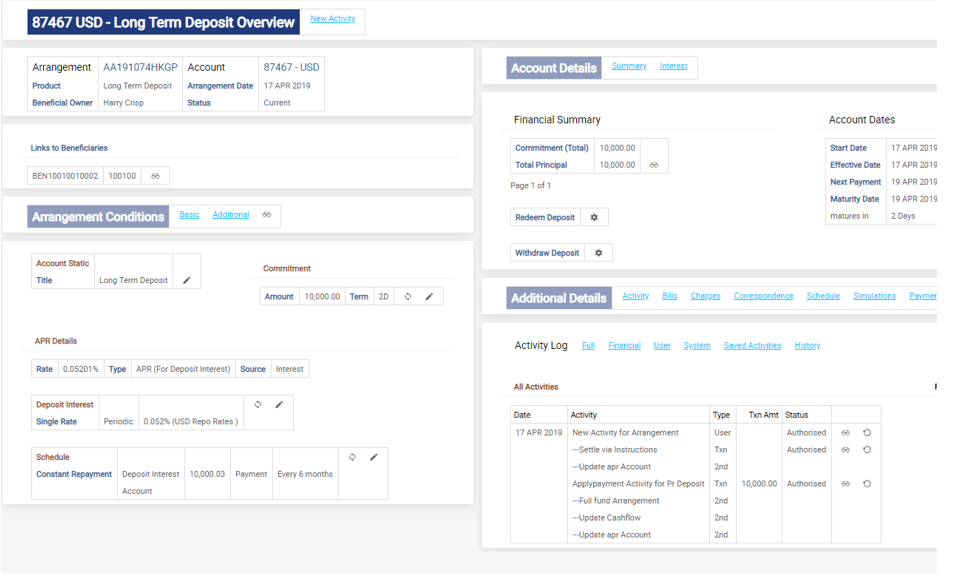

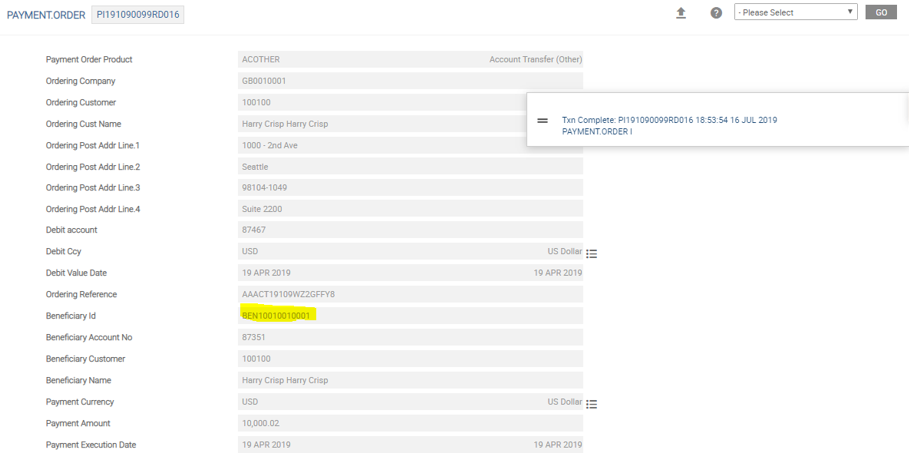

A Fixed Term deposit for the principal balance of USD 10,000 is due to mature on the 19th April and paid out via a Payment Order.

The settlement has already been established with the required beneficiary and payment order product details configured.

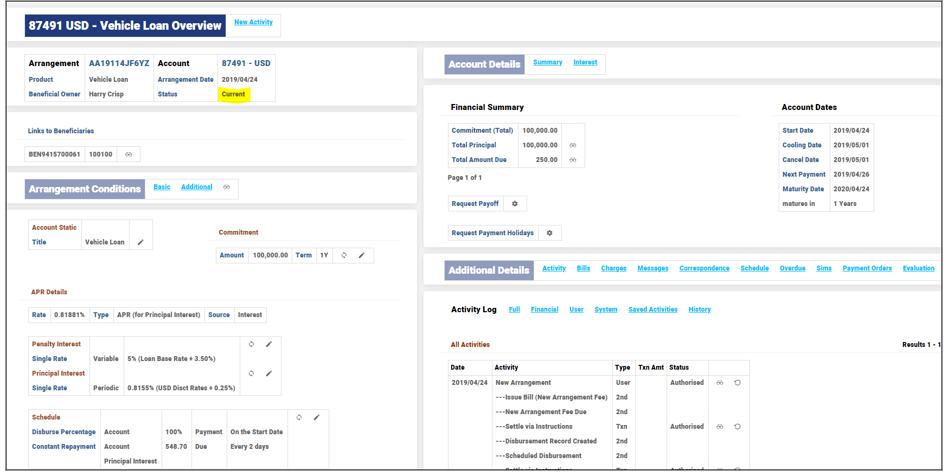

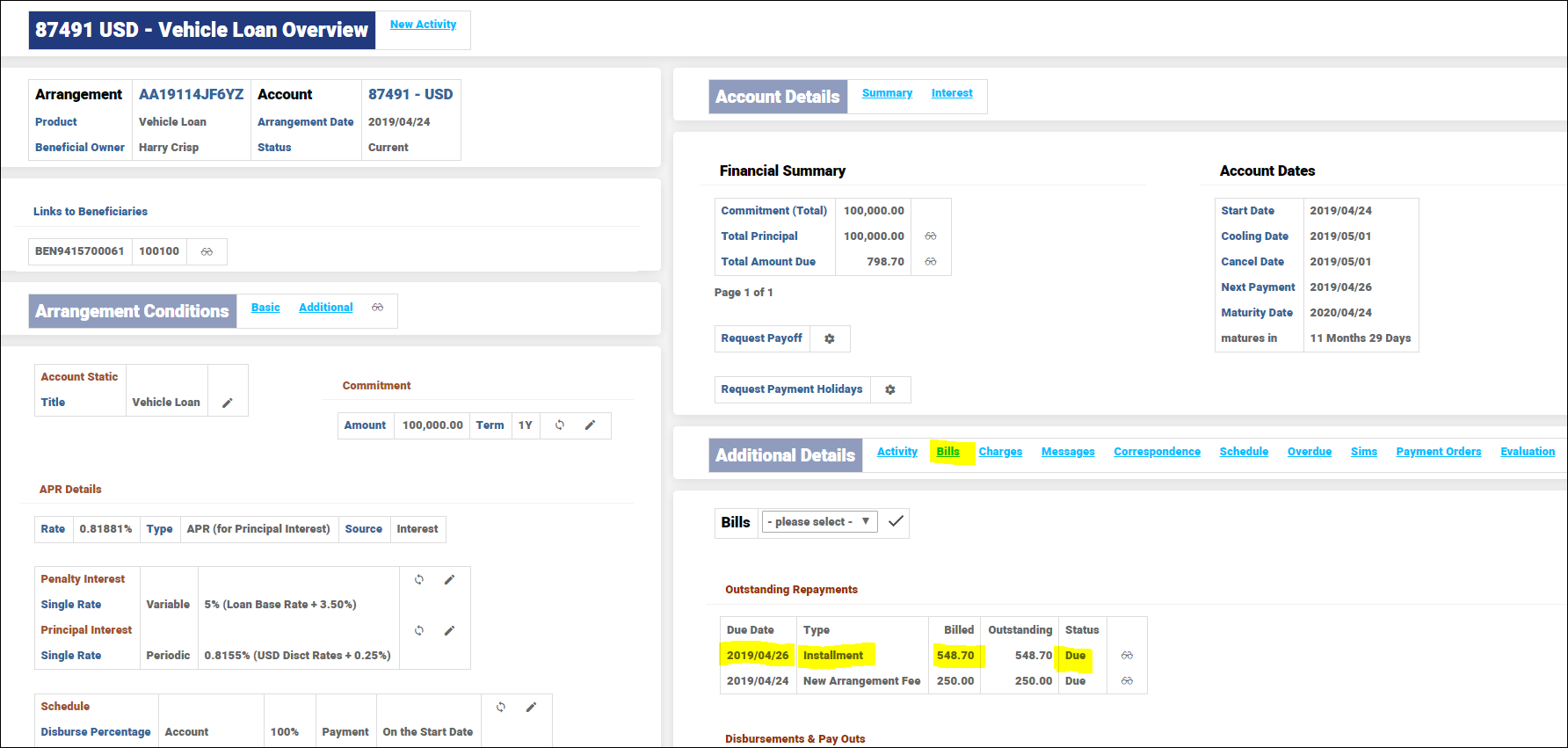

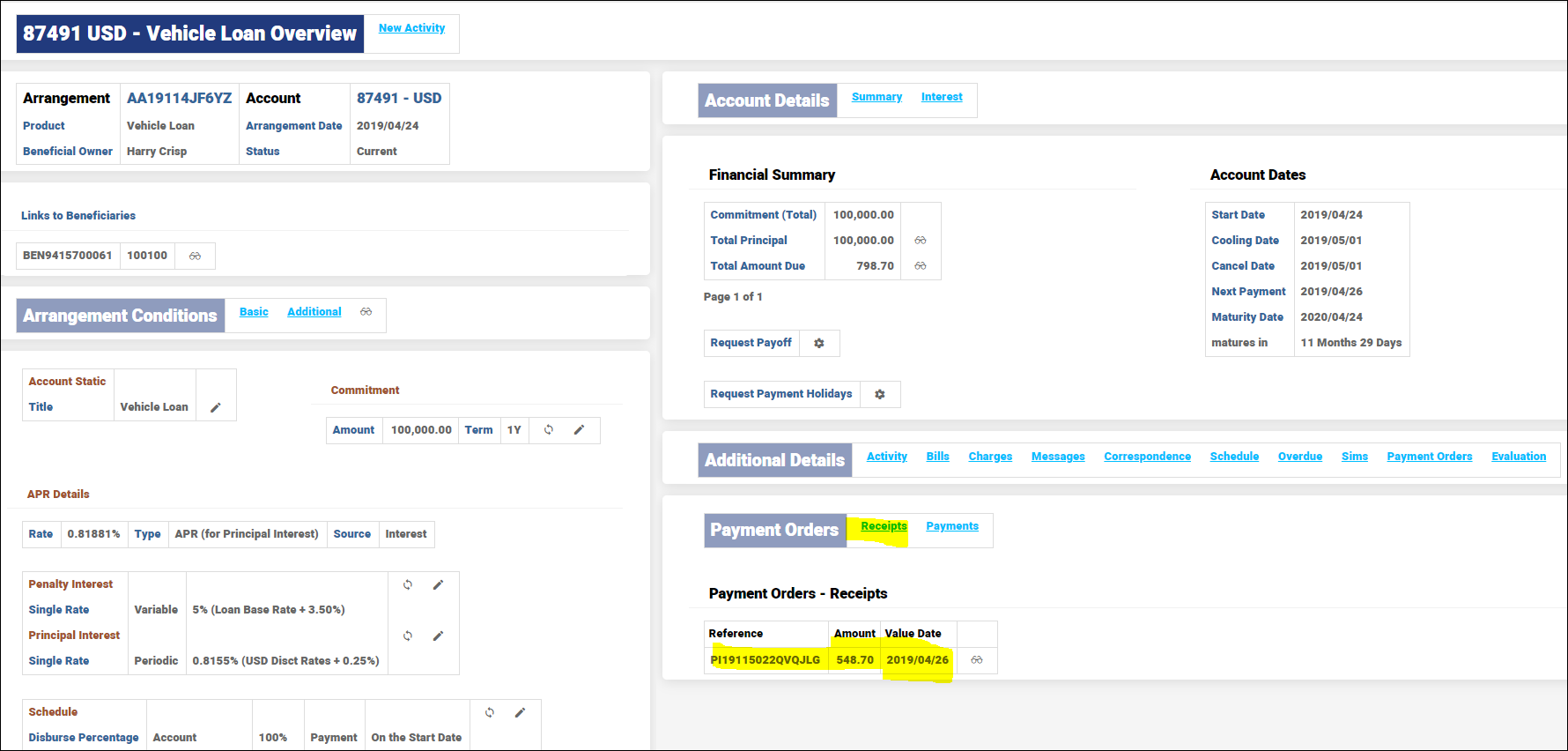

A vehicle loan for USD100,000 with a constant repayment frequency for every 2days is created.

After 2 days of COB, the bill gets generated for 548.70 USD on 26th April 2019.

Payment Order generated for Repayment amount of 548.70 USD on 26th April 2019.

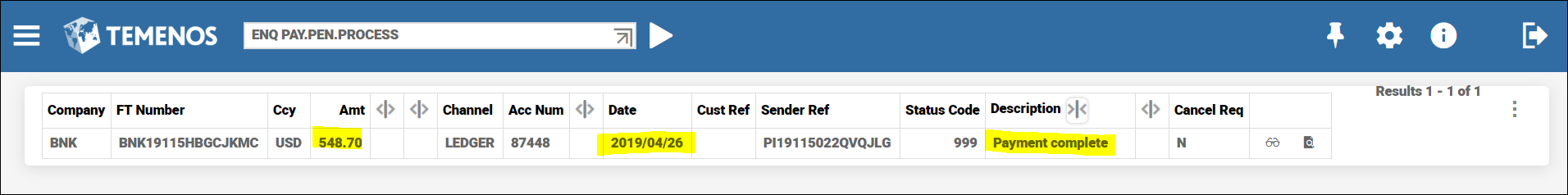

Run the BNK/PAYMENT.STPFLOW.HEAVY Service and check in the ENQ PAY.PEN.PROCESS enquiry whether the payment is successful or not.

A Fixed Term deposit for the principal balance of USD 10,000 is due to mature on the 19th April and paid out via a Payment Order.

The settlement has already been established with the required beneficiary and payment order product details configured.

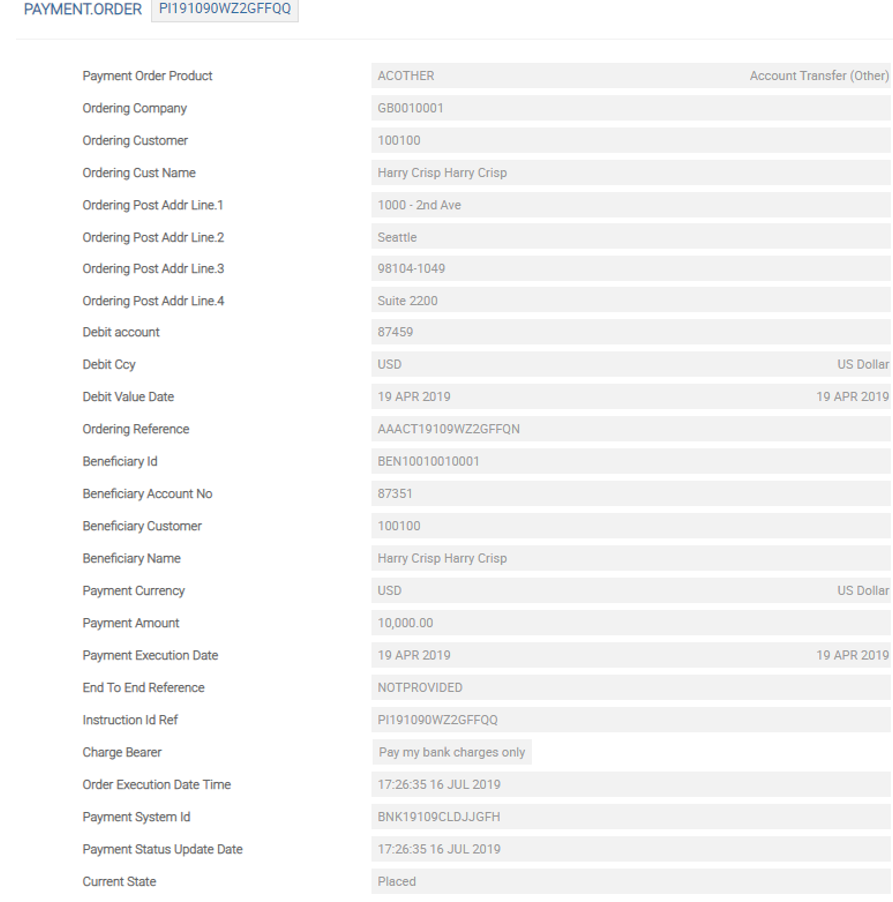

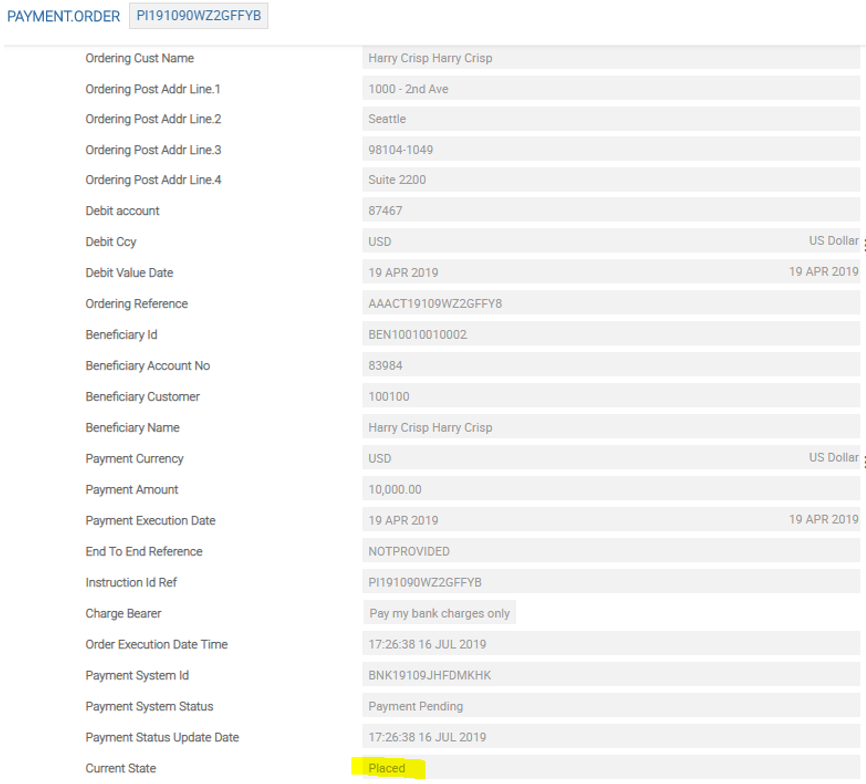

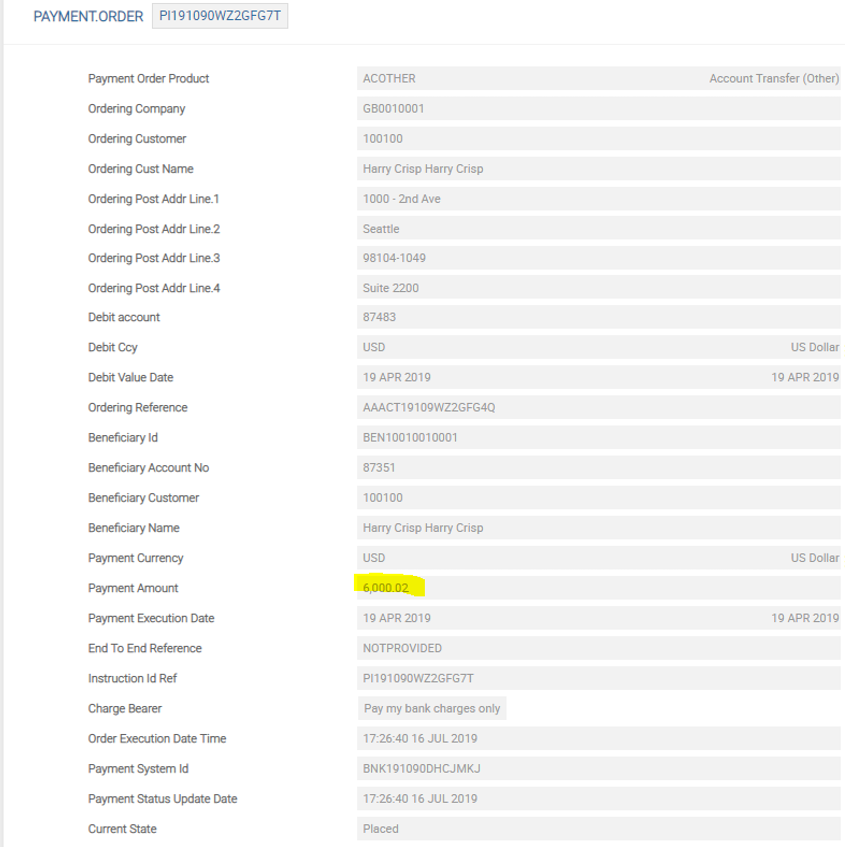

Payment Order generated

Contract is matured and ready to get settled to the beneficiary.

But due to incorrect beneficiary information and the bill is not settled. A manual Payment Order has to be created to settle the bill.

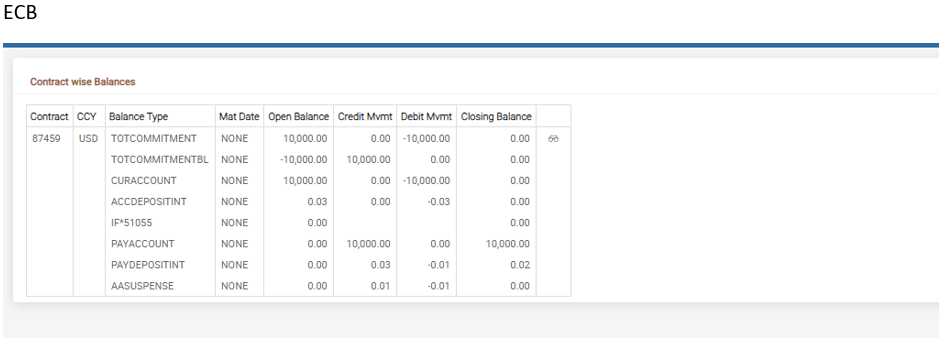

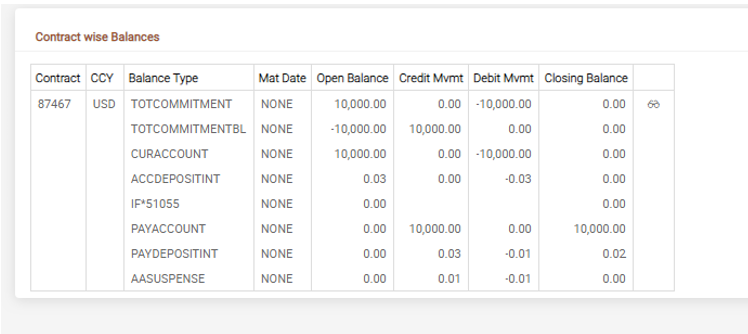

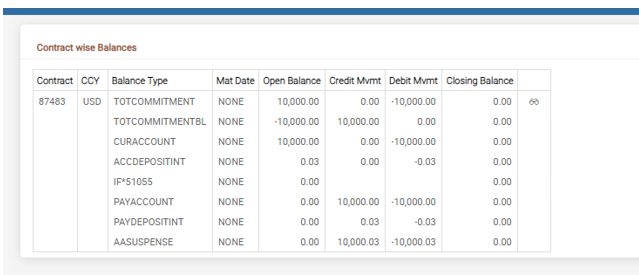

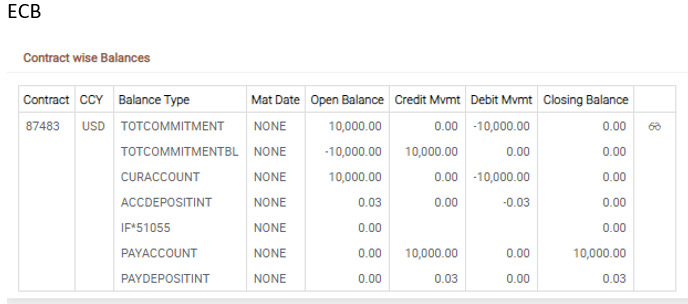

Confirmation is received that payment has been made – Pay balances are allocated.

- Debit the PAYACCOUNT balance for USD10,000.00

- Debit the PAYDEPOSITINT balance for USD0.03

The bill is marked as Settled.

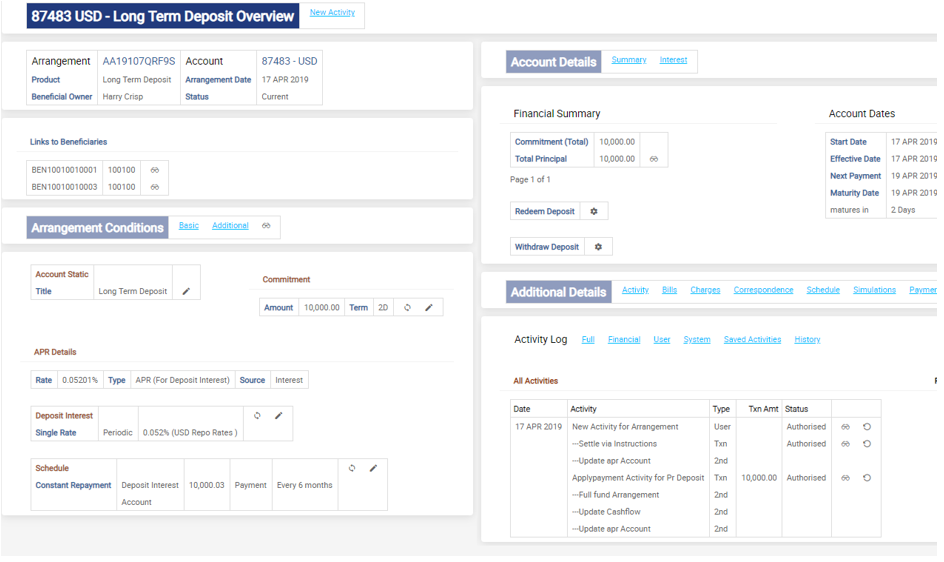

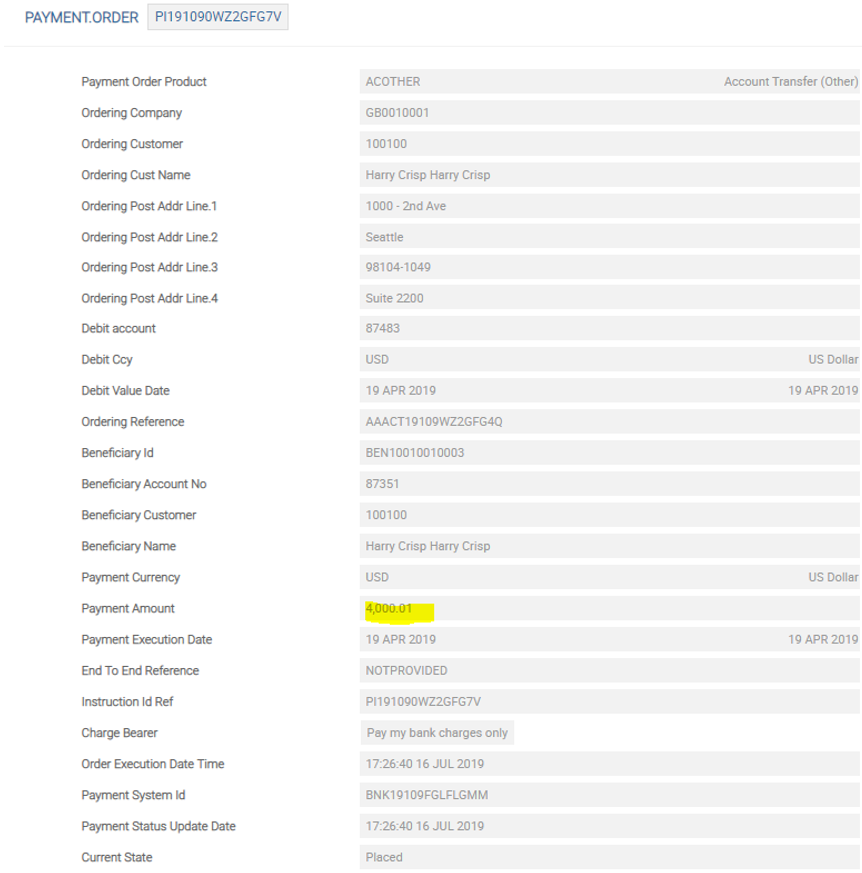

A Fixed Term deposit is due to mature on the 19t April with principal and interest being paid out via a Payment Order. The principal balance is USD10,000.00.

Meanwhile the customer sends an instruction for the deposit’s maturity and asks for 60% to be paid to one beneficiary and the remainder to be paid to a second beneficiary.

The settlement had already been established but the instructions are amended based on the communication received.

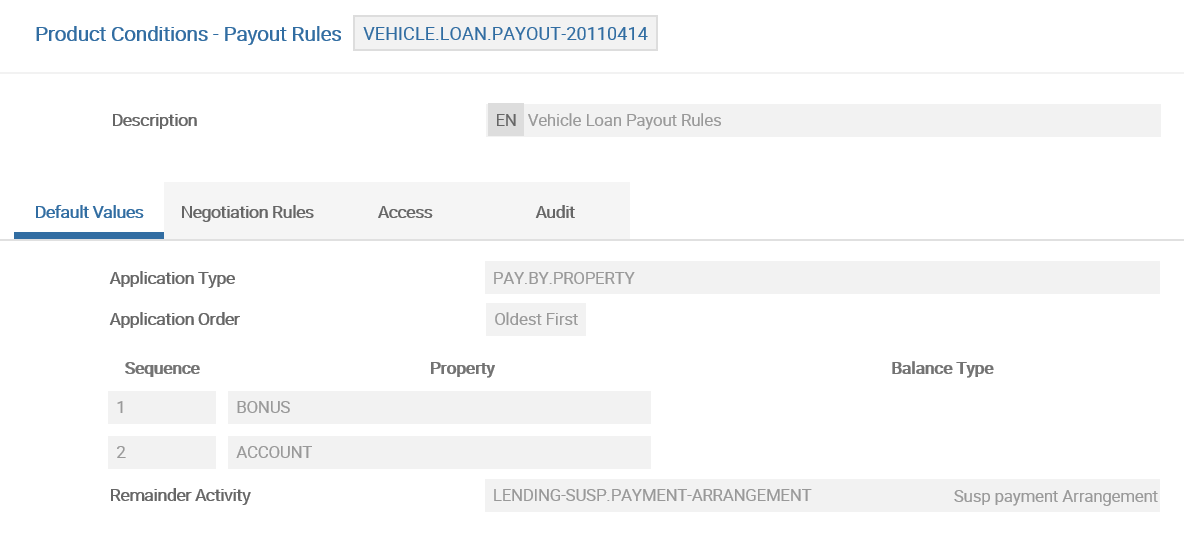

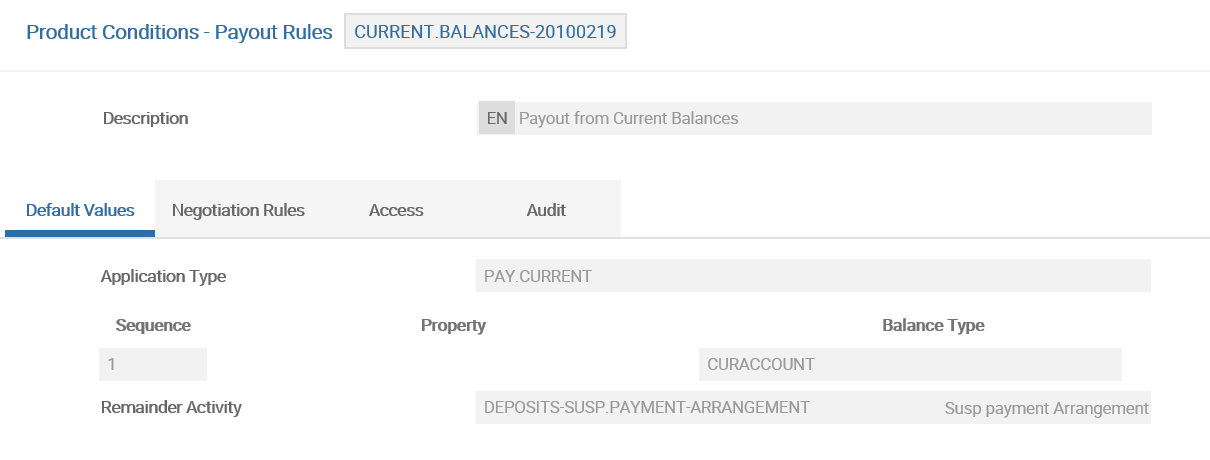

The Product’s PAYOUT.RULES are configured to settle in the following AA Property order with a DEPOSITINT (interest) first then the ACCOUNT (Balance) sequence.

The bill is marked as Settled.

A payment order can be generated on the value date or on in advance using the payment order product defined in the payment order product. The advance days is determined from payment order system and currency settings.

The Activity to issue payment order in advance is triggered by the system in advance. For advance payment orders, when the ISSUE.ORDER activity is triggered for the payment order, no accounting entries are posted until the receiving payment system sends an acknowledgement for the payment order.

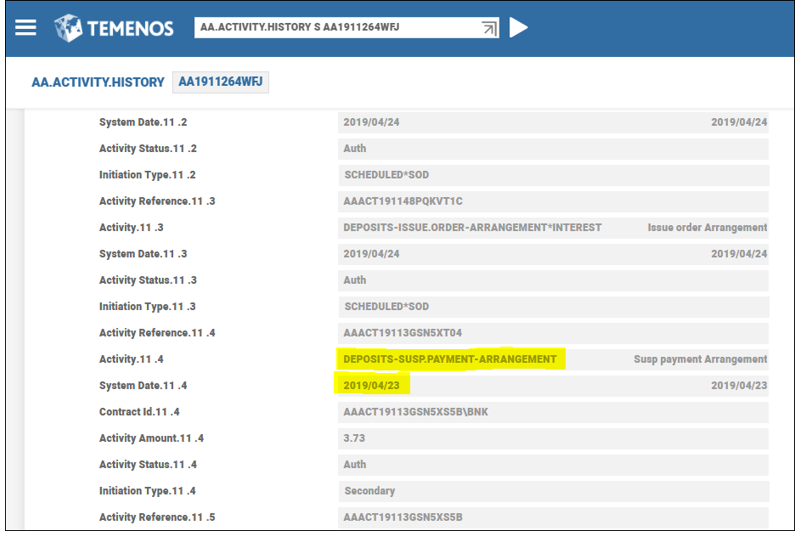

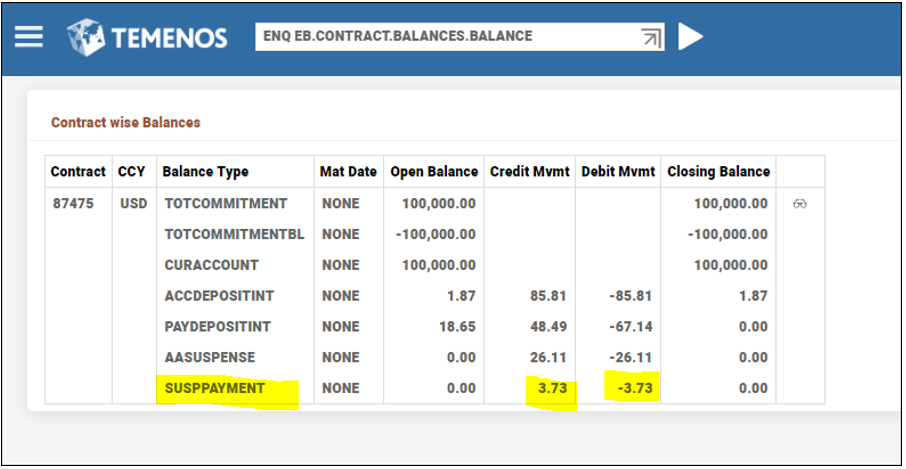

When a pay bill has this payment order raised in advance, the beneficiary account has to be paid in advance by certain number of days. As there a no PAY balances yet, system triggers reminder activity. Hence, when a product is configured for advance payment orders, LENDING-SUSP.PAYMENT-ARRANGEMENT must be used as the reminder activity in Payout Rules. Thus the unbilled amount is parked in SUSPPAYMENT balance. The action DEBIT.SUSPPAY is used for this purpose in Settlement Property Class.

When an acknowledgement is received via OFS, <PL>-APPLYPAYMENT-PAYOUT.RULES is triggered, based on the payment rules defined, to settle each of the property or balances. If there are no balances to be settled, reminder activity is triggered thus indicating that the activity is an acknowledgement towards the payment order and posted against SUSPPAYMENT balance type.

Thus during the <PL>-SUSP.PAYMENT-ARRANGEMENT activity, the system posts a debit to SUSPPAYMENT and credits AASUSUPENSE.

On the value date, the ISSUE.BILL activity is triggered and MAKE.DUE is also triggered.

The balance in PAY balance is offset with SUSPPAYMENT. That is, a debit in PAY balance and credit in AASUSPENSE. The bill is marked as settled on value date when SUSPPAYMENT is zero. DEBIT.SUSPPAY action in Settlement Property Class and SETTLEMENT-DEBIT.SUSPPAY-PAY-SUSPPAYMENT events are used in this process.

The ADVANCE.PAY action is not linked to MAKE.DUE activities anymore. But LENDING-AUTO.DISBURSE-TERM.AMOUNT is triggered by ADVANCE.PAY if activity is MAKEDUE.DISBURSE, initiation type is scheduled and payment order is initiated in advance. This is to update the CURACCOUNT balances for the disbursement bill.

<PL>-ADJUST.SUSPPAY.BALANCE-BALANCE.MAINTENANCE activity can be used to adjust the balance in SUSPPAYMENT when payment order amount is different from that of the actual bill amount. The ADJUST.SUSPPAY.BALANCE action is used to adjust balances to SUSPPAYMENT balance type is used in the activity. The events to raise accounting entries for ADJUST.SUSPPAY.BALANCE are ACCOUNT-CREDIT-DUE-SUSPPAYMENT and ACCOUNT-DEBIT-PAY-SUSPPAYMENT.

During Redeem or Payoff, any balance in SUSPPAYMENT is automatically adjusted by the system. The ACCOUNT-REDEEM-DUE-SUSPAYMENT, ACCOUNT-ADVANCE.REPAY-DUE-SUSPAYMENT, ACCOUNT-CR.MOVEMENT-DUE-SUSPAYMENT, ACCOUNT-DR.MOVEMENT-DUE-SUSPAYMENT events are used to raise adjustment accounting entries for SUSPPAYMENT during REDEEM and PAYOFF activities of an Account.

When an activity charge is configured to be payed-out via payment order, the payment order is generated by issue bill activity and settled via payout rules and hence there will be no impact on SUSPPAYMENT balance if the primary activity is reversed.

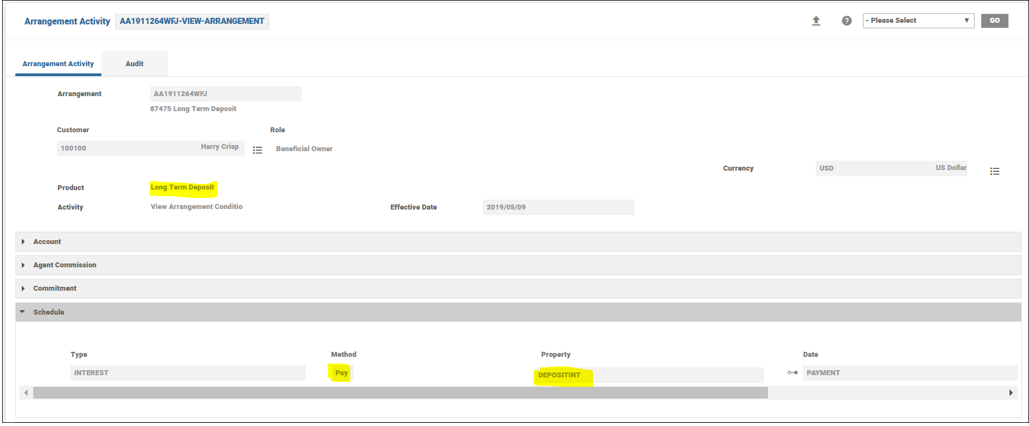

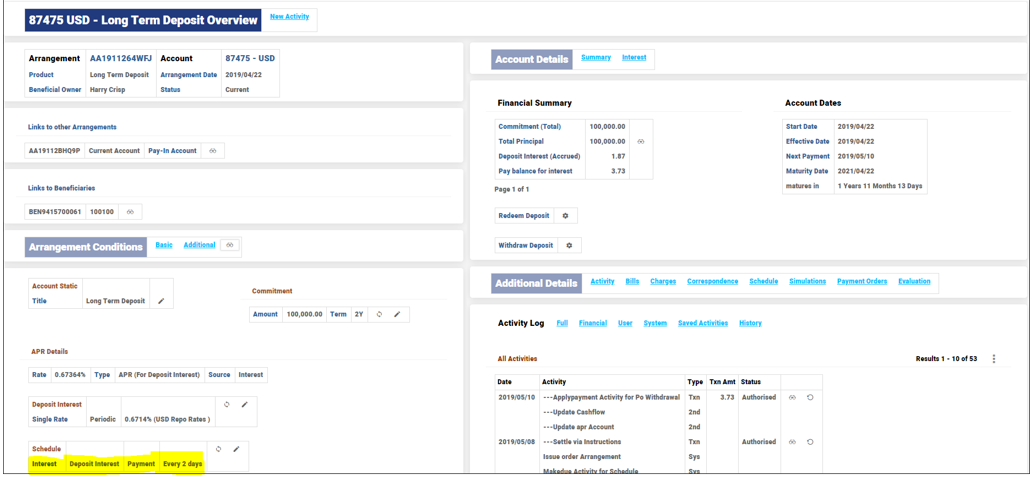

A Long Term Deposit arrangement with Payment Method as PAY for DEPOSITINT Property is created and funded with a Deposit Interst Payout scheduled for every two days.

ISSUE.OREDER Activity gets generated two days prior to the actual bill date based on the setup in the CURRENCY and PAYMENT.OREDER.PRODUCT applications.

DEPOSITS-SUSP.PAYMENT-ARRANGENT Activity gets triggered and the Interest amount parked in the new balance type SUSPPAYMENT balance type.

The Settlement Property Class can be used when bills issued are to be settled directly by debiting an account in a third party bank. This is achieved by linking a mandate defined in the Direct Debit (DD) module to an arrangement account which is done through this Settlement Property.

For the direct debit to work, the mandate should have an ACTIVE or AVAILABLE status. When bills are issued, the system creates the DD.ITEM records for the payment types that are specified in the Settlement Property. When the Combine Bills field in payment schedule condition is set to Yes, the amounts of the bills that satisfy the below-mentioned criteria are combined to generate a single record in DD.ITEM:

- Bills are issued on the same date.

- Bills are made-due on the same date.

- Bills are configured to be auto-settled using the same DD Mandate.

On the claim date (the value date of the bill payment), the arrangement account is credited with funds and appropriated according to the rules specified in PAYMENT.RULES Property.

When a claim is generated if the transaction code in DD.TXN.CODES for CLAIMED ITEM CREDIT is mapped to an Activity via Activity Mapping, the corresponding Activity starts running. This settles the bills that are made due and updates the necessary files.

When a claimed item is returned, then the Repayment Activity has to be reversed and the corresponding files have to be reinstated to its initial status.

The payment rule which has been created specifically for the direct debit should have the LENDING-CREDIT-ARRANGEMENT activity in the Remainder Activity field, such that when the claim is actually processed, the credit will first be made by the DD module to the unallocated balance of the arrangement account. This should have only the properties of the payment types defined in the Settlement property condition of the arrangement. It should not have any additional properties

The Apply Payment field in the Payment Schedule property should be input with the payment rule for the direct debit. This will result in the AA module appropriating the unallocated balance to the properties specified for settlement.

- After the new arrangement input, the account number of the arrangement is used to create a DD.DDI record (mandate) to provide a link to the arrangement.

- The DD.DDI record status should be AVAILABLE to make use of the direct debit functionality to settle the bills. In the first instance, when the DD.DDI record is created, the status becomes NEW and after authorisation, the same should be changed to AVAILABLE.

- The mandate created through DD.DDI should be updated in the Mandate Ref field in the Settlement Property Condition of the arrangement using LENDING-UPDATE-SETTLEMENT Activity. The Payment Type field can hold any of the payment types defined in Payment Schedule. The Settle Method field should be DD.

- During bill issuance, records in DD.ITEM are created for every payment type defined in Settlement Property with the contract reference as the AA.ARRANGEMENT.ACTIVITY ID of the issue-bill Activity.

- The Issue Bill Activity triggers creation of DD.ITEM records for the payment types that are mentioned in the Settlement Property.

- The status of the DD.DDI record is NEW.ITEM till the payment is processed and the contract reference updated is the respective issue-bill activities for the arrangement for different payment types. Bill is in ISSUED status. After the DD processing on the payment date of the bill, the DD.ITEM record updates the status to CLAIMED.ITEM.

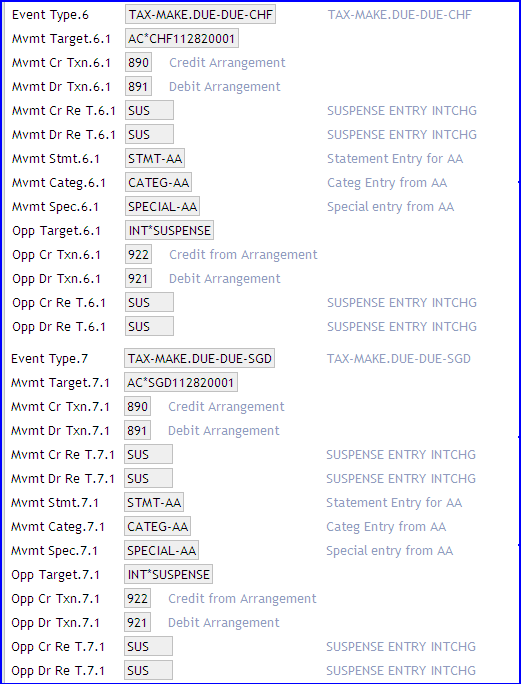

The system provides the facility for foreign currency settlement of bills for an arrangement. The user can have foreign currency arrangements with local currency settlement accounts and vice-versa. Cross currency settlement can also be set up where in settlement happens to a foreign currency account or arrangement from another foreign currency arrangement, with the local currency being a different currency.

For the various currencies used, the user must create event types, AC.ALLOCATION.RULE records should be created as shown below.

Example Event Types

TAX-MAKE.DUE-DUE-GBP TAX-MAKE.DUE-DUE-EUR TAX-MAKE.DUE-DUE-CHF TAX-MAKE.DUE-DUE-SGD

The following are counter booking related fields

Account to be used as counter booking account when the current arrangement is off-balance and counter bookings should therefore not go to PL account.

In a normal interest or charge processing, the system debits or credits the arrangement and credits or debits the PL. In the case of off-balance sheet memo accounts, even the accrual of interest does not hit the PL. During make-due or pay or capitalise, the system debits or credits the memo account but needs another account to book the other side of the transaction. This field is used for that purpose.

It is mandatory for off-balance accounts which have any setup to process interest or charges.

This field is used for counter booking. For example, in the case of memo accrual of credit interest, the memo account is credited with the interest accrued and the counter booking account is debited. In such cases, the Activity specified in this field is used to run on the Account.

This field is mandatory for off-balance accounts when the counter booking account is specified.

It is also used for counter booking. For example, in the case of memo accrual of debit interest, the memo account is debited with the interest accrued and the counter booking account is credited. In such cases, the Activity specified in this field is used to run on the Account.

This field is mandatory for off-balance accounts when the counter booking account is specified.

- It is possible to configure capitalisation or make due and settlement processing for memo interest and fees.

- Counter Booking Account

- An Account attribute is available in the Settlement Property Class.

- For all interest & fees settlement, one side is the memo account’s principal balance (or the settlement account) and the other side to balance that memo entry, is the account specified in this field.

- During make-due or capitalisation, there is nothing for the system to make-due or capitalise as all accounting is suppressed during accruals. No ACC balances are maintained for memo accounts.

- At this point, the system raises a bill and invokes the settlement processing.

- The settlement processing in turn raises the necessary accounting between the account (or the settlement account in case the payment method is due or pay) and the counter booking account.

- ACCOUNT-SETTLE.SUSP-DUE-SETTLEMENT.ACCOUNT

Accounting to debit CUR balance of Settlement account.

- ACCOUNT-SETTLE.SUSP-PAY-SETTLEMENT.ACCOUNT

Accounting to credit CUR balance of Settlement account.

- ACCOUNT-SETTLE.SUSP-DUE-COUNTER.BOOK.ACCOUNT

Accounting to debit CUR balance of counter booking account

- ACCOUNT-SETTLE.SUSP-PAY-COUNTER.BOOK.ACCOUNT

Accounting to credit CUR balance of counter booking account

- ACCOUNT-SETTLE.SUSP-DUE-CURRENT.ACCOUNT

Accounting to debit CUR balance of schedule account during capitalisation of off balance accounts.

- ACCOUNT-SETTLE.SUSP-PAY-CURRENT.ACCOUNT

Accounting to credit CUR balance of schedule account during capitalisation of off balance accounts.

The following are Internal FX (Foreign Exchange) related fields

- Currency - This field is applicable for internal FX transactions, and indicates the currency for which FX contra settlement account is to be maintained.

- Settlement Account - This field is applicable for internal FX transactions. Contra settlement accounts to post the offset entries such that pool balance that does not change are maintained here.

Dr EUR TR 1000 Cr Contra EUR TR 1000

Dr Contra USD TR 1250 Cr USD TR 1250

For both payin (for example - loan repayment) and payout (for example – maturing deposit) functionality, the system provides the ability to define multiple settlement accounts. The user can define a settlement configuration by either a percentage or fixed amount with the different amounts of the bill being debited or credited to multiple accounts. Per individual account for settlement within Temenos Transact the account debit rule is still honoured.

Associated to the Settlement Account field can be blank in either the Percent or Amount field, the system considers the default account. The percentage amount or fixed amount is honoured first and if a remainder exists then this account is considered for the remainder, usual account debit rule values are still honoured.

The defined accounts have the following balances:

|

Account Number |

Current Balance |

|---|---|

|

10995 |

Account Balance £3,000.00 |

|

10944 |

Account Balance £5,000.00 |

|

11495 |

Account Balance £550.00 |

Although 100% settlement has been defined a setting of None this means for each individual account being defined the evaluation and rule setting of None will be honoured.

In the above case, only a total of £1,972 can be settled and this amount is taken from accounts 10995 and 10944, as account 11495 can’t satisfy the portion of £1,428 i.e. 42% none is taken from this account and the remainder is made due by the system.

The accounts are debited as follows:

10995 : £1,122 leaving the balance as £1,878

10944 : £850 leaving the balance as £4,150.00

11495 : zero leaving the balance as £550.00

Bills with the same payment date which are automatically settled using the same Temenos Transact account can be combined and settled as a single settlement.

When automatic settlement using Temenos Transact account is defined, the Settlement condition can be configured with the Payin Account Settlement and Payout Account Settlement fields to combine the amounts of the bills and to generate a single settlement when all the following criteria are met:

- Combine Bills in the payment schedule condition is set as Yes.

- Bills should have the same payment date.

- Bills are configured to be settled using the same Temenos Transact account.

- Same Settle Activity is defined for all the bills.

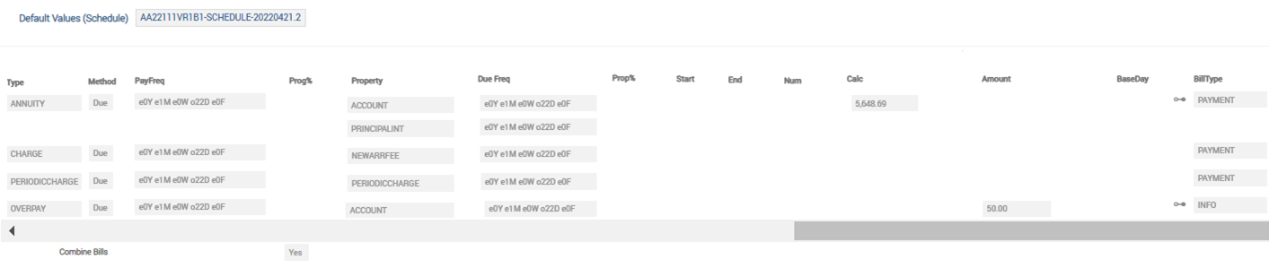

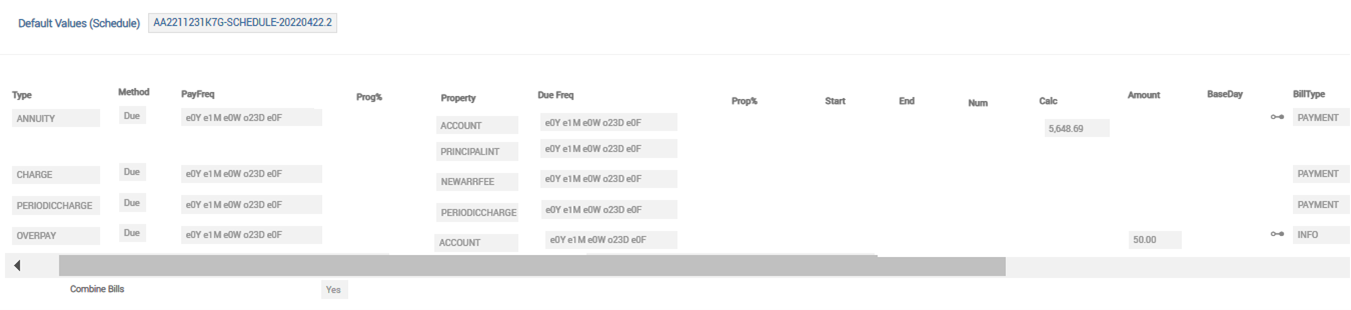

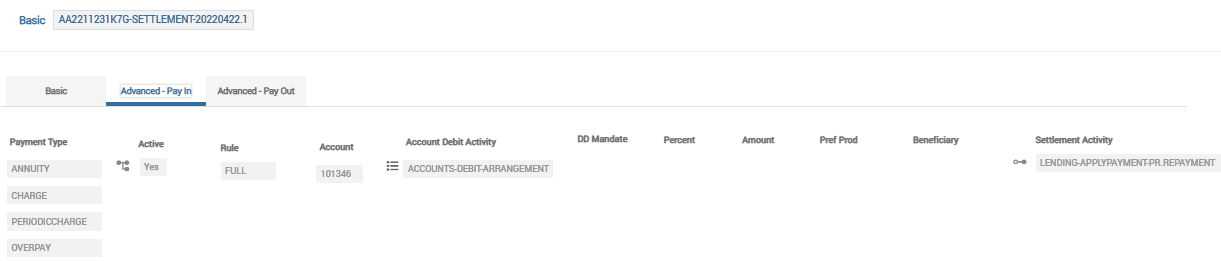

Consider a loan with the following bills scheduled to be made due on day 22 of every month:

- Instalment amount of USD 5648.69

- Scheduled charge of USD 999

- Periodic charge that collects all the deferred charges for the month

- Regular overpayment of USD 50

The Combine Bills field is set as Yes in the payment schedule condition.

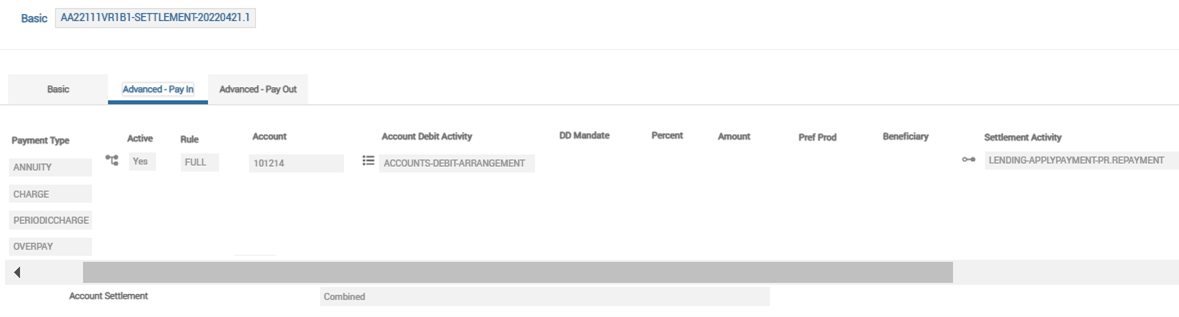

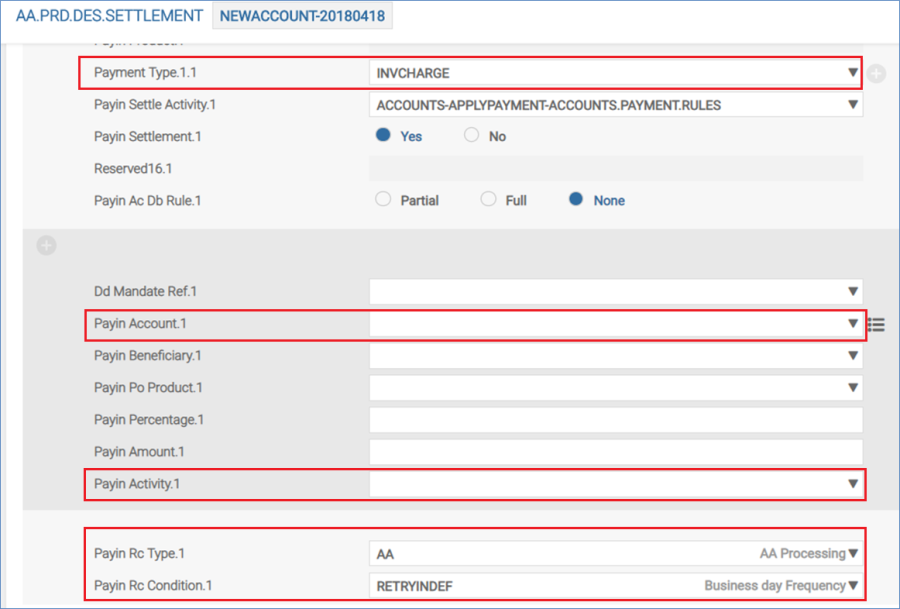

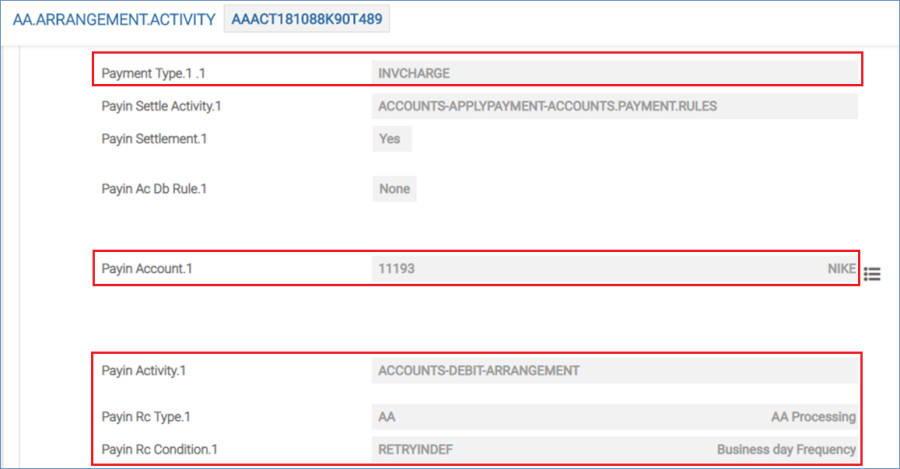

The settlement instructions are defined to automatically settle the due bills using the settlement account 101214. All the payment types configured in the settlement instructions have the same Payin Settle Activity and the Payin Account Settlement field is set to Combined.

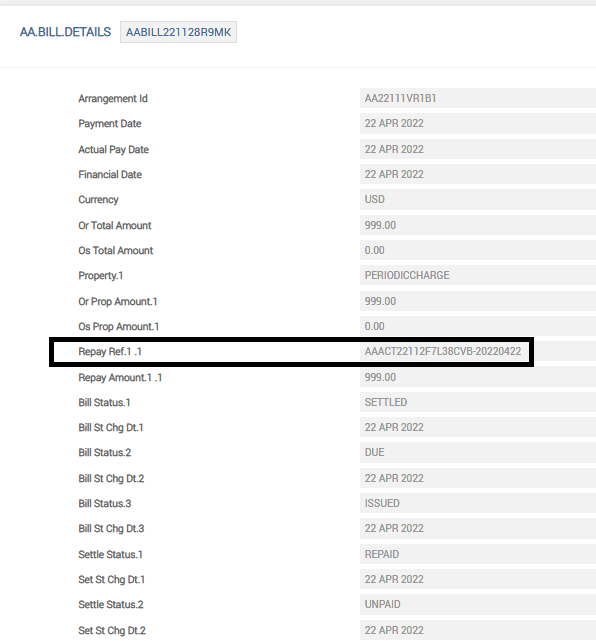

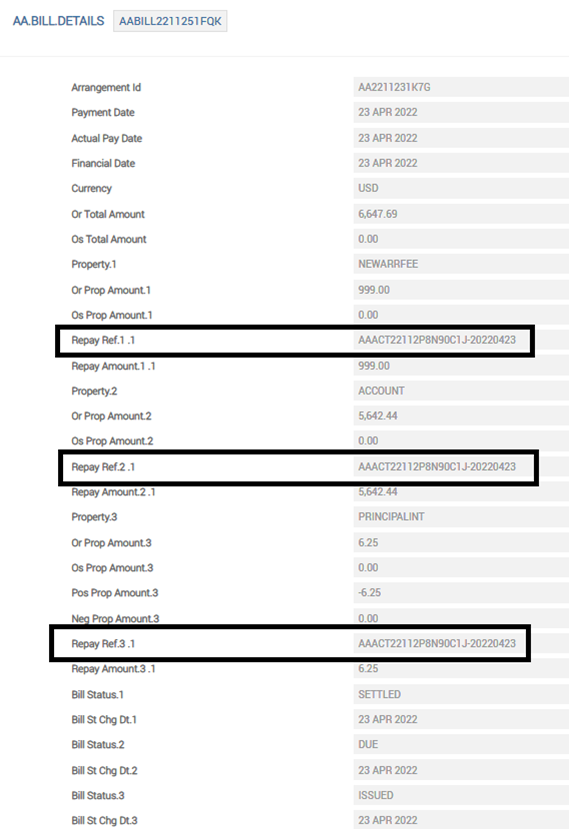

Since the Payin Account Settlement field is set to Combined, on the bill due date 22 April, the amounts of the bills that satisfy the below criteria are combined and settled using a single settlement entry:

- Combine Bills in the payment schedule condition is set as Yes.

- Bills have the same payment date (22 April).

- Bills are configured to be settled using the same Temenos Transact account (101214).

- Same Settle Activity LENDING-APPLYPAYMENT-PR.REPAYMENT is defined for all the bills.

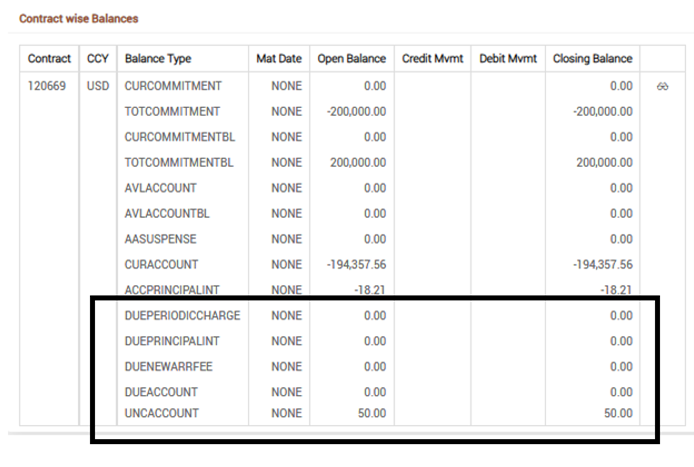

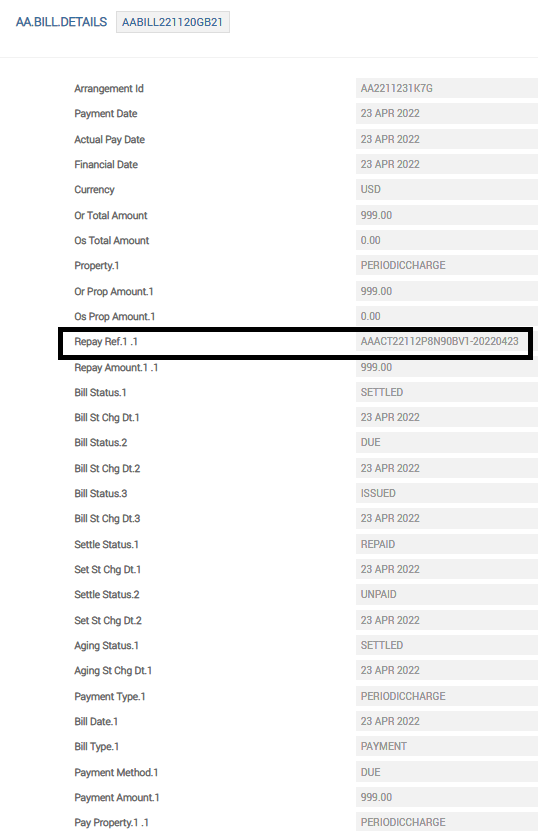

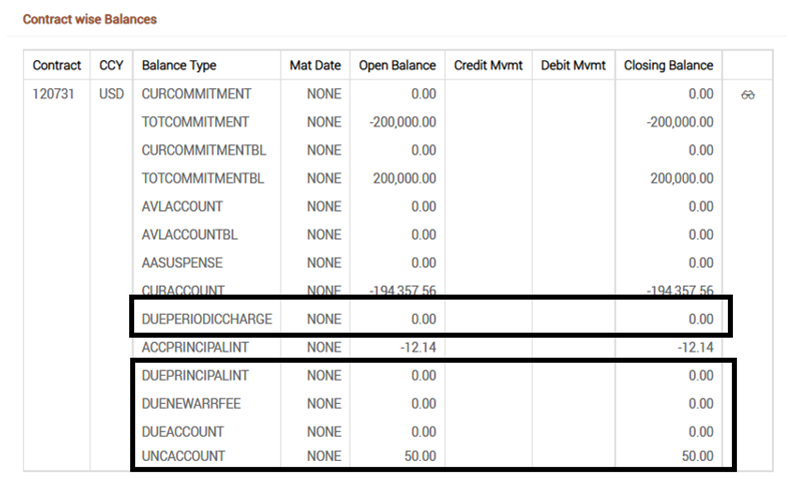

The corresponding due balances are settled as seen in the below screenshot.

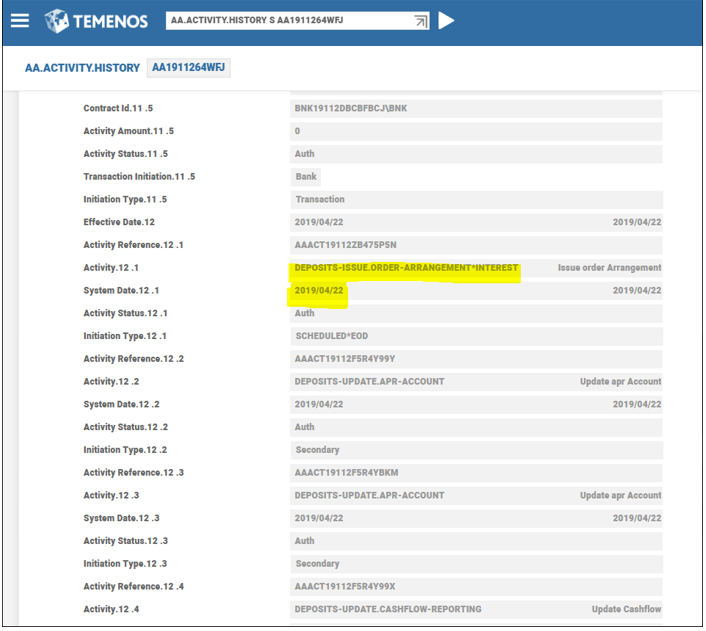

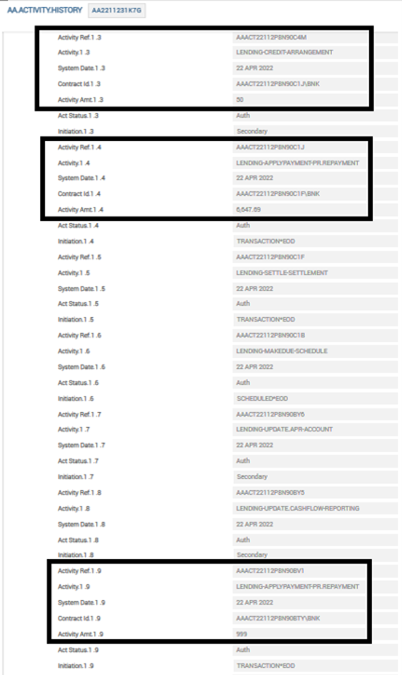

The AA.ACTIVITY.HISTORY table for the arrangement shows that the bills are settled using a single settlement entry for the combined amount. The payment rule condition is defined to credit USD 50, the regular overpayment amount to the UNC<ACCOUNT> balance. That is, the Remainder Activity field in the payment rule condition is set to LENDING-CREDIT-ARRANGEMENT.

Consider a loan with the following bills scheduled to be made-due on the 22nd of every month:

- Instalment amount of USD 5648.69

- Scheduled charge of USD 999

- Periodic charge that collects all the deferred charges for the month

- Regular overpayment of USD 50

The Combine Bills field is set as Yes in the payment schedule condition.

The settlement instructions are defined to settle the Due bills automatically using the settlement account 101346. All the payment types configured in the settlement instructions have the same Payin Settle Activity and the Payin Account Settlement field is set to blank.

Since the Payin Account Settlement field is left blank, on the bill due date (22 April), the functionality to combine the bill amounts and generate a single settlement is not applicable. The system continues to generate the settlement entries based on whether the settlement instructions are multi-valued or sub-valued.

In this case, the system settles the annuity, scheduled charge and overpayment amount using a single settlement entry. The periodic charge is settled using a separate settlement entry.

The corresponding due balances are settled as seen in the below screenshot.

The AA.ACTIVITY.HISTORY table for the arrangement shows that the system settles the bills using multiple settlement entries. The payment rule condition is defined to credit the regular overpayment amount of USD 50 to the UNC<ACCOUNT> balance. That is, the Remainder Activity in the payment rule condition is set to LENDING-CREDIT-ARRANGEMENT).

The following are the attributes related to Offset

The Settlement Property Class is enhanced to define offsetting rules for processing of commissions. This is done to offset due and pay commissions by configuring the corresponding Property Class or Property that requires offsetting. The fields in default values (Offset) are shown below:

- Property Class: Property Class balance which needs to be offset.

- Property: Property balance that needs to be offset.

- Active: It defines whether offset of balances is required for the Property Class or Property.

Allowed options are:

- Yes – denoting offset required

- No – denoting offset not required.

- Offset Pay In: It specifies the Offset Payment Rule Activity that defines the list of due balances which has to be offset using the pay balance.

- Offset Pay Out: It specifies the Offset Payout Rule Activity which defines the list of pay balances which has to be debited to offset the due balance created.

- Activity classes for offsetting are available in all product lines for payment and pay out rules property.

- <Product Line>-OFFSET-<Payment Rules>

- <Product Line>-OFFSET-<Payout Rules>

- The Offset Activity Class gets triggered whenever a due bill or payment bill is made due. The due or pay amount is then offset against the existing balance before being handed over to the remainder in the Settlement Activity.

- Settlement instructions for payin and payout are triggered after offset:

- Excess funds after settlement are available as due or pay amount.

- UNC settlement is also triggered after offset is completed.

- For DD claims, claim amount received is settled through UNC which is triggered after offset is completed.

- Amount pending after offset is split between multiple settlement accounts if setup.

- Order of bill property is updated in arrangement to settle when two bills are made due at the same point.

- Periodic charges for offset under settlement setup is not supported.

- From accounting perspective, instead of settling a due and pay bill separately, the net amount is settled – Hence there is no separate impact in position.

During Activity, Rule Based or Scheduled Charge Capitalisation, if an account has insufficient funds the pending amount is invoiced to the customer, to capitalise the charge.

For the Payment Type that has Alt Payment Method set to Cap and Inv, charges are set to capitalise. This indicates that bill amount has to capitalise for the funds based on Account Debit Rule and invoiced for the pending balance.

The charge pending for capitalisation is moved to INV<CHARGE>

In order to settle the Charges:

When Charge is set to capitalise it is collected from the same account (pending amount is invoiced). Hence, the system doesn’t mandate to input the Payin Account Rule or Payin Activity (as directed by Payment Type having Alt Payment Method as Cap and Inv)

In the below example, Payment Type has Alt Payment Method set to Cap and Inv. There are no Settlement Instructions given in Payin Account or Activity. Transaction Cycling is configured using RC Type and RC Condition.

It is also possible to collect the charge from another account by giving a Payin Account Rule or Payin Activity. In this case the charge is settled from another account based on Account Debit Rule and pending amount is invoiced.

In the below example, Payment Type has Alt Payment Method set to Cap and Inv. There are Settlement Instructions is specified given in Payin Account and Activity. Also, Transaction Cycling is configured using RC Type and RC Condition.

In either of the above cases, it is possible to retry settling the pending amount in <INV>CHARGE using Transaction Cycler related fields namely RC Type and RC Condition.

|

Number |

Details |

Validation |

Error |

Message |

Comment |

|---|---|---|---|---|---|

|

1 |

Settlement account must allow external postings |

Payin Settlement or Payout Settlement or Default Settlement Account as the case may be |

AA-PAYIN.AC.ALLOW.EXT.POSTING |

Payin account & doesn't allow external posting |

|

|

2 |

Settlement account must be a member of the same bundle -Only if this Account is part of a Bundle Hierarchy. This Validation only applies for CS, SA and CT but not to a normal AR Arrangement. For a Normal AR Arrangement, the Settlement Account could be Memo and have its own Diversion Account. i.e., a TR can be attached as a Settlement account to a normal AR, AL or AD |

As Override during Update activity, Settle Payoff & Transform but Error during MakeDue-Schedule |

AA-ACT.NOT.MBR.OF.SAME.BUNDLE |

Account is not a member of same bundle |

Currently we don't allow CLOSURE if the account is a bundle member. For now it is a two-step process of unlinking and then closing |

|

3 |

AcDbRule must always be FULL for payin accounts - Only if this Account is part of a Bundle Hierarchy |

Error always - the appropriate AC.DB.RULE |

AA-PAYIN.AC.DB.RULE.MUST.BE.FULL |

Account Debit Rule must be set to FULL within a Bundle Hierarchy |

|

|

4 |

For any property in PaymentSchedule, ActivityCharges, ActivityRestriction with payment method as DUE, a payin account must be defined |

|

AA-PAYIN.AC.MAND.PMT.TYPE.OFF.BAL |

For Schedule : Payin account is mandatory for payment type defined in Property (that is defined in Schedule); For Activity Charges and Activity Restrictions - Payin Account is Mandatory for Payment Type for Activity charges /Activity Restriction Property |

|

|

5 |

For any property in PaymentSchedule, ActivityCharges, ActivityRestriction with payment method as PAY, a payout account must be defined |

|

AA-PAYOUT.AC.MAND.FOR.PPTY.OFF.BAL |

Payout account is mandatory for property & defined in (that is defined in Schedule); For Activity Charges and Activity Restrictions - Payout is Mandatory for Payment Type for Activity charges /Activity Restriction Property |

|

|

6 |

If property or property class from #5 is defined in settlement, but payout switch is OFF |

|

AA-PAYOUT.SET.SWITCH.NOT.ON |

Settlement switch is not set to YES for Property or Property Class |

|

|

6B |

If any Payment Type from #6 above is defined in Settlement, but Payin switch OFF |

|

AA-PAYIN.SET.SWITCH.NOT.ON |

Settlement switch is not set to YES for Payment Type |

|

|

7 |

If no settlement instruction has been defined for the payout property or property class from #5 |

|

AA-PAYOUT.SET.INSTRUCTION.NOT.FOUND |

Settlement instruction is not found for property or Property Class |

|

|

7B |

If no settlement instruction has been defined for the payment type from #6 |

|

AA-PAYIN.SET.INSTRUCTION.NOT.FOUND |

Settlement instruction is not found for Payment Type Payment Type |

|

|

8 |

Counter booking account is mandatory if any payment method in PaymentSchedule, ActivityCharges, ActivityRestriction has payment method as PAY, DUE or CAPITALISE - unless bill type is AUTO.WAIVE (for PaymentSchedule) |

|

AA-COUNTER.BOOKING.ACCOUNT.MAND |

Counter booking account is mandatory |

|

|

9 |

Counter booking account must be a member of the same bundle (hierarchy) |

|

AA-ACT.NOT.MBR.OF.SAME.BUNDLE |

Account is not a member of same bundle |

|

|

10 |

Counter booking account must allow external postings |

|

AA-CTR.BK.AC.NOT.ALLOW.EXT.POSTING |

Counter booking account & must allow Posting to be made |

|

|

11 |

Counter booking activities are mandatory - Only if Counter Booking Account is specified. |

Always Error - Counter Booking Credit Activity and Counter Booking Debit Activity |

AA-MAND.FIELD |

Input is mandatory |

On the contrary, Counter Booking Activities can be specified without Counter Booking Account - say, defaulted from Product |

|

12 |

Counter booking activities must be valid |

|

AA.INVALID.ACTIVITY.TYPE |

Invalid Activity Type in Activity.Class |

This is checked in AA.ACTIVITY.CLASS |

|

13 |