Introduction to Fixed Asset Management

Fixed Asset Management (FIXAMT) module provides banks a complete financial control over the fixed assets throughout its life cycle from acquisition through depreciation and disposal, preventing any misappropriation of bank assets.

Fixed assets include items, such as land and buildings, motor vehicles, furniture, office equipment, computers, fixtures and fittings, and plant and machinery. Fixed asset lifecycle events are recorded as a dated activity, providing an efficient method of enquiring or tracking the asset life-cycle events. The following activities are supported:

- Register

- Capital Work-In-Progress

- Purchase or Acquire

- Depreciation

- Capital Improvement

- Transfer

- Dispose

- Write-off

Fixed Asset Accounting

The Fixed Asset Management module supports two approaches for maintaining the asset balances:

- Account Based Method – Asset balances are consolidated and managed within internal accounts based on the Asset Classification and Asset Entity. Read Configuring Asset Accounts for more information.

- Contract Based Method – Each asset is treated as a separate contract and the asset balances are individually maintained under static Asset Types.

Clients adopting the Fixed Asset Management module from the 202402 release onward are advised to follow the Contract-Based Method, as it is the designated and only supported method for future implementations.

Product Configuration

This section explains the accounting treatment, grouping of fixed assets and configuration of accounting categories, transaction codes, depreciation definition, and so on, for specific group of assets. Fixed Asset Classification is established as a two-tier structure as Asset Class and Asset Type.

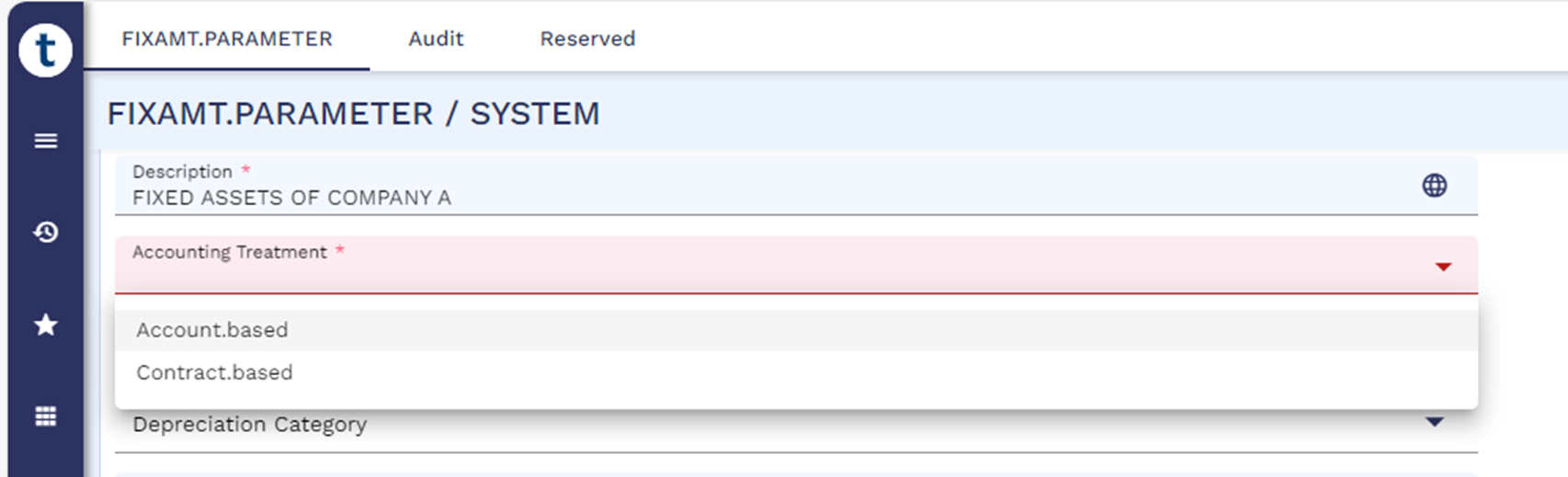

The accounting treatment for the fixed assets is established in FIXAMT.PARAMETER either at SYSTEM level or COMPANY level, allowing for two configurations namely Account-Based or Contract-Based using the Accounting Treatment field.

In the Contract-Based method, each asset's balances are maintained individually and reported in relation to a dedicated product category code for fixed assets as against the account-based method where the balances of all assets falling under same Asset Class are reported under Internal Account Category heads.

The following are the accounting category related master data definitions that can be configured using the FIXAMT.PARAMETER application.

|

S.No. |

Field Name |

Description |

|---|---|---|

|

1. |

Product Category |

Indicates the category code used in reporting the balances of the fixed assets. |

|

2. |

Depreciation Category |

Indicates the P/L Category where the Depreciation expenses of the assets are booked. |

|

3. |

Profit Category |

Indicates the P/L Category where the Profit realised by disposing an asset is booked. |

|

4 |

Loss Category |

Indicates the P/L Category where the Loss incurred due to disposal of an asset is booked. |

|

5. |

Interim Profit Category |

Indicates the P/L Category where the Interim Profit realised on the foreign currency asset is booked. |

|

6. |

Interim Loss Category |

Indicates the P/L Category where the Interim Loss realised on the foreign currency asset is booked. |

|

7. |

Payables Acct Category |

Indicates the category where all payments to be paid out to a third-party (for example, seller of the asset) are booked. |

|

8. |

Receivables Acct Category |

Indicates the category where any receipts received from a third-party are booked. |

|

9. |

Expense Category |

Indicates the PL Category Code to be used for booking any expense related to Fixed Assets. |

|

10. |

Write-Off PL Category |

Indicates the PL Category Code to which the asset write-off expenses is booked. |

The following transaction codes related master data definitions can be configured using the FIXAMT.PARAMETER application.

|

S.No. |

Field Name |

Description |

|---|---|---|

|

1. |

Activity Txn Details |

Associated multi-value drop-down field contains references to the list of assets' life-cycle activities for which transaction codes need to be configured. Transaction codes can be configured only for following activities using this set of fields.

|

|

2. |

Txn Code Dr |

Part of Activity Txn Details associated multi-value field. Defines the transaction code used in the debit leg of the accounting entry that is posted for the respective activity. |

|

3.. |

Txn Code Cr |

Part of Activity Txn Details associated multi-value field. Defines the transaction code used in the credit leg of the accounting entry that is posted for the respective activity |

|

4. |

Spec Txn Code |

Denotes the transaction codes from RE.TXN.CODE application to be used for the generation of entries during contract-based accounting. |

The system requires the mandatory setup of the FIXAMT.PARAMETER before initiating the creation of an asset class, while simultaneously allowing the flexibility of optional fields within the ASSET.CLASS application. While processing, configurations specified at the Asset Class level take precedence and if these are not defined, the system defaults to the settings established in the FIXAMT.PARAMETER application.

Fixed assets can hold multiple accounting balance types through its life cycle. The list of hard-coded non-contingent balance types under which various balances of fixed assets must be maintained and the associated activity that can affect the balances in contract-based accounting type are listed below.

|

Asset Balance Type |

Description |

Activities affecting the balance types |

|---|---|---|

|

FACURBAL |

Holds the asset principal balance or the actual cost of the asset. |

Purchase Capital Improvement Dispose Write-off Increase / Decrease Asset Value |

|

FAPROVBAL |

Holds the balance of the provision made against the asset as a part of depreciation processing |

Depreciation Dispose Write-off |

|

FACWIPBAL |

Holds the balance of work-in-progress payments made to suppliers against the respective asset |

Capital Work-in Progress (CWIP) Purchase |

|

FAWOBAL |

When the asset is written off, this balance type holds the written-off amount of the asset |

Write-off |

Temenos Transact provides a highly flexible functionality for creating general ledger (GL) accounts. Once configured, the system automatically generates GL accounts even when new data elements for Grouping Conditions for Accounting EntriesP. Read Grouping Conditions for Accounting Entries for more information on the Accounting Entries for general ledger.

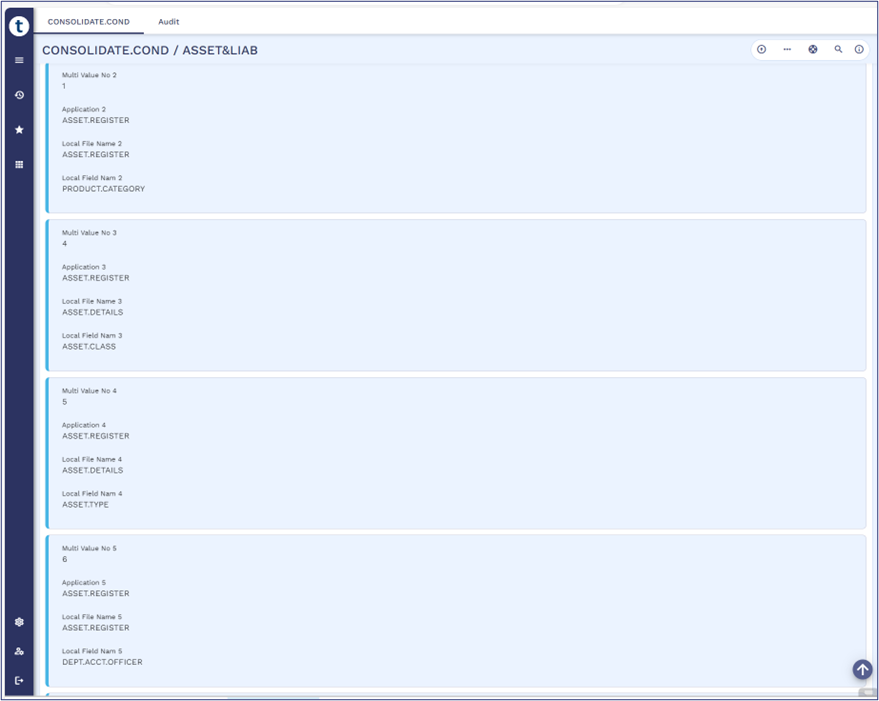

- The grouping structure is defined in the CONSOLIDATE.COND parameter file. The CONSOLIDATE.COND parameter consists of two records covering the grouping conditions for consolidation of:

- Assets and Liabilities – ASSET&LIAB as CAL (Consolidate Asset Liab)

- Profit and Loss – PROFIT&LOSS as CPL (Consolidate Profit Loss)

- The financial reporting of the fixed assets is configured with the product module ‘AR’ – Asset Register and allows to include fixed assets attributes in the definition of consolidation keys for both CAL and CPL. This includes:

- Asset Class, Asset Type and Asset Entity

- Any other single value fields including local reference fields from the ASSET.REGISTER and ASSET.DETAILS applications.

-

Consider the configuration of Asset and Liability in CONSOLIDATE.COND application to generate a CAL key by grouping condition like Product Category, Asset Class, Asset Type and Department Account officer. This is illustrated below.

-

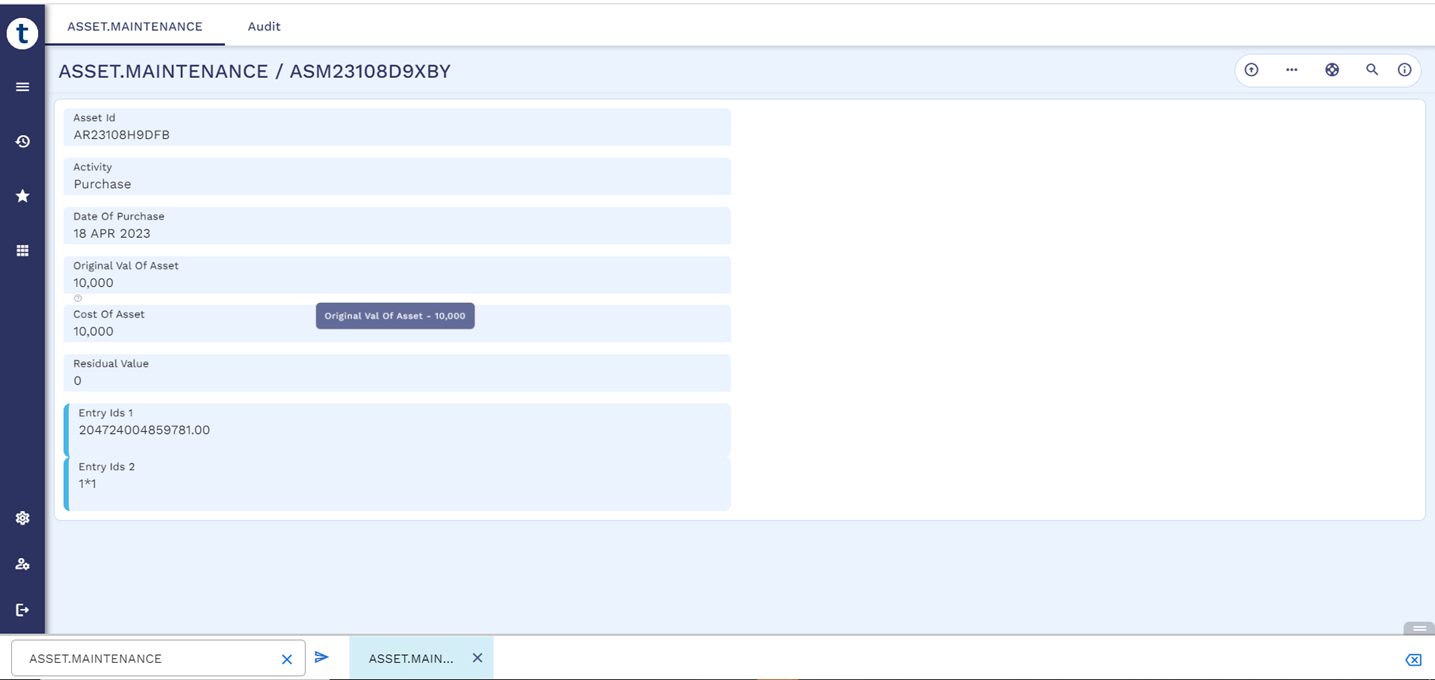

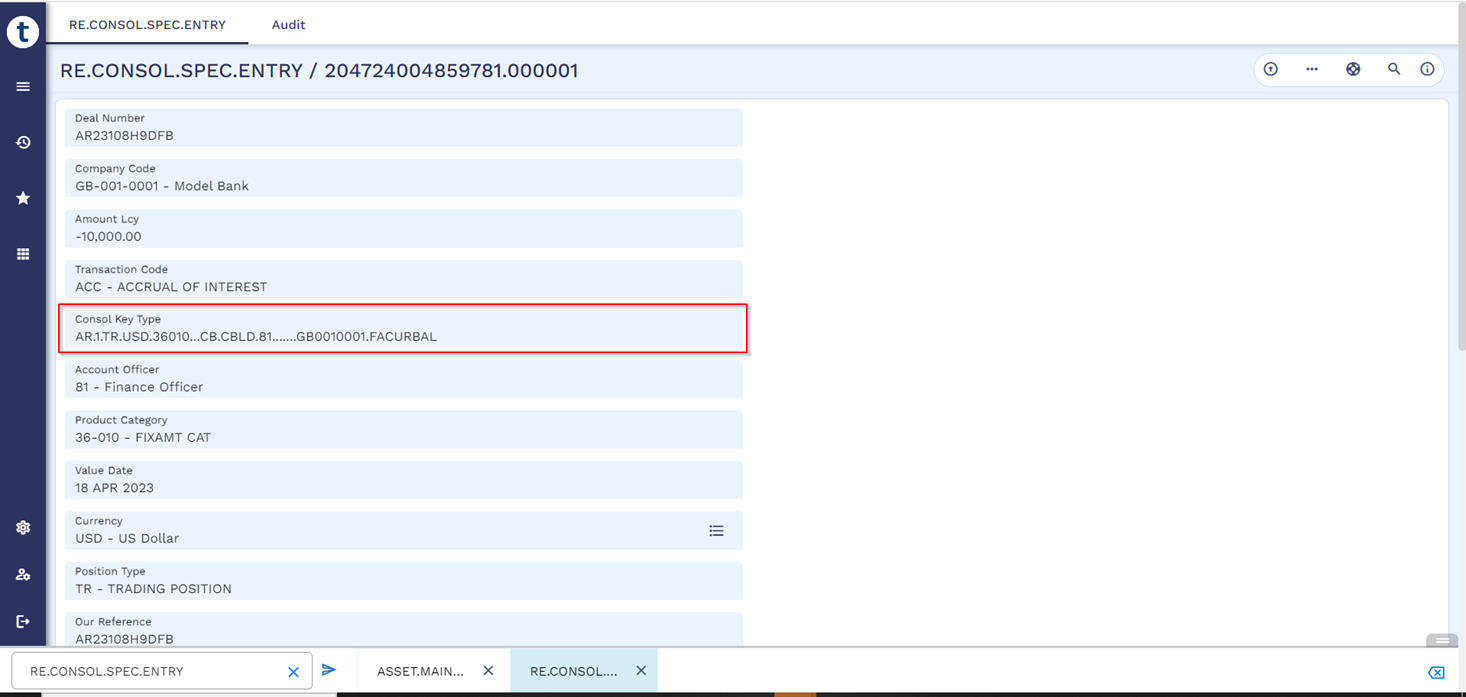

Upon performing the Register and Purchase Activity, accounting entries reflects the Consolidate Asset Liab CRF Key formation based on the above configuration.

-

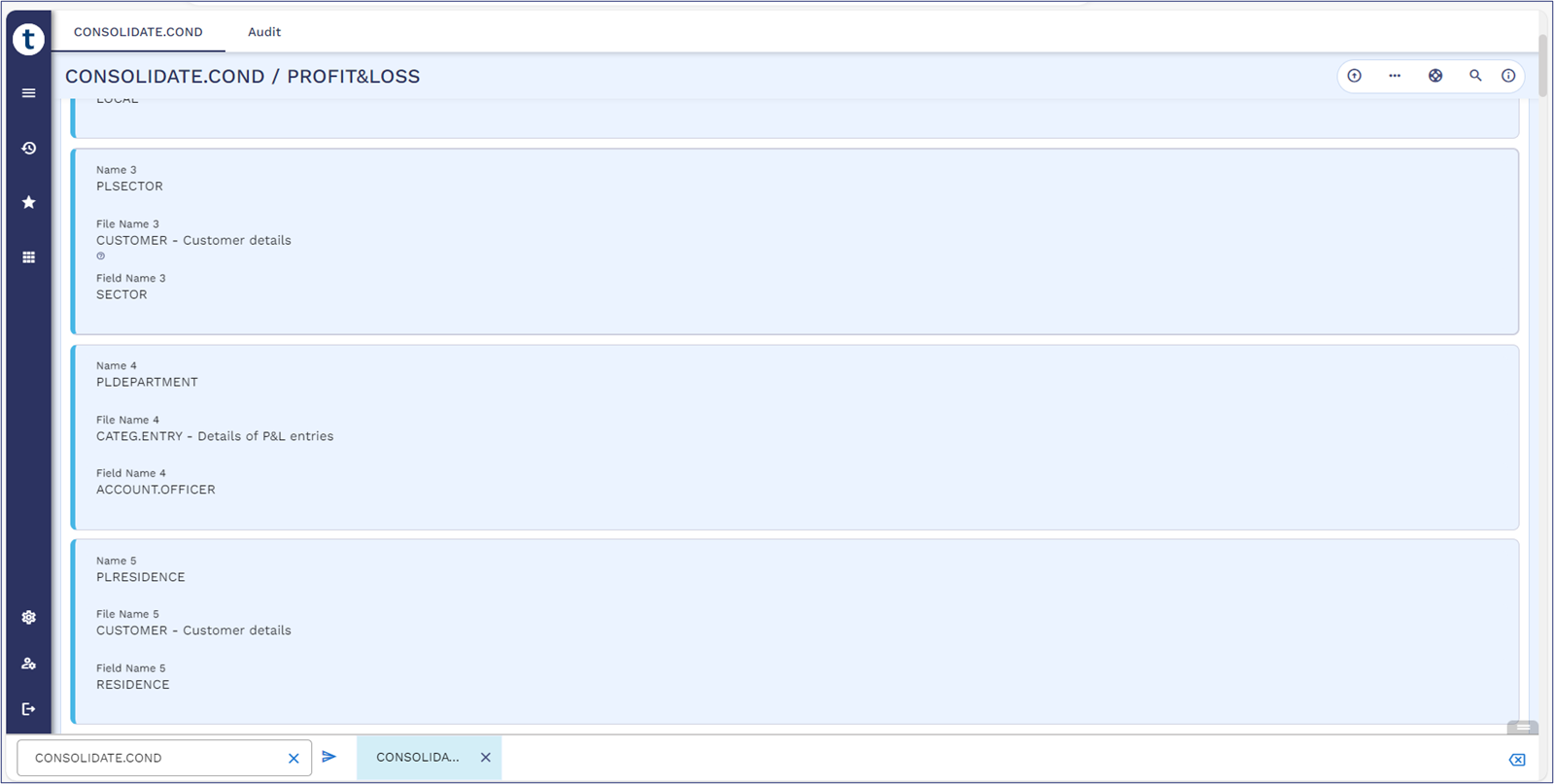

Consider the configuration of Profit and Loss in CONSOLIDATE.COND application to generate a CPL key by grouping Dept Account Officer from Fixed Assets. This is illustrated below.

-

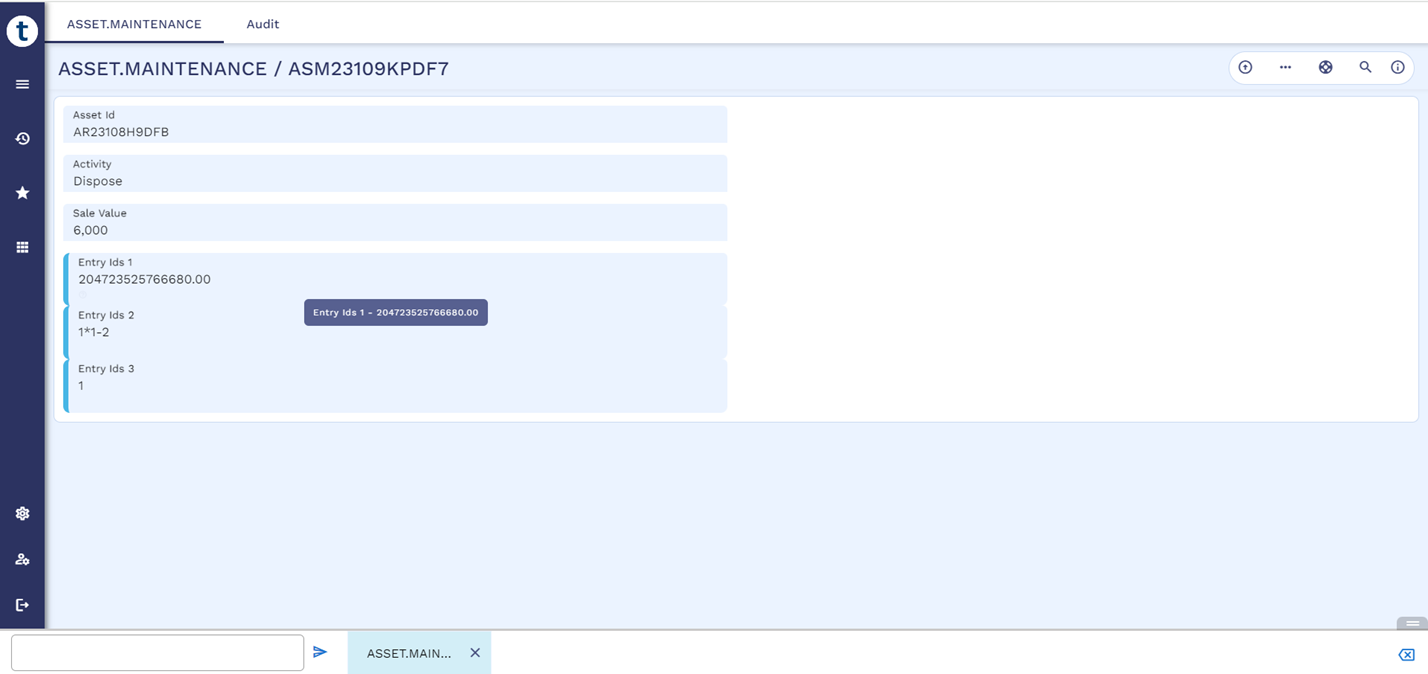

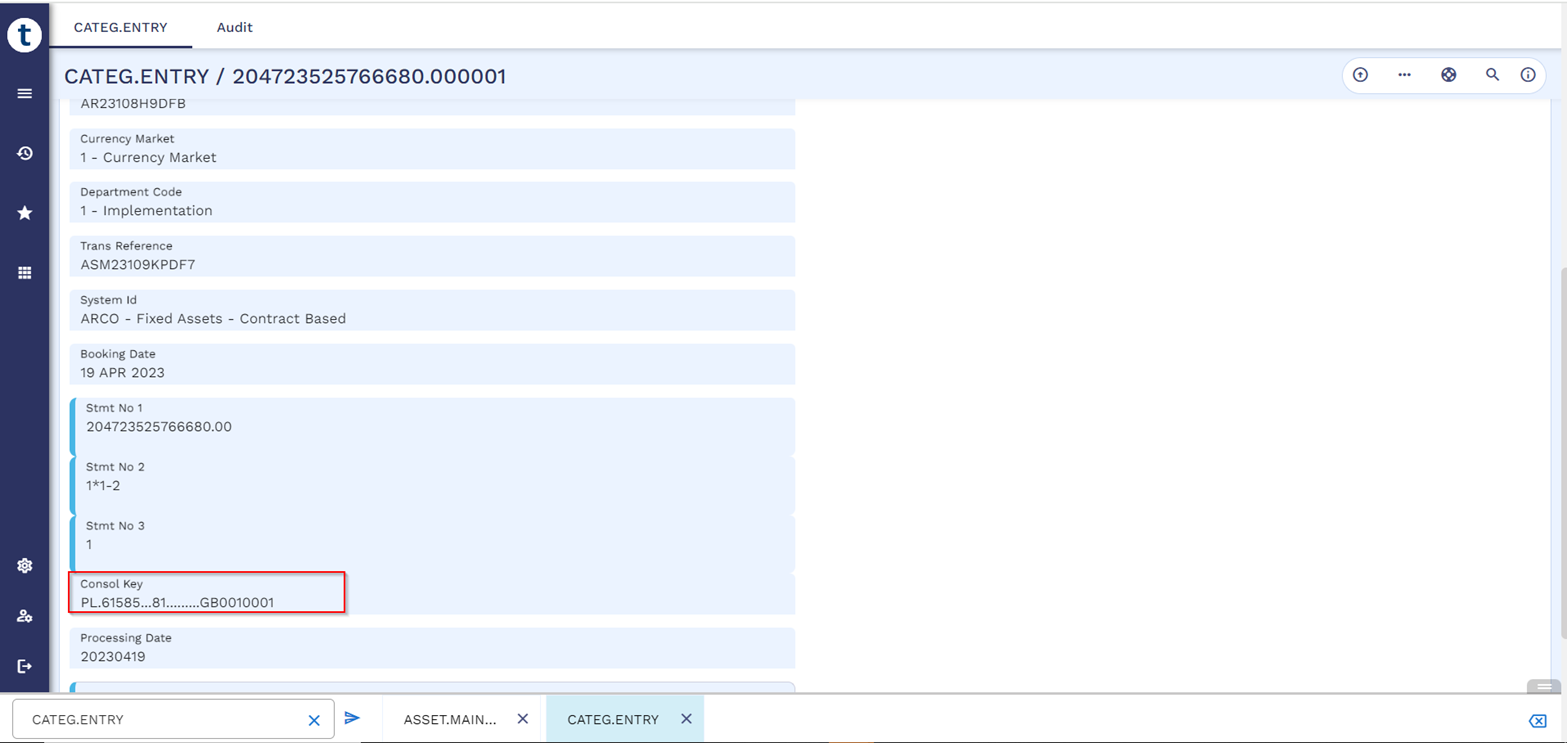

Upon performing a Disposal activity, the accounting entries are generated based on the CPL CRF Key Configuration.

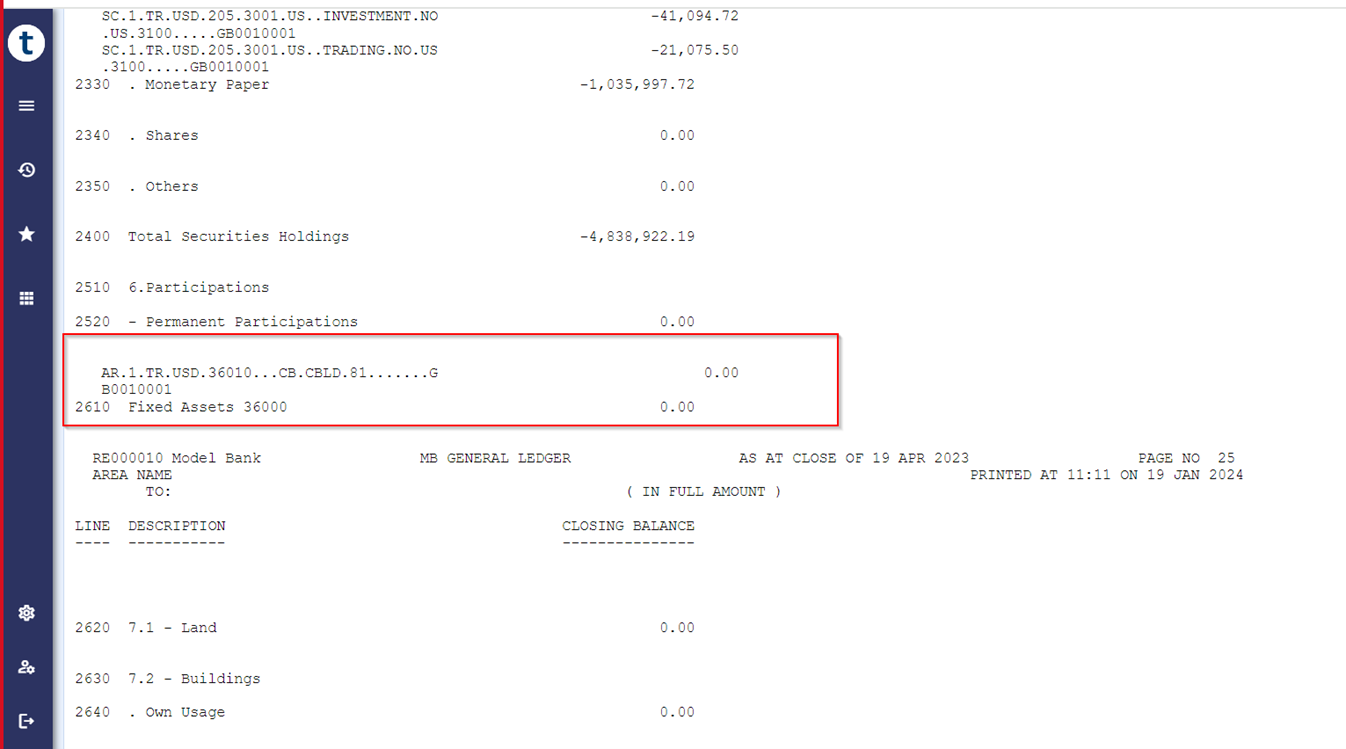

‘AR.1.TR.USD.36010.CB.CBLD.81..’, where the user-definable parameters are defined using fixed asset attributes apart from fixed parameters. The attributes details are as follows:

|

Attribute |

Description |

|---|---|

|

AR |

Asset Register |

|

1 |

Currency Market |

|

TR |

Trading Position |

|

USD |

Currency |

|

36010 |

Product Category |

|

CB |

Asset Class |

|

CBLD |

Asset Type |

|

81 |

Department Account Officer (DAO) |

‘PL.61585.81........GB0010001, where the user-definable parameters are defined using attributes apart from Fixed parameters. The attributes details are as follows:

|

Attribute |

Description |

|

PL |

PL |

|

61585 |

Product Category |

|

81 |

Department Account Officer (DAO) |

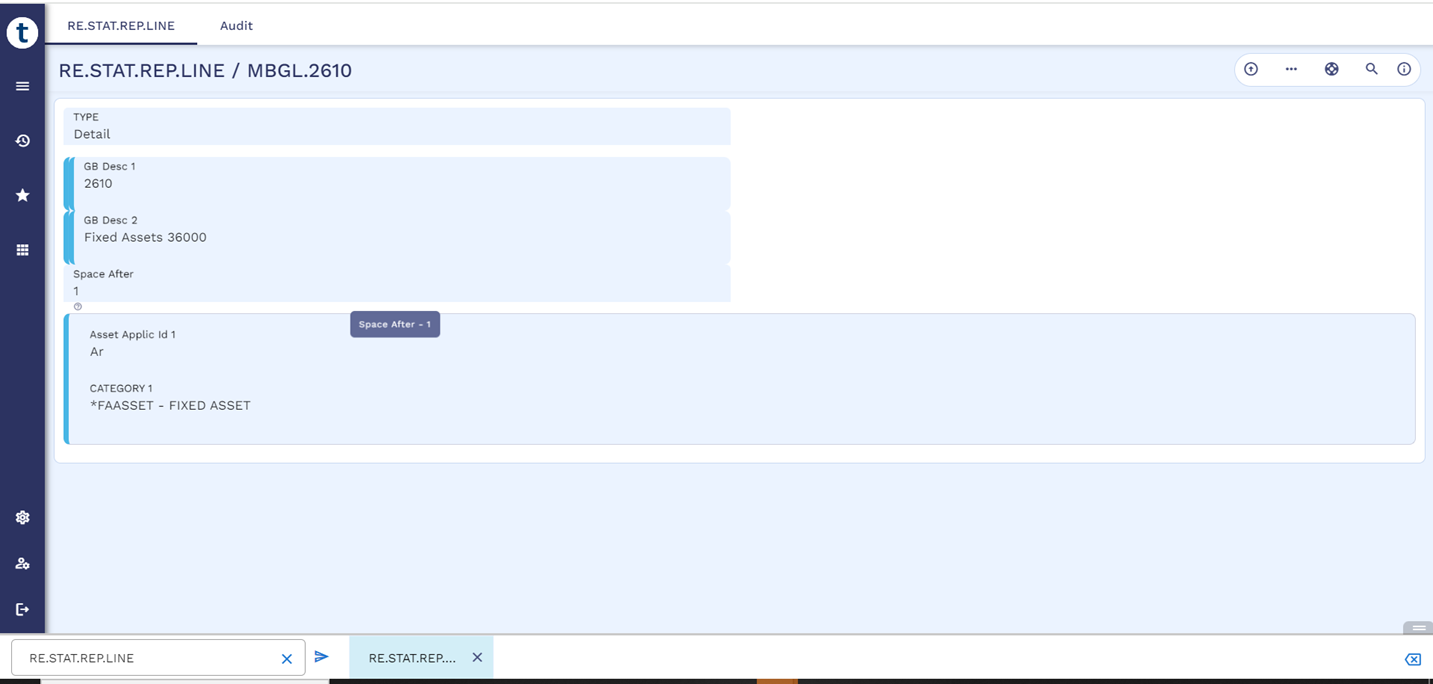

To produce the general ledger reports, it is necessary to load the details about the columns to be printed, report headings, totals, and details for a specific line is essential. This information is loaded into the report static data files, from which a report content file is updated. This file is further enhanced with the inclusion of key and currency type details for CRB records that are intended to be printed on each line. Read General Ledger Reports for more information on the Accounting and Reporting configurations used to produce reports.

- Configuration of RE.STAT.REP.LINE to group the balances of fixed assets under single line.

- A GL report reflecting the balances after disposal the balance type becomes zero for the Fixed Assets with the CRF Keys is shown below.

Illustrating Model Parameters

Model Parameters are not applicable for this module.

Illustrating Model Products

Model Products are not applicable for this module.

In this topic