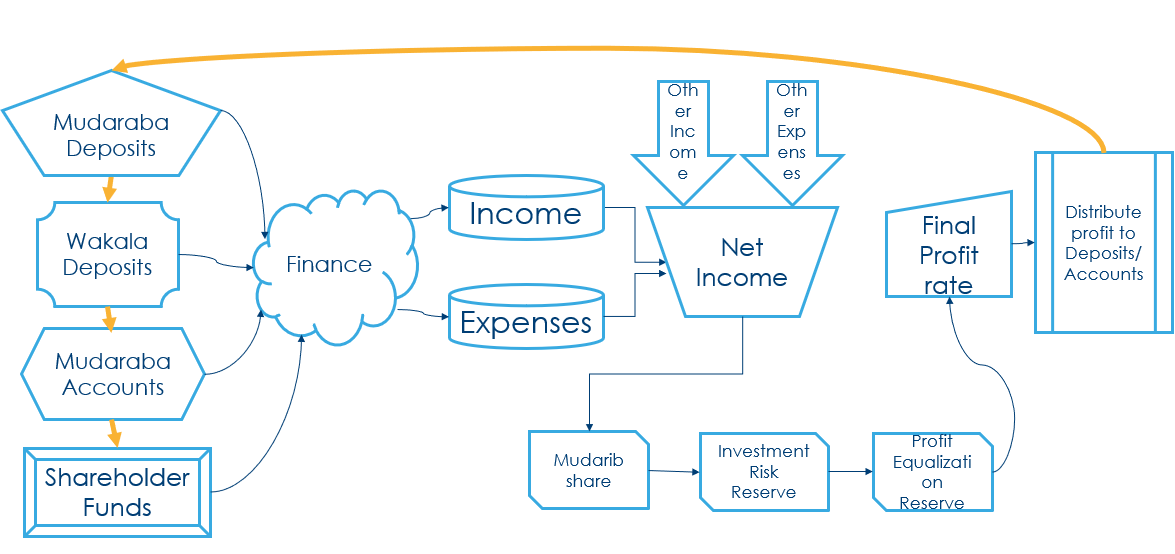

Introduction to Profit Distribution System

Profit Distribution System (PDS) provides the mechanism for Islamic banks to calculate and distribute profits for,

- Mudaraba deposits

- Wakala deposits

- Mudaraba savings accounts

The module manages various pools with finance or deposit products linked to those pools. Banks pool funds from customers and these funds are used to perform business activities such as investment, financing, purchase and lease using Islamic principles. Profit earned from business activities is distributed for deposit and account holders.

Defining Product Features

The following are the product features:

- Automatic allocation of pool ID based on the conditions parameterised. Islamic finance, deposit and account products assigned to a particular pool ID during booking.

- Multiple pools can be created with,

- Profit and expense categories setup for each pool

- Manual addition of additional income or expense

- Routine based modification of the calculated net profit amount

- Ability to setup profit calculation order (IRR, PER, Mudarib share and routine based calculation) for each pool. This can be set in any order at the pool level.

- Profit distribution frequency for each account or deposit type linked to the pool

- Setting up of tier balance-based profit calculation for accounts by using Band or Level profit rates.

- Setting up of special weightages for priority customer at customer or account level

- Amendment of pool ID assigned to the deposit or account from the last PDS end date +1

- Profit Equalization Reserve (PER) can be defined for each pool ID and can be utilised in the subsequent months, when needed

- Defines Investment Risk Reserve (IRR) for each pool ID and can be utilised in subsequent months, when needed

- Pay Hiba using special spread as additional profit

- Ability to accrue profit for Mudaraba deposits or Mudaraba accounts by using the provisional rate. Posting of accrual adjustment accounting entries on the date of PDS distribution based on the actual profit rate. The banks can set an option to use the last distributed profit rate as provisional accrual rate for the next period.

- Ability to capitalise the profit amount for Mudaraba deposits based upon the profit payment method.

- Ability to add shareholder contribution to the pool calculation by using manual or automatic method

- Ability to reverse the Last PDS distribution run.

- Provisions to run simulation before profit distribution

- Ability to pay the profit amount calculated during PDS simulation for Mudaraba savings accounts without posting profit accruals (using the charges feature).

- Customised enquiries to see the results

The following are the list of major functionalities supported:

- Linking pool ID with deposits or accounts

- Islamic deposit arrangements – Creation and maintenance

- Islamic accounts – Creation and maintenance

- Profit distribution system management

- Simulation

- Target rate update

- Input spread and special spread

- Input target rate

- Simulation – Projection

- Distribution

- Reverse – Distribution

Configuration

This section explains the various parameters and system core table setup that need to be set for operation of the profit distribution.

ID.SYSTEM.PARAMETER

This table specifies the system level attributes for setting up profit distribution process. The key parameters are listed below:

- Allowed ID is SYSTEM

- Defines profit distribution frequency for paying profit amount to Mudaraba deposits or accounts. It can be setup at pool or system level. During profit distribution, calculated profit amount is paid to the customer based on Distrib Freq field from ID.POOL.PARAMETER table. In case, Distrib Freq field is not set in ID.POOL.PARAMETER table, then the system uses the distribution frequency set in Distrib Freq field from ID.SYSTEM.PARAMETER table.

- Defines transaction types to raise accounting entries

- Defines the number of days after which the pool tracker file records are moved to history files

- Defines the user activities that can be run during distribution process for arrangements

- Defines the posting restriction code used for Islamic accounts marked to close on PDS run

- Setup the Migration Mode field to update the history of PDS calculations from the legacy system during data migration. Once the data migration is completed it needs to be switched off as it enables the bank to update the PDS profit rate for the past period, which is used during profit amount recalculation for Mudaraba deposits.

- Setup the Direct Pay Profit field as Yes to pay the profit amount as charges without posting any profit accruals.

If this field is set as yes, then:

- It is not possible modify the field value.

- It is not possible to reverse the last PDS distribution.

- Special HIBA profit rate is not considered during the profit payment.

After the system level configuration, the banks set-ups the model parameters as explained below:

Model Parameters

The parameter files and system tables are setup to support the Islamic profit distribution operations. This section provides a brief overview of the system and parameter setup for holding the static data.

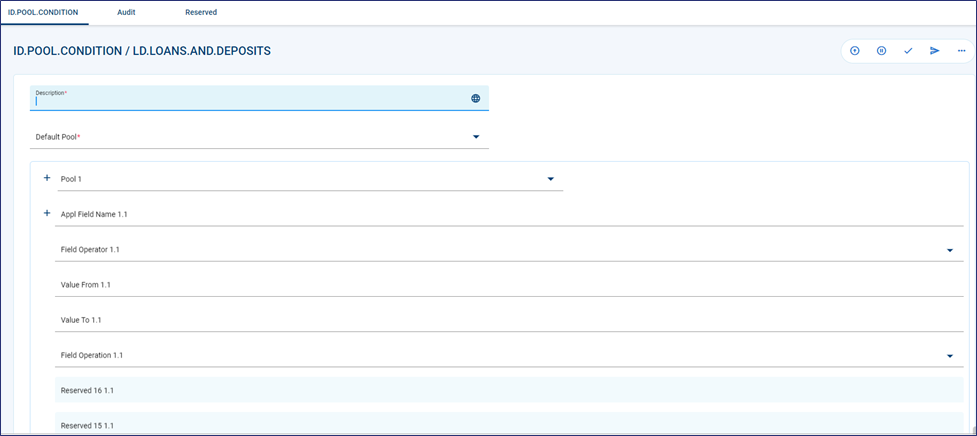

This table is used to configure the conditions for setting default values for the pool ID in the relevant applications. When an asset or liability transaction is created, the pool ID should be captured. The user can enter the pool ID manually or enable the system to populate automatically by setting up the conditions in this table. The key parameters details are listed below:

- Allowed IDs are valid application names, for example, AA.ARRANGEMENT, ACCOUNT, SEC.TRADE, LD.LOANS.AND.DEPOSITS, MM.MONEY.MARKET and LETTER.OF.CREDIT.

- Defines the conditions to identify the pool ID based on the Appl Field Name, Field Operator, Value From and Value To fields.

- Defaults the pool, when the other defined conditions fails to identify the pool.

This parameter table is used to configure the pool and the related parameter details for each pool.

- Id - The ID for ID.POOL.PARAMETER is numeric and the allowed values are from 1 to 999.

- Description - This field is used to provide description about the pool ID. It is a multi-lingual field as it allows to enter the description in multiple languages.

- Available Date - This field is used to capture the pool available date. The maximum back value date allowed should be less than or equal to 30 days from the current system date. There is no restriction on the forward value date.

- Currency - This field is used to specify the default pool currency. Simulation calculations use this currency as the base for calculation. Allowed values are from the CURRENCY application.

- Currency Market - This field is used to specify the currency market. Currency conversion in pool calculation use the mid-rate. Allowed values are from the CURRENCY.MARKET application.

- Profit Basis - This field is used to choose the profit basis for pool calculation. Allowed values are from the INTEREST.BASIS application. It is required to configure the same profit basis in the pool parameter and at the account or deposits level.

To know more about the fields used in defining the categories used for calculating the pool income, click

To know more about the fields used for defining the categories used for calculating the pool expense, click

- Deposit Cat - This field is used to capture the category of Mudaraba deposit or Mudaraba savings account used for creating arrangements for this pool. Allowed values are from the CATEGORY table. This is a multi-value field used with Distrib Freq to set different profit payment frequencies for each Deposit category.

- Distrib Freq - This field is used to capture the profit distribution frequency for the category captured in the Deposit Cat field.

- Deposit Currency - This field is used to capture the deposit currencies of the pool. It is a multi-value field used for entering multiple currencies. Allowed values are from the CURRENCY table.

- Account Cat - This field is used to capture the Mudaraba savings account categories participating in the pool calculation. It is a multi-value field. Allowed values are from the CATEGORY table.

- Profit Calc Order - This field is used to capture the profit calculation order for simulation calculation. During simulation calculation, the distributable profit amount calculated from the net profit amount by using the calculation order setup in this field. Allowed values are:

- IRR – Investment Risk Reserve percent set in the Irr Percent field is applied to the net profit amount calculated. This can also be set in the ID.PDS.WEIGHT table.

- PER – Profit Equalization Reserve percent set in the Per Percent field is applied to the net profit amount calculated. This can also be set in theID.PDS.WEIGHT table.

- MUDARIB – Mudarib Fee set in the weightage table is applied to the net profit amount calculated.

- LOCAL.RTN – A routine is attached to the Addl reserve Rtn field to deduct additional reserves. Allowed values are from EB.API.

- Per Categ - This field is used to capture the PER category for accumulating or paying the PER amount during PDS distribution. Allowed values are from the CATEGORY table. An internal account has to be created by using the category defined in the Account Seq field in ID.SYSTEM.PARAMETER

- Per Percent - This field is used to capture the PER percentage for simulation calculation. Allowed values are from 0 percent – 100 percent up to six decimals. This can be defined in ID.PDS.WEIGHT at the pool condition level. The order of priority is fetched from ID.PDS.WEIGHT else if there is no configuration available, then the order is fetched from the ID.POOL.PARAMETERor ID.PDS.ACTION.

- Irr Categ - This field is used to capture the IRR category for accumulating or paying the IRR amount during PDS distribution. Allowed values are from the CATEGORY table. An internal account has to be created by using the category set in the ID.SYSTEM.PARAMETER>Account Seq field.

- Irr Percent - This field is used to capture the IRR percentage for simulation calculation. Allowed values are from 0 percent – 100 percent up to six decimals. This can be set in ID.PDS.WEIGHT at the pool condition level. The order of priority is fetched from ID.PDS.WEIGHT else, if no configuration is available, then the order is fetched from ID.POOL.PARAMETER or ID.PDS.ACTION.

- Reserve Util Order - This field is used to capture the reserve utilisation order for modifying the profit rate calculated. It is possible to modify the profit rate calculated during PDS simulation. The recalculated profit amount is set to utilise from PER, IRR, SHAREHOLDER funds. PDS Distribution accounting entries are raised based upon the order set in this field.

- PER – PER amount available in PER account is used.

- IRR – IRR amount available in IRR account is used.

- SHAREHOLDER – Shareholder expenses PL category is used.

- Hiba Pay Cat - HIBA is a gift or bonus amount paid to the customer on top of the profit rate calculated during simulation. This field is used to capture the PL expenses category for paying the HIBA amount. Allowed values are from the CATEGORY table (>50000).

- Mudarib Fee Cat - Mudarib fee is the management fee that the bank collects for managing the customer funds. This field is used to capture the PL income category to credit the Mudarib fee amount. Allowed values are from the CATEGORY table (>50000).

- Mudarib Adjust Cat - This field is used to capture the adjustment PL category for crediting or debiting the profit accrual expenses for Mudaraba deposits or accounts. Allowed values are from the CATEGORY table (>50000).

- Wakala Adjust Cat - This field is used to capture the adjustment PL category for crediting or debiting the Wakala profit amount adjustment. Allowed values are from the CATEGORY table (>50000).

To know more about the fields related to Share Holder Equity, click

-

Maturity Dist Adjust - This field is used to indicate whether the profit adjustment accounting entries have to be raised for the current period during distribution. On the date of Mudaraba deposit maturity (normal maturity) the accrued profit amount is credited to the customer account. If this field is set as YES, then during current distribution, apply the profit rate calculated in PDS run to the matured Mudaraba deposits attached in the pool.

- Ro Dist Adjust - This field is used to indicate whether the Mudaraba deposit needs to be considered into the PDS calculation from PDS start date/ Rollover date. The profit adjustment accounting entries must be raised for the rolled-over period during profit distribution. On the rollover date, the accrued profit amount is credited to the customer account. While calculating the PDS profit rate , if this field is set as:

- Yes - The deposit balance is considered from the PDS start date till PDS end date and the profit rate is calculated. The PDS calculated profit rate is applied to the Mudaraba deposit from PDS start date till the PDS end date even if there is a rollover date in-between the deposit period.

- Yes-Detached - The deposit balance is considered from the PDS start date till PDS end date. If the deposit is rolled over during the period, then the deposit balance is considered separately for PDS calculation.

The period from PDS start date till rollover date and the period rollover date till PDS end date/ pre-closure date is identified separately and profit rates are calculated accordingly. The calculated profit rates are updated in the deposit balances (ID.DEPOSIT.BALANCES) as two separate records with a variation in the ID (<PDS Action reference>-<Arrangement reference> and <PDS Action reference>-<Arrangement reference>-EM) of the records. The PDS calculated profit rate is applied accordingly for each period to the Mudaraba deposits.

- Not set - The deposit balance is considered from the deposit rollover date. The deposit balance from PDS start date till the rollover date is not considered into the PDS calculation. The PDS calculated profit rate is applied to the Mudaraba deposit from the Rollover date till the PDS end date.

- Prft Acctng Value Date – This field is used to configure the value date used for posting the profit payment accounting entries for Mudaraba deposits and Mudaraba savings accounts. It is a mandatory field and it is not possible to amend this field value after the authorisation of Pool ID creation. The following options are available:

- Frequency date - The profit payment accounting entry is posted using the profit payment frequency date configured in ID.POOL.PARAMETER or ID.SYSTEM.PARAMETER (Distrib Freq) as value date. This is the default value.

- PDS Period End Date - The profit payment accounting entry is posted using (Last PDS period end date + 1) as value date.

To know more about the fields related to Wakala Deposits, click

To know more about the fields where routines are attached, click

The fields described below are applicable for fixed-profit rate deposits. A fixed profit rate is agreed with the customer and the system should pay or accrue the profit amount based on that agreed profit rate irrespective of the PDS calculated profit rate. Any fluctuations in the PDS calculated profit rate cannot impact the fixed profit rate agreed with the customer. It implies, the special HIBA profit component is already loaded in the fixed profit rate agreed with the customer during deposit creation. Upon PDS distribution, an adjustment accounting entry is posted for the consolidated difference between the expected profit rate (profit rate agreed with the customer) and the actual profit rate (profit rate calculated during PDS). The category codes used for this purpose are:

- Spl Hiba Adj Pl Categ - This field is used to capture the special HIBA adjustment PL category. Allowed values are from the CATEGORY table (>50000).

- Spl Hiba Income Categ - This field is used to capture the special HIBA income PL Category. It should allow the user to capture the CATEGORY from 50000 to 69999.

- Spl Hiba Expense Categ - This field is used to capture the special HIBA expenses PL category. It should allow the user to capture the CATEGORY from 50000 to 69999.

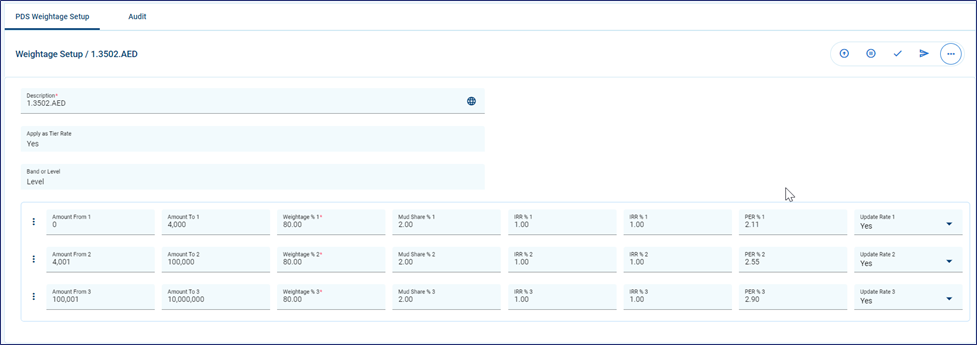

PDS calculation uses weighted (average or minimum or daily) balance of Mudaraba deposits or Mudaraba accounts or Wakala deposits. The pool condition for setting up the weightage can be set by using the combination of Pool ID, Category (differentiates the tenor), Currency, Profit distribution frequency and Broken Deposits condition (BRK). The weightage for each pool condition along with the IRR percentage, PER percentage, Mudarib share, accrual profit rate are set in this table for each balance amount bracket.

-

Id - The ID comprises of <POOL ID>.<CATEGORY>.<CURRENCY>.<Profit Distribution Frequency>.<BRK>. The ID accepts a value of ‘ALL’ for Pool ID and Category.

- 1.3251.USD – Implies, ‘Category 3251’, linked to ‘Pool 1’, and ‘Currency is USD’.

- ALL.ALL.GBP – Implies, ‘Category ALL’, linked to ‘Pool ALL’, and ‘Currency is GBP’.

- 1.3051.AED.M01 – Implies, ‘Category 3051’, linked to ‘Pool 1’, ‘Currency is AED’, and ‘Profit distribution frequency is M01’.

- 1. ALL.SAR – Implies, ‘Category ALL’, linked to ‘Pool 1’ and ‘Currency is SAR’.

- 1.3001.USD.ALL.BRK – Implies, ‘Category 3001’, linked to ‘Pool 1’, ‘Currency is USD’, Broken deposit condition.

- Description - This field is used to provide a description. It is a multi-lingual field that allows to set description in multiple languages.

- Amount From - This field is used to capture the starting range for the balance bracket amount. Numeric values allowed are up to 19 digits.

- Amount To - This field is used to capture the ending range for the balance bracket amount. Both values in the Amount from and Amount to fields are inclusive in the range. Numeric values allowed are up to 19 digits.

- Weightage - This field is used to capture the weightage in terms of percentage to apply on the amount. Allowed values are from 0 - 999999% up to six decimals. The weightage set in this field is used to calculate weighted balance for deposit balance ranges in the balance bracket.

- Mud Share - This field is used to capture the Mudarib share percentage. Allowed values are from 0% - 100% up to six decimals. The weightage set in this field is used to calculate the Mudarib fee.

- Irr Percent - This field is used to capture the Investment Risk Reserve percentage. Allowed values are from 0% - 100% up to six decimals. The weightage set in this field is used to calculate the IRR amount.

- Per Percent - This field is used to capture the Profit Equalization Reserve Percentage. Allowed values are from 0% - 100% up to six decimals. Weightage setup in this field used to calculate the PER amount.

- Accrual Rate - This field is used to default the profit rate used for daily accruals to Mudaraba deposits. During Mudaraba deposit booking, the profit rate set for the pool condition is evaluated and set as default in the deposit arrangement by considering the values input in the arrangement input page. If the set pool condition ends with ‘BRK’ keyword, then the profit rate is used during profit amount recalculation for pre-closed deposits.

- Update Rate - This field is used to indicate whether the profit rate calculated during PDS run needs to update automatically to the pool condition. Allowed values are :

- Yes - Then update takes place automatically to the Accrual Rate field with the profit rate calculated in PDS run.

- No - Then a manual update is required for the Accrual Rate field as and when required.

- Apply as Tier Rate - While creating the Mudaraba savings account, it is possible to define the profit rate as a tier rate with band or level conditions. This field can be set as Yes to default the accrual rate configured for different balance brackets.

It cannot be set as Yes for ALL.ALL condition. It is not allowed to modify this field definition after authorisation.

- Band or Level – This field is used to indicate whether the tier definition of profit rates is applied by using band or level calculation method. It is not allowed to modify this field definition after authorisation.

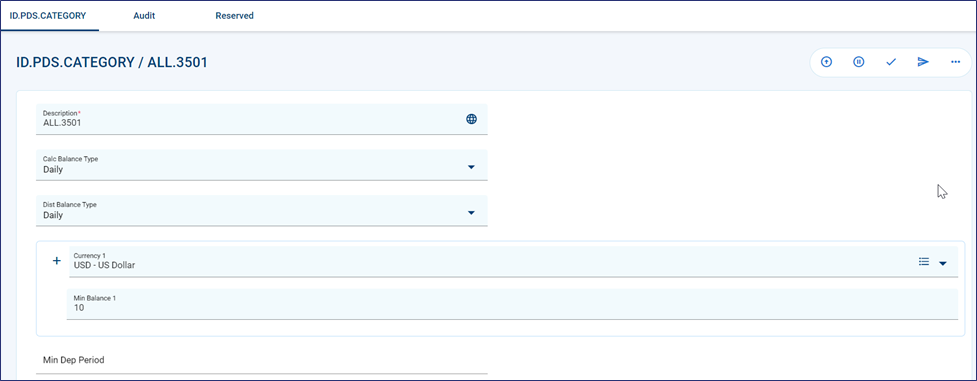

PDS calculation uses different calculation methods like daily, average and minimum. It is possible to define this, by using a combination of Pool ID, Category and ALL. Currency wise minimum balance for excluding accounts or minimum deposit period for excluding the Mudaraba deposits from participating in pool calculation is set in this table.

-

Id - ID comprises of <CATEGORY> or <POOLID.CATEGORY>. It is possible to provide ‘ALL’ for Pool ID and Category (ALL.ALL). The configuration <U-Category> is used to set and refer the exclusion conditions in ID.ACCOUNT.CONDITION during PDS simulation.

- 1.3601 – Denotes the conditions set for ‘Pool 1’ and ‘Category 3601’

- 3605 – Denotes the conditions set for ‘Category 3605’. Conditions are applicable for all pools.

- ALL.ALL – Denotes the conditions set for ‘Pool ALL’ and ‘Category ALL’. Conditions are applicable for ALL pools and ALL categories.

- U-3601 – Denotes the conditions set for ‘Category 3601’. The minimum balance exclusion criteria can be defined in ID.ACCOUNT.CONDITION. While running PDS simulation the exclusion conditions configured in ID.ACCOUNT.CONDITION should be evaluated for the accounts opened with the category 3601. The minimum balance amount set in ID.PDS.CATEGORY becomes void for this setup.

- Description - This field is used to provide a description. It is a multi-lingual field that allows to set description in multiple languages.

- Calc Balance Type – This field is used to set the different balances that the PDS calculation or distribution for deposits or accounts use. Allowed values are ‘Daily’, ‘Average’, and ‘Minimum’. Based upon the balance type set in this field the participation balance for deposits or accounts is calculated.

- Dist Balance Type - This field is for future use.

- Currency & Min Balance - ‘Currency’ and ‘Min Balance’ are multi-value fields used to set the currency wise minimum balance required for Mudaraba savings accounts participating in the pool calculation. If the condition is not satisfied, then the balance of the respective Mudaraba account is excluded in pool calculation and the profit amount is not paid. Allowed values for Currency field is a valid record from CURRENCY table. Allowed values for Min Balance field is numeric.

- Min Dep Period – This field is used to set the minimum deposit period for Mudaraba deposits participating in Pool calculation. If the condition is not satisfied, then the balance of the respective Mudaraba deposit is excluded in pool calculation and the profit amount is not paid. Allowed values are from 0D – 999D.

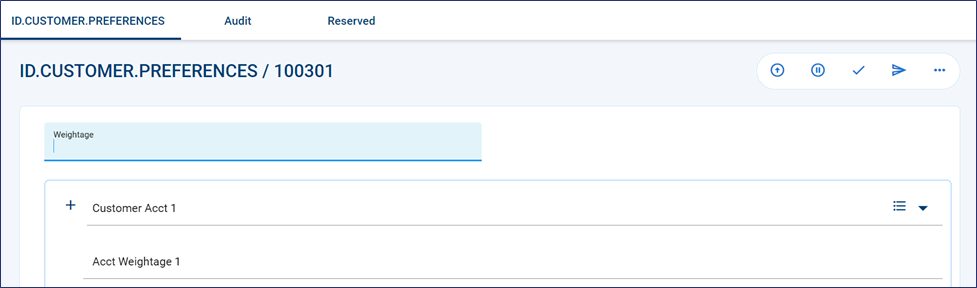

It is necessary to provide special weightages for the specific customers that provide more business value to the bank. This table used to set the weightage at the customer or account level.

During simulation calculation, the weightage for each pool condition is fetched from the weightage set in ID.PDS.WEIGHT. The special weightage set at the customer or account level is used if available for PDS calculation.

- Id - Allowed values are from the CUSTOMER application.

- Weightage - This field is used to capture the weightage in terms of percentage to apply on the amount. Allowed values are from 0% - 999999%. Weightage set in this field is used to calculate the weighted balance for deposit balance ranges in the balance bracket.

- Customer Acct - This field is used to capture the account number of the customer. Allowed values are from the ACCOUNT application. It is a multi-value field used to setup different weightages for each account.

- Acct weightage - This field is used to capture the weightage in terms of percentage to apply on the amount. Allowed values are from 0 - 999999%. The weightage set in this field is used to calculate the weighted balance for deposit balance ranges in the balance bracket.

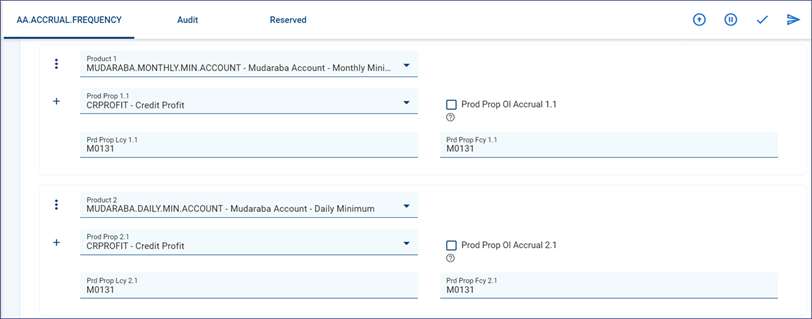

This parameter table is used to configure the accrual frequency. It is required to configure accrual frequency as Monthly for the product configured with transaction exclusion and balance exclusion criteria.

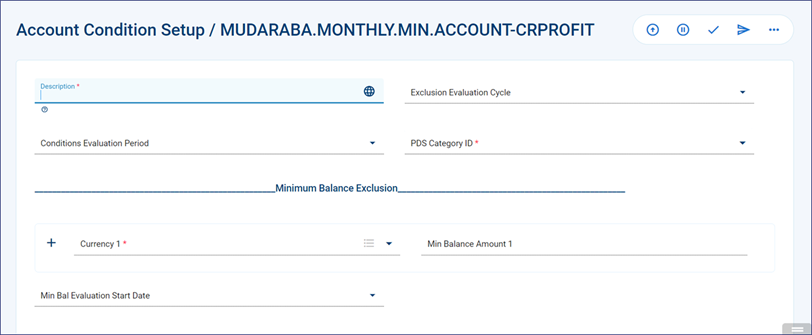

This table is used to configure the evaluation criteria required to calculate the transaction count and balance exclusions. It can be configured for each product along with the profit property name used for evaluation (Product Name – Property Name). The following are the related fields.

- Exclusion Evaluation Cycle – This field indicates the evaluation period of the configured conditions. The default value is Monthly, which implies that the exclusion criteria must be evaluated on a monthly basis.

- Conditions Evaluation Period – This field indicates the evaluation period of minimum balance criteria. The supported values are Monthly and Daily.

- PDS Category ID – This field indicates the unique identification of the record in the ID.PDS.CATEGORY table. The user can configure the balance amount used for PDS calculation in the existing parameter in the ID.PDS.CATEGORY table. This field is used to provide a link to the ID.PDS.CATEGORY table and validate that the calculation balance type is Minimum. It is required to create a separate record in the ID.PDS.CATEGORY table for the configured account product category by using the ID as U-<CATEGORY>.

- Min Balance Amount – This field indicates the currency-wise minimum balance amount used for evaluating the minimum balance amount exclusion.

- Min Balance Evaluation Start Date – This field indicates whether the system should begin the minimum balance evaluation from the account opened date or the account funded value date.

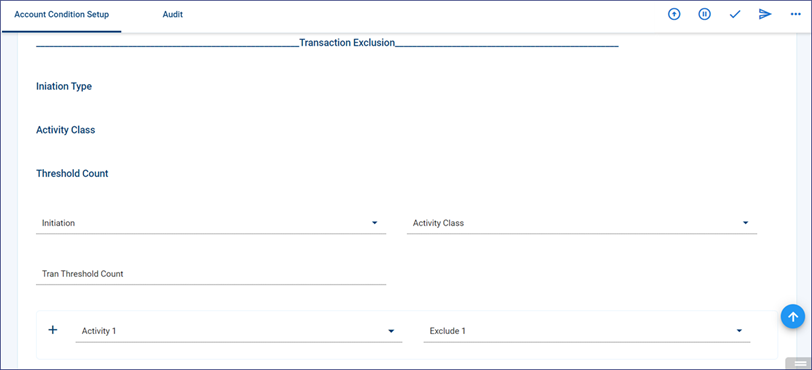

- Initiation Type – This field indicates the transaction initiation type for transaction exclusion evaluation. To configure the transaction exclusion criteria, set the transaction initiation type as Customer for the account debit activities.

- Exclude – This field indicates to include or exclude the required activities from the transaction exclusion evaluation.

- Tran Threshold Count – This field indicates the allowed transaction count eligible for-profit payment. The user needs to create separate transaction codes for the transactions posted through various channels (branch, internet banking, mobile banking, and other channels).

- Activity -This field indicates the named activity for the transactions posted through various channels, which links those transaction codes and named activity to the Mudaraba accounts product >>Activity mapping.

This parameter table is used to set the tenor-wise recalculation categories used for automatic profit amount recalculation during the pre-closure of the Mudaraba deposit.

- ID – This field allows a valid deposit product created using arrangement architecture.

- Rest period – This field is used to capture the tenor of the deposit in months or days. R can be used to capture the remaining term.

- Recalc category- This field is used to capture the category code used during profit recalculation.

- Recalc profit adjustment percentage – This field is used to capture the recalculated profit adjustment amount percentage. The profit amount is recalculated by using the completed tenor multiplied by the ‘recalculate profit adjustment percentage’ to arrive at the profit amount paid to the customer account.

Model Products

| Product Group | Product Name | Features |

|---|---|---|

| Pool Linking | Linking finance or deposit or account to pool with manual or automatic process | |

| Islamic Deposits |

1 Month Mudaraba Deposit 12 Month Mudaraba Deposit 2 Year Mudaraba Deposit 3 Month Mudaraba Deposit 6 Month Mudaraba Deposit Long Term Mudaraba Deposit |

|

| Advanced profit fixed Mudaraba Deposit |

|

|

| Mudaraba Savings Plan |

|

|

| Wakala Deposit |

|

|

| Islamic Savings Accounts |

Mudaraba Accounts Mudaraba Daily Product Savings Accounts |

|

| PDS Process – Simulation |

|

|

| PDS Process – Distribution |

|

|

| Reverse – PDS Process – Distribution |

|

In this topic