Introduction to Islamic Financing

Islamic banking refers to a system of banking or banking activity that is consistent with the principles of the Shari'ah (Islamic rulings) and its practical application through the development of Islamic economics. It started during the late 20th century when a number of Islamic banks were formed to provide an alternative banking system. Islamic banking has the same purpose as conventional banking except that it operates in accordance with the rules of Shari’ah.

Shari'ah prohibits payment or acceptance of interest charges (riba) for lending and accepting money, as well as carrying out trade and other activities that provide goods or services considered contrary to its principles. To ensure adherence to these underlying Islamic principles, most Islamic banks have a Shari'ah board comprising Islamic scholars that scrutinises proposed transactions and maintains an overall review of the bank’s Islamic financing methods and operations

The following are the basic concepts of Islamic banking:

- Interest – Cannot be charged for the mere use of money. Islamic financial institutions must trade in real assets or services.

- Uncertainty – Does not allow any contract based occurrence or non-occurrence of a future uncertain event.

- Speculation or gambling – Does not allow trading or investment transactions, which involve the risk of incurring losses as well as earning profits.

- Prohibited activities or commodities – Does not finance enterprises involved in,

- Financial services (Interest-based)

- Gambling

- Alcoholic liquor

- Mobilisation of funds – Does not mobilise funds by paying interest to their depositors.

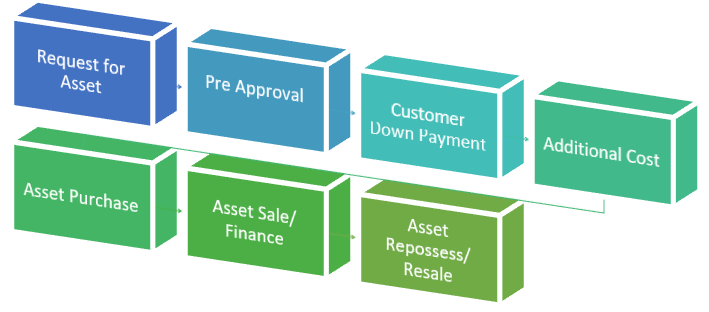

Islamic banking follows the below workflow for buying an asset and selling it to the client:

A brief description of each Islamic workflow is given below:

| Work-flow Stages | Description |

|---|---|

|

Asset Request |

|

|

Asset Approval |

|

|

Asset Purchase |

|

|

Payment Management |

|

|

Sale or Finance |

|

Islamic finance functionality comprises of,

Asset purchase related activities is designed based on Sharia based workflow. The workflow supports asset-based banking practices in Islamic banking. It comprises of requesting for the asset from suppliers, purchase of asset, client contribution management, and vendor payments.

The main functionalities are:

- Asset capture

- Islamic contract

- Commodity delivery and sale

- Asset review

- Down payment

- Payment management

Islamic Finance supports sale of asset through financing or outright sale. This functionality offers various Islamic finance products for sale of assets, amendment to sale conditions, and handling over dues, repurchase and repossession of asset and resale functionalities.

The finance products are grouped as shown below:

| Finance Products | Groups |

|---|---|

|

Profit Upfront Sale

|

|

|

Profit Accrual Sale

|

|

|

Multi-structured Products |

|

Islamic Finance (IS) is part of Temenos’ Islamic Banking suite of products. This product functionality uses Arrangement Architecture Lending (AL) to book finance arrangements.

Islamic Banking is asset based banking where the asset is bought by the bank using asset management activities and sold to the client on deferred payment basis using finance management activities.

Configuring Islamic Banking

This section orients the user on asset purchase and finance management related activities. Asset management comprises of,

- Asset creation

- Asset purchase

- Asset tracking or delivery

- Asset review and payment activities

- Finance management activities

The following applications provide functionalities to create and manage the assets:

| Application Name | Description |

|---|---|

|

Asset Capture |

Used to create,

|

| IS.CONTRACT | Used to,

|

| IS.CONTRACT.DELIVERY | Used to track the delivery of commodities or assets. |

| IS.COMMODITY.SALE | Used to sell the delivered commodities to clients either partially or fully. |

| IS.ASSET.REVIEW | Used to manage the review activities for assets |

| IS.PAYMENT | Used to manage Islamic banking payment activities. |

Islamic Finance is used to sell the asset to the client on deferred payment basis. The AA.PRODUCT.LINE application provides a high-level definition of the business components (Property Classes), required to construct a product belonging to that line. A product line is described by the property classes, which constitute it. A financial institution can use these Property Classes as building blocks to construct individual products, which is available for sale to its customers.

Islamic finance comprises of the following Property Classes:

|

|

The AA.PROPERTY is an instance of AA.PROPERTY.CLASS and these components constitute a finance product. The Property Classes and properties are made mandatory or optional based at the AA.PRODUCT.GROUP level but subject to the product line definition. AA.PRODUCT.DESIGNER is used to create the required finance products.

Illustrating Model Parameters

Parameter files and system tables need to be setup to support the Islamic banking operations. This section provides a brief overview of the system and parameter setup for holding the static data for Islamic asset management operations. Refer to, Retail Lending (AL) user guide for information on parameter setup for finance management operations.

The below parameter table are setup to support Islamic Banking operations:

Illustrating Model Products

Islamic finance provides the asset management and finance management functionalities for Temenos Transact.

The module allows the user to create below mentioned products:

| Product Group | Product Name | Product Attributes |

|---|---|---|

| NA | Asset Capture |

|

| NA | Islamic Contract |

|

| NA | Commodity Delivery and Sale |

|

| NA | Asset Review |

|

| NA | Payment Management |

|

| Finance - Profit Up-front Sale |

Commodity Murabaha |

|

| Ijara Finance |

|

|

| Murabaha Finance |

|

|

| Finance - Multi Structured Products |

|

|

| Finance - Profit Accrual Sale | Bai Salam |

|

| Construction Finance |

|

|

| Diminishing Musharaka Finance |

|

|

| Forward Ijara Finance |

|

|

| Mudaraba Finance |

|

|

| Qard Hassan Finance |

|

In this topic